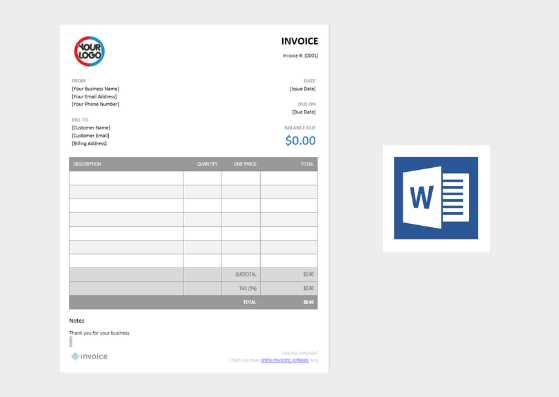

Download Free Invoice Templates Today

Managing financial transactions efficiently is essential for any business or freelance endeavor. Having access to well-designed documents can streamline this process, ensuring clarity and professionalism in all exchanges. These resources not only enhance your brand image but also save valuable time during invoicing tasks.

By utilizing readily available formats, individuals can easily adapt them to their specific needs. This flexibility allows for customization, enabling you to add your branding elements and personal touch. With various designs at your fingertips, it’s possible to create appealing and functional documents that effectively convey essential information to clients.

Furthermore, understanding the significance of accurate documentation can lead to improved financial management. Properly structured papers not only facilitate better cash flow but also minimize errors in billing. Embracing these accessible resources will empower you to manage your finances with confidence and ease.

Benefits of Using Free Invoice Templates

Utilizing no-cost billing resources can significantly enhance the efficiency of financial operations for businesses and freelancers alike. These resources offer numerous advantages that can simplify the process of managing transactions and ensure professionalism in client communications.

- Cost-Effective Solutions: Free resources eliminate the need for expensive software or design services, allowing individuals to allocate their budgets to other critical areas.

- Time Savings: Pre-designed documents can be quickly customized, reducing the time spent on formatting and layout adjustments.

- Professional Appearance: Well-crafted documents convey professionalism, helping to build trust and credibility with clients.

- Flexibility: Available formats can be tailored to fit specific business needs, including branding elements and unique service descriptions.

- Improved Accuracy: Utilizing structured formats helps minimize errors, ensuring that all necessary information is included and correctly presented.

- Streamlined Record Keeping: Consistent use of standardized documents aids in maintaining organized financial records, making it easier to track payments and transactions.

Embracing these resources not only facilitates a more efficient workflow but also contributes to enhanced financial management practices, ultimately benefiting overall business operations.

How to Customize Your Invoice Template

Tailoring your financial documents to reflect your brand and meet specific needs is a crucial step in professional communication. Customization not only enhances the visual appeal of your paperwork but also ensures that it effectively conveys all necessary information. By following a few straightforward steps, you can create personalized documents that stand out to your clients.

Start by incorporating your business logo and colors to establish brand identity. This visual consistency reinforces recognition and professionalism. Next, ensure that your contact information is clearly displayed, making it easy for clients to reach you with any inquiries. Including your website and social media links can also promote further engagement.

Adjust the layout and sections according to your services. Highlight important details such as payment terms, due dates, and itemized charges to enhance clarity. Utilizing clear headings and bullet points can further improve readability and organization.

Finally, consider adding a personal touch by including a brief thank-you note or message to clients. This small gesture can strengthen relationships and foster goodwill. By following these steps, you will create compelling documents that not only serve their purpose but also reflect your brand’s values and professionalism.

Top Websites for Invoice Downloads

Finding high-quality resources for creating billing documents can be essential for streamlining financial processes. Numerous websites offer a wide variety of options that cater to different needs and preferences, making it easy to locate the right fit for your business. Here are some of the best platforms to explore.

- InvoiceGenerator.com: This site provides a simple and user-friendly interface for creating customized documents quickly. Users can choose from several styles and formats that suit their requirements.

- Template.net: Offering a vast library of professionally designed documents, this platform allows users to filter by category, ensuring an efficient search experience.

- Canva: Known for its design capabilities, Canva also features numerous pre-made billing resources that can be easily customized to align with your branding.

- Invoiced: This website offers a range of practical solutions for businesses, including free resources that are easily accessible and adaptable.

- FreshBooks: While primarily accounting software, FreshBooks provides free resources that can help users create well-structured financial documents.

- Zoho Invoice: This platform not only offers software for invoicing but also provides various free documents that can be tailored to meet individual needs.

Utilizing these websites can greatly enhance your ability to create professional and effective billing documents that cater to your specific business requirements.

Choosing the Right Format for Invoices

Selecting the appropriate format for your billing documents is essential for effective communication and professionalism. The right choice not only enhances the visual appeal but also ensures that all necessary information is conveyed clearly. Various formats are available, each catering to different needs and preferences.

When deciding on a format, consider the following factors:

- File Type: Common options include PDF, Word, and Excel. PDFs are widely used for their compatibility and professional appearance, while Word and Excel allow for easier editing.

- Design Flexibility: Choose a format that allows for customization. Some software provides pre-designed options that can be easily modified to suit your branding and style.

- Ease of Use: Select a format that is user-friendly. This will save you time and effort when creating documents and reduce the chances of errors.

- Compatibility: Ensure that the chosen format is compatible with your accounting software or other tools you use. This will facilitate seamless integration and management of financial records.

