Download Free Deposit Invoice Template in Word Format

In business transactions, clear and professional documentation is essential for maintaining transparency and ensuring smooth financial exchanges. One common form of such documents is used to request an initial payment or a partial sum before the completion of a full service or delivery. These documents help set expectations, outline the terms of payment, and serve as a record for both parties involved.

With the right tools, creating these payment-related documents can be a simple and efficient process. Instead of drafting each document from scratch, using ready-made, customizable formats can save time and reduce the risk of errors. Such documents can be easily tailored to fit the unique needs of different transactions, whether for large-scale projects or smaller engagements.

By leveraging an accessible and widely-used software program, anyone can design, edit, and manage these important documents. Customizing them to meet specific business requirements allows for more professional communication and helps in maintaining a reliable record-keeping system.

Deposit Invoice Template Word: Complete Guide

When managing business transactions, having a standardized document to request partial payments is essential for ensuring clarity and mutual understanding between the parties involved. Such documents serve not only as a formal request for funds but also as a record that outlines the payment structure, terms, and conditions of the agreement. The ability to create and customize these documents efficiently can save time and improve overall professionalism.

This guide will walk you through the steps of creating a professional payment request document using a widely accessible software program. Whether you are a freelancer, small business owner, or part of a larger organization, customizing a document to your specific needs is key to maintaining smooth financial operations. By following this guide, you’ll be able to produce a clear, well-structured payment request every time.

From understanding the key components that should be included in such documents to knowing how to format and adjust them for different transactions, this guide covers everything you need to get started. With the right approach, you can ensure your business operations run smoothly and avoid any potential misunderstandings with clients or partners.

What is a Deposit Invoice?

A payment request document is commonly used in business transactions when a portion of the total amount is due upfront, prior to the completion of a full service or delivery. This type of document serves as a formal agreement between the two parties, outlining the initial payment expectations and helping to secure commitment for the upcoming work or product. It ensures that both the client and the service provider have a clear understanding of the financial terms.

Typically, this document includes essential details such as the amount due, the purpose of the payment, the agreed-upon terms, and any relevant dates or deadlines. It acts as a legal acknowledgment of the client’s intention to proceed with the project while also protecting the service provider’s interests by securing initial funding.

- It helps formalize the financial aspect of a contract.

- It establishes trust and clarity between both parties involved.

- It serves as a reference for future payment schedules and balances.

Using such a document allows businesses to manage cash flow more effectively and ensures that payments are made in a timely manner, reducing the risk of non-payment or delays.

Why Use a Word Template for Invoices?

Using a pre-designed document format for payment requests provides a quick, efficient way to create professional-looking paperwork. These ready-to-use formats save time by offering a structured layout that ensures all necessary details are included. Rather than starting from scratch, businesses can rely on these formats to streamline the creation process and focus on customizing key elements to suit their needs.

One of the main benefits of utilizing such a format is consistency. By using a standardized format, you maintain uniformity across all your financial documents, which reflects positively on your business image. Consistent formatting not only makes your paperwork look more professional but also reduces the risk of missing critical information.

Additionally, the flexibility of these formats allows for easy customization. You can quickly adjust the layout, add or remove specific sections, and update details without having to worry about the overall structure. This adaptability makes them suitable for various types of transactions, whether they involve small or large amounts, and for different industries.

