Download and Customize Editable Invoice Template PDF

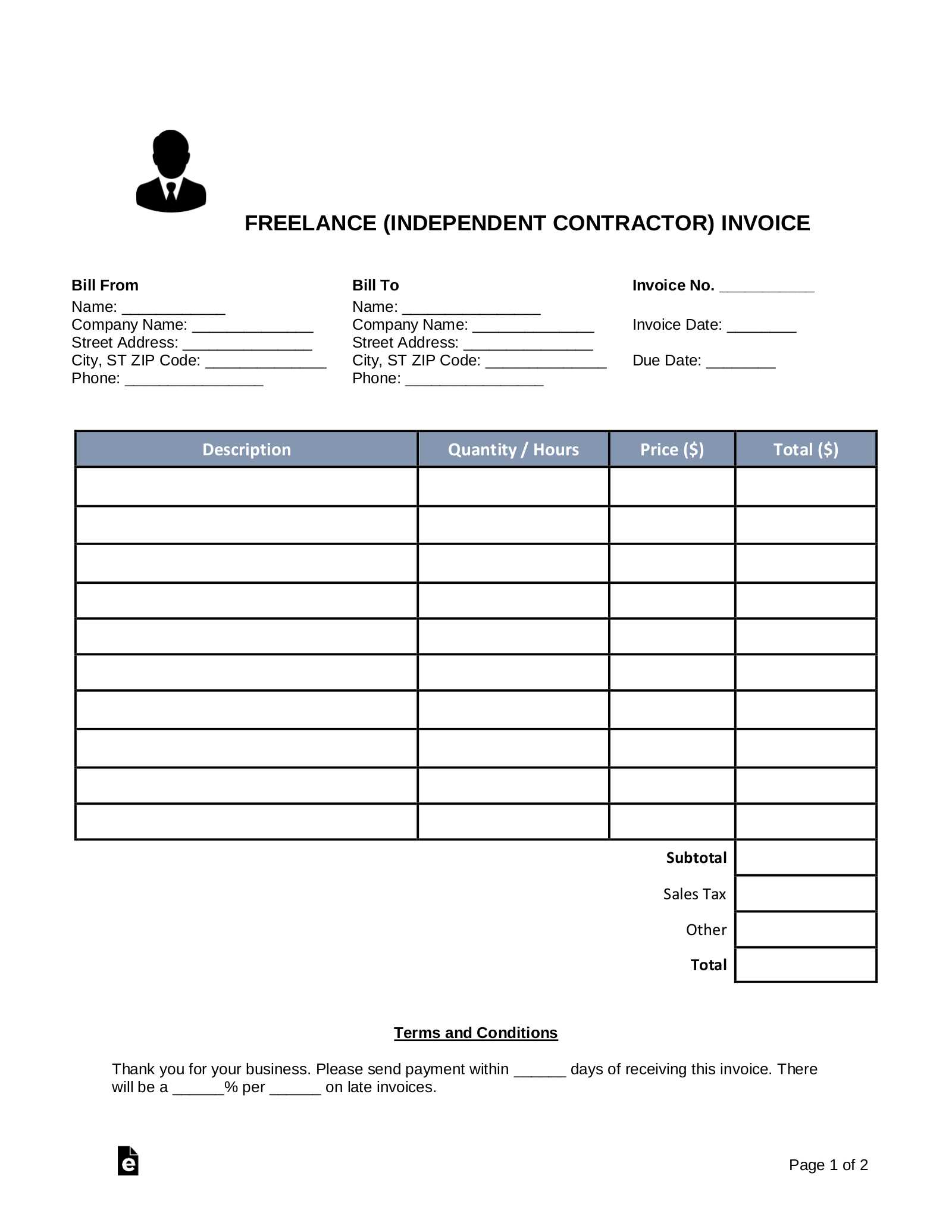

Managing financial transactions efficiently is a crucial aspect of running any business. Having a reliable document that allows you to record and track payments with ease can save time and reduce errors. Customizable documents can be an invaluable tool, providing flexibility to adjust details as needed while maintaining professionalism.

With the right tools, creating professional records becomes straightforward. Whether you’re a freelancer, small business owner, or part of a larger organization, access to an easily modifiable form can simplify your workflow. These documents are designed to be user-friendly, offering a range of features that ensure clear and accurate information for both you and your clients.

Maximizing efficiency in financial documentation can help ensure that all transactions are processed smoothly. With the ability to make changes when necessary, these tools also allow for quick adaptation to various business requirements. The result is a more organized approach to managing your financial records.

