Docs Invoice Template Easy and Free to Customize for Your Business

Managing business transactions and maintaining financial records requires clear and organized billing. Having an effective system for issuing statements to clients ensures timely payments and reduces errors. Whether you’re a freelancer, a small business owner, or part of a larger organization, using an efficient method for generating financial documents is crucial for smooth operations.

With the right tools, customizing a billing document to reflect your company’s branding, style, and essential details becomes easy. You can quickly produce professional-looking statements that are not only functional but also aligned with your brand’s image. Tailoring the design to fit your needs can enhance the client experience and streamline your administrative tasks.

By utilizing pre-built formats, you save time and effort while still ensuring that each document contains all necessary information. These formats can be adapted to different types of businesses, from service providers to product-based companies. The flexibility of modern digital tools allows for seamless adjustments, making it possible to stay on top of your finances without the complexity of manual processes.

Docs Invoice Template Guide

Creating professional billing statements is essential for businesses of all sizes. Whether you are dealing with clients, partners, or customers, having a well-structured document that outlines the services rendered or products delivered ensures clarity and helps maintain strong financial records. This guide will walk you through the process of creating a customizable billing document that meets your business needs.

Understanding the Key Components

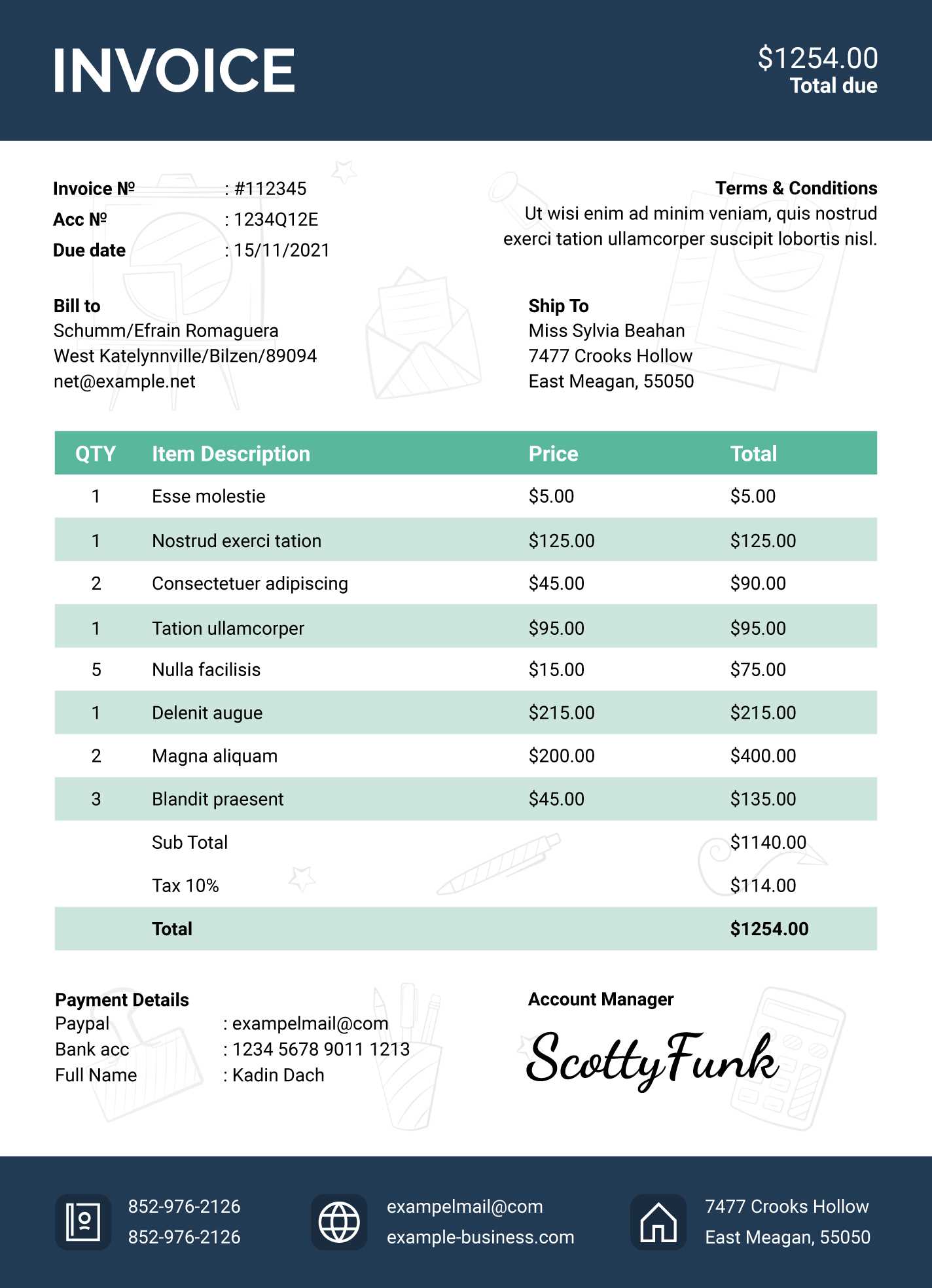

A well-organized billing document typically includes several crucial elements. These elements ensure that both the service provider and the client understand the terms of the transaction and avoid any confusion. Here are the main sections to consider when designing your own billing document:

| Component | Description |

|---|---|

| Header | Contains your company’s name, logo, and contact information. |

| Client Information | Details of the recipient, including their name, address, and contact info. |

| Itemized List | A clear breakdown of the services provided or products sold, including quantities and prices. |

| Payment Terms | Outlines when the payment is due, any late fees, and accepted payment methods. |

| Total Amount | The sum of all charges, including taxes and any discounts applied. |

