Download Free Invoice Template for Your Business Needs

Managing payments efficiently is a critical task for businesses of all sizes. One essential aspect of this process is creating clear, professional documents that outline the amount due, services rendered, and payment terms. Having a reliable structure in place can help avoid mistakes and ensure you get paid promptly.

Instead of creating these documents from scratch each time, many businesses turn to pre-designed formats that can be customized to suit their needs. These ready-made solutions can save time, enhance consistency, and reduce errors. With the right structure, you’ll maintain professionalism while focusing on what truly matters: running your business.

In this guide, we will explore the best options available to help you create flawless billing records quickly and easily. Whether you’re a freelancer, a small business owner, or part of a larger organization, these tools can simplify your workflow and provide you with the flexibility to adapt to your specific requirements.

Download Free Invoice Templates for Your Business

For any business, having a streamlined process for billing and payment collection is crucial. Using professionally designed documents can simplify this task, saving both time and effort. Thankfully, there are various free resources available to help you create these documents without the need to start from scratch.

By utilizing free resources, you gain access to pre-designed formats that can be easily personalized to fit your business needs. These solutions ensure that your records are consistent and aligned with industry standards. Moreover, free resources can be a perfect fit for small businesses, startups, and freelancers who want to keep costs low.

- Access to multiple formats like Word, Excel, and PDF

- Customization options to add your business logo and branding

- No need for complex software or design skills

- Quick and easy to use, even for beginners

In the next section, we’ll explore the best places to find these free resources, and how you can quickly integrate them into your business workflow to make managing payments more efficient.

Why You Need an Invoice Template

Efficient billing is an essential aspect of any business. Having a pre-structured format for documenting transactions not only saves time but also ensures accuracy. Consistency in your payment records can improve cash flow, reduce misunderstandings with clients, and contribute to a more professional image.

Save Time and Effort

Creating billing documents manually for each transaction can quickly become a time-consuming process. By using a pre-designed format, you can fill in the details with minimal effort, allowing you to focus on other important tasks. This streamlined approach enhances productivity and helps avoid delays in the billing cycle.

Maintain Professionalism and Accuracy

Clear, well-organized records convey trust and reliability. Using a standardized structure for each transaction ensures that all necessary details, such as payment terms, due dates, and amounts, are correctly included. This reduces the risk of errors that could lead to confusion or disputes with clients.

Having a well-structured document also adds a level of professionalism that can strengthen client relationships and boost your reputation in the market. By utilizing ready-made formats, you demonstrate an organized and efficient approach to managing business finances.

How to Choose the Right Invoice Template

Selecting the right structure for your billing records is key to maintaining a smooth and professional payment process. The right format can save you time, reduce errors, and present your business in a positive light. With so many available options, it’s important to choose one that aligns with your needs and the nature of your business.

Consider Your Business Needs

The first step in choosing the right format is understanding your business’s requirements. If you’re a freelancer, a simple document with basic payment details might be sufficient. However, for a larger business, you may require more complex structures, including tax information, itemized lists, or multiple payment options. The key is selecting a layout that fits your specific billing workflow.

Check for Customization Options

Another important factor to consider is how customizable the format is. Ideally, the solution you choose should allow you to easily add your business logo, adjust the payment terms, and change the color scheme to match your branding. A well-designed, customizable structure can enhance your professionalism and make your documents look more polished.

Key considerations when selecting a solution:

- Does it suit the size and complexity of your business?

- Can you personalize it with your branding and business details?

- Is it compatible with the software you already use for accounting?

By evaluating these factors, you can select a solution that streamlines your billing process and ensures consistent, accurate records for all your transactions.

Top Benefits of Using Invoice Templates

Utilizing pre-designed formats for billing can provide significant advantages for businesses, no matter their size. These ready-made solutions simplify the process of creating accurate and professional records, making it easier to manage payments, ensure consistency, and save valuable time. Below are the top benefits of incorporating these solutions into your workflow.

| Benefit | Description |

|---|---|

| Time Efficiency | Using a pre-structured document eliminates the need to create one from scratch each time, allowing you to generate bills quickly and move on to other tasks. |

| Consistency | A standardized format ensures that all the necessary details, such as payment terms and service descriptions, are always included in a uniform manner. |

| Professional Appearance | Presenting a polished, organized document enhances your business’s image and helps build trust with clients, making you look more credible and reliable. |

| Reduced Errors | By using a consistent layout, the risk of omitting important details or making mistakes in calculations is greatly minimized. |

| Easy Customization | Many ready-made solutions allow for personalization, so you can adjust the format to suit your specific needs and branding without much effort. |

By leveraging these benefits, businesses can streamline their billing processes, enhance their professionalism, and ensure more accurate and efficient financial management.

