Easy Invoice Template for Word to Simplify Your Billing

Managing finances and ensuring timely payments is a critical part of running any business. Creating professional-looking bills can be time-consuming, but with the right tools, the process becomes much more efficient. Having access to customizable document formats allows you to quickly produce accurate statements for clients, saving both time and effort.

By utilizing pre-designed formats, you can streamline your billing system without needing advanced technical skills. These structured documents offer flexibility for customization, allowing you to tailor each bill to reflect your brand and specific business needs. Whether you’re a freelancer or a small business owner, adopting a well-organized approach can help you stay on top of your financial tasks.

With minimal effort, you can create a professional and consistent billing structure that simplifies your workflow. This guide will walk you through the basics of setting up these documents, ensuring you have the tools needed to send clear and accurate requests for payment every time.

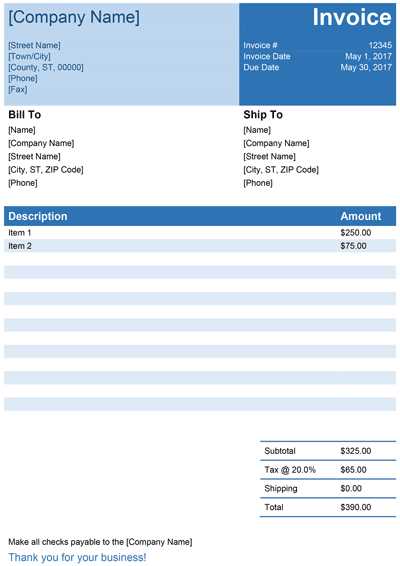

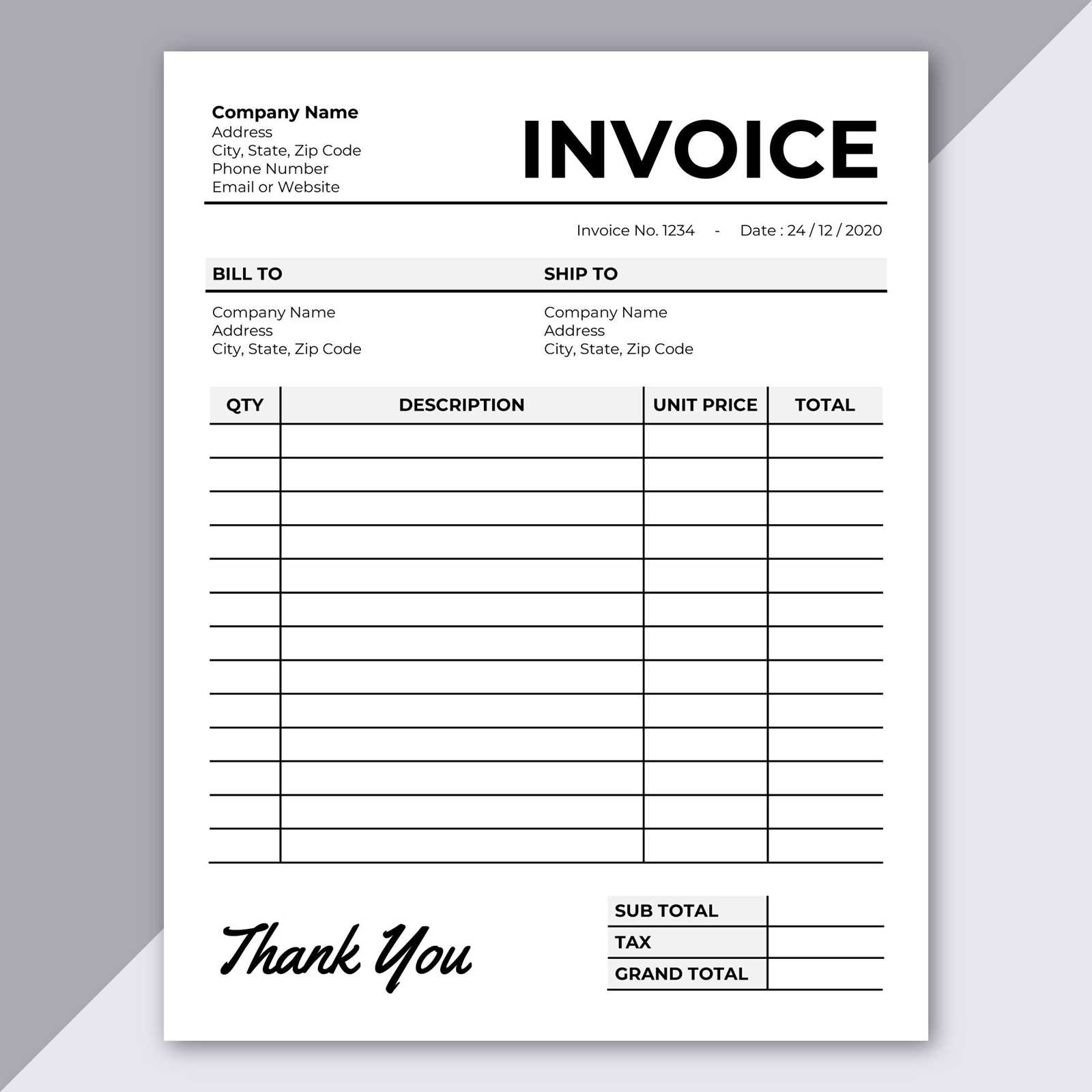

Easy Invoice Template for Word

For any business, having a well-organized system for generating and sending bills is crucial for smooth financial operations. With the right structure, you can quickly create professional documents that clearly outline what is owed, ensuring accuracy and consistency in every transaction. Pre-built formats designed for quick customization are a simple and effective solution for creating such documents, saving time while maintaining professionalism.

