Best DJ Invoice Template for Mac Customizable and Easy to Use

For any DJ, managing finances is an essential part of running a successful business. Whether you’re a seasoned professional or just starting out, having an efficient way to handle payments and keep track of earnings is crucial. A well-designed system can save you time, reduce errors, and help maintain a smooth relationship with clients.

Creating a streamlined process for invoicing can significantly simplify your workflow. Instead of manually drafting each bill, you can use automated tools that allow you to quickly generate accurate and professional documents. These tools are designed to cater to the unique needs of DJs, taking into account everything from event details to payment schedules.

With the right tools at your disposal, you can ensure that your payments are processed quickly and professionally, allowing you to focus on what really matters – delivering an unforgettable experience for your clients. Whether you’re working with a wide range of clients or managing multiple events, having an organized and reliable system for handling financial transactions is a game changer.

Essential Features of DJ Billing Tools

When it comes to managing payments in the DJ industry, having a reliable and feature-rich tool can make all the difference. Whether you’re handling single bookings or managing multiple events, it’s important that your system can cover all necessary aspects of the transaction process. The right solution will help you stay organized, ensure accuracy, and give a professional impression to your clients.

Key Features for DJ Payment Systems

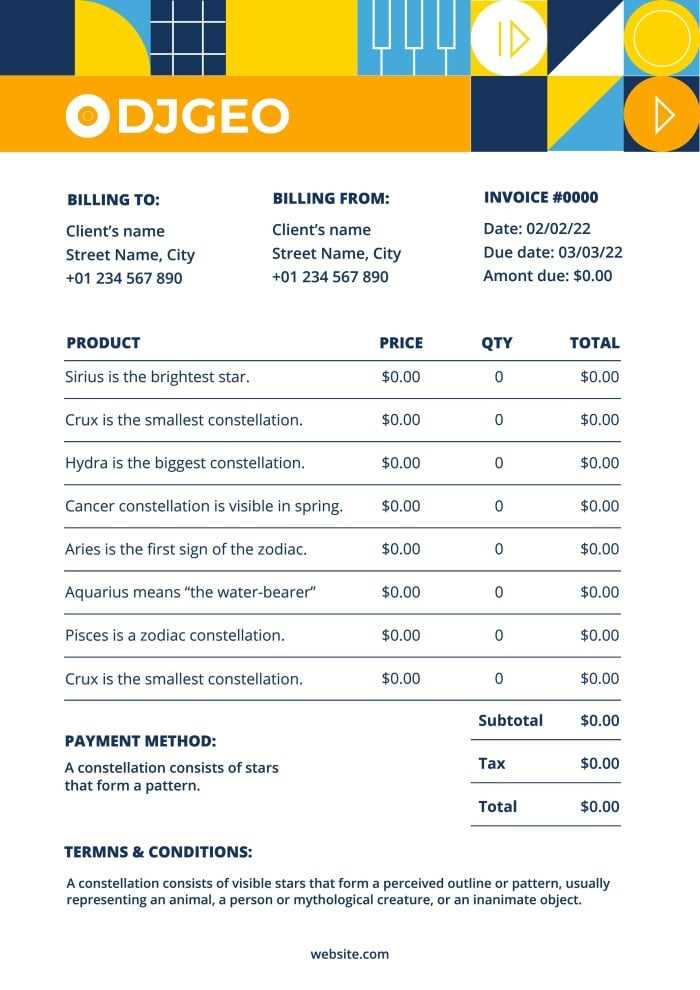

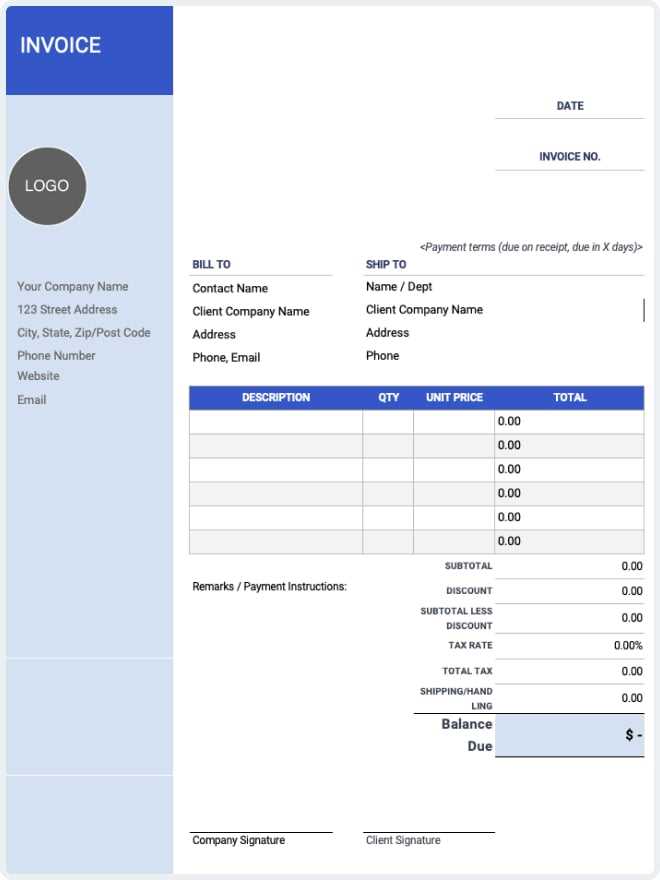

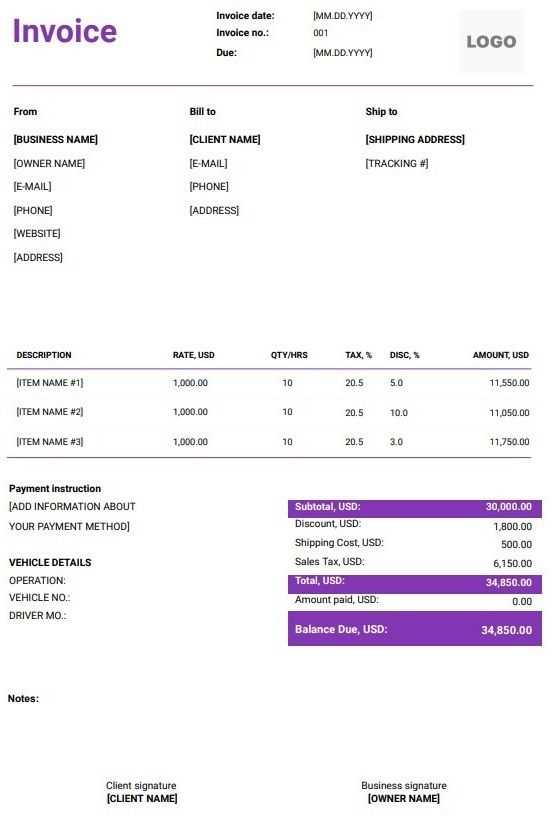

- Customizable Layouts: Personalizing your documents with unique branding and event details allows you to create a distinct, professional look for every job.

- Clear Payment Terms: Including clear terms, such as payment deadlines and late fees, helps set expectations and avoid misunderstandings.

- Itemized Services: Breaking down the services provided, such as performance time, equipment rental, and travel expenses, gives your clients a transparent view of what they are paying for.

- Tax Calculations: Automatically calculating taxes based on local rates ensures compliance and accuracy, reducing manual errors.

- Payment Tracking: Tracking whether a payment has been made, is pending, or overdue helps you keep a close eye on outstanding amounts.

- Multiple Payment Methods: Offering various options, such as credit cards, bank transfers, or PayPal, gives clients flexibility and convenience in completing their transactions.

Why These Features Matter

- Efficiency: Time-saving features like pre-filled information and automated calculations reduce the amount of time spent on administrative tasks.

- Professionalism: A well-structured and polished document enhances your reputation and ensures a smooth business relationship with clients.

- Accuracy: Ensuring that all details, from prices to payment deadlines, are correct helps avoid disputes and confusion.