Customizing Your Document

Once you understand the essential components, you can begin customizing the structure and appearance of your document. The beauty of using a digital tool for creating financial documents is the ability to modify elements as needed. You can add your brand’s logo, adjust fonts and colors, and even change the layout to suit your business style. Most importantly, ensure that all the necessary information is included so the document is clear and comprehensive.

With the proper customization, your billing document not only serves its primary function but also reinforces your business identity and professionalism. Whether you need to add a personal touch or follow specific formatting standards, digital tools offer flexibility to meet your requirements efficiently.

What is a Docs Invoice Template

A billing document is a critical tool used by businesses to request payment from clients or customers after providing goods or services. It outlines the transaction details, such as the items or services provided, the cost, and the total amount due. A ready-made format allows businesses to quickly create and customize these documents without starting from scratch each time.

Key Features of a Billing Document Format

Pre-designed structures provide a simple and efficient way to generate professional billing documents. These formats typically include sections for all necessary information and are designed to be easily customized for different types of transactions. Some of the key features include:

- Header Section: Contains the business name, logo, and contact details.

- Recipient Information: Includes the client’s name, address, and contact info.

- Item Breakdown: A list of services or products provided, with quantities and pricing.

- Payment Terms: States the due date and any applicable payment methods or late fees.

- Total Amount: Shows the final amount due, including any taxes or discounts.

Why Use a Pre-Designed Format?

Using a pre-built structure for your billing documents offers several advantages:

- Saves Time: No need to create a new document from scratch each time.

- Ensures Consistency: A standardized format makes all documents look professional and aligned with your brand.

- Easy Customization: Pre-designed formats can be tailored to your specific needs, including adding your logo and adjusting the layout.

- Reduces Errors: By including all required fields, it minimizes the chances of omitting important information.

Overall, using a structured document format helps streamline the billing process, ensuring accuracy and professionalism in all transactions.

Benefits of Using Invoice Templates

Utilizing a pre-structured billing document offers significant advantages for businesses, whether small or large. By relying on a set format, you can quickly generate accurate and professional-looking records for your transactions. This not only saves time but also ensures that each document maintains a consistent quality, regardless of who prepares it.

Time Efficiency

One of the most significant advantages of using a ready-made document structure is the amount of time it saves. Instead of manually creating a new document from scratch for every transaction, you can simply fill in the relevant details. This streamlined approach helps you focus on other important aspects of your business.

- Quick Setup: Pre-designed structures allow you to complete a billing record in just a few minutes.

- Easy Customization: You can adapt the document to fit specific needs without starting over each time.

Consistency and Professionalism

Standardized billing documents maintain a high level of professionalism and consistency, ensuring that all communications with clients look polished. When every record follows the same format, it reflects well on your business and helps to establish a professional image.

- Uniform Appearance: Every document will look the same, reinforcing brand identity.

- Clear Structure: A consistent format helps clients quickly identify key information, reducing misunderstandings.

Using pre-built structures provides both practicality and professionalism, making it easier to manage financial documents with ease and accuracy.

