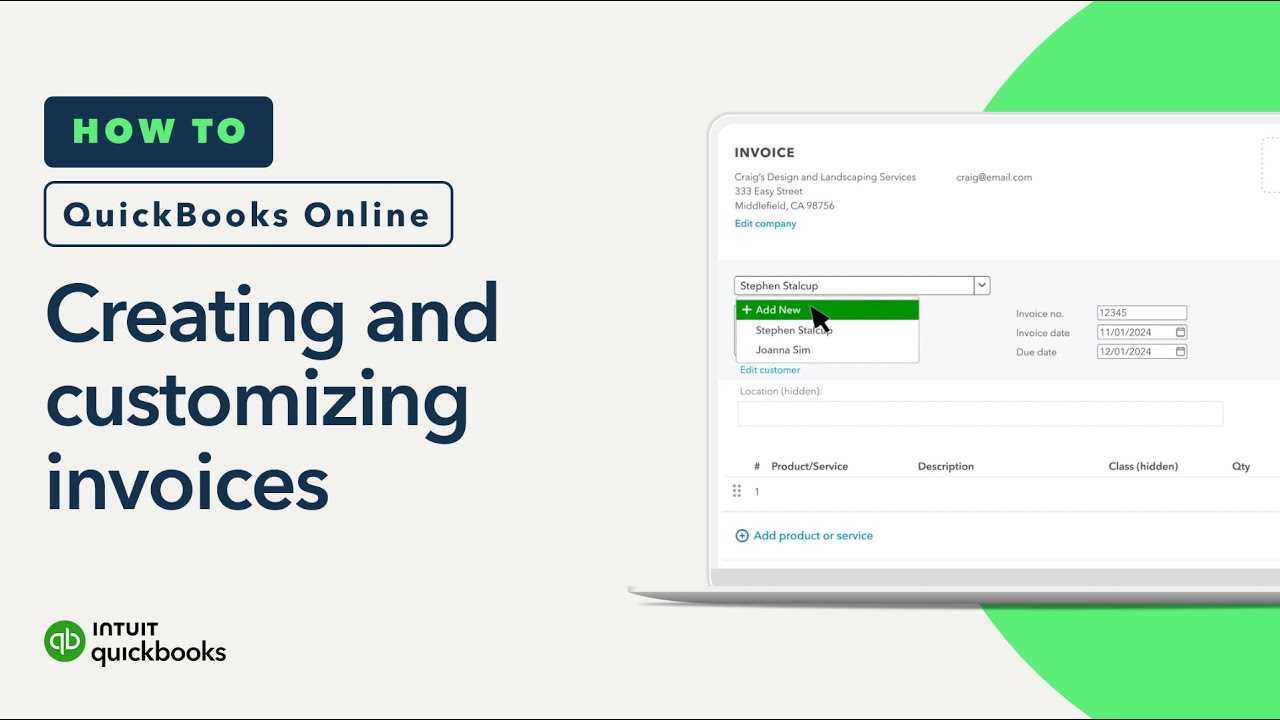

Editing Invoice Templates in QuickBooks Self Employed Made Simple

Creating professional documents that reflect the identity and standards of your business is essential for building trust and ensuring clear communication. Customizing the appearance and details in your business files can significantly enhance their appeal and functionality, providing a seamless experience for both you and your clients.

By tailoring various elements, including layout, colors, and specific data fields, you can ensure that each document aligns perfectly with your brand and meets specific needs. Flexibility in adjusting content and design also allows for better clarity and adaptability across different projects, helping you maintain a consistent look that resonates with clients.

With the right adjustments, your documents become more than just standard forms–they evolve into powerful representations of your business, supporting both efficiency and professionalism. This article will guide you through essential steps to personalize your business documents, offering tips to help you make the most of available tools for optimal customization.

