Free Electrical Contractor Invoice Template for Easy Billing

Managing payments and keeping track of work completed is crucial for any service-based business. Without clear and professional documents to outline charges, it can be difficult to ensure timely compensation. Having the right tools in place not only saves time but also enhances the overall client experience.

One of the most effective ways to streamline this process is by using well-structured documents that detail services rendered, costs, and payment terms. These documents are essential for maintaining transparency and promoting smooth transactions between service providers and their clients.

Whether you’re just starting out or have been in the business for years, having access to a reliable and easy-to-use tool to create such documents can significantly improve your workflow. With the right format, you can ensure that every detail is accounted for, helping to avoid errors and delays in payments.

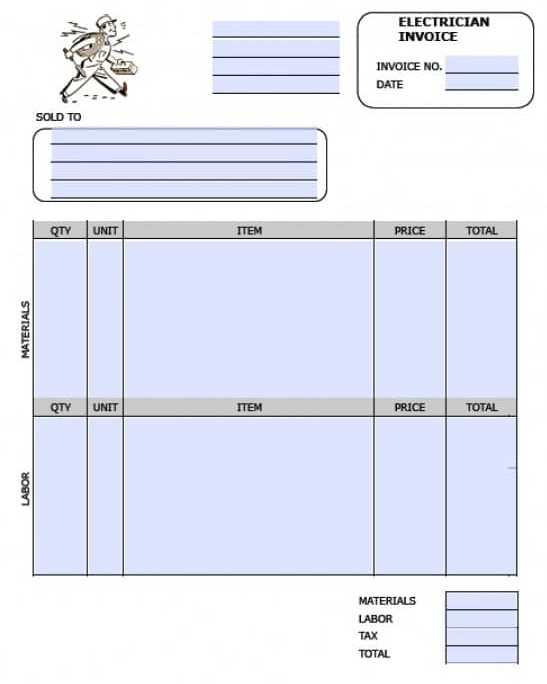

Free Electrical Invoice Template for Contractors

For any professional providing repair or installation services, having a well-organized document to outline payment details is essential. Such a document serves as both a formal agreement and a receipt, helping to keep transactions clear and transparent. With the right structure, service providers can create these documents quickly, ensuring clients have all necessary information for processing payments.

Access to an easily customizable document makes it simple to input job specifics, charges, and deadlines. Using a pre-designed format allows you to save time and effort while maintaining a polished, professional appearance. It helps eliminate the need to start from scratch with each new project, which can be especially useful for those with multiple ongoing jobs.

Many online resources offer these documents at no cost, allowing you to find a suitable design that fits your business needs. By choosing one of these options, you can ensure that your clients receive clear, detailed statements without the hassle of creating them manually every time.

How to Use an Electrical Invoice Template

Creating a clear, professional document to outline charges and payment terms is essential for smooth transactions with clients. By using a pre-designed format, service providers can quickly enter necessary information and generate a polished statement for each job. Below is a simple guide to help you use such a format effectively.

Step-by-Step Instructions

1. Download or open your chosen document format: Choose a design that suits your business and download or open it on your device. Most designs will be compatible with word processors or spreadsheet software.

2. Fill in client information: Enter the client’s name, address, and contact details at the top of the document. This ensures that all information is accurate and easy to reference.

3. List services provided: Detail each service completed, including the description, quantity, and price for each task. This breakdown helps clients see exactly what they are being charged for.

4. Add payment terms: Clearly state payment due dates, methods of payment accepted, and any late fees that may apply. Providing this information upfront avoids confusion later.

Example of Completed Document

| Service Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Wiring Installation | 2 | $100 | $200 |

| Outlet Replacement | 5 | $50 | $250 |

5. Review and send: Once all details are filled in, double-check for any errors before sending the document to your client. You can send it via email, postal mail, or another preferred method.

Benefits of Using a Free Invoice Template

Using a pre-designed document for payment requests offers several advantages for service providers, whether they are just starting out or managing an established business. It saves time, reduces errors, and ensures consistency across all transactions. Below are the key benefits of utilizing such a tool in your business operations.

