Delivery Service Invoice Template for Efficient Billing and Professional Invoices

Efficient billing is crucial for any business looking to maintain smooth operations and strong client relationships. With the right tools, managing payments and tracking transactions becomes much simpler. One of the best ways to ensure consistency and professionalism in financial documentation is by using a pre-designed format that can be easily customized for your needs.

By utilizing ready-made formats, businesses can save valuable time while avoiding the potential errors that come with creating records from scratch. These solutions allow for quick input of necessary details, ensuring that all important information is clearly presented. Whether you’re a small startup or an established company, adopting such a system can significantly enhance your workflow.

In this guide, you’ll explore how using an efficient system for tracking financial exchanges can improve accuracy, save time, and provide your clients with clear and professional documents. The convenience of a well-structured document allows for a seamless billing experience for both parties.

Why Use a Delivery Service Invoice Template

Maintaining accuracy and professionalism in financial documentation is essential for any business. Using a pre-designed structure to handle billing can streamline the entire process, helping to avoid errors, improve clarity, and save time. Adopting a standardized format ensures that all necessary details are included, which in turn enhances the relationship with clients and strengthens business operations.

Here are several reasons why you should consider adopting a structured billing solution:

- Efficiency: A ready-made structure allows for quick data entry, reducing the time spent on manual tasks.

- Consistency: It ensures all documents are uniform, which helps in maintaining a professional image with every transaction.

- Accuracy: Predefined sections ensure all critical details, such as prices, terms, and dates, are included correctly.

- Time-saving: By eliminating the need to create documents from scratch, businesses can allocate time to other important tasks.

- Customization: These formats can be tailored to fit the specific needs of the business, making it easy to adjust for varying circumstances.

Incorporating a well-structured document into your billing process helps avoid the common pitfalls that can come with manual record-keeping. This approach leads to more reliable financial exchanges and fosters trust between businesses and their clients.

How an Invoice Template Saves Time

Creating financial documents from scratch can be a time-consuming task, especially when accuracy is crucial. By utilizing a pre-designed structure, businesses can automate much of the process, allowing them to focus on more important tasks. The key benefit lies in the ability to quickly enter necessary details without worrying about formatting or missing important information.

Quick Data Entry

One of the most significant time-saving advantages of using a pre-built format is the ability to enter information quickly and consistently. Instead of starting from a blank page, all key sections are already in place, allowing you to focus solely on entering data like amounts, dates, and client details.

- Pre-filled fields for common details

- Standardized layout reduces decisions about design

- Customizable sections for specific needs

Reduced Risk of Errors

Manually creating billing documents increases the likelihood of making mistakes, which can be time-consuming to correct. A structured approach ensures that all the essential information is captured correctly the first time, helping to avoid revisions and delays.

- Automatic formatting reduces the chances of errors

- Predefined sections ensure important details aren’t overlooked

- Less time spent on proofreading and revisions

In summary, using a pre-structured document for your financial records can drastically cut down on the time spent preparing and reviewing. It allows for faster, more reliable processing of transactions, benefiting both the business and its clients.

