Downloadable Service Invoice Template for Convenient Billing

Efficient billing is essential for any business. Having the right document format can simplify the process of requesting payment from clients while ensuring all necessary details are included. Whether you are a freelancer, small business owner, or service provider, using a pre-designed structure can save time and reduce errors.

Customized billing formats offer flexibility, allowing you to include specific details relevant to your industry or client needs. With easy-to-use options available, creating professional and accurate billing statements has never been easier. This simple solution helps maintain clarity and organization in your financial records.

By leveraging an editable and adaptable form, you can easily track payments, apply adjustments, and ensure consistency in your business operations. The ability to quickly generate a clean, clear document means less time spent on administrative tasks and more focus on delivering quality services.

Downloadable Service Invoice Template Guide

Creating professional payment requests is essential for maintaining smooth financial transactions with your clients. Having the right format for documenting charges ensures clarity and reduces the risk of errors or misunderstandings. By utilizing a pre-designed structure, you can quickly generate accurate records, saving both time and effort in your administrative work.

With an editable document, you can easily tailor each request to fit the unique needs of each job or client. This allows you to include key details such as payment terms, due dates, and itemized lists of services rendered, all while maintaining consistency across your business practices. The flexibility to adjust the format ensures that you are always presenting a polished and professional image.

Using a readily available format simplifies the process of generating payment records, reducing the chances of missing crucial information. You can also track your earnings more effectively, as these documents often integrate well with accounting systems and other financial tools. Whether you need to adjust the layout or add custom fields, having a reliable framework at your disposal streamlines your business operations.

Why Use a Service Invoice Template

Using a structured format to request payments helps ensure consistency and accuracy across your business transactions. By utilizing a pre-designed form, you can easily include all necessary information, avoiding the risk of missing critical details. This not only saves time but also enhances your professionalism when interacting with clients.

Improved Organization and Efficiency

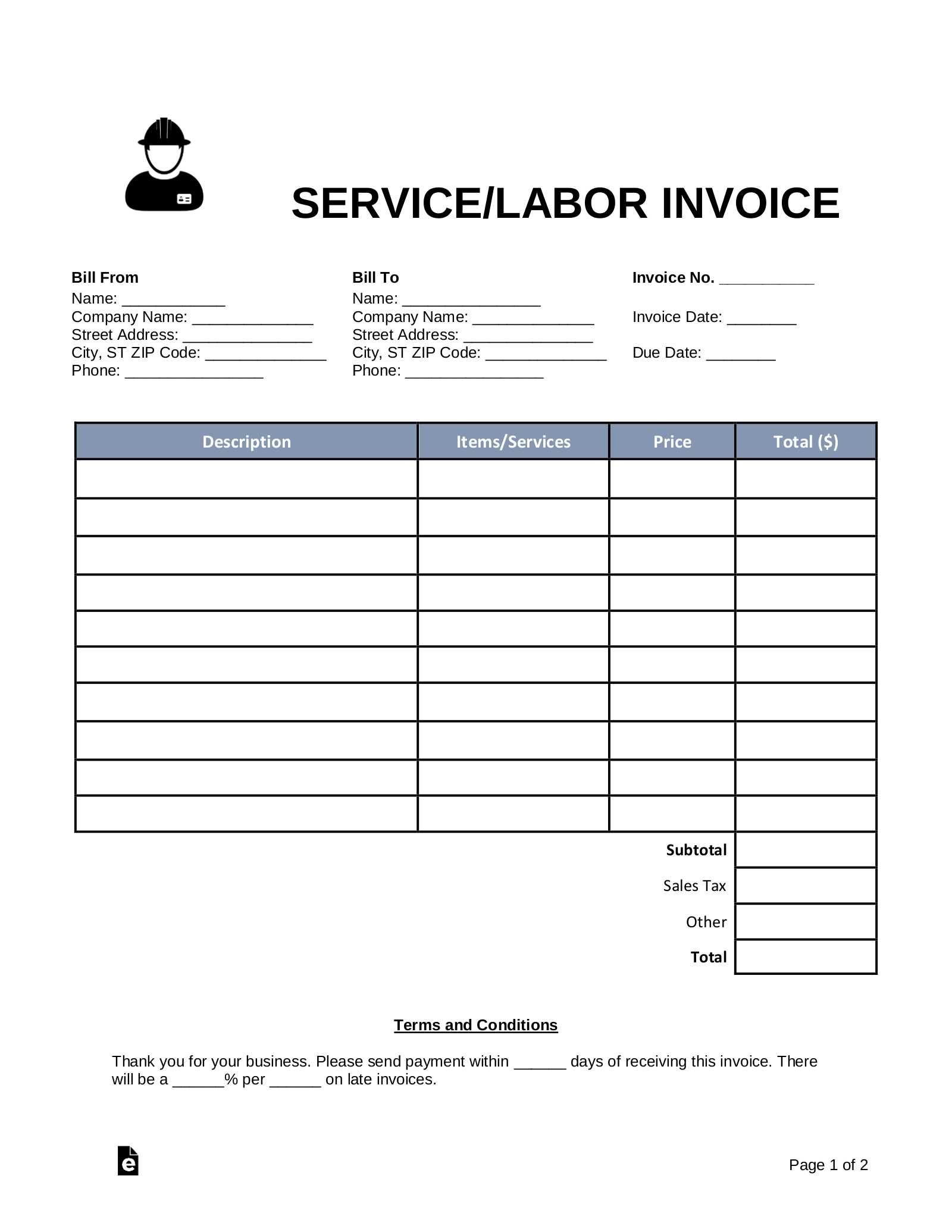

With a ready-made format, you eliminate the need to create documents from scratch each time. The layout is already set up to include essential components like client information, job descriptions, pricing, and payment terms. This streamlined approach increases efficiency, ensuring you can focus more on your core business activities.

