Downloadable Invoice Template in Word Format for Easy Invoicing

In today’s fast-paced business environment, having an efficient method for managing financial transactions is essential. A well-structured document can significantly enhance professionalism and streamline communication with clients. By utilizing pre-designed formats, individuals and businesses can save time while ensuring accuracy in their financial dealings.

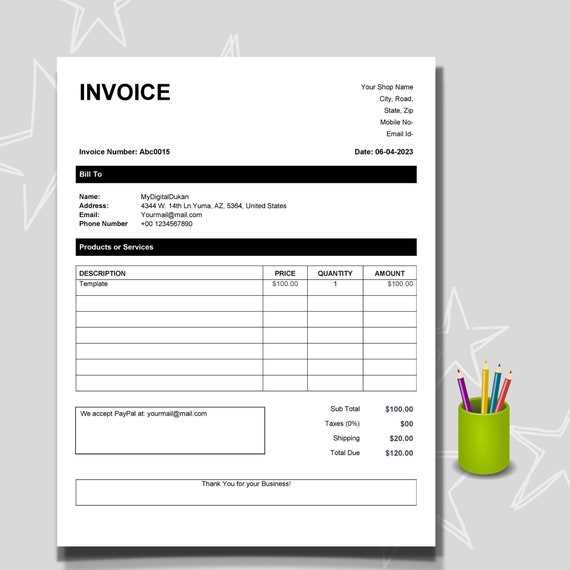

Personalization plays a vital role in making these documents stand out. Customizing elements such as branding, color schemes, and layout can help convey a unique identity, reflecting the essence of your business. Additionally, ensuring that these documents are user-friendly and easy to navigate can enhance client satisfaction.

Whether you are a freelancer, a small business owner, or part of a larger organization, employing effective billing solutions can lead to improved cash flow and better client relationships. This article explores various aspects of creating and utilizing these essential documents, guiding you towards a more organized financial approach.

Downloadable Invoice Template Word

In the realm of financial documentation, having readily accessible formats is crucial for streamlining billing processes. These resources provide an effective means to create professional documents that cater to specific business needs. With the right design and structure, these materials can simplify the task of managing client transactions, ensuring clarity and efficiency.

Advantages of Using Ready-Made Formats

Utilizing pre-designed resources offers numerous benefits, including time savings and consistency in appearance. Users can easily customize these materials to reflect their branding while maintaining a professional look. Additionally, employing such tools can reduce errors, as the structured layout guides users through the necessary components of financial records.

How to Access and Customize Your Documents

Many platforms offer a variety of options for obtaining these essential documents, often for free or at a minimal cost. Once accessed, users can modify elements such as fonts, colors, and layouts to suit their preferences. This level of customization ensures that the final product not only meets functional requirements but also aligns with the overall identity of the business.

Benefits of Using Invoice Templates

Implementing structured financial documents can significantly enhance the efficiency of managing transactions. These organized formats not only save time but also improve the overall presentation of billing information. By employing these resources, businesses can ensure consistency and professionalism in their communications with clients.

Time-Saving Efficiency

One of the primary advantages of utilizing structured documents is the ability to streamline the billing process. Instead of starting from scratch each time, users can quickly modify existing formats to fit their needs. This approach minimizes administrative work, allowing professionals to focus on other essential aspects of their business.

Improved Accuracy and Consistency

Structured documents help reduce errors commonly associated with manual entries. By following a predefined layout, users can ensure that all necessary information is included and correctly formatted. Additionally, using consistent designs fosters a sense of reliability and trust among clients, as they become accustomed to seeing a familiar style in their transactions.

How to Customize Your Invoice

Adapting your financial documents to reflect your unique brand identity is essential for maintaining professionalism. Customization allows you to personalize the layout, color schemes, and overall design, ensuring that your communications are both effective and visually appealing. By tailoring these documents to fit your business’s personality, you can enhance client relationships and convey a sense of trustworthiness.

Selecting the Right Design is the first step in customization. Consider your brand’s colors and fonts, as these elements should be consistent with your overall marketing materials. Choose a layout that is easy to read and navigate, highlighting critical information such as payment terms and contact details.

Incorporating Personal Touches is another important aspect of the customization process. Adding your logo, a personalized message, or unique identifiers can make your documents stand out. Ensure that all essential fields are present, and review the format for clarity and professionalism. This attention to detail will make a lasting impression on your clients.

