Editable and Free Printable Invoice Templates for Your Business

For any business, maintaining an organ

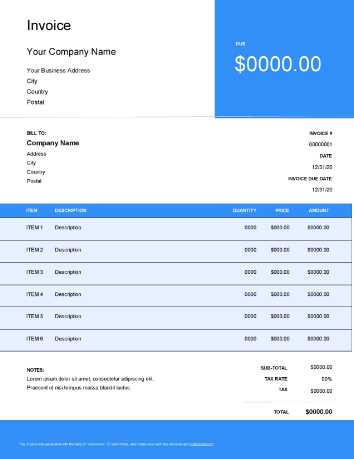

Editable Free Printable Invoice Templates

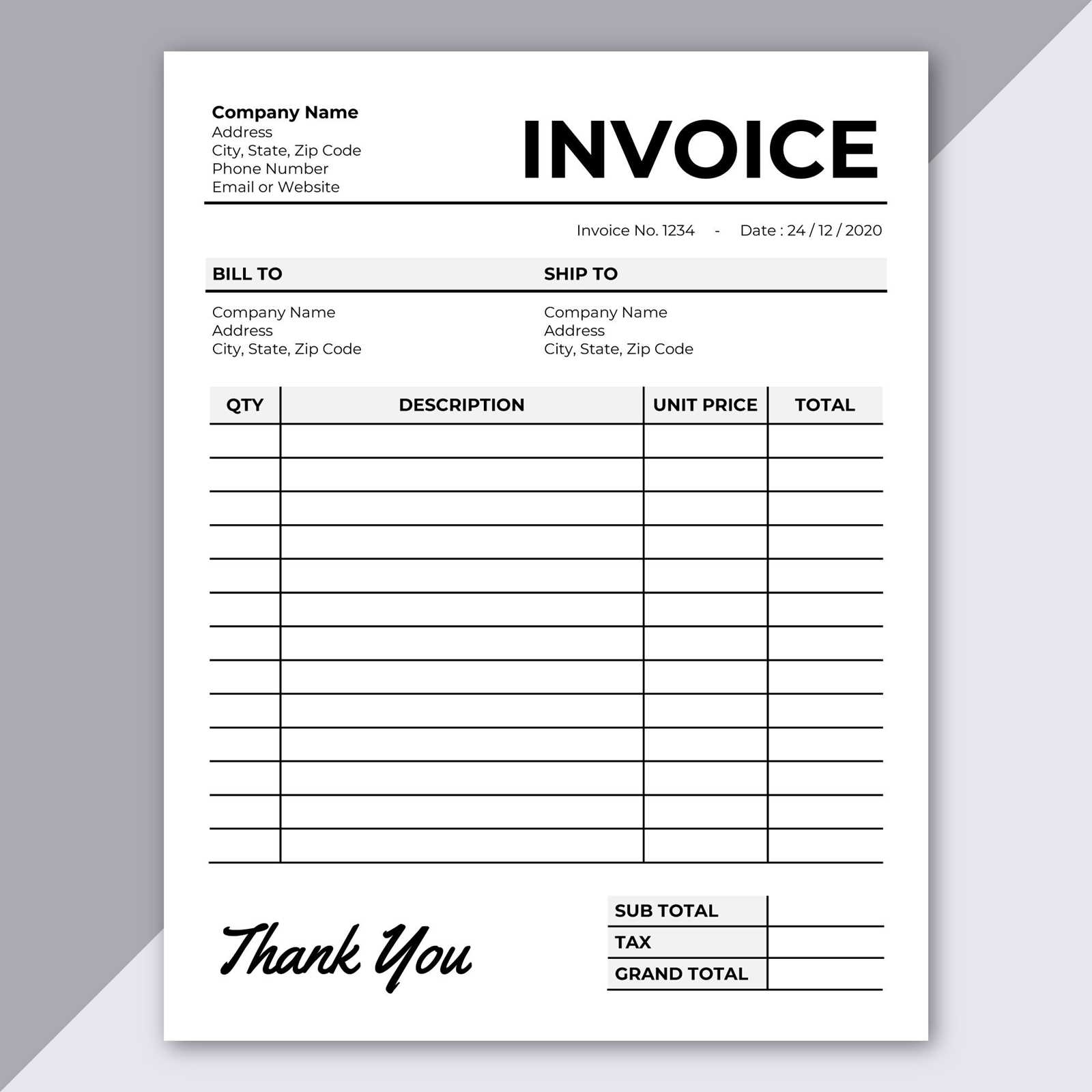

Having access to customizable documents is essential for any business looking to streamline its payment process. By using ready-made designs that allow you to adjust fields according to your needs, you can quickly create accurate records for your transactions. These documents are flexible, making it easy to update client information, item descriptions, or pricing without hassle.

With a wide range of options available, businesses can choose from various styles that match their branding and the nature of their services. Whether you’re offering a simple service or a detailed product list, these pre-designed solutions can be easily adapted to suit your specific requirements. You can modify the structure, add your logo, or adjust the format to ensure the final result aligns with your professional image.

One of the key advantages of these ready-to-use solutions is the time they save. Instead of starting from scratch each time, you can simply select a suitable layout, fill in the necessary information, and instantly generate a document ready for printing or digital distribution. This efficiency is invaluable for businesses of all sizes, ensuring that you can focus more on your core activities rather than the administrative tasks.

Why Use Invoice Templates for Your Business

For any business, having a consistent and efficient way to request payment is crucial for maintaining smooth operations. Using pre-designed forms allows you to create professional-looking documents quickly while ensuring all necessary information is included. This eliminates the guesswork and reduces the chances of errors, making the entire billing process more reliable and effective.

By utilizing ready-to-use designs, businesses can save time and focus on other essential tasks. Instead of drafting a new document for each transaction, you can rely on a structured layout that automatically fills in the details. This ensures consistency across all communications, which enhances your company’s image and builds trust with clients.

Furthermore, these tools provide flexibility, allowing you to adjust the content to meet specific requirements. Whether it’s customizing the design, adding new fields, or changing the layout, such documents give you the control to tailor each one to your needs. This flexibility helps to align your documents with your brand’s identity and maintain a professional appearance in all transactions.