- Time Efficiency: Instead of creating payment requests from scratch each time, you can quickly fill in the necessary details, saving valuable time that can be spent on other tasks.

- Professional Appearance: A well-structured document helps create a professional image, which is important for building trust with clients and enhancing your reputation.

- Consistency: Using the same format for all payment requests ensures consistency, making it easier for clients to understand and track their payments.

- Accuracy: Pre-designed formats help minimize errors, as they provide a structured layout that guides you on what to include and where to place it.

- Cost-Effective: Many platforms offer these resources without any charge, allowing you to access quality designs without any financial commitment.

- Easy Customization: These documents can be easily modified to suit your specific needs, ensuring they reflect your services, pricing, and branding accurately.

By using a pre-designed document, you streamline the billing process and ensure smooth, transparent transactions with your clients.

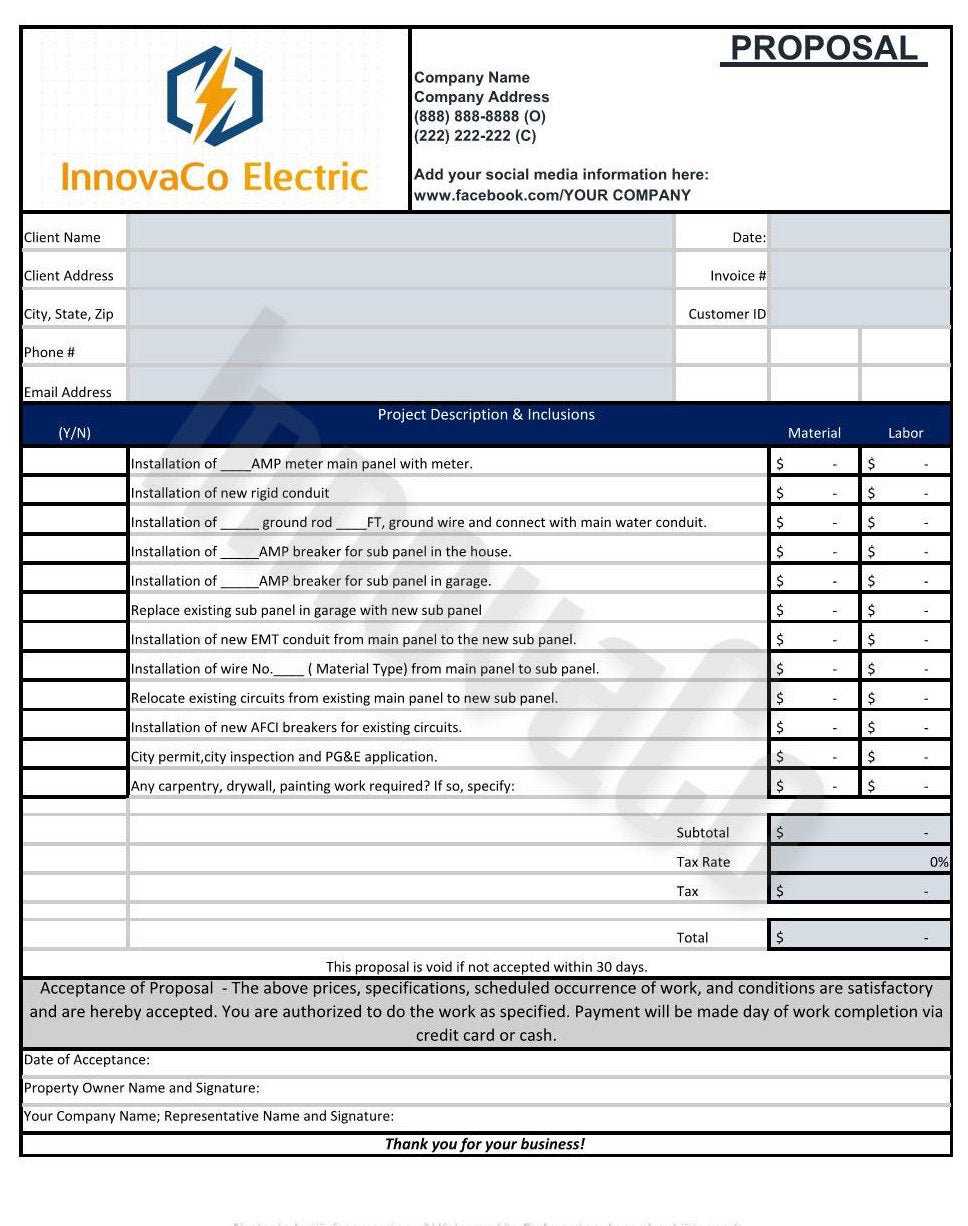

Steps to Customize Your Invoice

Customizing a billing document is essential to ensure that it reflects your business and communicates all necessary details to your clients. Whether you’re adjusting it for a specific project or adding your company’s branding, the process is simple and straightforward. Below are the steps to tailor your document to suit your needs.

1. Enter Your Business Information

The first step is to fill in your company’s name, address, and contact details at the top of the document. This ensures that the client knows exactly who the payment is for and how to reach you for any questions or concerns.

2. Add Client Details