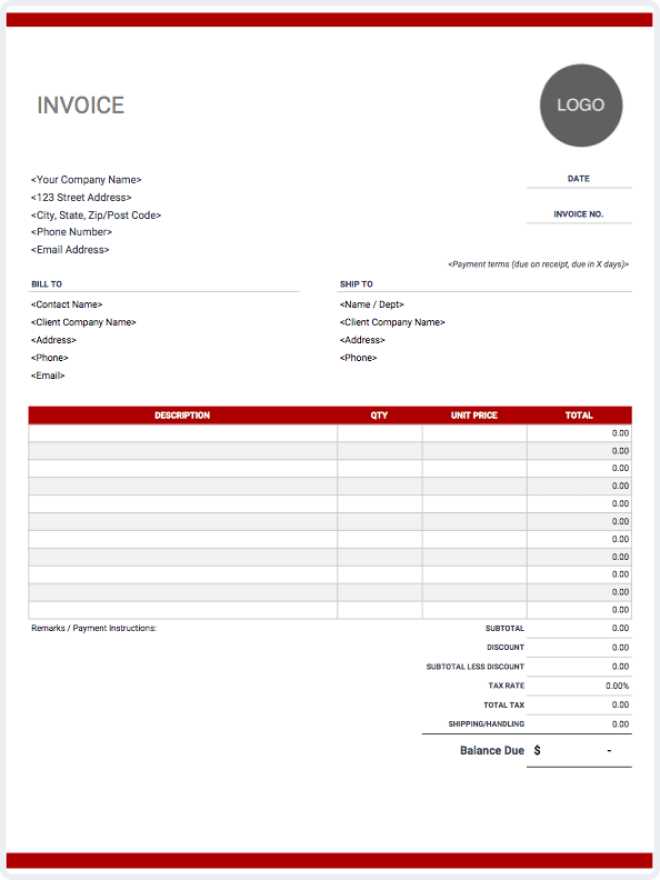

Customizing Your Invoice Template for Branding

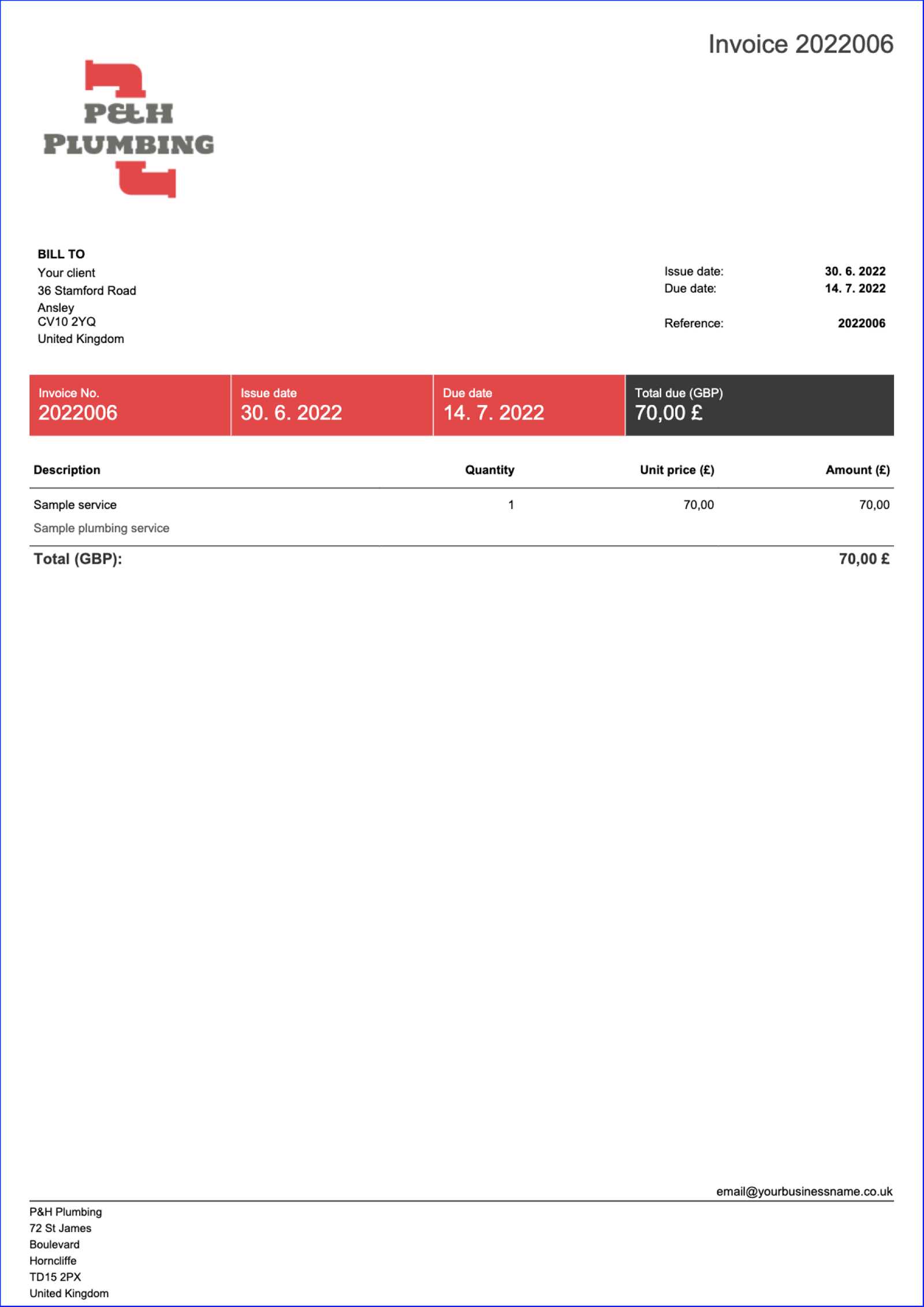

Aligning your billing documents with your brand identity is an important step in presenting a cohesive and professional image to your clients. Customizing these forms allows you to incorporate your business’s unique elements, making your documents not only functional but also a reflection of your company’s style and values.

By personalizing the layout, you ensure that each communication you send, whether it’s a bill or a receipt, enhances your brand recognition. This includes adding your logo, adjusting color schemes, and selecting fonts that align with your overall business identity. Customization also helps create a sense of consistency, making your documents easily recognizable and helping to build trust with clients.

| Customization Aspect | How It Enhances Branding |

|---|---|

| Logo | Including your company logo at the top of the document makes your brand more visible and helps clients associate the document with your business instantly. |

| Color Scheme | Choosing colors that match your brand palette can make your billing documents more visually appealing and align them with your overall marketing materials. |

| Fonts | Selecting fonts that are consistent with your brand’s voice and style helps reinforce your brand identity, making your documents look more professional and cohesive. |

| Tagline or Slogan | Incorporating a tagline or slogan can add a personal touch and remind your clients of what your business stands for, strengthening your overall brand message. |

Customizing these details helps to create a stronger, more recognizable connection with your clients, leaving a lasting impression every time they receive a document from you.

Where to Find Free Invoice Templates

Finding high-quality, free solutions for your billing needs can greatly simplify your workflow and save you time. Many online resources offer ready-made formats that you can access without any cost. These documents are typically designed to be customizable and easy to use, allowing you to quickly generate accurate and professional records.

Popular Online Platforms for Free Resources

- Microsoft Office Templates – A reliable source offering a variety of billing documents compatible with Word and Excel, which can be customized to your needs.

- Google Docs – Free, cloud-based templates that allow for easy collaboration and access across devices, ideal for businesses on the go.

- Canva – A user-friendly platform providing customizable designs with drag-and-drop functionality, perfect for businesses seeking creative formats.

- Zoho – Provides free templates as part of their cloud software suite, designed for quick and efficient billing processes.

- Template.net – Offers a range of free document solutions, including billing layouts suitable for various industries.