Benefits of Free Printable Invoice Designs

Using pre-made billing forms offers numerous advantages for businesses looking to streamline their payment processes. By adopting structured designs, you can ensure consistency, save valuable time, and maintain a professional appearance. This approach minimizes errors and allows you to quickly generate necessary documentation without starting from scratch each time.

One of the main advantages is the cost-effectiveness. Many ready-made solutions are available at no charge, enabling businesses to produce high-quality documents without any additional expenses. Whether you’re a small business or a freelancer, this approach allows you to access well-designed forms that can be easily customized to fit your needs.

| Benefit | Description |

|---|---|

| Time-Saving | Quickly create professional documents without having to design them from the ground up. |

| Consistency | Maintain uniformity in your documentation, which is important for building trust with clients. |

| Cost-Efficiency | Access high-quality designs without spending money on custom solutions or software. |

| Flexibility | Adjust the content and layout to suit your specific business needs, ensuring a personalized approach. |

These benefits make it easier for businesses to stay organized, present a professional image, and manage their financial records more efficiently. Whether you’re sending a bill to a long-time client or a new customer, having a well-designed and easily customizable document at your disposal helps foster smooth business transactions.

How Editable Templates Save Time

Efficiency is essential in business operations, and having a system that streamlines repetitive tasks can make a significant difference. By using pre-designed documents that can be quickly adjusted and customized, you eliminate the need to start from scratch each time you need to generate a new record. This ability to instantly modify content and layout drastically reduces the time spent on administrative tasks.

Faster Document Creation

One of the most immediate benefits is the speed with which you can create a new document. Instead of manually designing each record or re-entering basic information for every transaction, you can simply fill in the necessary fields. This process becomes much quicker as you don’t have to worry about formatting or layout, which is already taken care of by the pre-set structure.

Reduced Errors and Rework

Using a consistent format helps minimize the risk of mistakes, which can be time-consuming to correct. When the layout and sections are pre-organized, there’s less chance of omitting important details or making errors in structure. This saves time that would otherwise be spent on revisions and ensures that your documents are accurate from the start.

Ultimately, leveraging ready-to-use designs allows you to focus more on your core tasks while ensuring that your administrative duties are handled swiftly and professionally. This time-saving advantage helps businesses of all sizes remain agile and efficient.

Customizing Invoice Templates for Your Needs

When it comes to managing financial documents for your business, personalization is key. Tailoring your document design to reflect your brand, industry, and specific requirements can make a significant difference in both professionalism and functionality. Customizing the layout, adding relevant fields, and adjusting styles allows you to create documents that are not only useful but also aligned with your company’s image.

Adjusting Layout and Structure

Start by considering the structure of your document. Different businesses have different priorities, so it’s essential to include sections that reflect the specific needs of your operations. You can modify the layout in several ways:

- Include detailed descriptions of services or products provided.

- Highlight payment terms and deadlines in a prominent area.

- Organize fields for both client and provider information in a clear manner.

- Set up space for additional notes, such as special instructions or discounts.

