Download Free Invoice Template to Streamline Your Billing

Efficient financial management is crucial for any business, whether you’re a freelancer or a growing enterprise. A well-organized billing system can save time, reduce errors, and improve cash flow. However, creating consistent and professional documents for every transaction can be a challenge. Fortunately, there are simple solutions that can help you maintain accuracy and professionalism without reinventing the wheel each time.

By utilizing ready-made tools, you can quickly generate well-structured documents tailored to your needs. These solutions are designed to handle essential information such as pricing, payment terms, and client details, ensuring clarity and reducing the likelihood of mistakes. With the right resources, managing finances becomes far less time-consuming, allowing you to focus on other critical areas of your business.

Whether you’re a small business owner or a freelancer, having access to customizable formats can significantly simplify your administrative tasks. These formats not only help ensure consistency but also give your paperwork a polished, professional appearance that can impress clients and partners alike. The best part is that you don’t have to invest in expensive software to achieve this level of efficiency.

Download Free Invoice Template for Your Business

Efficient billing is an essential part of running any business, ensuring that you maintain a steady cash flow and keep track of payments. Having access to well-structured documents designed for transactions can significantly reduce time spent on administrative tasks and increase accuracy. By using pre-designed solutions, you can easily create consistent, professional paperwork for your clients and customers.

There are various reasons why using such solutions is beneficial for your business:

- Save Time: Pre-made documents allow you to quickly fill in the necessary details without starting from scratch each time.

- Enhance Professionalism: Ready-made documents ensure that all of your business correspondence looks polished and cohesive.

- Minimize Errors: Standardized formats help you avoid common mistakes like missing details or incorrect calculations.

- Customizable: Most solutions allow you to tailor the design to suit your branding, ensuring consistency across your business materials.

For businesses of any size, utilizing these structured solutions makes managing financial records simpler and more organized. From freelancers to established companies, this method allows you to focus on growth while reducing administrative overhead. Moreover, it provides flexibility, as you can easily adapt the documents to meet various business needs.

Accessing these tools is simple and doesn’t require costly software or extensive technical skills. With just a few clicks, you can find a variety of options that suit your specific business needs and preferences, making it easier than ever to stay on top of your financial paperwork.

Why You Need an Invoice Template

Running a successful business requires efficiency and consistency in all aspects, including billing. A standardized approach to creating financial documents can save valuable time and ensure that all necessary details are accurately included. Without a clear structure, mistakes can easily occur, leading to confusion and delays in payments. Having a reliable format to rely on helps streamline this process and maintain professionalism in every transaction.

Maintain Consistency Across Transactions

Consistency is key to building trust with your clients. When you use a set structure for all of your financial records, it conveys reliability and attention to detail. Clients are more likely to respond positively to clear, well-organized documents, which can improve payment timelines and overall satisfaction. A uniform format ensures that nothing is overlooked and that the information remains easy to follow for both parties.

Minimize Errors and Oversights

Creating financial documents manually can lead to simple mistakes, such as miscalculations or missing essential information. With a pre-designed structure, these errors are less likely to occur, reducing the chance of disputes and delays. A clear layout helps ensure that all necessary fields are filled out, including pricing, terms, and contact details, improving the overall accuracy of your records.