Editing Invoice Templates in QuickBooks Self Employed

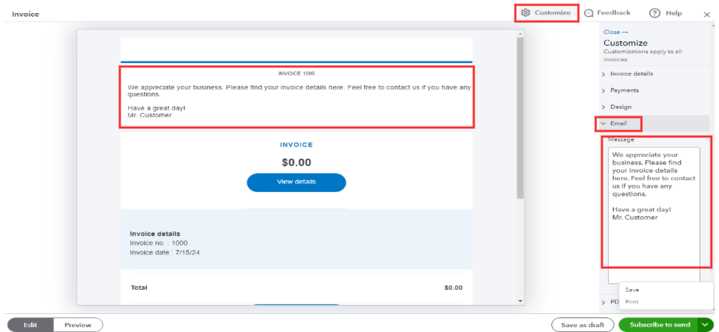

Customizing business documents to suit your brand and operational needs can greatly enhance how you interact with clients. By personalizing various elements, you ensure that each document reflects a unique and professional approach that aligns with your business values. Through adjustments to format, design, and essential fields, your documents become tools that facilitate smoother communication and promote a consistent brand image.

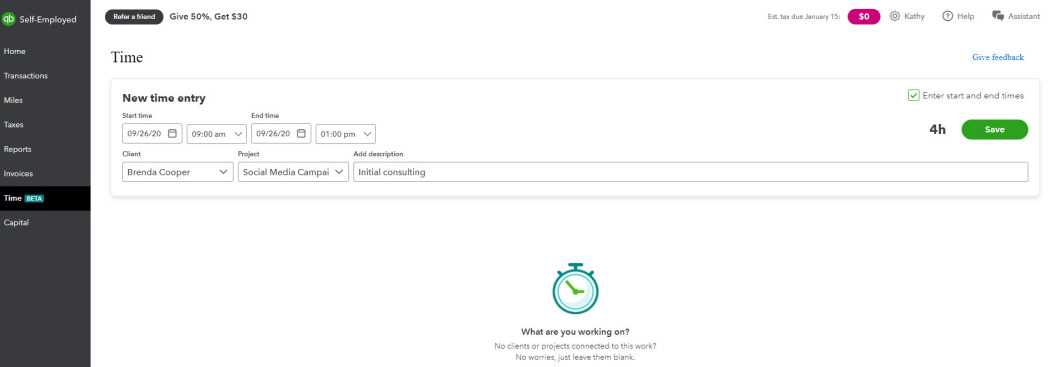

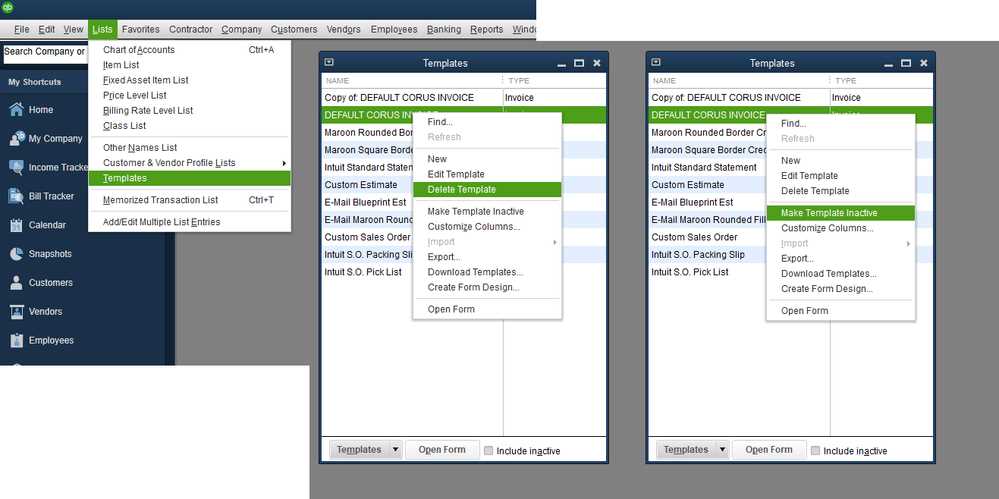

Adjusting the Document Layout

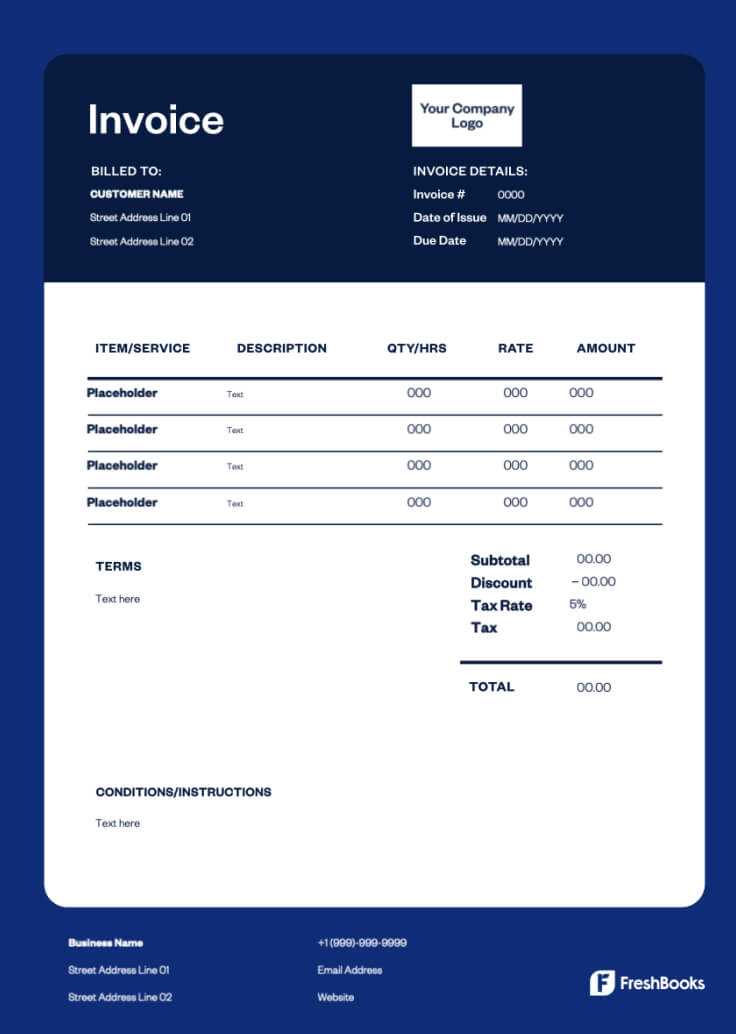

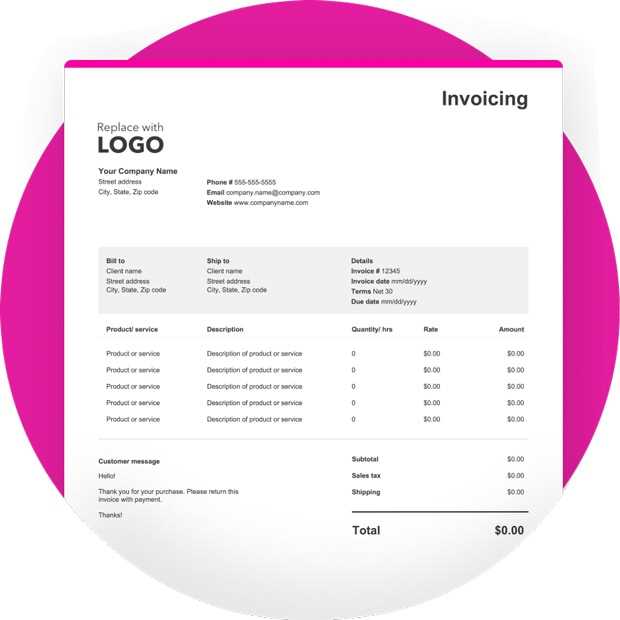

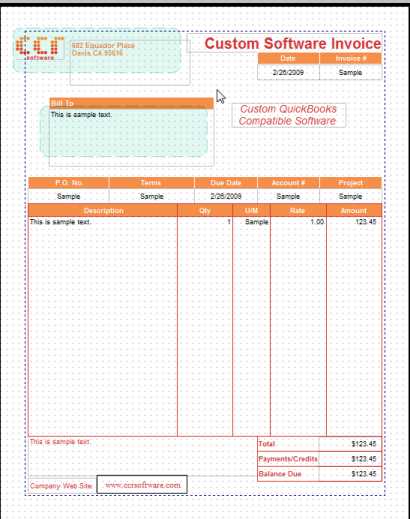

The overall layout plays a crucial role in making your business documents readable and visually appealing. Customizing sections, aligning key details, and reordering content elements can improve clarity. This includes organizing sections for payment information, client details, and itemized lists. Such adjustments ensure that important information is easy to find, contributing to a seamless experience for clients.

Customizing Fields and Details

Adding or removing specific fields allows you to tailor documents to different client requirements or types of work. For instance, you might want

Editing Invoice Templates in QuickBooks Self Employed

Customizing business documents to suit your brand and operational needs can greatly enhance how you interact with clients. By personalizing various elements, you ensure that each document reflects a unique and professional approach that aligns with your business values. Through adjustments to format, design, and essential fields, your documents become tools that facilitate smoother communication and promote a consistent brand image.

Adjusting the Document Layout

The overall layout plays a crucial role in making your business documents readable and visually appealing. Customizing sections, aligning key details, and reordering content elements can improve clarity. This includes organizing sections for payment information, client details, and itemized lists. Such adjustments ensure that important information is easy to find, contributing to a seamless experience for clients.

