Easy to Use Doula Invoice Template for Professional Billing

When providing support during childbirth, clear communication about payment is essential for both clients and service providers. Ensuring that all financial transactions are organized and transparent helps build trust and allows both parties to focus on what matters most–the experience itself. A well-structured billing document is an essential part of this process, ensuring that your services are properly acknowledged and compensated.

Developing an effective system for tracking charges and payments can streamline the entire process, making it easier to maintain accurate records and avoid any confusion. Whether you are new to this profession or have been offering support for years, having a simple yet professional tool to handle these tasks can save time and reduce stress. Using a customizable form designed for your needs can simplify billing and help maintain professionalism in your business.

In this guide, we will explore how to create a billing document that suits your business style, including the key components you should include, the best formats to choose, and tips for managing payments efficiently. This approach will help you keep your practice organized and ensure timely payments while providing a smooth experience for your clients.

Doula Invoice Template Overview

For professionals offering birth support, having a structured way to document and request payment is crucial. A properly designed billing form not only facilitates the payment process but also ensures clarity and professionalism in business transactions. These forms help keep track of services rendered, fees charged, and payment history, contributing to a smoother experience for both the provider and the client.

When creating a billing document, it is essential to include specific details that accurately reflect the nature of the services provided. A well-organized form should be clear and concise, leaving no room for confusion. Below are the main features that a comprehensive billing document should include:

- Client Information: Include the client’s name, address, phone number, and email for easy reference.

- Service Breakdown: Clearly list the services provided along with their respective prices. This allows clients to see exactly what they are being charged for.

- Payment Terms: Specify the due date for payment and any late fee policies if applicable.

- Total Amount Due: Provide the total sum to be paid, including taxes or any additional charges if relevant.

- Payment Instructions: Outline the acceptable methods of payment, whether via check, bank transfer, or online platforms.

- Additional Notes: Use this section to provide any special instructions or information relevant to the client or the transaction.

Having a consistent format for each transaction can make billing more efficient, reduce errors, and enhance client trust. Many professionals opt to use pre-designed forms that can be customized according to individual needs, ensuring that all essential details are captured in a streamlined manner. The goal is to create a seamless and transparent process that makes financial transactions straightforward for both parties.

What is a Doula Invoice?

A payment request document is a formal statement that outlines the services provided by a professional and specifies the amount due for those services. This document serves as a record for both the service provider and the client, ensuring clarity about the financial terms of their agreement. For those offering birth and postpartum support, such a document plays a vital role in maintaining a smooth financial process and preventing misunderstandings.

The purpose of this document is to detail the services rendered, break down the corresponding charges, and communicate payment terms clearly to the client. It also functions as a receipt once payment is made, providing both parties with a record of the transaction. Without this document, there is a higher risk of confusion regarding fees and payment expectations, which can lead to complications in the business relationship.

Typically, the payment request document will include key information such as the provider’s contact details, a description of the services provided, the total amount due, and payment instructions. Depending on the specific arrangement, it may also feature terms like due dates, deposit requirements, and late payment penalties. This document is an essential tool for maintaining a professional image and ensuring that all transactions are completed smoothly and efficiently.

Importance of Professional Invoicing for Doulas

For professionals providing birth and postpartum support, presenting clear and accurate financial documents is crucial for establishing trust with clients. A well-prepared payment request not only helps ensure timely compensation but also reinforces the credibility of the service provider. Professional billing reflects attention to detail and a commitment to transparent business practices, both of which are essential in building strong, long-lasting client relationships.

By using structured billing documents, service providers can avoid misunderstandings regarding the cost of services and payment expectations. When clients receive a comprehensive, easy-to-understand breakdown of fees, it reassures them that the professional is organized and reliable. A consistent approach to financial documentation can also prevent disputes and facilitate smooth transactions throughout the course of the business relationship.

Benefits of Professional Billing Documents

| Benefit | Description |

|---|---|

| Clarity | Clear itemization of services provided helps clients understand exactly what they are being charged for. |

| Organization | Professional billing documents keep records organized, making it easier to track payments and manage finances. |

| Trust | Transparency in billing increases trust and enhances the overall client experience. |

| Efficiency | Structured billing saves time for both the service provider and the client, reducing the chances of errors. |

How It Impacts Client Relationships

When clients receive a detailed and professional document that clearly explains payment terms, they are more likely to feel confident in their decision to hire a particular service provider. This level of professionalism can also lead to higher client satisfaction, which is critical for word-of-mouth referrals and building a positive reputation in the field. Ultimately, the use of a well-organized payment request can result in better financial management and more successful business outcomes.

Key Elements of a Doula Invoice

When creating a billing document for services rendered, it is essential to include specific details that ensure both the service provider and the client understand the financial agreement. A well-structured document not only clarifies what the client is being charged for but also provides a clear record of the transaction. The following are the critical components that should be included in any payment request form.

1. Service Description and Breakdown

Clearly itemizing the services provided is essential to avoid confusion. Each service should be listed separately with a brief description of what was performed and the corresponding fee. This transparency helps clients see exactly what they are paying for and can prevent disputes over charges.

