Drive Invoice Template for Easy and Efficient Billing

Managing financial transactions efficiently is crucial for any business, whether you’re a freelancer or running a larger operation. One of the most effective ways to maintain organization and ensure prompt payments is by using digital documents designed for billing. These customizable files offer a simple, professional approach to handling your financial paperwork without the hassle of manual processing.

With the right tools, you can easily create structured, clear, and professional-looking documents that not only save time but also help you stay on top of your business’s cash flow. By leveraging online solutions, you gain flexibility, accessibility, and the ability to collaborate in real-time, all while maintaining a polished appearance that reflects well on your brand.

Whether you’re looking for a basic layout or something more advanced, these digital solutions cater to various needs and can be adapted as your business grows. They ensure that each transaction is documented clearly, helping avoid errors and misunderstandings, while also providing a convenient way to track your financial progress.

Drive Invoice Template Benefits for Your Business

Using customizable digital documents for billing and payment tracking offers significant advantages to any business. These tools streamline financial processes, making them quicker, more accurate, and less prone to errors. When integrated with cloud storage, they provide additional benefits such as ease of access, secure sharing, and collaboration in real-time, making them essential for modern businesses looking to improve efficiency and reduce administrative burdens.

Key Advantages for Your Business

- Efficiency – Automating and standardizing billing tasks saves valuable time and reduces manual work.

- Professional Appearance – Customizable designs ensure that your documents reflect a polished and consistent brand image.

- Easy Accessibility – With cloud-based solutions, documents are accessible anytime and anywhere, improving flexibility for both business owners and clients.

- Reduced Errors – Templates help eliminate common mistakes, such as incorrect calculations or missing details, ensuring more accurate records.

- Improved Organization – Keeping all financial records in one centralized location makes it easier to track payments and manage your cash flow.

Why This Solution Is Perfect for Small and Medium Enterprises

- Cost-Effective – Many of these tools are free or low-cost, making them an ideal choice for small businesses with limited budgets.

- Scalability – As your business grows, these digital documents can be easily adapted to meet the changing needs of your company.

- Secure Sharing – Cloud storage allows you to share documents with clients and team members securely, without the risk of losing important files.

- Easy Integration – These solutions often integrate seamlessly with accounting and project management software, enhancing overall workflow.

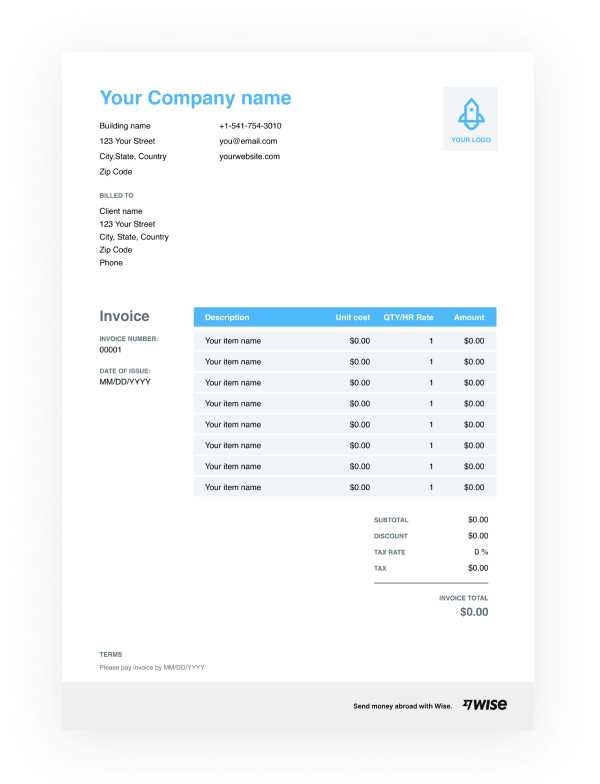

How to Create a Drive Invoice Template

Creating a customized document for billing is easier than ever with the right tools. By following a few simple steps, you can design a document that meets your business needs, looks professional, and helps you manage transactions efficiently. Whether you’re starting from scratch or using a pre-built format, the process is straightforward and can be done in just a few minutes.