These features are not only helpful but necessary for creating a seamless billing process, ultimately allowing you to focus on what you do best–performing and entertaining your clients.

Why Mac Users Prefer DJ Billing Tools

For DJs who use Apple devices, the choice of software and tools often comes down to reliability, ease of use, and seamless integration with other apps. Mac users tend to gravitate towards solutions that complement the smooth, intuitive experience the operating system offers. When it comes to managing payments and client interactions, having the right tool can greatly improve efficiency and reduce the time spent on administrative tasks.

Advantages for Apple Device Owners

- User-Friendly Interface: Apple’s operating system is known for its clean, minimalist design, which extends to apps and tools. This makes it easier for DJs to navigate and use billing solutions without feeling overwhelmed by complex features.

- Integration with Other Apple Apps: Many billing platforms on macOS seamlessly integrate with other Apple programs like Contacts, Calendar, and Mail, helping DJs manage client information and schedules all in one place.

- High-Quality Visual Design: Apple’s ecosystem prioritizes high-resolution graphics and design consistency, making it easy to create professional, polished billing documents with minimal effort.

- Security and Reliability: macOS offers robust security features that ensure sensitive client data, like payment details, remains protected. This adds an extra layer of peace of mind when managing financial transactions.

- Syncing Across Devices: For DJs who use multiple Apple devices, cloud-based billing tools allow for syncing across MacBooks, iPads, and iPhones, ensuring easy access to documents and payment updates on the go.

Why These Features Matter for DJs

- Efficiency: Streamlined processes save time, allowing DJs to focus more on their craft and less on administrative tasks.

- Professionalism: The aesthetic quality and polished feel of Apple-compatible tools create a lasting impression of professionalism with clients.

- Convenience: The ability to manage bookings, payments, and communications all within a single, cohesive system adds convenience and reduces the likelihood of errors or missed details.

For DJs using Apple devices, the combination of efficiency, design, and security makes these solutions an ideal choice, ensuring a smooth and hassle-free experience for both the DJ and their clients.

How to Create a DJ Billing Document on Mac

Creating a professional payment request for your DJ services doesn’t have to be complicated. With the right tools and a few simple steps, you can generate a polished, accurate document that reflects your work and helps you get paid on time. Whether you’re working with a one-time client or handling regular bookings, the process can be streamlined on an Apple device, making it efficient and easy to manage.

Step-by-Step Guide to Creating a Billing Document

- Choose the Right Tool: Start by selecting the appropriate software or app. You can use programs like Pages, Numbers, or dedicated billing software available on the App Store. Many options offer pre-built layouts specifically designed for service providers like DJs.

