Dba Invoice Template for Easy Billing and Professional Invoicing

When managing a business, efficient financial communication is key to maintaining smooth operations. One of the most essential tasks is generating clear and accurate records of transactions. Whether you’re dealing with clients, customers, or vendors, having a standardized format for requesting payments can save time and avoid misunderstandings. This is where a well-designed billing document comes into play.

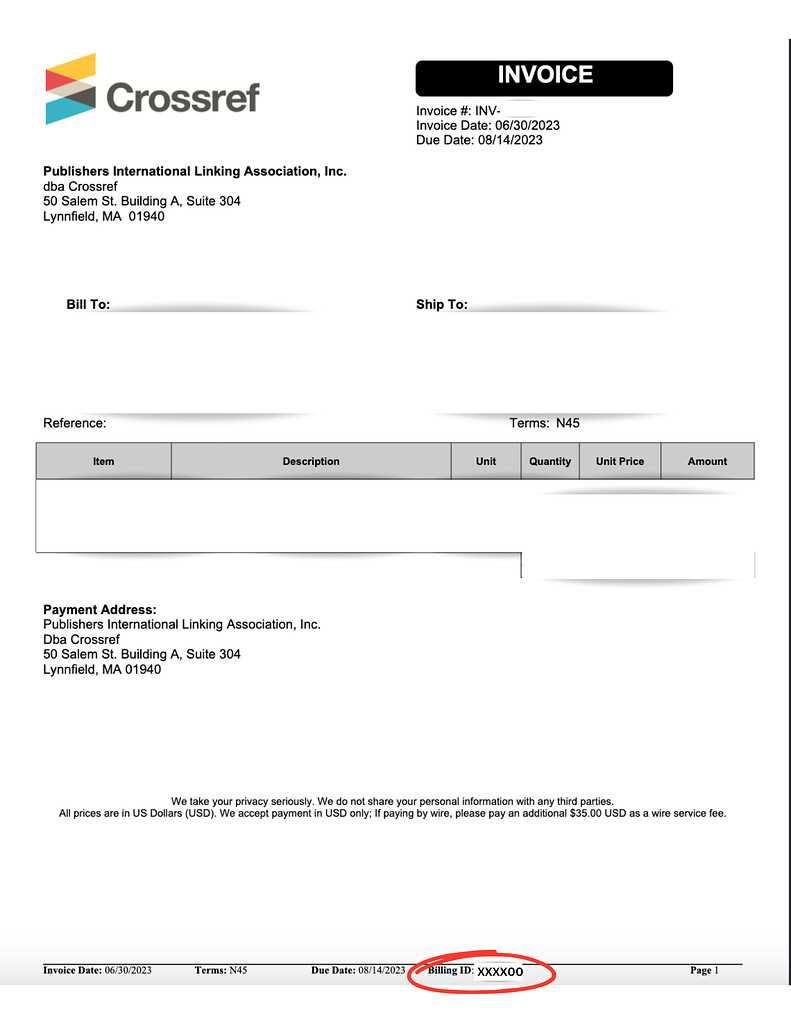

Customizing a document for invoicing purposes allows you to maintain consistency and professionalism across all transactions. It should contain all necessary details, such as the amount owed, payment terms, and contact information. The right structure not only ensures clarity but also reflects the credibility of your business.

In this guide, we’ll explore how to craft an effective billing record, highlighting the key components and offering practical tips for customization. Whether you are a freelancer, small business owner, or large enterprise, understanding how to create the perfect form is crucial to streamlining your payment process.

What is a Billing Document Format

A standardized document used to request payments for goods or services is an essential tool for any business. This type of record ensures that all transaction details are captured clearly and consistently, helping both parties avoid confusion and ensuring smooth financial exchanges. It includes specific information that outlines the terms of the transaction and makes it easier to track accounts receivable.

Typically, such a document will include the following key elements:

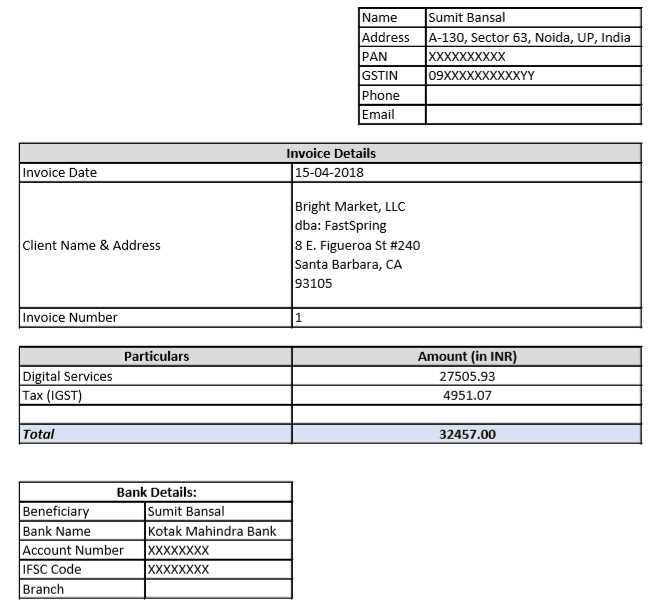

- Business Information: The name, contact details, and registration number of the company or individual requesting payment.

- Client Information: The name and address of the person or business being billed.

- Transaction Details: A detailed list of the products or services provided, including quantities, rates, and any applicable taxes or discounts.