Consistency and Professionalism

Using a uniform document format ensures that all your payment requests appear professional and well-organized. Clients will appreciate the clear and concise presentation, which can strengthen your business relationships. A consistent layout also helps you maintain a better overview of your financial records.

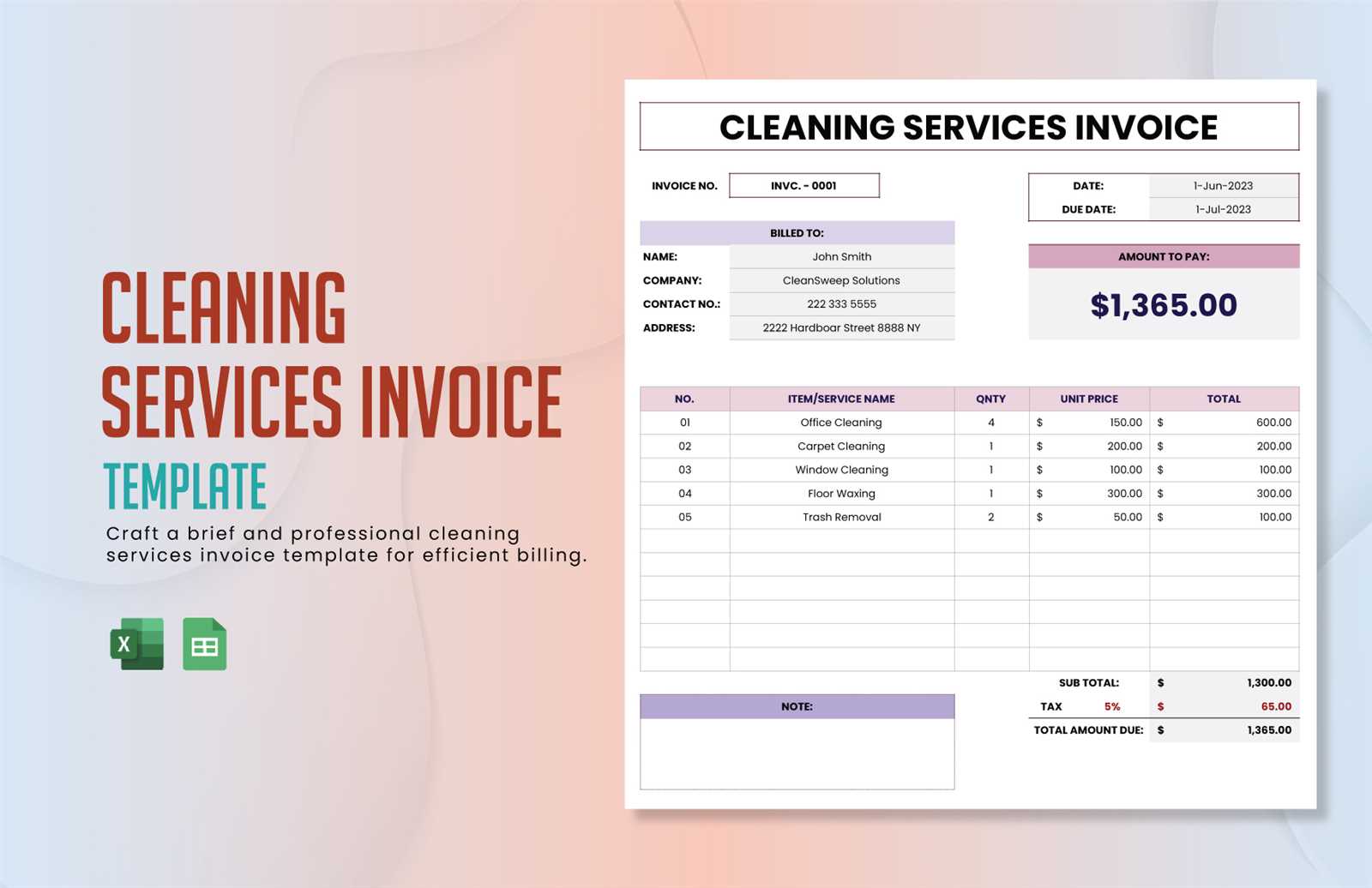

Benefits of Customizable Invoice Templates

Using an adjustable format for creating billing documents offers significant advantages for businesses of all sizes. Customizable formats allow you to tailor each record to meet the specific needs of your clients and your business operations

How to Choose the Right Template

Selecting the appropriate format for your billing documents is crucial for maintaining professionalism and ensuring that all necessary details are included. It’s important to choose a layout that aligns with the type of work you do and meets your clients’ needs. The right structure can improve the clarity of your records and make the billing process more efficient.

Consider Your Business Type

Different businesses require different information on their billing documents. For instance, a freelance designer may need to detail creative services, while a contractor might need to include labor rates and materials. Think about the specific elements your billing records must contain and ensure the format allows for customization in those areas.