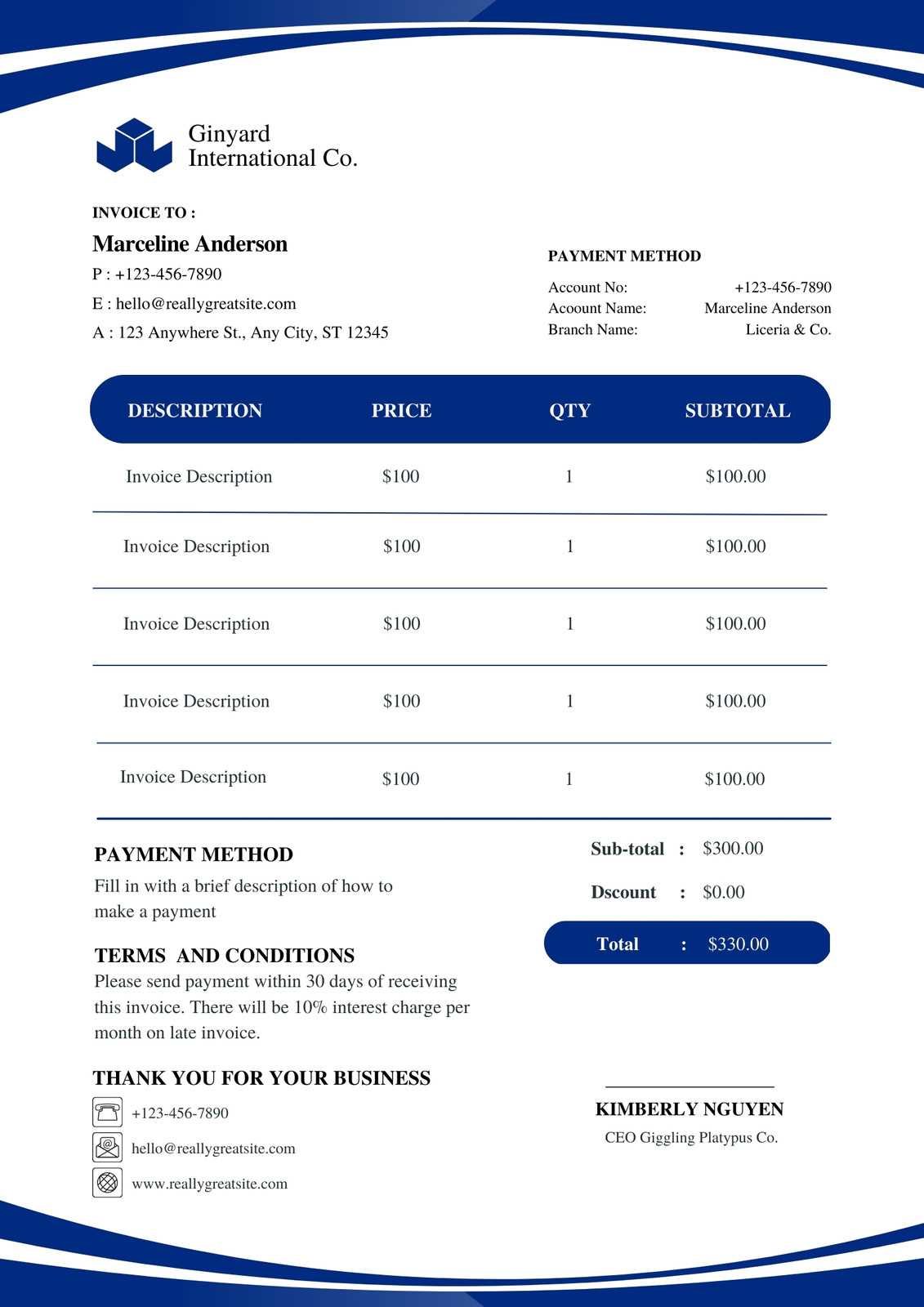

- Enter Client Information: Include the client’s name, contact information, and event details. Make sure to specify the event date, location, and any specific requirements the client requested for the performance.

- Itemize Your Services: Break down your services clearly. This may include performance time, equipment rental, travel fees, or any additional services provided, such as lighting or special requests. Listing everything ensures transparency for your client.

- Add Payment Terms: Clearly define payment expectations, including the total amount due, payment methods accepted, and any deposit or advance requirements. You may also want to include penalties for late payments if applicable.

- Calculate Taxes: Depending on your location, ensure that applicable taxes are automatically calculated or manually entered. Many billing solutions can help with this step by applying the correct tax rate based on your region.

