Download Free Excel Invoice Template for Easy Billing

Managing financial transactions is a crucial aspect of any business, and ensuring that all payments are documented correctly can save both time and effort. The right tools can help you create professional and accurate records, allowing you to focus on growing your company rather than worrying about administrative tasks. With the right resources, preparing and managing payment statements becomes an easy and efficient process.

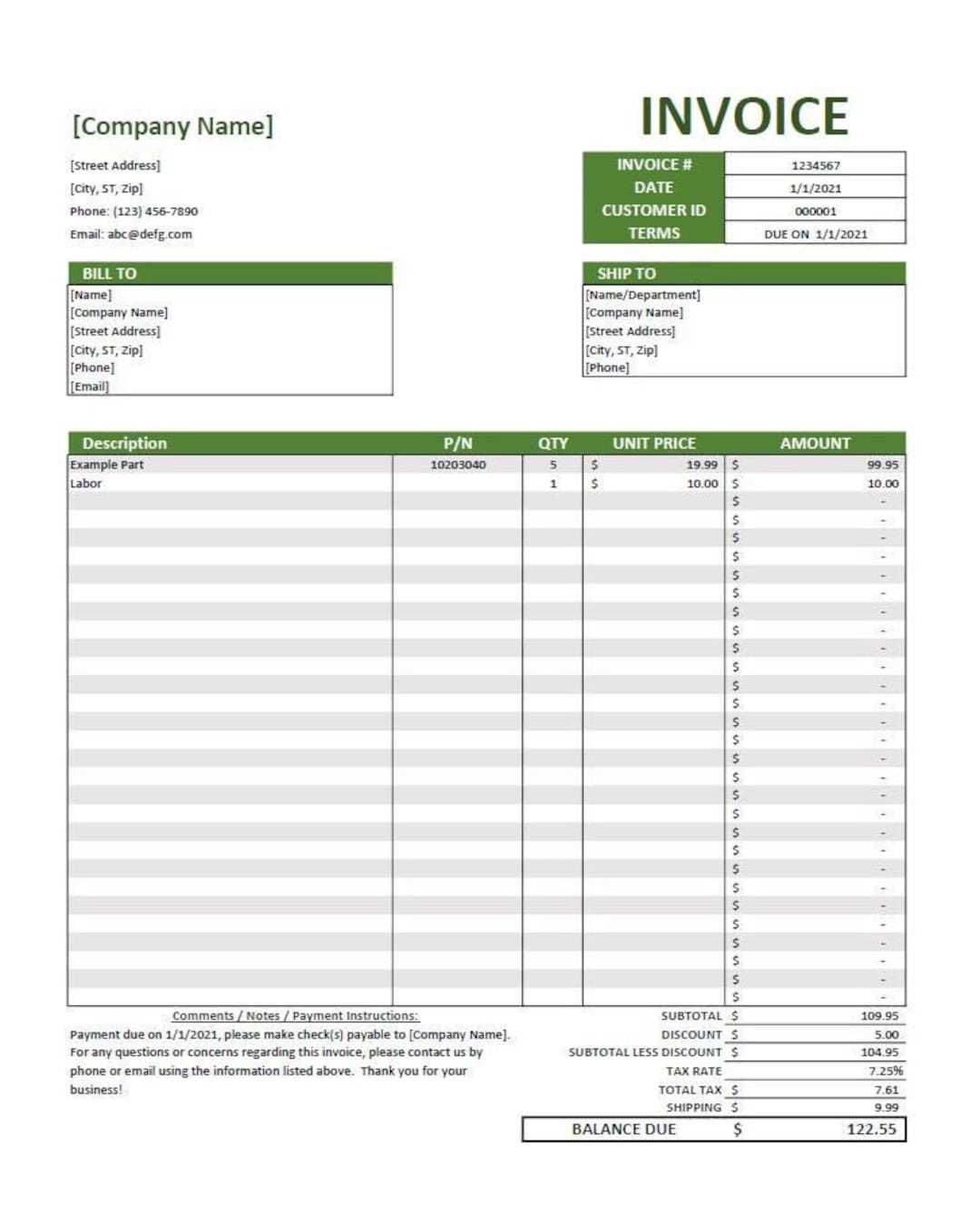

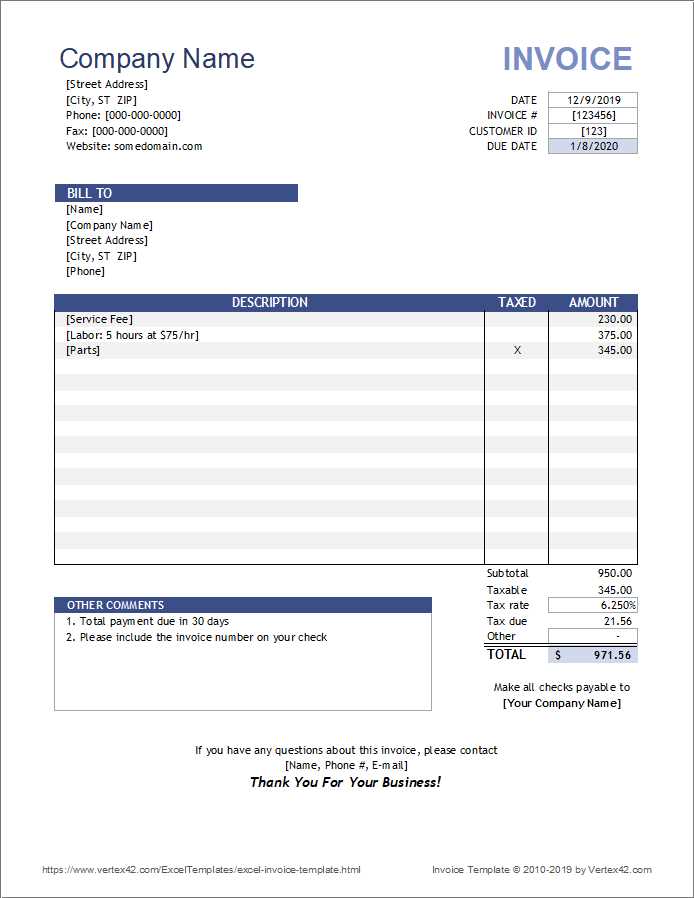