Look for Flexibility and Usability

The format should not only meet your current needs but also allow for future adjustments as your business grows or changes. Look for a layout that is easy to edit, whether through a simple word processor or spreadsheet software. Ensure it’s user-friendly and doesn’t require technical expertise to make changes.

| Feature | Why It’s Important |

|---|---|

| Customization Options | Allows you to tailor the document to your specific needs and clients. |

| Ease of Use | Ensures that you can quickly edit and generate new records without hassle. |

| Professional Design | Maintains a polished, business-like appearance that impresses clients. |

| Integration with Tools | Allows seamless integration with your accounting or financial systems. |

Steps to Download and Use a Template

Getting started with a pre-designed document structure is quick and easy. By following a few simple steps, you can download a ready-made layout and start customizing it to suit your business needs. Here is a guide on how to obtain and use this tool effectively for generating billing records.

- Find a Trusted Source: Look for reliable websites or platforms that offer well-designed formats. Ensure they provide formats that are compatible with your preferred editing software, such as Word, Excel, or PDF.

- Choose the Right Format: Select a structure that fits your specific needs. Consider the type of work you do and the information you need to include in the document. Look for a layout that allows for easy customization.

- Download the File: Once you’ve selected the right layout, download the file to your device. Most platforms will offer a simple download button to save the file to your computer or cloud storage.

- Customize the Document: Open the file in your chosen software and add your personal or business details. This might include client names, descriptions of services, costs, payment terms, and due dates.

- Save and Use: After making all the necessary adjustments, save the document with a new name for easy access in the future. You can now use this document for your billing purposes, ensuring it’s ready to send to clients when needed.

By following these simple steps, you’ll have an efficient and professional format ready to go, helping streamline your billing process and ensuring that all essential details are included in every record.

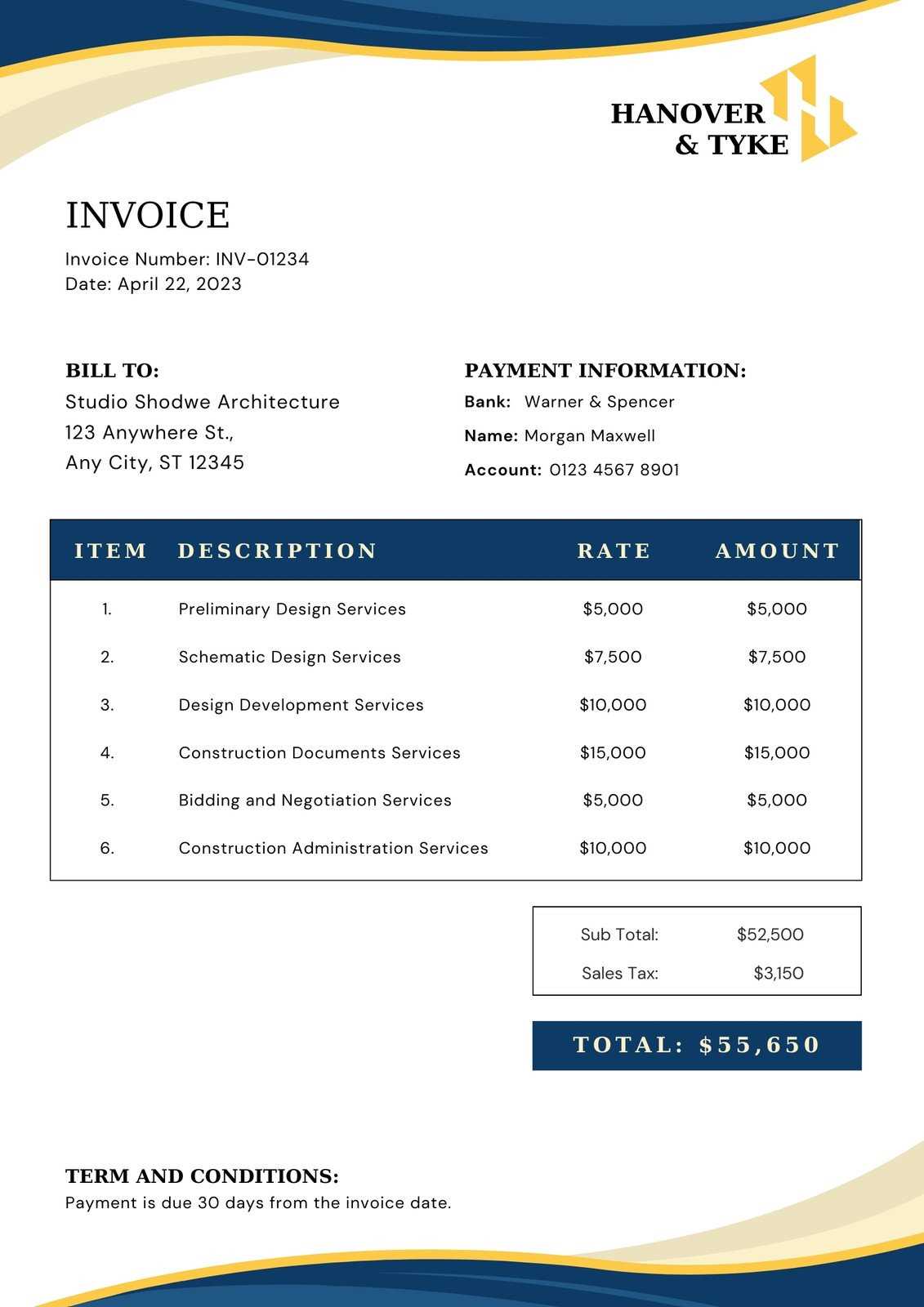

Essential Information for a Service Invoice

For any billing document to be effective, it must include all the necessary details to ensure clear communication between you and your clients. Whether you are working on a one-time project or ongoing tasks, having a consistent format with essential information can prevent confusion and ensure prompt payments. Each section plays a crucial role in making the record both professional and comprehensive.

