Doterra Invoice Template for Streamlined Billing

Managing financial transactions efficiently is crucial for any business. Whether you’re a small entrepreneur or part of a larger organization, having a structured method for handling payments and keeping track of earnings is essential. Using a well-designed document to manage billing can save valuable time and reduce errors.

Customizable documents allow you to tailor each statement to the specific needs of your clients, ensuring professionalism and clarity. These tools are designed to help you stay organized and streamline your workflow, enabling smoother communication between you and your customers.

In this guide, we’ll explore how to create and manage these essential tools effectively. By focusing on ease of use and versatility, you can simplify the process of tracking payments and managing your finances more effectively.

Doterra Invoice Template Overview

Having a reliable system to handle payment documentation is crucial for businesses of all sizes. This system helps ensure that all financial transactions are clear, organized, and easily accessible. A well-structured document that can be customized to suit specific needs allows for smooth communication with clients and ensures all details are captured accurately.

Key Benefits of a Customized Document

A personalized payment document offers numerous advantages, including the ability to tailor the layout to your brand, add relevant details, and maintain consistency. By using a flexible tool, businesses can adjust their billing methods to reflect specific service offerings, pricing structures, and customer needs.

Features to Look for in a Billing Solution

The ideal billing solution should include essential fields for itemizing services or products, calculating totals, and providing clear payment instructions. It should also allow for easy tracking of outstanding balances and provide a professional appearance that builds trust with clients.

Why Choose a Doterra Invoice Template

Opting for a customizable billing solution offers multiple advantages for businesses looking to streamline their financial processes. These solutions provide an efficient and professional way to handle payments while ensuring accuracy and consistency. Here are some reasons why selecting a tailored document system is beneficial for your business:

- Time-Saving: Pre-designed formats eliminate the need to start from scratch, speeding up the billing process.

- Customization: Easily adjust the layout and content to suit your brand and the specific services you offer.

- Professional Appearance: A well-structured document creates a polished and trustworthy image, helping to build strong relationships with clients.

- Accuracy: Using a predefined structure reduces the risk of errors, ensuring all necessary details are captured correctly.

- Consistency: Maintaining a uniform style for all transactions helps ensure that your business looks organized and reliable.

Choosing a versatile and easy-to-use solution allows businesses to focus on what matters most: delivering quality service to their customers, while the administrative tasks are handled efficiently.

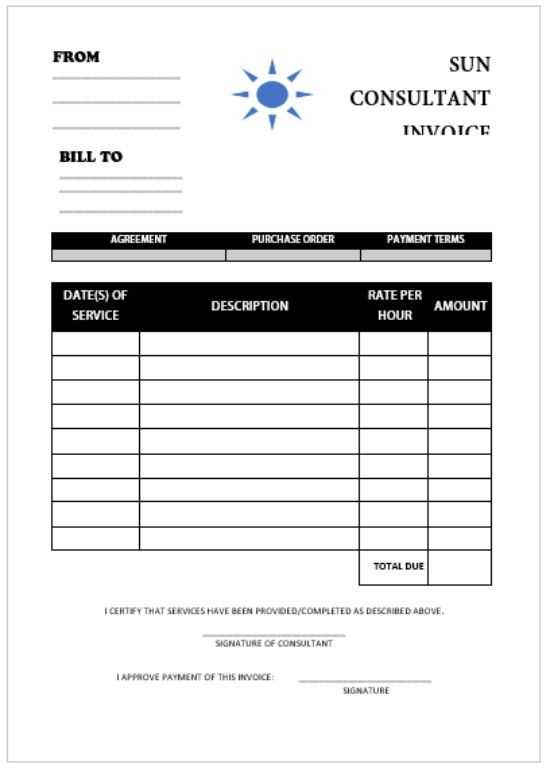

How to Create a Doterra Invoice

Creating a professional billing document that meets your business needs can be straightforward with the right approach. By using an organized format, you ensure that every necessary detail is included, making the process smoother for both you and your clients. Here’s a step-by-step guide on how to create a customized payment record.

Step 1: Gather Essential Information

Before you start creating your billing document, collect all relevant information to ensure accuracy:

- Client Details: Name, address, and contact information.

- Service/Product Details: Description, quantity, and price for each item or service provided.

- Payment Terms: Due date, payment methods, and any applicable taxes or discounts.

- Company Information: Your business name, contact information, and logo.

