How to Use an Editable QuickBooks Invoice Template for Easy Billing

Managing payments efficiently is essential for any business, large or small. The ability to create professional, customizable documents for requesting payment can save time and reduce errors. By using tools designed to simplify this process, business owners can ensure they present a polished image while maintaining accuracy and consistency.

These tools allow for full customization of payment requests, ensuring that each document fits the specific needs of your business and clients. Whether you’re adding your company logo, adjusting payment terms, or organizing client information, the flexibility they provide makes managing financial transactions more straightforward.

With the right software, you can not only create these documents quickly but also automate follow-ups, track payments, and ensure that everything is in order for your records. This streamlined approach allows you to focus more on growing your business and less on administrative tasks.

Editable QuickBooks Invoice Template Overview

Creating professional documents for requesting payment is an essential part of running a business. With the right tools, you can easily craft customized payment requests that reflect your company’s brand and meet specific client needs. These tools provide flexibility, allowing you to modify key details such as amounts, due dates, and client information while maintaining consistency in design and format.

By using customizable billing forms, you can quickly generate professional-looking documents that are ready to send to clients with minimal effort. The ability to personalize these documents ensures that your business stands out and creates a more efficient process for both you and your clients. Additionally, this customization helps reduce human error and ensures accuracy in the payment process.

These solutions often come with built-in features to track payments, set reminders, and manage client details, giving you more control over your billing process. The integration of such tools into your workflow can save time, improve productivity, and ensure smooth financial operations for your business.

Benefits of Using an Editable Template

Customizable billing forms offer numerous advantages for businesses looking to streamline their financial operations. These tools allow you to adjust key elements of each document to match the specific needs of your clients and transactions. The ability to modify details such as payment terms, contact information, and pricing ensures that every document is accurate and relevant, which in turn helps build trust and professionalism.

One of the main benefits of using these flexible solutions is the time savings. Instead of creating documents from scratch for each transaction, you can quickly update pre-existing formats, allowing you to focus on other important aspects of your business. This reduces the chances of errors and speeds up the invoicing process.

Additionally, having the ability to adjust each document makes it easier to maintain consistency across your financial communications. Whether you’re working with recurring clients or new ones, the ability to tailor your documents ensures a polished, professional look every time. With automated features for tracking payments, reminders, and reporting, these tools also enhance your ability to manage finances effectively and efficiently.

How to Customize Your Invoice

Customizing your payment request forms ensures that each document accurately represents your business while meeting the specific needs of your clients. The process involves adjusting various elements, such as the layout, fields, and content, to create a professional and personalized experience. By taking the time to tailor each form, you ensure clarity, accuracy, and a consistent brand image.