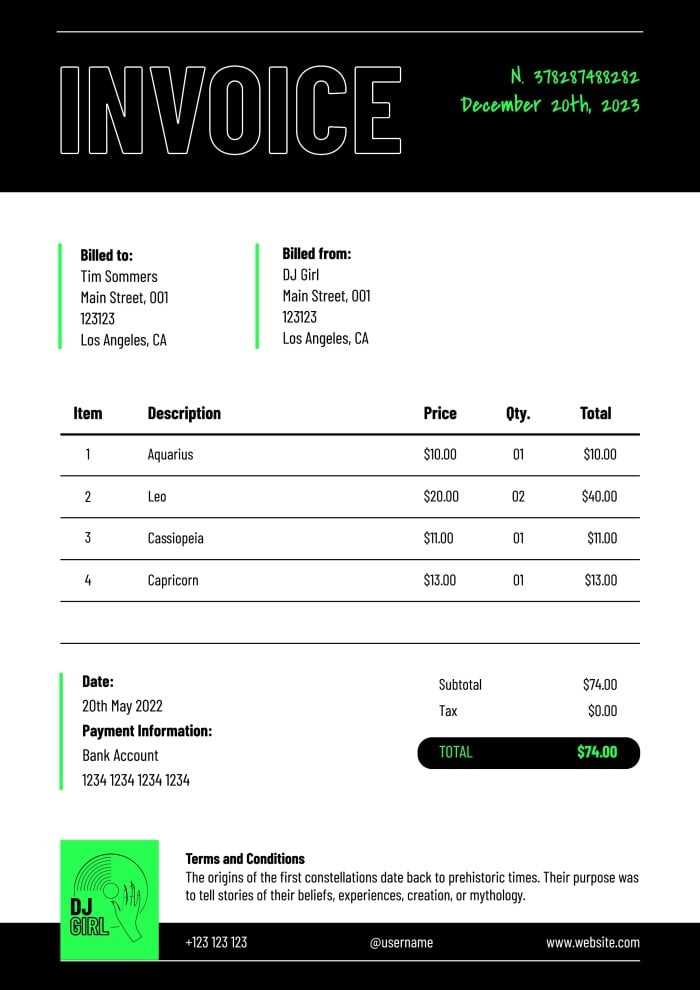

- Design Your Document: Adjust the layout to suit your style. Include your logo, adjust fonts, and choose colors that align with your brand. The more personalized your document looks, the more professional it will appear to clients.

- Save and Export: Once everything is filled out and formatted, save your document. You can export it as a PDF to ensure it is easy to send and can be opened by clients on various devices.

Tips for a Professional Look

- Consistency: Use the same fonts, colors, and logo across all your billing documents to maintain a cohesive brand identity.

- Clarity: Keep the text clear and concise. Avoid clutter and make sure all key information stands out.

- Use a Template: Even though you may create your own, using pre-built templates can save time while still allowing you to add personalized details.

Creating an organized and professional billing document on an Apple device can make the payment process smoother for both you and your clients. By following these steps, you’ll ensure that every transaction is clear, accurate, and handled with ease.

Top DJ Billing Tools for macOS

For DJs using Apple devices, selecting the right tool to handle client payments and financial transactions is essential for running a smooth business. With the variety of software and applications available, it’s important to find options that are both easy to use and feature-rich. Below are some of the top-rated options designed to meet the unique needs of DJs, from simple documents to full-fledged billing solutions.

Best Billing Solutions for DJs

These tools offer flexibility, ease of use, and customization, making them perfect for DJs who want to create professional payment requests quickly and efficiently:

| Tool | Features | Price |

|---|---|---|

| QuickBooks | Customizable documents, automated calculations, tax management, payment tracking | Monthly Subscription |

| FreshBooks | Time tracking, expense management, recurring invoices, multiple payment options | Monthly Subscription |

| Zoho Invoice | Pre-built layouts, automatic reminders, multi-currency support, invoice scheduling | Free with premium options |

| Wave | Completely free, customizable documents, tax calculations, financial reporting | Free |

| PayPal Invoicing | Easy to use, integrated payment processing, no monthly fee, customizable templates | Free (transaction fees apply) |

Why Choose These Tools?

- Customizability: These tools offer a range of customization options, allowing DJs to personalize their documents with logos, colors, and service breakdowns.

- Ease

Customizing Your DJ Billing Document

Personalizing your billing documents is an important step in creating a professional image for your DJ business. A well-designed document that reflects your unique brand can make a lasting impression on clients and help you stand out in a competitive industry. Customizing these documents allows you to add your personal touch, making the process smoother and more efficient while ensuring that all necessary details are included.

When tailoring your billing documents, there are several aspects you can adjust to match your brand and business needs:

- Branding: Incorporate your logo, business name, and color scheme to create a cohesive and professional appearance. Consistent branding helps reinforce your identity and leaves a lasting impression on clients.

- Font and Style: Choose fonts and styles that align with your brand. Simple, clean fonts are often the best choice, but you can select a typeface that fits your personal aesthetic and matches your overall look.

- Service Details: Make sure to clearly outline all the services you provided, including performance time, equipment rental, and additional offerings like lighting or special requests. Providing a breakdown ensures transparency and avoids misunderstandings.

- Payment Terms: Include clear payment terms, including due dates, accepted payment methods, and any penalties for late payments. Being upfront about your terms helps manage client expectations.

- Contact Information: Ensure that your contact details are easy to find, including phone numbers, email addresses, and website URLs. Make it easy for clients to reach you with any questions or follow-ups.

By customizing your billing documents, you can create a seamless, professional experience for your clients while ensuring all important details are clear and easy to follow. This not only helps you stay organized but also enhances the credibility and professionalism of your business.

Free DJ Billing Solutions for macOS

For DJs looking to manage their payments without spending money on expensive software, there are many free tools and resources available that offer professional-grade features. These solutions allow you to quickly generate detailed and accurate documents, all while keeping costs down. Whether you’re a freelance DJ or just starting your business, using a free billing tool can simplify your administrative tasks without compromising on quality.

Here are some of the best free options for DJs looking to create professional billing documents on their Apple devices:

- Wave Accounting: This free software offers customizable documents with built-in financial tracking, allowing you to manage your earnings, taxes, and payments all in one place.

- Zoho Invoice (Free Plan): Zoho’s free plan offers a robust set of features including automatic reminders, multi-currency support, and basic reporting, ideal for small businesses or solo DJs.

- PayPal Invoicing: While it charges transaction fees, PayPal allows you to create simple and clean billing documents for free, with the added benefit of integrated payment processing.

