Download and Customize Editable Invoice Template

Managing finances and ensuring prompt payments can be a challenge for any business. One of the most crucial tools in this process is having a reliable method for creating professional billing documents. A well-designed form can help present your charges clearly, reflect your brand’s identity, and streamline your payment collection process.

With the right resources, creating such documents becomes a straightforward task. Instead of relying on complicated software or spending time designing from scratch, you can access pre-made options that allow for quick customization. These flexible solutions enable you to tailor the layout, fields, and content to suit the unique needs of your business.

Whether you are a freelancer, a small business owner, or part of a larger company, using versatile billing documents can save you time and effort. The ability to adjust every detail ensures that your invoices are both professional and aligned with your company’s standards, making them easier to use and understand for clients.

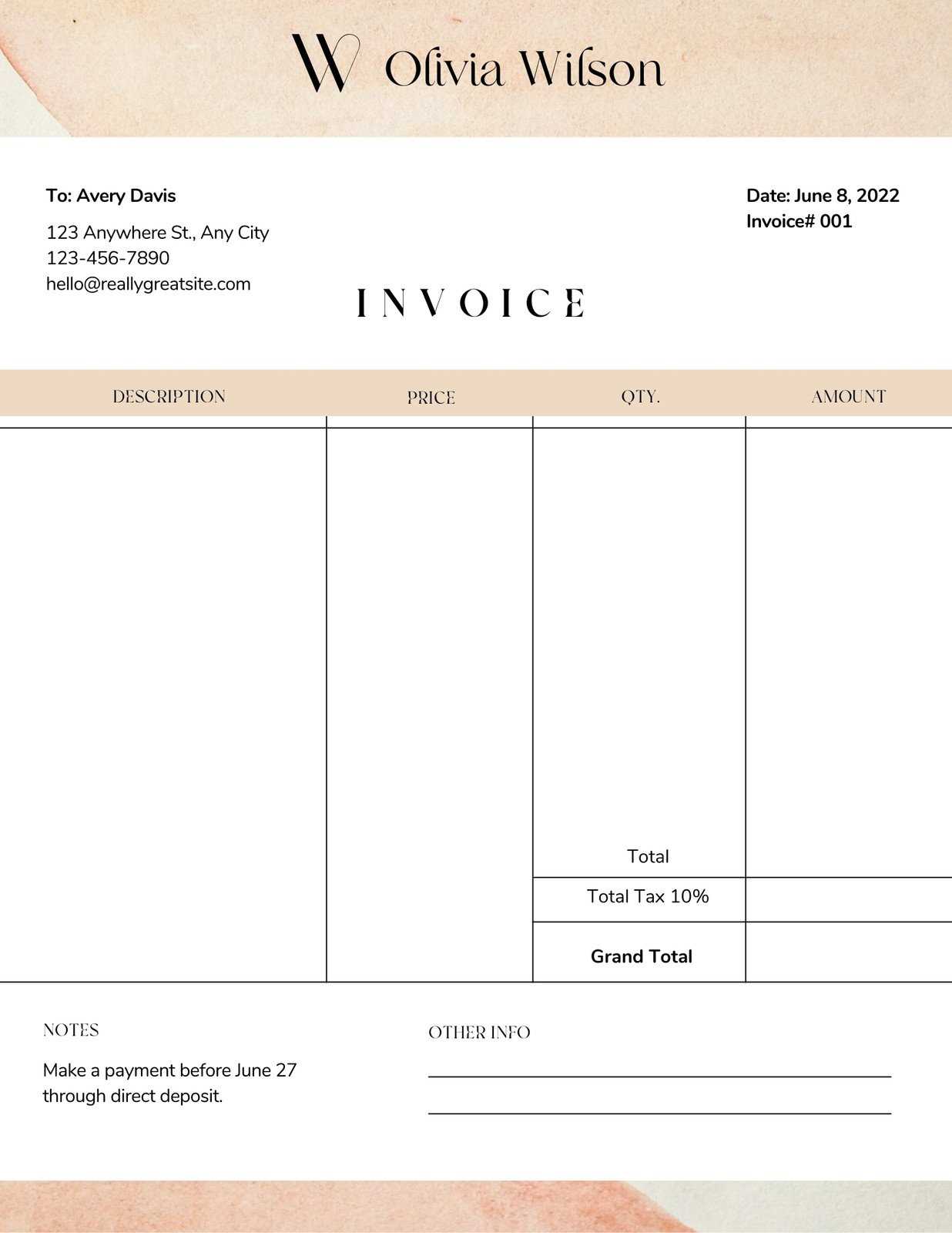

Downloadable Editable Invoice Template

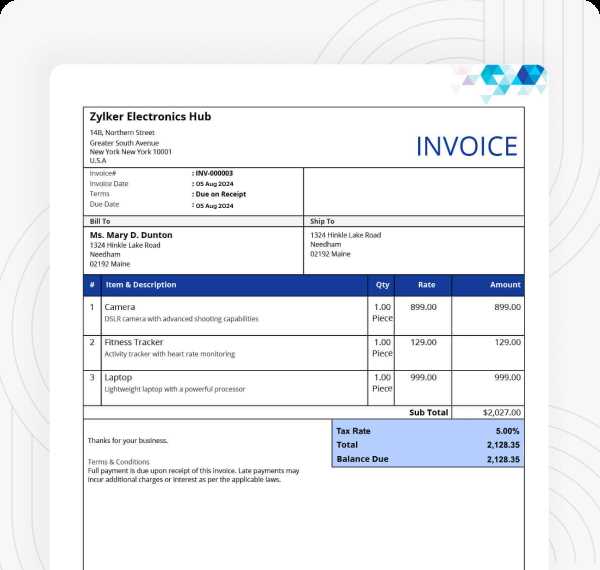

Having access to customizable billing forms is a vital resource for any business. These forms can be tailored to match the specific needs of your company, ensuring clarity and professionalism in your communications with clients. With a variety of pre-designed options available, it’s easier than ever to create polished documents that reflect your brand identity and facilitate prompt payment.

The beauty of these customizable solutions lies in their flexibility. You can modify fields, add logos, adjust the layout, and even include payment terms to match the nature of your services. This makes it possible to streamline the billing process, eliminating errors and improving the overall customer experience.

For small businesses, freelancers, or larger enterprises, using a customizable billing form simplifies the process of issuing payments. Instead of manually creating each document from scratch, you can quickly generate professional paperwork that meets your specific business requirements and ensures timely compensation.

Why Choose an Editable Invoice Template

Customizing your billing documents offers significant advantages for businesses of all sizes. The ability to adjust each element of the document ensures that it aligns with your specific needs and reflects the professional standards of your company. This flexibility helps to create more accurate and polished communications with clients, fostering stronger relationships and improving payment efficiency.