Other Free Resources to Explore

- Freelance Websites – Many freelance platforms, like Upwork and Fiverr, offer free templates as part of their service packages.

- Small Business Websites – Websites dedicated to small business resources often provide free templates and guides for managing financial documents.

- Open-Source Communities – Platforms like GitHub often feature open-source documents, where you can access free resources shared by the community.

By exploring these platforms, you can easily find a solution that fits your business’s needs without the need to invest in expensive software or services. Most of these formats are ready to use and can be customized to align with your business identity, making them ideal for both small businesses and freelancers.

Using Invoice Templates for Small Businesses

For small businesses, managing finances efficiently is key to maintaining smooth operations and ensuring timely payments. Pre-designed documents for recording transactions provide a simple solution, helping owners save time while keeping financial records accurate and consistent. These tools offer an easy way to create professional-looking records, which is especially beneficial for businesses with limited resources.

Advantages for Small Business Owners

Using ready-made formats offers numerous benefits for small businesses, such as:

| Advantage | Benefit for Small Businesses |

|---|---|

| Time-Saving | Small businesses often have limited staff and resources. Pre-designed solutions reduce the time spent creating documents from scratch, allowing owners to focus on other critical tasks. |

| Cost-Effective | Most free options available online can be accessed without any financial investment, which is crucial for businesses with tight budgets. |

| Professional Presentation | Even without a large marketing budget, using a polished, consistent format helps small businesses present themselves as reliable and professional to clients. |

| Accuracy and Consistency | Pre-structured documents help reduce the risk of errors, ensuring that all relevant details are included and organized in a clear, standardized way. |

How Small Businesses Can Customize These Solutions

Customization is key for making these documents feel aligned with your brand. Many free solutions allow small business owners to add their company logo, adjust fonts, and choose colors that match their branding. This not only enhances the professional appearance of the documents but also helps to build brand recognition with every transaction.

By incorporating these ready-made documents into their workflow, small businesses can improve their financial management, enhance professionalism, and ensure that every transaction is accurately documented without the need for complex software or extra expense.

Creating Professional Invoices with Templates

Generating clear, accurate, and professional records for each transaction is essential for maintaining trust with clients and ensuring timely payments. By using structured formats, businesses can easily create documents that meet legal requirements, present information in an organized manner, and reflect their brand’s professionalism. A consistent approach to billing helps businesses stand out and manage their finances more effectively.