2. Client and Provider Information

Both parties’ contact details should be included to ensure there is no ambiguity about who the transaction is between. This typically includes the client’s full name, address, phone number, and email. The service provider’s contact information should also be listed, including the name of the business (if applicable) and relevant details for any follow-up questions.

3. Total Amount Due and Payment Terms

The total sum that the client owes should be clearly stated, along with payment terms. This includes specifying whether the payment is due immediately or within a certain timeframe. Any late fees or additional charges for overdue payments should be outlined to ensure clarity.

4. Payment Methods and Instructions

Including accepted payment methods, such as bank transfer, credit card, or online payment platforms, ensures the client knows how to complete the transaction. Clear instructions for submitting payment will help avoid delays.

5. Dates and Due Date

Each document should include the date the services were rendered as well as the due date for payment. This helps track the timeline of the services and ensures timely payments are made.

Including all of these elements in a payment document provides clarity and helps ensure smooth financial transactions. It also contributes to the overall professionalism of the service provider and builds trust with clients.

How to Create a Doula Invoice

Creating a professional payment request document requires a thoughtful approach to ensure all necessary information is clearly communicated. This not only helps facilitate timely payments but also ensures transparency and fosters trust between the service provider and the client. By following a few simple steps, you can create an effective billing form that accurately reflects the services provided and outlines payment expectations.

1. Gather Essential Information

The first step in creating a billing document is gathering all necessary details. This includes the client’s full name and contact information, the date the services were provided, and a breakdown of the services rendered. Be sure to list each service separately, including the price for each one. You should also note any deposits, partial payments, or discounts that apply to the final total.

2. Choose a Format

Next, choose the format for your document. You can either use a physical template to manually fill in the details or create a digital version using spreadsheet software or specialized invoicing tools. Digital options often offer the benefit of automated calculations, which reduce the risk of errors in totaling the charges.

Once you’ve chosen your format, ensure that the document includes all necessary components, such as a detailed description of services, the total amount due, payment instructions, and any relevant terms. This will ensure that the client has all the information they need to process the payment without confusion.

