Download Free Proforma Invoice Excel Template

Managing business paperwork is an essential task for any company. Having the right tools to streamline the process can save time and improve accuracy. When it comes to generating estimates, quotes, or preliminary transaction records, it’s important to use an effective system that aligns with professional standards.

One of the most practical methods for creating these essential documents is through using spreadsheet software. These tools allow for customization and easy calculations, helping businesses quickly adapt to specific needs and maintain consistency across all records.

For those seeking a straightforward way to generate professional-looking records, a structured spreadsheet file can be the ideal solution. By utilizing predefined formats, users can focus on the details of their transactions without getting bogged down by formatting or complex calculations.

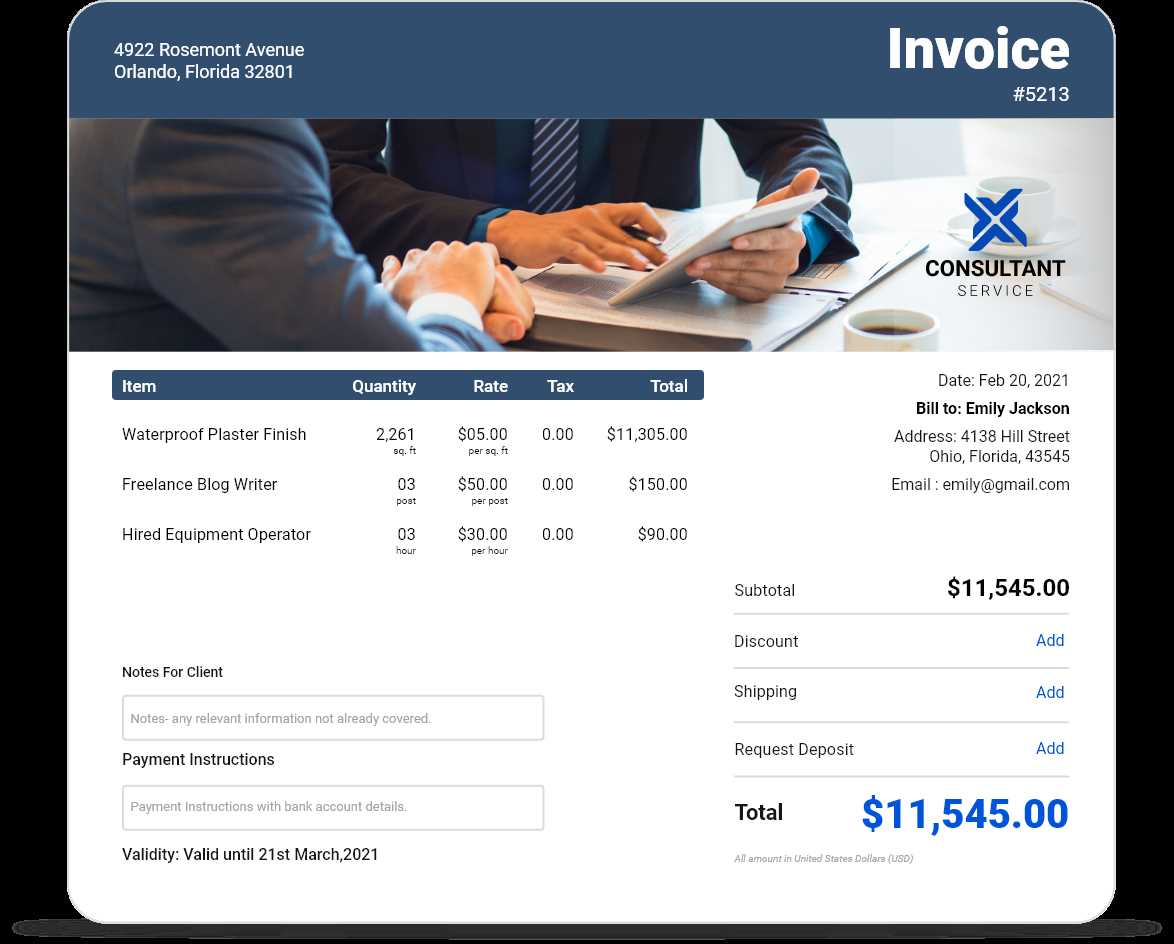

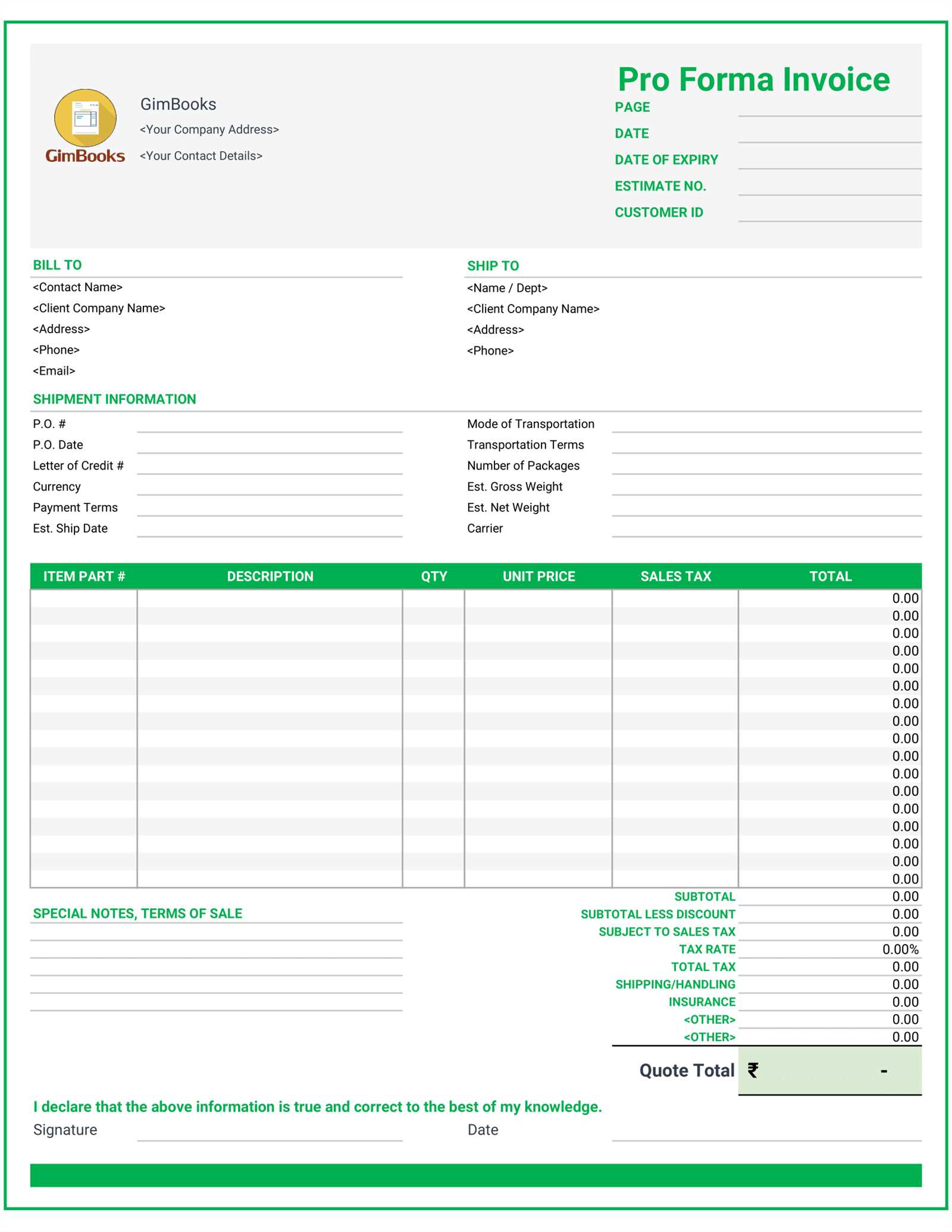

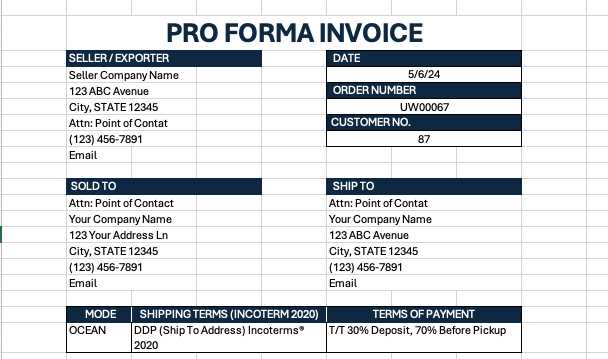

Free Proforma Invoice Excel Template Download

In the modern business world, it’s crucial to have a simple yet effective system for preparing preliminary financial documents. Whether you’re issuing a quote, an estimate, or a transaction proposal, a well-organized and professional-looking record can make all the difference. With the right tools, creating such documents becomes a seamless task, allowing you to focus on other essential aspects of your business.

