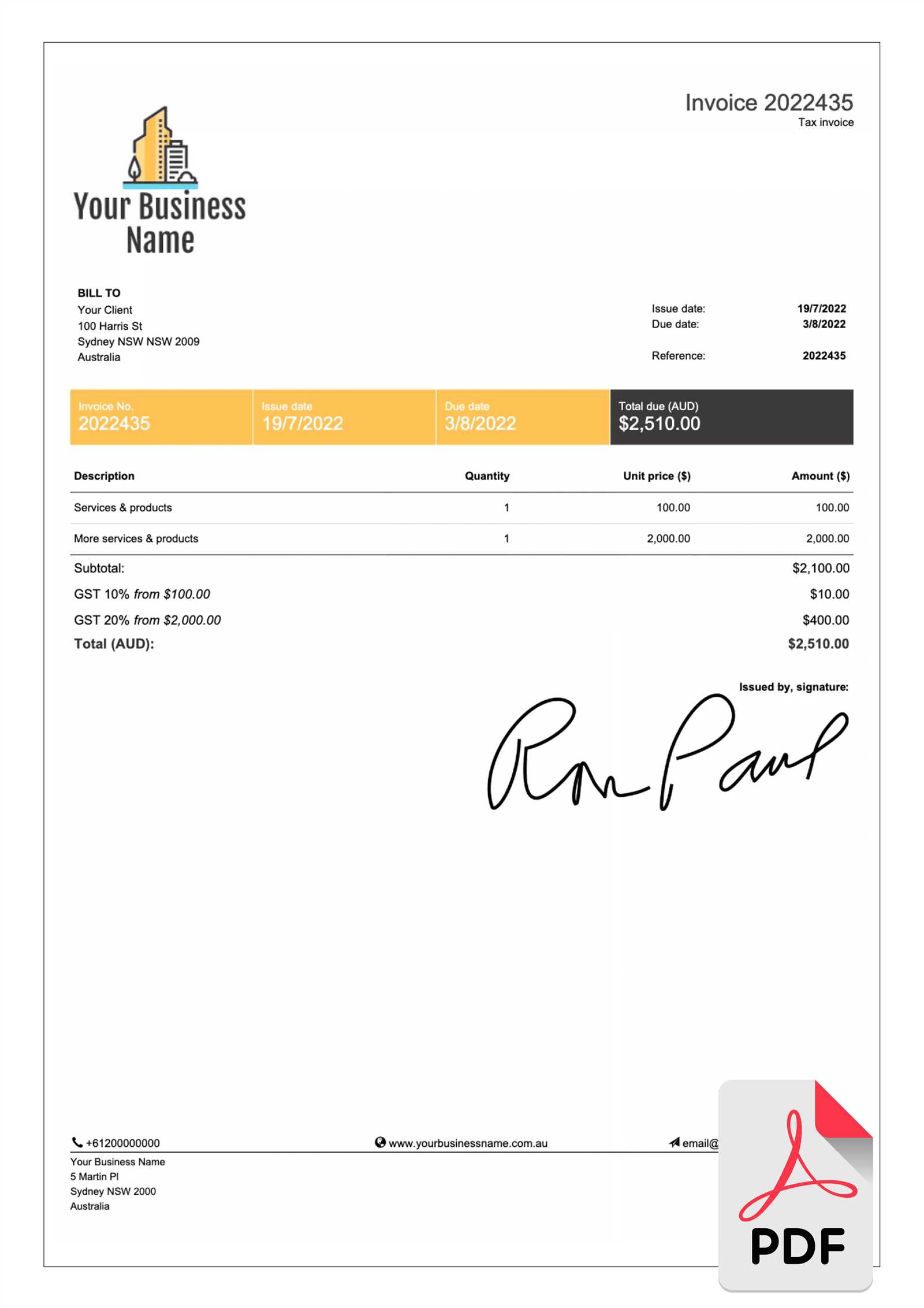

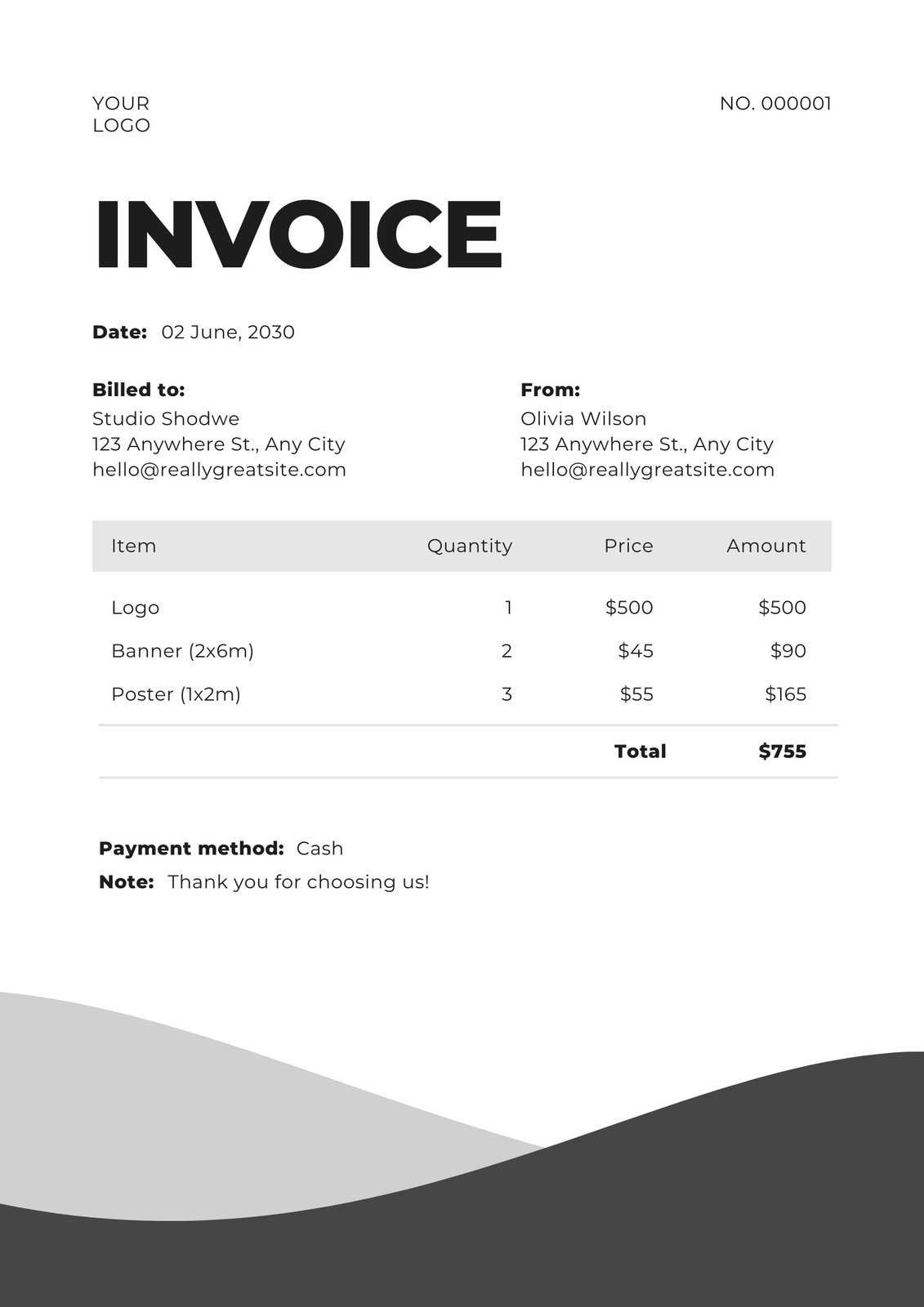

Download a Free Basic Invoice Template

Managing your billing and payment requests efficiently is essential for maintaining smooth business operations. Having a well-organized document for requesting payments not only saves time but also ensures clarity between you and your clients. Whether you’re a freelancer, a small business owner, or part of a larger company, using a standardized form can significantly improve your invoicing routine.

Creating a simple yet effective payment request form doesn’t have to be complicated. By utilizing pre-made designs, you can easily customize and personalize them to fit your specific needs. This approach helps you maintain professionalism and accuracy while minimizing the chance of errors in the payment process.

Many different industries benefit from having a straightforward format to follow. From service-based businesses to product sellers, a customizable document can be tailored to any scenario. By taking advantage of these tools, you’ll enhance your workflow and focus on what truly matters – growing your business.

Download Basic Invoice Template

Having a well-structured payment request form is essential for any business. It ensures that all necessary details are included and helps maintain professionalism in your financial transactions. By using a pre-designed document, you can save time and avoid errors when creating your own version. These ready-to-use forms can be easily customized to match your business style and requirements.

Whether you are a freelancer, a small business owner, or part of a larger organization, a simple and effective document can be tailored to your specific needs. Choosing the right design allows you to focus on providing your services or products without worrying about formatting issues. You can modify sections like pricing, terms, and payment methods according to your preferences.

By utilizing these resources, you’ll be able to send professional-looking requests for payment without the hassle of creating one from scratch. Streamlining the billing process helps improve cash flow and strengthens your relationship with clients, making your business operations more efficient and less time-consuming.

Why You Need an Invoice Template

Having a standardized form for requesting payments is crucial for any business. It ensures consistency, reduces the chances of mistakes, and speeds up the process. Without a structured document, tracking transactions and maintaining clear communication with clients can become complicated and time-consuming.

Using a pre-designed form saves you the effort of creating a new document from scratch every time. With the right format, you can easily adjust the content to fit different services, products, or billing cycles. This efficiency is especially valuable when handling multiple clients or large volumes of work.

Professionalism and accuracy are key factors in building trust with your clients. A well-organized document not only reflects your attention to detail but also helps avoid misunderstandings about payment terms. By incorporating all the necessary information, you ensure that the request is clear, complete, and ready for payment without delays.

