How to Use a Disbursement Invoice Template for Accurate Payment Management

Efficiently managing payments and keeping accurate financial records is crucial for any business. Whether you’re handling client reimbursements, contractor fees, or any other form of distribution, having a standardized document to track these transactions can save time and reduce errors. By utilizing a structured form, you can ensure clarity, consistency, and compliance across all your payment processes.

Creating a formal record for each distribution not only improves transparency but also helps in organizing your finances. With a well-designed form, you can easily document essential details such as amounts, dates, recipient information, and payment methods. This approach minimizes the risk of confusion and ensures that all parties involved are on the same page.

Customized solutions are available to fit the specific needs of your business, whether you’re a freelancer, a small business owner, or a large enterprise. Implementing such a system can lead to faster processing times and a more efficient workflow, ultimately enhancing the overall financial management of your organization.

Understanding Disbursement Invoices

When managing business payments, it’s essential to have a formalized method of documenting every transaction. This allows both the payer and the recipient to have a clear record of the distribution, ensuring that all details are accurately captured. A proper document for each payment helps businesses track financial outflows, verify correct amounts, and maintain accountability across all parties involved.

At its core, such a document serves as an official record, summarizing key details such as the total amount, the date of transaction, the recipient’s information, and the purpose of the payment. This clarity helps to avoid confusion or disputes over amounts or services rendered. Furthermore, it becomes an important part of financial recordkeeping for both tax and audit purposes.

Efficient management of such documentation can save businesses time and resources, reducing the risk of errors or missed payments. By adopting a standardized process, companies can streamline their payment workflows and ensure consistency, even when dealing with multiple payments or a high volume of transactions.

What is a Disbursement Invoice Template?

In the world of business finance, maintaining an organized approach to tracking payments is essential. A structured document designed for recording financial distributions simplifies this process by providing a standardized format that businesses can follow each time a transaction occurs. This document serves as an official record, capturing key details of each payment made, ensuring consistency and reducing the potential for errors.

At its core, such a tool is a pre-designed form that helps streamline the creation of payment records. It includes all necessary fields to document the amount, recipient, payment method, and other relevant transaction details. By using this form, businesses can quickly and accurately create records for each transaction, ensuring that no essential information is overlooked.

Adopting this method saves time and increases accuracy, making it easier to track financial outflows, manage multiple payments, and comply with legal or regulatory requirements. With a well-organized structure, the process becomes more efficient, especially for businesses dealing with frequent or complex transactions.

Why You Need a Disbursement Invoice Template

Having a standardized method for recording financial transactions is essential for any business. Without a clear and consistent approach, tracking payments can become cumbersome and prone to errors. A ready-made form designed specifically for documenting payments ensures that every detail is captured accurately, minimizing confusion and preventing costly mistakes.

By using a pre-structured document, you simplify the process of creating accurate records for each transaction. This allows businesses to quickly generate and manage payment details, reducing administrative workload. Additionally, it helps ensure that important information, such as payment amounts, dates, and recipient details, is always included.

Efficiency and accuracy are two of the most significant advantages. With a set format in place, businesses can process payments faster, stay organized, and avoid discrepancies. Furthermore, having well-documented records is crucial for tax compliance, audits, and maintaining transparent financial practices.

Benefits of Using a Template for Disbursements

Using a standardized form for tracking and documenting payments offers numerous advantages for businesses of all sizes. By having a consistent structure in place, you ensure that every transaction is recorded clearly and accurately. This streamlined approach can greatly improve efficiency, reduce errors, and help maintain a well-organized financial system.

Improved Efficiency and Time Savings

One of the key benefits of using a structured document is the time it saves. Instead of manually creating a record from scratch for each payment, you can quickly fill out predefined fields, allowing you to process transactions more swiftly. This can be especially valuable for businesses that handle a high volume of payments, as it minimizes the administrative burden.

Enhanced Accuracy and Compliance

Another significant advantage is the accuracy it brings to financial tracking. With all required fields clearly outlined, you reduce the likelihood of missing important information or making clerical errors. This level of consistency also aids in compliance with legal and tax requirements, ensuring that your records are complete and ready for audits when needed.