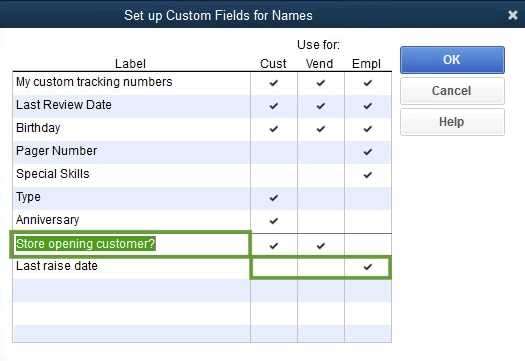

Customizing Fields and Details

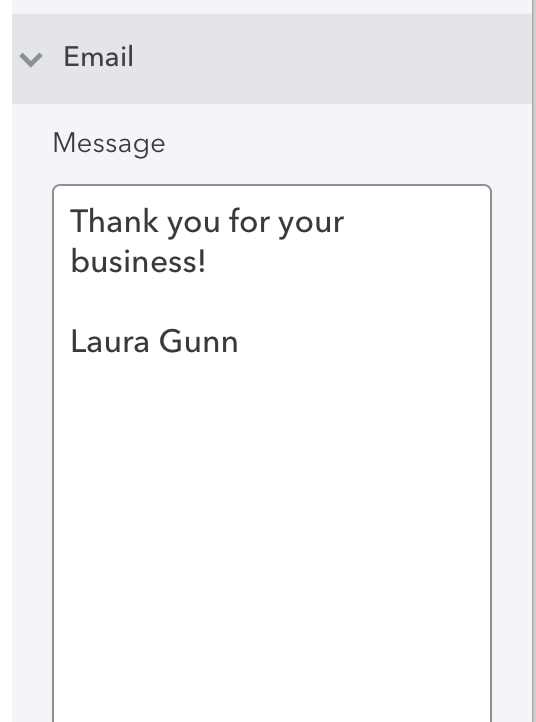

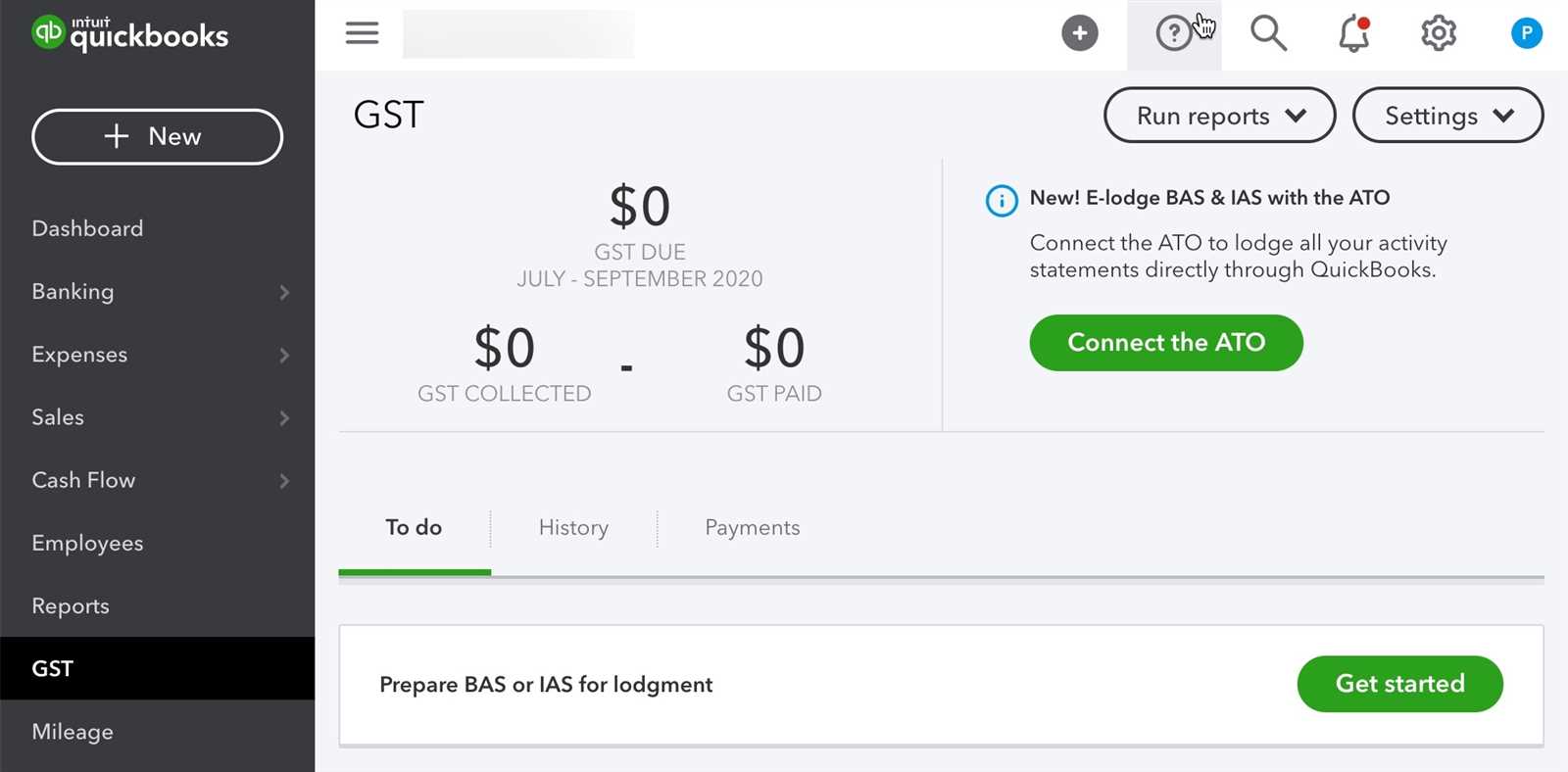

Adding or removing specific fields allows you to tailor documents to different client requirements or types of work. For instance, you might want to include custom notes, modify tax information, or adjust fields that relate to specific projects. This level of personalization ensures that each document is both informative and relevant, minimizing the need for follow-up questions.