How to Customize Your Invoice

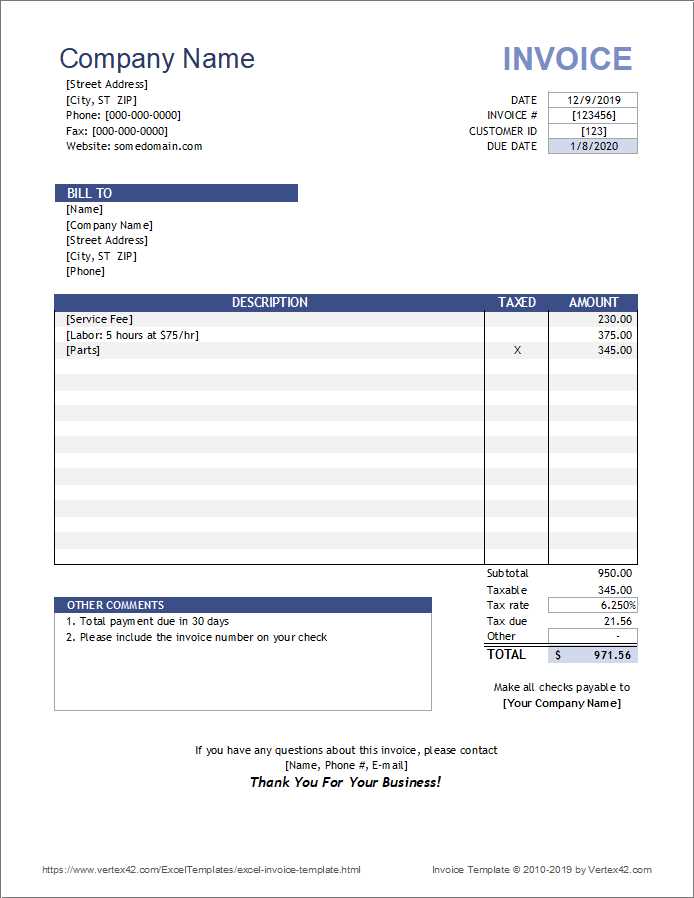

Customizing a payment request form allows you to tailor it to your business’s specific needs and branding. By adjusting key elements such as company logo, payment terms, and client details, you ensure that the document reflects your professionalism and aligns with your business style. The ability to make these changes quickly can save time and prevent mistakes in the billing process.

Adjusting Key Details

Start by updating the essential sections, such as your contact information, the client’s details, and the list of products or services provided. This ensures that the form is relevant to each specific transaction.

| Section | Customizable Elements |

|---|---|

| Header | Company name, logo, address |

| Client Information | Client name, address, contact |

| Items or Services | Description, quantity, price |

| Payment Terms | Due date, payment methods, penalties |

Enhancing the Design

To make your document more visually appealing, you can modify the fonts, colors, and layout. A clean and professional design will make it easier for your clients to read and understand the payment details. Consider adding your business branding elements, like your color scheme or font style, to give your documents a consistent look.

Free Invoice Templates for Every Business

Every business, regardless of size or industry, can benefit from using a structured document to request payments. Offering free, customizable forms provides an accessible solution for entrepreneurs and companies alike. These ready-made designs help streamline the billing process while maintaining consistency across all transactions.

From freelancers to large corporations, these resources cater to different needs. Whether you’re offering services, selling products, or handling subscriptions, there is a form that can be easily adjusted to match your requirements. These documents are not only convenient but also save time, allowing you to focus more on your work instead of the administrative side.

Utilizing these free options allows businesses to present professional-looking payment requests without the need for expensive software or complex setups. Customizable and user-friendly, these solutions are ideal for anyone looking to simplify their billing routine while ensuring all necessary details are included and formatted correctly.

