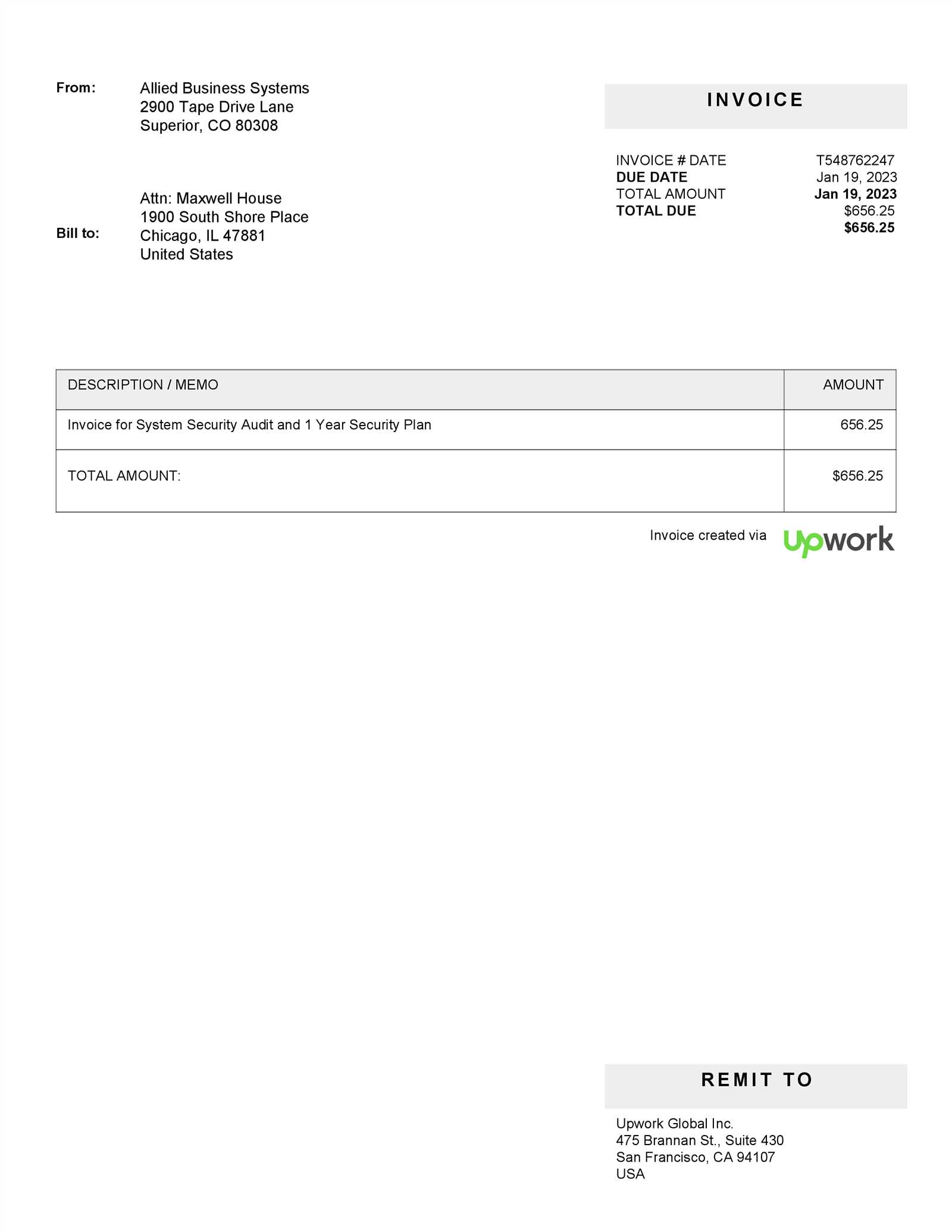

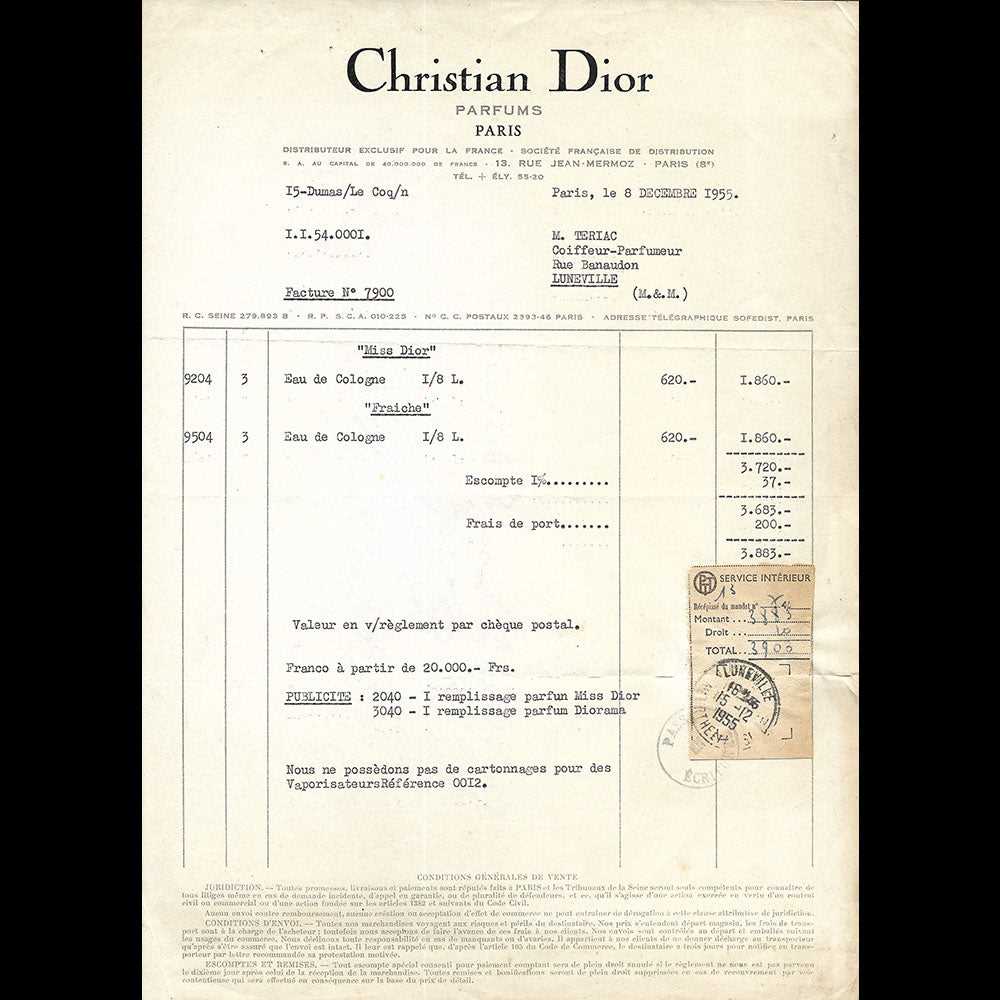

Dior Invoice Template for Easy Customization and Use

In today’s fast-paced business world, maintaining a professional appearance is crucial, especially when it comes to financial communications. Having a well-structured, visually appealing format for invoicing can elevate your brand and simplify financial transactions. Whether you’re a small business owner or an established brand, a polished billing format can save time and enhance client satisfaction.

Customizable documents are a valuable tool for businesses looking to improve their invoicing practices. These pre-designed files can be easily tailored to fit your specific needs, offering flexibility and efficiency. By adopting such a solution, you can ensure that your documents are not only functional but also reflect the professionalism of your brand.

In this guide, we will explore how to create and personalize these essential documents, discuss the key features to look for, and explain the benefits they can offer in terms of accuracy, clarity, and time management. By the end, you’ll have all the information needed to enhance your financial operations with ease and style.

Document Design Overview

When managing financial transactions, having a structured and visually appealing document format is essential for both clarity and professionalism. A well-designed form not only helps in conveying important details accurately but also leaves a positive impression on clients and partners. This type of document is crucial for ensuring smooth communication between businesses and their clients, providing all necessary information in a clear, concise manner.

Importance of Professional Design

One of the main benefits of using a pre-designed document is the time saved in formatting and structuring each entry. These designs offer an easy-to-use solution that allows businesses to focus on the content rather than spending time on layout adjustments. With customizable features, you can tailor the design to match your brand’s identity, creating a consistent and professional image across all your communications.

Key Features of an Effective Document Design