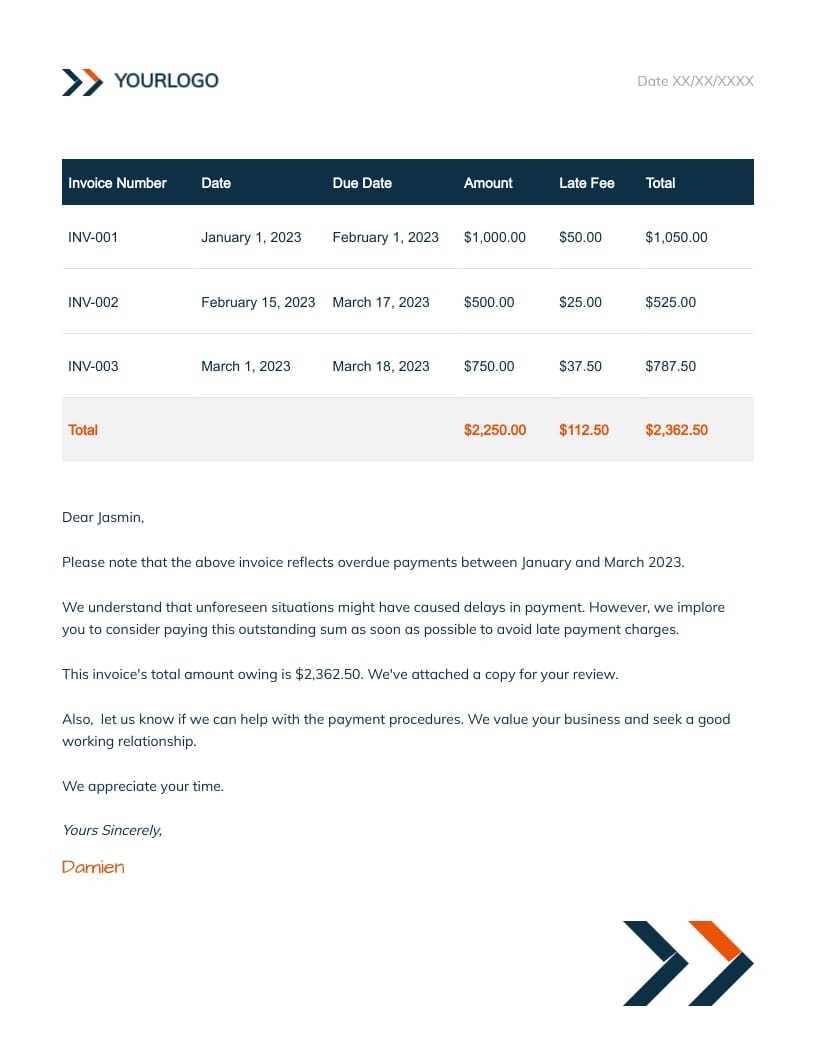

- Payment Terms: Clear instructions on when and how the payment should be made, including any deadlines or late fees.

- Unique Reference Number: A distinctive number used to track and identify the document for future reference.

By using a consistent and structured approach, businesses can streamline their billing processes, reduce errors, and maintain professional relationships with their clients and partners.

Why Use a Billing Document Format

Utilizing a structured document to request payment offers several advantages for businesses, both large and small. A well-organized record not only ensures professionalism but also improves efficiency by standardizing the way financial transactions are handled. By using a pre-designed format, you can save time, avoid mistakes, and maintain consistency across all your financial communications.

Key Benefits of Using a Structured Billing Format

- Consistency: A uniform approach ensures that every transaction is documented the same way, reducing the risk of errors or omissions.

- Professional Appearance: A polished document with the right information conveys credibility and trustworthiness to clients.

- Time Efficiency: Pre-made formats save time by eliminating the need to start from scratch with each transaction, allowing you to focus on other tasks.

- Legal Protection: A well-detailed record helps protect your business in case of disputes by providing clear, agreed-upon terms.

How It Simplifies Financial Tracking

- Better Record Keeping: Standardized formats make it easier to organize and store financial records for future reference or audits.

- Easy Integration: Many formats are compatible with accounting software, making it simpler to track payments and maintain accurate books.

- Faster Processing: A clear and concise document accelerates the approval process for clients, leading to quicker payments.

Incorporating such a document into your business operations not only streamlines the payment process but also strengthens your financial management system, helping you stay organized and efficient in managing client relationships.

Benefits of Customizing Your Billing Document

Tailoring your payment request form to meet the specific needs of your business offers several advantages. A customized document allows you to align the appearance and content with your brand while ensuring it contains all necessary information in a format that works best for you and your clients. Personalizing your records can enhance professionalism and make the payment process more efficient.

Increased Professionalism and Branding

Customizing your billing form provides an opportunity to showcase your business identity. By adding your logo, brand colors, and specific design elements, you create a more polished and cohesive experience for clients. This attention to detail reinforces your brand image and helps clients associate the form with your company’s values and professionalism.

Improved Clarity and Functionality

By tailoring the document’s structure, you can highlight the most important details that are relevant to your business. Whether it’s payment instructions, product descriptions, or terms of service, customization ensures that everything is clear and easy to find. This makes it easier for both you and your client to understand the transaction and reduce any potential confusion.

- Custom Payment Instructions: You can include specific payment methods or deadlines that suit your business needs.

- Personalized Client Information: Display important contact details to streamline communication.

- Flexible Layout: Adjust the document to include any unique terms or conditions related to your products or services.

Ultimately, customizing your payment request form leads to better client relationships, quicker processing times, and a more professional approach to your financial operations.

