Ultimate Guide to Electrical Contractor Invoice Template

Managing finances efficiently is crucial for any business, especially in the service industry. A well-structured billing document is essential for maintaining professionalism and ensuring timely payments. By implementing an organized approach to billing, you can improve cash flow and enhance customer satisfaction.

Utilizing a standardized billing format allows for consistency and clarity, making it easier for clients to understand their charges. With various options available, customizing your billing documents can help reflect your brand while meeting specific business needs. This adaptability ensures that you can present your services accurately and professionally, fostering trust and reliability with your clients.

In this guide, we will explore the key components of an effective billing document, the benefits of using a structured format, and tips for creating a user-friendly design. By focusing on these aspects, you can streamline your financial processes and set the stage for successful transactions.

Understanding the Importance of Invoices

Accurate billing documents play a vital role in any service-oriented business, serving as the cornerstone of financial transactions. They not only facilitate payment collection but also ensure clear communication between service providers and clients. By providing detailed summaries of services rendered, these documents help to eliminate confusion and foster a positive business relationship.

Establishing Professionalism

A well-structured billing document conveys professionalism and attention to detail. Clients are more likely to trust a business that presents clear and organized financial information. This trust can lead to repeat business and positive referrals, enhancing the company’s reputation in the industry.

Ensuring Financial Accuracy

In addition to establishing credibility, these documents are crucial for maintaining accurate financial records. They provide a transparent account of services provided and payments due, which aids in budgeting and forecasting. With comprehensive records, businesses can track income, manage expenses, and prepare for tax obligations efficiently.

Key Elements of an Effective Invoice

Creating a comprehensive billing document involves several essential components that ensure clarity and efficiency in financial transactions. Each element serves a specific purpose, contributing to the overall effectiveness of the document. A well-designed format not only helps in proper communication but also streamlines the payment process.

Essential Components

Below are the critical components that should be included to enhance the utility of your billing documents:

| Component | Description |

|---|---|

| Contact Information | Includes the names, addresses, and contact numbers of both parties involved. |

| Date | The date when the services were rendered or the billing document was issued. |

| Service Description | A detailed account of the services provided, including quantities and unit prices. |

| Payment Terms | Clearly outlines the payment methods and deadlines to avoid misunderstandings. |

| Total Amount Due | The final amount owed, including taxes and additional charges, if applicable. |

Enhancing Clarity and Professionalism

Incorporating these elements not only improves the clarity of the billing document but also elevates the professionalism of your business. A clear and organized document can help build trust with clients and facilitate timely payments, ensuring a smoother financial workflow.

How to Create a Professional Invoice

Crafting a polished billing document is essential for any business aiming to convey professionalism and efficiency. A well-prepared document not only reflects your brand but also facilitates clear communication regarding financial transactions. By following a structured approach, you can create a document that meets both your needs and those of your clients.

The following steps outline how to effectively design and assemble a comprehensive billing document:

| Step | Description |

|---|---|

| Choose a Format | Select a layout that suits your business style, ensuring it is easy to read and navigate. |

| Add Your Branding | Include your logo, business name, and contact information prominently at the top. |

| Detail the Services | Provide a clear description of the services rendered, including dates and quantities. |

| Specify Payment Terms | Outline the payment methods accepted and the due date for payment. |

| Calculate the Total | Ensure that the final amount is accurate and includes any applicable taxes or fees. |

By following these steps, you can create a billing document that not only meets your business requirements but also enhances your professional image. A thoughtful approach to your billing process can improve client relationships and expedite payment collection.

Common Mistakes in Invoicing

Creating a billing document can be straightforward, yet many businesses fall into common pitfalls that can lead to confusion and delayed payments. Understanding these frequent errors is essential for enhancing the efficiency of your financial processes. By identifying and addressing these mistakes, you can improve the clarity of your transactions and maintain positive relationships with your clients.

Overlooking Details

One of the most prevalent mistakes is neglecting to include essential information, such as service descriptions, dates, and payment terms. When critical details are missing, it can create confusion for clients and result in payment delays. Always double-check that all necessary information is present and clearly communicated.

Incorrect Calculations

Another common issue arises from mathematical errors in the total amounts. Miscalculations can lead to distrust and frustration among clients. It is crucial to review all calculations meticulously and consider using software tools that minimize human error, ensuring accurate billing every time.

