Easy to Use Doc Invoice Template for Your Business Needs

Managing your financial transactions efficiently is essential for maintaining a professional image and ensuring timely payments. A well-organized document for requesting payments can save you time, reduce errors, and help build trust with clients. This process involves creating structured files that contain all necessary details, from the service provided to the total amount due.

With customizable formats, these documents allow businesses to maintain consistency while adapting to specific needs. Whether you’re a freelancer, a small business owner, or a larger enterprise, having a reliable and easy-to-use form is crucial. It not only simplifies the process but also enhances communication between you and your clients, ensuring transparency and clarity.

By understanding how to design and utilize such documents effectively, you can streamline your financial workflows and focus on growing your business. In the following sections, we’ll explore how to create, customize, and optimize these essential tools for successful transactions.

Doc Invoice Template Overview

In today’s fast-paced business environment, having a clear and organized way to request payments is crucial. A structured document serves as an essential tool for ensuring that all necessary details are included, making the process efficient for both the sender and the recipient. These documents not only help you keep track of transactions but also enhance your professional image.

What Makes These Documents Effective?

What sets this type of document apart is its simplicity and versatility. It allows for quick customization, ensuring that businesses can tailor the layout and content to their specific needs. Regardless of the industry, a well-crafted request for payment can make a significant difference in cash flow and client satisfaction.

- Easy customization for different industries

- Clear structure with all key details included

- Helps avoid confusion and delays in payments

Why Use a Structured Format?

Opting for a pre-designed, flexible format minimizes the time spent on creating such documents from scratch. By using a consistent structure, businesses can ensure they never miss critical information, such as payment terms or due dates. Additionally, these documents can be reused, saving valuable time on future transactions.

- Reduces the risk of errors

- Increases efficiency for repeated use

- Enhances professionalism in client communications

Why Choose a Doc Invoice Template

Opting for a pre-designed and editable format to manage payment requests brings a variety of benefits. These ready-made structures simplify the process by providing a consistent and professional layout, saving both time and effort. Rather than starting from scratch each time, businesses can rely on a format that ensures all important details are consistently included and organized.

Key Advantages of Using a Pre-designed Format

- Time Efficiency: By using a structured file, you avoid reinventing the wheel for each transaction. Simply fill in the necessary details, and you’re ready to go.

- Consistency: A standardized format ensures that every document you send out follows the same professional structure, which can enhance your business’s reputation.

- Customization: Most editable formats allow for quick adjustments to suit specific client needs or different types of services offered.

- Reduces Mistakes: By using a proven structure, the risk of omitting key details or formatting errors is minimized, ensuring a more accurate request for payment.

How It Benefits Small Businesses and Freelancers

Small businesses and freelancers often have limited resources and time, making it even more important to streamline processes. With a ready-to-use format, these entrepreneurs can focus on core tasks while maintaining a professional approach to billing. In addition, having a document that aligns with industry standards fosters trust with clients and ensures smoother financial operations.

- Affordable and Accessible: Many pre-made formats are free or low-cost, making them an economical solution for small-scale operations.

- Easy to Use: No need for advanced software or skills – basic word processing tools can be used to edit and save these documents.

Benefits of Using Doc Invoices

Utilizing a well-structured document for billing purposes brings several key advantages to businesses and individuals alike. By relying on a ready-made layout, you ensure that every payment request is clear, professional, and complete. This not only simplifies the process but also helps maintain smooth financial operations, fostering better relationships with clients and streamlining internal workflows.

Increased Professionalism

A polished, well-organized document reflects positively on your business. Using a standardized structure ensures that clients receive clear and professional communication, making it easier to understand the details of the transaction. This can significantly enhance your reputation and contribute to building trust with clients.

- Improved client trust through clear communication

- Professional design that reflects your brand

- Consistent formatting across all transactions

Efficiency and Time-Saving

With a predefined structure, you reduce the time spent creating each document from scratch. Whether you’re a freelancer or a growing business, this efficiency allows you to focus on other critical tasks, increasing productivity. These documents can also be reused for future transactions, providing a long-term solution for repetitive billing tasks.