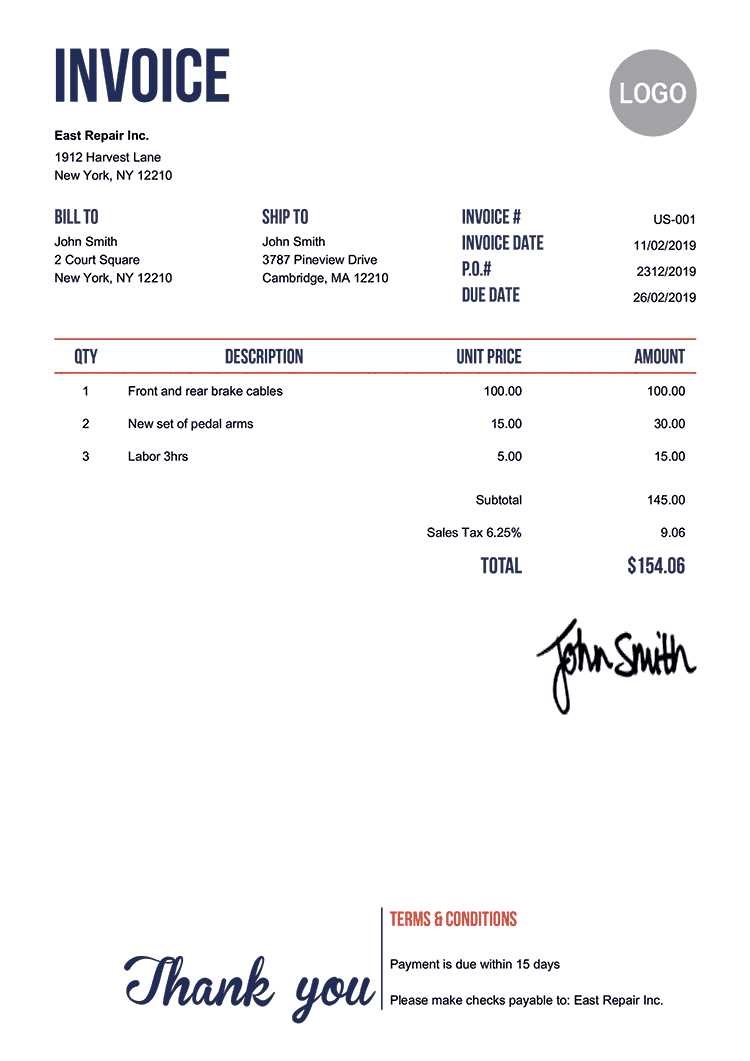

The most important elements to include are the client’s information, a detailed list of services or products provided, and the total cost. Additionally, it’s essential to outline payment terms, such as the due date and any applicable taxes or discounts applied to the final amount.

By ensuring all relevant data is clearly presented, both you and your clients can avoid misunderstandings and ensure that payment is processed promptly. Having all of this information in place helps to maintain a professional and transparent business relationship.

Tips for Personalizing Your Invoice

Customizing your billing document can add a personal touch and help create a lasting impression on your clients. Personalization not only makes the document unique but also ensures that all relevant information is highlighted in a way that suits your business style and the services you provide. Here are some key tips to make your records stand out:

- Branding Elements: Include your company logo, business name, and contact details at the top of the document. This gives the document a professional appearance and helps clients easily recognize your business.

- Custom Descriptions: Use personalized descriptions for each service or product. Instead of generic terms, describe each task with specific language that reflects the nature of your work.