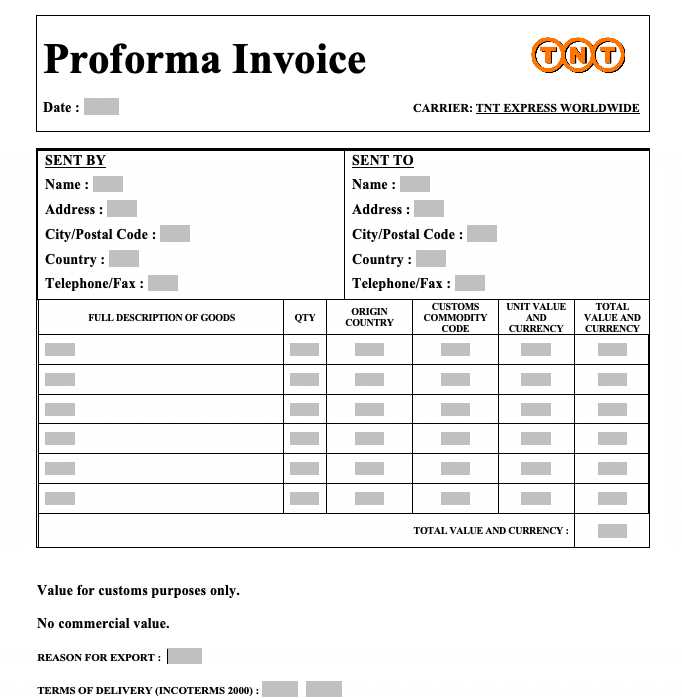

Essential Features of an Invoice Template

To create professional and clear billing documents, certain elements must be present in any pre-designed structure. These features ensure that both businesses and clients can easily understand the terms, payments, and deadlines involved. Having the right components in place helps avoid confusion and ensures timely payment processing.

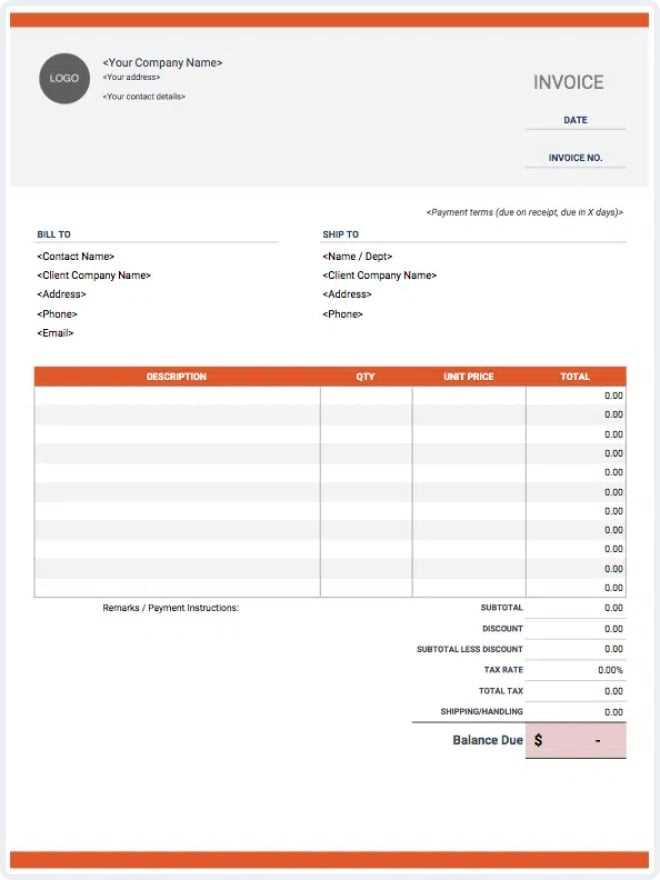

Key Elements of a Well-Structured Document

A well-organized format includes various essential components that must be included for clarity and accuracy. These elements help businesses keep track of transactions and make it easy for clients to process payments without errors.

| Feature | Description |

|---|---|

| Business Information | Includes the company name, address, and contact details for easy identification. |

| Client Information | Contains the client’s name, address, and contact details to ensure proper billing. |

| Transaction Details | Lists the items or services provided, including quantities and rates, for clarity. |

| Total Amount | Displays the total payment due, including any applicable taxes or fees. |

| Payment Terms | Outlines the due date and payment methods available to the client. |

Why These Features Matter

Each of these features plays an important role in ensuring that the financial documents are both professional and effective. By incorporating these elements, businesses can minimize errors, maintain transparency, and encourage prompt payments. A clear, organized format also enhances the client’s experience, making them more likely to continue doing business with you.

Creating Professional Invoices Easily

Generating clear and professional billing documents doesn’t have to be complicated. With the right approach, you can quickly produce polished and accurate records without spending excessive time on design or formatting. By using a structured approach, businesses can ensure every document meets professional standards while maintaining efficiency.