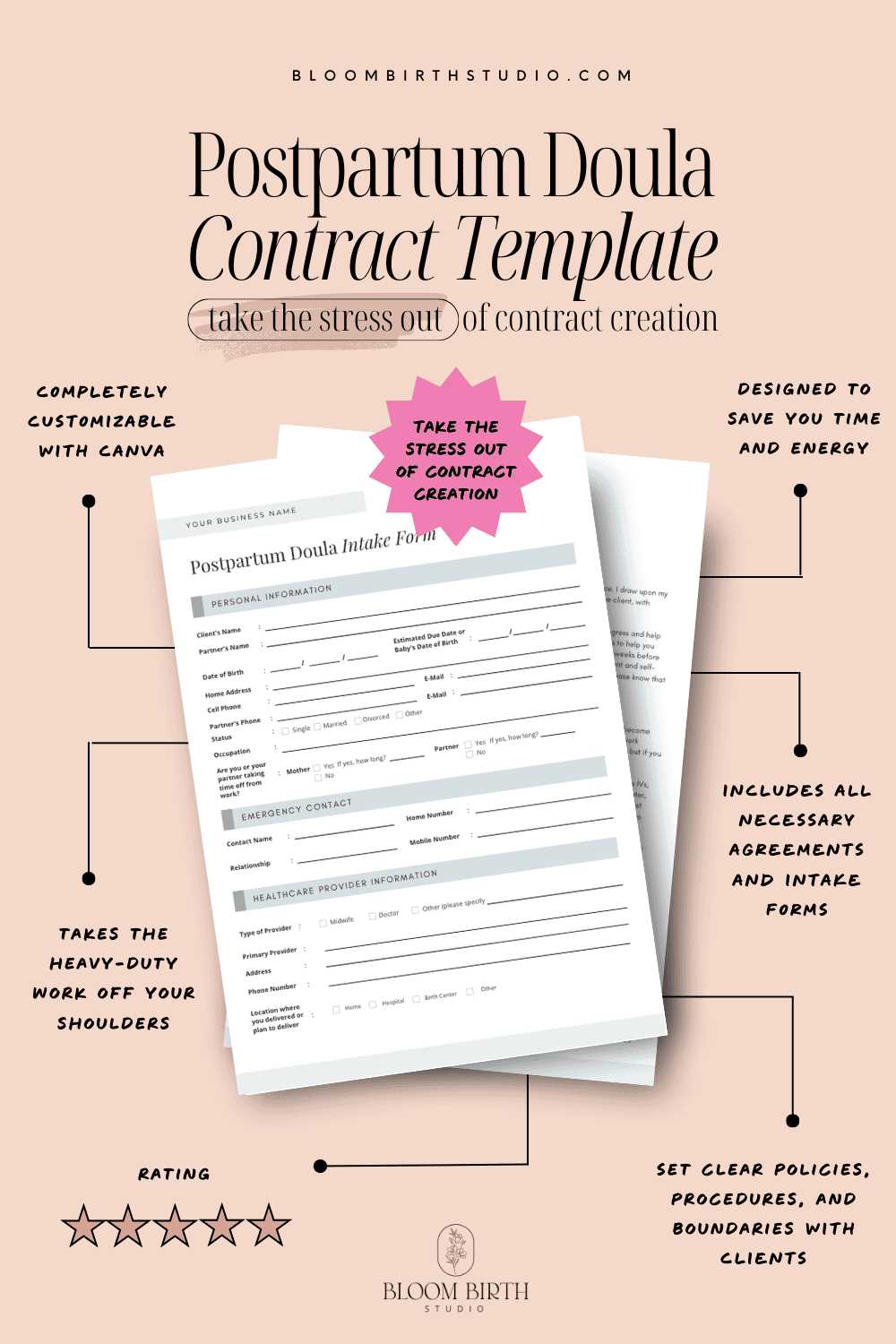

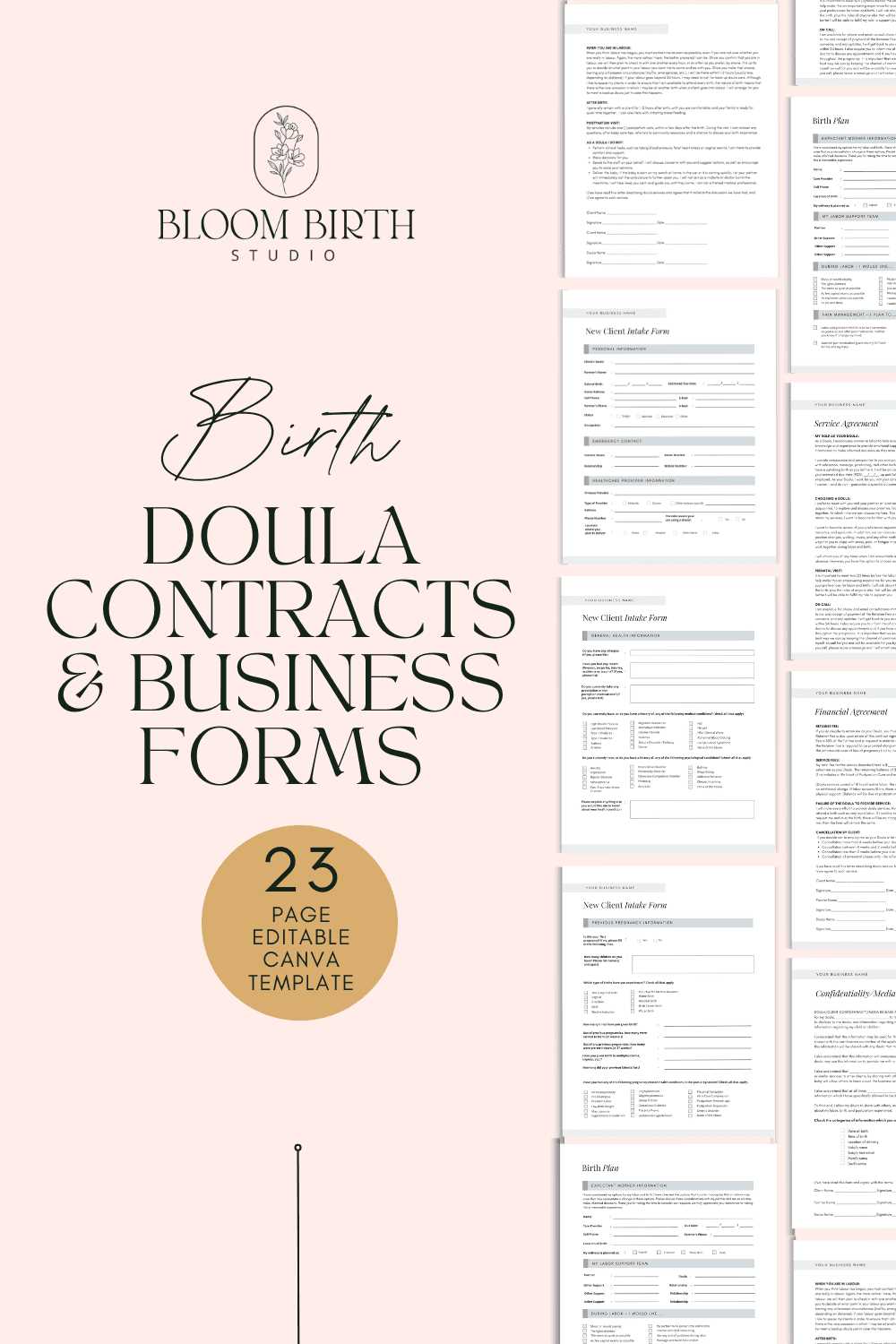

Customizing Your Doula Invoice Template

Customizing a billing document to suit your business needs is an important step in presenting a professional image. Tailoring the design and structure ensures that the document reflects your unique services, brand, and client expectations. Whether you are using a digital form or a printed version, customization allows you to include relevant details and present information clearly and consistently.