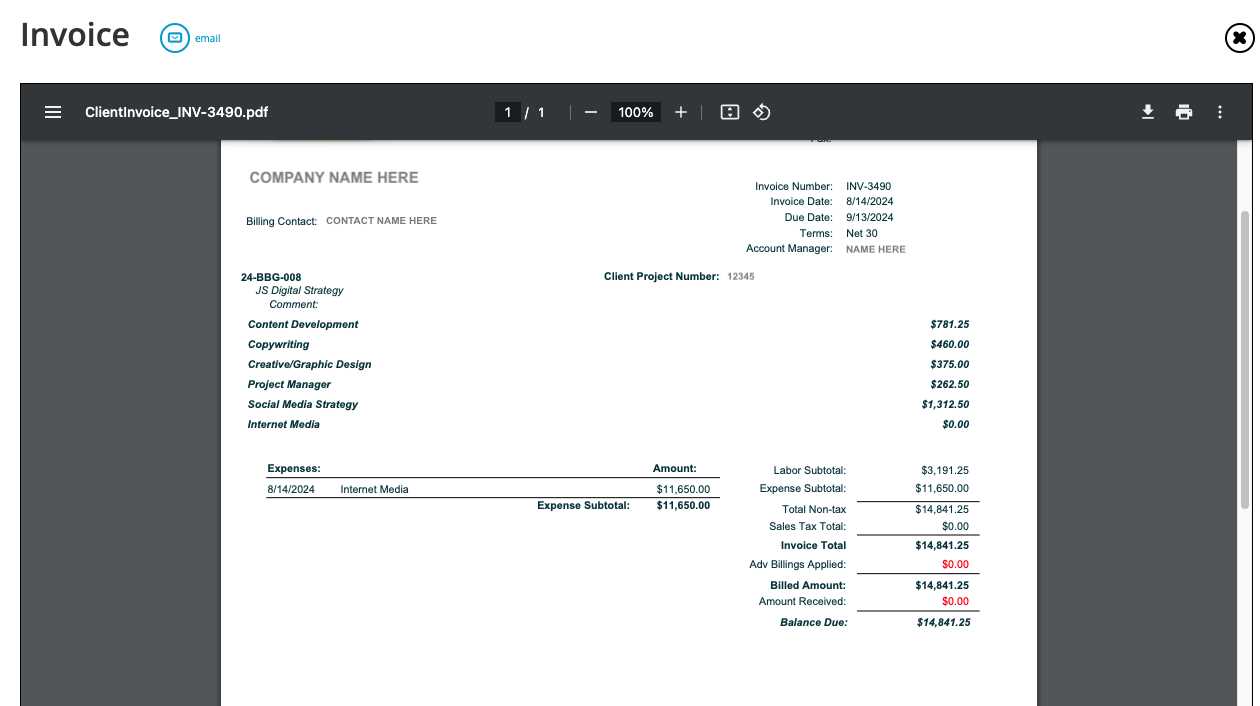

How to Create a Billing Record

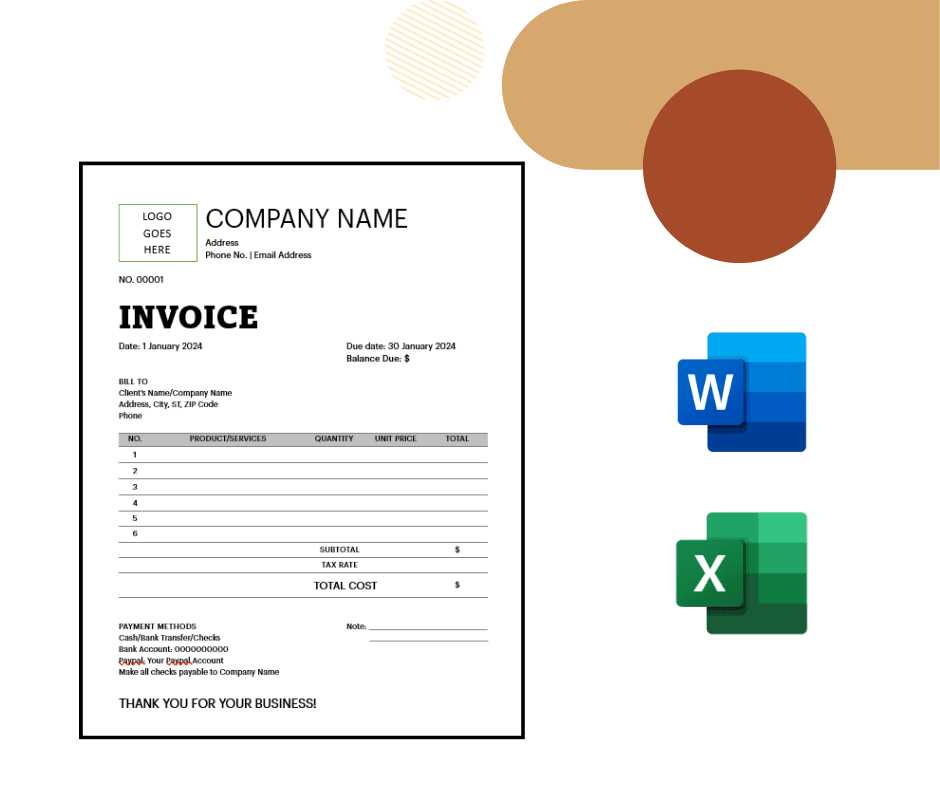

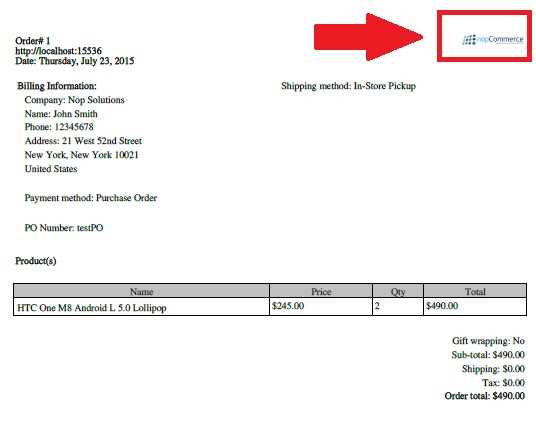

Creating a professional payment request form is an essential skill for any business. This document should clearly outline the transaction details, including the amount due, the services or goods provided, and the payment terms. By following a structured process, you can ensure that all necessary information is included and the document looks polished and professional.

