Digital Marketing Services Invoice Template for Easy Billing

Managing financial transactions efficiently is essential for maintaining a smooth business operation. Proper documentation ensures clarity between service providers and clients, minimizing errors and confusion. Creating accurate and professional documents can streamline your workflow and strengthen client trust.

Creating customized documents allows businesses to reflect their brand while including necessary payment information. A well-organized document not only aids in tracking payments but also helps in managing outstanding balances effectively. By choosing the right structure, you can make sure that all vital details are clear and accessible.

In this section, we explore how to design a functional document that meets your business needs. From the essential components to design tips, we cover everything you need to create professional, easy-to-understand records for your clients.

Digital Marketing Services Invoice Template Overview

For any business, the ability to present clear and organized payment documents is crucial to ensure timely transactions. An effective billing document serves as a vital tool for both businesses and clients, facilitating smooth financial exchanges. By structuring payment details in a coherent format, you can ensure that both parties understand the terms and expectations, reducing misunderstandings.

Key Elements of a Billing Document

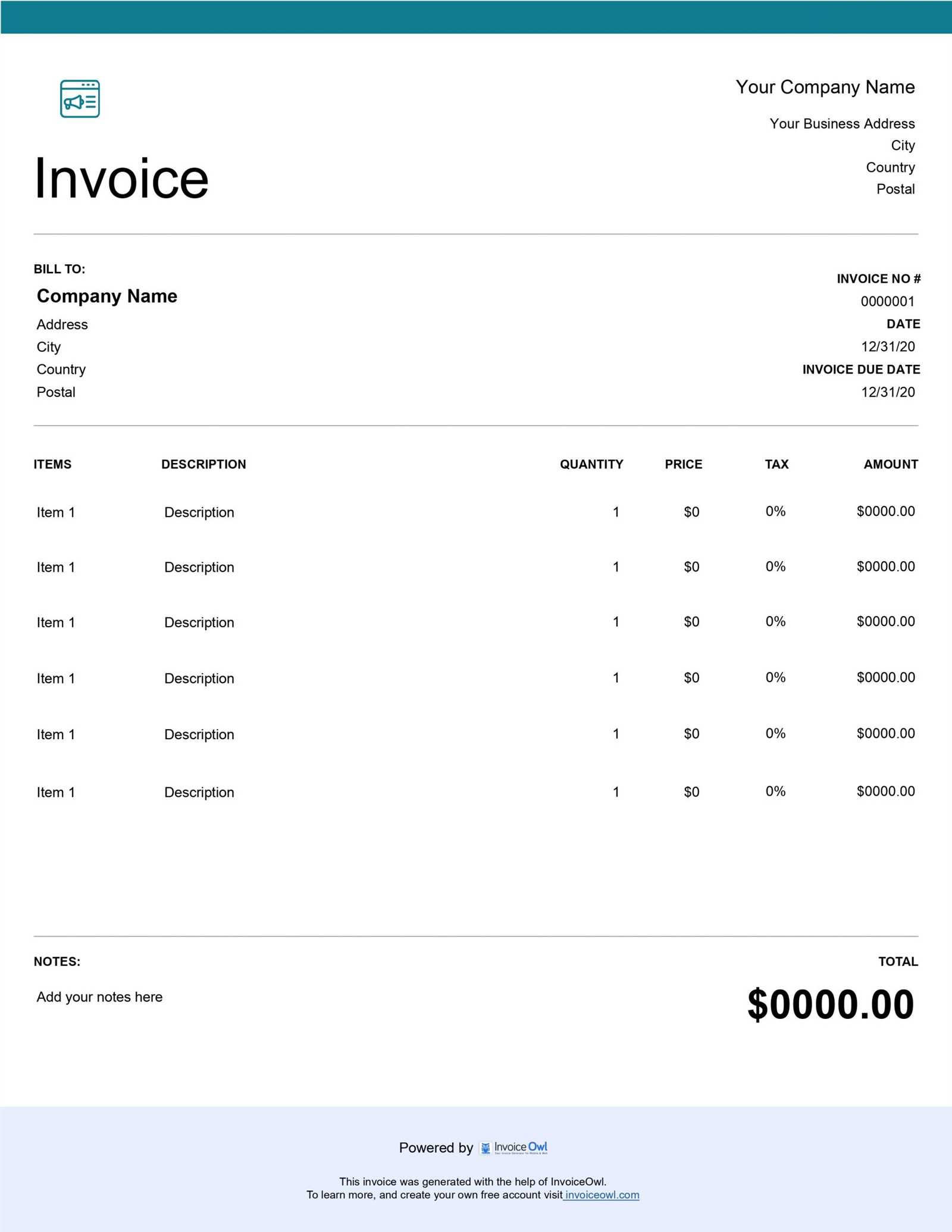

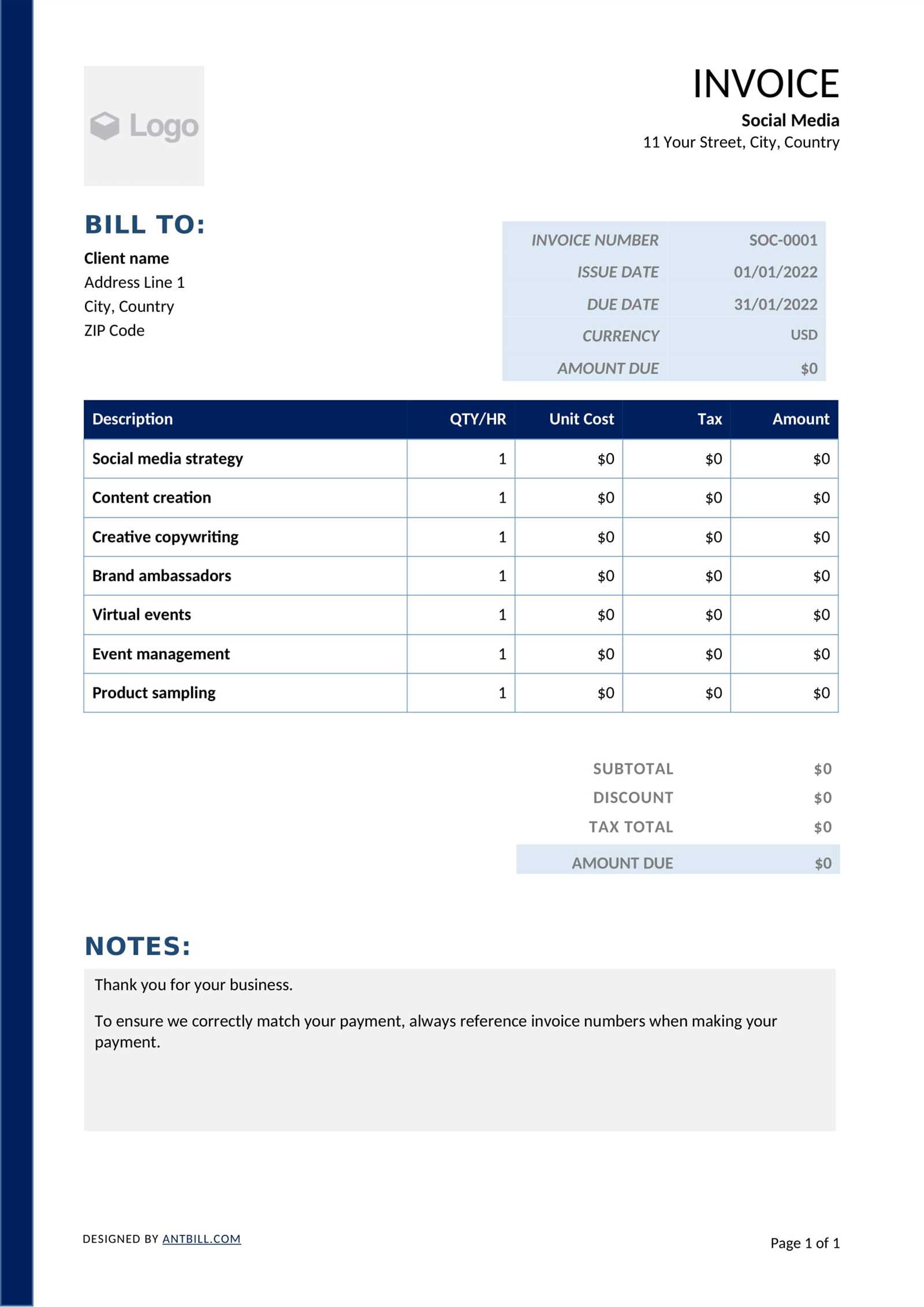

The key to a successful document lies in its structure and the clarity of its components. A well-organized document should include critical details such as payment amount, due date, and a breakdown of provided services. Each section should be designed to be easily navigable, allowing clients to quickly find the necessary information. Below is a sample layout:

| Component | Description |

|---|---|

| Client Information | Includes the name, address, and contact details of the client. |

| Provider Information | Contains the details of the service provider, such as name and contact information. |

| Service Breakdown | A clear list of all tasks or products delivered, with respective costs. |

