Editable Sales Invoice Template for Quick and Professional Invoicing

Efficient management of financial transactions is crucial for any business, whether it’s a small startup or a large corporation. Having a system in place that allows for the quick generation of clear and professional financial documents can save time, reduce errors, and improve client relations. This article explores how to enhance your billing workflow by using documents that can be easily customized to suit your specific needs.

By leveraging flexible solutions, businesses can ensure that their charging statements are not only accurate but also reflect their brand identity. A well-designed billing form includes all necessary details, from itemized lists to payment terms, while being easy to modify as needed. Whether you’re invoicing one client or managing a high volume of transactions, knowing how to tailor these documents can lead to a more organized and streamlined process.

Customizable billing formats offer businesses the flexibility to adapt to different situations. They allow for quick adjustments, whether it’s for changing tax rates, adding discount options, or updating the format to reflect new business services. These adaptable solutions ensure consistency and professionalism while minimizing the risk of confusion or mistakes.

Customizable Billing Document Overview

Creating professional billing documents tailored to your specific needs can simplify the entire financial process for any business. The ability to modify essential details, such as customer information, itemized charges, and payment terms, allows for greater flexibility and accuracy. These documents can be adjusted to reflect different types of transactions and business requirements, offering both efficiency and professionalism.

Key Features of Custom Billing Documents

- Ability to update client details quickly

- Easy customization of item descriptions and prices

- Flexible layout that adjusts to business branding

- Option to add or remove fields as needed

- Simple integration with accounting software

These features make customizable billing formats ideal for a range of businesses. From freelancers to large enterprises, anyone can benefit from having the ability to create accurate and personalized financial statements in no time.

Why Customizable Formats Matter for Businesses

- Increases efficiency by saving time on document creation

- Reduces errors by ensuring consistency across all documents

- Enhances professional appearance, improving customer perception

- Allows for quick adjustments based on changing regulations or internal policies

Using a system that enables easy updates and modifications ensures that your billing process is always up-to-date and aligned with your company’s needs, while also fostering trust with clients.

Why Use a Customizable Billing Document

Having the ability to easily adjust billing forms can significantly streamline the way a business handles transactions. When working with a document that can be tailored to fit different circumstances, businesses gain more control over their financial communication. Whether for a one-time project or a recurring service, a flexible approach to generating payment requests ensures that every document is both accurate and professional.

Customization offers several benefits, including saving time on document creation, reducing the risk of errors, and increasing the overall efficiency of your operations. A form that can be quickly modified allows businesses to respond to changing client needs, tax laws, or internal procedures without the hassle of starting from scratch each time.

Flexibility is crucial in today’s fast-paced business environment. The ability to adjust fields like payment terms, service descriptions, or even client information ensures that you can keep up with evolving business demands while maintaining consistency across all your financial documents. This flexibility not only improves accuracy but also helps businesses present themselves in a more polished and professional light.

Benefits of Customizable Billing Documents

Having the option to adjust billing forms offers numerous advantages that can enhance the efficiency and accuracy of any business’s financial processes. With a flexible system, companies can easily modify essential details, ensuring that each document is tailored to fit specific client needs, business requirements, or regulatory changes. This ability to make quick updates can save valuable time and reduce the risk of mistakes, providing greater control over the entire billing cycle.

One of the primary benefits is improved efficiency. Customizing documents on the fly eliminates the need to create new forms from scratch, allowing businesses to quickly adapt to changes. Whether adjusting pricing, adding new services, or updating contact information, businesses can make these changes within minutes, avoiding delays in payment processing.

Consistency is another major advantage. A customized form can be designed to match a company’s branding, ensuring that every document sent to clients looks professional and uniform. This consistency not only boosts brand image but also creates a seamless experience for customers, who will become familiar with the layout and information structure.

Additionally, customizable formats ensure accuracy. When businesses can easily modify documents, they can include the most up-to-date and correct information, reducing the chances of errors that could lead to misunderstandings or payment delays. Whether it’s adjusting terms or including detailed item descriptions, businesses can ensure that all relevant information is captured correctly every time.

How to Create a Billing Statement

Creating a well-structured billing statement is an essential skill for any business. A clear and accurate document helps ensure that clients understand the charges and provides all the necessary details to facilitate smooth payments. The process of creating such a document involves a few simple steps, ensuring that all key information is included and formatted correctly.

