Dog Walking Invoice Template for Easy and Professional Billing

Managing transactions is a crucial part of any pet care business. Reliable payment tracking can bring structure to your business while enhancing your professional image. A well-organized billing system simplifies the way services are logged, paid for, and tracked over time, giving both you and your clients a seamless experience.

Adopting structured forms for payments can reduce confusion, ensure timely payments, and create a lasting impression on clients. With clear formats that cover essential information, pet caregivers can focus more on their responsibilities, knowing that payments are efficiently managed.

Choosing a suitable billing structure also allows for customization, enabling businesses to align with their unique brand while meeting client expectations. This flexibility can foster better client relationships, as each transaction feels personalized and carefully handled. For pet care professionals, an organized payment approach ensures smoother operations and happier customers.

Create a Customized Dog Walking Invoice

Personalized billing forms offer a way to showcase your brand while maintaining an organized financial record. A tailored format ensures every detail is clear, giving your clients confidence in the service provided. Adding your unique touches not only enhances your professional image but also allows for easy management of each transaction.

Key Elements to Include

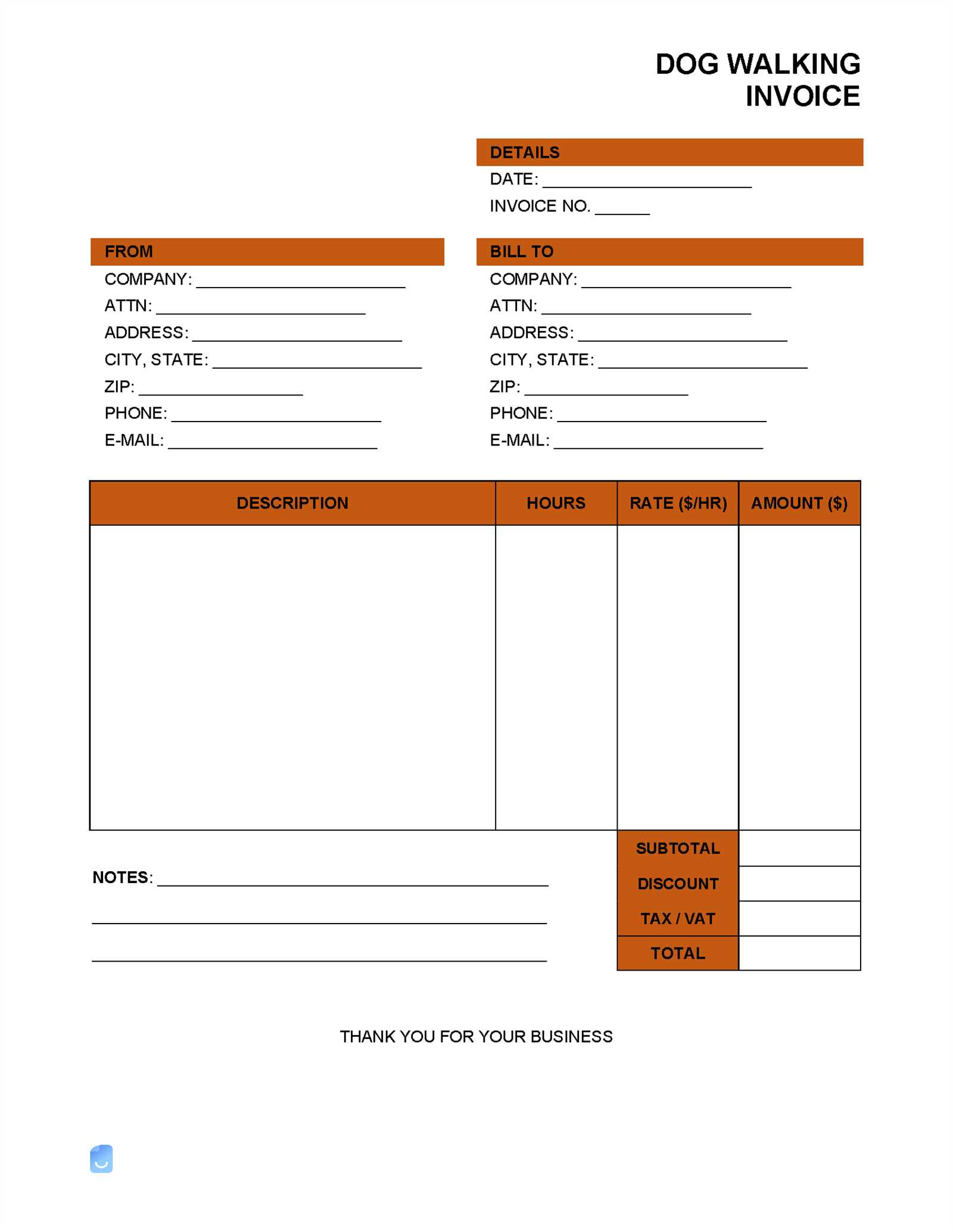

A customized billing form should cover essential information that clients need for clarity. This includes details about the service, payment specifics, and your contact information. Including these items in a clear, structured layout improves transparency and helps avoid misunderstandings.

| Field | Description | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | Full name, address, and contact details of the client. | ||||||||||||||||||||||||||||||||||

| Service Description | A brief over

Create a Customized Dog Walking InvoicePersonalized billing forms offer a way to showcase your brand while maintaining an organized financial record. A tailored format ensures every detail is clear, giving your clients confidence in the service provided. Adding your unique touches not only enhances your professional image but also allows for easy management of each transaction. Key Elements to IncludeA customized billing form should cover essential information that clients need for clarity. This includes details about the service, payment specifics, and your contact information. Including these items in a clear, structured layout improves transparency and helps avoid misunderstandings.