Why Choose a Pre-Designed Format?

Using ready-made structures provides several advantages:

- Efficiency: Reduces the time spent creating new documents from scratch.

- Consistency: Ensures uniformity in how payments are requested from clients, helping establish a professional image.

- Customization: Easily adjust the content to reflect specific business needs or client information.

- Flexibility: Modify the structure as necessary without complex software or technical knowledge.

Steps to Customize Your Document

Once you’ve chosen a suitable pre-made format, here are the simple steps to customize it:

- Open the document: Load the selected structure in your preferred editing program.

- Fill in your details: Include your business name, client information, and payment terms.

- Modify the sections: Adjust the items, prices, and totals as needed for each transaction.

- Save and send: Once finalized, save the file in your preferred format and share it with the client.

With these simple steps, you can quickly generate a clear, professional statement that makes billing easier for both you and your clients.

Why Use an Invoice Template

Having a pre-designed structure for billing is essential for businesses of all sizes. It simplifies the process of creating accurate and consistent payment requests, ensuring that every detail is properly addressed. By using a well-organized format, you save valuable time and avoid common mistakes that can lead to confusion or delayed payments.

Key Benefits of Using a Pre-Designed Structure

- Time-saving: Reduces the effort needed to manually design each payment request from scratch.

- Accuracy: Ensures all necessary fields are included, reducing the risk of errors and omissions.

- Professional appearance: Gives your documents a polished look, which can help build trust with clients.

- Consistency: Maintains a uniform approach for all your billing, making it easier for clients to understand and follow.

- Customization: Offers flexibility to easily update and tailor the document for different clients or projects.

How It Improves Financial Organization

By using a standardized format, businesses can better track payments, identify overdue amounts, and maintain clear records. These templates help keep everything organized, making it easier to manage accounts, especially when dealing with multiple clients or ongoing projects. With a reliable system in place, you reduce the chances of overlooking important details, ensuring smoother financial operations.

Benefits of Customizing Word Templates

Personalizing a pre-designed structure for billing allows businesses to better align documents with their branding and specific needs. Customization enhances both the functionality and appearance of the document, giving a more professional and tailored touch to each transaction. It ensures that the final product reflects the business’s identity while maintaining clarity and consistency in every request for payment.

Here are some key advantages of adapting these structures to your needs:

- Brand Recognition: Customizing allows you to add your logo, color scheme, and other elements that reflect your business identity.

- Flexibility: You can easily adjust the layout to accommodate different pricing models, payment terms, or client-specific details.

- Improved Communication: Customizing ensures the document is clear and aligned with your client’s expectations, making it easier for them to understand what’s owed.

- Efficiency: By modifying a pre-made structure, you eliminate the need to redesign from scratch for each client or project.

Ultimately, customization offers a balance between professionalism and personalization, making it easier to build strong, lasting relationships with clients while maintaining organized financial records.

