How to Use an Editable Invoice Template for Easy and Professional Billing

In the modern business world, having a streamlined process for managing financial transactions is essential. Whether you are a freelancer, a small business owner, or running a larger company, creating professional and consistent documents for charging clients is a must. Using a flexible document design allows you to customize the details to fit your unique needs and ensure smooth interactions with your customers.

Customizing billing documents gives you the ability to tailor key information such as pricing, dates, and client details, all while maintaining a polished and professional appearance. This flexibility saves you time, reduces errors, and ensures you are always sending out documents that reflect your brand identity.

From adjusting the layout to including specific payment terms or discounts, this approach ensures that each document serves its purpose perfectly. It helps you maintain clear communication, build trust with your clients, and create a professional reputation for your business. With the right tools, customizing these essential business documents becomes an easy and efficient task that can elevate your overall administrative workflow.

Editable Billing Document Overview

For any business, having a flexible and professional solution for generating transaction records is crucial. These tools allow you to tailor financial documents quickly and efficiently, adjusting details such as client names, dates, amounts, and terms. This approach ensures that you present a consistent and well-organized format to your clients every time, helping maintain clarity and professionalism in your dealings.

One of the main advantages of customizable billing forms is their ability to adapt to the specific needs of each business. You can modify fields to reflect various pricing structures, payment terms, or other special conditions. Whether you’re sending a regular charge or a one-off fee, these documents can be easily updated to match the unique requirements of each transaction.

Key Features of Customizable Documents

| Feature | Description |

|---|---|

| Flexible Fields | Adjust details such as client information, services provided, and amounts due. |

| Branding Options | Insert company logos and color schemes to match your brand identity. |

| Payment Terms | Set payment deadlines, discounts, and other terms that suit your business model. |

| Quick Updates | Modify any document field easily as client information or charges change. |

Why Customizing Documents is Important

By utilizing a flexible document solution, businesses can ensure that they are not only reducing errors but also enhancing the customer experience. A well-structured, personalized document reflects professionalism and ensures clarity in communication. Furthermore, it speeds up the entire billing process, making it easier for both the business and the client to track payments and keep records organized.

Benefits of Customizable Billing Documents

Customizing your business documents offers numerous advantages that can improve your workflow, enhance professionalism, and simplify administrative tasks. By using flexible designs that allow you to personalize essential details, you ensure that each record accurately reflects your brand and meets your specific needs. Whether you’re sending regular payments or handling one-off charges, the ability to make adjustments ensures that everything is tailored to the transaction.

Customization allows businesses to easily adapt to different client requirements, changing terms, and evolving pricing structures. This not only saves time but also reduces the risk of mistakes that could arise from manually editing or reformatting each document. By keeping everything in a pre-set, adaptable structure, the process remains quick, efficient, and accurate.

Improved Efficiency

One of the most immediate benefits is the significant reduction in time spent on creating new documents. With pre-designed fields and sections, all that is needed is a quick update to reflect the current client or job. This streamlined approach minimizes administrative workload, allowing you to focus more on core business activities.

Enhanced Professionalism

Personalized documents that include your branding, such as logos, color schemes, and fonts, can leave a lasting impression on clients. These polished, professional materials not only reflect the quality of your work but also help establish trust and credibility in your business relationships. A well-designed document adds an extra layer of professionalism to every transaction.

How to Choose the Right Document Design

Selecting the appropriate format for creating financial records is essential to ensure clarity, professionalism, and ease of use. A well-chosen design should align with your business needs, client preferences, and industry standards. When deciding on the best layout for your billing paperwork, consider functionality, customization options, and how it reflects your brand.

First, assess the complexity of your business transactions. If your services or products are straightforward, a simple and clean design may suffice. However, for more detailed transactions or if you work with multiple clients with varying terms, you may want a more structured design that allows for easy adjustments. The format should allow you to include all necessary details without being overly cluttered.

Key Features to Look For

- Customizable Fields: Ensure that you can modify client details, pricing, and payment terms.

- Clear Layout: Opt for a design that highlights important information, making it easy for clients to read and understand.

- Branding Options: Look for options that allow you to incorporate your company logo, colors, and fonts for a professional touch.

- Flexibility: Choose a design that can easily accommodate both recurring and one-time charges, as well as different payment methods.

Consider User Experience

Ease of use is another key factor. A good layout should not only be visually appealing but also simple to navigate and update. Look for options that allow you to quickly fill in the necessary details without unnecessary steps. This will ensure that you can send out your records without delays or errors, improving your overall workflow.