Choosing the Right Invoice Template

Selecting an appropriate billing format is crucial for effective financial management in any business. The right design can enhance clarity, streamline processes, and improve client relationships. By considering various factors, you can identify a format that aligns with your brand and meets your operational needs.

Here are some key considerations when selecting a suitable billing format:

| Factor | Description |

|---|---|

| Brand Consistency | Choose a design that reflects your business’s identity and maintains consistency with other marketing materials. |

| Customization Options | Look for formats that allow for easy modifications to suit different services and client needs. |

| User-Friendly Layout | Select a clear and organized structure that makes it easy for clients to understand charges. |

| Compatibility with Software | Ensure the format can be easily integrated with your accounting or management software for seamless processing. |

| Mobile Accessibility | Consider formats that are compatible with mobile devices, allowing clients to view documents on the go. |

By carefully evaluating these factors, you can choose a billing format that not only enhances your professional image but also facilitates smooth transactions, ensuring satisfaction for both your business and your clients.

Benefits of Using Invoice Templates

Utilizing a standardized billing document offers numerous advantages for businesses seeking to streamline their financial operations. By adopting a consistent format, companies can enhance their professionalism and ensure clarity in their transactions. The use of a predefined structure not only saves time but also minimizes the likelihood of errors, ultimately contributing to smoother financial interactions.

One of the primary benefits is increased efficiency. With a set layout, businesses can quickly generate documents without needing to create each one from scratch. This saves valuable time that can be better spent on core business activities.

Moreover, a consistent format enhances brand recognition. Clients are likely to associate a familiar layout with your business, reinforcing your identity in their minds. This visual consistency builds trust and reliability.

Additionally, employing a structured format helps ensure that all necessary information is included, reducing the chances of misunderstandings or disputes over charges. Clarity in communication fosters positive client relationships, encouraging timely payments and ongoing collaboration.

In summary, using a standardized billing document not only improves efficiency but also enhances professionalism, brand recognition, and client satisfaction, making it a valuable tool for any business.

Customization Options for Your Invoice

Tailoring your billing document to reflect your unique business identity can significantly enhance its effectiveness. Personalization not only sets you apart from competitors but also strengthens your brand presence in the minds of your clients. With various customization options available, you can create a document that meets both your operational needs and your clients’ expectations.

One important aspect of customization is branding elements. Incorporating your logo, business colors, and fonts creates a cohesive look that resonates with your overall marketing strategy. This visual identity helps foster brand recognition and trust among clients.

Another option is the flexibility of content. You can modify sections to suit different services, ensuring that all relevant information is presented clearly. This includes adding or removing specific line items, adjusting pricing formats, and detailing payment terms to fit each client’s situation.

Additionally, consider the layout design. A well-structured document with intuitive organization allows clients to easily navigate and understand the charges. This improves communication and reduces the chances of disputes over billing.

In conclusion, customizing your billing document not only enhances its visual appeal but also improves clarity and effectiveness, making it a vital component of successful financial interactions.

Invoice Terms and Payment Instructions

Clear communication regarding financial obligations is essential for maintaining healthy client relationships. Defining payment terms and providing straightforward instructions ensures that clients understand their responsibilities and the process for completing transactions. By laying out these details, businesses can promote timely payments and minimize confusion.

Here are common terms and instructions that should be included in your billing documents:

| Term/Instruction | Description |

|---|---|

| Due Date | The specific date by which payment must be received, ensuring clients are aware of their timelines. |

| Payment Methods | Detail the accepted forms of payment, such as credit cards, bank transfers, or checks, to facilitate client convenience. |

| Late Fees | Outline any penalties for overdue payments, encouraging promptness and accountability. |

| Discounts for Early Payment | Offer incentives for clients who settle their accounts before the due date, fostering goodwill and promptness. |

| Contact Information | Provide details for inquiries or issues regarding the billing document, ensuring clients have access to support. |

By clearly outlining terms and instructions, businesses can create a smoother payment process, reduce misunderstandings, and enhance overall client satisfaction.

Tracking Payments and Due Dates

Effectively managing payment deadlines and tracking client settlements are crucial aspects of financial administration. Keeping an eye on when payments are due and when they are received ensures that cash flow remains consistent, and any potential delays are addressed promptly. Having a reliable tracking system can prevent missed payments and improve overall business efficiency.

