Download Dental Invoice Template Excel for Easy Billing

Managing financial records efficiently is crucial for any practice, especially in the healthcare field. A well-organized system helps professionals keep track of services provided and payments received. With the right tools, the process becomes simpler, more accurate, and less time-consuming.

Using structured documents allows practices to maintain clarity and professionalism in their transactions. By customizing these documents, users can easily adjust to specific needs, ensuring that each client is billed correctly. Moreover, having a reliable and consistent system can reduce errors and improve overall efficiency.

Leveraging technology makes it possible to automate several aspects of the billing process. With the right format, all relevant information can be included, from patient details to charges and taxes, saving time for both the provider and the client. It ensures that all data is accurately captured and properly formatted for quick processing.

Integrating these solutions into daily operations can significantly improve financial management and contribute to smoother workflow. Whether for a small clinic or a large practice, having the right tools in place supports better service and streamlined administrative tasks.

Benefits of Using Excel for Dental Invoices

Utilizing spreadsheets for managing financial documents offers numerous advantages, especially when handling large volumes of data. The flexibility and ease of use make it an ideal choice for professionals who need a customizable solution that can adapt to their specific requirements. With the right approach, these tools help streamline the entire process, improving both accuracy and efficiency.

One of the key benefits of using such software is the ability to automate calculations. Complex formulas for taxes, discounts, and totals can be set up in advance, reducing the risk of human error and saving valuable time. Additionally, the format can be easily modified, allowing users to make adjustments as needed for different types of services or clients.

| Benefit | Description |

|---|---|

| Customization | Tailor documents to specific needs with ease, adjusting fields and layouts for different types of services. |

| Accuracy | Automated calculations reduce errors, ensuring all numbers are correct without manual input. |

| Efficiency | Faster document creation with predefined structures, saving time for both billing and payment processing. |

| Organization | Keep track of multiple clients, services, and payments within a single, easy-to-manage file. |

Furthermore, spreadsheets can serve as a central hub for record-keeping, enabling easy access to past transactions and simplifying future reference. With the ability to track payments and outstanding balances, professionals can quickly assess the status of their financial records, enhancing workflow and decision-making.

How to Create an Invoice Template

Creating a well-structured document for billing and payment management is an essential task for any practice. A good design allows for easy customization and ensures all necessary details are captured. By following a few simple steps, you can create an efficient billing document tailored to your needs.

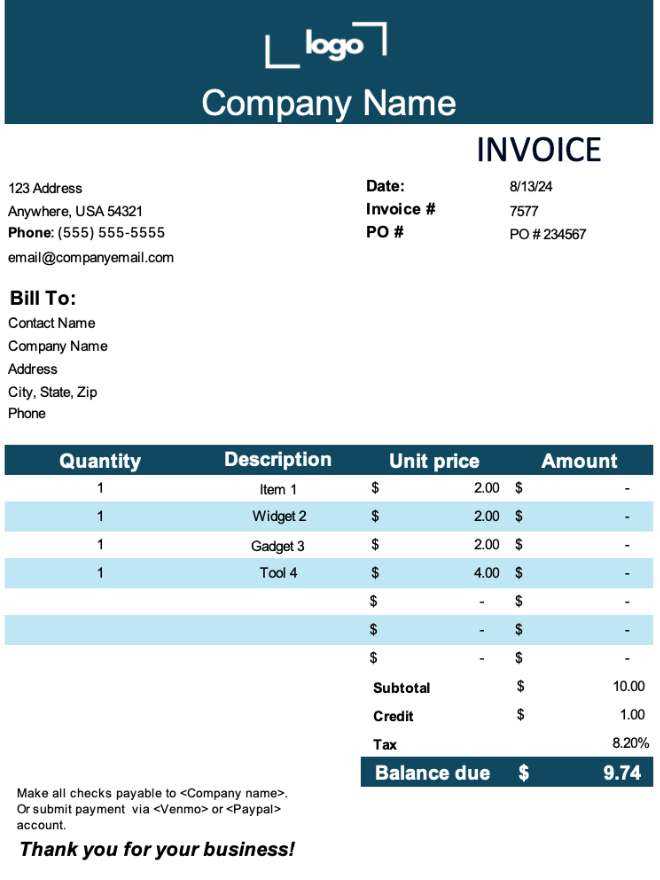

Step 1: Set Up Your Document

Start by choosing a platform that suits your needs. Once you’ve selected your tool, begin with a blank sheet or an existing framework that you can modify. Here’s what to include in the basic structure:

- Header with business details: Include the name, address, and contact information of your practice.