Benefits of Customizing Your Invoice

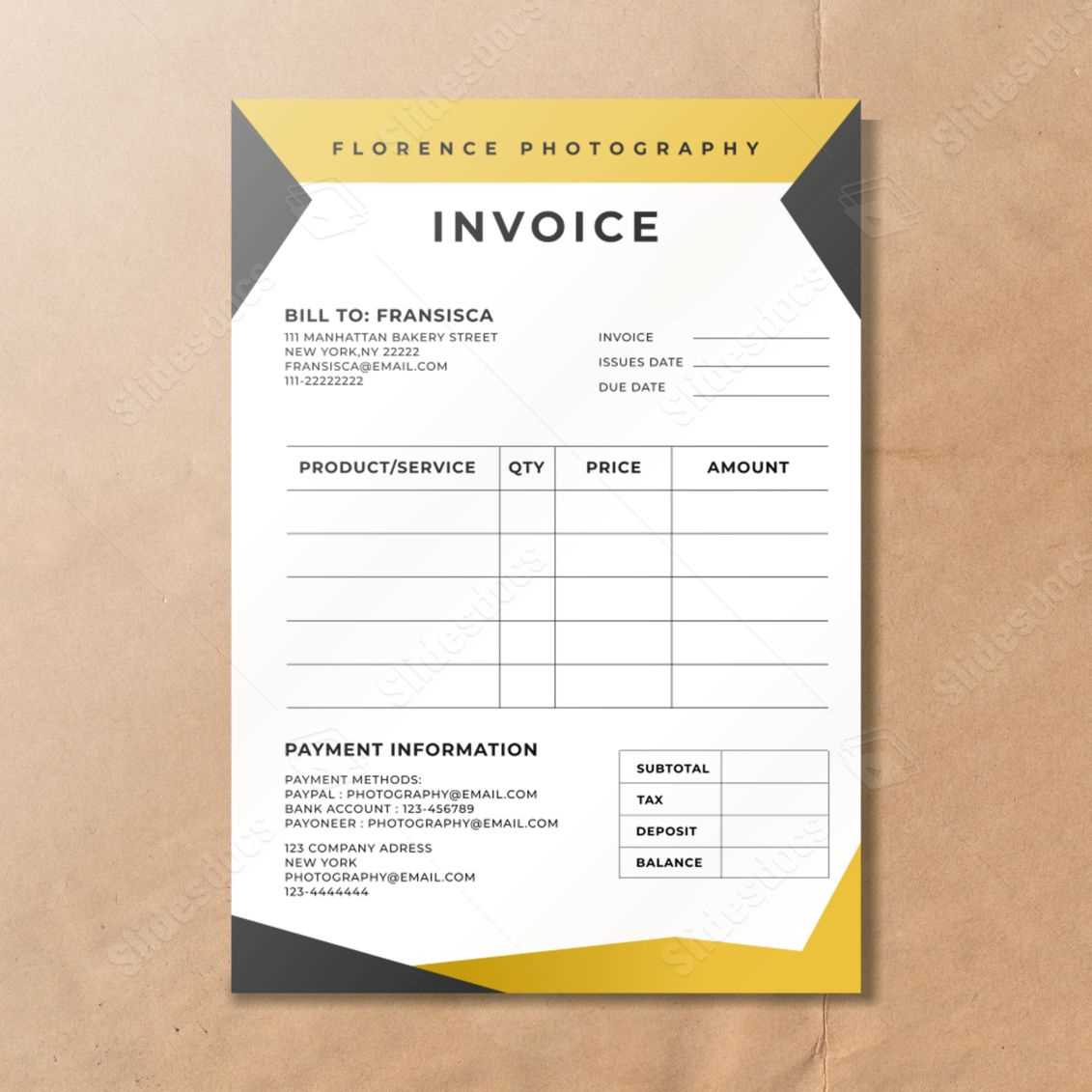

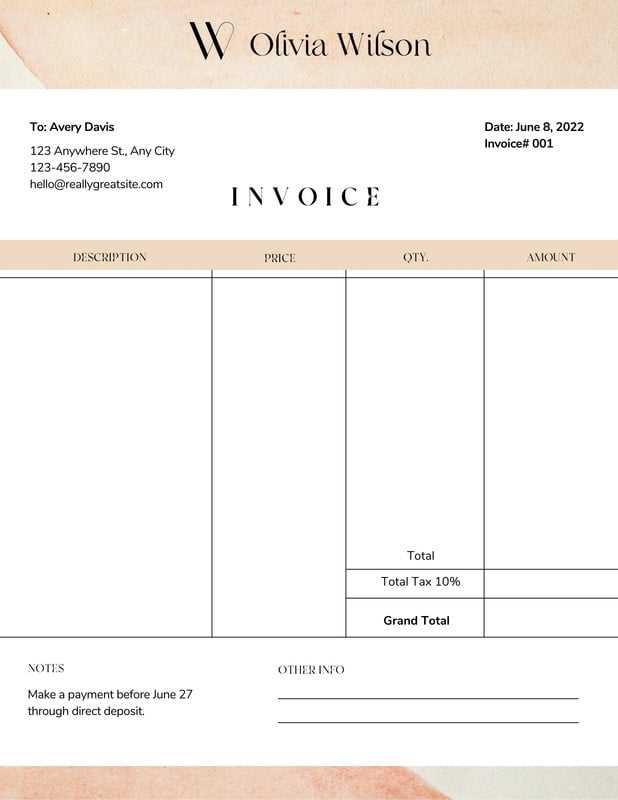

Customizing your payment request documents offers several advantages, particularly when it comes to improving professionalism and meeting specific business needs. By tailoring these documents, you can ensure they reflect your brand’s identity and communicate the right information clearly to your clients. Customization allows for a more personalized touch, which can enhance your client’s overall experience.

Improve Professional Appearance

When you modify the layout and design of your payment request documents, you create a consistent and polished image for your business. Customizing elements such as your company logo, color scheme, and fonts can make your documents look more official and trustworthy. This not only boosts your brand’s visibility but also reinforces professionalism in every transaction.

Better Organization and Clarity

By adjusting the content to suit the specific needs of your transaction, you can ensure that all essential information is presented clearly. Whether you need to highlight payment terms, deadlines, or particular instructions, customization helps you organize the document in a way that makes it easy for your client to understand. Clarity and organization reduce the chances of confusion and ensure smoother communication between you and your client.

Furthermore, having a flexible format means you can include additional details that might be relevant to a particular job or industry, making the document more comprehensive and adaptable to various situations.

How to Create a Deposit Invoice in Word

Creating a payment request document in a word processing program is a simple yet effective way to formalize a transaction. With just a few steps, you can create a clear, professional-looking document that outlines the terms of the payment and provides all necessary details. This process can be done quickly, allowing you to focus on the content rather than the layout.