Flexibility to Meet Business Needs

By choosing a customizable option, you gain the ability to modify details such as the layout, payment terms, and even the design of the document. This customization ensures that every transaction is documented clearly and professionally, tailored to your company’s branding and communication style. You can also easily add or remove information depending on the requirements of each individual client or project.

Time and Cost Efficiency

Instead of spending time creating a new document from scratch every time you need to bill a client, a customizable form allows for quick adjustments, reducing the amount of work required for each transaction. This not only saves time but also minimizes the likelihood of errors, leading to fewer revisions and faster payments.

Benefits of Customizable Invoice Designs

Customizing your billing documents brings numerous advantages that can enhance your business operations. The ability to adjust the appearance and structure of your forms allows you to create professional, clear, and effective communication with clients. This customization ensures that every detail reflects your company’s image and helps maintain consistency in all interactions.

One of the main benefits of tailored forms is their ability to improve efficiency. By modifying the design and layout to your specific needs, you can streamline the billing process, making it faster and more accurate. The flexibility to adjust terms, itemized lists, or payment instructions means that you can provide clients with exactly the information they need without confusion or delays.

Additionally, personalized documents can enhance your brand identity. Including logos, custom fonts, and specific color schemes ensures that each document carries your company’s distinct look, reinforcing your professionalism and making your communications instantly recognizable.

How to Edit Your Invoice Template

Editing your billing document is a straightforward process that can be done with the right tools. Customizing your form allows you to adjust details such as payment terms, itemized charges, and contact information. Whether you are making minor tweaks or major changes, understanding how to efficiently modify the document is essential for keeping your transactions clear and professional.

Step-by-Step Guide to Modifying Your Form

Follow these simple steps to edit your document quickly and effectively:

- Select the Right Software: Choose an easy-to-use editing tool such as a word processor or spreadsheet software, which allows you to modify text and fields.

- Open the Document: Open your pre-designed form in the chosen software. Ensure that it’s compatible with the program you are using for a smooth editing experience.

- Modify Fields: Edit fields such as company name, client details, item descriptions, and prices. Make sure the information is accurate for each transaction.

- Add Personalization: Include your company logo, brand colors, and other design elements to match your business’s visual identity.

- Save and Export: After editing, save the document in your desired format (PDF, Word, etc.) for easy sharing and printing.

Tips for Efficient Editing

- Consistency: Maintain consistent formatting throughout the document, including font style, size, and color, to ensure clarity and professionalism.

- Accuracy: Double-check all client details, payment terms, and amounts before finalizing the document to avoid errors.

- Save as a Master Copy: Keep a blank version of the document that can be used for all future transactions to save time on repetitive changes.

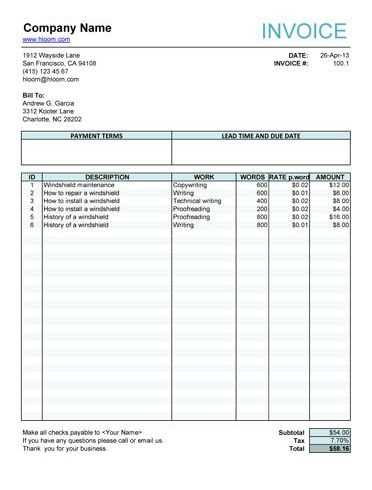

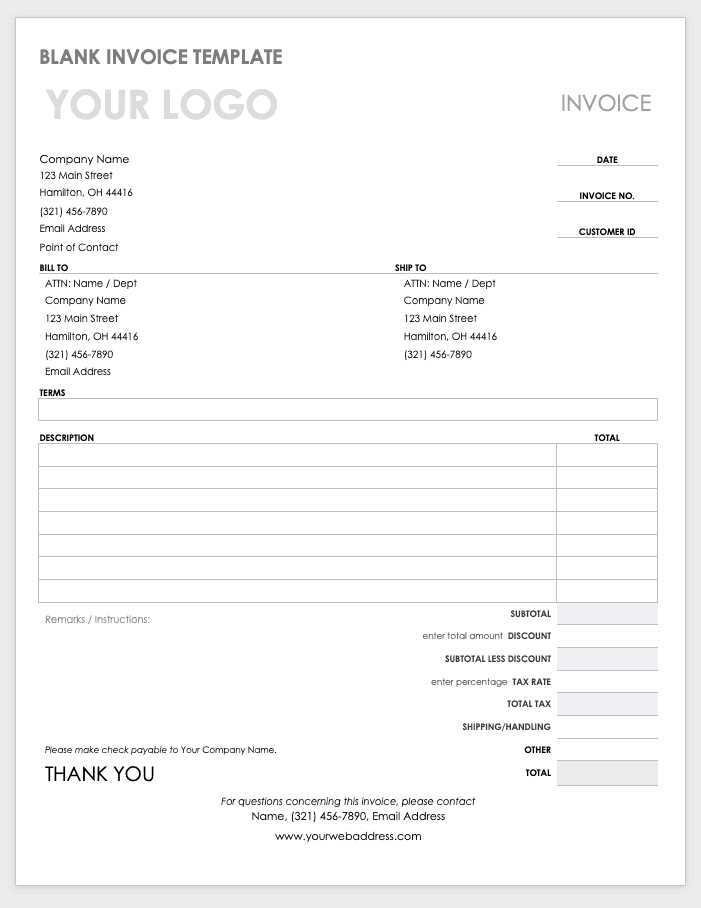

Best Software for Editing Invoice Templates

Choosing the right software for customizing your billing forms is essential to ensure accuracy, efficiency, and a professional look. The ideal tool should allow easy modification of text, fields, and design elements, while offering flexibility to suit your specific needs. Below are some of the top options available for creating and adjusting your documents quickly.

