Download a Free Drywall Invoice Template for Easy Billing

When managing any construction or renovation project, clear and professional billing plays a crucial role in ensuring smooth financial transactions. For professionals in the trade, creating detailed and accurate billing documents can be a time-consuming task. However, with the right tools, this process can be simplified and streamlined, reducing the risk of errors and delays in payment.

By using a structured format for your charges, labor, and materials, you ensure transparency and enhance client trust. Having a consistent system for detailing work completed and fees owed can also help you stay organized and ensure timely payments. Whether you are a freelancer or part of a larger company, it’s essential to have access to an efficient and customizable system for billing your clients.

In this article, we will explore practical solutions that will help you create clear and comprehensive payment documents, saving you time and ensuring that you get paid promptly for your hard work. From choosing the right structure to personalizing content, you’ll find all the tools you need to optimize your invoicing process.

Drywall Invoice Template Overview

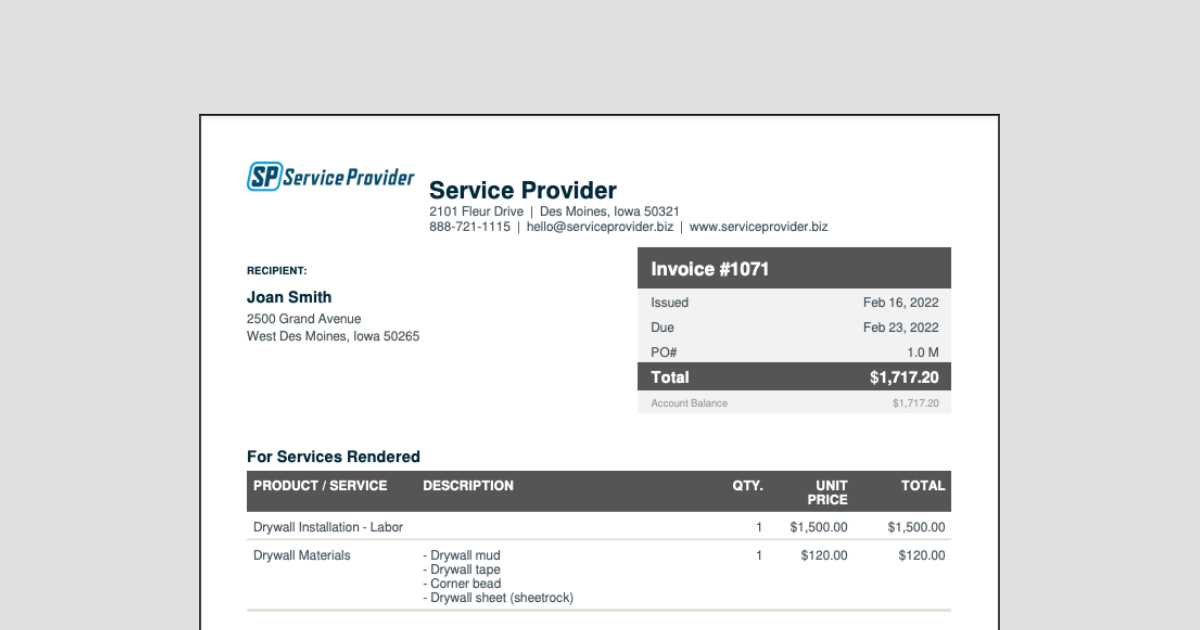

For professionals in construction and renovation, an organized approach to billing is essential for maintaining clarity and ensuring timely payments. A well-structured document serves not only as a record of completed work but also as a tool for communication between contractor and client. It outlines the specifics of the job, including the work performed, materials used, and the total amount due. This streamlined method reduces misunderstandings and fosters professionalism in business relationships.

Why Use a Structured Billing Document

Using a clear and consistent document for charging clients offers several advantages. It saves time by eliminating the need to start from scratch with each project. With a predefined layout, you can easily input relevant details, such as hours worked, materials used, and agreed-upon rates. Additionally, it helps maintain professionalism, ensuring that clients receive an easy-to-read summary of costs and services rendered.

