Design Service Invoice Template for Your Business Needs

Managing financial transactions smoothly is crucial for any business, especially for those offering custom solutions and artistic work. Clear and accurate documentation of the work completed ensures both the provider and the client are on the same page, leading to better business relationships and smoother payments.

For professionals in creative industries, having a well-structured method to request compensation is essential. By using organized documents, you can outline all aspects of the completed work, including costs, deadlines, and terms of payment, in a straightforward manner. These documents not only promote professionalism but also help avoid misunderstandings.

In this section, we explore various ways to streamline the billing process with practical tools that can be easily adapted to suit any project. The goal is to simplify how you manage payments, so you can focus more on the creative side of your business while ensuring timely compensation for your work.

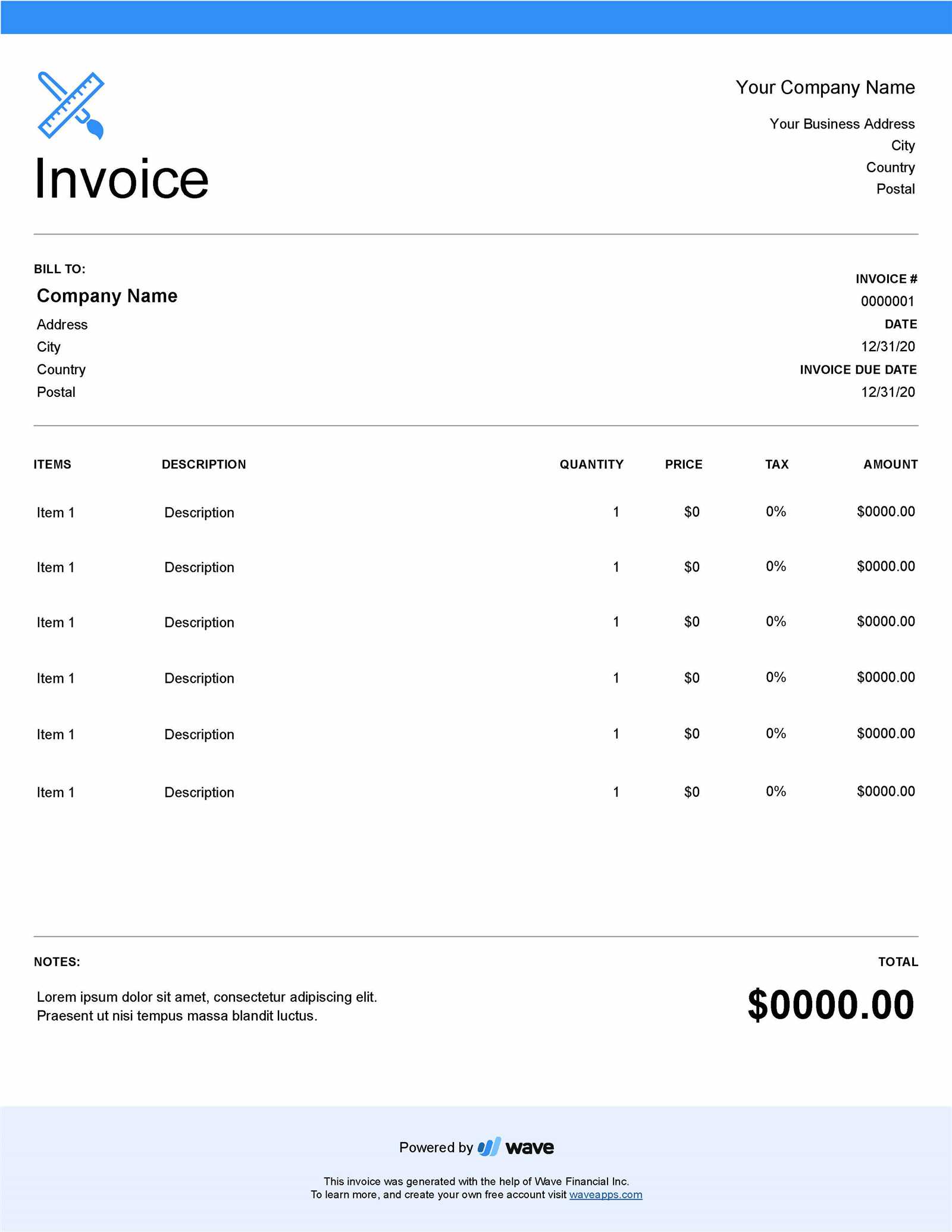

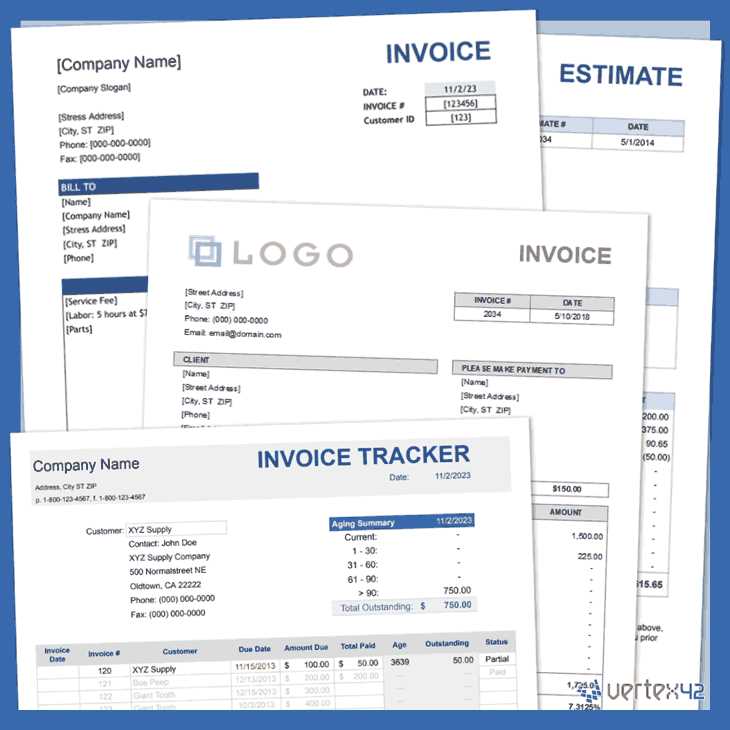

Design Service Invoice Template Overview

Efficient documentation of the work completed and the compensation due is a key part of any professional transaction. It not only ensures that both parties are clear about the agreed terms, but also helps in maintaining a smooth workflow, especially for those working in creative and custom fields. Such documents serve as a formal request for payment and provide detailed information regarding the tasks performed.

These documents often include key elements that reflect the nature of the project, the cost breakdown, and the terms of payment. Whether you’re a freelancer, a small business owner, or part of a larger company, having a standardized method for creating these records can save you time and prevent potential errors.