Step-by-Step Guide to Crafting a Payment Request

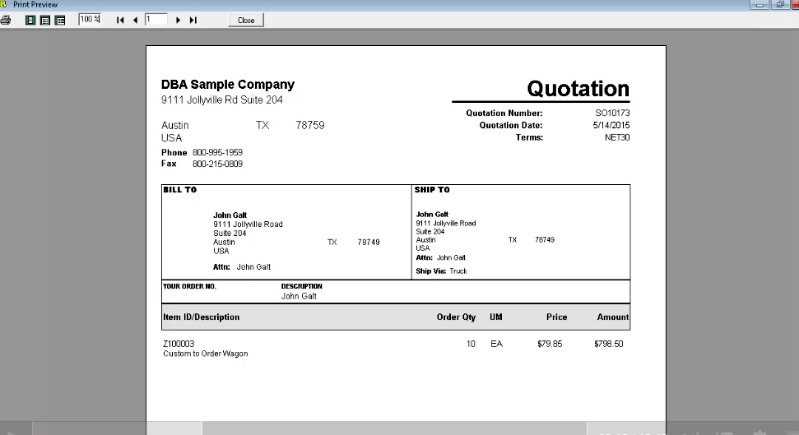

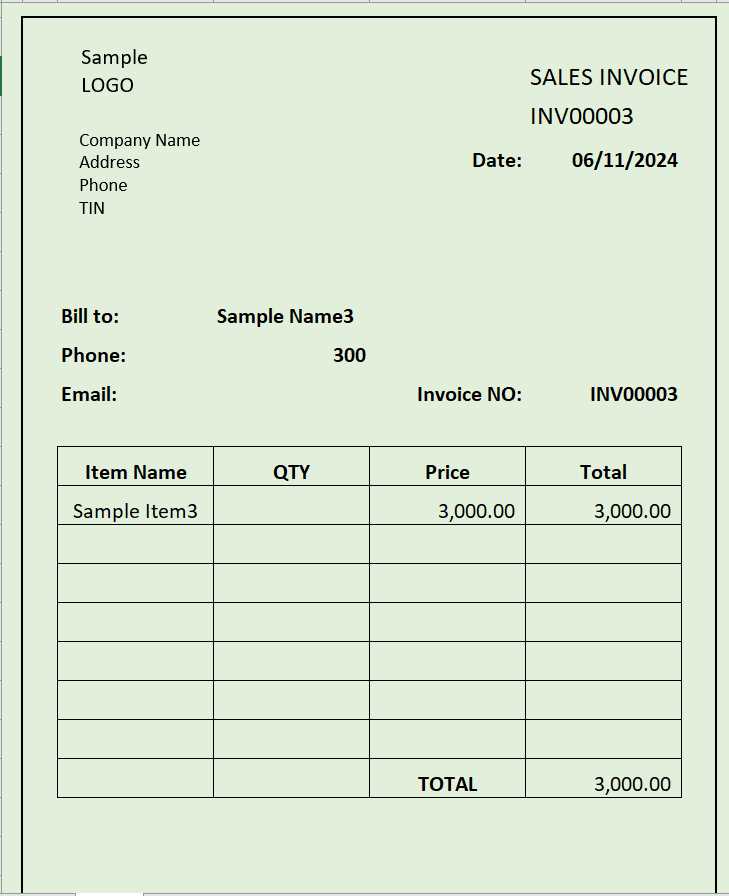

- Start with Basic Business Information: Include the name, address, phone number, and email of your business. This helps clients identify the source of the document and contact you if necessary.

- Include Client Details: Make sure to add the full name, address, and contact information of the person or business being billed.

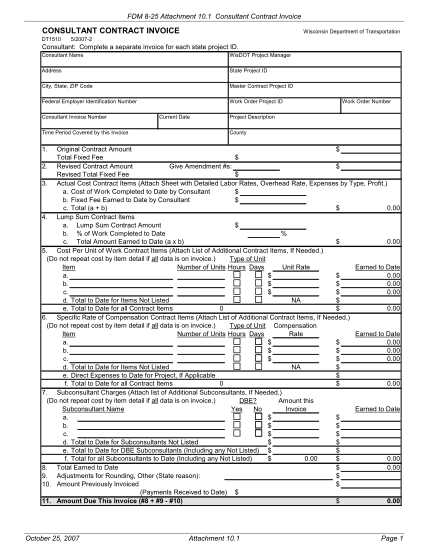

- List the Services or Products: Clearly describe each item or service provided, including quantities, rates, and any applicable discounts or promotions.

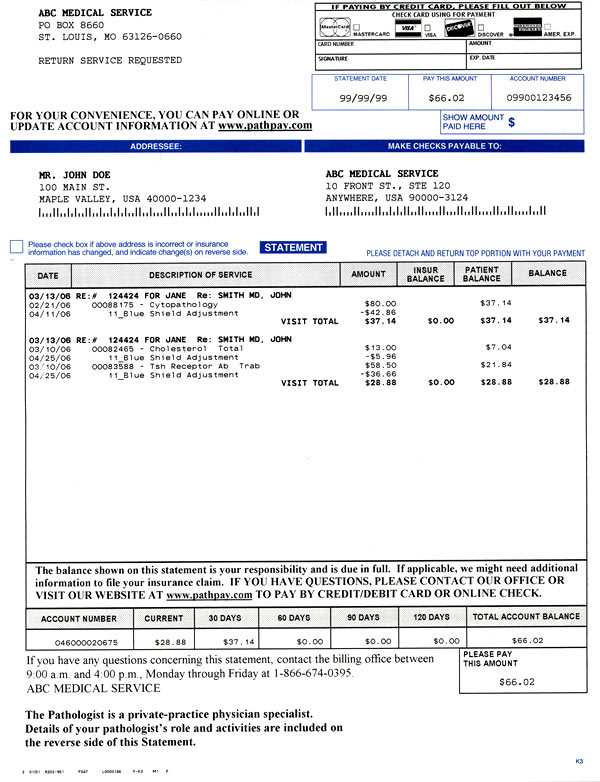

- Include Payment Terms: Specify when the payment is due, acceptable payment methods, and any late fees or penalties for overdue payments.

- Assign a Unique Reference Number: Give the document a unique number for easier tracking and to avoid any confusion when referencing the payment.

- Calculate the Total: Add up all amounts, including taxes and discounts, to show the total amount due clearly.

Additional Considerations

- Design for Clarity: Use a clean, organized layout that makes it easy for clients to read and understand.