| Total Amount | The total cost of services rendered, including applicable taxes and discounts. |

| Payment Terms | Specifies the deadline for payment, methods of payment, and any late fee conditions. |

Customizing Your Billing Document

Customization plays a significant role in aligning the document with your business needs. Personalizing a payment form helps maintain a professional image while reflecting your brand’s identity. By adjusting the design, adding a logo, or modifying payment terms, you can create a document that suits both your style and your client’s preferences. A carefully crafted record helps build a lasting professional relationship with your clients.

Why Use a Professional Invoice Template

Using a professionally designed payment document can significantly enhance the way a business handles financial transactions. A well-structured form provides clarity, improves organization, and fosters trust between the provider and the client. With the right design, all necessary details are easy to find, reducing the chance of confusion and ensuring smooth processing of payments.

By adopting a standard format, businesses can present themselves as professional and reliable, which is essential in establishing credibility. Whether you’re a freelancer or a large company, a polished payment document reflects the seriousness of your work and can help you avoid common billing issues.

| Benefit | Description |

|---|---|

| Professional Appearance | A clean, organized design gives a professional impression to clients, enhancing your business’s reputation. |

| Time Efficiency | Pre-made layouts save time by eliminating the need to create a new document each time. |

| Consistency | Using a uniform format ensures that all documents are aligned with your business’s branding and expectations. |

| Accuracy | Structured layouts reduce the likelihood of missing essential details or making calculation errors. |

| Clear Communication | Well-organized forms make it easier for clients to understand payment terms, reducing potential misunderstandings. |

With these benefits, it’s clear why adopting a consistent, professional payment document layout can contribute to a more efficient and positive business experience for both providers and clients.