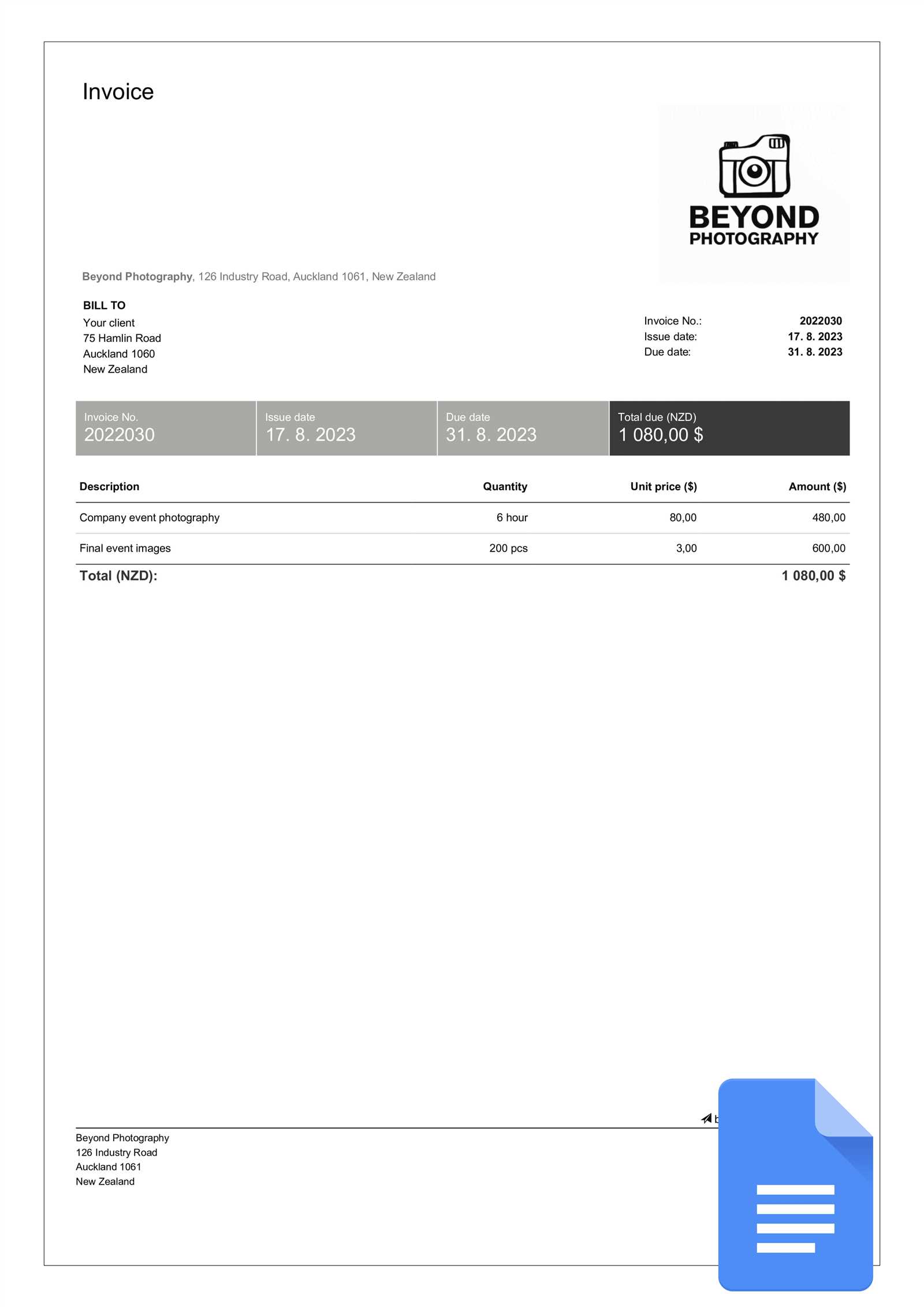

How to Create an Invoice in Docs

Generating a billing document using a word processing tool is a simple and effective process that allows you to produce professional and accurate records. By following a few straightforward steps, you can create a document that includes all necessary details such as your business information, the services provided, and payment terms. This section will guide you through the process of creating a comprehensive billing record from scratch using a word processor.

Step 1: Open a New Document

Start by opening a new blank document in your word processing application. This will be the canvas for your billing record. You can use any word processing software that allows you to format text and insert tables, images, and other elements.

Step 2: Add Business Information

The first section of the document should include your business details, such as the company name, address, phone number, and email. You may also want to add your logo for a more professional look. Position this information at the top of the document so it stands out.

Step 3: Include Client Information

Below your business information, add the client’s details, including their name, address, and contact information. Make sure to include a unique reference number or code for the billing record to ensure easy identification.

Step 4: List Products or Services

The next section should include a detailed list of the services or products provided. For each item, include a brief description, the quantity, the unit price, and the total cost. Use a table to organize this information, as it will make the document easier to read and more professional.

Step 5: Set Payment Terms

Specify the payment terms clearly. Include the due date for payment, any applicable late fees, and the accepted payment methods. It’s essential that this section is straightforward to avoid confusion later.

Step 6: Calculate Total

At the bottom of the document, include the total amount due. This should account for any discounts or taxes applied. Make sure the calculation is correct to avoid discrepancies.

Step 7: Finalize the Document

Once you have filled in all the required details, review the document for any errors. Ensure the formatting is consistent and professional. Save the document in your desired format, such as a PDF, and it is now ready to be sent to your client.

By following these simple steps, you can quickly create accurate and clear billing records that meet both your business needs and your clients’ expectations.