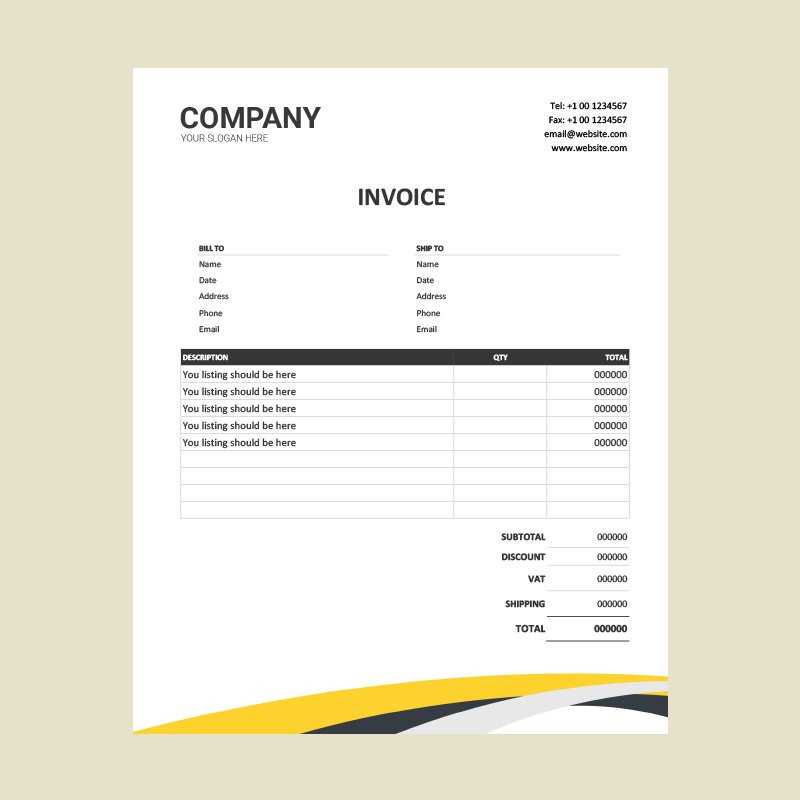

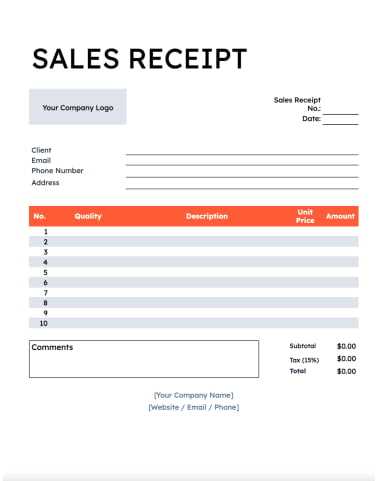

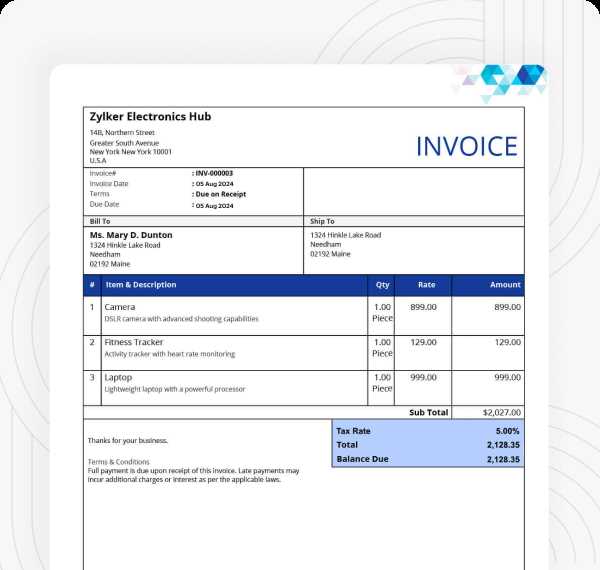

How to Customize Your Invoice Template

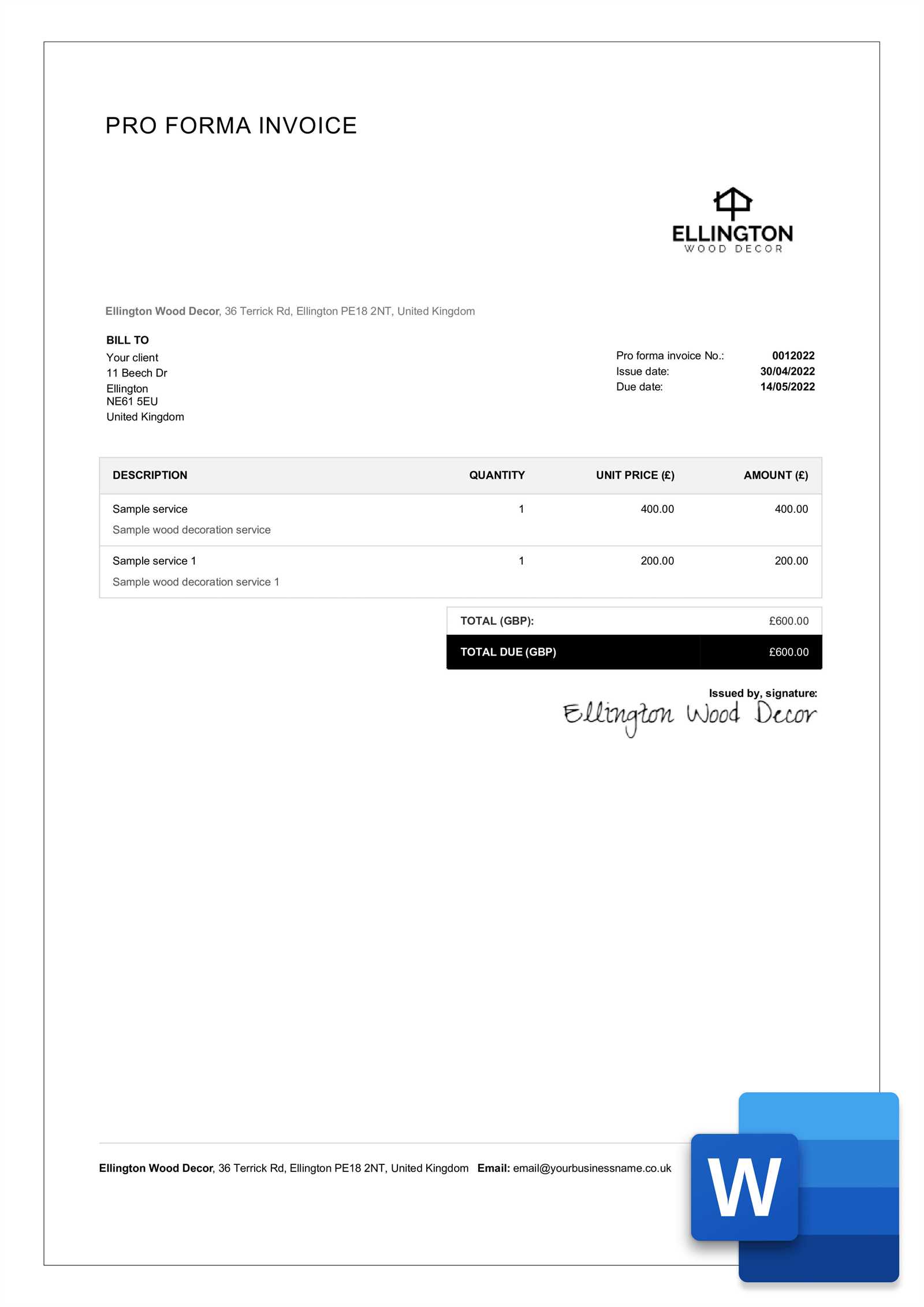

Customizing your billing documents is an essential step to make them align with your brand and business needs. Personalizing these records helps convey a professional image while ensuring all the necessary details are included. Tailoring the layout and content allows you to match your company’s style and ensure that every transaction is presented clearly and consistently.