Methods for Tracking

To streamline the process, businesses can utilize software tools, spreadsheets, or manual records to monitor outstanding balances and due dates. These methods provide transparency and reduce the likelihood of human error. By maintaining an organized system, businesses can stay on top of pending payments and keep clients informed.

Handling Overdue Payments

In cases where payment deadlines are missed, having a structured approach to follow-up is essential. This may include sending reminders, imposing late fees, or discussing alternative payment arrangements with clients. Clear documentation of any overdue balances can also protect businesses in case of disputes.

| Task | Action |

|---|---|

| Track Due Dates | Use digital tools or spreadsheets to set reminders for when payments are due and track the payment status. |

| Monitor Payments | Regularly check accounts to confirm that payments have been made, updating records accordingly. |

| Follow-Up on Overdue Payments | Send timely reminders and offer solutions such as installment plans to encourage payment completion. |

By systematically tracking payments and their respective deadlines, businesses can maintain a steady cash flow, minimize financial disruptions, and cultivate positive relationships with clients.

Integrating Documents with Accounting Software

Efficiently managing financial transactions is essential for any business. By connecting billing statements with accounting platforms, companies can automate many tasks related to tracking payments, generating reports, and maintaining accurate financial records. This integration not only saves time but also reduces the likelihood of human error and ensures consistency across business operations.

Benefits of Integration

One of the primary advantages of linking documents to accounting software is automation. The process eliminates the need for manual data entry, allowing the system to automatically update records when payments are made or new charges are added. This ensures that financial records are always up-to-date, improving decision-making and compliance with regulations.

How to Set Up Integration

Setting up integration between billing systems and accounting software involves a few simple steps. Many software solutions offer pre-built integrations that can be activated with minimal effort. Businesses should ensure that their software is compatible with their existing tools, and that it provides an easy-to-use interface for tracking all financial activities.

Once set up, businesses can instantly synchronize documents with their accounting platform, view financial reports in real-time, and generate detailed statements for tax purposes or audits. This streamlines overall accounting processes, making financial management more efficient and less time-consuming.

Legal Requirements for Documents

Understanding the legal obligations tied to creating business documents is crucial for maintaining compliance. These requirements ensure that all transactions are clearly documented and can be used as evidence in case of disputes, audits, or legal proceedings. Various laws exist to protect both businesses and customers, ensuring transparency and fairness in financial exchanges.

Depending on the jurisdiction, businesses are typically required to include specific information on their documents to meet legal standards. This includes details such as the business’s name, address, registration number, and the recipient’s contact information. In addition, it’s essential to accurately reflect the transaction amount, any applicable taxes, and the payment terms to avoid misunderstandings or legal complications.

Essential Information for Compliance

To comply with local laws, it is important to include the following key details:

| Item | Description |

|---|---|

| Business Information | Name, address, and tax ID number |

| Client Information | Recipient’s name and address |

| Transaction Details | Description of services or products provided |

| Amount | Total charges, taxes, and any applicable fees |

| Payment Terms | Due date and accepted payment methods |

By adhering to these legal requirements, businesses can avoid potential penalties and disputes. It’s essential to stay informed about local laws and update documents accordingly, ensuring that all transactions are properly documented and legally binding.

Handling Disputes and Payment Issues

Managing disagreements and payment problems is an inevitable part of any business. Whether due to misunderstandings, delays, or dissatisfaction with services provided, it’s essential to address these situations promptly and professionally. The way such issues are handled can significantly impact the relationship with clients and the overall reputation of the business.

Clear communication and documentation play a key role in resolving disputes. By keeping thorough records of all transactions, agreements, and communications, businesses can provide evidence to support their position. Offering flexible payment solutions or negotiating a mutually agreeable settlement can often lead to a smoother resolution, benefiting both parties.

Steps for Resolving Payment Disputes

When facing payment issues, it’s crucial to follow a structured approach to ensure a fair outcome. Below are several steps to consider:

- Clarify the Issue: Understand the reason behind the payment delay or dispute. This might involve reviewing contracts, terms, and conditions.

- Communicate Clearly: Reach out to the client in a professional manner to discuss the issue, offering possible solutions.

- Negotiate: Consider offering alternative payment methods or an extended deadline if the client is facing financial challenges.