- Include a Due Date: Make sure to add a payment due date to encourage timely payments.

- Offer Multiple Payment Methods: Specify the various ways clients can pay to make the process more convenient.

By following these steps, you can create a well-structured and professional payment request form that reflects your business’s values and helps streamline the payment process.

Essential Elements of a Billing Document

To ensure your payment request form is complete and professional, certain key components must always be included. A well-structured document not only helps avoid confusion but also ensures that both parties understand the terms of the transaction. Each element plays a critical role in making the document clear, organized, and legally sound.

Key Components of a Payment Request

- Business Information: The name, address, contact details, and any relevant registration numbers of your business should be clearly stated. This helps identify your company and gives your document an official appearance.

- Client Information: Include the full name and contact details of the individual or company receiving the request. This ensures that the payment is correctly directed.

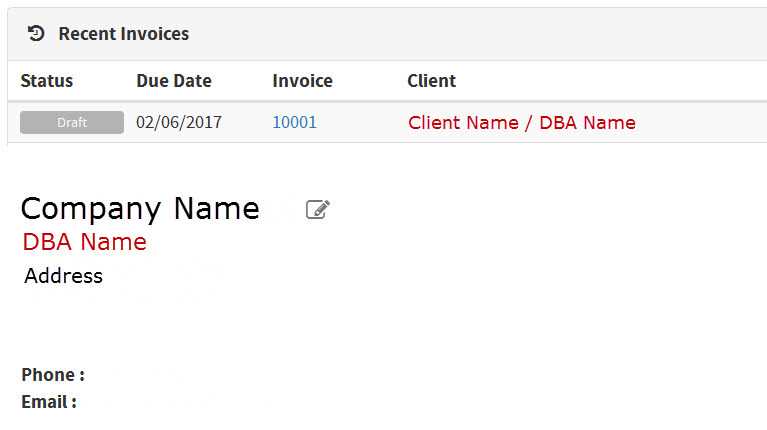

- Unique Reference Number: Assigning a unique identifier to the document makes it easier to track and reference in future correspondence or records.

- Detailed Breakdown of Goods or Services: List all products, services, or tasks provided, including quantities, individual rates, and descriptions. This transparency helps prevent disputes and ensures clarity for the client.

- Payment Terms: Clearly define the payment conditions, including the due date, any late fees, and accepted payment methods.

- Total Amount Due: Make sure the total amount due is prominently displayed and includes any applicable taxes, discounts, or additional charges.

Additional Considerations for a Polished Document

- Professional Design: A clean, organized layout improves readability and presents a more professional image.

- Due Date: Ensure the payment due date is easy to spot to encourage timely payments and avoid delays.

- Payment Instructions: Include clear instructions on how to make the payment, offering multiple methods if possible.

By incorporating all of these elements, your payment request form will be both functional and professional, helping to facilitate clear communication and timely payments from clients.

Free Billing Documents Available Online

For businesses looking to streamline their payment request process without the need for custom designs, free forms can be a valuable resource. These ready-made documents can be easily downloaded and customized to suit your specific needs. With various options available, it’s possible to find a format that aligns with your business’s requirements while saving time and effort on creation.

Where to Find Free Billing Forms

Numerous websites offer free downloadable forms that are both user-friendly and customizable. Some of the most popular platforms include:

- Business Resource Websites: Many business-focused sites offer a variety of free templates designed for different industries.

- Document Hosting Services: Platforms such as Google Docs and Microsoft Office offer easy-to-edit templates that can be downloaded directly to your device.

- Freelance Platforms: Sites like Upwork or Fiverr may provide free resources as part of their freelance community tools.

- Accounting Software Providers: Many software tools like QuickBooks and Wave provide free forms as part of their basic packages.

Advantages of Using Free Forms

- Cost-Effective: Free forms are ideal for small businesses or freelancers who need professional-looking documents without any added cost.

- Ease of Use: These forms are often pre-designed with all the essential fields, making them simple to fill out and personalize.

- Time-Saving: Ready-made forms eliminate the need for design or structure planning, allowing you to focus on the content.

Whether you’re just starting out or looking for a quick solution, free downloadable forms can be a great tool to simplify the billing process and ensure your documents are clear, professional, and legally sound.

Choosing the Right Billing Document Format

Selecting the correct structure for your payment request is a crucial step in ensuring clarity, professionalism, and efficiency. The format you choose should be easy to understand, aligned with your business needs, and adaptable to various types of transactions. A well-chosen format not only enhances your business image but also streamlines the payment process, reducing the chances of errors or disputes.

Key Considerations for Choosing the Right Format

When selecting a format, it’s important to consider several factors that will influence both the functionality and presentation of your document. Below is a comparison of common options:

| Format Type | Pros | Cons |

|---|---|---|

| Simple Layout | Quick to fill out, minimal distractions, easy to understand. | Lacks detailed information, may appear too basic for some clients. |

| Detailed Layout | Includes all relevant information, looks professional, customizable. | Can be more time-consuming to fill out, may appear overly complex. |

| Creative Design | Visually appealing, aligns with brand identity, stands out. | Can be distracting, too much design may overwhelm important details. |

| Minimalist Design | Clean, focused on essential details, easy to read. | Lacks visual appeal, may seem too plain for some industries. |

Choosing Based on Your Business Needs

- Small Businesses or Freelancers: A simple or minimalist format can be efficient and cost-effective while maintaining professionalism.

- Large Enterprises: A detailed or creative design might be preferred, especially if you need to convey more information or want to align with your corporate branding.

- Service-Based Industries: Opt for a detailed layout to clearly outline services rendered, rates, and any applicable terms.

- Product-Based Businesses: Consider using a simple format that lists product names, quantities, and prices to maintain clarity.

By evaluating the needs of your business

How to Add Taxes to Your Billing Document

When preparing a payment request, it’s crucial to include applicable taxes to ensure that the final amount reflects the correct total due. This helps comply with tax regulations and ensures transparency with your clients. The process of adding taxes to a billing document varies depending on your location and the type of product or service you’re providing. Below is a guide on how to accurately apply taxes to your billing documents.