Simplifying the Process

The key to creating professional documents with ease is simplifying the process. Predefined structures allow you to focus on entering the necessary information, such as amounts, dates, and client details, while the design and layout are already taken care of. This minimizes distractions and ensures that your documents always look polished and consistent.

- Pre-built layouts save time and effort.

- Clear sections ensure all necessary details are included.

- Customization options allow you to tailor the format to your specific needs.

Enhancing Client Experience

In addition to saving time, a well-designed document can enhance your client’s experience. By providing a clear, organized record of the transaction, clients can easily understand the details and process payments without confusion. This professional approach helps build trust and encourages timely payment.

Whether you are a small business owner or an established company, using an easy-to-create structured record is an effective way to maintain professionalism and efficiency in your financial dealings.

Customizing Your Delivery Service Invoice

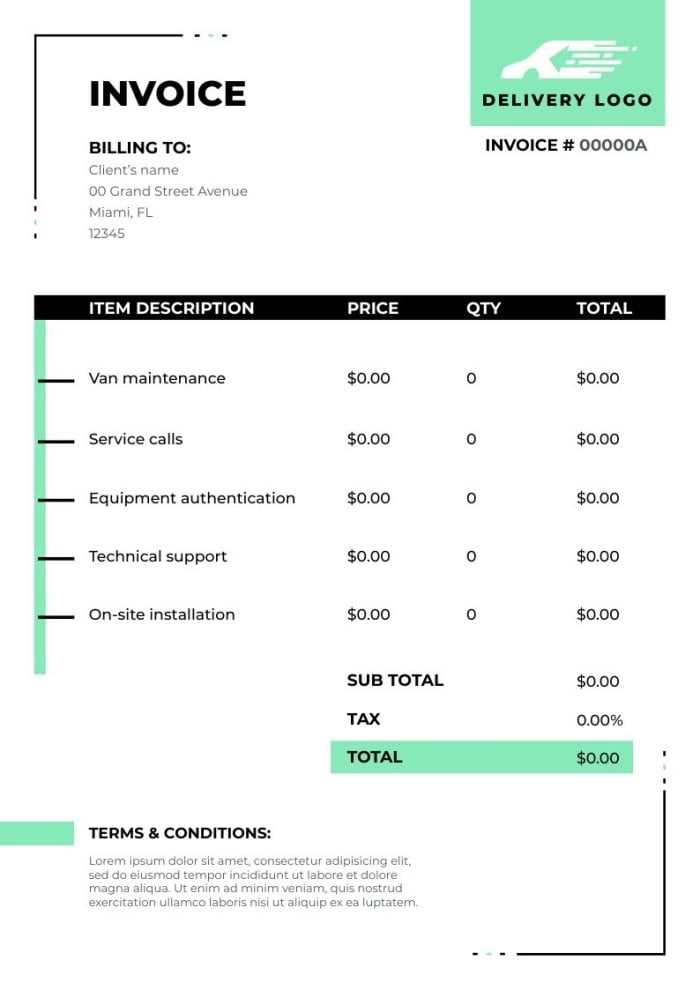

When it comes to creating a billing document for transportation or shipment tasks, personalizing it to suit the specific nature of your operations can make a significant difference. Customization allows you to reflect your brand identity, provide clear and concise details to your clients, and streamline the entire payment process. Tailoring this document is essential for enhancing professionalism and ensuring that all necessary information is clearly presented.

Adjusting elements such as company logos, itemized lists, and payment instructions can improve communication and make the document more user-friendly. You can also modify fields to align with your workflow, ensuring that both you and your clients find it easy to track costs, services rendered, and terms.