- Professional Appearance: The format should reflect the quality of your services. A well-organized document creates a positive impression on clients and reinforces your brand image.

By carefully considering these aspects, you can select a format that best meets your needs and enhances your financial documentation process.

Tips for Designing Professional Invoices

Creating visually appealing and well-structured financial documents is vital for maintaining a professional image. A thoughtfully designed document not only enhances readability but also conveys credibility to clients. Here are some essential tips to help you craft polished billing resources.

1. Maintain Consistent Branding: Use your business colors, logo, and fonts throughout the document. Consistency reinforces brand identity and creates a cohesive look that clients will recognize.

2. Organize Information Clearly: Structure your document logically. Include sections for contact information, services rendered, payment terms, and total amounts. A clear layout helps clients quickly find the details they need.

3. Use Professional Language: Choose a tone that reflects your business ethos. Clear and polite language enhances professionalism and fosters trust between you and your clients.

4. Include Necessary Details: Ensure that all essential information is present, such as invoice numbers, dates, and payment instructions. Omitting details can lead to confusion and delays in payments.

5. Keep It Simple: Avoid cluttering your document with excessive graphics or information. A clean, minimalist design often appears more professional and is easier for clients to read.

6. Review and Proofread: Before sending out your document, check for any errors or inconsistencies. A thorough review can help you maintain a polished and professional appearance.

By following these tips, you can create effective billing resources that not only look professional but also facilitate smooth financial transactions.

Common Mistakes When Creating Invoices

Producing accurate billing documents is crucial for ensuring timely payments and maintaining professional relationships with clients. However, several common errors can hinder this process, leading to confusion and potential payment delays. Identifying and addressing these pitfalls can help streamline your financial transactions.

Missing Essential Information

One of the most significant mistakes is failing to include all necessary details. Essential elements to include are:

- Business name and contact information

- Client’s details

- Unique document number

- Service or product descriptions

- Total amount due and payment terms

Omitting any of these can create confusion and result in delayed payments.

Inaccurate Calculations

Errors in calculations can lead to discrepancies and mistrust. Common issues include:

- Incorrect tax rates applied

- Math mistakes in totaling charges

- Failing to account for discounts or late fees

To avoid these errors, double-check all figures before sending out your document.

By being aware of these common mistakes and taking steps to avoid them, you can enhance the efficiency and professionalism of your billing processes.

Integrating Invoices with Accounting Software

Seamlessly connecting billing documents with accounting applications can significantly enhance financial management and streamline administrative tasks. This integration facilitates automatic updates to financial records, reducing the risk of human error and saving valuable time. Understanding the benefits and methods of integration is essential for businesses aiming to improve their financial processes.

Here are some key advantages of integrating billing documents with accounting software:

| Benefit | Description |

|---|---|

| Efficiency | Automation reduces manual data entry, allowing for quicker processing of transactions. |

| Accuracy | Minimizing human error leads to more precise financial records and less discrepancy in accounts. |

| Real-Time Updates | Immediate syncing ensures that all financial data is current, providing up-to-date insights. |

| Improved Cash Flow Management | Timely invoicing and tracking enhance cash flow, aiding in financial planning and stability. |

| Better Reporting | Integration allows for comprehensive reporting, helping businesses analyze performance and trends. |

By integrating billing documents with accounting systems, businesses can not only improve their operational efficiency but also foster stronger financial management practices.

Understanding Invoice Legal Requirements

Comprehending the legal obligations associated with billing documents is vital for maintaining compliance and avoiding potential disputes. Each jurisdiction may have specific regulations that govern what information must be included and how these records should be managed. Being informed about these requirements helps businesses uphold transparency and professionalism.

Here are essential legal elements commonly required in billing documents:

- Seller Information: Full name or business name, address, and contact details.

- Buyer Information: Client’s name, address, and any relevant identification numbers.

- Date of Issue: The date when the document is generated.

- Unique Identifier: A distinct number or code to track the document.

- Description of Goods or Services: Clear and detailed information about the items or services provided.

- Pricing Details: Itemized list of costs, including any applicable taxes or discounts.

- Payment Terms: Clear instructions regarding payment deadlines and accepted methods.

By ensuring that all legal requirements are met, businesses can protect themselves from disputes and enhance their credibility with clients.

How to Save Time with Templates

Utilizing pre-designed documents can significantly streamline your administrative processes, allowing you to focus on core business activities. These ready-made formats eliminate the need to start from scratch, providing a consistent structure that can be customized as necessary. This approach not only saves time but also enhances productivity and organization.

Advantages of Using Pre-designed Formats

Implementing these resources can lead to various benefits, including:

| Advantage | Description |

|---|---|

| Efficiency | Quickly fill in necessary details without recreating the layout each time. |

| Consistency | Maintain a uniform appearance across all documents, enhancing professionalism. |

| Customization | Easily adjust content to meet specific needs while keeping the original design intact. |

| Accessibility | Readily available formats can be used anytime, simplifying the process of record-keeping. |

| Cost-Effectiveness | Minimize the need for professional design services, saving money and resources. |

Implementation Tips

To make the most of pre-designed documents, consider the following tips:

- Choose formats that align with your brand identity.

- Regularly update the content to reflect current offerings and services.

- Utilize software that allows for easy modifications to enhance usability.

By integrating pre-designed documents into your workflow, you can significantly reduce the time spent on administrative tasks and improve overall operational efficiency.