- Client information: Add spaces for the client’s name, address, and contact details.

- Date and unique identification: Include a date field and a reference number for tracking purposes.

Step 2: Include the Services and Costs

After setting up the basic information, list the services provided along with their corresponding charges. You can break down the costs for each item to ensure clarity and transparency:

- List all services provided along with quantities and rates.

- Include a space for discounts or additional charges if applicable.

- Ensure that there is a clear section for taxes or other financial considerations.

Step 3: Formatting and Final Touches

Once you have all the necessary data, organize it in a visually appealing format. Ensure that the document is easy to read and all important information is easy to locate. You can also add your practice logo and any other branding elements to personalize the document further.

By following these steps, you can create a professional and effective billing document that fits the specific needs of your practice, helping you to stay organized and efficient.

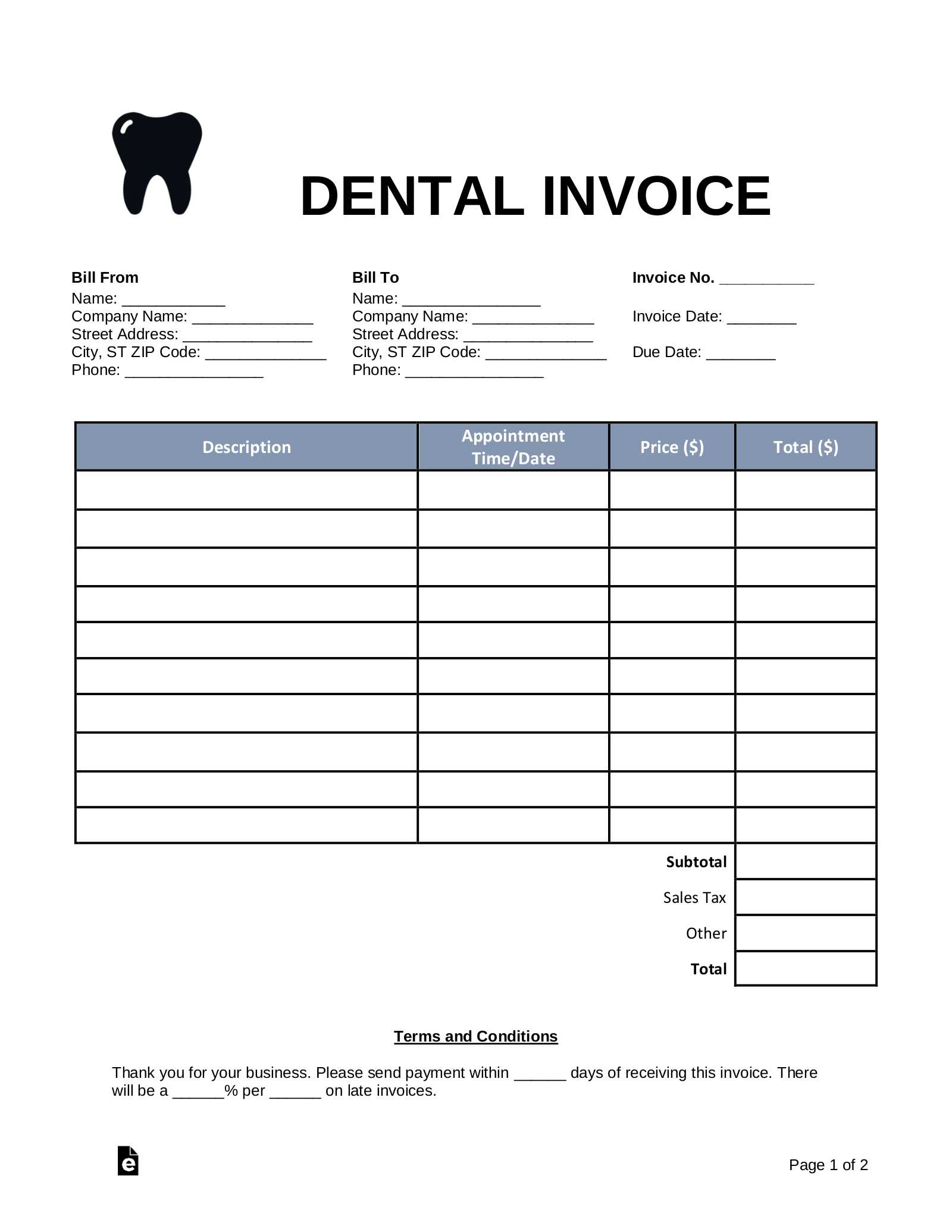

Essential Features of a Dental Invoice

When creating a financial document for professional services, it is important to include certain elements that ensure clarity and efficiency. These essential components help both the service provider and the client easily understand the charges and payment terms. A well-structured document reflects professionalism and supports accurate record-keeping.

There are several key features that should always be present in a financial record, ensuring that all necessary information is captured and communicated effectively. These features contribute to an organized and transparent transaction process.

| Feature | Description |

|---|---|

| Service Details | Each service provided should be clearly listed, with corresponding quantities, rates, and descriptions. |

| Client Information | Client’s name, address, and contact details must be included to ensure the document is correctly attributed. |

| Unique Identification Number | A reference number helps track each transaction, ensuring easy retrieval for future reference. |

| Payment Terms | Specify the payment due date and any late fees or penalties if payment is delayed. |

| Tax Calculation | Include details of any applicable taxes or additional fees that are relevant to the charges. |

| Total Amount | Clearly show the total amount due, including all services, taxes, and adjustments for clarity. |

These features are crucial in ensuring that the document serves its intended purpose–facilitating smooth transactions and providing an accurate financial record for both the provider and the client. A clear, organized structure helps maintain professionalism and reduces the likelihood of disputes or confusion.