The first step is to include the business and client information. This includes the name, address, and contact details of both parties. It’s important to ensure that all details are accurate, as this establishes a professional impression and prevents any confusion. Be sure to include a unique reference number to easily track each transaction.

Next, list the products or services provided in detail. Include item descriptions, quantities, and individual prices. This breakdown ensures transparency and helps clients understand exactly what they are being charged for. It’s important to clearly state whether any discounts or adjustments are applied to the final amount.

After outlining the charges, make sure to include payment terms and due dates. Clearly state when the payment is due, as well as any late fees or interest that may be applicable. Including this information ensures that clients are aware of their obligations and helps prevent delays in payment.

Finally, be sure to include a total amount due, as well as any applicable tax or additional charges. This final sum should be clearly visible and easy to locate on the document to avoid confusion. With these key elements in place, your document will be clear, professional, and ready for use.

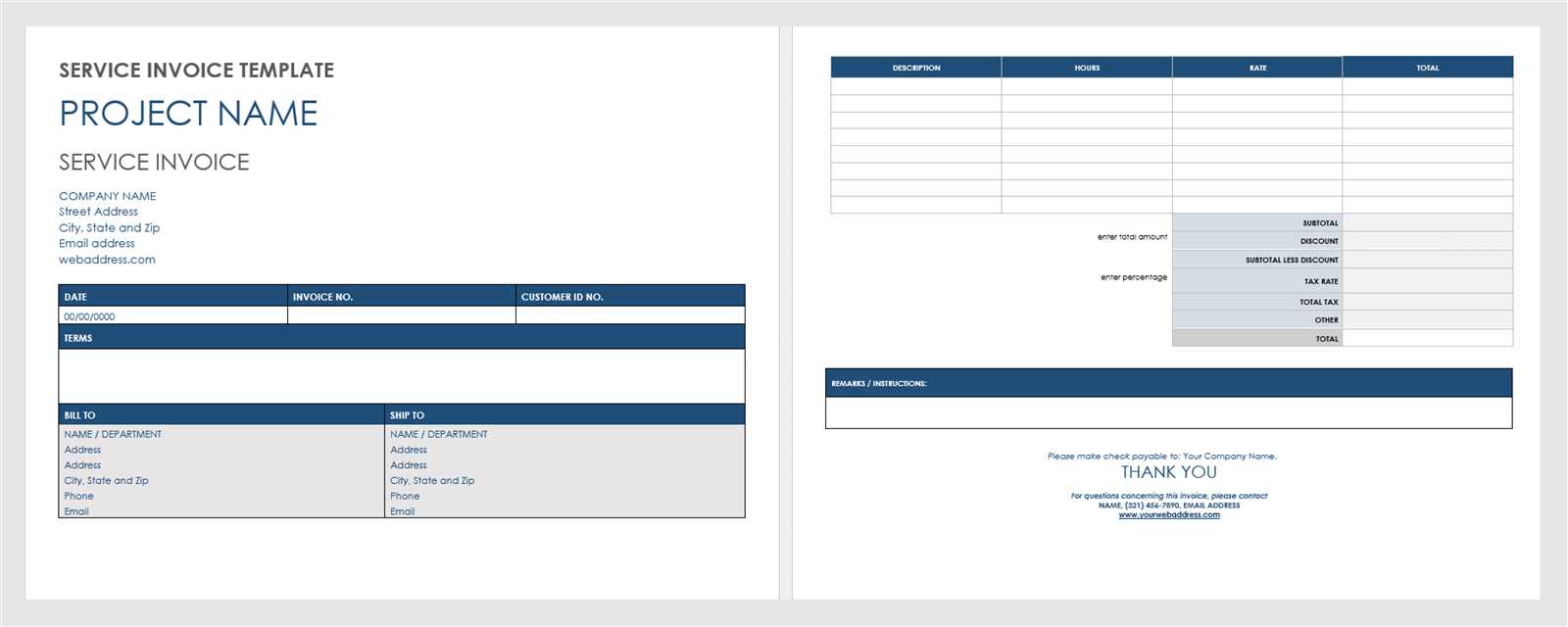

Essential Elements of a Billing Document

Creating a professional and clear financial document requires including specific details that ensure transparency and facilitate smooth transactions. A well-structured form provides both the business and the client with all the necessary information to understand the charges, payment terms, and other important conditions. The following sections highlight the key elements that should be included in every billing document.