Increased organization is an additional benefit that comes with adopting this approach. By using a consistent format, you can easily compare and reference past transactions, making it simpler to manage accounts and maintain transparency in your financial records.

How to Create a Disbursement Invoice

Creating a formal document to record payments and transactions involves several key steps to ensure accuracy and completeness. A well-structured form should include all the necessary details to avoid confusion and to maintain clear financial records. By following a simple process, you can easily generate this document each time a transaction occurs, streamlining your workflow and ensuring consistency across all payments.

Start by gathering all relevant information, such as the recipient’s name, the amount being paid, the date of the transaction, and the purpose of the payment. This information is crucial for creating a clear and accurate record. Once you have the data, input it into the predefined fields of your form. Make sure to include payment methods, any applicable references, and ensure that everything is legible and correctly formatted.

After filling out the necessary fields, review the document to confirm the accuracy of the information. It’s essential to check for any missing details, such as the correct payment amount or recipient’s contact details. Finally, save and store the document in a secure place for future reference, whether digitally or in physical form, to ensure easy access and retrieval when needed.

Key Elements of a Disbursement Invoice

When creating a formal document for recording financial transactions, it’s essential to include specific details to ensure clarity and accuracy. A well-designed record captures all necessary information to prevent misunderstandings and keep track of payments efficiently. Each element plays a crucial role in maintaining an organized and transparent financial process.

The first critical element is the transaction date, which marks the day the payment is made. This helps to establish a timeline for financial records and allows easy reference for future documentation. Next, the payment amount must be clearly stated, along with the currency used if applicable, ensuring there’s no ambiguity about the funds being transferred.

Another important section includes the recipient’s details, such as their full name or business name, along with their contact information. This ensures that the payment is correctly attributed and makes it easier to track who received the funds. Additionally, the payment method (e.g., bank transfer, check, cash) should be indicated to provide a complete record of how the transaction occurred.

Finally, a description of the purpose or the service being paid for is necessary. This provides context for the transaction and can help resolve any potential future questions about the payment. By including all of these elements, you can create a comprehensive document that facilitates smooth financial management and ensures accuracy in tracking expenses.

Common Mistakes to Avoid in Disbursement Invoices

When creating formal records to track financial transactions, certain mistakes can lead to confusion, errors, or even legal complications. By being aware of these common pitfalls, you can ensure that your documents are accurate, professional, and reliable. Below are some of the most frequent mistakes businesses make when documenting payments.

- Missing Key Details: Omitting important information, such as the transaction date, recipient’s name, or payment amount, can lead to disputes or incomplete records. Always double-check that all required fields are filled out correctly.

- Incorrect Payment Amount: One of the most common errors is entering the wrong payment amount. This can result in confusion for both parties and can complicate future reconciliations. Always verify the sum before finalizing the document.

- Failure to Specify Payment Method: Not including how the payment was made (e.g., bank transfer, credit card, check) is a frequent oversight. This detail helps provide clarity and prevents misunderstandings about the transaction.

- Not Describing the Purpose: Failing to include a description of the payment’s purpose or associated service can make the record unclear. Providing context helps both parties understand the reason for the transaction.

- Inconsistent Formatting: If the document format is inconsistent, it can create confusion or look unprofessional. Use a consistent layout to ensure the document is easy to read and follow.

- Neglecting to Save or Store Records: After completing a record, not properly saving or organizing it can lead to lost information. Ensure all documents are stored securely and accessible for future reference.

Avoiding these common mistakes will help maintain a streamlined, professional approach to financial documentation. By paying attention to detail and following best practices, businesses can ensure smooth operations and accurate records for all their financial transactions.