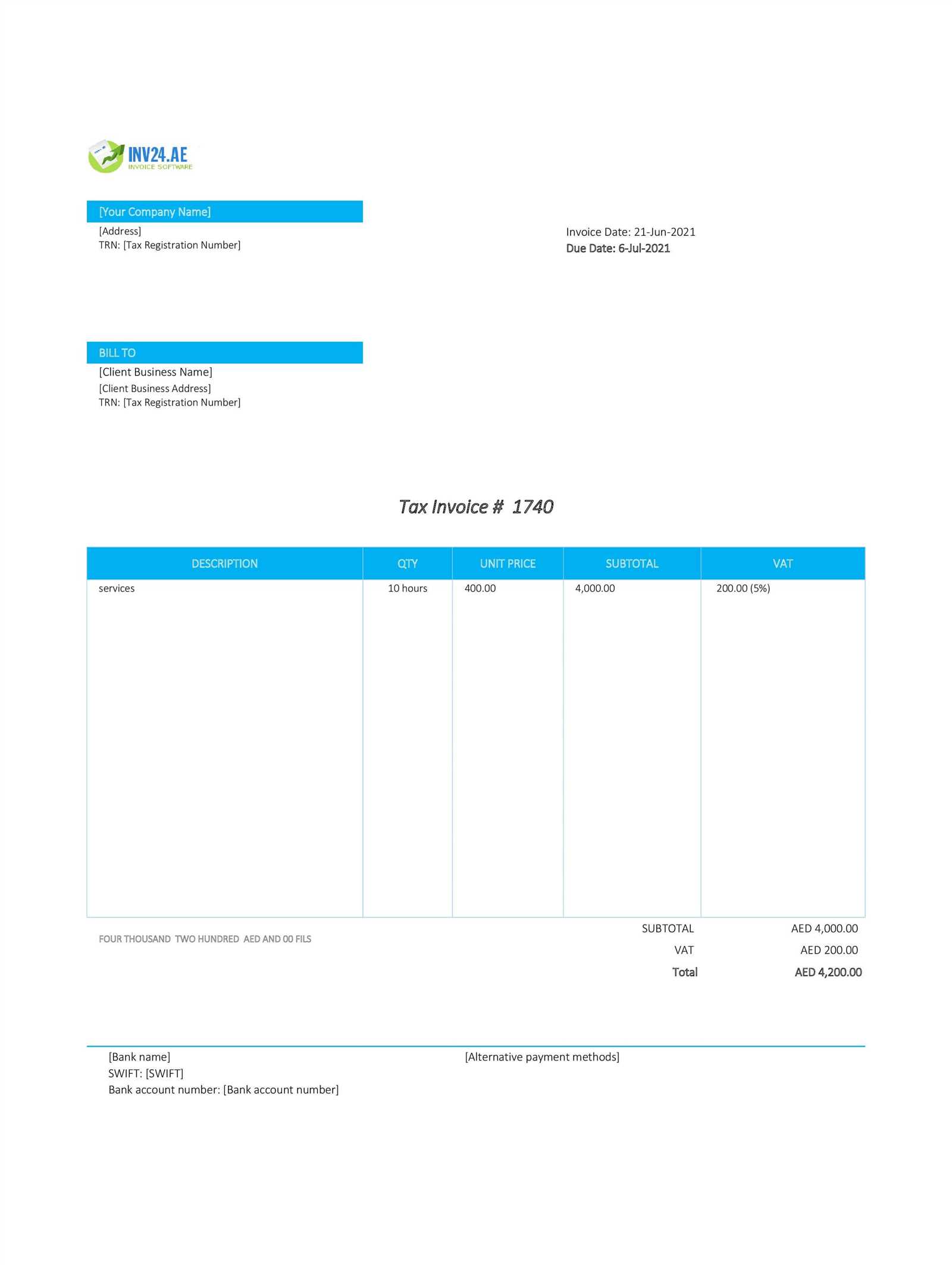

- Payment Instructions: Add custom payment methods or instructions that are specific to your business, such as preferred payment platforms or bank details.

- Color Scheme and Fonts: Choose colors and fonts that match your brand’s identity. This subtle touch can make the document more visually appealing while reinforcing your business’s image.

- Special Notes: Consider including a thank you note or a personalized message to show appreciation for the client’s business. This small gesture can strengthen customer relationships.

By making these adjustments, you’ll ensure that your billing document is not only functional but also a reflection of your brand and professionalism.

Free vs Paid Service Invoice Templates

When it comes to selecting a layout for your billing documents, one of the first decisions you’ll face is whether to use a free or a paid version. Both options have their advantages, but the best choice depends on your specific business needs, the level of customization required, and the resources available to you. Understanding the pros and cons of each can help you make an informed decision.

Advantages of Free Templates

Free formats can be a great choice for small businesses or freelancers who are just starting out or have a tight budget. These options are usually simple and straightforward, providing the basic fields needed for most billing purposes. Many free layouts are available online and can be easily downloaded or edited to suit your needs. While they may lack advanced features, they still offer a professional presentation for your records.

Benefits of Paid Templates

On the other hand, paid layouts often come with more advanced features and greater flexibility. These may include more comprehensive customization options, automated calculations, integration with accounting software, and premium designs. Investing in a paid version can save you time in the long run by providing you with tools that allow for more efficient and streamlined processes. Additionally, these options may offer customer support or updates, ensuring that your documents remain up-to-date with industry standards.

Ultimately, the choice between free and paid layouts comes down to the specific needs of your business. If you require advanced functionality or want a more polished look, a paid option may be the better investment. However, if you’re just starting out and need something simple, free layouts are often more than sufficient.

Common Mistakes to Avoid When Invoicing

Billing documents are a critical part of any business transaction, and it’s essential to ensure that they are accurate and clear. However, mistakes in these records can lead to confusion, delayed payments, and strained client relationships. Understanding the common errors made when creating such documents can help you avoid costly mistakes and maintain professionalism in your business.

One frequent issue is failing to include all necessary details, such as the client’s information, a clear description of the work completed, or payment terms. This can create confusion and delay the payment process. Another common mistake is leaving out the due date or payment methods, which can lead to misunderstandings about when and how payment should be made.

In addition, inconsistent or incorrect calculations, such as adding the wrong tax or discount, can cause friction with clients and potentially lead to legal issues. It’s also important to avoid using generic or unclear language, as this can make the record look unprofessional and hard to understand. Lastly, sending out records without double-checking for errors, like spelling mistakes or missing figures, can hurt your credibility.

By paying attention to these common pitfalls, you can ensure your billing process is smooth, efficient, and transparent for both you and your clients.

