Download Free Word Invoice Template for Simple and Professional Billing

When managing finances, having a well-structured billing system is essential. A properly formatted document can save time, enhance professionalism, and ensure clear communication with clients. Whether you’re running a small business or handling freelance work, using ready-made documents can simplify the entire process.

Customizable solutions are widely available to help users craft their own personalized billing statements. These tools allow individuals to adjust fields, add branding, and easily generate invoices for various business needs. With just a few simple steps, you can create professional-looking records to reflect your services or products.

By utilizing a flexible document, you can quickly adapt to different billing situations, ensuring accuracy and consistency across all transactions. Embracing these resources helps streamline your workflow, ultimately contributing to a smoother, more efficient financial management process.

Download Free Word Invoice Template

Having access to a pre-designed document for billing can simplify the process of creating clear and professional records for any business. With the right tool, you can easily adjust fields, add branding, and personalize each entry to suit your needs. This allows you to maintain consistency and accuracy across all your transactions while saving valuable time.

Why Choose a Pre-Made Billing Document?

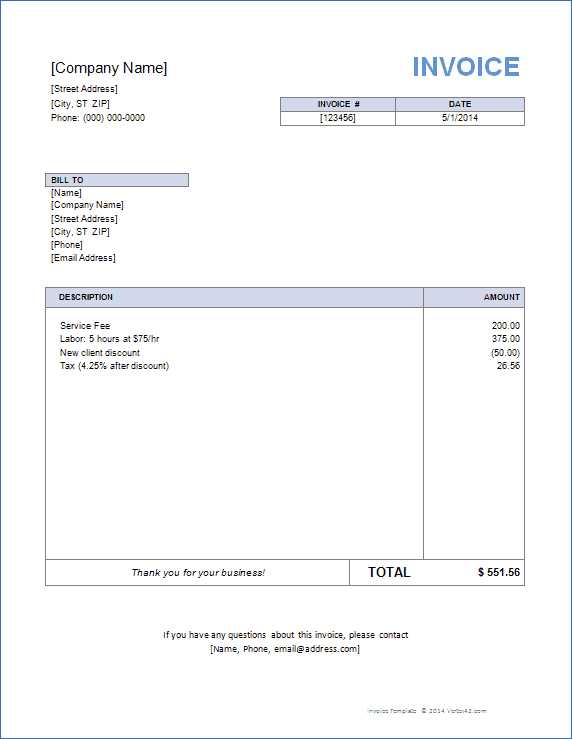

Using a customizable billing form is an efficient way to ensure that each transaction is documented correctly. Pre-designed layouts offer the flexibility to modify essential fields such as client names, dates, amounts, and descriptions of services provided. Whether you are working on a one-time project or managing long-term contracts, having a structure to work from ensures a professional presentation each time.