Customizing Your Disbursement Invoice Template

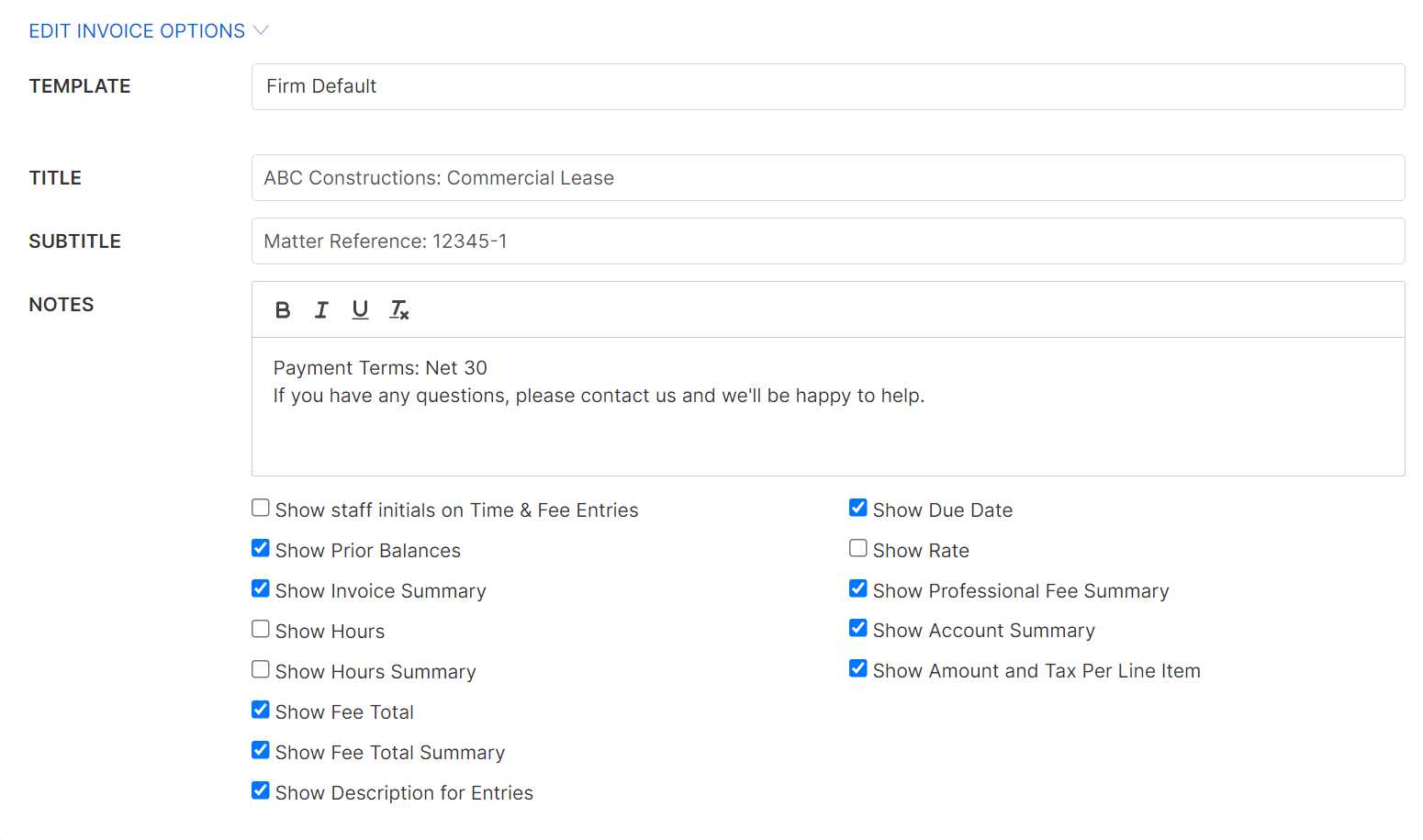

Personalizing your payment records is an essential step in ensuring that they meet your business’s specific needs and branding. Customizing the layout, fields, and design of the form can improve its usability, make it look professional, and help you stay organized. By tailoring your documentation to reflect your company’s unique processes, you can streamline your workflow and enhance efficiency.

Key Areas for Customization

There are several areas where customization can improve both the appearance and functionality of your forms. These include:

| Element | Customization Tips |

|---|---|

| Header Section | Include your business logo, company name, and contact information for a more personalized look. |

| Recipient Details | Customize the fields to capture additional information, such as tax ID numbers or specific project references. |

| Payment Terms | Adjust the payment terms section to reflect your standard agreements, such as net payment terms or discounts for early payments. |

| Description Section | Include a detailed description area to clarify the reason for each transaction or link it to a specific contract or project. |

Design and Layout Adjustments

Along with functional customizations, adjusting the design of your document can make it easier to read and more aligned with your brand. Ensure that the layout is clean and organized, with clearly separated sections. Using colors that match your branding or fonts that are easy to read can also make the document appear more professional and visually appealing.

