Downloadable Blank Invoice Template for Quick and Easy Billing

For any business, having a structured and easy-to-use system for handling financial transactions is crucial. When you need to request payments for services or goods, using pre-designed documents can streamline the process and improve professionalism. These ready-made forms are especially helpful for small businesses and freelancers who may not have the resources to create custom documents from scratch.

Customization is key when it comes to these forms. Whether you’re working with clients locally or internationally, tailoring these files to reflect your branding and specific requirements makes communication clearer. Plus, their simplicity ensures that your billing process remains organized, allowing for faster payments and fewer errors.

In the following sections, we’ll explore why using these documents is beneficial, how to customize them effectively, and where you can find high-quality versions that suit your needs. This tool is a must-have for anyone looking to improve their financial workflows and enhance their business image.

Downloadable Blank Invoice Template for Small Businesses

For small business owners, maintaining an efficient and professional system for billing is crucial to ensure smooth cash flow. When you’re handling multiple clients or projects, using standardized documents can save time and prevent errors. A customizable billing form allows you to input specific details while ensuring that all necessary information is included in a clear, concise manner. This method helps you to create consistent and professional payment requests with ease.

Whether you are offering services or selling products, these forms can be tailored to suit your specific business needs. Having a pre-set structure with space for client information, service descriptions, amounts, and payment terms makes it easier to manage invoices efficiently and keep records organized.

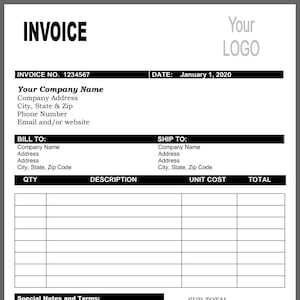

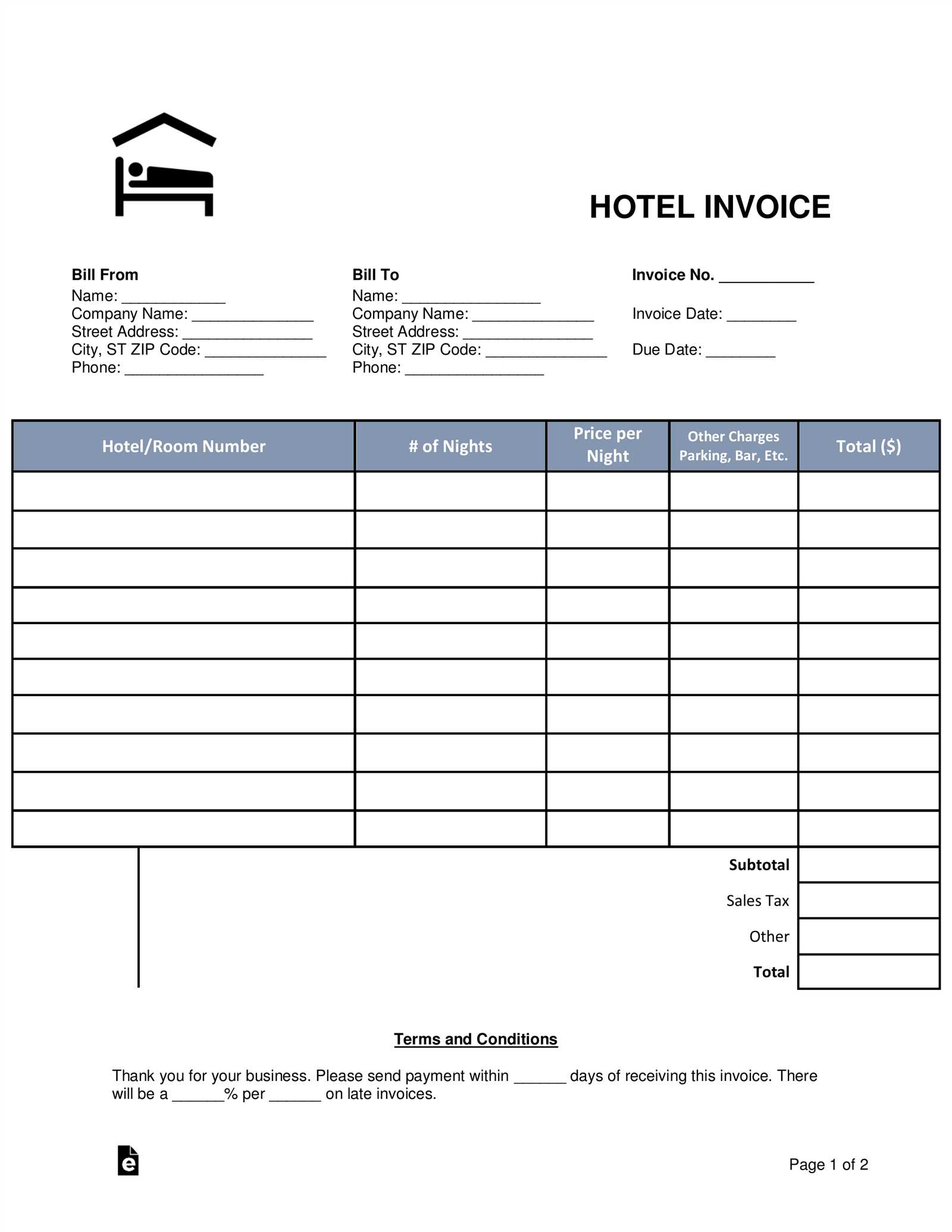

Below is an example of what such a document might include:

| Field | Description |

|---|---|

| Business Name | Your company or personal name that will appear on the form. |

| Client Details | Name and contact information of the client you’re billing. |

| Item/Service Description | A brief description of what was provided or sold. |

| Quantity and Rate | The number of items or hours worked and their rate. |

| Total Amount | The total cost for the services or products, including applicable taxes. |

| Payment Terms | Details on the due date and accepted payment methods. |

| Notes | Any additional notes, such as terms of service or payment instructions. |

By using a well-structured document, small businesses can ensure that they are presenting professional and clear payment requests to their clients. Additionally, these forms help maintain accurate records, making accounting and financial planning much easier. With just a few simple steps, you can personalize your own form and start managing your billing more effectively.