Step-by-Step Guide

- Choose the Right Platform – Select a platform or cloud service that allows you to create, store, and manage your billing documents, such as Google Sheets or Docs. These tools offer flexibility and easy access from anywhere.

- Select a Template or Start Fresh – If you’re starting with a pre-made option, browse available designs and pick one that fits your business needs. Alternatively, you can create a new document from scratch.

- Customize Your Document – Tailor the content to your business. Include key information such as your company name, contact details, payment terms, and client information. Make sure to clearly display itemized services or products, with corresponding amounts.

- Adjust the Layout – Arrange the sections logically for easy reading. Use clear headings and organize the document in a way that makes it simple for clients to understand. Consider adding your logo or branding elements to enhance the professional appearance.

- Incorporate Payment Instructions – Clearly specify how payments should be made, including accepted methods and due dates. This reduces confusion and encourages timely payments.

- Save and Share – Once your document is ready, save it in your preferred format (e.g., PDF) and share it with your clients. Cloud-based tools also allow you to easily send links to documents or collaborate with team members for quick review.

Additional Tips for Personalization

- Include a Personal Message – Adding a short note or thank-you message can help build better relationships with your clients.

- Set Up Automation – Some platforms allow you to automate the creation of new documents, saving time on recurring transactions.

- Track Payment Status – Use integrated tools to track the payment status of your clients and set reminders for overdue payments.

Customizing Your Drive Invoice Template

Personalizing your billing documents is a great way to enhance professionalism and ensure they align with your business needs. Customization allows you to make your financial documents unique by adding specific details such as your logo, payment terms, and other business-specific information. This not only improves the overall presentation but also ensures your clients have all the necessary details to make prompt payments.

Here are a few key areas to focus on when adjusting your document for your business:

1. Add Your Branding

Incorporating your logo and company colors gives your document a professional look and strengthens brand recognition. Make sure your branding is consistent throughout the document, including fonts and color schemes, to create a cohesive design.