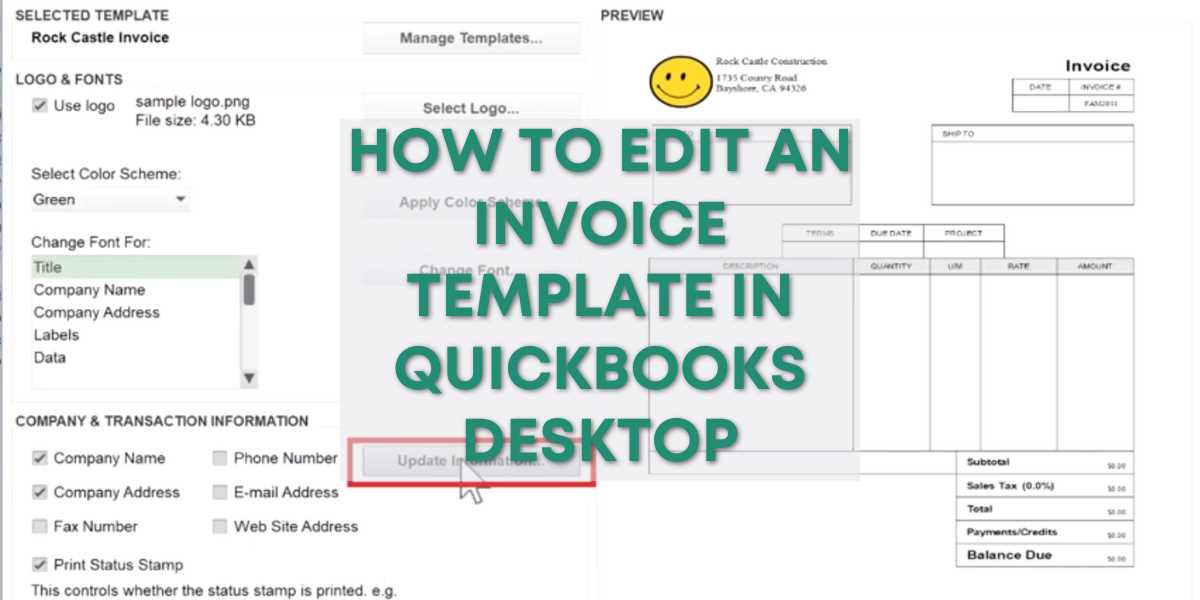

Adjusting the Layout and Design

One of the first steps in personalizing your documents is modifying the layout and overall design. This can include changing the font style, size, and color, as well as adjusting the placement of key information such as company name, client details, and payment terms. Adding your company logo or custom colors will further enhance the branding, ensuring that every document reflects your unique identity.

Modifying Key Fields and Details

Another important aspect of customization is modifying the fields to match your specific business requirements. You can add or remove sections based on the type of service or product you provide. This may include areas for item descriptions, quantities, prices, taxes, or discounts. Additionally, updating the payment terms, due dates, and other relevant details ensures that each form is tailored to your transaction needs.

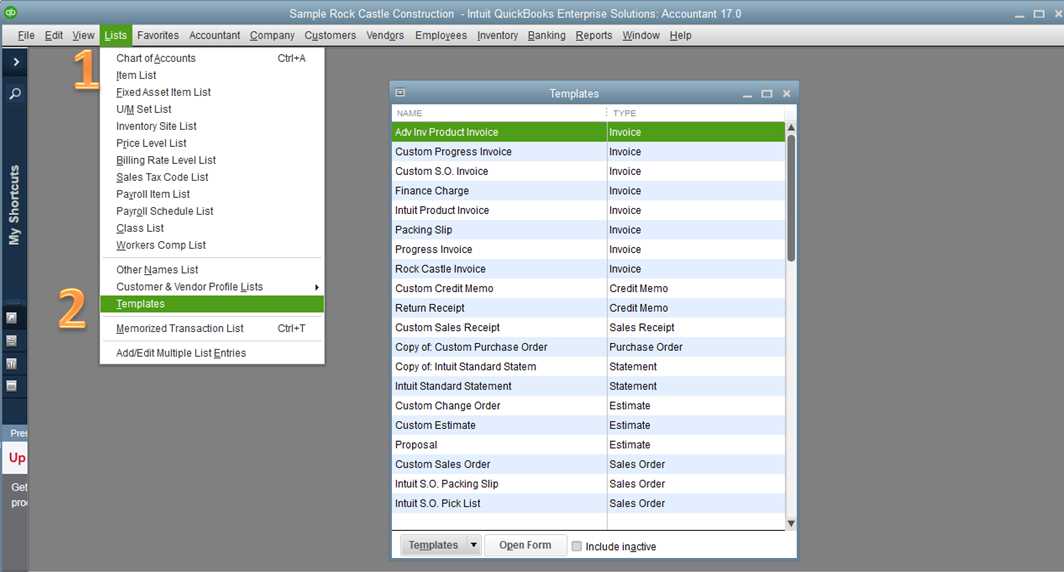

Step-by-Step Guide to QuickBooks Invoices

Creating a payment request using the right software can be a straightforward process if you follow the correct steps. With an easy-to-use tool, you can generate professional documents in no time, ensuring that all necessary details are included. This step-by-step guide will walk you through the process of setting up and sending these important financial documents, making it easier to manage your transactions.

Setting Up Your Document

Before generating your payment request, you need to set up a few key elements. Here’s how to get started:

- Choose a template: Select a pre-designed layout that suits your business needs.

- Enter your business details: Include your company name, address, and contact information.

- Customize the fields: Adjust the fields to include relevant details such as client name, service descriptions, and pricing information.

Adding Transaction Details

Once your document is set up, you can start entering the specific details related to the transaction. This includes:

- Item descriptions: Clearly list each item or service you are billing for.

- Quantities and rates: Add the number of units or hours worked along with the corresponding rate.

- Payment terms: Specify the due date and any applicable late fees or discounts.

Once all the information is filled in, you can preview the document before sending it to ensure everything is accurate.