Here are a few suggestions on how to personalize your document:

| Customization Element | Description |

|---|---|

| Logo and Branding | Incorporating your company’s logo, colors, and fonts reinforces your brand image and ensures your documents are easily recognizable. |

| Client Information | Including specific details about the client, such as contact info and special instructions, helps personalize each billing document and avoid confusion. |

| Itemized List | Breakdown of charges ensures transparency and allows customers to see what they’re being billed for, including rates for specific tasks or distances covered. |

| Payment Terms | Clearly outline the terms of payment, including due dates, accepted payment methods, and any late fees to avoid miscommunication. |

| Additional Notes | Including a section for any additional notes or disclaimers adds a personal touch and clarifies any details relevant to the billing process. |

By adjusting these sections, you ensure that each document accurately reflects the details of each transaction, making the entire process smoother for both parties.

Tips for Accurate Billing Details

Providing precise and clear billing information is crucial for maintaining smooth financial transactions. By ensuring every detail is correct, you can prevent disputes and ensure timely payments. Focusing on accuracy helps both you and your clients stay organized, reducing the chances of misunderstandings and errors in the billing process.

Double-Check Client Information

It’s essential to verify that all client details are up to date and accurately entered. This includes the client’s name, address, contact information, and any other relevant details. Mistakes in this section can lead to delayed payments or confusion on both sides. Ensure that the billing address matches the client’s shipping address if applicable, to avoid unnecessary issues with delivery or payment processing.

Clearly Define Charges

Every charge should be clearly listed, with a detailed breakdown of the costs involved. Specify the rate for each service rendered and avoid general descriptions. If your work involves multiple stages or additional expenses, such as fuel or extra labor hours, make sure each cost is outlined separately. This level of detail helps customers understand exactly what they are paying for, minimizing disputes over the final amount.

Additionally, make sure to include any applicable taxes, surcharges, or discounts, and state the total amount due in a clear, easily visible manner. If you offer flexible payment terms, such as partial payments or installment options, ensure they are clearly communicated to avoid any confusion down the line.

By following these tips and staying vigilant about the accuracy of every detail, you create a transparent and trustworthy process for your clients, which ultimately leads to faster payments and long-term business relationships.

How to Avoid Common Invoice Mistakes

Errors in billing documents can lead to delays, confusion, and even loss of revenue. By understanding common mistakes and taking steps to prevent them, you can ensure that your financial records are accurate, professional, and easy to process for your clients. A well-organized and mistake-free billing process improves trust and encourages prompt payments.

Key Mistakes to Avoid

- Incorrect Client Information: Always double-check the details, including the client’s name, address, and contact number. Errors here can lead to misdirected payments and confusion about charges.

- Missing or Incorrect Dates: Including the correct date of issue and due date is crucial. Missing or incorrect dates may lead to delays in payment or misunderstandings about when payments are expected.

- Unclear Descriptions of Charges: Vague descriptions of what services were provided or what the charges are for can create confusion. Always include clear, itemized details of the tasks performed and rates charged.

- Omitting Payment Terms: Failing to outline payment terms, such as due dates, late fees, or accepted payment methods, can cause unnecessary delays in payment and cause disputes.

- Errors in Amounts or Calculations: Double-check all calculations and ensure that no charges are left off or duplicated. Small arithmetic mistakes can lead to bigger financial issues.

Best Practices to Ensure Accuracy

- Review Before Sending: Take a moment to carefully review the entire document for any potential errors. Mistakes are easier to spot when you take your time.

- Use Professional Software: Utilize accounting or billing software that automatically calculates totals and ensures accurate formatting.

- Standardize Your Format: Use a consistent layout and structure for all your billing documents. This helps minimize errors and makes it easier to spot inconsistencies.

- Keep Records Organized: Always maintain proper records of your past transactions and check them for consistency when preparing new documents.

By taking these precautions and following these tips, you can avoid common mistakes and make the billing process smoother for both you and your clients.