When personalizing your payment request form, it’s essential to focus on the specific aspects that matter most to your clients and business. Here are a few key elements to consider when modifying your document:

| Customizable Element | What to Include |

|---|---|

| Branding | Incorporate your logo, business name, and contact details at the top to maintain a consistent brand identity. |

| Service Descriptions | Modify the description of services to match the specific offerings you provide, such as prenatal or postpartum support. |

| Payment Terms | Adjust payment due dates, late fees, and discount policies to align with your business practices. |

| Additional Notes | Include any unique instructions, such as refund policies or a reminder for clients to bring specific items to their appointment. |

| Colors and Fonts | Choose colors and fonts that reflect your personal style or business branding, creating a cohesive visual presentation. |

By customizing these elements, you ensure that your billing document is not only functional but also reflects your professionalism and attention to detail. A personalized document can help establish trust, streamline payments, and reinforce your commitment to providing exceptional service.

Choosing the Right Invoice Format

Selecting the right format for your payment request form is crucial for ensuring clear communication with your clients and streamlining the payment process. The format you choose will determine how easily the document can be understood, filled out, and processed by both you and the client. Whether you opt for a digital or paper version, the goal is to create a user-friendly and professional document that reflects the nature of your services.

There are several factors to consider when deciding on the best format for your billing documents. These include accessibility, ease of use, and the tools you are comfortable with. Below are a few options to help guide your decision:

1. Digital Formats

Digital formats are increasingly popular due to their convenience and efficiency. Using software like spreadsheets, word processors, or dedicated invoicing tools allows you to easily create, edit, and send billing documents. Digital versions also offer benefits such as automatic calculations, the ability to store copies for record-keeping, and the option to send documents via email or online payment platforms. They are ideal for those who wish to minimize paper use and streamline the administrative side of their business.

2. Paper Formats

For professionals who prefer a more personal touch, physical billing forms can be an excellent option. Paper documents are tangible and may feel more official for some clients. However, they require manual filling out and mailing, which can be time-consuming. For businesses that primarily work with local clients or in face-to-face settings, paper invoices might still be the preferred format.

3. Hybrid Formats

Some professionals opt for a hybrid approach, offering both digital and paper options based on client preferences. For instance, you could email a digital version of the document but also offer printed copies for those who prefer them. This flexibility can help accommodate a wider range of clients and make the payment process smoother for everyone involved.

Ultimately, the right format depends on your business needs, your clients’ preferences, and how you want to manage your administrative tasks. Regardless of the format you choose, the key is ensuring that the document is clear, professional, and easy to use for both parties.

Doula Invoice Templates for Different Services

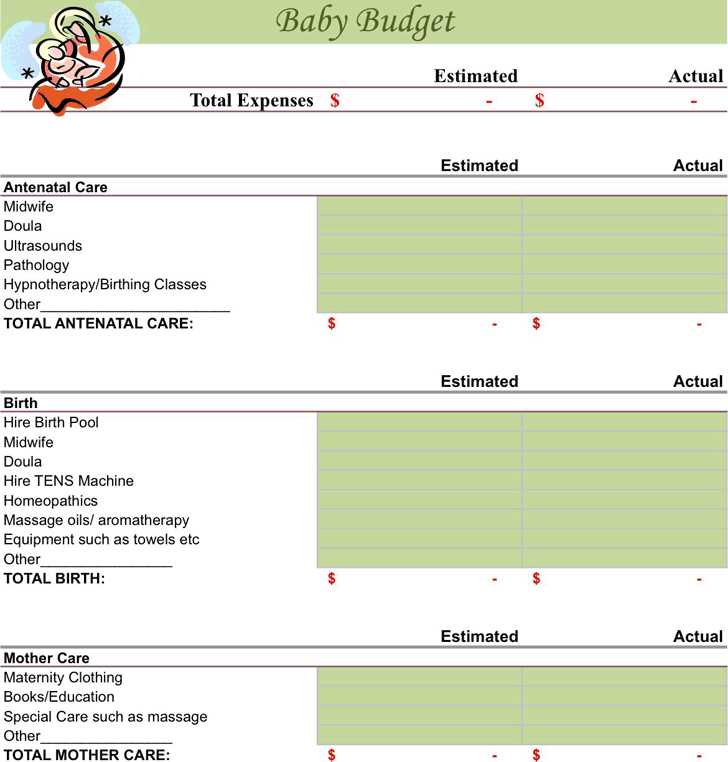

When offering various types of support, it’s essential to have a clear and specific billing document for each distinct service. Different services may require different pricing structures, terms, and descriptions, and having separate forms for each one ensures that both the provider and the client understand the costs involved. Whether you offer prenatal, labor, postpartum, or educational services, customizing your billing document for each type of service will help maintain clarity and professionalism.

Each service you provide might have a unique set of charges, payment schedules, or additional fees that need to be outlined in the payment request form. Below are some examples of how you can tailor your billing documents based on the type of service provided:

1. Prenatal Support Services

For prenatal consultations, classes, and check-ins, your document should list the specific sessions attended, such as individual consultations, group classes, or packages of prenatal visits. You may want to include options for discounts or bundled packages if the client books multiple sessions upfront. It’s also important to include details about deposit requirements, as prenatal services are often paid in installments.