- Faster document creation with minimal effort

- Easy to modify for new clients or projects

- Reusable format saves time on repeated billing

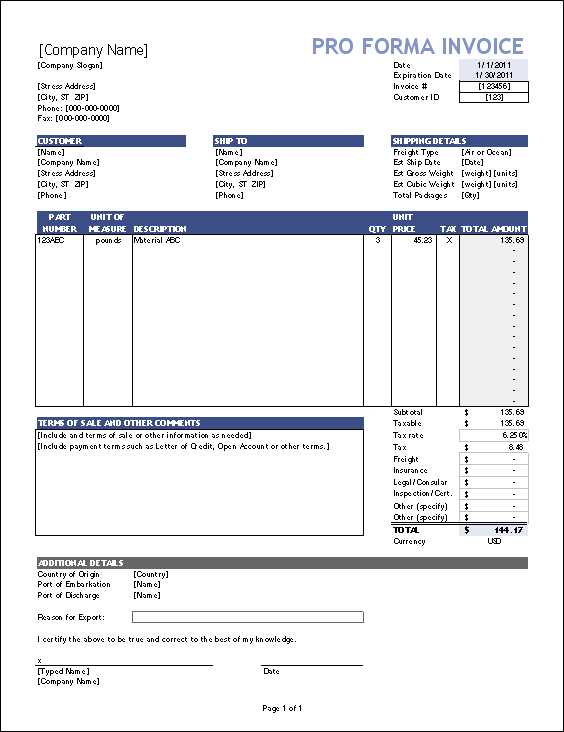

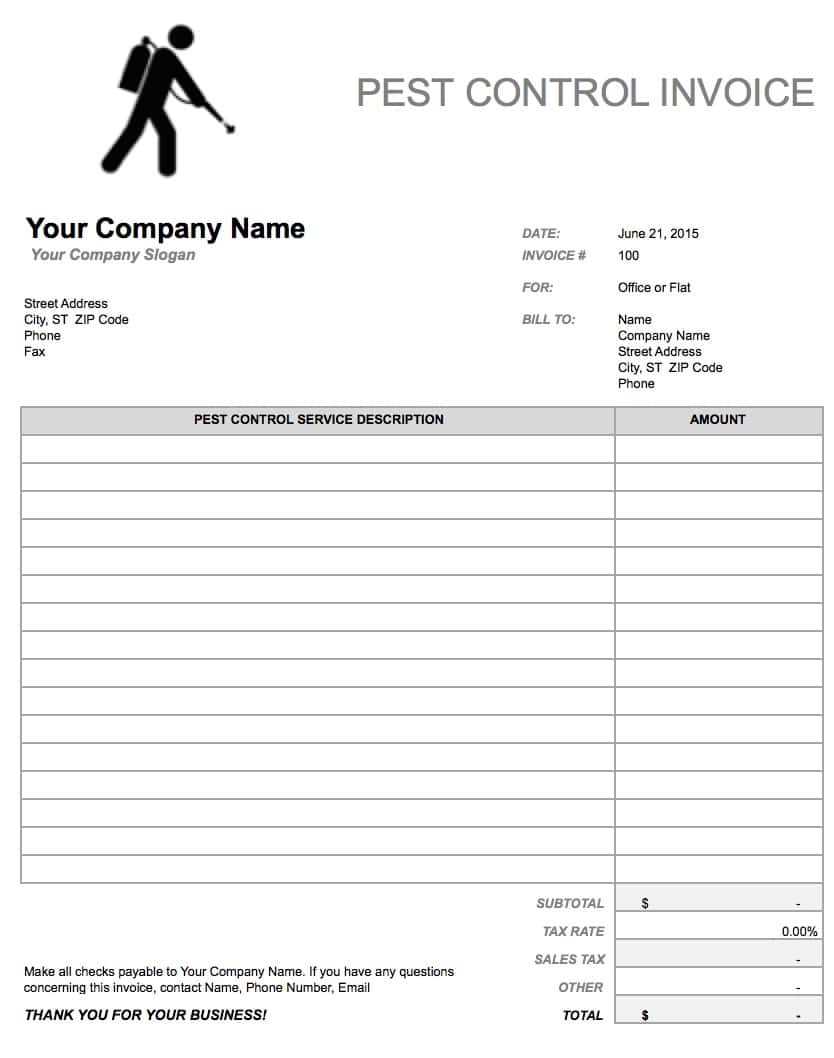

How to Customize a Doc Invoice

Personalizing a billing document to meet specific business needs is a simple yet essential step in streamlining your financial processes. Customization allows you to include vital details that reflect your branding, payment terms, and the services provided. By tailoring the layout and content, you ensure clarity and consistency in every transaction, creating a more professional experience for your clients.

Adjusting the Layout

Most editable billing documents allow for flexibility in layout design. You can modify fonts, colors, and text positioning to align with your brand’s identity. Ensuring that your business logo and contact details are prominently displayed is an important first step in personalizing the document.