Key Components of a Payment Request

- Client Information: Name, contact details, and billing address.

- Project Details: A clear description of the work completed or the products delivered.

- Cost Breakdown: A detailed list of charges for each task or deliverable.

- Payment Terms: Deadlines, payment methods, and any late fees.

- Dates: The date the document was created and the due date for payment.

Why Use a Standardized Format?

Having a standardized format helps ensure that you don’t miss any important information, and it also maintains consistency across multiple projects. When you consistently use the same structure, clients will also know exactly where to find specific details, making the process faster and more efficient. This approach fosters transparency and reduces confusion for both the client and the professional.

Why Use an Invoice Template

Utilizing a pre-structured document for requesting payment offers several advantages, especially when managing multiple projects or clients. It provides a consistent approach to outlining payment details, reducing errors and saving time. Instead of recreating the same document from scratch each time, a reusable format allows professionals to focus on delivering quality work rather than handling repetitive administrative tasks.

By using a well-organized document, businesses can ensure all necessary information is included, enhancing professionalism and reducing the likelihood of misunderstandings. A clear, structured layout helps clients understand exactly what they’re being charged for and when payments are due.

| Benefits | Impact |

|---|---|

| Consistency | Ensures each document follows the same structure, making it easier for clients to read and understand. |

| Time-saving | Reduces the need to recreate a new record for every project, increasing efficiency. |

| Professionalism | Shows attention to detail and helps maintain a polished, organized business image. |

| Accuracy | Minimizes the risk of missing essential details or including incorrect information. |

Overall, adopting a consistent structure helps ensure smoother financial transactions, creating a better experience for both professionals and clients alike.

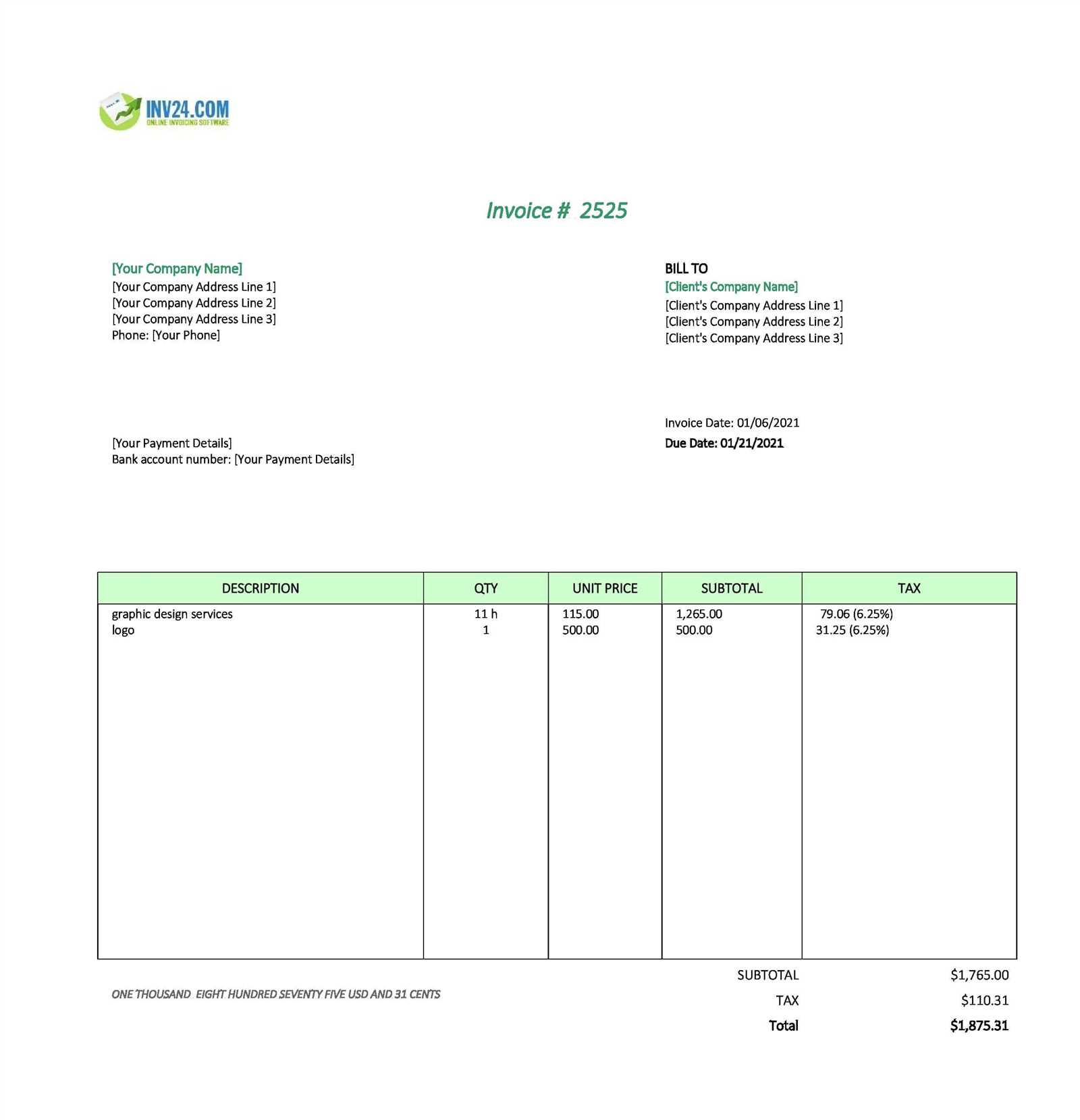

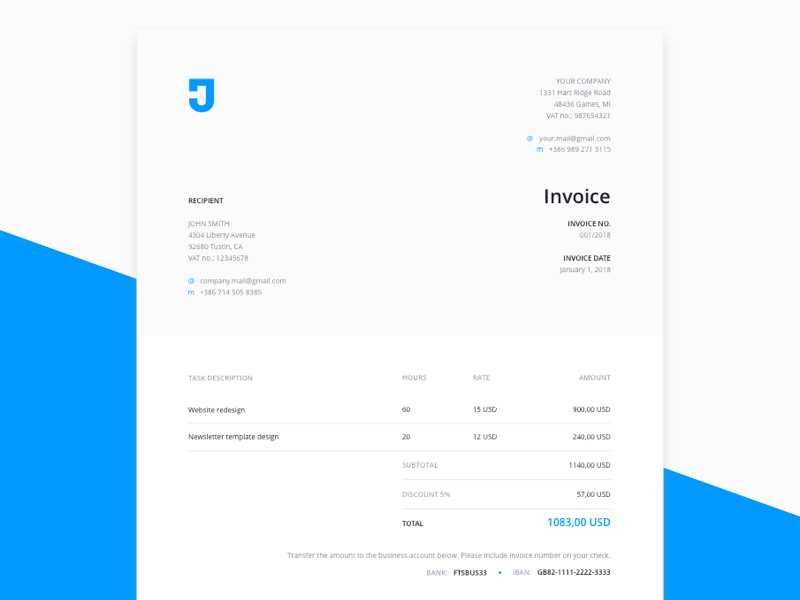

Essential Elements of a Design Invoice

When requesting payment for completed work, certain key details should always be included to ensure the process is clear and professional. These elements not only make the document easier to understand but also protect both parties by outlining the terms of the transaction. A well-organized record helps avoid misunderstandings and ensures that both the provider and the client are on the same page.