Benefits of Customizing Your Invoice

Personalizing your payment documentation offers several advantages that go beyond just appearance. A tailored document allows you to meet the unique needs of your business while presenting a more professional image to clients. Customization enables you to incorporate essential elements that reflect your brand identity, while also providing flexibility to suit various types of transactions.

When you adjust the layout and content to match your business model, it becomes easier to track specific financial details, manage payments, and communicate terms clearly. Customizing forms can also help you stand out from competitors by making your documents more memorable and cohesive with your brand’s overall look.

| Advantage | Description |

|---|---|

| Branding Alignment | Incorporating your logo, colors, and fonts helps maintain consistency with your overall brand image. |

| Tailored Content | Customizing allows you to include specific details relevant to your industry, such as unique payment terms or discount structures. |

| Increased Professionalism | A custom document reflects attention to detail and a high level of professionalism, which can build trust with clients. |

| Better Organization | Custom formats let you prioritize the most important details, ensuring that both you and your clients stay organized. |

| Client Experience | Clients will appreciate the personalized touch, enhancing their overall experience and increasing the likelihood of repeat business. |

Customizing your payment document is an investment that not only helps organize your business affairs but also strengthens your relationship with clients by showing a commitment to professionalism and clear communication.

Key Elements of a Marketing Invoice

To ensure smooth financial transactions, it’s important to include all necessary components in your billing document. Each element plays a vital role in making the payment process clear and straightforward for both the business and the client. By incorporating the right sections, you can avoid misunderstandings and streamline your workflow.

Essential Components

While the design of each document may vary, there are several key sections that should always be present. These ensure that all critical information is easily accessible and properly organized.

- Client Information: Always include the client’s name, address, and contact details for easy reference.

- Provider Details: Include your business name, address, and contact information to ensure clarity and transparency.

- Services Rendered: List all tasks or goods provided, with detailed descriptions to avoid confusion about what was delivered.

- Payment Terms: Clearly outline the payment due date, preferred payment methods, and any late fees or discounts that may apply.

- Total Amount: Include the total cost, including taxes and any applicable fees, so clients know the exact amount due.

Additional Helpful Details

Beyond the essential elements, certain details can further enhance the document’s clarity and usefulness.

- Invoice Number: Assign a unique reference number to each document for easy tracking.

- Due Date: Make the payment deadline clear to avoid confusion and encourage timely payment.

- Itemized Costs: Break down the costs for each service or product provided, giving clients a better understanding of what they’re paying for.

- Notes or Special Instructions: Provide any additional information or conditions that might be important for the client to know.

Incorporating these key elements ensures that the payment document is not only informative but also professional, helping to build trust with clients and maintain clear communication throughout the billing process.

How to Personalize Your Template

Customizing your billing document is an important step in creating a professional image while aligning with your business needs. Personalization not only enhances the document’s appearance but also ensures it reflects your brand identity and communication style. By making small adjustments, you can make the document more functional, clear, and uniquely yours.

Key Areas to Personalize

There are several areas where customization can make a significant impact. Adjusting these elements ensures the document fits your specific business style and client requirements.

- Logo and Branding: Add your company logo and use your brand’s colors and fonts to create a cohesive look that reflects your business identity.

- Contact Information: Ensure your business address, phone number, and email are correctly displayed, making it easy for clients to reach you.

- Payment Methods: Specify the available payment options you accept, such as bank transfers, credit cards, or digital payment platforms.

- Customized Descriptions: Modify the service or product descriptions to align with your specific offerings, ensuring clarity and relevance for each client.

- Personalized Notes: Add a personal message or instructions that relate directly to your client’s specific needs or project details.

Advanced Customization Tips

For further refinement, consider these advanced customization options to add both style and functionality to your document.

- Discounts and Promotions: Include fields for discounts or special promotions to give clients a sense of exclusivity and appreciation.

- Due Dates and Terms: Tailor the payment terms to reflect your business practices, including specific time frames or conditions related to late fees or early payment discounts.

- Itemized Billing: Break down services or products into line items, providing clients with a detailed view of the costs and enhancing transparency.

By taking the time to personalize each section, you not only make the document more user-friendly but also communicate professionalism and attention to detail, which can strengthen client relationships and improve payment turnaround times.

Choosing the Right Invoice Format

Selecting the appropriate format for your billing document is essential to ensure it is functional, clear, and professional. The right layout can improve the overall experience for both your clients and your business. A well-organized structure makes it easier to present payment details and facilitates faster processing, reducing the chance of confusion or missed information.

Factors to Consider When Choosing a Format

When deciding on a format for your payment document, there are several key factors to take into account to ensure it suits both your business needs and your clients’ preferences.

- Clarity and Simplicity: Choose a format that is easy to navigate. The simpler the design, the easier it is for clients to understand the details of the transaction.

- Professional Design: A clean and consistent design reflects your business’s professionalism. A structured format enhances your credibility and ensures your document looks polished.