- Google Docs or Sheets: If you’re looking for a more hands-on approach, you can create your own custom documents using free Google apps. With a bit of design work, you can produce professional results without spending a dime.

- FreshBooks (Free Trial): FreshBooks offers a 30-day free trial that lets you explore its billing features, such as time tracking, automated payments, and customizable service details.

These free solutions are perfect for DJs who want to save money without sacrificing quality. While some may offer more advanced features in their paid versions, the free versions provide all the essential tools needed to manage billing and track payments professionally.

By utilizing these free tools, you can streamline your payment process and maintain a polished business image, all while minimizing your expenses.

Benefits of Using DJ Billing Software

For DJs, managing financial transactions can be time-consuming and complex. Using specialized software designed for billing and payment management offers numerous advantages. These tools help automate the process, reduce human error, and create professional documents that enhance client relationships. With the right software, DJs can focus more on their craft while ensuring that payments are processed smoothly and accurately.

Time and Effort Savings

One of the biggest advantages of using billing software is the significant amount of time it saves. Instead of manually creating and tracking payments, DJs can rely on automated features that handle calculations, tax rates, and payment reminders. This allows DJs to spend less time on administrative tasks and more on music production or live performances.

- Automated Calculations: The software automatically calculates the total due, including taxes and any additional fees, eliminating the need for manual math.

- Pre-built Documents: Many software options offer pre-designed templates that can be quickly customized with client details, event info, and services provided.

- Payment Reminders: Automated reminders ensure clients never forget when payments are due, helping DJs avoid delays in receiving funds.

Professionalism and Accuracy

Using billing software allows DJs to present professional, well-organized payment requests. These documents can be customized to match the DJ’s branding, including logos, colors, and fonts, ensuring that each document aligns with the business’s identity. Additionally, accurate calculations and organized records help maintain a high level of professionalism.

- Consistency: The software ensures that every document follows the same high standard, reducing the risk of errors.

- Clear Documentation: Clients will appreciate receiving clear and detailed billing documents, which help avoid confusion or disputes.

- Easy Tracking: DJs can quickly access past transactions, making it easy to track paid and outstanding amounts.

With the right billing software, DJs not only streamline their financial processes but also build stronger relationships with clients by demonstrating professionalism and reliability.

Best Tools for Editing DJ Billing Documents

For DJs looking to create and modify professional billing documents, having the right editing tools is essential. Whether you’re customizing the layout, adding detailed service descriptions, or ensuring accurate calculations, the right software can streamline the entire process. Below are some of the best tools available to help DJs efficiently create and edit billing documents on their devices, making it easy to maintain professionalism and organization in your business.

Top Editing Software for DJs

The following tools provide a range of features, from basic text editing to advanced financial tracking, making them ideal for DJs who need flexible and efficient ways to handle payments:

- Microsoft Word: While not specifically designed for billing, Word offers great flexibility for creating custom documents. With pre-made layouts and customization options, it allows DJs to create detailed and professional-looking files quickly.

- Google Docs: A free, cloud-based solution that lets you access your billing documents from any device. Google Docs offers easy editing, real-time collaboration, and a range of customizable features, making it a popular choice for freelancers.

- Pages: Apple’s word processing software is perfect for creating clean, aesthetically pleasing documents. With built-in templates and drag-and-drop functionality, Pages allows DJs to create detailed documents with minimal effort.

- Canva: Known for its design capabilities, Canva offers a variety of customizable document templates. With drag-and-drop features, you can add your branding, adjust fonts, and even include graphics, making it ideal for those who want visually stunning billing documents.

- Zoho Invoice: A dedicated billing tool, Zoho allows DJs to create and edit documents with ease. It features customizable templates, automated tax calculations, and integrates payment processing directly within the platform.

- FreshBooks: FreshBooks is an excellent solution for managing both simple and complex billing needs. It provides easy document creation, automatic calculations, and a range of invoicing features designed specifically for freelancers and small business owners.

Why These Tools Stand Out

- Customization: These tools provide extensive customization options, from fonts and colors to service breakdowns, ensuring your documents reflect your brand.

- Ease of Use: Man

How to Include Payment Terms in Billing Documents

When creating billing documents, clearly outlining the payment terms is essential to ensure that both you and your clients have a mutual understanding of the financial expectations. Payment terms define the deadlines, payment methods, and any penalties for late payments, helping to avoid misunderstandings and ensuring timely compensation for your services. Here’s how you can effectively include payment terms in your billing documents.

Key Components to Include

To make your payment terms clear and comprehensive, consider including the following elements in your document:

- Due Date: Specify the exact date by which payment should be received. This could be a fixed date or a specific number of days after the service is completed.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, PayPal, or other online platforms. This ensures clients know how to make their payments.

- Late Payment Fees: If you apply penalties for overdue payments, clearly state the terms. For example, you could charge a fixed fee or a percentage of the total for each day or week the payment is delayed.

- Deposit Requirements: If you require a deposit before services are rendered, make sure to specify the amount or percentage, and note if it is refundable or non-refundable.

- Currency: For international clients, specify the currency you expect payments to be made in to avoid confusion.