Key Features of a Customizable Billing Document

When choosing a flexible billing solution, certain features can greatly improve the efficiency and professionalism of your financial paperwork. A well-structured document should offer the ability to adjust important details without compromising clarity or accuracy. By focusing on specific elements that are easily modifiable, businesses can ensure each transaction is documented correctly and in line with their unique needs.

Here are some of the most important characteristics to consider when selecting a flexible billing document:

Essential Modifiable Elements

- Client Information: The ability to input and update client names, addresses, and contact details quickly.

- Product or Service Descriptions: Customizable fields to specify the goods or services provided, including quantities and prices.

- Pricing Structure: Fields that allow you to adjust amounts based on different pricing tiers, discounts, or special offers.

- Payment Terms: Clear sections for payment due dates, late fees, or installment options that can be modified based on the terms of the agreement.

Additional Functional Features

- Brand Customization: The ability to insert company logos, color schemes, and fonts to maintain brand consistency across documents.

- Tax and Currency Settings: Easily adjustable tax rates and currency formats, especially useful for businesses operating internationally.

- Recurring Charges: Options to set up templates for ongoing billing, allowing for automatic updates to pricing or dates.

- Clear Layout: A design that ensures all key information is easy to read and logically organized for both you and your clients.

By selecting a solution with these key features, businesses can not only streamline their billing process but also ensure each document reflects the company’s professionalism and meets the needs of their clients efficiently.

Step-by-Step Guide to Customization

Customizing your billing documents is a straightforward process that allows you to tailor each record to the specific needs of your business and clients. By following a few simple steps, you can ensure that all the necessary information is included, while maintaining a professional and consistent look across all your paperwork. Below is a guide to help you navigate the customization process and make the most of your document’s flexibility.