An effective document should include essential elements such as clear sections for item descriptions, payment terms, and contact information. These documents also often allow for the inclusion of a company logo and customizable color schemes, ensuring that each form is aligned with your corporate identity. A straightforward layout with space for necessary details ensures accuracy and minimizes errors, which is essential for maintaining smooth business operations.

Why Use a Professional Document Design

Adopting a ready-made document design for billing and financial communications offers numerous advantages that simplify business operations. By using a standardized format, companies can streamline their processes, reduce errors, and maintain a consistent brand image across all client interactions. The use of such documents ensures clarity, professionalism, and efficiency, all of which contribute to a more organized and effective workflow.

- Time Efficiency: Pre-designed forms eliminate the need for creating a new layout for each transaction. This saves time and allows businesses to focus on core operations.

- Consistency: A consistent format ensures that every document reflects the same level of professionalism, reinforcing your brand identity with each use.

- Customizability: These documents can be easily customized to meet specific business needs, including the addition of logos, color schemes, and personal details.

- Accuracy: A structured design helps avoid mistakes, ensuring that all necessary information is included and correctly formatted.

- Ease of Use: Most designs are user-friendly, allowing anyone in the team to generate and send professional documents without specialized training.

By implementing a pre-made design for your financial communications, you can enhance the overall experience for your clients, making transactions more seamless and your operations more efficient.

Key Features of Professional Document Designs

Effective billing and transaction forms offer more than just a structured layout; they provide essential elements that enhance clarity, ensure accuracy, and promote brand consistency. A well-crafted document should incorporate a range of features that make it easy to use and personalize while maintaining a professional appearance. These key elements are crucial for businesses that want to manage their finances seamlessly and professionally.