Why Use a Structured Spreadsheet for Your Documents?

Using a structured file can save time and enhance consistency across all of your paperwork. A well-designed system helps ensure all necessary fields are included, such as contact details, item descriptions, prices, and terms of service. These systems also allow you to perform calculations automatically, minimizing errors and streamlining the process.

- Professional formatting for clear communication

- Easy to customize for different industries

- Calculation fields for accurate pricing and totals

- Fast data entry with pre-designed cells and fields

How to Get Started with Your Document System

To begin creating your records, you can easily access a ready-made file designed to meet common business needs. These files can be tailored to your specific requirements, whether you are working with a single product or managing multiple services. The key benefit of using such a system is its simplicity and adaptability, making it ideal for both small businesses and large enterprises.

- Select the file that suits your business needs.

- Customize fields like company name, address, and item descriptions.

- Input the relevant figures and let the spreadsheet handle calculations.

- Save and share your document with clients or colleagues.

Benefits of Using Proforma Invoices

Creating detailed preliminary documents is an essential part of maintaining transparency in business transactions. These records serve as a formal offer, outlining the terms and conditions of a potential sale or service agreement. Utilizing such documents brings several advantages, particularly when it comes to providing clients with clear expectations and managing internal processes effectively.

One of the key benefits of using this type of record is the ability to streamline communication. It ensures both the service provider and the client are aligned on pricing, terms, and delivery timelines. By having a standardized document in place, businesses can avoid misunderstandings and reduce the need for back-and-forth clarifications.

Additionally, these documents can act as a reference for future financial transactions, helping businesses maintain a consistent approach to cost estimation and payment terms. This proactive method is particularly useful for projects where scope and costs may change over time, allowing for easier adjustments and tracking of changes.

How to Customize Excel Invoice Template

Adapting a pre-built document to fit your business needs is a straightforward process that can save you significant time. Customizing your record allows you to tailor it to your specific services, pricing structure, and branding. Whether you’re creating a record for a single client or preparing a series of documents for multiple transactions, flexibility is key to ensuring that each one meets your professional standards.

Adjusting Key Fields for Your Business

Start by editing the main sections of the document, such as contact information, product or service descriptions, and pricing. These fields can be adjusted to reflect the specifics of each transaction. Simply replace the placeholders with your own data, ensuring accuracy in pricing and quantities.

- Contact details: Input your company’s name, address, and phone number for easy communication.

- Product/Service List: Include descriptions of items or services, ensuring clarity and accuracy.

- Pricing: Update the price fields with the correct figures, ensuring correct calculation of totals.

Personalizing the Design

Beyond the functional fields, you can enhance the document’s appearance by modifying colors, fonts, and logos. This helps maintain consistency with your branding and makes your document look more professional. With just a few adjustments, you can create a custom document that reflects your business style.

- Logo: Insert your company logo in the header for brand recognition.

- Font Styles: Use clear, readable fonts for ease of understanding.

- Color Scheme: Choose colors that align with your company’s visual identity.

Step-by-Step Guide to Access the Document

Getting started with a structured document for your business transactions is simple and quick. By following a few easy steps, you can gain access to a ready-made file that can be tailored to suit your needs. This process ensures that you have all the essential fields set up, so you can focus on the details of your specific transaction.

How to Access Your Record

Follow the steps below to get started with a professionally designed file that you can modify for any of your business dealings:

- Visit the Resource Page: Navigate to the section where the document is available for use.

- Select the File: Choose the document that best suits your business needs, whether for quotes, estimates, or proposals.

- Open the File: Click to open the document and review the contents to ensure it fits your requirements.

- Save the File: Once you’re ready, save the document to your computer for future use.

- Customize the Document: Start editing the file by replacing the placeholder text with your own business information and details for the transaction.

Additional Tips for Easy Access

- Check File Compatibility: Ensure the file format is compatible with your software before opening.

- Use Secure Sources: Make sure to access the file from a trusted and reliable platform to avoid any issues.

- Keep a Backup: Always keep a copy of the original document before making significant changes.