Here are a few key steps to consider when customizing your document:

- Logo and Branding: Add your company’s logo and colors to maintain consistency across all business materials. This creates a professional look and reinforces your brand identity.

- Contact Information: Ensure that your business address, phone number, email, and website are easily visible. This makes it easier for clients to reach you if necessary.

- Payment Terms and Methods: Clearly specify payment due dates, methods of payment, and any late fees. This helps set expectations and minimizes confusion.

- Itemized List: Provide a detailed breakdown of products or services rendered, including quantities, descriptions, and prices. This ensures transparency and helps avoid disputes.

- Custom Fields: Some businesses may require additional information such as purchase order numbers or specific client requests. Tailor your layout to include these fields if necessary.

By adjusting these aspects, you can create a document that is both functional and reflective of your unique business identity. Customization not only enhances professionalism but also ensures that the document meets your specific requirements, making the billing process smooth for both you and your clients.

Benefits of Using Free Invoice Templates

Utilizing pre-made billing solutions provides numerous advantages for businesses of all sizes. These resources are designed to simplify the process of creating accurate and professional documents, saving time and reducing errors. Whether you’re a freelancer, a small business owner, or part of a larger organization, leveraging ready-made formats can help streamline financial tasks and improve efficiency.

Time and Effort Savings

One of the primary benefits of using ready-made solutions is the significant amount of time saved. Instead of creating a document from scratch, you can simply fill in the relevant details, allowing you to focus on other important aspects of your business. This time-saving element is especially valuable for entrepreneurs and small teams with limited resources.

- Quick Setup: Pre-designed structures eliminate the need for extensive formatting, making the process faster and more efficient.

- Easy Customization: Most formats allow you to quickly modify details such as pricing, terms, and company information, offering flexibility while maintaining consistency.

- Instant Access: Ready-made documents are available instantly, meaning you don’t have to wait for software installation or technical support.

Professional Appearance

Another key advantage is the polished and consistent look these resources provide. Professional documents are crucial for building trust with clients, and using a structured layout ensures that every transaction is handled with care. Ready-made formats include essential fields that help present all information in a clear and organized manner, which can enhance your business reputation.

- Brand Consistency: You can customize colors, fonts, and logos to match your business’s branding, ensuring uniformity across all your client communications.

- Clear Structure: Pre-designed formats are organized to display key details in a logical order, making it easier for clients to read and understand the terms of the agreement.

- Reduce Mistakes: By following a proven format, you are less likely to omit important information or make errors that could delay payments or cause confusion.

In conclusion, using these pre-designed resources can greatly simplify the billing process, save time, and ensure professionalism in your business communications. With minimal effort, you

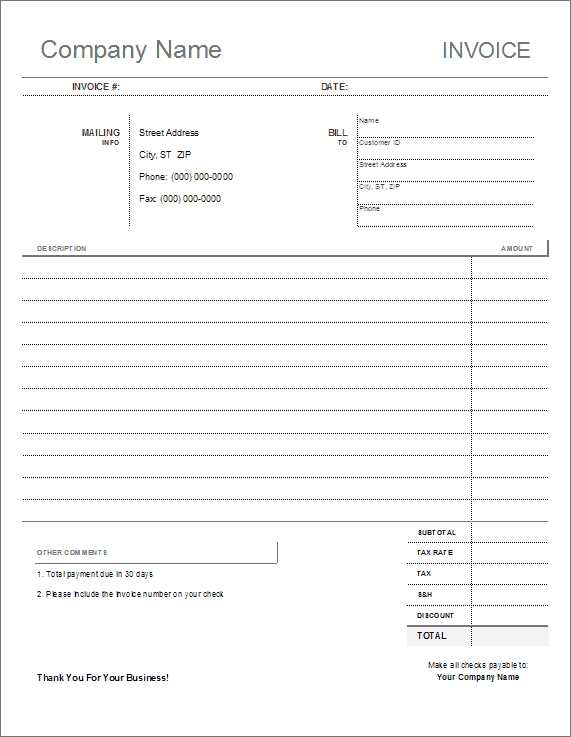

Choosing the Right Invoice Format

Selecting the appropriate structure for your financial documents is an essential step in maintaining organization and professionalism. The format you choose should suit your business model, client needs, and the complexity of your transactions. Having the right layout in place helps ensure that all the necessary details are presented clearly, making it easier for both you and your clients to understand terms and payment expectations.