Essential Elements of a Well-Designed Document

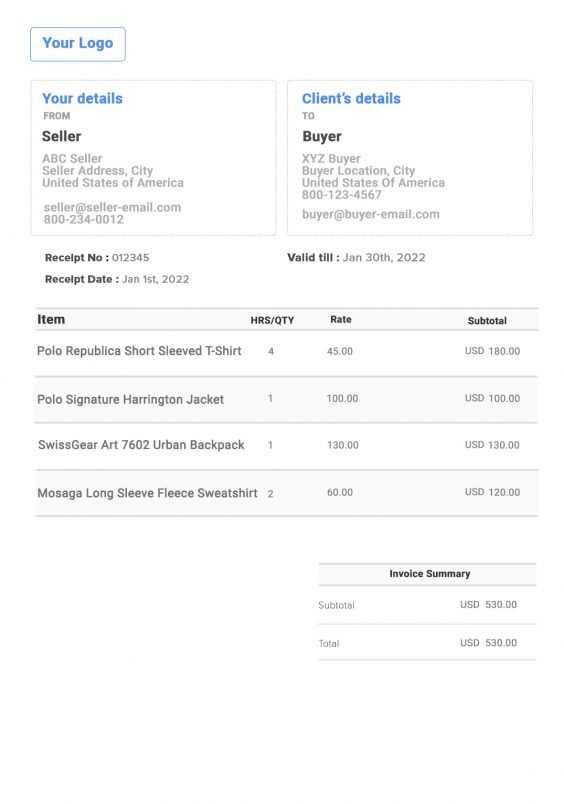

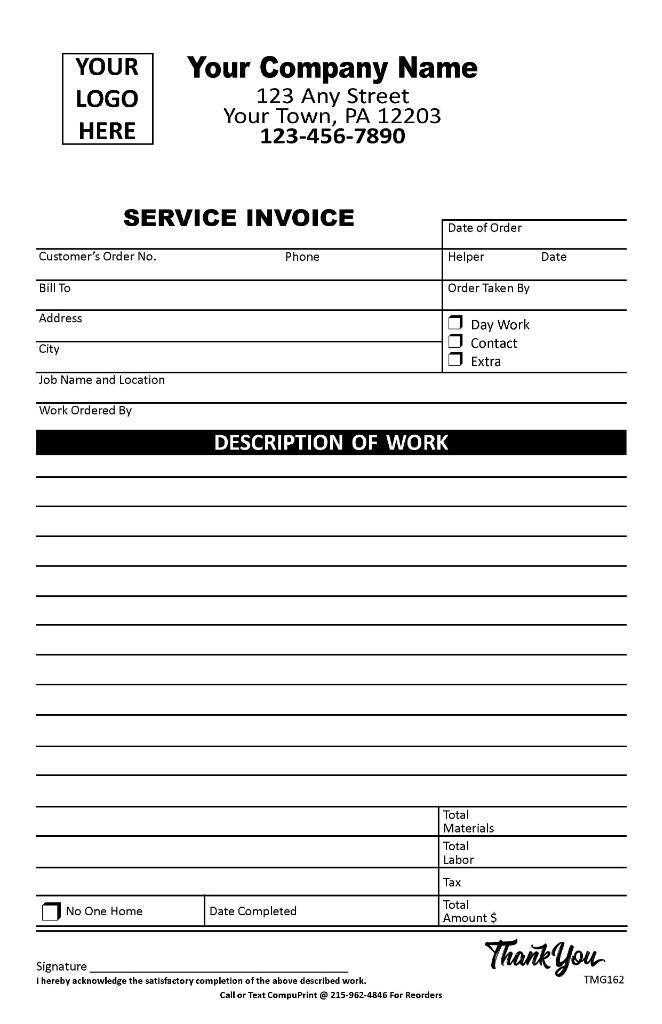

Each document design should include the following critical components to ensure it functions effectively:

- Company Details: Clearly displayed name, logo, and contact information make the document identifiable and professional.

- Transaction Information: Space for itemized listings, quantities, prices, and total amounts ensures that all necessary details are communicated effectively.

- Payment Terms: Sections for due dates, payment methods, and late fees provide clarity on payment expectations.

- Customizable Layout: The ability to modify fonts, colors, and branding elements makes it easy to align the document with a company’s identity.

User-Friendly Design

Another key feature is simplicity. The layout should be straightforward, with clear divisions between different sections, making it easy for both businesses and clients to read and understand the content. A clean, uncluttered design helps avoid confusion and ensures that the necessary information stands out. Moreover, the document should be easily editable, allowing for quick adjustments if required.