Why Use Editable Invoice Templates

Having a versatile document that can be easily customized to meet the needs of different transactions is essential for any business. A document that allows you to adjust details such as client names, amounts, dates, and services quickly can greatly enhance efficiency and reduce errors. The ability to modify this document ensures that every transaction is accurately recorded and professionally presented.

These documents can save time by eliminating the need to create new records from scratch for each client. They provide a structured format, which helps maintain consistency while offering flexibility in design and content. As a result, businesses can ensure that all financial records are up-to-date and properly tailored to their specific requirements.

The table below highlights key benefits of using customizable financial records:

| Benefit | Description |

|---|---|

| Time-saving | Pre-designed formats allow quick customization without the need for starting from scratch. |

| Accuracy | Adjustable details help ensure that every entry is correct and tailored to each client. |

| Professional Appearance | Structured layouts ensure a polished and consistent presentation for clients. |

| Flexibility | Quick modifications make it easy to adapt the document for different types of transactions. |

Benefits of PDF Invoice Templates

Using a standardized, digital document format offers several advantages, especially when it comes to managing financial transactions. This type of format ensures that records are easy to share, secure, and universally readable, which makes it ideal for businesses of all sizes. The ability to access and send these records electronically streamlines operations and enhances overall efficiency.

Here are some of the key benefits:

- Universal Compatibility: These files can be opened on almost any device, ensuring that your records are accessible to clients and colleagues across different platforms.

- Security: Sensitive information can be securely protected through password encryption, ensuring that only authorized individuals have access to the document.

- Professional Presentation: The consistent layout and design make these records look polished, helping businesses maintain a professional appearance with clients.

- Easy Sharing: Sending these documents via email is simple and ensures that they are received in their original format without any loss of quality or information.

- Environmentally Friendly: By using digital formats, businesses can reduce their reliance on paper, contributing to sustainability efforts.

Incorporating this approach into your business operations provides a straightforward and reliable method for handling financial records while enhancing both security and efficiency.

How to Download Editable Invoice Templates

Accessing customizable documents is a simple process that can be completed with just a few clicks. Many online platforms offer free or paid versions of these files, allowing businesses to quickly download and start using them. The process typically involves selecting a suitable document, downloading it to your device, and making any necessary adjustments to fit your needs.

Step-by-Step Process

The following steps outline how to obtain these customizable documents:

- Visit a trusted website offering digital forms for business use.

- Select the type of document you need based on the nature of your transactions.

- Choose the format that best suits your editing needs.

- Click the download link to save the file to your device.

- Open the document in an appropriate software tool and begin customizing.

Available Platforms

Various websites provide these digital documents, often in different formats. Below is a comparison of some popular platforms:

| Platform | Price | Customization Features |

|---|---|---|

| Template.net | Free & Paid | Wide variety of editable options |

| Canva | Free & Paid | Easy drag-and-drop editor |

| Microsoft Office | Subscription | Comprehensive editing features |

| Google Docs | Free | Simple customization options |

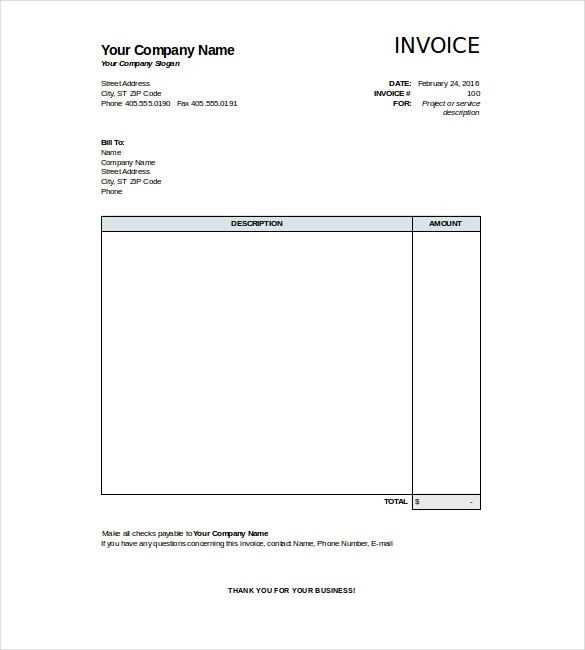

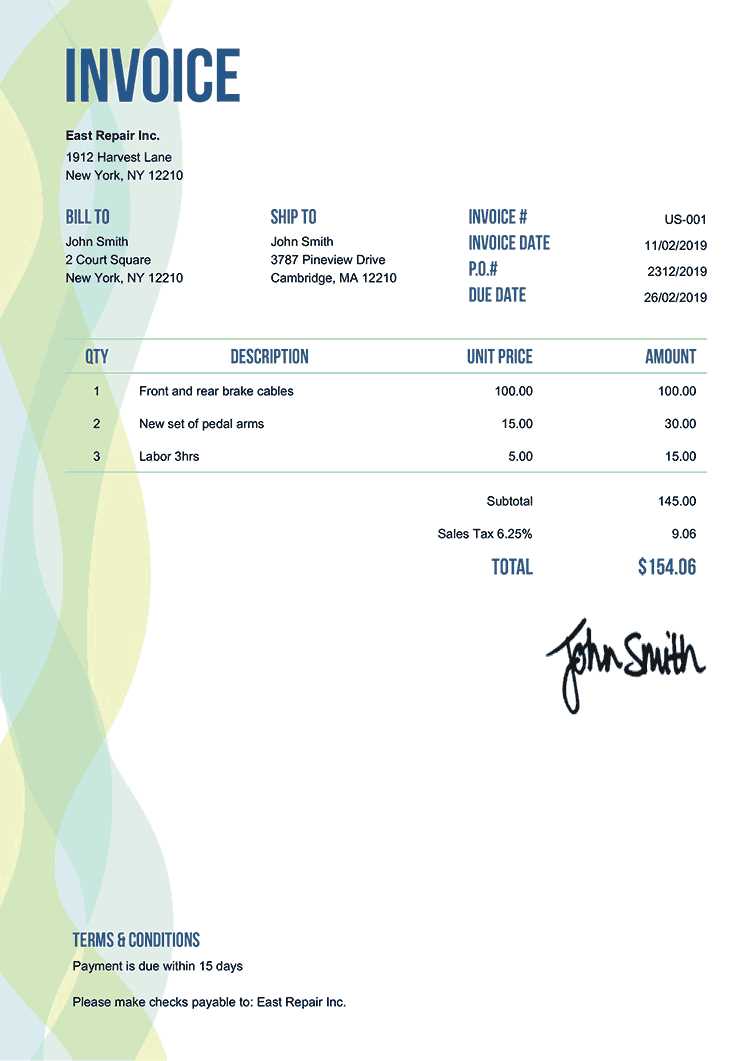

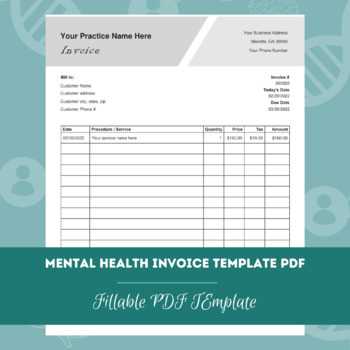

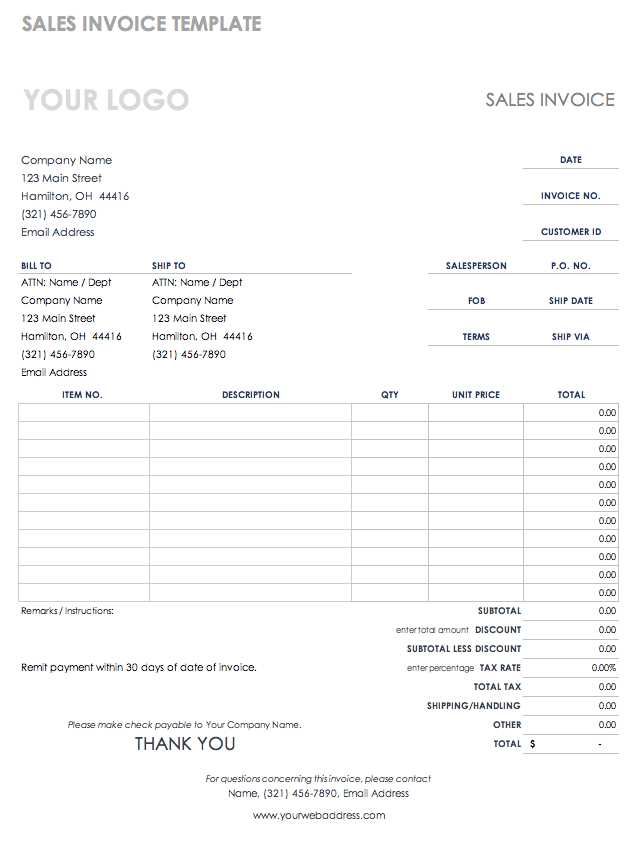

Customizing Your Invoice PDF Template

Personalizing your financial records is a simple yet essential step to ensure they accurately reflect your business transactions. The ability to adjust the details of the document, such as company information, pricing, and payment terms, allows you to create a professional and clear document tailored to each client. Customization ensures consistency while making the document relevant to the specific transaction at hand.

