How to Use a Direct Deposit Invoice Template for Faster Payments

In today’s fast-paced business environment, efficiency in financial transactions is crucial. Companies and freelancers alike are increasingly adopting automated systems to ensure timely and secure payments. A well-organized billing method that supports quick processing and seamless transfers is essential to maintain smooth cash flow and reduce administrative overhead.

One of the most effective ways to optimize this process is by using customizable payment forms that allow for easy setup of recurring transactions. By incorporating the right details into a payment document, businesses can eliminate delays, minimize errors, and ensure funds are transferred directly to the correct accounts. This approach not only saves time but also enhances the overall client experience.

Automation helps reduce human error, while providing both parties with clear records of each financial exchange. By shifting to a streamlined system, companies can focus more on their core operations, knowing that their invoicing and payment processing is being handled efficiently and securely.

Understanding Direct Deposit Invoice Templates

Efficient billing systems are a cornerstone of modern financial transactions. By using a standardized document designed for automated payment transfers, businesses can ensure faster and more accurate fund transfers. These documents are structured to include all essential details that facilitate swift processing, removing the need for manual intervention and reducing the risk of errors.

The main goal of such a system is to create a smooth, streamlined process where payments are transferred directly to a specified account without unnecessary delays. By using a customized payment document, both businesses and clients can ensure that all the required data is present in a clear and organized format, making the transaction process more transparent and reliable.

Customizability is one of the key benefits of these documents. They allow businesses to tailor the content to meet their specific needs, whether it’s for recurring services or one-time payments. This flexibility makes it easier to manage payments on time, enhancing operational efficiency and helping maintain strong client relationships.

Benefits of Using Direct Deposit Invoices

Automating the payment process brings a variety of advantages to businesses and clients alike. By utilizing a system that ensures fast and secure fund transfers, both parties can experience a more efficient and streamlined financial workflow. These solutions reduce the need for manual intervention, allowing for quicker processing and minimizing the chances of errors or delays.

One of the primary benefits is the speed of transaction completion. Payments are processed almost instantly, eliminating waiting times associated with traditional methods like checks. This leads to improved cash flow, as businesses can access their funds more quickly, and clients can be assured that their payments are handled efficiently.

Another advantage is the reduction of administrative overhead. With automated systems in place, there’s no need to manually track payments or reconcile accounts, as everything is documented and updated in real time. This not only saves time but also reduces the likelihood of mistakes in billing and payment tracking.

How Direct Deposit Simplifies Payments

Using automated payment systems significantly streamlines the entire payment process, reducing the complexity and potential for errors. With this approach, the transfer of funds happens electronically, ensuring that payments are made directly into the recipient’s account without the need for manual handling or physical checks. This method cuts down on paperwork and human involvement, making the entire process faster and more efficient.

The simplification also extends to the way both parties handle their financial records. Automated transfers provide clear and precise documentation for every transaction, reducing the chances of mistakes or misunderstandings. With everything processed digitally, businesses can easily track payments in real-time and clients can be assured that their payments are processed without delay.

Efficiency is a major benefit of such systems. Businesses can focus on operations rather than spend time managing payment logistics. Moreover, the security features of electronic transfers ensure that funds are sent directly to the correct accounts, offering both businesses and clients peace of mind.