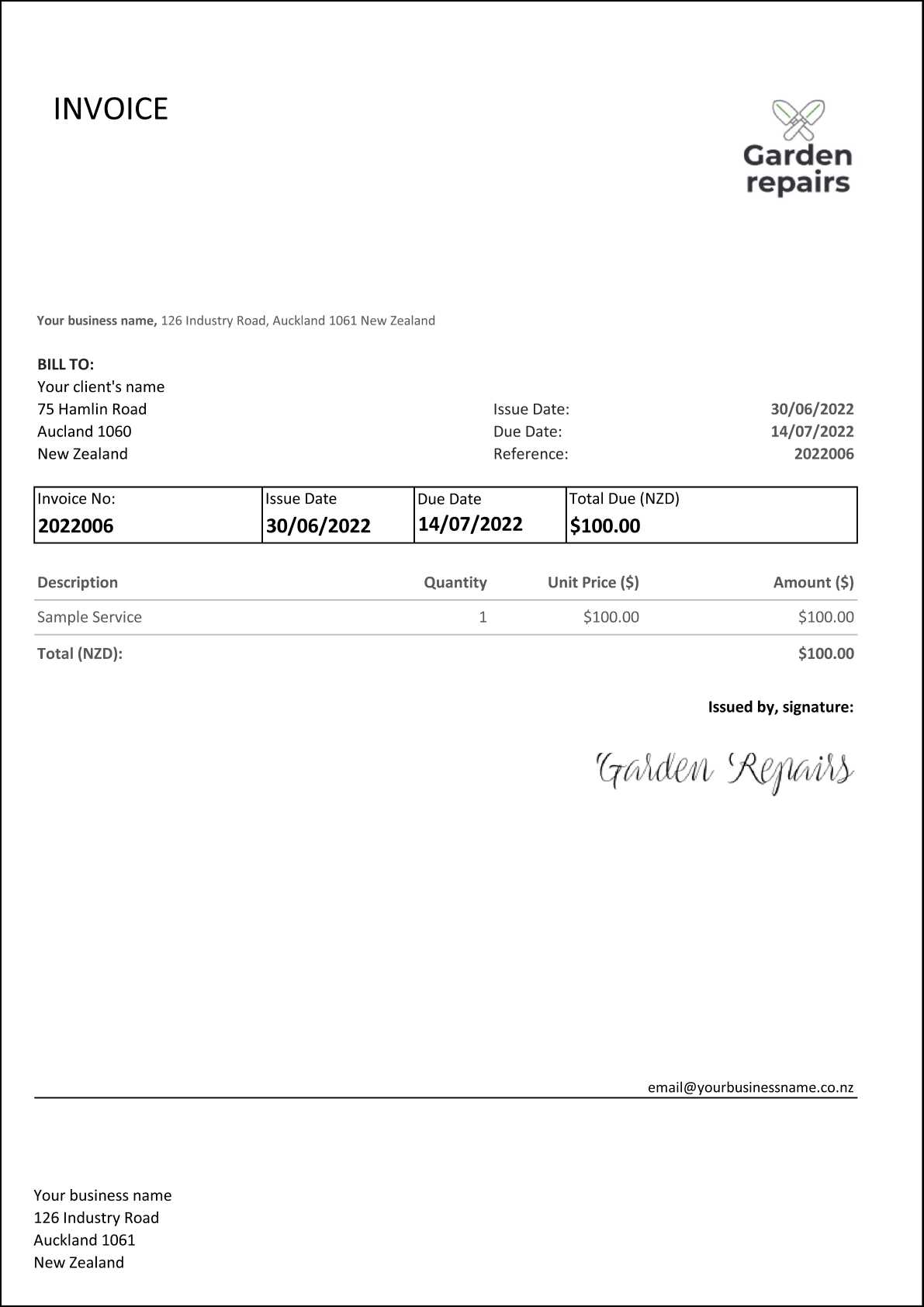

Step 1: Choose Your Layout

The first step is selecting the layout or design that best suits your needs. Look for a structure that accommodates all the essential elements, such as client details, product descriptions, and pricing information. It should be clean and easy to read, with clearly defined sections. Consider your branding and whether you want to include your logo or company colors to maintain consistency across your materials.

Step 2: Personalize Key Fields

Once you’ve selected the layout, the next step is to fill in the customizable fields. This typically includes:

- Client Information: Input the name, address, and contact details of your customer.

- Service or Product Details: List the items or services provided, along with quantities and prices.

- Payment Terms: Add any relevant payment instructions, due dates, or late fee clauses.

Ensure that all the necessary fields are completed and that the information is accurate. This is a crucial step in ensuring clarity and avoiding mistakes.

Step 3: Adjust for Special Conditions

If you have specific terms for different clients or services, use the flexible fields to adjust for those special conditions. You can include things like discounts, taxes, or different payment methods that may apply. Be sure to update these fields for each new document to ensure accuracy.

Step 4: Finalize and Save

After making all necessary adjustments, review the document carefully. Double-check the accuracy of all entered information, ensuring no details are missed. Once satisfied, save the document in your preferred format, whether it’s for printing or digital use.

Following these steps will not only save you time but will also allow you to create professional, consistent records tailored to your specific business needs. By streamlining the process, you ensure that every document sent out is clear, accurate, and aligned with your company’s standards.

Free vs Premium Billing Document Solutions

When choosing a document design for your business transactions, you’ll find two main options: free and premium solutions. Both types offer advantages, but they also come with different sets of features, customization options, and support. The choice between them depends largely on your business needs, budget, and the level of professionalism you aim to project in your communications with clients.

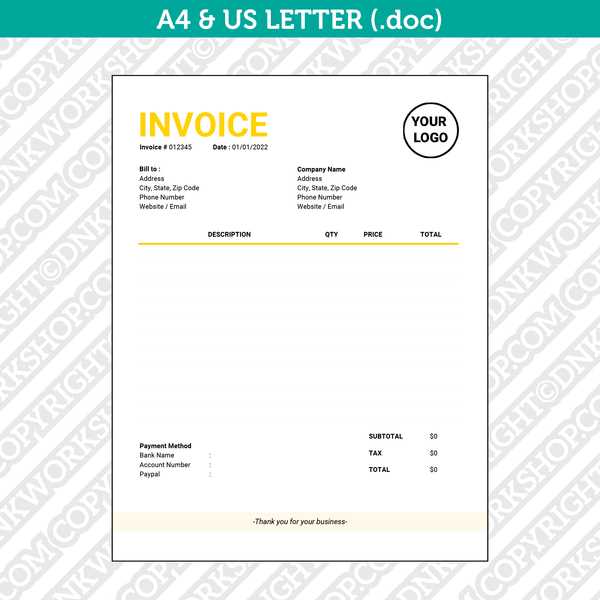

Free options typically provide basic functionality, offering a straightforward layout with the most essential fields for billing purposes. These can be a great starting point for freelancers or small businesses on a tight budget. However, free solutions often come with limitations, such as fewer customization options, more basic designs, and sometimes, restrictions on the number of uses or available formats.

Advantages of Free Solutions

- No Cost: Free templates come at no expense, making them an ideal choice for startups or businesses with minimal budgets.

- Simplicity: Easy to use and perfect for simple transactions or businesses that don’t require extensive customization.

- Quick Setup: Most free designs are ready to use immediately, saving time in the setup process.

Advantages of Premium Solutions

On the other hand, premium options often offer more advanced features, such as greater customization, better design flexibility, and additional support. These solutions may include more complex layouts, the ability to integrate branding elements like logos and color schemes, and options for recurring billing or dynamic pricing.

- Customizability: Premium solutions typically allow for a high level of customization, helping you create documents that align with your brand and specific client needs.