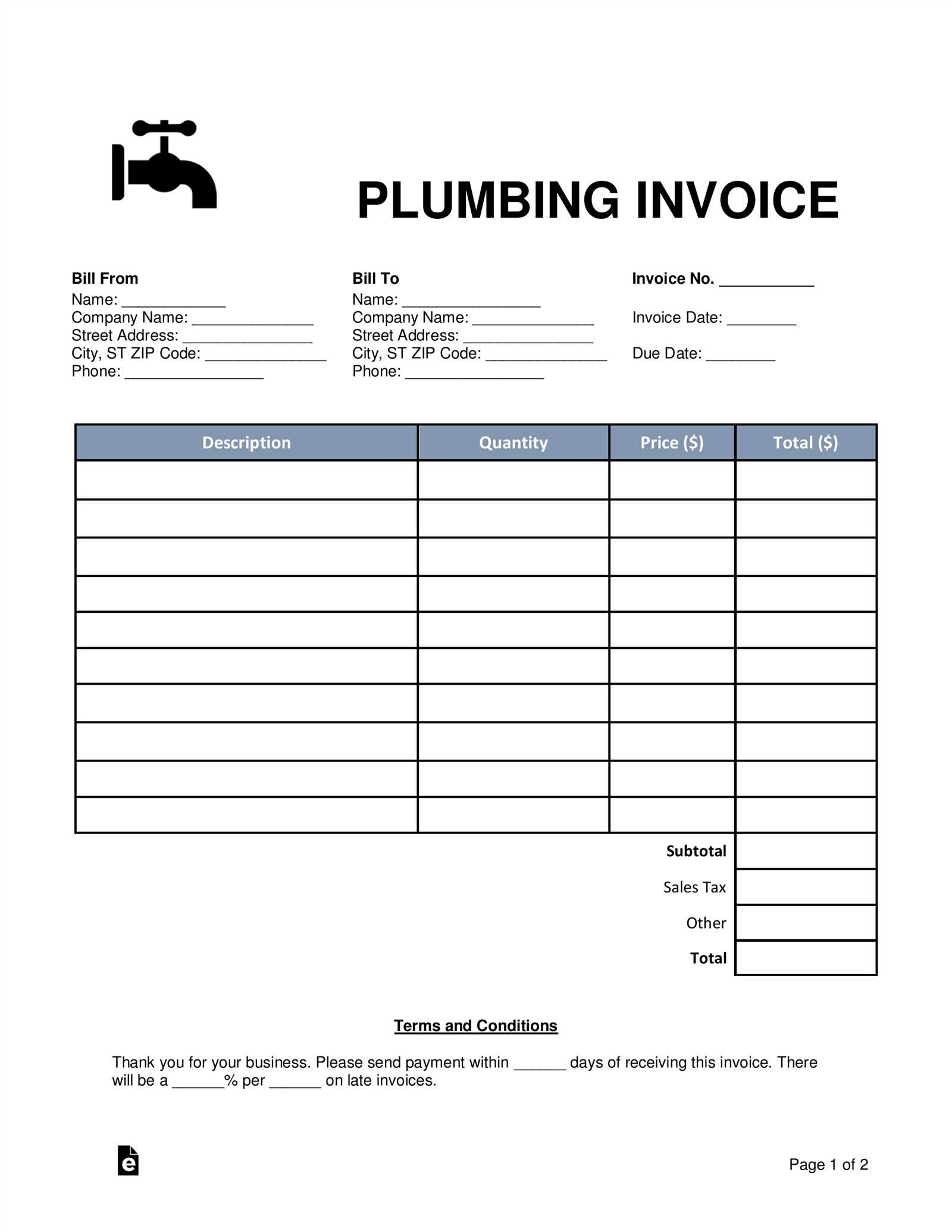

Simple Steps to Create an Invoice

Creating a clear and accurate payment request is easy when you follow a few straightforward steps. By organizing essential information and following a simple structure, you can ensure that your document is complete and professional. Here are the key actions to take when crafting your payment request.

- Include Your Contact Information – Begin by adding your company or personal details, such as name, address, phone number, and email. This ensures that the recipient knows how to reach you.

- Add Client’s Information – Clearly include the recipient’s name, business name, and contact details. This helps to avoid confusion and ensures proper delivery.

- List the Products or Services Provided – Detail the items or services provided, along with their individual costs, quantity, and any applicable taxes.

- Specify Payment Terms – State the payment due date, acceptable payment methods, and any penalties for late payments.

- Include a Total – Add up the amounts for all items or services, including taxes and discounts, to provide a final amount due.

- Check for Accuracy – Review the document to ensure all information is correct and that there are no errors in pricing or dates.

By following these simple steps, you can create a well-organized and professional document that ensures clear communication and faster payments from clients.

Benefits of Using Invoice Templates

Utilizing a pre-designed document for payment requests offers several advantages to businesses of all sizes. These forms simplify the billing process, save valuable time, and ensure consistency across all transactions. By leveraging these ready-to-use designs, you can focus more on your work while maintaining professionalism in every interaction with clients.

Time-Saving and Efficiency

One of the most significant benefits of using ready-made forms is the time saved. Instead of creating a new document from scratch for each transaction, you can simply customize an existing design with the specific details. This not only accelerates the billing process but also reduces the likelihood of errors, ensuring that each request is accurate and complete.

Professional Appearance

A well-structured and consistent payment request helps reinforce your business’s credibility. By using a pre-made design, you ensure that all necessary information is included in a clear, organized format. This professional presentation can improve client trust and help maintain a positive relationship, ultimately leading to quicker payments and fewer misunderstandings.

Common Invoice Elements You Should Include

To ensure that your payment request is clear, accurate, and legally sound, there are several key components that should always be included. These elements not only help organize the details of the transaction but also make it easier for your clients to process the payment quickly and correctly.

Essential Information for Identification

Basic details such as your business name, address, and contact information should always be at the top of the document. Similarly, include the recipient’s name and address to ensure that the payment request reaches the right party. These identifying details help avoid confusion and ensure proper tracking of the transaction.

Payment Details and Terms

Clearly state the due date, payment methods accepted, and any penalties for late payments. Additionally, listing the services or products provided, along with their costs and quantities, will prevent any misunderstandings. Including the total amount due, taxes, and any discounts will ensure that your client knows exactly what to pay.

Where to Find the Best Invoice Templates

Finding high-quality, customizable forms for payment requests is easy when you know where to look. Whether you’re seeking something simple and functional or more advanced and detailed, there are many resources available online that offer various designs suitable for different business needs.

Online platforms and websites provide a wide range of ready-made documents, often for free or at a minimal cost. Some popular software tools also feature built-in design options, allowing you to create professional-looking payment requests directly from their interface. Additionally, many content-sharing sites and design repositories host collections of customizable documents that can be tailored to specific industries or preferences.

For those looking for something more specific, industry-specific solutions are also available, offering specialized layouts that match particular business types. By choosing the right resource, you can quickly access a design that aligns with your company’s needs, saving you time and ensuring a polished and professional result.

How to Choose the Right Template

Selecting the right document for payment requests is essential for ensuring clarity and professionalism in your business transactions. The form you choose should align with your business type, billing needs, and personal preferences. By considering several key factors, you can easily find a design that suits your requirements and helps streamline your workflow.