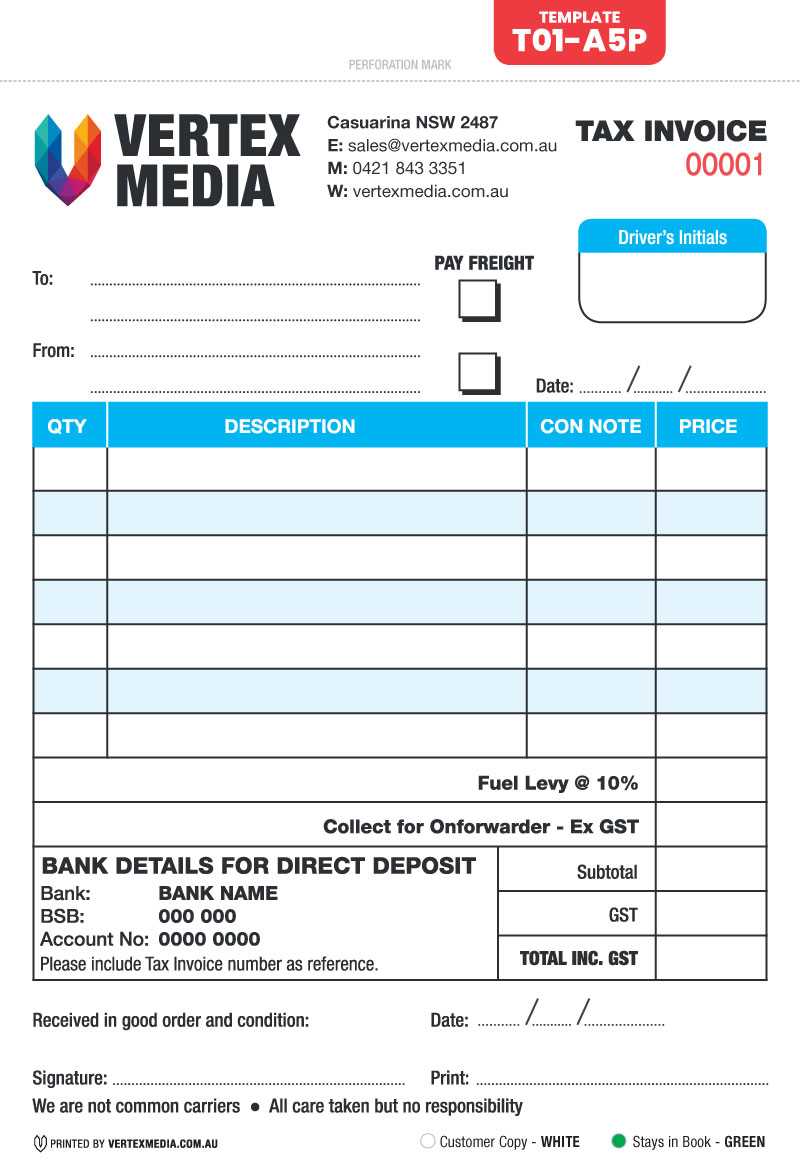

Key Components of an Invoice Template

An effective payment document should include several essential elements to ensure smooth and accurate transactions. These components provide the necessary details for both the payer and payee, ensuring that funds are transferred correctly and promptly. By including all required information, businesses can minimize confusion and ensure timely payments.

Essential Information for Accurate Transactions

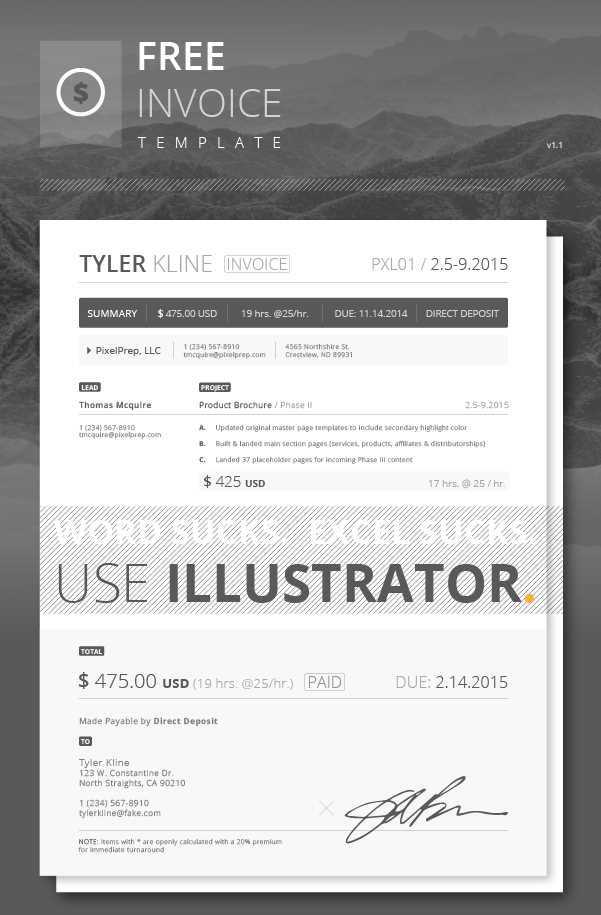

- Business Details: Include the business name, address, phone number, and email for easy contact.

- Recipient Information: Ensure the recipient’s name, address, and payment details are clearly stated.

- Payment Amount: Clearly display the total amount due, including any taxes or additional fees.

- Payment Due Date: Specify when the payment is expected to avoid delays.

- Unique Reference Number: This helps track the transaction and prevents errors.

Additional Features for Improved Clarity

- Itemized List: Provide a breakdown of products or services provided, including individual prices.

- Payment Methods: Indicate the accepted payment methods and provide relevant details for electronic transfers.

- Terms and Conditions: Include any late payment penalties, discounts, or other relevant terms.

By including these key elements, the payment document becomes an effective tool for smooth financial operations, ensuring all parties are informed and transactions are handled professionally.