- Professional Design: Higher-quality layouts that look polished and polished, contributing to a more professional presentation.

- Ongoing Support: Access to customer support, regular updates, and new features that ensure your documents remain relevant and functional.

Ultimately, the choice between free and premium options comes down to your business’s specific needs. If you require a simple, functional solution, free designs can get the job done. However, if you need more advanced features, branding options, and dedicated support, investing in a premium solution might be the right choice for your business.

How to Add Your Logo to Billing Documents

Including your company logo in financial documents is a simple yet powerful way to reinforce your brand identity. By adding your logo, you create a professional appearance that helps build trust with your clients and makes your documents instantly recognizable. Fortunately, adding your logo to any business record is a quick process that can be done in just a few easy steps.

Step 1: Choose the Right Format

Before you begin, ensure that your logo is in an appropriate format for insertion into the document. Common formats such as PNG, JPEG, or SVG work best, as they maintain quality and are compatible with most document editing platforms. It’s important to choose a file with a high resolution, so it remains sharp when displayed on both digital and printed versions.

Step 2: Insert the Logo into the Document

Once you have the correct file, open the document in your chosen editing program. Most word processors and design software will have an “Insert Image” or “Add Logo” option in the toolbar. Follow these steps to add your logo:

- Locate the “Insert” Option: Find the option that allows you to add images or graphics to the document.

- Upload the Logo: Select your logo file from your computer and insert it into the header or any other preferred section.

- Resize and Position: Adjust the size to fit your document’s layout and position it where it best complements the design, typically at the top left or center.

Once the logo is added, be sure to review the document to ensure that it appears clear and professional. Resize if necessary and ensure that the logo does not overlap with any important information such as payment details or service descriptions.

By following these simple steps, you can quickly add your logo to any business document, enhancing its professional appearance and aligning it with your overall brand strategy.

Common Mistakes When Using Billing Document Designs

While customizable billing documents offer great flexibility and convenience, it’s easy to make mistakes that can impact the professionalism and accuracy of your records. Many businesses, especially those new to creating their own financial paperwork, overlook important details that can lead to confusion or even payment delays. Understanding these common errors and how to avoid them can help ensure that your documents are always clear, accurate, and effective.

1. Missing or Incorrect Client Information

One of the most common mistakes is failing to properly update client information, such as names, addresses, or contact details. This can lead to confusion, miscommunication, or delayed payments. Always double-check that the client’s information is accurate before sending any document.

2. Not Including Clear Payment Terms

Another frequent issue is the omission or vagueness of payment terms. Whether it’s due dates, late fees, or accepted payment methods, failing to specify these details can cause misunderstandings and delayed payments. Always ensure that payment instructions are clear, specific, and prominently placed within the document.

3. Using Outdated or Inconsistent Formats

Consistency in design is key to creating a professional image. Using outdated formats or inconsistent designs across your documents can make your business appear unorganized. Ensure that all your records follow the same structure, font choices, and branding guidelines to create a cohesive look and feel.

4. Forgetting to Include Taxes or Discounts

Forgetting to add applicable taxes or discount codes can result in discrepancies and errors when clients review their bills. Always double-check that all additional charges, discounts, and tax rates are accounted for and accurately reflected in the document.

5. Inaccurate Calculations

Manual errors in calculations, such as adding the wrong amounts or miscalculating totals, can cause significant problems. It’s essential to verify that all pricing, taxes, and discounts have been calculated correctly. Some document solutions include automatic calculation features, which can help reduce the likelihood of errors.

6. Lack of Branding

Not incorporating your company’s logo, colors, and overall branding can make your documents appear less professional and harder for clients to recognize. Including these elements not only enhances the look but also reinforces your brand identity and trustworthiness.

By being mindful of these common mistakes and ensuring that your documents are accurate, consistent, and professional, you can avoid costly errors and maintain strong relationships with your clients.

Integrating Payment Methods in Your Billing Document

Including payment methods in your financial documents is an essential step in ensuring that your clients can easily settle their accounts. By offering a variety of payment options, you not only make it convenient for clients but also increase the likelihood of timely payments. Whether it’s through bank transfers, credit cards, or online payment platforms, providing clear instructions on how to pay is crucial for maintaining smooth business operations.

When integrating payment methods, it’s important to make sure that all relevant details are clearly outlined in the document. This includes providing the necessary account numbers, payment links, or instructions for alternative payment channels. Depending on your business and the preferences of your clients, you may want to offer several different methods to accommodate a wide range of payment preferences.

Here are a few tips to consider when adding payment options to your documents:

- Multiple Payment Methods: Offer a variety of payment options such as bank transfers, PayPal, credit card payments, or mobile payment apps to make it easier for clients to pay in their preferred way.