1. Business and Client Information

At the top of the document, include the business’s name, address, and contact details. It’s equally important to provide the client’s information, including their full name or company name, address, and contact details. This ensures that both parties are clearly identified, which is essential for legal and record-keeping purposes.

2. Itemized List of Products or Services

One of the most crucial components of any billing document is the breakdown of charges. Include a detailed list of products or services provided, including their quantities, descriptions, and individual prices. This list should be clear and easy to read, as it allows the client to understand exactly what they are paying for. Any discounts, promotions, or adjustments should also be noted in this section.

3. Payment Terms and Conditions

Clearly state the payment due date, along with any applicable terms such as late fees, early payment discounts, or installment options. This section helps avoid misunderstandings and ensures that both parties are on the same page regarding the timing and conditions of payment.

4. Total Amount Due

The total amount due should be prominently displayed at the bottom of the document. This final sum should include all applicable taxes, discounts, and fees. It is important that this amount is clearly visible to avoid confusion and ensure prompt payment.

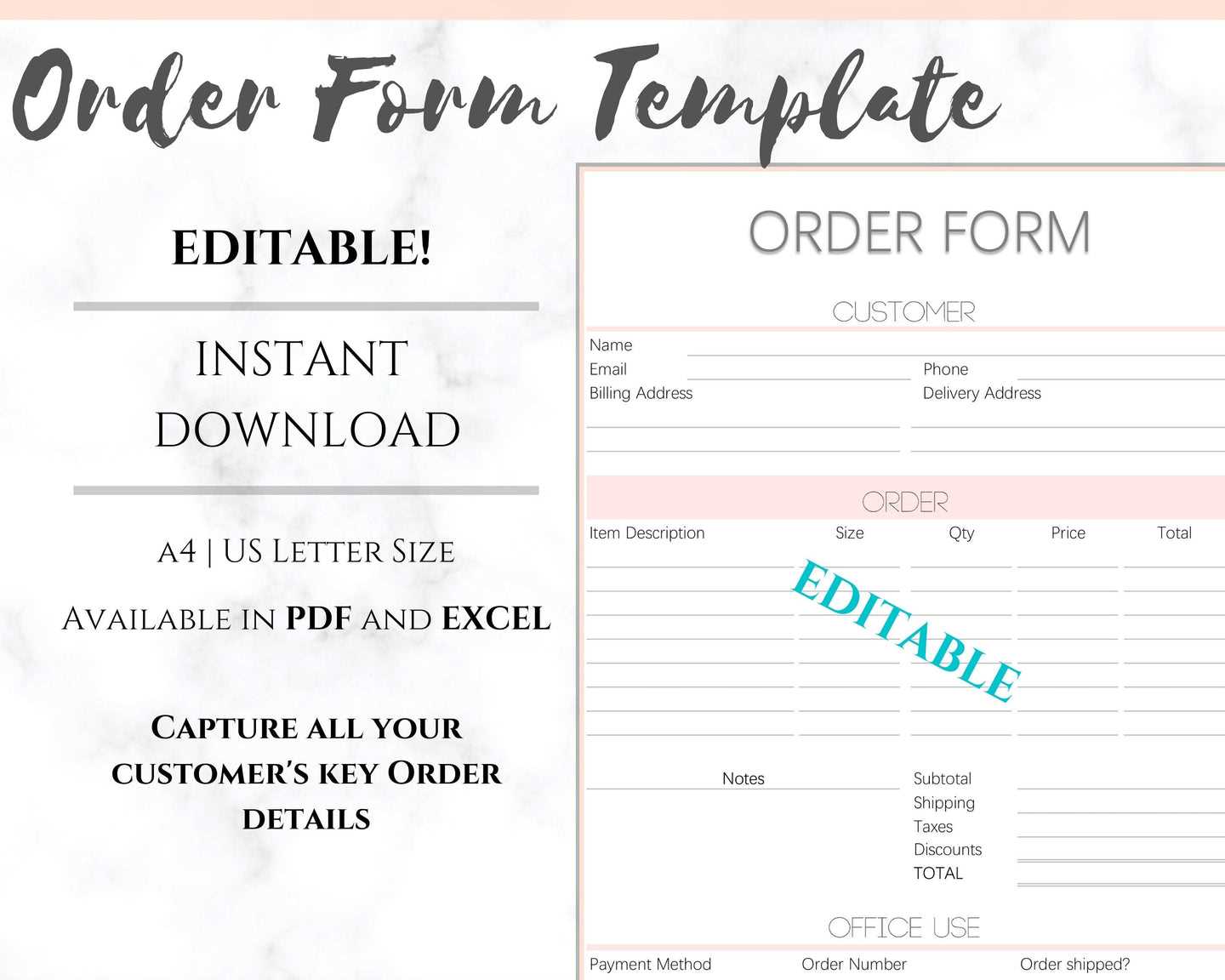

Common Formats for Billing Documents

There are several formats available for creating professional billing documents, each offering its own set of features and advantages. The choice of format often depends on the specific needs of a business, such as the volume of transactions, level of customization required, and integration with other tools. Understanding the most common formats can help you select the one that best suits your business operations and client communication style.

One of the most widely used formats is the PDF file. PDFs offer a high level of security and are easily shareable across different platforms and devices. They maintain a fixed layout, ensuring that the document appears exactly the same to both the sender and the recipient, regardless of the software or device used to view it.

Excel files are another popular format, particularly for businesses that need to create multiple documents quickly or perform calculations directly within the billing form. The ability to integrate formulas for automatic calculations makes Excel a time-saving tool, particularly for businesses that deal with variable prices or discounts.

For those seeking flexibility, Word documents can be a good choice. They allow for easy customization and editing, with the added benefit of being user-friendly and compatible with most word processing software. Word files are ideal for businesses that need to frequently adjust the content or layout of their billing statements while still maintaining a professional appearance.