- Add your business logo to enhance branding

- Choose fonts that reflect your company’s style

- Adjust the header to include necessary contact details

Modifying Payment Details and Terms

Another key aspect of customization is adjusting the financial information, such as the payment due date, amount owed, and payment methods. These sections should be clear and precise to avoid any misunderstandings. You can also include specific instructions or late fee policies, ensuring that both parties are aware of the terms from the outset.

- Update the due date and payment terms

- Specify accepted payment methods and account details

- Include additional notes like late fees or discounts

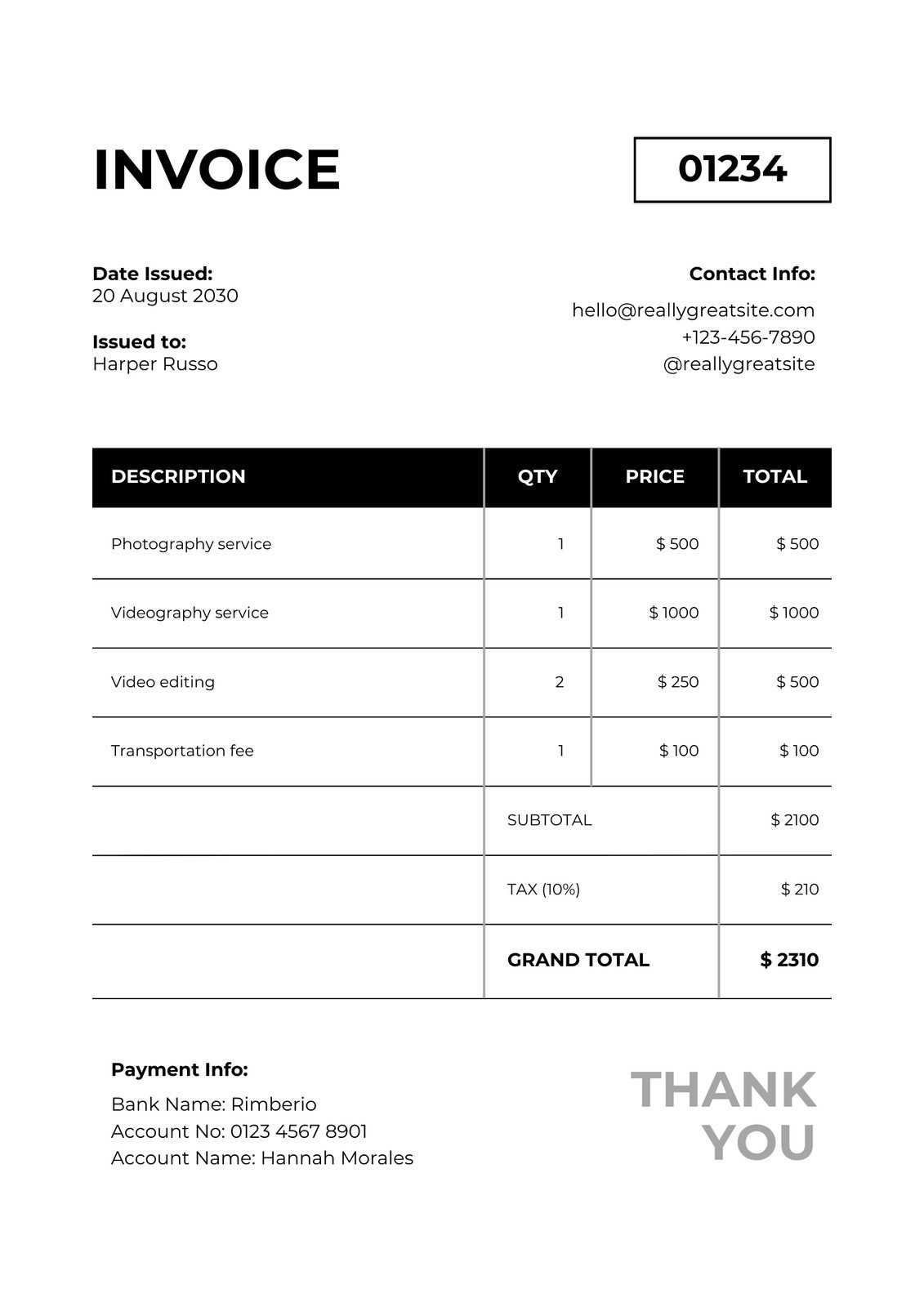