Next, add the client’s name, address, and contact information. This is crucial for proper record-keeping and ensures that you are sending the bill to the correct recipient.

3. Customize the Services Section

List the services you provided in detail, including a description, quantity, and individual cost. This transparency helps avoid confusion and clarifies exactly what the client is paying for.

4. Include Payment Terms

Be sure to include the payment due date, methods of payment accepted, and any penalties for late payments. This information will set clear expectations and help prevent delays in receiving payment.

5. Add Branding and Personal Touches

If you’d like to personalize your document further, consider adding your logo or company colors to make it feel more official. This small touch can go a long way in creating a professional image for your business.

Once you’ve made these changes, double-check the information for accuracy before sending it to your client. Customizing your document ensures that it’s tailored to your needs while maintaining a professional and clear format.

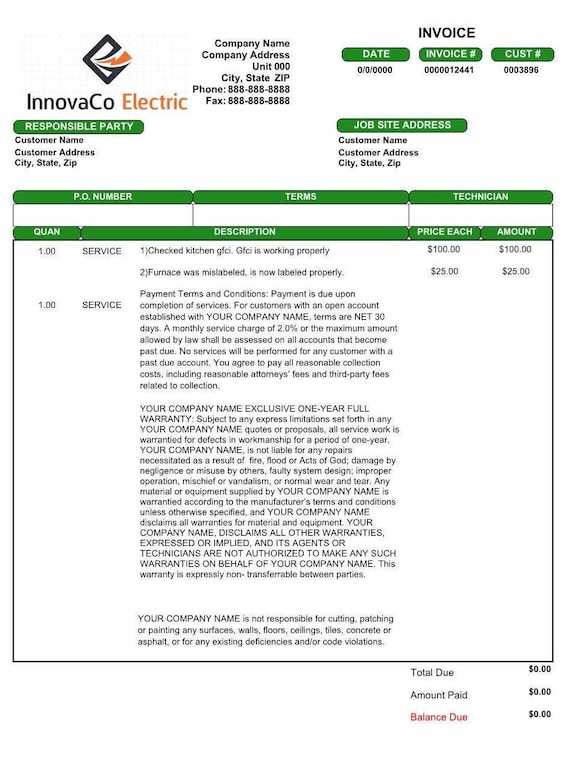

Essential Information for an Electrical Invoice

When creating a payment request document, it’s important to include specific details to ensure clarity and accuracy. The right information helps avoid confusion and ensures that both you and your client are on the same page. Below are the key components that should always be included in your billing statements.

1. Contact Information

Start by including your business name, address, phone number, and email address. It’s also important to include the client’s information for easy reference. Having all contact details in one place allows both parties to quickly reach out if needed.