Why Use a Blank Invoice Template?

For any business, having a standard format for requesting payments is essential to maintain consistency and ensure clarity. Using a ready-made document allows you to quickly fill in the required details and send a professional request to clients without having to create a new form each time. This not only saves time but also reduces the chances of making mistakes in the billing process.

With a pre-designed structure, you can focus on the specific details of the transaction while leaving the formatting to a reliable system. Whether you’re working with regular customers or new clients, this method guarantees that important information like payment terms, item descriptions, and amounts are always presented in a clear, consistent way.

Below are some reasons why businesses benefit from using these forms:

| Reason | Benefit |

|---|---|

| Consistency | Ensures that every payment request looks professional and contains all necessary details. |

| Time Efficiency | Filling out a pre-designed form is faster than creating a new one each time. |

| Clarity | Clients will always receive a document that clearly outlines the payment expectations. |

| Accuracy | Reduces the chances of omitting key details, ensuring that payments are processed correctly. |

| Professionalism | Presenting a well-structured request builds trust and shows that you are organized and serious about your business. |

Incorporating these forms into your workflow simplifies the entire process, making it easier to manage your finances and build positive relationships with clients. By using a pre-structured document, you can maintain a high level of professionalism with minimal effort.

How to Customize an Invoice Template

Personalizing your billing forms is crucial to ensure that they reflect your business identity and meet specific needs. A standardized form can be easily modified to include your logo, business details, and unique terms of service. By adjusting the layout and content, you can make sure that each document you send matches your branding and is aligned with your specific requirements.

Customization can range from simple edits like adding your company’s name and contact details to more complex adjustments such as changing the overall design and structure. It’s important to maintain a balance between clarity and personalization to avoid confusion for your clients while making the document represent your business professionally.

Here are some steps you can follow to modify your billing document:

| Step | Description |

|---|---|

| Insert Your Logo | Add your company logo at the top to enhance brand recognition. |

| Update Contact Information | Make sure your business name, address, phone number, and email are accurate. |

| Modify Client Details Section | Ensure there is space to input the correct client name, address, and contact info. |

| Adjust Payment Terms | Change the payment deadlines or accepted methods to fit your business needs. |

| Customize Item Descriptions | Describe your products or services in a way that is clear to your clients and tailored to each transaction. |

| Choose Your Currency | Ensure the correct currency symbol is displayed to match the country of transaction. |

| Modify the Layout | Adjust the table formatting and font to make the document visually appealing and easy to read. |

Once you’ve made the necessary

Benefits of Using Invoice Templates

Using pre-structured forms for payment requests offers a wide range of advantages that can help businesses stay organized and professional. These ready-made documents save time, reduce errors, and create a more streamlined workflow. By utilizing standardized formats, companies can ensure consistency across all client communications, making the billing process more efficient and predictable.

Improved Efficiency

One of the main benefits of using a standardized payment request form is the speed it offers. Instead of designing a new document each time, you can quickly fill in the necessary details, saving valuable time. With consistent formatting, you don’t have to worry about formatting or forgetting important information–everything you need is already in place.

Enhanced Professionalism

Using a well-designed document adds a level of professionalism to your business. It shows clients that you’re organized, detail-oriented, and serious about your work. A polished request for payment leaves a positive impression and builds trust, which can lead to stronger client relationships and repeat business.

Additional benefits of using pre-designed forms include:

- Consistency – Every payment request is clear, concise, and follows the same format, reducing confusion.

- Customizability – Even though these forms follow a standard structure, they can be easily customized to suit specific client needs or business requirements.

- Accuracy – Having a fixed format ensures that all critical details, like payment terms and services provided, are included correctly, minimizing the chances of mistakes.

By incorporating these documents into your workflow, you can ensure that the billing process is handled quickly, accurately, and professionally every time.