2. Labor and Birth Support

When providing labor and birth support, the document should clearly state the fee for being on call, the length of time spent with the client, and any special requests, such as travel or overnight stays. This type of service may have different pricing based on the intensity of support, and you may include additional fees for extended hours or emergency services.

3. Postpartum Care Services

For postpartum visits, your billing document should include detailed descriptions of each visit, whether it’s in-home support, lactation assistance, or postpartum doula services. Include the number of visits and the length of time for each one, as well as any specific follow-up care provided, such as breastfeeding support or emotional assistance during the early weeks after childbirth.

4. Education and Workshops

If you offer classes or workshops, your document should list the price per session or for a series of classes, as well as any materials or resources provided. You may also offer virtual workshops, in which case it’s helpful to specify whether the service will be delivered in person or online, along with any technology or access instructions.

By customizing your billing documents to reflect the specifics of each type of service, you help clients understand exactly what they are paying for and ensure that there are no surprises. This approach allows you to maintain professionalism and transparency, building trust with your clients and making the payment process smoother for everyone involved.

Best Practices for Billing Clients

Effective billing is crucial for maintaining healthy business relationships and ensuring timely payments. Establishing clear, professional practices not only helps you manage your finances but also fosters trust and transparency with your clients. By following a few simple guidelines, you can create a smooth billing process that benefits both you and those you serve.

Below are some of the best practices to consider when handling payments for services:

1. Clear and Transparent Communication

- Provide Detailed Descriptions: Always include a breakdown of services on the billing form. This makes it clear to clients exactly what they are being charged for, reducing misunderstandings.

- Be Transparent About Costs: Clearly outline your fees upfront, including any additional charges, such as travel fees, emergency support, or late payment penalties.

- Establish Payment Terms Early: Discuss your payment policies with clients before services are rendered. Ensure they understand when payments are due, whether deposits are required, and the methods you accept.

2. Use Consistent and Professional Formats

- Standardize Your Documents: Use a consistent format for all payment requests to maintain a professional image. Whether it’s a physical or digital form, ensure it’s clean, easy to read, and includes all the necessary information.

- Include Relevant Information: Always include the client’s details, the date of service, your contact information, payment due date, and any agreed-upon terms. This avoids confusion and ensures all parties are on the same page.

- Provide Clear Payment Instructions: Specify the methods of payment you accept (bank transfer, check, online payment systems), and provide necessary details such as account numbers or links.

3. Maintain Flexibility and Respect

- Offer Payment Plans: If you offer services that span over a period of time, such as prenatal or postpartum support, consider offering installment payment options to ease the financial burden on your clients.

- Respect Client Preferences: Some clients may prefer receiving billing documents via email, while others may prefer printed forms. Be open to adapting to their preferences for a smoother experience.

- Follow Up Promptly: If payment is overdue, follow up with a polite reminder as soon as possible. Offering flexibility in case of financial difficulties can help maintain goodwill and strengthen your client relationships.

By following these best practices, you can simplify your billing process, ensure timely payments, and maintain a positive reputation for professionalism and fairness in your business. Clear, respectful, and transparent billing practices contribute to long-lasting client relationships and help you stay organized and on top of your finances.

Tracking Payments with an Invoice

Tracking payments is an essential aspect of managing your business’s finances. By having a clear and structured record of payments, you can easily monitor outstanding balances, follow up on overdue amounts, and ensure that all services are properly compensated. A payment record document not only helps you stay organized but also provides clients with a clear statement of what they owe and what has been paid.

Using a formal payment record allows both the service provider and client to keep track of transactions. This document typically includes essential details such as the amount due, the date of service, the payment status, and any outstanding balances. Additionally, maintaining accurate records simplifies your accounting process, making it easier to prepare for taxes and financial audits.

By marking each payment made on your record and noting any adjustments or partial payments, you ensure transparency in the transaction history. It’s important to update the document as soon as a payment is received, so both parties have an up-to-date record of the balance. Clear tracking can help prevent miscommunication and foster trust between you and your clients.

Common Mistakes to Avoid in Invoices

Creating a billing document may seem straightforward, but there are several common errors that can lead to confusion, delayed payments, or even disputes with clients. Avoiding these mistakes can help ensure that your payment requests are clear, professional, and efficient, ultimately leading to smoother financial transactions.

Some of the most frequent mistakes include missing or incorrect information, failing to outline terms clearly, or making assumptions about the payment process. These errors can cause frustration for both you and your clients, so it’s important to be thorough and meticulous when preparing your documents.

Here are a few common pitfalls to be aware of:

- Incomplete Contact Information: Failing to include full details for both the service provider and client can create confusion, especially if there are questions or follow-up needed. Always double-check that names, addresses, and contact details are accurate.

- Missing Payment Terms: Not clearly outlining the payment due date, late fees, or acceptable methods of payment can lead to misunderstandings. Make sure the terms are clearly stated, including any specifics like deposit requirements or installment options.