Key Elements of a Billing Document

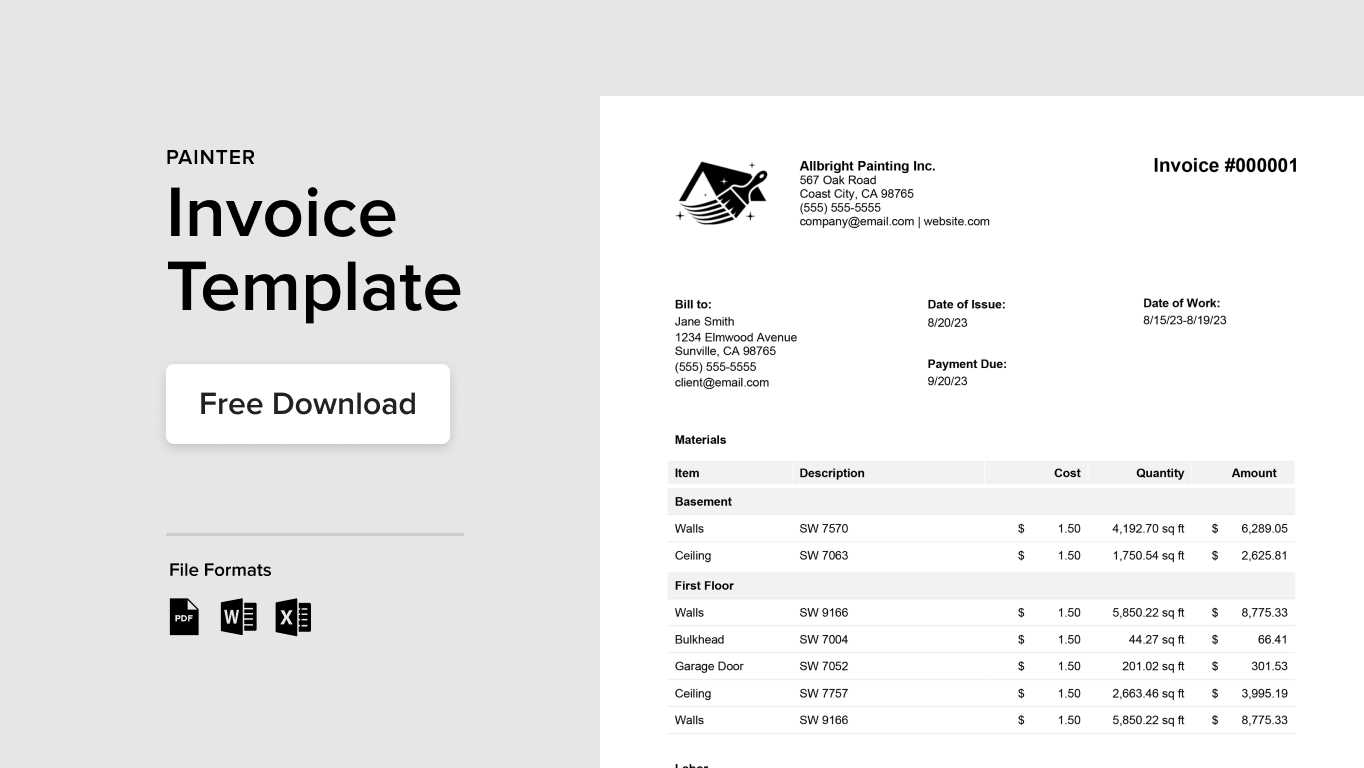

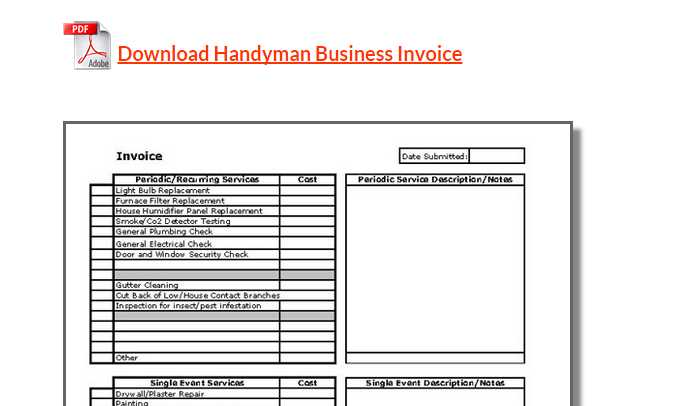

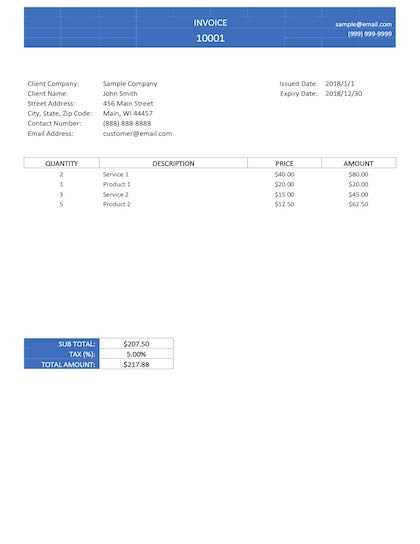

Each record should include specific sections to ensure it is comprehensive and understandable. The most important elements include:

| Section | Description |

|---|---|

| Client Information | Details like the client’s name, address, and contact information. |

| Project Description | A brief overview of the services provided and materials used. |

| Labor Costs | Charges based on hourly rates or fixed fees for work completed. |

| Materials and Supplies | A breakdown of materials purchased for the project and their associated costs. |

| Total Amount Due | The final cost to be paid by the client, including all fees and taxes. |

By ensuring that each of these sections is included and clearly defined, you create a document that is not only useful for tracking payments but also serves as a professional reflection of your business practices.

Why Use a Drywall Invoice Template

For construction professionals, using a standardized document for billing is an effective way to streamline the payment process. A well-designed billing document not only saves time but also reduces the likelihood of errors and disputes. By following a consistent format, contractors can ensure that all relevant information is captured clearly and professionally, making it easier for clients to understand the charges and settle payments promptly.

Here are several key reasons why adopting a structured billing document is beneficial for any contractor:

- Time Efficiency: A predefined structure allows you to quickly fill in project details without starting from scratch each time, saving valuable time on every project.

- Consistency: Using the same format for all your projects ensures uniformity in how you present your charges, which builds trust and reliability with clients.

- Professionalism: A well-organized billing document enhances your business’s professional image, helping you stand out in a competitive market.

- Accurate Record Keeping: Having a clear record of services rendered, materials used, and costs ensures that both parties are on the same page and prevents miscommunication.

- Easy Customization: You can tailor the document to suit the specifics of each project, while still adhering to a consistent structure that works for all your clients.

By leveraging a customizable billing document, you ensure that all critical information is captured efficiently, helping you maintain a smooth cash flow and positive client relationships.

Key Features of a Good Invoice