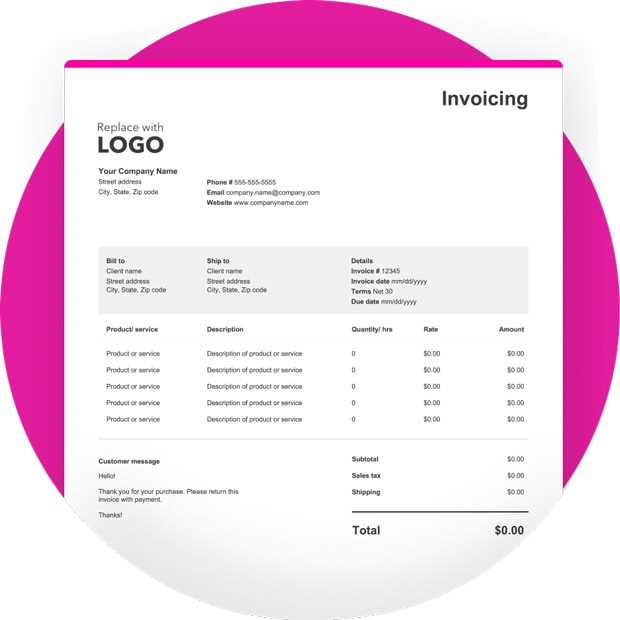

Best Practices for Delivery Invoice Formatting

Proper formatting is key to creating a professional and effective billing document. A well-structured layout ensures that the details are easy to read, reduces confusion, and helps clients understand the charges at a glance. By following best practices, you can make sure your billing documents are organized, consistent, and aligned with your business needs.

Here are some essential guidelines to consider when formatting your billing statements:

| Formatting Element | Description |

|---|---|

| Clear Header | The header should prominently display the company name, contact information, and the purpose of the document. Make it easy to identify and professional in appearance. |

| Structured Layout | Organize the document in a logical flow. Include sections for client details, itemized list, charges, payment terms, and totals. This structure improves readability and helps ensure all necessary information is included. |

| Legible Fonts | Use a readable font size (usually between 10pt and 12pt) and choose simple, professional fonts. Avoid using too many font styles, as it can make the document look cluttered. |

| Itemized Breakdown | Provide a detailed breakdown of each charge. Include descriptions, rates, and quantities, so clients know exactly what they’re paying for. A table format for itemized charges is often the best choice. |

| Use of White Space | Ensure there’s enough space between sections and elements. Overcrowding the document with too much information in a small area can make it hard to read. White space improves clarity and visual appeal. |

| Highlight Important Information | Make the total amount due, due date, and payment methods stand out by using bold text or placing them in a box. This ensures that these key pieces of information are easily noticed. |

By adopting these formatting best practices, you can create well-organized and professional billing documents that are easy to navigate and understand for both your clients and your team.

Choosing the Right Invoice Template Software

Selecting the right software for generating billing documents can streamline your financial processes and help maintain professionalism in your transactions. The right tool allows you to customize formats, automate calculations, and create polished, consistent documents quickly. When considering software options, it’s important to evaluate the features that best suit your business needs, ensuring both ease of use and flexibility.

Key Features to Look for

Here are some essential features to consider when choosing software for generating billing documents:

| Feature | Description |

|---|---|

| Customization Options | Choose a tool that allows for extensive customization. You should be able to tailor layouts, add logos, adjust fonts, and modify fields to fit your unique business style. |

| Automation Capabilities | Look for software that can automatically calculate totals, taxes, and discounts. This helps prevent errors and speeds up the billing process. |

| Integration with Accounting Tools | Opt for software that integrates with your accounting or payment systems. This reduces the need for manual data entry and ensures a seamless flow of information across platforms. |

| Cloud Access | Cloud-based tools provide access from any device and allow for easy sharing, saving, and retrieval of billing documents from anywhere. |

| Tracking and Reporting | Software that offers tracking and reporting features lets you monitor outstanding payments, generate financial reports, and keep an eye on your cash flow. |

Popular Options to Consider

There are many software options available that cater to different business needs. Some popular tools include:

- QuickBooks: Ideal for small businesses, offering comprehensive invoicing features alongside full accounting integration.

- Zoho Invoice: A flexible option with a user-friendly interface and customizable templates for various business types.