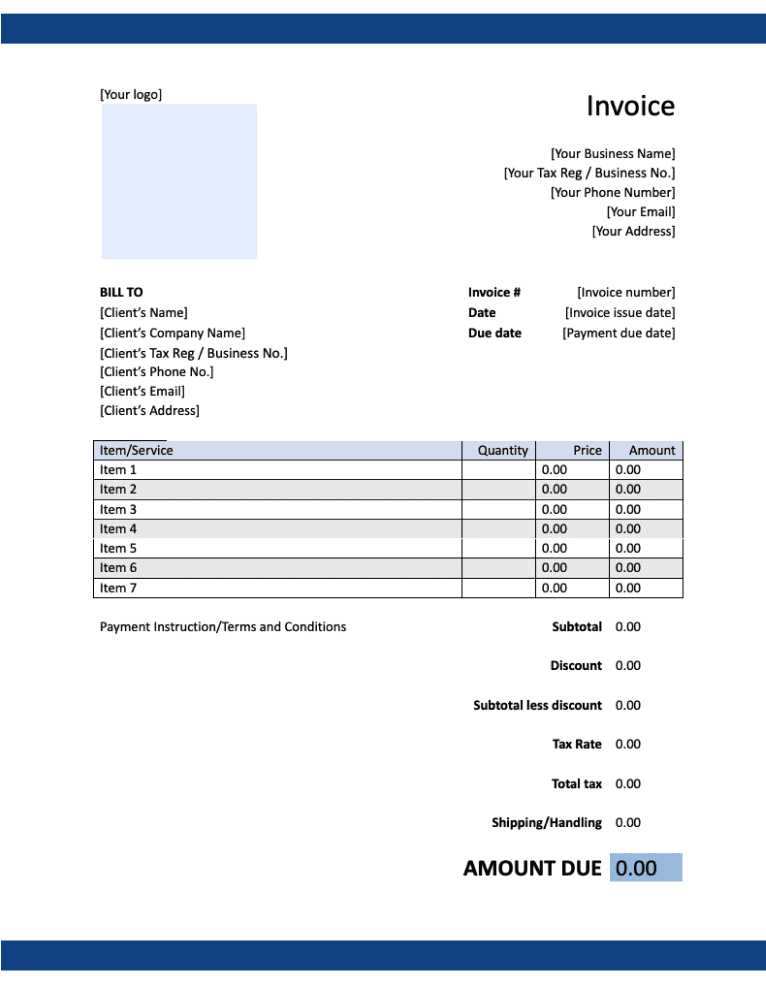

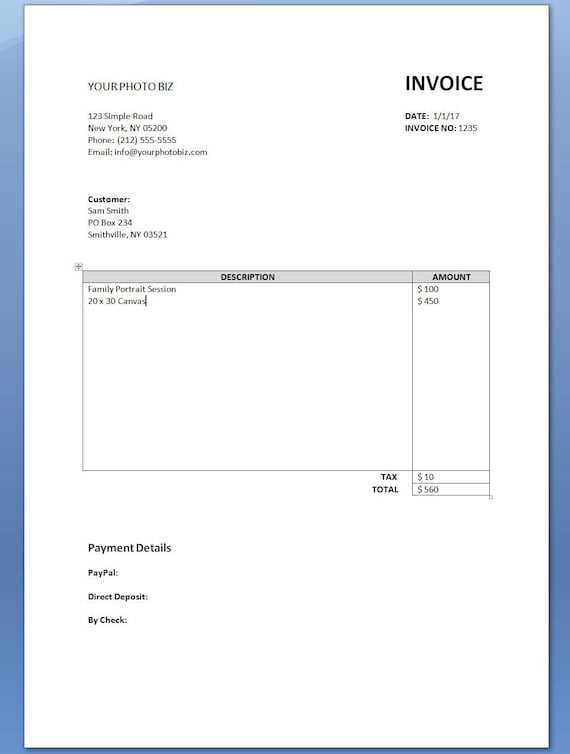

First, open your preferred word processing software and start with a blank document. Begin by adding your company information at the top, including your name or business name, address, phone number, and email address. This ensures your client can easily contact you if needed.

Next, include the recipient’s details–such as their name, address, and contact information–followed by a unique document reference number and the date of issue. These pieces of information will help both parties keep track of the transaction. Afterward, create a section that outlines the payment amount, the purpose of the payment, and any terms or conditions that apply, such as due dates or payment methods.

Make sure to highlight any important deadlines or special instructions. Using bold text or underlining can make these sections stand out, ensuring they are easy to spot. Once all the details are added, review the document for accuracy and clarity before saving and sending it to your client.

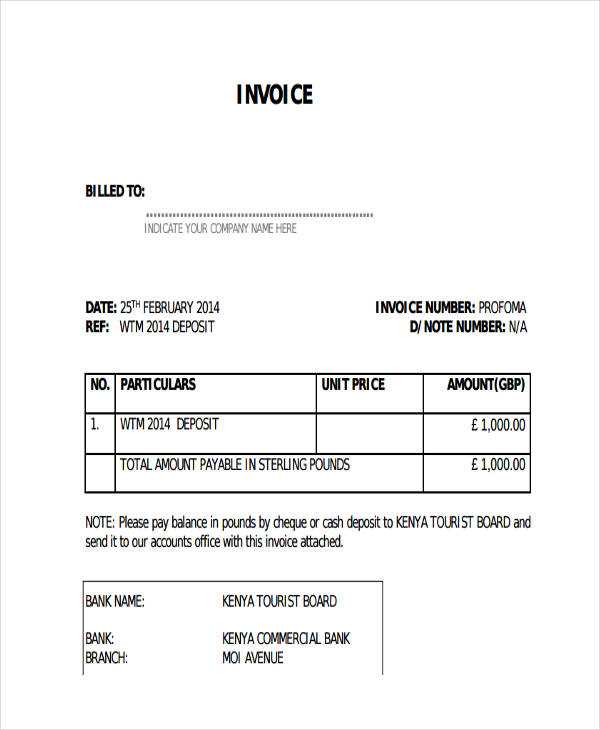

Essential Information to Include in a Deposit Invoice

When creating a document to request an initial payment or partial funds, it is important to ensure that all necessary details are included. A well-structured document helps set clear expectations for both the client and the service provider, reducing the chances of confusion or disputes. Here are the essential elements that should always be included in such a document:

- Business Information: Your company name, address, phone number, and email should be clearly displayed at the top of the document for easy reference.

- Client Information: Include the name, address, and contact details of the client or customer who will be making the payment.

- Document Number and Date: Assign a unique reference number to the document and include the date it was issued. This helps with record-keeping and tracking.

- Payment Amount: Clearly specify the amount requested, including any applicable taxes, fees, or discounts. Ensure that this is easily identifiable in the document.

- Payment Terms: Outline the conditions of payment, including the due date, payment methods, and any late fees or penalties that may apply if the payment is not received on time.

- Description of Services or Products: Provide a brief description of the work, goods, or services being provided, as well as any other relevant information regarding the project.

- Terms and Conditions: Include any other specific terms that both parties have agreed upon, such as delivery schedules or refund policies.

By ensuring these key details are clearly presented, you can avoid potential misunderstandings and ensure a smooth payment process.