Consider Your Business Type

The first step in selecting the right structure is to consider the nature of your business. Different industries may have unique requirements when it comes to documenting transactions. For example, service-based businesses may need a detailed breakdown of hours worked, while product-based businesses require itemized lists with pricing and quantities. Identifying your specific needs will help you choose the most suitable layout.

- Service Businesses: Look for a format that allows you to specify hourly rates, work descriptions, and the time spent on each task.

- Product-Based Businesses: Choose a structure that includes product names, quantities, unit prices, and total costs.

- Consulting and Freelancing: A simple, professional layout with space for project milestones, fees, and deadlines works best.

Evaluate the Complexity of Your Transactions

Next, consider how complex your transactions are. If your business involves multiple items or various services, you may need a format that can accommodate detailed itemized lists. On the other hand, if you offer a single service or product, a simpler structure might be sufficient. The key is to ensure that your chosen format allows you to accurately present the necessary information without overwhelming the recipient.

- Simple Transactions: A basic structure with clear sections for the amount due, terms, and client details is often enough.

- Complex Transactions: Opt for a more detailed layout with itemized lists, taxes, discounts, and payment methods.

- Recurring Billing: Choose a format that allows you to specify subscription periods, regular charges, and renewal dates.

Choosing the right format for your billing documents ensures smooth transactions and fosters clear communication with clients. By considering the nature of your business and the complexity of your deals, you can select a structure that best fits your needs while maintaining a professional appearance.

Top Websites for Free Invoice Downloads

There are numerous online platforms offering resources to help businesses create professional billing documents with ease. These websites provide a range of customizable formats that cater to different business needs, whether you’re a freelancer, a small business owner, or part of a larger organization. Accessing these resources can simplify your administrative tasks, improve accuracy, and enhance the overall presentation of your financial paperwork.

1. Invoice Generator

Invoice Generator is a user-friendly platform that allows you to create custom billing documents quickly. With a straightforward interface, you can input your business details, client information, and services or products sold. The platform also lets you adjust the layout and style to fit your business needs, making it ideal for anyone looking to generate a professional document in just a few minutes.

- Key Features: Customizable sections, easy to use, no account needed.

- Best For: Small businesses and freelancers seeking quick and efficient document creation.

2. Wave Accounting

Wave Accounting is a comprehensive accounting tool that offers many features beyond just document creation. In addition to generating financial records, it also tracks expenses, income, and taxes, making it ideal for businesses that need a more robust solution. The platform is free to use for invoicing and offers a range of professionally designed formats.

- Key Features: Integrated accounting tools, customizable designs, supports multiple currencies.

- Best For: Small to medium businesses that need an all-in-one solution for accounting and billing.

3. Zoho Invoice

Zoho Invoice offers a set of flexible tools that let you create personalized billing documents. The platform supports multiple languages and currencies, which is beneficial for businesses that serve international clients. Zoho also includes features such as time tracking and expense management, making it suitable for service-based businesses.

- Key Features: Multi-currency support, time tracking, and expense management.

- Best For: Service providers and businesses with a global client base.

4. Invoicely

Invoicely is another excellent option for those who need to create professional billing records quickly. It offers a simple, intuitive interface that makes generating documents hassle-free. You can also i

How to Save Time with Templates

In any business, time is one of the most valuable resources. Streamlining processes and reducing manual tasks can make a huge difference in productivity. One of the most effective ways to save time is by using pre-designed solutions for common business functions, such as creating financial records. With these resources, you can focus on other critical tasks while still maintaining a professional and consistent approach to your paperwork.

Filling in Pre-Formatted Fields

One of the primary advantages of using pre-structured solutions is the ability to quickly input relevant details into ready-made fields. Instead of starting from scratch, you can fill in your business name, client information, product or service details, and prices in a matter of minutes. This process is far faster than manually formatting a document each time.

- Pre-filled Sections: Most formats have pre-arranged fields that you simply need to complete, minimizing the effort spent on formatting and organization.

- Speedy Customization: With predefined sections, adjusting the layout to suit each individual client or transaction becomes quick and straightforward.

- Less Time Spent on Design: Because the design and structure are already taken care of, you can focus solely on inputting the necessary data.

Consistency Across Documents

Another time-saving benefit is the ability to maintain consistent formatting across all your financial records. Instead of manually adjusting the layout for each document, you can use the same format for every transaction. This consistency not only saves time but also enhances your business’s professional appearance and reduces errors.

- Automatic Alignment: A structured format automatically aligns the content, ensuring that all documents follow the same professional standards.

- Standardized Sections: Fields like payment terms, pricing, and itemized lists are included every time, which means you don’t have to rethink or reformat each document.

- Reduced Risk of Omissions: Using a standardized format helps ensure that all essential details are included, reducing the chances of overlooking important information.

By implementing pre-designed solutions, businesses can significantly reduce the time spent on routine tasks. This time-saving approach allows you to focus on growing your business while still ensuring that all of your financial records are handled accurately and professionally.

Creating Professional Invoices Quickly

Creating high-quality billing documents doesn’t need to be a time-consuming task. With the right approach, you can produce professional and accurate records in just a few minutes. By using organized structures and clear designs, you can ensure that all necessary details are presented neatly and efficiently. This allows you to maintain a consistent and professional appearance, while saving valuable time that would otherwise be spent on formatting and layout.