For a billing document to be effective, it must contain several essential elements that make it clear, professional, and easy to understand. The goal is to ensure that both the service provider and the client have a mutual understanding of the terms, fees, and work completed. A well-structured record will not only streamline the payment process but also help prevent misunderstandings that could delay settlement or cause disputes.

Essential Information to Include

To make your billing document both functional and legally sound, it should include key details that define the agreement between you and your client. These are the most important pieces of information:

- Contact Information: Include your business name, contact details, and your client’s information for easy reference.

- Project Description: A brief summary of the work completed, including any specific services or products provided.

- Payment Terms: Clarify when payments are due, the acceptable payment methods, and any penalties for late payment.

- Itemized Costs: Break down the charges into clear categories (e.g., labor, materials) with corresponding amounts to ensure transparency.

- Unique Identification: Each document should have a unique number or code for tracking purposes.

Design and Readability

While the content of the document is crucial, its layout and design should not be overlooked. A clean and professional appearance can improve client perception and facilitate easier understanding. Consider the following design aspects:

- Logical Structure: Arrange the content in a way that flows naturally, starting with your contact details, followed by project details, and ending with payment information.

- Readable Fonts: Use simple, legible fonts and enough white space to make the document easy to navigate.

- Clear Formatting: Highlight key details such as total amounts, due dates, and payment methods for quick reference.

By focusing on these key features, you ensure that your billing documents are not only informative but also professional, making it easier for clients to process payments and keeping your business operations running smoothly.

How to Customize Your Invoice

Customizing your billing document allows you to tailor it to each specific project, ensuring that all the necessary details are included while maintaining a professional appearance. Personalization not only enhances clarity but also gives clients a sense of professionalism and trust in your services. Adjusting your document for different types of projects, pricing structures, or clients is an important step in streamlining your business processes.