By taking the time to adjust these elements, you create a more tailored, efficient system for managing payments, improving both the functionality and presentation of your financial records.

Disbursement Invoice vs Regular Invoice

Though both documents serve the purpose of recording financial transactions, there are key differences between those used for tracking outgoing payments and the more common ones used for billing customers. Understanding these distinctions can help businesses choose the right approach depending on the nature of the transaction and ensure proper documentation in each case.

Key Differences in Purpose

The primary difference between these two types of records lies in their purpose. A standard billing document is typically issued by a seller to request payment from a customer for goods or services rendered. It outlines the amount owed, payment terms, and any relevant details about the purchase.

In contrast, a record for tracking financial distributions is used to document payments made by a business to a third party. This could be a contractor, vendor, or employee, often in the form of reimbursements or payments for services. Unlike a regular billing statement, the focus is on confirming that funds have been properly disbursed rather than requesting payment.

Content and Structure

Another key difference is the content and structure of the documents. While both records typically include details like amounts, dates, and parties involved, a standard billing record will often contain a description of the products or services being sold, along with itemized pricing. On the other hand, a document used for tracking outgoing payments will focus more on the transaction details, such as the recipient’s name, the method of payment, and the purpose of the payment.

Understanding these distinctions can help businesses ensure that they use the right form for the right situation, improving financial recordkeeping and streamlining payment processes.

Best Practices for Disbursement Invoices

When creating formal documents to track outgoing payments, following best practices ensures accuracy, professionalism, and consistency in your financial records. Properly handling these documents helps streamline business operations, improve transparency, and reduce the risk of errors. Below are some key guidelines to follow when managing payment records.

Essential Guidelines for Effective Payment Records

- Always Include Clear Payment Details: Make sure each record clearly lists the transaction amount, recipient’s information, and the payment method used. This ensures no ambiguity in your records.

- Document the Purpose of the Payment: Always provide a brief but clear description of what the payment is for. This can help in cases of future reference or audits.

- Use Consistent Formatting: Stick to a consistent layout for all documents to ensure that they are easily readable and professional. This consistency also helps prevent errors.

- Double-Check for Accuracy: Always review the information before finalizing the record. Small errors in amounts or dates can lead to confusion and costly mistakes.

- Store Records Securely: Keep a well-organized and secure system for storing your payment records, whether digital or physical. This will make it easier to retrieve important documents when needed.

Maintaining Legal and Financial Compliance

- Stay Up-to-Date with Regulations: Ensure that your forms comply with the latest legal requirements, such as tax codes and payment guidelines, to avoid fines or penalties.

- Be Transparent in All Transactions: Transparency is key to building trust with your vendors, contractors, and clients. Providing detailed records ensures that everyone involved is on the same page.

- Ensure Proper Authorization: Always verify that payments are authorized according to your internal procedures. This will help avoid fraud and ensure that payments are legitimate.

By following these best practices, businesses can improve their financial management, maintain accurate records, and reduce the risk of errors in their payment processes.

How to Format Your Disbursement Invoice

Proper formatting is crucial for ensuring that your financial records are clear, professional, and easy to understand. A well-structured document not only helps convey important information but also improves workflow and minimizes the risk of errors. When formatting a document for recording outgoing payments, attention to detail is essential for consistency and readability.

To achieve this, it’s important to include specific sections in a logical order. Here’s a basic structure to follow when creating an effective and clear record:

| Section | Details to Include |

|---|---|

| Header | Include your business name, logo, and contact information. Clearly label the document as a payment record to avoid confusion. |

| Transaction Date | State the exact date the payment was processed. This helps establish a clear timeline for your financial records. |

| Recipient Details | Include the recipient’s name or business name, along with contact information or payment address. |

| Payment Amount | Clearly state the total amount paid, including any applicable taxes or additional fees. This should be the main point of reference for both parties. |

| Payment Method | Specify how the payment was made (e.g., bank transfer, check, credit card), to ensure transparency. |

| Description of Payment | Provide a brief description or reference to the reason for the payment. This can help both parties keep track of transactions and avoid misunderstandings. |

| Signature/Authorization | Some records may require a signature or authorization for verification, especially for large or important transactions. |

By following this structure, you can create a document that is organized, professional, and easy to understand. Proper formatting ensures that your financial records are both effective and efficient, making it easier to track payments, manage cash flow, and maintain clear communication with stakeholders.