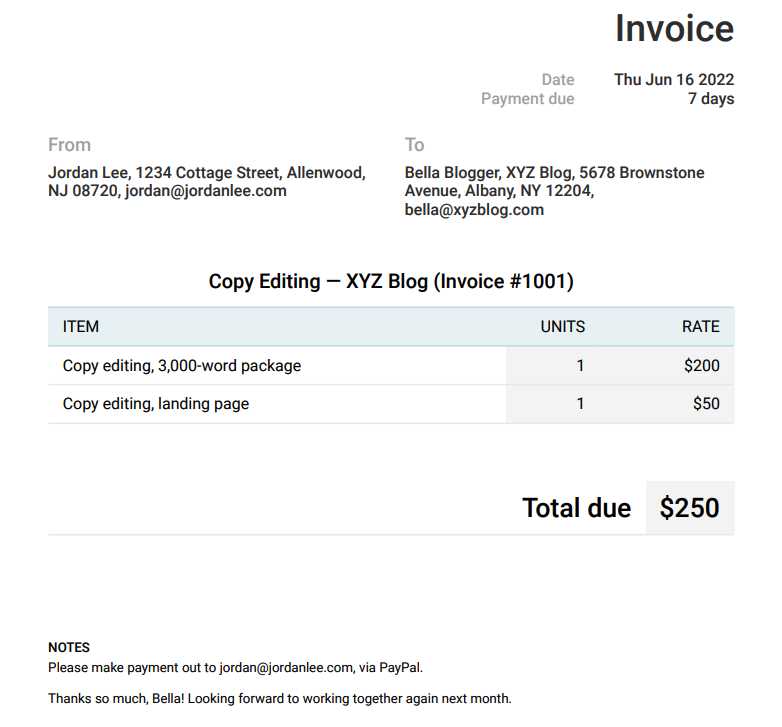

How to Create a Direct Deposit Invoice

Creating a payment document for electronic transfers is a straightforward process that involves ensuring all necessary details are included to facilitate fast and secure transactions. This document serves as a clear record of the transaction and provides both parties with the information needed to complete the transfer efficiently. By following a few simple steps, you can create a professional and effective document for any payment process.

Step-by-Step Guide

- Include Your Business Information: Start by adding your company’s name, address, contact information, and any other relevant details. This ensures that the recipient knows who is sending the document and how to get in touch if necessary.

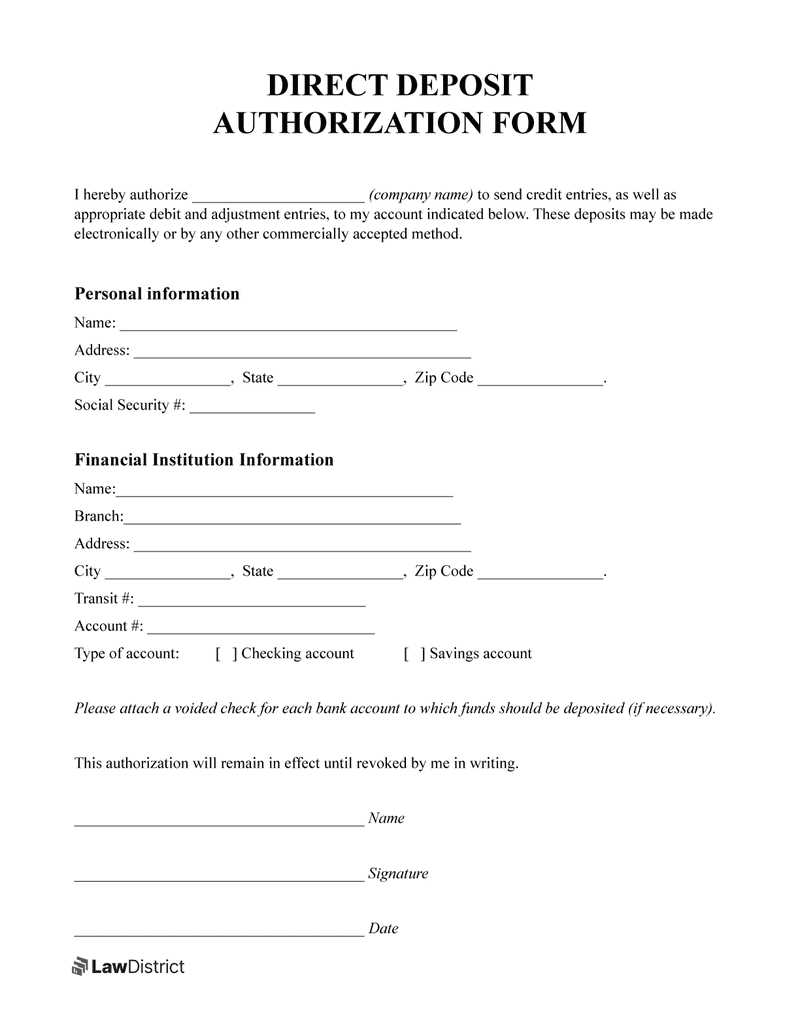

- Provide Recipient Details: Clearly list the name, address, and contact details of the recipient. Include the recipient’s bank details if necessary, so they can easily process the transfer.