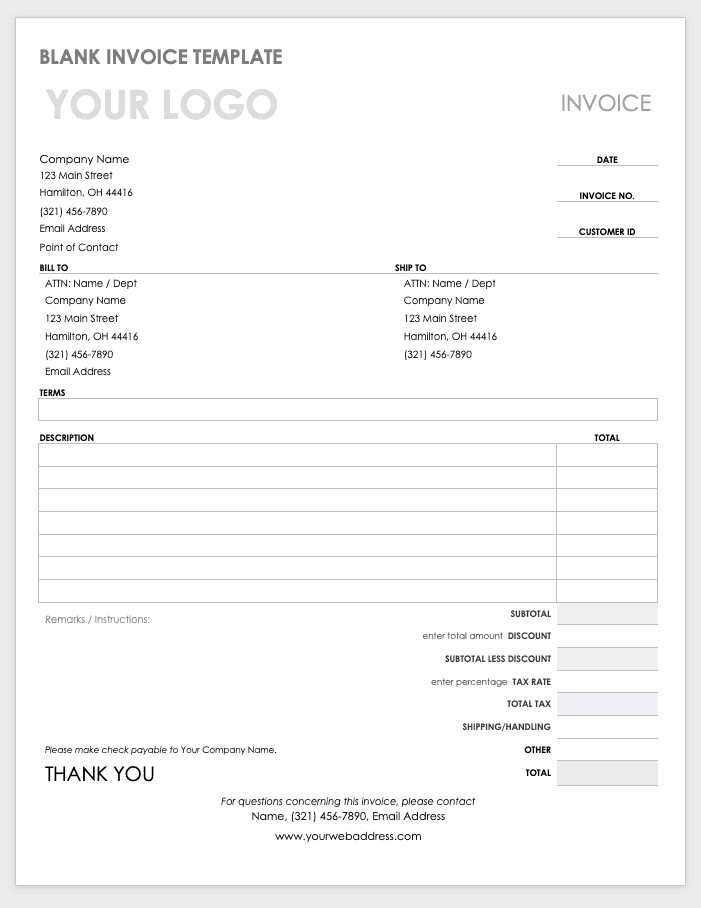

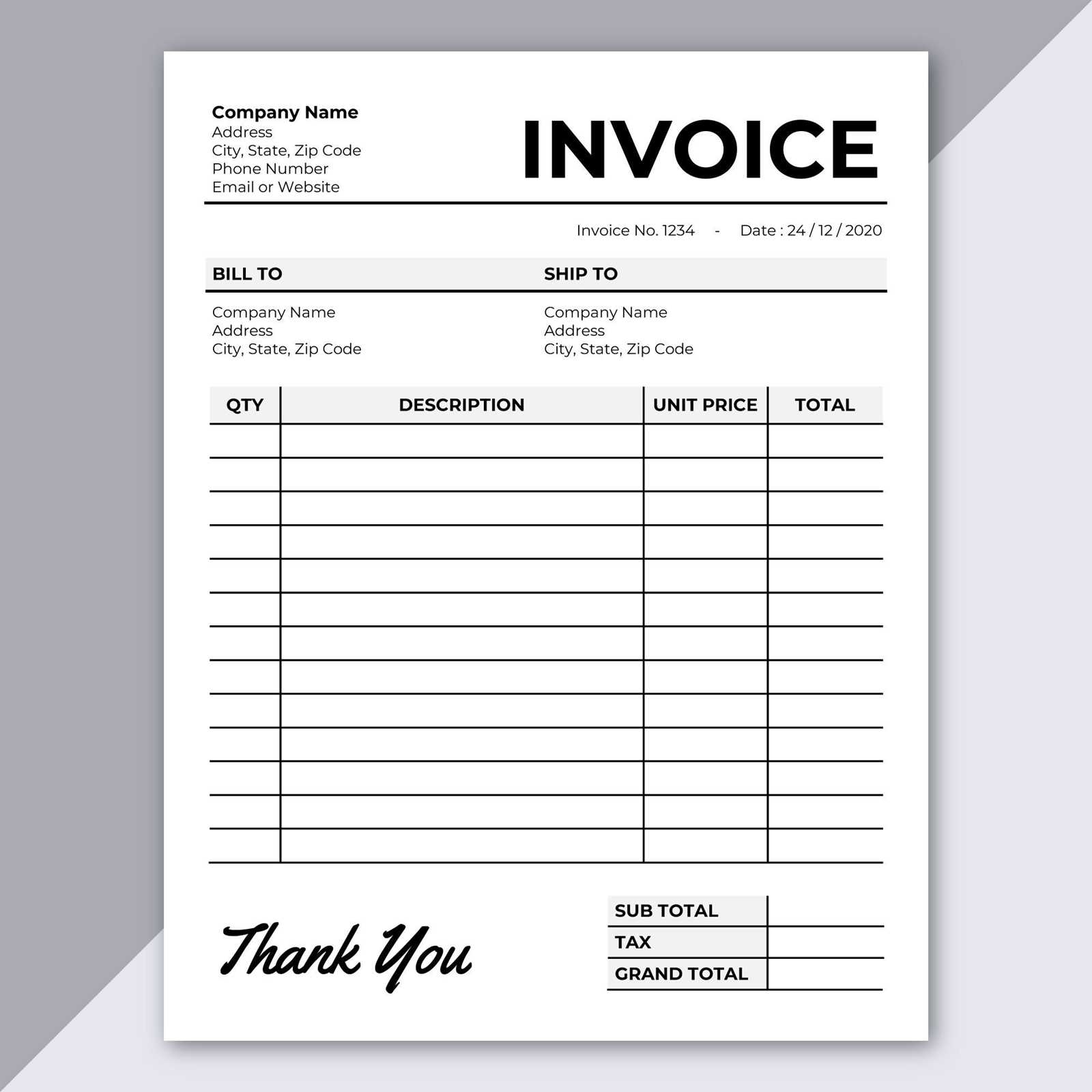

Key Elements of a Professional Document

A well-organized document should contain several key elements that contribute to its clarity and professionalism. These include:

| Key Element | Description |

|---|---|

| Business Information | Your company’s name, contact details, and logo should be clearly visible to help clients easily identify the document and contact you if needed. |

| Client Information | Including your client’s name, address, and contact details ensures that there is no confusion about who the payment is due from. |

| Itemized List | A detailed breakdown of services rendered or products sold, along with individual prices, helps clarify charges for your clients and ensures transparency. |

| Payment Terms | Clearly defined terms, such as due dates, payment methods, and any late fees, help ensure that both parties understand the expectations surrounding payment. |

| Professional Layout | A clean, easy-to-read design with consistent formatting demonstrates professionalism and can enhance your brand’s image. |

How Pre-Structured Formats Help Achieve Professionalism

By using pre-structured solutions, businesses ensure that all necessary components are included in each document. These formats are designed to be easy to edit, allowing you to personalize the details for each transaction while maintaining a consistent look. Customization options–such as adding your business logo, adjusting fonts, or changing colors–allow you to reflect your brand’s unique identity. This consistency not only improves client trust but also reduces the likelihood of errors.

With a structured, professional approach to billing, businesses can foster stronger client relationships and ensure that payments are made in a timely and accurate manner.

How to Edit and Personalize Invoice Templates

Personalizing your billing documents is a vital step to ensure that each one reflects your brand and is suited to the specific details of each transaction. Editing a pre-designed layout allows you to incorporate your business’s unique elements, such as logos, colors, and contact information, while ensuring that all necessary details are included in a clear and organized way.

Steps to Edit Your Billing Documents

Editing and personalizing these documents is often a straightforward process. Here are the key steps to follow:

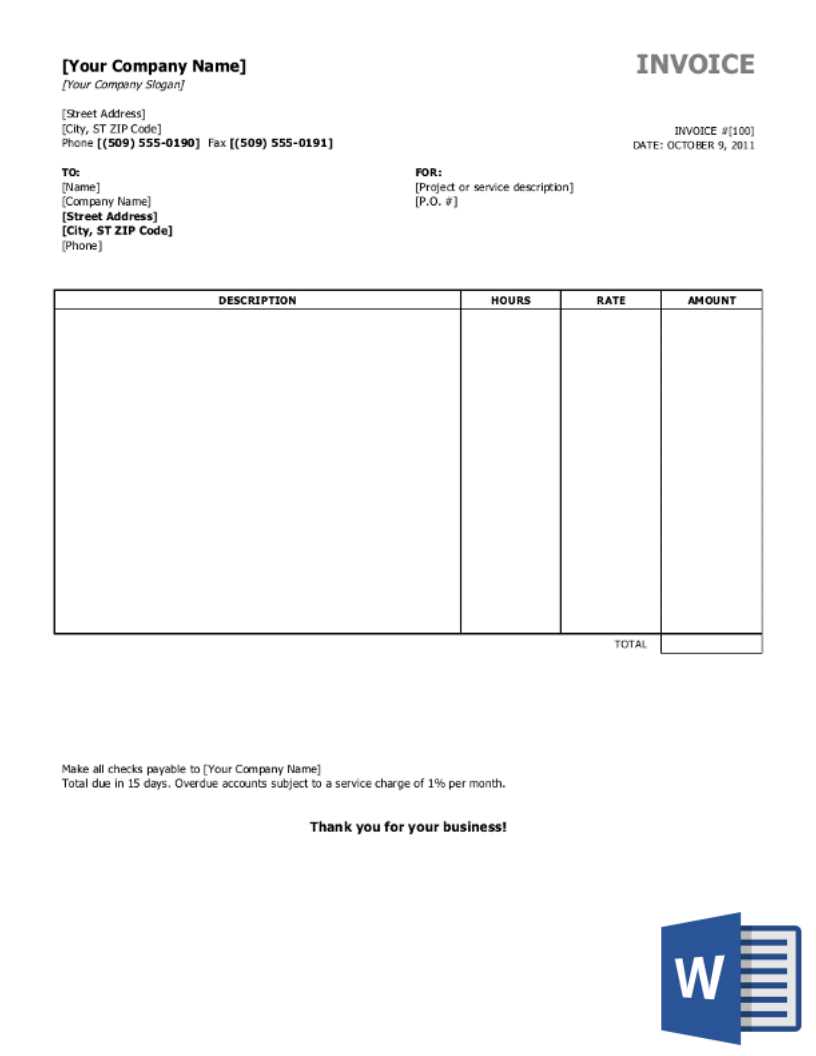

- Open the Document in Your Preferred Program: Most ready-made formats can be opened in programs like Microsoft Word, Excel, or Google Docs, which makes editing simple.