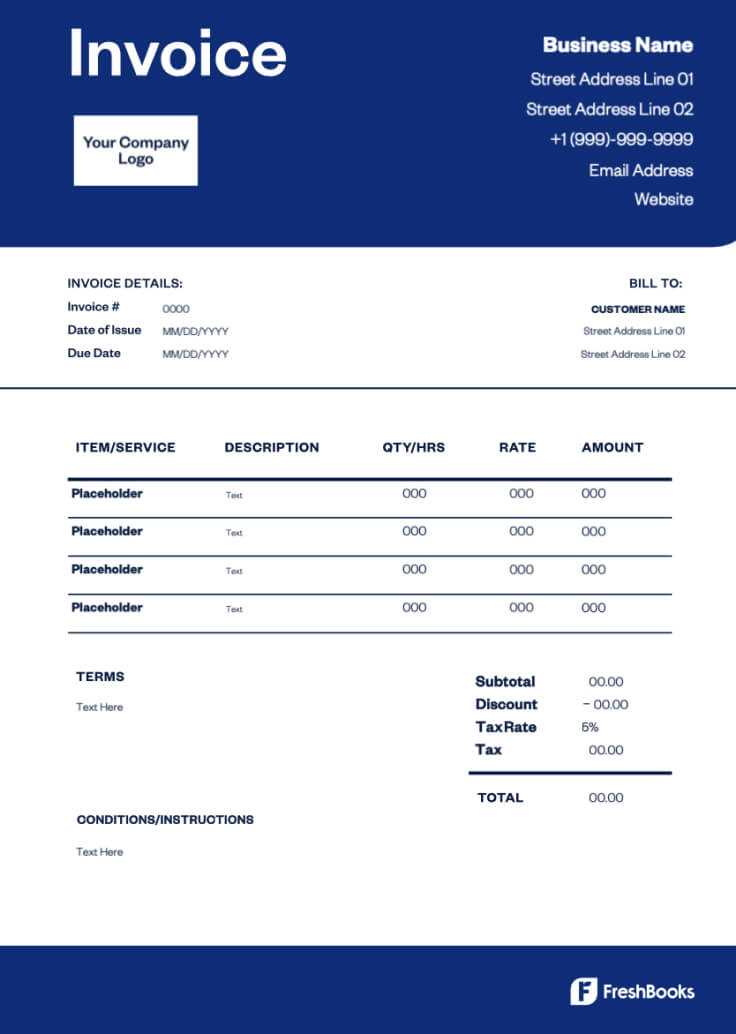

Top Software Options for Customizing Forms

| Software | Features | Best For |

|---|---|---|

| Microsoft Word | Easy text editing, flexible design options, customizable layouts | Businesses that need simple, quick adjustments |

| Google Docs | Cloud-based, accessible from anywhere, easy collaboration | Teams or freelancers needing cloud access and real-time editing |

| Excel | Spreadsheet-based, automatic calculation of totals, customizable fields | Companies needing automatic calculations for large lists of services or products |

| Canva | Easy-to-use graphic design features, customizable templates | Businesses focused on visual branding and design |

| Zoho Invoice | Dedicated invoicing software with client management, reporting features | Businesses looking for an all-in-one solution |

Choosing the Right Tool for Your Needs

The best choice for your business depends on your specific requirements. If you need advanced design flexibility, software like Canva is ideal, while Excel is better suited for those who require automatic calculations. For a simple, cloud-based option, Google Docs is an excellent choice, while Zoho Invoice provides a dedicated invoicing solution with additional management features.

Creating Professional Invoices with Templates

Generating polished, professional documents for your clients is crucial for maintaining a strong business image and ensuring smooth financial transactions. Using pre-designed forms allows you to quickly create well-structured paperwork that not only looks professional but also contains all the necessary information. These ready-made solutions make it easier to focus on your business while presenting accurate and clear details to your clients.

By utilizing ready-made designs, you can customize important aspects such as payment terms, services provided, and your company’s branding. This ensures consistency across all your communications and saves time when managing multiple clients. Customizing these documents can also help you maintain a professional look, which reflects well on your brand and promotes trust with clients.