- FreshBooks: Known for its simplicity, automation, and excellent customer support, it’s great for freelancers and small enterprises.

- Invoice2Go: A mobile-friendly tool that allows for easy billing and payment tracking on the go.

Choosing the right software depends on your specific requirements, the size of your business, and the features you prioritize. By considering these options, you can find a solution that helps you create professional documents and improve your overall billing process.

Importance of Clear Payment Terms

Clearly defined payment terms are essential for ensuring smooth financial transactions between businesses and clients. When both parties understand when and how payments are due, it reduces the risk of confusion, late payments, and disputes. Transparent terms help set expectations from the start and foster trust and professionalism in any business relationship.

Without clear payment guidelines, clients may not know when to pay or what penalties exist for late payments, leading to unnecessary delays and friction. By specifying terms upfront, businesses can ensure timely payments and avoid misunderstandings that could impact cash flow.

Key Elements of Clear Payment Terms

- Due Date: Clearly state when payment is expected. This helps clients plan their finances and ensures there is no ambiguity about deadlines.

- Accepted Payment Methods: Specify which payment methods are accepted (e.g., credit card, bank transfer, PayPal). This prevents confusion and ensures clients know how to pay.

- Late Fees: Outline any penalties for late payments, including the amount or percentage charged after a specific period. This encourages prompt payment and discourages delays.

- Discounts for Early Payment: Offering a discount for early payment can incentivize clients to settle accounts sooner, improving your cash flow.

- Partial Payments: If applicable, clarify whether partial payments are acceptable and how they should be handled. This can help clients who need flexibility but still want to meet their obligations.

Benefits of Clear Payment Terms

- Improved Cash Flow: With clear terms, businesses can better predict when payments will be received, helping them manage cash flow more effectively.

- Avoiding Disputes: By setting expectations upfront, both parties understand their responsibilities, reducing the likelihood of misunderstandings or disputes later.

- Enhanced Professionalism: Clear and precise payment terms demonstrate professionalism and transpar