- Clear Instructions: Be specific about the payment process, including any account details, payment platforms, or necessary links. Providing step-by-step instructions can help clients avoid confusion.

- Payment Deadlines: Always include the due date for payments and any applicable late fees to encourage timely payments and avoid delays.

- Secure Payment Options: Ensure that all payment methods listed are secure and trusted by your clients. Mentioning any security measures or encryption used can help reassure clients about the safety of their payments.

By carefully integrating payment methods into your documents, you create a seamless and professional experience for your clients while ensuring that payments are processed efficiently.

Best Tools for Creating Customizable Billing Documents

Creating professional, customizable financial records is essential for businesses of all sizes. The right tools can help streamline the process, ensuring that each document is tailored to your specific needs while maintaining a polished, consistent appearance. With the vast range of options available today, selecting the best software or platform for your needs can make a significant difference in terms of efficiency and quality.

1. Microsoft Word or Google Docs

For businesses looking for simplicity and ease of use, both Microsoft Word and Google Docs offer excellent solutions for creating basic, customizable documents. These word processing programs allow users to build their own layouts from scratch or use pre-designed layouts that can easily be adjusted to meet your specific requirements.

Both tools provide the ability to insert tables, text boxes, and logos, and the flexibility to format each section. Google Docs, being cloud-based, offers the added benefit of real-time collaboration, which is ideal for teams working remotely or across different locations.

2. Canva

Canva is an intuitive graphic design tool that offers a wide variety of pre-designed layouts for all types of documents, including billing records. With drag-and-drop functionality, users can quickly customize fonts, colors, and images to match their brand. Canva’s easy-to-use interface is perfect for those who may not have graphic design experience but still want to create polished and professional documents.

Canva also allows users to download their creations in multiple formats, including PDF, which is ideal for sending or printing the final document. The free version offers many features, while the premium version unlocks even more advanced tools and templates.

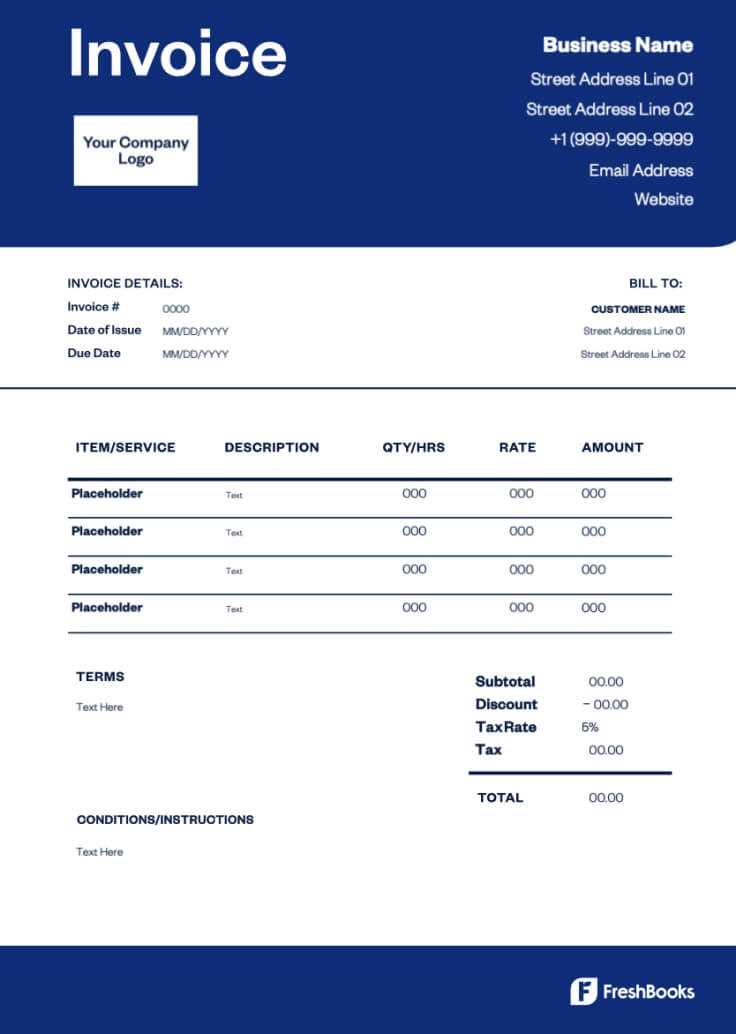

3. FreshBooks

FreshBooks is a cloud-based accounting and invoicing platform that allows small businesses to create and send professional billing documents with ease. Beyond just creating bills, FreshBooks offers a full suite of tools to manage clients, track time, and handle payments–all in one place. With customizable fields, automated reminders, and tax calculation tools, FreshBooks helps streamline your entire billing process.