Understanding Proforma Invoices for Business

In any business transaction, clarity and transparency are essential. A well-structured preliminary document is key to outlining the details of a potential sale or agreement. This type of document provides both parties with an understanding of the terms, costs, and expectations, without committing to a final purchase or service agreement. It acts as a preview, ensuring that both the supplier and the customer are on the same page before proceeding further.

These documents serve as a reference point and allow businesses to establish trust by offering a clear and formal presentation of the transaction details. This helps to avoid misunderstandings, particularly in complex or large-scale transactions.

Key Elements of a Business Record

| Element | Description |

|---|---|

| Item or Service Description | Clearly outlines the products or services being offered, including specifications and quantities. |

| Pricing Information | Details the cost of each item or service, as well as any additional fees or taxes that may apply. |

| Terms and Conditions | Specifies payment methods, delivery schedules, and any other agreements between the parties involved. |

| Validity Period | Indicates how long the offered terms are valid, ensuring clarity on when the agreement expires. |

By including these key details, the document serves as a comprehensive outline of the business arrangement, setting expectations for both sides. This structure minimizes potential conflicts and provides a clear path forward for all parties involved.

Choosing the Best Template for Your Needs

Selecting the right document for your business is an important step in ensuring smooth and professional transactions. A well-organized file helps you present accurate information to clients and partners, making it easier to track agreements and maintain consistency across all records. The key is to find a format that matches the scale and nature of your business, while offering the flexibility to adjust to various transaction types.

Consider Your Business Type

The first step in choosing the right file is understanding your business’s needs. Different industries have different requirements, so selecting a record that reflects your specific needs will make the process much more efficient. For example, a service-based business may need fields for labor hours, while a retail business might focus more on product descriptions and quantities.

- Service businesses: Focus on fields for services rendered, hours worked, and hourly rates.

- Product-based businesses: Ensure the record includes space for item descriptions, quantities, and unit pricing.

- Freelancers and contractors: Look for a structure that allows you to easily list project milestones, deadlines, and costs.

Features to Look For

Once you know what type of record works best for your business, focus on specific features that can make the process more efficient. A good structure should include customizable fields, easy-to-read layouts, and automatic calculations. Having a record that allows you to quickly update prices, descriptions, and quantities can save you a lot of time in the long run.

- Customizable fields: Make sure the record allows you to add or remove sections based on your needs.

- Automatic calculations: Look for formulas that can automatically calculate totals, taxes, or discounts.

- Clear layout: Ensure the document is easy to navigate and read, even for clients with little business knowledge.

Common Mistakes to Avoid in Invoicing

Creating a formal document for business transactions is essential to maintain clarity, transparency, and professionalism. However, it’s easy to overlook key details or make common errors that can lead to confusion, delays in payments, or strained client relationships. Understanding these pitfalls and how to avoid them is crucial for maintaining smooth financial operations and ensuring that your transactions are both accurate and timely.

Missing or Incorrect Information

One of the most frequent mistakes is omitting important details or including incorrect information. Whether it’s an incorrect price, a missing description, or outdated contact details, these errors can cause delays or misunderstandings. Make sure that every field is filled out correctly and that all details are accurate.

- Incorrect contact details: Double-check that your company’s information is up-to-date, including address, phone number, and email.

- Wrong pricing: Verify that the cost of each item or service is correct, including taxes and discounts.

- Missing dates: Ensure that the date of issue and payment due date are clearly stated.

Failure to Maintain a Clear Structure

A cluttered or confusing document layout can make it difficult for your clients to understand the terms of the transaction. A disorganized structure could also result in missed details or mistakes. Using a clean, organized format with clear headings and well-defined sections will make it easier for both you and your clients to track and review the information.

- Lack of itemization: Break down the services or products clearly, so your clients can easily see what they’re being charged for.

- Poor readability: Choose a readable font and structure, using headings and bullet points to organize the information effectively.

Key Features of a Proforma Invoice

When preparing a preliminary document for a transaction, it is important to ensure that it includes all essential details. This record serves as an outline or a preview of the formal agreement, and its features are critical to making the terms clear to both parties. A well-structured document helps ensure transparency and avoids misunderstandings regarding costs, quantities, and other vital information.

Essential Components

To create a clear and comprehensive document, there are certain elements that should always be included. These components help define the scope of the agreement and outline what the customer can expect.

- Business Information: The name, address, and contact details of both the buyer and seller should be clearly stated.