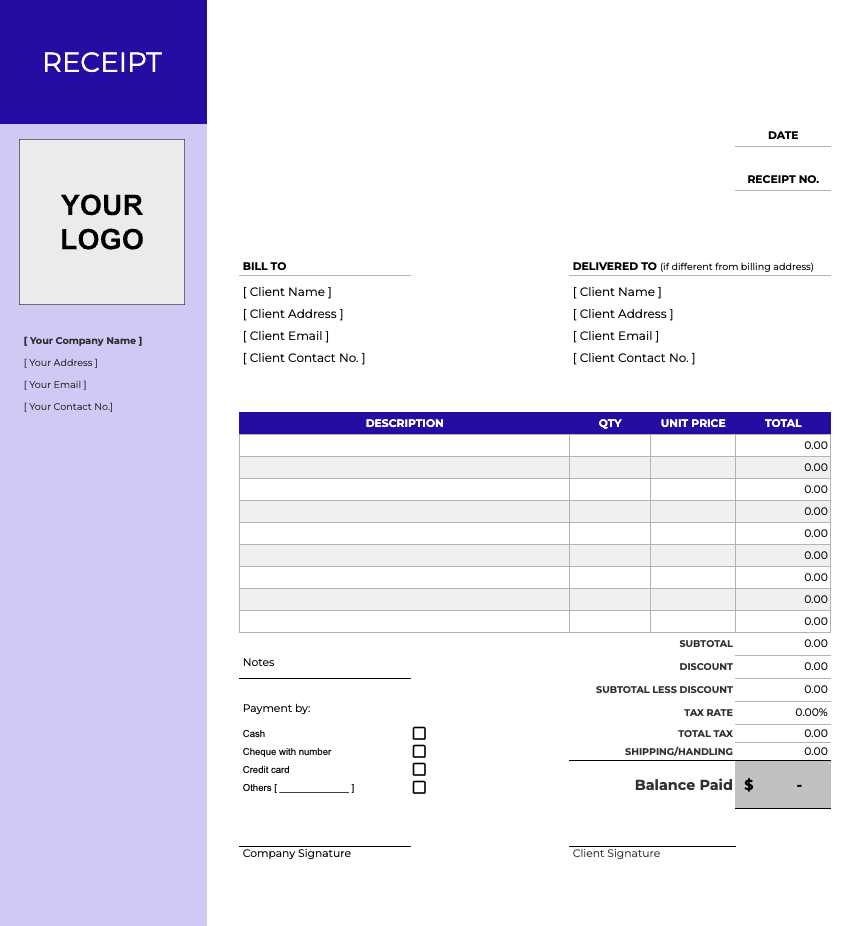

Tracking Payments with Your Invoice Template

Efficiently monitoring payments is a critical part of maintaining a healthy cash flow and keeping financial records up to date. Having a clear and organized method for tracking paid and unpaid amounts helps ensure you don’t miss any transactions and can follow up promptly when needed. The right approach to payment tracking provides both clarity and peace of mind for businesses and clients alike.

Incorporating specific fields into your billing documents can streamline this process. These fields allow you to quickly see the payment status, track due amounts, and identify any discrepancies. By maintaining a structured record, you can minimize errors and reduce time spent chasing late payments.

Key Fields for Payment Tracking

- Payment Status: Clearly mark whether a payment has been made, is pending, or is overdue. This section helps both you and your client understand the current status at a glance.

- Payment Date: Record the date when the payment was made. This helps you keep track of when payments are received, making it easier to manage accounting and reconcile your records.

- Outstanding Amount: Indicate any remaining balance if the full amount has not been paid. This helps prevent confusion and serves as a reminder for both parties regarding the amount due.

- Payment Method: Note the method used to make the payment (e.g., bank transfer, credit card, check). This can be helpful for reference and tracking purposes.

- Transaction Reference: Include any reference number associated with the payment. This helps you identify specific transactions in your records or when dealing with customer inquiries.

How to Organize Payment Tracking

- Use a Payment Log: Maintain a separate log or spreadsheet where you

How to Handle Late Payments in Invoices

Managing overdue payments is an essential part of keeping your business financially healthy. When clients fail to meet payment deadlines, it can disrupt your cash flow and lead to frustration. However, handling late payments with professionalism and clarity can help resolve the issue while maintaining positive relationships with your customers.

Clearly defined payment terms, as well as a structured process for addressing late payments, can help ensure that overdue amounts are collected without causing tension. This process should include clear communication, reminders, and, if necessary, penalties for delayed payments.

Steps to Take When Payments Are Late

- Send a Friendly Reminder: Often, clients simply forget about the due date. A polite reminder shortly after the deadline has passed can prompt them to settle their balance without hard feelings.

- Contact the Client Directly: If payment has not been received after your reminder, reach out directly via phone or email to inquire about the status. Sometimes there may be an issue on their end that you can resolve quickly.

- Apply Late Fees: If your payment terms include penalties for overdue amounts, make sure these are enforced. Inform the client of the additional fees, but do so in a professional and transparent manner.

- Set a New Deadline: If the client is facing difficulties, work with them to set a new payment deadline. Document the new terms in writing to avoid future misunderstandings.

- Consider Legal Action: As a last resort, if the client continues to refuse payment despite repeated requests, consider seeking legal assistance or using a collection agency to recover the owed amount.

Penalties for Late Payments

Late fees can act as an effective deterrent for overdue payments. When including them, make s

Why Invoice Templates Improve Cash Flow

Using structured and consistent billing documents plays a crucial role in maintaining healthy cash flow for any business. A well-designed format ensures that all necessary details are clearly presented, reducing the likelihood of payment delays and minimizing errors that can cause payment discrepancies. By streamlining the billing process, businesses can enhance efficiency and ensure quicker payments, which directly impacts cash flow management.