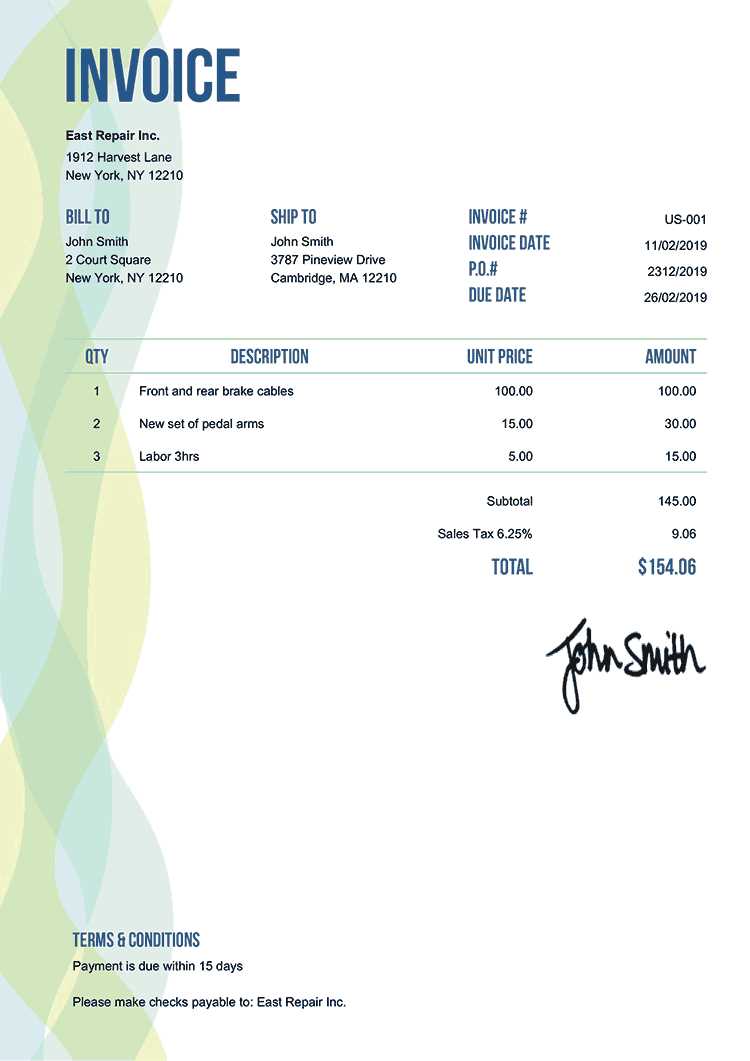

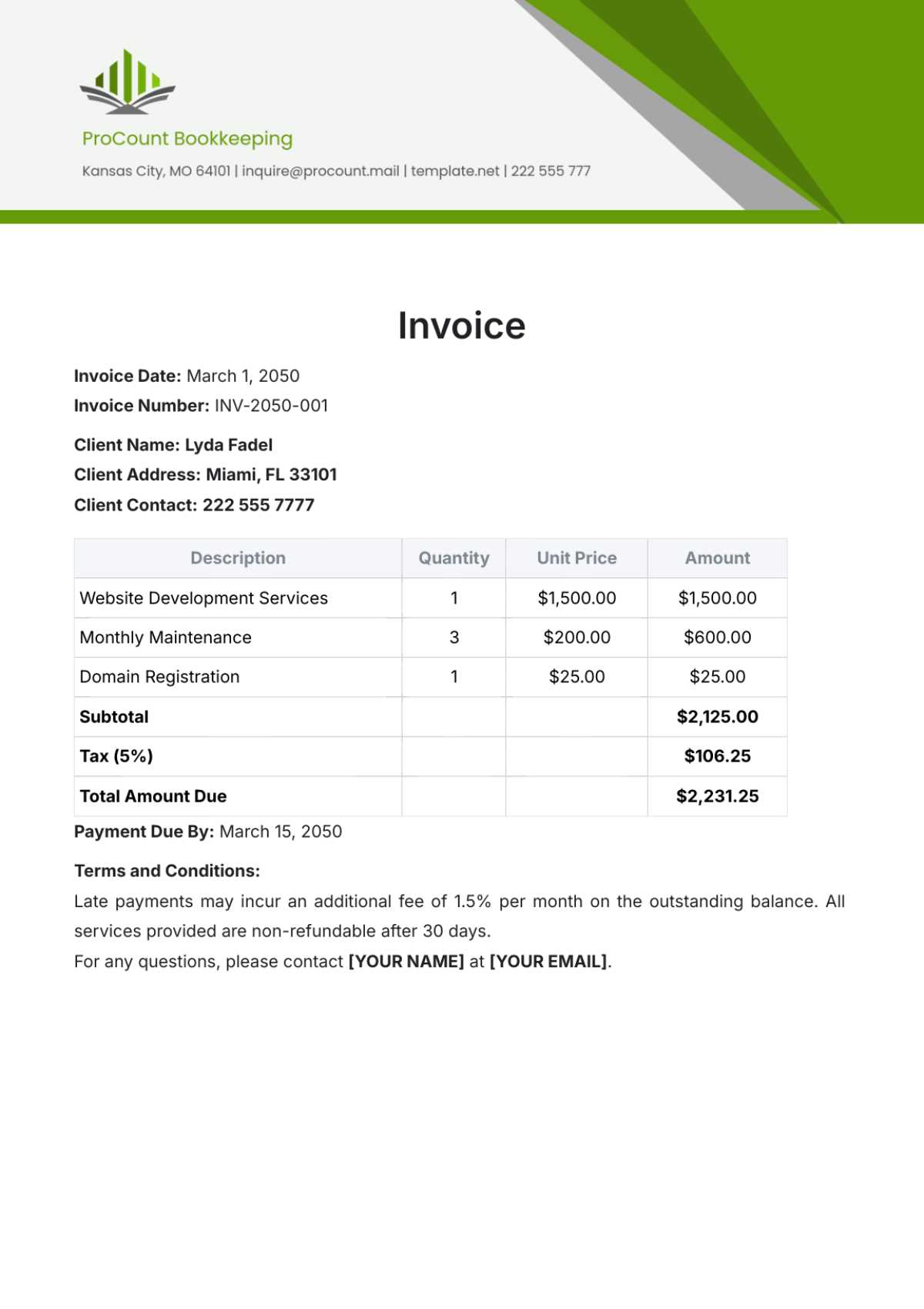

Key Elements of a Professional Document

| Element | Description |

|---|---|

| Contact Information | Include your business name, address, and contact details to ensure clear communication. |

| Payment Terms | Specify the due date, accepted payment methods, and any applicable late fees. |

| Services or Products | Clearly list the products or services provided, including quantities and prices. |

| Branding | Incorporate your company logo and use brand colors to create a consistent look. |

| Itemized Breakdown | Provide a detailed breakdown of charges for transparency and clarity. |

By including these elements in your documents, you ensure that all the necessary details are easily accessible, helping clients understand charges and improving your chances of timely payments. A professional approach to billing can have a positive impact on your business relationships and boost your reputation as a reliable partner.

How to Add Your Company Logo

Incorporating your company logo into your billing documents is an essential step in enhancing your brand identity. It ensures consistency across all business communications and adds a professional touch to your paperwork. A well-placed logo not only makes your documents visually appealing but also helps clients recognize your brand instantly.

To add your logo, you’ll typically need to upload or insert an image file (such as PNG or JPEG) into the document. The process is simple and can be done using most word processors or design software. Below is a general guide to help you add your company logo efficiently:

Steps to Add Your Logo

- Prepare the Image: Ensure that your logo is in a high-quality format with a transparent background for better integration with your document.

- Open Your Document: Use the editing software you are comfortable with (e.g., Microsoft Word, Google Docs, or a design tool) to open your billing form.

- Insert the Logo: Use the “Insert” function in your software to place the image file of your logo. Position it at the top or in a location that is easily visible but doesn’t overcrowd the form.

- Adjust Size and Position: Resize the logo to fit the layout of your document. Ensure it’s not too large or small, as it should remain clear and professional without overpowering the content.

- Save and Export: Once you’re satisfied with the placement and size, save the updated document in your desired format (PDF, DOCX, etc.).

Adding your logo is a quick yet effective way to enhance the professional appearance of your documents, making them more recognizable and reinforcing your business’s visual identity. With just a few simple steps, you can create polished and consistent branding across all your client communications.

Incorporating Payment Terms in Invoices

Clear payment terms are crucial for ensuring smooth financial transactions between businesses and clients. Including these terms in your billing documents helps to set expectations and avoid confusion regarding due dates, payment methods, and any penalties for late payments. By specifying these details upfront, you create a transparent agreement that promotes trust and timely settlements.

When adding payment terms, it is important to be specific and concise. The terms should outline the amount due, the due date, accepted payment methods, and any applicable discounts or late fees. This not only helps clients understand their obligations but also reduces the likelihood of delayed payments.

Key Elements of Payment Terms

- Due Date: Specify the exact date by which payment is expected. For example, “Payment due within 30 days from the issue date.”

- Accepted Payment Methods: Clearly state how the client can pay, whether by bank transfer, credit card, PayPal, or other methods.

- Late Fees: Mention any late fees or interest charges that will be applied if payment is not received by the due date.

- Early Payment Discounts: If you offer discounts for early payment, specify the conditions, such as “10% discount if paid within 10 days.”

Why Payment Terms Matter

Including detailed payment terms in your documents not only improves cash flow but also protects your business from payment delays. It clarifies the expectations for both parties, making it easier to follow up on overdue payments and minimizing misunderstandings. By addressing payment specifics in advance, you can ensure a smoother financial process and strengthen your client relationships.