The core components of a payment request include identifying information about both parties, a clear breakdown of the charges, and the payment terms. These items provide transparency and create a formal record of the work completed and the agreed-upon compensation.

Key Details to Include

| Element | Description |

|---|---|

| Client and Provider Information | Contact details such as name, address, and phone number for both parties involved. |

| Project Description | A summary of the completed work, including specific tasks or deliverables. |

| Payment Breakdown | A detailed list of costs associated with the work, including rates and quantities. |

| Terms and Due Date | Clear instructions regarding payment methods, deadlines, and any late fees. |

| Unique Identification Number | A reference number to help both parties track the document for future reference. |

Importance of Each Element

Including these key details helps ensure that the payment process is smooth and efficient. By providing all necessary information upfront, both the professional and the client are able to track the work, review the charges, and settle the balance without confusion. It also promotes transparency and trust in the business relationship.

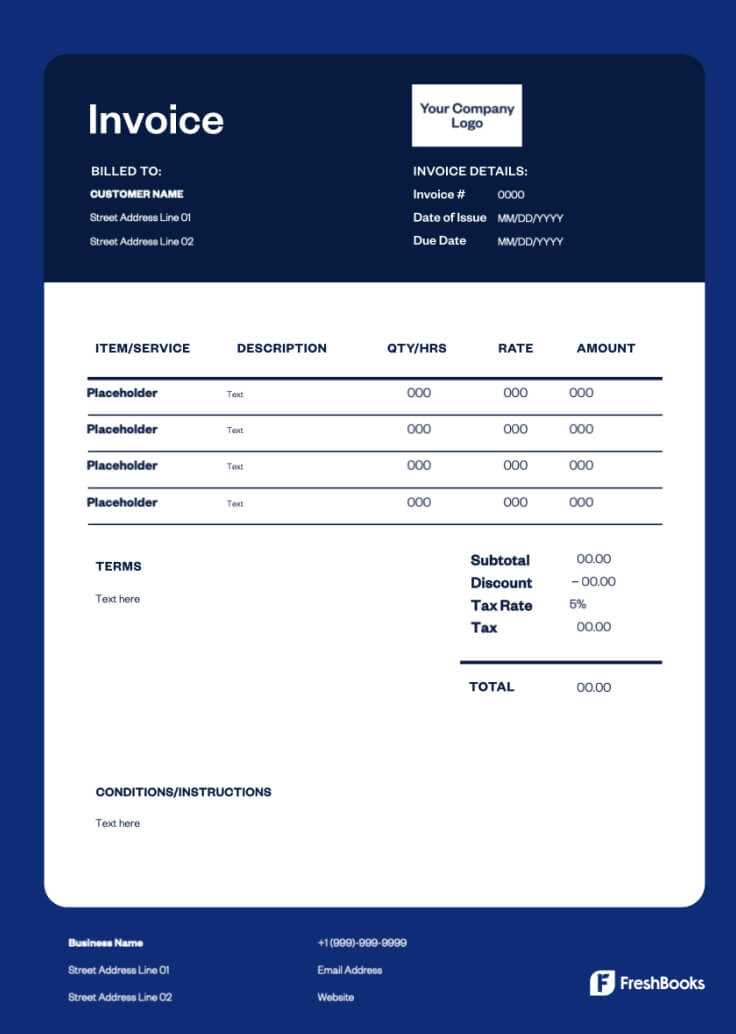

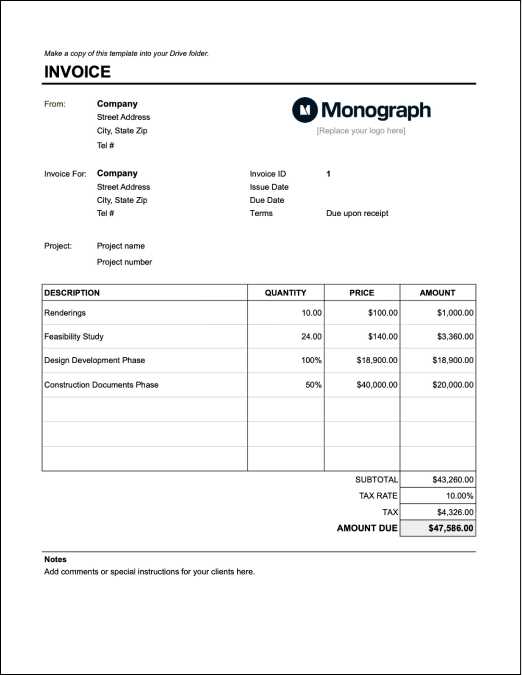

How to Customize Your Template

Adapting a pre-made document to suit your unique needs is an essential part of managing client transactions effectively. Customizing these records ensures that they reflect the specifics of each project while maintaining a consistent and professional look. By making a few simple adjustments, you can tailor the document to meet your business requirements and provide clarity for your clients.

Customizing involves more than just changing names or amounts; it also includes adjusting sections to match the scope of work, payment terms, and specific client preferences. This personalized approach not only adds professionalism but also helps avoid confusion when processing payments.

Here are a few areas you may want to customize:

- Header Section: Modify the document’s title or add your company logo to make it uniquely yours.

- Client Information: Ensure that each document contains the correct contact information for both parties involved.

- Work Details: Customize the description of completed tasks or deliverables to fit the specific project.

- Payment Terms: Adjust payment methods, deadlines, or other conditions based on each client’s agreement.

- Design Layout: You can tweak fonts, colors, and spacing to match your brand identity and improve readability.

Customizing your document with these elements ensures:

- Clarity: A tailored record makes the financial details easier to understand for both parties.

- Efficiency: You reduce the need for back-and-forth communication about payment details.

- Professionalism: A polished, customized document helps leave a strong impression on clients.

With these simple steps, you can quickly create personalized documents that streamline your billing process and enhance your client relationships.

