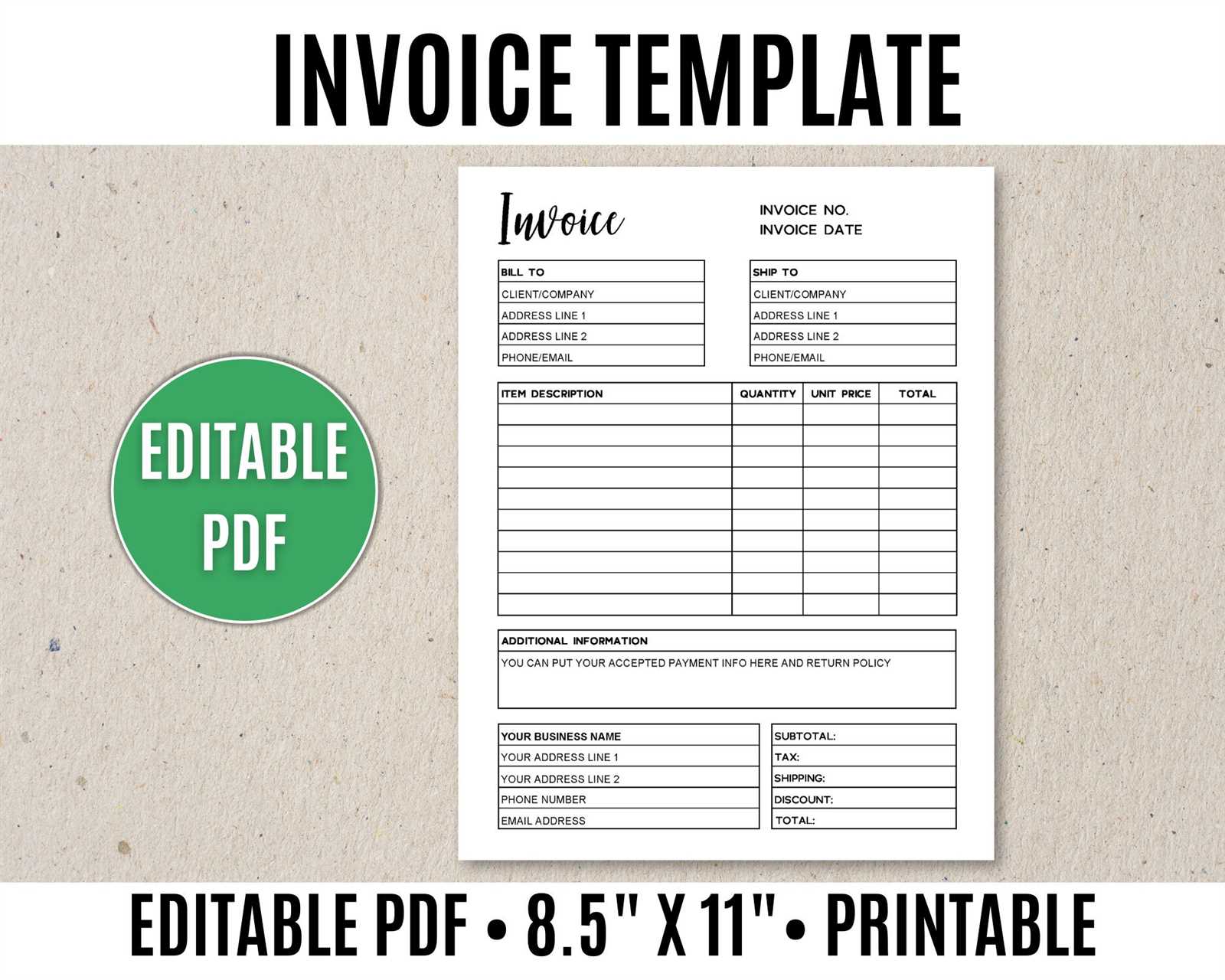

Editable Printable Invoice Template for Easy Customization

In today’s fast-paced business world, having a reliable and flexible way to create financial records is essential. Whether you’re a freelancer, a small business owner, or managing a larger enterprise, simplifying the process of generating and issuing payment requests can save both time and effort. Having a system that allows you to adjust the content according to specific needs and details is crucial for ensuring accuracy and professionalism in every transaction.

Customizable billing solutions offer a streamlined approach for creating documents that look professional and can be tailored to fit your unique business requirements. By using a format that can be easily edited, you can quickly adapt it to different clients, services, and payment terms, making it easier to maintain a consistent and organized financial workflow. The flexibility of this method also ensures that the final document meets both legal and business standards without unnecessary complications.

From small startups to established companies, everyone can benefit from having an adaptable method for creating financial records. By utilizing an intuitive and simple-to-use format, businesses can save time, reduce errors, and maintain clarity in their transactions. This approach helps foster stronger relationships with clients, providing clear, concise, and professional statements with each interaction.

Customizable Billing Document for Easy Use

Having a versatile and easy-to-use document for financial transactions is an essential tool for businesses of all sizes. It allows you to create accurate and professional records, which can be quickly adjusted to suit the specifics of each deal. By using a system that lets you modify details such as amounts, dates, and recipient information, you can ensure that each request is clear and tailored to the needs of both parties.

These dynamic documents are designed to be simple yet comprehensive, offering a variety of fields that can be easily updated with relevant information. Whether it’s for services rendered, product sales, or other business interactions, the format allows flexibility to meet various requirements. The ability to adjust and update each document quickly helps maintain an efficient workflow and reduces the time spent on administrative tasks.

- Simple structure: Quick and easy to fill out, with clearly labeled sections for relevant details.

- Flexible fields: Customize names, dates, quantities, and pricing as needed.

- Professional appearance: Present a polished and consistent look to clients with minimal effort.

- Time-saving: Reduces the need to create a new document from scratch each time.

By using this adaptable approach, businesses can ensure that each transaction is documented accurately, while also maintaining a consistent, professional appearance across all communications. Additionally, the ability to modify and save these documents ensures that future transactions can be completed more efficiently, reducing the risk of errors and saving valuable time.