To begin the modification process, first open the document in the appropriate software or tool. You can then update key details such as:

- Business Name and Logo: Including your company logo and name ensures that your records are easily identifiable and professional.

- Client Information: Customizing the recipient’s details ensures that the document is tailored for each specific client.

- Payment Terms: Adjust the payment due date, discounts, or any additional charges based on the agreement.

- Line Items and Prices: Modify the services or products provided, including their description, quantity, and cost, to reflect accurate charges.

Additionally, some platforms offer further customization options such as choosing fonts, colors, or the layout to better align with your brand’s visual identity. This flexibility ensures your financial records are not only accurate but also presentable in a way that represents your business effectively.

Step-by-Step Guide to Editing PDFs

Modifying a digital document is a straightforward task when using the right tools. Editing allows you to make changes to important details, such as names, amounts, and descriptions, ensuring the document aligns with the latest transaction information. Whether you need to update a client’s details or adjust the content, the process is simple and effective with the proper software.

Tools You’ll Need

To begin, you’ll need a reliable software tool that supports document editing. Some popular options include:

- Adobe Acrobat Reader: Widely used for editing and viewing digital documents.

- Smallpdf: An online tool that allows for easy document modifications.

- Foxit PDF Editor: A full-featured software for advanced edits.

- Google Docs: Although primarily for word documents, it allows for basic modifications to certain types of files.

Editing Steps

Follow these steps to customize your document:

- Open the Document: Launch the chosen software and open the file you wish to edit.

- Select the Editing Tool: Depending on your software, click on the “Edit” or “Text” tool to begin adjustments.

- Make Your Changes: Modify the text, add or remove items, and update any necessary fields.

- Save Your Work: After editing, be sure to save the file to preserve the changes you’ve made.

By following these simple steps, you can easily modify your document and ensure it meets your current needs.