This platform is particularly useful for freelancers and small business owners looking for an all-in-one solution that simplifies financial management while offering customizable features.

4. Zoho Invoice

Zoho Invoice is another powerful tool for generating custom billing documents. It allows for a high level of customization, including the ability to add your company logo, select currency types, and adjust payment terms. Zoho also integrates with other Zoho business tools, making it an excellent option for those already using their suite of applications.

With its cloud-based setup, Zoho Invoice ensures that your documents are accessible from anywhere, and it offers automation features like recurring billing and payment reminders to keep your workflow efficient.

Choosing the right tool depends on your specific business needs, whether you’re looking for simplicity, advanced features, or a combination of both. The tools listed above provide varying degrees of customization and ease of use, helping you create professional documents with minimal effort.

How to Save and Store Your Billing Documents

Storing your financial records properly is crucial for both organizational and legal reasons. Whether you need to track payments, manage client relationships, or comply with tax regulations, maintaining a reliable system for saving and storing these documents can save time and prevent costly mistakes. By implementing the right practices, you ensure that your records are easily accessible and secure when needed.

There are different methods for storing billing documents, depending on your business needs, the volume of transactions, and the tools you have available. Below are some common strategies for saving and organizing these files:

1. Cloud Storage Solutions

Cloud storage platforms are increasingly popular for saving and storing important business documents. These services allow you to access your records from any device with an internet connection, ensuring flexibility and security. Popular cloud storage services include Google Drive, Dropbox, and Microsoft OneDrive.

- Pros: Access from anywhere, automatic backups, and sharing capabilities.

- Cons: Subscription fees for larger storage capacities, depending on the provider.

2. Local Storage on Your Computer

For businesses that prefer not to rely on cloud-based services, storing documents directly on your computer or local servers is another viable option. However, this method requires regular backups to avoid losing important files in case of system failure.

- Pros: No subscription fees, total control over your files.

- Cons: Risk of data loss if backups are not regularly done, limited accessibility from other devices.

3. Use of Document Management Systems

Document management systems (DMS) offer advanced options for storing, categorizing, and retrieving business records. These systems often include powerful features like automated organization, metadata tagging, and search capabilities that make it easy to find specific files when needed. Some examples include Zoho Docs and DocuSign.

- Pros: Improved organization, efficient search functions, and secure access controls.

- Cons: Can be expensive and may require training to fully utilize.

4. Physical Storage (For Printed Documents)

In some cases, businesses may choose to print their records and store them physically. While this method may seem outdated in the digital age, it is still an option for those who prefer a hard copy for legal or backup reasons. Ensure that physical records are kept in a safe, organized place, such as filing cabinets or locked storage boxes.

- Pros: Tangible copies for records, no reliance on digital storage.

- Cons: Takes up physical space, can be difficult to organize efficiently, and prone to damage over time.

Best Practices for Organizing Stored Documents

Regardless of the method you choose, it’s essential to organize your documents effectively to streamline retrieval and reduce clutter. Below are some best practices:

| Best Practice | Description | |||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Printable vs Digital Customizable Billing DocumentsWhen creating business records, you have the option to either produce physical copies for printing or rely on digital formats for electronic distribution. Each method has its advantages depending on your workflow, client preferences, and the type of interaction you wish to have with your customers. Understanding the benefits and limitations of both printable and digital formats can help you decide which approach works best for your business needs. Printable VersionsPrintable versions of financial documents are typically used when a hard copy is required or when clients prefer receiving physical records. These can be printed directly from your computer and handed over to clients in person or sent via traditional mail. Printable documents offer the advantage of providing something tangible, which may be important for certain legal or record-keeping purposes.

Digital VersionsDigital formats are becoming increasingly popular due to their convenience, speed, and environmental benefits. These documents can be created and sent electronically, allowing clients to receive them almost instantly via email or through online payment platforms. Digital versions are often easier to manage, store, and track compared to printed documents.