Why Use an Editable Billing Document

Creating clear and accurate financial records is a crucial part of any business. Having a document that can be customized according to your needs offers significant advantages, making the process faster and more efficient. A flexible system that allows you to quickly adapt the information for different clients, services, or products ensures that your transactions are always precise and professional. The ability to adjust details, such as amounts or payment terms, ensures accuracy and saves time.

Benefits of Customizable Financial Records

Here are some key reasons why using a flexible document format is beneficial for businesses:

| Benefit | Description |

|---|---|

| Time Efficiency | Save time by reusing a structure that only requires minor adjustments for each new transaction. |

| Professional Presentation | Ensure a consistent, polished look for every record, enhancing credibility with clients. |

| Customization | Quickly modify content such as dates, quantities, or pricing to match specific client or project details. |

| Reduced Errors | Pre-filled fields help minimize mistakes and ensure the right details are included every time. |

How It Enhances Business Efficiency

By having the ability to modify each document easily, businesses can streamline their accounting and billing processes. This customization helps ensure that each document is tailored to meet the unique requirements of each transaction. Furthermore, it allows businesses to maintain a consistent format, improving both internal organization and client relations. When combined with automated tools or software, these adaptable documents can significantly cut down the time spent on administrative tasks, giving you more time to focus on core business activities.

How to Customize Your Billing Document

Adapting a standard financial document to suit your specific needs is an important step in ensuring accuracy and professionalism. Customizing these records allows you to incorporate essential details such as client information, transaction terms, and service descriptions. The process can be as simple as filling in predefined fields or as complex as adjusting the structure to match your business’s unique requirements. A well-designed system gives you the flexibility to modify various aspects of the document to reflect the specifics of each transaction.

Steps to Customize Your Document

Follow these basic steps to personalize your financial records efficiently:

| Step | Action |

|---|---|

| 1. Add Client Details | Insert the client’s name, address, and contact information to ensure the document is specific to the correct recipient. |

| 2. Update Transaction Information | Modify service or product descriptions, including quantities, rates, and dates of service or delivery. |

| 3. Adjust Payment Terms | Set the payment due date, methods, and any applicable discounts or late fees. |

| 4. Include Your Branding | Incorporate your business logo and contact details for a more professional and personalized appearance. |

Tips for Effective Customization

Customizing your financial documents should go beyond just filling in blanks. Here are some additional tips for ensuring your records stand out:

- Be consistent: Ensure that all fields follow the same format to maintain clarity and professionalism.

- Use clear language: Avoid jargon or overly complex descriptions to ensure your client easily understands the terms.

- Incorporate your brand: Use your company’s color scheme and logo to create a cohesive visual identity.

- Double-check for accuracy: Verify all details, such as pricing and dates, to prevent errors that could lead to misunderstandings or delays in payment.

Benefits of Customizable Billing Documents

Using a flexible and reusable financial document offers numerous advantages for businesses. It simplifies the process of generating payment requests and ensures consistency in communication with clients. The ability to adjust the content for each transaction allows businesses to maintain a high level of professionalism while saving valuable time. This adaptability is key to reducing errors, increasing efficiency, and enhancing overall business operations.

Key Advantages

- Time-saving: Reusing a standardized structure reduces the time spent creating new documents from scratch for each transaction.

- Professional Appearance: A consistent format creates a polished and organized look, helping to build trust and credibility with clients.

- Customization: Easily adjust the content to reflect the specifics of each transaction, including client details, pricing, and terms.

- Accuracy: Reduces the likelihood of mistakes by providing predefined fields that guide users through the document creation process.

- Convenience: Offers a simple and efficient solution for creating detailed records, whether for one-time or recurring transactions.

How It Helps Businesses Stay Organized

By utilizing a system that allows for easy adjustments, businesses can ensure that all transactions are documented in a uniform manner. This consistency helps with record-keeping, making it easier to track payments and manage accounts. Additionally, these documents can be saved, archived, and referred to as needed, providing a reliable source of information for future business dealings. The ability to generate such records quickly and accurately also enhances cash flow management and client communication.