Common Invoice Formats Explained

Understanding the various types of financial documents is crucial for effective billing and record-keeping. Different formats serve specific purposes and cater to distinct business needs. Familiarizing yourself with these styles can enhance your ability to choose the most suitable option for your transactions.

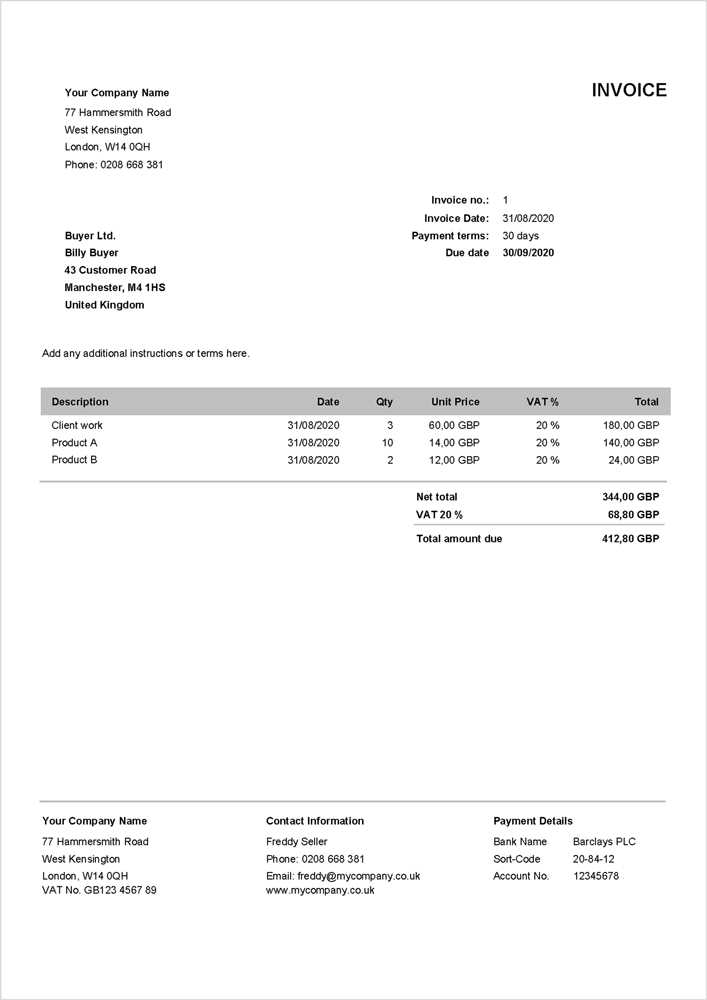

Standard Billing Documents

The most widely used format is the standard billing document, which includes essential components such as the date, itemized list of services or products, payment terms, and total amount due. This straightforward structure ensures clarity, making it easy for clients to understand their obligations. By using a well-organized layout, businesses can facilitate prompt payments and maintain a positive relationship with their customers.

Recurring Billing Statements

For businesses that offer subscription services or regular payments, recurring billing statements are beneficial. These documents streamline the process by providing a consistent format for ongoing charges, ensuring clients are aware of their upcoming obligations. Including details like frequency and duration helps avoid confusion and enhances transparency in financial dealings.

Best Practices for Invoicing

Implementing effective strategies for financial documentation can significantly improve your cash flow and client relationships. By adhering to established best practices, businesses can create clear and professional records that facilitate timely payments. This section highlights essential approaches that enhance the invoicing process and ensure a smoother transaction experience.

| Best Practice | Description |

|---|---|

| Clear Itemization | Provide a detailed breakdown of services or products rendered to enhance transparency and understanding. |

| Consistent Branding | Use your company logo and color scheme to maintain a professional image across all documents. |

| Prompt Delivery | Send your records promptly after the service or product delivery to encourage timely payment. |

| Payment Terms Clarity | Clearly state payment terms, including due dates and accepted methods of payment. |

| Follow-Up Reminders | Establish a system for reminding clients of upcoming or overdue payments to ensure timely responses. |

Free Resources for Invoice Templates

Accessing quality financial documents can significantly simplify the billing process for businesses of all sizes. Fortunately, there are numerous free resources available online that provide customizable formats to suit various needs. These tools not only save time but also help maintain a professional appearance in financial dealings.

Online Platforms Offering Free Formats

- Canva: Offers a variety of visually appealing designs that can be easily customized to fit your brand.

- Google Docs: Provides simple formats that can be modified and shared easily within teams.