Choosing between printable and digital versions depends on the needs of your business and your clients. For a modern, efficient workflow, digital documents are often the preferred choice. However, for businesses that require hard copies for legal, regulatory, or client preference reasons, printable versions remain an essential option. Tips for Professional Billing Document DesignCreating a well-designed financial document is essential for conveying professionalism and ensuring clarity in business transactions. A clean, organized layout not only helps clients understand the details of the transaction but also reinforces your brand’s image. Whether you are designing from scratch or customizing a pre-made structure, focusing on key design principles can make a significant difference in the impact of your documents. 1. Keep the Layout Simple and CleanA cluttered design can confuse clients and make it difficult to quickly locate important information. Keep your layout straightforward, with clearly defined sections for the client’s details, the transaction summary, and payment instructions. Avoid overcrowding the document with unnecessary graphics or text, as simplicity enhances readability and professionalism. 2. Use Clear, Legible FontsTypography plays a crucial role in document design. Choose clean, easy-to-read fonts, such as sans-serif types like Arial, Helvetica, or Open Sans. The text should be large enough to read comfortably, especially for important details like the total amount due, payment terms, and due dates. Avoid using too many different fonts, as this can make the document feel disorganized. 3. Incorporate Your Brand’s IdentityYour financial documents should reflect your company’s branding. Include your logo, company colors, and consistent font styles to maintain a cohesive and professional image. These elements help reinforce your brand’s identity and make your documents easily recognizable to clients. 4. Provide Clear Payment InstructionsEnsure that the payment terms and methods are clearly stated. Include all relevant information, such as bank account details, payment links, or accepted credit card methods, in a prominent location. Avoid making clients search for this information–clear visibility will encourage timely payments and reduce confusion. 5. Organize Information with TablesTables are an excellent way to organize and present data in a structured manner. Use them to break down charges, taxes, discounts, and totals in an easy-to-read format. Clearly label each column and row to ensure that clients can quickly understand the breakdown of the charges. Tables also help keep information neat and aligned, contributing to a more professional appearance. 6. Use a Logical FlowThe order in which information is presented can greatly affect how the document is perceived. Start with your company’s details at the top, followed by the client’s information, the transaction details, and then the payment instructions. Ensure that the document flows naturally from one section to the next, so clients can easily follow the information. 7. Include Legal or Compliance InformationIn some industries, there may be legal requirements for the inclusion of certain information, such as tax identification numbers, terms of service, or specific disclosures. Make sure to include any necessary compliance details in a discreet but accessible location to avoid issues down the line. 8. Optimize for Mobile ViewingMore clients are viewing financial documents on mobile devices. When designing, ensure that your document is easily readable o How to Handle Currency and Tax RatesAccurately managing currency and tax rates is a vital part of any financial document. Whether you’re dealing with international clients or local businesses, ensuring that all rates are applied correctly helps avoid confusion and ensures compliance with legal requirements. Understanding how to incorporate these elements into your documents is essential for transparency and professionalism. 1. Select the Correct CurrencyWhen dealing with clients from different regions, it is important to clearly indicate the currency in which payment is expected. This helps prevent misunderstandings and ensures that both parties are on the same page. Follow these steps to manage currency effectively:

2. Handling Sales TaxIncorporating tax into your business documents is a requirement in many regions. You must ensure that tax rates are applied correctly and are easy to identify for your clients. Here’s how to manage this:

3. Handling Multiple Taxes or Fees

In some cases, there might be more than one tax or fee applied to a transaction. For example, in addition to sales tax, a transaction might also be subject to service or environmental fees. Make sure each tax or fee is clearly separated and labeled. Here are a few tips:

4. Adjusting for Discounts or PromotionsDiscounts or promotional offers should be factored into the total amount, especially when taxes are involved. Here are ways to handle them properly:

Correctly applying currency and tax rates ensures accuracy and transparency in your financial documentation. Taking the time to understand these elements and how they interact within your records will promote trust and professionalism in your business relationships. Ensuring Compliance with Local RegulationsIn any business transaction, adhering to local regulations is essential to maintain legality and professionalism. Each region or country may have specific requirements for the format, content, and handling of financial records. Understanding these requirements is crucial for avoiding penalties and ensuring smooth business operations. By following best practices and staying informed about regulatory changes, businesses can ensure they remain compliant with local laws. Key Regulatory ConsiderationsDifferent regions have varying regulations related to financial documentation, and businesses must ensure that they meet these requirements. Some of the key considerations include:

Important Elements to Include for ComplianceThere are several key elements that should be present in financial documents to ensure compliance with local regulations:

Staying Up-to-Date with Regulatory ChangesRegulations can change frequently, so it is important for businesses to stay informed about any legal updates in their jurisdiction. This can involve subscribing to local business newsletters, consulting with legal professionals, or using software solutions that update automatically to reflect new requirements. By integrating these elements into your financial documents and keeping up with regulatory cha How to Track Payments Using TemplatesTracking payments is a critical aspect of managing finances in any business. Proper documentation and clear organization ensure that payments are accurately recorded, reducing the risk of missed transactions or errors. By utilizing a structured format, you can easily track the status of each payment and maintain accurate financial records. This section will discuss how to effectively monitor payments with a well-organized document structure. 1. Use Clear Payment Status IndicatorsOne of the most effective ways to track payments is by including a payment status section in your records. This allows you to quickly assess whether an amount has been paid, is pending, or is overdue. Clear labels and color codes can be used to distinguish between different statuses.