| Customization Option | Purpose |

|---|---|

| Logo Placement | Adds branding and enhances recognition |

| Contact Information | Ensures clients can easily reach you |

| Font and Color Adjustments | Enhances readability and matches brand style |

| Payment Terms Section | Clarifies expectations for both parties |

By making these refinements, you can create documents that are not only functional but also visually engaging and consistent with your business image. A few well-considered changes can significantly elevate the overall presentation and usability of your documents.

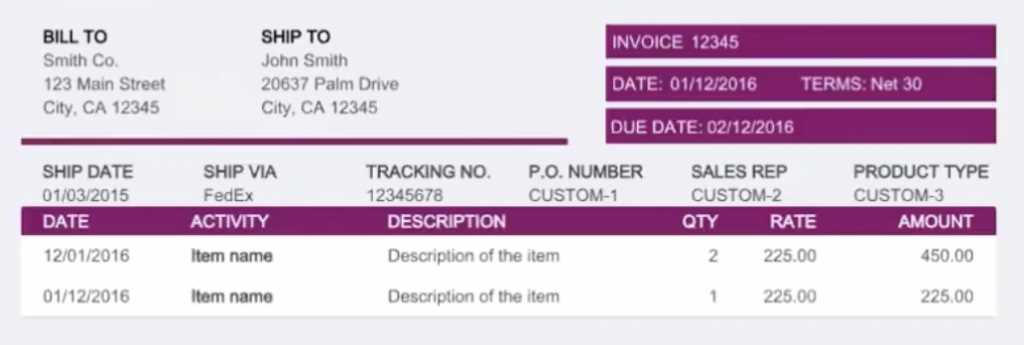

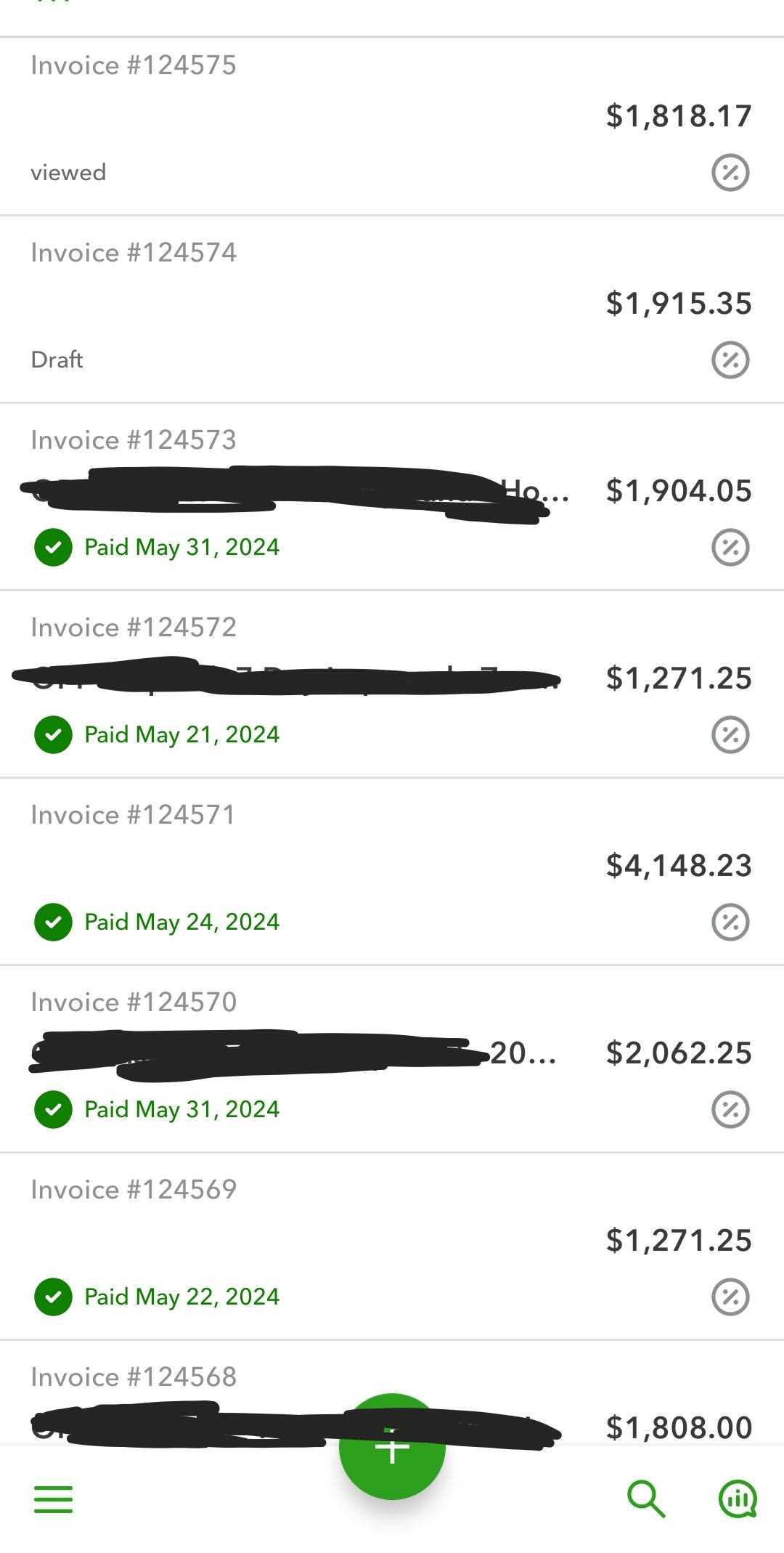

Adding Business Information to Invoices

Including essential details about your company in each document not only promotes professionalism but also provides clients with a clear understanding of whom they are working with. Accurate and detailed business information helps establish trust and allows clients to contact you easily whenever needed. Each element, from your logo to contact details, plays a role in creating a memorable and transparent experience.

Displaying consistent and comprehensive business details in your documents is essential for building client confidence. Elements such as your company name, contact information, and address help make the document look polished while ensuring clarity in communication.

| Business Detail | Purpose | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Company Name | Identifies your business clearly | |||||||||

Logo

Customizing Fonts and Colors for Branding

Applying a cohesive look to your business documents helps convey a strong brand identity, making them instantly recognizable to clients. Through the selection of fonts and colors that reflect your brand, you can create a consistent, professional appearance that aligns with your company’s image. Thoughtful customization of these visual elements enhances readability and leaves a lasting impression. Fonts are a key aspect of branding as they set the tone for your document’s overall look. Choosing a style that is both readable and distinctive allows your communication to feel polished and trustworthy. Meanwhile, colors add personality and can be matched to your brand’s palette, reinforcing brand awareness every time a client views your document. By integrating these custom elements, you not only improve the aesthetic appeal but also strengthen brand consistency across all client interactions. Consistent use of brand-aligned colors and font styles supports professionalism and helps clients associate these details with your business, building familiarity and trust. Modifying Invoice Fields for Specific Needs

Tailoring document fields to match the requirements of different projects or clients can help streamline your processes and enhance clarity. Adjusting the types of information included in each document ensures that it is as relevant as possible, addressing unique needs and presenting a well-organized overview of the work completed. This flexibility allows your documents to remain both professional and adaptable. When customizing fields, consider which details will be most valuable for each scenario. Commonly modified sections include:

|