Step-by-Step Guide to Customizing Templates

Customizing financial documents allows you to personalize them according to the unique needs of your practice. Whether you’re adjusting the layout, adding specific information, or including new fields, this process ensures that the document serves its exact purpose. By following a few simple steps, you can create a professional, customized record that fits your specific requirements.

Step 1: Choose the Right Framework

Select a starting point that aligns closely with your needs. You can begin with a blank sheet or modify an existing layout to suit your specific preferences. Make sure the basic structure includes key details such as service descriptions, payment terms, and client information.

Step 2: Add Custom Fields

Identify additional fields that are relevant to your business. For example, you might want to include areas for payment instructions, discounts, or additional service charges. Make sure to position these fields clearly within the document to maintain readability.

Step 3: Format for Clarity

Proper formatting makes a document easier to read and understand. Adjust font sizes, spacing, and alignment to create a visually appealing structure. Organize the sections in a way that allows quick identification of the most important information, such as total amount due and payment due date.

Step 4: Insert Calculations

If necessary, set up automatic calculations for totals, taxes, and discounts. By using built-in functions, these numbers will update automatically based on the input data, reducing errors and saving time.

Step 5: Finalize and Save

Once you’ve added all the necessary elements, review the document for accuracy. Make sure all fields are correctly labeled and the overall layout is clean and professional. Save the document as a new file so you can easily reuse the customized version in the future.

By following these simple steps, you can create a personalized and efficient document that reflects your practice’s needs while maintaining a professional appearance.

Improving Billing Accuracy with Excel

Ensuring the accuracy of billing is crucial for maintaining a smooth financial operation. By utilizing a well-organized system, it becomes easier to minimize errors and streamline the entire billing process. With the right approach, you can automate key tasks, reduce human mistakes, and provide clear and precise records for both clients and your practice.

Automating Calculations and Totals

One of the most effective ways to improve accuracy is by automating calculations. Using built-in functions, you can easily calculate the total amount due, taxes, discounts, and other financial considerations. This reduces the risk of manual calculation errors and ensures consistency across all documents. Once set up, these functions will automatically update whenever new data is entered, saving time and enhancing precision.