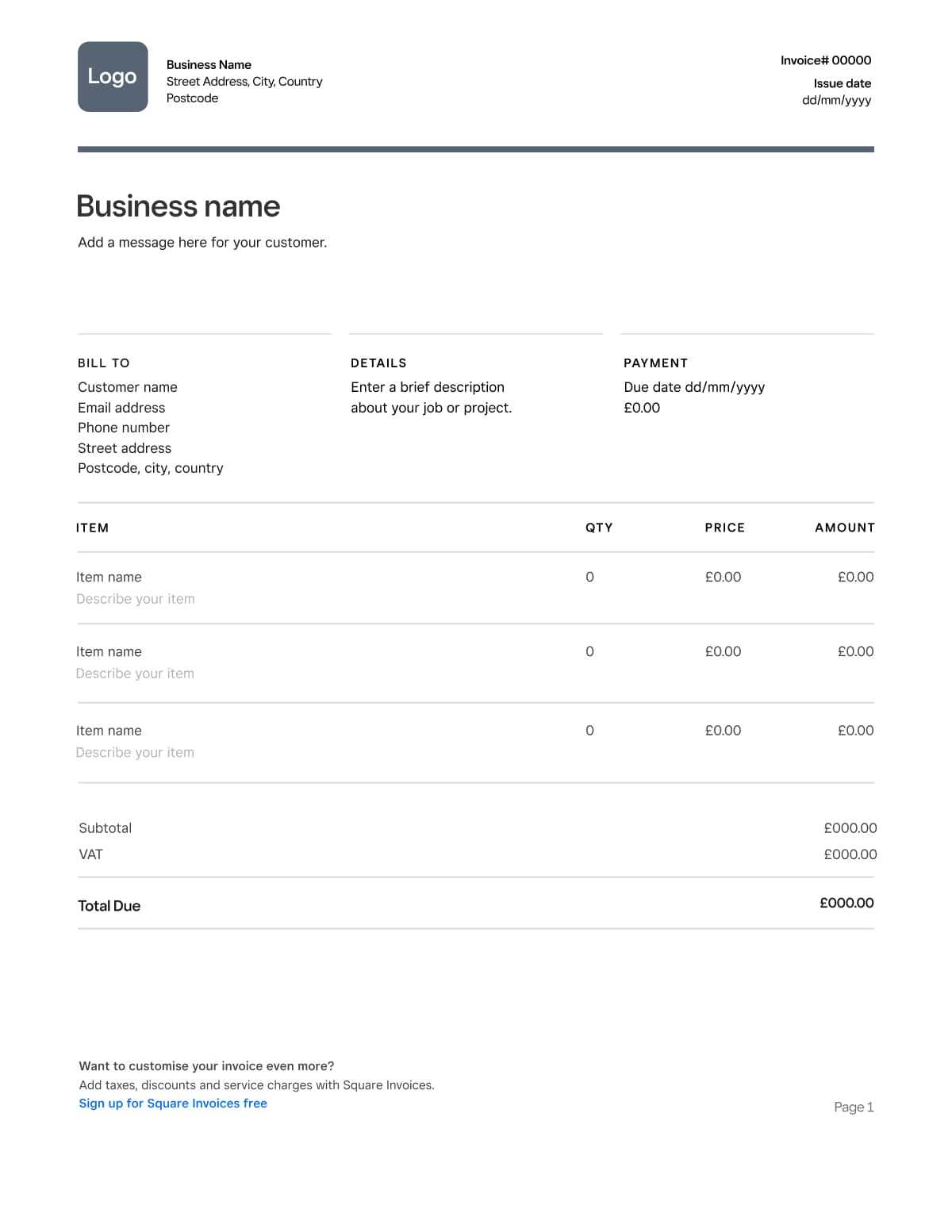

Using pre-designed documents can simplify your billing system. These documents are customizable, enabling you to include specific details such as your company’s name, payment terms, and pricing information, all while maintaining a professional appearance. The best part is that they can be adapted to suit various needs, from small transactions to large-scale projects.

Whether you are just starting or looking for a more organized approach, utilizing these ready-made solutions can save time and reduce errors. They offer a seamless way to track payments, communicate with clients, and stay on top of your financial records without hassle.

Download Free Invoice Templates for Excel

When it comes to organizing financial transactions, having ready-to-use documents can greatly simplify the process. Whether you are a freelancer, small business owner, or part of a larger company, using a well-structured document helps maintain consistency and clarity in all your payment-related communications. Pre-designed options allow you to quickly create accurate records without the need to start from scratch each time.