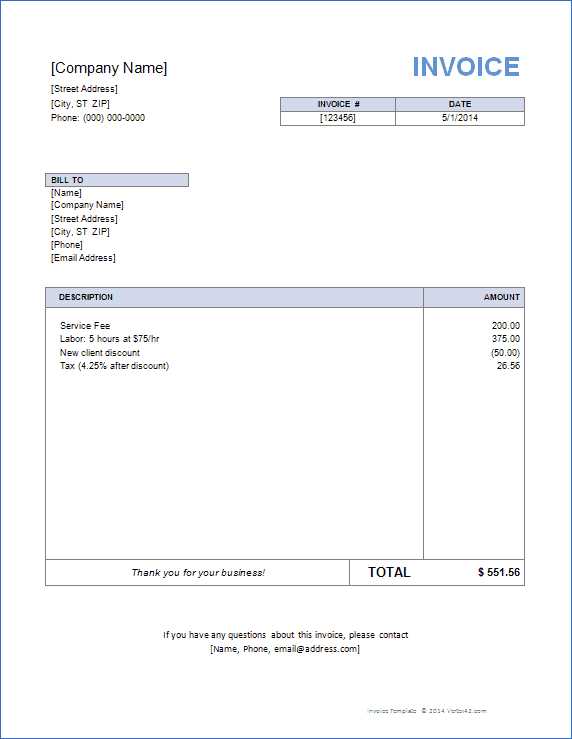

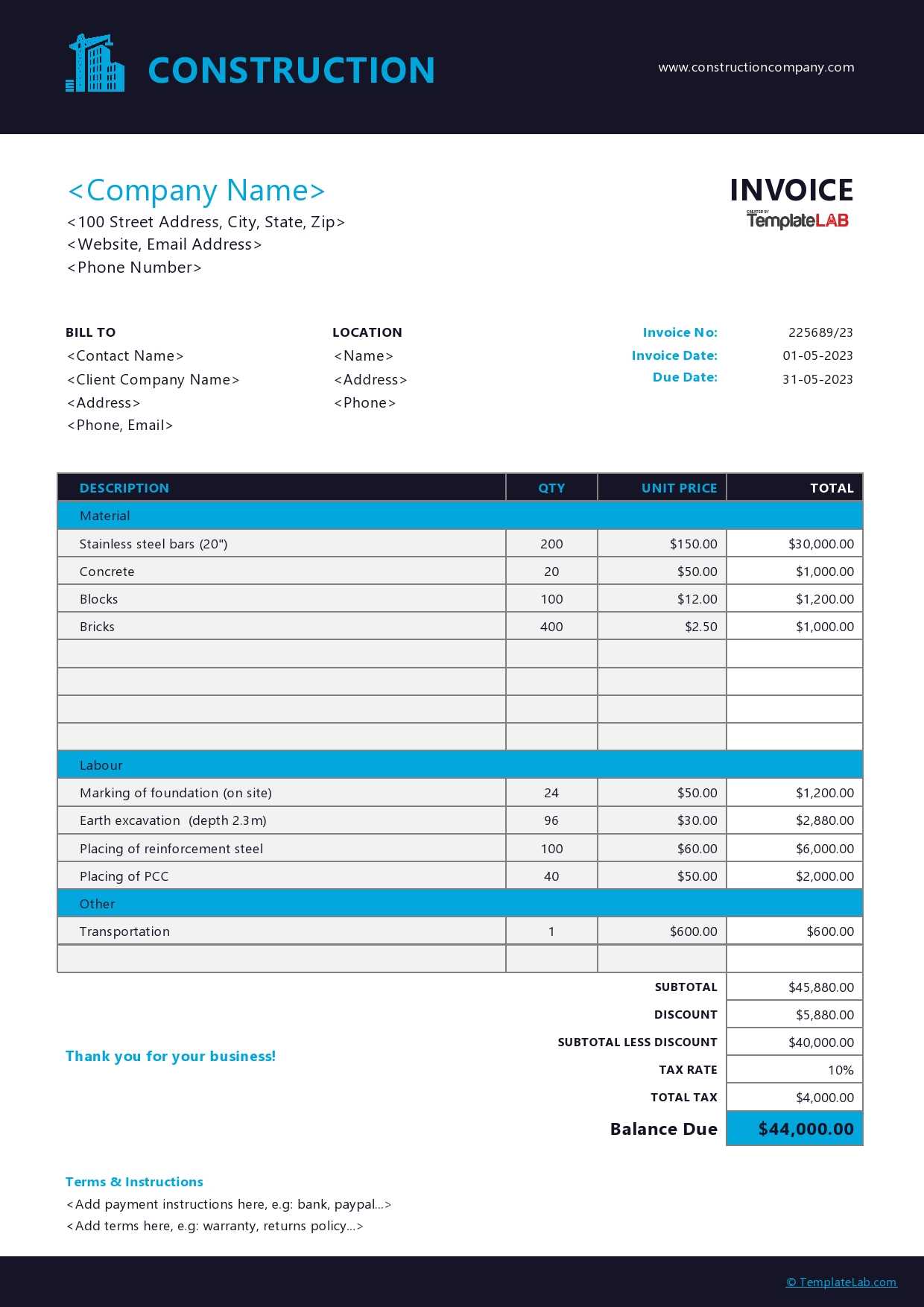

Key Components of a Professional Billing Document

A well-structured record should include essential information that is easy for clients to understand. A professional layout ensures that both the sender and recipient can quickly review the details of the transaction without confusion. The following table highlights the key sections commonly included in a professional document:

| Section | Description |

|---|---|

| Header | Includes business name, logo, and contact information for easy identification. |

| Client Details | Client’s name, address, and contact information to ensure accurate delivery. |

| Description of Goods/Services | A clear breakdown of what was sold or provided, including quantities and prices. |

| Payment Terms | Clear instructions regarding payment deadlines, accepted methods, and any penalties for late payments. |

| Total Amount Due | Final cost including taxes, discounts, and any additional fees, if applicable. |