- Detailed Descriptions: Include clear descriptions of the items or services, including quantities and specifications.

- Pricing Breakdown: Provide the cost of each item or service, as well as any taxes or discounts applied.

- Terms and Conditions: List the payment methods, delivery timelines, and any other important contractual terms.

- Validity Date: Specify how long the offered terms are valid to prevent any confusion or misunderstandings about the deal.

Formatting and Structure

The clarity of the structure and layout of the document is just as important as the content itself. A well-organized file helps the recipient quickly understand the terms and makes it easier to reference specific details.

- Clear Headings: Use distinct headings and sections to separate key information for easy navigation.

- Readable Fonts: Choose a legible font that ensures all details are easily readable.

- Itemized List: List each product or service separately, including relevant details such as unit price, quantity, and total cost.

How Proforma Invoices Improve Efficiency

Implementing clear and organized documentation in business transactions significantly enhances operational efficiency. When a preliminary document is used to outline the key details of a transaction, both buyers and sellers can better manage expectations, minimize errors, and streamline the entire process. By laying out terms, pricing, and other essential information beforehand, this type of document helps avoid unnecessary back-and-forth communication and ensures a smoother path to finalizing agreements.

Faster Decision-Making

When both parties have access to a structured summary of the terms and conditions, they can quickly assess whether they agree with the proposed arrangement. This eliminates the need for prolonged negotiations or clarifications, speeding up the decision-making process. With everything clearly laid out, businesses can move forward with confidence, reducing time spent on revisions and inquiries.

- Clear Pricing: Transparent pricing structures allow buyers to make quick decisions without needing to request further clarification.

- Set Expectations: By clearly stating terms, both parties know what to expect from the transaction, leading to fewer disputes and misunderstandings.

Reduced Errors and Misunderstandings

A well-prepared document reduces the chances of errors or miscommunication between businesses and clients. It ensures that all the details are agreed upon before the formal agreement is made, eliminating last-minute surprises. This attention to detail helps prevent costly mistakes and reduces the risk of disputes, saving both time and money in the long run.

- Clear Layout: Organizing information in an easy-to-understand format helps minimize confusion for both parties.

- Accurate Information: Ensuring that pricing, quantities, and terms are correct from the start reduces the chances of errors down the line.

Why Excel is Ideal for Invoices

Using spreadsheet software for creating business documents offers numerous advantages, especially when it comes to managing financial records. Its versatility, ease of use, and built-in calculation tools make it an ideal platform for generating structured documents. With the ability to organize data in rows and columns, users can quickly input, modify, and update transaction details without hassle, ensuring accuracy and efficiency throughout the process.

Efficient Data Management

One of the key reasons spreadsheets are popular for financial documentation is their ability to manage and organize large amounts of data easily. With just a few clicks, you can sort, filter, and modify entries, making it quick to find the necessary information and ensure that all details are correctly accounted for.

- Sorting and Filtering: Effortlessly organize products or services in any order, whether by name, price, or date.

- Customizable Layout: Tailor the structure of the document to fit specific needs, making it easy to highlight important information.

Built-in Calculation Tools

Spreadsheets come with powerful calculation features that can automatically update totals, apply taxes, or calculate discounts. These built-in formulas reduce the risk of human error, saving time and ensuring consistency in the final numbers. This level of automation helps speed up the entire process, from inputting data to generating a finalized document.

- Automatic Calculations: Let the software calculate totals, taxes, and discounts instantly based on predefined formulas.

- Real-Time Updates: As you make changes to individual items, the document automatically adjusts totals, ensuring accuracy at all times.

How to Protect Your Invoice Data

Ensuring the security of your financial documentation is critical in today’s digital age. As these records often contain sensitive information, such as payment details, client data, and business terms, protecting them from unauthorized access or corruption is essential. By implementing proper security measures, you can safeguard your data from potential threats and avoid costly consequences.

Use Strong Passwords and Encryption

One of the first steps in protecting your financial records is to secure the files with strong passwords and encryption. This ensures that only authorized users can access the sensitive information contained within the documents. Strong encryption algorithms also prevent unauthorized individuals from tampering with or altering the data.

- Password Protection: Always use complex passwords for your files, avoiding easily guessable combinations. Consider using a password manager to generate and store strong passwords.

- Encryption: Encrypt your files to ensure that, even if accessed by unauthorized parties, the data remains unreadable without the decryption key.