How to Customize Your Billing Document

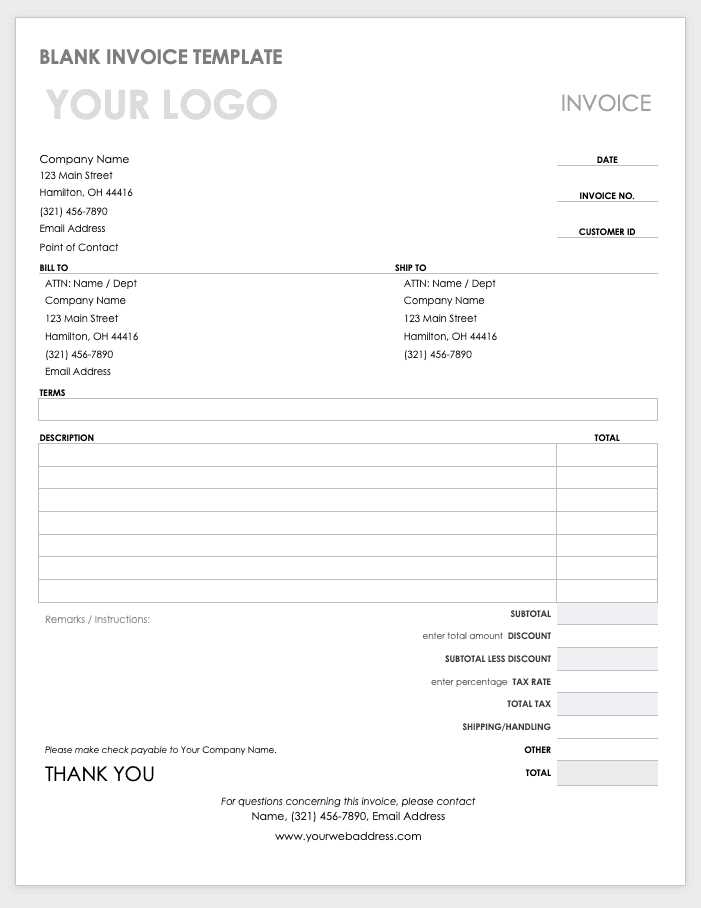

Personalization is key when using a ready-made billing document. It allows you to align the design with your brand’s identity by adding your company logo, adjusting fonts, or including any specific terms related to payment. Most platforms offering these resources allow you to tailor them easily, ensuring your documents reflect your business’s unique style while maintaining their professional integrity.

Why Use a Word Invoice Template?

Utilizing a pre-designed document for billing can streamline the process of creating clear and professional records. Instead of starting from scratch each time, having a structured format at hand ensures consistency and accuracy, which is essential for maintaining a reliable financial system. It simplifies the creation of payment requests, saving time and reducing the chance for errors.

Save Time and Effort

One of the key advantages of using a ready-made billing structure is the significant amount of time saved. By simply filling in the relevant details, you can generate a professional-looking document in a fraction of the time it would take to create one manually. This efficiency is especially valuable for busy professionals and small businesses that need to generate multiple requests in a short period.

Ensure Consistency and Professionalism

Using a pre-designed document helps maintain uniformity across all transactions. Whether you are invoicing one client or managing several accounts, having a consistent layout enhances the professional image of your business. Customizable fields allow for personalization, but the overall structure ensures that every document meets industry standards for clarity and organization.

How to Customize Your Invoice Template

Personalizing a billing document allows you to align it with your brand while ensuring it meets your specific business needs. Customization ensures that the document is not only professional but also tailored to reflect your company’s style and the nature of the services you provide. Adjusting certain sections can help make the payment process clearer for both you and your clients.

Step-by-Step Customization Process

To get started with modifying your document, follow these simple steps:

- Adjust Header Information: Update the document header with your business name, logo, and contact details. This gives your document a professional look and helps clients easily identify it as coming from your company.

- Modify Payment Terms: Add your specific payment terms, such as due dates, late fees, or preferred methods of payment. This section helps clarify expectations for both parties.