- Invoice Generator: A user-friendly tool that allows you to create and download personalized documents in minutes.

- Zoho Invoice: Offers free billing solutions that include templates and automated features for small businesses.

Document Sharing Websites

- Template.net: A resource with a wide range of free formats available for download in different styles.

- Microsoft Office Online: Provides access to various document formats that can be edited using online tools.

- Freepik: Offers numerous graphic designs and layouts for creating attractive financial documents.

Choosing the Right Template Style

Selecting an appropriate design for your financial documents is essential for conveying professionalism and ensuring clarity. The right style not only reflects your brand’s identity but also enhances the reader’s experience. By considering various factors, you can choose a format that meets your specific needs and resonates with your clients.

Understanding Your Audience

Identifying your target audience is a critical step in choosing a design. Different clients may have varying preferences based on their industry and expectations. For example, a corporate client might appreciate a more traditional and formal appearance, while a creative industry client may prefer a modern and visually striking layout. Tailoring your choice to align with your audience’s expectations can foster a positive impression.

Evaluating Layout and Structure

The layout of your document should facilitate easy navigation and comprehension. Consider the arrangement of key elements such as headings, itemized lists, and totals. A well-organized structure will guide the reader’s eye and highlight important information effectively. Using ample white space can also improve readability and make the document appear less cluttered.

Integrating Invoices with Accounting Software

In today’s digital landscape, linking your billing documents with accounting systems can streamline financial processes and improve accuracy. This integration not only reduces manual data entry but also enhances tracking and reporting capabilities. By utilizing modern accounting software, businesses can achieve a more cohesive and efficient financial management system.

Benefits of Integration

- Time Savings: Automation of data transfer minimizes repetitive tasks, allowing teams to focus on higher-value activities.

- Improved Accuracy: Reducing manual entry lowers the risk of errors, ensuring that all financial records are correct.

- Real-Time Tracking: Immediate updates to accounts enable businesses to monitor cash flow and outstanding payments effortlessly.

- Enhanced Reporting: Integrated systems can generate comprehensive financial reports, providing valuable insights for decision-making.

Steps for Successful Integration

- Choose Compatible Software: Ensure that your accounting platform can seamlessly integrate with your chosen billing solution.

- Follow Setup Instructions: Carefully adhere to integration guidelines provided by the software to ensure a smooth connection.

- Test the Integration: Conduct tests to verify that data flows accurately between the systems before fully implementing the process.

- Train Your Team: Provide training to staff on how to utilize the integrated system effectively for optimal results.

Tracking Payments Effectively

Monitoring financial transactions is crucial for maintaining a healthy cash flow and ensuring timely receipt of funds. An effective tracking system allows businesses to stay on top of incoming payments, manage outstanding balances, and provide clients with accurate information regarding their accounts. By implementing organized methods and utilizing available tools, you can enhance your financial management processes.

Methods for Effective Tracking

Here are some strategies to improve payment tracking:

| Method | Description |

|---|---|

| Automated Systems | Utilize software solutions that automatically log and update payment statuses, reducing manual effort. |

| Regular Reconciliation | Consistently compare your records with bank statements to identify discrepancies and ensure accuracy. |

| Payment Reminders | Set up reminders for clients regarding upcoming due dates to encourage timely payments. |

| Clear Invoicing | Ensure that your billing documents are clear and detailed, outlining payment terms and due dates. |

| Tracking Reports | Generate regular reports to analyze payment trends, outstanding balances, and client payment behaviors. |

Legal Considerations for Invoices

Understanding the legal framework surrounding financial documents is essential for maintaining compliance and protecting your business interests. Properly structured financial statements not only facilitate smooth transactions but also safeguard against disputes and legal issues. Ensuring adherence to local laws and regulations is crucial in establishing trust with clients and avoiding potential pitfalls.

Key Legal Elements

When creating financial statements, consider the following essential components:

- Identification Information: Include your business name, address, and contact details, along with the recipient’s information, to establish a clear point of reference.

- Date of Issue: Clearly state the date the document is issued, which is critical for determining payment terms and timelines.

- Payment Terms: Specify the terms of payment, including due dates, acceptable payment methods, and any late fees that may apply.

- Itemized Charges: Provide a detailed breakdown of products or services rendered, including quantities and pricing, to enhance transparency.

- Tax Compliance: Ensure that any applicable taxes are correctly calculated and displayed, in accordance with local tax laws.