Step 2: Choose a Structure and Design

Once you have all the necessary details, it’s time to structure the document. A clean, organized layout helps ensure clarity. You can choose from pre-made designs or create one from scratch:

- Header: Include your business name, logo, and contact information.

- Client Section: Place the client’s information clearly on the top portion of the document.

- Line Items: List each service or product provided with individual pricing and totals.

- Footer: Add any payment instructions, terms, or thank-you messages.

By following these steps, you’ll create a comprehensive and professional document that reflects your brand and ensures smooth transactions with clients.

Key Features of Doterra Invoice Templates

When selecting a document for managing financial transactions, certain features are essential to ensure it serves its purpose effectively. A well-structured solution not only saves time but also enhances professionalism and clarity. Below are the key attributes that make these tools highly efficient and easy to use for businesses of all sizes.

Customization and Flexibility

Adaptability is one of the most important aspects of any billing document. The ability to adjust fields such as item descriptions, prices, and client details allows businesses to cater to different customer needs and services. This flexibility also ensures that your branding can be incorporated, creating a consistent and professional appearance.

Clear and Concise Layout

An effective financial document should have a clean and easy-to-read design. Important sections such as client details, itemized list, and payment instructions should be clearly separated. This organization ensures that both you and your client can quickly understand the terms of the transaction, reducing confusion and potential mistakes.

In addition, a properly formatted document includes essential fields like tax rates, total due, and payment terms, making it a comprehensive tool for both parties involved.

Customizing Your Doterra Invoice Template

Personalizing your billing document allows you to align it with your business branding and specific needs. Customization ensures that each transaction is presented professionally and includes all necessary details tailored to your unique services. The following steps outline how to modify and personalize your payment record for maximum efficiency and brand consistency.

Adjusting Layout and Design

One of the first elements to customize is the layout. A clean, organized structure enhances readability. Consider the following when adjusting the design:

- Logo and Business Name: Place your logo prominently at the top, along with your business name and contact details.

- Color Scheme: Use colors that match your brand identity to create a cohesive look throughout the document.

- Fonts: Choose professional fonts that are easy to read, ensuring that the document looks polished and clear.

Modifying Content Fields

Every business has specific needs, and your payment record should reflect that. You can easily modify sections such as:

- Itemized List: Include detailed descriptions of services or products provided, along with pricing and quantity.

- Payment Terms: Specify the due date, late fees, or discounts applicable to ensure clear expectations with clients.

- Additional Notes: Add custom fields for any special instructions or messages that can personalize the experience.

Customizing these features will help create a billing document that aligns with your business goals and customer expectations, making it easier to manage payments efficiently.

Best Practices for Using Doterra Invoices

Effectively managing billing documents ensures smooth transactions and fosters positive relationships with clients. Following best practices helps to avoid common errors and streamline your workflow. Below are essential guidelines to make the most of your billing system.

- Be Consistent with Formatting: Consistency in layout and structure not only makes your documents more professional but also ensures that important details are easily accessible. Stick to a clear, uniform format for all transactions.

- Double-Check Information: Always verify client details, payment amounts, and dates before sending out documents. This minimizes the risk of mistakes that could lead to payment delays.

- Include Clear Payment Terms: Clearly state payment due dates, acceptable payment methods, and any late fees. This sets expectations upfront and encourages timely payments.

- Follow Up Promptly: After sending your document, follow up with clients if payments are delayed. A gentle reminder helps keep the process moving and ensures there are no misunderstandings.

- Keep Records Organized: Store all billing documents in an organized system, whether digital or physical. This makes tracking payments and addressing any issues much easier.

By adopting these best practices, you can ensure smoother transactions, improve cash flow, and maintain a professional image with your clients.

Design Tips for Your Invoice Template

A well-designed billing document not only helps convey professionalism but also makes it easier for clients to understand the details of their transactions. The right design can improve clarity, ensure accuracy, and create a lasting impression. Below are some essential design tips to enhance the effectiveness of your billing records.

Keep It Simple and Clean

A cluttered document can confuse clients and lead to missed information. A clean, minimalistic design ensures that all critical details stand out:

- White Space: Use plenty of white space to make the document easy to read. Avoid overcrowding sections.

- Logical Flow: Arrange information in a way that follows a natural order, from business details to client information, then to the services or products provided.

- Font Choices: Choose simple, professional fonts. Stick to one or two fonts throughout the document for consistency.