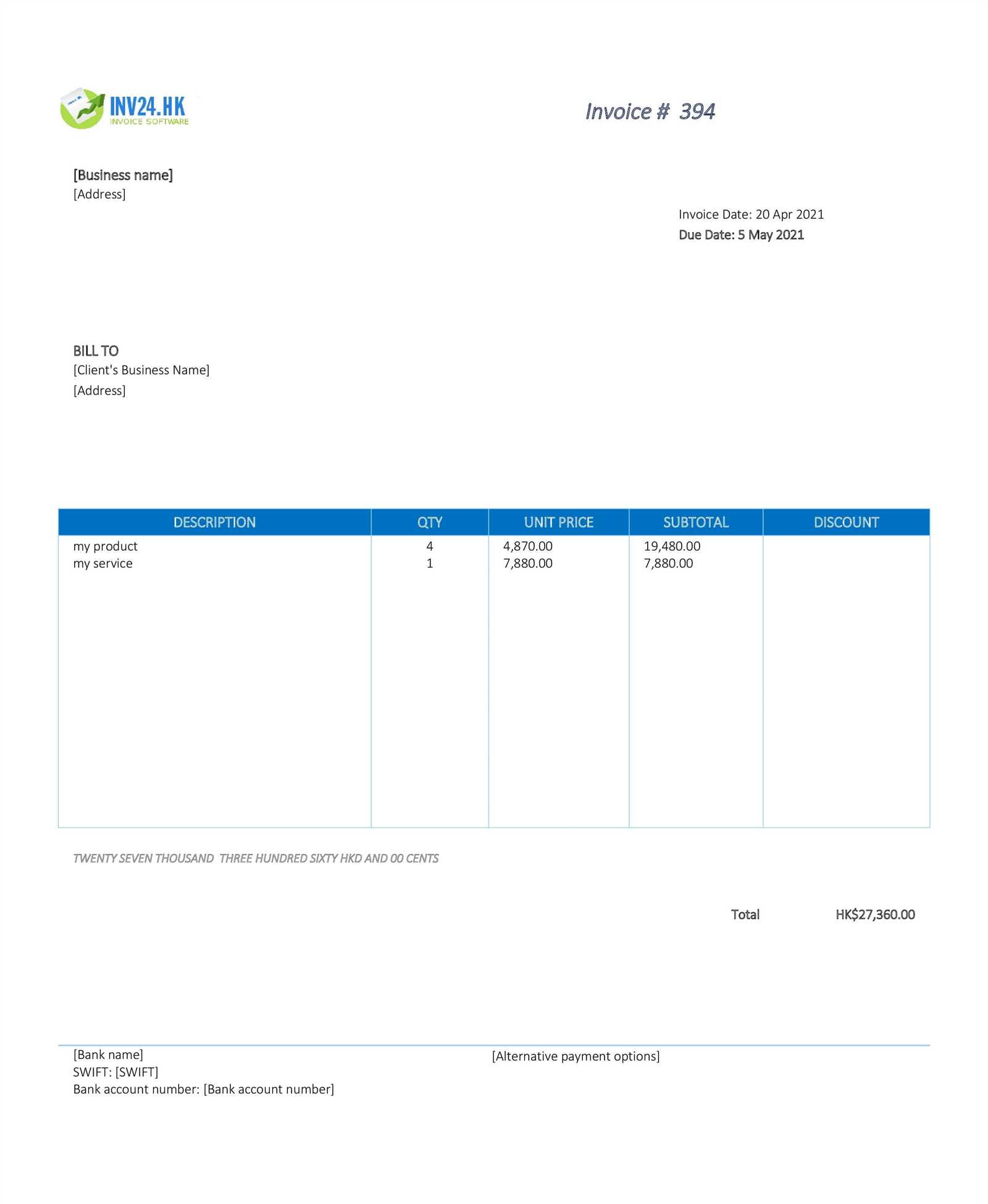

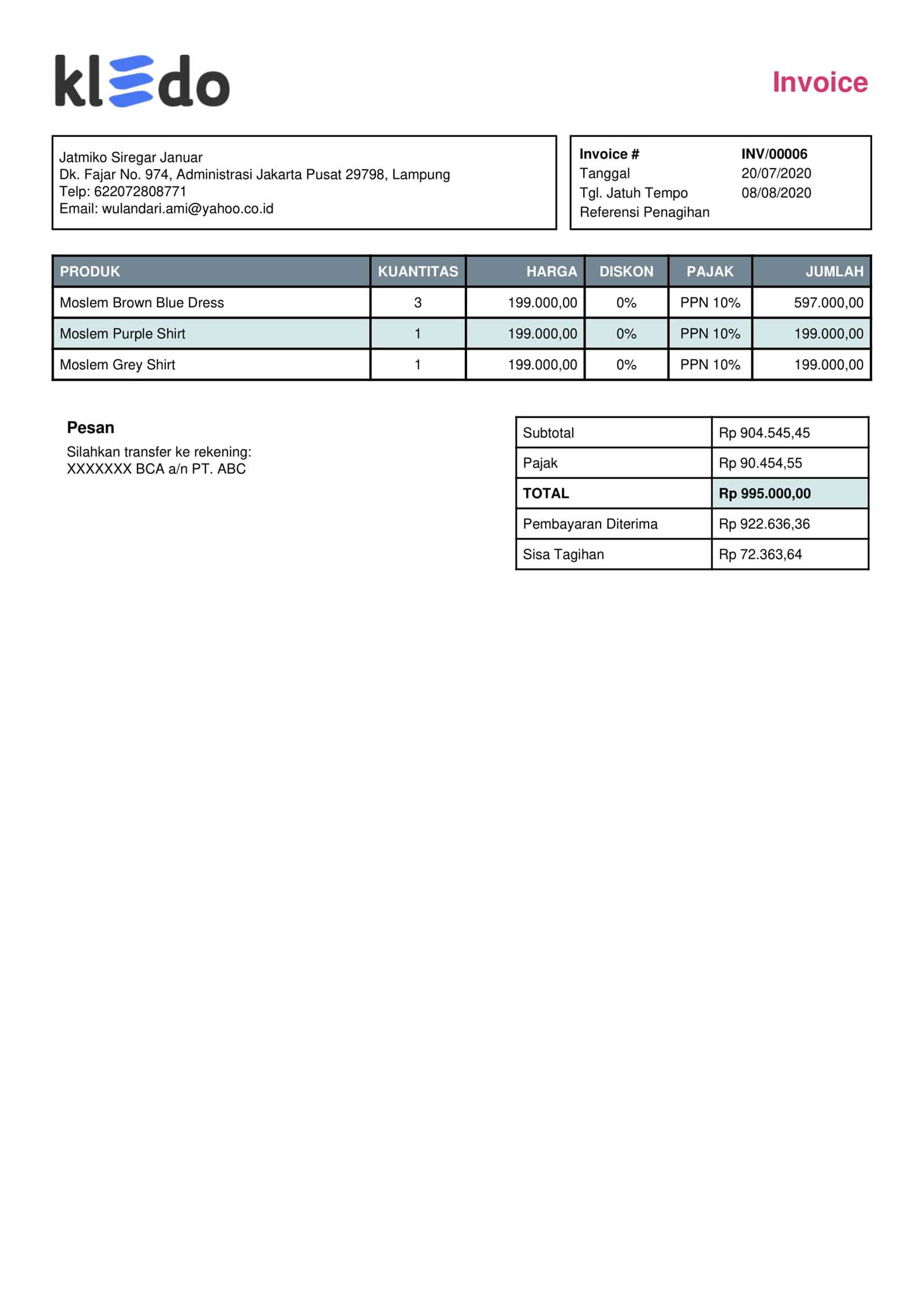

Different Types of Invoice Templates Available

Various formats for billing documents cater to different business needs and industries. Choosing the right kind can enhance clarity and professionalism, ensuring that all necessary details are clearly communicated. Understanding the available options can help you select the most suitable design for your requirements.

Here are some common varieties of billing documents:

- Standard Format: The most commonly used style, suitable for general transactions, featuring essential details like items, quantities, prices, and total amounts.

- Pro Forma: A preliminary bill that outlines the expected costs before the final sale is completed, often used for quotations or estimates.

- Credit Note: Issued when a refund is necessary, this format indicates that a certain amount is credited back to the buyer.

- Time-Based: Ideal for service providers, this format allows for billing based on hours worked or services rendered, often including hourly rates and total hours.

- Recurring: Designed for subscription services, this format automates regular billing cycles, providing consistent invoicing for ongoing services.

- Commercial: Used for international transactions, this document includes additional information required for customs and tax purposes.

By selecting the appropriate type of billing document, businesses can ensure clear communication with their clients and maintain a professional image.

Using Invoices for Effective Cash Flow

Maintaining a healthy financial flow is essential for any business. One effective method to achieve this is by utilizing billing documents to track payments and manage receivables. Properly structured accounts can enhance the efficiency of cash management and ensure timely income.

Importance of Timely Billing

Issuing billing documents promptly after the delivery of goods or services is crucial. Quick invoicing helps minimize the time between providing a service and receiving payment, thus improving overall cash flow. Additionally, clear terms of payment outlined in the document can set expectations for clients and encourage timely transactions.