- Seek Mediation: If a resolution cannot be reached, consider involving a neutral third party to help mediate the situation.

Preventing Future Payment Issues

To reduce the chances of future disputes, businesses should set clear expectations from the beginning. This includes defining payment terms, specifying deadlines, and providing transparent billing. Additionally, offering clients multiple payment methods and sending reminders ahead of deadlines can help avoid delays and misunderstandings.

By handling payment issues professionally and proactively, businesses can preserve client relationships and ensure timely compensation for services rendered.

Tips for Prompt Payments

Ensuring that payments are received on time is a critical aspect of maintaining smooth business operations. Late payments can disrupt cash flow and cause unnecessary stress. However, by implementing a few simple strategies, businesses can encourage clients to pay promptly and avoid delays.

1. Set Clear Payment Terms

Establishing clear and concise payment terms from the start helps prevent confusion later on. Specify the due date, accepted payment methods, and any late fees that may apply if payment is delayed. By setting expectations upfront, clients are more likely to pay on time.

2. Offer Multiple Payment Methods

Providing clients with various payment options can significantly reduce delays. Allowing payments through bank transfers, online payment platforms, or credit cards offers convenience and flexibility, making it easier for clients to settle their dues promptly.

3. Send Regular Reminders

Sending reminders as the payment due date approaches can help keep the task top-of-mind for clients. A gentle reminder a few days before the due date, followed by a follow-up after the deadline has passed, increases the likelihood of timely payments.

4. Offer Early Payment Discounts

Incentivizing clients to pay ahead of schedule can be effective. Offering a small discount for early payments encourages promptness and can help businesses receive funds faster.

5. Enforce Late Fees

Having a system in place for late fees can motivate clients to make payments on time. While this should be used as a last resort, knowing that there are consequences for late payments can encourage clients to adhere to deadlines.

By implementing these strategies, businesses can foster better relationships with clients and maintain a healthy cash flow with fewer payment delays.

How to Use Digital Invoicing Tools

Digital invoicing tools are essential for businesses looking to streamline their billing processes. These tools help automate and simplify the creation, sending, and tracking of billing statements. By leveraging these tools, businesses can save time, reduce errors, and improve overall efficiency.

1. Choose the Right Tool

The first step in using digital invoicing tools is selecting the right one. Several options are available, each offering unique features. When choosing a tool, consider the following:

- User-friendly interface: Ensure the tool is easy to navigate, even for those with limited technical knowledge.

- Customization options: Look for tools that allow you to add branding, adjust payment terms, and modify the design to match your business style.

- Integration: Choose a tool that integrates with your accounting or payment software to avoid manual data entry.

2. Create a Professional Statement

Once you’ve selected the right tool, you can start creating professional documents. Most digital tools offer pre-built templates, but you can also customize them to suit your needs. Key elements to include are:

- Business name, address, and contact information

- Client’s details

- Itemized list of goods or services provided

- Payment terms and deadlines

3. Send and Track Payments

Digital invoicing tools allow you to send billing statements via email or even directly through the tool. After sending, you can track when the recipient opens the document and monitor payment progress. Most tools provide reminders for overdue payments, making it easier to follow up on pending balances.

By utilizing digital invoicing tools, businesses can improve their billing process, reduce administrative work, and ensure quicker payment collection. The convenience and functionality offered by these tools make them a valuable asset for any business.