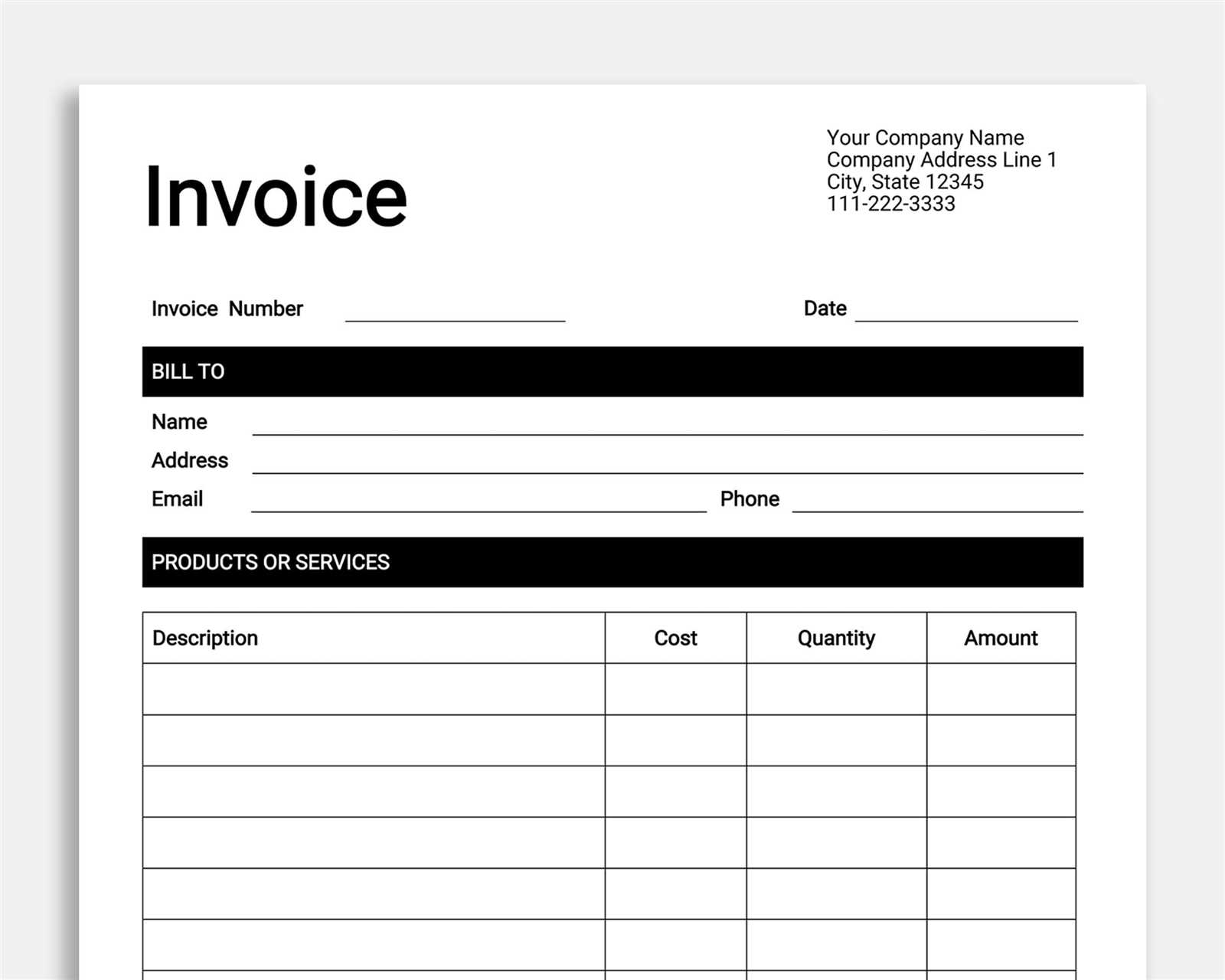

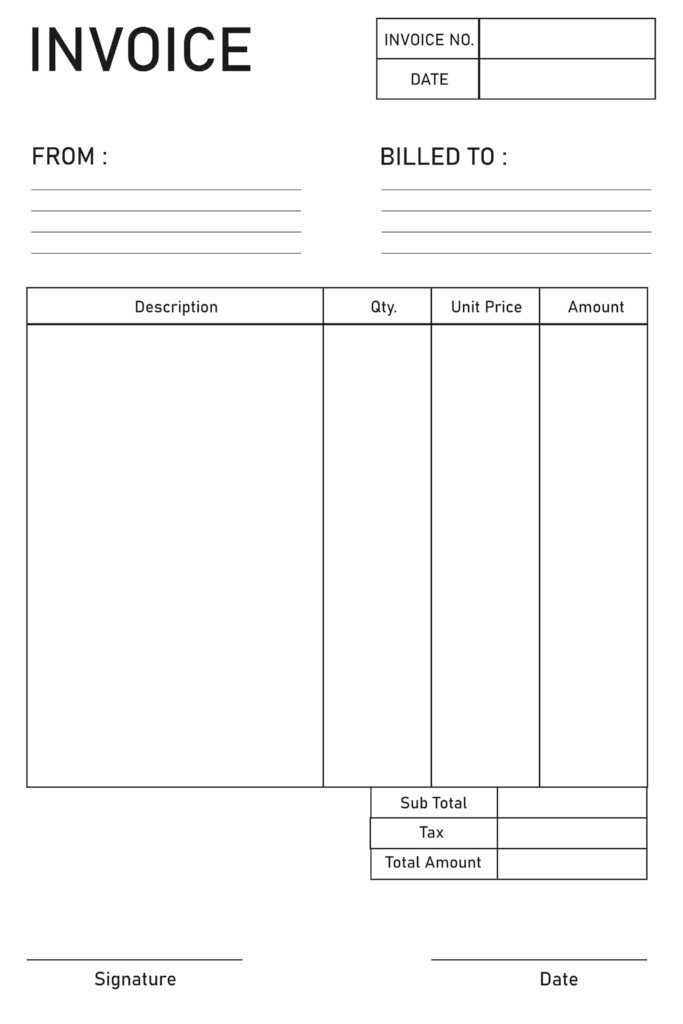

Best Practices for Invoice Design

Creating a well-organized and professional document is crucial for maintaining a positive business image and ensuring clarity in transactions. An effective layout should provide all essential details clearly, making it easy for clients to understand the charges and payment terms. By following design best practices, you can create documents that reflect your business’s professionalism and are easy to process.