Monitoring Receivables

Regularly reviewing outstanding payments allows businesses to identify late transactions and follow up with clients as needed. Effective management of receivables can prevent cash flow issues and support better financial planning. Implementing a systematic approach to monitoring accounts will help ensure that the business remains solvent and prepared for future expenses.

Ensuring Accuracy in Your Invoices

Maintaining precision in billing documents is crucial for successful transactions and positive client relationships. Accurate records not only prevent misunderstandings but also enhance professional credibility. A focus on detail ensures that all information presented is clear and reliable.

Here are some key practices to ensure accuracy:

| Practice | Description |

|---|---|

| Double-Check Entries | Review all numerical values and descriptions to confirm correctness before sending. |

| Standardize Formats | Use consistent formats for dates, pricing, and terms to avoid confusion. |

| Verify Client Information | Ensure that recipient details such as name, address, and contact information are accurate. |

| Utilize Software Tools | Consider using accounting software to automate calculations and minimize human error. |

Implementing these practices will significantly reduce the chances of errors, fostering trust and reliability in your business transactions.

Invoice Template for Small Businesses

For small enterprises, having a structured billing document is essential for ensuring prompt payments and maintaining professional standards. A well-designed billing document serves not only as a request for payment but also as a reflection of the business’s image. Utilizing a consistent format helps streamline the billing process, making it easier for both the service provider and the client.

Small businesses can benefit significantly from employing a standardized document that includes key elements such as:

- Business Information: Clearly state the business name, address, contact details, and logo to enhance brand recognition.

- Client Details: Include the recipient’s name, address, and contact information for proper communication.