How to Customize Your Billing Document

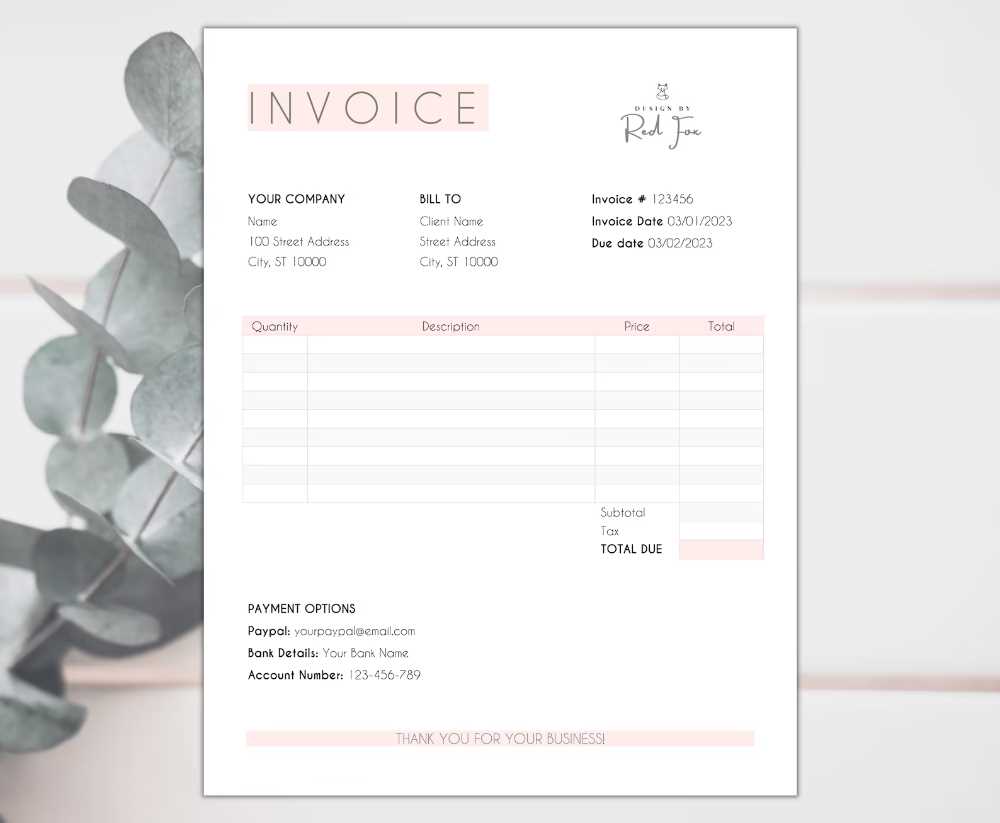

Customizing your financial document ensures that it aligns with your brand’s identity and suits your specific business needs. Whether you’re adding a logo, adjusting colors, or modifying the layout, personalizing your billing forms is a simple yet effective way to maintain professionalism and make your communications stand out. Here’s how you can easily customize your document for maximum impact.

Steps to Personalize Your Document

Follow these simple steps to modify your financial form:

- Insert Your Company Details: Add your company logo, name, and contact information at the top of the form. This helps clients immediately recognize the document and builds brand consistency.

- Adjust the Layout: Choose the most suitable arrangement for your information. Decide where key sections such as item descriptions, payment terms, and totals should appear for clarity and ease of use.

- Modify Colors and Fonts: Change the font style and colors to match your brand’s aesthetic. Customizing these elements ensures that the document reflects your company’s image and creates a cohesive experience for clients.

- Include Additional Details: Depending on your needs, you can add extra fields such as payment instructions, tax information, or terms and conditions. Make sure the document covers all necessary aspects of the transaction.

- Save and Reuse: After customization, save the document as a template for future use. This allows you to maintain consistency and reduces the time spent on creating new documents for each client.

Ensuring Professional Quality

While personalizing the form, ensure that the layout remains clean and readable. Avoid overcrowding the document with too much information. A well-organized design ensures that clients can quickly understand the key points, such as the total amount due and payment terms. By customizing the document in a thoughtful way, you can maintain a high level of professionalism while also reflecting your unique brand identity.

Benefits of Using a Pre-Designed Document

Using a pre-designed document for financial transactions brings significant advantages to businesses looking to streamline their processes. By adopting a ready-made format, companies can save time, ensure consistency, and improve the overall efficiency of their operations. This method not only simplifies the creation of professional forms but also enhances accuracy and brand identity.

- Time-Saving: With a pre-designed structure, there’s no need to start from scratch each time. This allows businesses to generate professional documents quickly, without the hassle of formatting and layout adjustments.

- Consistency: A consistent design ensures that all financial communications maintain a uniform appearance, strengthening your brand’s professionalism. Clients will recognize your business through the cohesive presentation of all documents.

- Improved Accuracy: Pre-designed forms often come with set fields and sections, reducing the likelihood of missing or incorrect information. This helps prevent errors and enhances the overall quality of your communications.

- Customization Options: While these documents come pre-structured, they are also flexible, allowing for easy adjustments such as adding logos, changing color schemes, or updating text to suit your needs.

- Professional Appeal: Ready-made documents are designed with an emphasis on clarity and professionalism, ensuring that your communication looks polished and well-organized, which can enhance client relationships.

By using such a pre-designed solution, you ensure that every financial document you send is accurate, clear, and reflective of your business standards, making transactions smoother for both you and your clients.

Where to Download Professional Document Designs

Finding the right place to download pre-designed business forms can greatly enhance your efficiency. There are several trusted sources online where you can access high-quality, customizable files that meet professional standards. Whether you need a simple layout or something more complex, these platforms offer a variety of options to suit different business needs.

Here are some of the best places to download customizable business document designs:

| Platform | Type of Documents | Customization Options | Price |

|---|---|---|---|

| Template Websites | Billing, contracts, estimates | Full customization | Free & Paid |

| Design Marketplaces | Premium document sets | Advanced customization | Paid |

| Business Software Platforms | Automated forms, invoicing | Minimal customization | Subscription |

| Online Document Generators | Simple forms, quotes | Limited customization | Free |

By exploring these platforms, you can easily find a solution that fits your business needs. Many sites also offer free trials or samples, allowing you to test the designs before committing to a purchase. Choose a platform that offers flexibility, easy editing, and professional-looking layouts to ensure your forms look polished and represent your brand effectively.

Step-by-Step Guide to Business Billing Forms

Creating a professional and effective business document is easier than it might seem. By following a simple, structured approach, you can quickly generate forms that look polished and convey all the necessary information. This guide will walk you through the process of designing and customizing your billing forms, ensuring they meet all your business needs.