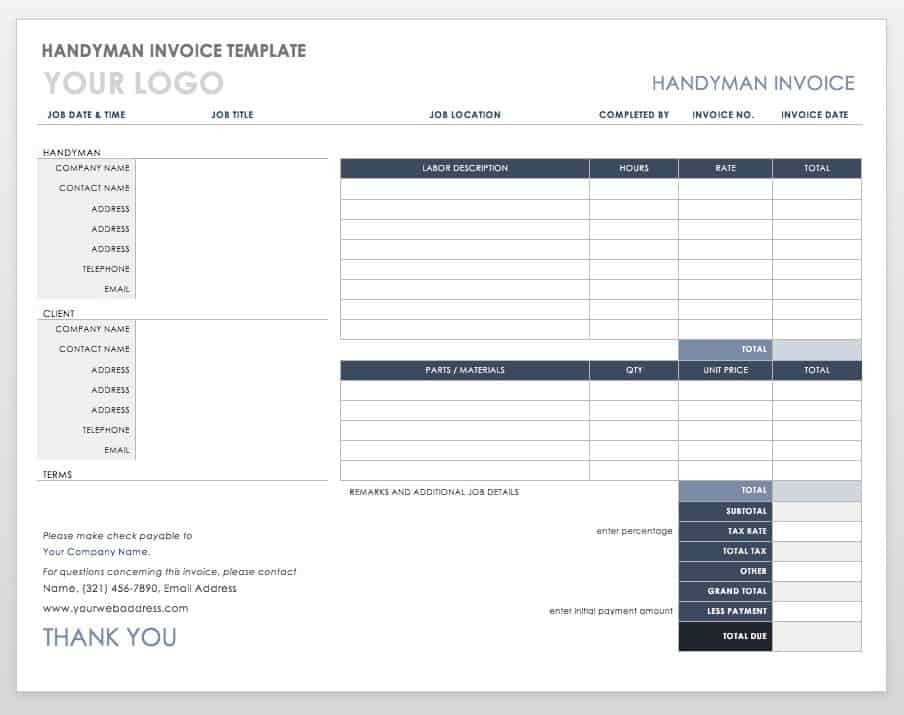

Free Deposit Invoice Templates for Word

Finding a reliable and easy-to-use document layout for requesting partial payments can save time and effort, especially for small business owners or freelancers. There are many free, pre-designed formats available that allow for quick customization, ensuring that your payment request is both professional and clear. These resources can be accessed online and downloaded directly into your preferred software program, enabling you to get started right away.

Where to Find Free Payment Request Formats

- Online template libraries and business websites

- Free document sharing platforms like Google Docs and Microsoft Office templates

- Design-focused websites offering customizable documents

Advantages of Using Free Layouts

- Cost-effective: No need to invest in expensive software or premium layouts.

- Time-saving: Ready-made designs eliminate the need to create documents from scratch.

- Easy customization: Modify the layout to suit your business style, add your branding, and adjust terms quickly.

- Professional results: These formats are designed to ensure your document looks polished and well-structured.

These free resources offer a simple solution to creating a high-quality, customized payment request without the hassle of designing a document from the ground up. By using these layouts, you can focus on the content, knowing that the structure and design are already handled.

Common Mistakes When Using Invoice Templates

Using pre-designed formats to create payment-related documents can significantly speed up the process and reduce errors. However, there are some common mistakes that individuals make when utilizing these resources. While these layouts are convenient, it’s essential to ensure accuracy and clarity in order to avoid potential issues with clients or payment delays.

Common Errors to Avoid

- Leaving out essential information: Failing to include crucial details, such as the correct payment amount, terms, or recipient information, can cause confusion and delays in processing payments.

- Using outdated formats: Not updating your document design or details may lead to inconsistencies or errors in the information presented to your clients.

- Inconsistent formatting: Using different fonts, sizes, or colors throughout the document can make it look unprofessional and harder to read.

- Ignoring legal or tax requirements: It’s important to include all necessary legal and tax information, such as business registration numbers or applicable sales tax rates, to ensure the document is compliant with regulations.

- Overcomplicating the layout: Including unnecessary sections or using overly complex designs can make the document confusing. Keep the layout simple and to the point.

How to Ensure Accuracy and Clarity

To avoid these mistakes, follow a clear checklist before sending out your document:

| Step | What to Check |

|---|---|

| 1 | Ensure all business and client details are correct and up to date. |

| 2 | Confirm that the payment amount is accurate and reflects any taxes, discounts, or fees. |

| 3 | Review the payment terms and due dates to avoid misunderstandings. |

| 4 | Check the document for consistent fonts, spacing, and alignment. |

| 5 | Ensure all legal information, such as tax numbers and business registration, is included where applicable. |

By being mindful of these common mistakes, you can ensure your payment request documents are accurate, professional, and easy for your clients to process.

How to Format a Deposit Invoice in Word

Properly formatting your payment request document is essential for ensuring clarity and professionalism. A well-organized layout makes it easier for both you and your client to review the details, while also reducing the chances of errors or confusion. Formatting involves more than just filling in information; it’s about presenting everything in a way that is easy to read and visually appealing.

Key Elements to Focus On

When formatting your payment-related document, focus on the following key elements to create a clean and organized layout:

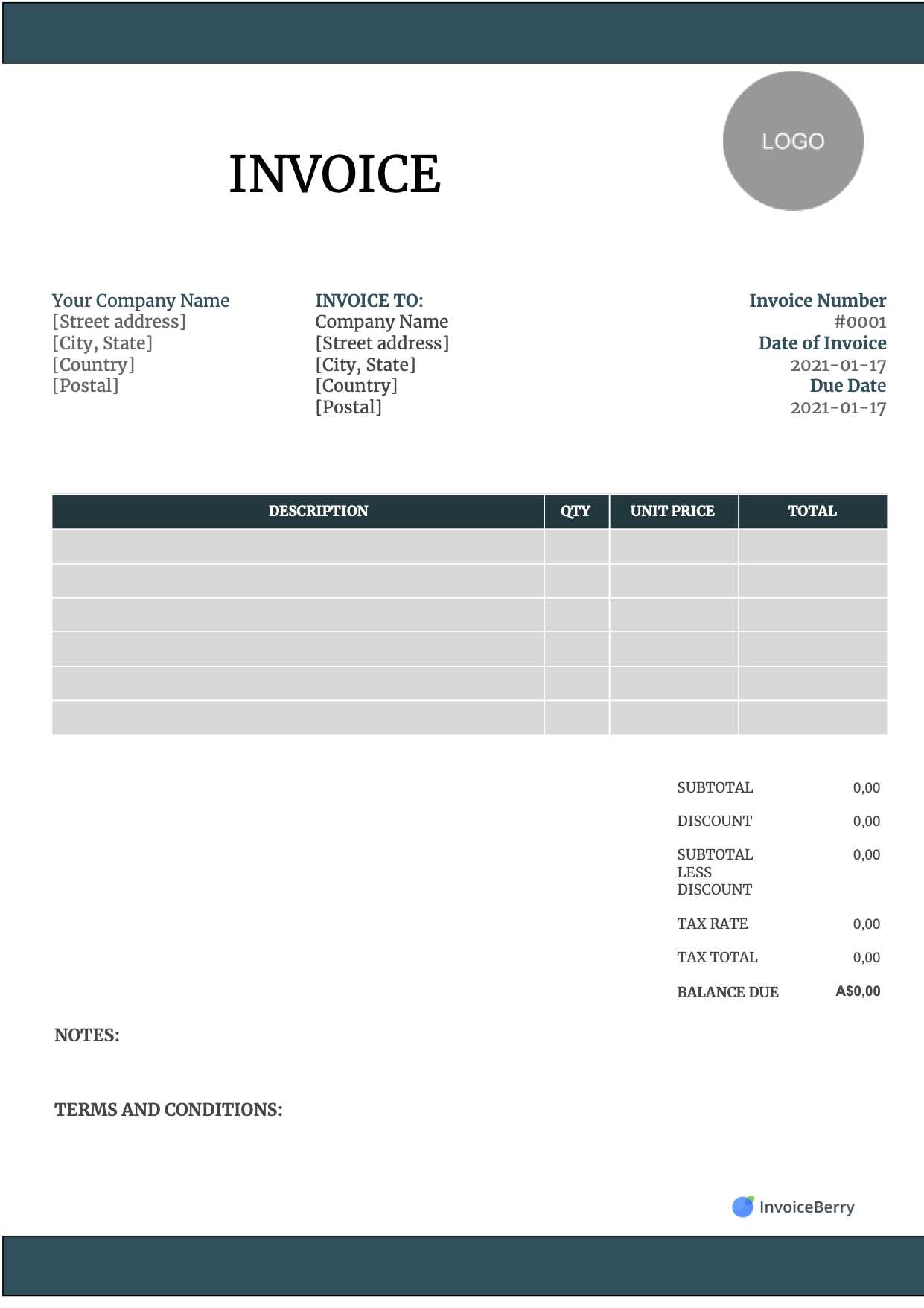

- Header: Include your company’s name, logo, and contact information at the top of the document. Make sure these elements are clearly visible to establish your business identity.

- Client Information: Add the client’s name, address, and contact details below your information to ensure they can reach you if necessary.

- Document Number and Date: Use a unique reference number for each document and include the date of issue. This is helpful for record-keeping and future reference.

- Payment Details: Clearly specify the amount requested, payment terms, and due dates. Make this section stand out by using bold or larger font sizes for key figures.

- Description of Services: Provide a concise description of the goods or services being paid for. This helps both parties understand what the payment is related to.

Formatting Tips for Clarity and Readability

- Use a consistent font: Stick to a professional, easy-to-read font like Arial, Calibri, or Times New Roman. Avoid using too many different font styles or sizes.

- Keep spacing even: Ensure there is enough white space around headings and sections so the document doesn’t look crowded or overwhelming.

- Highlight important details: Use bold text for key pieces of information such as the payment amount, due date, and total balance.

- Align text properly: Use left alignment for text and right alignment for numerical values, ensuring everything is neatly aligned for easy reading.

By following these formatting guidelines, you can ensure that your payment request documents not only look professional but are also functional and easy for your clients to understand.

Customizing Your Template for Different Needs

Every business has unique requirements when it comes to documenting financial transactions. Whether you’re requesting a partial payment for a project, an upfront fee for services, or an advance on goods, customizing your payment request document ensures it meets the specific needs of each situation. Adjusting the layout and content can help make your documents more relevant and professional for different clients and circumstances.

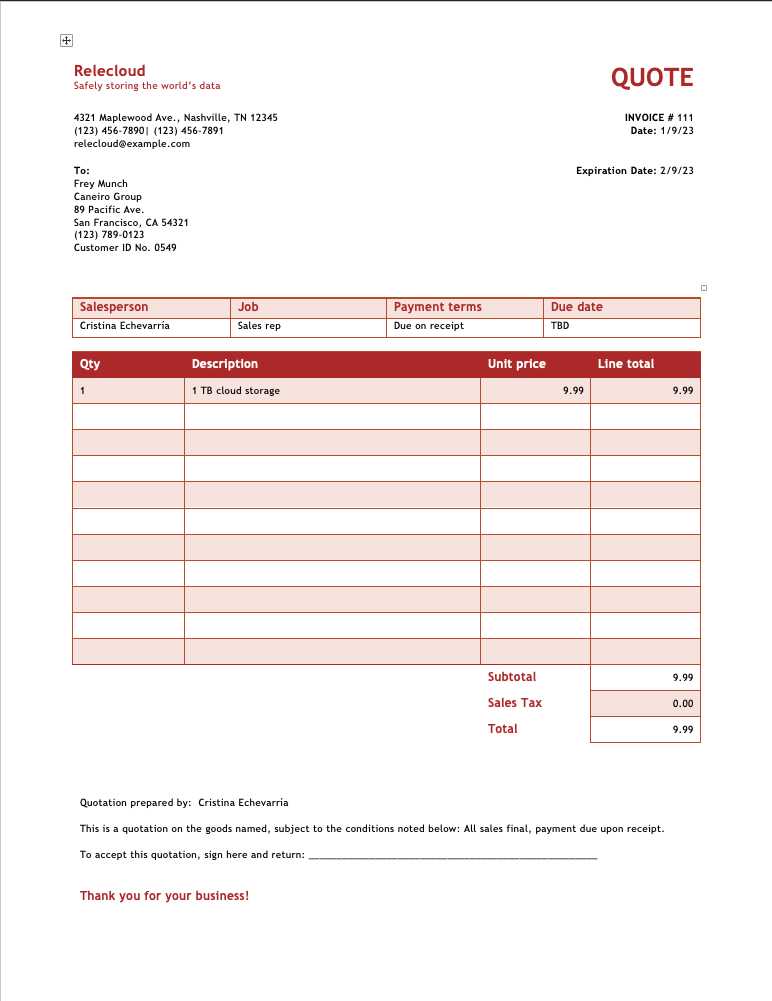

Adjusting for Different Transaction Types

The structure of your payment request document should vary depending on the nature of the transaction. For example, if you’re dealing with a long-term project, you might include detailed milestones or stages of work to be completed before further payments are due. For smaller, one-time payments, the document may need fewer sections and a more straightforward presentation.