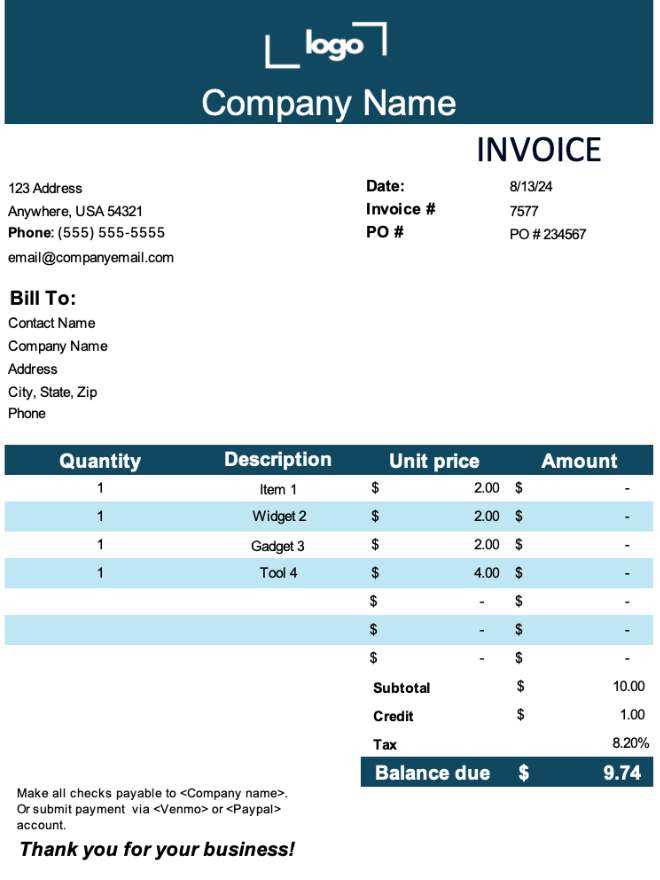

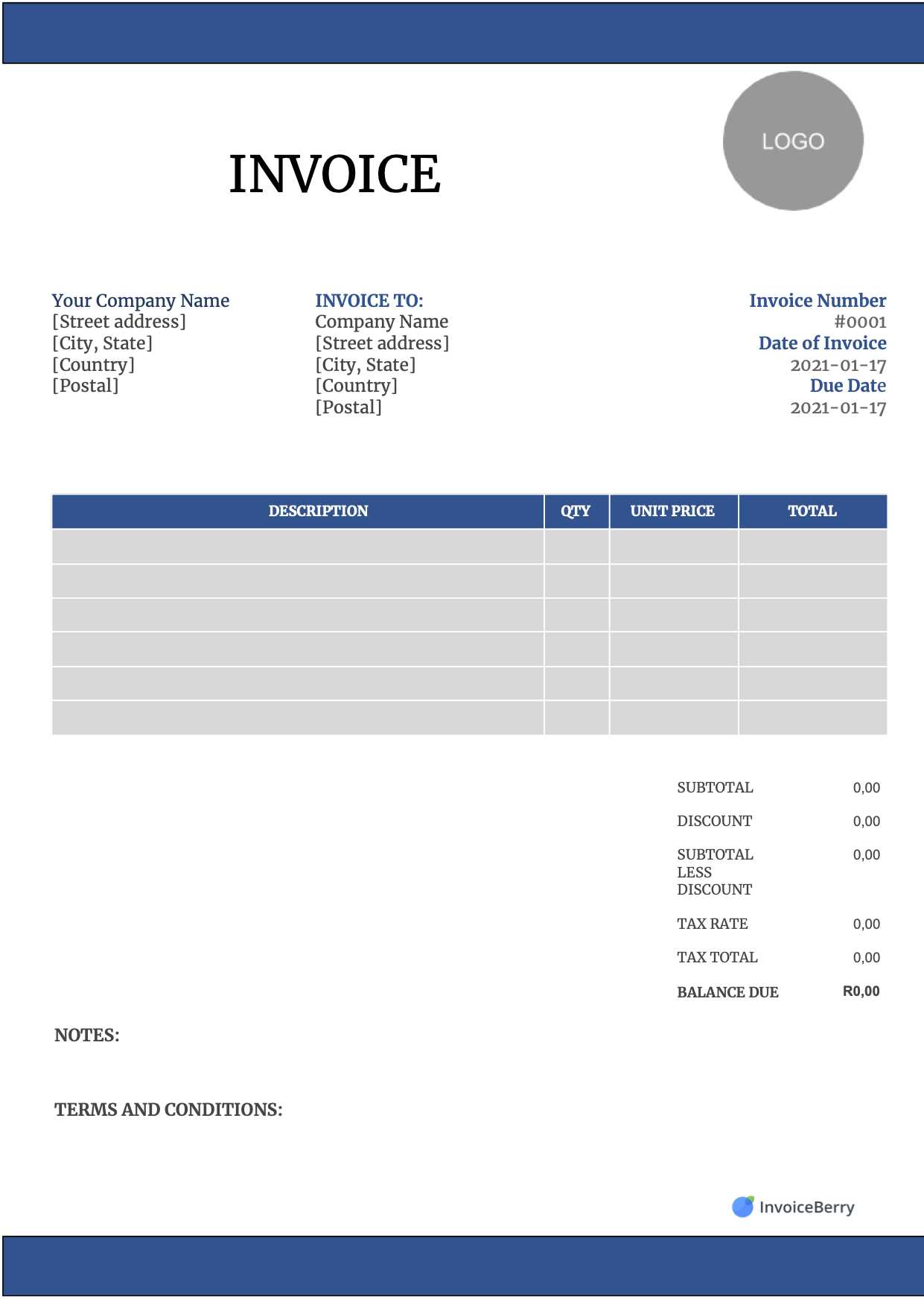

Incorporating Branding Elements

Another important aspect of customization is adding branding elements to the document. This helps establish a professional image and make the document look more official. Consider the following tips:

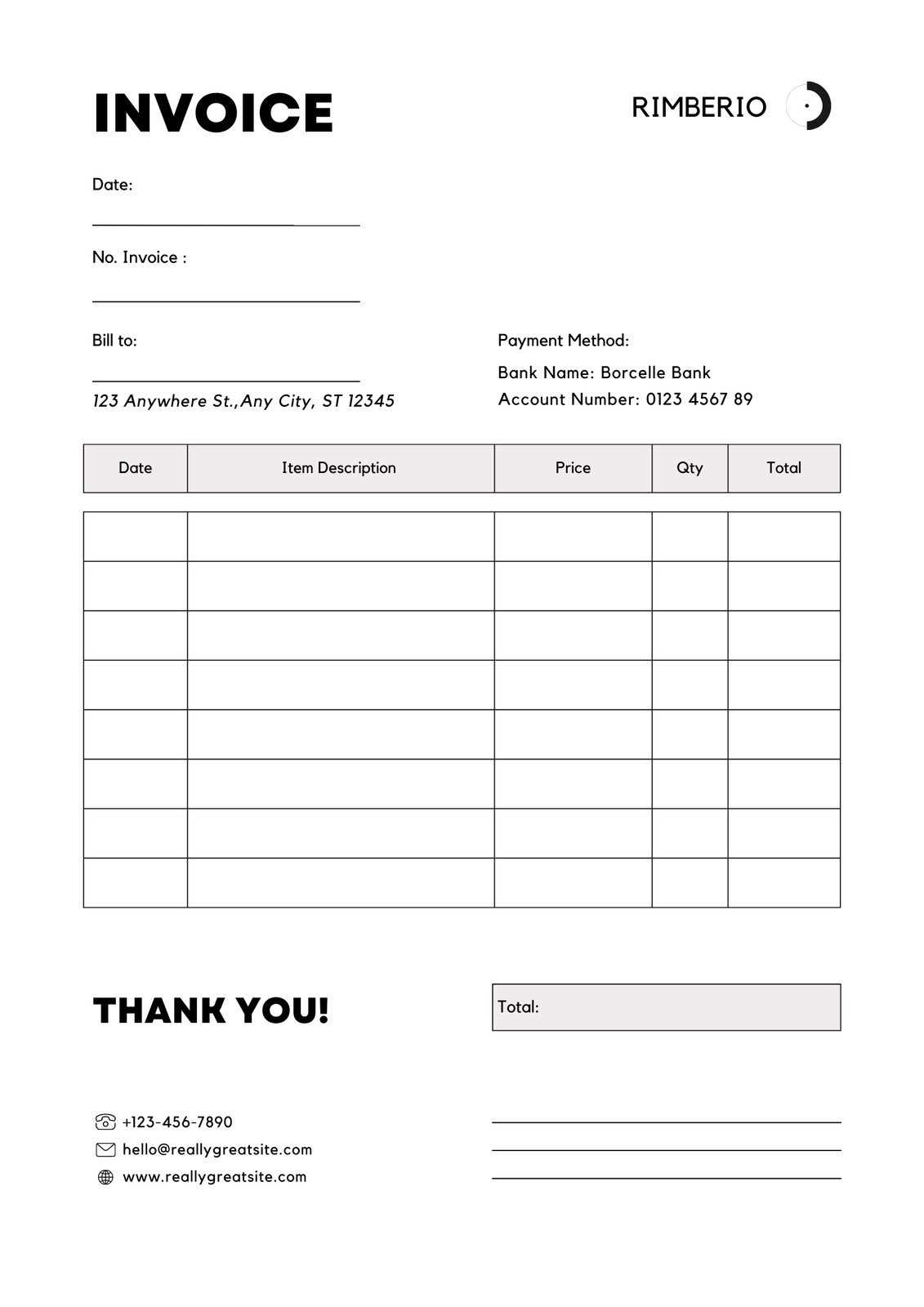

- Use your company logo and choose matching colors and fonts to create visual consistency.