- Update Business Information: Ensure that your company’s name, address, phone number, and email are prominently displayed at the top of the document. This helps clients quickly identify the source.

- Insert Client Details: Add the client’s name, address, and contact information in the appropriate fields, ensuring accuracy for seamless communication.

- Modify the Payment Breakdown: List the goods or services provided, along with their prices, and make any necessary adjustments for each specific job or purchase.

- Customize Payment Terms: Define the due date, payment method options, and any late fees or discounts. This clarifies the expectations for both parties.

Personalization for Branding

To make your documents truly reflect your business’s identity, consider the following customization options:

- Branding Elements: Add your logo, use your business’s color scheme, and choose fonts that align with your brand style.

- Adjust Layout: You can modify the layout to make the document more visually appealing and easier to read for your clients. Ensure the document is clear, organized, and professional.

- Include Additional Information: You may want to add a tagline, payment instructions, or a thank-you note to personalize the experience for your clients.

By following these steps and taking advantage of customization options, you can create billing documents that are not only functional but also a true reflection of your business’s professionalism and attention to detail.

Key Features to Look for in Templates

When selecting a pre-designed solution for managing your billing and transaction records, it’s important to consider the essential features that ensure efficiency, clarity, and professionalism. A good document should be easy to use, customizable, and capable of handling all necessary details. Whether you’re a freelancer or a small business owner, having the right features can significantly improve your workflow and client interactions.

Here are some key aspects to look for when choosing a suitable format:

| Feature | Description |

|---|---|

| Clear Layout | The document should have an organized and simple structure that makes it easy to read and navigate. Clear sections for payment details, client information, and terms help both parties understand the transaction. |

| Customizability | A good solution should allow you to adjust key elements such as your business logo, fonts, colors, and layout, ensuring that the document reflects your brand identity. |

| Itemized List of Charges | Each item or service provided should be listed separately with corresponding prices. This not only helps with transparency but also reduces the chance of disputes over billing details. |

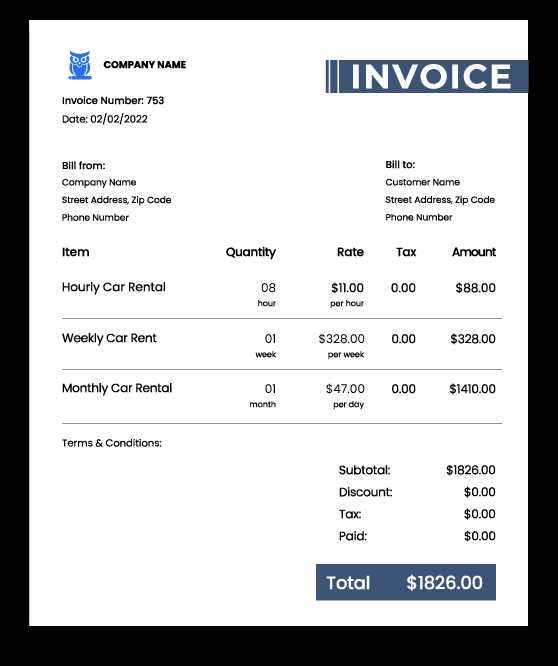

| Payment Terms Section | Clearly defined payment terms, such as due dates, late fees, and accepted payment methods, should be included to set clear expectations with your clients. |

| Tax and Discount Calculations | It’s important that the solution supports tax and discount fields, enabling you to automatically calculate totals based on rates and percentages. |

| Professional Design | The overall look of the document should be polished and professional, which helps to establish credibility with clients. A clean, modern design creates a positive impression and makes your business appear trustworthy. |

Choosing the right features can make a significant difference in streamlining your billing process. By looking for these essential elements, you ensure that your documents are not only functional but also a reflection of your professional image.