Consequences of Non-Compliance

Failing to adhere to legal standards can result in various repercussions, such as:

- Disputes with clients over unclear terms or charges.

- Potential legal action from regulatory bodies for non-compliance.

- Loss of credibility and trust with clients, which can affect future business opportunities.

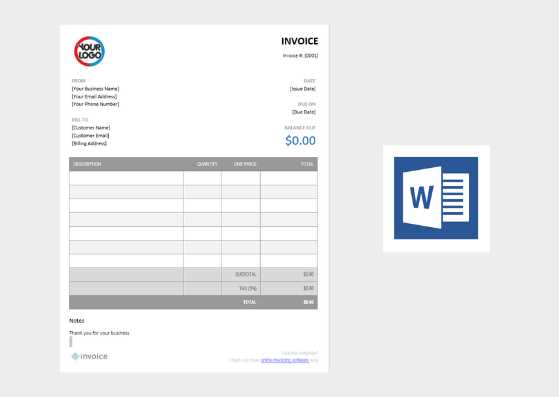

Designing Professional Invoices

Creating visually appealing and functional financial documents is essential for establishing a professional image and ensuring clarity in transactions. A well-designed statement not only reflects the quality of your business but also facilitates effective communication with clients. Attention to detail in the layout and presentation can enhance the overall user experience and promote timely payments.

Elements of Effective Design

When crafting your financial documents, consider incorporating the following key elements:

- Consistent Branding: Utilize your company logo, colors, and fonts to maintain brand consistency, making it easily recognizable to clients.

- Clear Layout: Organize information in a logical manner with clearly defined sections, making it easy for clients to navigate and understand the details.

- Readable Fonts: Choose legible fonts and appropriate sizes to ensure that all text is easily readable, even in print form.

- Whitespace Utilization: Incorporate sufficient whitespace to avoid clutter, allowing the recipient to focus on key information without distractions.

- Attention to Detail: Double-check for accuracy in figures and spelling to convey professionalism and reduce the risk of misunderstandings.

Incorporating Visual Elements

Adding visual elements can enhance the appeal of your financial documents:

- Graphs and Charts: Use visual representations to summarize information, making complex data more accessible.

- Color Coding: Implement color schemes to differentiate between various sections, aiding quick reference and comprehension.

- Icons: Incorporate icons for common actions or categories to provide visual cues that enhance the reading experience.

How to Save and Share Invoices

Effectively managing financial documents involves not only creating them but also ensuring they are stored securely and shared appropriately. Knowing how to save and distribute these documents can streamline your operations and enhance communication with clients. By following best practices, you can maintain professionalism while ensuring that all parties have access to necessary records.

One of the first steps in handling financial documents is to choose the right file format for saving. Common formats include PDF, which preserves formatting and is widely accepted, or Excel, which allows for easy editing and calculations. It’s essential to use descriptive filenames that include details like the client’s name and the date to facilitate easy retrieval later. For example, naming a file “ClientName_2024-11-05_Receipt” helps in organizing and identifying documents quickly.

When it comes to sharing these documents, several methods can be employed:

- Email: Sending files directly through email is a quick way to share documents. Always use a professional tone in your message and attach the file in a universally accepted format.

- Cloud Storage: Utilizing services like Google Drive, Dropbox, or OneDrive allows for easy sharing and access control. You can share links to documents, ensuring that only authorized individuals can view or edit them.

- Client Portals: If you have a dedicated platform for clients, uploading documents there can enhance security and provide a central location for accessing all relevant materials.

Regardless of the method chosen, it is vital to ensure that the recipients have the necessary permissions to access the documents while maintaining confidentiality and security of sensitive information. By following these practices, you can efficiently manage and distribute financial records, fostering better relationships with your clients.

Using Templates for Recurring Invoices

Managing ongoing billing processes can be time-consuming and often requires meticulous attention to detail. Utilizing pre-designed documents can significantly streamline this task, allowing for consistent presentation and accuracy across all communications. This approach not only saves time but also enhances professionalism, ensuring that clients receive clear and organized statements regularly.

By adopting structured documents for repeated transactions, businesses can maintain uniformity in their financial communications. This can be particularly beneficial for service providers who engage in regular engagements with clients. A well-structured format allows for easy updates and modifications, enabling businesses to adjust pricing, services, or other details as necessary without starting from scratch each time.