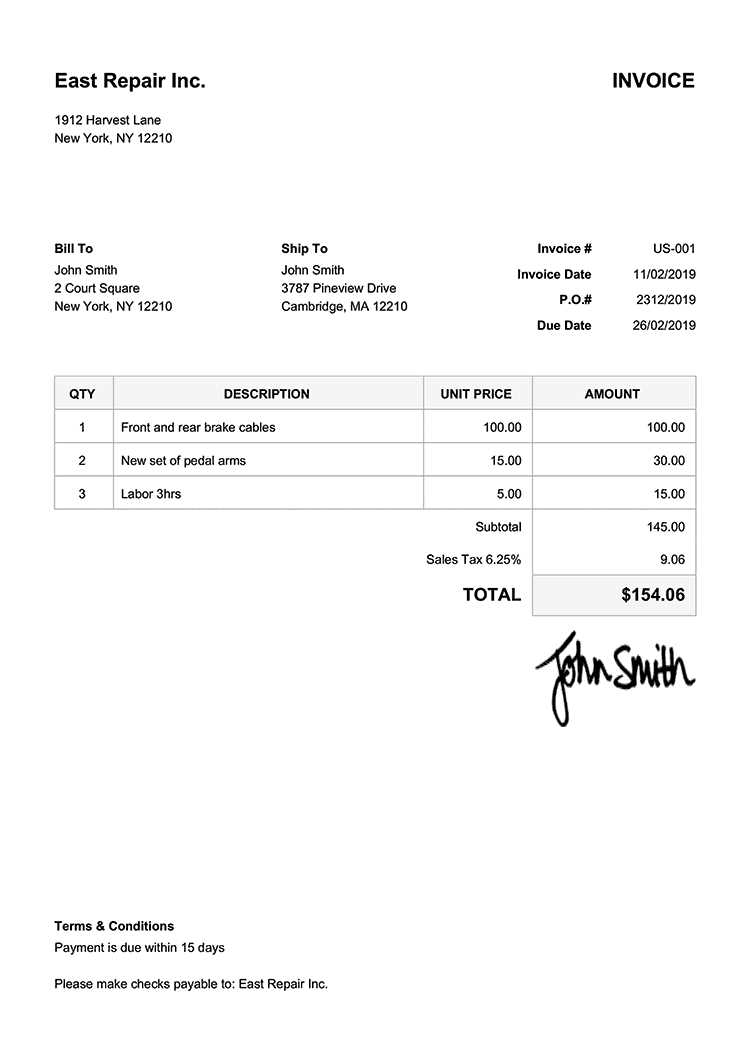

Best Practices for Professional Invoices

Creating clear and professional billing documents is essential for maintaining strong relationships with clients and ensuring smooth financial transactions. A well-prepared document not only reflects the value of your work but also enhances your credibility. By following a few best practices, you can ensure that your requests for payment are accurate, timely, and easy for clients to understand.

Adhering to the following guidelines can help ensure that your financial records are always professional and leave a positive impression on your clients.

- Be Clear and Detailed: Provide a comprehensive breakdown of all costs, making sure the client understands exactly what they are being charged for.

- Use Professional Language: Avoid casual or vague terminology. Use formal, clear, and direct language to maintain professionalism.

- Include All Relevant Dates: Always include the date the document was created, the due date for payment, and the date the work was completed or delivered.

- Ensure Proper Contact Information: Double-check that both your contact details and the client’s are accurate and up to date.

- Payment Methods: Clearly specify accepted payment methods, such as bank transfers, checks, or digital platforms, and include any necessary account details.

- Be Consistent: Use the same format for all records to make them easily recognizable and ensure that clients know what to expect.

Following these best practices helps you stay organized, reduces the chances of disputes, and speeds up the payment process, all while reflecting a high level of professionalism.

Adding Payment Terms to Your Invoice

Clearly stating the conditions under which payment is expected helps ensure smooth financial transactions between you and your clients. Specifying payment terms can prevent misunderstandings and reduce the chances of delays. These terms outline when and how the amount should be settled, as well as any penalties for late payments. Having a clear agreement in place not only protects both parties but also helps establish professionalism and trust in your business relationships.

Define the Payment Due Date

One of the most crucial aspects of payment conditions is defining the exact date when payment should be made. This can be a fixed calendar date, or it can be based on a set number of days after the completion of the work or the delivery of goods. Common due date options include “Net 30,” which means payment is due within 30 days, or a more specific date such as “Due on December 1st.” Establishing this helps both parties know when funds should be transferred.

Specify Late Payment Penalties

To encourage timely payments, it is wise to outline the consequences for delays. Many businesses include a late fee or interest charge if the payment is not received by the agreed date. This can be a fixed amount or a percentage of the total due. For example, a 2% monthly late fee might be applied to any outstanding balance. Including such terms ensures that clients understand the importance of meeting deadlines and the impact of any delays on your business.