Step-by-Step Guide to Adding Taxes

- Identify the Tax Rate: The first step is to determine the correct tax rate for your product or service. This can vary based on your country, state, or even city. Make sure to verify the applicable tax laws before proceeding.

- Specify Taxable Items: Clearly indicate which goods or services are subject to tax. Some items may be exempt, so it’s important to specify these details on the document.

- Calculate the Tax Amount: Multiply the price of taxable goods or services by the tax rate. For example, if the item costs $100 and the tax rate is 10%, the tax would be $10.

- Show the Tax Breakdown: On the billing document, list the tax amount separately from the total price. This ensures clarity and transparency for your client.

- Calculate the Total Due: Add the tax amount to the total price of the goods or services. The final amount due should include both the original price and the tax.

Example of a Tax Breakdown

| Description | Amount |

|---|---|

| Product A | $100.00 |

| Sales Tax (10%) | $10.00 |

| Total Due | $110.00 |

By following these steps, you can ensure that taxes are accurately applied, keeping your business compliant with local tax laws while providing a clear and professional document for your clients.

Tips for Professional Billing Document Design

Creating a visually appealing and well-organized payment request form is essential for leaving a positive impression on your clients. A professional design not only ensures that the necessary information is easy to find but also reflects your business’s credibility and attention to detail. Below are some key tips for designing an effective and polished billing document.

Key Design Elements to Consider

- Simple and Clean Layout: Keep the design minimalistic to ensure clarity. Avoid clutter and use sufficient white space to make the document easy to read.

- Brand Consistency: Incorporate your company logo, brand colors, and fonts to create a cohesive look that aligns with your overall branding.

- Clear Section Headings: Use bold or larger font sizes for headings to help the reader easily navigate between different sections of the document, such as client details, payment terms, and itemized lists.

- Legible Font: Choose a clean and professional font that is easy to read, even at smaller sizes. Avoid overly decorative fonts that may distract from the content.

Additional Tips for a Polished Design

- Logical Flow: Organize the information in a logical sequence, with the most important details (like client name, due date, and total amount) clearly visible at the top.

- Use of Lines and Borders: Subtle lines or borders can help differentiate sections, but avoid overuse, which can make the document appear too busy.

- Highlight Key Information: Use bold text or contrasting colors for critical information, such as the total due or payment deadline, to make sure they stand out.

- Include Contact Information: Make it easy for clients to reach you by clearly displaying your business phone number, email address, and website.

By following these design tips, you can ensure that your payment requests look professional and reflect the high standards of your business, making it easier for clients to process and pay their dues

How to Include Payment Terms in Billing Documents

Including clear and concise payment terms in your billing documents is essential for setting expectations and avoiding misunderstandings with your clients. Payment terms outline how and when payments are expected, and specifying them upfront ensures both parties are aligned. Below are some guidelines for including these terms in your payment requests.

Essential Payment Terms to Include

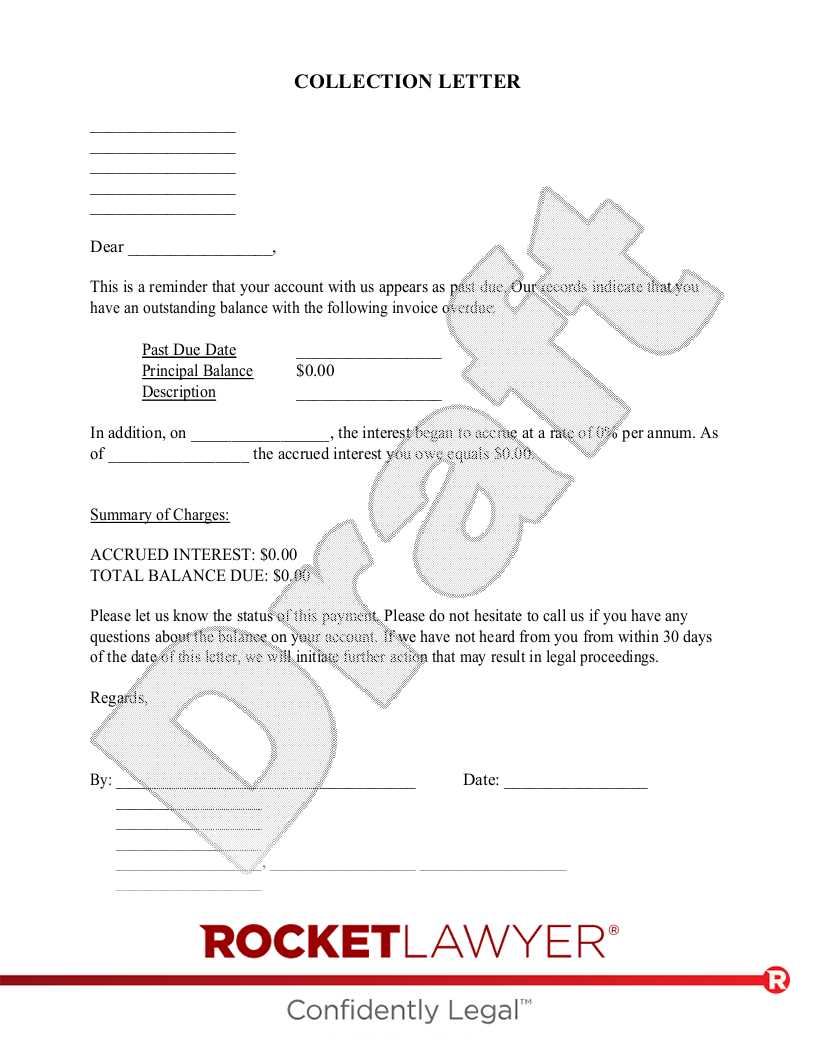

- Due Date: Clearly state when the payment is due. This can be a specific calendar date or a number of days after the service or product is provided (e.g., “Due 30 days after receipt”).