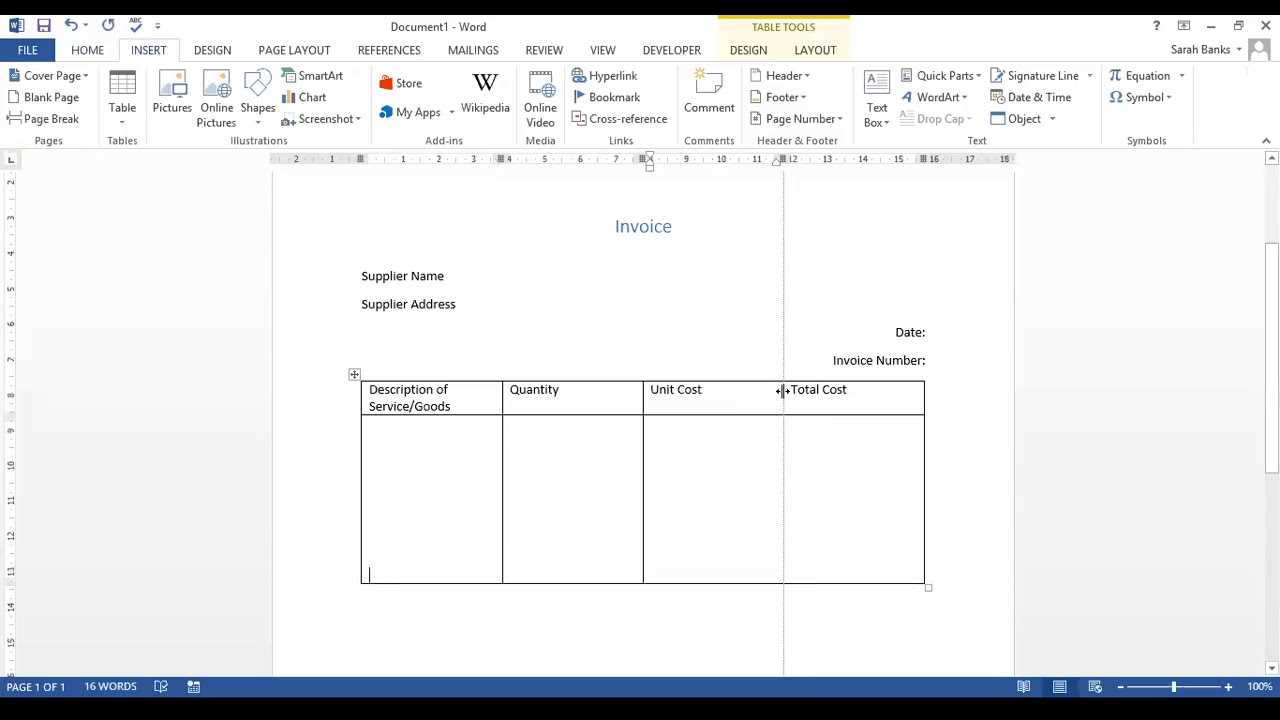

How to Create Your Own Invoice

Creating a professional billing document from scratch is a straightforward process that can be customized to suit your specific needs. With the right structure and key information, you can easily generate a clear and accurate payment request for any project or service. Below is a simple guide to help you design your own billing statement that covers all necessary details while keeping the process efficient.

Follow these steps to create a basic document:

- Step 1: Start with your business name, address, and contact details at the top.

- Step 2: Add the client’s name, address, and any relevant contact information.

- Step 3: Specify the services or products provided, along with the corresponding amounts.

- Step 4: Include payment terms, such as due date, late fees, or preferred payment methods.

- Step 5: Double-check all figures and ensure all necessary details are clearly outlined.

Once the basic structure is in place, you can further personalize the document to make it look more professional. Below is an example of how the layout might look:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 10 hours | $50 | $500 |

| Project Management | 5 hours | $75 | $375 |

| Total | $875 |

By following this simple structure, you

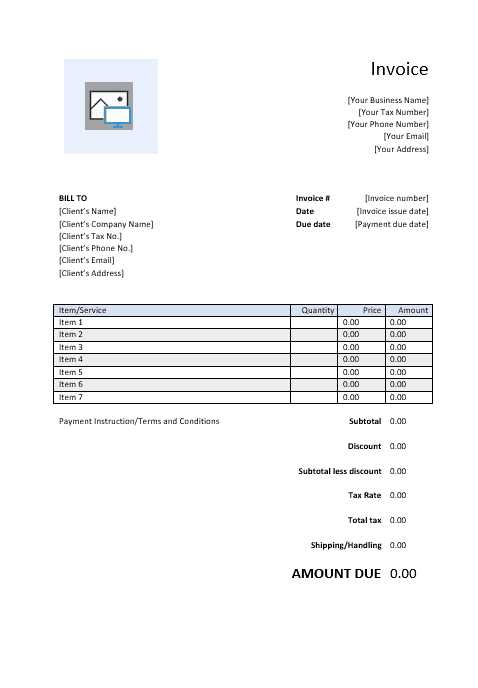

Top Features of Word Invoice Templates

Using pre-designed billing structures can greatly enhance the efficiency of creating payment requests. These formats are built with essential elements already in place, making it easier for users to input necessary details while maintaining a consistent and professional layout. Below are some key features that make these documents so effective for managing transactions.

Essential Components for Efficient Billing

- Pre-set Layouts: Organized sections for service descriptions, quantities, and totals help users quickly fill in the relevant information.

- Customizable Fields: Users can easily adjust and add specific details such as client names, services rendered, or pricing structures.

- Automatic Calculations: Many formats include built-in fields that automatically calculate totals, taxes, or discounts, reducing the risk of human error.

- Payment Terms Section: Pre-designed areas for including payment instructions, due dates, and late fee policies ensure clarity for both parties.

- Branding Opportunities: These formats often allow users to insert logos, adjust color schemes, and match fonts to align with their company’s brand identity.

How These Features Streamline the Billing Process

- Save Time: Pre-structured formats eliminate the need to manually design a document from scratch each time.

- Increase Accuracy: Built-in fields help minimize errors in calculations and data entry.

- Improve Professionalism: A well-organized and branded document enhances the business’s image, making it appear more polished to clients.

- Easy to Update: The flexibility to modify details ensures that changes such as new services or price adjustments can be quickly made.

These key features make pre-designed documents a powerful tool for businesses looking to streamline their billing process and maintain a professional approach to financial transactions.