2. Detailed Service Descriptions

Break down the work completed into clear, concise descriptions. For each service, include the quantity, unit price, and total cost. This transparency helps avoid any misunderstandings and ensures your client knows exactly what they’re being charged for.

3. Payment Terms

Clearly state the payment due date and the accepted methods of payment. Also, include any late fees or penalties for overdue payments. This section ensures that your client understands their obligations and the terms of the transaction.

4. Unique Identification Number

Each billing document should have a unique reference number for easy tracking. This identifier helps both you and your client locate the document in case of any questions or follow-ups. It also helps with your accounting and record-keeping.

5. Taxes and Additional Charges

Be sure to include any relevant taxes, fees, or surcharges. This ensures transparency and avoids confusion about the final amount due. Always check local regulations to ensure that you’re including the correct tax rate for your area.

By including these essential details, you can create a clear, professional payment request that provides all necessary information for your client and helps you stay organized in your business transactions.

Why Contractors Need Professional Invoices

For any business providing skilled services, issuing clear and professional documents outlining work completed and payment terms is essential. These documents not only ensure that you receive compensation for your services but also help to establish a trustworthy reputation with clients. A well-designed payment request provides clarity, reduces misunderstandings, and fosters stronger business relationships.

Building Trust and Credibility

When you provide a polished document that clearly outlines the services rendered and charges, it sends a message of professionalism to your clients. This can be the difference between getting paid on time or facing delayed payments. Clients are more likely to trust businesses that present themselves professionally, and a well-structured payment request contributes to this image.

Efficient Record Keeping

Professional payment documents help both you and your client keep track of what was agreed upon. Having clear records of work completed, payments made, and outstanding balances is essential for tax purposes, audits, and ensuring timely payments. It also simplifies accounting for your business, making it easier to track finances and manage cash flow.

Example of a Professional Payment Request

| Service Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Installation of Fixtures | 3 | $150 | $450 |

| System Repair | 2 | $100 | $200 |

By using clear and structured documents, you ensure that your clients know exactly what they are being billed for, which helps reduce disputes and delays in payment. A professional approach not only improves your business efficiency but also enhances customer satisfaction and trust.

Designing a Simple Invoice for Electrical Services

Creating a straightforward billing document for your services doesn’t need to be complicated. A well-designed document should clearly communicate the work performed, associated costs, and payment details, all in an easy-to-read format. Keeping it simple helps your clients understand the charges and ensures a smoother transaction process. Below are the key elements to include when designing a basic payment request for your services.

Key Components of a Simple Billing Document

A clean and simple structure is crucial for making your billing document clear and professional. Below is an example of a basic layout that includes all the necessary information while remaining easy to understand.

| Service Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Wiring Setup | 1 | $200 | $200 |

| Socket Installation | 4 | $50 | $200 |

| Inspection Fee | 1 | $100 | $100 |

| Total | $500 | ||

By keeping the format simple, you can ensure that clients can quickly review the charges and understand exactly what they are paying for. Additionally, you can add basic details such as the job date, payment terms, and contact information, which further improves the clarity and professionalism of your billing process.

How to Avoid Billing Mistakes

Ensuring accuracy in your billing documents is crucial for maintaining good relationships with clients and ensuring timely payments. Mistakes can lead to confusion, delayed payments, and even disputes. Here are some practical tips to help you avoid common errors when creating payment requests.

1. Double-Check All Information

One of the most important steps is to review all details before sending a document. Verify that the client’s name, contact details, and service descriptions are correct. Small mistakes, such as a misspelled name or wrong address, can create confusion and delay payments.

2. Be Clear with Service Descriptions

Ensure that each service provided is described clearly, with enough detail for the client to understand what was done. Avoid vague terms and instead, list specific tasks, quantities, and rates. This clarity helps prevent misunderstandings about what the charges are for.

3. Include Accurate Pricing

Confirm that the pricing for each service is correct. Use consistent rates and make sure any discounts, taxes, or additional fees are properly applied. Recheck the final total to avoid any discrepancies between the listed price and the amount due.