Enhance Visual Appeal

Aesthetics play an important role in creating a document that resonates with clients. Here are a few ways to add visual appeal:

- Branding: Incorporate your company logo and use your brand’s color scheme to make the document feel cohesive.

- Sections and Borders: Use borders or shading to separate sections clearly. This helps clients quickly locate information.

- Tables for Clarity: Present itemized lists or charges in table format to improve readability and organization.

By following these design tips, you can ensure your billing documents are not only functional but also visually appealing and easy to navigate, leading to better client experiences and smoother transactions.

Free Doterra Invoice Templates Available

For businesses looking to streamline their billing process without incurring additional costs, there are several free options available for creating professional financial documents. These tools allow you to generate customized billing records without the need for expensive software or complicated designs. Below are some of the advantages of using free options and where to find them.

Benefits of Free Billing Solutions

Opting for free document solutions offers a variety of benefits for businesses of all sizes:

- No Cost: Free options allow you to save money while still receiving high-quality, professional documents.

- Ease of Use: Many free tools come with simple drag-and-drop functionality or pre-designed layouts that make the process quick and user-friendly.

- Customization: Even without a fee, many free tools allow for substantial customization, including adding logos, adjusting fields, and modifying payment terms.

Where to Find Free Resources

There are numerous online resources where you can download free billing formats:

- Online Generators: Websites offer easy-to-use generators that allow you to fill in the required details and download your document instantly.

- Software Platforms: Some accounting software platforms provide free basic versions that include pre-designed documents for billing.

- Printable Templates: You can find free downloadable documents that you can print and customize manually if needed.

By utilizing these free solutions, businesses can maintain a professional appearance and manage financial transactions efficiently without the need for a large investment.

Integrating Doterra Invoices with Software

Integrating your financial documentation with software solutions can significantly improve efficiency and reduce human error. By syncing your billing records with software, you can automate tasks, ensure consistency, and save valuable time. Here, we explore how to successfully integrate your billing tools with modern business software.

Advantages of Integration

Integrating your billing documents with software provides a range of benefits:

- Automation: Automating processes like generating, sending, and tracking documents can save time and reduce the risk of mistakes.

- Real-time Updates: Syncing your records with software allows for instant updates, keeping both your documents and financial records current.

- Improved Accuracy: Integration eliminates the need for manual data entry, decreasing the chances of errors in amounts, dates, or client details.

How to Integrate Your Billing System

To successfully integrate your billing system with software, consider the following steps:

- Choose the Right Software: Select software that is compatible with your existing billing tools and meets your business’s needs, such as accounting platforms or CRM systems.

- Import Document Templates: Many platforms allow you to import existing templates or documents, making the transition seamless.

- Configure Syncing Features: Set up automatic synchronization for client information, payment history, and other relevant data to keep everything aligned.

- Monitor and Adjust: Regularly review the integration to ensure it works smoothly and make any adjustments if needed.

Integrating your billing process with software can provide long-term benefits for your business, allowing you to focus on growth while ensuring accurate and timely financial records.

How Doterra Invoices Improve Efficiency

Streamlining the billing process can significantly enhance operational efficiency. By utilizing structured and standardized financial documents, businesses can reduce time spent on manual tasks, minimize errors, and improve overall workflow. Below are some ways in which effective billing solutions contribute to a more efficient business environment.

Time-Saving Benefits

Implementing a well-organized billing system helps businesses save valuable time in several key areas:

- Quick Generation: Pre-designed documents allow for quick input of transaction details, enabling faster generation of records without having to start from scratch.

- Automated Calculations: Automated fields reduce the need for manual calculations, ensuring accuracy and eliminating repetitive tasks.

- Faster Processing: Streamlined templates and integration with software help expedite document processing and eliminate delays in sending and receiving payments.

Reducing Errors and Miscommunication

Accurate records lead to fewer mistakes and miscommunications, which can slow down business operations. Effective financial documentation addresses this by:

- Standardizing Information: Using a consistent format helps ensure all necessary information is included, reducing the chance of overlooking important details.

- Preventing Misunderstandings: Clear itemization and payment terms make it easier for clients to understand what is owed, minimizing the chances of disputes or confusion.

- Improved Accuracy: Reducing human input lowers the risk of data entry errors, ensuring more precise financial records and fewer corrections needed.

By adopting efficient billing practices, businesses can save time, reduce errors, and foster better relationships with clients, all while ensuring smooth financial operations.