Lastly, online platforms and accounting software offer cloud-based formats that are increasingly popular. These systems allow businesses to generate, send, and track billing documents in real-time, often integrating seamlessly with inventory management, customer databases, and payment processing systems. Online platforms are particularly valuable for businesses that want to automate the entire billing process and improve overall efficiency.

Choosing the Right Billing Document Format

Selecting the most suitable format for your billing documents is a crucial decision that can impact the efficiency and professionalism of your financial processes. The right choice will depend on various factors, including the size of your business, the complexity of your transactions, and how frequently you need to generate or update your documents. It’s important to consider several key aspects when making your selection to ensure the chosen option fits your business needs.

Key Considerations When Choosing a Billing Document Format

- Ease of Use: Consider how easy it is to customize and use the document format. If you require frequent updates or changes, a format that allows for quick adjustments will save you time.

- Branding Flexibility: Choose a format that lets you incorporate your business logo, colors, and other branding elements. Consistency in presentation helps reinforce your business identity.

- Compatibility: Ensure that the chosen format works well with the software tools you already use, such as accounting programs or customer relationship management systems.

- Client Preferences: Some clients may prefer specific formats (e.g., PDFs for secure document sharing or Excel for detailed breakdowns). Being able to meet these preferences can help maintain strong client relationships.

- Automation Features: If your business deals with a high volume of transactions, consider using a format that integrates automation features, such as automatic calculations or batch processing, to speed up the process.

Common Format Options to Consider

- PDF: Ideal for fixed and finalized documents that need to be shared electronically. This format maintains formatting consistency across all devices and platforms.

- Excel: Great for businesses that need flexibility in calculations, such as for variable pricing or discounts. Excel is also useful for tracking multiple documents in one spreadsheet.

- Word: A versatile format for businesses that require frequent customization or personalization of their documents. It allows for easy editing while keeping a professional look.

- Online Tools: Cloud-based formats that integrate directly with your business’s accounting and customer management systems. These platforms are ideal for businesses looking to automate their billing processes.

By carefully evaluating these factors, you can choose the most efficient and effective format for your billing documents, ensuring that they are both functional and professional.

