Customizable Duct Cleaning Invoice Template for Efficient Billing

When running a service-oriented business, managing payments and documentation efficiently is key to ensuring smooth operations. Having a well-organized system for generating detailed statements helps maintain professionalism and keeps transactions transparent. A properly structured billing document not only outlines the work completed but also enhances your relationship with clients by providing clarity and reducing confusion.

Customizable billing forms can save time, reduce errors, and improve accuracy when it comes to capturing all the necessary details. With the right structure, these forms allow service providers to quickly adjust information, apply necessary charges, and track outstanding payments. This is especially important for businesses that offer routine services or need to document variable rates.

By using a ready-made format designed for efficiency, companies can create consistent records that meet industry standards, ensuring that clients are invoiced correctly and on time. This also allows for easier integration with accounting tools, making the financial side of the business simpler to manage. Whether you’re a small business owner or a large service provider, having access to a professional invoicing system is essential for growth and sustainability.

Understanding the Importance of Duct Cleaning Invoices

For any service provider, accurate documentation of work performed is crucial for maintaining a professional reputation and ensuring timely payments. Clear and well-organized billing records serve as a reference point for both the business and its clients, preventing misunderstandings and promoting trust. Without a proper system in place, it becomes challenging to track services rendered, apply correct charges, and stay on top of financial obligations.

These financial documents not only specify the work completed but also outline agreed-upon prices, payment terms, and any additional fees. This transparency helps set clear expectations from the start, ensuring that clients know what to expect and that businesses are compensated fairly for their time and expertise. When such records are maintained consistently, it simplifies accounting and reporting processes, contributing to better business management.

Moreover, having a reliable invoicing method in place can reduce administrative workload, streamline communication with customers, and prevent errors that could delay payments or create disputes. With a properly structured system, businesses are better equipped to handle complex tasks, such as calculating different charges or applying discounts, while keeping everything well-documented for future reference.