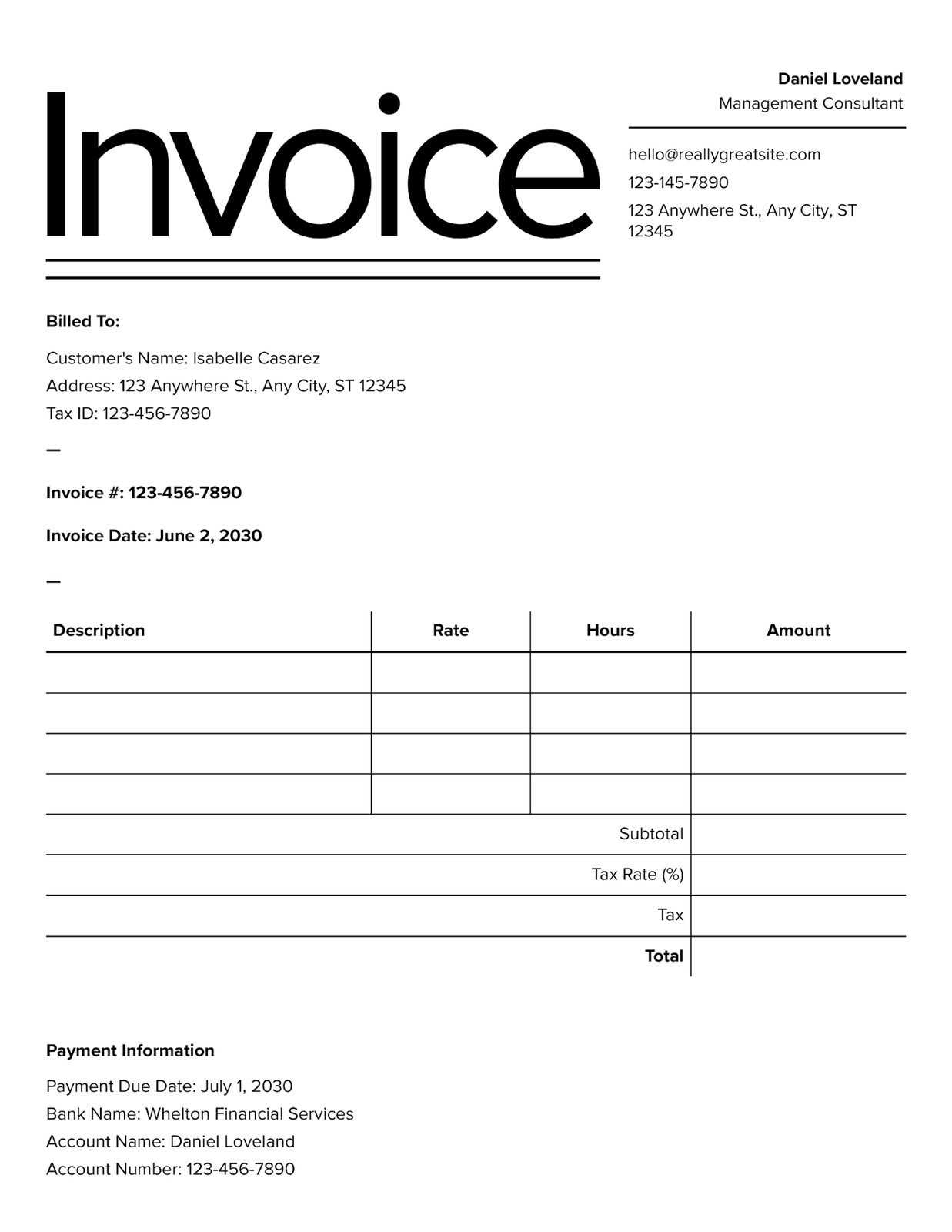

Best Invoice Templates for Freelancers

For freelancers, having the right documents to manage billing and payments is crucial for maintaining professional relationships and ensuring timely compensation. Using a pre-designed layout tailored to your specific needs can save you time and ensure that all important details are included. Below, we’ve outlined some of the best options available for freelancers looking to streamline their payment process.

Top Features to Look for in a Freelancer Billing Document

- Simplicity: A clear and concise layout is essential, as freelancers often deal with multiple clients and need to create documents quickly.

- Customizability: The ability to add your logo, personalize colors, and adjust fields according to your needs is essential for branding and ease of use.

- Professional Design: A well-designed document enhances your professional image, making clients more likely to pay on time.

- Payment Details: Ensure that sections for payment terms, due dates, and preferred methods are clearly outlined.

- Hourly or Project-Based Rates: Freelancers often charge by the hour or project, so having a flexible document to handle different pricing structures is important.

Best Billing Formats for Freelancers

- Minimalist Design: For freelancers who prefer a clean, no-frills approach, minimalist designs keep things simple while still maintaining a professional look.

- Creative and Visual Designs: Freelancers in creative fields, such as graphic design or photography, may benefit from a more visually appealing layout that showcases their work style.

- Time Tracking Templates: For those who bill by the hour, a format that allows you to track and display hours worked is essential.

- Itemized Service Breakdown: An itemized structure is ideal for freelancers offering multiple services, allowing each task to be listed separately with its respective cost.

By using one of these pre-designed solutions, freelancers can not only save time but also present themselves as organized and professional, ensuring that clients are confident in their billing practices and more likely to pay on time.