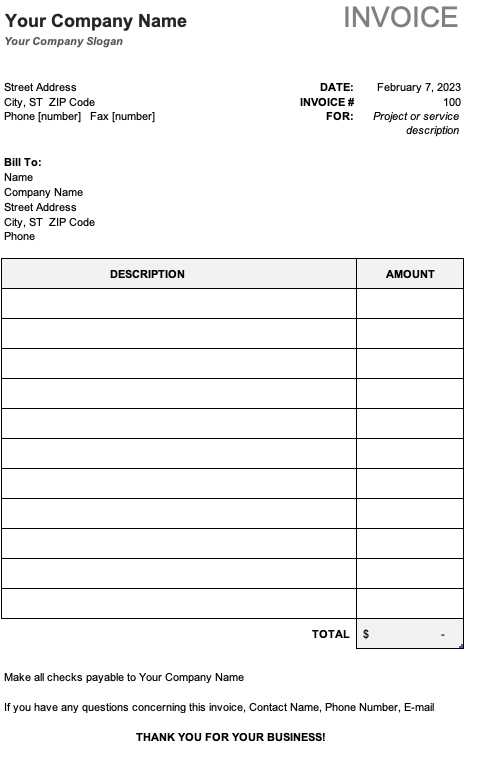

How to Customize Your Billing Document

Customizing your billing document ensures that it meets your specific needs and reflects your business’s unique style. A tailored document not only improves clarity but also enhances professionalism, helping you stand out and maintain a consistent image. The customization process involves adjusting various sections to include relevant information, modify the layout, and align with your branding. Below are the key steps to follow in order to make the necessary adjustments to your billing forms.

Steps for Customizing Your Billing Document

- Update Business Information: The first step is to add your company’s name, address, phone number, email, and logo. This ensures your branding is clearly visible and gives your document a professional touch.

- Adjust Client Details: Make sure you have the correct contact information for each client, including their name, address, and any other specifics needed for that transaction. This will help avoid mistakes and ensure smooth communication.

- Modify the Item List: Review the products or services you are charging for and update descriptions, quantities, and prices. Include any applicable discounts, taxes, or additional fees to reflect the accurate total.

- Set Payment Terms: Customize payment due dates, late fee policies, or any special conditions related to that particular transaction. This clarifies expectations and helps avoid confusion.

- Include Additional Notes: You can add personalized messages or instructions, such as a thank-you note or payment instructions, to enhance client relationships.

Tips for Effective Customization

- Consistency in Design: Ensure the layout, font, and color scheme match your brand guidelines for a cohesive look.

- Clear and Simple Language: Use straightforward language to describe services, payment terms, and other details to avoid any misunderstandings.

- Keep the Format Clean: A cluttered document can confuse clients. Keep the design simple, with adequate spacing between sections, and make the most important information stand out.

By following these steps and tips, you can easily create a billing document that not only meets your business needs but also presents a polished a

Free vs Paid Billing Documents

When choosing a format for creating billing documents, businesses often face the decision between free and paid options. Both come with their own advantages and limitations, and understanding these differences can help you make the best choice based on your specific needs. Whether you’re a freelancer, a small business owner, or part of a larger organization, each type has distinct features that can impact efficiency, customization, and overall functionality.

Advantages of Free Billing Documents

- Cost-Effective: The most obvious benefit of free options is that they come at no cost, making them ideal for startups or small businesses with limited budgets.

- Ease of Access: Many free templates are available online and can be downloaded or used instantly. This provides quick solutions for those in need of a simple document.

- Basic Functionality: Free formats typically include essential features like client details, item descriptions, and total amounts due, making them suitable for businesses with straightforward billing needs.

Advantages of Paid Billing Documents

- Advanced Customization: Paid solutions often offer a higher degree of customization, allowing businesses to create fully tailored documents that match their branding and specific needs.

- Professional Designs: Paid options typically feature more polished, professional designs that enhance the overall appearance of your documents, creating a stronger impression on clients.

- Integrated Features: Paid formats often come with built-in features such as automatic calculations, tax settings, and the ability to connect to accounting software for seamless integration and more efficient workflow.

- Customer Support: Paid options usually provide access to customer support, ensuring that any issues or questions can be addressed quickly by professionals.

Ultimately, the choice between free and paid options comes down to the complexity of your business needs. While free formats are perfectly fine for simple transactions, paid solutions may be worth the investment if you require more customization, advanced features, or a more professional appearance.

How to Save Time with Customizable Documents

When managing financial transactions, time is of the essence. The ability to quickly generate accurate and professional billing documents can significantly streamline your workflow and reduce the time spent on administrative tasks. Customizing your documents to suit your specific needs can save valuable hours, enabling you to focus on more important aspects of your business.

Key Ways Customizable Documents Save Time

- Quick Personalization: Customizable formats allow you to easily adjust client details, product descriptions, and pricing without needing to start from scratch. You can reuse the same structure and only update the relevant fields, speeding up the process.