Common Mistakes in Doterra Invoices

Even with structured billing processes in place, errors can still occur that affect the accuracy of financial documents. These mistakes can lead to confusion, delayed payments, or strained business relationships. Here are some of the most common mistakes businesses make when preparing their financial records and how to avoid them.

Missed or Incorrect Details

Omitting or incorrectly listing essential details is one of the most frequent issues businesses face:

- Missing Client Information: Failing to include full client contact details or account numbers can lead to delayed payments or miscommunications.

- Incorrect Item Descriptions: Vague or incomplete descriptions of products or services may confuse clients and lead to payment disputes.

- Wrong Payment Terms: Listing inaccurate payment due dates or terms can cause confusion regarding deadlines, affecting timely payments.

Formatting and Calculation Errors

Even small formatting or calculation mistakes can have a significant impact on financial records:

- Inconsistent Formatting: Different date formats, currencies, or font choices can make the document appear unprofessional and difficult to read.

- Incorrect Calculations: Mistakes in adding or multiplying amounts can lead to incorrect totals, which might cause disputes or delay payments.

- Missing Taxes or Fees: Failing to apply the correct tax rate or service fees can result in undercharging or overcharging, creating issues with clients and financial reporting.

By paying attention to detail and avoiding these common mistakes, businesses can ensure their financial documents are accurate, clear, and professional, fostering smoother transactions and better relationships with clients.

How to Save Time with Doterra Templates

Efficiency in managing financial records can greatly enhance a business’s ability to focus on growth and customer service. By using pre-structured documentation, tasks such as creating and sending financial documents become faster and less prone to error. Here’s how adopting ready-made solutions can save valuable time in your business operations.

Streamlining Document Creation

When using pre-designed documents, much of the work is already done for you, allowing you to focus on the essential details:

- Pre-filled Fields: Most document formats include automated fields for client information, services, and dates, reducing the need for manual data entry.

- Quick Customization: With a template, you can easily replace specific details like product names or prices, allowing you to generate a document in just a few minutes.

- Consistency: Templates ensure that every document is formatted the same way, eliminating time spent on reformatting or adjusting the layout for each new record.

Automating Repetitive Tasks

Automation is one of the key time-saving benefits when using pre-structured solutions:

- Automatic Calculations: Many templates include built-in formulas for taxes, discounts, and totals, ensuring calculations are accurate and saving time on manual math.

- Reusable Formats: Once a document layout is set up, it can be reused for multiple transactions without needing to start from scratch every time.

- Faster Submission: With all fields pre-arranged, sending documents to clients or partners becomes as simple as reviewing the details and hitting send.

By integrating structured solutions into your workflow, you eliminate redundancies, reduce errors, and create space for more important tasks, ultimately saving significant time and improving overall productivity.

Tracking Payments Using Doterra Invoices

Effectively monitoring payments is essential to maintaining smooth cash flow and ensuring timely settlements. By organizing billing records in a clear and structured manner, businesses can easily track payments and stay on top of outstanding balances. Here’s how you can streamline the payment tracking process using organized financial documentation.

Creating a Payment Tracking System

One of the simplest and most efficient ways to track payments is by including detailed payment history in your records. A comprehensive system helps you manage overdue payments and monitor progress for each transaction. Below is an example of how a typical payment record can be organized:

| Client Name | Transaction Date | Amount Due | Amount Paid | Payment Status | Due Date |

|---|---|---|---|---|---|

| John Doe | 2024-10-01 | $150.00 | $150.00 | Paid | 2024-10-15 |

| Jane Smith | 2024-10-05 | $200.00 | $100.00 | Partially Paid | 2024-10-20 |

| Mike Johnson | 2024-10-07 | $300.00 | $0.00 | Unpaid | 2024-10-22 |

Benefits of Payment Tracking

By using this organized approach to document payments, businesses can enjoy several advantages:

- Clear Overview: Easily track the amount paid, outstanding balances, and payment due dates in one place.

- Improved Cash Flow Management: Monitor overdue payments and follow up as needed, ensuring that financial obligations are met promptly.

- Accurate Reporting: With accurate payment tracking, businesses can generate reliable financial reports and identify trends in payment behavior.