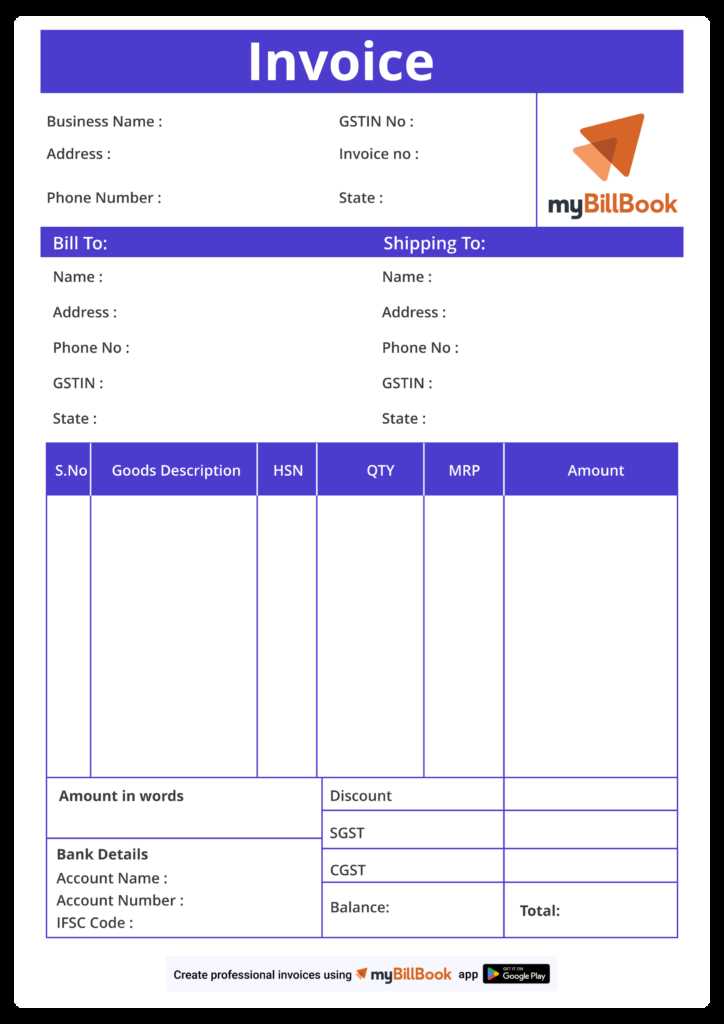

- Personalize the Service Details: Update the description of the products or services offered. Make sure to be as clear and detailed as necessary, including unit prices, quantities, and any applicable taxes.

- Include Custom Notes: You can add any additional information or special instructions that you want to include in the footer or notes section of the document.

Best Practices for Customization

- Keep It Simple: Avoid overloading the document with unnecessary design elements. A clean and organized layout improves readability.

- Ensure Accuracy: Double-check all details, including contact information and payment terms, to avoid errors.

- Make It Consistent: Maintain consistency in font styles, colors, and formatting to reflect your brand’s identity.

Top Benefits of Word Invoice Templates

Using pre-designed billing documents offers several advantages for businesses of all sizes. These ready-made formats not only save time but also help ensure consistency, professionalism, and accuracy in financial communication. Customizable layouts allow you to adapt each document to your unique needs, while maintaining a streamlined process for both you and your clients.

Efficiency and Time-Saving

One of the key benefits of using a pre-structured billing document is the amount of time saved in generating payment requests. Instead of designing a document from scratch each time, you can simply input the necessary details, making the process quick and easy. This efficiency is especially valuable when managing multiple clients or projects simultaneously.

Professional Appearance

A well-structured document automatically conveys professionalism. Whether you are running a large enterprise or a small freelance business, using a polished format for billing shows attention to detail and helps build trust with your clients. This can positively impact your business reputation and the likelihood of timely payments.

Consistency in Record-Keeping

By using a consistent layout, you ensure that all your billing records are organized in the same way. This uniformity makes it easier to track payments, follow up with clients, and maintain accurate financial documentation. Consistent record-keeping helps you stay organized and can be useful during tax season or audits.

Customizable Features

Pre-designed documents allow for easy customization. You can adjust them to fit your branding by adding logos, changing fonts, or modifying the layout to match your company’s style. This flexibility ensures that each document aligns with your business identity while maintaining a clear and professional format.

Free Templates for Different Invoice Needs

Different types of businesses and services require varying formats for billing documents. Whether you are offering a product, a service, or working on long-term contracts, having access to a selection of pre-designed layouts helps meet these diverse needs. By using customizable options, you can select the most suitable structure for your specific requirements, ensuring clarity and professionalism in every transaction.

Common Billing Formats

Here are some of the most common types of billing documents, each tailored to meet different business needs:

| Billing Type | Description | Ideal For |

|---|---|---|

| Standard Billing | A basic structure used for one-time or regular transactions. | Freelancers, Contractors |

| Recurring Billing | Designed for ongoing services with regular payment intervals. | Subscription-Based Businesses |

| Itemized Billing | Details each individual service or product provided, with associated costs. | Retailers, Consultants |

| Pro Forma Billing | Preliminary invoice typically used before final payment is made. | Large Projects, Export Businesses |

Selecting the Right Format

When choosing a layout for your billing documents, consider the nature of your services, the frequency of billing, and your client’s needs. For example, if you offer ongoing monthly services, a recurring format would help streamline the process. On the other hand, itemized documents are best suited for businesses that sell products or provide services with different pricing components. Regardless of the option you choose, customization ensures that you can adapt each layout to best suit your workflow and branding.