Consider the complexity of your transactions. If your business deals with simple sales, a straightforward, minimalistic design may be sufficient. However, if your services or products involve detailed descriptions, multiple line items, or specific payment terms, a more comprehensive format may be necessary to capture all the information.

Customization options are another important factor. Choose a design that can be easily modified to include your business logo, adjust pricing sections, and incorporate other unique features. A flexible format ensures that your document can evolve with your business needs, whether you’re expanding your offerings or updating your terms.

Setting Up Payment Terms on Your Invoice

Clearly outlining payment terms is crucial for ensuring smooth transactions and avoiding misunderstandings. By specifying the conditions under which payment should be made, you set clear expectations for both you and your clients. These details help protect your business interests and encourage timely payments.

Here are the key elements to consider when establishing payment terms:

- Due Date – Clearly state when payment is expected, whether it’s upon receipt, 30 days after the date of issue, or another agreed-upon time frame.

- Payment Methods – Indicate the acceptable methods of payment, such as bank transfer, credit card, PayPal, or checks.

- Late Fees – Include information about any penalties or interest charges for overdue payments. This can help motivate clients to pay on time.

- Discounts for Early Payment – If you offer any incentives for early payments, such as a percentage discount, make sure to specify the conditions.

By setting these terms clearly and consistently, you minimize confusion and create an environment of professionalism and trust with your clients. Adjusting the terms to suit your business needs can also help optimize cash flow and ensure your payment process is efficient.