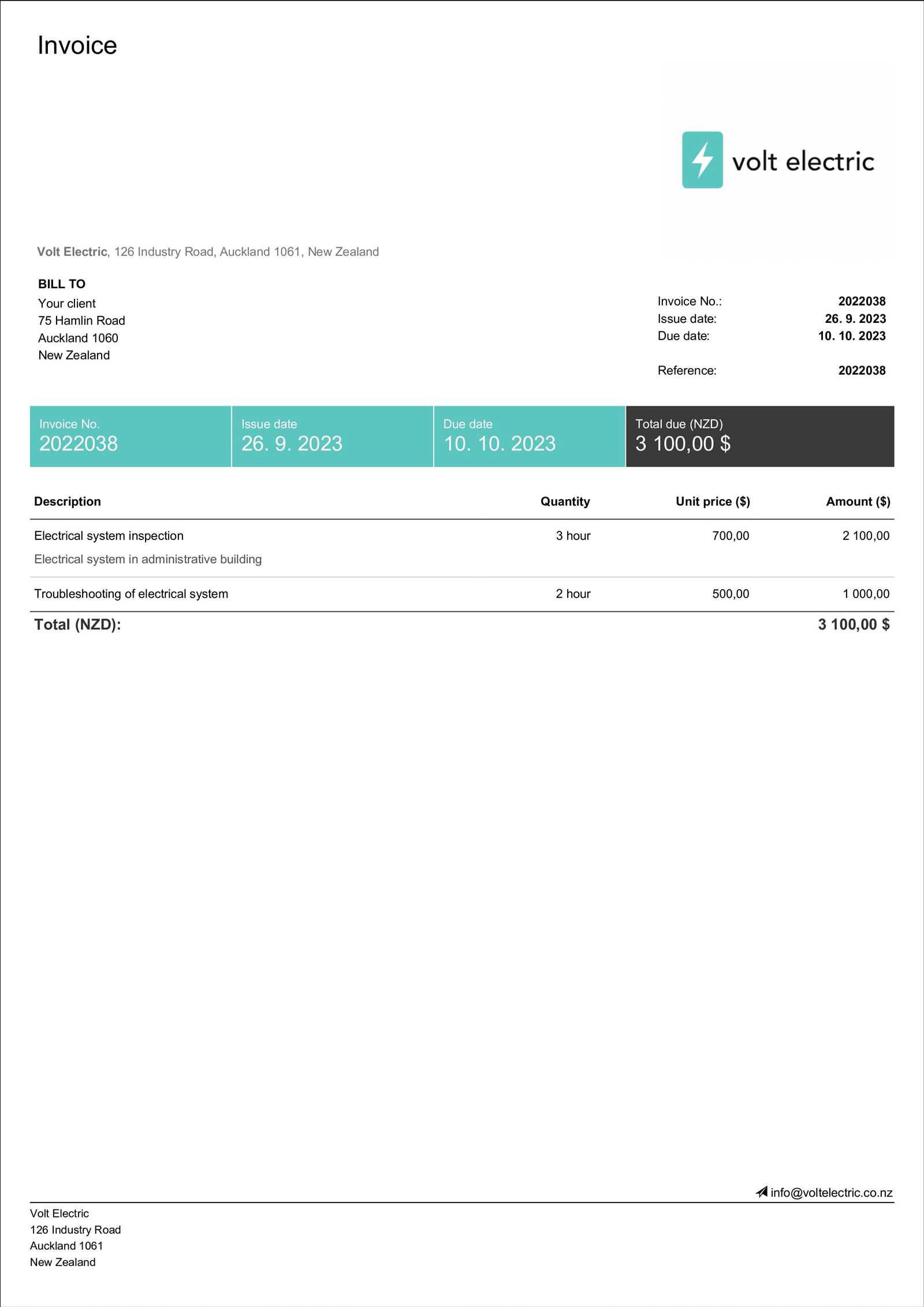

Invoice Templates for Various Services

When running a business, it is essential to have a clear and professional way to request payment for services provided. Having specific formats for different industries ensures clarity and accuracy in the billing process. Each service has unique needs, and customizing payment requests for each can simplify the overall experience for both the provider and the client.

For businesses offering a range of services, such as consulting, design work, or home repairs, it is important to choose the right format. For example, a consulting service invoice might focus on hourly rates and the number of hours worked, while a service involving goods might require detailed descriptions of products provided alongside the associated costs.

1. Service-Based Billing

For businesses offering services rather than physical products, the billing format often includes:

- Hourly or daily rates: Clearly outline the rate per hour or day worked.

- Scope of work: Provide a detailed description of the service rendered, including any specific tasks completed.

- Payment terms: Specify when payment is due and any late fees that may apply.

2. Product-Based Billing

If your business involves the sale of physical goods along with services, an alternative format should be considered. This format generally includes:

- Product descriptions: List each item sold, its quantity, and price.

- Shipping details: If applicable, outline any shipping or handling fees.

- Taxes and discounts: Specify any taxes or discounts applied to the total amount due.

By customizing the payment request format for various services, businesses ensure that clients understand the charges, leading to smoother transactions and fewer misunderstandings. This also builds trust and professionalism in business dealings.