- Ensure that your contact details, including website and social media, are easily visible.

- Incorporate any legal disclaimers or business information that clients might need to know.

By customizing your documents, you can ensure they serve your business needs effectively, promote your brand, and provide a professional experience for your clients.

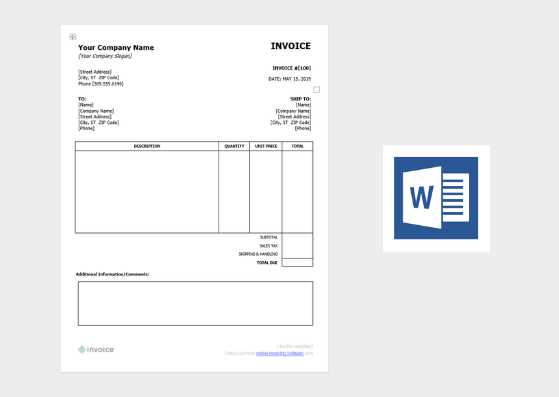

Popular Invoice Template Formats to Consider

Choosing the right format for your business documents is crucial for clarity and efficiency. Depending on your industry and the nature of your transactions, certain designs and structures may be more effective. The format you select should balance functionality with ease of use, ensuring both you and your clients have a smooth experience when processing payments and reviewing details.

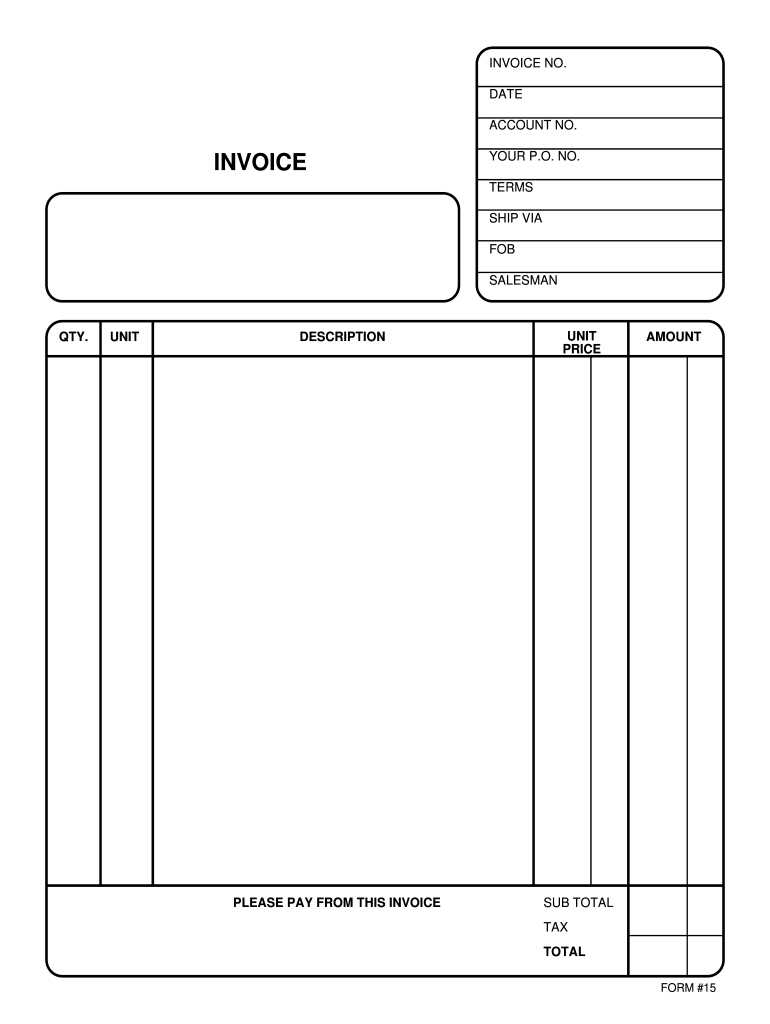

Basic Layouts

For many small businesses, a simple, straightforward layout is often the most effective. Basic structures focus on providing all the essential information in an organized and easy-to-read manner. Key components usually include:

- Client and provider information, including names, addresses, and contact details.

- Itemized list of goods or services provided, including quantities and prices.

- Payment terms and due dates to set clear expectations.

- Total amount due, clearly marked for transparency.

This format is popular due to its simplicity, making it easy for clients to understand the charges and proceed with payments without confusion.