Access Professional Documents for Any Business Need

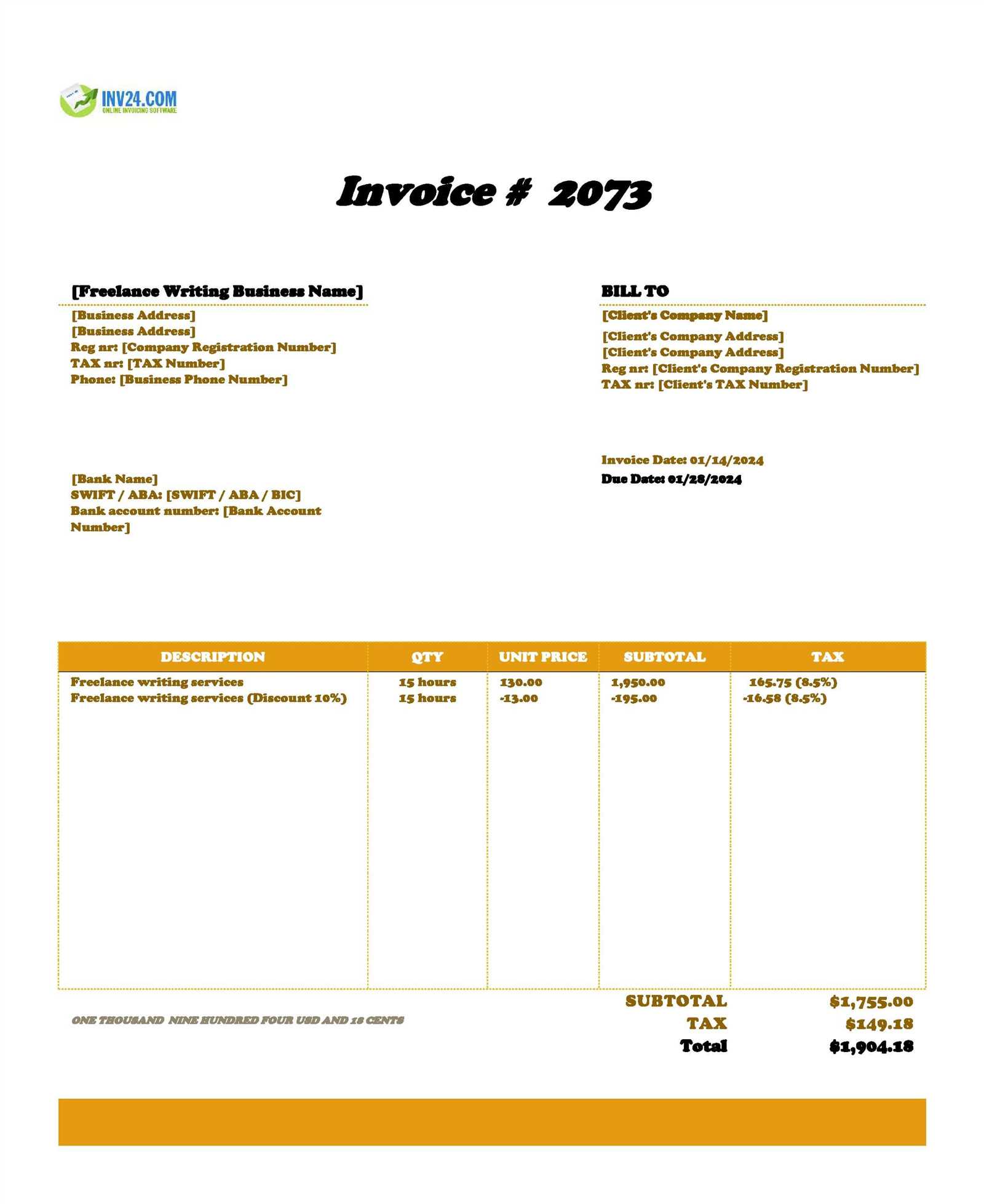

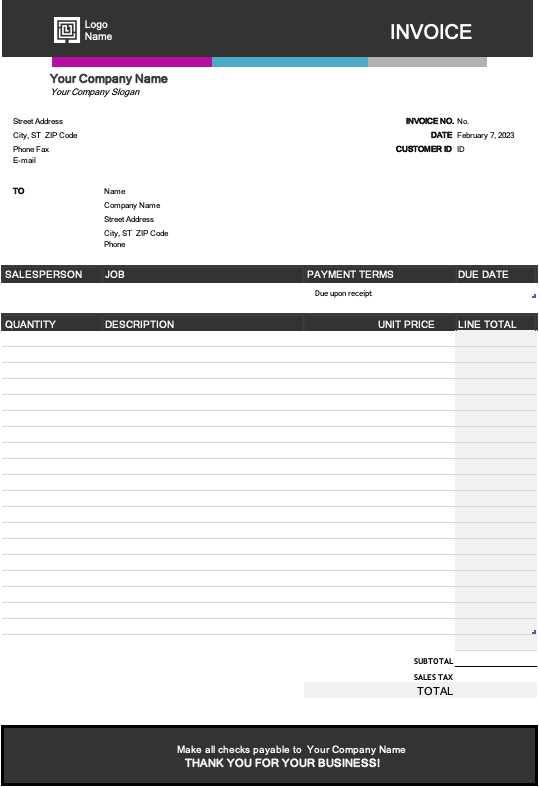

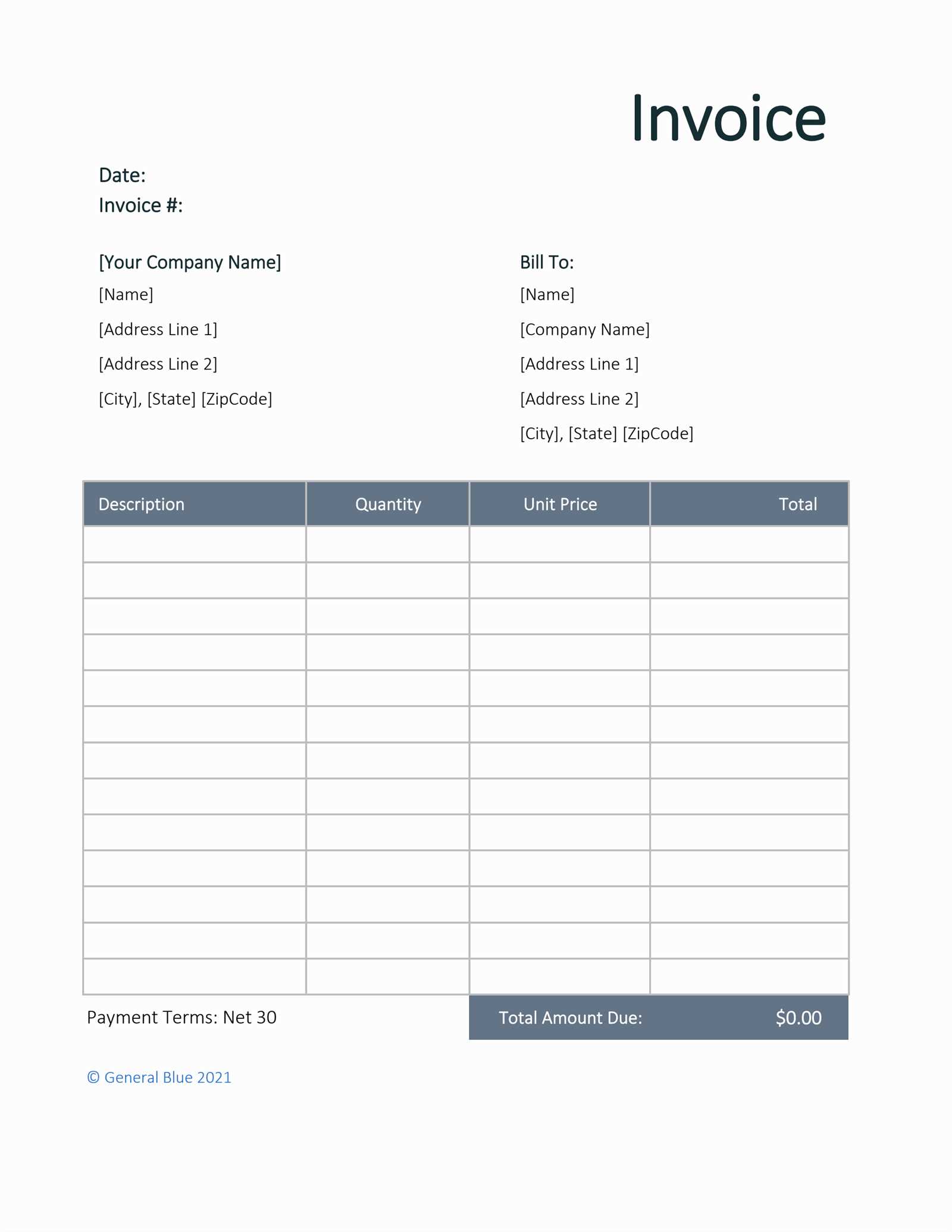

There are many resources available that offer customizable, ready-made documents to suit various industries and business types. These options come with built-in sections for important details such as service descriptions, pricing, and due dates, ensuring you don’t miss any crucial information. The best part is that you can modify these to fit your specific requirements, allowing you to create professional paperwork with minimal effort.

Why Choose These Ready-Made Solutions

Opting for pre-built solutions helps save valuable time and effort, especially if you are not familiar with creating your own financial documents. Many of these resources are designed to meet standard business requirements, which means you don’t need to worry about formatting issues. With just a few clicks, you can personalize the layout and data fields to reflect your unique business operations, ensuring accuracy and professionalism with every document you issue.

Why Use Excel for Invoicing?

Managing business transactions efficiently requires a tool that offers both flexibility and ease of use. Many business owners choose spreadsheet software to handle their payment records due to its simplicity, accessibility, and powerful features. With a well-organized structure, this software allows users to create and manage financial documents quickly, reducing the likelihood of errors while maintaining a professional look.