How to Create an Invoice in Word

Creating a professional billing document is straightforward when using a word processing program. With the right structure, you can easily generate a clear, organized payment request that reflects your business’s professionalism. Here is a step-by-step guide to help you craft a polished and effective document.

Step-by-Step Guide to Creating a Billing Document

- Open a New Document: Start by opening a blank document in your word processing software. Choose a standard layout to ensure your document looks clean and organized.

- Insert Your Business Information: At the top of the document, include your company name, logo, and contact information (address, phone number, email). This helps make your document easily identifiable and professional.

- Set Up the Client’s Information: Below your business details, input the client’s name, company name, address, and contact information. This ensures that the recipient’s information is clearly stated.

- Include the Document Title: Label the document clearly as a “Billing Statement” or “Payment Request” at the top, so that it’s easily recognizable.

- Detail the Products or Services: Create a table or list that outlines the items or services provided. Include descriptions, quantities, unit prices, and the total cost for each item.

- Add Payment Terms: Specify the due date, payment methods, and any late fees or discounts for early payments. This section provides clarity on expectations.

- Calculate the Total: Sum the individual items or services to calculate the total amount due. This should be clearly labeled for easy understanding.

- Finalize the Document: Review the document for accuracy, ensuring that all information is correct and professional. Once complete, save the document and share it with your client.

Formatting Tips for a Polished Look

- Use a Clean Font: Choose simple, readable fonts like Arial or Times New Roman for clarity.

- Keep the Layout Organized: Use tables to neatly align the product/service details, prices, and totals.

- Highlight Important Information: Bold or underline key sections, such as the total amount due or due date, to make them stand out.

By following these steps, you can create a clear and professional billing document that will help streamline your payment process and ensure smooth transactions with your clients.

Best Practices for Professional Invoices

Creating a professional billing document is essential for maintaining clarity and ensuring that clients understand the payment expectations. A well-designed statement not only reflects your business’s professionalism but also helps avoid confusion or delays in payment. By following best practices, you can ensure that your documents are clear, complete, and easy to process for both you and your clients.

First and foremost, always include essential details such as your business name, contact information, and a clear title for the document. This helps recipients immediately recognize the purpose of the document and know how to contact you if necessary. Along with these details, make sure the client’s information is accurate and up-to-date, as this ensures there are no misunderstandings about the intended recipient.

When listing the services or products provided, be thorough and specific. Include clear descriptions, quantities, individual prices, and applicable taxes, so the client understands exactly what they are being charged for. A well-structured breakdown reduces the chances of disputes or questions later on. Also, clearly outline your payment terms, including due dates, accepted payment methods, and any late fees for overdue payments. This provides clear expectations and encourages prompt payment.

Another key practice is to maintain a consistent format across all your billing documents. This uniformity helps create a recognizable and reliable brand image while also ensuring that all essential information is consistently included in every document. Additionally, always double-check for accuracy, especially the total amount due and any tax calculations, as errors can cause unnecessary delays and confusion.

By following these best practices, you can ensure that your billing documents are professional, clear, and effective in securing timely payments and maintaining positive client relationships.

Common Mistakes to Avoid on Invoices

When preparing a billing document, it’s crucial to be mindful of potential errors that could cause confusion or delays in payment. Even small mistakes can lead to misunderstandings with clients or complications in your accounting. By being aware of common pitfalls, you can ensure that your billing documents are accurate, clear, and professional.

Key Mistakes to Avoid

- Missing or Incorrect Contact Information: Ensure that both your business and the client’s details are correct and up-to-date. Incorrect contact information can lead to missed communications and payment delays.

- Unclear Payment Terms: Avoid vague language. Clearly state the due date, accepted payment methods, and any late fees. Ambiguity in payment expectations can lead to confusion and delayed payments.

- Omitting Important Details: Always include a description of the services or products provided, along with their prices, quantities, and any applicable taxes. Missing details can cause clients to question the charges.