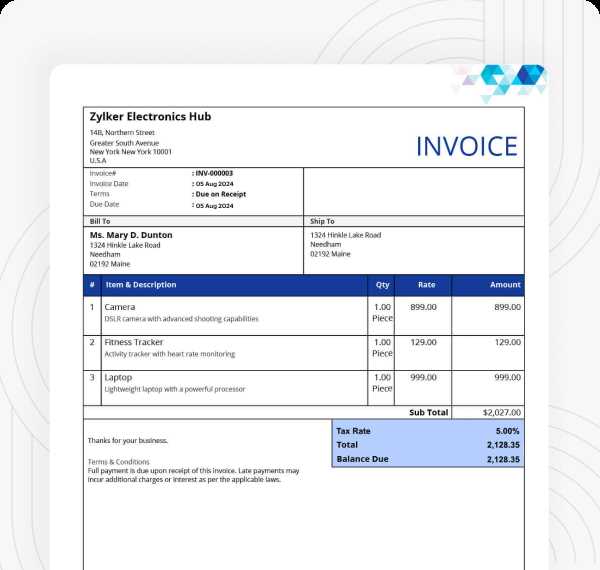

Best Software for Editing Invoices

When it comes to creating and customizing your billing documents, using the right software can make a significant difference. A good program not only helps you design professional-looking records but also streamlines your workflow by automating key tasks like calculations, taxes, and payment tracking. There are many options available, from simple tools for basic editing to more advanced platforms with integrated features.

Popular Software Options

Below are some of the most popular programs used for creating and managing billing records, each offering unique features to suit various business needs:

| Software | Features | Best For |

|---|---|---|

| QuickBooks | Automatic calculations, tracking payments, customizable designs | Small to medium-sized businesses that need accounting integration |

| FreshBooks | Cloud-based, time tracking, automated reminders, custom templates | Freelancers and service providers |

| Zoho Invoice | Customizable templates, multi-currency support, expense tracking | Freelancers and businesses with international clients |

| Microsoft Excel | Custom formulas, wide compatibility, easy to use | Small businesses that need a simple, affordable solution |

| Wave | Free, customizable templates, automatic tax calculations | Freelancers and small businesses with limited budgets |

Choosing the Right Tool for Your Business

When deciding which program is right for you, consider factors such as ease of use, cost, and the level of customization needed. Some platforms, like QuickBooks, offer advanced accounting features, while others, like Wave, provide essential tools at no cost. Think about what features will best suit your needs and make the invoicing process as efficient as possible.

How to Add Tax and Discounts

When preparing a billing document, including taxes and discounts is crucial for accurate payment processing. Taxes may vary depending on location, product, or service type, while discounts are often applied to encourage prompt payment or reward customer loyalty. Understanding how to correctly apply both can help ensure your records are complete and that your clients are charged fairly.

Adding Tax to Your Billing Document

To add tax, you need to know the applicable tax rate for your region and industry. The rate is typically calculated as a percentage of the total amount before tax. Here are some steps to follow:

- Determine the tax rate based on your local tax laws.

- Calculate the tax by multiplying the subtotal by the tax rate (e.g., 10% of $100 = $10).

- Include the tax amount clearly on the document, labeling it as “Tax” or “Sales Tax” along with the applicable rate.

- Ensure the total after tax is shown as the final amount due.

Applying Discounts

Discounts can be a useful tool for businesses to encourage quick payment or reward loyal customers. There are different types of discounts, such as percentage-based or flat-rate discounts. Here’s how to include them:

- Decide on the discount type–percentage or fixed amount.

- Apply the discount after tax has been added to avoid reducing the tax amount incorrectly.

- Clearly label the discount, such as “Early Payment Discount” or “Loyalty Discount,” and include the percentage or amount being deducted.

- Make sure the final total after tax and discount is correctly calculated and displayed.

| Description | Calculation | Final Amount |

|---|---|---|

| Subtotal | $100 | $100 |

| Tax (10%) | $100 x 10% = $10 | $110 |

| Discount (5%) | $110 x 5% = -$5.50 | $104.50 |

By correctly applying taxes and discounts, you ensure that your clients have a clear understanding of the costs and that you remain compliant with financial regulations. Always double-check the calculations before finalizing the document to avoid errors and discrepancies.

Formatting Your Billing Document for Clarity

Creating a clear and well-organized billing document is essential for both you and your clients. A clean, readable layout helps avoid confusion and ensures that all necessary information is easily accessible. Proper formatting also fosters professionalism and can reduce the chances of disputes or delays in payment.

Key Elements to Include

When formatting your document, there are several key elements that should be prominently displayed to ensure clarity:

- Contact Information: Include your business name, address, phone number, and email. Don’t forget to add the recipient’s contact details as well.

- Billing Details: Clearly itemize the services or products provided, along with their quantities and prices. Each line item should be easy to read and well-organized.

- Dates: Specify the date the document was created, as well as the due date for payment. This helps avoid confusion regarding payment terms.

- Taxes and Discounts: Clearly list any applicable taxes or discounts, including the percentages or amounts applied.

- Total Amount Due: Always highlight the final amount due, ensuring it is clearly separate from other details.

Tips for Effective Layout

Here are some layout tips that can enhance the readability of your document:

- Use a Clean Font: Choose a simple, easy-to-read font like Arial or Times New Roman. Avoid overly decorative fonts that can make the document difficult to read.