Using Templates for Consistency

Creating a standardized document format helps maintain consistency in every transaction. By reusing a pre-made structure for all records, you ensure that all necessary fields are always included and correctly labeled. This also makes it easier to track any changes, reducing the chance of missing critical information or repeating mistakes from previous records.

By integrating these strategies into your financial documentation process, you can significantly improve accuracy and efficiency, leading to smoother operations and better client satisfaction.

Common Mistakes in Dental Invoices

While creating financial documents for services, it’s easy to overlook certain details that can lead to mistakes and confusion. These errors, whether they are minor or significant, can cause delays in payments, misunderstandings with clients, and even legal issues. Understanding the common pitfalls can help you avoid them and ensure your records are accurate and professional.

Some of the most frequent mistakes involve missing or incorrect information, calculation errors, or improper formatting. These issues can be easily prevented with careful attention to detail and a consistent approach to documentation.

| Common Mistake | Impact | How to Avoid |

|---|---|---|

| Missing Client Information | Can lead to confusion and delays in payment processing | Ensure that all relevant client details, such as name, address, and contact information, are correctly filled out |

| Incorrect Service Charges | Results in disputes and payment discrepancies | Double-check all rates and services before finalizing the document |

| Failure to Include Taxes | Can lead to financial discrepancies and potential legal issues | Include the appropriate tax rate and ensure it is calculated correctly |

| Calculation Errors | Can cause financial losses or mistrust | Use automatic calculations to minimize the risk of human error |

| Unclear Payment Terms | Can result in delayed payments or confusion | Clearly state payment deadlines and any applicable late fees |

By addressing these common issues and taking the time to review your financial documents before sending them out, you can reduce the risk of errors and maintain a professional, efficient process for handling transactions.

Saving Time with Pre-made Templates

Using pre-designed formats for financial documentation can significantly reduce the time spent on creating records from scratch. These ready-to-use structures allow for quick customization, ensuring that the necessary fields and calculations are already set up. This method eliminates the need to repeatedly input the same information or adjust layouts for each new document, saving both effort and time.

Efficiency is key when it comes to administrative tasks. With pre-built formats, you can streamline your workflow and avoid repetitive tasks. Once customized to fit your needs, these formats can be reused for multiple transactions, further speeding up the process and reducing errors.

Time saved by using a pre-made system can be redirected towards more important aspects of your operations, such as client communication or enhancing service quality. This approach ultimately leads to improved productivity and ensures that the billing process remains smooth and efficient.

How Excel Templates Improve Organization

Using structured formats for financial documentation helps keep all relevant information in one place, making it easier to access and manage. These prearranged systems allow for better organization by ensuring that each element of the record is accounted for and consistently placed. By having an organized system in place, you eliminate the need to search through disorganized files or documents.

Clear structure is one of the main benefits of using a standardized system. With designated sections for client information, service details, and amounts, you ensure that each part of the record is easily identifiable. This setup minimizes the chance of missing crucial details and allows for faster processing.

Improved workflow comes from having everything in an organized and consistent manner. This approach leads to reduced stress, greater efficiency, and less time spent on sorting or correcting documents. The ability to easily find and update information also enhances collaboration between team members, making the entire process more streamlined.

Tips for Designing Professional Invoices

Creating clear and professional financial documents is essential for maintaining a good relationship with clients and ensuring timely payments. A well-designed document reflects positively on your business and can help avoid confusion. Here are some tips to help you create polished and professional records:

- Keep it simple: Use a clean layout with easy-to-read fonts. Avoid clutter and focus on the essential information.

- Include all necessary details: Ensure that each document includes the client’s name, transaction details, payment terms, and contact information. These elements provide clarity and prevent misunderstandings.

- Use consistent branding: Incorporate your business logo, colors, and fonts to make the document feel cohesive with your company’s image.

- Include clear headings: Organize the content with well-defined sections, such as “Services Provided,” “Total Amount,” and “Payment Due.” This improves readability and helps clients find what they need quickly.

- Provide payment instructions: Make sure to include clear instructions for how payments should be made, along with any necessary account details.