When the billing process is standardized, it becomes easier to track payments, follow up on overdue amounts, and manage financial records. This consistency leads to more timely settlements and reduces the administrative burden of handling billing issues. Additionally, clear payment terms and easy-to-read structures encourage clients to pay promptly, which can significantly improve liquidity.

By utilizing consistent formats, businesses can automate and simplify the entire process, which reduces the time spent on manual calculations and paperwork. This allows business owners to focus on core operations while ensuring that payments are processed efficiently and accurately.

Overall, using organized billing formats not only reduces administrative costs but also fosters better relationships with clients by making the payment process transparent and efficient, contributing to improved cash flow in the long run.

Benefits of Using Digital Delivery Invoices

Embracing modern technology in business operations brings a range of advantages, especially when managing transactions. With digital documentation tools, businesses can streamline their processes, enhance accuracy, and reduce overhead costs. The shift towards electronic formats ensures quicker processing, better organization, and easier access to key financial data, all contributing to a more efficient workflow.

Increased Efficiency and Accuracy

Switching to electronic records eliminates manual errors that can occur with paper-based tracking. Automated systems help businesses generate and manage records with minimal effort, reducing the time spent on administrative tasks. The result is an improved level of accuracy and a faster turnaround for each transaction.

Environmental and Cost Savings

By reducing the need for paper, printing, and physical storage, businesses can lower their operating costs while contributing to sustainability efforts. The adoption of digital methods not only cuts down on waste but also frees up valuable space within the office environment, creating a more organized and eco-friendly approach to business operations.

Overall, digital management tools not only optimize day-to-day tasks but also position businesses for long-term success, all while providing a seamless, cost-effective experience for both clients and companies.

Securing Customer Information on Invoices

Protecting sensitive customer data is essential for maintaining trust and complying with privacy regulations. In today’s digital age, where information is constantly exchanged, businesses must implement robust security measures to safeguard personal and financial details. Ensuring that all records are handled securely not only protects clients but also strengthens the reputation of a business.

Encryption and Secure Storage

One of the most effective ways to protect customer data is through encryption. By using advanced encryption techniques, businesses can ensure that all sensitive information is rendered unreadable to unauthorized parties. Additionally, securely storing these records in encrypted databases or cloud systems helps prevent potential data breaches, ensuring that all client data remains protected over time.

Access Control and Regular Audits

Limiting access to confidential data is another crucial step in securing customer information. By implementing strict access controls, businesses can ensure that only authorized personnel can view or manage sensitive records. Regular audits and monitoring of these access points further help identify any potential vulnerabilities and take corrective actions before a breach occurs.

How to Send Invoices Efficiently

Streamlining the process of sending billing documents can save valuable time and improve cash flow management. By adopting efficient methods for creating, sending, and tracking these documents, businesses can ensure timely payments and reduce administrative overhead. Here are some key strategies for optimizing the delivery of billing statements.

1. Automate the Process

Manual creation and distribution of records can be time-consuming. Automation tools can help businesses generate and send documents quickly, reducing errors and delays. Automated systems can also track when clients receive and open their documents, allowing businesses to follow up proactively if necessary.

2. Use Digital Delivery Methods

- Email: Sending documents via email is one of the fastest and most cost-effective ways to deliver billing details. Attach the necessary files in a clear format, such as PDF, to ensure easy access and viewing.

- Cloud Platforms: For ongoing transactions, using cloud-based platforms allows businesses to share documents securely with clients, who can access them anytime and from any device.

- Electronic Payment Links: Including a direct payment link within the document itself can accelerate the payment process by making it easy for clients to pay immediately after receiving the document.

3. Set Clear Payment Terms

Make sure your documents clearly specify the payment due date and any penalties for late payments. This transparency helps clients understand their obligations and ensures that there are no misunderstandings. Including these terms in a prominent position can also encourage timely settlement of accounts.

4. Keep Track and Send Reminders

Efficient tracking tools allow you to monitor which clients have received and viewed their billing documents. If payments are not received on time, automated reminders can be sent, ensuring clients are prompted to pay without requiring manual intervention.