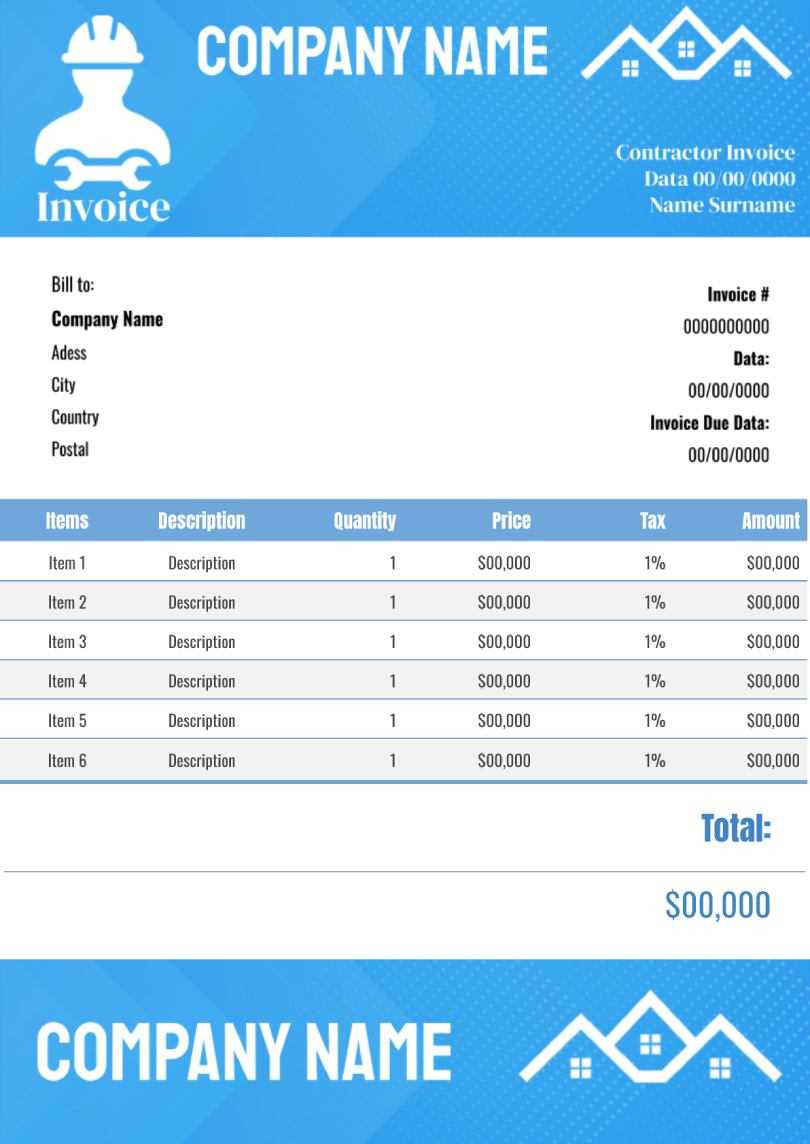

Customizing Your Docs Invoice Template

Personalizing your billing document allows you to reflect your business identity and ensure that it meets all your specific needs. Customizing a pre-made format is simple and ensures that your records are not only professional but also unique to your brand. By adjusting certain elements, you can make your document more aligned with your business style while still maintaining clarity and structure.

Here are some key areas where customization can improve both the look and functionality of your document:

| Customization Area | How to Adjust |

|---|---|

| Logo and Branding | Add your company’s logo and colors to the header or footer to create a cohesive brand experience for your clients. |

| Fonts and Colors | Choose professional fonts and complementary colors that reflect your brand’s identity. Make sure the text is easy to read and contrasts well with the background. |

| Document Layout | Adjust the layout to suit your needs. For example, you can move the total amount to a more prominent position or add extra space between sections for better clarity. |

| Additional Sections | If your business requires specific details, you can add extra fields like payment instructions, terms and conditions, or a discount section. |

After making these customizations, your billing documents will not only be functional but also reflective of your business style. Keep in mind that while personalizing is important, it is also essential to maintain a clear, easy-to-read structure. Your clients should always be able to find the information they need quickly and without confusion.

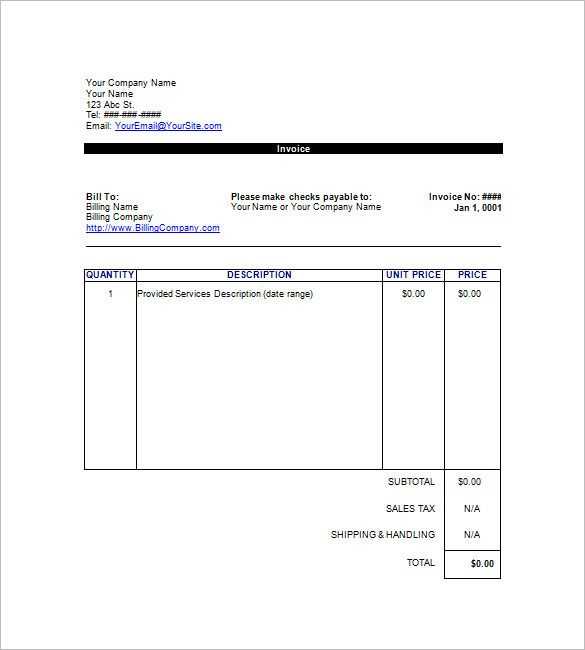

Free Docs Invoice Template Download

Accessing a pre-designed billing document can save you time and ensure accuracy when managing financial transactions. With a ready-made structure, you can quickly create professional records for your clients without having to start from scratch. In this section, you can find a free download link to a customizable format that suits various business needs.

Why Download a Pre-Made Billing Format?

Downloading a pre-built document offers several benefits for businesses of any size. Not only do you save valuable time, but you also ensure that each record maintains consistency and professionalism. The ease of customization allows you to adjust the format to fit your brand’s specific style, whether you’re a freelancer, a small business, or a larger organization.

- Quick Setup: Start using it immediately without the hassle of creating a document from scratch.

- Professional Look: Ensure that every transaction looks polished and consistent.

- Customizable: Tailor the format to meet your specific requirements, such as adding payment terms or special notes.