Adding a Personal TouchCustomizing each billing form allows you to communicate your brand’s personality. You might include a friendly thank-you note or personalized message for loyal clients. Small details like these can make the experience more memorable and reflect the care you put into each interaction. How to Design a Pet Care InvoiceCreating an efficient billing format for pet services is essential for smooth transactions and client satisfaction. A thoughtfully crafted form can help keep records accurate, provide clients with a clear breakdown of costs, and reflect your professionalism. By incorporating essential elements and an organized layout, you can ensure that every payment interaction feels straightforward and polished. Structuring Your Billing FormA well-designed billing document should contain key components that clarify charges and communicate important details to clients. Consider including fields that cover the essentials of each service interaction, from contact information to payment terms. This comprehensive approach helps build trust and maintain a transparent relationship with clients.

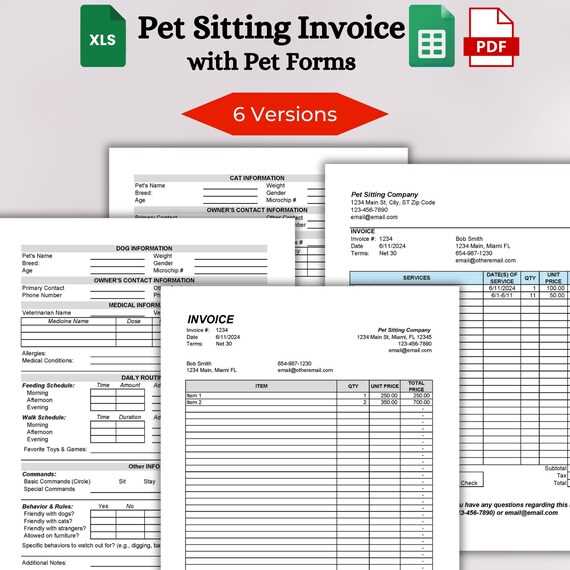

Paid ResourcesIf you’re looking for more advanced features, customization options, or a professional edge, paid resources may be the way to go. These services often offer extensive template libraries, customizable fields, and features like automatic calculations, which can save you time and ensure accuracy.

Choosing between free and paid resources depends on your business’s needs. Free tools are ideal for simplicity, while paid platforms offer additional benefits like automation and branding that could help streamline your processes and enhance client relationships. How Invoices Enhance Your Business ImageProfessional billing documents play a crucial role in shaping the perception of your business. When clients receive clear, well-organized statements, it reflects your attention to detail, reliability, and commitment to providing a quality service. A well-crafted statement not only ensures smoother transactions but also reinforces trust and credibility with your clients. Professionalism and TrustA polished, consistent statement can make a significant difference in how your business is viewed. By presenting your clients with a formal and accurate document, you are showing that you are organized and committed to transparency in your dealings. Here are a few ways billing forms enhance your professional image:

Efficiency and Client SatisfactionHaving a structured method for billing also helps improve operational efficiency. Automated or standardized forms reduce the time spent on administrative tasks, allowing you to focus more on delivering excellent service. Clients appreciate receiving detailed, straightforward billing documents, which can lead to faster payments and more satisfied customers.