2. Adjust Layout and Sections

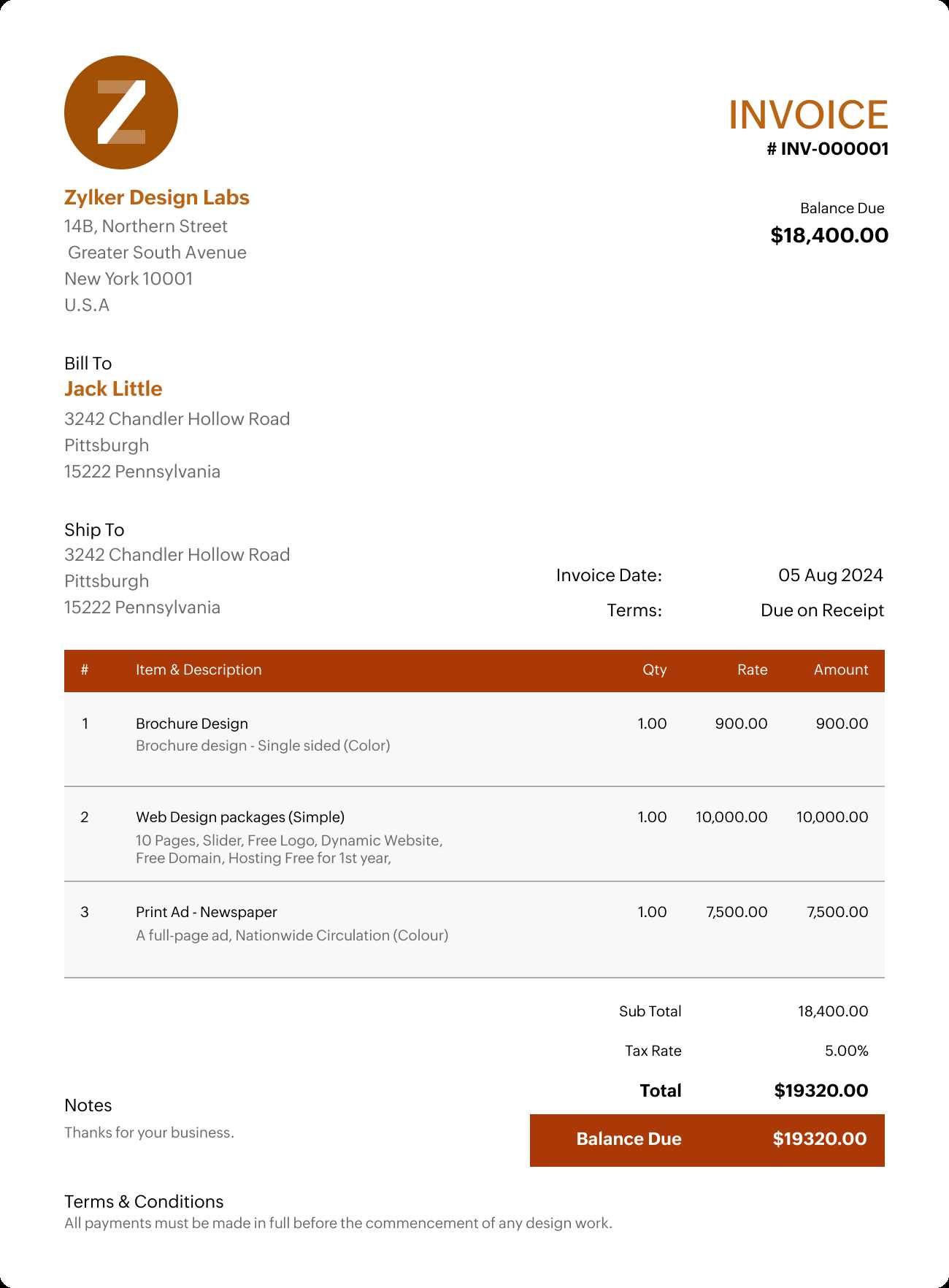

The layout of your document is crucial for readability and ease of use. Customizing sections like the header, itemized list, and payment details ensures clarity and reduces confusion. Below is an example of how to structure the key sections:

| Section | Details to Include |

|---|---|

| Header | Your company name, logo, and contact information |

| Itemized List | Detailed description of products or services provided, along with individual costs |

| Payment Terms | Due date, accepted payment methods, and late payment penalties (if any) |

| Footer | Additional notes, thank you message, or terms and conditions |

3. Modify Font Styles and Sizes

Adjusting the fonts and text sizes within the document can make it more visually appealing and easier to read. For example, use larger fonts for headings or important details such as payment amounts. Stick to clear, professional fonts for a polished look.

4. Include Extra Information

If your business requires additional data–such as tax IDs, account numbers, or other relevant details–be sure to add them in the appropriate sections. These additions not only help with accounting but also provide your clients with everything they need to process the payment.

Top Features of Drive Invoice Templates

Using well-designed digital documents for billing can greatly enhance your business’s financial management. These documents come with a range of features that not only save time but also improve accuracy and professionalism. The following highlights some of the key attributes that make these customizable solutions highly effective for businesses of all sizes.

1. Customization Options

The ability to fully customize your documents is one of the biggest advantages of using digital solutions. From adjusting the layout to adding your own branding elements, customization ensures that each document fits your specific business needs.

2. Automated Calculations

Many online billing tools come with built-in formulas for automatic calculations, reducing the risk of human error. This feature is particularly useful when you need to quickly add up totals, apply taxes, or calculate discounts.

3. Cloud Accessibility and Collaboration

Cloud-based documents allow you to access and edit your financial records from anywhere. This is particularly helpful for teams or freelancers working remotely, as it enables seamless collaboration and easy sharing of files with clients or colleagues.

4. Professional Appearance

These solutions are designed to produce clean, organized, and visually appealing documents. Professional-looking files help your business maintain a polished image, which can improve client relationships and trust.

5. Easy Tracking and Record Keeping

Most cloud-based platforms automatically save each version of your document, making it easy to track changes over time. This feature is important for record-keeping, as it allows you to view past transactions and maintain organized financial records.

Key Features Comparison

| Feature | Benefit |

|---|---|

| Customization | Tailor the document to match your brand and business needs. |

| Automated Calculations | Save time and avoid errors by using built-in formulas for totals and taxes. |

| Cloud Accessibility | Access and edit your documents from any device with an internet connection. |

| Professional Design | Ensure your documents look polished and reflect your company’s professionalism. |

| Record Keeping | Track changes and maintain an organized history of transactions. |

By taking advantage of these powerful features, you can significantly improve how your business handles financial documentation, ultimately saving time and reducing stress while maintaining a professional image.