- Accepted Payment Methods: List the payment methods you accept, such as bank transfer, credit card, or online payment platforms (e.g., PayPal, Stripe).

- Late Fees or Penalties: Specify any fees that will be charged for overdue payments. For example, “A 5% late fee will be applied for payments made after 30 days.”

- Discounts for Early Payment: If you offer any discounts for early payment, mention them in this section. For example, “A 2% discount will be applied if payment is received within 10 days.”

- Partial Payments: If applicable, outline your policy for partial payments, such as “50% deposit required upfront with the remaining balance due upon completion.”

How to Present Payment Terms Clearly

- Use a Dedicated Section: Create a separate section or clearly labeled paragraph for the payment terms to make them easy to locate.

- Be Specific and Unambiguous: Avoid vague language. The more specific you are, the fewer chances there are for confusion.

- Highlight Important Details: Use bold text or different colors to emphasize the due date and any late fees or discounts to ensure clients notice these key points.

By including well-defined payment terms in your billing documents, you set clear expectations for your clients, which can help speed up payments and reduce the risk of misunderstandings.

Billing Document Numbering and Organization Tips

Effective organization and numbering of your payment request forms is vital for maintaining accurate records and ensuring smooth financial management. A consistent numbering system not only helps track each document but also reduces the likelihood of confusion or duplicate entries. Below are some best practices for numbering and organizing your billing records.

Best Practices for Numbering Billing Documents

- Sequential Numbering: Always use a sequential numbering system to ensure that each document is uniquely identified. This helps you keep track of all issued forms and prevents any overlap or errors.

- Include Date References: Incorporate the date into the numbering, such as “2024-001,” where “2024” refers to the year and “001” is the sequential number. This makes it easier to organize documents by date and helps with future reference.

- Use Prefixes for Categorization: If you deal with multiple types of documents (e.g., services and products), consider adding a prefix to distinguish between them. For example, “SVC-001” for service-based documents and “PRD-001” for product-related requests.

- Avoid Reusing Numbers: Once a number has been assigned to a document, do not reuse it. This practice prevents confusion and ensures that each document has a unique identifier for easy tracking and referencing.

How to Organize Billing Records Efficiently

- Maintain a Record Log: Keep a detailed log or spreadsheet that records each document number, date issued, client name, and amount due. This will make it easier to track payment status and follow up with clients if necessary.

- Use Digital Tools: Consider using accounting software or a cloud-based system that automatically generates and organizes billing records. These tools can help with invoice generation, storage, and reporting, streamlining your financial workflow.

- Separate Files by Client or Date: For physical records, consider organizing files by client name or by month/quarter to quickly locate past documents when needed. Digital files can also be categorized into folders based on these criteria for easier access.

- Regularly Back Up Your Records: Always back up your digital billing documents and logs. This ensures that you have a safe copy of your records in case of system failures or other issues.

By following these numbering and organization tips, you can improve your workflow, r

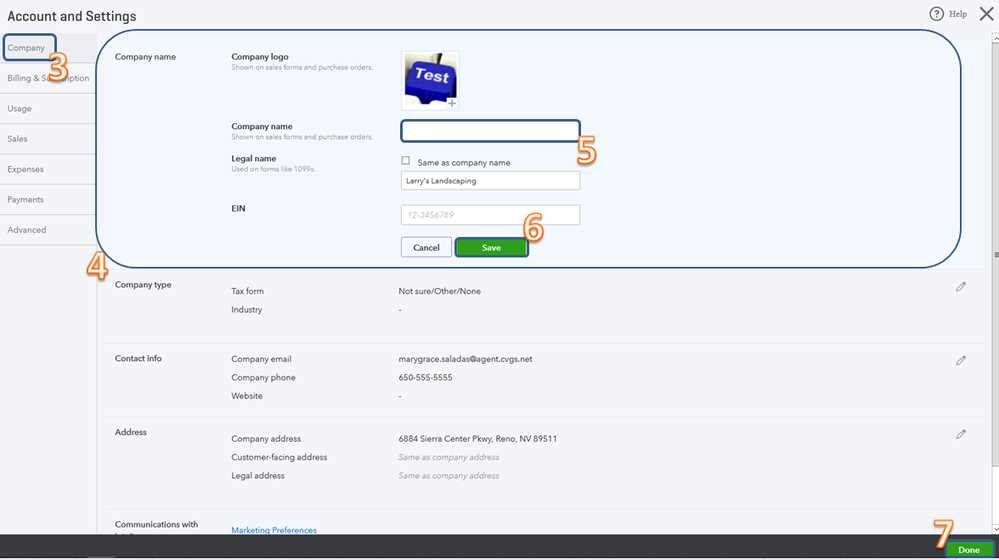

How to Customize Billing Document Forms

Customizing your payment request documents allows you to tailor them to your specific business needs, ensuring that they align with your branding and provide all the necessary details for your clients. Whether you’re adjusting the layout, adding custom fields, or incorporating your company logo, personalization can help create a professional appearance and streamline the payment process. Below are steps on how to effectively modify your billing forms.

Steps to Customize Your Billing Forms

- Choose the Right Software: Select a word processor, spreadsheet, or dedicated accounting tool that allows you to edit the layout and content of your documents. Popular choices include Microsoft Word, Google Docs, or accounting software like QuickBooks and FreshBooks.

- Add Your Branding: Incorporate your company logo, brand colors, and fonts into the document. This reinforces your brand identity and helps maintain consistency across all your business communications.

- Modify the Layout: Adjust the arrangement of sections to prioritize key information. For example, you may want to move the payment terms or total due to a more prominent position. Make sure the document is easy to read and the layout is clear.

- Include Custom Fields: If your business requires specific information (e.g., client account numbers, purchase orders, or product descriptions), add custom fields to ensure you capture all relevant details. Make sure these fields are clearly labeled.

- Specify Payment Instructions: If you offer multiple payment methods, include clear instructions for each option. Specify bank account details, online payment links, or checks as payment methods, and make sure they are easy for your clients to follow.