- List the Products or Services: Provide a detailed breakdown of what is being paid for, including quantities, unit prices, and any applicable taxes or additional charges.

- Specify the Payment Amount: Clearly state the total amount due, making sure it includes all services, taxes, and any discounts applied.

- Set the Payment Due Date: Indicate the deadline by which payment should be made to avoid any late fees or penalties.

Additional Considerations

- Payment Methods: If the recipient can use different payment methods, specify the options available and provide the necessary instructions.

- Reference Number: Include a unique number for the transaction to easily track it in your accounting system.

- Terms and Conditions: Add any specific terms regarding the transaction, such as late payment penalties, refunds, or discounts for early payment.

By following these steps and including all relevant details, you ensure that the payment process is smooth and transparent for both parties involved.

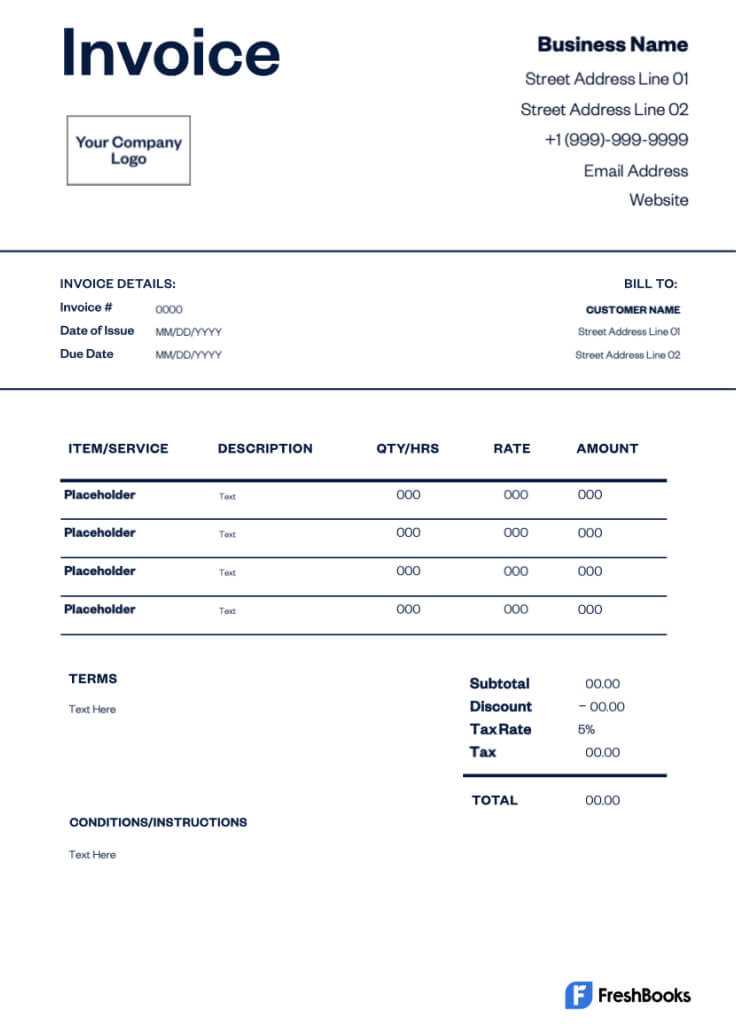

Customizing Your Direct Deposit Invoice

Personalizing your payment document is an important step in creating a more professional and efficient transaction experience. Customization allows you to tailor the document to your specific business needs, ensuring it includes all relevant details in a clear and easy-to-understand format. By adapting the design and content, you can make sure the document aligns with your company’s branding and operational requirements.

Key Elements to Customize

- Branding and Logo: Adding your company’s logo and using brand colors helps reinforce your identity and gives the document a polished, professional appearance.

- Payment Terms: Modify payment terms to suit your specific needs, such as adjusting due dates, offering early payment discounts, or outlining late payment penalties.

- Contact Information: Ensure your contact details are up-to-date, making it easy for recipients to reach out if they have questions or concerns about the payment.

- Additional Fees or Discounts: Customize the sections related to extra charges or discounts based on specific products or services offered to the client.