Here are some key design tips to follow:

| Design Element | Best Practice |

|---|---|

| Clarity and Readability | Use clear fonts, a simple color scheme, and ample spacing to ensure the document is easy to read. |

| Logical Structure | Organize the document in a way that follows a natural flow: header, client information, service or product details, and total. |

| Consistent Branding | Incorporate your company’s logo, colors, and fonts to align the design with your business’s branding. |

| Clear Breakdown | Include a detailed breakdown of charges and payment terms to avoid any confusion for the client. |

| Payment Information | Highlight the payment terms and due dates, making it easy for clients to understand when and how to make payments. |

By following these best practices, you ensure your documents are not only functional but also professional, helping build trust with clients and promoting efficient transactions.

Free Invoice Templates Available Online

There are numerous online resources that offer free tools to create and modify professional documents. These platforms provide customizable files that can be tailored to meet your specific needs, whether for personal use or business transactions. With these free tools, users can create well-organized records without the need for expensive software or design expertise.

Here are some popular platforms offering free resources:

| Platform | Features |

|---|---|

| Canva | Offers a wide selection of customizable designs with easy-to-use editing features. |

| Zoho | Provides templates for various business needs, including detailed formatting options. |

| Invoice Simple | Free online tool with pre-designed formats that can be personalized and downloaded instantly. |

| Microsoft Office | Offers free downloadable designs in Word or Excel formats, compatible with various business needs. |

| Google Docs | Offers simple, customizable designs that can be accessed and edited directly from the web. |

These free resources make it easy for anyone to create professional documents quickly and efficiently, streamlining your administrative processes without incurring additional costs.

Choosing the Right Invoice Format

Selecting the proper document format is essential for ensuring smooth transactions and clear communication with clients. The format you choose can influence how professional and understandable your records appear, as well as how easily they can be processed. Different formats may offer varying degrees of customization, ease of use, and compatibility with other software or systems.

Here are some factors to consider when choosing the right format for your documents:

| Factor | Considerations |

|---|---|

| Ease of Use | Choose a format that is simple to edit and fill out without requiring advanced software knowledge. |

| Compatibility | Ensure the format is compatible with the software or devices your clients or team members use. |

| Customization | Look for formats that allow for branding, including logos, colors, and personalized content fields. |

| Security | Consider formats that offer password protection or encryption for confidential information. |

| Professionalism | Opt for a format that ensures your document looks polished and is easy to read and understand. |

By carefully evaluating these factors, you can select the most appropriate format to meet both your business needs and client expectations, enhancing your professionalism and improving workflow efficiency.

How to Save Editable Invoice Templates

Once you’ve customized your document to meet your needs, it’s important to save it correctly to ensure that all changes are retained for future use. The right saving method allows you to access the file quickly and easily, whether you’re storing it on your device or sharing it with others. Different formats offer varying levels of flexibility, security, and compatibility, so it’s essential to choose the best one for your specific purpose.

Here are some steps to properly save your documents:

- Choose the Right Format: Save your file in a format that suits your needs, such as Word, Excel, or a text format. For sharing or printing, formats like JPEG or PNG are also useful.

- Use Cloud Storage: For easy access from any device, consider saving your file to cloud storage services like Google Drive, Dropbox, or OneDrive.

- Ensure Proper Naming: Name your file in a clear, consistent way so that you can easily identify it later. Include relevant information like date and client name.

- Back Up Regularly: To avoid losing important data, always back up your files. Store them in multiple locations, like external drives or cloud storage.

- Save Versioned Copies: If you’re working on multiple drafts, save different versions of the document to keep track of changes over time.

By following these simple steps, you can ensure that your files are saved efficiently and remain accessible when needed, helping you streamline your workflow and keep your records organized.

Managing Your Invoices Efficiently

Efficient management of your financial documents is crucial for smooth business operations. By keeping track of your records, ensuring timely payments, and maintaining organization, you can prevent issues like missed deadlines or confusion. A streamlined process helps reduce administrative tasks and keeps your financial workflow running smoothly.

Best Practices for Effective Management

Implementing certain strategies can significantly improve your ability to manage records:

- Use a Centralized System: Keep all documents in one place, whether digitally or in physical form. Digital tools like accounting software or cloud storage can help you access your files from anywhere.

- Set Clear Deadlines: Establish deadlines for payment and make sure they are clearly communicated. Automated reminders or calendar entries can help ensure timely follow-ups.

- Organize Files by Date or Client: Sorting your records by client name or the date they were issued makes it easier to locate specific documents when needed.