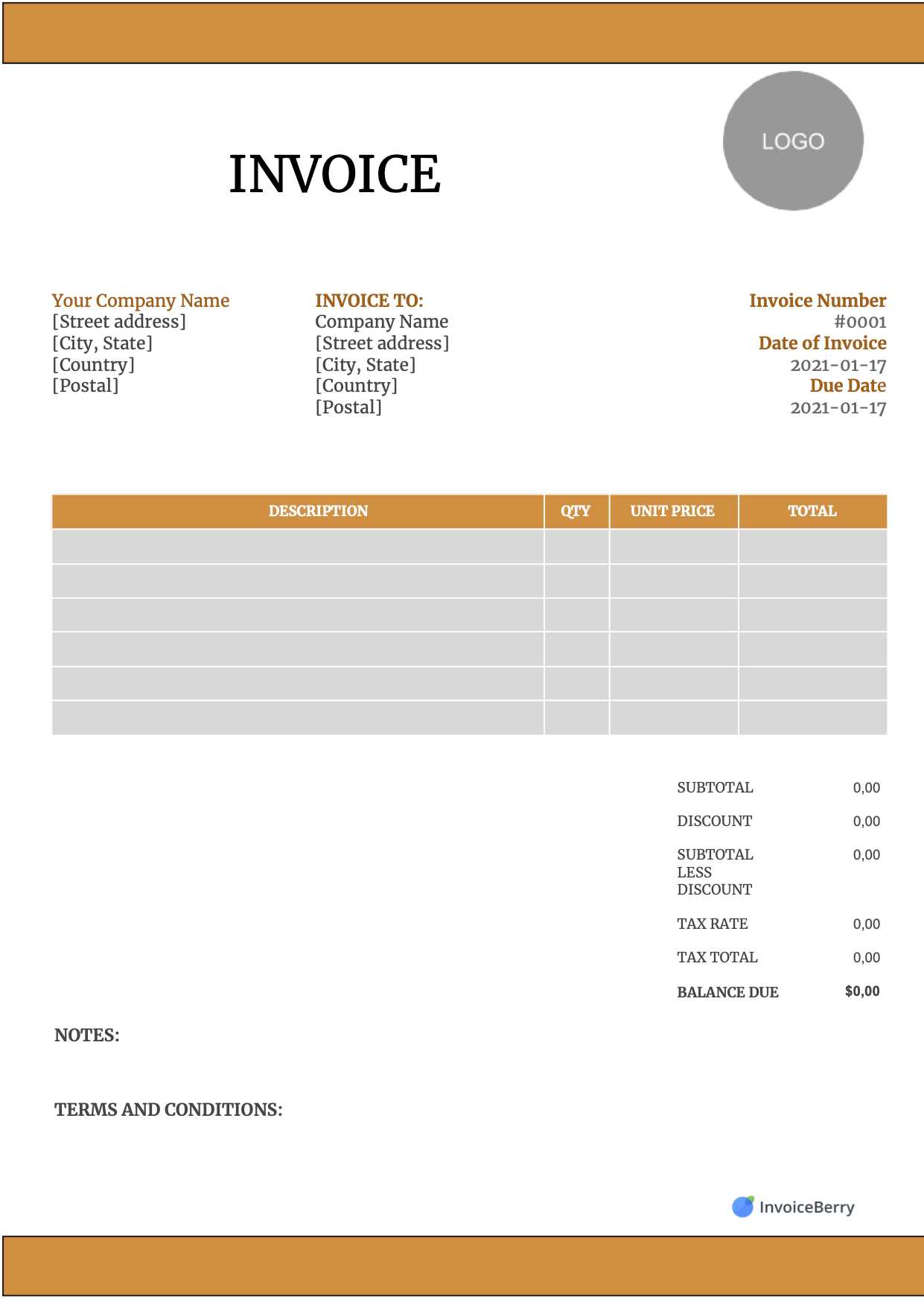

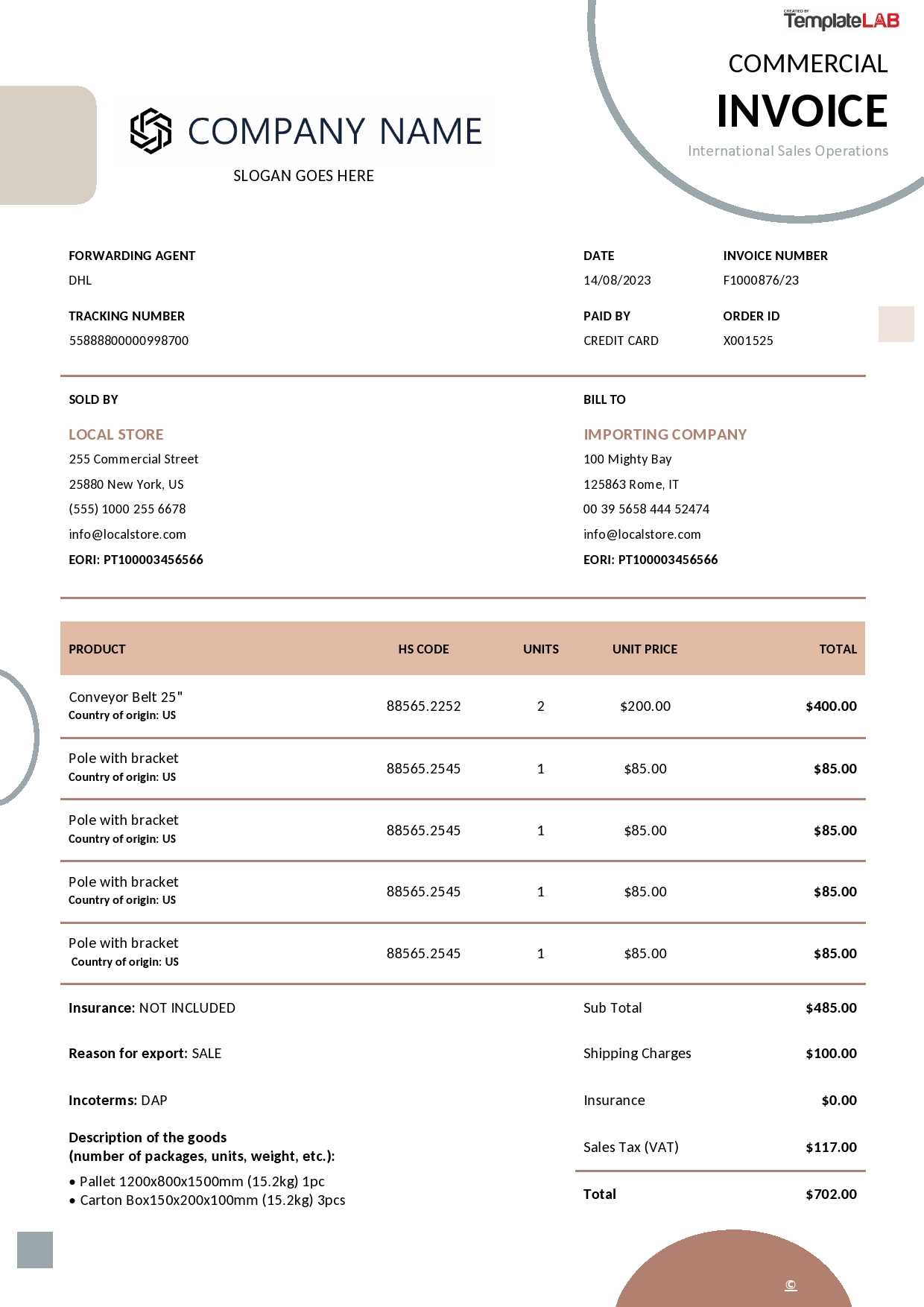

Essential Elements of an Invoice

When creating a document to request payment for goods or services, it is crucial to include all necessary information to ensure clarity and avoid confusion. A well-organized document not only helps in speeding up the payment process but also ensures that both parties are aligned on the terms of the transaction. Below are the key elements that should be present in every billing document.

| Element | Description |

|---|---|

| Business Information | Includes the name, address, phone number, and email of the business issuing the request. |

| Client Information | Details of the client, including their name, address, and contact information. |

| Unique Identifier | A unique number or code that differentiates this document from others, often referred to as a reference or ID number. |

| Transaction Date | The date when the services were provided or goods were delivered. |

| Amount Due | The total amount to be paid for the goods or services provided, including any taxes or additional charges. |

| Payment Terms | Clear terms about when the payment is due, including any late fees or early payment discounts. |

| Payment Methods | Details on how the client can make the payment, such as bank transfer, credit card, or PayPal. |

| Notes or Instructions | Any special instructions, terms, or reminders for the client, such as refund policies or service warranties. |