Advanced Customization Options

- Itemized Breakdown: Include a detailed list of products or services provided, with individual prices and quantities, allowing recipients to easily understand the breakdown of costs.

- Payment Instructions: Add specific instructions for electronic payments, such as bank account details or digital payment platforms, ensuring a smooth transfer process.

- Custom Fields: Some systems allow you to add custom fields to capture additional information, such as project codes or customer IDs, making your payment documents even more tailored to your operations.

By making these adjustments, you can create a document that is not only functional but also reinforces your brand and improves the client’s experience, all while ensuring the transaction process is as smooth as possible.

Common Mistakes to Avoid with Invoices

When creating a document for payment processing, it’s easy to overlook certain details that could cause delays or confusion. Common mistakes can lead to payment discrepancies, misunderstandings with clients, or even legal complications. By being aware of these errors, you can ensure a smoother transaction process and avoid unnecessary issues down the line.

Frequent Errors to Watch Out For

- Missing Payment Information: Not including essential details such as bank account information or payment methods can delay transfers and cause confusion.

- Incorrect Amounts: Double-check the total amount due, including taxes and additional charges. Simple arithmetic errors can result in payment disputes or delays.

- Failure to Specify Due Dates: Without a clear payment due date, clients may delay their payments, impacting cash flow.

- Unclear Item Descriptions: Lack of detail in itemized lists can lead to confusion over what exactly is being billed, potentially leading to disputes.

- Not Including Reference Numbers: Failing to add a unique reference number can make it difficult to track payments, especially for large volumes of transactions.

How to Avoid These Issues

- Double-Check All Details: Always review the document for accuracy, from amounts to payment terms.

- Clear and Consistent Formatting: Use easy-to-read formats and maintain consistency across all documents to avoid errors.

- Ensure Contact Information is Current: Make sure both your contact details and the recipient’s are up-to-date for easy communication.

By avoiding these common mistakes, you can ensure that your payment process is smooth, professional, and efficient for both you and your clients.

Choosing the Right Payment Method

Selecting the appropriate method for processing payments is crucial for ensuring smooth financial transactions. The right choice depends on several factors, including transaction speed, security, and convenience for both the payer and the recipient. Different methods offer various benefits and drawbacks, so it’s important to evaluate each option based on your specific needs and business context.

For instance, some businesses may prefer electronic transfers due to their speed and low cost, while others may find checks more suitable for certain clients or regions. The key is to align the payment method with your business operations and the preferences of your customers or partners.

Factors to Consider

- Transaction Speed: Electronic transfers are often faster, completing within hours or days, while checks may take longer to clear.

- Security: Some payment methods offer enhanced security, such as bank transfers or digital wallets, which can help protect sensitive financial information.

- Costs: Be mindful of transaction fees associated with different methods, as some options may incur higher costs, particularly for international payments.

- Customer Preferences: Consider what payment methods your clients are most comfortable with to avoid friction and ensure prompt payments.

By carefully evaluating these factors, you can choose a payment method that best fits your needs and ensures a smooth and efficient transaction process.

How to Integrate Direct Deposit with Invoices

Integrating automated payment transfers with your billing system streamlines the payment process, ensuring quicker and more reliable transactions. By combining these two elements, businesses can eliminate manual intervention, reduce errors, and enhance cash flow management. This integration ensures that payments are processed automatically, allowing for faster completion and more efficient accounting.

To integrate automated fund transfers with your billing system, you’ll need to ensure that both the payment details and the necessary electronic transfer information are included in each document. Additionally, you’ll want to set up the appropriate software or service that can securely process these transactions on your behalf. Here’s a general approach to making this integration seamless:

Steps for Integration

- Set Up Electronic Payment Accounts: Ensure you have a secure and reliable method for processing electronic payments, such as a business bank account or digital payment platform.

- Link Payment Information: Add the recipient’s payment details–such as bank account or digital wallet information–directly into the billing document to facilitate the transfer.

- Automate Payment Reminders: Use software that can automatically notify clients when payments are due, reducing the chances of delays.

- Update Your Accounting Software: Integrate your payment system with accounting tools to automatically update payment statuses, making reconciliation easier and more accurate.

By following these steps, you can effectively integrate automated payment transfers into your business operations, improving both efficiency and accuracy for all involved parties.

Best Software for Invoice Templates

Choosing the right software for creating payment documents can significantly improve the efficiency of your billing process. The best tools not only allow for easy customization but also offer features that automate key aspects, such as tracking payments, generating reports, and integrating with other financial systems. Here’s a look at some of the top software options that can help you create professional, customized payment documents with ease.