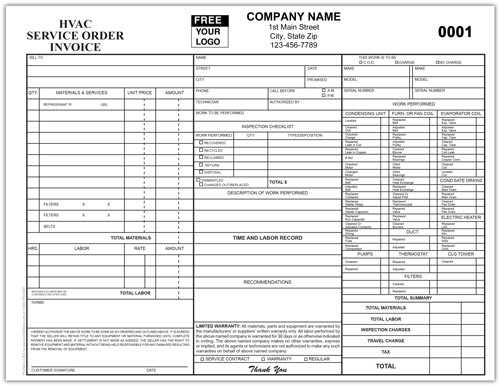

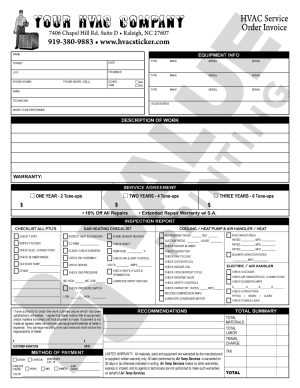

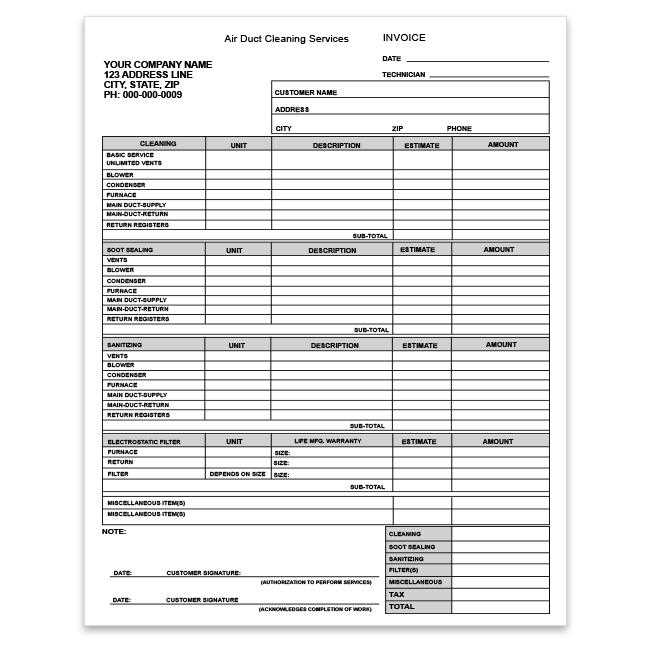

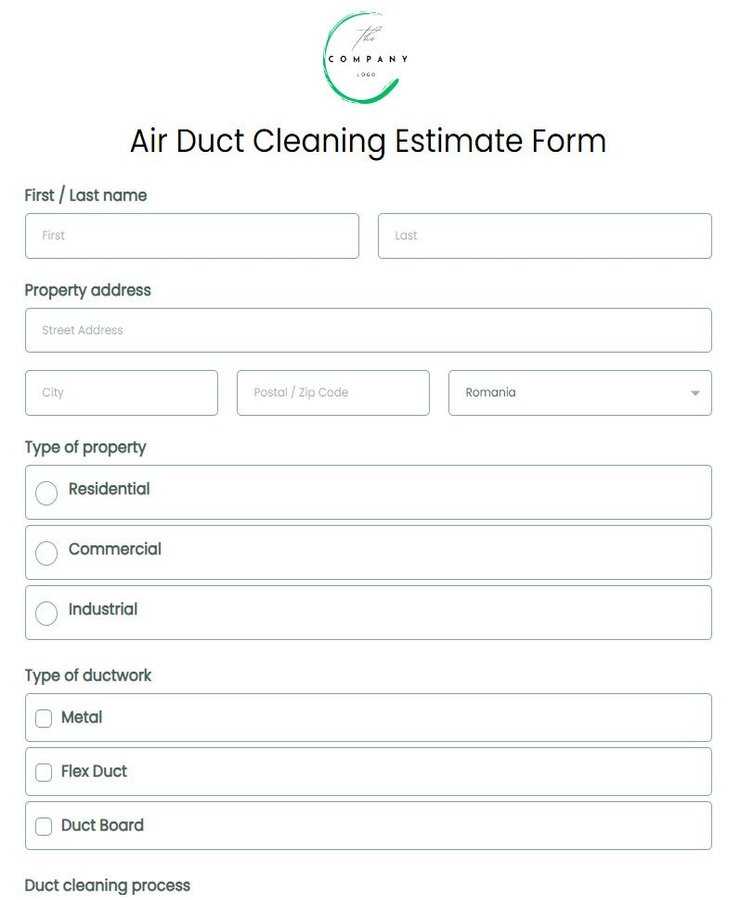

How to Create a Duct Cleaning Invoice

Creating a detailed billing statement is essential for any service business to ensure accurate payment and maintain professionalism. The key is to include all relevant information in a clear and organized manner, making it easy for the client to understand the charges and for the business to keep track of transactions. A well-structured document should capture the specifics of the job, including the type of work completed, the materials used, and the total cost.

The first step is to include the basic contact information for both the service provider and the client. This typically involves the name, address, and contact details of both parties. Next, include the date of the service and a unique reference number for the billing record. This helps in easy identification and organization, especially when dealing with multiple clients or large volumes of work.

Following this, a clear breakdown of services provided should be listed. This can include a description of the work, the time spent, and the associated charges. If applicable, any taxes, discounts, or additional fees should also be specified to ensure complete transparency. Finally, it’s important to note the payment terms, including the due date and acceptable methods of payment, to avoid any delays or confusion.

Key Elements of a Professional Invoice

For a document to be considered professional and effective in any business transaction, it must contain specific details that ensure clarity and accuracy. A well-organized document not only helps the business keep track of payments but also ensures that the client understands the services provided and the costs involved. These key elements establish trust and help avoid disputes or confusion about charges.

Essential Information to Include

- Business and Client Details: The name, address, and contact information of both the service provider and the customer.

- Document Identification: A unique reference number to easily track and organize the billing record.

- Service Description: A detailed list of the tasks or services completed, including the scope and specific actions performed.

- Date of Service: The exact date when the work was carried out, which is essential for payment terms.

- Total Amount Due: A clear breakdown of all charges, including any taxes, fees, or discounts.

Additional Components for Clarity

- Payment Terms: Specify when the payment is due and any penalties for late payment.

- Methods of Payment: Clearly list the accepted payment methods, such as bank transfer, credit card, or check.

- Notes or Comments: Any additional information that may be relevant to the client, such as warranties or future service discounts.

By including all these elements, the document becomes a comprehensive and transparent record that serves both the service provider and the client. This reduces the risk of misunderstandings and helps maintain a smooth and professional working relationship.

Why Use a Duct Cleaning Invoice Template

Using a standardized format for creating billing documents brings numerous advantages for service providers. It saves time, ensures consistency, and reduces the risk of errors, making the billing process much more efficient. Whether you’re managing a small business or a large service operation, having a pre-designed structure helps streamline administrative tasks and maintain a high level of professionalism in client interactions.

Benefits of Using a Pre-Designed Format

- Time Efficiency: A ready-made structure allows you to generate documents quickly, eliminating the need to start from scratch each time.

- Accuracy: Pre-set fields ensure that all necessary details are included and correctly formatted, reducing the likelihood of mistakes.

- Consistency: Using the same structure for every transaction promotes uniformity, making your documentation easily recognizable and professional.

- Customization: While templates provide structure, they also offer flexibility to adjust for unique services, rates, and client-specific details.

- Improved Client Relations: Clear and professional documents foster trust and transparency, leading to better client satisfaction.

How It Helps with Business Management

- Tracking Payments: A consistent format helps you organize and monitor payments more effectively, ensuring that you can follow up on overdue accounts.

- Legal and Tax Compliance: Using a standardized document helps meet legal and tax requirements by ensuring that all relevant information is included.

- Integration with Accounting Systems: Pre-designed formats can be easily integrated with accounting software, simplifying financial record-keeping and reporting.

By adopting a consistent approach to creating billing records, businesses can save time, improve operational efficiency, and enhance their professional image, all while providing a better service experience to their clients.