Step 1: Choose the Right Design

Select a pre-made layout that suits your business requirements. Many platforms offer a variety of designs that can be easily customized to fit your brand’s style and preferences. Look for a format that is clear, well-organized, and includes all the essential sections.

Step 2: Add Your Company Details

Ensure your business is easily identifiable by adding your company’s logo, name, and contact information at the top of the form. This makes the document instantly recognizable and reinforces your brand’s professional image.

Step 3: Include Transaction Information

Next, include all relevant details about the transaction. This includes:

- Item descriptions: Provide a clear breakdown of what is being purchased or billed.

- Quantity and price: List the number of items and their individual cost.

- Total amount: Calculate the final amount due, including any taxes or discounts.

Step 4: Set Payment Terms

Clearly outline the payment conditions, including:

- Due date: Specify when payment is expected.

- Accepted payment methods: Indicate how payment can be made (e.g., bank transfer, credit card, etc.).

- Late payment fees: If applicable, include information about penalties for delayed payments.

Step 5: Review and Save

Before finalizing, double-check all the details for accuracy. Ensure that all information is correct and that the document looks professional. Once you’re satisfied, save the form as a reusable template for future transactions.

Step 6: Send to Your Client

Once the form is ready, you can easily share it with your client through email or any other preferred method. Be sure to follow up if needed, ensuring a smooth payment process.

By following these simple steps, you’ll create clear, professional billing documents that enhance your business’s credibility and streamline financial operations.

Choosing the Right Document Design for Your Business

Selecting the appropriate form layout for your business is essential for creating a consistent, professional image while simplifying your workflow. With various options available, it’s important to choose a design that not only meets your aesthetic preferences but also supports your operational needs. Whether you’re handling small transactions or large-scale contracts, the right design can help streamline your financial processes and improve your brand’s credibility.

Key Considerations When Choosing a Layout

When evaluating which design to use for your business, consider the following factors:

- Business Type: Different industries may require specific features. A service-based business might need more room for detailed descriptions, while a retail business might focus on itemized pricing.

- Brand Identity: The document should reflect your company’s branding through colors, fonts, and overall design. Consistency in design helps reinforce your company’s image.

- Ease of Use: Choose a layout that is easy for both you and your clients to navigate. The simpler and more intuitive, the better.

- Flexibility: Consider how easily the document can be customized for different clients, transactions, or services.

Design Features to Look For

The right design should have certain key features to ensure it functions well across various scenarios:

| Feature | Importance | Customization |

|---|---|---|

| Company Branding | Helps reinforce brand identity | Easy to customize logos, colors, and fonts |

| Clear Layout | Ensures readability and professionalism | Adjustable fields for various types of transactions |

| Essential Fields | Includes all necessary information for transactions | Customizable for additional details, discounts, or terms |

| Automation Options | Streamlines data entry and reduces errors | Integrates with accounting or CRM tools |

By selecting a design with these features, you can ensure that your forms are both functional and aligned with your brand’s professional standards. Choosing the right document design helps optimize your business operations and enhances your client’s experience.

Integrating Billing Forms with Your Accounting Software

Integrating your business documents with accounting software can significantly improve the efficiency and accuracy of your financial processes. By syncing your pre-designed forms with your accounting system, you can automate data entry, reduce human errors, and streamline your overall workflow. This integration allows for seamless tracking of transactions, easy reporting, and a more organized approach to managing finances.

Benefits of Integration

Connecting your billing forms to accounting software offers several advantages:

- Automation: Automatically transfer data from your documents into the accounting system, eliminating the need for manual entry.

- Accuracy: Reducing human error in data entry ensures that your financial records are precise, which is critical for tax filings and audits.

- Time Savings: Streamlining the process frees up time for other tasks, allowing your team to focus on more important activities like customer service and growth strategies.

- Real-Time Updates: Integration ensures that your accounting records are always up to date, giving you immediate access to financial reports and balances.

How to Set Up Integration

Setting up this connection is typically straightforward. Follow these basic steps to integrate your billing documents with your accounting software:

- Choose Compatible Software: Ensure that the accounting software you are using supports integration with your document format. Popular accounting platforms often have built-in features or plugins for easy syncing.

- Export Data: Many accounting systems allow you to import or export data in various formats. Choose a format that matches your business documents for smooth transfer.

- Set Up Automatic Syncing: Configure your system to automatically update records when a new document is created or edited. This reduces the need for manual updates and keeps your financials consistent.

- Test the Integration: Before fully adopting the integration, test it to ensure that data flows correctly between your document and accounting systems.

By following these steps, you can ensure a seamless connection between your financial forms and accounting software, streamlining your business operations and improving overall efficiency.

Best Practices for Designing Billing Documents

Creating an effective and professional billing document is essential for any business. The design should not only convey important transaction details clearly but also reflect the business’s identity. By following best practices in layout, content organization, and visual elements, you can ensure that your documents are both functional and visually appealing, leading to better client communication and smoother financial processes.

Here are some key practices to consider when designing your billing documents:

- Keep It Simple: Avoid cluttering the document with unnecessary information. A clean, straightforward layout will ensure that your client can quickly find the details they need, such as the total amount due, payment terms, and item descriptions.

- Highlight Key Information: Make important details stand out. Use bold or larger fonts for headings such as “Total Due” or “Due Date.” This ensures that your clients won’t miss the most critical aspects of the transaction.