Streamlining the Process

Using a predefined structure ensures that each document includes these important elements, saving you time when creating them. With customizable sections, you can quickly adjust details like pricing, client names, or service descriptions. Many online platforms even allow you to save previous records, enabling you to reuse information and maintain consistency across multiple transactions.

By leveraging these streamlined solutions, you can focus on other aspects of your business while still delivering professional, well-organized billing records to your clients in no time.

Common Features in Invoice Templates

When creating financial documents, certain elements are essential to ensure clarity and professionalism. These key features are designed to provide both the business and the client with all the necessary details about the transaction. A well-structured record ensures that there are no misunderstandings and that payment terms are clear, helping to build trust and improve cash flow management. Below are some of the most common and important features you’ll find in many pre-designed solutions.

Here are the typical components you can expect to find:

- Business Information: This section includes the name, address, and contact details of the business issuing the document. It also often includes a logo or branding to reinforce company identity.

- Client Information: The recipient’s details, including their name, address, and contact information, to ensure that the document is correctly addressed.

- Document Number: A unique identification number for each record, which helps with tracking and organizing past transactions.

- Issue and Due Dates: The date the document was created and the date by which payment is due. These dates are essential for setting clear expectations.

- Description of Goods or Services: A detailed list of the products or services provided, including quantities, unit prices, and total cost for each item or service.

- Taxes and Discounts: Information about any applicable taxes, fees, or discounts that should be applied to the total amount due.

- Total Amount Due: The final amount to be paid after taxes, discounts, and any other adjustments have been applied. This is the most important figure on the document.

- Payment Instructions: Clear instructions on how to make the payment, including acceptable methods (e.g., bank transfer, credit card) and any relevant payment terms (e.g., net 30 days).

- Notes or Terms and Conditions: Any additional terms, such as late payment penalties, warranties, or return policies, to ensure both parties understand the agreement.

Including these components in your business records ensures that all necessary information is conveyed in a clear, organized manner. It helps avoid confusion and minimizes the risk of disputes. By using these standard features, you can streamline your financial paperwork and maintain

How to Add Your Branding to Invoices

Incorporating your business’s brand identity into your financial documents is essential for creating a consistent and professional appearance. By adding your unique visual elements, such as your logo, colors, and font choices, you reinforce your brand’s presence in every transaction. A well-branded document not only looks more professional but also strengthens your business’s reputation and helps clients easily recognize your communication.

Here are some effective ways to incorporate your brand identity into your billing records:

- Include Your Logo: Adding your business logo at the top of the document is one of the easiest ways to personalize it. This helps clients immediately associate the document with your brand.

- Use Brand Colors: Incorporate your company’s colors into the design of the document. This can be done in the header, footer, or in text highlights, such as payment due dates or total amounts.

- Choose Your Brand Fonts: Ensure the fonts you use for your business correspondence align with the fonts used in other branding materials like your website or marketing collateral. This creates a cohesive look across all your materials.

- Include Taglines or Slogans: If your business has a slogan or tagline, consider including it subtly at the bottom of your document. This adds an extra layer of branding and reinforces your message.

- Personalize the Footer: Customize the footer with your website link, social media profiles, or any other key contact details, so clients can easily reach out to you for further communication.

By adding these elements, you ensure that your financial documents don’t just look professional–they also help build and reinforce your brand’s identity. Clients will appreciate the attention to detail, and your documents will stand out, contributing to an overall positive experience in your business dealings.

Integrating Payment Options into Invoices

Providing clear and convenient payment options is crucial for ensuring timely and efficient transactions. By integrating multiple payment methods into your billing documents, you offer your clients flexibility and make it easier for them to pay you on time. Offering various payment methods also reduces the likelihood of delays, as clients can choose the most convenient option for them.

Including payment options directly in your financial documents can streamline the entire process. Here are some common methods to consider:

| Payment Method | Description |

|---|---|

| Bank Transfer | Provide your business’s bank account details for direct transfer. This is often preferred for larger amounts due to lower fees. |

| Credit/Debit Cards | Accept payments via major credit and debit cards. Payment processors like Stripe or PayPal can be easily integrated for online payments. |

| Online Payment Systems | Use platforms like PayPal or Square for quick and secure online transactions. These options are ideal for international clients and smaller transactions. |

| Checks | For clients who prefer traditional methods, include your mailing address so they can send a check for payment. |

| Cash | If applicable, offer clients the option to pay in cash, especially for local or in-person transactions. |

By including these payment options in your documents, you help clients easily navigate the process and make the payment as smooth as possible. It’s essential to be clear about the terms, such as payment deadlines, accepted methods, and any fees that might apply, so there are no misunderstandings. A seamless payment process helps ensure timely collections and strengthens client relationships.