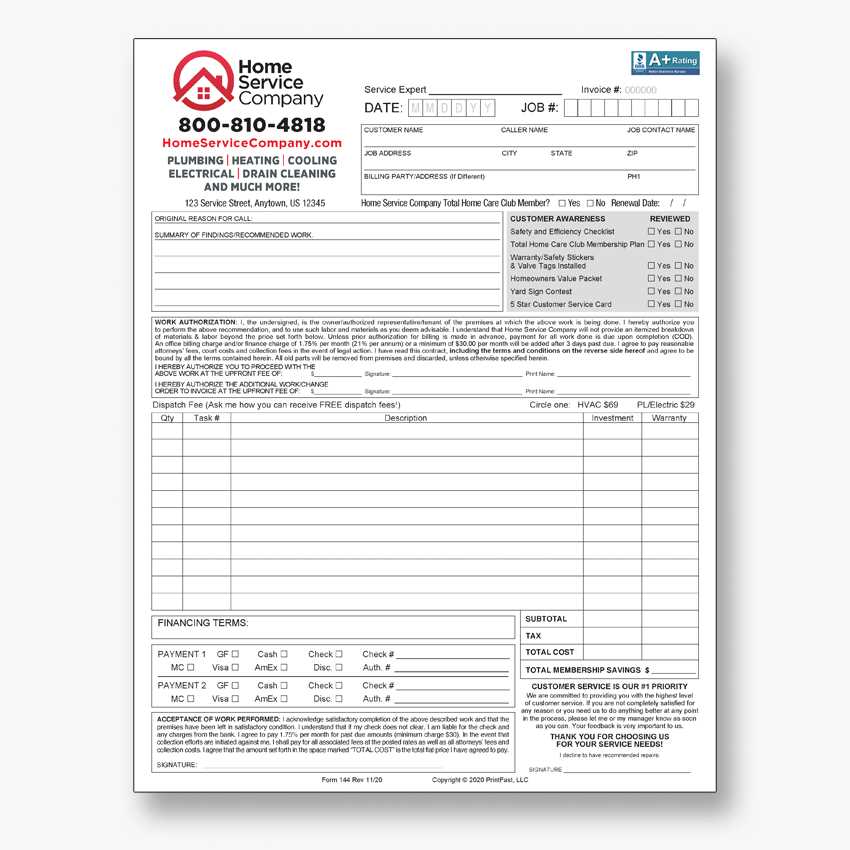

Benefits of Customizable Invoice Templates

Customizable billing formats offer significant advantages to service providers looking for flexibility and personalization in their financial documentation. By adapting these formats to meet specific business needs, companies can create more accurate, relevant, and professional documents that cater to both the nature of their services and the unique requirements of their clients. Whether you’re managing variable pricing, offering discounts, or dealing with multiple types of services, a customizable system ensures that each record is tailored appropriately.

Enhanced Flexibility and Personalization

- Tailored to Business Needs: A flexible format allows businesses to include or remove specific fields based on the services provided, such as unique pricing structures or special rates.

- Brand Consistency: Customizable documents can be designed to align with the business’s brand identity, incorporating logos, fonts, and colors that enhance professionalism and recognition.

- Adjustable Terms and Conditions: Companies can easily modify payment terms, discounts, or service details, adapting to different client agreements and requirements.

Increased Efficiency and Accuracy

- Streamlined Documentation: Customizable options allow businesses to standardize frequently used entries, such as service descriptions or pricing models, reducing the time spent creating each new record.

- Minimized Errors: Pre-set structures for common fields, such as taxes and rates, reduce the likelihood of mistakes, ensuring that each document is consistent and accurate.

- Easy Adjustments: Customizable formats can quickly be updated to reflect new pricing structures or service offerings, allowing businesses to stay current without overhauling their entire system.

By using adaptable billing documents, businesses can increase operational efficiency, improve client relationships, and maintain a professional image that stands out in competitive markets.