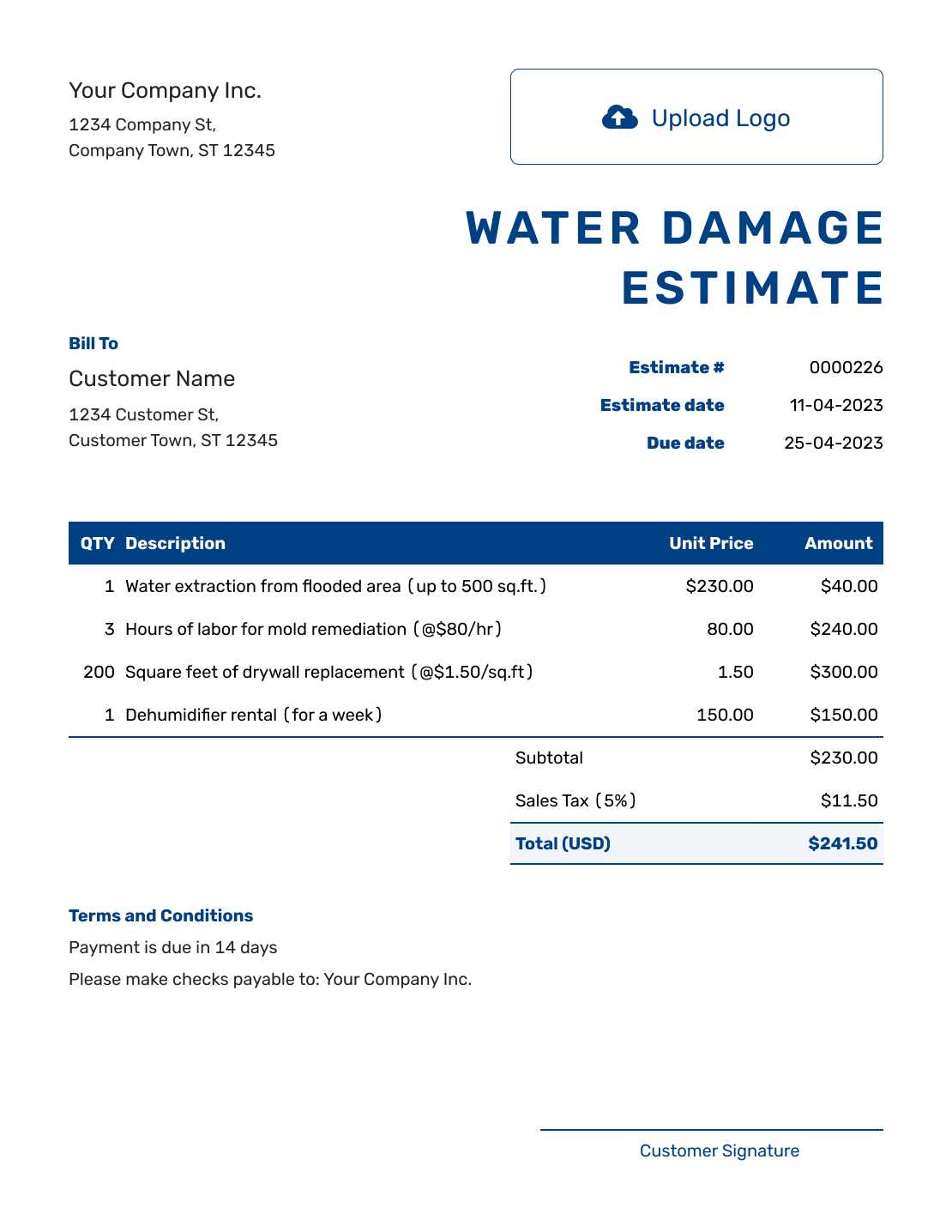

Here are some key areas you can customize to make your billing documents fit your needs:

| Area | How to Customize |

|---|---|

| Business Branding | Add your logo, company colors, and a tagline to reinforce your brand identity. |

| Payment Terms | Adjust payment due dates, late fees, and available payment methods to suit the client or project specifics. |

| Service Descriptions | Modify the list of services provided to accurately reflect the work completed in each project. |

| Pricing and Discounts | Include any customized pricing structures, rates, or applicable discounts based on the client agreement. |

| Additional Notes | Insert space for any special terms, guarantees, or project-specific instructions you need to communicate. |

By making these adjustments, you ensure that each billing document is perfectly aligned with the unique requirements of your clients and projects, improving both accuracy and professionalism in your business interactions.