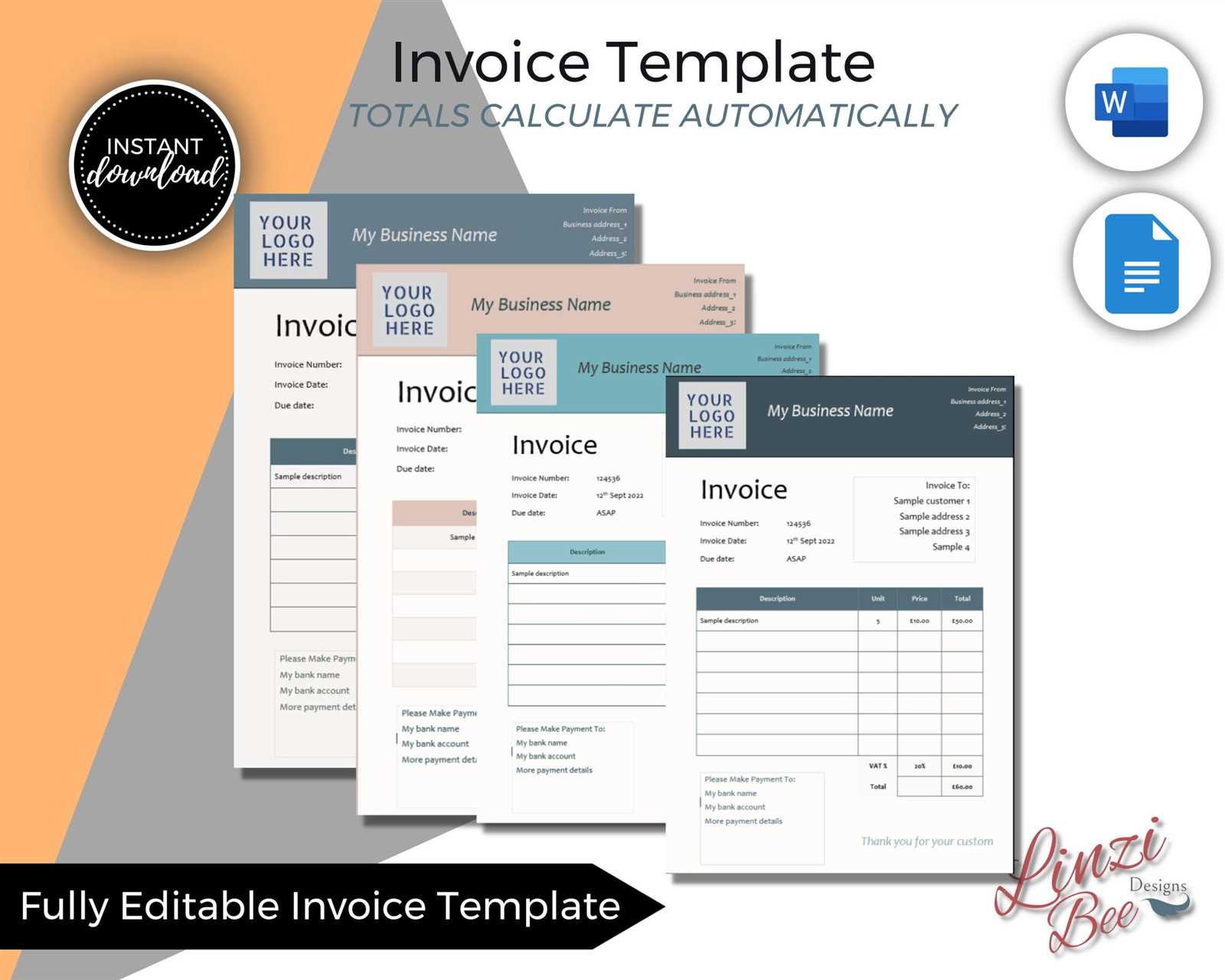

Choosing the Right Billing Document Design

Selecting the proper design for your financial records is essential for maintaining a professional appearance and ensuring clear communication. The design you choose should align with your business’s brand and meet the specific needs of your transactions. A well-organized layout that is both functional and visually appealing will help foster trust with clients and make it easier to manage financial details. When choosing a design, it’s important to consider factors such as simplicity, clarity, and customization options to ensure that the document is effective and adaptable for all your business dealings.

Factors to Consider When Selecting a Design

Several key elements should influence your choice of design to ensure it works effectively for your needs:

| Factor | Considerations |

|---|---|

| Branding | Ensure the design reflects your company’s logo, colors, and overall branding for a consistent, professional look. |

| Layout | Choose a layout that is easy to read, with clear headings and sections for client details, payment terms, and itemized charges. |

| Customization | Select a design that allows you to easily modify fields, such as dates, pricing, and service descriptions, to suit each transaction. |

| Simplicity | Opt for a clean, straightforward design that avoids unnecessary complexity while still presenting all necessary information. |

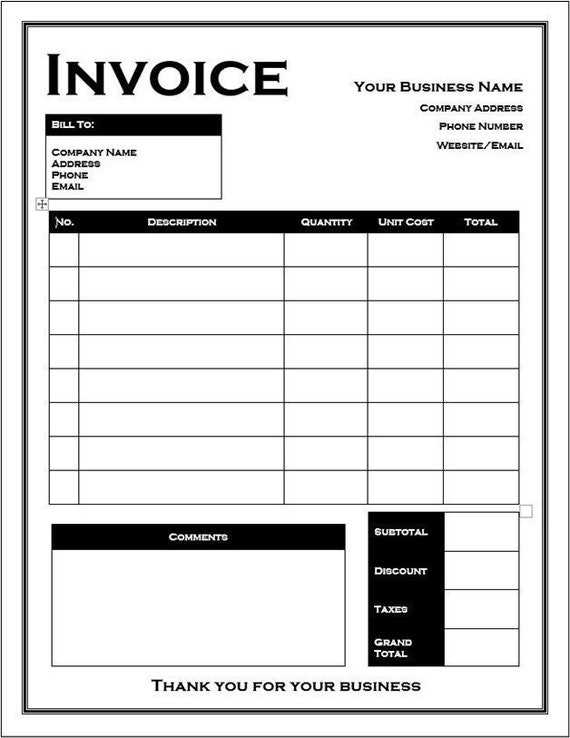

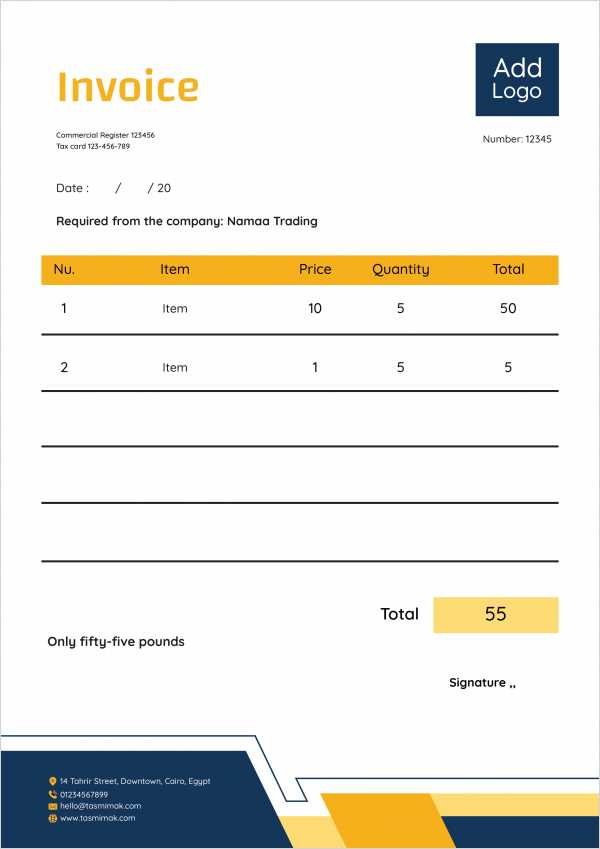

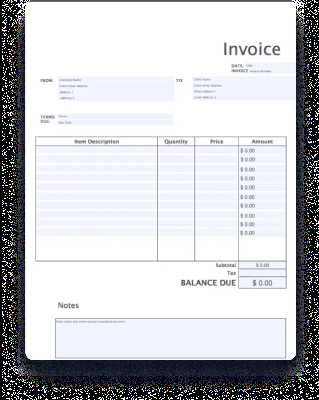

Common Design Options

Here are some common types of designs you might encounter or consider when selecting a document structure:

- Classic Layout: A traditional design featuring a clear header with company details, followed by a simple table for services and pricing.

- Modern Minimalist: A sleek and clean design with plenty of white space, making it easy to read and quick to fill out.

- Brand-Focused Design: A design that heavily incorporates your company’s branding, with logos, color schemes, and custom fonts that align with your brand identity.

- Detailed Breakdown: A comprehensive format that includes multiple sections for taxes, discounts, and additional charges, ideal for complex transactions.

Choosing the right design ensures that the document is not only visually appealing but also functional and easy to navigate. A well-chosen design helps to create a positive impression and contributes to smoother business interactions with clients.

Step-by-Step Guide to Creating Billing Records

Creating a professional and accurate financial record for your transactions doesn’t have to be difficult. With the right structure and attention to detail, you can produce clear, organized documents that are easy for both you and your clients to understand. This step-by-step guide will walk you through the essential elements needed to create effective payment requests, ensuring all necessary information is included and formatted properly.

Step-by-Step Process

Follow these simple steps to create clear and accurate billing records:

- Step 1: Gather Necessary Information

Before you start, make sure you have all the relevant details, including the client’s name, address, contact information, and the specifics of the transaction (services, products, pricing, etc.). - Step 2: Choose a Layout

Select a design that suits your business needs. This could be a simple table format for basic transactions or a more detailed layout if you need to include multiple charges, discounts, or taxes. - Step 3: Input Your Business Information

Include your company’s name, address, contact information, and logo if applicable. This ensures that clients can easily identify the source of the document. - Step 4: Enter Client Information

Make sure to include the client’s name, address, and contact information to ensure that the document is correctly attributed to them. - Step 5: List Services or Products

Include a detailed breakdown of the items or services provided. List them in a clear, itemized format, and include quantities, unit prices, and total amounts. - Step 6: Set Payment Terms

Specify the payment due date, accepted payment methods, and any additional terms, such as late fees or early payment discounts. - Step 7: Review and Finalize

Double-check all information for accuracy. Ensure that all numbers are correct, and that the layout is clear and easy to understand. This is the time to catch any potential errors before sending the document. - Step 8: Send the Document

Once finalized, send the document to the client via email, mail, or your preferred delivery method. Make sure to include any necessary instructions for payment.

Additional Tips

- Keep It Simple: Use clear, concise language and avoid unnecessary complexity. The document should be easy to read and understand.

- Be Consistent: Use the same layout and format for all your billing records to create a professional, cohesive look across all transactions.

- Use Automated Tools: Consider using invoicing software or digital tools that can automate parts of the process and reduce the chance of human error.

By following these steps and tips, you’ll be able to generate clear, professional billing records that keep your business organized and streamline the payment process for both you and your clients.