- Automatic Calculations: Many customizable documents come with built-in calculation functions, such as tax and discount calculations, which help eliminate manual errors and speed up the process of determining totals.

- Pre-filled Fields: By saving common information, such as business address, payment terms, and service descriptions, you can quickly generate documents without re-entering the same data each time.

- Integration with Other Tools: Some customizable formats can be integrated with accounting software or client databases, allowing data to be pulled automatically, further reducing the need for manual input and ensuring accuracy.

Benefits Beyond Time-Saving

- Consistency: With a predefined structure, each document you generate will maintain a consistent format, improving your professional image and reducing errors caused by discrepancies in layout or content.

- Less Stress: The ability to quickly create and send billing documents reduces the administrative burden, helping you stay on top of your financial processes with less effort and worry.

By utilizing customizable billing documents, businesses can significantly reduce the time spent on creating and managing financial paperwork, freeing up more time for other essential tasks and improving overall efficiency.

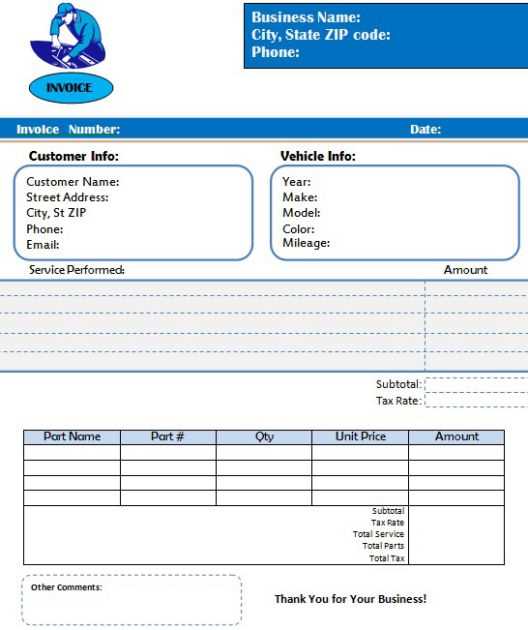

Billing Documents for Small Businesses

For small businesses, creating clear, professional, and accurate billing statements is crucial to maintaining cash flow and establishing trust with clients. A well-designed billing document can make the entire process more efficient, reducing administrative burdens and ensuring that all financial transactions are recorded correctly. Small business owners often seek customizable solutions that can scale with their needs while keeping costs manageable.

Why Small Businesses Need Customizable Billing Forms

Small businesses benefit from having a billing document that can be quickly tailored to different clients, services, or products. Whether it’s a one-time service or a recurring project, having the ability to adjust details such as payment terms, item descriptions, and pricing can save time and ensure accuracy. Customizable documents provide the flexibility to include any necessary details without having to create new forms from scratch for every transaction.

Furthermore, such forms help maintain a consistent brand image. By adding your business logo, using the same layout for all documents, and keeping the design simple but professional, your clients will receive a consistent, high-quality impression. This consistency also reinforces your business’s credibility and ensures that all communication is clear and easily understood.

Key Features of an Effective Billing Form for Small Businesses

- Client and Business Information: Clearly display the name, address, and contact details of both your business and the client. This section serves as a reference for any correspondence and ensures there are no misunderstandings.

- Detailed List of Services or Products: Provide a breakdown of the services rendered or goods sold. Include item descriptions, quantities, and unit prices to ensure transparency.

- Payment Terms: Specify the due date for payment, any late fees, and accepted payment methods. This is critical for avoiding payment delays and ensuring that clients understand your expectations.

- Total Amount Due: Clearly state the total amount due, including applicable taxes, fees, or discounts, to ensure the client knows exactly what they are paying.

By utilizing a

Integrating Billing Documents with Accounting Software

Efficient financial management is essential for any business, and one way to streamline your workflow is by integrating your billing documents with accounting software. This integration allows for automated tracking, faster processing, and better financial visibility, reducing the manual effort required to manage your accounts. By connecting your billing system with accounting tools, businesses can maintain accurate records and improve overall financial efficiency.

Benefits of Integrating Billing Documents with Accounting Tools

- Automation of Data Entry: When your billing documents are integrated with accounting software, the data from your transactions can be automatically imported, reducing the need for manual input. This minimizes errors and ensures accurate financial records.