- Use a Clear, Organized Layout: Break the document into clear sections, such as a header for business information, a body for transaction details, and a footer for payment instructions or terms. This hierarchy helps clients quickly navigate the document.

- Incorporate Branding Elements: Integrate your company logo, color scheme, and fonts to align the document with your brand identity. Consistent branding across all business communications helps build recognition and professionalism.

- Include All Necessary Information: Ensure the document includes all the required fields, such as item descriptions, quantities, prices, payment terms, and your business’s contact information. Missing information can create confusion and lead to delays in payment.

- Make It Legible: Use fonts that are easy to read, and ensure that the text size is appropriate. The document should be accessible on both digital and printed formats, so consider how it will look in different media.

- Ensure Legal Compliance: If applicable, include any necessary legal or tax information, such as VAT numbers or terms and conditions, to comply with industry standards or regional laws.

By adhering to these best practices, you can create billing documents that are not only functional but also reinforce your business’s professionalism and brand identity, contributing to smoother transactions and better customer relationships.

Common Mistakes in Billing Documents

Even the most experienced business owners can make errors when preparing their billing documents. These mistakes can lead to confusion, delays in payments, or damage to your professional image. Recognizing common pitfalls and avoiding them can ensure that your financial communications are clear, accurate, and effective. Below are some of the most frequent mistakes businesses make when preparing financial forms.

| Common Mistake | Impact | How to Avoid |

|---|---|---|

| Missing Key Information | Clients may delay payments or request clarifications | Ensure all necessary fields are included: item descriptions, quantities, prices, payment terms, etc. |

| Unclear Payment Terms | Confusion about when and how to pay | Clearly outline payment due dates, accepted payment methods, and any late fees |

| Incorrect Pricing or Totals | Leads to disputes and delayed payments | Double-check calculations and ensure that prices, taxes, and discounts are accurate |

| Lack of Branding | Looks unprofessional and untrustworthy | Incorporate your company logo, colors, and consistent fonts to strengthen brand identity |

| Unorganized Layout | Hard for clients to navigate and find important details | Use a clear, structured layout with distinct sections for important information |

| Forgetting Contact Information | Clients may struggle to reach you for queries or payments | Always include complete contact information, including phone number and email |

By avoiding these common mistakes, you can create billing documents that are clear, professional, and accurate, ensuring smooth transactions and better client relationships.

How Billing Documents Help with Branding

A well-designed financial document serves more than just a functional purpose–it can also be a powerful tool for reinforcing your brand identity. By carefully crafting your business documents, you can ensure that every interaction with clients, from the initial transaction to the final payment, reflects your brand’s values and professionalism. The right design choices can enhance your image, foster trust, and help distinguish your business from competitors.

Here’s how your billing forms contribute to strengthening your brand:

- Consistency Across Communication: When you integrate your brand’s color scheme, logo, and font choices into your financial documents, you create a consistent and cohesive look across all client-facing materials. This consistency helps reinforce brand recognition and builds trust with your clients.

- Professionalism and Attention to Detail: A clean, polished billing form signals professionalism. It shows that you care about the details and are committed to providing high-quality service, which can enhance your reputation and encourage client loyalty.

- Creating a Memorable Experience: Your business documents are often one of the last touchpoints a client has with your brand after a transaction. Making sure that these forms are aesthetically pleasing and thoughtfully designed leaves a lasting positive impression, which can lead to repeat business and referrals.

- Building Brand Recognition: By consistently using branded documents for all transactions, your clients begin to recognize your brand not just through advertisements or logos, but in every interaction, creating a stronger brand presence in their minds.

Incorporating your branding into financial documents is an effective and subtle way to communicate your business values while maintaining professionalism and creating a lasting impression. It turns a simple transactional document into an extension of your brand, making every touchpoint with clients an opportunity for reinforcement.

Legal Considerations for Billing Documents

When preparing financial documents for your business, it’s crucial to be aware of the legal requirements and standards that govern such forms. These documents are not only a tool for recording transactions, but they also serve as legal proof of agreements, payments, and liabilities. Ensuring that your forms comply with local laws and industry regulations will help protect your business from potential legal disputes and ensure smooth operations.

Here are some key legal considerations to keep in mind when designing your financial documents:

- Compliance with Tax Regulations: Depending on your region, there may be specific rules about how tax information must be presented on financial documents. Ensure that your document includes necessary details such as tax rates, VAT numbers, and breakdowns of taxable amounts to stay compliant with local tax laws.

- Clear Payment Terms: To avoid misunderstandings and legal disputes, always clearly outline the payment terms on your documents. This includes payment due dates, late fees, and any applicable penalties. Having these terms in writing helps establish the legal framework for how payments should be handled.

- Accurate Documentation: Financial records must reflect the true nature of transactions. Falsified or inaccurate billing documents can lead to fraud accusations, tax audits, and legal penalties. Ensure all details–such as item descriptions, quantities, and prices–are correct and verifiable.

- Retention of Records: Many jurisdictions require businesses to retain financial records for a specified number of years for audit purposes. Keeping accurate copies of your business documents, including those used for billing, is not just good practice–it’s often a legal obligation.

- Consumer Protection Laws: Consumer protection laws often govern how businesses must treat clients and what must be disclosed on financial documents. For example, in some regions, businesses must clearly disclose refund policies or the terms of service on their documents.

By understanding and adhering to these legal considerations, you ensure that your financial documents are both legally valid and professionally sound. This not only helps protect your business but also fosters trust with your clients, showing them that you take your legal obligations seriously.