4. Set Clear Payment Terms

Clearly outline the payment methods you accept and the due date for payment. Indicate any late fees or penalties for overdue payments to avoid confusion later. Ambiguity in payment terms can lead to delays and frustration for both you and your client.

5. Keep Records of Every Transaction

Maintain a copy of each document sent and any correspondence related to payments. This will help you track outstanding balances and easily reference past transactions in case any issues arise.

By taking these precautions, you can significantly reduce the risk of errors in your billing process, ensuring smoother transactions and a professional reputation.

Key Features of an Electrical Invoice Template

A well-designed payment request document ensures that all the necessary details are clearly presented, helping both the service provider and the client stay organized. By including specific components, you can make your billing process efficient, transparent, and professional. Below are the key features that every effective billing document should have.

Essential Components

To ensure that your billing statement is comprehensive and easy to understand, consider including the following details:

| Feature | Description |

|---|---|

| Contact Information | Include both your business and client details to ensure easy communication and proper tracking of the transaction. |

| Service Descriptions | Clearly outline the tasks performed, the quantity, and the unit price to avoid any confusion regarding charges. |

| Payment Terms | State when payment is due, the available methods of payment, and any late fees or penalties for overdue payments. |

| Unique Reference Number | Assign a unique identification number to each document for easy tracking and future reference. |

| Tax and Additional Fees | Clearly display any applicable taxes or extra charges, ensuring transparency and compliance with local laws. |

Including these key features helps create a professional and organized payment request, ensuring that all parties understand the charges and payment expectations. It also simplifies record-keeping and makes the overall process more efficient.

What to Include in an Electrical Invoice

Creating a payment document that clearly outlines the services provided, the charges, and the terms of payment is essential for maintaining a smooth and professional business transaction. To ensure clarity and avoid misunderstandings, it is important to include key details in your document. Here are the essential elements that should be part of any service billing statement.

1. Service Description and Breakdown

Clearly list the work completed, including a detailed description of each task, the time spent, and the individual charges for each service. This transparency ensures the client understands exactly what they are paying for. It also helps to avoid any potential disputes regarding the scope of work.

2. Payment Terms and Due Date

Specify when the payment is due, the accepted methods of payment, and any penalties or fees for late payments. Setting clear expectations around payment will help ensure that both parties are on the same page and can help reduce delays in processing payments.

By including these crucial details, your payment document will be clear, professional, and transparent, helping to build trust with your clients and ensuring that the transaction goes smoothly.

Legal Requirements for Electrical Invoices

When creating a payment request document for your services, it is important to ensure compliance with relevant legal standards. Different jurisdictions may have specific requirements that must be met for the document to be legally valid. These requirements help protect both the service provider and the client, ensuring that both parties have a clear understanding of the terms of payment and service. Below are the key legal aspects to consider when preparing a payment document.

1. Business Information

Service Provider Details: Your business name, address, and contact information must be clearly listed on the document. In many regions, it is required by law to include these details for transparency and record-keeping purposes. This allows your clients to easily identify you and provides proof of your business’s legitimacy.

2. Client Information

Client Details: Similarly, the client’s name and address should be included. This ensures that the payment request is directed to the correct person or organization and helps in case of any disputes or clarifications in the future.

3. Service Description and Dates

Work Details: You must include a detailed description of the services provided, including the dates when the work was performed. This helps establish a clear record of the transaction and ensures that both you and the client understand the scope of the work completed.

4. Tax Information

Taxes and VAT: Depending on your location, you may be required to include the appropriate sales tax or value-added tax (VAT) on your document. Ensure that the tax rate is applied correctly and that it is clearly itemized. Failure to include this information could result in legal complications or penalties.

5. Payment Terms and Deadlines

Payment Terms: Clearly outline the payment due date, accepted payment methods, and any applicable late fees. Some regions require specific wording or guidelines for payment terms to be legally binding, so it’s essential to be precise and transparent about these details.