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, integration with accounting, automatic payment tracking | Small businesses and freelancers looking for an all-in-one solution |

| FreshBooks | Easy-to-use interface, time tracking, online payments | Service-based businesses needing simple invoicing and time management |

| Zoho Invoice | Automated payment reminders, recurring billing, multi-currency support | Global businesses that require recurring billing and payment automation |

| Wave | Free to use, integrates with bank accounts, receipt scanning | Small businesses on a budget or those just starting |

| Invoicely | Multi-currency and language support, online payment integrations | International businesses that need customizable invoicing options |

By choosing the right software, you can streamline your billing process, ensure accurate transactions, and improve the overall client experience. Consider your specific business needs and workflow when selecting a tool to ensure the best fit for your operations.

Security Considerations for Direct Deposits

When handling automated payment transfers, security is a top priority. Ensuring that sensitive financial information is protected is critical to avoid fraud, data breaches, and other security threats. As businesses increasingly rely on digital systems to process payments, it is essential to implement best practices for safeguarding both your organization and your clients from potential risks.

By employing strong encryption, securing sensitive data, and adhering to industry standards, businesses can significantly reduce vulnerabilities in their payment systems. Additionally, educating employees and clients on secure payment practices can further enhance security. Here are key security considerations to keep in mind when managing electronic payments:

Key Security Measures

| Security Measure | Description |

|---|---|

| Encryption | Ensure that all sensitive data, including account numbers and payment details, is encrypted both during transmission and at rest. |

| Multi-Factor Authentication (MFA) | Implement MFA for access to payment systems to add an additional layer of security beyond just passwords. |

| Regular Software Updates | Keep payment processing software up-to-date with the latest security patches to prevent exploits from vulnerabilities. |

| Secure Payment Gateways | Use reputable and secure payment gateways that comply with industry standards, such as PCI DSS, to process electronic transactions. |

| Employee Training | Train employees on recognizing phishing attempts and other common scams that may compromise sensitive financial information. |

Best Practices for Clients

- Verify Payment Details: Clients should double-check payment information before making transfers to ensure funds go to the correct account.

- Monitor Transactions: Regularly review bank statements and payment histories to detect any unauthorized transactions early.

- Use Secure Networks: Avoid using public

How Direct Deposit Reduces Transaction Costs

Automating payment transfers can significantly reduce the costs associated with traditional payment methods, such as checks or cash transactions. By using electronic systems to process payments, businesses can eliminate many of the fees, delays, and administrative overhead typically involved in manual payment processes. This shift not only saves time but also helps streamline accounting and financial operations.

Here are several ways in which electronic payments help lower transaction costs:

Cost-Saving Benefits

- Reduced Processing Fees: Traditional payment methods, such as bank checks, often come with fees for processing, mailing, and handling. Electronic transactions, on the other hand, typically have lower associated costs.

- Elimination of Paperwork: With automated transfers, there’s no need for paper checks or invoices, saving money on paper, printing, and postage.

- Faster Processing Times: Electronic payments are processed more quickly than checks, reducing the time spent waiting for payments to clear and minimizing any associated costs.

- Fewer Errors and Disputes: Automation reduces the likelihood of manual errors, such as incorrect account numbers or payment amounts, which can lead to costly corrections or delays.

- Lower Risk of Fraud: Automated transfers, particularly when secured with encryption and other security measures, reduce the risk of fraud, which can be costly for businesses to resolve.

Long-Term Savings

- Reduced Bank Fees: Many banks offer lower fees for businesses that use electronic payment methods instead of paper-based transactions.

- Improved Cash Flow Management: Electronic payments enable businesses to track and manage transactions more easily, avoiding potential costs associated with missed or delayed payments.

- Increased Efficiency: Automation eliminates the need for manual intervention, allowing employees to focus on more productive tasks, which results in cost savings over time.

By leveraging electronic payment methods, businesses can lower transaction costs, improve efficiency, and enhance overall financial management, leading to greater profitability and operational effectiveness.