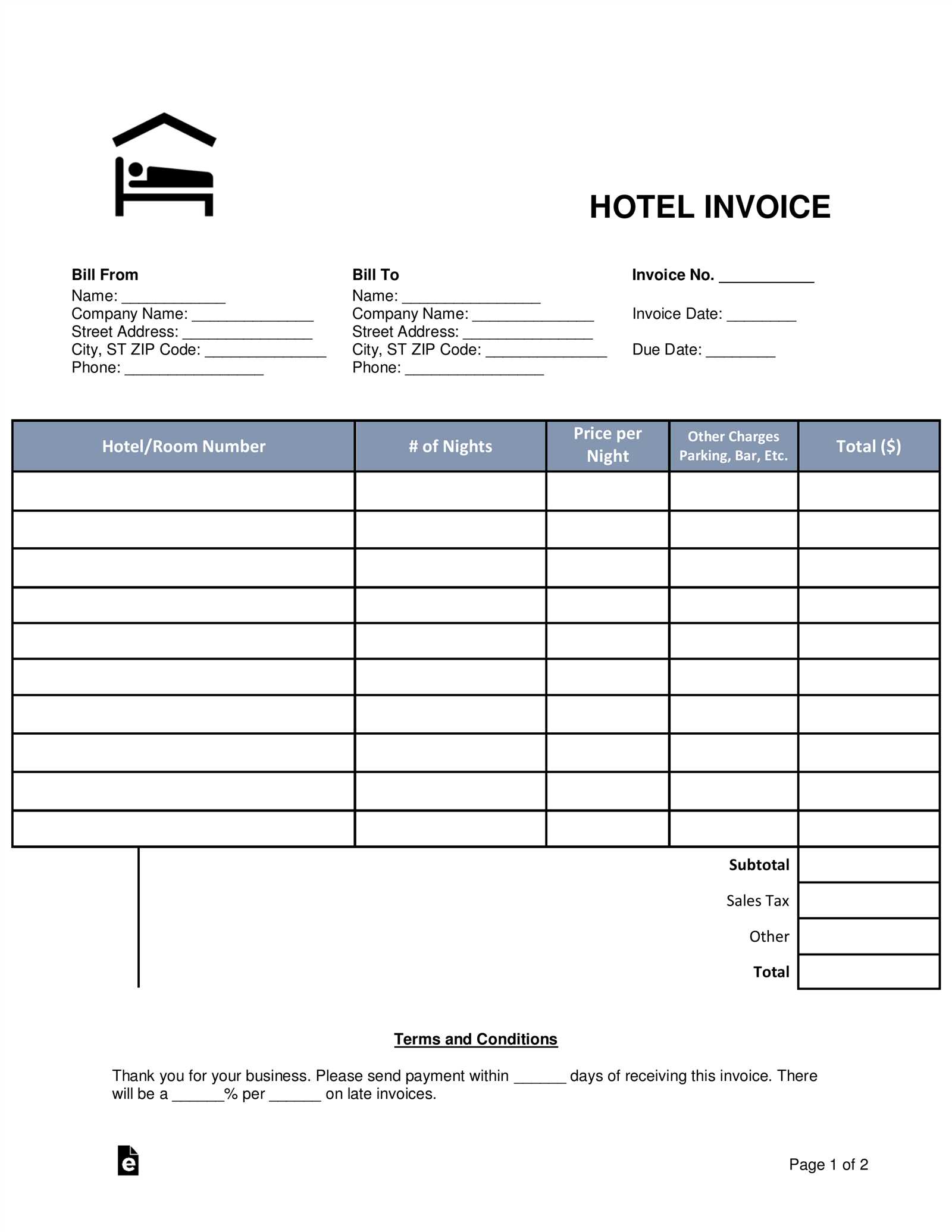

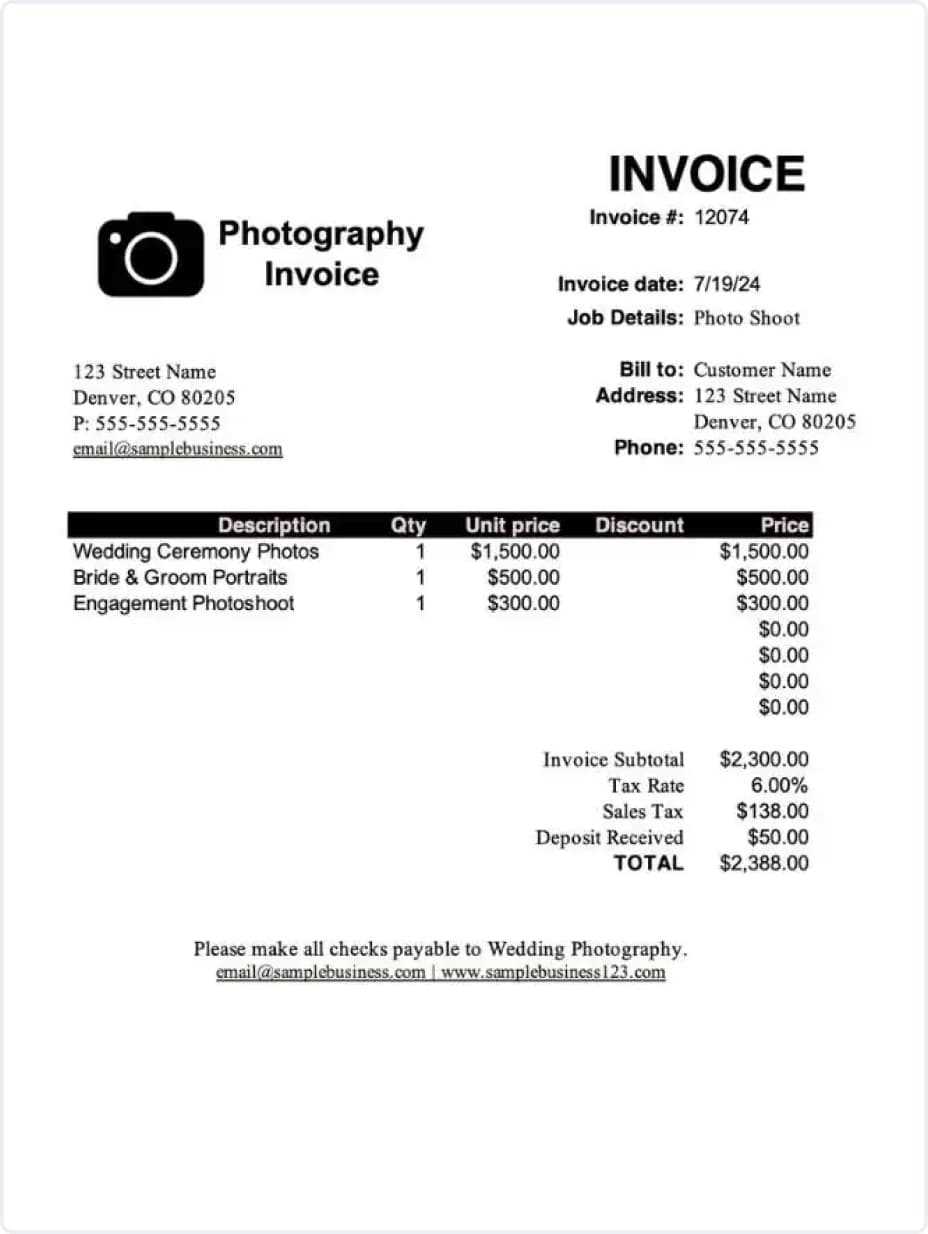

Detailed Professional Formats

For businesses that require more complex information, such as those in consulting or project-based industries, a more detailed design might be necessary. These formats include additional sections like:

- Project or service description, outlining specific tasks or deliverables.

- Hourly rates or per project breakdowns if applicable.

- Discounts or special offers that apply to

How to Choose the Right Template for Your Business

Selecting the right document design for your business is an essential step in streamlining financial management. The format you choose should align with your company’s needs, help you maintain professionalism, and ensure all critical details are included in a clear and organized manner. Different industries have unique requirements, and understanding these needs will guide you toward the most effective solution.