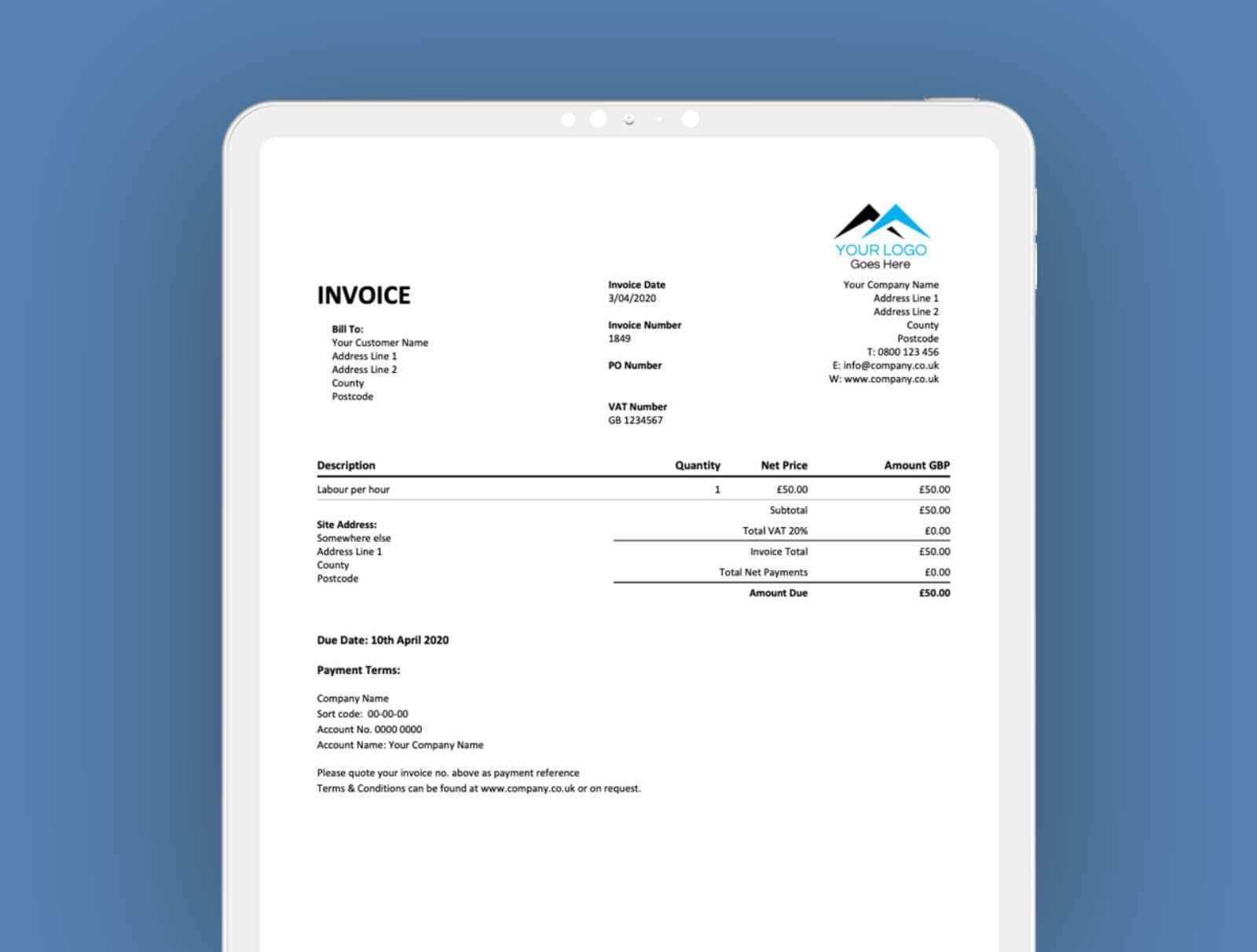

Legal Requirements for Design Invoices

When creating billing documents, it’s essential to include specific details that comply with local and international legal regulations. These details help ensure that your transactions are transparent, protect both parties involved, and satisfy tax authorities. Not only does proper documentation facilitate smoother business dealings, but it also helps avoid legal complications and potential penalties. Understanding the mandatory elements is crucial for maintaining professionalism and operating within the law.

Essential Information to Include

Each billing document should contain key details, such as the names and addresses of both the client and the provider, as well as a unique reference number for tracking purposes. Additionally, the document should specify the nature of the transaction, the agreed-upon amount, and any applicable taxes or discounts. Failure to include these basic components could render the document invalid or incomplete from a legal standpoint.

Tax Identification and Compliance

In many regions, it’s required to display your tax identification number (TIN) or equivalent on billing documents. This is necessary for tax reporting and ensures that the transaction is recognized by the authorities. Furthermore, it’s important to follow the local tax laws regarding VAT or sales tax, which can vary depending on your location or the client’s location. Including the correct tax rates and categorizing the charges appropriately will help maintain compliance and avoid penalties from tax authorities.

Common Mistakes to Avoid in Invoicing

While creating billing documents may seem straightforward, several common errors can lead to confusion, delays in payment, or even legal issues. By understanding and avoiding these mistakes, you can ensure smoother financial transactions with clients and maintain a professional reputation. Below are some frequent pitfalls to watch out for when preparing your financial requests.

Key Mistakes to Avoid

| Mistake | Consequence | How to Avoid |

|---|---|---|

| Missing or incorrect contact details | Delays in payment, confusion about billing information | Ensure client name, address, and payment details are correct |

| Unclear payment terms | Disputes over payment due dates, late fees | Specify clear payment due dates and terms upfront |

| Failure to itemize charges | Misunderstanding of services rendered, potential dissatisfaction | Provide a detailed breakdown of all services or goods provided |

| Not including tax details | Non-compliance with tax regulations, issues with authorities | Always list applicable taxes and tax identification numbers |

| Using unclear or vague descriptions | Confusion over what is being billed, potential disputes | Use precise language to describe what the client is being charged for |

Avoiding these common mistakes can help build trust with clients and ensure that payments are made promptly and accurately. Being meticulous about your billing documentation will also protect your business in case of any disputes or audits.

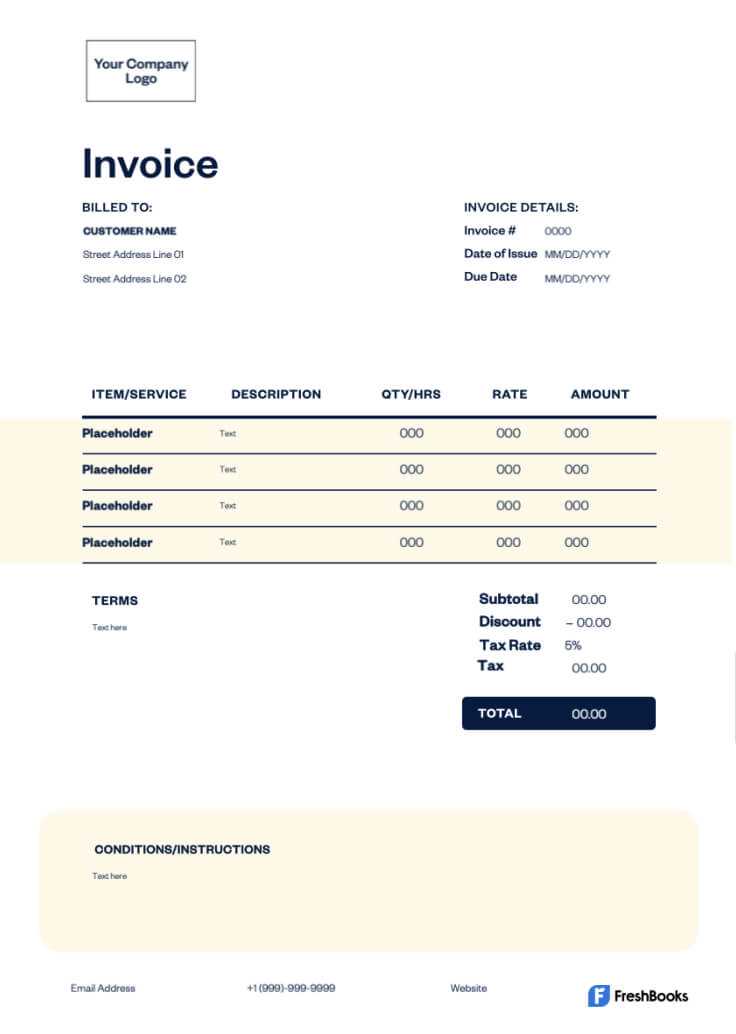

Choosing the Right Format for Your Invoice

Selecting the appropriate format for your billing document is crucial to ensure clarity, accuracy, and ease of use for both you and your client. A well-organized and professional layout makes the payment process smoother and helps prevent confusion or delays. The right format depends on your business needs, client preferences, and the nature of the transaction. Whether you opt for a digital or printed version, it’s important to keep your document clear, concise, and easy to read.