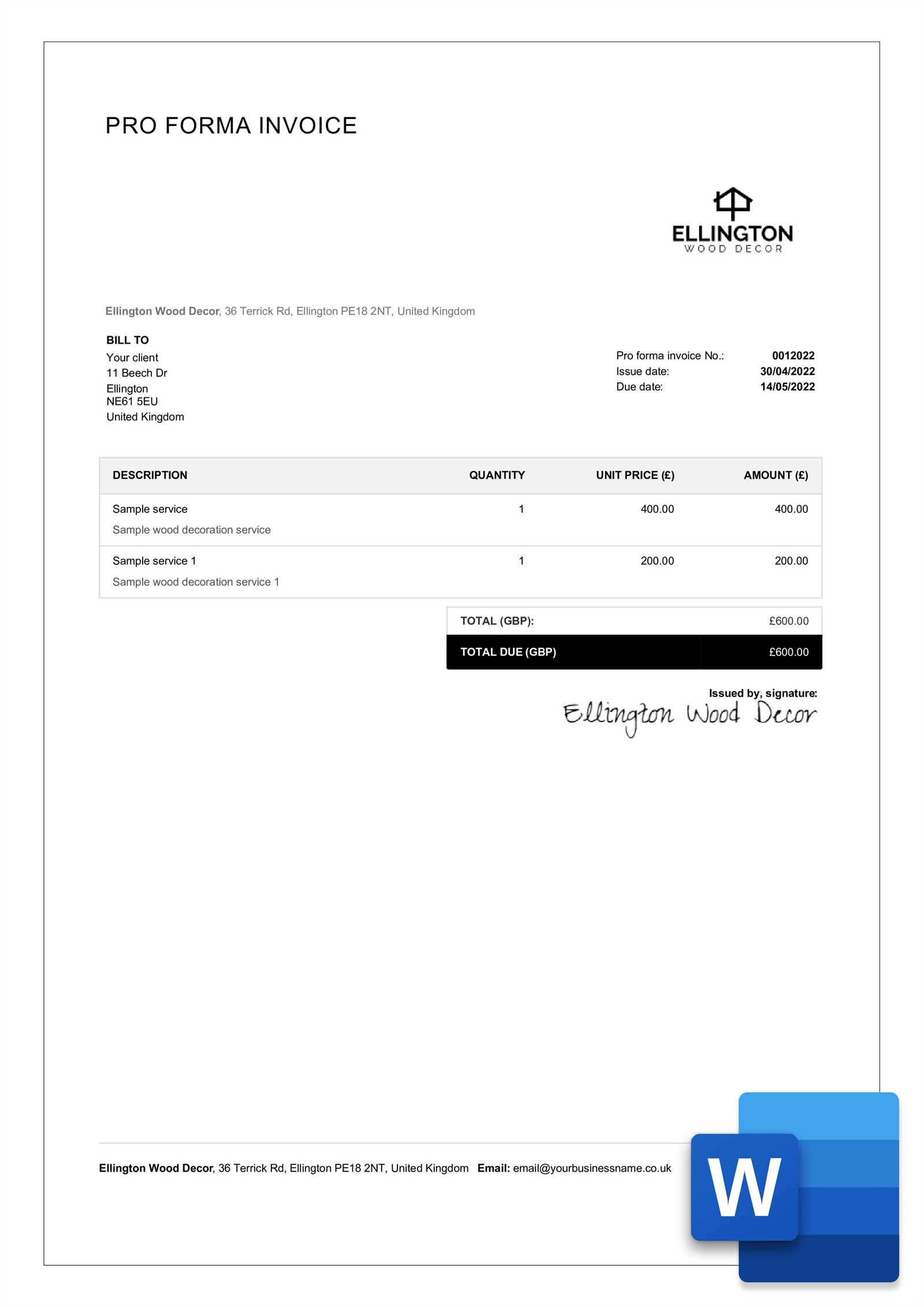

Free vs Paid Editable Invoice Templates

When selecting a design for your billing documents, one of the main decisions is whether to use a free or paid solution. Both options have their advantages and disadvantages, depending on your specific needs. Free solutions are readily accessible and can be a good starting point for businesses with basic requirements. However, premium designs often offer more advanced features and greater customization to match your business’s unique branding and workflow.

In this section, we’ll explore the differences between free and paid options, highlighting the key benefits and limitations of each. Understanding these distinctions will help you make an informed decision on which option best suits your business needs.

Advantages of Free Designs

- Cost-Effective: Free solutions are ideal for small businesses or freelancers with tight budgets.

- Quick Access: These forms are readily available and can be used almost immediately after downloading.

- Simplicity: Basic designs are easy to use and suitable for businesses with straightforward billing needs.

- No Commitment: Free options often don’t require any long-term commitments or subscriptions.

Benefits of Paid Options

- Advanced Customization: Paid designs often allow for more detailed and flexible adjustments to better reflect your brand.

- Professional Features: Premium options may include additional functionalities such as automated calculations, client management tools, or built-in payment tracking.

- Higher Quality: Paid designs generally offer higher-quality visuals, fonts, and layouts that give your documents a polished, professional appearance.

- Ongoing Support: With a paid option, you may receive customer service or technical support to help with any issues you encounter.

Choosing between free and paid designs ultimately depends on your business’s requirements and budget. Free designs are an excellent choice for startups or individuals just starting, while paid options can provide long-term value with greater flexibility and additional features to enhance your client interactions.

How to Ensure Invoice Accuracy

Ensuring the accuracy of your billing documents is crucial for maintaining professionalism and avoiding any payment disputes. A mistake in the details can lead to confusion, delayed payments, or even lost business. Therefore, taking the time to double-check every aspect of your documents before sending them out is a vital step in the billing process.

Accurate billing is not just about entering the correct amounts; it also involves verifying client details, item descriptions, and payment terms. By following a structured process, you can minimize errors and ensure your documents reflect the true amount owed.

Key Tips for Accuracy

- Double-Check Client Information: Always confirm that the recipient’s name, address, and contact details are correct to avoid miscommunication.

- Review Product or Service Details: Ensure that descriptions, quantities, and unit prices match the terms agreed upon with your client.

- Confirm the Total Amount: Verify that the totals add up correctly and include any taxes, discounts, or additional fees.

- Cross-Verify Payment Terms: Check that the payment terms, due dates, and any late fees are clearly stated and accurate.

- Use Automated Tools: Leverage digital tools or software that automatically calculate totals, reducing the risk of manual errors.

Why Accuracy Matters

Accurate documents not only help in getting paid on time but also project an image of professionalism. By consistently delivering precise billing documents, you build trust with your clients, improve cash flow, and avoid unnecessary disputes or delays in payments.

Tips for Streamlining the Billing Process

Efficient billing is essential for smooth financial management in any business. Streamlining the process not only reduces the risk of errors but also saves time and ensures faster payments. By optimizing your billing system, you can focus more on running your business and less on administrative tasks.

Implementing a few strategic practices can help make the billing process faster, more accurate, and less stressful. Whether you’re handling a few transactions or managing a large volume of clients, these tips can enhance the way you handle your financial documents.

Key Strategies for Efficiency

- Automate Repetitive Tasks: Use software to automatically generate documents, calculate totals, and send reminders, reducing the need for manual data entry.

- Standardize Formats: Establish a consistent format for your financial documents to make the process quicker and easier to manage.