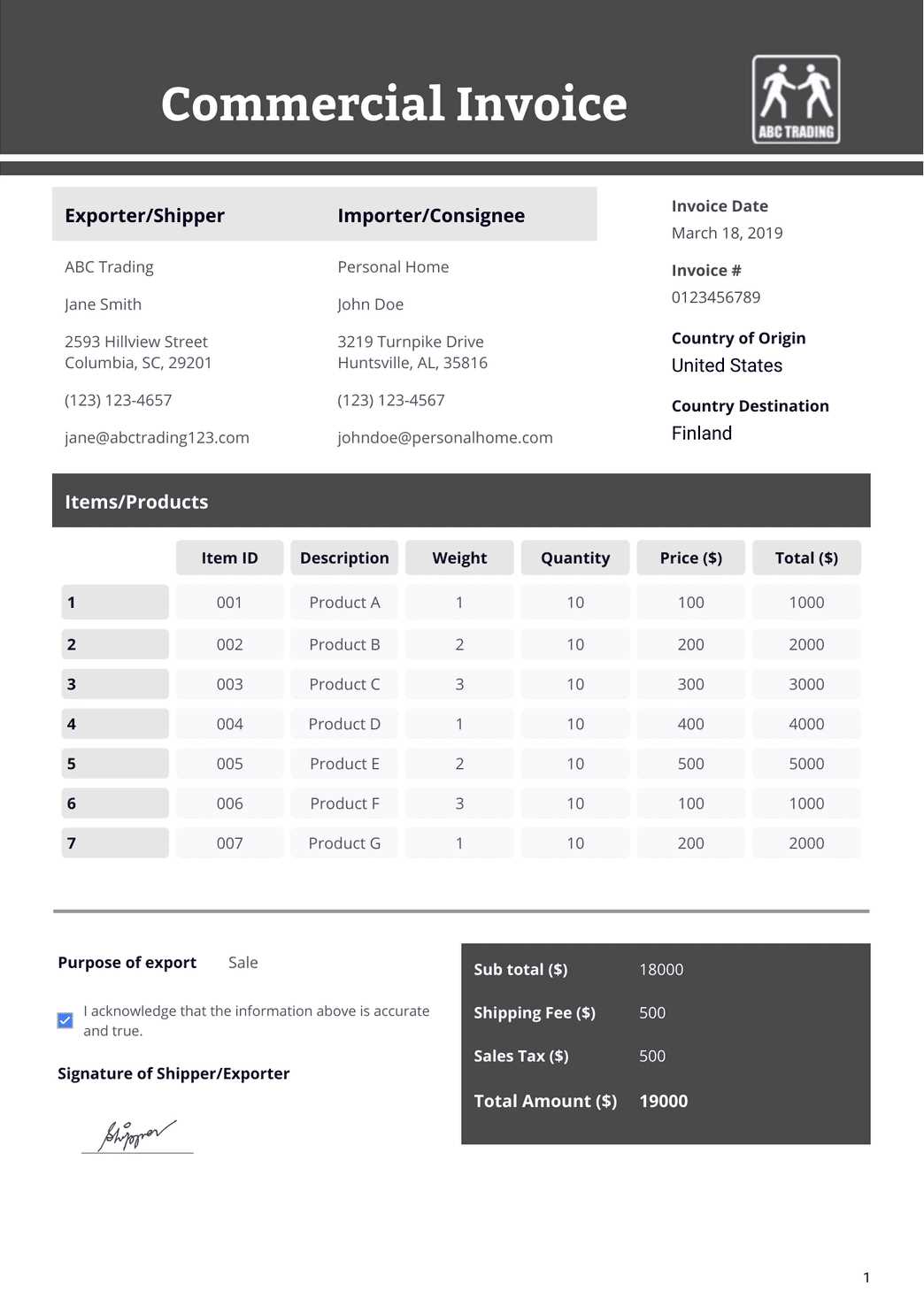

Essential Fields in a Billing Document

To create a well-structured financial record, certain key elements must be included to ensure that all necessary information is communicated clearly. A comprehensive document helps to avoid confusion and provides a clear breakdown of services, products, and payment terms. By including these essential details, businesses can maintain accuracy and professionalism in their dealings with clients.

Here are the most important fields to include in your financial records:

- Business Information: Include your company’s name, address, contact details, and logo. This ensures that the document is clearly attributed to your business and provides the client with the necessary information for follow-up.

- Client Information: Ensure that the client’s full name, address, and contact details are included. This is essential for accurate record-keeping and ensures the document reaches the correct recipient.

- Document Number: Assign a unique identifier for each record. This helps both you and your client track payments and prevent confusion between multiple transactions.

- Service or Product Description: Provide a detailed list of the goods or services provided, including quantities, rates, and any applicable discounts. This ensures transparency in pricing and helps clients understand exactly what they are being charged for.

- Dates: Include the date the document is issued, along with the due date for payment. This is important for tracking deadlines and managing accounts.

- Payment Terms: Clearly state the terms of payment, including methods (e.g., bank transfer, credit card) and any penalties for late payments. This helps set expectations and ensures that both parties are aware of the payment schedule.

- Total Amount Due: Clearly list the total amount owed, including any applicable taxes, fees, or additional charges. This provides a straightforward summary of the payment due.

By ensuring these fields are properly filled out, you help facilitate a smooth transaction process and maintain clear, organized records for both your business and your clients.

How to Save Time with Pre-Formatted Documents

Efficiency is a key factor in running a successful business, and one of the best ways to streamline administrative tasks is by using pre-formatted documents. With the right system in place, creating detailed financial records becomes a faster, more organized process. These ready-to-use structures allow you to quickly fill in the necessary information without having to start from scratch each time, freeing up valuable time for other tasks.

How Pre-Formatted Documents Speed Up the Process

By using a pre-designed structure, you can significantly reduce the amount of time spent creating financial records. Instead of manually formatting each document, you can focus on inputting only the specific details for each transaction. This not only saves time but also ensures consistency across all your records.

- Quick Adjustments: You only need to update key fields, such as client details, dates, and amounts, which eliminates the need to reformat or reorganize the document.

- Consistency: Using the same structure for all documents ensures that your records are uniform and easy to read, reducing the chance of errors or confusion.

- Fewer Mistakes: Pre-defined fields guide you through the process, ensuring that all necessary information is included and minimizing the risk of forgetting key details.

Additional Time-Saving Benefits

By automating parts of the process with pre-structured documents, you can focus on more important tasks while maintaining an organized workflow. Whether you’re handling multiple transactions in a day or managing a large client base, this approach allows you to stay on top of your financial documentation without wasting time on formatting. Additionally, if you use digital tools or invoicing software, you can further speed up the process with features like auto-fill and templates that store common information for future use.

In conclusion, implementing pre-formatted systems into your business operations can drastically reduce the time spent on administrative tasks, helping you stay efficient and focused on growing your business.

Best Tools for Editing Billing Document Formats

When managing your business finances, having the right tools for customizing and updating your billing records can save you a significant amount of time and effort. These tools allow you to quickly adjust and personalize your financial documents, ensuring that they meet your business needs while maintaining a professional appearance. Whether you’re looking for simple software or advanced features, there are various solutions available that can streamline the process of document creation and modification.

Top Tools for Customizing Billing Records

Here are some of the most effective tools that can help you customize and manage your financial documents:

- Microsoft Word: A simple yet powerful tool that offers a range of customizable document layouts. You can create professional documents from scratch or modify existing structures, with the ability to insert tables, text, and logos.

- Google Docs: This free, cloud-based word processor allows you to create, edit, and share documents with ease. It provides various templates and customization options, with the added benefit of real-time collaboration.

- Canva: Canva offers a range of easy-to-use templates for various business needs, including customizable billing formats. Its drag-and-drop interface makes it simple to design visually appealing documents without needing design skills.

- FreshBooks: Ideal for small businesses, FreshBooks offers invoicing software that allows you to create, send, and track billing documents. It provides professional templates that can be customized with your logo, terms, and payment details.

- Zoho Invoice: A comprehensive invoicing solution that lets you create professional, fully customizable billing documents. Zoho’s templates are easy to edit, and it also offers automation tools for recurring transactions and payment reminders.

- Adobe Acrobat: For businesses that require more advanced customization, Adobe Acrobat allows you to edit PDF documents. This is particularly useful if you need to make changes to documents that have already been created, such as updating dates or client details.