By following these simple tips, you can ensure that your financial documents are both professional and efficient, building trust with clients and improving the overall experience for both parties.

Tracking Payments Using Excel Templates

Managing and tracking payments effectively is crucial for maintaining financial stability in any business. By utilizing well-organized systems, you can ensure that every transaction is recorded accurately and monitored in real-time. With structured documents, it’s easier to keep track of due payments and follow up on any outstanding amounts. This method enhances financial oversight and minimizes the risk of errors.

Organizing Payment Data

Recording transactions with the proper details, such as payment dates, amounts, and methods, helps maintain clear and up-to-date records. This organization ensures that all payments are accounted for, reducing the chances of overlooking any outstanding balance.

Monitoring Outstanding Balances

By using automated calculations, you can quickly assess which payments are still pending and calculate the remaining balance. This feature helps to manage cash flow and keeps the business informed about its financial status without the need for manual updates.

Overall, leveraging a well-organized tracking system enables smoother payment management and better financial control, leading to more efficient operations and stronger client relationships.

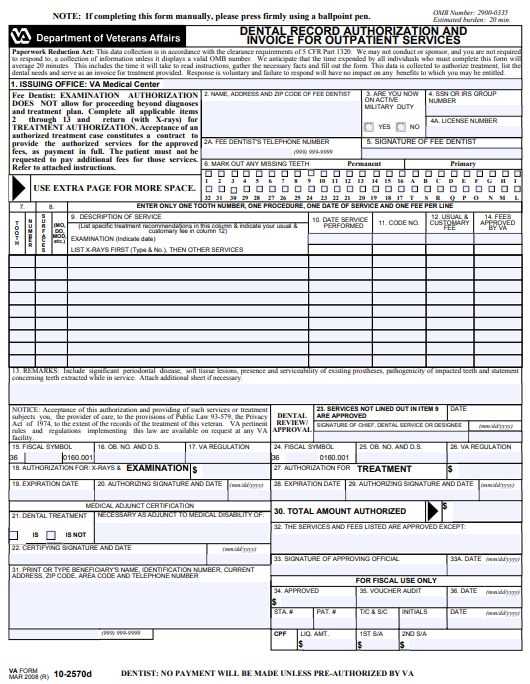

Ensuring Compliance with Dental Regulations

Adhering to industry standards and regulations is vital for maintaining trust and ensuring that all business practices are transparent and legally sound. In the field of healthcare services, it’s crucial that all financial documentation complies with the set guidelines to avoid penalties and uphold professionalism. A systematic approach to meeting regulatory requirements is key to maintaining an efficient and compliant operation.

- Accurate Record Keeping: Ensuring that all transactions are documented properly helps maintain compliance with financial regulations, which are essential for auditing purposes.

- Adherence to Local Laws: Each region may have specific laws concerning billing, taxes, and reimbursement, so it’s important to stay updated on local legal requirements.

- Maintaining Patient Confidentiality: Following privacy laws, such as protecting sensitive patient data, is not only a legal requirement but also builds trust with clients.

By keeping these factors in mind, businesses can create an environment that fosters compliance and promotes confidence in both services and financial practices.

Integrating Patient Details in Invoices

Incorporating patient-specific information into billing documents ensures a seamless and personalized process. By including accurate personal details, service descriptions, and financial information, healthcare providers can facilitate easy reference and improve the transparency of financial transactions. This practice not only enhances communication but also helps in streamlining payment processes and maintaining records for future reference.

Key benefits of integrating patient data:

- Clear Identification: Including patient names, addresses, and treatment details helps in easily identifying services provided, reducing confusion during payment processing.

- Improved Accuracy: Accurate details minimize errors in billing and help avoid discrepancies in payments.

- Efficient Record-Keeping: Integrating patient information ensures that records are organized, making it easier for both healthcare providers and patients to review historical data.

By ensuring the inclusion of patient data in billing records, providers can enhance the billing process, making it more accurate and aligned with both legal and professional requirements.