- Organize Information with Tables: Use tables to organize the services/products, quantities, prices, and totals. This helps break up the information and makes it easier to scan.

- Incorporate Clear Headings: Use bold headings or lines to separate different sections, such as “Services Provided,” “Tax,” and “Total Amount Due.”

- Leave Space for Notes: If needed, add a section for additional comments or notes, like payment instructions or terms of agreement.

| Item | Quantity | Price | Total |

|---|---|---|---|

| Consulting Service | 2 hours | $50/hr | $100 |

| Materials | 5 units | $20/unit | $100 |

| Subtotal | $200 |

By following these formatting guidelines, you can ensure that your billing document is clear, professional, and easy to understand for your clients, ultimately leading to smoother transactions and improved cli

Why Consistent Billing Improves Business

Maintaining a regular and organized approach to billing is crucial for the success of any business. Consistency in the way financial documents are created and sent helps streamline operations, reduces errors, and enhances customer satisfaction. By establishing a clear and predictable process, businesses can foster trust with clients and improve overall efficiency.

Key Benefits of Consistent Billing

Here are several advantages of keeping your billing system consistent:

- Improved Cash Flow: Regular billing helps ensure timely payments, keeping cash flow steady and reducing financial strain.

- Reduced Errors: When billing practices are standardized, there’s less room for mistakes, leading to more accurate charges and fewer disputes.

- Better Client Relationships: Clients appreciate predictable and transparent billing. This builds trust and makes the payment process smoother.

- Streamlined Record Keeping: Consistency makes it easier to track payments, manage expenses, and generate financial reports.

How to Achieve Consistent Billing

To maintain a consistent billing approach, consider the following practices:

- Use Standardized Documents: Create a template or format for all billing statements to ensure uniformity.

- Automate Reminders: Set up automated systems to remind clients of upcoming payments or overdue balances.

- Establish Clear Terms: Define your payment terms upfront, including deadlines, late fees, and acceptable payment methods.

Example of a Clear Billing Breakdown

Here’s a sample breakdown of how consistent billing can be formatted to help businesses stay organized:

| Item | Quantity | Price | Total |

|---|---|---|---|

| Consultation Fee | 1 session | $100 | $100 |

| Materials | 5 items | $20 each | $100 |

| Total Amount Due | $200 |

By adopting consistent practices, businesses can ensure their financial processes are efficient, helping to maintain healthy relationships with clients and achieve long-term success.

Tracking Payments Using Billing Forms

Effectively tracking payments is essential for managing a business’s financial health. By using well-structured billing documents, you can keep a record of all transactions, monitor outstanding balances, and ensure timely payments from clients. These forms not only serve as a clear record of services provided but also help streamline the payment process and prevent missed or delayed payments.

How Payment Tracking Improves Cash Flow

Tracking payments through organized billing forms offers several advantages that directly impact cash flow management:

- Timely Payments: Clear documentation and tracking allow you to follow up on outstanding payments quickly, reducing delays.

- Minimized Errors: When details are documented properly, it reduces the likelihood of mistakes or discrepancies in payment amounts.

- Improved Client Communication: By keeping track of all payments, you can easily inform clients of their due or overdue balances, fostering transparency.

- Easy Financial Monitoring: Tracking payments in a systematic way allows you to quickly evaluate your financial position and forecast future income.

Steps to Effectively Track Payments

Here are some key strategies for tracking payments using billing documents:

- Record Payment Dates: Always include payment dates on your records to monitor when each payment is made or overdue.

- Maintain Payment Status: Mark whether a payment is pending, received, or overdue, and note any partial payments received.

- Keep Detailed Records: Include all necessary details, such as transaction numbers, payment methods, and the amounts paid, to maintain a complete financial history.

- Follow-Up with Clients: Use the billing forms to track overdue payments and send reminders when needed to maintain a smooth cash flow.

Example of Tracking Payment Status

Below is an example of how to incorporate payment tracking into your billing forms:

| Client Name | Amount Due | Payment Date | Status |

|---|---|---|---|

| John Doe | $500 | 01/15/2024 | Paid |

| Jane Smith | $300 | Pending | Due 02/01/2024 |

| Michael Johnson | $200 | 01/10/2024 | Overdue |

By using structured documents to track payments, businesses can better manage their finances, ensuring that they are paid prompt

Integrating Billing Forms with Accounting Tools

Integrating your billing documents with accounting software can greatly enhance financial management for your business. This integration allows for seamless tracking of payments, easy invoicing, and accurate record-keeping, while minimizing manual data entry. By syncing these documents with accounting tools, you can ensure that your financial records are always up-to-date and provide a clear view of your revenue and expenses.

Benefits of Integration

When you connect your billing documents with accounting software, you unlock several key advantages:

- Time-Saving: Automated data entry eliminates the need for manual input, saving time and reducing the chance for errors.

- Real-Time Tracking: Payments and transactions are automatically updated in real-time, ensuring your financial records are always current.

- Enhanced Reporting: Integrating with accounting tools allows you to generate detailed financial reports, helping you track profits, losses, and other key metrics more easily.

- Better Organization: All your financial data is stored in one place, making it easier to access and analyze for business insights.

How to Set Up Integration

Setting up integration between your billing forms and accounting software is a straightforward process. Here are the steps to get started:

- Choose Compatible Software: Ensure that the accounting software you use supports integration with your billing forms or other tools.