Why Use Google Drive for Invoices

Managing billing documents digitally offers significant advantages for businesses looking to streamline their processes. Google’s cloud-based platform provides a range of features that make it an excellent choice for storing, creating, and sharing financial paperwork. Its integration with other tools and ease of access from any device ensures that you stay organized and efficient, no matter where you are.

One of the key reasons to use Google’s platform is its simplicity and flexibility. It allows you to easily create professional documents and keep them organized in one secure location. Whether you need to generate a new document, update an existing one, or collaborate with others, Google’s suite of tools provides everything you need without the complexity of traditional software solutions.

Key Advantages of Using Google’s Platform

- Accessibility – Store and access your documents from anywhere, on any device with an internet connection.

- Real-Time Collaboration – Share documents and work together with clients or team members in real time, improving communication and efficiency.

- Easy Sharing – Quickly send documents to clients via links, with control over permissions to view, comment, or edit.

- Automatic Saving – Changes are saved automatically, ensuring you never lose important information and reducing the risk of data loss.

- Integration with Other Google Tools – Seamlessly integrate your documents with other tools like Google Sheets, Google Docs, and Google Calendar for a more cohesive workflow.

Using Google’s platform for your financial documents also ensures they are always up-to-date and secure. With powerful cloud storage and encryption, you can feel confident that your records are protected from data breaches or hardware failures.

Drive Invoice Templates for Small Businesses

For small businesses, managing financial paperwork can be time-consuming and often overwhelming. Having the right tools to streamline billing, track payments, and stay organized is essential. Cloud-based solutions provide small businesses with an easy and affordable way to generate professional documents, ensuring they look polished while reducing administrative burdens.

Customizable digital solutions offer flexibility and simplicity, enabling small business owners to quickly create accurate records without the need for expensive software. These tools help automate calculations, organize information clearly, and even allow for easy sharing with clients, all from a centralized location. With features designed for ease of use, these solutions are a game-changer for small businesses looking to simplify their financial processes.

Why Small Businesses Benefit from Digital Billing Solutions

- Cost-Effective – Many cloud-based platforms are free or come at a low cost, making them an ideal option for small business owners with tight budgets.

- Easy to Use – You don’t need advanced technical skills to use these tools. Their user-friendly interface ensures that anyone can quickly generate, customize, and manage their financial documents.

- Time-Saving – Automating repetitive tasks like calculations and formatting allows you to focus on more important aspects of your business.

- Professional Results – Even with minimal effort, you can produce well-designed documents that reflect a professional image to clients, enhancing trust and credibility.

- Improved Organization – With everything stored in the cloud, it’s easy to organize and retrieve documents, ensuring you never lose track of important records.

How to Choose the Right Solution

When selecting a digital document solution, consider your specific needs. Look for a platform that offers customizable options, automated features, and cloud storage. Additionally, make sure the solution allows easy sharing with clients and integrates with other tools you may already be using, such as accounting software or payment processors.

Common Mistakes in Invoice Creation

Creating accurate and professional financial documents is crucial for ensuring timely payments and maintaining good client relationships. However, many businesses make mistakes that can cause confusion, delays, or even affect their reputation. By understanding the common errors that occur during the document creation process, you can avoid these pitfalls and ensure your records are always clear, precise, and effective.

1. Missing or Incorrect Details

One of the most common mistakes is failing to include all necessary information or providing incorrect details. Missing client information, payment terms, or itemized services can lead to misunderstandings and delayed payments. Always double-check that your documents are complete and accurate before sending them out.

2. Ambiguous Payment Terms

Vague or unclear payment terms can lead to confusion or disputes. Ensure that your payment expectations are crystal clear, including due dates, accepted payment methods, and any penalties for late payments. This helps prevent issues down the road and encourages timely transactions.

3. Inconsistent Formatting

Inconsistent formatting can make a document difficult to read and look unprofessional. It’s important to maintain uniformity in font sizes, text alignment, and section placement. A clean, organized format will help your clients easily understand the details and quickly process their payments.