Benefits of Using These Tools

- Time Efficiency: These tools simplify the process of creating and editing financial records, allowing you to quickly adjust details without starting from scratch.

- Customization: Many of these tools offer extensive customization options, enabling you to personalize your documents to suit your brand and business style.

- Professional Output: Whether you’re using a basic word processor or advanced software, these tools ensure that your documents maintain a polished and consistent appearance.

- Automation: Tools like FreshBooks and Zoho Invoice offer automation features that can save time on repetitive tasks, such as sending payment reminders or generating recurring documents.

By choosing the right tools for customizing your billing documents, you can enhance your business’s efficiency, reduce manual effort, and ensure that your financial records remain professional and accurate.

Printed Documents vs Digital Records

When it comes to handling business transactions, one of the key decisions involves choosing between physical and digital formats for documenting payments and services rendered. Both options come with their own sets of advantages and disadvantages, depending on the needs of the business and the preferences of the client. While paper-based records may feel more traditional, digital formats have become increasingly popular due to their efficiency and environmental benefits. Understanding the differences between these two methods can help businesses choose the right approach for their operations.

Benefits of Physical Documents

- Tangible and Reliable: A printed record offers a physical, concrete document that clients can hold onto, store, or file. This can be important for businesses that require hard copies for legal or accounting purposes.

- Professional Presentation: For some clients, receiving a paper document may appear more official or trustworthy, enhancing the professionalism of the transaction.

- Less Dependent on Technology: Physical documents don’t require any electronic systems or devices to be accessed, making them useful for clients who may not be as comfortable with digital technology.

Advantages of Digital Records

- Convenience: Digital formats can be created, edited, and sent quickly, streamlining the process for both businesses and clients. There’s no need for printing, mailing, or dealing with paper storage.

- Environmentally Friendly: Going digital reduces paper waste, making it a more sustainable choice. This can also contribute to a greener image for businesses that prioritize eco-conscious practices.

- Cost-Effective: Eliminates the costs of printing, paper, and postage, making digital records a more affordable option for many businesses.

- Easy to Track and Store: Digital records can be easily stored, archived, and searched. Many tools also allow for automatic backups, ensuring the safety of your data.

- Quick Payments: Digital documents can include links for direct payment, making it faster and easier for clients to settle their accounts immediately.

Which One Is Right for Your Business?

The choice between printed and digital records largely depends on your business’s workflow, client preferences, and the type of transaction. Some businesses may still prefer physical documents due to client expectations or regulatory requirements. Others may find that digital formats suit their needs better due to the speed, flexibility, and cost-effectiveness they offer.

- For businesses with clients who prefer tangible documents: Physical records may be the better choice, especially in industries like legal services or high-end retail.

- For businesses focused on speed and efficiency: Digital documents can streamline operations and help you quickly send and receive payments, especially in industries like freelancing, e-commerce, or subscription-based services.

Ultimately, the decision between printed and digital records depends on the nature of your business and the specific needs of your clients. Many businesses choose to offer both options, allowing flexibility depending on the client’s preference.

Creating Professional Billing Documents for Clients

When working with clients, creating polished and well-structured financial records is essential to ensure clarity, professionalism, and effective communication. A well-designed document not only serves as a clear request for payment but also reflects your business’s credibility. By paying attention to details such as layout, content, and presentation, you can enhance your business’s reputation and foster positive relationships with clients.

Key Elements of a Professional Document

To create a document that exudes professionalism, it’s important to include all the necessary components that both you and your clients will need to reference. A comprehensive document should contain clear and concise information that leaves no room for confusion. Here are the key elements to include:

- Contact Information: Include your business name, address, phone number, and email. This should be positioned prominently at the top of the document, ensuring that clients can easily reach you if necessary.

- Client Details: Accurately list the client’s name, address, and contact information. This helps to avoid any mix-ups and ensures the document is correctly addressed.

- Unique Identification Number: Each document should have a unique reference number for tracking purposes. This can help avoid confusion when handling multiple transactions.

- Clear Breakdown of Services or Products: Provide a detailed list of the services rendered or products sold, including quantities, unit prices, and any discounts applied. This section should be easy to read and well-organized.

- Payment Terms: Clearly outline the payment due date, the methods of payment accepted, and any penalties or discounts associated with timely or late payment.

- Total Amount Due: Provide a clear total at the bottom of the document. This should include the subtotal, applicable taxes, and final amount due to avoid any confusion.

Design Tips for a Polished Look

The design of your document plays a crucial role in how it is perceived. A well-structured, clean design can make a significant difference in how your clients view your professionalism. Here are some tips to help you create a polished document:

- Consistency: Use a consistent font style and size throughout the document. Stick to basic fonts like Arial or Times New Roman for clarity and professionalism.

- White Space: Use white space effectively to avoid a cluttered or overwhelming look. Ensure that there is enough space between sections, so the document is easy to navigate.

- Branding: Incorporate your company’s logo and colors to reinforce your brand identity. This will give yo

How to Add Your Branding to Billing Documents

Branding plays a crucial role in creating a consistent and professional image for your business. When it comes to financial records, incorporating your brand’s elements into the design can help reinforce your business identity and make your documents more recognizable. By adding key branding features like your logo, colors, and fonts, you ensure that your documents reflect your business’s unique style and enhance your overall reputation.

Key Elements to Include for Effective Branding

To properly brand your financial documents, there are several key elements you should consider integrating. These features not only contribute to a professional appearance but also increase the likelihood that your documents will stand out to clients and partners.

- Company Logo: Placing your logo at the top of the document, usually near the business name, ensures that clients can immediately recognize the source of the record. It should be clear, high-resolution, and appropriately sized.

- Brand Colors: Using your brand’s color scheme throughout the document gives it a cohesive look. Incorporate these colors into headers, borders, and important sections to make the document visually appealing and aligned with your overall branding.