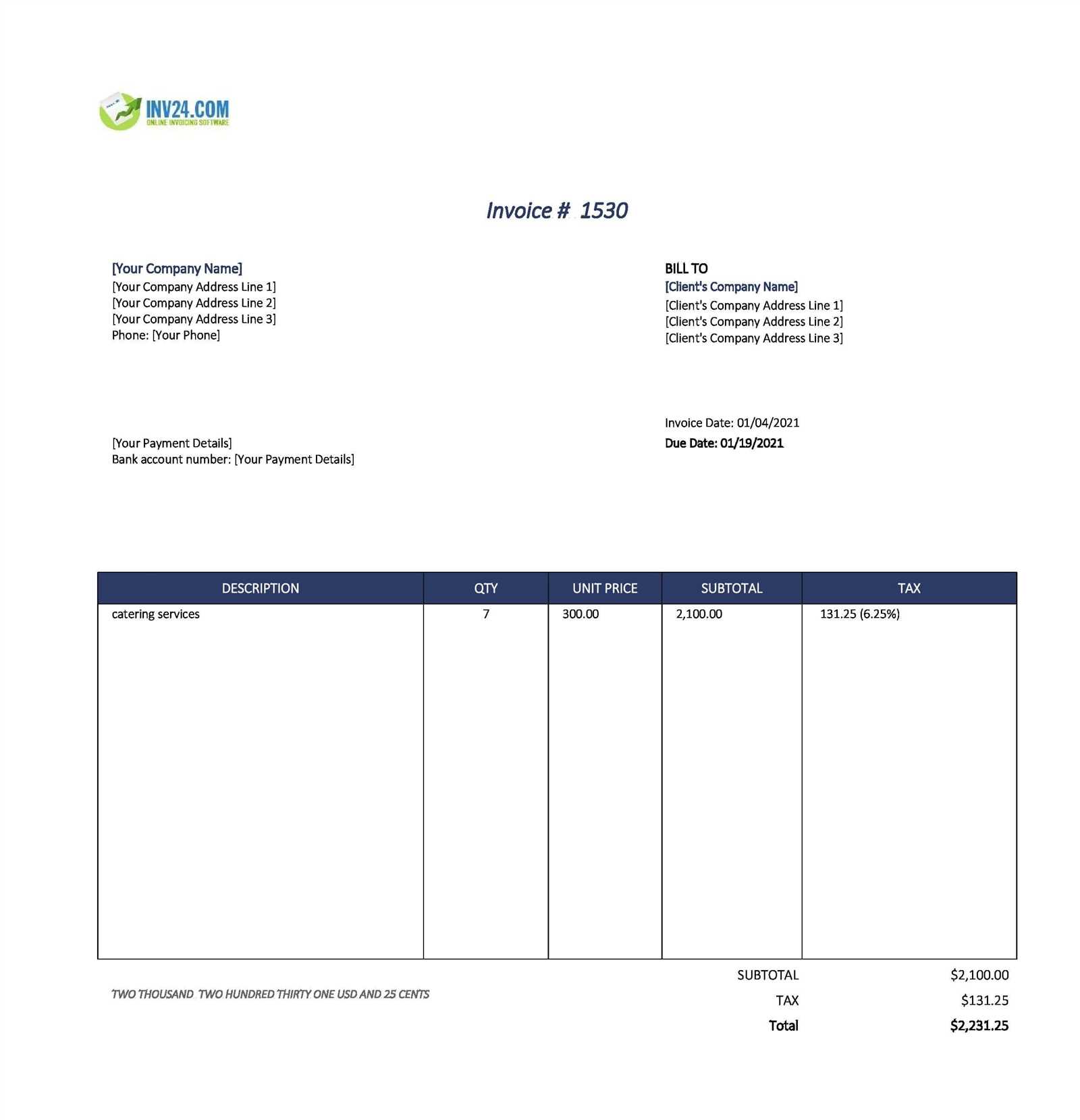

How to Calculate Taxes on Dental Services

Calculating taxes on healthcare services can be a crucial step in ensuring that billing is accurate and compliant with local tax regulations. Understanding the applicable tax rates for specific services is important for both healthcare providers and patients. Proper tax calculations can avoid legal issues and make the financial aspects of medical care more transparent.