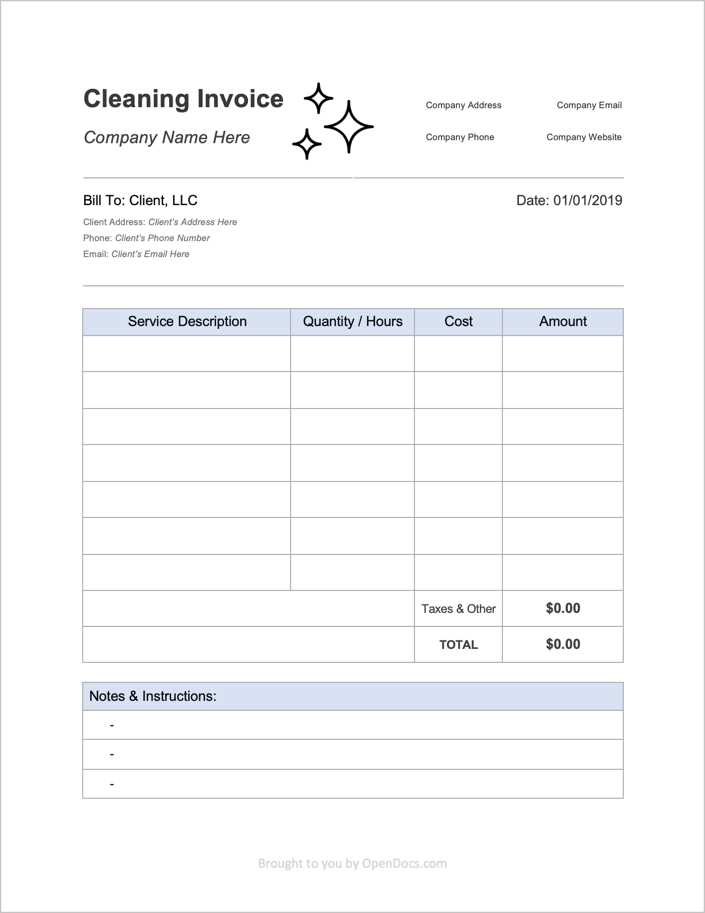

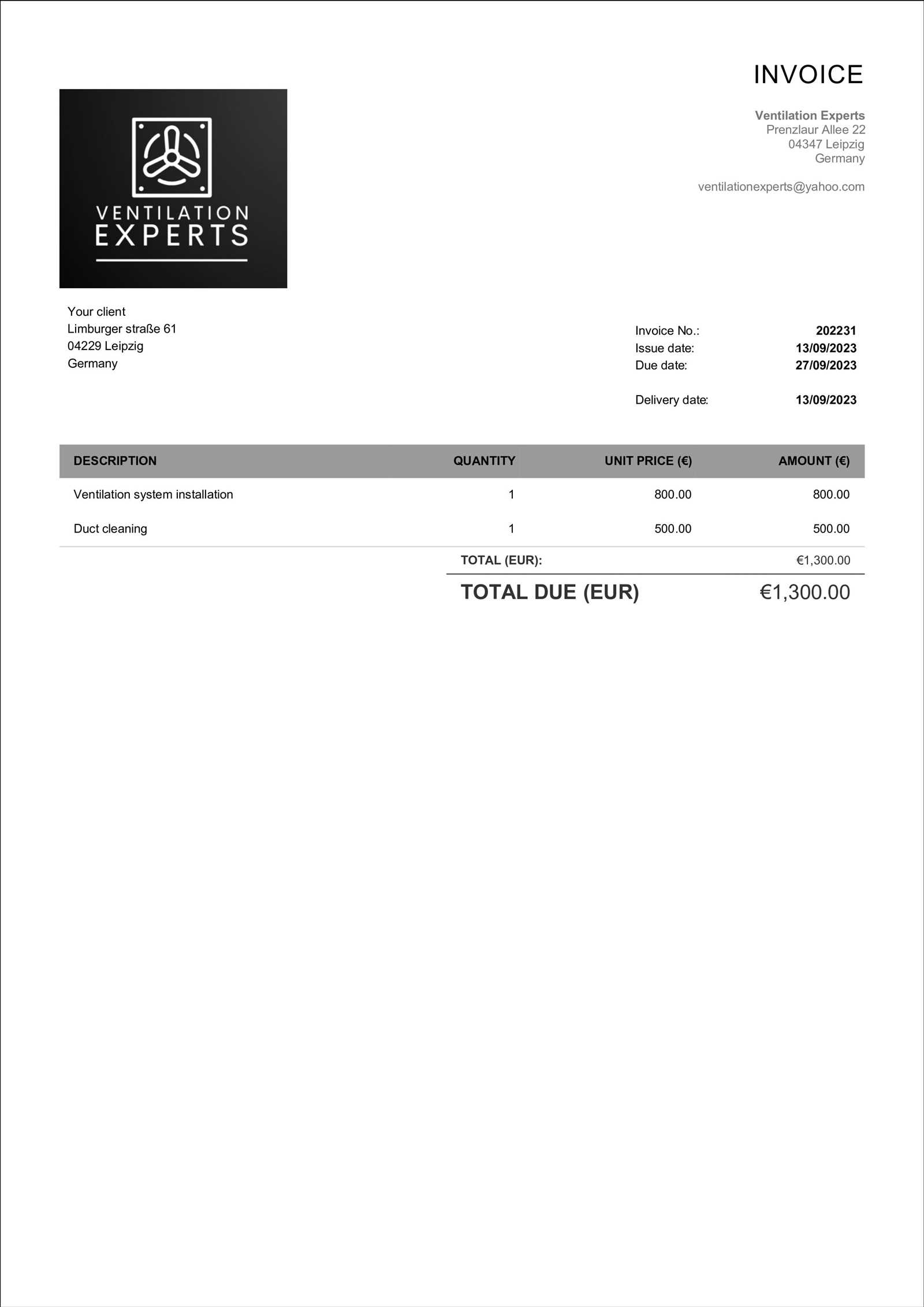

Free Templates for Duct Cleaning Invoices

For service businesses looking to simplify their billing process, free customizable formats are a great resource. These ready-made documents provide a professional structure while allowing businesses to tailor each record to their specific needs. Whether you’re just starting out or looking to streamline your current process, these free resources can save time and ensure accuracy in your financial documentation.

Advantages of Using Free Resources

- Cost-Effective: Free formats eliminate the need for expensive software or services, making them ideal for businesses with tight budgets.

- Quick Setup: Most free formats are easy to download and ready to use immediately, helping businesses get up and running with minimal effort.

- Customization Options: Despite being free, these formats are often highly customizable, allowing users to adjust fields, colors, and branding elements as needed.