Key Features of QuickBooks Templates

When it comes to creating professional billing documents, the right features can make all the difference. A well-designed solution offers numerous tools that help streamline the process of generating and managing payment requests. These features ensure accuracy, consistency, and ease of use, allowing businesses to focus on what matters most–serving their clients and growing their operations.

Some of the key features of these billing solutions include:

- Customizable Layouts: Tailor the design and format of each document to fit your business branding and client preferences.

- Predefined Fields: Automatically include essential details such as business name, client contact information, and transaction specifics.

- Itemized Lists: Clearly break down the services or products being billed, along with corresponding quantities and prices.

- Automated Calculations: The software automatically calculates totals, taxes, and discounts, reducing the chance for errors.

- Flexible Payment Terms: Easily set due dates, payment methods, and late fees, allowing you to establish clear expectations for clients.

These features, along with many others, work together to simplify the billing process, making it easier for businesses to stay organized and maintain a professional image.

Setting Up Your QuickBooks Account

To fully utilize the billing and financial management features of your software, you first need to properly set up your account. This process ensures that all your business information is correctly integrated, enabling efficient document creation, payment tracking, and financial reporting. Here’s a simple breakdown of the essential steps involved in setting up your account.

| Step | Action | Details |

|---|---|---|

| 1 | Create an Account | Sign up for an account by providing your business email and contact information. |

| 2 | Enter Business Details | Input your business name, address, and tax identification number to ensure accurate records. |

| 3 | Set Up Payment Methods | Link your preferred payment methods for clients, including credit card or bank details. |

| 4 | Configure Billing Preferences | Adjust your document settings, including due dates, payment terms, and currency preferences. |

| 5 | Add Clients and Products | Input the contact information for your clients and list the services or products you offer. |

Once these steps are completed, your account will be fully set up, allowing you to start generating professional billing documents and managing your finances with ease.

Common Mistakes to Avoid in Invoices

When generating payment requests, even small errors can lead to confusion or delayed payments. It’s crucial to pay attention to detail and ensure that every document you send is accurate and clear. Below are some common mistakes that businesses often make when creating financial documents, and how to avoid them for smoother transactions.

1. Missing or Incorrect Client Information

One of the most basic mistakes is failing to accurately list the client’s contact details. Always double-check the name, address, and other essential information before sending the document. Inaccurate contact details can lead to delivery issues or confusion, which can delay the payment process.

2. Incorrect Calculations and Totals

Another common mistake is errors in the pricing, taxes, or totals. Ensure that you accurately calculate the amounts for each item or service provided, along with the correct tax rate. Automated calculation tools can help reduce these errors, but it’s always important to manually verify the totals to prevent discrepancies.

Tip: Double-check the due date and ensure that the correct payment terms are applied, especially for recurring transactions or special discounts.

3. Lack of Clear Payment Terms

Without clear payment instructions, your clients may be uncertain about when and how to pay. Always include specific terms regarding due dates, late fees, and acceptable payment methods. Providing clarity on these details can help avoid unnecessary back-and-forth with clients.

By being vigilant and double-checking all the details, you can avoid these common mistakes and ensure that your billing process is smooth and professional. Making these small adjustments can significantly improve your cash flow and client relationships.

Best Practices for Invoice Design

Creating well-designed payment request documents is essential for maintaining professionalism and ensuring clarity in your transactions. The design not only impacts the document’s appearance but also influences how easily your clients can understand the payment terms and details. Following certain best practices can help you craft documents that are both functional and aesthetically pleasing.

1. Keep the Layout Simple and Clean

A cluttered design can confuse your clients and make it difficult for them to find important details. Stick to a clean, organized layout that highlights the most important information, such as the amounts, due dates, and payment methods. Use whitespace effectively to separate different sections and make the document easy to read. Avoid overloading the page with unnecessary details or distracting elements.

2. Use Consistent Branding

Incorporating your business’s branding into the design helps establish a professional image and creates consistency across all your communications. Use your company logo, colors, and fonts to personalize the document. This not only makes it look more official but also reinforces your brand identity. Just make sure that the design remains clear and legible–don’t overdo it with too many graphics or colors.

By adhering to these simple guidelines, you can create effective and visually appealing payment request documents that your clients will find easy to understand and trustworthy. A well-designed document can enhance your reputation and ensure smoother business transactions.