Digital vs. Paper Formats

With the rise of digital tools and software, many businesses now prefer to send their financial documents electronically. Digital formats like PDFs are easy to share, store, and track, reducing the risk of losing important paperwork. Additionally, online payment links can be embedded for faster transactions. However, certain clients may still prefer paper-based documents, especially if they operate in industries where traditional methods are more common. It’s important to consider your client’s preferences and legal requirements when choosing between digital and physical formats.

Customization and Readability

Regardless of the format, your billing document should be easy to understand. Choose a layout that allows you to clearly present the details of the transaction. Use headings, tables, and bullet points to break down complex information. Customization options like branding (logos, colors, fonts) can also enhance the professionalism of your document. A clean, well-organized layout increases the likelihood of timely payments and reflects positively on your business image.

Integrating Your Template with Software

Integrating your billing document format with accounting or financial software can greatly streamline the administrative process. By connecting your documents to the right tools, you can automate much of the work involved in generating and tracking payments, which saves time and reduces human error. These integrations allow for seamless data transfer, instant updates, and easy access to your financial records, improving both efficiency and accuracy in your business operations.

Benefits of Software Integration

| Benefit | Explanation |

|---|---|

| Automation | Automatically populate fields like client details, pricing, and tax rates, saving time and ensuring accuracy. |

| Real-Time Tracking | Track the status of payments and outstanding balances in real time, helping you stay on top of your finances. |

| Increased Accuracy | Reduce human error by eliminating manual entry and ensuring all data is consistent across systems. |

| Seamless Reporting | Generate financial reports and summaries directly from your records, making tax filing and audits easier. |

Choosing the Right Software

When selecting software to integrate with your billing format, it’s essential to consider compatibility, ease of use, and the specific features your business requires. Popular accounting platforms often offer built-in invoice generation tools, while other software might require customization or additional plugins. Make sure the solution you choose supports automated processes, client management, and secure payment methods to ensure a smooth and efficient workflow.

How to Track Payments Efficiently

Keeping track of payments is essential for managing cash flow and ensuring that your business operations run smoothly. Efficient tracking helps you monitor outstanding balances, identify overdue amounts, and stay organized. By using the right tools and practices, you can avoid confusion and delays, ensuring timely payments and maintaining strong relationships with clients.

Methods for Tracking Payments

| Method | Description | Pros |

|---|---|---|

| Manual Record-Keeping | Tracking payments on paper or in spreadsheets by manually entering transaction details. | Low cost, flexibility, complete control over entries. |

| Accounting Software | Using digital tools to automate the tracking of payments, often integrated with bank accounts. | Automation, accuracy, real-time tracking. |

| Payment Processing Platforms | Utilizing online payment systems (e.g., PayPal, Stripe) to track incoming payments automatically. | Instant updates, secure transactions, easy client access. |

Best Practices for Payment Tracking

To maintain an efficient system, ensure that every payment is logged immediately, and regularly reconcile your records with bank statements or payment processors. Set up reminders or alerts for overdue amounts and categorize payments based on their status–paid, pending, or overdue. By keeping your records up to date and using automated tools, you can reduce errors and avoid missing any payments, leading to better financial management.

Designing for Clarity and Readability

Creating clear and easy-to-read documents is essential for effective communication. When the details of a financial transaction are presented in a straightforward and organized way, it reduces the chances of misunderstandings and errors. A well-structured layout allows the recipient to quickly find the necessary information, leading to smoother processing and faster payments. Ensuring that your document is both visually appealing and functional will help maintain a professional image while improving efficiency.

Key Elements for Readability

| Element | Best Practice | Benefit |

|---|---|---|

| Typography | Use clear, legible fonts with appropriate sizing for headings and body text. | Improves readability and reduces strain on the reader’s eyes. |

| White Space | Ensure adequate spacing between sections, text blocks, and margins. | Prevents clutter, making it easier for the reader to follow the content. |

| Consistent Formatting | Use uniform font styles, colors, and heading hierarchy throughout. | Enhances visual consistency, making the document feel organized and professional. |

| Tables and Lists | Break down complex information into tables or bullet-point lists. | Improves clarity by making data easy to scan and understand quickly. |

Maintaining Structure and Flow

To maintain structure, group related information together and follow a logical sequence. Use headings and subheadings to guide the reader through the document, and avoid overcrowding any section with excessive details. A clear structure allows the reader to absorb the most critical information first, ensuring that they understand the core message without being overwhelmed.

How to Handle Client Disputes

Disputes can arise when clients have concerns or disagreements about the charges, terms, or the nature of the work completed. Handling such situations professionally and promptly is essential for maintaining positive relationships and protecting your business. A clear approach to resolving conflicts can prevent escalation and lead to mutually beneficial solutions. The key to addressing disputes lies in clear communication, empathy, and a fair process for both parties involved.

Steps to Resolve Disputes Effectively

1. Stay Calm and Listen: The first step in managing any disagreement is to remain calm and listen to your client’s concerns. Understand the issue from their perspective and acknowledge their frustration. By showing empathy, you can often de-escalate tension and open the door to a productive conversation.

2. Review the Details: Before offering a solution, review all the relevant details to ensure that you have a clear understanding of the situation. This might include going over the work completed, the agreed terms, and any supporting documents. Verifying the facts helps to clarify misunderstandings and strengthens your position when discussing the issue.

Negotiating a Resolution

3. Offer a Fair Solution: Once the facts are clear, propose a fair and reasonable solution. If the dispute is due to an error on your part, take responsibility and offer a correction or compensation, if applicable. If the issue stems from a misunderstanding, explain your position and try to find common ground. Offering alternatives or compromises can help to preserve the relationship while resolving the issue.

4. Put Everything in Writing: After reaching an agreement, make sure to document the resolution and any changes to the original terms. A written record protects both parties and ensures that everyone is on the same page moving forward.

By handling disputes professionally, you not only resolve the immediate issue but also demonstrate reliability and fairness, which can lead to stronger long-term relationships with your clients.

Sending Invoices and Follow-Ups

Sending financial documents and following up with clients for payment are crucial steps in maintaining a smooth workflow and ensuring timely cash flow. The process involves not only sending the document itself but also ensuring that the recipient has received it and addressing any questions or delays promptly. A clear communication strategy and well-timed follow-ups can help you maintain a professional image while reducing the chances of late payments.

Steps for Sending Financial Requests

When sending a payment request, it’s important to follow a consistent process to ensure clarity and avoid misunderstandings. Here are key steps to take:

- Confirm the Details: Before sending the document, double-check that all information is correct–client details, payment terms, amounts, and due dates.

- Choose the Right Delivery Method: Depending on the client’s preferences, send the document via email, postal mail, or an online platform. Make sure the recipient can easily access and review it.

- Include a Clear Subject Line: When sending by email, use a straightforward subject line like “Payment Request for [Your Business Name] – [Invoice Number].” This makes it easier for the client to locate the document later.