- Regularly Update Your Records: Review and update your files regularly. This includes marking paid or overdue documents, adjusting any details, and tracking outstanding payments.

Tools for Streamlining Your Workflow

Several tools and methods can help streamline the process of managing your records:

- Accounting Software: Programs like QuickBooks, FreshBooks, or Xero automate much of the financial record-keeping and provide easy tracking of transactions.

- Cloud Storage: Use services like Google Drive, Dropbox, or OneDrive to store and share your documents securely. Cloud storage ensures that you can access them from any device.

- Mobile Apps: Many mobile applications allow you to manage your documents on the go, making it easier to stay organized when traveling or working remotely.

By adopting these methods and utilizing the right tools, you can ensure efficient management and avoid unnecessary stress when handling your business documentation.

Top Software for Editing PDF Templates

When it comes to managing and modifying your financial documents, having the right software can make the process much more efficient. The right tools allow you to customize forms, update details, and ensure everything is aligned with your business needs. Whether you’re creating professional documents or simply updating existing ones, the appropriate software can save you time and effort.

Best Tools for Customizing Your Documents

Here are some of the top software options available for customizing your files:

| Software | Features | Platform |

|---|---|---|

| Adobe Acrobat Pro DC | Comprehensive editing tools, secure file sharing, and e-signatures. | Windows, macOS |

| Foxit PhantomPDF | Easy editing, cloud storage integration, and robust security options. | Windows, macOS |

| PDFelement | User-friendly interface, form filling, and text editing capabilities. | Windows, macOS, iOS, Android |

| Smallpdf | Online editing, file conversion, and easy sharing features. | Web-based |

| Sejda | Online editor, offers a range of tools for modifying content. | Web-based, Windows, macOS |

Choosing the Right Tool for Your Needs

The software you choose should depend on your specific needs. If you require a lot of advanced features, Adobe Acrobat Pro DC may be the best option for its robust toolkit. For a simpler solution, tools like Smallpdf or Sejda may suffice for light editing tasks. Consider your workflow, budget, and the types of features you need when selecting the right tool.

By selecting the best tool for your requirements, you can easily streamline the document editing process and maintain professional standards across your business communications.

Invoice Template Security Features

When working with sensitive financial documents, ensuring that the information remains secure is paramount. Many tools and solutions offer features that help protect your documents from unauthorized access, tampering, or distribution. Security measures help businesses maintain confidentiality, protect against fraud, and ensure compliance with industry standards.

Here are some common security features available when working with financial forms and documents:

| Security Feature | Description | Benefits |

|---|---|---|

| Password Protection | Secures your document with a password to prevent unauthorized access. | Ensures only authorized individuals can view or edit the document. |

| Watermarking | Incorporates visible marks or text into the document to prevent unauthorized duplication. | Helps identify the origin of the document and deters copying. |

| Digital Signatures | Enables you to sign documents electronically, ensuring authenticity and integrity. | Verifies the document’s origin and ensures it hasn’t been altered. |

| Encryption | Encrypts the file to make it unreadable to unauthorized users. | Enhances security by ensuring only authorized recipients can access the document. |

| Access Control | Allows setting permissions on who can view or edit the document. | Provides granular control over who can interact with the file. |

By implementing these security features, businesses can safeguard their financial documents and ensure that sensitive information is protected against potential threats. Whether it’s password protection, encryption, or access control, these measures help maintain document integrity and confidentiality.

Common Mistakes When Editing Invoices

When modifying financial documents, even small errors can lead to significant consequences. It is important to be aware of common pitfalls to ensure the accuracy and professionalism of the final product. Mistakes in details like amounts, dates, or client information can result in confusion, delayed payments, or legal issues.

Some of the most frequent mistakes made when altering these documents include:

- Incorrect Client Information: Failing to update the recipient’s details, such as name or address, can cause delays in communication or even prevent proper delivery of the document.

- Missing or Wrong Dates: Not adjusting the issue or due dates can create confusion regarding payment terms, leading to disputes or late payments.

- Wrong Amounts or Calculation Errors: Simple miscalculations or entering incorrect amounts can lead to overcharging or undercharging, affecting business relationships and trust.

- Failure to Include Terms and Conditions: Leaving out payment terms or specific conditions can cause misunderstandings or disputes later in the process.

- Not Using Consistent Formatting: Inconsistent fonts, text sizes, or layout may make the document look unprofessional and can lead to misinterpretation.