How to Save and Reuse Templates

Once you’ve created a well-designed document for your payment requests, the next step is ensuring that you can reuse it without starting from scratch every time. Saving and reusing your custom designs can save you valuable time and effort, especially when dealing with recurring clients or similar types of transactions. Here’s how you can easily store and access your customized forms for future use.

1. Save Your Document as a Template

Most software solutions allow you to save your customized form as a reusable file. Once you’ve created a payment request with all the necessary fields and information, save it with a clear and descriptive name. This way, you’ll be able to easily identify and open the saved file whenever needed.

2. Set Up Automated Reminders and Settings

To make your workflow even more efficient, some systems allow you to set up automated features based on your saved designs. For example, you can configure recurring reminders for payments or automatically update client details, ensuring that your future documents are always up-to-date with minimal input required.

3. Organize Saved Documents by Client or Project

It’s important to maintain organization when saving your documents. Store them in clearly labeled folders or categories according to client names or specific projects. This will help you quickly find the right document when creating a new payment request.

By following these simple steps, you’ll save time, reduce mistakes, and maintain consistency across your financial documentation. Reusing your custom documents can also make your workflow smoother, allowing you to focus on growing your business instead of redoing repetitive tasks.

Integrating Your Template with QuickBooks

Once you’ve designed your customized billing documents, the next logical step is to integrate them with your accounting software. This integration allows for a seamless transition between creating payment requests and managing your financial records. By syncing your custom forms with your accounting system, you can automate key tasks, reduce data entry errors, and track your transactions more efficiently.

Here’s how to integrate your custom documents with your accounting system:

- Upload the Document: Most accounting platforms allow you to upload custom billing formats. Begin by exporting your saved file in a compatible format (such as PDF or Word) and then upload it to the system.

- Map Key Fields: Once the document is uploaded, you may need to map key fields such as client names, addresses, and transaction details to corresponding fields in your accounting software. This ensures that all the relevant information is pulled directly from your database.

- Enable Automation: Many systems offer automated features that can help streamline your workflow. For example, you can set up automatic reminders for due dates or even send payment requests directly from the software.

- Test and Verify: After setting up the integration, perform a test by creating a sample payment request. Check to ensure that the data flows correctly and that the document is generated as expected.

Integrating your custom forms with your accounting software not only simplifies the process but also helps maintain consistency across all your financial communications. By automating repetitive tasks, you save time and reduce the chance of errors, allowing you to focus more on growing your business.

Free vs Paid Invoice Templates

When it comes to creating professional payment request documents, you have two main options: free or paid solutions. Both types offer unique benefits and features, but the choice between the two often depends on your specific business needs. While free options can be a great starting point, paid solutions tend to offer more advanced features, customization, and support. Understanding the key differences between them can help you decide which is best suited for your business.

Free Templates

Free forms can be a good choice for small businesses or freelancers who are just starting out. These options typically include basic designs with essential fields for payment details. While they may not offer extensive customization, they are often easy to use and accessible to anyone.

Paid Templates

Paid solutions, on the other hand, provide more advanced features and greater flexibility. These can include customizable layouts, integration with accounting software, automated features, and premium customer support. With a paid solution, you can create a more professional look and have access to tools that save you time and improve efficiency.

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic layout with limited options | Advanced customization for branding |

| Automated Features | No automation | Payment tracking, reminders, recurring billing |

| Integration | Limited or no integration | Full integration with accounting software |

| Support | Minimal or community support | Priority support and customer service |

Choosing between free and paid options depends on your business’s needs and growth goals. If you need basic functionality and have limited budget, free solutions may work for you. However, if you’re looking to scale your business, improve professionalism, and automate processes, investing in a paid solution may be the better choice.

How to Add Your Business Logo

Including your business logo in financial documents is a great way to enhance your brand identity and present a more professional appearance. Whether you’re sending a payment request or another type of document, adding a logo can help your business stand out and make your communications more memorable. Here’s how you can easily add your logo to your custom forms.

1. Prepare Your Logo File

Before adding your logo, ensure you have the correct file type. Common formats like JPEG, PNG, or SVG are typically supported, but be sure to choose a high-quality image to maintain a crisp, professional appearance. It’s a good idea to use a transparent background (for PNG or SVG files) to seamlessly integrate the logo with the design of your document.

2. Insert Your Logo into the Document

Once you have your logo file ready, you can follow these simple steps to insert it into your document:

- Open your design tool: Whether you’re using a document editor or custom billing software, open your project.