Example Payment Terms Table

Here’s an example of how you can format payment terms clearly in your document:

Payment Term Details Due Date Payment is due 14 days from the date of service completion. Accepted Methods Bank transfer, PayPal, Credit card (via Square). Late Fees A late fee of 5% will be applied for each week payment is overdue. Deposit A 30% deposit is required before event date to confirm the booking. This is non-refundable. Currency All payments should be made in USD (United States Dollar). By clearly outlining payment terms in your billing documents, you not only maintain professionalism

Managing Multiple DJ Bookings with Billing Documents

As a DJ, juggling multiple bookings can become overwhelming, especially when it comes to tracking payments, event details, and outstanding balances. To streamline the process and stay organized, it’s essential to use a structured approach for managing your financial documentation. Properly handling your bookings with well-organized payment records will help you stay on top of your finances and ensure that all clients are billed accurately and promptly.

Organizing Your Bookings

Efficiently managing multiple events starts with creating a clear system for tracking each booking and its associated payments. Here’s how you can stay organized:

- Event Tracking: Maintain a comprehensive list of all upcoming events, including client details, event dates, and payment status. Using a digital calendar or a spreadsheet can help you visualize your schedule.

- Service Breakdown: For each booking, clearly list the services provided (e.g., performance time, equipment rental, additional requests). This ensures clients understand exactly what they are being billed for.

- Payment Deadlines: Set reminders for each client’s payment due date. Having a clear schedule for when payments are expected helps reduce the risk of late payments and confusion.

- Outstanding Balances: Track the amount due for each booking and follow up with clients if payments are overdue. Use automated tools that send reminders to clients as deadlines approach.

Using Billing Software for Efficiency

Billing software and tools designed for freelancers can help you streamline your payment process and save time managing multiple bookings. These tools allow you to create, track, and manage financial documents in a more organized way, keeping all your details in one place. Some benefits include:

- Automated Reminders: Many billing tools automatically send reminders when payment is due or when a payment is late, ensuring you never miss a follow-up.

- Customizable Documents: Easily customize your documents with client details, service descriptions, and payment terms, making it simple to adjust for each booking.

- Multi-Booking Management: Some software allows you to handle multiple clients at once, making it easier to track payments and create a central hub for all your financial records.

- Easy Access and Updates: Using cloud-based software allows you to access and update your records from any device, whether you’re on the go or working from home.

By organizing your bookings with well-structured records and using billing tools, you can reduce stress, avoid mistakes, and ensu

Using DJ Billing Documents to Track Payments

Tracking payments is essential for managing your finances as a DJ, especially when dealing with multiple events and clients. A well-structured billing document serves as both a professional record and a tool for monitoring which payments have been received and which are still pending. By clearly outlining payment details and statuses, you can stay organized and avoid confusion, ensuring a smooth flow of revenue.

Tracking Payment Status

One of the key features of a billing document is its ability to track the status of payments. Here’s how you can use these documents effectively to monitor incoming payments:

- Payment Due Date: Clearly specify the payment due date in your document. This helps both you and your clients understand the timeline for when payments should be made.

- Amount Paid: When a client makes a payment, update the document with the amount received. This provides a clear record of transactions and ensures you know exactly how much has been paid at any given time.

- Remaining Balance: Include a section that shows any outstanding balance after a partial payment has been made. This allows you to quickly see what is still owed and follow up accordingly.

- Payment Method: Track the payment method (e.g., bank transfer, PayPal, cash) used by the client. This information can be helpful for bookkeeping and reconciling accounts.

Benefits of Using Billing Documents for Payment Tracking

By incorporating payment tracking features into your billing documents, you gain several benefits that enhance both organization and professionalism:

- Improved Cash Flow Management: With clear documentation of payments, it becomes easier to keep track of incoming funds, ensuring that you have a full understanding of your cash flow at all times.

- Less Confusion with Clients: Having a well-documented payment history reduces the chances of disputes with clients over whether or when payments were made.

- Easy Financial Reporting: Well-maintained payment records help you generate reports for tax purposes or business analysis. You can easily see how much you’ve earned over a specific period and where you need to follow up.

- Time-Saving: Instead of manually tracking payments through spreadsheets or other methods, a well-organized document can save you time by consolidating all the information in one place.

Using billing documents to track payments is an effective way to stay on top of your finances, ensuring timely payments and improving client relationships. It also helps you manage your overall business operations more efficiently, allowing you to focus more on the creative side of your DJ career.

How to Handle Taxes in DJ Billing Documents

As a DJ, understanding how to handle taxes in your financial documents is crucial to maintaining legal compliance and ensuring you receive the correct payments. Taxes can vary based on location, service type, and your business structure. Properly including tax information in your payment requests helps both you and your clients know the exact amount due and prevents any misunderstandings about financial obligations.

Determining the Appropriate Tax Rate

The first step in handling taxes is knowing which rate applies to your services. Tax rates can differ depending on the country, state, or even the city in which you operate. Here’s how you can ensure you’re charging the correct amount:

- Research Local Tax Laws: Look up the applicable sales or service tax rates in your area. Some regions may have different tax rates based on the type of service, such as entertainment or music performance.

- Consider Your Business Structure: If you’re a freelance DJ or a registered business, the tax rate might change based on whether you’re self-employed or operating as a company.

- Check for Tax Exemptions: Some events may qualify for tax exemptions, such as nonprofit events. Be sure to confirm whether you need to apply taxes in such cases.

Including Taxes in Your Billing Documents

Once you’ve determined the correct tax rate, the next step is to properly include this information in your financial documents. Here’s how to handle it effectively:

- Clearly State the Tax Rate: Always list the tax rate applied to the service separately in the document. This makes it clear to the client how much of the total cost is attributed to taxes.