How to Download and Use the Format

To get started, simply click the download link below and save the file to your device. The document is compatible with most word processing programs, allowing you to make necessary edits and adjustments. Once downloaded, you can start filling in client details, product descriptions, pricing, and payment terms, and send it directly to your client for quick processing.

Download Link: Download Your Free Billing Document

Best Practices for Invoice Design

Creating a clear, professional-looking billing document is essential for maintaining good client relationships and ensuring timely payments. The design of your financial records plays a significant role in how your business is perceived, as well as in how easily clients can understand and process the information. By following best practices, you can make sure that your records are not only functional but also visually appealing and easy to read.

Keep the Layout Simple and Organized

A well-organized layout is key to helping clients quickly locate important information. Avoid cluttering the document with too many details or excessive text. Focus on a clean design with clear headings, consistent spacing, and a logical flow of sections.

- Use Headings: Clearly define sections like “Client Information,” “Itemized List,” and “Total Amount” to guide the reader through the document.

- Group Related Information: Keep related items together, such as placing the total amount near the payment terms to highlight the key financial details.

- White Space: Use plenty of white space to avoid overwhelming the reader with too much text in one area. This will improve readability and overall appearance.

Incorporate Your Brand Identity

Adding your business logo, brand colors, and fonts can make your documents more recognizable and professional. This simple step not only reinforces your brand identity but also adds an element of consistency across all your communications.

- Logo Placement: Position your logo at the top of the document to ensure it’s easily visible.

- Consistent Fonts and Colors: Use your company’s standard fonts and color scheme to create a cohesive look that reflects your brand.

Ensure Clarity and Accuracy

Accuracy is paramount in any billing document, but clarity is just as important. Make sure your document clearly communicates all the necessary information, such as item descriptions, quantities, unit prices, and total amounts. Avoid jargon or overly complex terminology, and use simple, straightforward language.

- Itemized List: Break down all services or products provided with specific details, including the cost per unit and total for each item.

- Payment Terms: Clearly state the payment due date and any applicable late fees or discounts.

- Tax Information: If relevant, ensure taxes are clearly outlined and easy to understand.

By following these best practices, you can create a billing document that is not only visually attractive but also functional and professional, making it easier for clients to process their payments while reinforcing your business’s credibility.

Essential Elements of an Invoice

Creating a comprehensive billing document requires more than just listing services or products provided. To ensure clarity, avoid disputes, and facilitate timely payments, certain key elements must be included. These elements provide both the payer and the payee with all necessary information, reducing the chances of confusion and ensuring smooth transactions.

Key Information to Include

The following are the essential components that should be present in any billing document:

- Business Details: Include your company name, address, phone number, and email. Adding your logo can also help with brand recognition.

- Client Information: Clearly list the client’s name, address, and contact details. This helps identify the recipient and avoids errors in delivery.

- Unique Reference Number: Each document should have a unique number or code for easy tracking and reference, especially for accounting and record-keeping purposes.

- Date of Issue: Always include the date the document was generated to ensure proper timing for payment processing.

Financial Details

Besides basic contact information, the financial sections are critical for clarity and transparency:

- Itemized List: Provide a detailed list of services or products, including quantities, unit prices, and total amounts for each item. This ensures that the recipient understands what they are being charged for.

- Payment Terms: Specify the payment due date, any applicable late fees, and accepted payment methods. It’s important to be clear about when and how payment should be made.

- Total Amount Due: Clearly highlight the total amount owed, including any taxes, discounts, or additional fees, to avoid any misunderstandings.

By ensuring that all of these essential elements are present, you create a document that is not only professional but also easy for clients to review and process, ultimately leading to faster and more accurate payments.

How to Add Company Branding to Docs Template

Incorporating your company’s branding into financial documents is an essential way to maintain consistency and enhance professionalism. Adding elements such as your logo, brand colors, and custom fonts helps reinforce your identity and creates a cohesive experience for your clients. This section will guide you through the simple steps of customizing a billing record to reflect your brand effectively.

Step 1: Insert Your Logo

Your logo is one of the most recognizable aspects of your brand, so it should be prominently displayed at the top of your document. Position it in the header section to ensure it stands out and is visible on every page of the document.

- File Format: Make sure the logo is high quality, either in PNG or SVG format for clarity and scalability.

- Size: Ensure the logo is appropriately sized–not too large to overwhelm the document, but large enough to be clearly visible.

Step 2: Customize Fonts and Colors

The fonts and color scheme used in your document should align with your brand’s style guide. Choose fonts that are easy to read and professional, and apply your brand’s primary color palette to create a cohesive look.

- Fonts: Stick to 1-2 fonts to maintain a clean and organized appearance. Choose a font for headings that contrasts with the body text for better readability.

- Colors: Apply your brand’s colors to key elements like headings, borders, and highlights. Avoid using too many colors to maintain a clean, professional look.

Step 3: Add Custom Footer Information

Including a custom footer with contact details, your company’s website, or social media links is another great way to enhance your brand presence. This section can also include legal disclaimers or payment instructions tailored to your business.

- Contact Details: Include a phone number, email, and physical address to make it easy for clients to reach you.