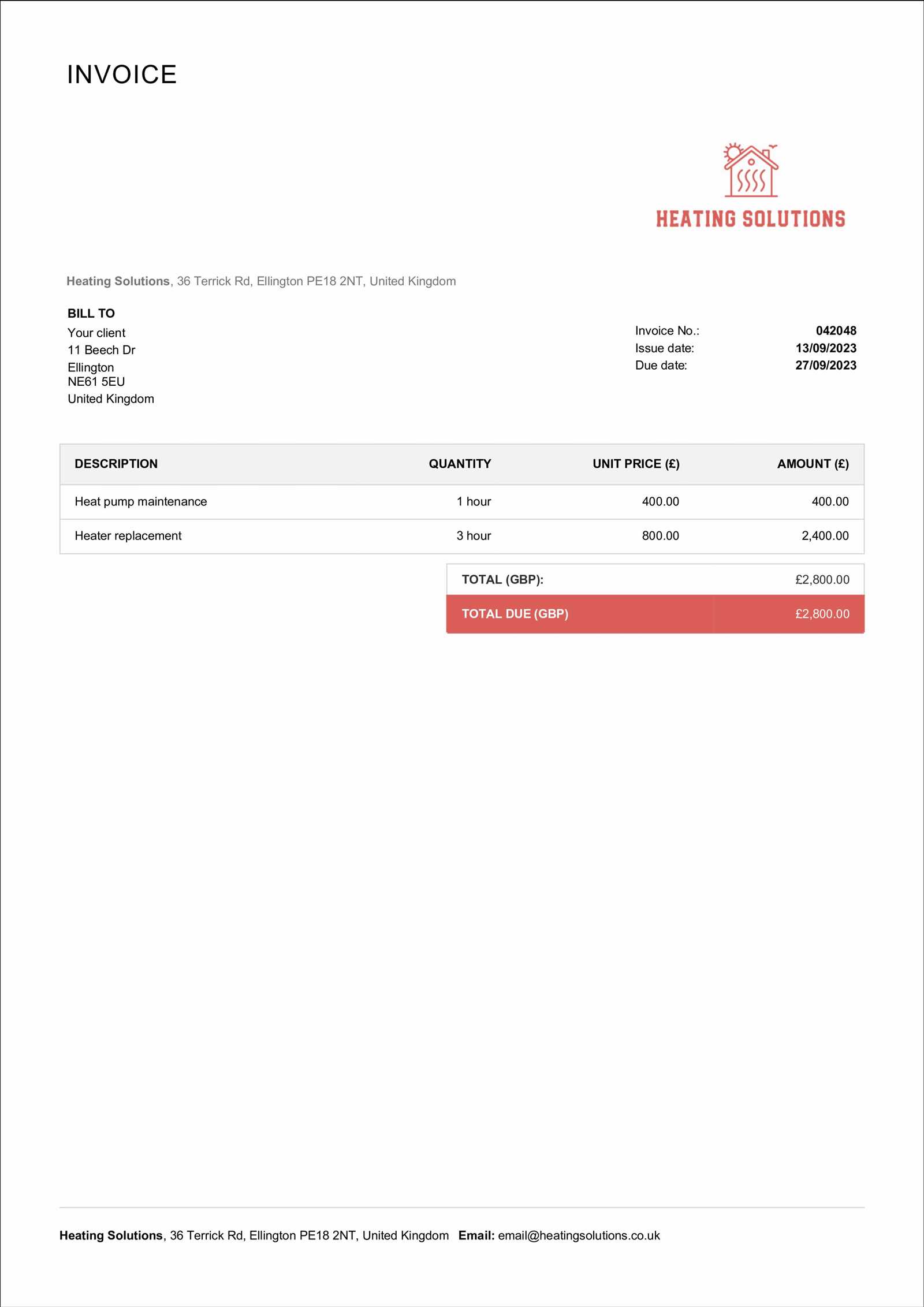

Example of a Simple Billing Format

Below is a basic structure for a service billing document. This example can be downloaded and adjusted to suit various business needs:

| Field | Description |

|---|---|

| Business Name & Contact Info | Details of your company, including name, address, and phone number. |

| Client Name & Contact Info | Information about the customer receiving the service. |

| Service Date | The date the work was completed or provided. |

| Service Description | A brief overview of the work performed. |

| Total Amount Due | The total charges for the services, including any taxes or additional fees. |

| Payment Terms | Details on when payment is due and any late fees or discounts. |

By utilizing free, customizable formats, businesses can ensure that each transaction is documented clearly and professionally, without the added cost or complexity of specialized software.

Design Tips for Duct Cleaning Invoices

The design of a billing document plays a crucial role in creating a positive impression and ensuring clarity for both the service provider and the client. A well-structured, visually appealing document not only helps in conveying professionalism but also makes it easier to track and manage financial transactions. Whether you’re using a pre-designed format or creating one from scratch, the right design can streamline the process and minimize errors.

Keep It Clean and Simple

Simplicity is key when it comes to designing any financial document. Avoid cluttering the layout with too many elements, as this can confuse the client or make the document hard to read. Focus on the essentials, such as contact details, service description, amounts, and payment terms. A clean, minimal design ensures that the most important information stands out and is easy to locate.

- Use clear headings to separate different sections of the document, such as “Service Details” and “Total Amount Due.” This helps the client navigate the document quickly.

- Consistent formatting throughout the document (such as aligning text and using a legible font) will contribute to the professional appearance and readability.

Brand Your Documents

Customizing the design to reflect your brand identity can help build recognition and trust. Incorporate your company’s logo, colors, and fonts to make the document feel like an extension of your business. This not only enhances your professionalism but also helps clients remember who provided the service, especially in industries where repeat business is important.

- Logo Placement: Position your logo at the top of the document for maximum visibility.

- Color Scheme: Choose a color palette that aligns with your brand but avoids overwhelming the reader. Use accents, like bold text or borders, to highlight key sections.

With these design tips, your documents will not only look professional but also help foster better communication with clients and improve payment accuracy.