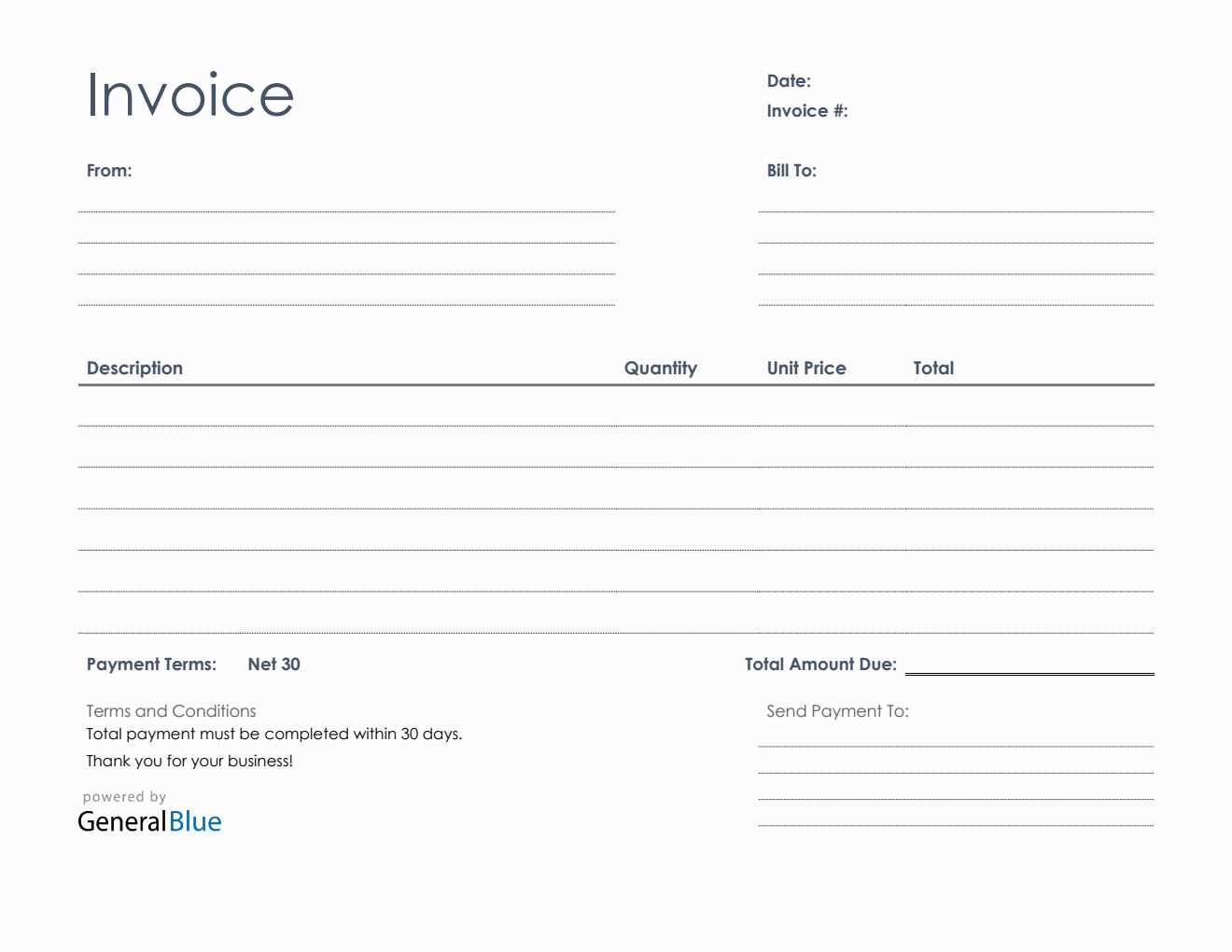

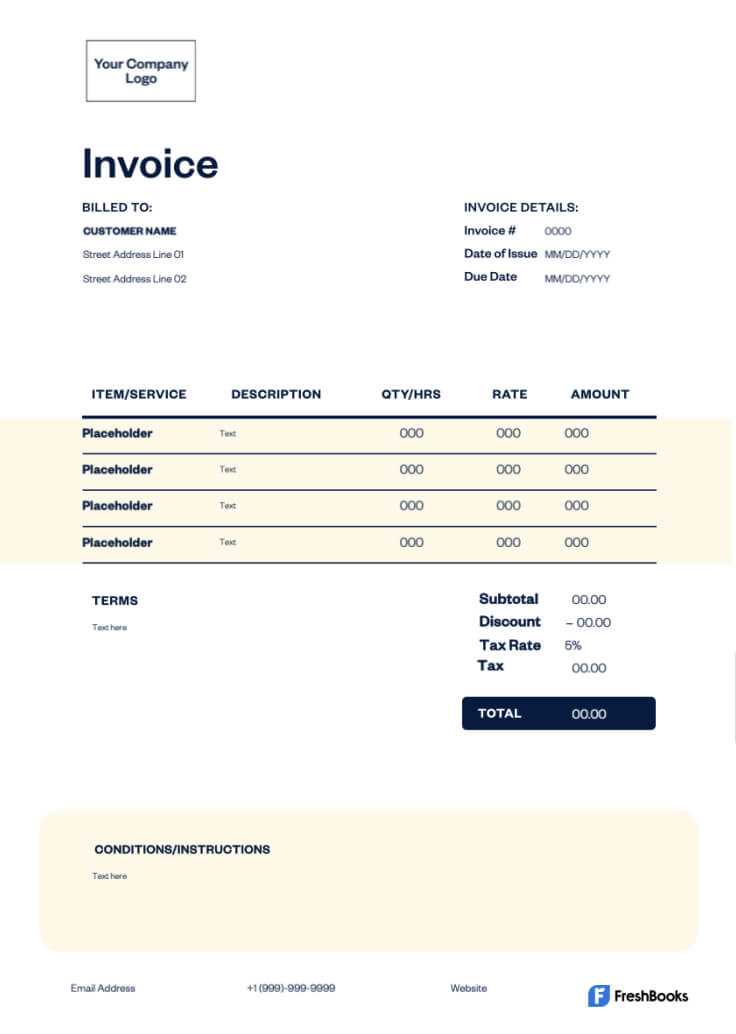

Choosing the Right Template for Your Business

Selecting the right document format for billing is a crucial step in streamlining your financial processes. A well-chosen layout not only helps you stay organized but also ensures that your clients receive clear and professional payment requests. It’s important to consider your business needs, the services or products you offer, and the expectations of your clients when making a decision.

Here are a few factors to consider when choosing a billing format:

- Industry-Specific Needs: Different businesses may require specific information. For example, a consultant may need a section for hourly rates, while a product-based business might focus on item descriptions and quantities.

- Client Expectations: Understanding what your clients expect from you is key. Some clients may prefer a simple, straightforward document, while others may appreciate additional details like terms and conditions, or payment instructions.

- Ease of Use: Choose a format that is easy for you to update and modify as needed. The simpler the layout, the less time it will take to generate a new document for each transaction.

- Professional Design: Ensure the design reflects your brand’s identity. A professional, clean layout adds credibility and helps you stand out in your industry.

- Functionality: Look for formats with built-in features such as automatic calculations, customizable fields, or sections for taxes, discounts, and payment terms to save time and reduce errors.

Choosing the right structure will not only improve your workflow but will also help you build stronger client relationships by providing clear and consistent documentation for every transaction.