- Real-Time Tracking: Integration allows for real-time updates on payments, outstanding balances, and financial status. This helps businesses stay on top of cash flow and avoid delays in follow-up with clients.

- Improved Accuracy: By linking your billing documents to accounting software, you ensure that all numbers, taxes, and totals are calculated automatically, reducing the risk of human error and discrepancies.

- Faster Financial Reporting: The data from your billing documents can be directly used for generating financial reports, such as profit and loss statements, tax reports, and balance sheets. This saves time and provides a clear financial picture with minimal effort.

How to Integrate Billing Documents with Accounting Software

- Choose Compatible Software: Select accounting software that allows integration with your billing system. Many platforms offer native integrations or third-party plugins for popular accounting software like QuickBooks, Xero, or FreshBooks.

- Enable Data Sync: Set up automatic synchronization between your billing platform and accounting software. This ensures that every transaction, payment, or adjustment is reflected in your financial records.

- Customize for Your Needs: Tailor your integration settings to suit your business requirements, such as adjusting tax rates, currencies, or invoicing frequencies. Customization helps optimize the flow of data and ensures accuracy.

Integrating your billing documents with accounting software simplifies financial processes, enhances accuracy, and ensures timely reporting. This integration ultimately saves time, reduces errors, and enables better decision-ma

Best Practices for Professional Billing

Maintaining a professional approach to creating and managing billing documents is essential for building trust with clients and ensuring timely payments. By following best practices, businesses can streamline their billing process, reduce errors, and present a polished image that enhances client relationships. Professionalism in billing not only reflects well on your business but also helps avoid misunderstandings and payment delays.

Key Principles for Effective Billing

- Clarity and Accuracy: Ensure that all details on the document are accurate, including client information, product descriptions, quantities, and pricing. Clear and precise information prevents confusion and delays in payment.

- Consistent Branding: Always include your business logo, color scheme, and any relevant brand elements on your billing documents. Consistency reinforces your business identity and builds credibility.

- Professional Language: Use polite and clear language, especially in payment terms and conditions. Professionalism in your tone can positively impact the client’s perception of your business.

- Timely Issuance: Issue billing documents promptly after the product is delivered or service is rendered. A quick turnaround reflects well on your business practices and encourages timely payments.

Effective Formatting Tips

- Simple Layout: Keep the layout clean and organized. Use headings, bullet points, and appropriate spacing to make the document easy to read and navigate.

- Clear Payment Terms: Specify the payment due date, accepted methods, and any applicable late fees or discounts. This transparency helps set clear expectations and reduces potential conflicts.

- Include Contact Information: Always provide your contact details on the document, making it easy for clients to reach you in case of questions or concerns.

By adhering to these best practices, businesses can enhance their billing process, ensure smoother transactions, and project a professional image that fosters trust and long-term client relationships.

Legal Considerations for Billing Documents

When creating billing documents, it is important to ensure that they comply with the legal requirements set forth by local, national, or international laws. Accurate and legally compliant billing practices not only protect your business but also help maintain transparency with clients. Failing to meet legal standards could result in penalties, disputes, or even legal action. Therefore, understanding the key legal considerations involved is essential for businesses of all sizes.

Key Legal Aspects to Include in Billing Documents

- Correct Business Information: Always include your registered business name, address, and relevant tax identification numbers. This helps ensure that your documents are legally valid and recognizable by tax authorities.

- Client Identification: Ensure that the client’s details, such as name and billing address, are accurate. Including this information helps in identifying both parties for legal purposes and prevents disputes over transactions.

- Tax Information: Most jurisdictions require that taxes be clearly stated on billing documents. Be sure to include the appropriate tax rate, tax number, and any applicable exemptions. This is especially important for businesses that operate across different regions or internationally.

- Payment Terms: Clearly outline the payment terms, including the due date, penalties for late payments, and accepted methods of payment. These terms serve as the foundation for resolving disputes if a payment is delayed or incomplete.

- Detailed Itemization: Providing a clear breakdown of the products or services provided, along with their prices, ensures that both parties understand the terms of the transaction. This also serves as a record for tax reporting and audit purposes.

Legal Risks and How to Avoid Them

- Non-compliance with Tax Laws: Failure to include the correct tax details or charging the wrong tax rates can lead to fines. Make sure your billing documents are in line with local tax laws and update them regularly to reflect any changes.