- Locate the logo placement area: Typically, your business logo will go in the header or top section of the document. Look for a “Header” or “Logo” section within the editing tool.

- Upload the logo: Use the “Upload” or “Insert Image” option to add your logo file to the document.

- Adjust size and alignment: Once uploaded, adjust the size of the logo to ensure it fits well without overwhelming the page. Align it to the left, center, or right, depending on your preference.

By following these steps, your logo will be added to every document, providing a consistent and professional look for all your business communications.

Managing Client Information in Templates

Efficiently handling client data is crucial for maintaining accurate records and ensuring smooth transactions. By organizing and storing essential client information in your custom documents, you can easily populate the necessary fields, minimize errors, and save time when generating new documents. Proper management of client details ensures that your communications are personalized, professional, and up-to-date.

1. Storing Client Information

To streamline the process of generating payment documents, it’s important to have a centralized system for storing client details. This allows you to quickly retrieve contact information, billing addresses, and past transaction records. You can store this data either in your accounting system or within your document creation software.

- Client Names: Ensure that client names are always entered correctly and consistently.

- Billing and Shipping Addresses: Keep both addresses updated to avoid any confusion during transactions.

- Payment Preferences: Track preferred payment methods and terms to streamline invoicing and ensure accuracy.

2. Automating Client Data Entry

Many systems offer the ability to automate the population of client data into custom forms. This feature can save significant time and reduce errors by automatically filling in client details from your database. Setting up automated fields ensures that you don’t need to manually input the same information repeatedly, allowing you to focus on other aspects of your business.

By properly managing and storing client information, you can create personalized, error-free documents that make your workflow more efficient and maintain a professional image for your business.

How to Set Payment Terms in QuickBooks

Establishing clear and consistent payment terms is vital for ensuring timely payments and maintaining healthy cash flow. By defining payment conditions, such as due dates, discounts for early payments, and penalties for late payments, you can ensure that both you and your clients are on the same page. Setting up these terms in your accounting software simplifies the process and automates payment reminders, improving your overall billing efficiency.

1. Setting Default Payment Terms

To begin, you’ll want to define your standard payment terms for all future transactions. This can be done by setting default terms within your accounting system, allowing them to automatically apply to new client records and transactions. Common payment terms include:

- Net 30: Payment due within 30 days of the transaction date.

- Due on Receipt: Payment is expected immediately upon receiving the document.

- 2/10 Net 30: A 2% discount if payment is made within 10 days, with the full amount due within 30 days.

By configuring these terms in your system, you ensure consistency and reduce the need for manual adjustments each time you issue a new document.

2. Customizing Payment Terms for Individual Clients

For clients with special arrangements or specific requirements, you can customize payment terms on a case-by-case basis. This allows flexibility while still maintaining structure. In your software, simply select the client from your database and adjust their payment terms to reflect their unique agreement. Whether it’s extended terms or negotiated discounts, having the ability to set personalized payment schedules is a useful feature.

Once your terms are set up, your software will automatically apply them to new documents, ensuring that all details are clear and reducing the likelihood of confusion or late payments.

Tracking Payments with Invoice Templates

Monitoring payments is an essential part of managing your business finances. With the right tools, you can efficiently track client payments and stay on top of outstanding balances. By integrating payment tracking into your billing documents, you can easily see which transactions have been completed, which are pending, and which may be overdue. This feature helps ensure timely payments and provides clarity for both you and your clients.

1. Including Payment Status in Your Documents

One of the simplest ways to track payments is by including a payment status section within your custom documents. This section can clearly indicate whether the payment has been received, is due, or is overdue. The payment status can be updated as the transaction progresses, offering a visual reminder for both parties.

- Paid: This indicates that the payment has been fully processed and received.

- Pending: This status shows that the payment is yet to be completed but is still within the agreed-upon terms.

- Overdue: If the payment hasn’t been made by the due date, this status helps highlight the overdue balance.

2. Linking Payment Methods for Easier Tracking

To enhance your payment tracking system, include details about the payment method on your forms. Whether a client pays by credit card, bank transfer, or other methods, noting this information can help you keep accurate records of how payments are received. Additionally, linking payment methods with transaction dates will allow you to follow up on outstanding payments more efficiently.

By incorporating these simple tracking methods into your documents, you can easily manage payments, reduce confusion, and keep your business finances organized.