Integrating Templates with Accounting Software

Integrating structured forms for financial records with accounting software can significantly streamline your business processes. By connecting these forms to your accounting system, you automate data entry, reduce errors, and ensure that all transactions are captured accurately. This integration helps save time, improves financial reporting, and enhances overall efficiency in managing your accounts.

Streamlining Data Entry and Accuracy

When you link your payment records directly to your accounting software, the data is automatically imported into your financial system. This eliminates the need for manual data entry, which not only saves time but also reduces the risk of human error. Once the information is integrated, you can quickly track payments, reconcile accounts, and generate reports without the need to enter the same data multiple times.

Improving Financial Reporting and Transparency

Integrating your payment records with accounting software also improves the accuracy and timeliness of your financial reporting. As soon as a transaction is recorded, the software updates the necessary ledgers and balance sheets, ensuring that your financial data is always current. This leads to better visibility into your cash flow and helps with budgeting, forecasting, and preparing for audits.

By utilizing this integration, businesses can simplify their accounting processes and ensure that financial records are always accurate, up-to-date, and ready for analysis.

Legal Requirements for Disbursement Invoices

When documenting financial transactions, it’s important to ensure that your records comply with local laws and regulations. Different jurisdictions have specific requirements regarding the content, format, and retention of payment records. By adhering to these legal standards, businesses can avoid potential legal issues and ensure transparency in their financial dealings.

Key Legal Considerations

- Accurate Record-Keeping: It’s essential that all payments are documented accurately, with clear details about the amount, recipient, and purpose of the payment. Failing to do so can result in legal complications, especially during audits.

- Retention Period: Depending on local laws, businesses are often required to retain payment records for a specific period, such as 3-7 years. Make sure you are familiar with the retention requirements in your jurisdiction.

- Tax Compliance: Payment records may be subject to tax reporting, meaning they need to include relevant information such as taxes paid, VAT, or other applicable deductions. This helps ensure your business remains in compliance with tax authorities.

- Data Privacy: Personal information such as the recipient’s name and address should be handled according to data protection laws, such as GDPR or other relevant privacy regulations. This includes ensuring that data is stored securely and is not shared improperly.

- Payment Authorization: In many cases, the payment must be authorized by specific parties within the organization. Keeping records of these approvals ensures that the transaction was legitimate and properly vetted before funds were distributed.

Ensuring Compliance

- Stay Updated with Local Laws: Laws and regulations surrounding financial documentation can change over time, so it’s crucial to stay informed about any updates that might affect your record-keeping practices.

- Consult Legal and Financial Experts: If you’re unsure about the legal requirements for your records, it’s always a good idea to consult with legal or financial experts to ensure that your documentation practices are in compliance with applicable laws.

By following these legal requirements, businesses can protect themselves from potential fines, penalties, or disputes. Properly mana

How to Automate Disbursement Invoice Creation

Automating the creation of financial documents can save significant time and effort while reducing errors. By implementing automated processes, businesses can streamline their accounting functions and ensure that records are consistently accurate. Automation tools can pull data from existing systems, generate the necessary forms, and even send them to recipients, all without manual intervention.

To successfully automate the creation of payment records, several key steps need to be followed. Here’s an overview of how this process can be set up:

| Step | Description |

|---|---|

| 1. Choose Automation Software | Select an accounting or invoicing software that offers automation features, such as QuickBooks, Xero, or FreshBooks. These tools can integrate with your business’s financial system. |

| 2. Connect Payment Data Sources | Link your software with other systems that handle payments, such as your bank account or payment gateway. This allows the software to automatically pull transaction details. |

| 3. Set Up Custom Fields | Ensure the software includes the necessary fields for your specific needs, such as recipient name, payment method, and amount. Customize the fields so the output is relevant to your business. |

| 4. Define Payment Triggers | Set up triggers that will automatically generate payment records when certain conditions are met. For example, a payment can be generated once a purchase order is approved or a contract is fulfilled. |

| 5. Review and Finalize | Once the automation system is set up, review the output regularly to ensure everything is functioning as expected. This allows you to catch any errors before they affect your financial records. |

Automating the creation of payment records not only saves time but also ensures greater consistency and accuracy in financial reporting. By eliminating the need for manual entry, businesses can focus on higher-level tasks, like strategic planning and customer service, while leaving routine tasks to automated systems.