Using this method, you can ensure that all payments are properly tracked, allowing you to maintain an efficient and

Maintaining Professionalism with Doterra Templates

Presenting a polished and professional image to clients is crucial for any business. One way to achieve this is by using well-structured and visually appealing documents for financial transactions. When creating and sending billing statements, attention to detail and consistency can go a long way in building trust and credibility with clients.

Importance of Consistency in Billing Documents

Consistent formatting and design help to establish your brand identity while conveying professionalism. Using clear, easy-to-read layouts and providing all necessary details–such as payment terms, services rendered, and contact information–ensures that your communications are efficient and effective. Clients are more likely to engage with a business that presents itself clearly and organized.

Building Trust Through Organized Documentation

When your financial documents are well-organized, it not only improves communication but also demonstrates reliability and commitment to quality service. Clients are more likely to feel secure and valued when they receive invoices that reflect a thoughtful, professional approach. This can ultimately lead to more positive relationships and long-term business partnerships.

By maintaining a high standard of professionalism in your billing practices, you ensure that your business is seen as trustworthy, responsible, and attentive to client needs. This not only helps with client retention but can also enhance your overall business reputation in the marketplace.

Ensuring Accuracy in Doterra Invoices

Accurate documentation is a cornerstone of efficient business operations. Whether you are managing a small business or running a larger enterprise, ensuring that your billing records are precise is essential to avoid misunderstandings and maintain trust with clients. A small mistake can lead to confusion, delays, or disputes, which can negatively impact your relationship with customers.

Key Factors for Accuracy

To ensure that your financial documents are accurate, pay attention to the following aspects:

- Correct Client Information: Always verify that the client’s name, address, and contact details are accurate. This prevents delivery issues and helps avoid miscommunication.

- Accurate Service Descriptions: Clearly outline the products or services provided. Include quantities, unit prices, and detailed descriptions to prevent confusion over what was delivered.

- Proper Calculations: Double-check that all mathematical calculations, including taxes, discounts, and totals, are correct. Errors in math can undermine the professionalism of your document.

- Timely Updates: Ensure that your financial records reflect the most current pricing and payment terms. Outdated or inconsistent rates can lead to discrepancies.

Tools to Help Maintain Accuracy

There are several tools available that can help streamline the creation of accurate documents, such as:

- Automated Systems: Using invoicing software or financial management platforms can reduce human error by automating calculations and ensuring consistency in formatting.

- Templates: Pre-designed formats with fields for each detail ensure that nothing is overlooked and help maintain uniformity across all documents.

- Data Validation: Many tools offer data validation features to check the accuracy of contact details and ensure that entered information is correct.

By focusing on these areas and using the right tools, you can greatly enhance the accuracy of your financial documents, thereby improving overall operational efficiency and maintaining strong, positive relationships with your clients.

Legal Considerations for Doterra Invoices

When preparing financial documents for your business, it’s essential to be aware of the legal requirements that ensure compliance and protect both you and your clients. Legal considerations can vary depending on your location, the type of service or product being provided, and the nature of the transaction. Understanding these aspects is critical to maintaining professional standards and avoiding potential legal issues.

Key Legal Requirements

There are several important legal factors to keep in mind when creating financial records:

- Correct Information: Always include accurate details such as business name, registration number, tax identification number, and legal address. These details help establish the legitimacy of the document and ensure compliance with tax regulations.

- Compliance with Tax Laws: Make sure the document adheres to local tax regulations, including proper tax rates, itemized taxes, and payment terms. Failing to include the correct tax amounts can result in penalties.

- Clear Payment Terms: Clearly state payment due dates, late fees, and acceptable payment methods. This helps prevent any misunderstandings and ensures both parties are on the same page regarding payment expectations.

- Retention Period: Understand the legal requirements for how long you must keep your financial records. Many countries require businesses to store such records for several years for tax and audit purposes.

Legal Risks of Non-Compliance

Failure to follow legal standards when creating financial documents can expose you to several risks, including:

- Tax Penalties: Inaccurate tax calculations or missing tax information could lead to tax fines or penalties from regulatory authorities.

- Disputes with Clients: Ambiguities in terms and conditions may lead to payment delays, disputes, or legal action. Clear, legally sound documents reduce the risk of these issues.

- Loss of Business Reputation: Non-compliance with legal regulations can harm your business’s credibility and trustworthiness, impacting your long-term success.

To avoid these legal challenges, it is important to stay informed about the requirements in your jurisdiction and ensure that your financial records are consistently accurate, transparent, and compliant.