- For large projects: Include a breakdown of the phases or deliverables, with corresponding payment amounts for each milestone.

- For smaller or recurring payments: Ensure clear, simple payment instructions with fewer details and concise terms.

- For goods or product-based transactions: List specific items or quantities, along with prices, to clarify what the payment covers.

Personalizing for Different Clients

Tailoring your document for each client is another way to make it more effective. You might choose to add personalized messages, such as a thank-you note for their business or a reminder of your terms and conditions, depending on the client’s preferences or history with your business.

- For new clients: Include a brief introduction or welcome message along with your payment terms to build trust.

- For repeat clients: Keep it simple, using a more streamlined format with an emphasis on clarity and ease of use.

By making small adjustments, you can create documents that feel more tailored and ensure they work in a way that suits both you and your clients’ specific needs.

Automating Deposit Invoices with Word

Automating your payment request documents can save valuable time and reduce the chances of errors, especially when dealing with recurring transactions or large volumes of requests. By setting up pre-filled fields, you can streamline the process and ensure consistency across all documents. Automation tools within your word processing software can help you generate these documents quickly while maintaining accuracy and a professional appearance.

One way to automate your payment-related paperwork is by utilizing features such as mail merge or form fields. These tools allow you to input client-specific details, such as names, addresses, or payment amounts, without manually entering the information each time. This method is especially helpful when dealing with multiple clients or frequent transactions.

Another approach is to create custom macros that fill in common details automatically, such as company information or payment terms. Once these macros are set up, you can generate a new document with just a few clicks, which ensures that the layout, style, and content remain consistent.

By automating the process, you can focus more on your core tasks, reduce the risk of mistakes, and streamline the entire document creation workflow. This leads to faster turnaround times and better client relations, all while keeping your paperwork organized and professional.

Using Invoice Templates for Small Businesses

For small business owners, maintaining professionalism and efficiency in financial documentation is crucial. Using pre-designed documents for payment requests can significantly streamline the billing process, reduce administrative overhead, and ensure consistency across all transactions. These resources are particularly beneficial for businesses with limited time or resources, as they provide a fast and effective way to create clear, organized payment requests.

By utilizing these ready-made formats, small businesses can focus on delivering quality products or services, while ensuring that all financial matters are handled smoothly. The ability to customize these documents for each client or transaction makes them versatile, and easy to adapt to various business needs.

Here are some key advantages small businesses can gain from using pre-designed documents:

| Benefit | Explanation |

|---|---|

| Time-saving | Quickly create payment-related documents without having to design them from scratch. |

| Consistency | Ensure uniformity across all transactions, maintaining a professional appearance. |

| Customization | Easily tailor the content to match different clients or payment terms, ensuring clarity. |

| Reduced Errors | Pre-designed sections minimize the risk of missing or incorrect details, ensuring accuracy. |

| Cost-effective | Free or low-cost resources save money on expensive software or professional services. |

For small businesses looking to enhance their efficiency and professionalism, utilizing pre-designed payment request documents can be a simple yet effective solution. By customizing these formats to fit your unique needs, you ensure smoother transactions and better communication with your clients.

How to Save and Print Your Deposit Invoice

Once you’ve completed your payment request document, it’s important to save it properly and ensure it’s ready to be printed or shared digitally. Saving and printing the document correctly guarantees that it looks professional and is easy for both you and your client to manage. Here’s how to do it efficiently.

Saving Your Document

To ensure that your payment request is preserved in a format that is easy to access and share, follow these steps:

- Choose the right format: Save your document as a PDF for a secure, non-editable version that’s easy to share and print. Alternatively, you can save it as a DOCX file if you need to make further edits later.

- Name the file clearly: Use a naming convention that helps you easily identify the document, such as “ClientName_Transaction_Date.” This makes it easier to find and organize multiple documents.

- Save in a dedicated folder: Create a specific folder for financial documents or transactions to keep your files organized and accessible when needed.

Printing Your Document

Once your document is saved, it’s time to print it. Here’s how you can ensure a smooth printing process:

- Preview before printing: Always check the document’s layout in print preview to ensure everything is aligned correctly and no text is cut off.

- Choose the right printer settings: Ensure that your printer is set to print in high-quality mode and that the correct paper size is selected (usually A4 or letter size).

- Print in color or black and white: Depending on your preferences and the importance of visual elements like logos or colors, choose whether to print in color or black and white.

- Double-check the number of copies: Make sure you print the correct number of copies, especially if you need to send one to the client and keep another for your records.

Following these steps will ensure that your payment request document is both saved and printed in the best possible quality, helping you maintain a professional image with your clients and keeping your records organized.

Legal Considerations for Deposit Invoices

When creating any financial documentation, it’s essential to ensure that the content complies with relevant laws and regulations. Payment requests are not only a way to formally request funds, but also a legal document that could be used in disputes or audits. Understanding the legal considerations involved in preparing these documents can help avoid costly mistakes and ensure your business is protected.

Key Legal Elements to Include

There are several important components that should be present in every financial request document to ensure it is legally sound:

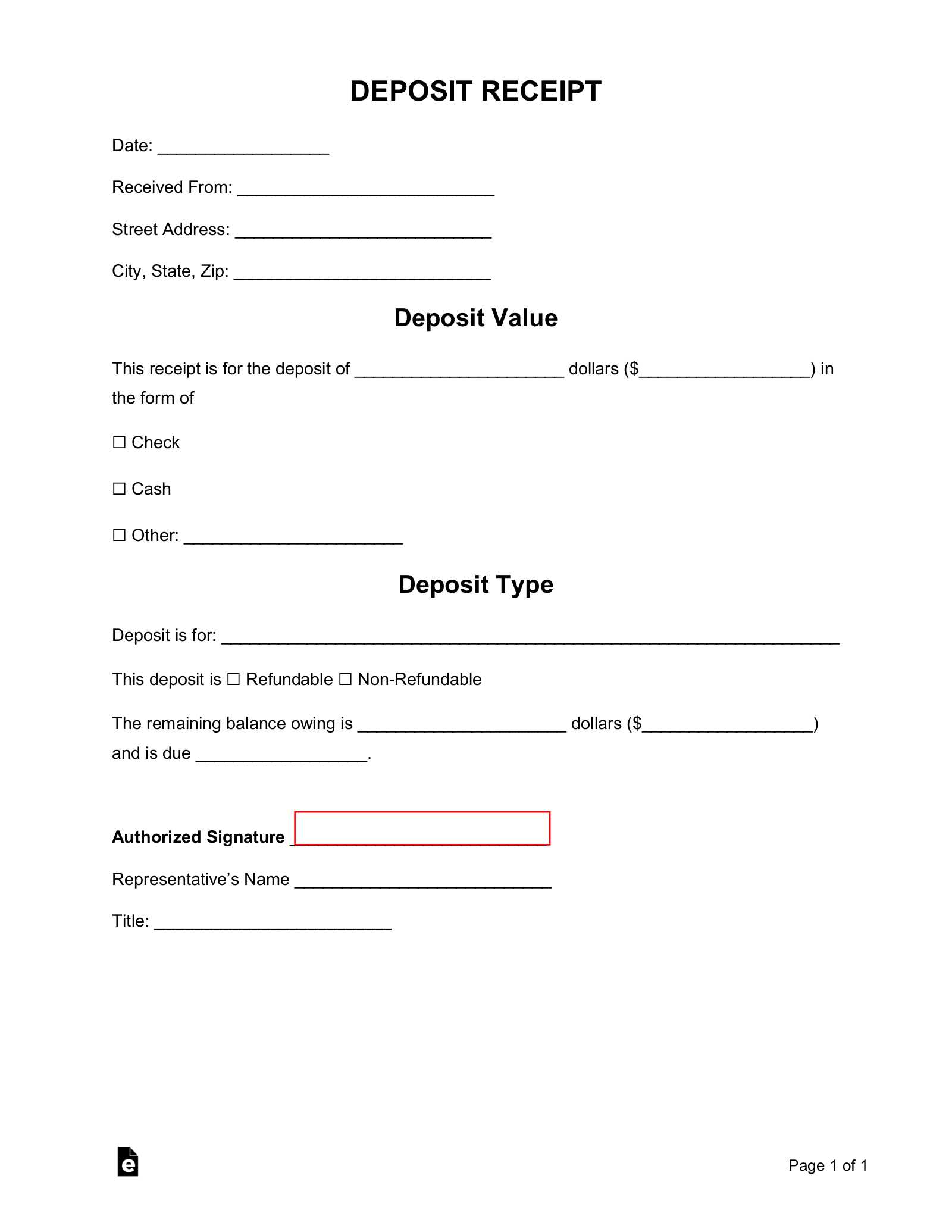

- Clear Terms and Conditions: Outline the terms of payment, including amounts, due dates, and any penalties for late payment. This ensures both parties understand their obligations.

- Legal Compliance: Include any required tax information, such as sales tax numbers or VAT, to ensure the document complies with tax laws.

- Accurate Business Information: Always include your correct business name, address, and registration details to avoid confusion or claims of fraudulent activity.

- Client Details: Clearly list the client’s name and contact information to avoid ambiguity in case of disputes.

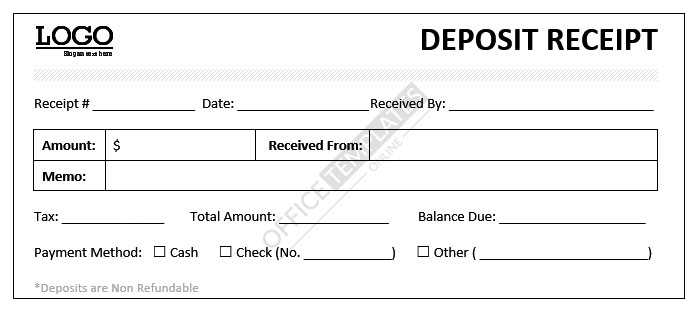

- Payment Terms: Specify whether the payment is a partial amount, refundable, or non-refundable, to avoid potential disagreements down the line.

Legal Risks of Incomplete or Incorrect Documents

Failure to include important legal details in your payment request document can lead to significant issues, such as:

- Disputes: If your document lacks clear payment terms, it may lead to misunderstandings or conflicts over amounts or due dates.

- Tax Penalties: Omitting necessary tax information, such as VAT numbers or business registration, can result in fines or penalties from regulatory authorities.

- Legal Enforceability: A document lacking key elements may not be enforceable in court if there is a legal dispute over payments.

By ensuring that your payment-related documents are legally compliant and well-detailed, you reduce the risk of legal issues and provide greater protection for both your business and your clients.

Top Features of a Good Payment Request

A well-crafted payment request document not only serves as a formal tool for collecting funds but also reflects the professionalism and credibility of your business. Whether you’re asking for a partial payment for a service or an advance on goods, ensuring the document contains key features makes it clear, precise, and effective. Here are the top qualities that make a good payment request document stand out.

Essential Elements to Include

To create a payment request that is both professional and functional, you must include several core components that help facilitate smooth transactions:

- Clear Identification: Your business name, contact information, and logo should be prominently displayed at the top to establish your identity. Including client details is also essential to avoid confusion.

- Unique Reference Number: Every payment request should have a distinct reference number for easy tracking and future reference.

- Breakdown of Services or Products: Clearly describe the goods or services provided, including quantities, rates, and a total amount. This transparency prevents misunderstandings later on.

- Accurate Payment Terms: List the total amount, due date, and accepted payment methods. Providing this information upfront helps avoid delays and confusion.

- Legal and Tax Information: Ensure that any necessary legal details, such as VAT numbers or applicable taxes, are included to comply with regulations.

Design and Layout Considerations

The layout of your payment request plays a critical role in how easily it can be understood and processed. Here are a few design tips:

- Simple, Clean Layout: Avoid clutter by keeping the design straightforward. Use headings and sections to organize the content in a logical order.

- Readable Fonts and Size: Choose professional, easy-to-read fonts like Arial or Times New Roman and maintain a consistent font size throughout the document.