Ultimately, investing time in creating professional billing documents not only streamlines your operations but also enhances the overall perception of your business. A professional image fosters client trust, which is key to growth and success. Tracking Payments with Invoice SoftwareManaging payments efficiently is essential for maintaining a smooth cash flow in any business. With the help of specialized software, tracking payments becomes more streamlined, helping business owners stay organized and minimize the risk of errors. Automated payment tracking features allow for quicker reconciliation, ensuring that all transactions are properly accounted for. Key Features of Payment Tracking SoftwareUsing software to manage payments offers a variety of benefits, from improved accuracy to faster financial reporting. Here are some key features that make these tools invaluable:

Benefits of Using Payment Tracking SoftwareInvesting in payment tracking software can significantly improve your business operations and help you maintain better relationships with clients. Some notable advantages include:

Incorporating payment tracking software into your business not only saves time but also enhances accuracy, leading to more efficient operations and greater customer satisfaction. Steps to Streamline the Billing ProcessEfficiently managing payment collection is crucial for any business. A streamlined process ensures timely payments, reduces errors, and saves both time and effort. By implementing a systematic approach, business owners can enhance their workflow, improve customer satisfaction, and maintain a steady cash flow. 1. Set Clear Payment TermsClearly defined payment terms establish expectations for both parties involved. When clients know when and how they need to pay, the process becomes smoother. Here’s how you can clarify your payment terms:

2. Use Automated Billing SystemsAutomation significantly reduces administrative work and minimizes human errors. With the help of billing software, invoices can be generated and sent automatically, ensuring consistent communication and faster payment processing.

3. Maintain Detailed RecordsTracking payments and keeping accurate records is essential for smooth financial management. With a well-organized system, you can easily monitor which payments are received and which are still pending.

4. Offer Multiple Payment OptionsProviding a variety of payment methods can encourage faster payments and improve customer satisfaction. Clients appreciate having different ways to settle their dues.

By following these steps, businesses can simplify their billing procedures, reduce administrative tasks, and enhance the overall customer experience. With a more efficient process in place, managing payments becomes less time-consuming and more accurate. Using Mobile Apps for InvoicesMobile applications have revolutionized the way businesses manage their billing and payment systems. These apps offer a convenient, on-the-go solution for creating, sending, and tracking payments, all from a mobile device. They simplify the entire process and can enhance productivity by allowing business owners to manage their financial tasks wherever they are. Benefits of Using Mobile Apps

Popular Mobile Apps for Managing Payments

By integrating mobile apps into your business operations, you can simplify billing tasks, reduce paperwork, and maintain a better overview of your finances. These tools are especially useful for entrepreneurs and small businesses who need a flexible and efficient way to handle their payments. Whether you’re handling single or recurring transactions, mobile apps can keep your process organized and efficient. Common Mistakes to Avoid in InvoicingManaging financial documents effectively is crucial for maintaining a smooth business operation. However, mistakes during the billing process can lead to confusion, delayed payments, and potential disputes. By understanding and avoiding common errors, businesses can ensure accuracy, professionalism, and timely transactions. Key Mistakes to Watch Out For

Tips for Preventing These Errors

By avoiding these common mistakes, you can create a more efficient and reliable billing system, improving both client satisfaction and your cash flow management. Sample Layout for Billing StatementsA well-organized billing statement can streamline payment processes and present a professional image to clients. A clear layout not only makes the details easy to understand but also ensures that all necessary information is included for smooth transactions. Below is a sample structure of a typical document used for charging clients, with key sections to consider when creating your own. Essential Components of the Document

Example of a Basic Layout

By using a clear and structured format, you can help ensure that clients understand what is being charged and how to make payments. This reduces the chances of confusion and enhances the professional appearance of your business documents. |