Efficiency and Customization

One of the main reasons for using spreadsheet tools is the ability to customize documents without restrictions. Users can easily modify columns, rows, and data fields to suit their specific business needs, enabling them to include additional information like taxes, discounts, and payment terms. The software also allows users to automatically calculate totals, making it easier to manage different pricing structures.

Time-Saving Features

Spreadsheets offer several time-saving functions that streamline the entire process of creating and sending financial records. These features include automatic calculations, data validation, and simple formula functions that allow businesses to quickly generate accurate statements without the need for manual entry. Below is an example of how this software can automatically calculate totals and taxes:

| Item Description | Unit Price | Quantity | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product A | $10.00 | 3 | $30.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Product B | $20.00 | 2

Benefits of Using Free Invoice TemplatesUsing pre-designed documents to manage financial transactions offers a wide range of advantages, especially for businesses looking to streamline their billing process. These ready-made resources can save time, reduce errors, and create a professional appearance, all without requiring specialized software or technical expertise. Below are some of the key benefits that come with utilizing these resources.

Enhanced Accuracy and Reduced ErrorsBy automating calculations and including built-in fields for important details, these documents reduce the chances of making mistakes. Whether it’s calculating totals or adding taxes, having a ready-to-use structure ensures the correct numbers are applied every time. Customizable to Your Needs

Even though these resources are pre-designed, they offer the flexibility to be adjusted to your specific needs. You can modify the layout, add or remove sections, and input any additional information that reflects your business operations. This adaptability makes them useful for a variety of industries, from freelancers to larger companies. How to Customize Excel Invoice TemplatesPersonalizing a ready-made document to suit your business needs can greatly enhance both the appearance and functionality of your financial records. Customizing these resources allows you to tailor them to your brand’s identity, specific pricing structures, and operational requirements. Below are some simple steps to help you make adjustments and ensure your documents are both professional and accurate. Basic CustomizationsThe first step in personalizing your document is to update the basic information. These essential details will form the core of your document and ensure that each record reflects your business accurately. Here are some common fields to customize:

Advanced Customizations

Once the basics are in place, you can adjust the structure and functionality of the document. These modifications allow you to fine-tune the document to match your business model and preferences:

By following these simple steps, you can create a tailored financial document that meets your exact needs and enhances the professionalism of your business communications. Top Features to Look for in TemplatesWhen choosing a pre-designed document for managing financial records, it’s essential to consider the key features that will help streamline your workflow. The right layout can not only save time but also improve accuracy, consistency, and the overall professionalism of your business communications. Here are some important elements to look for when selecting a ready-made resource. Essential Functional FeaturesFirst and foremost, the document should be designed with practical functionality in mind. These core features are crucial for simplifying the task of creating and tracking transactions:

Design and Usability FeaturesWhile functionality is critical, the design and user experience are also important factors. A visually clear and easy-to-navigate layout can make a big difference:

By focusing on these key features, you can find a solution that meets both your practical and branding needs, enhancing your ability to create polished financial documents with ease. How to Create Professional Invoices in ExcelCreating polished and professional payment records is essential for maintaining clear communication with clients and ensuring timely payments. With the right structure, you can easily organize essential details such as pricing, terms, and services, all while keeping a consistent and professional format. The following steps will guide you through creating an effective payment document from scratch or by using an existing layout as a foundation. Step 1: Set Up Your Document Layout Start by organizing the basic structure of your document. Divide the page into sections to make sure each part is clear and accessible. At the top, include your company name, contact details, and logo (if applicable). Next, create a section for client information, including the client’s name, address, and any other relevant contact details. Finally, leave space for transaction details such as itemized charges, quantities, prices, taxes, and the total amount due. Step 2: Add Automatic Calculations To make the process more efficient and minimize errors, incorporate formulas into your document to automatically calculate totals, taxes, and other necessary charges. This feature will save you time and ensure consistency in every document. For example, use formulas to sum up line items, calculate tax based on the subtotal, and adjust the total accordingly. If you’re unsure about how to apply these formulas, many online guides can help you set them up. Step 3: Customize the Appearance Once the structure is in place, customize the look of your document to reflect your brand’s identity. Choose a clean, simple font for easy readability and adjust the layout to make sure all sections are aligned and properly spaced. You can use borders, shading, and bold text to make important details stand out, such as payment terms or the total amount due. Consistency in font size and style throughout the document will give it a polished and professional feel. Step 4: Review and Save Before finalizing the document, carefully review all the details for accuracy. Check the client information, line items, and calculations to ensure everything is correct. Once you’re confident in the document’s accuracy, save it in your preferred format for future use. You can even save it as a template to quickly create future payment documents with minimal adjustments. By following these steps, you can create a clean, professional, and error-free payment record every time, improving your overall business workflow and client relationships. Download Options for Excel Invoice TemplatesWhen selecting ready-made documents to manage your financial transactions, it’s important to consider the different sources where you can find customizable options. There are various platforms and websites offering these resources, each with its unique set of features and benefits. Whether you’re looking for a basic design or a more sophisticated option, you’ll find several possibilities to suit your needs. Where to Find Ready-Made DocumentsHere are some popular sources for accessing pre-designed documents that can help streamline your billing process:

Features to Consider When Choosing a SourceWhen exploring download options, consider these important aspects to ensure the resource you choose meets your business needs:

By considering these factors and exploring the different download options available, you can select the most suitable resource for your business, improving your financial record management with minimal effort. How to Save and Manage Your InvoicesOnce you have created your payment records, it’s essential to establish a system for saving and organizing them. Proper management of these documents ensures that you can easily access them when needed for tracking payments, preparing reports, or resolving any disputes. A good filing system will also help you stay on top of your financial obligations and improve your business’s overall efficiency. Saving Documents for Easy AccessWhen saving your records, it’s important to use a consistent naming and storage method. Here are some useful tips for organizing your files:

Tracking and Managing PaymentsProper tracking of payments ensures that you stay on top of your finances and reduces the risk of overdue balances. A good system should include clear tracking for each transaction and allow for easy updates. Below is an example of how you can structure a payment tracking table:

|