- Service Description: Provide a detailed breakdown of the products or services offered, including quantities and prices.

- Total Amount Due: Clearly present the total amount owed, including any applicable taxes or discounts.

- Payment Terms: Specify the payment due date and acceptable payment methods to avoid any misunderstandings.

By implementing these components, small businesses can create effective billing documents that promote clarity, facilitate payments, and enhance overall professionalism.

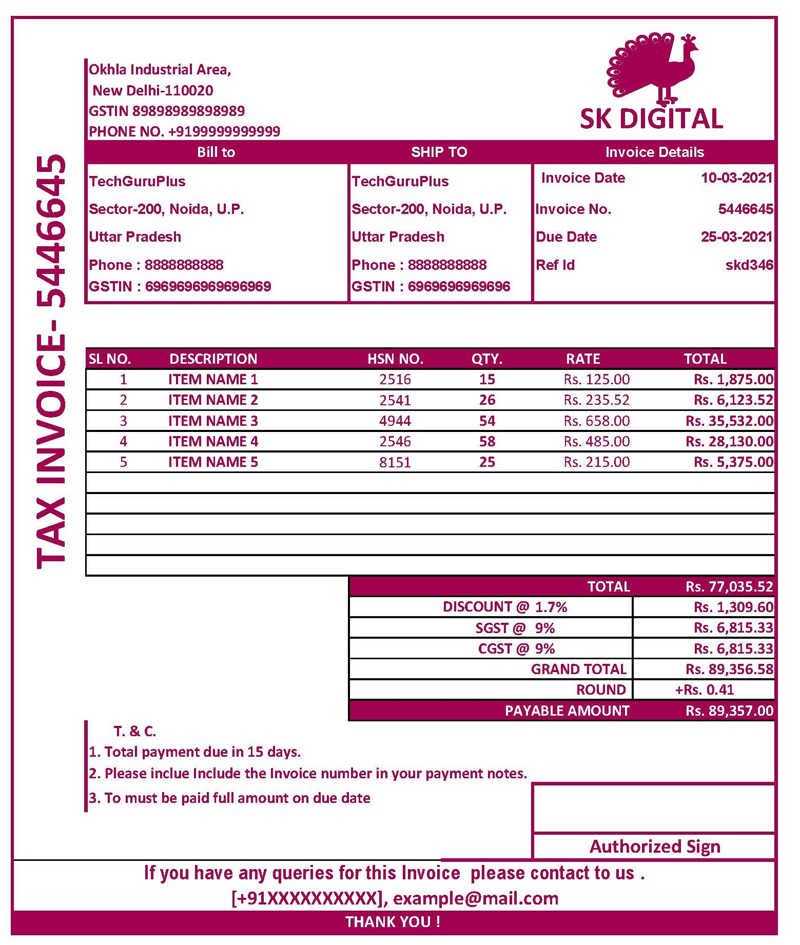

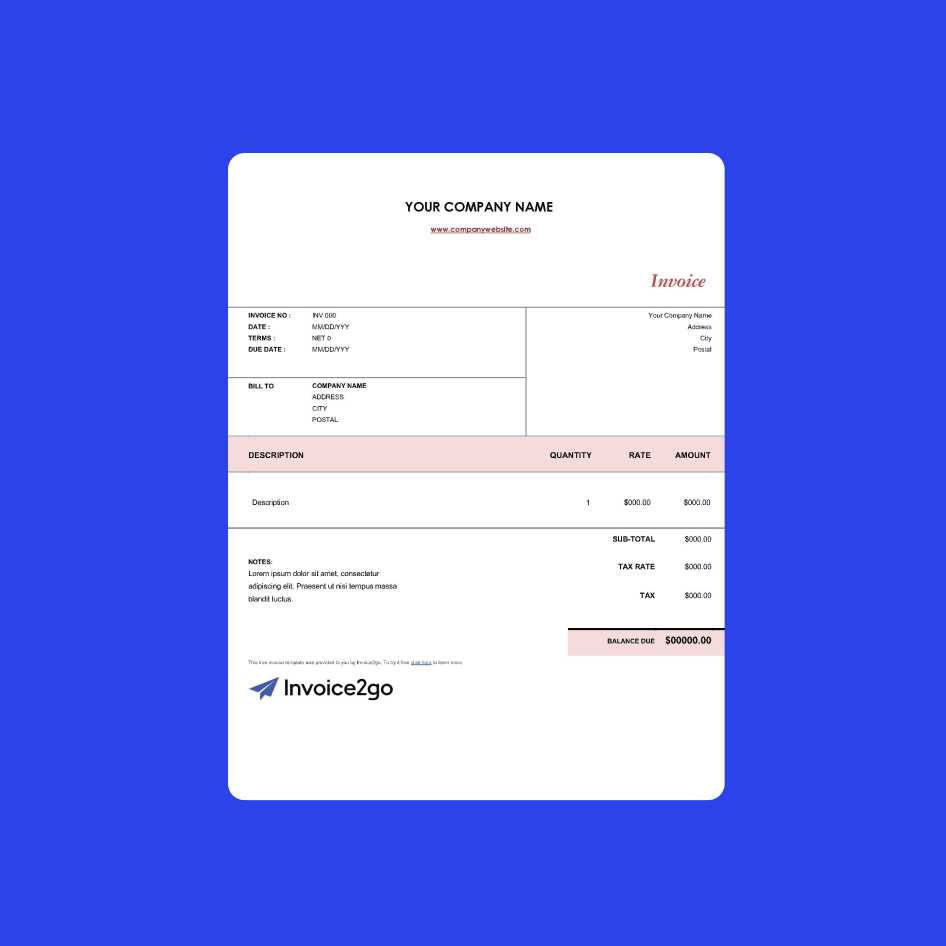

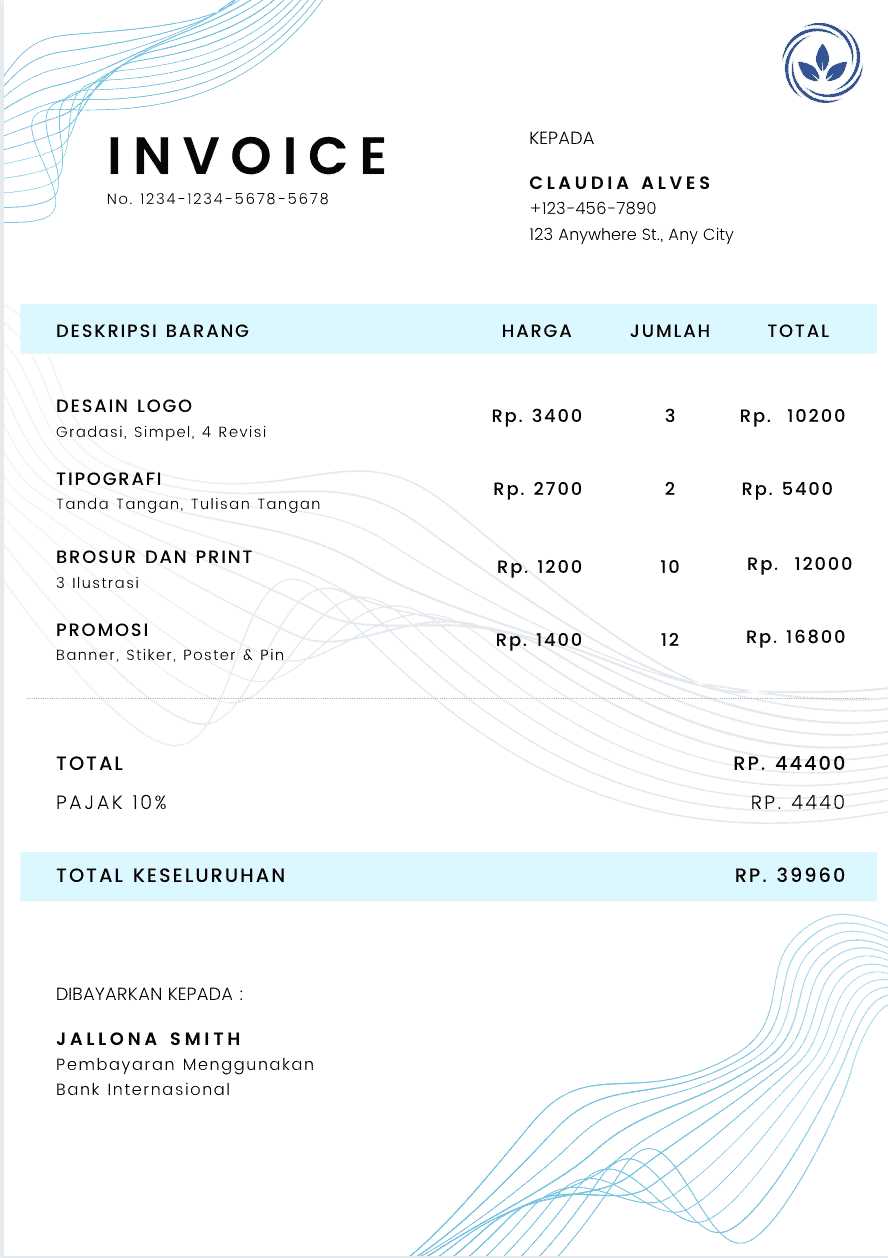

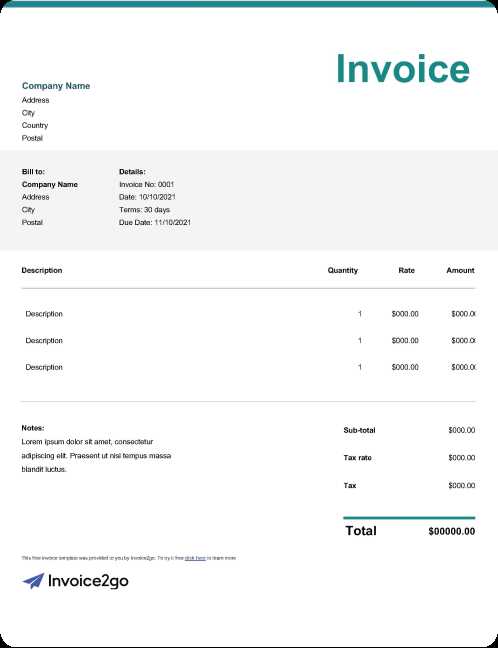

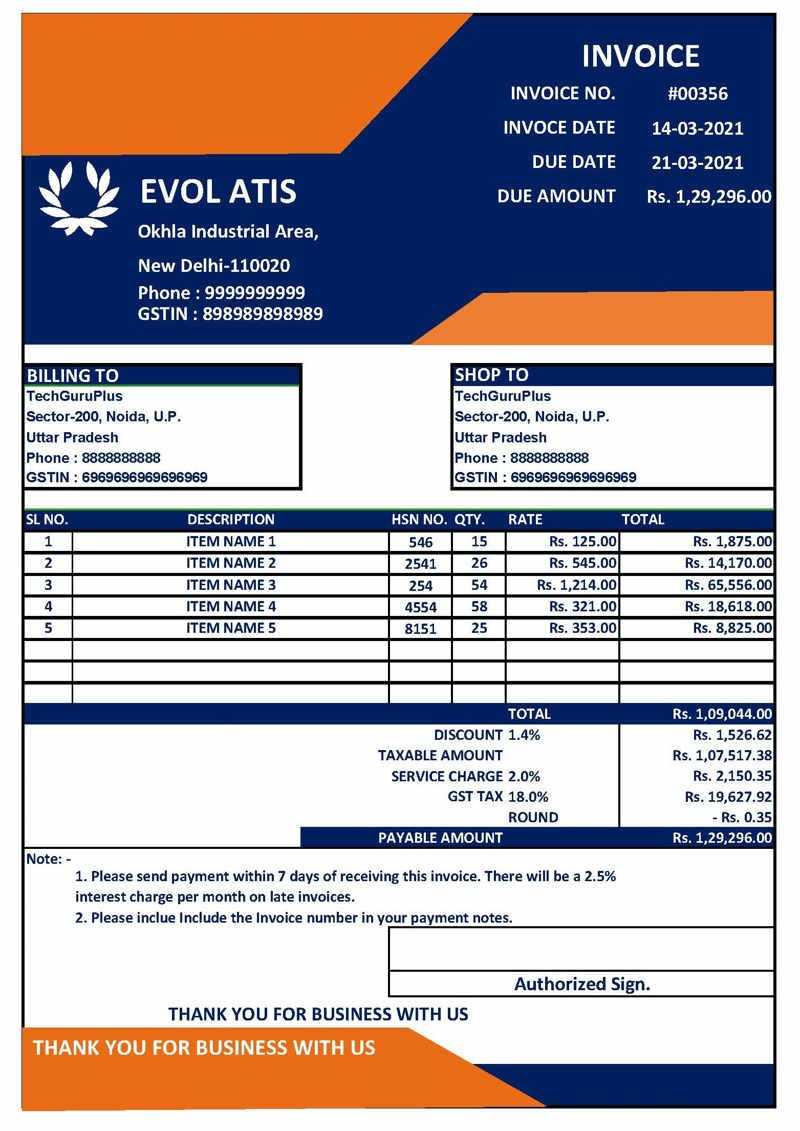

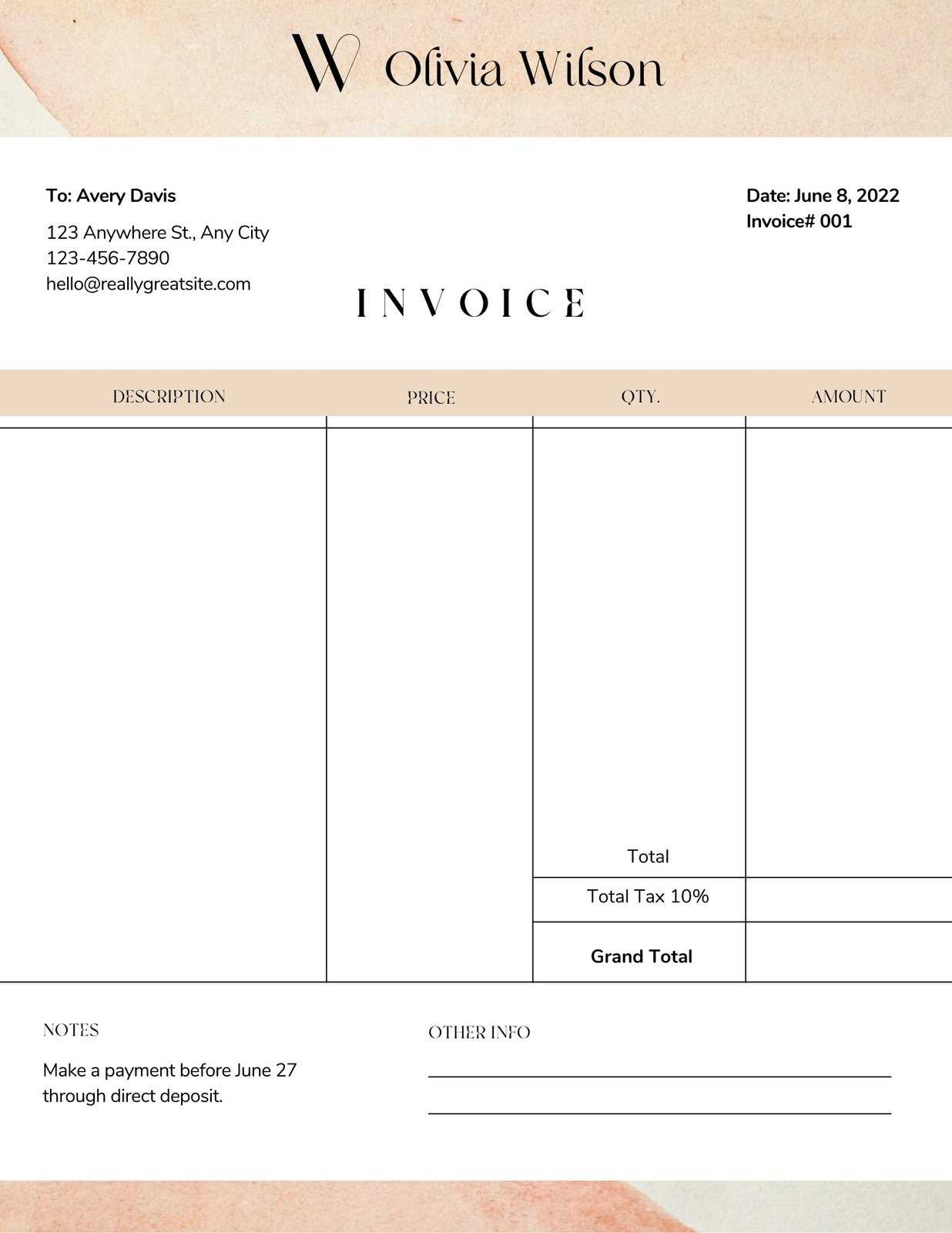

Examples of Creative Invoice Designs

Innovative billing documents can enhance a company’s image and make a lasting impression on clients. By incorporating unique elements and creative layouts, businesses can turn routine requests for payment into visually appealing communications. Here are some examples of imaginative designs that can inspire your own documents:

1. Minimalist Style: A clean and simple layout focusing on essential information without clutter can be very effective. Using plenty of white space and a limited color palette can create an elegant look that emphasizes professionalism.

2. Illustrated Themes: Incorporating custom illustrations or graphics related to your industry can add a personal touch. For instance, a graphic designer might use design tools or elements that reflect their work, making the document not just a request for payment but a showcase of their creativity.