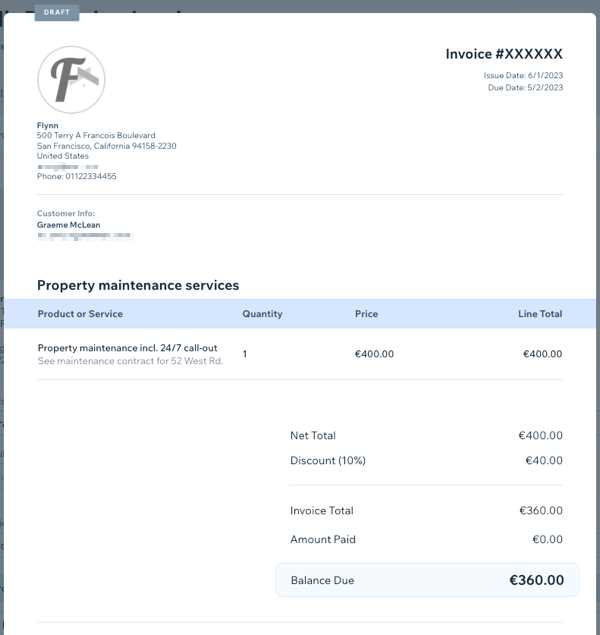

Creating Recurring Invoices for Direct Deposit

Setting up automated payment schedules is an excellent way to streamline billing for recurring services or subscriptions. By creating regular payment requests that are automatically generated at set intervals, businesses can reduce administrative tasks and ensure timely payments without the need for manual invoicing each time. This approach enhances both efficiency and cash flow management for businesses and clients alike.

When setting up recurring payment documents, it is important to choose the right software that can automate the process and handle payment schedules. Below are some key steps and considerations for creating recurring billing systems that work smoothly with automated transactions.

Steps to Create Recurring Billing Documents

- Set Payment Intervals: Determine how often payments will be processed–whether weekly, monthly, quarterly, or annually–and set up your system accordingly.

- Automate Payment Reminders: Configure your system to send automatic reminders to clients before each payment date, ensuring they are aware of upcoming charges.

- Clear Terms and Amounts: Clearly state the amount due and the payment schedule in each document to avoid confusion and ensure transparency.

- Recurring Payment Authorization: Make sure clients provide consent for recurring payments, which may require them to authorize the transaction once before it is processed automatically.

Advantages of Recurring Payment Systems

- Consistency in Revenue: Recurring payments ensure steady cash flow by automating the collection of funds at regular intervals.

- Time Savings: Automating billing reduces the time spent manually creating and sending out payment requests each period.

- Reduced Late Payments: Automation reduces the risk of late payments, as payments are processed automatically on the agreed-upon date.

- Improved Client Experience: Clients appreciate the convenience of automated payments, which save them time and prevent any missed payments.

By implementing a recurring payment system, businesses can save time and money while improving customer satisfaction and maintaining better control over cash flow management.

Ensuring Accuracy in Payment Details

Accuracy in payment processing is crucial for maintaining trust and preventing errors that can disrupt financial operations. Small mistakes in payment information, such as incorrect account numbers or payment amounts, can lead to delayed transactions, lost revenue, or even disputes. It is important to ensure that all payment details are accurate and up-to-date, both for the business and the client.

By establishing clear procedures for verifying and cross-checking payment information, businesses can minimize the risk of errors. Here are some essential strategies to ensure that payment details are accurate and reliable every time.

Key Strategies for Accurate Payment Details

- Double-Check Account Information: Always verify account numbers, routing codes, and other essential details before processing any payment to ensure accuracy.

- Use Payment Automation Tools: Leverage automated systems that can cross-check payment information in real-time, reducing human error.

- Confirm Client Details Regularly: Periodically confirm client payment details to ensure that no changes have been made, such as new bank accounts or updated billing addresses.

- Implement Error Alerts: Set up automated alerts to notify you if any discrepancies or missing information are found during the payment process.

Common Errors and How to Avoid Them

Error Type Solution Incorrect Account Numbers Always double-check account details and use validation tools to avoid typos or incorrect entries. Missed Payments Set up recurring reminders and automated payments to avoid missed or delayed transactions. Wrong Payment Amount Use automated systems to calculate the correct amount based on agreed terms and verify before submission. Missing Payment Information Ensure all necessary information, including account numbers and payment references, are included before processing payments. By following these best practices, businesses can minimize errors, speed up the payment process, and ensure that all transactions are completed smoothly and accurately.

Legal Requirements for Direct Deposit Invoices

When handling automated payment requests, it is important to ensure that all documentation complies with applicable legal regulations. Properly formatted payment documents not only ensure smooth financial transactions but also protect both businesses and clients by ensuring transparency and legal compliance. Failing to meet legal requirements can result in disputes, fines, or even the invalidation of payments. Therefore, understanding the legal framework is crucial when creating and managing these documents.

In many countries, there are specific rules surrounding the format and content of payment documents, especially when transactions are made electronically. These legal guidelines often include requirements related to the clarity of terms, proper documentation of transaction details, and the protection of both parties’ rights.

Key Legal Considerations

- Clear Payment Terms: Always include the agreed payment amount, due date, and method of payment. Legal regulations often require businesses to provide clear and concise terms to prevent misunderstandings.