- Review Legal Information: Ensure that any legal disclaimers, terms of service, or tax information are included in the document. This is especially important for businesses that operate in multiple regions or have specific tax regulations to comply with.

Additional Customization Tips

- Use Professional Fonts: Choose fonts that are clean and professional. Avoid overly decorative fonts that may make the document difficult to read.

- Incorporate Clear Section Dividers: Use lines or borders to separate sections and make the document more organized. This helps clients quickly locate key details such as payment amounts or terms.

- Save as a Template: After customizing, save your document as a reu

Integrating Your Billing Document with Accounting Software

Linking your payment request forms to accounting software can streamline your financial processes, reduce errors, and save time. With integration, your business can automate the tracking of payments, manage expenses, and ensure accurate reporting. This section covers how to connect your billing documents with accounting tools and why it’s beneficial for your business.

Steps to Integrate Billing Forms with Accounting Software

- Choose Compatible Software: Select accounting software that allows for easy import and export of billing records. Popular tools like QuickBooks, Xero, and FreshBooks offer seamless integration with payment requests.

- Enable Automation Features: Many accounting platforms have automated features that allow you to directly generate, send, and track payment requests from within the software. Set these up to save time and reduce manual entry.

- Link Customer Data: Ensure your client information is synced with the software. By connecting your customer database, you can easily autofill fields like client names, contact details, and billing addresses on your payment request forms.

- Sync Payment Status: After sending a request, ensure that payment statuses are automatically updated in the software once payments are received. This allows for real-time tracking and reduces the chance of missing transactions.

- Customize the Integration: Some software options allow you to customize how data is imported from your payment requests. Set up your system to automatically include tax rates, discounts, and late fees as needed.

Benefits of Integration

- Time Savings: Automating the process of generating and sending billing documents means less time spent on manual tasks. Once integrated, the process can be fully automated, from creating the document to tracking payments.

- Accuracy: Integration reduces the risk of errors from manually entering data or missing important details. By syncing the software, you ensure that client details, amounts, and payment terms are always correct.

- Improved Financial Tracking: Accounting software provides real-time data on payments, outstanding balances, and financial reports. This visibility allows you to make informed decisions and manage cash flow more effectively.

Example of Integration with Accounting Software

Step Actio Common Mistakes in Billing Document Creation

When creating billing documents, it’s easy to make small errors that can lead to confusion, delays, or even financial losses. These mistakes often arise from oversights in formatting, inaccurate data, or unclear terms. By understanding and avoiding these common errors, you can ensure that your billing process remains smooth, professional, and efficient. Below are some of the most frequent mistakes made during document creation.

Frequent Errors to Avoid

- Missing Contact Information: Failing to include essential details such as your business’s phone number, email, or physical address can cause delays in communication. Always ensure these details are clearly displayed.

- Incorrect Client Details: Make sure the client’s name, address, and any other relevant information are accurate. Errors in this information could lead to confusion or the document being returned.

- Unclear Payment Terms: Vague or missing payment instructions can lead to misunderstandings. Be specific about payment methods, due dates, and any potential late fees. A lack of clarity can delay payments or cause disputes.

- Failure to Include Itemized Charges: Not providing a detailed list of goods or services delivered can make it difficult for clients to understand what they are paying for. An itemized breakdown improves transparency and trust.

- Omitting Tax Information: Always ensure that applicable taxes are included and clearly outlined. Whether it’s sales tax, VAT, or other charges, clients should be able to see exactly what they are being taxed for.

Formatting and Organizational Mistakes

- Poor Layout: A cluttered or confusing document layout can make it difficult for clients to quickly find key information like the amount due or payment terms. Keep your design clean, simple, and easy to navigate.

- Missing Document Number: Every payment request should have a unique identifier. Failing to include a number can make it difficult to track transactions, leading to confusion and potential errors in accounting.

- Incorrect Due Date: An inaccurate or missing due date can cause payment delays. Always specify the exact date when the payment is expected and avoid using vague terms like “ASAP” or “soon.”

- Inconsistent Currency Formatting: If you’re working with international clients, ensure that currency symbols

Best Practices for Sending Billing Documents Promptly

Sending your payment requests in a timely manner is crucial for maintaining cash flow and establishing a professional relationship with your clients. Delayed billing can lead to payment issues, misunderstandings, and even damage your reputation. By following a few best practices, you can ensure that your payment documents are sent promptly and efficiently, helping you stay on top of your finances.

Timely Sending Strategies

- Automate the Process: Set up automated systems through accounting software that generate and send billing documents as soon as the work is completed or goods are delivered. Automation ensures that no document is overlooked or delayed.

- Send Immediately After Completion: As soon as a service is completed or a product is shipped, send the payment request. The sooner you send it, the quicker you’ll receive payment.

- Establish a Clear Payment Cycle: Determine and communicate a set schedule for sending billing documents. Whether it’s weekly, bi-weekly, or monthly, consistency in timing helps clients expect and prioritize payments.

- Use Digital Delivery Methods: Email and online invoicing platforms allow you to send payment requests instantly. Using electronic methods ensures faster delivery compared to traditional mail.

- Set Up Reminders: Many accounting systems allow you to send automated reminders when documents are due. A polite reminder a few days before the due date can help ensure prompt payment without unnecessary follow-up.

Additional Tips for Fast Billing

- Review the Document Before Sending: Ensure all details, including client information, amounts, and terms, are correct. Errors can delay the payment process, so take a moment to double-check before hitting “send.”

- Use an Easy-to-Read Format: Make sure the document is clear and easy for your clients to understand. If the document is overly complicated, clients may delay reviewing and processing it.

- Send Through Multiple Channels: If possible, send the payment request through more than one medium. For example, send it by email and upload it to a client portal, ensuring it doesn’t get lost or missed.

By implementing these best practices, you can streamline your billing process and improve the timeliness of payments. The faster you send your payment documents, the faster you’ll receive compensation for your services or products, contributing to the overall health of your business.