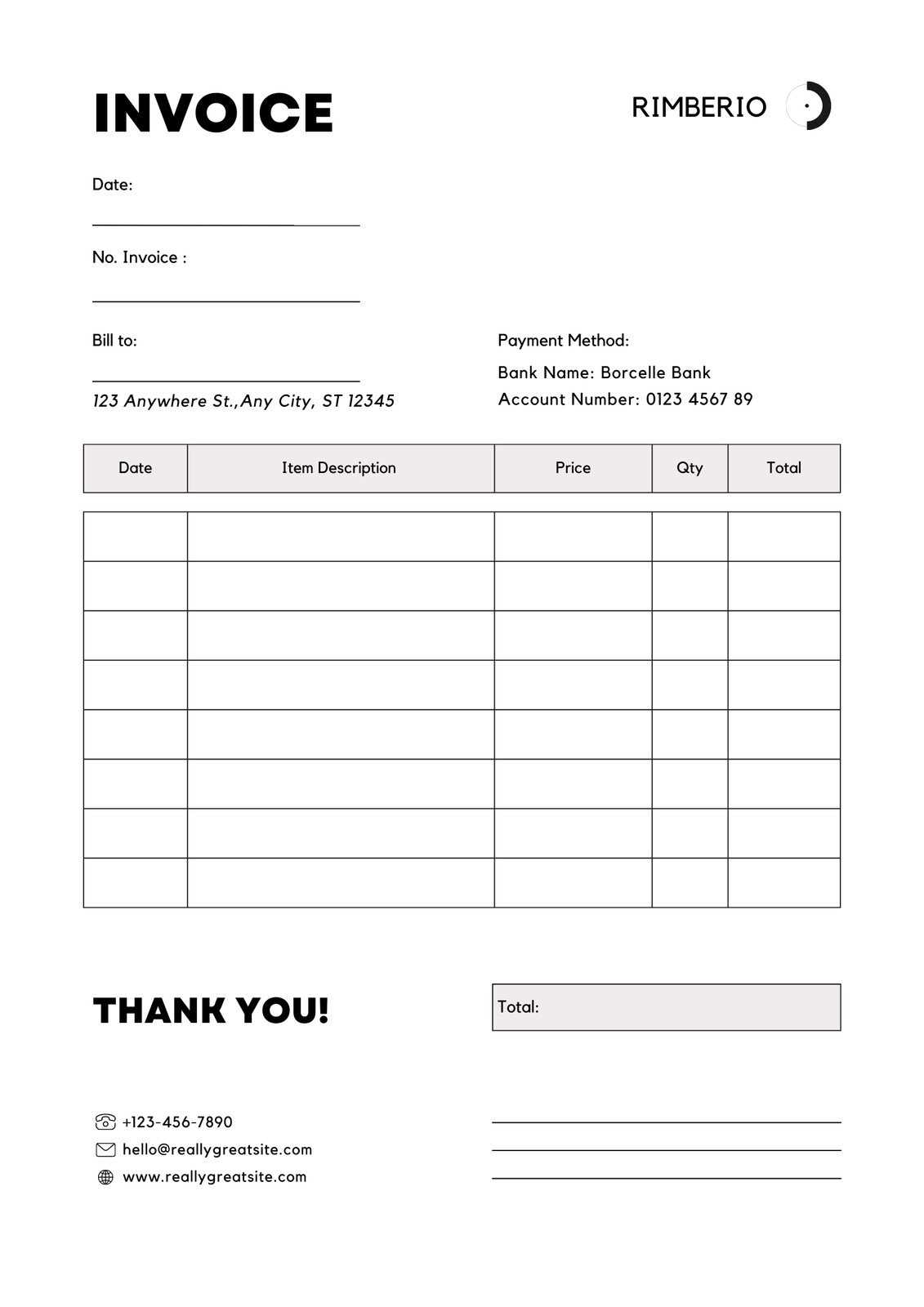

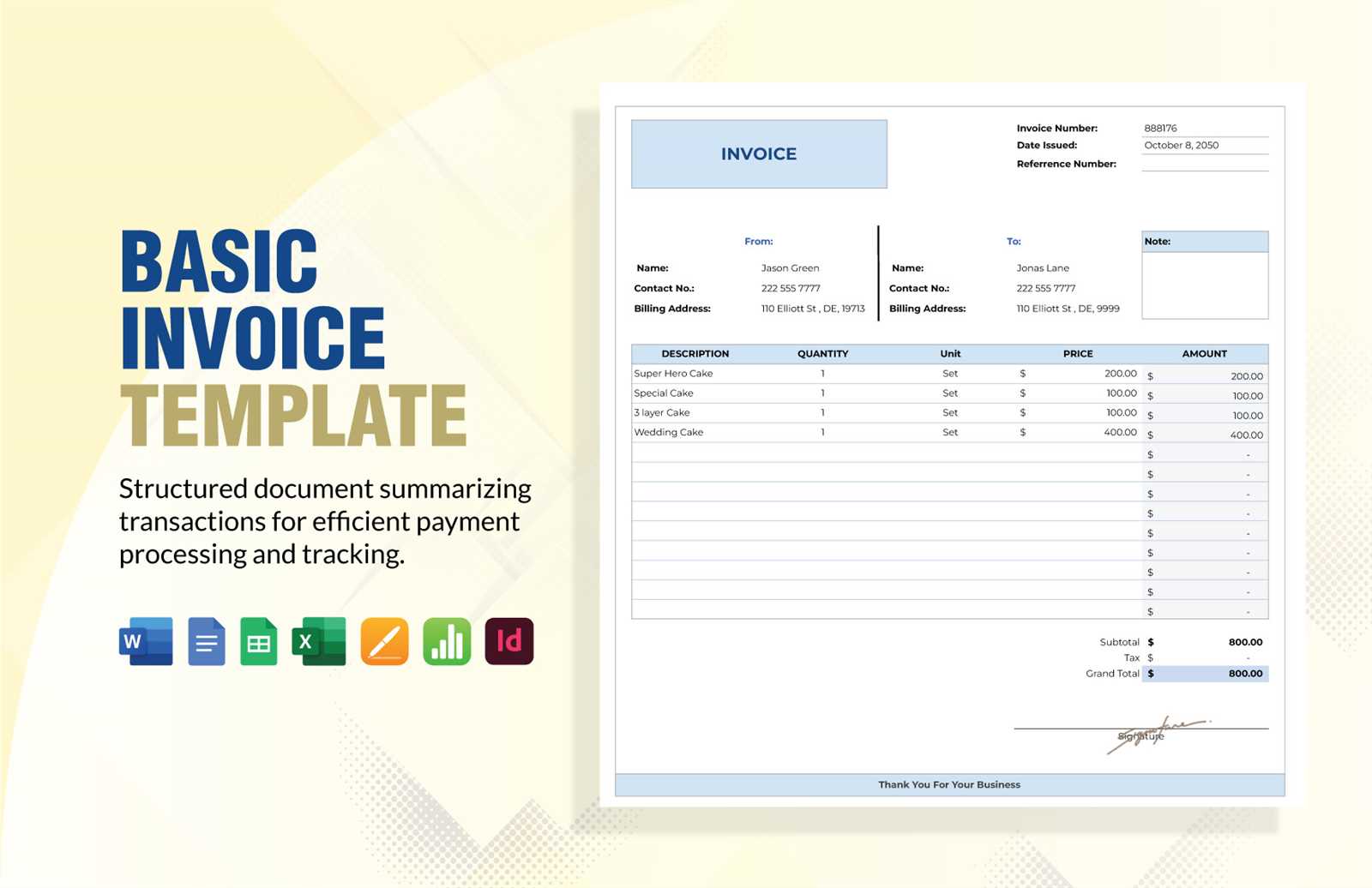

Invoice Templates for Different Industries

Each industry has its own set of requirements when it comes to billing and payment requests. The format and content of a payment request can vary depending on the services or products provided, the type of clients, and specific regulatory or contractual obligations. Tailoring the design of these documents to suit your industry can help streamline your billing process and ensure clarity for both you and your clients.

For example, service-based industries, such as consulting or design, often require detailed descriptions of the work performed, hourly rates, and any additional charges. In contrast, product-based businesses might focus more on itemized lists of goods sold, including quantities and unit prices. Additionally, industries such as construction or healthcare may need to include more specific terms, like payment schedules or insurance details.

By selecting or customizing a payment request format that aligns with your specific business needs, you can enhance efficiency, reduce errors, and maintain professionalism in every transaction.

How to Save Time with Invoice Templates

Using pre-designed forms for billing can significantly reduce the amount of time spent on creating documents from scratch. These ready-to-use layouts allow you to quickly input the necessary information, ensuring that you don’t have to spend time designing or formatting each new request. This efficiency helps you focus on your core tasks while maintaining consistency in your documentation.

Streamlining the process means you won’t need to manually enter the same details for every transaction. Fields such as company name, contact information, payment terms, and tax rates can be pre-filled or easily updated, saving valuable time with every new payment request.

Consistency is another key benefit. Using a standard design ensures that all your documents look professional and are easy for clients to read, reducing the need for clarification or follow-up. This consistency also helps you manage and track payments more efficiently, making your workflow smoother and more organized.