Benefits of Digital Invoices for Contractors

Adopting digital billing solutions offers numerous advantages for contractors looking to streamline their operations. Transitioning from paper-based records to electronic documents can significantly improve efficiency, reduce errors, and speed up payment processes. Digital records are not only easier to manage but also provide greater flexibility, allowing for quicker updates and distribution.

Here are some of the key benefits that digital billing systems bring to contractors:

- Faster Processing: Sending electronic documents eliminates the delays of printing, mailing, and waiting for physical delivery, enabling faster client response times.

- Improved Accuracy: With automated calculations and pre-set templates, digital records reduce the risk of human error in calculations and data entry.

- Easy Storage and Retrieval: Digital files can be stored securely and accessed at any time, saving space and making it easier to find historical records for reference or tax purposes.

- Professional Appearance: Customized digital documents look more polished and professional, which helps build trust with clients and enhances your business’s credibility.

- Streamlined Communication: Digital formats allow you to send reminders, track payments, and keep clients informed without needing manual follow-up.

- Environmental Impact: By reducing paper usage, you contribute to a greener, more sustainable business practice.

By embracing digital billing methods, contractors can save time, enhance customer relationships, and stay ahead of the competition with a modern, efficient approach to managing finances.

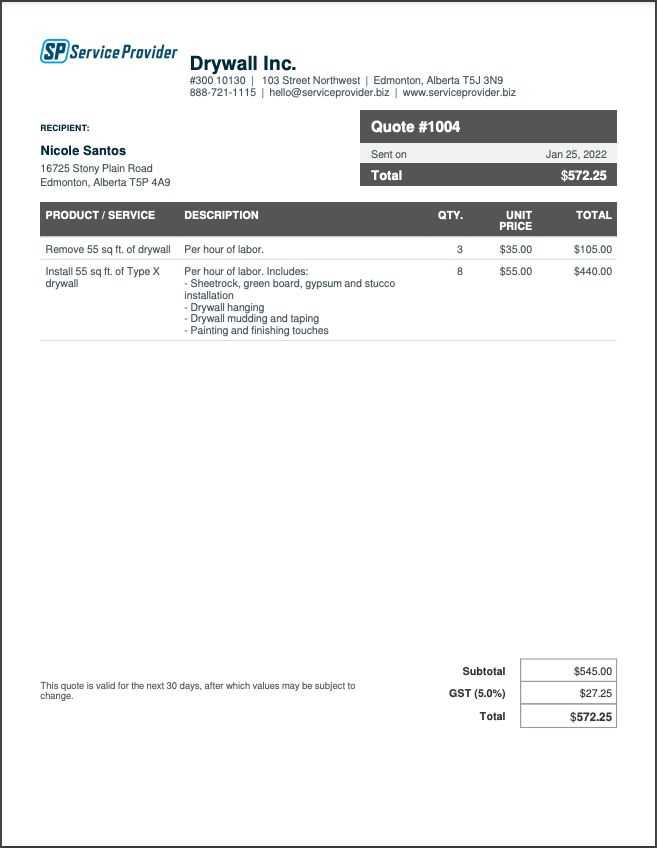

Essential Information to Include in an Invoice

For a billing document to be effective, it must contain all necessary details that ensure both parties have a clear understanding of the terms, services rendered, and costs involved. A comprehensive record helps avoid confusion, facilitates timely payments, and serves as an official document for financial tracking. By ensuring that all essential information is included, contractors can present a professional image and streamline the payment process.