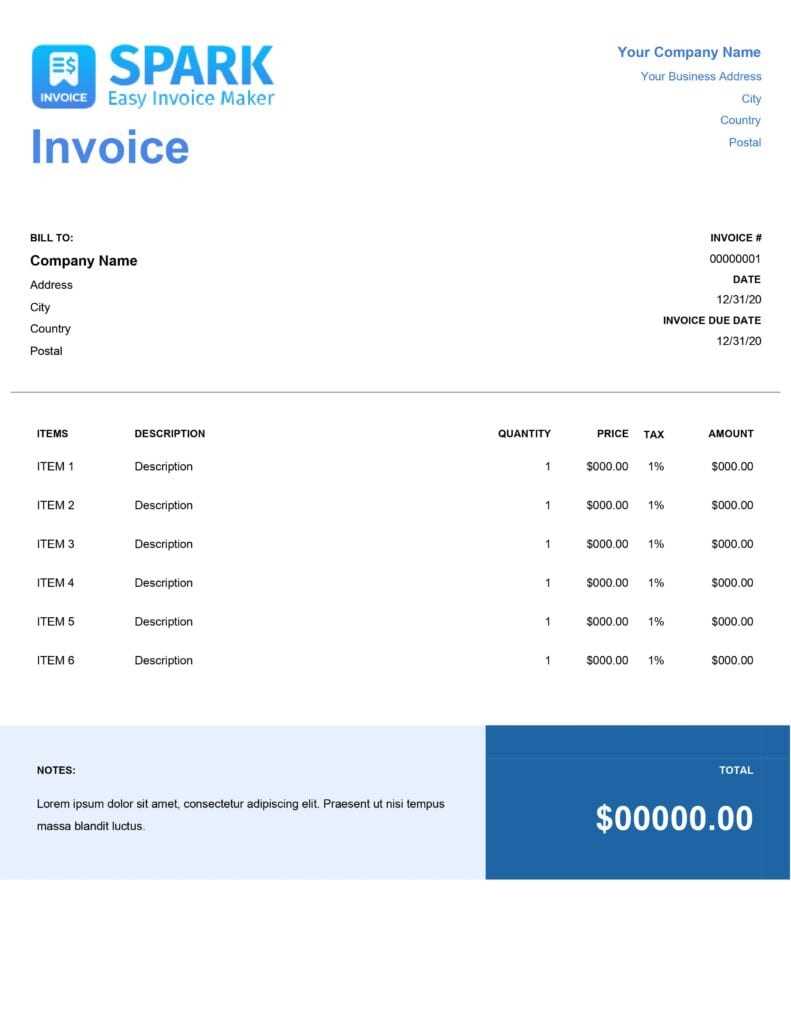

Different Invoice Templates for Various Industries

Each industry has unique needs when it comes to requesting payments, and the format of the document can reflect those differences. Whether you’re in retail, freelancing, or the service sector, customizing your billing document ensures that it aligns with the specific nature of your business. Having the right structure is essential to accurately represent the products or services you offer and provide all necessary details in a clear and organized way.

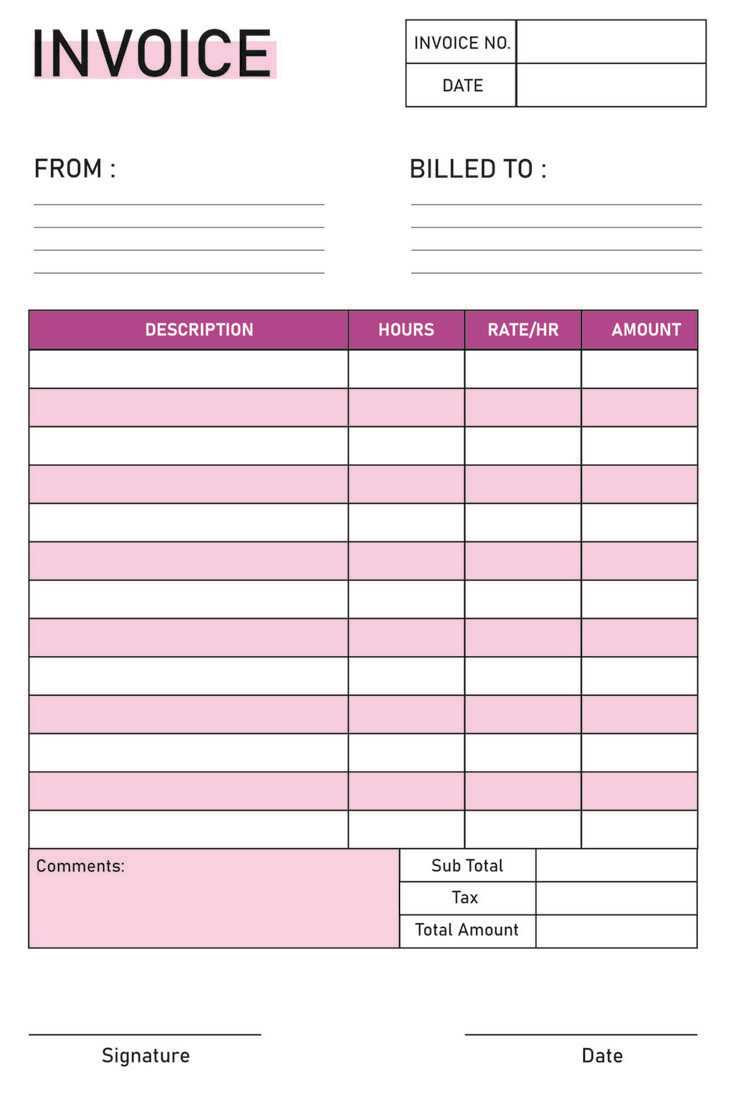

For example, freelancers and contractors may need a simpler document that highlights hourly rates and project milestones, while businesses in the retail sector might require more detailed breakdowns, including product descriptions, quantities, and taxes. Recognizing these differences is important when choosing the appropriate format for your transactions.

Service-Based Industries

In fields like consulting, graphic design, or web development, billing documents typically focus on hourly rates, service descriptions, and project timelines. These documents often include milestones or stages of completion, allowing clients to track progress and make payments as each phase is completed. This structure ensures transparency and reduces potential disputes.

Product-Based Businesses

For businesses selling physical goods, such as retail shops or wholesalers, the document often includes product names, quantities, individual prices, and taxes. This detailed breakdown helps clients understand exactly what they are paying for and can be crucial for both inventory and accounting purposes. These forms may also include shipping or handling charges if applicable.

Customizing the structure of your payment request based on the industry you operate in ensures that all relevant details are included. Whether it’s a simple service description for a freelancer or a detailed inventory list for a retailer, tailoring your document to fit your business needs is a key factor in ensuring accuracy and professionalism.

How to Save Time with Templates

Time is a valuable resource for any business, and optimizing your workflow is key to success. By using pre-designed forms for payment requests, you can significantly reduce the time spent on administrative tasks. Instead of starting from scratch every time you need to bill a client, these ready-made structures allow you to quickly fill in the necessary details, saving you effort and allowing you to focus on growing your business.

With a standardized document, there’s no need to worry about formatting or remembering what information needs to be included. Everything is laid out for you, and all you need to do is input client details, services provided, and payment terms. This simplicity speeds up the process and minimizes the chances of missing important details, making your billing more efficient overall.

Streamlined Workflow

Once you have a standard format in place, you can reuse it for every new transaction. This eliminates the need to repeatedly create or search for the correct structure, streamlining your workflow. The document can be filled in quickly, adjusted if necessary, and sent off without delay, which helps you avoid wasting time on repetitive tasks.