Adjusting Templates for International Use

When operating globally, it’s important to adapt your billing documents to meet the needs of international clients. Different countries have varying requirements regarding taxes, currency, and payment methods, which means that a one-size-fits-all approach may not be suitable. Customizing your format ensures that your transactions are clear, professional, and compliant with local regulations.

Key Factors to Consider

- Currency and Payment Methods – Adjust your document to reflect the appropriate currency for each transaction. Ensure that your payment methods are compatible with international systems like wire transfers, PayPal, or local options.

- Tax Rates and Regulations – Some regions require specific tax rates to be displayed, such as VAT or GST. Ensure that you include the correct tax information according to local law.

- Language Preferences – Consider translating your billing form or offering multiple language options to ensure that your clients can easily understand the details of the payment request.

Customizing for Different Markets

In addition to language and tax specifics, it’s crucial to be aware of the payment schedule norms and other business practices that vary across countries. Adapting your forms to align with local customs can help you build stronger relationships and maintain professionalism in every transaction.

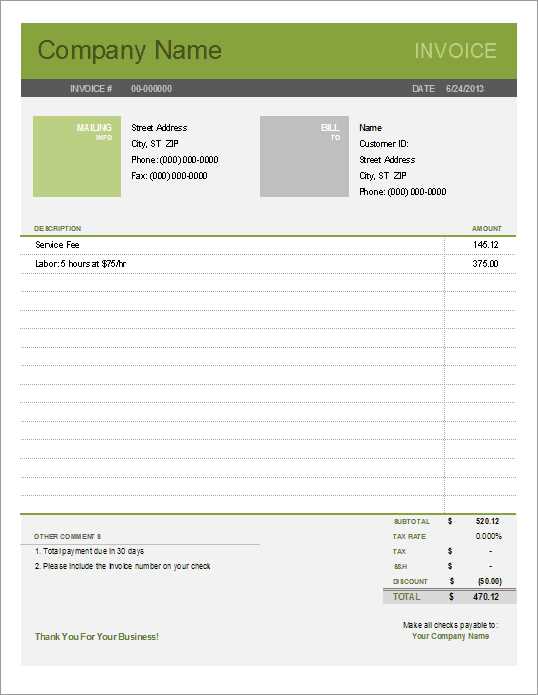

Tips for Professional Invoice Design

Creating clear and visually appealing billing documents is essential for maintaining professionalism and ensuring prompt payments. A well-designed document not only helps your clients understand the details easily but also leaves a positive impression of your business. By focusing on key design elements, you can make your billing process smoother and more effective.

Essential Design Elements

- Clear Layout – A clean, organized layout with properly aligned sections makes your document easy to navigate. Ensure that there is enough white space to avoid clutter and that each section is clearly defined.

- Consistent Branding – Include your company’s logo, colors, and fonts to maintain consistency with your brand. This not only reinforces your company’s identity but also adds a level of professionalism to the document.

- Legible Fonts – Use clear, easy-to-read fonts for all text, including headings, descriptions, and amounts. Avoid overly decorative fonts that can make your document harder to understand.

Additional Tips for Clarity

- Bold Important Information – Highlight key details such as the total amount due, payment due date, and contact information to draw attention to the most crucial parts of the document.

- Organized Sections – Separate your document into distinct sections, such as client information, description of goods or services, payment terms, and totals, to ensure that each part is easy to find and understand.

- Use of Color – Subtle use of color can enhance readability, but be mindful of choosing professional and complementary colors that don’t overpower the text.

By incorporating these design tips, you can create visually appealing and easy-to-understand billing documents that enhance the professionalism of your business and help ensure timely payments.

How to Avoid Common Invoice Mistakes

When creating billing documents, it’s easy to overlook small details that can lead to confusion or delays in payments. By understanding the most common mistakes and knowing how to prevent them, you can ensure your documents are clear, accurate, and professional. This not only improves your relationship with clients but also helps to streamline your payment process.

- Incorrect Client Information – Double-check that the client’s name, address, and contact details are accurate. Small errors can lead to misunderstandings and delayed payments.

- Missing or Wrong Payment Terms – Clearly state the payment terms, including due dates, late fees, and accepted methods. Ambiguous payment terms can create confusion and result in delayed payments.

- Not Including a Unique Reference Number – Always assign a unique reference or invoice number to each billing document. This makes it easier for both you and your client to track payments and reduce administrative errors.

- Omitting Tax Information – If applicable, make sure that tax details (such as VAT or sales tax) are properly included. Not specifying taxes correctly can lead to compliance issues or confusion over the total amount due.

- Vague Descriptions – Provide detailed descriptions of the products or services provided. Clients should be able to understand exactly what they are being charged for to avoid disputes or delays in payment.

- Not Including Payment Instructions – Ensure you provide clear instructions on how to make the payment. Whether it’s through a bank transfer, credit card, or another method, make the process as simple as possible for your client.

By taking the time to review your billing documents and address these common issues, you can reduce the risk of errors and foster better communication with your clients. Clear, accurate documents help avoid delays and ensure smooth transactions for both parties.