- Font Style and Size: Stick to fonts that are consistent with your brand’s identity. Professional, easy-to-read fonts like Arial, Helvetica, or Times New Roman are commonly used for business documents. Use your brand’s preferred font styles for headings and body text to maintain consistency.

- Tagline or Slogan: If applicable, adding a short company slogan or tagline can reinforce your business’s values and services. Position it at the footer or in a smaller section to avoid cluttering the main content.

Best Practices for Implementing Branding

While branding is important, it’s equally essential to maintain a balance between aesthetics and readability. Here are some tips to ensure your branding enhances your documents without overwhelming the core information:

- Simple and Clean Layout: Keep the design minimalistic. Your logo and brand elements should complement the content, not detract from it. Avoid overcrowding the document with too many colors or decorative elements.

- Consistent Use of Branding: Make sure your branding appears consistently across all documents. This creates a unified experience for your clients, whether they’re reviewing a contract, payment record, or another business-related document.

- Appropriate Placement: Place branding elements in areas where they won’t interfere with important information. For instance, logos can go in the header, while color accents can be used for section headings or borders.

- Ensure Readability: While incorporating branding, ensure that text remains legible and clear. Avoid using light-colored fonts on light backgrounds or overly decorative fonts that might distract from the content.

Example Branding Implementation in a Billing Document

Below is a simplified table layout showcasing how

Billing Document Structure for Small Businesses

For small businesses, creating a professional and clear record of transactions is essential for maintaining financial accuracy and ensuring smooth cash flow. Having a reliable structure for generating these documents can streamline the payment process and improve client relations. A well-organized format helps both the business and the client to easily track services rendered, payment terms, and any outstanding balances. For small business owners, simplicity, clarity, and customization are key when setting up these financial records.

When selecting or creating a structure for your financial records, it’s important to include all necessary details while keeping the layout clean and professional. A good design should reflect the personality of your business while ensuring all required fields are addressed. Whether you’re handling one-off transactions or recurring business relationships, having a consistent format will save you time and reduce errors.

Additionally, adopting a format that allows for easy customization is beneficial, as your business may evolve, and you might need to update your document style or content. Whether you’re tracking one-time services or ongoing agreements, consistency in your document format helps establish trust with clients and ensures smooth financial operations.

Customizing Billing Documents for Different Industries

Every industry has its own unique requirements when it comes to managing financial transactions. Customizing the structure and content of your financial records ensures that the information is both relevant and clear to your clients. Whether you’re running a freelance service, retail business, or a professional consultancy, adapting your documentation to fit the specific needs of your industry is key to maintaining a professional image and efficient workflow.

While some industries may need more detailed breakdowns, others may require additional fields, such as project milestones or product specifications. Customizing your financial documents with these considerations in mind helps ensure that the record serves its purpose for both your business and your clients. Below are a few examples of how different industries may approach document customization:

1. Freelance Services

- Project Descriptions: Include detailed descriptions of the services provided, including hourly rates, task breakdowns, or milestones achieved.

- Client and Project Info: Clearly define the project name or reference number and the client’s contact information to avoid confusion.

- Payment Terms: Freelancers often use specific terms for payment, like hourly rates or flat fees for each milestone, so make sure to reflect this in the document.

2. Retail Businesses

- Product Details: Include a detailed list of products sold, including quantity, unit price, and any applicable discounts or promotions.

- Taxes and Shipping: Retailers often need to add tax calculations, shipping fees, or handling charges to the document, so ensure these are clearly outlined.

- Return Policy: Adding a note on return policies or warranty information can be beneficial in a retail setting.

3. Consulting and Professional Services

- Service Hours: A breakdown of time spent on consultations or professional services is often necessary for transparency.

- Consultant or Service Fees: Specify different rates for different services, including any applicable discounts for long-term engagements.

- Project Milestones: For larger projects, it can be helpful to include a list of project milestones or deliverables tied to specific payment dates.

4. Construction and Contracting

- Work Breakdown: Provide a detailed list of completed work, including materials used, labor costs, and any subcontractor fees.

- Project Phases: Include payment terms that align with different phases of the construction project, such as deposits, progress payments, and final settlement.

- Permits and Licenses: For certain construction projects, adding a section for permits or licenses can help clarify additional costs.

5. Healthcare and Medical Services

- Procedure Codes: Include detailed information on medical procedures or consultations, using standardized codes (like ICD or CPT) for insurance claims or transparency.

- Insurance Information: Include sections for insurance claims, co-pays, and the breakdown of patient responsibility.

- Medical Notes: Provide a sp

How to Ensure Billing Document Accuracy

Accurate billing is crucial for maintaining trust with clients and ensuring smooth financial operations. Errors in your records can lead to confusion, delayed payments, or even damage to your business’s reputation. To avoid these issues, it is essential to follow a clear process that checks for accuracy at every stage. Ensuring the correctness of the details in your financial documents will save time, prevent disputes, and create a positive impression with your clients.

There are several key practices that can help you ensure the accuracy of your billing documents:

1. Double-Check Client Details

- Correct Contact Information: Always verify the client’s name, address, and contact details before finalizing any document.

- Clear Service Details: Ensure that the services provided or products delivered are correctly described, with accurate quantities and unit prices.

2. Review Dates and Payment Terms

- Accurate Dates: Double-check the dates listed for the work completed and the payment due. Any discrepancies between agreed-upon dates and those listed can cause confusion.

- Clear Payment Terms: Make sure the payment terms are correctly stated, including the due date, penalties for late payment, and accepted methods of payment.

3. Confirm Calculations and Totals

- Subtotal and Taxes: Ensure all calculations, including taxes, discounts, and the subtotal, are accurate. Use a calculator or automated tools to avoid errors.

- Final Amount: Double-check the final total, including any adjustments, to confirm that it matches the expected amount.

4. Verify Additional Costs

- Extra Charges: If there are additional charges (such as shipping or handling), make sure they are clearly listed and correctly calculated.