Assess Your Business Needs

Start by evaluating the complexity of your transactions. If your business primarily deals with straightforward sales, a simple structure with basic fields might be sufficient. However, if you offer customized services, need to track hours worked, or deal with long-term projects, a more detailed format might be necessary. Consider these factors:

- Nature of your products or services: Are you selling physical items, offering digital products, or providing services that require itemized details?

- Billing frequency: Do you invoice clients regularly or only after a project is completed?

- Special payment terms: Are there discounts, deposits, or late fees that need to be incorporated?

Keep Branding Consistency

Your business documents should reflect your brand identity. The design you choose should match the colors, fonts, and style of your company’s overall branding to ensure a cohesive and professional look. Ensure that:

- Your logo is clearly displayed and easy to recognize.

- Fonts and colors align with your brand guidelines for visua

Essential Information to Include in an Invoice

To ensure smooth transactions and clear communication with your clients, it’s vital to include all the necessary details in your financial documents. A well-structured record not only helps avoid misunderstandings but also serves as a legal document in case of disputes. Here are the key elements that should always be included in a billing statement.

- Business and Client Information: Both the seller’s and buyer’s full contact details should be easily identifiable. This includes names, addresses, phone numbers, and email addresses.

- Unique Identification Number: Assign a specific number to each document for easy reference and tracking. This is important for organizing records and for any future correspondence.

- Date of Issue: Clearly state when the document is generated. This helps define the timeframe for payment and any applicable terms.

- Description of Goods or Services: Provide a clear and concise breakdown of what was provided, including quantities, individual prices, and any other relevant details that clarify the transaction.

- Payment Terms: Outline how much is owed, payment methods accepted, and the due date. If there are any discounts, late fees, or specific payment schedules, make sure these are stated clearly.

- Taxes and Additional Charges: Include any applicable taxes, shipping fees, or other extra costs that affect the total amount due. Ensure these are separated and explained to avoid confusion.

- Footer Notes: Any additional information that could be helpful for your client, such as your company’s return policy, business registration number, or customer service contact details, should be placed here.

By including all of these essential elements, you ensure that your documents are not only professional but also legally sound, fostering trust and clarity in all business dealings.