- Incorrect Calculations: Double-check the math! Mistakes in pricing or totals can create issues, especially if the client notices discrepancies. Always verify that taxes, discounts, and final totals are correct.

- Not Including an Invoice Number: Each document should have a unique reference number for tracking purposes. Missing this detail can make it difficult to organize records or follow up on payments.

- Using Inconsistent Formats: Consistency is key to a professional appearance. Stick to a clean, recognizable layout for all your documents. Disorganized or inconsistent formats can confuse clients and undermine your credibility.

How to Prevent These Errors

- Review the Document: Always take the time to double-check every detail before sending it to the client. Simple errors can be easily caught with a quick review.

- Use a Structured Format: Using a consistent structure helps ensure you don’t miss any important sections, like descriptions or totals.

- Keep Records Organized: Maintain a system for tracking issued documents and payments to ensure you stay on top of your billing cycle.

Avoiding these common mistakes will help you maintain a smooth and professional relationship with your clients, ensuring that your payment process is both efficient and transparent.

Where to Find Quality Invoice Templates

When looking for ready-made billing documents, it’s important to choose reliable sources that offer high-quality and customizable options. The right platform can provide a wide variety of layouts to meet your specific needs, whether you are invoicing for services, products, or subscriptions. Below are some of the best places to find professional and user-friendly formats.

Top Sources for Quality Billing Documents

| Source | Features | Best For |

|---|---|---|

| Online Marketplaces | Variety of professional designs, customization options, and industry-specific formats. | Businesses of all sizes looking for versatile, customizable documents. |

| Business Software Suites | Pre-built billing formats integrated with accounting tools for easy use. | Small businesses and freelancers who need a streamlined billing process. |

| Cloud-Based Platforms | Easy-to-edit templates, cloud storage, and invoicing features for remote access. | Freelancers and remote teams that need flexible access and online management. |

| Professional Websites | Downloadable documents with high customization, often offered by financial professionals or consultants. | Freelancers, consultants, and small business owners looking for specialized formats. |

How to Choose the Right Source

When selecting a platform or provider for your billing documents, consider the specific needs of your business. If you need a simple and easy-to-use solution, an online marketplace or cloud-based platform might be ideal. For those who need integrated features for accounting and invoicing, software suites may be a better choice. Additionally, specialized websites that cater to professional services often offer highly customizable layouts that can be tailored to specific industries or business types.

How to Edit Your Invoice Template

Editing a pre-designed billing document allows you to customize it to meet your specific business needs. Whether you need to update client information, adjust pricing details, or include your branding, this flexibility ensures that each document accurately represents your services. Here’s a simple guide to help you make necessary changes and create a polished, professional payment request every time.

Step-by-Step Guide to Editing

- Open the Document: Start by opening the existing billing layout in your word processor or preferred editing software.

- Update Business Information: Ensure that your business name, logo, and contact details are correctly displayed at the top of the document.

- Modify Client Details: Replace the default client information with your customer’s name, address, and contact details to ensure proper delivery of the request.

- Adjust Service or Product Listings: Update the descriptions, quantities, unit prices, and any applicable taxes. This is where you can tailor the document based on the specific services or items you’re billing for.

- Review Payment Terms: Confirm that payment terms are correct, including due dates, payment methods, and any late fee conditions.

- Calculate and Update Totals: Double-check all calculations for accuracy. Make sure that subtotals, taxes, and final amounts are correct.

- Save and Export: Once all changes have been made, save the edited document. You can export it as a PDF for easy sharing or keep it in the original format for future edits.

Tips for Efficient Editing

- Consistency is Key: Ensure that fonts, colors, and layout styles are consistent throughout the document to maintain a professional appearance.

- Use Placeholder Text: If you are creating multiple documents, using placeholder text for certain fields like client names and service descriptions can speed up the process.

- Keep It Simple: Avoid cluttering the document with unnecessary details. Focus on clarity and simplicity to ensure the client easily understands the billing information.