- Break Down the Amount: Show a clear breakdown of the service cost and the tax amount to ensure transparency. This will help avoid confusion and make the payment process smoother.

- Include Tax Identification Numbers: Some regions require businesses to display their tax identification number (TIN) or other related info. Including this in your documents can help your clients verify your legitimacy.

- Keep Records for Tax Filing: Always keep copies of your tax-inclusive documents for your own records, especially when filing taxes. This will help you track how much tax you’ve collected and ensure you’re compliant with local regulations.

Handling taxes properly in your billing documents ensures you stay compliant with legal requirements and keeps your business organized. By being transparent and accurate with tax calculations, you also build trust with your clients, making your services appear more professional and reliable.

Common Mistakes in DJ Billing

When managing payments and financial documentation, it’s easy to make mistakes that can lead to confusion or delayed payments. Even experienced DJs can sometimes overlook key details when preparing their payment records, which can affect their business operations. Identifying and avoiding common errors in billing will help you maintain professionalism, build client trust, and ensure you’re compensated accurately for your services.

Common Billing Errors to Avoid

Here are some of the most frequent mistakes DJs make when handling payment records:

- Missing Client Information: Failing to include important client details, such as names, addresses, and contact information, can lead to confusion and prevent you from properly following up on payments.

- Incorrect Payment Amounts: Whether it’s forgetting to apply a discount or miscalculating service fees, incorrect amounts can result in disputes and delayed payments. Double-check all figures before sending out a document.

- Not Including Payment Deadlines: A key element of any billing record is specifying when the payment is due. Without a clear due date, clients may procrastinate, which can lead to late payments or misunderstandings.

- Failure to Track Deposits: If you require a deposit before an event, failing to track the amount paid upfront and the remaining balance can create confusion when it’s time to settle the full amount.

- Omitting Taxes: If applicable, not including the correct tax rate or failing to break down the tax amount can make your records look unprofessional and may lead to legal issues if you’re not compliant with local tax laws.

- Not Providing Clear Descriptions of Services: When clients receive a bill, they need to understand exactly what they’re paying for. Vague descriptions of services can cause clients to question charges, leading to delays in payment.

Tips for Avoiding These Mistakes

To minimize errors and ensure that your billing records are clear and professional, consider these tips:

- Double-Check Your Details: Always review your billing documents before sending them to clients. Ensure that all figures, dates, and service descriptions are accurate.

- Use Billing Software: Consider using billing software to automate calculations, add required details, and track payments. This reduces human error and keeps everything organized in one place.

- Set Clear Payment Terms:

Time-Saving Tips for DJ Billing

Managing payment records and financial documents can be time-consuming, especially for busy DJs juggling multiple events. However, with the right tools and practices, you can significantly reduce the time spent on paperwork and focus more on what you love–performing. Below are some practical tips to help you streamline your billing process and save valuable time.

Utilize Automation and Templates

One of the most efficient ways to speed up the billing process is by automating repetitive tasks and using pre-made documents. Here are some time-saving strategies:

- Pre-built Payment Documents: Using a pre-designed document can save you the effort of starting from scratch each time. Customize the document once with your business details, and then simply update the client information and service specifics.

- Automated Calculations: Using software that automatically calculates totals, taxes, and discounts can save you from manually entering numbers. This ensures accuracy and eliminates the time spent doing math.

- Recurring Clients: For clients you work with regularly, store their information and services in your system to quickly generate future documents with minimal adjustments.

Organize and Streamline Your Workflow

An organized approach can drastically reduce the time you spend managing your financial records. Here’s how you can streamline your process:

- Cloud Storage: Store all your financial documents in a cloud-based system. This allows you to access and update your records from anywhere, reducing time spent searching for files or manually syncing documents across devices.

- Track Payments in Real-Time: Use digital tools that automatically track and update payment statuses. This way, you can instantly see which clients have paid, which are pending, and avoid unnecessary follow-ups.

- Batch Processing: Instead of sending individual documents to clients one by one, consider grouping similar tasks together. For example, prepare and send all your payment requests for the week in one go, or update multiple clients’ records at once.

By implementing these strategies, you can significantly reduce the amount of time spent on managing financial documentation. Automation, efficient organization, and streamlined workflows allow you to focus on growing your business and improving your craft, while ensuring your clients receive prompt and professional billing records.

Best Practices for Professional DJ Billing

As a DJ, presenting a polished, professional image is essential for building trust and establishing credibility with clients. This includes ensuring that your financial documents are clear, accurate, and reflect the quality of your services. Following a few best practices can help you maintain a high standard and avoid misunderstandings, making it easier for you to get paid on time and keep a strong relationship with your clients.

Key Practices for Clear and Professional Billing

Here are some essential tips to follow when preparing your billing documents to ensure they meet professional standards:

- Provide Clear Service Descriptions: Clearly outline the services provided, including the type of event, hours worked, and any additional services such as sound equipment rental or travel fees. This helps clients understand exactly what they are paying for.

- Include All Necessary Information: Always ensure that your document includes the client’s full name or company name, contact information, payment due date, and any agreed-upon terms. Having all relevant details reduces the chances of confusion.

- Be Transparent About Rates: Make sure your pricing is clearly outlined, including hourly rates or flat fees, and any additional charges. Transparency ensures that clients know what to expect and helps avoid any disputes over costs.

- Professional Branding: Incorporating your logo, business name, and contact information at the top of the document helps reinforce your brand identity and adds a professional touch to the document.