- Customization Flexibility: Select a format that allows for customization to match your specific services, branding, and client requirements.

- Compatibility: Ensure the format you choose is compatible with your tools (e.g., accounting software) and easy for your clients to access and read, whether on paper or digitally.

Popular Format Options

There are different formats available that can work well for your business. Below is a comparison of some of the most commonly used layouts:

| Format | Description |

|---|---|

| Basic Layout | A simple, no-frills format that focuses on essential details. Great for small businesses or freelancers looking for minimal complexity. |

| Itemized Layout | A detailed layout that breaks down each service or product provided, showing individual costs. Perfect for businesses with diverse offerings. |

| Professional Design | Highly polished format with advanced branding options, ideal for businesses that want to impress clients with a sophisticated and well-branded document. |

| Customizable Template | A flexible format that can be easily modified to suit your specific needs. Best for businesses that need to adjust the document regularly based on varying service offerings. |

Choosing the right format is crucial for maintaining professionalism, enhancing client satisfaction, and improving the efficiency of your billing process. Take time to evaluate the options based on your business goals and client preferences to ensure the best possible experience for both parties.

Common Mistakes to Avoid in Invoices

Creating a billing document may seem straightforward, but small mistakes can lead to confusion, delayed payments, and strained client relationships. It’s crucial to avoid common errors that could hinder the clarity of the document and affect your business’s professionalism. Being mindful of the most frequent pitfalls can help ensure smooth transactions and a positive experience for both you and your clients.

Frequent Errors to Watch For

Below are some common mistakes that can undermine the effectiveness of your payment document. By understanding these errors, you can take steps to avoid them and ensure your document is clear, accurate, and professional.

- Missing Contact Information: Failing to include complete and accurate contact details for both parties can lead to confusion or difficulties when clients need to reach you.

- Unclear Payment Terms: Not specifying the payment due date or terms (e.g., late fees, early discounts) can cause misunderstandings and delays in payment.

- Omitting an Invoice Number: Forgetting to assign a unique reference number to your document can make it difficult to track payments or resolve any potential disputes.

- Incorrect or Missing Costs: Listing incorrect prices or failing to itemize charges clearly can cause frustration and even disputes with clients.

- Overcomplicating the Design: A cluttered or overly complex layout can confuse clients and make the document harder to understand. Keep the format simple and clear.

- Not Including Due Dates: Without a clear due date, clients might overlook the deadline for payment, leading to unnecessary delays.

- Inaccurate Tax Information: Incorrect or missing tax calculations can create confusion and potentially result in compliance issues with tax authorities.

How to Avoid These Mistakes

To avoid these errors, always double-check your document before sending it. Consider creating a checklist to ensure that all essential information is included and accurate. Additionally, using a clear and simple format will make it easier for clients to understand the details, leading to quicker and smoother payments.

- Proofread: Review the document for any spelling or mathematical errors before sending it out.

- Use a Standardized Format: Stick to a consistent format that includes all necessary details in an organized manner.

- Be Clear and Concise: Ensure that all descriptions are easy to understand and that terms are clearly defined.

By avoiding these common mistakes, you can create a more effective, professional billing document that builds trust with clients and reduces the chance of payment delays.