Fewer Errors and Revisions

By relying on a consistent structure, you reduce the likelihood of mistakes. With all the necessary sections already laid out, you simply need to complete them correctly. This cuts down on time spent making revisions or correcting errors after sending a document. An organized system leads to fewer follow-ups with clients and smoother payment processing.

By using pre-made forms, you ensure that each billing cycle is faster and more accurate, which frees up time for other important tasks, from working with clients to managing your team or expanding your services.

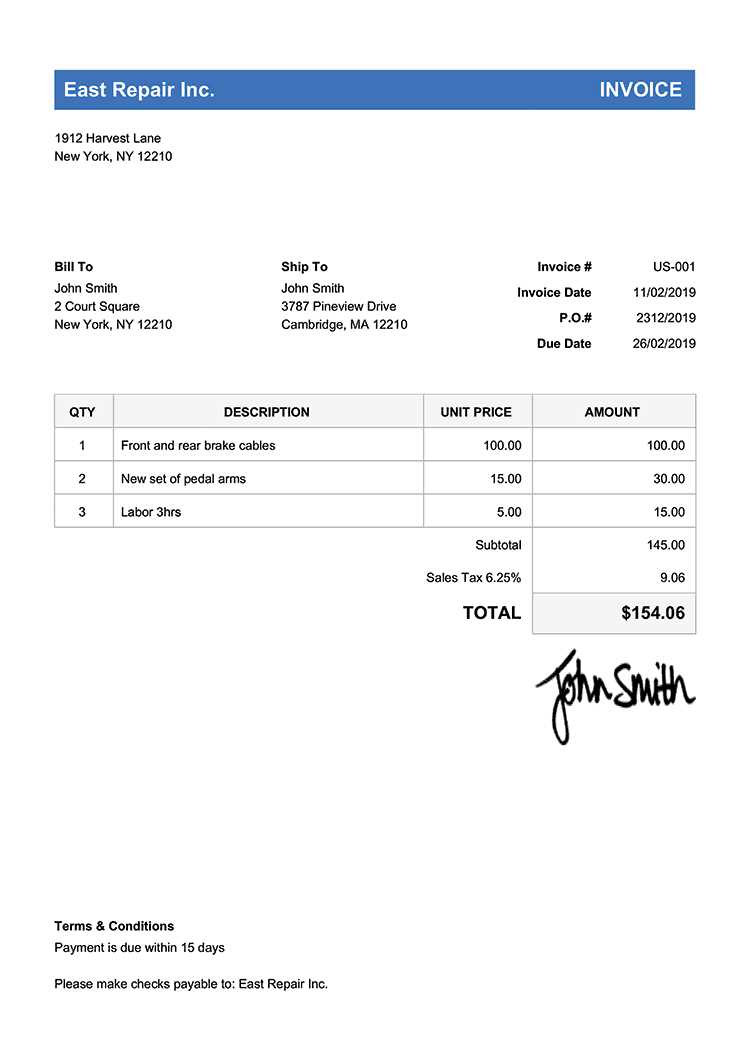

Essential Elements of an Invoice

A well-organized payment request is crucial for both businesses and clients. Regardless of the industry, certain key components must be included to ensure that all necessary details are captured and presented clearly. Including these elements helps prevent confusion, ensures timely payments, and improves overall communication with clients.

Here are the fundamental sections that should be present in any billing document:

| Element | Description |

|---|---|

| Business Information | Include your company name, address, phone number, and email. This makes it clear who the client is paying. |

| Client Information | Include the client’s name, address, and contact details to ensure that payments are directed to the correct entity. |

| Unique Identifier | A unique number or code for the transaction. This helps with tracking and accounting. |

| Service or Product Description | A clear and detailed description of the goods or services provided, including quantities, pricing, and any applicable discounts. |

| Payment Terms | Details about payment due dates, late fees, and accepted payment methods. This helps set clear expectations for both parties. |

| Total Amount Due | The final amount to be paid, including any taxes, shipping, or additional charges. |

| Notes | Any additional details, such as special terms of service, delivery information, or personalized messages to the client. |

By ensuring that all these essential elements are present in your payment request, you can minimize errors and ensure smooth transactions. A complete and well-structured document provides clarity for both your business and your clients, helping to establish trust and improve your cash flow.

Free vs Paid Invoice Templates

When choosing a form for requesting payments, businesses often face the decision between free and paid options. While both can serve the purpose of generating professional documents, each offers different features, customization options, and levels of support. Understanding the differences can help you make an informed decision based on your needs, business size, and budget.

Free Options

Free forms are often a good starting point for small businesses or freelancers who have simple billing needs. These documents typically offer the basic structure required to generate payment requests, but with limited customization options. Here are some key points to consider when using free forms:

- Basic Features: Free forms usually include only the most essential elements such as client details, item descriptions, and payment amounts.

- Limited Customization: Many free options are fixed in layout and design, offering limited space for personal branding or additional details.

- No Support: Free options typically come without customer service or technical support if you run into issues.

- Accessibility: These forms are easily accessible and available on a variety of websites or platforms without any cost.

Paid Options

On the other hand, paid forms often provide more advanced features and greater flexibility. Businesses that require more complex documents or wish to maintain a polished, professional appearance might find paid options more beneficial. Here are the main advantages of paid forms:

- Advanced Features: Paid versions often come with additional features such as integration with accounting software, automatic tax calculations, and detailed reporting.

- Customizability: These forms can be fully customized to include your company logo, change fonts, colors, and layouts, allowing for a more personalized presentation.

- Technical Support: Paid services typically offer support in case you encounter issues or need assistance with customization.

- Professional Design: Paid options often come with more polished, sophisticated designs that help improve your business’s overall appearance.

Ultimately, the decision between

Top Sources for Downloadable Invoice Templates

Finding high-quality, customizable documents for payment requests is essential for businesses of all sizes. Whether you’re a freelancer, a small business owner, or part of a larger organization, having access to reliable sources can make the billing process much smoother. Various platforms offer these forms for free or for purchase, and choosing the right one depends on the features you need and the level of customization you’re looking for.