Creating Recurring Invoices Efficiently

When offering services or products on a regular basis, automating the billing process can save valuable time and reduce errors. Recurring payment requests ensure that clients are billed on time, without the need for manual input each cycle. By setting up a streamlined system, businesses can ensure consistency and efficiency in their financial operations.

1. Setting Up Automated Billing Cycles

One of the easiest ways to manage repeated payments is by automating the billing schedule. Consider the following steps:

- Choose a frequency: Determine how often the client should be billed–monthly, quarterly, or annually.

- Set up templates: Create a basic structure that includes recurring items, payment terms, and service details, which can be reused for each cycle.

- Automate reminders: Set up email or notification reminders for clients a few days before the payment is due to ensure timely payments.

2. Managing Variations in Recurring Payments

Some services may require adjustments in the billing amount over time. To handle variations efficiently, use these tips:

- Flexible pricing: Allow for easy updates in the amount billed based on the scope of service or product changes.

- Tracking usage: If pricing is based on usage or consumption, keep detailed records to update the bill accordingly.

- Clear communication: Always inform clients in advance of any changes to the billing amount to maintain transparency and trust.

By automating recurring charges and staying organized, businesses can minimize errors, improve cash flow, and reduce the time spent on administrative tasks. This approach not only saves effort but also enhances client satisfaction by ensuring consistency and reliability in the billing process.