4. Forgetting to Save or Back Up Documents

It’s easy to forget to save or back up your billing documents, especially when you’re working quickly. Losing important records can cause unnecessary stress and prevent you from tracking payments effectively. Be sure to save all documents securely, and consider backing them up to the cloud for easy access and long-term storage.

5. Incorrect Tax Calculations

Incorrect tax calculations can create problems with both clients and tax authorities. Always verify that the tax rates applied are correct and that the calculations are accurate. Using automated solutions can help reduce the chances of errors in this area.

Overview of Common Mistakes

| Mistake | Consequence | Solution | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Missing or Incorrect Information | Delays, misunderstandings | Double-check client details and service descriptions | ||||||||||||||||||||||||||||||||||||

| Ambiguous Payment Terms | Late or disputed payments | Clearly state due dates, payment methods, and penalties | ||||||||||||||||||||||||||||||||||||

| Inconsistent Formatting | Poor presentation, difficult to read | Use consistent fonts, text alignment, and spacing | ||||||||||||||||||||||||||||||||||||

| Forgetting to Save or Back Up | Loss of important records | Save documents and back them up to

How to Automate Invoicing with DriveAutomating the creation and management of financial documents can save significant time and reduce the chances of errors. By integrating cloud-based solutions, you can streamline the process of generating, sending, and tracking your billing records with minimal manual effort. This allows you to focus more on growing your business while ensuring that your transactions are organized and efficiently managed. Automation in cloud-based platforms offers various features, such as preset document formats, recurring billing setups, and the ability to sync with other tools you use for accounting or customer relationship management. These features can help reduce repetitive tasks and ensure that your billing system remains consistent and timely, without the need for constant oversight. Steps to Automate Your Billing Process

By automating your billing process with cloud-based tools, you can reduce administrative overhead, maintain consistency, and improve your overall efficiency, allowing you to focus on other important areas of your business. Drive Invoice Template for FreelancersFreelancers often juggle multiple clients and projects at once, making it crucial to have a streamlined, professional way to manage billing. Using digital solutions for creating and sending payment requests helps freelancers save time and maintain an organized workflow. With the right structure, freelancers can ensure that their financial documents are clear, accurate, and timely, making it easier to get paid on time and keep track of earnings. Cloud-based solutions are ideal for freelancers, offering flexibility, easy access from anywhere, and the ability to create customized documents quickly. These tools can help you automate much of the administrative work, allowing you to focus more on delivering value to your clients and growing your freelance business. Why Freelancers Should Use Digital Solutions

Essential Features of a Freelancer Billing Document

By using cloud-based tools to create personalized billing records, freelancers can ensure that their documents are professional, efficient, and easy to manage. This approach not only saves time but also ensures a smooth process for both freelancers and clients, leading to faster payments and a more organized business. Free vs Paid Drive Invoice TemplatesWhen it comes to creating billing documents, businesses often face the decision of choosing between free or paid solutions. Both options offer distinct advantages, but the right choice largely depends on the complexity of your needs, the level of customization required, and your budget. Understanding the key differences between free and paid digital document solutions can help you make an informed decision based on your specific requirements. Free solutions are often a good starting point, especially for small businesses or individuals just starting out. These tools typically provide basic features such as document creation and simple formatting. However, for businesses that require more advanced functionalities like automation, detailed reporting, or advanced customization, paid solutions may be a better option. Advantages of Free Solutions

Advantages of Paid Solutions

While free solutions are a great starting point, businesses that grow and require more advanced features may find it beneficial to invest in a paid option. The choice between free and paid platforms ultimately depends on the level of sophistication you need and the resources available to your business. How to Share Drive Invoices SecurelyWhen sending financial documents, it’s crucial to ensure that both the sender and recipient can access the files safely and without the risk of unauthorized access. Secure sharing not only protects sensitive information, but also helps maintain professional relationships with clients by demonstrating responsibility in handling their data. Fortunately, there are several ways to securely share billing records with clients, ensuring that your business stays protected while maintaining efficiency. By using cloud-based solutions, businesses can take advantage of built-in security features such as encrypted file storage, access control, and detailed permission settings. These tools offer various options to ensure that documents are shared safely, whether you’re sending them directly to clients or collaborating with team members. Below are some best practices to securely share financial documents. Best Practices for Secure Document Sharing