- Reimbursement Information: If applicable, include reimbursement details for any expenses that have been agreed upon with the client.

5. Use Consistent Formats

- Standardized Fields: Use a consistent format for fields like item descriptions, dates, and totals. This makes it easier to spot discrepancies and ensures that the document is easy to read.

- Professional Layout: A clean and organized layout reduces the risk of overlooking important information and improves the overall clarity of your billing document.

6. Implement an Approval Process

- Peer Review: Before sending out any billing document, have another team member or colleague review it for errors. A second set of eyes can often catch mistakes that you may have missed.

- Use Tools: Leverage software tools that automatically flag common errors, such as duplicate entries or calculation mistakes.

By following these steps, you can ensure that your billing records are accurate, professional, and error-free. A thorough review process will not only help you maintain good relationships with clients but also protect your business from unnecessary disputes and delays in payment.

Tips for Organizing Billing Records

Efficient organization of financial records is vital for businesses of all sizes. Properly managing your documents helps you stay on top of payments, track expenses, and maintain a clear financial overview. By establishing a structured system for storing and organizing your billing documents, you can save time, reduce the risk of errors, and improve overall efficiency. Here are some tips to help you streamline and organize your billing records effectively:

1. Use a Consistent Naming Convention

- Clear Labels: Label each record clearly by including the client name, date, and unique reference number. This makes it easier to find specific documents later.

- Avoid Ambiguity: Stay consistent in naming conventions to prevent confusion. For example, always use “Invoice” followed by a number or date rather than vague labels like “Document 1”.

2. Categorize Records by Client or Project

- Client Folders: Organize all documents related to each client in their own folder or subfolder. This keeps records in one place and reduces time spent searching.

- Project-Based Organization: For businesses that handle multiple projects, organize records by project name or reference number, making it easy to track payment progress and outstanding amounts.

3. Maintain a Digital Filing System

- Cloud Storage: Using cloud-based storage ensures that your records are accessible from anywhere and are backed up securely. It also makes it easier to share documents with clients or team members.

- Document Management Software: Invest in specialized software designed for managing financial documents. These tools often come with built-in organization features, such as categorization and tagging, to streamline the process.

4. Create a Payment Tracking System

- Payment Status: Keep track of the payment status for each document. Create categories like “Paid,” “Unpaid,” and “Pending” to make it easier to monitor what is still due.

- Use Spreadsheets: For a simple solution, use a spreadsheet to track the status of each record, including amounts due, payment dates, and outstanding balances.

5. Set Up a Regular Review Process

- Monthly Checks: Dedicate time at the end of each month to review your records, ensuring all entries are correctly updated, payments are accounted for, and no documents are missing.

- Consistency: Regularly check for errors and ensure that your filing system remains consistent to avoid confusion later on.

6. K

Billing Document for Freelancers

As a freelancer, creating clear and professional financial records is essential for maintaining smooth business operations. A well-structured billing document not only ensures you get paid on time but also builds credibility with your clients. Freelancers, whether in design, writing, or other services, benefit from having a consistent and easy-to-use structure that outlines services rendered, payment terms, and any other relevant details. This helps maintain transparency and reduces the risk of disputes.

When crafting a billing document for freelance work, it’s important to customize it to reflect the nature of your business and the specific agreements made with your clients. The document should be simple yet detailed enough to avoid confusion. Below are some essential elements that should be included in your billing record:

Key Elements to Include

- Client Information: Include your client’s full name or business name, contact details, and billing address to ensure that the document reaches the right person and avoids any miscommunication.

- Project Description: Clearly outline the services you provided, including a breakdown of tasks or milestones completed. This can include hourly rates, flat fees, or a combination of both depending on your pricing structure.

- Payment Terms: Specify the agreed-upon payment terms such as due dates, late fees, or deposit requirements. Include any special payment methods or instructions as needed.

- Total Amount Due: Be sure to calculate the total amount due, including any applicable taxes or fees. Make it easy for your client to understand how the final amount is reached.

Sample Layout

Item/Service Quantity Rate Total Design Consultation 5 hours $50/hr $250 Website Development 1 Project $1,000 $1,000 Subtotal: $1,250 Sales Free and Paid Billing Document Options

When it comes to creating professional financial records, businesses have a variety of options. Whether you’re a freelancer, a small business owner, or working in a larger enterprise, having access to the right tools can make a big difference in efficiency. Many platforms offer both free and paid solutions that cater to different needs and budgets. While free options may be suitable for individuals or startups, paid solutions often come with additional features and customization capabilities that can benefit businesses looking for more flexibility and support.

Understanding the differences between free and paid options can help you decide which one best fits your requirements. Below, we break down both categories to guide you in choosing the right solution for your needs:

Free Options

- Basic Design: Free options typically offer simple, pre-designed formats that can be easily filled in with your own details. They are great for quick, one-off transactions or small-scale operations.

- Limited Customization: Most free solutions allow basic customization, such as adding your company name, client details, and service descriptions. However, you may not be able to modify the layout or advanced features.

- No Support: Free tools often do not provide customer support. If you encounter an issue, you may need to figure it out on your own.

- Example Free Tools: Some popular free options include Google Docs, Microsoft Word, and basic online platforms like Wave and Zoho.

Paid Options

- Advanced Features: Paid solutions often come with more sophisticated features such as automatic calculations, customizable fields, branding options, and integration with accounting software.

- Full Customization: With premium tools, you can typically design your records to match your brand’s style, adjusting colors, fonts, and layout to create a personalized look.

- Customer Support: Paid platforms usually offer dedicated support, ensuring you can get assistance if you run into any issues while creating or managing your documents.

- Example Paid Tools: Some well-known paid platforms include QuickBooks, FreshBooks, and Invoicely. These often come with features like expense tracking, recurring billing, and more.

In conclusion, choosing between free and paid billing solutions depends on your business’s needs. If you’re just starting or have simple requirements, free options can be an excellent choice. However, if you’re looking for more robust tools with advanced features and customization, investing in a p