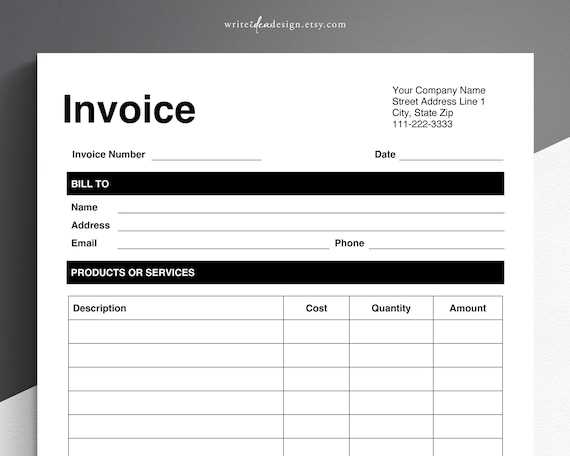

Free Doc Invoice Templates for Small Businesses

For small businesses, managing finances efficiently is crucial, and having access to ready-made billing documents can make a significant difference. Free, customizable formats allow entrepreneurs to maintain a professional appearance while keeping costs low. By using these pre-designed structures, businesses can save time and avoid errors, ensuring that all essential details are included in every transaction.

Why Free Formats Are Beneficial

Free formats offer a cost-effective solution, especially for small businesses with limited resources. These documents are easy to find and download, and most are fully customizable to suit various industries. Whether you’re invoicing clients for services or goods, these ready-to-use documents can simplify the process and keep your operations running smoothly.

| Benefit | Description |

|---|---|

| Cost-Effective | There’s no need for expensive software or professional services to create an effective billing document. |

| Time-Saving | Ready-made layouts minimize the time spent on creating documents, allowing more focus on growing the business. |

| Easy Customization | Modify the layout and content to suit your specific business needs, such as adding your logo or adjusting payment terms. |

| Professional Look | Using a standardized structure gives your billing documents a polished, professional appearance, enhancing your business image. |

Where to Find Free Formats

There are many online resources offering free, downloadable files that can be tailored for any small business. These platforms often provide different styles and designs, ensuring that you can find one that aligns with your brand’s personality and needs. Many options also include guidance on how to edit and use the documents, making it even easier to get started.