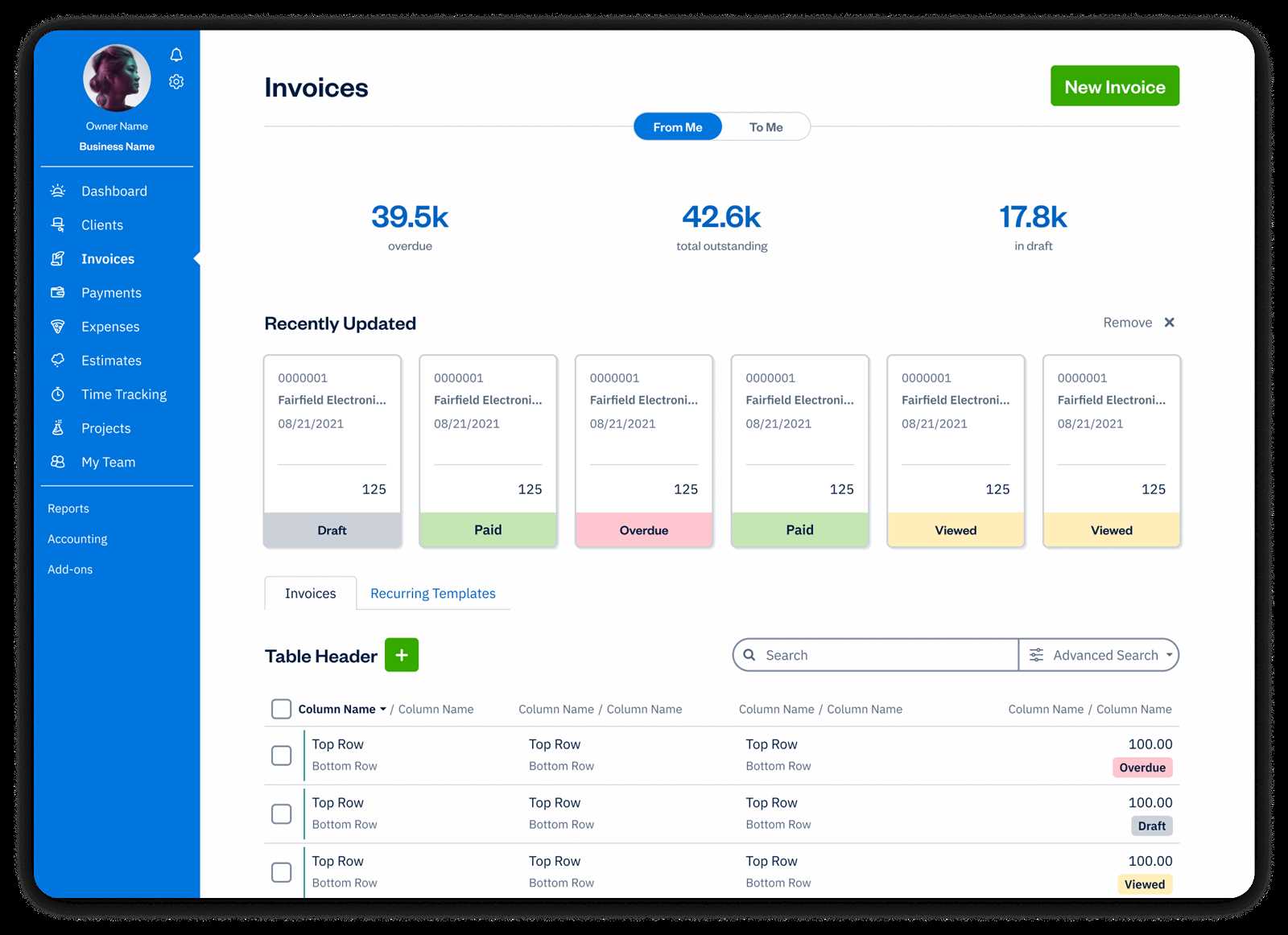

Invoice Software for Duct Cleaning Services

Managing financial records can be a challenging task for any business, especially when handling multiple clients and varying service charges. Using dedicated software for creating billing documents streamlines the entire process, from generating accurate records to tracking payments and organizing financial data. These tools help service providers maintain professionalism, reduce errors, and improve the overall efficiency of business operations.

Benefits of Using Billing Software

- Automation: Invoice software automates many aspects of the billing process, including calculations, tax rates, and payment reminders, saving valuable time and effort.

- Accuracy: With built-in templates and pre-configured formulas, the software minimizes the risk of human error, ensuring that all amounts are correctly calculated and formatted.

- Time-Saving: The software allows you to quickly create, customize, and send documents, reducing the time spent on administrative tasks and improving workflow.

- Integration: Many programs can be integrated with accounting and payment systems, making it easier to track expenses, payments, and financial reports in one place.

Choosing the Right Software for Your Business

When selecting billing software, it’s essential to consider the unique needs of your business. Look for tools that offer customization options, user-friendly interfaces, and reliable customer support. Additionally, consider cloud-based solutions that allow access from anywhere, ensuring that you can manage your records on the go.

- Customizable Fields: Choose software that allows you to add specific services, rates, and taxes based on your business requirements.

- Cloud-Based Access: Cloud solutions offer the flexibility to work from multiple devices and collaborate with team members in real-time.

By incorporating billing software into your operations, you can improve accuracy, save time, and maintain a more organized financial system, all of which contribute to a smoother and more professional business experience.

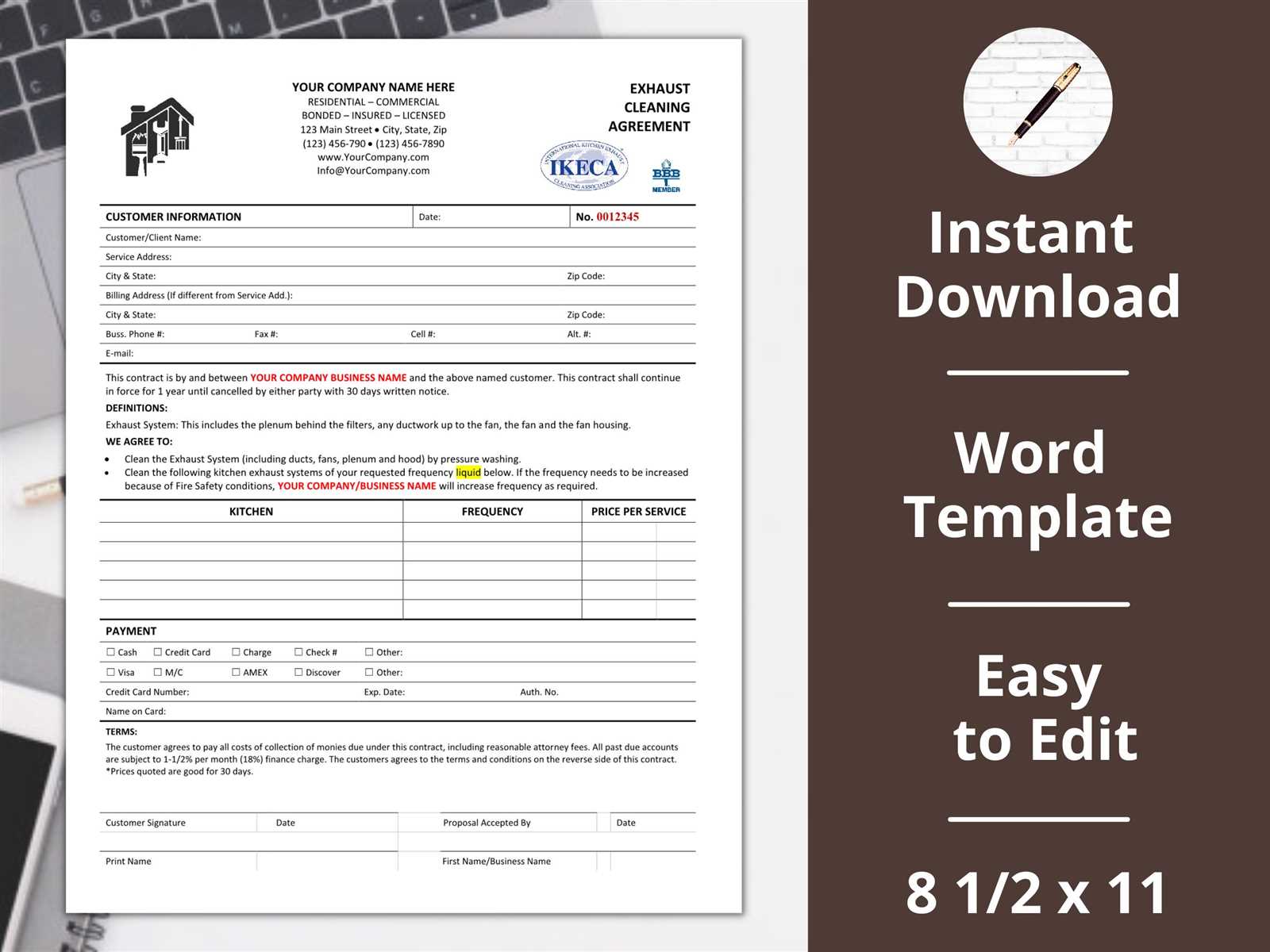

Legal Requirements for Duct Cleaning Invoices

When generating financial documents for services provided, it is crucial to ensure compliance with local, state, and federal regulations. Proper documentation not only helps protect your business but also ensures that your clients have clear records for tax and accounting purposes. There are specific legal elements that must be included in these records to meet legal standards and avoid disputes.