How to Organize Your Invoice Records

Maintaining an organized system for tracking business transactions is essential for both financial clarity and efficient operations. Properly managing your billing records ensures that you can quickly access past documents, track outstanding payments, and stay on top of your cash flow. An effective organization strategy helps reduce the risk of errors and ensures you are always prepared for audits or client inquiries.

Here are several ways to keep your financial records well-organized:

- Use a Consistent Naming Convention: Create a system for naming your documents that allows for easy sorting and retrieval. For example, use a combination of the client’s name and the date (e.g., “JohnDoe_2024-05-12”) to keep everything in chronological order.

- Organize by Client or Project: Group all related records for each client or project in dedicated folders. This method helps you locate documents quickly without wasting time searching through unrelated files.

- Keep Digital and Physical Copies: While digital records are easier to store and retrieve, it’s also wise to keep a physical copy for critical documents. Ensure both formats are organized in the same way for consistency.

- Utilize Accounting Software: Use digital accounting tools to automate record-keeping. These platforms can automatically generate reports, track due payments, and organize records by client or date, reducing manual effort.

- Implement a Timeline for Payments: Set up reminders or automatic notifications for due dates. This helps you track when payments are expected, when they’re overdue, and follow up with clients as needed.

- Regularly Review and Archive Old Documents: Periodically review your stored records and archive older files that are no longer needed for daily operations. This keeps your system streamlined and easy to navigate.

By following these steps, you can ensure that your financial documents are always in order. A well-organized system not only improves efficiency but also ensures that you have the necessary information at your fingertips whenever you need it.

Tips for Keeping Invoices Error-Free

Accurate billing documents are essential for maintaining smooth financial operations and fostering trust with clients. Even small mistakes, such as incorrect amounts or missing details, can lead to confusion, delays in payments, and potential disputes. Therefore, it’s crucial to implement strategies that reduce the risk of errors and ensure each document is precise and professional.

Common Areas Where Errors Occur

Certain sections of your billing documents are more prone to mistakes. By focusing on these key areas, you can minimize the chances of errors:

- Client Information: Double-check that the client’s name, address, and contact details are correct. Small typographical errors can lead to misunderstandings or delays in communication.

- Pricing and Quantities: Ensure that the numbers for quantities, unit prices, and total amounts are accurate. A simple miscalculation or a missed zero can affect the final amount.

- Dates: Always confirm the issue date and payment due date are correctly entered. Mistakes in dates can cause confusion about when payment is expected.

- Payment Terms: Be clear and consistent about payment deadlines and methods. Misunderstandings about terms can cause delays and disputes.

Steps to Ensure Accuracy

Here are some effective methods to help avoid errors in your business records:

- Double-Check Details: Before finalizing any document, review all the information, including client details, amounts, and terms. A second look can often catch simple mistakes that may have been overlooked initially.

- Use Automated Tools: Accounting or invoicing software can automatically calculate totals, taxes, and discounts. These tools also reduce the risk of human error when entering data manually.

- Implement a Review Process: Have another team member or colleague review your document before sending it out. A fresh set of eyes can often spot issues that you might miss.

- Maintain Consistency: Use standardized formats and consistent terminology across all of your records. This will reduce the chances of mistakes and ensure that all documents are aligned with your business practices.

- Keep Detailed Records: Keep copies of previous transactions and reference them when creating new documents. This ensures that you do not accidentally repeat errors or omit important information from previous records.

By following these tips and taking a proactive approach to error-proof your documents, you can maintain professionalism and ensure that your financial processes run smoothly. Accuracy not only helps with timely payments but also strengthens your business’s reputation and client relationships.

Why Digital Invoices Are More Efficient

In today’s fast-paced business world, speed and convenience are crucial for maintaining smooth operations. Switching to digital billing documents offers several advantages over traditional paper methods. Not only does it streamline the entire process, but it also helps reduce costs, minimize errors, and improve overall efficiency. By leveraging technology, businesses can simplify their financial processes and offer a more seamless experience for clients.

Key Benefits of Digital Billing

Digital billing solutions provide numerous advantages that help businesses save time and resources while increasing accuracy and accessibility:

- Faster Processing: Digital records can be created, sent, and received almost instantly. This reduces the time spent on mailing and waiting for physical documents to arrive, speeding up the entire transaction process.

- Cost-Effective: Digital documents eliminate the need for paper, postage, and storage space. This results in significant savings for businesses, especially over time.

- Environmentally Friendly: By eliminating paper and reducing waste, digital records contribute to more sustainable business practices.

- Improved Accuracy: With automated calculations and predefined fields, digital tools reduce the chances of human error, such as incorrect totals or missing details.

- Easy Access and Retrieval: Digital records can be stored securely and accessed quickly from anywhere, eliminating the need for physical filing systems and making it easy to find past transactions when needed.

- Enhanced Security: With digital documents, you can implement encryption and password protection, ensuring that sensitive financial data remains safe and secure.

Streamlining Your Workflow

Incorporating digital solutions into your business operations doesn’t just benefit your financial processes–it can also improve workflow and client relationships. By offering electronic payment options and automating follow-up reminders, businesses can ensure faster payments and reduce the chances of missed deadlines. Digital tools also enable businesses to integrate their billing system with accounting software, making it easier to track payments, generate reports, and manage finances more efficiently.