Ensuring Accuracy in Billing Documents

Accurate financial documentation is essential for smooth business operations. Inaccuracies in transaction details, pricing, or terms can lead to confusion, payment delays, and even legal issues. Ensuring precision in every aspect of your business documents not only helps maintain transparency with your clients but also strengthens your professional reputation. By adopting a thorough approach to accuracy, you can avoid costly mistakes and foster trust in your brand.

Key Areas to Focus on for Accuracy

To ensure the highest level of accuracy in your financial records, pay attention to the following critical areas:

- Item Descriptions: Ensure that each product or service is clearly described, with the correct quantity, unit price, and any relevant specifications. Misunderstandings can arise if item details are vague or incorrect.

- Pricing and Taxes: Double-check the prices and tax calculations to ensure they are accurate and align with any applicable agreements or legal requirements. Errors in this area can lead to disputes over payment amounts.

- Payment Terms: Clearly state the payment due dates, acceptable methods, and any applicable fees or discounts. Vague or incomplete terms can cause confusion and delay payments.

- Dates: Ensure that dates for transactions, due payments, and delivery times are accurate and consistent. Missing or incorrect dates can lead to misunderstandings and financial discrepancies.

Methods to Improve Accuracy

There are several strategies you can implement to improve the accuracy of your business forms:

- Use Automated Systems: Software tools that automate calculations and document creation can significantly reduce the risk of human error. Many accounting and invoicing platforms allow you to generate forms with accurate totals, taxes, and other calculations.

- Proofreading and Double-Checking: Always take the time to review your documents before sending them to clients. A second pair of eyes can often catch errors that may have been overlooked.

- Keep Detailed Records: Maintain clear and organized records of every transaction, including contracts, agreements, and receipts. This will allow you to cross-check your billing documents with the original terms agreed upon with clients.

By focusing on these areas and methods, you can ensure that your business documents are accurate, which will help foster stronger client relationships and streamline your financial processes.

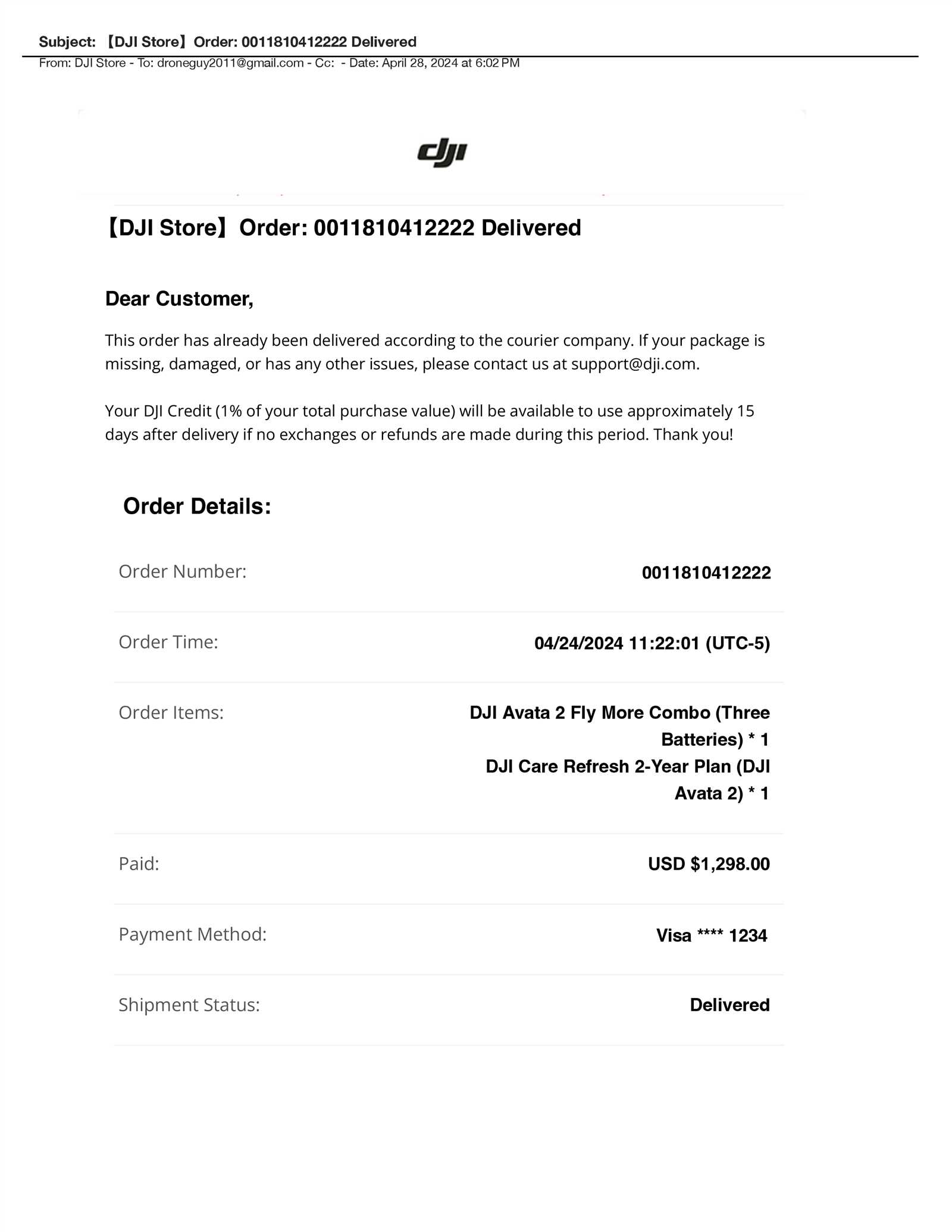

How to Export Billing Documents

Exporting financial documents is an important task for businesses that need to share transaction records with clients or store them for future reference. By exporting these forms in a compatible format, you can ensure that they are accessible, easy to distribute, and properly stored for accounting or tax purposes. Depending on the software or tool you use to create your business records, the process of exporting may vary, but the general steps remain the same.