Additional Security Considerations

By implementing these security measures, you can ensure that your financial records are shared safely, reducing the risk of data breaches and maintaining trust with your clients. Secure sharing is a critical component of professional document management and should never be overlooked. Integrating Drive Invoice Templates with Accounting SoftwareFor businesses looking to streamline their financial operations, integrating document creation tools with accounting software can provide significant benefits. By combining the power of automated billing systems with accounting platforms, businesses can ensure that all financial data is accurately tracked, updated in real-time, and synced seamlessly. This integration reduces manual data entry, improves efficiency, and ensures that your records are always up to date, saving both time and effort. Connecting your billing system to accounting software offers numerous advantages, such as simplifying the process of tracking payments, managing taxes, and generating reports. With the right integration, you can also eliminate discrepancies between your invoices and financial records, providing a clear, comprehensive overview of your business’s financial health. Benefits of Integrating Billing with Accounting Software

Steps to Integrate Your Billing System with Accounting Software

By integrating your billing and accounting platforms, you can simplify your financial management, reduce errors, and improve your overall efficiency. This integration allows for a more accurate and less time-consuming workflow, enabling you to focus on what matters most–growing your business. Design Tips for Professional InvoicesA well-designed billing document not only ensures clear communication but also enhances your business’s professionalism. The design of your payment requests plays a significant role in how clients perceive your business and can influence their payment behavior. By incorporating clean, organized layouts and visually appealing elements, you can create a document that stands out and encourages timely payments. A professional-looking document conveys trustworthiness and reliability, which are essential for maintaining good client relationships. When designing your financial records, it’s important to balance functionality with aesthetics. An effective design should be easy to read, highlight key information, and reflect your business’s brand. Below are some tips for creating documents that are both visually appealing and practical. Key Design Elements for Effective Documents

Essential Information to Include

By following these design principles, you can create billing documents that are both functional and visually appealing. A well-crafted design ensure How to Track Payments with Drive TemplatesTracking payments is a critical part of maintaining healthy cash flow and ensuring that your business operations run smoothly. When you use digital solutions for generating financial documents, such as billing records, you can also leverage these tools to track payments in real-time. By incorporating payment tracking features, businesses can easily monitor which clients have paid, which invoices are still outstanding, and when to follow up on overdue balances. Integrating payment tracking into your digital workflow can save time, reduce errors, and provide a clear overview of your financial situation. With just a few clicks, you can update payment statuses, view historical data, and even send automatic reminders to clients who have yet to settle their balances. Below are the best methods for using digital document solutions to track payments effectively. Methods for Tracking Payments

Best Practices for Payment Tracking

By using digital solutions that allow for efficient payment tracking, you can stay on top of your financial transactions and ensure that your business remains financially healthy. Tracking payments not only helps you manage your accounts more effectively, but it also gives you greater control over your cash flow and reduces the chances of overlooking unpaid balances. Best Drive Invoice Template for EntrepreneursFor entrepreneurs, having a professional and streamlined method for generating billing documents is essential to maintain efficient operations and ensure timely payments. Selecting the right tools and formats for creating financial records can help business owners stay organized and create a positive impression with clients. The ideal solution should not only be easy to use but also customizable to meet the unique needs of each business. By choosing the right system for billing, entrepreneurs can automate repetitive tasks and focus more on growing their business. The best billing solutions for entrepreneurs typically include pre-designed formats that are simple to personalize while also offering all necessary fields for capturing essential transaction details. These systems can simplify invoicing, reduce human error, and offer time-saving features like recurring billing or automatic payment reminders. Below are some key features to look for when selecting an ideal document creation solution for your business. Key Features of the Best Billing Document Systems

When choosing a system for creating and managing financial documents, ensure that it is compatible with your workflow and provides all the tools necessary to streamline your billing process. Whether you’re handling a few clients or a growing customer base, the right solution will help you save time, reduce administrative costs, and ensure accuracy in your financial records. |