- Unclear Service Descriptions: Vague or overly broad descriptions of services can make it difficult for clients to understand what they are being charged for. Always be specific about what services were provided and the cost for each individual service.

- Mathematical Errors: Simple mistakes in calculations can lead to discrepancies between what the client owes and what is stated on the document. Double-check all amounts and totals to avoid such errors.

- Not Tracking Payments: Failing to update the document after a payment has been made can cause confusion regarding outstanding balances. Always mark payments as received and update the status promptly.

- Unprofessional Format or Layout: A poorly formatted document can make it difficult for the client to read or understand the charges. Use a clear, organized structure with a logical flow, including clear headings and itemized lists.

By paying attention to these details and avoiding common mistakes, you can ensure that your billing documents are professional, accurate, and easy for clients to understand. This will help streamline the payment process and improve your overall business efficiency.

Benefits of Using a Doula Invoice Template

Using a pre-designed billing document offers numerous advantages for professionals offering personal care services. It helps streamline the payment process, maintain consistency, and ensure that all relevant details are included in each request. Whether you’re managing multiple clients or simply want to reduce administrative work, a well-structured payment form can save time and enhance the professionalism of your business.

1. Time Efficiency

One of the key benefits of using a standardized document is the time it saves. Rather than creating a new form from scratch for each client, a ready-made structure allows you to simply fill in the necessary details, such as the client’s name, services provided, and total amount due. This eliminates the need for repetitive formatting and calculation work, allowing you to focus more on client care.

2. Consistency and Professionalism

Consistency is important when building your brand and maintaining client trust. Using the same layout for every payment request ensures that your billing documents look professional and are easy to understand. Clients will appreciate the clarity, and having a uniform format reinforces your commitment to high-quality service.

By utilizing a standardized form, you also reduce the risk of missing important information or making errors. With all the necessary sections pre-designed–such as service descriptions, fees, and payment terms–you’re less likely to overlook important details. This increases the accuracy of each document, helping prevent disputes and ensuring timely payments.

In summary, using a pre-designed form offers efficiency, consistency, and accuracy, which contribute to a smoother billing process and a more professional appearance for your business.