By following these simple steps and tips, you can quickly and efficiently edit your billing documents, ensuring they are tailored to your business needs while m

Printing and Sending Your Invoice

Once you’ve created and customized your billing document, the next step is to prepare it for delivery. Whether you choose to send it digitally or by traditional mail, it’s important to ensure the document is formatted correctly and that you follow best practices for both efficiency and professionalism. This section will guide you through the process of printing and sending your payment request to clients.

How to Print Your Billing Document

Printing a billing document is straightforward, but there are a few things to keep in mind to ensure it looks professional and is easy for the client to read:

- Check Layout and Margins: Before printing, make sure the content is well aligned on the page. Check that there are no cut-off edges and that all information is visible.

- Use Quality Paper: When sending a physical copy, use high-quality paper to give a professional impression. A clean, crisp print on a heavier stock can enhance the perceived value of your document.

- Print a Test Page: Before printing multiple copies, always do a test print to ensure everything is formatted properly. This prevents waste and ensures your document looks its best.

Methods for Sending Your Billing Request

Once the document is printed and ready, you can choose the most efficient way to send it. Here are the most common methods for delivering your billing request:

- Email: Email is often the quickest and most convenient way to send a document. Save your file as a PDF to prevent formatting issues and to ensure that your client receives the document in the same format you intended. Attach the file to the email and include a brief message explaining the billing details.

- Postal Mail: If you prefer to send a hard copy, make sure to use a reliable mailing service. Use an envelope that fits the document without folding it to maintain a professional appearance. Consider using certified or tracked mail if sending large amounts or for high-value transactions.

- Online Platforms: If you use an online invoicing service, these platforms often offer integrated sending options. You can directly send your payment request through the platform, which may also provide automated follow-up reminders and confirmations of receipt.

By following these steps, you ensure that your billing document reaches your client in a professional and timely manner. Whether you choose to send it via email, traditional mail, o

How to Add Your Branding to Invoices

Incorporating your company’s branding into your billing documents not only enhances their professional appearance but also strengthens your brand identity. Adding consistent visual elements such as logos, fonts, colors, and design styles makes your documents instantly recognizable, which helps create a lasting impression with clients. Here are some key strategies to effectively apply your branding to payment requests.

Incorporating Your Brand Elements

To give your document a cohesive, branded look, start by integrating the following elements:

- Logo Placement: Your logo should be prominently displayed at the top of the document, ideally near your business name and contact information. This ensures it’s one of the first things your client notices.

- Consistent Fonts: Use the same fonts that you use across your website and marketing materials. Choose clear, professional fonts for readability and consistency.

- Brand Colors: Apply your brand colors to headings, borders, and section highlights. Ensure that the colors complement each other and don’t overpower the content. This helps maintain a professional and polished look.

- Tagline or Slogan: If your business uses a tagline or slogan, consider adding it at the bottom of the document, under the contact information. This reinforces your brand message without overwhelming the design.

Formatting and Design Tips

When designing your billing document, make sure that it is easy to read and visually appealing:

- Keep it Simple: Avoid cluttering the document with excessive text or decorative elements. Focus on clarity and professionalism.

- Alignment and Spacing: Ensure proper alignment of text, numbers, and sections. Use adequate spacing between different sections (like the list of services/products and payment details) to make the document easy to follow.

- Use a Header/Footer: Incorporate your brand’s style into the document’s header and footer. This can include your business name, logo, or website URL, ensuring the branding is consistent throughout the document.

By applying these branding strategies, your billing documents will not only serve their primary function but also act as an extension of your company’s identity, leaving a strong and professional impression with your clients.

Legal Considerations When Creating Invoices

Creating a billing document is not just a business practice; it’s also a legal one. It’s essential that these documents comply with relevant regulations and clearly outline the terms of the transaction. Failing to meet legal requirements can lead to disputes, delayed payments, or even legal challenges. This section will cover key legal aspects to consider when drafting your billing requests.

Essential Legal Elements to Include

To ensure your billing documents are legally compliant, it’s important to include the following details:

- Invoice Number: Each document must have a unique reference number. This helps to track transactions and prevents confusion, especially in case of audits or disputes.