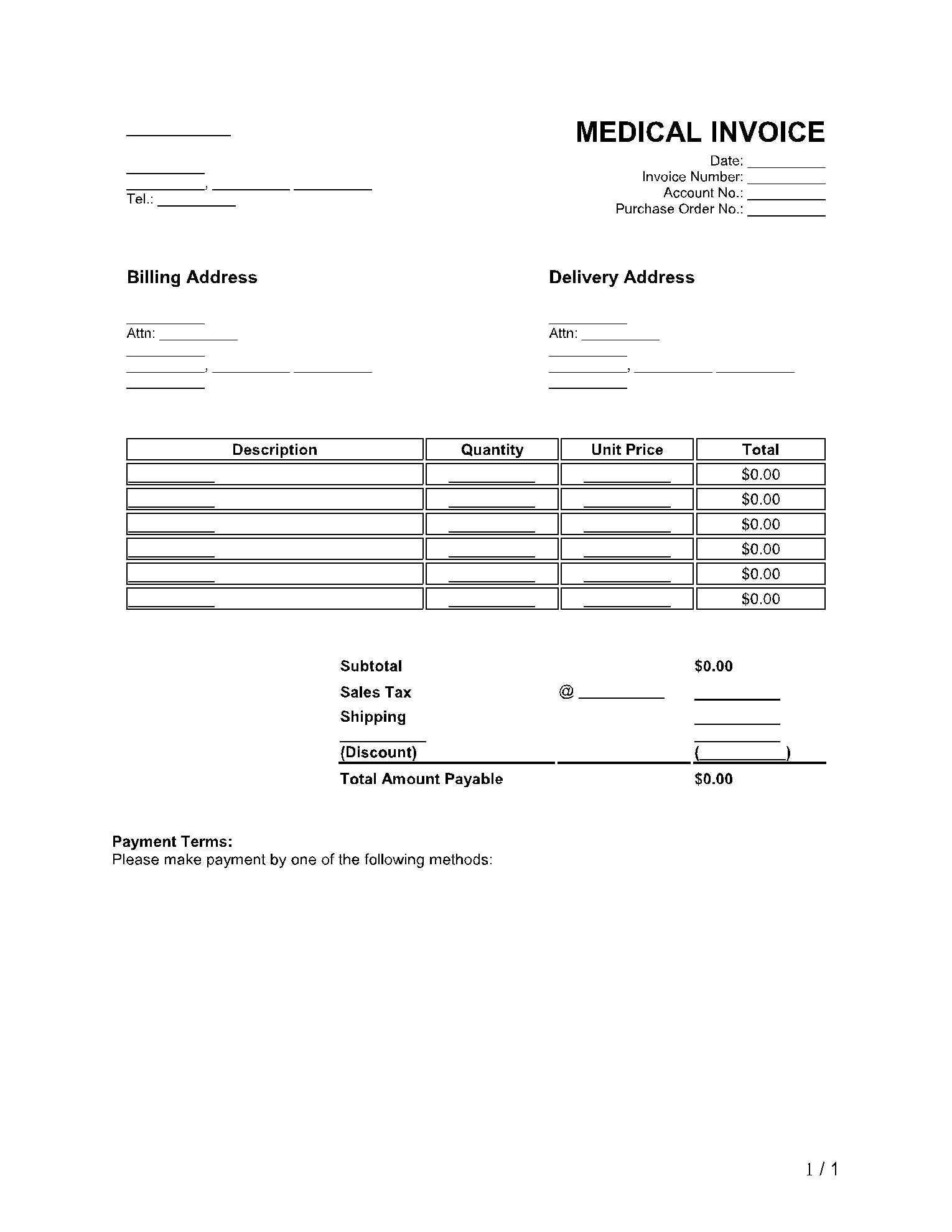

Common Mistakes When Creating Invoices

Creating a payment request document might seem straightforward, but small mistakes can lead to misunderstandings, delayed payments, and a lack of professionalism. It’s essential to be mindful of the details when preparing such documents to ensure accuracy and clarity. Below are some of the most common errors made when drafting these critical documents and how to avoid them.

1. Missing or Incorrect Contact Information

One of the most frequent mistakes is neglecting to include complete and accurate contact details. Without proper information, clients may have difficulty reaching you in case of queries or payment issues. Ensure that both your and the client’s contact information is up-to-date and clearly visible on the document.

- Solution: Always double-check that both your business and the client’s name, address, phone number, and email are correct.

2. Incorrect or Missing Payment Terms

Failure to clearly define payment terms can lead to confusion regarding due dates or late fees. It’s crucial to state when the payment is due, what methods are acceptable, and any late fee policies if applicable. Without these terms, clients may delay payments or misunderstand your expectations.

- Solution: Specify due dates, payment methods, and any additional terms such as early payment discounts or penalties for late payments.

3. Lack of Clear Descriptions

Providing vague or incomplete descriptions of products or services is another common issue. Clients should always know exactly what they are paying for. Be as specific as possible to avoid any ambiguity.

- Solution: List services or items in detail, including quantities, unit prices, and any relevant dates for services rendered or goods delivered.

4. Failing to Include a Unique Identifier

Not assigning a unique number to each document can make it harder to track transactions and payments. Without a reference number, clients might struggle to keep records, and it will be more challenging to follow up on overdue payments.

- Solution: Ensure every request for payment has a unique reference or ID number for easier tracking and better organization.

5. Incorrect Calculations

Simple math errors, like incorrect totals or tax calculations, can lead to frustration and delayed payments. Always double-check your arithmetic and ensure that any taxes or additional fees are accurately applied.

- Solution: Use an automated calculation tool or double-check all amounts to ensure that they add up correctly.