- Data Protection: Ensure that any sensitive payment information, such as bank account details, is securely transmitted and stored to comply with data privacy laws such as GDPR or CCPA.

- Transaction Records: Legal compliance often requires businesses to maintain a detailed record of all payments for a certain period. These records may be requested for audit purposes or to resolve disputes.

- Currency and Tax Compliance: Payment documents must indicate the correct currency and tax details as per local financial regulations, especially when conducting cross-border transactions.

- Client Consent: It is essential to obtain clear consent from clients for recurring payments, ensuring that the terms are fully understood and legally binding.

Consequences of Non-Compliance

- Fines and Penalties: Failure to comply with legal standards may result in monetary penalties or fines imposed by regulatory authorities.

- Invalidation of Payment: Incorrectly formatted or incomplete documentation may result in delayed or rejected payments, causing disruption to business operations.

- Legal Disputes: Inaccurate or vague terms can lead to disagreements, which may escalate into costly legal battles if not addressed properly.

By ensuring that payment documents meet legal requirements, businesses can foster trust with clients and ensure that all financial transactions are processed smoothly and in compliance with the law.

Managing Invoice Templates Efficiently

Efficient management of billing documents is essential for maintaining smooth financial operations. Streamlining the process not only saves time but also reduces the risk of errors and ensures consistency across all transactions. By implementing best practices for organizing and handling these documents, businesses can improve their overall workflow and create a more seamless experience for both clients and employees.

To manage billing documents effectively, businesses must focus on organization, automation, and tracking. Establishing a clear system for creating, storing, and retrieving these documents will help improve efficiency and reduce administrative burdens. Below are some strategies to optimize the management of billing documents.

Key Strategies for Efficient Management

- Use Automation Tools: Leverage software to automate the generation and sending of billing documents, reducing manual effort and ensuring timely distribution.

- Standardize Formats: Create standardized formats for all your documents to ensure consistency. This simplifies the process and makes it easier to train employees.

- Organize Digital Records: Use a centralized digital storage system where all payment documents are securely stored and easily accessible, eliminating the need for paper-based records.

- Regular Updates and Maintenance: Periodically review and update document templates to ensure that they reflect any changes in business policies, tax rates, or client agreements.

- Track Payments: Implement systems to track issued billing documents and ensure that payments are received on time, minimizing delays or missed payments.

Tools for Streamlining the Process

- Cloud-Based Solutions: Utilize cloud-based software to create, send, and store billing documents, ensuring access from anywhere and improving collaboration.

- Integrated Accounting Software: Use integrated accounting tools that automatically link payment documents to client records and financial reports, improving accuracy and reducing manual data entry.

- Customizable Solutions: Choose software that allows you to tailor document layouts and features according to your specific business needs.

By following these strategies, businesses can improve the efficiency and accuracy of their financial operations, ensuring timely payments and enhanced client satisfaction.

Improving Cash Flow with Direct Deposit

Optimizing cash flow is crucial for maintaining a healthy business, and one effective way to achieve this is by leveraging automated payment systems. By switching to electronic transactions, businesses can accelerate the movement of funds, reduce delays, and eliminate the inefficiencies of traditional methods. This shift helps to maintain a steady cash flow, ensuring that businesses can meet financial obligations and seize growth opportunities without unnecessary disruptions.

When payments are processed automatically and electronically, they occur faster than traditional methods, such as checks, and with fewer errors. This efficiency directly contributes to improved liquidity and better management of financial resources.

How Automated Payments Boost Cash Flow

- Faster Payment Processing: Electronic transactions are processed almost instantly, meaning that funds are available sooner compared to waiting for checks to clear or bank transfers to process.

- Reduced Payment Delays: Automation eliminates the delays associated with manual processing, ensuring that payments are made on time and reducing the risk of late fees.

- Improved Forecasting: With automated payment systems, businesses can more accurately predict when funds will be received, making it easier to manage budgets and plan for expenses.

- Lower Transaction Costs: By eliminating physical payment methods, businesses can save on bank fees, postage, and administrative costs associated with manual payment tracking and processing.

Additional Benefits for Business Cash Flow

- Increased Payment Consistency: Automated systems ensure that recurring payments are made consistently, reducing the risk of missed payments or inconsistent revenue streams.

- Enhanced Customer Experience: Offering convenient payment methods can increase customer satisfaction and encourage timely payments, further boosting cash flow.

- Reduced Risk of Fraud: Electronic payment systems often come with enhanced security measures, reducing the potential for fraud and chargebacks that can negatively affect cash flow.

By adopting automated payment solutions, businesses can create a more efficient and reliable financial system that ensures smooth operations and supports sustained growth.