How to Send Invoices via Email

Sending payment requests via email is a fast and efficient way to communicate with clients and ensure they receive your billing information promptly. By using email, you can eliminate the need for physical mail and track delivery, making the process more streamlined. Additionally, most email systems allow you to attach documents directly, which makes sharing important details such as payment amounts and due dates simple and secure.

Here’s how to send your billing documents via email:

| Step | Description |

|---|---|

| 1. Prepare the Document | Ensure that your document is complete with all necessary details such as the client’s name, billing items, due date, and payment instructions. Double-check for any errors before sending. |

| 2. Save the Document | Save your completed document in a compatible file format, such as PDF, for easy viewing and downloading by the recipient. |

| 3. Compose the Email | Open your email client and create a new message. Address the email to your client, and include a clear subject line, such as “Payment Request for [Client Name].” |

| 4. Attach the Document | Attach the saved document to the email. Most email platforms allow you to drag and drop files or use an “Attach File” button to upload your document. |

| 5. Add a Message | Write a brief message in the body of the email. Include a polite reminder of the due date and any instructions on how the client can make their payment. |

| 6. Send the Email | Once everything is in place, review your email and click “Send.” Make sure to use the client’s correct email address to avoid any issues with delivery. |

By following these steps, you can efficiently send your billing documents via email, ensuring your clients receive timely notifications and facilitating faster payments. This method also keeps everything digital and easy to manage, as you can track sent messages and receipts for future reference.

Automating Invoicing in QuickBooks

Automating the process of generating and sending billing documents can significantly reduce administrative workload and improve efficiency. By setting up automatic billing cycles, reminders, and recurring payments, businesses can ensure that clients are consistently invoiced on time, without needing to manually create each document. This level of automation also helps in maintaining accurate financial records, reducing human errors, and ensuring that all details are consistent across transactions.

1. Setting Up Recurring Billing

One of the easiest ways to automate your billing process is by setting up recurring cycles for clients who make regular purchases or payments. This feature allows you to create an invoice once, define how often it should be sent, and let the system generate and send the invoice automatically at the specified intervals.

- Define the frequency: Set up billing for daily, weekly, monthly, or annual intervals depending on the nature of your services.

- Set payment terms: Include specific payment terms, such as due dates, late fees, or early payment discounts, that are automatically applied each time.

- Review and adjust: Regularly review recurring settings to ensure they align with any changes in your pricing structure or client agreements.

2. Automating Payment Reminders

Automated reminders are a great way to encourage timely payments and reduce late fees. By configuring your system to send email reminders before and after the due date, you can ensure that clients are aware of their upcoming payments and avoid delays.

- Pre-due reminders: Set a reminder to notify clients a few days before the payment is due.

- Post-due reminders: Send a follow-up reminder if the payment has not been received after the due date has passed.

- Customizable messages: Personalize reminder emails to include specific payment instructions, late fees, or other relevant details.

By automating these tasks, you can focus more on your business operations while ensuring your clients are billed accurately and on time.

How to Export and Print Invoices

Exporting and printing billing documents is an essential step in managing financial transactions. It allows you to keep physical records, provide hard copies to clients, or maintain backups for accounting purposes. With the right tools, you can easily convert your digital documents into printable formats, making it simple to share or archive them as needed. This process not only saves time but also ensures consistency and accuracy across all of your transactions.

1. Exporting Billing Documents

Exporting your billing documents is straightforward and can be done in just a few steps. You can typically export them to PDF or other formats, ensuring that the details remain intact and easily accessible for both you and your clients.

- Choose the Document: Select the billing document you wish to export from your system.

- Export Format: Choose the desired file format (e.g., PDF, Excel, Word) based on how you plan to use or share the document.

- Save the File: After exporting, save the file to your computer or cloud storage for easy access and sharing.

2. Printing Billing Documents

Once you’ve exported your billing documents, printing them is just as easy. Most systems provide an option to directly print documents from the exported file, or you can open the file on your device and use standard print settings.

- Open the Exported Document: Open the file in your preferred viewer (such as Adobe Reader for PDFs or Excel for spreadsheets).

- Choose Printer Settings: Adjust the print settings, such as page layout, orientation, and number of copies.

- Print: Select the “Print” option and ensure the printer is correctly connected and set up.

By following these steps, you can easily export and print your billing documents, keeping your records organized and ensuring clients receive hard copies when needed. Whether for legal purposes or just for convenience, having physical copies of important documents is a good practice for any business.