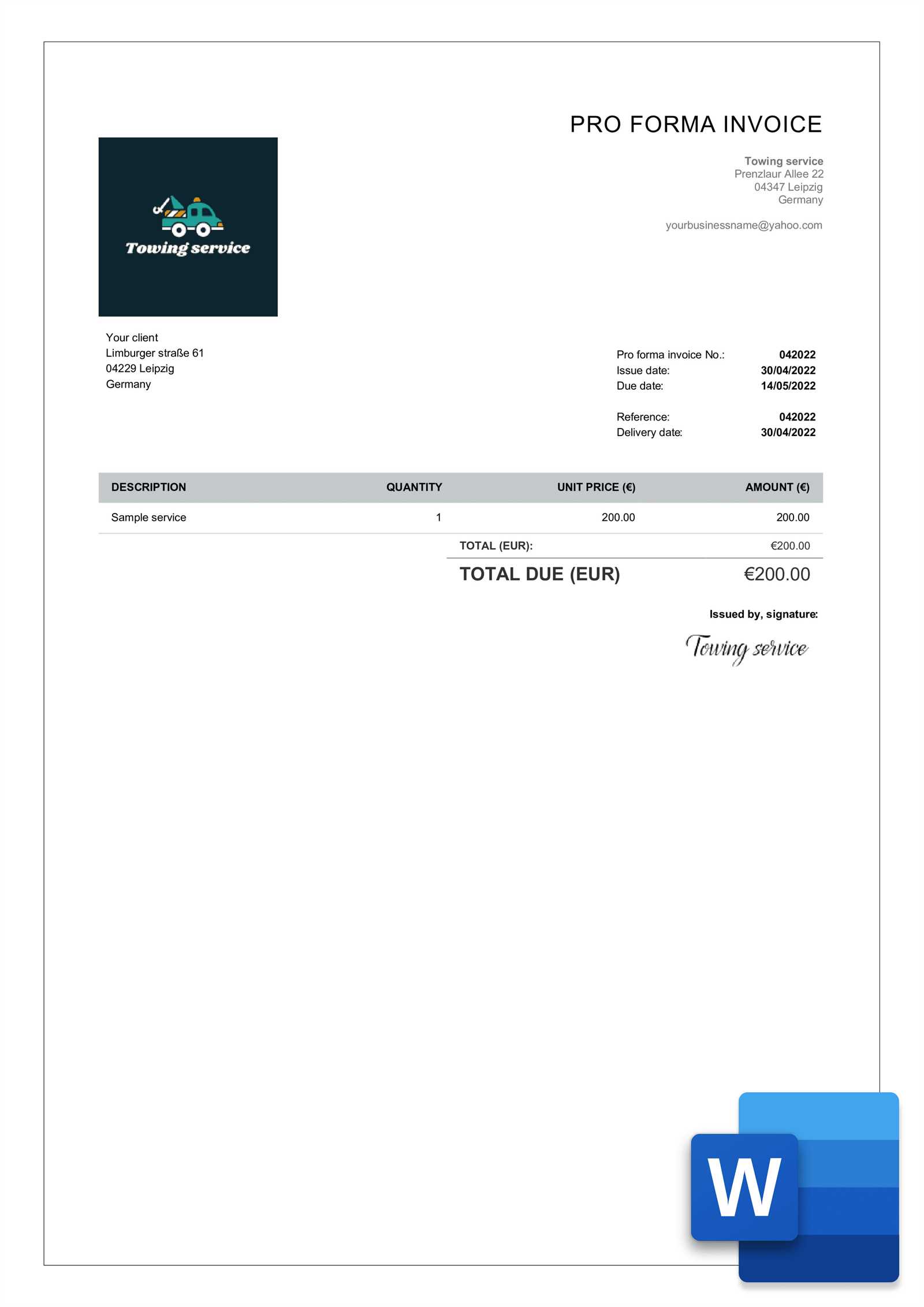

How to Add Logo and Branding

Incorporating your company’s logo and brand elements into your payment requests not only makes them more professional but also helps reinforce your business identity. Customizing your document to reflect your branding ensures consistency across all client communications, which can enhance trust and recognition. Here’s how to effectively add your logo and other brand elements to your billing documents.

Steps to Add Your Logo and Branding:

- Step 1: Insert Your Logo – Place your logo at the top of the document where it is easily visible. Most editing programs allow you to insert an image or logo file directly into the header section, ensuring it appears on every page.

- Step 2: Adjust Colors – Modify the colors of your document to match your brand palette. This includes the background color, text color, and accents that align with your company’s colors.

- Step 3: Customize Fonts – Select fonts that reflect your company’s style. Whether your brand is modern or classic, ensure that the font you use is professional and easy to read.

- Step 4: Add Contact Information – Include your business address, phone number, email, and website in the footer or header to make it easy for clients to reach you.

- Step 5: Maintain Consistency – Ensure that all elements of the document (from colors to layout) are consistent with your other branded materials, such as business cards, contracts, and promotional materials.

By incorporating your company’s visual identity into your billing documents, you not only create a professional appearance but also strengthen your brand’s presence in your clients’ minds. A well-branded payment request can make a lasting impression and promote your business’s image.

Organizing Your Client Information Effectively

Proper organization of client details is key to running an efficient and professional business. When you structure client information clearly, it helps ensure that billing is timely, accurate, and streamlined. Whether you’re managing a few clients or a large portfolio, having a well-organized system will save time, reduce errors, and improve communication.

Key Elements to Organize

Start by focusing on the most essential information:

- Client Name and Contact Details: Always keep the name, address, phone number, and email address updated and easily accessible.

- Payment Terms: Note any specific agreements about payment schedules, late fees, or discounts for early payments.

- Service/Product Information: Keep a record of what was provided to the client, including descriptions, quantities, and prices.

- Transaction History: Maintain a clear log of all past payments, due dates, and outstanding balances for each client.