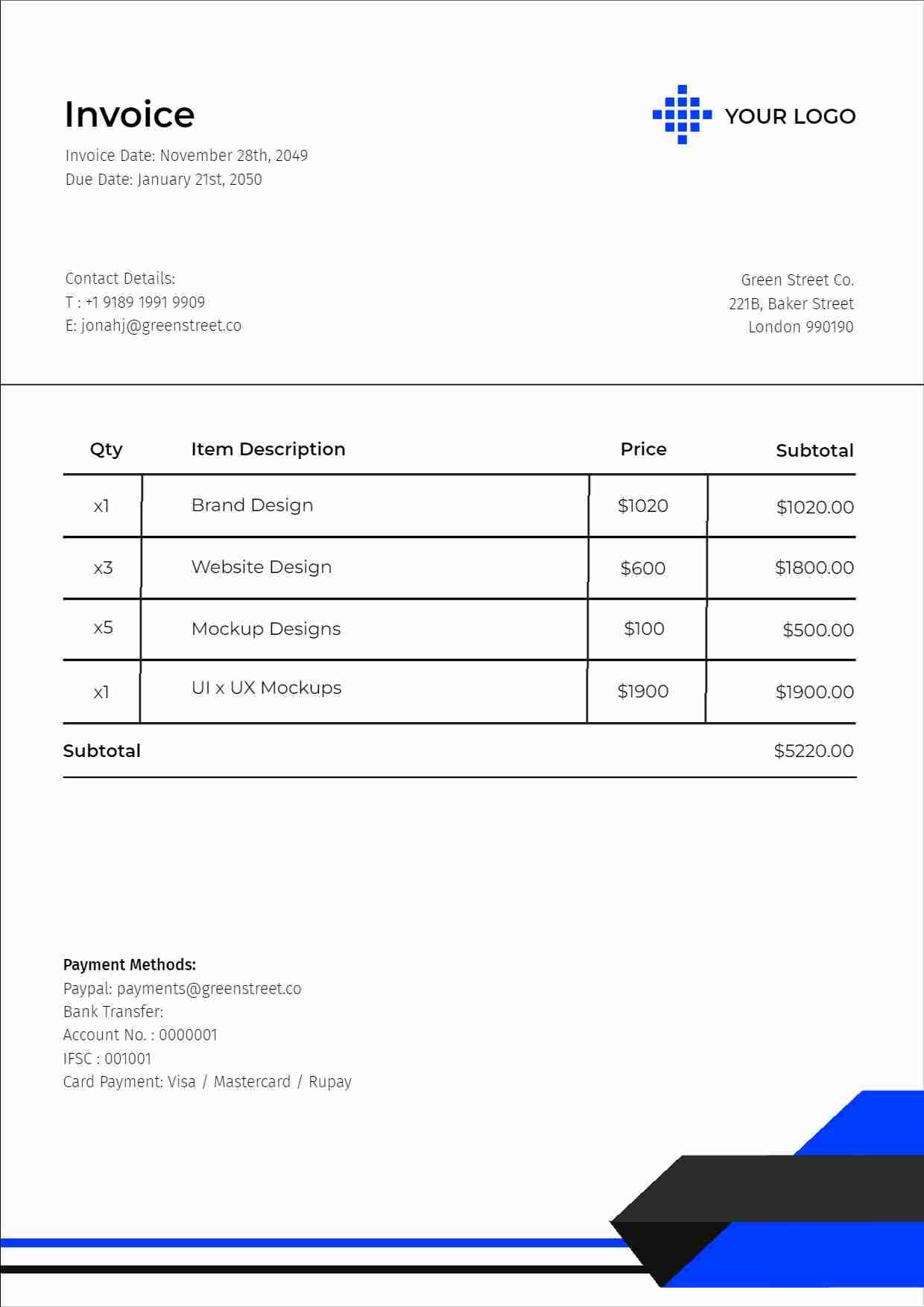

How to Include Service Details Correctly

Providing accurate and clear details of the work performed is essential for ensuring that both you and your clients are on the same page. Properly listing the tasks or items in a clear and organized manner helps avoid misunderstandings and ensures transparency. Well-defined descriptions not only justify the charges but also enhance the professional image of your business.

Essential Elements to Include

When detailing the work or products provided, it’s important to be as specific and clear as possible. A vague description can lead to confusion and potentially slow down the payment process. Here are the key elements to include for clarity:

- Clear Descriptions: Be specific about what was provided. Avoid generic terms and include exact details of the work done or products delivered.

- Quantities and Units: For each item or service, include the quantity or number of hours worked, as well as the unit price if applicable.

- Dates of Service: Include the exact dates the work was performed or the product was delivered, especially if the work spanned multiple days or weeks.

- Hours Worked: If applicable, list the number of hours worked, including the hourly rate to give clients a full breakdown.

- Any Additional Charges: If there were extra costs outside of the initial agreement, clearly itemize them to avoid confusion later on.

Example of a Properly Detailed Entry

Here’s an example of how you can structure a service entry to ensure all the necessary details are included:

| Service Description | Quantity/Hours | Unit Price | Total |

|---|---|---|---|

| Content Writing for Blog Post | 5 Hours | $50/hour | $250 |

| SEO Optimization | 3 Hours | $60/hour | $180 |

| Graphic Design for Social Media Post | 2 Designs | $80/design | $160 |

As shown in the example, including clear descriptions, quantities, and prices will help your clients understand exactly what they are being charged for. This transparency can lead to faster payments and fewer disputes.

Setting Payment Terms on Your Invoice

Clearly defining the terms of payment is crucial for ensuring that both you and your clients are aligned on expectations. Payment terms help establish when the payment is due, what payment methods are acceptable, and any penalties for late payments. By clearly communicating these details, you reduce the risk of confusion or delays and improve your chances of receiving payments on time.

When setting payment terms, it is important to be both specific and fair, considering both your needs and the client’s situation. Here are some key elements to include:

- Due Date: Specify a clear due date for payment. This gives your client a concrete deadline and ensures there are no misunderstandings regarding when payment is expected.

- Accepted Payment Methods: Indicate the payment methods you accept, such as bank transfer, credit card, or online payment platforms. This provides clarity for the client on how to make the payment.

- Late Payment Penalties: If applicable, outline any late fees or interest charges for overdue payments. This serves as a reminder for clients to pay on time and discourages delays.

- Early Payment Discounts: Offering a small discount for early payments can encourage clients to settle their bills quickly and improve cash flow.

Including these details clearly on your document ensures that both parties are on the same page and can help maintain a professional relationship. A well-defined set of payment terms can prevent disputes, improve payment timeliness, and contribute to smoother financial transactions overall.