Here are the critical components that should be included in every billing document:

| Section | Description |

|---|---|

| Business Information | Include your business name, address, contact details, and logo to establish your brand and ensure the client can reach you easily. |

| Client Details | Provide the client’s name, address, and contact information to ensure the document is directed to the correct recipient. |

| Unique Reference Number | Assign a unique ID number to each record for easy tracking and future reference. |

| Services Provided | List the tasks completed or materials provided, with clear descriptions and quantities for transparency. |

| Payment Amount | Break down costs into categories (labor, materials, etc.) and clearly state the total amount due. |

| Payment Terms | Specify the due date, accepted payment methods, and any late fees or penalties for overdue payments. |

| Tax Information | Include applicable taxes, VAT, or other charges, ensuring compliance with local regulations. |

| Notes and Terms | Provide any additional terms or special instructions relevant to the payment, such as warranties or agreements on follow-up services. |

By including these elements, you ensure your billing document is clear, comprehensive, and professionally formatted, which enhances communication and improves

How to Create a Billing Document from Scratch

Creating a billing document from scratch involves compiling essential details about the work completed, the materials used, and the agreed-upon costs. Starting with a blank page may seem daunting, but with a structured approach, you can create a professional and accurate record that will help you maintain clear communication with clients and ensure timely payments. The process is straightforward, requiring attention to detail and consistency in formatting.

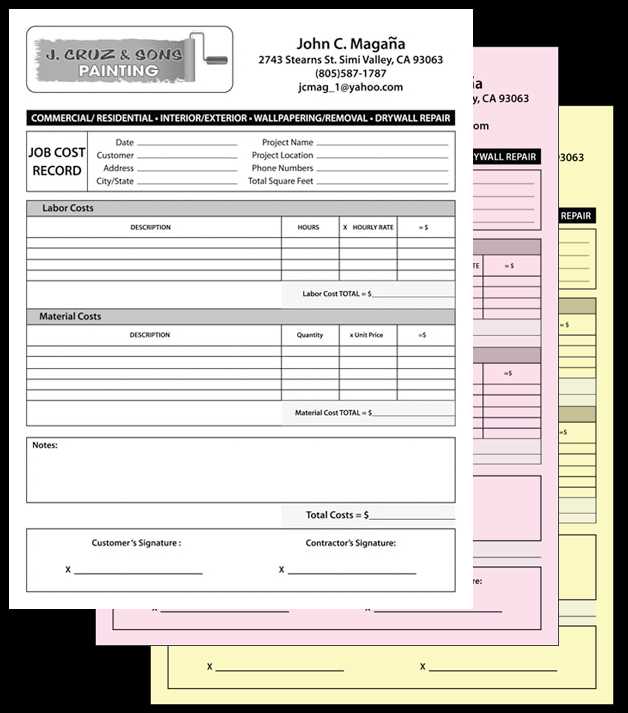

Steps to Create a Customized Billing Document

Follow these steps to build an effective record from the ground up:

- Include Your Business Information: Begin by adding your company name, contact details, and logo. This will personalize the document and make it clear who the client is dealing with.

- Client Details: Add the client’s name, address, and any relevant contact information for easy reference.

- Assign a Unique Number: Give the document a unique reference number for tracking and easy future access.

- Describe the Services: Provide a detailed breakdown of the work performed, including hours spent, tasks completed, and any products or materials provided.

- List the Costs: Break down the costs of each service or product. Include labor charges, material fees, taxes, and any other expenses.

- State Payment Terms: Clearly specify the payment due date, any late fees, and acceptable payment methods.

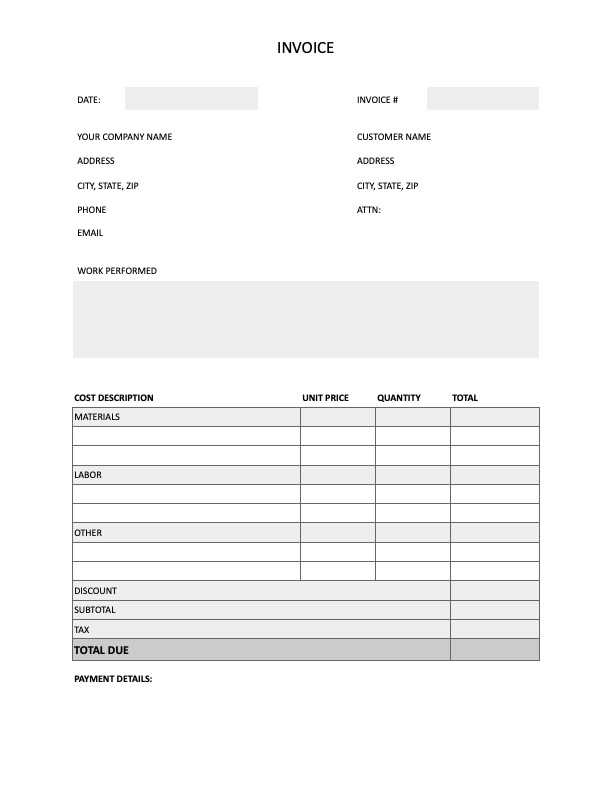

Sample Layout for Your Billing Document

Here’s an example of a basic layout to follow when creating your document:

| Section | Details |

|---|---|

| Business Information | Company name, address, phone number, email, and logo |

| Client Information | Client’s name, address, and contact details |

| Document Number | Unique reference number for easy tracking |

| Service Breakdown | A detailed list of all tasks performed or materials provided |

| Cost Breakdown | Labor charges, materials, taxes, and total cost |

| Payment Terms | Due date, payment methods, and any penalt

How to Avoid Common Billing Mistakes

Billing errors can lead to delayed payments, confusion, and even strained client relationships. Ensuring your records are clear, accurate, and professional is essential for maintaining smooth financial transactions. By paying attention to key details, contractors can minimize mistakes and improve the overall billing process. Avoiding common pitfalls will not only help you get paid on time but also strengthen your reputation with clients. Here are some tips to help you steer clear of typical billing mistakes:

By being thorough and diligent in your approach to billing, you can avoid these common mistakes and create a smooth, efficient payment process for both you and your clients. Understanding Billing Terms and ConditionsTerms and conditions are a critical part of any financial document as they define the rules and expectations for both parties involved. They serve as the legal framework that outlines the payment process, due dates, and any penalties or fees associated with late payments. Understanding these terms ensures both the contractor and the client are clear on the agreement, which helps prevent disputes and ensures smooth financial transactions. Key Elements of Payment Terms

While terms and conditions can vary from one contract to another, there are certain standard elements that should always be included to ensure clarity and transparency:

Why Clear Terms Matter

Setting out clear and fair terms helps to protect both parties and ensure the process is transparent. It not only establishes a professional understanding but also minimizes the likelihood of confusion or conflict down the line. When both you and your client are on the same page regarding payment expectations and obligations, the relationship remains positive and focused on the work at hand. By understanding and clearly outlining billing terms and conditions, you can foster smoother transactions, quicker payments, and more professional client interactions. Best Practices for Organizing Billing Documents

Keeping your financial records organized is essential for both efficiency and accuracy. Proper organization ensures that you can quickly find and manage your documents, track payments, and maintain clear communication with clients. Adopting a consistent approach to organizing your financial records helps reduce the risk of errors and delays while keeping your business running smoothly. Here are some best practices for organizing your billing records effectively:

By following these practices, you can improve the efficiency of your billing process, reduce the chance of mistakes, and ensure that all financial documents are easy to find when needed. An organized system also helps you maintain a professional image and makes it easier to comply with tax and regulatory requirements. How to Track Payments Using Billing Documents

Keeping track of payments is essential for maintaining a healthy cash flow and ensuring that clients pay on time. Properly tracking payments allows you to monitor outstanding balances, avoid late fees, and streamline your financial management. By integrating clear payment tracking methods into your billing process, you can stay organized and up to date on your finances. Steps to Track Payments EffectivelyTo track payments efficiently, follow these key steps:

Using Accounting Software to Simplify Payment TrackingIf you’re managing multiple projects, accounting software can help automate and simplify the tracking process. Many platforms allow you to link payments to specific documents, automatically update payment statuses, and even generate reports for easier financial analysis. By staying organized and diligent in tracking payments, you ensure a smoother cash flow and avoid unnecessary delays in receiving compensation for your work. An effective payment tracking system reduces errors, enhances communication, and helps maintain strong client relationships. Choosing the Right Billing SoftwareSelecting the appropriate software for managing financial documents is a crucial decision for any business. With the right tool, you can streamline the entire billing process, automate calculations, and track payments efficiently. The software you choose can significantly impact how smoothly your financial operations run, so it’s important to find a solution that fits your needs, budget, and business size. Key Features to Look for in Billing Software

When evaluating different software options, consider the following features to ensure the platform meets your business requirements:

Popular Billing Software Options

Here are a few widely used billing software solutions that can help simplify your financial processes:

|