Steps to Export Billing Documents

Follow these simple steps to export your business records accurately:

- Choose the Right Software: Select the platform or tool that is best suited for generating and exporting your business documents. Popular options include accounting software or specialized billing systems that offer export features.

- Finalize Your Document: Before exporting, double-check the details in your form to ensure all information is correct and up to date. Review item descriptions, totals, payment terms, and any other critical information.

- Select the Export Format: Choose the file format you want for exporting, such as PDF, Excel, or CSV. PDFs are ideal for sharing finalized forms with clients, while Excel or CSV formats can be useful for further analysis or integration with other systems.

- Export and Save: Click on the export option in your software and save the document to your desired location. Many tools allow you to save the file to your computer, cloud storage, or directly to an email for quick sharing.

Best Practices for Exporting

To ensure smooth and efficient exporting, consider the following best practices:

- Keep Files Organized: Create a structured naming convention and organize your exported files in folders to make them easy to locate later. This will save you time when searching for specific records in the future.

- Verify Export Accuracy: Always verify that the exported document matches the original version. Look for any formatting issues or missing information that could occur during the export process.

- Backup Files Regularly: To protect against data loss, back up your exported documents regularly. Store copies in both physical and cloud storage to ensure long-term access.

By following these steps and best practices, you can easily export your billing documents in a format that meets your business needs while ensuring that all transaction records are safely stored and easily accessible.

Managing Multiple Billing Documents Efficiently

For businesses dealing with a high volume of financial documents, efficient management is key to maintaining smooth operations and ensuring that no details are overlooked. Whether it’s tracking payments, ensuring timely follow-ups, or organizing records, managing numerous billing forms can become overwhelming without a system in place. By implementing streamlined processes and leveraging the right tools, you can simplify the management of multiple transactions and keep your business organized.

Best Practices for Efficient Management

Here are some effective strategies to manage multiple financial records with ease:

- Centralized Storage: Store all documents in one accessible location, such as a cloud-based platform or a secure server. This makes it easier to retrieve records and track payments, especially when dealing with multiple clients.

- Use Automated Tools: Leverage accounting software that automates key tasks, such as generating forms, calculating totals, and sending reminders. Automation can reduce errors and save valuable time.

- Organize by Date or Client: Sorting your records by date or client name helps you stay organized and ensures you can quickly locate specific transactions when needed. Grouping forms into folders based on these categories is a simple way to keep things structured.

How to Track Multiple Transactions

To help you track and manage various transactions efficiently, consider using a table to visualize the key details of each form:

| Client Name | Amount | Due Date | Status |

|---|---|---|---|

| Client A | $1,200 | 2024-11-15 | Pending |

| Client B | $850 | 2024-11-10 | Paid |

| Client C | $3,500 | 2024-11-20 | Pending |

By organizing your documents in this manner, you can easily track the status of each transaction and ensure timely follow-ups for any overdue payments. Keeping detailed records and regularly updating them will help you stay on top of multiple billing forms, avoid confusion, and improve your business’s cash flow management.

How to Get Professional Billing Document Designs

Creating visually appealing and professional business documents is essential for establishing credibility and making a lasting impression on your clients. Whether you are starting a new business or looking to update your current forms, having a well-designed format is key. A professional design not only reflects your brand but also enhances the overall customer experience by making financial documentation clear, easy to understand, and visually cohesive.

Ways to Obtain Professional Designs

If you’re looking to obtain high-quality designs for your business records, here are a few options to consider:

- Hire a Graphic Designer: A professional designer can create custom forms tailored to your brand’s identity. By working with a designer, you can ensure that the documents are not only functional but also reflect the aesthetic values of your business.

- Use Design Software: If you have basic design skills, using tools like Adobe Illustrator, Canva, or Microsoft Word can help you create professional-looking documents. These platforms offer pre-built templates that can be customized to fit your needs, allowing you to create personalized, high-quality forms.

- Purchase Ready-Made Designs: Many online platforms offer downloadable designs created by professionals. These are often fully customizable and can be used immediately with little effort, making them a quick and cost-effective option for businesses looking to save time.

Where to Find Pre-Made Designs

If you prefer using pre-designed forms, here are some websites where you can find high-quality, customizable billing documents:

- Template Marketplaces: Websites like Etsy, Template.net, and Creative Market offer a wide variety of ready-made designs for business documents, including customizable billing forms.

- Accounting Software Providers: Many accounting platforms offer professional document designs as part of their service packages. These designs are often integrated with the software, making it easier to generate accurate and branded forms directly from the tool.

Whether you choose to create your own designs, hire a professional, or use pre-made options, investing in high-quality billing documents can significantly enhance your brand image, improve customer satisfaction, and ensure your business runs smoothly.