- Legal Disclaimers: If relevant, include terms and conditions, a privacy policy, or any other legal information that pertains to the transaction.

By following these steps, you can easily integrate your company’s branding into any billing document, making it not only functional but also a true reflection of your brand’s identity.

Common Mistakes to Avoid in Invoices

Creating a professional billing document is an important part of business transactions, but even small mistakes can lead to confusion, delayed payments, or strained client relationships. To ensure smooth and efficient processing, it’s essential to avoid common errors that could impact the accuracy and clarity of your financial records. This section outlines key mistakes to watch out for when generating billing documents.

Missing or Incorrect Information

One of the most common mistakes is failing to include or incorrectly entering essential details. This can cause delays in payment processing and lead to confusion on both sides.

- Incomplete Client Details: Always include the full name, address, and contact information of the client. Double-check that the details are accurate.

- Incorrect Amounts: Ensure that the pricing for each item, the subtotal, and the total amount due are calculated correctly. A simple mistake in math can lead to trust issues.

- Missing Date or Reference Number: Failing to include the issue date or a unique reference number can make it harder for both you and your client to track the document.

Unclear Payment Terms

Ambiguity in payment terms is another common error. If your client is unsure about the due date or how to pay, it may lead to delays or misunderstandings.

- Unspecified Due Date: Clearly state when the payment is due to avoid confusion and ensure timely payment.

- Lack of Payment Methods: Make sure to list all accepted payment methods, such as bank transfer, credit card, or online payment platforms.

- Vague Late Fees: If you charge late fees, outline the specifics, such as the percentage or amount and when it will be applied.

By carefully reviewing each document for these common mistakes, you can avoid unnecessary complications and ensure that your billing records are accurate, clear, and professional.

How to Save and Share Your Docs Invoice

Once you have created a professional billing document, it’s important to save it in a secure format and share it with your client in a way that is both efficient and accessible. Ensuring that the document is properly saved, formatted, and delivered can streamline the payment process and prevent any potential issues. This section will guide you through the best practices for saving and sharing your financial records.

Saving Your Billing Document

Saving your document correctly ensures that it can be accessed later for reference or revisions. There are several formats to choose from, depending on your needs and the software you are using.

- PDF Format: Saving your document as a PDF is one of the best options because it preserves the layout and formatting, making it universally accessible across devices.

- Word Document: If you plan to edit or adjust the content later, saving it as a Word document (.doc or .docx) is a good choice, as it allows for easy changes.

- Cloud Storage: Store your document in a cloud service like Google Drive or Dropbox for easy access, sharing, and backup. This also ensures that your document is accessible from multiple devices.

Sharing Your Billing Record

Once the document is saved, sharing it with your client is the next important step. There are multiple ways to share your billing record efficiently.

- Email: The most common method is to email the saved document as an attachment. Ensure the subject line is clear (e.g., “Billing Record for [Your Business Name] – [Invoice Number]”).

- Cloud Sharing: If you use cloud storage, you can generate a sharing link and send it directly to the client. This method allows for easy access and ensures the client has the latest version of the document.

- Printed Copy: In certain cases, you may want to send a physical copy of the document via postal mail. Ensure it’s properly printed and legible.

By following these steps, you ensure that your billing document is saved securely and shared efficiently, minimizing the chance of confusion or delays in payment.

Using Docs Invoice Template for Freelancers

For freelancers, having a clear, professional billing document is crucial for ensuring timely payments and maintaining a positive client relationship. Using a ready-made structure can simplify the process, allowing freelancers to focus more on their work while keeping their finances in order. This section explores how freelancers can effectively use a pre-designed billing format to streamline their invoicing process.

When you’re working as a freelancer, the ability to create and send billing documents quickly and accurately is essential. A pre-designed structure helps ensure that you include all the necessary details while maintaining a professional look. The simplicity of using a customizable format can help you avoid errors and save time, allowing you to focus on delivering quality services to your clients.

By using a standard structure, freelancers can maintain consistency across all transactions, which helps improve credibility. Additionally, personalizing your document with your logo, business name, and payment details can enhance your professional image and make your communication with clients clearer.

Whether you are just starting out or have been freelancing for years, leveraging a pre-designed format is a smart way to manage your billing without the hassle of creating a new document for every project. It helps to standardize your process, reducing stress and ensuring that your invoicing is as smooth as possible.

Incorporating Tax Rates in Your Invoice

When creating a financial document for a business transaction, it’s essential to include applicable tax rates to ensure that the final amount is correct and transparent. Accurately calculating and displaying tax on your billing record not only helps you comply with local regulations but also provides clarity for your clients. This section outlines how to incorporate taxes in your financial records and ensure proper calculation.

Understanding Tax Rates

Tax rates vary depending on the region, the type of service or product provided, and whether the transaction is subject to sales tax, VAT, or other forms of taxation. It’s important to identify the correct tax rate for your jurisdiction and apply it correctly to the billed amount. Here’s a general approach to handling taxes:

- Research Local Tax Laws: Ensure you know the correct tax rate for your area and industry. This could include sales tax, VAT, or other applicable taxes based on your location.

- Different Tax Rates: Depending on the type of product or service, you might need to apply different tax rates to different items within the same document.