- Organize Client Information: Keep a well-organized database with up-to-date client details, which can be easily accessed when generating new documents.

- Set Clear Payment Terms: Ensure that payment expectations, such as due dates and fees for late payments, are clearly defined and easy for clients to understand.

- Regularly Follow Up: Set reminders for following up on overdue payments to avoid delays in the payment process.

Tools for Simplifying Billing

| Tool | Description | Benefit |

|---|---|---|

| Accounting Software | Automates the creation of financial documents and tracks payments | Reduces manual effort and ensures accuracy |

| Payment Gateways | Allows clients to pay directly online | Speeds up the payment process and minimizes delays |

| Templates | Pre-designed forms for easy document creation | Reduces time spent creating documents from scratch |

By incorporating these strategies and tools into your routine, you can significantly improve the efficiency of your financial workflows, ultimately leading to quicker payments and better cash flow management.

Common Invoice Mistakes to Avoid

Even the smallest mistakes in your billing documents can lead to confusion, payment delays, or disputes with clients. By being aware of common errors, you can ensure that your financial records are clear, professional, and accurate. Preventing mistakes not only boosts your credibility but also helps maintain smooth business operations.

While most mistakes are easily avoidable, they can sometimes be overlooked, leading to unnecessary issues down the line. Below are some of the most common mistakes to watch out for when creating your financial documents.

Common Mistakes to Avoid

- Incorrect Client Information: Always double-check the client’s name, address, and contact details. An error here can cause your documents to be sent to the wrong person or department, delaying payment.

- Missing or Wrong Item Descriptions: Ensure that the products or services listed are clear and accurate. Vague descriptions can lead to misunderstandings and disputes over charges.

- Unclear Payment Terms: Be explicit about payment due dates, late fees, and acceptable payment methods. Ambiguous terms can cause delays in receiving payment.

- Mathematical Errors: Simple calculation mistakes can undermine your professionalism. Always double-check totals, taxes, discounts, and any other figures.

- Failure to Include Tax Information: If applicable, ensure that tax rates and amounts are correctly stated. This prevents issues for both you and the client come tax season.

How to Prevent Mistakes

- Use Software or Tools: Automated tools can help reduce human errors by calculating totals and filling in client details.

- Proofread Documents: Always review your documents for accuracy before sending them out.

- Standardize Your Format: Establish a clear and consistent layout for your documents, making it easier to spot mistakes.

By paying attention to these common mistakes and taking the necessary precautions, you can maintain a professional approach to your billing and ensure timely payments from clients.

How Editable Invoices Improve Efficiency

Streamlining the billing process is crucial for maintaining smooth business operations. By using flexible document formats, businesses can enhance their efficiency and reduce the time spent on administrative tasks. These adaptable formats allow for faster document creation, easy updates, and consistent customization, all of which contribute to a more organized workflow.

When the process of generating and modifying financial records is simplified, businesses can focus more on delivering their products or services rather than getting bogged down in paperwork. This flexibility offers several key benefits that can improve both internal processes and client interactions.

Key Benefits of Using Customizable Documents

- Faster Document Creation: Having a pre-made structure to work with means less time spent on designing or re-entering information, allowing for quicker turnaround on transactions.

- Reduced Errors: With fields that can be easily updated, you can eliminate the risk of outdated information being used, which helps avoid mistakes that could cause delays or misunderstandings.

- Consistent Branding: Flexibility in design allows you to maintain a consistent look for all your financial documents, reinforcing your brand identity and professionalism in client communications.

- Easy Customization: Adjusting details such as product descriptions, payment terms, and amounts can be done quickly and accurately, saving time when dealing with varied client needs.

Improving Client Relationships

- Quick Response to Changes: Customizable documents enable you to swiftly adapt to client requests or updates, ensuring that the billing process stays aligned with their expectations.

- Better Client Experience: By providing clean, error-free documents that reflect professionalism and clarity, you foster trust and improve the overall client experience.

Incorporating flexible document formats into your billing process not only enhances efficiency but also promotes a more professional and client-friendly approach to managing financial transactions.

Organizing and Storing Your Invoices

Proper organization and storage of financial documents are essential for maintaining an efficient and smooth business operation. By keeping your records well-organized, you can easily track transactions, manage client relationships, and stay prepared for audits or tax season. A clear and systematic approach to storing these important files ensures that you can retrieve them quickly when needed and reduces the risk of misplacing or losing critical information.

Effective management of your records goes beyond just saving them; it involves categorizing, labeling, and archiving them in ways that make them easily accessible, secure, and compliant with any regulatory requirements. Below are some best practices to help you stay organized and keep your files in top condition.

Best Practices for Organizing Records

- Use Clear File Naming Conventions: Create a consistent system for naming your documents. Include key details such as the client name, the date, and a brief description of the service provided. This makes it easier to search and locate specific records.

- Category-Based Filing: Sort your documents by categories such as client, service type, or transaction date. This helps you organize large volumes of data and find specific records more quickly.

- Cloud Storage Solutions: Storing documents in the cloud offers the advantage of easy access from anywhere and enhanced security features. Cloud platforms also allow for real-time collaboration, ensuring that everyone involved in the process has the most up-to-date information.

- Back-Up Systems: Regularly back up your documents to ensure that important records are not lost due to system failures or accidental deletion. Having a secondary storage option provides an extra layer of protection.

Storing for Long-Term Access

- Digital Archives: For long-term storage, consider archiving files in secure digital formats that are easy to retrieve. Most cloud storage services offer options for archiving older records while keeping them accessible when necessary.

- Compliance with Regulations: Be sure to store your documents in accordance with local tax laws and regulations. Retaining files for the required period and ensuring their security is essential for legal compliance.

By applying these organizational strategies, you can keep your financial records in order, improve your workflow, and reduce the risk of errors or delays when managing transactions.

How to Save and Share Your Invoices

Efficiently saving and sharing financial documents is crucial for smooth business operations. Whether you need to store them for future reference or send them to clients for payment, knowing the best practices for saving and sharing these documents ensures timely transactions and proper record-keeping. Using the right methods for both storage and distribution helps you maintain organization, meet deadlines, and maintain professional communication with clients.

There are several ways to store and share your records securely. By choosing the right formats and tools, you can ensure that your files remain accessible, protected, and easy to share with others. Below, we’ll explore the most effective ways to save and distribute your business documents.

Saving Your Financial Documents

- Choose Secure Storage Locations: Whether you’re saving files on your computer or in the cloud, it’s essential to choose secure, reliable storage solutions. Cloud storage offers flexibility and security, while external hard drives can provide offline backups for peace of mind.

- Organize by Category: To keep your records organized, create folders for different clients, services, or billing periods. This makes it easier to find specific documents when needed and keeps your system tidy.