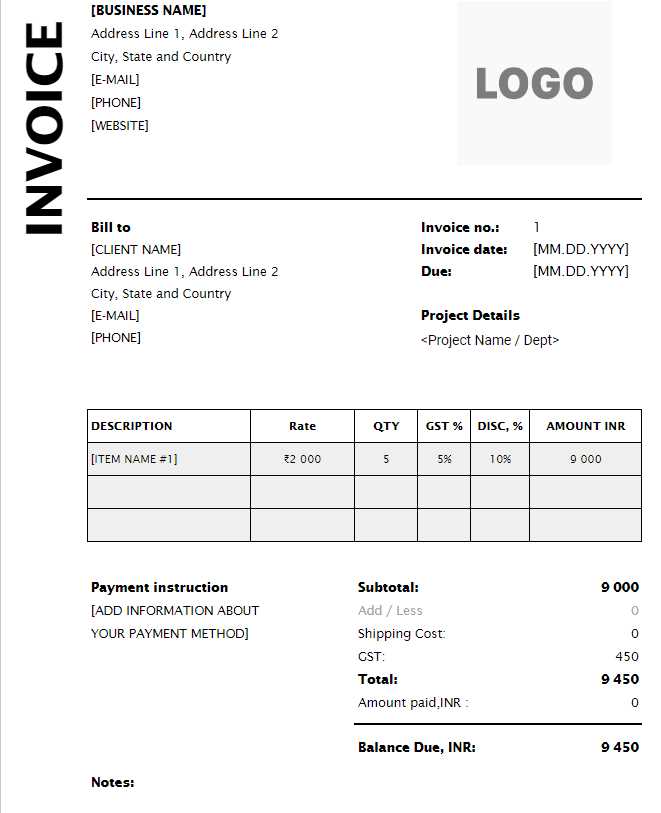

Adding Tax and Discounts in Invoices

Incorporating taxes and discounts into your billing documents is essential for transparency and accurate pricing. Taxes are often legally required, while discounts can be used as a way to incentivize timely payments or reward loyal clients. Properly adding these elements ensures that your client understands the full breakdown of the charges and helps maintain professionalism in your transactions.

Here are some important points to consider when adding tax and discounts:

- Clearly State Tax Rates: Specify the tax rate applied to the charges, whether it is a local, state, or federal tax. It’s important to list the exact percentage and ensure that it is correctly calculated on the total cost.

- Itemize Discounts: If you offer a discount, clearly indicate the amount or percentage and the conditions under which the discount applies. For example, if the discount is for early payment, include the exact due date for the discount to take effect.

- Show Tax and Discount Separately: Break down the tax and discount amounts separately from the base price. This gives clarity to the client and shows how the final total is calculated.

- Ensure Legal Compliance: When adding taxes, make sure that the tax rates you apply align with the local laws and regulations, as failing to do so can lead to legal issues or disputes with clients.

- Use Clear Labels: Label all sections clearly, such as “Sales Tax,” “Discount,” and “Total After Discount,” so your client can easily understand how the final amount is derived.

By including taxes and discounts clearly and accurately, you can help prevent confusion or disputes and foster a more transparent business relationship with your clients. This practice ensures that your financial transactions are handled correctly and professionally, leading to smoother payments and stronger client trust.