- Exemptions: Some goods or services might be tax-exempt, so make sure to clearly distinguish these on the billing record.

How to Display Tax Rates in Your Billing Record

When adding tax to your financial record, it’s important to list the tax rate applied and show the exact amount for clarity. Here’s an example of how this information might look:

| Item Description | Amount | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

| Consulting Service | $500.00 | 10% | $50.00 | $550.00 |

| Web Design | $1,000.00 | 8% | $80.00 | $1,080.00 |

| Total | $130.00 | $1,630.00 |

In the example above, each item has its corresponding tax rate and tax amount clearly displayed, ensuring that the client understands how the total is calculated. Always verify that the tax calculations are correct before sending out the document to avoid errors and maintain professionalism.

By carefully incorporating tax rates into your financial records, you help foster trust with your clients and ensure that all legal and financial obligations are met without confusion.

Tracking Payments with Docs Templates

Managing and tracking payments is a vital aspect of running a business, ensuring that clients pay on time and that you maintain accurate financial records. When you use a structured document format for billing, it’s easy to keep track of which payments have been received and which are still outstanding. This section will explore how to incorporate payment tracking features into your billing structure, helping you stay organized and on top of your finances.

Creating a Payment Tracking System

To effectively track payments, your billing document should include a dedicated section for payment status. This section should clearly indicate whether the payment has been made, is pending, or overdue. Here’s how to structure it:

- Payment Status: Add a field to mark the payment status, such as “Paid,” “Pending,” or “Overdue.” This helps both you and your client quickly identify the status of the transaction.

- Payment Date: Include the date the payment was received. This is crucial for both tracking purposes and ensuring timely reporting for tax or accounting needs.

- Amount Paid: Always show the amount the client has paid, especially if the total differs from the original amount due. This helps to prevent confusion and ensures clarity on both sides.

Tracking Payments Over Time

If you manage multiple transactions, it’s useful to track payments across several documents. For this purpose, you can maintain a payment log or a spreadsheet with all issued documents and their payment statuses. Here’s how you can structure the log:

| Document Number | Issue Date | Amount Due | Amount Paid | Status | Payment Date |

|---|---|---|---|---|---|

| INV-001 | 01/01/2024 | $500.00 | $500.00 | Paid | 01/15/2024 |

| INV-002 | 02/01/2024 | $700.00 | $350.00 | Partial Payment | 02/10/2024 |

| INV-003 | 03/01/2024 | $800.00 | $0.00 | Pending |

By tracking payments this way, you can easily monitor your outstanding amounts, identify overdue payments, and ensure that every transaction is properly documented. This level of organization helps you maintain better control over your cash flow and reduces the risk of missed payments.

Using a structured approach to track payments not only helps with man

How to Invoice Multiple Clients in Docs

When managing multiple clients, keeping track of payments and ensuring that all transactions are properly documented can become challenging. Instead of creating separate documents for each client, it’s possible to streamline the process by efficiently managing multiple billing records within one structured format. This section explores how to handle invoicing for multiple clients in a single document, making the process more organized and less time-consuming.

Creating a Multi-Client Billing Document

One of the most effective ways to handle invoices for multiple clients is to create a single document that lists all the transactions separately. By doing this, you can easily manage different clients, their services, and payment details in one place. Here are some steps to structure such a document:

- Separate Sections for Each Client: Create distinct sections within the document for each client, including their billing information, services rendered, and amounts due.

- Individual Billing Items: For each client, list the individual services or products provided along with the corresponding costs, so that each section is clear and easy to read.

- Clear Payment Status: Ensure each client’s section has a payment status column that indicates whether the payment is pending, completed, or overdue.

Example of a Multi-Client Billing Document

The following is an example of how to structure a billing record for multiple clients in a single document:

| Client Name | Service Provided | Amount | Payment Status | Due Date |

|---|---|---|---|---|

| John Doe | Consulting Services | $500.00 | Paid | 01/15/2024 |

| Jane Smith | Web Design | $1,200.00 | Pending | 02/01/2024 |

| Acme Corp | Branding Consultation | $750.00 | Paid | 01/30/2024 |

| Beta Ltd | SEO Optimization | $650.00 | Partial Payment | 02/10/2024 |

This structure allows you to maintain an organized and clear record of transactions with multiple clients. You can easily identify who has paid, who still owes, and when the payments were due.

By consolidating all your client transactions into a single document, you save time and reduce the chances of making errors. It als

Integrating Payment Methods on Your Invoice

When creating a billing document, it’s essential to provide clear and accessible payment options for your clients. Including various payment methods not only makes it easier for your clients to pay but also ensures faster and more reliable transactions. In this section, we’ll explore how to effectively integrate different payment methods into your billing document and provide clear instructions for each option.

Choosing the Right Payment Methods

Before adding payment options to your billing document, consider the preferences of your clients and the most common payment methods for your industry. Offering multiple payment options increases the chances of getting paid promptly. Common methods to include are:

- Bank Transfer: Include your bank account details such as account number, sort code, and bank name. This method is often preferred for larger payments.

- Credit/Debit Card: Include instructions for payment via card, such as linking to a secure payment processor like PayPal or Stripe.