By following these legal requirements, you ensure that your billing documents are not only professional but also compliant with local regulations, providing both you and your client with clear legal protections.

Free Invoice Templates vs Paid Software

When deciding how to manage your billing process, you have two main options: using free documents available online or opting for a paid software solution. Both approaches have their own advantages and limitations. Understanding the differences can help you choose the best option for your business, whether you’re just starting or looking to scale your operations.

Advantages of Free Templates

Free billing documents are a great option for small businesses or individuals who need a straightforward solution without additional costs. These templates are usually simple to use and can be customized with your business details. They are available in a variety of formats, such as Word, Excel, or PDF, making them accessible to almost anyone. Some benefits include:

- No cost: These are usually completely free, making them a budget-friendly option.

- Easy customization: You can quickly adjust them to suit your business and service type.

- Quick setup: Download, fill out, and send – it’s an easy and fast process.

Disadvantages of Free Templates

While free documents may be a good start, they can also come with limitations. They often lack advanced features such as automation, integration with accounting software, or detailed reporting. Additionally, you may need to manually calculate totals, taxes, and apply discounts, which can increase the chance of errors.

Advantages of Paid Software

Paid software solutions typically offer more robust features, including automated calculations, customized reporting, and integration with your financial management tools. These platforms can save you time and help streamline your business processes. Key benefits include:

- Automation: Software can automate calculations, apply tax rates, and even generate recurring bills, minimizing errors.

- Customization: Paid solutions offer more options for customizing your documents, including branding and advanced formatting.

- Reporting and Analytics: These platforms often include detailed reports to track your income, expenses, and overall business performance.

Disadvantages of Paid Software

On the downside, paid software usually comes with a subscription fee, which may not be ideal for very small businesses or freelancers who don’t need advanced features. Additionally, some tools can have a learning curve, requiring a bit of time to become familiar with their functions.

Ultimately, the decision between free documents and paid software depends on your business needs. If you only need a simple solution and have limited resources, free documents may be the best choice. However, if you’re looking for more features, convenience, and time-saving tools, a paid solution may be worth the investment in the long run.

Improving Cash Flow with Proper Invoicing

Maintaining healthy cash flow is essential for the long-term success of any business. One of the most effective ways to ensure timely payments and improve your financial stability is by issuing accurate and professional billing statements. When done correctly, these documents help you get paid faster and reduce the risk of payment delays. Below, we explore how proper billing practices can positively impact your cash flow.

1. Prompt and Clear Payment Requests

One of the simplest ways to improve your cash flow is by ensuring that payment documents are issued promptly and with clear terms. Delaying your billing can lead to delayed payments, which negatively affect your cash flow. Always send your request as soon as the service is completed, and make sure the document clearly outlines the payment due date, total amount, and accepted payment methods.

2. Payment Terms and Conditions

Establishing clear payment terms can help prevent delays. Specify the due date, the payment methods you accept, and any penalties for overdue payments. For example, offering early payment discounts or charging interest on late payments can incentivize clients to pay sooner, helping to improve cash flow. Additionally, setting up automatic reminders for overdue payments can reduce the chances of missed payments.

Example of Clear Payment Terms

| Service Description | Amount | Payment Due Date | Late Fee |

|---|---|---|---|

| Installation of Lighting | $500 | 30 days from completion | 5% after 30 days |

| System Inspection | $250 | 15 days from completion | 5% after 15 days |

By establishing clear and firm terms from the start, clients will be more likely to prioritize your payments. Well-organized and prompt documentation ensures you can avoid cash flow interruptions and maintain a steady flow of income for your business.

How to Send Invoices to Clients

Sending billing documents to clients is a crucial step in ensuring timely payments and maintaining a professional relationship. It’s important to choose the right method of delivery and include all necessary information to make the process smooth and efficient. Below, we’ll explore the best practices for sending payment requests to clients and how to do so in a way that promotes clear communication and quick processing.