- Missing Payment Deadlines: Not specifying clear payment deadlines or terms can lead to confusion. Clearly state payment due dates and any penalties for late payments to avoid misunderstandings with clients.

- Inadequate Documentation: Insufficient information on your billing documents may make it difficult to prove the legitimacy of a transaction. Always ensure that your documents are complete and thorough to protect your business legally.

By understanding and implementing the proper legal considerations, businesses can ensure that

How to Handle Tax in Billing Documents

Correctly managing tax on billing documents is crucial for maintaining compliance with local, national, and international tax laws. It ensures that your business is accurately reporting sales, avoiding penalties, and providing clarity to your clients. The way tax is applied to transactions can vary depending on location, type of product or service, and the tax regulations governing the sale. Properly addressing these factors on your billing documents can save you time and prevent legal issues down the line.

Steps to Properly Include Tax on Billing Documents

- Determine the Applicable Tax Rate: The first step is to identify the correct tax rate for the transaction. This can vary based on the region, the nature of the products or services, and whether the transaction is subject to local or state taxes. Ensure you are using the latest rates as tax laws can change periodically.

- Clearly Itemize the Tax: Include a separate line for tax in your document to provide full transparency to your client. Make it clear whether the tax is inclusive or exclusive of the total price. This will help avoid confusion and set the right expectations regarding payment.

- Specify the Tax Jurisdiction: If your business operates in multiple regions, specify the relevant tax jurisdiction on the document to indicate the source of the tax rate. This can be helpful if your client is inquiring about different tax regulations based on their location.

- Apply Tax on the Correct Amount: Ensure that tax is applied to the correct base amount. For example, tax should be calculated on the total sale price, including any applicable discounts or surcharges, but not on shipping charges unless specified by law.

Common Tax Issues to Avoid

- Incorrect Tax Rates: Using outdated or incorrect tax rates can lead to overcharging or undercharging your clients. It’s important to regularly review and update tax rates in your billing system to ensure compliance.

- Failure to Specify Exemptions: Some goods or services may be tax-exempt depending on the region or type of transaction. Be sure to highlight any exemptions on the document to ensure accuracy.

- Not Including Tax Breakdown: Clients appreciate knowing exactly how much they are paying in tax. Providing a clear breakdown can help avoid confusion and establish trust in your billing process.

By correctly handling tax on your billing documents, you can ensure compliance with tax laws, provide transparency to your clients, and maintain the accuracy of your financial records. This careful attention to detail helps avoid costly mistakes and ensures smooth transactions for your business.

Design Tips for a Clean Billing Layout

Creating a clear and professional layout for your billing documents is essential for both usability and aesthetics. A well-designed document not only enhances the client’s experience but also helps ensure that all important information is easy to find. A clean layout can prevent confusion, speed up processing, and project a polished image of your business. Focus on simplicity, readability, and structure to make your document both effective and visually appealing.

Essential Design Principles for Clarity

- Use Ample White Space: Proper spacing between sections, lines, and text makes a document feel less cluttered. White space allows the reader to focus on key details and creates a professional, polished look.

- Organize Information Hierarchically: Prioritize the most important details at the top–such as your business and client information–and follow with itemized sections. This makes it easier for clients to quickly understand the content.

- Choose Readable Fonts: Opt for clean, legible fonts such as Arial, Helvetica, or Times New Roman. Avoid decorative fonts that may distract from the information. Maintain consistency by using one or two complementary font styles throughout the document.

- Use Clear Section Headers: Bold and slightly larger headers help break up the document and guide the reader through the content. Clear titles for each section (e.g., “Client Details,” “Product Description,” “Payment Terms”) improve navigation and readability.

Visual Enhancements to Improve Impact

- Incorporate Your Brand Colors: Use your brand’s colors subtly to highlight key sections or headings. This helps reinforce your business identity while keeping the design cohesive and professional.

- Consistent Alignment: Ensure that text, columns, and other elements are aligned properly. This makes the document look neat and organized, avoiding any distractions or inconsistencies.

- Use Simple Icons or Graphics: Small, minimalistic icons or logos can enhance the design without overwhelming the reader. Be cautious not to overuse graphics, as this can detract from the main content.

A clean and well-organized layout is essential to creating an effective billing document. By following these design tips, you can improve the user experience, boost professionalism, and ensure that your documents are easy to navigate, while still reflecting your brand’