Backup Your Data Regularly

Having secure backups is essential in case of data loss due to hardware failure, cyberattacks, or accidental deletion. Regularly saving copies of your financial records in secure locations ensures that you can quickly recover important documents without significant disruptions to your business operations.

- Cloud Storage: Store your backups in a reliable cloud service with strong security protocols to protect against data breaches.

- Offline Backups: Additionally, keep physical copies of critical files on external drives or other secure offline media.

Adjusting Template for Different Businesses

Each business has its unique set of needs when it comes to documenting financial transactions. Whether you’re running a small service-based company or a large retail operation, customizing your records to match the specific requirements of your business type ensures clarity and precision. The flexibility of spreadsheet tools allows for easy adjustments, enabling you to tailor the document structure, content, and presentation to suit your business model.

Tailoring Fields to Specific Needs

Different industries require different types of information in their documents. For example, a service provider may focus more on labor charges, while a retailer might emphasize product descriptions and quantities. By adjusting the fields in your document, you can ensure that it captures all the necessary details relevant to your particular business sector.

- Service-Based Businesses: Include fields for hourly rates, labor descriptions, and project timelines.

- Product-Based Businesses: Add columns for product names, quantities, unit prices, and discounts.

Customizing Branding and Style

Your company’s branding should be reflected in all business communications, including financial records. Adjusting colors, fonts, and logos in the document not only gives it a professional appearance but also reinforces your brand identity. Customizing the style of your document ensures consistency and makes it instantly recognizable to clients.

- Logo Placement: Position your logo prominently at the top of the document for brand visibility.

- Color Scheme: Use your company’s official colors to create a cohesive look that aligns with your brand.

- Font Styles: Choose clear, easy-to-read fonts that align with your company’s professional image.

How to Calculate Costs on Proforma Invoices

Accurately calculating costs is essential for any business when preparing financial documents. These calculations ensure that both you and your clients are on the same page regarding the amounts due. Whether you’re offering products or services, understanding how to properly account for various factors such as unit prices, taxes, and discounts is key to maintaining transparency and avoiding errors in your business transactions.

Breaking Down the Costs

The first step in calculating the total cost is to break down the components of the transaction. This includes listing the individual items or services, determining their unit cost, and multiplying by the quantity. This method provides a clear understanding of the base cost before applying any additional charges.

- Unit Cost: Identify the price for each individual product or service.

- Quantity: Multiply the unit cost by the number of items or hours of service provided.

Adding Taxes and Discounts

Once you have the base cost, you must factor in any taxes and discounts. Taxes can be calculated as a percentage of the subtotal, while discounts are typically subtracted from the total amount due. Make sure to clearly specify the tax rate and the discount terms in your document for full transparency.

- Taxes: Calculate the tax by multiplying the subtotal by the appropriate tax rate.

- Discounts: Subtract any discounts offered from the subtotal or after tax, depending on the terms.

Final Total

After accounting for all the components, sum up the base cost, taxes, and discounts to arrive at the final total. This will give a clear, accurate reflection of the amount due for the transaction. Double-checking your calculations ensures that no errors are made before sending out the document.

Saving and Sharing Your Proforma Invoice

Once you have completed your financial document, the next important step is ensuring it is saved and shared correctly. Proper storage ensures that you can easily access the document whenever needed, while sharing it efficiently helps to maintain communication and transparency with your clients or partners. This process also plays a crucial role in maintaining records for future reference or audits.

Saving Your Document

When saving your financial document, it’s important to select a format that is easily accessible and compatible with your system. Most people prefer using formats such as PDF or other widely supported file types. These formats preserve the integrity of the content, preventing accidental changes once the document is finalized.

- PDF: Ideal for preserving the document’s layout and preventing unauthorized edits.

- Spreadsheet Files: Useful if you need to make future updates or calculations.

- Cloud Storage: Ensures that you can access the document from multiple devices and locations.

Sharing the Document

Sharing your finalized document with clients, suppliers, or other relevant parties is essential for smooth business operations. There are various methods to share the document securely, including email or cloud-based file-sharing platforms. Ensure that the format you choose is easily accessible for the recipient to avoid delays in communication.

- Email: A quick and direct way to send the document, ensuring a time-stamped record of the transaction.

- Cloud Sharing: Platforms such as Google Drive or Dropbox allow for easy sharing and access across different devices.