Below are some of the best places where you can find professional and easy-to-use forms that meet your needs:

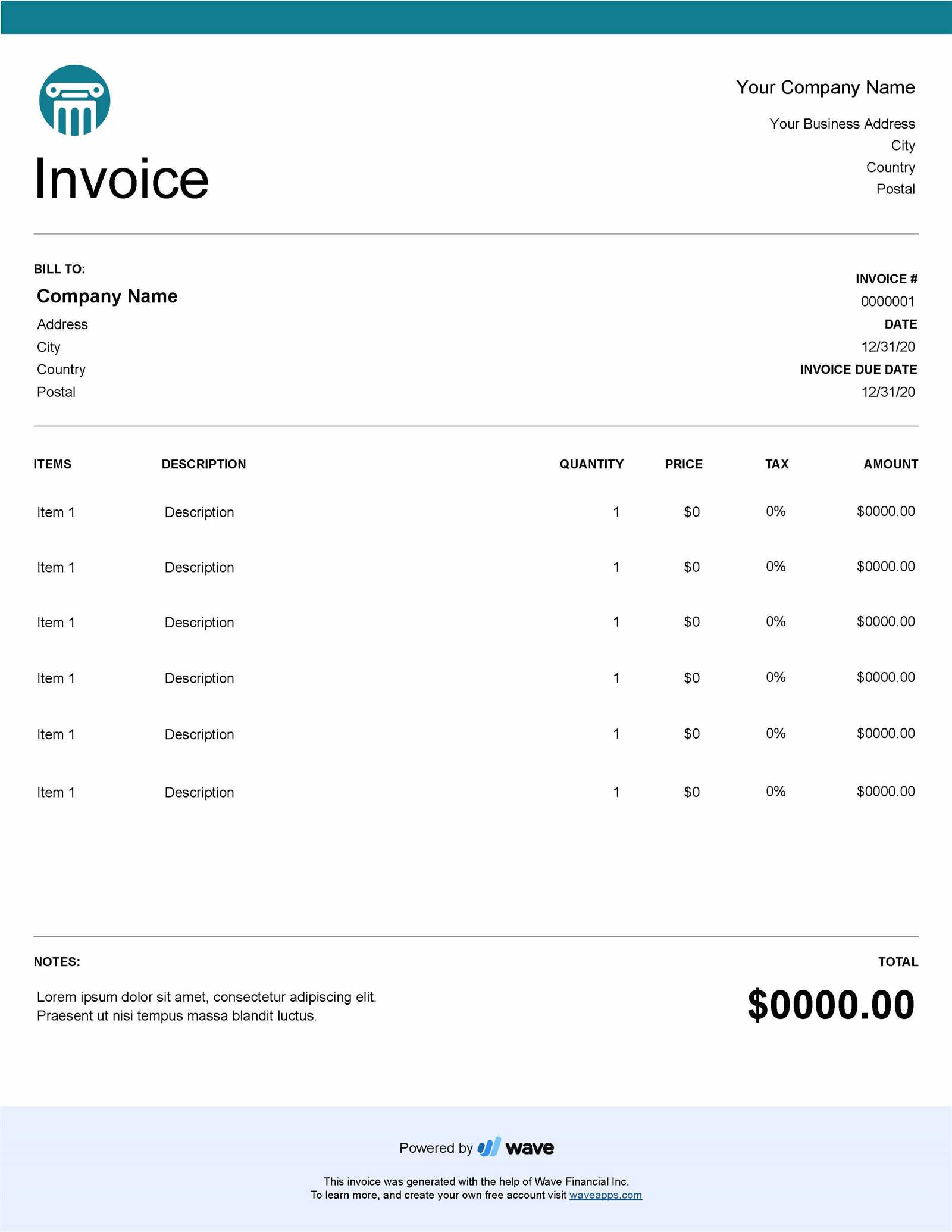

1. Microsoft Office

Microsoft Office provides a wide range of templates for payment requests that can be customized using Word or Excel. These forms are ideal for users familiar with Office tools, offering flexibility and ease of use. Many of these templates come with pre-filled examples and simple designs, making them perfect for quick setup and use.

2. Google Docs and Google Sheets

Google Docs and Google Sheets offer free, easy-to-edit forms through their cloud-based platform. Users can select from a variety of basic designs and adjust them according to their needs. The advantage of Google tools is that they are accessible from anywhere and allow for real-time collaboration, making them ideal for remote teams.

3. Canva

Canva is a popular design platform known for its user-friendly interface and creative options. It offers a variety of customizable payment request designs that can be easily adapted to your brand. Canva allows you to add logos, adjust colors, and customize text, making it a great choice for businesses looking to create visually appealing forms without the need for graphic design skills.

4. Template.net

Template.net is a comprehensive website offering a large collection of downloadable forms for different industries. The website provides both free and paid options, including highly customizable formats with advanced features. If you’re looking for specific templates for various business types or industries, Template.net is a great resource.

5. FreshBooks

FreshBooks, an accounting software provider, also offers professional billing forms that can be customized and integrated into their system. This is particularly useful for small business owners who want to streamline their accounting and payment processes. With FreshBooks, you can generate and send bill

How to Edit a Blank Invoice Template

Customizing a document for payment requests is a simple process, especially when you have a pre-designed structure to work with. Editing these forms allows you to add your business information, client details, and itemized charges, making each document unique to the specific transaction. Whether you’re using software like Word, Excel, or an online design tool, knowing how to personalize these documents will help you maintain professionalism and clarity.

Here are the key steps you can follow to easily edit a ready-made payment request form:

1. Open the Document

The first step is to open the document in the software or platform where it’s stored. If you’re using a file from Microsoft Word, Excel, or Google Docs, simply double-click to open it. If you’re working in a design tool like Canva, log into your account and access the document from your dashboard.