- Business Identification: Include your full business name, address, and contact details, as well as any tax identification numbers or registration numbers required by local authorities.

- Client Information: Accurately list the client’s name, address, and contact details to avoid any misunderstandings or miscommunications.

- Clear Payment Terms: Clearly state the due date for payment, late fees, and acceptable payment methods. This provides transparency and helps avoid future payment disputes.

- Tax Information: Depending on your jurisdiction, it may be required to list applicable taxes (e.g., VAT or sales tax) and specify the rate applied. Ensure that the tax details comply with local laws.

Best Practices for Legal Compliance

In addition to the basic elements, follow these best practices to ensure your billing documents are legally sound:

- Keep Records: Maintain a copy of every billing document for your records. This is crucial for tax purposes, resolving disputes, and keeping your accounting organized.

- Review Local Laws: Research the specific legal requirements in your country or region. Some areas may have additional invoicing regulations, such as specific wording or formatting requirements.

- Consult a Legal Professional: If you’re unsure about any legal aspects of creating billing documents, it’s always a good idea to consult a lawyer or tax professional to ensure compliance with applicable laws.

By understanding and addressing these legal considerations, you can avoid complications and ensure your billing documents are

How to Track Payments from Invoices

Tracking payments is a crucial part of managing your business’s cash flow and ensuring timely compensation for your services or products. By keeping track of which clients have paid and which are still outstanding, you can avoid confusion and follow up effectively when necessary. This section covers the best methods and tools to help you track payments efficiently and stay organized.

Manual Tracking Methods

If you prefer to keep things simple, manual tracking can be done using spreadsheets or dedicated ledgers. Here’s how:

- Spreadsheet Tracking: Create a spreadsheet to record each transaction, including the client name, payment amount, payment date, and status. This method is cost-effective but can become cumbersome as the volume of payments increases.

- Ledger or Paper Records: For those who prefer a more traditional approach, maintaining a physical ledger with payment details can work. However, this is less efficient and more prone to errors compared to digital tools.

Using Accounting Software for Payment Tracking

For more efficiency and automation, many businesses turn to accounting software that offers built-in payment tracking features. Here’s what these tools typically offer:

- Automated Payment Reminders: Accounting software can send automatic reminders to clients with outstanding balances, reducing the need for manual follow-ups.

- Payment Status Updates: These tools allow you to quickly view which payments have been made and which are pending, often with real-time updates when payments are processed.

- Integration with Bank Accounts: Many platforms integrate with your business’s bank account, allowing automatic reconciliation of received payments with your records.

By using accounting tools or maintaining accurate records manually, you can ensure that all payments are tracked effectively, making it easier to manage your business finances and reduce the risk of missed payments.

Using Word Templates for Small Businesses

For small businesses, creating consistent and professional documents is essential for building credibility and ensuring smooth operations. Whether it’s for billing, contracts, or other client-facing documents, having pre-designed layouts saves time and ensures uniformity. In this section, we’ll explore how small business owners can use document layouts to streamline processes and maintain professionalism without the need for expensive software or services.

Benefits of Using Pre-Designed Documents

Using pre-built designs offers several advantages, especially for small businesses looking to stay organized while saving time:

- Time Efficiency: Pre-designed layouts allow you to quickly generate documents without starting from scratch every time. This is particularly useful for repetitive tasks like sending billing requests.

- Consistency and Professionalism: Having a consistent look across all business documents fosters a professional image and makes your business appear more established and trustworthy.

- Customization Flexibility: While templates provide a structure, they are easy to modify to suit your business needs. You can update logos, adjust text, and change details like payment terms or services offered.

How to Use Pre-designed Documents Effectively

Here are a few tips for small businesses to get the most out of pre-designed layouts:

- Ensure Accuracy: Always double-check the information before sending or printing. Even though the structure is pre-designed, the content must be correct and up-to-date.

- Brand Integration: Make sure to include your business logo, color scheme, and font choices in the document design to reinforce your brand identity.

- Adjust for Specific Needs: Customize the document for specific clients or projects. For example, tailor service descriptions, terms, or prices as needed to reflect each transaction.