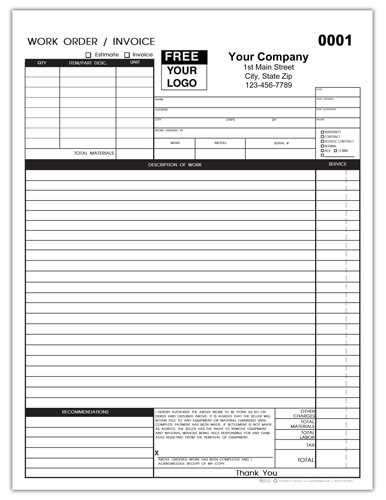

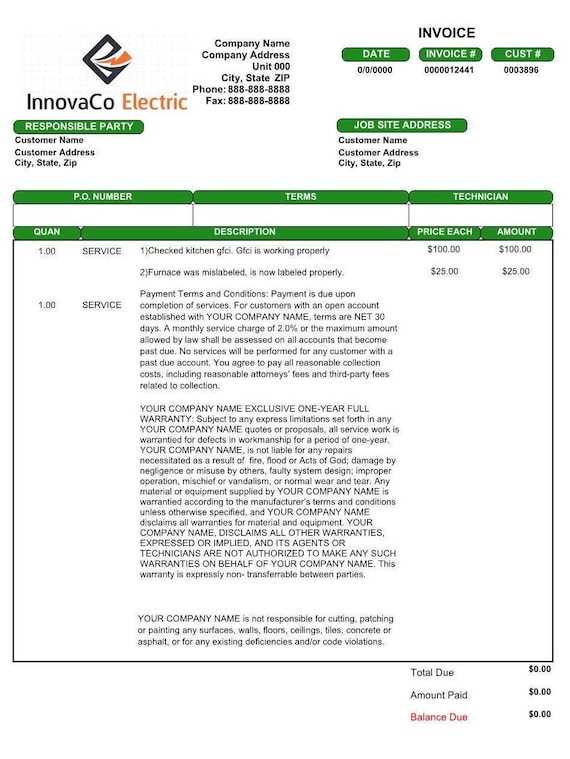

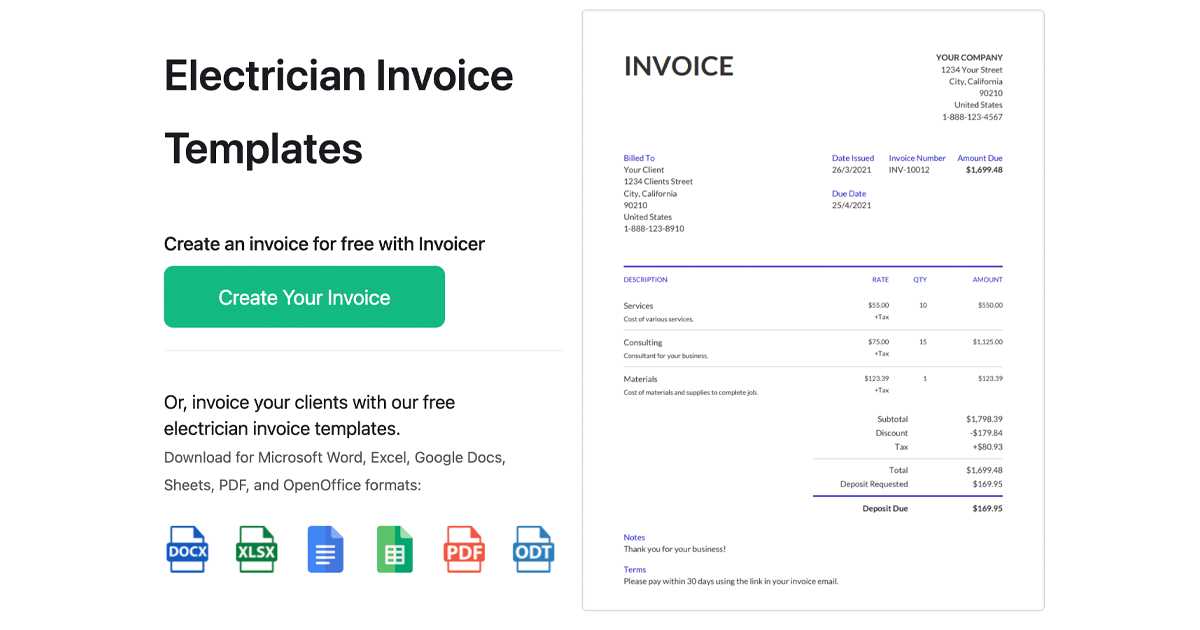

Examples of Well-Designed Invoices

A well-structured billing document serves as both a request for payment and a professional representation of your business. When designed correctly, it not only conveys essential financial details but also leaves a lasting positive impression on your clients. Here are some examples of well-crafted billing statements that emphasize clarity, simplicity, and professional appeal.

1. Clean and Minimalist Layout

A simple, clean design ensures that all important details are easy to find, reducing the chances of confusion or errors. Here are some characteristics of an effective minimalist layout:

- Clear headings: Use large, bold text for key sections like the service description, payment terms, and totals.

- Ample white space: A well-spaced layout improves readability, making it easier for the recipient to follow the details.

- Simple color scheme: Stick to neutral tones with a touch of accent color to highlight important information, such as due dates or amounts owed.

2. Branding and Personalization

Adding your business’s logo and a personal touch to the document helps reinforce your brand and build rapport with clients. Features to consider include:

- Company logo: Place your business’s logo at the top to make your billing document easily recognizable.

- Customizable fields: Allow space for additional personal notes or thank-you messages to strengthen the relationship with your client.

- Professional fonts: Use modern, easy-to-read fonts that complement your brand’s style without cluttering the layout.

In conclusion, a well-designed payment request ensures that all crucial details are communicated clearly while maintaining professionalism. By incorporating simple design principles and your unique branding, you can create a polished document that enhances your company’s image and improves client relations.

Staying Organized with Invoicing Systems

Managing financial transactions and tracking payments can become overwhelming without a structured approach. By using effective systems, you can stay organized, ensuring that no payment goes unnoticed and all records are easily accessible. A good system not only saves time but also minimizes errors and ensures timely payments.

1. Digital Record Keeping

Transitioning from paper records to digital systems offers numerous benefits, such as easy access and automatic backup. Digital systems provide the following advantages:

- Instant updates: Record updates are reflected in real-time, reducing the risk of missing important information.

- Searchable data: Easily search for past transactions or outstanding payments with just a few clicks.

- Automated reminders: Set reminders to ensure that payments are requested and received on time.

2. Categorization and Sorting

Organizing records into categories allows for better clarity and simplifies tracking. Some helpful strategies include:

- Client segmentation: Group clients based on factors such as payment frequency or location for more efficient management.

- Date-based sorting: Sort transactions by date to help with timely follow-ups and reporting.

- Customizable labels: Use customizable labels or tags for easy identification of completed or pending transactions.

By incorporating these strategies into your financial management, you ensure that your processes remain efficient and organized. Maintaining an effective system allows you to track transactions seamlessly and ensures that your business operations run smoothly.