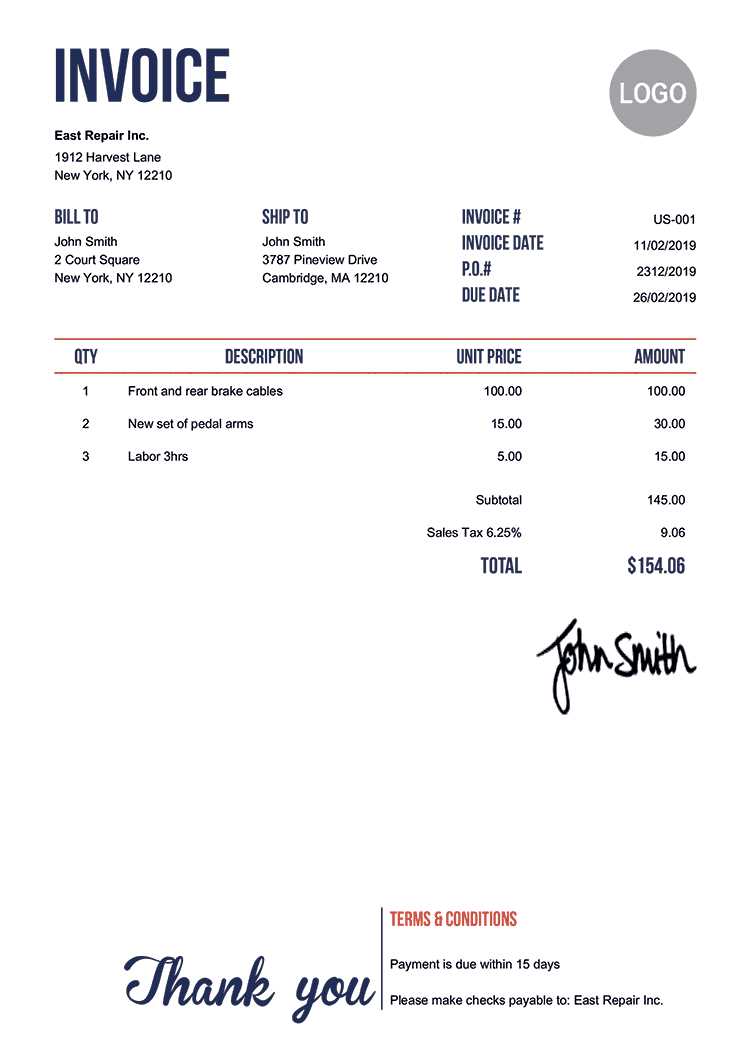

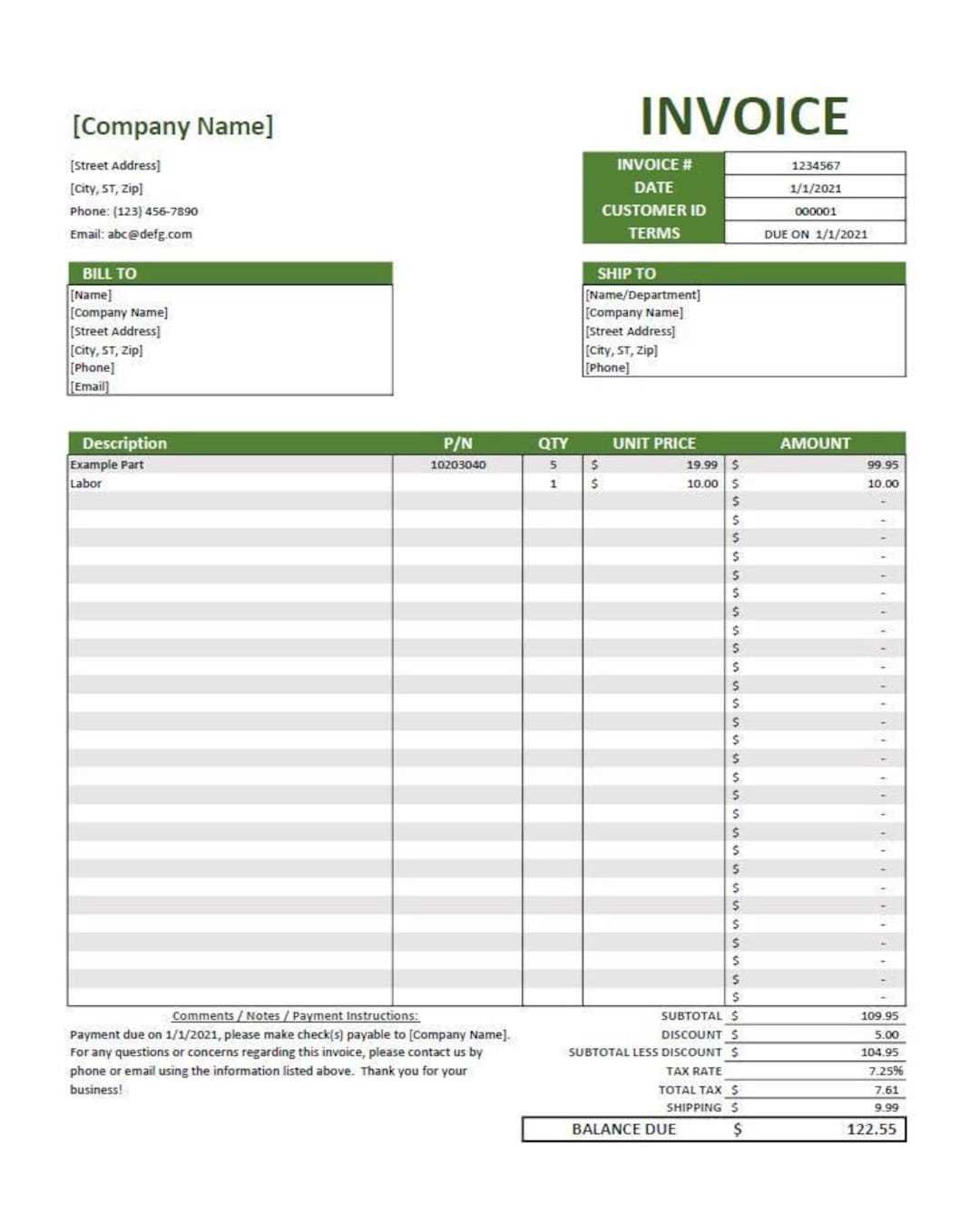

How to Fill Out an Editable Invoice Template

Completing a billing document correctly ensures that all parties are on the same page regarding the transaction details. The process involves entering specific information about the sale, the parties involved, and the payment terms. Whether you are filling out a simple form or a more complex layout, each section needs to be carefully filled out to avoid errors or confusion.

Step-by-Step Process

Follow these steps to ensure that all necessary information is included and correctly formatted:

- Enter Client and Seller Information: Start by adding the full names, addresses, and contact details for both parties. This makes it clear who is involved in the transaction.

- Assign a Unique Document Number: Each billing document should have its own identification number. This helps with record-keeping and future reference.

- List of Goods or Services Provided: Include an itemized list of products or services delivered. Specify the quantity, unit price, and total cost for each item.

- Specify the Payment Terms: Clearly state the payment due date, accepted payment methods, and any other terms like early payment discounts or late fees.

Example of a Completed Document

Here is an example of how the sections might appear in a structured document:

Item Description Quantity Unit Price Total Consulting Services (Project A) 10 hours $50 $500 Web Design (Package B) 1 Best Tools for Creating Invoices

Generating professional billing documents doesn’t have to be complicated. With the right tools, you can create customized records that suit your business needs while maintaining accuracy and professionalism. Whether you’re looking for a simple design or a more advanced solution with added features, there are a variety of tools available to help streamline the process and ensure consistency in your financial paperwork.

Here are some of the best tools you can use to generate detailed and professional billing records:

- FreshBooks: A popular option for small businesses, FreshBooks offers easy-to-use features for creating, sending, and tracking payments. The tool allows for detailed customization and integrates with various accounting systems.

- QuickBooks: Known for its comprehensive financial management capabilities, QuickBooks includes features for generating professional documents, tracking payments, and managing taxes–all in one platform.

- Wave: This is a free accounting tool that includes basic functions for creating billing records. It’s a great choice for freelancers and small businesses looking for an intuitive and straightforward solution.

- Zoho Invoice: Zoho offers powerful customization options, allowing you to tailor documents to your brand. It also includes automated features for recurring billing and payment reminders, which makes it ideal for businesses with subscription models.

- Microsoft Excel or Google Sheets: If you’re looking for a more hands-on approach, spreadsheet tools offer flexibility and control. You can easily create your own layout and formulas to generate calculations, although this method may require more manual effort.

Each

Common Mistakes When Using Invoice Templates

While using pre-designed document structures can save time and ensure consistency, it’s easy to make mistakes if you’re not careful. Even with a well-organized format, small errors can lead to confusion, payment delays, or even legal issues. Understanding the common pitfalls and how to avoid them will help ensure your records are accurate and professional.

- Missing or Incorrect Contact Information: One of the most common errors is failing to include complete and accurate contact details. Double-check both the sender’s and recipient’s information to avoid delivery issues or miscommunication.

- Incorrect Dates: Always ensure that the document creation date and due date are correct. An incorrect date can lead to confusion about when payments are due, potentially causing delays or disputes.

- Forgetting Payment Terms: Clearly state the payment due date, methods of payment, and any late fees or discounts. If this section is missing or unclear, it can lead to delayed payments or misunderstandings.

- Not Including Itemized Details: Failing to break down the products or services provided can leave clients unsure about what they are paying for. Always provide a detailed list with descriptions, quantities, and individual prices for transparency.

- Incorrect Calculation of Total Amount: Double-check all calculations, including taxes, discounts, and totals. Simple math errors can lead to overcharging or undercharging, which can hurt your business reputation.

- Overlooking Branding: W

Why Accuracy is Crucial in Invoices

When it comes to financial records, precision is essential. Whether you’re managing a small business or handling large-scale transactions, errors in your documents can lead to confusion, payment delays, and even legal complications. Ensuring every detail is correct not only fosters trust with clients but also ensures smooth business operations and minimizes the risk of disputes.

Impact on Payment Processing

Accurate details in a financial document are necessary for efficient payment processing. Small mistakes, such as incorrect amounts or missing information, can delay the payment cycle. Clients may refuse to pay until discrepancies are resolved, and this can lead to cash flow issues for your business. A clear, error-free record ensures that payments are processed promptly, improving your financial stability.