2. Customize Key Information

Once the document is open, you’ll need to update the fields with your specific details. Start by replacing the placeholder text with your business name, address, contact information, and logo. If the form includes fields for client information, fill in their name, address, and any other relevant contact details.

Other elements to customize:

- Service or Product Descriptions: Clearly describe the goods or services you are billing for. Be specific about the quantities and prices.

- Payment Terms: Adjust payment terms, including due dates, discounts, and late fees as applicable.

- Total Amount: Calculate and update the final amount due, including any applicable taxes or shipping charges.

3. Adjust Design and Layout (Optional)

If the document allows for customization of its design, you can modify the layout, colors, and fonts to align with your business branding. Adjust the table formatting if necessary to ensure that everything looks neat and organized. Many online tools allow you to drag and drop elements, making it easy to personalize the look without any design experience.

Once all the necessary changes are made, save the document in your preferred

Common Mistakes When Using Templates

While using pre-designed forms for billing can save time and improve efficiency, it’s easy to make certain mistakes that can affect the accuracy and professionalism of your payment requests. These errors can lead to confusion, delays in payment, and even damage client relationships. Understanding common pitfalls can help you avoid these issues and ensure that every transaction is processed smoothly.

Here are some of the most common mistakes to watch out for when customizing and using these pre-structured documents:

1. Failing to Update Client Information

One of the easiest mistakes to make is forgetting to update the client’s name, address, and contact details. Using outdated or incorrect client information can cause confusion, and in some cases, it can delay payments. Always double-check that the client’s details are accurate before sending out the payment request.

2. Incorrect Calculation of Amounts

Another frequent error is incorrectly calculating totals, taxes, or discounts. Even a small mistake in adding or subtracting amounts can result in undercharging or overcharging the client. Be sure to carefully review all charges, including any additional fees or taxes, before finalizing the document.

3. Overlooking Payment Terms

Many forms include fields for payment terms such as due dates, late fees, and accepted payment methods. Failing to properly customize or overlook these terms can lead to misunderstandings with your clients. Make sure that payment terms are clear, consistent, and aligned with the agreements you’ve made.

4. Using Generic Designs

While many pre-structured forms come with a simple design, using a generic layout without any customization can give the impression of a lack of professionalism. It’s essential to adjust the document to reflect your brand’s identity, adding your logo, colors, and fonts, to ensure it looks polished and trustworthy.

5. Missing Essential Information

Omitting key details such as the date of the transaction, unique identifiers (invoice numbers), or descriptions of the goods/services provided can lead to confusion and delays. Always ensure that the essential elements are clearly laid out and that nothing is left out.

By being mindful of these common mistakes, you can improve the quality and effectiveness of your payment requests. Taking the time to review and customize each form will not only help avoid errors but also enhance your business’s professionalism and efficiency.

How to Convert Invoice to PDF Format

Converting your payment request document into a PDF format is a simple and effective way to ensure that the file is universally accessible and retains its formatting across different devices and platforms. PDF files are also more secure and professional, making them ideal for sending official documents to clients. Whether you’re using software like Microsoft Word, Google Docs, or an online design tool, converting your document to PDF is a straightforward process.

1. Using Microsoft Word or Excel

If you’ve created your payment request using Microsoft Word or Excel, the process of converting to PDF is quick and easy. Follow these steps:

- Finish editing your document and make sure all the necessary details are filled in correctly.

- Click on the “File” menu in the top-left corner of the application.

- Select “Save As” and choose the location where you want to save the file.

- In the “Save as type” dropdown menu, select PDF.

- Click “Save,” and your document will be converted into a PDF format.

2. Using Google Docs or Google Sheets

If you’re working with Google Docs or Sheets, the conversion process is also simple:

- After completing your document, go to the “File” menu at the top of the screen.

- Hover over “Download” and select the PDF Document (.pdf) option.

- The document will automatically download as a PDF file to your computer.

3. Using Online Conversion Tools

If you don’t have access to programs like Microsoft Office or Google Docs, there are various free online tools available to convert your documents to PDF. Websites like Smallpdf, ILovePDF, or PDF2Go allow you to upload your file in different formats (such as Word, Excel, or even images) and convert them into PDF for free. Simply upload your file, click the “Convert” button, and download the resulting PDF.

4. Using Canva or Other Design ToolsInvoice Template for Freelancers and Contractors

For freelancers and contractors, having a clear and professional document for billing clients is essential. These documents not only ensure timely payment but also help to establish credibility with clients. Whether you’re working on a one-time project or a long-term contract, a well-structured payment request can provide clarity on services rendered, payment amounts, and expectations. In this section, we’ll explore how to create and customize such documents for independent professionals.

Key Elements of a Freelancer Payment Request

A freelancer’s payment request needs to cover specific details that reflect the nature of their work. Here are the key components that should be included:

- Contact Information: Include your name, business name (if applicable), address, phone number, and email. Ensure the client’s details are also listed correctly.

- Unique Identifier: Assign a unique number to each payment request for easy reference. This helps keep records organized and assists clients with tracking payments.

- Work Description: Clearly describe the work performed, including the services provided, project milestones, or specific tasks completed. This section should be as detailed as needed.

- Hourly or Flat Rate: Indicate whether you charge by the hour or for the whole project, and list your rate or fee for the job.

- Payment Terms: Include the payment deadline, preferred payment methods (e.g., bank transfer, PayPal), and any late fees if applicable.

- Total Due: Summarize the total amount owed by the client, including taxes or additional charges where applicable.

Best Practices for Freelancers

To make sure your payment requests are professional and effective, here are some best practices to follow:

- Be Clear and Specific: Ambiguity can cause confusion or delays. Ensure that all work details, rates, and payment terms are explicitly stated.

- Set Clear Deadlines: Include a specific due date for payment. This helps to avoid misunderstandings and encourages timely payments.