- Online Payment Platforms: Provide links to online payment systems such as PayPal, Venmo, or others that your business supports.

- Checks: If you accept checks, include your mailing address and specify the recipient name for the check.

Displaying Payment Methods Clearly

Once you’ve selected the appropriate payment methods, it’s crucial to display them clearly on your document. A simple, easy-to-read format can prevent confusion and ensure that your clients know exactly how to pay. Below is an example of how to integrate payment options into your billing document:

| Payment Method | Details |

|---|---|

| Bank Transfer | Account Number: 123456789 Sort Code: 01-23-45 Bank: XYZ Bank |

| Credit/Debit Card | Pay via PayPal (link) or Stripe (link) |

| Online Payment Platforms | Pay via Venmo: @YourBusiness |

| Check | Make payable to: Your Business Mail to: 123 Business St, City, Country |

By clearly listing your payment options and providing all the necessary details, you make it simple for your clients to pay you on time. Additionally, always make sure to highlight the preferred payment method or any specific instructions for payment deadlines.

Offering multiple payment methods not only makes the payment process more convenient but also demonstrates professionalism and flexibility, fostering

How to Automate Invoice Creation in Docs

Creating billing documents manually can be time-consuming, especially when dealing with multiple clients and recurring tasks. Automating the process can save valuable time and reduce the chance of errors. In this section, we’ll explore how to streamline the creation of billing documents, allowing you to generate accurate and consistent records with minimal effort.

Using Built-In Tools for Automation

Many document creation platforms offer built-in tools or add-ons to automate the process of generating billing records. These tools can help you set up templates and automate common tasks like data entry, calculation of totals, and formatting. Here are some ways to automate invoice creation:

- Formulas for Calculations: Use built-in formulas to automatically calculate totals, tax rates, discounts, and balances. This reduces the need for manual calculations and ensures accuracy.

- Predefined Fields: Set up predefined fields for recurring information such as client details, services provided, and due dates. This saves you from typing the same information repeatedly.

- Macros or Scripts: For more advanced automation, consider using macros or scripts that can generate the document and populate it with relevant details based on your input.

Integrating with Other Tools

Automating billing document creation can be even more efficient when you integrate your document platform with other business tools. By connecting your document creation process to customer management, payment tracking, and accounting software, you can automatically pull in necessary information and streamline your workflow. Here are some options:

- CRM Integration: Automatically populate client details from your Customer Relationship Management (CRM) system into the document, saving time on data entry.

- Accounting Software: Integrate with accounting platforms like QuickBooks or Xero to automatically sync financial information, such as payment history or tax rates, into your billing records.

- Payment Processors: Link your document platform with payment processors like PayPal or Stripe to automatically track payments and update the payment status in your documents.

By automating key aspects of the billing document creation process, you not only save time but also reduce the risk of errors, enhance efficiency, and improve your overall business workflow. Automation allows you to focus on other critical tasks while maintaining consistency and accuracy in your financial records.

Why Docs is Ideal for Invoices

When it comes to creating and managing billing documents, selecting the right tool is crucial for efficiency and ease of use. A platform that allows for seamless creation, sharing, and storage of financial records is essential for any business. In this section, we’ll explore why a cloud-based document platform is an ideal choice for creating and handling billing paperwork, from ease of access to customization options.

Convenience and Accessibility

One of the main reasons this platform is so well-suited for billing purposes is its accessibility. Being cloud-based means you can access and edit your documents from anywhere, on any device, without the need for additional software or complex setups. This is especially beneficial for businesses that need flexibility in managing their financial records while on the go. Here are the key advantages:

- Anytime, Anywhere Access: As long as you have an internet connection, you can access, edit, and share your billing documents from any device–whether you’re in the office or on the road.

- Real-Time Collaboration: Collaborate with team members or clients in real time, allowing multiple users to edit or review the document simultaneously.

- Easy Sharing: Once the document is ready, it can be easily shared via email, cloud storage, or even direct links, ensuring that clients receive the required information quickly.

Customizability and Formatting Options

Another reason this platform is an excellent choice for creating billing records is the variety of formatting options available. Whether you’re looking to create a simple invoice or a more detailed, customized billing document, this tool offers templates and the flexibility to design a document that fits your needs. You can:

- Use Pre-Built Layouts: Choose from pre-designed templates that are specifically tailored for billing, making the document creation process quicker and easier.

- Personalize Your Documents: Adjust fonts, colors, and logos to ensure your documents align with your brand identity.

- Add Custom Fields: Customize fields such as service descriptions, taxes, and payment terms, so your documents reflect all the necessary details specific to each client.

Security and Storage

Security is another important factor when handling billing records. With cloud-based platforms, your documents are stored securely, often with automatic backups and encryption to protect sensitive data. This ensures that your financial information is safe and accessible only to authorized individuals. In addition, cloud storage eliminates the risk of losing physical paperwork or dealing with cumbersome storage systems.

By choosing a reliable and user-friendly platform for your billing documents, you can save time, reduce errors, and create a more professional experience for your clients. The combination of convenience, customizability, and security makes this platform the perfect choice for managing billing documents efficiently and effectively.