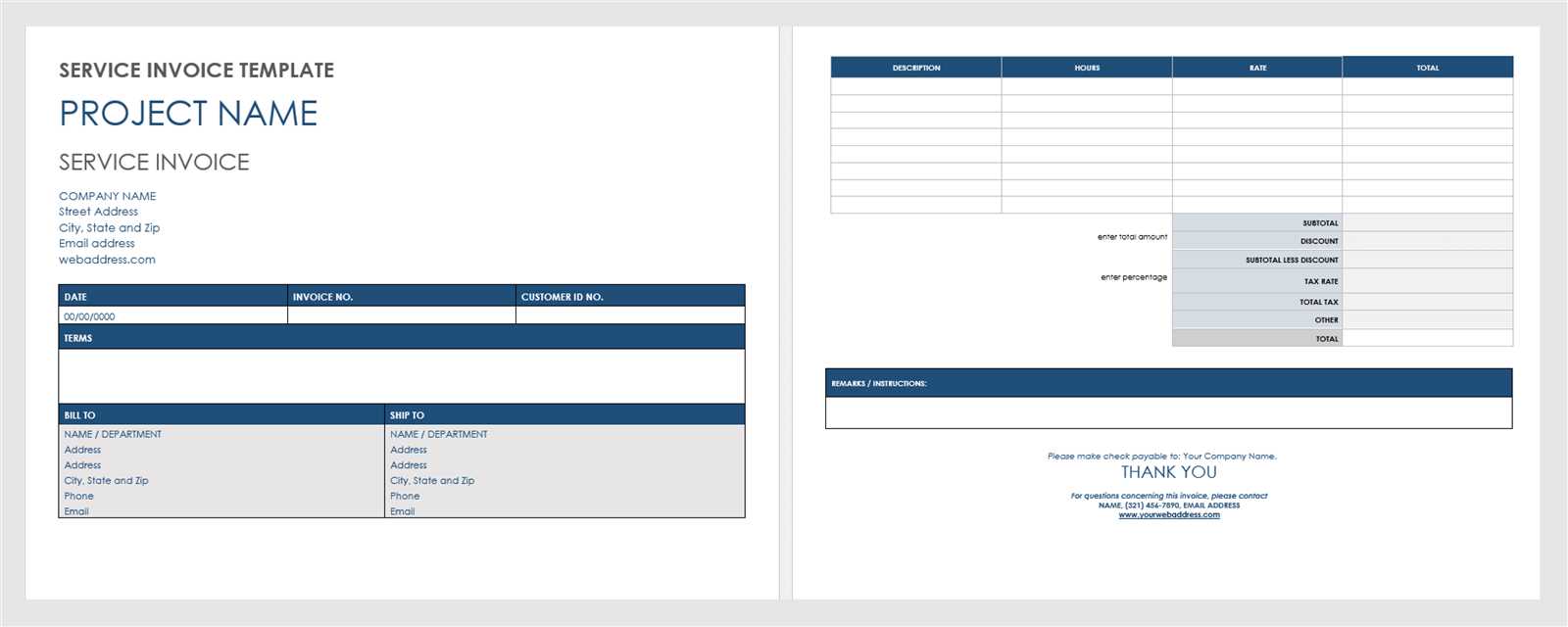

Invoice Design Tips for Digital Marketers

Creating a well-designed billing document is essential for ensuring that your clients can easily understand the charges and terms. The layout, style, and organization of your document contribute not only to its professionalism but also to its effectiveness in communicating essential details. A clean, well-structured bill helps establish credibility and can lead to faster payments and fewer disputes.

Here are some key design tips to consider when creating a billing document:

- Simple and Clean Layout: Avoid clutter and make sure all the information is easy to read. A clean, minimal design with sufficient white space improves the document’s readability and professionalism.

- Use Branding Elements: Include your company logo, color scheme, and fonts to create a branded look. This adds a personal touch and helps strengthen your brand identity with clients.

- Organize Information Clearly: Divide the information into clear sections, such as client details, service description, costs, and payment terms. Use headers to organize each section logically.

- Highlight Key Details: Emphasize important information, such as the due date, total amount due, and payment terms. Use bold or larger text for these key elements to draw attention.

- Provide Clear Contact Information: Ensure that your contact details are easy to find in case the client has any questions or concerns about the bill.

Example of a Clear Design

Below is an example of how you can structure the information in a well-organized, clean layout:

| Service Description | Hours | Unit Price | Total |

|---|---|---|---|

| Content Creation for Website | 10 hours | $50/hour | $500 |

| SEO Optimization | 8 hours | $70/hour | $560 |

| Social Media Campaign Design | 5 hours | $60/hour | $300 |

| Total | $1360 |

With a well-organized document, your clients can easily review the charges, see the breakdown of costs, and understand the total amount due. A thoughtful, professional design reflects well on your business and encourages a positive client experience.

Ensuring Clear Payment Instructions

Clearly outlining the payment process in your billing documents is crucial for avoiding misunderstandings and ensuring timely payments. By providing explicit instructions, you help your clients understand exactly how and when they should make their payments. This transparency not only fosters trust but also streamlines the entire payment process, reducing the chances of delays or errors.

Here are some essential elements to include when detailing payment instructions:

- Specify Payment Methods: Clearly state which payment methods you accept, such as bank transfer, credit card, or online payment platforms. This ensures that your client knows how to complete the transaction without confusion.

- Include Payment Terms: Indicate the payment due date and any applicable late fees for overdue payments. Make sure these terms are highlighted so that there is no ambiguity regarding deadlines.

- Provide Account Information: If the payment is to be made via bank transfer, include your bank details, such as account number, bank name, and routing number. This information should be accurate and up-to-date to avoid transaction errors.

- Offer Multiple Payment Options: If possible, give clients several ways to pay. This flexibility can help speed up the process, as clients may prefer one method over another.

- Be Concise and Direct: Avoid unnecessary jargon or overly complicated language. Use simple, straightforward phrasing to make it as easy as possible for clients to understand how to proceed with their payments.

By including clear, concise payment instructions, you minimize the chances of miscommunication and ensure a smoother financial transaction process. This helps maintain strong relationships with clients and encourages prompt settlement of outstanding balances.

Tracking Your Payments Efficiently

Efficiently tracking payments is essential for maintaining accurate financial records and ensuring that all transactions are completed on time. A well-organized approach to monitoring payments not only helps with cash flow management but also minimizes the chances of overlooking missed or late payments. By implementing the right tools and processes, you can stay on top of your finances with ease.

Here are some strategies to track your payments effectively:

Use a Payment Tracking System

Utilizing a digital tool or software designed for tracking payments can streamline the process. These systems allow you to log payment dates, amounts, and methods, making it easy to track outstanding balances and ensure that each transaction is recorded accurately. Many systems also offer automated reminders, notifying clients of upcoming or overdue payments.

Maintain Detailed Records

For every payment you receive, ensure that you keep detailed records that include the client’s name, payment amount, date received, and any reference number or transaction ID. This information is valuable for both tracking and resolving potential disputes. By storing this data in an easily accessible format, you can quickly retrieve payment details when needed.

Additionally, creating a dedicated payment tracking spreadsheet or database can provide a visual overview of your financial status. This method allows you to track both paid and unpaid amounts, monitor outstanding balances, and identify any potential gaps in your cash flow.

By implementing these methods, you can keep your payment records organized and up-to-date, ensuring that you always have a clear picture of your financial standing.

How to Handle Late Payments Smoothly

Dealing with overdue payments is an inevitable part of managing your finances, but handling them with professionalism and tact can make all the difference in maintaining positive relationships with your clients. It’s essential to address late payments promptly while keeping the communication polite and respectful. By using the right approach, you can minimize any tension and encourage faster settlements.