- Customize for Each Client: Tailor each payment request to suit the client’s specific project or agreement. Personalizing the document reflects your professionalism and attention to detail.

- Keep Records: Retain copies of all payment requests and transactions for bookkeeping purposes. This will help in the event of disputes and for tax filing

How Invoice Templates Improve Professionalism

Using a structured, pre-designed document for billing can significantly enhance the professional image of a business or freelancer. It ensures consistency in communication with clients and reinforces trustworthiness. When clients receive a well-organized and clearly formatted payment request, it demonstrates attention to detail, reliability, and respect for their time. In this section, we will explore how utilizing a customizable form can contribute to a more professional business operation.

1. Consistency in Communication

One of the primary benefits of using a predefined billing document is the consistency it brings to your interactions with clients. When every transaction is accompanied by a professional, uniform format, it fosters a sense of stability and reliability. Clients can quickly familiarize themselves with the layout and expect the same level of quality every time they receive a document from you. Consistency in your billing process also helps reduce misunderstandings and ensures that all necessary details are included in each request.

2. Time Efficiency and Accuracy

Time is a crucial factor in maintaining professionalism. A pre-built form allows you to fill in the necessary details swiftly without having to reinvent the structure for each client. It also minimizes the risk of errors, ensuring that every essential element–such as amounts, payment terms, and due dates–is accurately filled in. This reduces the likelihood of needing to follow up with clients over mistakes or missing information.

3. Branding and Customization

Personalization is key to professionalism. A customized billing form that includes your business logo, colors, and other branding elements enhances the visual identity of your business. It creates a cohesive experience for your clients, aligning your invoices with the overall branding of your products or services. This attention to detail shows that you take your business seriously and value your client’s experience.

By implementing structured and branded billing documents, you can streamline your operations, improve client interactions, and ultimately strengthen the professional perception of your business.

Using Invoice Templates for International Billing

When dealing with international clients, it’s essential to ensure that payment requests are clear, professional, and compliant with the regulations of different countries. Utilizing a well-structured billing form for international transactions can help manage complex aspects like currency conversion, tax rules, and varied payment methods. A carefully designed document ensures that your clients understand the charges, making the process smoother for both parties. In this section, we will explore how to adapt your forms for global use and avoid common pitfalls in international billing.

1. Handling Multiple Currencies

When billing clients abroad, one of the most important considerations is currency. It’s crucial to specify the currency in which the payment is due and to include any relevant exchange rates. If you’re dealing with multiple currencies, using a clear format to display these details will help prevent confusion and ensure that your clients know exactly how much they need to pay. This can be done by either displaying the amount in both currencies or using an updated exchange rate at the time of billing.

2. Adhering to Local Tax Regulations

Tax laws vary widely from country to country, and failing to apply the correct tax rate or include necessary tax details can lead to compliance issues. Be sure to check if your client’s country requires VAT (Value Added Tax), GST (Goods and Services Tax), or other local taxes. A flexible billing form should allow you to easily input tax rates and provide a breakdown for the client. It’s important to also include your tax identification number or any other relevant business registration information based on local laws.

3. Language and Formatting Considerations

Language differences can also create challenges when working with international clients. If you’re dealing with clients in non-English-speaking countries, it’s a good idea to offer your payment requests in the local language, or at least provide key sections (like the work description, terms, and payment information) in both languages. Additionally, ensure that the document’s formatting follows international standards, including the proper date format, decimal separators, and clear currency symbols.

By customizing your billing documents to accommodate the complexities of international transactions, you can improve communication with global clients, reduce misunderstandings, and ensure that payments are process

Securely Storing Your Invoice Templates

Properly storing your billing documents is crucial for both security and organization. Whether you’re saving completed documents, drafts, or reusable forms, maintaining a secure and accessible system will protect sensitive financial data and ensure you can easily find and use them when needed. In this section, we’ll explore how to securely store these important files and best practices for managing them effectively.

1. Use Cloud Storage for Easy Access

One of the most efficient ways to store your documents is by using a cloud-based storage service. This method allows you to access your files from any device, anytime, and provides robust security features to protect your data. Some popular cloud storage platforms include:

- Google Drive: Provides free storage with strong security features and easy sharing options.

- Dropbox: Known for its simple interface and ability to integrate with other business tools.

- OneDrive: Offers seamless integration with Microsoft Office tools and is a good option for businesses using Microsoft products.

2. Backup Your Documents Regularly

While cloud storage is convenient, it’s always a good idea to have an additional backup. Regularly back up your files to an external hard drive or a different cloud service to ensure that even in the event of a technical issue, your important documents are safe. Keep your backups organized by creating a dedicated folder for payment requests and related files.

3. Organize Your Files with Folders and Labels

To stay organized, create a clear folder structure for your files. Group them by client, project, or payment cycle, depending on what makes the most sense for your business. Use labels or tags to add additional details, such as the status of a document (e.g., “paid,” “pending,” or “overdue”). This helps you easily locate specific documents without wasting time searching.

4. Encrypt Sensitive Documents

If you’re storing completed payment documents or drafts that contain sensitive client information, it’s important to encrypt them. Encryption protects your files by making them unreadable to unauthorized users. Many cloud services offer encryption as part of their security features, but you can also encrypt documents manually using software like:

- 7-Zip: A free, open-source software that allows you to compress and encrypt files with a password.

- VeraCrypt: A robust disk encryption tool that can securely store files in encrypted volumes.

5. Limit Access to Your Documen

How to Track Payments with Invoice Templates

Tracking payments is an essential part of managing your finances and maintaining a smooth cash flow. By using structured billing forms, you can easily monitor which clients have paid, which are overdue, and which require follow-ups. An organized system for tracking payments helps ensure that nothing slips through the cracks and allows you to stay on top of outstanding balances. In this section, we’ll discuss how to use customizable forms to track payments effectively and maintain financial control.