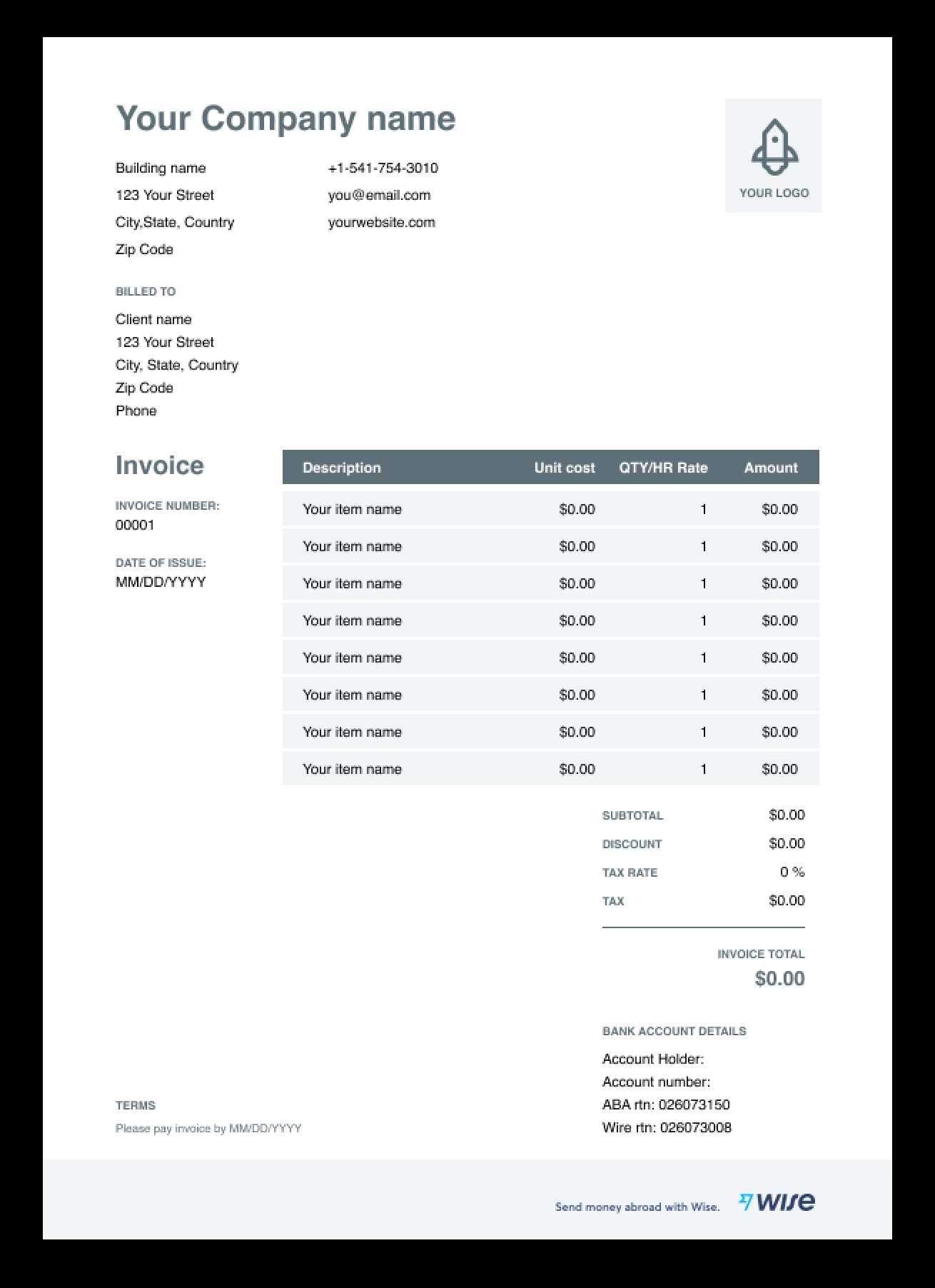

Invoice Template Formats: PDF, Excel, Word

When creating billing documents, the format you choose can greatly impact how easily you can manage, edit, and share them with clients. Different file formats offer various benefits depending on your specific needs, and understanding these options can help you select the most appropriate one for your business. Below, we explore the advantages of using PDF, Excel, and Word formats for your billing records.

Advantages of Each Format

- PDF Format: Ideal for final, uneditable documents, PDFs ensure that the layout remains intact across different devices. This format is perfect for sending a polished and professional bill that cannot be accidentally altered. It’s the best option when you want to ensure that the client sees exactly what you’ve created.

- Excel Format: Perfect for those who need flexibility in calculations and easy updates. Excel is great for itemized billing, especially when you’re tracking multiple line items or working with hourly rates. This format also allows you to use formulas to automatically calculate totals, taxes, and discounts, saving time on manual calculations.

- Word Format: This format is best for users who want something simple and easy to edit. Word allows for easy customization, from fonts and colors to layouts, and is a good choice for freelancers or small businesses who need to make quick adjustments or want to integrate text-based information with their bills.

When to Use Each Format

- PDF: Choose this format when you need to send a final version that will not be altered. It’s also ideal for professional settings where clients expect a polished, print-ready document.

- Excel: Best suited for situations where you need to track hours, calculate totals, or update amounts frequently. Excel is a great choice if you are managing multiple clients or working on complex projects with varying pricing.

- Word: A solid choice for simple, straightforward documents that you may need to edit regularly. Word offers a balance between ease of use and customizability, making it a good option for smaller businesses or service providers.

Each format has its strengths, so the right one for you depends on your specific needs, whether it’s for a quick update, detailed calculations, or sending a secure and unchangeable document to clients.

How Invoice Templates Save Time and Money

Efficient billing is essential for smooth business operations, and having a pre-designed document to record and send payments can significantly reduce both time spent on administrative tasks and the risk of costly errors. By using a structured format, businesses can streamline the process of creating, sending, and tracking payments, making it easier to maintain financial organization while ensuring that all details are accurately included.

Here’s how utilizing pre-designed solutions can save you valuable time and money:

| Benefit | How It Saves Time and Money |

|---|---|

| Consistency | Using a consistent layout across all your documents reduces the time spent on formatting. You don’t need to create a new design for every transaction, which speeds up the process. |

| Minimized Errors | Pre-set fields for client information, amounts, and due dates reduce the chances of forgetting important details or making calculation mistakes, which could lead to financial loss or customer dissatisfaction. |

| Easy Customization | Most structured solutions can be easily customized with client-specific details, allowing you to quickly generate accurate records without wasting time on manual entry for each document. |

| Professional Appearance | These ready-made solutions give your business a professional look, which can help increase customer trust and potentially lead to faster payments, improving cash flow and reducing follow-up costs. |

| Automation of Repetitive Tasks | For recurring services or clients, using a pre-designed structure allows you to automate and replicate the same format for future transactions, saving both time and effort. |

By cutting down on time spent creating documents and minimizing the chances of costly mistakes, using a well-organized and easily customizable solution can significantly improve the efficiency of your business operations, allowing you to focus on other areas of growth.

Common Mistakes When Using Invoice Templates

While pre-designed billing solutions can save time and reduce errors, it’s still possible to make mistakes during the process. These mistakes can lead to confusion with clients, delays in payment, and a lack of professionalism. Being aware of these common pitfalls can help you avoid issues that may arise and ensure smooth transactions every time.

1. Incorrect or Missing Client Information

One of the most common mistakes is failing to update or double-check client details. Missing or incorrect information, such as the client’s name, address, or contact details, can cause delays or even result in missed payments. Always verify that the client’s information is accurate and complete before sending the document.

2. Overlooking Payment Terms

Not clearly defining payment terms is another frequent issue. Without clear due dates, late fees, or accepted payment methods, clients may be uncertain about when and how to pay. Always make sure that the payment terms are clearly stated in every billing document to avoid misunderstandings.

3. Failing to Itemize Charges

When working with multiple services or products, failing to itemize charges can lead to confusion. Clients may question the total amount or ask for more detailed breakdowns of the charges. Ensure that every service or product is listed separately with the corresponding price, quantity, and description to avoid disputes.

4. Ignoring Branding and Consistency

Using a generic, unbranded format may undermine your business’s professionalism. It’s essential to personalize your documents with your business logo, color scheme, and consistent fonts. Lack of branding can make your documents look less credible and may affect the client’s perception of your business.

5. Forgetting to Save and Organize Files

Another mistake is not saving the billing document properly or organizing them effectively. Failing to keep track of sent documents or creating inconsistent file names can lead to confusion later, especially if you need to refer back to a past transaction. Make sure to save and organize your documents in a clear, consistent manner for easy retrieval.

By being mindful of these common mistakes and taking steps to avoid them, you can ensure that your billing process runs smoothly and that you maintain a professional relationship with your clients.

Integrating Invoice Templates with Accounting Software

For businesses that deal with frequent transactions, integrating billing documents with accounting software can streamline financial operations and reduce manual input. When your billing system is directly connected to your accounting tools, you can automate calculations, track payments, and generate financial reports with minimal effort. This integration ensures accuracy and helps maintain up-to-date records, ultimately saving time and preventing costly errors.

By syncing your billing documents with accounting software, you can access a range of benefits:

- Automation of Data Entry: When billing documents are integrated with accounting tools, client and transaction data are automatically populated. This reduces the need for manual entry and eliminates common errors.