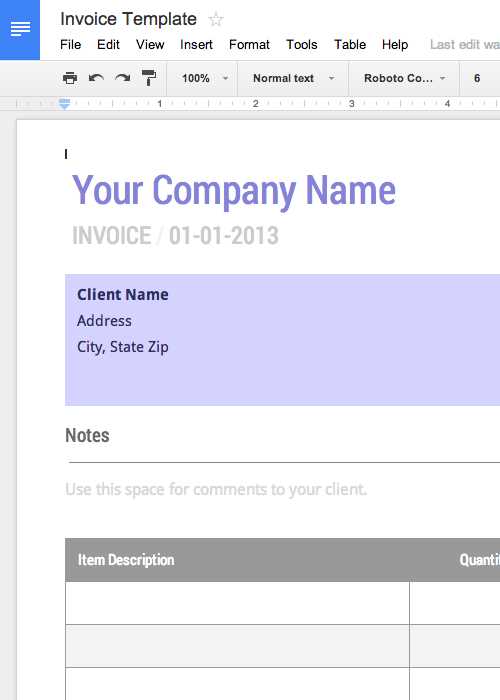

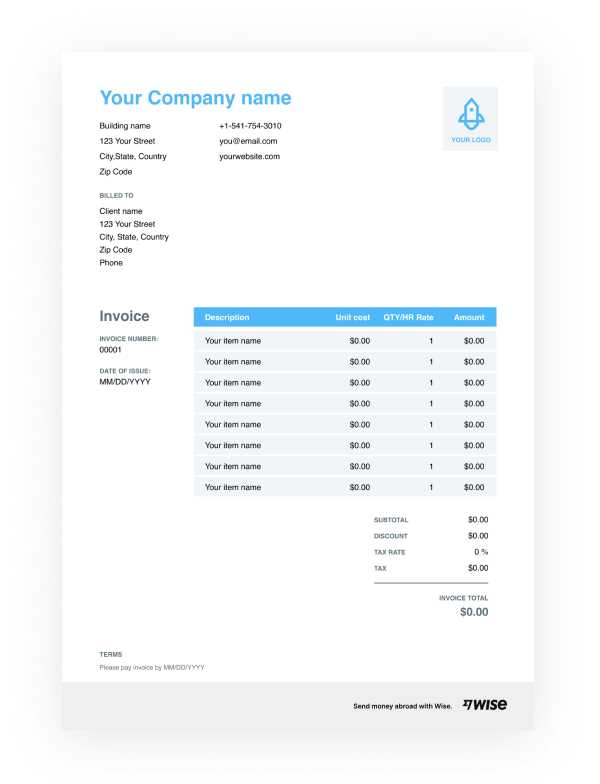

Doc Invoice Template vs PDF Format

When choosing the right format for your payment request documents, it’s important to understand the key differences between editable word-processing formats and static file formats. Both options have their unique advantages depending on your needs, whether you prioritize ease of editing or ensuring a consistent, universally readable format. Below is a comparison of the two formats, highlighting their strengths and limitations.

| Feature | Editable Format (e.g., Word, Google Docs) | Static Format (e.g., PDF) |

|---|---|---|

| Ease of Editing | Highly customizable and easy to edit, allowing for quick adjustments to content, layout, or design. | Not editable once created, ensuring that the final version cannot be easily changed, providing more security. |

| File Size | Typically larger in file size, especially if you add images or complex elements. | Usually smaller in size, making it easier to send via email or upload to websites. |

| Professional Appearance | While it can be formatted nicely, the look of the document depends on the software used and may vary across devices. | Offers a consistent, polished appearance across all devices and operating systems, maintaining the integrity of your design. |

| Compatibility | Requires the recipient to have access to word processing software (e.g., Word, Google Docs) to view and edit. | Universally compatible and can be viewed on almost any device with a PDF reader, ensuring easy access for recipients. |

| Security | Editable format may lead to accidental or unauthorized changes unless protected with specific settings. | Once created, the document is locked, providing a higher level of security and preventing unauthorized changes. |

In summary, if you need flexibility and the ability to make changes quickly, an editable format might be the best option. On the other hand, if you prioritize consistency and security, especially for finalized documents, a static file format like PDF could be a better choice. Depending on the context and your specific requirements, either format can serve you well in creating professional payment request documents.

How to Save Time with Invoice Templates

Creating payment request documents from scratch can be time-consuming, especially when you need to send multiple requests every month. However, by utilizing pre-designed and customizable formats, you can save valuable time and focus on more important aspects of your business. These ready-made structures allow for quick edits and can be reused for various clients or services, making the process much more efficient.

Streamlining the Creation Process

One of the main advantages of using a pre-structured document is the ability to quickly fill in necessary details, such as client information, services rendered, and amounts due. Instead of starting from a blank page, you can rely on a consistent format that only requires small adjustments for each new transaction. This drastically reduces the time spent on formatting and ensures that all required fields are included every time.

- Reuse for multiple clients: Once you’ve customized the structure, simply update the client and transaction details.

- Less formatting work: No need to adjust margins, fonts, or layouts every time you create a document.

- Save frequently used data: Store customer details, payment terms, and recurring charges for quick insertion into new documents.

Consistency and Accuracy

Another time-saving benefit of using a pre-designed document is that it helps maintain consistency across all your billing requests. With all the essential elements in place, you reduce the risk of missing important details. Moreover, standardized formats allow you to avoid errors that can arise from manually creating documents each time, leading to fewer corrections and follow-ups.

- Reduce errors: The structure ensures you don’t forget key elements like payment terms, contact info, or transaction IDs.

- Increase professionalism: A consistent layout enhances your business’s credibility and client trust.

- Faster reviews: Clients will appreciate receiving clear and professional documents that are easy to read and understand.