- Attach Supporting Documents: If needed, attach any relevant details such as contracts, receipts, or project summaries that justify the charges.

Effective Follow-Up Strategies

Following up on unpaid amounts should be done professionally and with respect. Timely reminders can help avoid confusion or delays. Here’s how to handle follow-ups effectively:

- Send a Reminder Early: A gentle reminder a few days before the due date can help ensure payment is processed on time.

- Follow-Up After the Due Date: If the payment is missed, send a polite follow-up email or letter. Include details of the original amount and any late fees, if applicable.

- Maintain Professionalism: Even if payments are delayed, always remain courteous and understanding. A respectful tone helps maintain a good client relationship.

- Set Clear Next Steps: If the payment is still overdue, outline any consequences, such as late fees or suspension of further work, and provide clear instructions on how to resolve the issue.

By following these best practices, you can ensure that your financial documents are sent and handled efficiently, leading to faster payments and fewer misunderstandings with clients.

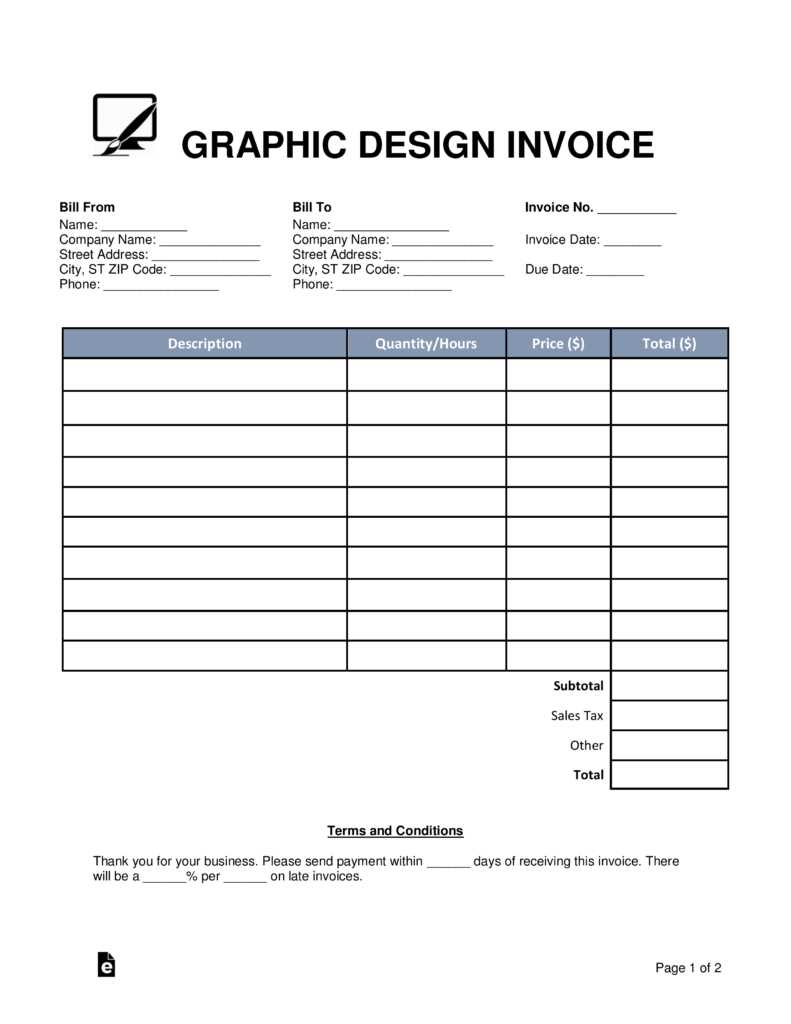

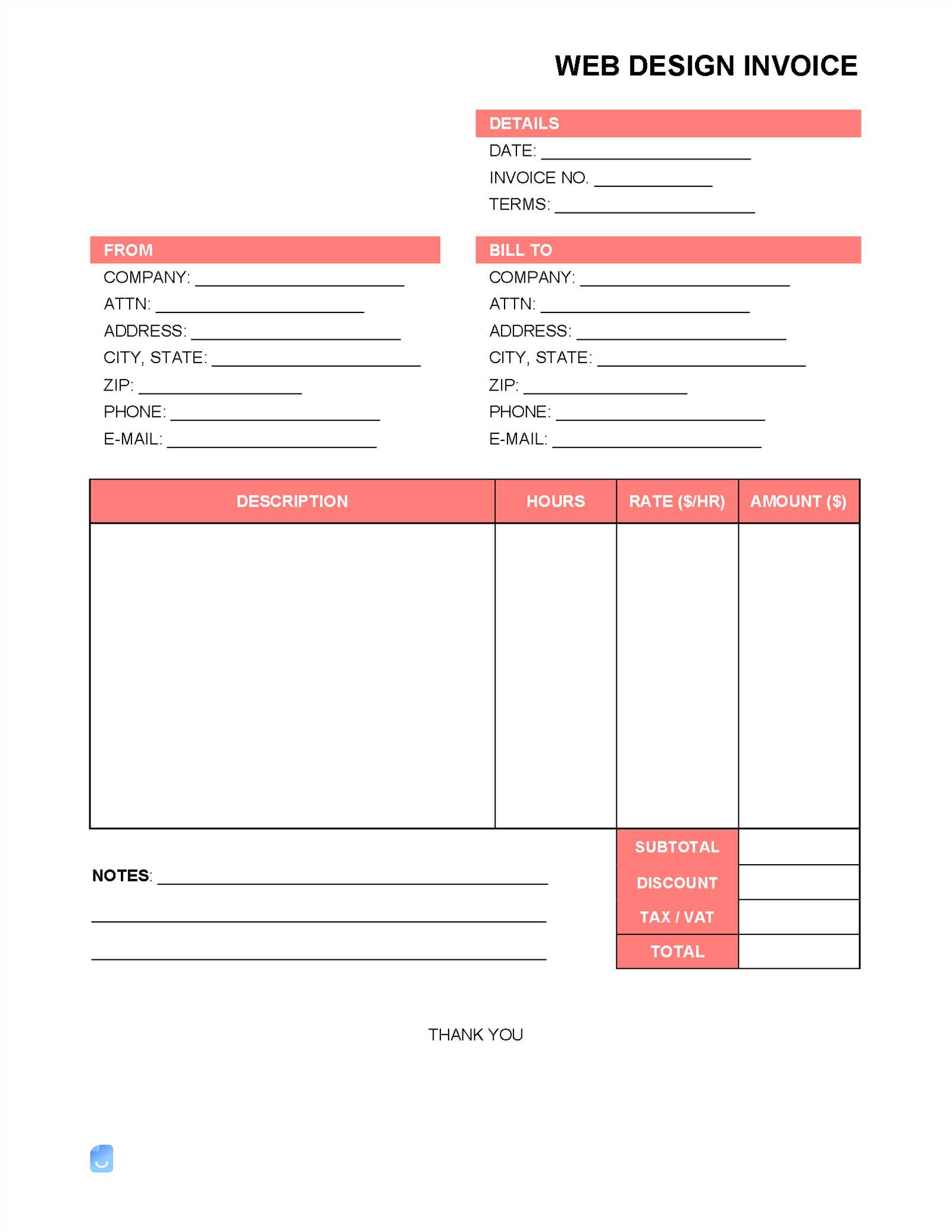

Invoice Template for Small Design Businesses

For small businesses in creative industries, having a professional document for billing is essential. A well-structured and clearly formatted financial request helps ensure that clients understand the charges, payment terms, and deadlines. It also provides a formal record of the work completed, protecting both parties in case of disputes. Customizing such documents to reflect your business’s unique services and style can help strengthen your brand image while maintaining clarity in your financial communications.