- Secure Links: Shareable links can provide controlled access, reducing the risk of unauthorized alterations.

Tips for Professional Looking Invoices

Creating a polished and professional financial document is essential for establishing trust and credibility with clients. A well-designed document not only reflects the quality of your business but also ensures clarity in communication regarding services or goods provided. Here are some tips to make sure your document looks professional and serves its purpose effectively.

Use a Clean and Simple Layout

A cluttered design can confuse the recipient and create a negative impression. Stick to a clean, simple layout that highlights the key information. Organize the details in a logical manner so that clients can easily understand the transaction at a glance.

- Clear Headings: Use bold or larger fonts for headings such as “Client Information” or “Total Amount”.

- Proper Spacing: Ensure there’s enough space between different sections to avoid crowding of text.

- Consistent Font: Use professional fonts such as Arial, Helvetica, or Times New Roman.

Include All Essential Information

Make sure all necessary details are included in the document to avoid confusion or disputes later on. Essential information helps both parties understand the terms and reference the document easily when needed.

- Company and Client Details: Include the full name, address, and contact information for both parties.

- Unique Reference Number: Each document should have a unique identifier for easy tracking.

- Clear Breakdown: Show a detailed breakdown of services or products provided, including quantities, rates, and any applicable taxes.

How to Integrate Proforma Invoices with Accounting Software

Integrating financial documents with accounting software can streamline your business processes and improve accuracy in managing financial data. By automating the transfer of information from these documents to your accounting system, you reduce the chances of manual errors and save valuable time. This section explores how to seamlessly connect your financial documents with accounting tools for efficient tracking and reporting.

Choose Compatible Accounting Software

Before integrating, ensure that your accounting software is compatible with the format and structure of the documents you are using. Many modern accounting platforms support importing data from spreadsheets or other document formats. Verify that your chosen software can easily process the type of information you intend to manage.

- Check Import Options: Look for options to import data directly from documents, such as CSV or PDF formats.

- Cloud-Based Solutions: Opt for cloud-based accounting tools that offer seamless integration with other business applications.

Set Up Automatic Data Syncing

Once you’ve selected the right software, the next step is to automate the data synchronization between your documents and accounting software. This can often be done by linking your document system directly to the software, so that information is transferred automatically without the need for manual entry.

- Enable Auto-Sync: Enable automatic syncing of transaction details such as amounts, client names, and payment terms.

- Regular Updates: Set up regular updates to ensure that all documents are transferred in real-time or on a scheduled basis.

By integrating these documents with accounting software, you ensure that your financial tracking is always up to date and that you can generate accurate reports whenever needed.

Best Practices for Proforma Invoice Management

Efficient management of financial documents is crucial for maintaining smooth business operations. By organizing and tracking these documents systematically, you can ensure better communication with clients, improve financial accuracy, and streamline administrative tasks. In this section, we will explore key strategies to enhance the management of these documents, leading to more effective record-keeping and overall business efficiency.

Establish a Clear Filing System

A well-organized filing system is the foundation of effective document management. By categorizing and labeling your records appropriately, you can easily access and track relevant information when needed. A digital filing system is ideal for minimizing clutter and ensuring quick retrieval.

- Label Documents Properly: Use clear and consistent labels for easy identification, such as date and client name.

- Maintain Separate Folders: Create distinct folders for different clients or project types to keep related documents together.

- Use Cloud Storage: Opt for cloud-based storage solutions that allow you to access documents from anywhere while ensuring they are backed up.

Regularly Update and Review Records

Keep your records up to date by regularly reviewing and updating them as new transactions and agreements occur. This prevents any discrepancies in your financial records and ensures timely communication with clients regarding any pending payments or changes in terms.

- Set Reminders: Use reminders or alerts to notify you when documents need to be updated or reviewed.

- Track Changes: Maintain a log of modifications to keep a clear record of any amendments made.

Implement Standardized Processes

Standardizing the way you handle and create financial documents can help ensure consistency across your business. This includes using a uniform format, clear language, and setting predefined rules for handling payments and disputes. By following consistent practices, you improve the professional appearance of your business and reduce the risk of errors.

- Create Templates: Design reusable document templates to ensure consistency in format and information.

- Define Payment Terms: Standardize your payment terms and ensure they are clearly communicated in every document.

By implementing these best practices, you can manage your financial documents more effectively, reduce administrative overhead, and improve overall business operations.