Maintaining Professionalism and Trust

Accuracy in your documents directly affects how your clients perceive your business. Inaccurate or sloppy paperwork can appear unprofessional and may damage your reputation. Clients expect transparency and reliability in their dealings, and providing them with precise and well-organized documents helps build trust. Mistakes can lead to questions about your business’s credibility, potentially causing customers to seek services elsewhere.

By prioritizing accuracy in all your financial records, you create a smoother experience for both your clients and your business. A well-organized, precise document not only helps avoid misunderstandings but also enhances your company’s reputation for reliability and professionalism.

Top Online Platforms for Printable Invoices

When it comes to creating and managing professional billing records, online platforms provide an efficient and convenient solution. These tools allow businesses to generate customized documents with ease, ensuring all required details are included while maintaining a polished, consistent appearance. Whether you’re a freelancer, small business owner, or part of a large enterprise, the right platform can streamline your financial processes and improve your workflow.

1. FreshBooks

FreshBooks is a comprehensive tool designed for small businesses and freelancers. Known for its user-friendly interface, it enables users to create and manage professional documents quickly. It offers a variety of customizable options, including the ability to set up recurring billing, add taxes, and track payments in real-time. FreshBooks also integrates seamlessly with accounting software, making it ideal for managing finances in one place.

2. QuickBooks Online

QuickBooks Online is one of the most widely used accounting platforms. It provides a robust set of tools for managing financial records, including the ability to generate customized documents. QuickBooks allows businesses to track expenses, accept payments online, and automate reminders for overdue payments. Its integration with payroll and tax systems makes it an all-in-one solution for businesses of all sizes.

3. Zoho Invoice

Zoho Invoice offers an intuitive platform with a variety of customization features. Users can create branded documents, automate recurring payments, and set payment reminders. The platform also allows for easy collaboration with team members and clients, streamlining communication during the billing process. Zoho integrates with other Zoho products, providing a comprehensive business management suite.

4. Wave Accounting

Wave Accounting is a no-cost solution for freelance

How to Save and Print Your Invoices

Once you’ve completed your document, the next important step is ensuring it’s saved and ready for printing. Whether you need to send it to a client or keep a physical record, the process of saving and printing can be done quickly with a few simple steps. First, ensure your file is saved in a convenient location on your computer, such as your desktop or a designated folder. This makes it easy to access and manage later on.

To save the document, select the “Save As” option from your software’s menu, and choose a format like PDF or DOCX, depending on your needs. PDF is often preferred for its compatibility across devices and printers, ensuring that the layout and design remain intact. After saving, double-check the file to ensure all the necessary details are included and correct.

When you are ready to print, open the file and select the “Print” option from the software’s menu. Make sure your printer is connected and ready to go. Adjust any necessary settings such as page size or number of copies. If you’re printing for personal records or client submission, a clear and professional layout will ensure a positive impression.

Invoice Template Design Tips for Professionals

Creating a well-organized and professional-looking document is key to making a positive impression on clients and partners. The layout and design should not only reflect your brand but also ensure clarity and ease of understanding. A clear and concise design helps avoid confusion and ensures all necessary details are easily accessible.

Focus on Simplicity and Readability

Keeping the design clean and minimalistic is important. Avoid clutter and overly complex elements. Instead, focus on key sections that clients need to review quickly. Here are a few tips to maintain simplicity and clarity:

- Use a readable font size and style for text, ideally sans-serif fonts like Arial or Helvetica.

- Ensure there’s enough white space between sections to create a clean look and prevent overcrowding.

- Keep color schemes professional, with no more than two or three accent colors that align with your branding.

- Include clear section headers that stand out, making it easy for the reader to navigate through the document.

Organize Information Efficiently

Well-structured documents are crucial for both you and your client to understand the details quickly. Make sure all essential information is presented in an easy-to-digest format. Here’s how you can organize key components:

- Start with your contact details, followed by the recipient’s information.

- Clearly separate the itemized list of services or goods, making sure each line is easy to read.

- Include a summary of totals, taxes, and any discounts in a separate section at the bottom.

- Ensure that payment instructions are placed in a prominent location, such as at the bottom or near the total amount due.

How Editable Templates Improve Invoice Efficiency

Using a customizable document format streamlines the process of creating and managing business transactions. By having a consistent structure that can be quickly modified, you save time and reduce the potential for errors. This approach ensures that each transaction is processed faster and with greater accuracy, leading to improved workflow and less administrative overhead.

One of the primary advantages of a customizable layout is that it allows you to input specific details quickly, without the need to redesign the entire document each time. Whether you’re updating client information, adjusting amounts, or changing terms, the process becomes seamless and less time-consuming.

Additionally, a well-structured document that can be easily modified ensures that all critical information is included, preventing important details from being overlooked. Consistency across different transactions also contributes to better organization and makes it easier to track and reference past activities.

Automation is another key benefit. By setting up reusable sections, such as standard descriptions, payment terms, and tax calculations, you minimize manual entry. This not only speeds up the creation process but also reduces the likelihood of mistakes that could lead to confusion or delays.

How to Stay Organized with Invoice Templates

Staying organized is essential for maintaining smooth business operations, especially when managing client payments and financial records. Having a consistent structure for each transaction ensures that all necessary details are accounted for, easily accessible, and ready for review. A well-organized approach helps you track outstanding payments, avoid missing important details, and streamline your overall workflow.

Maintain Consistency Across Documents

One of the best ways to stay organized is by using a consistent format for all your financial documents. This consistency not only makes your work easier to navigate but also reinforces a professional image. Key elements such as company information, client details, and payment terms should be clearly defined and easy to locate in every document.

- Always include clear headers and subheaders to separate sections like payment terms, product details, and totals.

- Use the same layout for each transaction to avoid confusion and ensure the document is simple to follow.

- Standardize font sizes and styles to create a uniform look that’s easy to read and professional.

Keep Detailed Records for Easy Reference

Being able to quickly access past documents is vital for maintaining order. By organizing all your financial records in a systematic way, you can ensure that previous transactions are easy to retrieve whenever necessary.

- Save all documents in dedicated folders with clear labels, such as client name or project number.

- Consider using cloud storage or a document management system to organize and back up your files for greater accessibility.

- Keep track of important dates, such as payment due dates and billing cycles, to ensure timely follow-ups.