- Overlooking Currency or Tax Details: Not updating the correct tax rates or currency for international clients can result in incorrect charges or legal issues.

By staying vigilant and double-checking all fields, you can avoid these mistakes and ensure that your documents are clear, accurate, and professional. Taking the time to review everything carefully before sending it out is essential for maintaining positive business relationships and avoiding complications.

Ensure Accuracy with Invoice Templates

Maintaining precision when creating financial documents is crucial for smooth business operations. Small errors in these documents can lead to delayed payments, misunderstandings, and even legal issues. Using structured formats can help guarantee that all important details are properly included and presented clearly, reducing the chances of mistakes.

To ensure accuracy when creating these documents, consider the following tips:

- Double-check All Figures: Always review the numbers for accuracy. Small miscalculations, such as adding extra zeros or missing decimal points, can cause confusion.

- Use Automated Calculations: Leverage tools that automatically calculate totals, taxes, and discounts to minimize human error.

- Include Essential Information: Ensure that key details like your company’s contact information, client details, payment terms, and service descriptions are always included and up-to-date.

- Standardize Formats: Stick to a consistent layout that clearly presents the necessary information, such as item descriptions, quantities, and amounts due. This helps to avoid misinterpretations.

- Cross-check Dates: Verify that the issue and due dates are correctly filled out, as this can affect payment schedules and terms.

- Include a Clear Payment Method: Ensure that the payment instructions are explicit, including details on accepted methods and any necessary account information.

- Review Legal Terms: Include accurate terms and conditions, particularly if your business involves services that require specific legal agreements.

By following these steps, you can improve the accuracy of your documents, making them clear, professional, and error-free. Consistently using organized layouts and methods ensures a smoother workflow and fosters better relationships with clients and partners.

Advanced Customization for Invoices

Customizing financial documents to align with your business’s unique needs can greatly enhance the professional appearance and functionality of your records. Advanced modifications allow you to add specific details that cater to particular industries or client requirements, helping to create a more personalized experience. These customizations can range from altering the layout to integrating additional features such as branded logos, payment schedules, or customized terms.

For more sophisticated adjustments, consider the following options:

- Branding Integration: Customize the design with your company logo, color scheme, and font choices to create a cohesive, branded experience for your clients.

- Custom Fields: Add special fields to include additional information, such as custom service codes, project references, or client-specific terms, which are particularly useful for businesses offering tailored services.

- Dynamic Discounting: Set up automatic discounts based on certain criteria, such as early payment or bulk orders, to incentivize customers.

- Multiple Payment Methods: Enable various payment options (e.g., credit card, bank transfer, digital wallets) to cater to the diverse preferences of your clientele.

- Recurring Billing Setup: For businesses offering subscription-based services, set up templates that automatically generate and send recurring bills on a defined schedule.

- Automated Tax Calculations: Integrate tax rates based on geographic location or industry requirements, ensuring correct tax amounts are applied based on the client’s location.

These advanced customizations ensure that your documents not only meet regulatory standards but also provide a seamless, personalized service for your clients. By tailoring your financial documents, you can streamline processes, enhance customer relationships, and maintain a professional standard that reflects your business’s values.

How to Share Your Invoice PDF

Sharing financial documents with clients and stakeholders efficiently is crucial for maintaining a smooth business workflow. Whether you’re delivering a receipt, statement, or a formal request for payment, choosing the right method to share these files ensures timely and secure transactions. There are several ways to send these records, each with its own benefits depending on your needs and preferences.

Consider the following options when sharing your document:

- Email: The most common method for sharing files. You can attach the document directly to an email or use a file-sharing service to include a download link. Make sure to use clear subject lines and appropriate messaging to ensure the recipient knows what to expect.

- Cloud Storage Services: Services like Google Drive, Dropbox, or OneDrive allow you to upload your document and share a secure link with clients. This method is especially useful for larger files or when sending documents to multiple recipients.

- Secure File Transfer: For highly sensitive or large documents, consider using secure transfer protocols such as FTP or encrypted email services to protect the confidentiality of the information being shared.

- Payment Platforms: If your business involves online payments, many platforms offer integrated options to send financial records directly to clients after a transaction is made. This streamlines the process and provides clients with immediate access to the document.

Tip: When sharing sensitive documents, always make sure to protect your files with a password or encryption. This adds an extra layer of security and ensures that only authorized individuals can view the contents.

By choosing the right sharing method, you can ensure that your documents reach their destination securely and promptly, helping you maintain a professional relationship with your clients and partners.