- Back-Up Your Files Regularly: Always back up your records to a secondary location. This ensures you have a backup in case of system failures or accidental loss of data.

Sharing Your Financial Documents

- Use Secure Methods: When sharing financial documents, always use secure methods like encrypted email or trusted cloud services. Avoid sending sensitive files through unprotected channels to prevent unauthorized access.

- Consider File Formats: Save your documents in formats that are universally accessible and maintain formatting, such as PDF. This ensures that clients can easily view the document without compatibility issues.

- Use Digital Signatures: For added security, consider using digital signatures to verify the authenticity of your documents when sending them to clients. This adds a layer of professionalism and trust to your communication.

By following these practices, you can easily manage, store, and share your business documents efficiently, ensuring both organization and professionalism in your transactions.

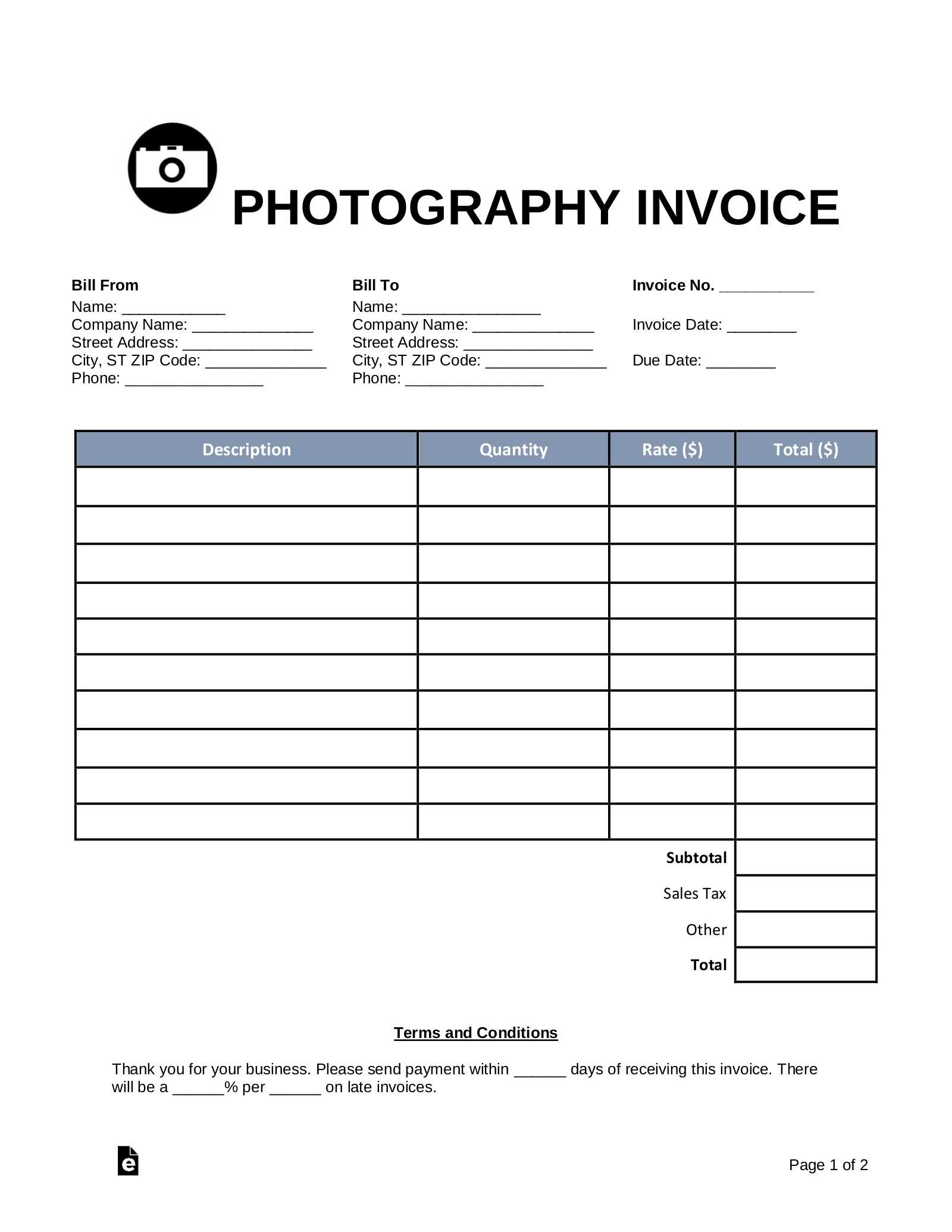

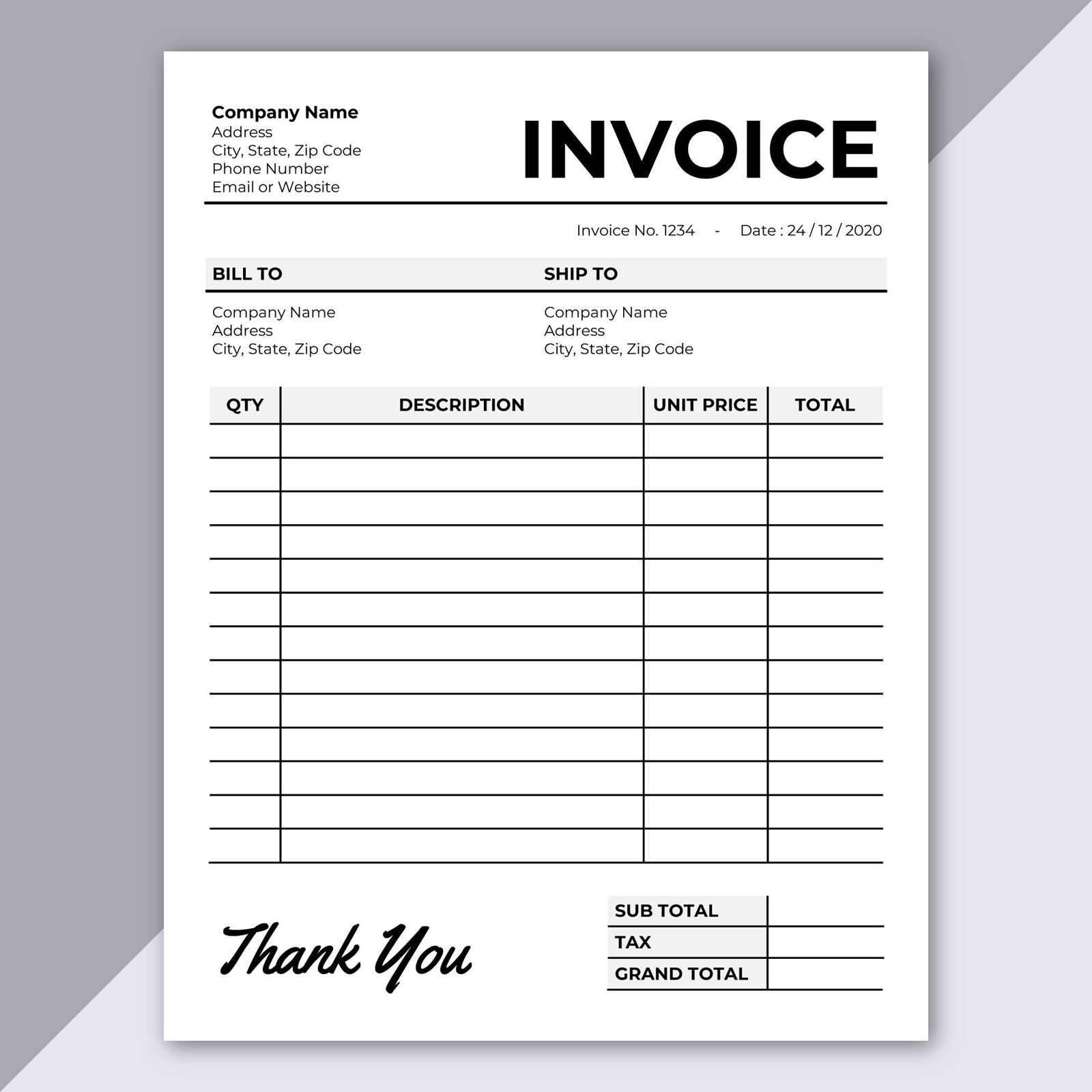

Choosing the Right Template for Your Business

Selecting the appropriate document structure for your business is essential for maintaining consistency and professionalism in all of your financial dealings. The right design not only reflects your brand but also ensures that the necessary information is clearly presented. When choosing a layout for your records, consider factors such as your industry, the type of services you provide, and the expectations of your clients.

By choosing a layout that suits your needs, you can improve your workflow, make the process more efficient, and avoid confusion in future transactions. Whether you prefer a simple and minimalist design or a more detailed one, finding the right format can make a significant difference in the way your business is perceived.

Key Considerations When Selecting a Design

- Brand Consistency: The design should align with your company’s branding, including your logo, colors, and overall visual style. This helps create a cohesive experience for your clients and reinforces your professional image.

- Client Needs: Consider the type of information your clients need. Some businesses may require a more detailed structure, while others may prefer a simpler layout. Make sure your format includes all the relevant details in an easy-to-understand way.

- Flexibility: Choose a format that allows you to easily customize and update as your business evolves. The layout should be versatile enough to accommodate various services, pricing structures, and changes in your contact information or business details.

Types of Layouts to Consider

- Simple and Clean: A straightforward format is ideal for businesses that need to convey basic information quickly and clearly without any unnecessary distractions.