Here are a few strategies to handle delayed payments effectively:

Send Friendly Reminders

Sometimes, clients may forget about payments or need a gentle reminder. Sending a polite follow-up email or message shortly after the due date can often resolve the issue without confrontation. Keep the tone friendly and understanding, acknowledging that life can sometimes cause delays. Remind them of the payment terms and ask if they need any assistance in completing the transaction.

Offer Payment Flexibility

If a client is experiencing financial difficulties or facing challenges with making the payment on time, consider offering flexible payment options. You could provide an extended deadline or allow them to break the payment into smaller, manageable installments. Offering this flexibility can help maintain a good relationship while ensuring that you eventually receive the payment in full.

Stay Professional: Regardless of the situation, always maintain a professional tone in your communications. If you need to escalate the issue, consider discussing it in person or over the phone to ensure clarity and avoid misunderstandings.

Establish Late Payment Penalties: To prevent future issues, it may be helpful to include late payment penalties in your terms and conditions. This can serve as a deterrent and encourage clients to pay on time, as they will know there are consequences for late payments.

By addressing overdue payments with understanding, clear communication, and flexibility, you can ensure that financial transactions remain smooth while preserving your professional relationships.

Free vs Paid Templates: Which to Choose

When it comes to managing your financial documents, choosing the right layout is crucial. There are many options available, from free designs to premium versions, each offering its own set of benefits. While free templates may seem like an attractive option, paid designs often provide additional features and customization options. Understanding the differences between these two options can help you make the right decision based on your needs and business requirements.

Advantages of Free Templates

Free templates are easily accessible and can be a great choice for small businesses or individuals with limited budgets. These designs usually include basic elements, such as fields for the client’s information, dates, and amounts. If you’re just starting out or have simple invoicing needs, a free option might be all you need.

- Low or no cost

- Simple and easy to use

- Basic design features

- Ideal for small, straightforward transactions

Benefits of Paid Templates

Paid versions often come with more advanced features, such as custom branding, automation, and enhanced customization options. These templates provide a more polished, professional appearance, and can save you time by streamlining your billing process. For businesses that need to create multiple documents regularly or require specific details to be included, investing in a paid option can be worthwhile.

- Customizable branding options

- Advanced design and formatting features

- Automation tools to streamline billing

- Better for businesses with high-volume transactions

Comparing Free vs Paid Templates

| Feature | Free Templates | Paid Templates |

|---|---|---|

| Cost | Free | Paid |

| Customization Options | Limited | Highly customizable |

| Professional Appearance | Basic | Highly professional |

| Automation Features | No | Yes |

| Best for | Small, simple needs | Businesses with frequent or complex billing needs |

Choosing between free and paid options ultimately depends on the nature of your business and the level of professionalism you require. For small-scale operations, free templates can often suffice, but as your business grows, investing in a paid solution may be the best way to ensure a streamlined and professional experience.

How to Send Invoices Securely Online

In today’s digital world, sending financial documents online has become the norm. However, ensuring that these documents are transmitted securely is crucial to protecting both your business and your clients. To avoid potential risks such as unauthorized access or data breaches, it’s important to use safe methods for transmitting these files. Here are some strategies you can implement to send your billing statements securely over the internet.

First, make sure to use a secure platform or service for sending your documents. Look for services that provide encryption and secure channels to prevent unauthorized access. Avoid sending sensitive information via unsecured email or through unreliable third-party websites.

Next, consider password-protecting your documents before sending them. This adds an extra layer of security, ensuring that only the recipient with the correct password can open and view the file. You can easily set a password for PDF files using various software tools available online.

Lastly, when sharing links to your documents, make sure the links are sent through encrypted messaging systems or secure communication channels. It’s also a good idea to verify the identity of the recipient before sending any confidential information. This can help ensure that the documents are received by the intended party only.

By following these simple precautions, you can confidently send your documents online while protecting sensitive data from potential security threats.

Improving Cash Flow with Efficient Invoicing

Managing cash flow effectively is crucial for any business, and one of the key factors that influence it is the timely and accurate processing of financial documents. Delayed payments or mistakes in billing can lead to cash flow problems, affecting your ability to cover expenses and invest in growth opportunities. By streamlining the billing process and ensuring that all records are clear and correctly prepared, you can accelerate payments and maintain a steady flow of income.

One way to improve your cash flow is by ensuring that your financial statements are issued promptly after the completion of a project or delivery of goods. The quicker your clients receive their billing details, the sooner they can process payment. Clear, well-structured statements that outline all necessary information, such as amounts owed, payment terms, and deadlines, help prevent confusion and delays in payment.

Another important aspect is setting clear payment terms and expectations upfront. By establishing specific payment deadlines and offering various payment methods, you can reduce the chances of late payments. Additionally, consider incentivizing early payments by offering discounts, or imposing late fees to encourage timely settlement.

Lastly, using automated reminders for overdue payments can help maintain your cash flow. Sending friendly reminders about upcoming or past due payments can prompt clients to settle their bills without damaging the client relationship. Consistently following up on unpaid bills ensures that your business continues to operate smoothly and that your revenue stream remains strong.

In summary, by optimizing the process of preparing and managing financial records, you can ensure quicker payments and better cash flow management for your business.