- Link Your Accounts: Connect your accounting software to the system that generates your billing documents, whether it’s a spreadsheet, accounting platform, or another software.

- Enable Automation: Set up automatic syncing to ensure that data, such as payment status and transaction details, flows seamlessly between the two platforms.

- Test the Integration: Before relying on the integration for all your transactions, test the connection to make sure the data is syncing correctly and accurately.

With the right setup, this integration can significantly streamline your financial workflows and help you maintain accurate and timely records. By automating tasks, you can focus on growing your business without getting bogged down by administrative work.

How to Protect Your Billing Information

Ensuring the security of your billing details is crucial for protecting your business and clients from fraud or unauthorized access. Sensitive financial information, such as payment data and transaction records, must be carefully handled and stored in order to avoid any potential breaches. By following a few key practices, you can safeguard your documents and reduce the risk of exposure.

Best Practices for Protecting Your Documents

Here are some effective ways to keep your billing information safe:

- Use Strong Passwords: Always protect access to your billing systems with strong, unique passwords. Avoid simple or commonly used phrases and enable two-factor authentication (2FA) for added security.

- Encrypt Sensitive Files: When storing or sharing documents containing financial information, ensure they are encrypted. Encryption adds an additional layer of protection, making it much harder for unauthorized individuals to access the data.

- Limit Access: Only provide access to financial records to trusted personnel. Use role-based access controls to ensure that each person only sees the information they need to perform their tasks.

- Regular Backups: Keep regular backups of your documents in secure locations. This will help you recover any lost or compromised data due to a system failure or breach.

- Monitor for Suspicious Activity: Regularly review your accounts and records for any unusual activity. Implement automated alerts to notify you if any unauthorized changes are made to your documents.

Secure Methods for Sharing Billing Information

When sharing financial details with clients or other parties, it’s important to use secure methods. Here are some tips for safe communication:

- Use Encrypted Email: If you need to send sensitive information electronically, make sure the email is encrypted to prevent unauthorized access during transmission.

- Secure Cloud Storage: Store documents in a secure, encrypted cloud service that offers features such as access control and data protection.

- Limit Paper Copies: Avoid printing sensitive documents unless necessary, and always store any paper records in a locked, secure location.

By implementing these practices, you can ensure that your billing information remains secure and protected from potential threats, safeguarding both your business and your clients.

Updating Your Billing Document Regularly

To ensure your financial records are always up-to-date and accurate, it is essential to make periodic revisions to your billing documents. This practice helps you stay compliant with current regulations, reflect any changes in your pricing structure, and improve the overall clarity and professionalism of your business communications. Regular updates not only prevent errors but also enhance the efficiency of your operations by keeping everything aligned with the latest requirements and standards.

Key Areas to Update

When revising your billing documents, focus on these crucial areas:

| Area | Reason for Update |

|---|---|

| Business Information | Ensure your contact details, business name, and tax ID numbers are current to maintain accuracy and legal compliance. |

| Pricing Structure | Update your rates or payment terms if there have been any changes, such as increased costs or special discounts. |

| Payment Methods | Ensure that the accepted payment methods are accurately listed and aligned with your current processing options. |

| Legal and Tax Information | Modify any legal disclaimers or tax calculations according to updated laws or financial policies. |

| Branding and Design | Refresh your document’s design to match any changes in your company’s branding, such as logos or color schemes. |

Benefits of Regular Updates

By maintaining an up-to-date billing document, you can enjoy several benefits:

- Compliance: Stay aligned with legal requirements, such as tax laws or industry standards, to avoid penalties.

- Improved Client Experience: Provide clear, transparent, and professional documents that enhance your reputation.

- Minimized Errors: Regularly check for mistakes or outdated information, which helps avoid discrepancies that could delay payments.

- Efficient Processes: Streamlined billing systems reduce time spent on corrections and ensure faster processing of payments.

Regular updates to your financial documents ensure that your business operates smoothly, stays compliant, and presents a polished image to clients. By dedicating time to these revisions, you can streamline your operations and keep your business running efficiently.

Where to Find Quality Billing Documents

Finding the right billing document can make a significant difference in how your business handles transactions. A well-organized and clear document not only enhances your professional image but also ensures accuracy and consistency in your accounting. Whether you’re looking for a free or premium version, there are many resources available where you can find quality documents that meet your specific needs. Knowing where to search is key to finding the best option for your business.

Here are some popular sources for obtaining high-quality documents:

| Source | Pros | Cons |

|---|---|---|

| Online Document Platforms | Variety of styles, customizable formats, both free and paid options | Some platforms may require a subscription or sign-up |

| Accounting Software | Integrated with financial tools, automatic updates, easy to use | May require a subscription, some options have a learning curve |

| Freelance Designers or Agencies | Fully customized designs tailored to your business needs | Can be costly, may take time to design |

| Document Creation Tools (Google Docs, Microsoft Word) | Simple to use, no subscription required, customizable | May require more time to design manually, limited advanced features |

| Industry-Specific Websites | Specialized options tailored to specific businesses, free or paid | Options may be limited outside of your industry |

When choosing a source, consider factors such as ease of use, customization options, and whether the document suits your specific business needs. By researching and selecting the best source, you ensure that your financial documents are professional, functional, and tailored to your business operations.