- Detailed and Professional: If you offer multiple services or products, a more elaborate design with sections for item descriptions, taxes, and payment terms may be necessary to ensure accuracy.

- Industry-Specific: Some industries have specific requirements for how documents should be formatted. Look for layouts that are tailored to your field to meet both your needs and the expectations of your clients.

Choosing the right design for your business is an investment in efficiency and professionalism. By ensuring that your format suits your specific needs, you can streamline your processes and make a lasting impression on your clients.

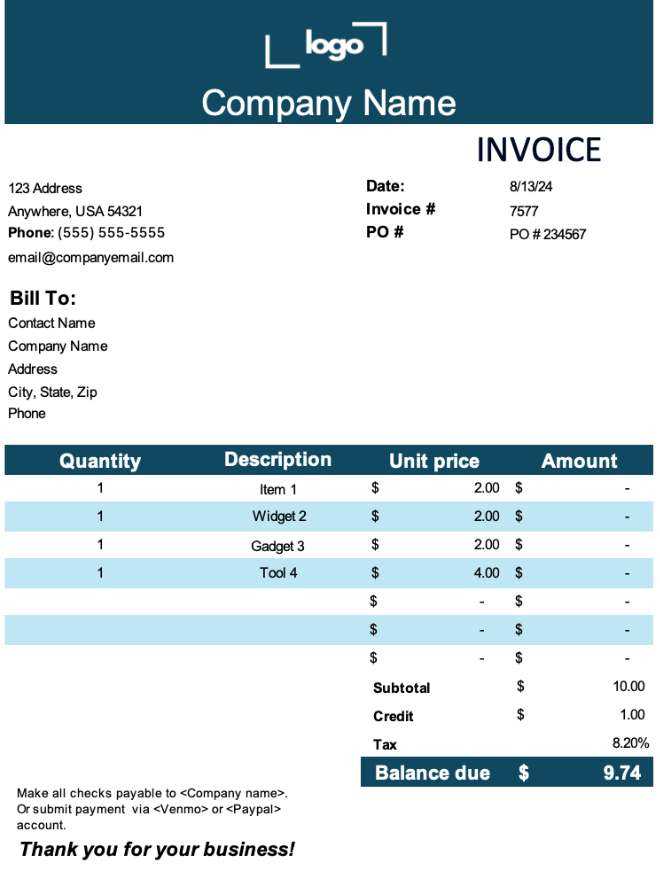

Understanding Invoice Customization Options

Customizing your financial documents allows you to tailor them to fit your business’s unique needs and branding. Personalizing how your records appear can enhance professionalism and provide clarity for your clients. Whether it’s adjusting the layout, adding specific fields, or incorporating your company logo, understanding the various customization options is essential for creating a more efficient and effective system.

Customization provides flexibility, ensuring that your financial documents are not only functional but also visually aligned with your brand identity. By selecting the right features to modify, you can improve communication with your clients and streamline the documentation process.

Key Customization Features to Consider

- Branding and Logo: Including your company’s logo and branding elements such as colors or fonts can help reinforce your brand identity and maintain a cohesive image across all your communications.

- Custom Fields: Modify the layout to include any additional details relevant to your business, such as special notes, delivery dates, or project numbers. This ensures that every document contains the necessary information for both you and your client.

- Payment Terms and Conditions: Customize sections to outline your payment policies clearly, including deadlines, late fees, and accepted payment methods, to avoid confusion and set expectations upfront.

Why Customization is Important

- Professionalism: Tailored documents convey a sense of professionalism and attention to detail, improving your business’s reputation with clients.

- Efficiency: Customized records that reflect your specific needs and preferences can make processing faster and more accurate, saving both time and effort.

- Client Satisfaction: A well-organized and clear document format enhances communication, ensuring that your clients understand the details of the transaction and reducing the likelihood of disputes.

By understanding and utilizing the available customization options, you can create financial documents that reflect your business’s values, enhance client relations, and improve overall operational efficiency.