- Include Payment Instructions: Specify the acceptable payment methods (e.g., bank transfer, PayPal, cash) and include any relevant details such as account numbers or payment links. This ensures clients know how to complete the payment smoothly.

- Set Clear Payment Terms: Clearly state the payment due date and any late fees for overdue balances. This provides both you and the client with a mutual understanding of expectations and timelines.

Maintaining Accuracy and Timeliness

Accuracy and punctuality are vital for maintaining a professional reputation. Here’s how you can keep your financial documents error-free and timely:

- Double-Check All Information: Before sending out any billing documents, carefully review them to ensure all details are correct, including dates, payment amounts, and client information. Small errors can lead to confusion or delays in payment.

- Send Documents Promptly: Send your payment requests as soon as possible after the event or service is completed. Timely documentation helps you get paid faster and signals professionalism to your clients.

- Track Payment Status: Keep track of payment statuses, including amounts paid and any outstanding balances. This will help you stay on top of your finances and follow up when necessary.

By following these best practices, you can ensure that your billing process reflects the professionalism

Integrating Payment Gateways with DJ Billing Documents

For modern DJs, offering a seamless and efficient payment experience is essential. Integrating payment gateways into your financial documents allows your clients to pay quickly and securely online, reducing delays and increasing your cash flow. This process simplifies payment collection, making it easier for both you and your clients to complete transactions smoothly. By offering multiple payment options directly within your billing records, you enhance your professionalism and streamline the payment process.

Benefits of Integrating Payment Gateways

Integrating payment gateways with your payment documents offers several key advantages:

- Convenience for Clients: Clients can pay instantly using their preferred payment method, such as credit/debit cards, PayPal, or even mobile payments, without needing to leave your document or email.

- Faster Payments: Online payments are processed quickly, allowing you to receive funds almost immediately. This reduces delays and helps improve your overall cash flow.

- Automation and Accuracy: Payment integration reduces the chance of manual errors. Payments are automatically recorded and tracked, allowing for easy reconciliation and ensuring that the correct amount is received.

- Improved Professionalism: Offering an easy and secure payment option directly in your financial documents adds an extra layer of professionalism and convenience, making it more likely that clients will pay promptly.

How to Integrate Payment Gateways

Integrating a payment gateway into your billing process is easier than it sounds. Here’s how you can get started:

- Choose a Payment Gateway: Select a payment processor that suits your needs, such as PayPal, Stripe, or Square. Consider transaction fees, ease of use, and customer support when making your choice.

- Set Up an Account: Sign up for a business account with your chosen payment gateway. This will allow you to generate secure payment links or buttons for your documents.

- Link to Your Billing Documents: Most payment gateways allow you to create customized payment links or buttons that you can easily insert into your payment records. This could be a “Pay Now” button or a direct link to your online payment page.

- Test the Integration: Before sending out any billing documents, test the payment link or button to ensure it works correctly and redirects to the proper payment platform.

By adding payment gateways to your financial documents, you create a streamlined and professional experience for your clients, leading to faster payments and improved financial management. The integration of these tools can significantly enhance your workflow, allowing you to focus more on your DJ career while handling payments with ease.

Why Accurate DJ Billing Records Are Crucial

For DJs, maintaining accurate and well-organized financial documentation is not just about getting paid–it’s about creating a professional image, building trust with clients, and ensuring that your business runs smoothly. Every event you work requires clear records that outline services, costs, and payment terms. Whether you’re a part-time DJ or a full-time performer, accuracy in your financial documents is essential for long-term success.

Key Reasons Why Accuracy Matters

Here are several reasons why precise and error-free billing records are critical for your DJ business:

- Building Client Trust: Clear and accurate billing demonstrates professionalism, helping to build trust with clients. When clients see that you have everything documented properly, they feel more confident in their decision to hire you.

- Ensuring Timely Payments: Mistakes in your financial records can lead to confusion about what’s owed, potentially delaying payments. Accurate billing ensures clients know exactly what they’re paying for and when the payment is due.

- Avoiding Legal Issues: Inaccurate records can lead to disputes, which may escalate to legal issues if not addressed. By ensuring your records are correct, you protect yourself from potential conflicts and maintain a solid reputation.

- Tax Compliance: Accurate financial documents are crucial for tax purposes. Keeping detailed records of your earnings and expenses will help you file taxes properly, avoiding potential fines or audits from tax authorities.

- Tracking Your Earnings: Accurate billing allows you to monitor your income, track trends, and identify profitable events. This data is invaluable when planning future projects or making adjustments to your pricing structure.

How to Ensure Accuracy in Your Billing Records

To ensure your financial documents are always accurate, consider the following tips:

- Double-Check All Details: Always review your billing records before sending them to clients. Ensure all service descriptions, payment amounts, dates, and client information are correct.

- Use Professional Tools: Use billing software or tools that automate calculations and track payment statuses. This reduces human error and helps keep everything organized.

- Keep Detailed Records: Maintain detailed logs of your services, including hours worked, additional costs, and any deposits received. This helps ensure nothing is overlooked and simplifies future reference.

- Set Clear Payment Terms: Clearly outline your payment terms, such as due dates, late fees, and accepted payment methods. This eliminates confusion and sets expectations upfront.

In conclusion, maintaining accurate billing records is not just a matter of getting paid; it’s a key factor in managing your business successfully. By ensuring your documents are error-free, you create a stro