Here are some advantages of using structured documents for ongoing billing:

- Efficiency: Pre-made formats can significantly reduce the time spent on creating new documents for each billing cycle, allowing for quicker processing and distribution.

- Consistency: Maintaining a uniform style helps reinforce brand identity and fosters trust with clients, as they receive familiar and recognizable documents.

- Customization: Many formats can be easily modified to accommodate changes in pricing, services, or client information while retaining the overall structure.

Implementing a systematic approach to recurring billing not only enhances operational efficiency but also contributes to improved cash flow management. By leveraging structured documents, businesses can ensure timely billing and foster better relationships with their clients.

Importance of Invoice Numbering

Properly organizing billing documents is crucial for any business, and one of the key aspects of this organization is the systematic numbering of each record. Implementing a unique identifier for each financial statement not only helps maintain a clear order but also facilitates better tracking and management of transactions. This practice can lead to increased efficiency in financial operations and better communication with clients.

Utilizing sequential identifiers serves multiple purposes. Firstly, it allows businesses to quickly reference and retrieve specific documents, which is particularly beneficial during audits or when addressing client inquiries. Secondly, having a consistent numbering system can help in spotting any discrepancies or missing records, thereby enhancing accountability and transparency in financial dealings.

Here are some key reasons why having a structured numbering system is essential:

- Organization: Sequential numbers create a clear and orderly method for cataloging documents, making it easier to manage records.

- Professionalism: A well-structured numbering system reflects positively on a business, showcasing attention to detail and commitment to organized financial practices.

- Legal Compliance: In many jurisdictions, maintaining a sequential order is a legal requirement, helping to ensure that all financial records are accurate and complete.

In conclusion, adopting a systematic approach to numbering can significantly enhance the efficiency and reliability of financial documentation. By ensuring each document is uniquely identified, businesses can streamline their operations and foster stronger relationships with their clients.

Tips for Avoiding Invoice Mistakes

Ensuring accuracy in financial documents is essential for maintaining positive relationships with clients and ensuring timely payments. Mistakes can lead to confusion, delayed payments, and can negatively impact a business’s reputation. Implementing effective strategies can minimize errors and streamline the billing process.

Here are some valuable tips to help avoid common pitfalls:

- Double-Check Information: Always review all details before sending out financial documents. Confirm that the client’s name, address, and payment terms are correct.

- Use Clear Descriptions: Provide specific descriptions of the services or products provided. This clarity helps clients understand what they are being billed for and can prevent disputes.

- Implement a Standardized Format: Consistency is key. Use a uniform structure for all documents to ensure nothing is overlooked. A standardized format also makes it easier to spot errors.

- Automate Where Possible: Utilize software that can help generate and track financial documents. Automation reduces the chance of human error and speeds up the process.

- Keep Records Organized: Maintain an orderly filing system for all transactions. This organization allows for easier reference and helps in identifying discrepancies quickly.

By adopting these practices, businesses can significantly reduce the likelihood of errors, enhance their credibility, and improve cash flow through timely and accurate financial communications.

What to Include in Your Invoice

Creating clear and comprehensive financial documents is essential for ensuring that clients understand the charges and can process payments without confusion. Including all necessary elements will help streamline the transaction process and enhance professionalism.

Here are the key components to incorporate in your financial document:

| Component | Description |

|---|---|

| Header | Include your business name, logo, and contact information at the top to establish identity. |

| Date | Specify the date the document is issued and, if applicable, the due date for payment. |

| Recipient Details | Clearly list the client’s name, address, and contact information to ensure proper delivery. |

| Unique Identification Number | Assign a unique reference number to facilitate tracking and organization of transactions. |

| Itemized List of Products/Services | Provide a detailed breakdown of what is being charged, including descriptions, quantities, and individual prices. |

| Total Amount Due | Clearly state the total amount that is owed, including any taxes or additional fees. |

| Payment Terms | Outline the accepted payment methods and any specific terms, such as penalties for late payments. |

By ensuring that each of these components is present, you will create a professional document that facilitates understanding and expedites the payment process.