Essential Information for Compliance

The following table outlines key elements that must be included in service-related financial records to meet legal requirements:

| Required Information | Description |

|---|---|

| Business Details | The legal name, address, and contact information of your business. This ensures that your records are traceable. |

| Client Information | The name and contact details of the customer receiving the service. This helps in identifying the correct recipient of the transaction. |

| Service Date | The date the service was rendered or completed. This is important for tax and payment tracking purposes. |

| Service Description | A detailed description of the service provided. It should be specific enough to avoid ambiguity in case of disputes. |

| Pricing and Fees | A clear breakdown of the charges, including rates, taxes, and any additional costs. This ensures transparency in the transaction. |

| Tax Identification Numbers | The relevant tax ID number for your business and the client, where applicable. This is especially important for tax compliance. |

| Payment Terms | Clearly outline payment terms, including the due date and any late payment penalties to ensure that both parties are aligned on payment expectations. |

Including these details ensures that your business complies with applicable regulations, and helps protect both your interests and those of your clients. Missing any of these required elements could lead to legal complications or issues during audits, so it is essential to incorporate them into every billing record.

Common Mistakes in Duct Cleaning Billing

When preparing financial records for services provided, it’s easy to overlook some important details that could lead to errors, confusion, or even disputes. While the process may seem straightforward, common mistakes can undermine the accuracy and professionalism of your documentation. Understanding these pitfalls can help you avoid costly mistakes and maintain smooth client relationships.

Typical Errors to Avoid

- Omitting Key Details: Failing to include essential information such as the client’s contact information, service date, or a detailed description of the work performed can create confusion and cause delays in payments.

- Incorrect Pricing: Not clearly outlining rates or failing to update pricing after a price change can result in disputes or misunderstandings over charges.

- Miscalculating Taxes: Errors in tax calculations can lead to compliance issues, as well as potential penalties for undercharging or overcharging your clients.

- Not Including Payment Terms: Without clear payment deadlines, your clients may not know when to pay, which can lead to delayed payments or missed deadlines.

Impact of These Mistakes

- Damaged Trust: Clients may lose confidence in your business if there are frequent errors in your records or billing.

- Payment Delays: If clients are unclear on the charges or payment terms, they may delay payments, impacting your cash flow.

- Legal Issues: Missing or incorrect information could cause legal complications, especially when dealing with taxes or compliance requirements.

By paying attention to these common mistakes and ensuring that each financial record is accurate and complete, businesses can maintain professionalism and avoid unnecessary issues with clients or authorities.

How to Calculate Duct Cleaning Charges

Accurately calculating the cost of services is essential for maintaining a profitable business and ensuring transparency with clients. Service charges can vary based on a number of factors such as the scope of work, the complexity of the job, the materials used, and even the location of the client. To establish a fair and clear pricing structure, businesses should consider these elements and develop a consistent approach for determining fees.

Factors to Consider When Calculating Service Charges

- Service Scope: The size and complexity of the work will directly affect the cost. A larger job with more components or specialized equipment may require higher rates.

- Time Spent: Charging by the hour is a common approach, especially for jobs where the time required can vary. Ensure that your hourly rate reflects the skill and effort needed to complete the task.

- Materials and Supplies: If your services require specific materials or products, include these costs in your total charge. Always calculate the price of consumables, equipment, or additional tools required.

- Location and Travel: If you are traveling a long distance or working in areas with higher costs of living, consider adding a travel fee or adjusting your pricing to account for these extra expenses.

- Discounts or Specials: If you offer discounts for repeat clients, bundled services, or promotional deals, be sure to factor these into your final pricing structure.

Pricing Models to Use

- Flat Rate: Set a fixed price for a particular service, which simplifies the process for both you and the client. This model is ideal for standard tasks with predictable costs.

- Hourly Rate: Charge based on the time spent on the job. This works well for projects where the time needed can vary widely from client to client.

- Per Unit Rate: If services are based on measurable quantities, such as the number of units or systems being serviced, calculate the cost per unit and multiply it by the total amount.

By carefully considering these factors and choosing the right pricing model, you can ensure that your services are priced fairly while also being competitive in the market. Always communicate your pricing structure clearly to clients, so there are no misunderstandings about the charges or the scope of work.

Best Practices for Invoice Formatting

Proper formatting of billing documents is essential to ensure clarity and professionalism. A well-structured document makes it easy for clients to understand the charges, review the services rendered, and process payments promptly. By following best practices for formatting, businesses can improve their credibility, streamline their administrative processes, and enhance customer satisfaction.

Key Formatting Guidelines

- Use Clear Headings and Sections: Organize your document into distinct sections, such as “Client Information,” “Service Details,” and “Payment Terms.” This helps clients quickly find the information they need.

- Consistent Layout: Ensure that all elements of your document are aligned, including text, tables, and pricing details. Consistent margins and spacing enhance readability and make the document look professional.

- Legible Font: Choose a clear, easy-to-read font such as Arial or Times New Roman. Avoid using overly stylized fonts that can make the document difficult to interpret.