Steps to Calculate Taxes

Follow these general steps to calculate taxes on healthcare services:

- Identify Applicable Tax Rates: Check your local tax laws to determine the specific tax rate that applies to medical or healthcare services in your region.

- Determine the Service Cost: Ensure that the price of the services rendered is clear and accurate, including any additional charges for materials or special procedures.

- Apply the Tax Rate: Multiply the total cost of the services by the applicable tax rate to calculate the tax amount.

- Calculate Total Charges: Add the calculated tax amount to the original cost of the service to get the final amount due.

Considerations When Calculating Taxes

- Exemptions: Some regions may offer tax exemptions for certain medical services or types of care. Be sure to check if your services qualify.

- Variable Tax Rates: Some areas may have different tax rates based on the type of service provided. For instance, preventative treatments may have different rates compared to cosmetic procedures.

By following these steps and ensuring accurate tax calculations, providers can ensure smooth transactions and prevent complications in the billing process.

Using Excel for Multiple Client Invoices

Managing billing for multiple clients can be complex, especially when dealing with large volumes of data. A streamlined system helps track charges, payments, and due amounts efficiently. By utilizing spreadsheet software, businesses can automate processes, reduce errors, and organize their client information in one accessible format, ensuring faster and more accurate billing for multiple clients.

Benefits of Using a Spreadsheet for Multiple Clients

- Centralized Data: All client information, including services provided, amounts due, and payment status, can be stored in one place for easy access and management.

- Time Efficiency: Automated calculations for taxes, discounts, and totals save time and reduce the need for manual entries.

- Customizable Fields: Create tailored columns for specific needs, such as client IDs, service descriptions, and payment history.

- Quick Updates: With just a few clicks, you can update and modify client details or billing information without starting from scratch.

Steps for Organizing Multiple Client Billing

- Set Up a Master Spreadsheet: Create a document that includes columns for essential information such as client names, services rendered, amounts, and payment due dates.

- Use Formulas for Calculations: Implement formulas to automatically calculate totals, taxes, or discounts to minimize manual calculations.

- Track Payments: Add a column for payment statuses (e.g., paid, unpaid, pending) to easily monitor which clients have settled their dues.

- Generate Individual Client Statements: Use filtering options to extract specific client data and generate customized summaries for each client as needed.

By utilizing a spreadsheet for multiple client billing, businesses can streamline their operations, reduce errors, and improve the overall efficiency of their billing process.

Best Practices for Invoice Templates

Creating well-organized billing documents is essential for smooth financial transactions. A clear and professional layout can ensure that clients understand the charges and make prompt payments. By following certain best practices, you can enhance the efficiency of the billing process, improve client satisfaction, and reduce errors in your records.

Key Elements of Effective Billing Documents

- Consistent Layout: Ensure that each document follows a consistent format. This includes using uniform fonts, headers, and section divisions for clarity.

- Clear Descriptions: Provide detailed descriptions for each charge. This ensures that the client understands what they are paying for and reduces the chance of confusion or disputes.

- Easy-to-Read Structure: Use appropriate spacing and alignment to create a visually appealing document. This improves readability and helps clients quickly locate key information like totals and due dates.

- Accurate Contact Information: Include all relevant details such as business name, address, phone number, and email for easy communication between both parties.

- Payment Terms: Clearly define payment terms, including due dates, accepted payment methods, and any penalties for late payments. This helps prevent misunderstandings regarding deadlines and fees.

Common Mistakes to Avoid

- Omitting Essential Information: Always include key details such as the client’s name, description of services, and breakdown of charges. Missing this information can lead to confusion or delays in payment.

- Complex Language: Avoid using jargon or overly complicated terms. Simple, straightforward language will make it easier for clients to understand their bill.

- Inconsistent Formatting: Avoid mixing different fonts or styles. Consistency helps to maintain a professional appearance and prevents the document from looking cluttered.

- Leaving Out Taxes or Discounts: Always clearly state if any discounts have been applied or if taxes are included in the final amount, to avoid confusion for both the sender and the recipient.

By adhering to these best practices, you can ensure that your billing documents are clear, professional, and efficient, helping to facilitate smooth financial transactions with clients.