Templates for Different Industries

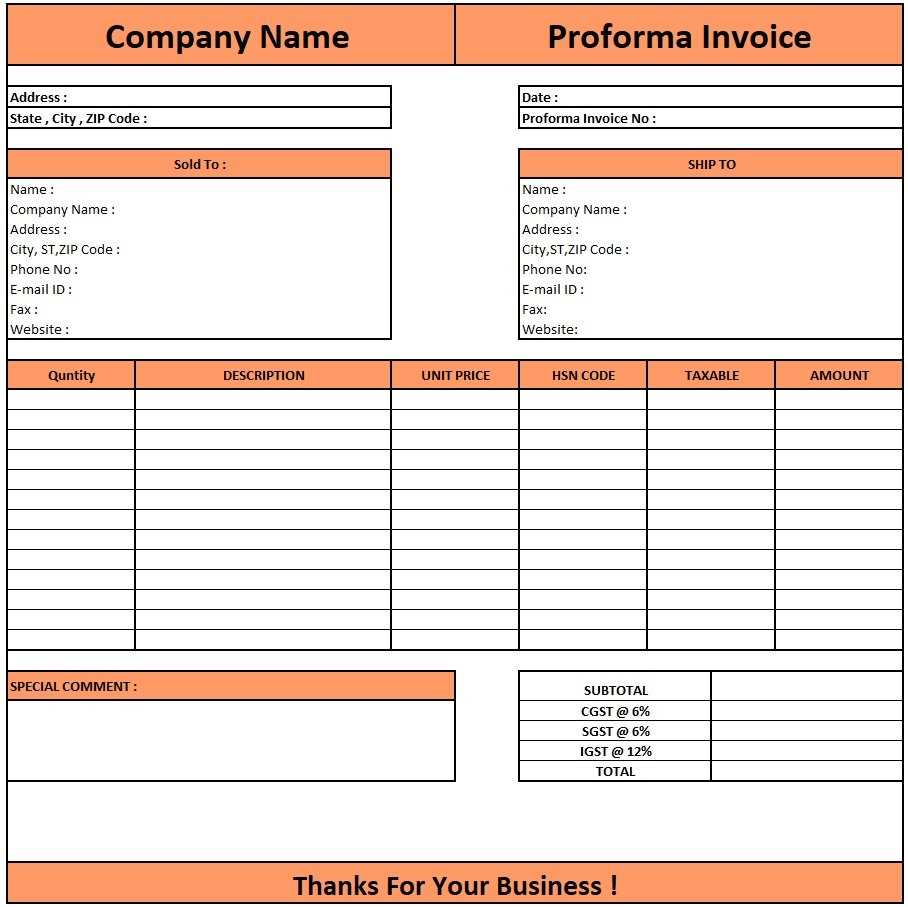

Various sectors have unique requirements and standards when it comes to generating financial documents. Understanding these specific needs can help ensure that the provided records meet industry expectations and enhance professionalism.

Here are some common industries and the types of documents that suit their specific needs:

- Freelance Services

- Detail-oriented documents that break down hours worked and rates charged.

- Inclusion of project descriptions and delivery timelines to maintain transparency.

- Construction

- Comprehensive records that include materials, labor, and any subcontractor fees.

- Progress billing options to accommodate large-scale projects with multiple phases.

- Retail

- Simplified forms that highlight items sold, quantities, and applicable taxes.

- Clear return policies and payment options to streamline customer transactions.

- Consulting

- Structured documents that summarize services provided and their associated costs.

- Clear terms of service and payment deadlines to set client expectations.

- Healthcare

- Detailed records that itemize services rendered and any associated fees.

- Patient information privacy considerations and insurance billing practices.

By tailoring records to meet the specific requirements of each sector, businesses can ensure better clarity and adherence to industry norms, fostering trust and satisfaction among clients.

Getting Feedback on Your Invoices

Seeking input on financial documents is crucial for improving clarity and ensuring that they meet the expectations of clients. By collecting and analyzing feedback, businesses can identify areas for enhancement and ultimately foster stronger relationships with their customers.

Importance of Client Input

Understanding how recipients perceive and interact with the provided records can reveal insights into their effectiveness. Client input can help identify:

- Areas of confusion or misunderstanding.

- Elements that may be missing or need additional details.

- Overall satisfaction with the format and presentation.

Methods for Collecting Feedback

There are several effective ways to gather opinions from clients regarding the financial documents:

- Surveys: Distributing short questionnaires can help gauge client satisfaction and identify specific concerns.

- Follow-Up Conversations: Engaging clients in direct conversations can yield valuable insights and foster open communication.

- Feedback Forms: Including a simple feedback form along with financial documents can encourage clients to share their thoughts easily.

By actively seeking and implementing feedback, businesses can continuously refine their financial documents, leading to improved client experiences and enhanced professionalism.