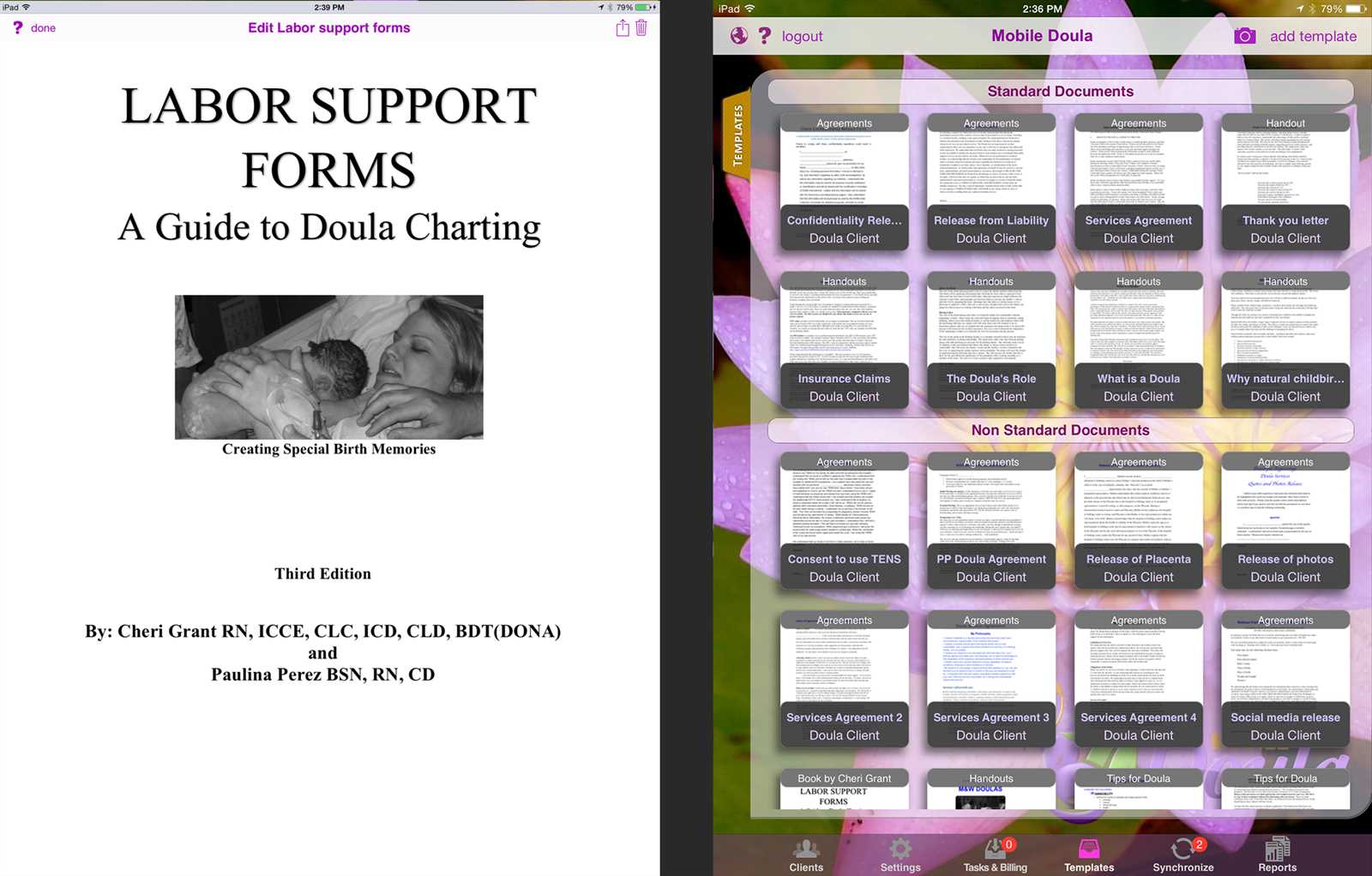

Doula Invoicing Software vs Templates

When it comes to managing billing for personal care services, professionals often face the decision of whether to use software or a pre-designed document. Both options offer distinct advantages, but the right choice depends on the nature of your business, your preference for automation, and the level of customization you need. Understanding the pros and cons of each can help you decide which method best suits your needs.

1. Invoicing Software

Invoicing software is a tool that automates the process of creating, sending, and tracking payment requests. This type of software often comes with features such as automatic calculations, payment tracking, and reminders, making it an excellent option for businesses that deal with multiple clients or offer a wide range of services. Many invoicing platforms also integrate with accounting software, allowing for seamless financial management.

The key benefits of using invoicing software include:

- Automation: The software can automatically generate and send payment requests, saving you time.

- Tracking and Reminders: It helps track outstanding payments and sends reminders to clients if needed.

- Professional Design: Software typically offers a variety of templates with professional formatting, enhancing your business’s appearance.

- Customization: You can easily adjust the document to fit specific needs, such as service bundles or special discounts.

2. Pre-Designed Billing Documents

Pre-designed billing documents (or customizable forms) are simple to use and don’t require a subscription or additional software installation. These forms are great for those who prefer a more hands-on approach to invoicing. With a pre-made document, you simply fill in the required details, print, and send it to the client. You can also customize the design to reflect your brand, ensuring a personalized touch without the need for advanced software.

The advantages of using pre-designed forms include:

- Cost-Effective: There are no ongoing fees for using a pre-designed form, making it a budget-friendly option.

- Ease of Use: There is no need for learning new software, and you can fill out the forms quickly with minimal effort.

- Flexibility: You have full control over the design and content of the document, which can be tailored to fit your business’s style.

While both methods have their merits, the decision between invoicing software and pre-designed forms ultimately depends on your needs. If you want a highly automated system that saves time and integrates with your

How to Handle Late Payments in Invoices

Dealing with late payments is a challenge that many service providers face. Whether it’s due to client oversight or financial difficulties, it’s essential to handle these situations professionally and efficiently. Clear communication, polite reminders, and a structured approach can help maintain positive client relationships while ensuring that you’re compensated for your services.

To manage overdue payments effectively, it’s important to have a strategy in place. This can involve setting clear terms from the start, sending reminders at appropriate intervals, and knowing when to escalate the issue if necessary. A consistent and calm approach can make all the difference in ensuring that payments are received in a timely manner without harming your reputation or client relationships.

1. Set Clear Payment Terms from the Start

To avoid late payments, always outline your payment terms clearly before providing any services. This includes specifying:

- Due Dates: Clearly state when the payment is expected, whether it’s a specific date or within a certain number of days after service.

- Late Fees: Inform clients about any additional charges that will apply if the payment is not made on time.

- Payment Methods: Provide details on the acceptable ways to make payments (e.g., bank transfer, online payment systems, etc.).

2. Send Friendly Payment Reminders

If a payment is overdue, sending a gentle reminder is the first step. A polite and professional tone is key to maintaining a positive relationship with your client. Keep the reminder simple and clear, restating the amount due, the original payment terms, and any late fees that might apply. It’s also helpful to provide an easy way for clients to make the payment, such as including a direct link to an online payment portal.

Consider setting up automated reminders through billing software or scheduling reminders on your calendar, so you don’t forget to follow up with clients who have missed their payment deadlines.

3. Offer Flexible Payment Options

If a client is having financial difficulty, offering a payment plan or extended deadline can be a helpful way to resolve the situation without jeopardizing your relationship. This shows flexibility and understanding while still ensuring that you receive payment for your services. However, make sure that any new payment terms are clearly documented and agreed upon by both parties.

4. Know When to Take Further Action

If repeated reminders and flexibility don’t lead to payment, you may need to consider more formal steps. These might include:

- Escalating to a Collection Agency: If the amount owed is significant and other methods have failed, involving a collection agency may be necessary.

- Legal Action:

Free vs Paid Doula Invoice Templates

When selecting a document to manage payment requests, professionals often face the decision between using free or paid options. Each choice offers its own set of advantages and limitations, making it important to consider factors such as functionality, customization, and long-term needs. Understanding the differences between free and paid solutions can help you make an informed decision that aligns with your business goals.