How to Keep It All in Order

- Use a CRM System: Customer Relationship Management (CRM) software can help track interactions, agreements, and financial details in one place.

- Spreadsheets: A simple spreadsheet can also be an effective way to organize client information. Use columns for name, contact info, payment status, and services provided.

- Cloud Storage: Cloud-based solutions allow you to keep client records and documents easily accessible, ensuring you can update them quickly and securely.

Effective organization helps you maintain a professional approach and fosters strong, lasting client relationships. When you can quickly access accurate information, you save time and reduce the risk of miscommunication or mistakes, making your entire billing and business process more efficient.

Using Tables for Professional Invoices

Tables are an excellent way to present billing details in a clear and organized manner. By structuring your payment requests with tables, you ensure that clients can easily read and understand the breakdown of charges, quantities, and totals. A well-designed table not only enhances readability but also adds a professional touch to your documents.

Key Benefits of Using Tables:

- Improved Clarity: Tables allow you to neatly organize information, making it easier for clients to follow the breakdown of products or services provided.

- Professional Appearance: A clean, structured table gives your document a polished, business-like look, reinforcing your professionalism.

- Quick Calculation: By using separate rows for individual items and totals, tables make it easy to calculate and check the accuracy of amounts, taxes, and discounts.

- Space Efficiency: Tables help maximize the use of space, keeping the document compact and visually appealing without overwhelming the client with large blocks of text.

Example of a Basic Table Layout:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 10 hours | $50 | $500 |

| Project Management | 5 hours | $75 | $375 |

| Total | $875 |

By utilizing tables, you create an easy-to-read format that clients can quickly understand, while also maintaining a professional appearance. This approach ensures that all the important details are presented in a neat and structured way, improving the overall clarity and effectiveness of your billing documents.

How to Calculate Taxes in Word Invoices

When creating payment requests, it’s important to accurately calculate any applicable taxes to ensure transparency and compliance. Taxes can vary based on location, product, or service, and properly accounting for them helps avoid discrepancies or misunderstandings with clients. By following a few simple steps, you can easily integrate tax calculations into your documents.