By using pre-designed layouts, small business owners can maintain consistency, improve efficiency, and present a more polished image without needing specialized software or extensive design skills. This approach can help businesses of all sizes save time while maintaining a professional and cohesive look for their communications.

How to Save Time with Invoice Templates

Creating payment requests can be time-consuming, especially when you are juggling multiple tasks in your business. By using pre-designed layouts, you can streamline the process, saving valuable time while ensuring consistency and professionalism. This section will explore the key ways in which using structured documents can help you work more efficiently and focus on what matters most in your business.

Automating Repetitive Tasks

One of the biggest time-savers is the ability to automate recurring tasks. Here’s how pre-made documents can help:

- Quickly Reuse Documents: Once you’ve customized a layout to match your business needs, you can easily reuse it for every new client or project. No need to start from scratch each time–just update the relevant details like client name, date, and service description.

- Pre-set Fields: By setting up fields for common information (such as your company name, contact details, or payment terms), you can fill out new requests in just a few clicks, ensuring accuracy and consistency.

- Standardized Layout: With a uniform structure for all your documents, you’ll spend less time adjusting formatting or design details. The layout is already set, so you can focus on the content.

Enhancing Efficiency and Reducing Errors

Using a ready-made structure helps you work faster and reduces the risk of mistakes, which can cause delays or confusion. Here are the advantages:

- Minimized Typing: By using fields or placeholders, you reduce the amount of manual typing, which not only speeds up the process but also lowers the chances of typos or incorrect information.

- Consistency in Style: Pre-designed layouts ensure that each document follows the same style, helping to maintain a professional image across all communications without needing to design or format each one manually.

- Reduced Time Spent on Calculations: Some layouts come with built-in fields for calculating totals, taxes, and discounts, which eliminates the need to perform these calculations manually, saving you time and preventing errors.

By incorporating pre-built documents into your workflow, you can speed up administrative tasks, ensure consistency, and reduce the time spent on repetitive tasks, leaving more time to focus on growing your business and serving your clients effectively.

How to Protect Your Invoice Information

Protecting sensitive financial information is essential to maintain trust with your clients and comply with legal regulations. In today’s digital world, safeguarding your documents from unauthorized access or fraud is a priority. This section covers key steps to ensure your payment requests are secure, both when they’re created and sent to clients.

Secure Your Document Storage

First and foremost, it’s vital to keep your documents stored in a safe manner. Here’s how to securely manage your business records:

- Use Encrypted Digital Storage: If you’re storing files on your computer or cloud service, make sure to use encrypted storage solutions. This ensures that only authorized users can access the files, protecting sensitive information from theft.

- Secure Your Physical Records: If you keep physical copies of your documents, store them in a locked filing cabinet or safe. Limit access to authorized personnel only to reduce the risk of theft or loss.

- Backup Your Files: Regularly back up your files to a secure location. In case of data loss, having a backup ensures you won’t lose important payment records or business documents.

Protecting Your Documents When Sending

When sharing your documents with clients, it’s essential to use secure methods of communication. Here are some best practices:

- Use Password Protection: When sending payment requests via email or file-sharing services, use password protection to prevent unauthorized access. Make sure to send the password separately via another communication method (e.g., text or phone call).

- Send via Secure Channels: Use encrypted email services or secure file-sharing platforms to send documents, ensuring the information is transmitted safely. Avoid sending sensitive documents through unencrypted or public channels like regular email or social media.

- Double-check Email Recipients: Always verify the recipient’s email address before sending any document containing sensitive information. This helps avoid sending documents to the wrong person, which could lead to a data breach.

Regularly Monitor and Update Security Practices

To stay ahead of potential security risks, you should periodically review and update your protection measures:

- Update Software: Regularly update your software, including anti-virus and anti-malware programs, to protect against new security vulnerabilities.

- Train Employees: If you have a team, ensure that everyone understands the importance of securing sensitive business documents. Provide training on best practices for data protection and safe document handling.

- Use Strong Passwords: Make sure that all accounts and systems used to store or access your documents have strong, unique passwords. Avoid using easily guessed passwords or