Ultimately, digital records help businesses stay competitive by enhancing efficiency, cutting costs, and improving the overall experience for both the company and its clients.

Legal Requirements for Invoices

When it comes to creating financial documents for your business, there are certain legal obligations you must adhere to. These requirements ensure that your records are compliant with tax regulations and protect both your business and your clients. By understanding and incorporating the necessary details into your documents, you can avoid potential legal issues and ensure smooth financial transactions.

Key Legal Elements to Include

Different regions and jurisdictions have specific rules regarding the contents of business documents. However, there are common elements that are generally required in most cases:

- Business Information: Your company’s name, legal address, and registration number (if applicable) should be clearly listed. This helps establish the legitimacy of your business.

- Client Details: Always include the name and contact information of the customer. This provides clarity on the party responsible for payment.

- Document Date: The date of issue is important for tracking deadlines and payment terms. It also helps in case of disputes or audits.

- Unique Document Number: A unique reference number should be assigned to each document to differentiate it from others. This makes it easier for both you and your client to track and reference.

- Product or Service Details: Clearly describe the goods or services provided, including quantities, unit prices, and any applicable discounts. This ensures both parties are on the same page regarding the transaction.

- Tax Information: Depending on your location, including VAT or sales tax may be required. Ensure the applicable tax rate and total amount are listed and accurate.

- Payment Terms: Clearly outline the payment due date, accepted payment methods, and any late fees or penalties for overdue payments.

Additional Considerations for Compliance

In addition to the basic information, there are other considerations you may need to include depending on local laws or industry-specific requirements:

- Currency: Indicate the currency used for the transaction, especially for international clients.

- Retention of Records: Some jurisdictions require businesses to keep their records for a certain period, typically 5–7 years, for tax and audit purposes.

- Electronic Signatures: In some cases, a digital signature may be required for online transactions, especially when dealing with e-commerce or international clients.

By ensuring that your b

Tracking Payments with Invoice Templates

Managing and tracking payments is crucial for maintaining cash flow and ensuring that all transactions are properly recorded. By incorporating specific features into your billing documents, you can streamline this process and make it easier to monitor which payments have been received and which are still pending. Effective tracking also helps in avoiding late payments and managing outstanding balances.

Key Features to Include for Payment Tracking

Including the right details in your financial records can make payment tracking much more straightforward. Here are some important features to consider:

- Payment Status: Clearly indicate whether the payment has been made, is pending, or is overdue. This allows you and your clients to easily track the status of each transaction.

- Due Dates: Include a clear payment due date to set expectations and encourage timely payments. This helps in managing late fees and payment reminders.

- Amount Paid: Record any partial or full payments made towards the balance. Including this information helps you and your clients understand what remains to be paid.

- Outstanding Balance: Always update and display the remaining balance. This ensures there’s no confusion about how much is still owed.

- Payment Method: Specify how the payment was made, whether it was via bank transfer, credit card, check, or online payment platform. This provides a clear record of all transactions.

Tools for Efficient Payment Tracking

There are several tools and systems you can integrate to improve payment tracking:

- Accounting Software: Many accounting platforms allow you to automatically track and categorize payments. These tools sync with your bank accounts and payment systems to provide real-time updates on payment statuses.

- Payment Reminders: Set up automatic reminders for clients with outstanding payments. This can help speed up collections and reduce the chances of overdue payments.

- Automated Reports: Use reporting features to generate summaries of payments, outstanding balances, and financial performance over time. These reports can be invaluable for financial planning and budgeting.

By including payment-tracking elements in your financial documents and using the right tools, you can ensure that payments are monitored efficiently and that you maintain a steady flow of income for your business. This not only helps improve cash flow but also builds trust with your clients by providing transparency and clear communication regarding payments.

How to Convert Invoices into PDF Files

Converting your financial documents into a PDF format is an effective way to ensure they are easily accessible, secure, and universally viewable. PDF files maintain their formatting across different devices and operating systems, making them ideal for sending to clients or storing for future reference. In this section, we’ll explore different methods for converting your documents into PDF files, as well as the benefits of doing so.

Methods for Converting Documents into PDF

There are several ways to convert your billing documents into PDF format, depending on the software or tools you are using:

- Using Word Processors: Most word processors, such as Microsoft Word or Google Docs, offer the option to save your document as a PDF. Simply go to the “Save As” or “Export” option, select PDF as the file format, and save your document.

- Dedicated PDF Software: Programs like Adobe Acrobat allow you to create PDFs from scratch or convert existing documents into PDF. This software provides additional features like adding security settings, such as passwords or watermarks.

- Online Conversion Tools: There are many free online tools that allow you to upload a document (such as a Word or Excel file) and convert it into a PDF. Websites like Smallpdf or PDF2Go offer easy-to-use interfaces for quick conversions.

- Printing to PDF: On both Windows and macOS, you can “print” a document to a PDF file. Simply select “Print” from your software, then choose the “Save as PDF” option instead of selecting a physical printer.

Why Convert to PDF?

Converting your financial records into PDF files offers several advantages:

- Universal Compatibility: PDF files can be opened on virtually any device, regardless of the operating system, making them ideal for sharing with clients, suppliers, or team memb