3. Bold Typography: Using striking fonts can help key information stand out. By playing with size, weight, and style, you can create a hierarchy that guides the reader’s eye and draws attention to important details.

4. Colorful Borders and Backgrounds: Adding a splash of color through borders or backgrounds can make your document pop. Just ensure that the colors align with your brand’s identity to maintain coherence.

5. Infographic Elements: Integrating charts or visual data representation can provide a quick overview of services rendered or payment history. This approach is particularly engaging and informative for clients.

By exploring these creative approaches, businesses can develop billing documents that not only fulfill their functional purpose but also enhance client relationships and improve brand recognition.

How to Send Invoices Electronically

In today’s digital age, the ability to transmit billing documents electronically has become essential for efficient business operations. This method not only saves time but also enhances communication with clients. Here are some effective ways to deliver your requests for payment online:

1. Email Delivery

One of the most common methods for sending requests for payment is via email. Follow these steps for a professional approach:

- Subject Line: Use a clear and concise subject line that includes relevant information, such as the billing period or service provided.

- Attach the Document: Ensure that your billing document is attached as a PDF or another widely accepted format to maintain formatting.

- Personalize the Message: Include a brief note in the email body, thanking the recipient for their business and providing a summary of the details.

2. Online Invoicing Platforms

Utilizing dedicated online platforms can streamline the process significantly. Consider these advantages:

- Automation: Many platforms allow for automated billing cycles, reducing the need for manual intervention.

- Tracking: You can monitor when a client has viewed the document, providing insight into their engagement.

- Payment Options: Some platforms enable clients to pay directly through the document, enhancing convenience.

By embracing electronic methods for sending billing documents, businesses can improve efficiency and foster better relationships with their clients, all while maintaining a professional image.

Benefits of Automated Invoice Solutions

Implementing automated solutions for billing processes can transform the way businesses manage their financial transactions. These systems offer numerous advantages that enhance efficiency, accuracy, and overall productivity. Here are some key benefits associated with using such solutions:

1. Increased Efficiency

Automated systems significantly reduce the time spent on administrative tasks. By streamlining workflows, businesses can allocate resources more effectively. Key features that contribute to this efficiency include:

| Feature | Description |

|---|---|

| Bulk Processing | Handle multiple transactions simultaneously, saving time on repetitive tasks. |

| Scheduled Dispatch | Automatically send requests for payment on predetermined dates. |

2. Enhanced Accuracy

Reducing human error is crucial in financial documentation. Automated solutions help maintain precise records by:

- Minimizing Manual Input: Automatic data entry reduces the likelihood of mistakes.

- Consistent Formatting: Standardizes the appearance of all financial documents, ensuring professionalism.

Adopting automated billing solutions not only improves operational workflows but also fosters better relationships with clients by providing timely and accurate financial documents.

Tracking Payments with Invoice Templates

Maintaining oversight of financial transactions is crucial for any business. Utilizing structured documents for billing can significantly aid in monitoring received payments, ensuring accurate record-keeping, and facilitating timely follow-ups. Here’s how effective organization can streamline this process.

1. Organizing Payment Information

A well-designed document can help track essential details regarding payments. Key elements to include are:

| Detail | Description |

|---|---|

| Client Information | Names, addresses, and contact details for easy reference. |

| Payment Dates | Record the date payments are due and received to monitor timelines. |

| Payment Status | Indicate whether the payment is pending, completed, or overdue. |

2. Facilitating Follow-ups

Having a clear structure allows for effective communication with clients regarding outstanding balances. Consider implementing:

- Automated Reminders: Set up notifications for upcoming due dates.

- Personalized Messages: Tailor follow-up communications based on individual client accounts.

By leveraging organized billing structures, businesses can enhance their cash flow management and foster stronger client relationships.