Essential Elements for Small Businesses

When creating a billing document for your small business, certain components should always be included to ensure clarity and accuracy:

- Business Information: Include your business name, address, contact details, and tax identification number, if applicable.

- Client Information: Ensure the recipient’s name, address, and any relevant contact details are included for proper identification.

- Project Details: Provide a clear description of the work completed, including timelines, materials used, or any deliverables.

- Pricing Breakdown: List each item or task with its corresponding cost. This transparency helps avoid confusion and builds trust.

- Payment Terms: Specify the due date, payment methods, and any penalties for late payments.

Customizing for Your Business

One of the benefits of creating your own billing documents is the ability to personalize them for your brand. You can add your logo, choose a color scheme, and set a tone that aligns with your business identity. Whether you want a minimalist approach or a more creative layout, tailoring the document to reflect your brand can make a lasting impression on clients while maintaining professionalism.

By implementing these key elements and customizing the format, your business can project a professional image, ensuring both clarity and a smooth transaction process.

Free vs Paid Invoice Templates

When selecting a format for generating financial documents, businesses often face the decision of whether to use free or paid options. Both have their advantages and disadvantages, depending on your specific needs, level of customization, and the scale of your operations. While free versions may offer basic functionality, paid alternatives often come with additional features, professional designs, and enhanced flexibility. Understanding the key differences can help you make an informed choice that suits your business’s goals and budget.

Advantages of Free Templates

Free options are appealing for small businesses or freelancers just starting out, as they don’t require any financial investment. These templates are typically easy to find and can be downloaded or accessed from various online platforms. Key benefits include:

- Cost-Effective: There are no upfront costs, making them ideal for those with limited budgets.

- Quick Setup: Many free templates are ready to use immediately, saving time in the setup process.

- Basic Functionality: For businesses with straightforward billing needs, free templates offer essential features such as simple layouts and basic fields.

Advantages of Paid Templates

On the other hand, paid options offer advanced features and customization possibilities that can help businesses present a more polished and professional image. Some benefits of paid templates include:

- Customizability: Paid versions often allow more extensive customization, enabling you to align documents with your brand identity.

- Advanced Features: Additional functionalities, such as automatic calculations, recurring billing, and integrations with accounting software, can streamline your process.

- Customer Support: Paid options usually come with customer support, which can be invaluable if you run into any issues or need help with more complex features.

Choosing between free and paid options ultimately depends on the specific requirements of your business. If you need simple, no-frills documents, free templates can suffice. However, if you’re looking for greater control over your documents and need additional features for more advanced needs, a paid solution might be a better investment.

Automating Your Invoicing Process

Automation can greatly simplify the process of generating and sending financial documents, saving time and reducing human error. By setting up automated workflows, businesses can streamline their operations, ensure consistency in billing, and improve cash flow management. Whether through software or cloud-based platforms, automating key tasks such as generating, sending, and tracking payments can make financial management more efficient and less prone to mistakes.

Benefits of Automation

Implementing automated systems for billing offers several key advantages that can significantly enhance the overall efficiency of your business:

- Time Savings: Automation eliminates the need to manually create each document, allowing you to focus on other important aspects of your business.

- Reduced Errors: With automated calculations and data entry, you minimize the risk of mistakes that could lead to confusion or disputes with clients.

- Consistency: Automation ensures that every client receives the same level of professional communication and accurate details, reinforcing your brand’s reliability.

- Faster Payments: Automated reminders and payment links can prompt clients to pay on time, improving your cash flow and reducing the need for manual follow-ups.

Steps to Automate Your Process

To successfully automate your billing system, follow these steps:

- Choose the Right Software: Select a platform that offers automated billing features, such as recurring payments, reminders, and integrations with your accounting systems.

- Set Up Custom Templates: Create reusable formats that automatically fill in client details, services rendered, and payment amounts to save time on each transaction.

- Configure Reminders: Set up automated payment reminders to be sent at specific intervals, such as a few days before the due date and again if the payment is overdue.

- Integrate Payment Gateways: Link your system to online payment platforms to allow clients to pay directly through the document, further speeding up the transaction process.

By automating these aspects of your financial processes, you can significantly reduce manual effort, minimize errors, and ensure that your clients are billed promptly and consistently. This allows you to maintain a more organized workflow and focus on growing your business.

Benefits of Consistent Invoicing

Maintaining a consistent approach to billing is essential for any business that wants to establish trust and professionalism with clients. When financial documents are sent regularly and in a standardized format, it creates a sense of reliability and organization. Consistency helps both the business and the client stay on the same page, reducing confusion and ensuring a smoother transaction process. It also makes financial tracking easier, as both parties can quickly reference past transactions without having to deal with discrepancies.

Improved Cash Flow Management

One of the primary benefits of consistent billing is improved cash flow. When you issue financial requests on a regular basis, it creates a predictable schedule for payments. This allows you to better forecast income and manage your operating expenses. Timely billing and clear terms ensure that clients understand their obligations, leading to fewer delays and more reliable payment cycles.

Enhanced Professionalism and Client Relationships

Consistency in the way you manage financial documentation not only reinforces your business’s professionalism but also builds stronger relationships with clients. Clients appreciate a predictable and transparent billing process, which fosters trust and reduces misunderstandings. By adhering to a consistent approach, you signal to your clients that your business is organized and dependable, making them more likely to return for future work or recommend you to others.

Streamlined Record Keeping

Another significant advantage is the ease of maintaining accurate records. When you follow a uniform format and schedule, tracking payments, identifying overdue balances, and reconciling accounts becomes much simpler. This reduces administrative time and ensures that all financial transactions are accounted for correctly, which is especially important during tax season or audits.

In conclusion, consistent billing practices not only improve financial clarity and operational efficiency but also contribute to long-term success by enhancing client trust and satisfaction. The more reliable and organized your approach, the easier it is to manage your business’s financial health.