Steps for Calculating Taxes:

- Step 1: Identify Tax Rate – Before applying taxes, determine the correct tax rate for your location or industry. This can vary depending on the type of service or product you offer and the jurisdiction in which you operate.

- Step 2: Calculate Taxable Amount – Identify the total amount that is subject to tax. In most cases, this would be the sum of your services or products before any discounts or additional fees.

- Step 3: Apply the Tax Rate – Multiply the taxable amount by the appropriate tax rate. For example, if the taxable amount is $500 and the tax rate is 10%, the tax would be $50 (500 * 0.10 = 50).

- Step 4: Add Tax to the Total – Once the tax is calculated, add it to the original amount to determine the final total due. In our example, the total would be $550 ($500 + $50).

Example Calculation:

| Description | Amount |

|---|---|

| Service Charges | $500 |

| Tax (10%) | $50 |

| Total | $550 |

By following this simple calculation process, you can ensure that taxes are accurately applied to your payment requests. This not only ensures compliance but also keeps your clients informed about the charges they are paying for, fostering trust and clarity.

Saving and Editing Invoice Templates

Once you’ve created a billing document, it’s important to save it properly for future use and ensure it’s easy to update as needed. Having a well-organized system for storing and modifying your documents saves time and helps maintain consistency across all client transactions. By following a few simple steps, you can easily keep your documents up-to-date and ready for use at any time.

Steps for Saving and Editing Billing Documents:

- Step 1: Save as a Master Copy – When creating a new structure, always save a master copy that you can use as a template. This allows you to retain a clean, unaltered version for future modifications without having to recreate the document each time.

- Step 2: Store in an Accessible Location – Organize your saved documents in an easily accessible folder or cloud storage so you can quickly find and use them when needed.

- Step 3: Edit as Necessary – When preparing a new request, simply open the saved file and adjust the details as necessary, such as updating client information, changing service descriptions, or modifying payment terms.

- Step 4: Save Under a New File Name – After editing, save the document under a unique name to differentiate it from the master copy and to keep track of individual transactions.

Example: If your master copy is named “Billing_Template,” save each new version as “Billing_ClientName_Date” to easily identify each document.

By saving and editing your documents efficiently, you ensure that every billing request is consistent and professional while minimizing the effort needed to generate new ones. This approach not only improves your workflow but also helps you maintain accurate records for future reference.

Printing and Sending Invoices Quickly

Efficiently printing and sending billing documents is crucial for maintaining smooth business operations. By streamlining these steps, you ensure that clients receive their payment requests promptly, which can help improve cash flow and reduce delays. Whether you’re sending physical copies or digital versions, having a quick process in place is essential for timely communication.

Printing Your Billing Documents

- Step 1: Review the Document – Before printing, ensure that all information is accurate, including client details, charges, and payment terms.

- Step 2: Select the Right Printer Settings – Choose the correct paper size, quality, and orientation to ensure your document prints clearly and professionally. For most business documents, a standard letter-size paper (8.5 x 11 inches) will work.

- Step 3: Print a Test Copy – If it’s the first time printing a document, do a test print to ensure everything looks correct, such as margins and formatting.

- Step 4: Print Multiple Copies if Needed – If you need to send physical copies to more than one recipient, print the required number of copies in one go to save time.

Sending Your Billing Documents

- Step 1: Email Delivery – Save the document as a PDF file for easy sharing, ensuring that the formatting remains intact. Attach the file to an email, and include a brief message explaining the details.

- Step 2: Use Professional Email Templates – To maintain a consistent and professional tone, create a standard email template that you can personalize for each client. This speeds up the process while still maintaining a personal touch.

- Step 3: Use E-Signature Tools – If your business requires signatures, consider using e-signature software to streamline the process and avoid delays in sending physical copies.

By following these simple steps, you can ensure that your billing documents are delivered quickly and efficiently, whether through email or postal mail. This helps to maintain professionalism and ensures your clients receive clear instructions on how to make timely payments.

How to Track Payments with Word Templates

Tracking payments is essential for maintaining a smooth cash flow and ensuring that all outstanding balances are managed effectively. By using a well-organized system within your documents, you can easily track which payments have been made and which are still pending. This not only helps you stay on top of your financial records but also simplifies communication with clients when payment reminders are necessary.

Steps to Track Payments:

- Step 1: Include a Payment Status Section – Add a column or section in your document dedicated to tracking payment status. Label it clearly, such as “Paid,” “Pending,” or “Overdue,” so you can easily update it as payments are made.

- Step 2: Record Payment Dates – For each payment received, note the date of the transaction. This allows you to monitor when payments are made and helps with reconciling records later.

- Step 3: Update the Amounts – After receiving a payment, update the “Amount Paid” field and subtract it from the total amount due. This will help you see how much remains outstanding.

- Step 4: Use Color Coding – To make tracking easier, consider using color coding. For example, mark “Paid” entries in green, “Pending” in yellow, and “Overdue” in red. This provides a visual cue for quick reference.