2. Organize Payment Information by Date and AmountTracking payments becomes easier when you organize payment data chronologically or by amount. Including a table with these key details ensures that you can quickly reference past transactions and identify any discrepancies or patterns.

This structure ensures that all payment details are easy to review and helps avoid confusion when following up with clients. A simple table can significantly streamline payment tracking and give you a clearer overview of your financial status. By including these tracking features, you can maintain better control over your business’s cash flow and ensure timely payments from clients. Why Invoice Templates Improve WorkflowStreamlining business processes is essential for increasing productivity and maintaining a smooth operation. Having structured documents in place allows businesses to save time, reduce errors, and maintain consistency across all transactions. By utilizing standardized forms, organizations can ensure that every financial record is complete, professional, and easily understood. This section explores how using a pre-designed document can enhance your workflow and improve overall efficiency. 1. Time-Saving and EfficiencyOne of the most significant benefits of using a standardized format for financial records is the time it saves. Rather than creating each document from scratch, a predefined structure ensures that all the necessary fields are already in place. This allows you to focus on the content rather than the layout, making the process faster and more efficient.

2. Reducing Errors and Ensuring ConsistencyAnother critical advantage is the reduction of errors. With a consistent format, you’re less likely to forget important details or make mistakes in the design. These forms can also include built-in features such as calculations for totals, tax rates, and discounts, which further reduces human error.

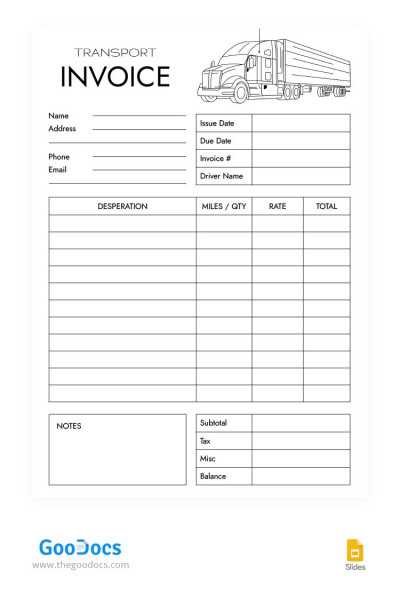

3. Better Organization and Record KeepingUsing a standardized format helps with better organization of records. You can easily track payments, manage due dates, and categorize documents for future reference. Templates can be saved and stored electronically, making it easier to access past transactions and stay organized, especially for businesses with high volumes of financial records. By adopting structured formats, businesses not only improve the efficiency of their operations but also build a more organized and professional approach to managing financial documentation. This ultimately leads to faster processing times, fewer mistakes, and a smoother workflow overall. Common Formats for Editable InvoicesWhen managing business transactions, it’s essential to choose the right format for documenting financial details. A well-structured document format can enhance communication, ensure consistency, and simplify the payment process. There are various formats available that cater to different business needs, each offering unique features for organizing and presenting financial information. Below, we explore some of the most commonly used formats for creating professional financial records. 1. PDF FormatPDF (Portable Document Format) is one of the most widely used formats for financial documents. It provides a professional look and ensures that the document layout remains consistent across different devices and platforms. This format is ideal for businesses looking to send finalized records that can’t be easily altered by recipients.

2. Word Documents (DOCX)Word documents are commonly used for creating financial records because they offer flexibility in editing and formatting. They can be easily modified, allowing businesses to quickly make changes when needed. Word documents also allow users to add tables, images, and other elements, making them a versatile option for creating detailed financial records.

3. Excel Spreadsheets (XLSX)For businesses that need to track large amounts of data or perform calculations within their financial documents, Excel spreadsheets are an excellent choice. This format allows users to easily input amounts, apply formulas for totals, taxes, and discounts, and organize the information into rows and columns.

4. Google Docs/SheetsCloud-based tools such as Google Docs and Google Sheets provide an easy and collaborative way to manage financial records. These formats allow multiple users to access, edit, and update documents in real time, making them a great choice for businesses that require teamwork and frequent updates.

5. HTMLHTML format is often used for businesses that need to generate dynamic financial records, particularly when integrating with online platforms. HTML allows for easy integration into websites and email systems, making it an ideal option for businesses with a strong online presence.

Choosing the right format depends on your specific needs, whether it’s for ease of editing, security, or data management. By selecting the most appropriate format, businesses can streamline their financial processes and improve efficiency when dealing with financial documentation. |