1. Include Payment Status Fields

One of the easiest ways to track payments is by including a payment status section in your documents. This section should clearly indicate the current status of the payment–whether it’s been paid, is pending, or is overdue. Below are some useful statuses to track:

- Paid: Mark the payment as “Paid” once it has been received.

- Pending: Use this status for documents that are sent but not yet paid.

- Overdue: Mark invoices that have passed the payment due date.

2. Keep a Record of Payment Dates and Amounts

Including a section for payment dates and amounts on your forms is critical for tracking payments. This allows you to quickly refer to when a payment was made and how much was paid. It’s also helpful for reconciling your records with bank statements. Consider including the following information:

- Payment Date: Include the exact date when the payment was made to keep track of timely transactions.

- Amount Paid: Ensure the amount paid is clearly listed, especially if partial payments have been made.

- Payment Method: Document how the payment was made (e.g., bank transfer, credit card, PayPal), as this can be useful for record-keeping and client communication.

3. Use Payment Reminders

Setting up automated reminders in your billing system can help you stay on top of overdue payments. If you’re using a customizable document format, you can include a section where you can manually track when to follow up with clients who haven’t paid on time. For example, include a “Next Follow-up Date” field that reminds you when it’s time to contact a client about their overdue payment.

By i

Best Practices for Invoice Design

A well-designed payment request not only ensures clarity but also helps build professionalism and trust with your clients. A clean, easy-to-read layout can make a significant difference in how your clients perceive your business. In this section, we will discuss best practices for creating effective and visually appealing payment documents that improve communication and ensure a smooth billing process.

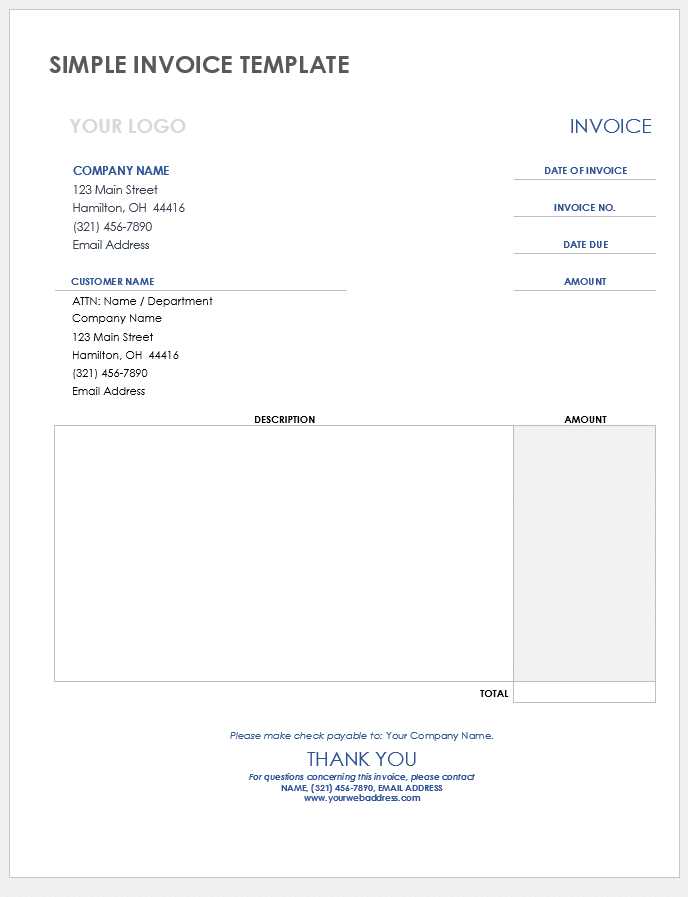

1. Keep the Layout Simple and Organized

Cluttered or overly complex forms can confuse clients and delay payments. A simple and organized layout enhances readability and ensures that clients can quickly find the information they need. Consider the following tips:

- Use clear headings: Label each section of the document (e.g., “Client Information,” “Payment Details”) to guide the reader.

- Prioritize important details: Make key information like the amount due, payment terms, and due date prominent.

- Avoid unnecessary elements: Eliminate any extraneous design elements that could distract from the essential details.

2. Choose Readable Fonts and Colors

The font and color scheme you choose play a crucial role in the document’s readability. Use fonts that are professional and easy to read, and ensure there is sufficient contrast between the text and the background. Here are some recommendations:

- Font style: Stick to standard, professional fonts like Arial, Times New Roman, or Helvetica.

- Font size: Ensure the text is large enough to be legible on all devices, with at least 10-12 pt for body text.

- Color palette: Use a simple color palette with a combination of dark and light colors for contrast. Avoid using too many bright or clashing colors.

3. Make Payment Information Stand Out

Ensure that the payment details are easy to find and clearly distinguishable. This includes the total amount due, due date, payment methods, and any relevant reference numbers. To achieve this:

- Highlight the total amount: Use bold or larger font sizes for the amount due to draw attention to it immediately.

- Include payment instructions: Clearly state how clients can pay (e.g., bank transfer, credit card, PayPal), including any necessary account information.

- Provide clear terms: Specify payment deadlines and any late fees or discounts for early payments.

4. Include Your Branding

Your business branding should be present in every communication with clients, including payment documents. Adding your company logo, colors, and contact information helps reinforce your brand identity and professionalism. Be sure to:

- Place your logo: Include your business logo at the top of the document to make it instantly recognizable.

- Use brand colors: Subtly incorporate your company’s colors into the design, but avoid making it overwhelming.

- Contact details: Ensure your business name, phone number, email, and website are easy to find.

5. Leave Space for Client Comments

It’s always a good idea to leave a section for client comments or special instructions. This space allows the client to clarify any questions or details about the payment, avoiding future misunderstandings. Adding this extra element shows flexibility and professionalism.

By following these best practices, you can create payment documents that are not only functional but also reflect your commitment to professionalism and attention to detail.