Example of Payment Tracking Layout:

| Client Name | Total Amount | Amount Paid | Payment Status | Payment Date |

|---|---|---|---|---|

| Client A | $500 | $500 | Paid | 10/05/2024 |

| Client B | $300 | $150 | Pending | 11/01/2024 |

| Client C | $200 | $0 | Overdue |

By keeping your payment records organized within the same structure, you can quickly monitor which transactions have been completed and which need follow-up. This method makes it easy to send reminders, manage client relationships, and maintai

Automating Invoice Creation in Word

Automating the creation of payment requests can save you valuable time and reduce the risk of errors. By setting up automated processes, you can quickly generate billing documents without having to manually enter repetitive information each time. This streamlining process not only increases efficiency but also ensures consistency across all your billing communications.

Ways to Automate the Creation of Billing Documents:

- Use Fillable Fields: Create a master document with predefined fields such as client name, address, service details, and payment terms. You can easily update these fields each time you generate a new document, reducing the need to retype the same information.

- Leverage Document Merging: If you’re handling multiple clients, use mail merge functions to automatically insert client-specific information into your documents. This can be especially useful for sending bulk payment requests with personalized details.

- Implement Macros: For more advanced automation, create macros that automate repetitive tasks. For example, you can set up a macro that fills in client details, calculates totals, and formats the document with just one click.

- Use Pre-built Software Solutions: Some software integrates with your document creation tool and automatically populates fields with client data, transaction details, and tax calculations. This eliminates the need to manually enter information each time you need a new document.

Example of Automating a Document with Fillable Fields:

For a simple automation process, create a master document with placeholders for client name, address, services provided, amounts, and payment terms. Save this as a reusable template. Each time you need to generate a new document, you can simply replace the placeholders with specific client details.

- Step 1: Open the master document.

- Step 2: Replace the placeholder fields with the client’s information.

- Step 3: Update the charges and services provided.

- Step 4: Save the document with a new file name for each transaction.

By automating the process of creating billing requests, you free up more time to focus on other essential tasks while ensuring that every document is accurate, consistent, and professional.

Common Mistakes to Avoid in Invoices

When creating payment requests, small errors can lead to confusion, delays, or even loss of revenue. It’s essential to ensure that every document is clear, accurate, and free from common mistakes. By understanding these common pitfalls and avoiding them, you can maintain professionalism and avoid potential issues with clients or financial records.

Common Errors to Avoid:

- Incorrect Client Information: Always double-check that the client’s name, address, and contact details are correct. A mistake here can delay payments and cause confusion.

- Missing Payment Terms: Be sure to clearly state your payment terms, including the due date and any penalties for late payments. Missing this information can lead to misunderstandings.

- Unclear Descriptions of Services: Ensure that the services or products provided are described in detail. Vague descriptions can lead to disputes over what is being charged.

- Mathematical Errors: Always double-check calculations, including totals, taxes, and discounts. Even small errors can undermine your credibility.

- Failure to Include a Unique Reference Number: Each billing document should have a unique reference number for tracking purposes. Without this, it can be difficult to match payments to specific transactions.

- Inconsistent Formatting: Maintaining consistent fonts, font sizes, and spacing is crucial for readability. A disorganized document may look unprofessional and be harder to follow.

Example of a Mistake-Free Billing Document:

| Description | Amount |

|---|---|

| Website Design Services | $1000 |

| Hosting Fees | $200 |

| Total | $1200 |

By paying attention to detail and avoiding these common mistakes, you can ensure that your payment requests are clear, accurate, and professional, which will help you build trust and credibility with your clients.

Why Word is Ideal for Invoices

When creating billing documents, choosing the right software can make all the difference. One of the most popular tools for creating professional payment requests is a word processing program. It offers several key advantages that make it a top choice for businesses of all sizes. From ease of use to flexibility in design, this software provides everything you need to create polished and functional documents quickly.

Key Advantages of Using Word for Billing Documents

- User-Friendly Interface: The software is easy to navigate, even for those without advanced technical skills. This allows you to create documents without needing extensive training or experience.

- Customizable Layouts: With a wide range of formatting options, you can customize your document to match your brand. Whether you need to add logos, adjust fonts, or include specific client information, it’s all possible.

- Prebuilt Features: The program comes with pre-designed styles and tools that make creating payment requests faster. You can take advantage of built-in tables, headers, and footers to structure your document effectively.

- Compatibility: Documents created in this software are easily shareable, whether via email, cloud storage, or physical print. The format is widely accepted, making it easy to send and receive documents across various platforms.

- Save Time with Automation: Using macros or fillable fields, you can automate common tasks such as adding client information, calculating totals, and applying taxes. This saves time, reduces errors, and increases efficiency.

Ideal for Professional and Personal Use

Whether you’re a freelancer or a large company, this tool is flexible enough to accommodate a wide range of billing needs. You can create a basic request for a small project or a detailed statement for complex services, all while maintaining a professional appearance. The ability to modify and personalize your documents makes it an excellent choice for businesses seeking a simple yet effective solution.

For these reasons, word processing software is a versatile and practical tool for creating payment requests that are not only functional but also polished and tailored to your specific needs.