- Highlight Key Information: Use bold or larger font sizes to draw attention to the most important information, such as the total amount due and the due date.

- Proper Alignment: Ensure all numbers, especially financial figures, are aligned for easy reading, typically right-aligned for better clarity.

By incorporating these features, you ensure that your payment request documents are clear, professional, and effective in helping to manage your finances and relationships with clients.

How to Track Deposits with Invoices

Managing payments and keeping track of financial transactions is a crucial part of running any business. When clients make partial payments or advances for services or products, it’s important to accurately record and monitor these amounts. A well-organized system for tracking these payments can help ensure that nothing is overlooked and that you maintain a clear record for accounting purposes.

By incorporating detailed payment records into your financial documentation, you can easily track the amounts received, outstanding balances, and due dates. Here’s how you can track partial payments using your payment request documents:

Steps to Effectively Track Payments

- Assign a Unique Reference Number: For each payment request, use a unique identifier that allows you to easily match partial payments to the corresponding documents. This helps in tracking and referencing payments more efficiently.

- Document the Payment Amounts: Clearly state the amount received for each payment, as well as the remaining balance due. This ensures that both you and the client have a shared understanding of what has been paid and what is still owed.

- Update Your Records Regularly: After each transaction, update your accounting or payment system with the most current payment status. This way, you always have an up-to-date view of your financial situation.

- Include Payment Due Dates: Always include specific due dates for the next payment or the final balance. This keeps both parties accountable and ensures that payments are made on time.

How to Keep Your Tracking System Organized

Keeping an organized system for tracking partial payments and balances is essential for ensuring smooth financial operations. Consider these best practices for staying organized:

- Maintain a Payment Log: Create a separate log or spreadsheet to track all payments received, along with the associated reference numbers and amounts. This log serves as a quick reference for checking payment status.

- Use Financial Software: Utilize accounting or payment management software that integrates with your documents to automatically update and track received payments. Many tools offer features that help organize and categorize payments.

- Provide Clients with Regular Updates: Regularly update your clients on the status of their payments, including what has been paid and what is remaining. This helps maintain transparency and reduces the likelihood of disputes.

By following these steps, you can effectively track and manage partial payments, reducing confusion and helping to keep your financial records accurate and organized. Proper tracking ensures that both you and your clients are on the same page and that no payments are missed or incorrectly recorded.

Tips for Professional Invoice Presentation

A well-designed payment request document not only ensures timely payment but also reflects the professionalism of your business. Clients are more likely to trust and respect your business when you present financial documents that are clear, polished, and easy to understand. This section will guide you through essential tips for presenting your payment requests in a professional and effective manner.

Key Design Principles

The way your payment request document looks can have a significant impact on how it is perceived. Here are some design tips to help you create a document that stands out:

- Clean and Simple Layout: Avoid clutter by using a clean, minimalist layout. Make sure the content is well-organized, and the document is easy to follow.

- Use a Professional Font: Choose a clear, readable font such as Arial, Calibri, or Times New Roman. Keep the font size between 10-12 points for readability.

- Brand Consistency: Incorporate your logo, brand colors, and fonts to make the document consistent with your company’s branding. This helps reinforce your business identity and professionalism.

- Clear Section Headings: Break your document into clear sections with bold headings for easy navigation. Sections like “Billing Information,” “Payment Details,” and “Terms and Conditions” should stand out.

Essential Content Features

Along with the design, the content of your payment request must also be accurate and well-structured. Here are the essential components to include:

- Accurate Contact Information: Your business name, address, and phone number should be clearly visible at the top, along with the client’s contact details.

- Precise Payment Breakdown: Clearly outline the goods or services provided, quantities, unit prices, and any applicable taxes or discounts. Transparency here helps avoid confusion.

- Unique Reference Number: Assign a unique reference number to each request. This makes it easier for both you and the client to track payments and resolve potential disputes.

- Payment Terms: Specify when the payment is due, the payment methods you accept, and any penalties for late payments. This helps set clear expectations.

Final Touches for a Polished Presentation

After ensuring your payment request is designed properly and contains all the necessary information, there are a few final touches that can enhance its professionalism:

- P

How to Share and Send Payment Requests

Once you have created your payment request document, it’s essential to send it to your clients in a way that is both professional and efficient. The method of delivery can influence how quickly the payment is processed and whether any issues arise. This section will guide you through the best practices for sharing and sending payment documents, ensuring that they reach your clients promptly and securely.

Different Methods to Share Payment Requests

There are several ways to share your payment request, depending on your business needs and client preferences. Below are some common methods:

- Email: The most common and efficient way to send payment documents. Ensure you attach the document as a PDF or another accessible file format to maintain the layout and prevent edits.

- Cloud Storage: Using cloud-based storage services like Google Drive, Dropbox, or OneDrive allows you to upload the document and share a link with the recipient. This method is useful for larger files or when you need to store the document for future reference.

- Postal Mail: While slower, sending a physical copy of the document through postal mail might be necessary for clients who prefer hard copies. Always use a reliable service and consider tracking the delivery for security purposes.

- Accounting or Payment Platforms: Some businesses use specialized platforms (like PayPal, QuickBooks, or FreshBooks) that allow you to send payment requests directly through their systems. These platforms also track payment statuses automatically.

Best Practices for Sending Payment Documents

Regardless of the method you choose, following a few best practices will ensure that the document is received and processed efficiently:

- Always Include a Clear Subject Line: In emails or digital messages, always use a subject line that clearly states the purpose of the communication, such as “Payment Request for [Service/Product].” This makes it easier for the recipient to identify and prioritize the document.

- Double-Check the Recipient’s Information: Make sure you are sending the document to the correct contact person and that their email address or mailing address is accurate. This helps avoid delays and confusion.

- Request a Confirmation: Ask the recipient to confirm receipt of the document, especially if you’re sending it electronically. This ensures they have received it and can act on it in a timely manner.

- Set a Follow-Up Reminder: If you haven’t received a response or payment by the expected date, set a reminder to follow up. Sending a polite reminder helps keep the payment process on track.

By following these guidelines, you can ensure that your payment requests are shared in a timely, professional, and efficient manner, helping to foster positive relations