Legal Requirements for Invoices

In many countries, certain rules and regulations govern the creation of billing documents. These legal requirements ensure transparency, fairness, and proper tax reporting. It is essential for businesses to understand what must be included to comply with local laws and avoid potential legal issues. Failing to adhere to these guidelines could result in penalties, delays in payments, or even legal action.

Key Legal Elements

- Business Information: Your business name, address, and registration number are often required. This helps to identify your company as the seller and confirms its legal status.

- Client Details: Including the client’s name and address is crucial, especially when dealing with international transactions. This ensures that the document is linked to the right party.

- Unique Reference Number: Each document should have a unique identifier, such as an invoice number. This helps to avoid confusion and ensures proper tracking in case of disputes or audits.

- Tax Identification Number: In many countries, businesses are required to display their tax ID number on billing documents, particularly for transactions that involve sales tax or VAT.

- Date of Issue: The date when the billing document is created must be clearly stated. This is necessary for both accounting purposes and tax compliance.

- Payment Terms: Clearly outline the payment terms, including the due date, payment methods, and any late fees. This is a key legal aspect that ensures both parties are aware of the expectations.

- Tax Breakdown: If applicable, the applicable tax rates (e.g., VAT) should be specified along with the amount due. This ensures transparency and helps the client understand how much tax they are paying.

Why Compliance is Important

Ensuring that your billing documents comply with legal requirements not only prevents disputes but also builds trust with your clients. Furthermore, keeping accurate records in line with legal standards can save time and money in the event of an audit or tax inspection.

It’s essential to stay informed about the legal standards in your region and update your documents accordingly. Consulting with an accountant or legal advisor can provide additional peace of mind and help you avoid common mistakes that could result in fines or complications.

How to Use Invoices for Financial Tracking

Proper financial tracking is essential for any business, and creating accurate billing documents is a key part of that process. These records not only help you manage cash flow but also provide valuable insights into your revenue and expenditures. By organizing and reviewing your financial documents regularly, you can make informed decisions about your business’s financial health.

Track Cash Flow

Using billing documents allows you to track incoming payments and outstanding amounts. By recording each transaction, you can easily monitor when payments are due and how much is still pending. This helps maintain healthy cash flow and prevents unexpected financial shortfalls.

Organize Revenue Streams

Billing records are an effective way to categorize and track different revenue sources. Whether you offer multiple products or services, each bill can be tagged or sorted according to its category. This makes it easier to analyze which areas of your business are generating the most income and which may need improvement.

Assist with Tax Reporting

Accurate billing records are vital when it comes time to report taxes. By keeping organized documentation, you ensure that you have all the necessary details to complete your tax filings correctly. Proper records also allow for smooth tax audits and ensure compliance with local regulations.

Monitor Customer Payment History

Tracking customer payments through billing records helps you understand payment patterns. If certain clients consistently delay payments, you can take proactive steps to address the issue, whether through adjusting payment terms or following up on overdue amounts.

Financial Planning and Budgeting

With a complete record of your transactions, you can make more accurate forecasts for future expenses and revenue. By understanding past income and expenditures, you can create a budget that aligns with your business goals, allowing you to plan for growth and potential financial challenges.

Regular Review and Adjustments

It’s essential to regularly review your financial records and make adjustments when needed. This includes analyzing trends, tracking outstanding payments, and ensuring that all transactions are properly documented. A consistent review of these records will help you stay on top of your business’s financial situation and identify areas for improvement.

By using billing documents effectively for financial tracking, you can gain better control over your business’s finances, optimize your budgeting process, and ensure the overall financial stability of your business.

Best Practices for Sending Invoices

Sending well-crafted billing documents is essential for ensuring timely payments and maintaining positive relationships with your clients. Effective communication, clear terms, and proper timing can help streamline the payment process, reduce errors, and improve cash flow management. Below are some best practices to follow when issuing financial records to clients.

1. Include All Necessary Details

Each billing document should contain all the information required for the recipient to understand and process the payment. Key elements include:

- Client details: Name, address, and contact information.

- Transaction date: The date when the services or products were provided.

- Payment terms: Clear instructions on when and how payments should be made.

- Itemized list: A breakdown of goods or services provided, along with their corresponding costs.

- Unique reference number: A number to help track and reference the document easily.

2. Send at the Right Time

Timing is crucial when sending billing documents. Send them as soon as the service or product is delivered, so your client is aware of the amount due and the payment schedule. Avoid delays in issuing documents, as late submissions can lead to confusion and unnecessary delays in payments.

Follow-up on Late Payments

Establish a follow-up procedure for late payments. If the payment due date passes without receiving the funds, send a polite reminder or contact the client to check on the status of the payment. Clear follow-ups will help maintain a professional rapport while ensuring that outstanding balances are cleared promptly.

Choose the Right Delivery Method

Consider the most appropriate delivery method for your audience. Electronic delivery is fast, efficient, and widely accepted, especially for international transactions. However, some clients may prefer printed documents. Ensure you know your client’s preferred method of communication to make the process smoother for both parties.

3. Maintain Professionalism and Clarity

Your billing documents should maintain a professional appearance, regardless of the delivery method. This includes using clean, easy-to-read formatting, correct spelling, and grammar. Clarity helps avoid confusion and ensures that clients can easily understand the details of the transaction, which in turn reduces the chances of disputes or delayed payments.

By following these best practices, you can improve the efficiency of your billing process, reduce errors, and foster stronger client relationships.