- Highlight Important Information: Use bold or larger fonts for essential details, such as the total amount due, payment terms, and due dates. This makes it easier for clients to spot key information quickly.

- Incorporate Your Branding: Customize your document with your company logo, colors, and any other elements that represent your business identity. This can help build brand recognition and give your document a polished, professional appearance.

Ensuring Clarity in Payment Instructions

- Include Payment Methods: Clearly list the accepted methods of payment, such as credit cards, bank transfers, or checks, to avoid confusion and streamline the payment process.

- State Payment Terms Clearly: Specify the payment due date, any late fees, and available discounts. This ensures that both you and your client have the same expectations regarding payment.

- Break Down Charges: Provide a detailed breakdown of the charges, listing individual services, taxes, and any additional fees. This transparency helps build trust and reduces the likelihood of disputes.

By adhering to these best practices, businesses can create billing documents that are not only aesthetically pleasing but also effective in communicating important details. Clear formatting reduces the chance of misunderstandings and improves the overall client experience.

Tracking Payments with Invoice Templates

Efficiently managing payments is a critical part of running any business. Keeping track of outstanding amounts, payment statuses, and due dates ensures smooth cash flow and reduces the risk of overdue accounts. By utilizing well-structured billing documents, businesses can easily track payments, send reminders, and maintain accurate financial records.

Key Strategies for Tracking Payments

- Mark Payment Status: Clearly indicate the payment status on each document, such as “Paid,” “Pending,” or “Overdue.” This allows you to quickly assess the current state of each transaction.

- Include Due Dates: Always specify the payment due date on each document. This helps both you and your clients stay on track and reduces the likelihood of missed payments.

- Record Partial Payments: If a client makes a partial payment, update the document to reflect the remaining balance. This provides a clear overview of what has been paid and what is still owed.

- Set Up Payment Reminders: Incorporate reminders or follow-up notices in your records. Automated tools or reminders linked to your document system can ensure timely communication regarding overdue payments.

Using Digital Tools for Payment Tracking

- Automated Systems: Many billing software tools allow you to automate payment tracking, sending reminders, and generating reports on outstanding balances. These systems can also update the status of payments in real time, providing you with the most up-to-date information.

- Centralized Record Keeping: Store all billing documents in a centralized digital system to easily access and monitor payments. This helps avoid lost documents and ensures you have all the information in one place.

By keeping detailed and organized records, businesses can streamline their payment process, improve cash flow management, and ensure that no payment is overlooked. Tracking payments effectively also builds trust with clients, demonstrating professionalism and attention to detail.

Integrating Invoices with Accounting Tools

Integrating financial records with accounting software is a powerful way to streamline business operations and ensure accuracy in financial tracking. By linking billing documents to your accounting tools, you can automate many administrative tasks, reduce human error, and maintain up-to-date records for tax purposes and financial reporting. This integration helps keep everything organized, making it easier to monitor payments, generate reports, and ensure compliance with financial regulations.

Benefits of Integration

- Automated Data Transfer: When your billing system is integrated with accounting tools, information such as payment amounts, dates, and client details can automatically sync, eliminating the need for manual data entry.

- Accurate Financial Reporting: Integration ensures that all revenue and expenses are accurately recorded, providing you with real-time financial insights and making it easier to generate profit-and-loss statements, balance sheets, and tax reports.

- Time-Saving: By eliminating manual tracking and data entry, integration saves time and allows you to focus more on core business activities. This also reduces the risk of discrepancies or missed transactions.

- Improved Cash Flow Management: Integrated tools can provide automated reminders for overdue payments, ensuring that you stay on top of receivables and improve your cash flow.

How to Integrate Billing with Accounting Tools

- Choose Compatible Software: Make sure that your billing and accounting systems can easily integrate with each other. Many popular accounting platforms, like QuickBooks or Xero, offer built-in integration with invoicing software.

- Set Up Automated Syncing: Once integrated, enable automatic synchronization of your records. This will ensure that every billing entry is reflected accurately in your financial system without requiring manual updates.

- Customize the Integration: Tailor the integration to your business needs by setting up specific categories or tags for services rendered, making it easier to track different types of income and expenses.

Integrating your billing documents with accounting tools brings efficiency and accuracy to your financial processes. It reduces errors, saves time, and provides you with better control over your business’s financial health, all of which contribute to more informed decision-making and smoother operations.

How Billing Documents Improve Business Efficiency

Effective financial documentation plays a key role in enhancing the efficiency of business operations. By maintaining clear, organized, and accurate records of services rendered, companies can streamline their administrative processes, reduce errors, and improve cash flow management. Well-structured billing records not only help track payments but also facilitate quick decision-making and optimize overall workflow.

Streamlining Administrative Tasks

- Automated Processes: Using digital billing tools or templates allows businesses to automate repetitive tasks like generating records, tracking payments, and sending reminders. This saves time and reduces the likelihood of errors from manual data entry.

- Centralized Information: By maintaining all financial documents in a centralized system, businesses can easily access and manage records, improving organization and efficiency in processing payments or preparing reports.

- Faster Processing: Clear and well-organized records help speed up the billing and payment process. Clients can quickly understand the charges, and businesses can more easily follow up on overdue accounts.

Enhancing Cash Flow and Client Relations

- Improved Payment Tracking: Organized billing documents help businesses track payments in real-time, which improves cash flow management. By clearly indicating due dates and payment statuses, businesses can reduce the risk of missed or delayed payments.

- Clear Communication: Properly formatted and detailed billing records set clear expectations with clients, reducing misunderstandings or disputes over charges. This strengthens customer trust and fosters long-term relationships.

- Faster Collections: Well-structured payment terms, including late fees or discounts for early payment, incentivize timely payments and help businesses maintain consistent cash flow.

By integrating efficient billing practices into daily operations, businesses can optimize their processes, improve client satisfaction, and ensure financial stability. Clear, accurate, and organized financial records not only enhance internal workflow but also support growth and scalability in a competitive market.