Free Billing Documents

Free billing forms are widely available online and can be a great option for those just starting out or those with minimal administrative needs. These documents are typically basic, easy to use, and require no financial investment. Free forms can be a good fit for individuals with a low volume of transactions or those who are just testing the waters in their business.

However, while free forms are cost-effective, they may lack advanced features, such as automatic calculations, customizable fields, or integrated payment tracking. Additionally, free options may offer limited design flexibility, which can make it more difficult to create a branded, professional appearance for your business.

Paid Billing Documents

Paid billing solutions, on the other hand, often offer more robust features and customization options. These documents are typically available as part of a software package or subscription service. With paid options, you gain access to advanced tools, such as automated calculations, professional layouts, and integration with accounting or payment processing platforms. These benefits can save time, reduce errors, and streamline your billing process.

While paid solutions come at a cost, the additional features and time-saving benefits they provide can be well worth the investment, especially for businesses with a larger client base or those seeking to enhance their financial management systems. Many paid platforms also offer ongoing support, which can be valuable if you encounter technical difficulties or need assistance with customization.

Ultimately, the decision between free and paid solutions depends on your business needs, budget, and long-term goals. Free options can be a great starting point for small businesses or those with minimal invoicing needs, while paid solutions may be better suited for those looking to scale their business and simplify their administrative tasks.

Legal Considerations for Doula Invoices

When it comes to billing for services, understanding the legal aspects of creating and managing payment requests is crucial for protecting both your business and your clients. Properly documented payment terms, clear agreements, and adherence to relevant tax laws are all essential components that help ensure the invoicing process runs smoothly and complies with regulations.

There are several legal factors to keep in mind when preparing a payment request, such as making sure you include necessary details like service descriptions, payment due dates, and applicable taxes. Additionally, you should be aware of local laws regarding business transactions and any specific requirements that may apply to your type of service or region. By paying attention to these legal considerations, you can avoid potential disputes and establish a clear, professional standard for your business practices.

1. Clear Service Agreements

One of the most important legal aspects is having a clear service agreement with your clients before beginning work. This contract should outline the terms of service, including pricing, payment schedule, and any additional fees for late payments or cancellations. When you define these terms up front, both you and your client are on the same page, which helps avoid misunderstandings or disputes later on.

Additionally, it’s a good practice to have clients sign this agreement before proceeding with services. The signed contract will serve as a legal record of the agreed-upon terms, which can be referred to if any issues arise during or after the service delivery.

2. Tax and Compliance Considerations

Another key legal consideration is tax compliance. Depending on your location, you may be required to charge sales tax on your services, especially if you are operating as a registered business. Be sure to check your local laws to determine whether you need to include sales tax on your payment requests and to ensure that the proper amount is added.

Additionally, as a business owner, you may need to report your earnings for tax purposes. This means keeping accurate records of all payments received. Using a detailed billing document helps ensure that you have a clear record of all transactions, which is essential for tax filing and avoiding any potential legal issues with tax authorities.

By understanding and addressing these legal considerations, you can maintain professionalism, ensure legal compliance, and foster positive, transparent relationships with your clients.

How to Send and Manage Doula Invoices

Efficiently sending and managing payment requests is essential for maintaining a smooth financial process in your service-based business. Whether you’re working with a few clients or have a growing client base, organizing how you send payment requests and track payments is key to ensuring timely compensation and avoiding errors. There are several steps to follow to ensure that your payment management process is seamless and professional.

1. Creating the Payment Request

The first step in managing your billing process is creating a clear and accurate payment document. Make sure that each document contains the following essential details:

- Client Information: Include the name and contact details of the client receiving the service.

- Service Breakdown: Clearly outline the services rendered, including the date and description of each service provided.

- Payment Due Date: Specify when the payment is expected and any grace period if applicable.

- Payment Methods: Provide clear instructions on how the client can make a payment, including accepted payment methods.

- Late Fees: Clearly state any late fees that will apply if the payment is not received by the due date.

2. Sending the Payment Request

Once the payment request is created, it’s time to send it to the client. There are various ways to deliver your payment request, depending on your preferences and the tools you have available:

- Email: Email is one of the most common methods for sending payment requests. You can either attach the document as a PDF or include the details in the body of the email itself.

- Online Payment Platforms: If you use an online platform for billing, many allow you to send digital payment requests directly to clients. This option is often automated and includes payment links, which makes it easier for clients to pay quickly.

- Physical Mail: While less common, some service providers prefer to send physical payment documents, especially if they have clients who are not comfortable with digital communication.

3. Tracking Payments and Managing Outstanding Balances

Effective payment management requires careful tracking of outstanding balances and monitoring when payments are made. Here are a few strategies to help you stay organized:

- Use Payment Software: Many online payment platforms offer features to help you track which invoices have been paid and which are still pending. This can save you time and prevent manual tracking errors.

- Create a Payment Log: If you prefer a manual system, maintain a payment log in a spreadshe