1. Choose the Right Delivery Method

There are several methods available for sending billing statements, and choosing the right one depends on your business model and client preferences. The most common options include:

- Email: Sending documents via email is one of the quickest and most efficient ways to deliver payment requests. It is paperless, easily accessible, and allows you to send reminders and follow-up messages as needed.

- Postal Mail: Some clients may prefer physical copies of their documents, especially if they are older or operate in a more traditional manner. Mailing a hard copy is also an option if you want to include additional documents or contracts.

- Online Payment Portals: If you use any accounting or financial software, you can send your billing documents directly through the system, allowing clients to pay online easily and securely.

2. Ensure Proper Formatting and Clear Details

Regardless of the method you choose, it is essential to ensure that your billing document is formatted professionally and contains all the necessary information. This includes:

- Business and client contact details

- A detailed breakdown of services rendered or products provided

- The total amount due and payment terms

- Clear instructions on how to make the payment (bank details, online payment links, etc.)

Example of Payment Request Details

| Service | Description | Amount |

|---|---|---|

| Installation | Wiring and fitting of lights in living room | $350 |

| Inspection | Safety check and system

Common Errors in Electrical Invoices

Even the most experienced businesses can make mistakes when preparing payment documents. These errors can cause confusion, delays, or even damage professional relationships. It’s essential to be aware of common mistakes to avoid them and ensure that your payment requests are clear, accurate, and professional. Below are some of the most frequent issues businesses face when creating and sending payment statements. 1. Incorrect Client InformationClient details: One of the most common errors is failing to accurately include the client’s name, address, or contact information. This can cause confusion and make it difficult for the client to process the payment. Always double-check that all client information is correct before sending the document. 2. Missing or Incorrect Payment TermsPayment terms: Another common mistake is not specifying the payment due date, the acceptable methods of payment, or any late fees. Without these details, clients may delay payments or misunderstand the expectations. Be sure to include clear and precise payment terms to avoid potential issues. 3. Calculation ErrorsMath mistakes: Whether it’s the subtotal, taxes, or final amount due, calculation errors are among the most common mistakes when preparing billing documents. These errors can lead to undercharging or overcharging, creating complications for both parties. Double-check all figures, including discounts and taxes, to ensure they are correct. 4. Lack of Service DescriptionsAmbiguous descriptions: When the services rendered are not clearly listed or described, clients may not understand exactly what they are paying for. Providing a detailed breakdown of the work completed is essential. This helps avoid confusion and ensures that clients feel confident about the charges. 5. Not Including Legal InformationLegal requirements: Depending on the location and nature of your business, there may be legal requirements that must be included in your payment document. This might include business registration numbers, tax identification numbers, or other regulatory information. Failing to include these details could lead to issues with compliance or tax reporting. Avoiding these common errors is crucial for maintaining professional relationships with your clients and ensuring smooth transactions. Always take the time to double-check your documents for accuracy and completeness before sending them out. Where to Find Free Invoice Templates OnlineFor those looking to streamline their billing process, there are a variety of online resources where you can find no-cost, ready-to-use payment documents. These resources can help simplify the billing process by providing professional-looking forms that can be customized to suit your business needs. Whether you prefer a simple design or a more detailed layout, there are many platforms that offer useful tools to make invoicing faster and easier. 1. Online Document Creation ToolsMany online platforms allow you to create customized billing documents for free. These tools typically offer a variety of styles and formats, allowing you to choose the design that best fits your business. Some popular options include:

2. Websites Offering Free Downloads

If you prefer to simply download a pre-made form without the need for customization, there are many websites that offer free templates for you to use. These websites often provide a variety of design options, from basic to more advanced, that can be downloaded as PDFs or Word documents. Some reliable sites include:

3. Using Accounting Software with Free FeaturesAnother great way to find billing documents is by using accounting software that offers free features. Some accounting tools provide basic billing functionality without requiring a paid subscription, making them a good option for small businesses and freelancers. These platforms typically allow you to create, send, and track payment requests all in one place. A few options include:

Table of Top Free Resources for Invoice Documents |