- Accurate Financial Records: Automatic syncing ensures that all financial data, including taxes, payments, and outstanding balances, is accurately recorded in real-time. This makes accounting more efficient and helps maintain accurate books.

- Streamlined Reporting: Integrated systems allow for seamless generation of financial reports. Whether you need a profit and loss statement or a tax report, everything can be generated with a few clicks, based on the data already captured in your system.

- Time Savings: With fewer manual steps required to update accounting records, you save time and reduce the likelihood of overlooking key financial details.

- Improved Cash Flow Management: By tracking payments and outstanding balances in real-time, you can quickly identify overdue transactions and follow up with clients efficiently, improving cash flow and reducing the time spent on collections.

Integrating your billing processes with accounting software not only increases efficiency but also enhances accuracy and transparency in your financial operations. It can help businesses maintain consistent records and improve overall financial management without additional effort or time investment.

How to Automate Invoices with Templates

Automating the process of generating billing documents can greatly improve efficiency for businesses. By setting up automated systems to handle recurring transactions, businesses can eliminate the need for manual data entry, reduce human errors, and save valuable time. With the right tools, this process can be set to generate and send out documents without the need for constant intervention, allowing for smoother operations and quicker payments.

Here’s a step-by-step guide on how to automate your billing process with pre-designed solutions:

| Step | Action |

|---|---|

| Step 1 | Choose an automation tool that integrates with your accounting software. Many platforms offer automated billing features that allow you to schedule and send out documents at specific intervals. |

| Step 2 | Set up recurring client information, including details like names, payment terms, and services rendered. Once these details are entered, they can be used across all future transactions. |

| Step 3 | Customize the document layout to match your brand, ensuring consistency across all generated documents. Most tools offer easy-to-use editing options to add your logo, colors, and preferred fonts. |

| Step 4 | Schedule the automation frequency. Depending on your business model, you can set up recurring billing for weekly, monthly, or project-based cycles. The system will automatically generate and send out the necessary documents based on the schedule. |

| Step 5 | Track the status of your automated billing. Most tools will allow you to monitor whether the documents were delivered, paid, or require follow-up actions. |

By automating the creation and delivery of billing documents, you can significantly reduce the time spent on administrative tasks while ensuring that your clients receive accurate and timely records. This not only improves your internal processes but also enhances client satisfaction and accelerates payments.

Legal Aspects of Using Invoice Templates

When generating billing documents for your business, it’s important to understand the legal requirements that govern these records. Proper documentation can help protect your business in case of disputes, audits, or tax-related issues. Using a structured format for your transactions not only ensures that all required details are included but also helps to maintain legal compliance and transparency in financial dealings.

Several key legal aspects need to be considered when preparing business records:

| Legal Consideration | Importance |

|---|---|

| Proper Documentation of Transactions | Having clear and accurate records ensures that all transactions are properly documented for tax purposes and future reference. This is critical for protecting both the business and the client in case of discrepancies. |

| Inclusion of Mandatory Details | Depending on your jurisdiction, there may be required fields that must appear on your billing records, such as the business registration number, VAT identification, and specific payment terms. Failure to include these details can lead to legal issues or non-compliance with tax authorities. |

| Retention of Records | Businesses are often required by law to retain financial records for a set period (e.g., 5-7 years). Using a consistent format makes it easier to organize and store documents in a way that complies with retention laws. |

| Tax Reporting Compliance | Accurate records are essential for correct tax reporting. Using a clear, standardized format ensures that all income and expenses are properly categorized, which is necessary for filing accurate tax returns and avoiding penalties. |

| Dispute Resolution | In case of disputes over payments, having clear and legally-compliant records will make it easier to resolve the issue. Properly formatted documents with clear terms help avoid confusion and clarify the agreed-upon payment details. |

By adhering to the legal requirements when creating billing documents, businesses can ensure smoother operations, avoid costly mistakes, and protect themselves against potential legal challenges. It’s always advisable to stay updated with local regulations and consult a legal professional when in doubt about specific legal obligations related to financial

Tips for Sending Invoices Promptly and Professionally

Timely and professional delivery of payment requests is essential for maintaining good client relationships and ensuring a steady cash flow. The way you send your billing documents can influence how clients perceive your business and how quickly they process payments. Following a few best practices can help you ensure that your documents are not only sent promptly but also reflect the professionalism of your business.

1. Send Documents Immediately After Services are Rendered

It’s important to send payment requests right after completing a job or delivering a product. Delaying the sending of payment details can lead to confusion or forgotten payments. Timeliness reinforces your professionalism and encourages quicker payments.

2. Personalize Each Document

Although using pre-designed documents can save time, always personalize them for each client. Include the correct contact information, project details, and payment terms specific to the service provided. Customization helps reinforce the professional nature of the transaction.

3. Use Clear and Concise Language

Avoid using jargon or overly complex wording. Keep your payment terms, dates, and amounts clear and easy to understand. If any details are unclear, clients may delay processing or raise questions, which can cause unnecessary back-and-forth.

4. Offer Multiple Payment Methods

Provide your clients with various payment options to make it as easy as possible for them to settle their dues. Include details for bank transfers, online payment systems, credit cards, or other accepted methods. Offering flexibility in payment options can encourage faster payments.

5. Send Friendly Payment Reminders

If payment is delayed, send a polite reminder with the same level of professionalism. A friendly follow-up email or call can help clients remember their due dates without feeling pressured, maintaining a positive relationship while ensuring you receive the payment.

6. Use Professional Branding

Ensure that your documents reflect your brand’s image. Include your logo, business name, and contact information in a clean and organized layout. This not only gives your communications a polished look but also strengthens your brand presence.

7. Keep Records of Sent Documents

Make sure to keep a record of all sent billing documents. This will help you track which clients have received and paid their dues, and will be useful in case of any disputes. Keeping proper records is key for both financial and legal purposes.

8. Automate the Process if Possible

Consider using automation tools to send recurring billing documents, reminders, and payment confirmations. Automating this process reduces the chances of delays and helps ensure that you are consistent in your follow-ups.

By sending payment documents promptly and professionally, you not only ensure that your clients pay on time but also project an image of reliability and competence, which can foster long-term relationships and steady business growth.