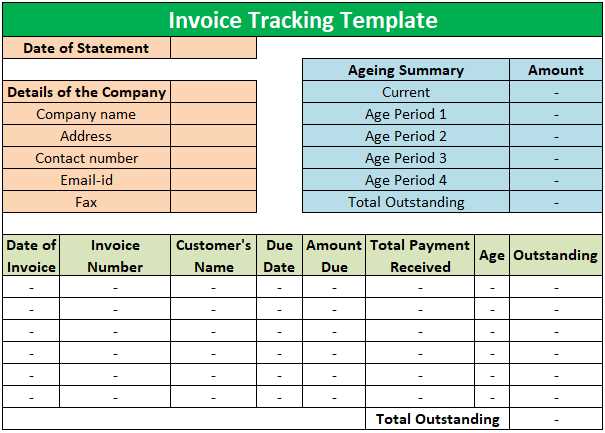

Managing Multiple Disbursement Invoices

When a business handles a large volume of payments, it becomes crucial to organize and manage records efficiently. Without proper tracking and management systems, processing multiple financial records can lead to errors, delays, and even legal complications. Effectively managing these documents ensures smooth operations, reduces the risk of mistakes, and helps maintain a clear overview of your financial transactions.

Organizing Payment Records

One of the first steps in managing multiple payment documents is to establish a clear organizational system. Categorize payments based on type (e.g., vendor payments, employee reimbursements, etc.) and date. You can organize these records in a digital folder system, using descriptive file names and folders for easy access. Additionally, using cloud-based solutions allows for better collaboration and remote access, improving the overall efficiency of your financial processes.

Tracking and Monitoring Payments

Tracking and monitoring all outgoing payments is essential to ensure accuracy and timeliness. Utilizing accounting software or spreadsheets with built-in tracking features can help you monitor pending payments, paid transactions, and due dates. This ensures that you never miss a payment deadline, and it helps avoid double payments or missed disbursements.

Automating recurring payments also helps reduce manual entry and minimizes the risk of human error. Setting up automatic reminders or recurring payment functions in accounting software allows you to streamline the process and ensure that all records are up-to-date.

By implementing these systems, businesses can maintain accurate and organized records, stay on top of their financial obligations, and reduce the administrative burden of handling multiple transactions.

Disbursement Invoice Template for Freelancers

For freelancers, creating accurate and professional financial records is essential for ensuring timely payments and maintaining strong client relationships. A well-structured payment record helps freelancers clearly communicate the amount owed for their work, track payments, and stay organized throughout their projects. Having a streamlined format makes the process of invoicing quicker and more efficient, allowing freelancers to focus on their core work.

When preparing payment documents, freelancers should follow a consistent structure that includes key details about the work completed and the payment terms. Here are the essential elements to include in a freelance payment record:

- Freelancer’s Contact Information: Include your full name, business name (if applicable), and contact details, such as your email address or phone number.

- Client’s Contact Information: Always provide the name, company (if applicable), and contact information of the client you are invoicing.

- Service Description: Clearly outline the work completed, including any specific tasks or projects. The description should be detailed enough to avoid confusion and ensure both parties are on the same page.

- Payment Amount: Specify the agreed-upon fee for the work completed. If the payment is based on hourly rates, include the number of hours worked and the hourly rate. For project-based work, include the total amount due.

- Payment Terms: Include payment due dates and any relevant details such as late fees, discounts for early payment, or payment methods accepted.

- Additional Notes: This section can be used for any important information, such as tax details, terms and conditions, or specifics on the project scope.

For freelancers, using a well-structured document can help ensure that all the necessary details are included and that clients understand what they are paying for. Consistency in your record-keeping allows for smoother transactions, fewer misunderstandings, and better financial management.