Download Daycare Invoice Template in Word for Easy Billing

Managing payments and ensuring clients are properly billed is crucial for any business. Having a clear, organized method to create professional-looking documents can save time and reduce errors. For caregivers and service providers, crafting an accurate statement is essential to maintaining good financial practices and client relationships. Luckily, using a digital document that can be easily personalized makes this process more efficient.

By choosing the right format, you can streamline your billing system. A flexible document allows you to adjust key details such as pricing, services rendered, and payment terms, ensuring every client receives the correct information. With the right setup, you can focus more on providing quality care and less on administrative tasks.

In this guide, we’ll explore how to leverage a commonly used file format to design your payment statements. Whether you are new to managing financial paperwork or looking to improve your existing method, these practical tools will help you keep track of payments, enhance your professionalism, and maintain clarity in your financial transactions.

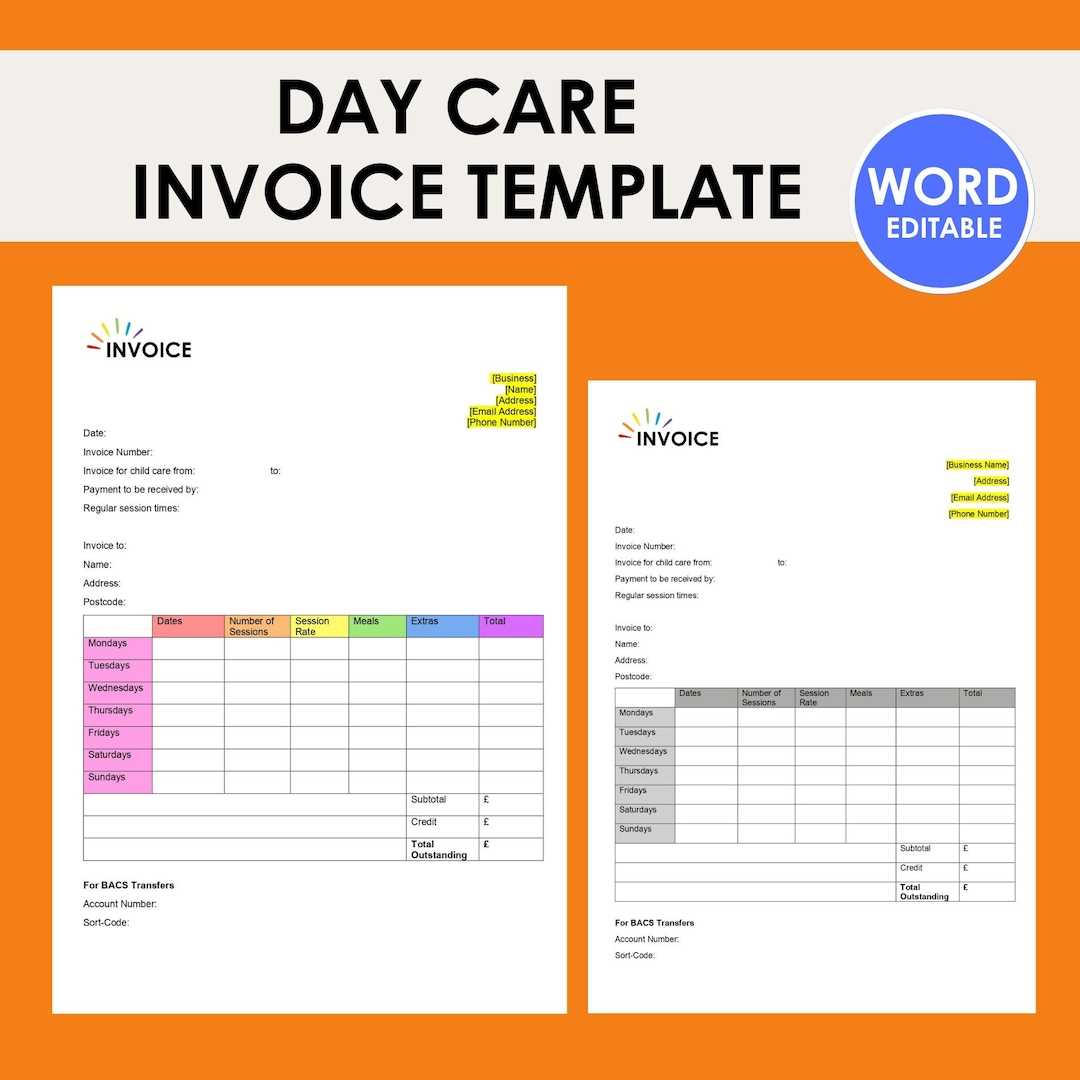

Daycare Invoice Template Overview

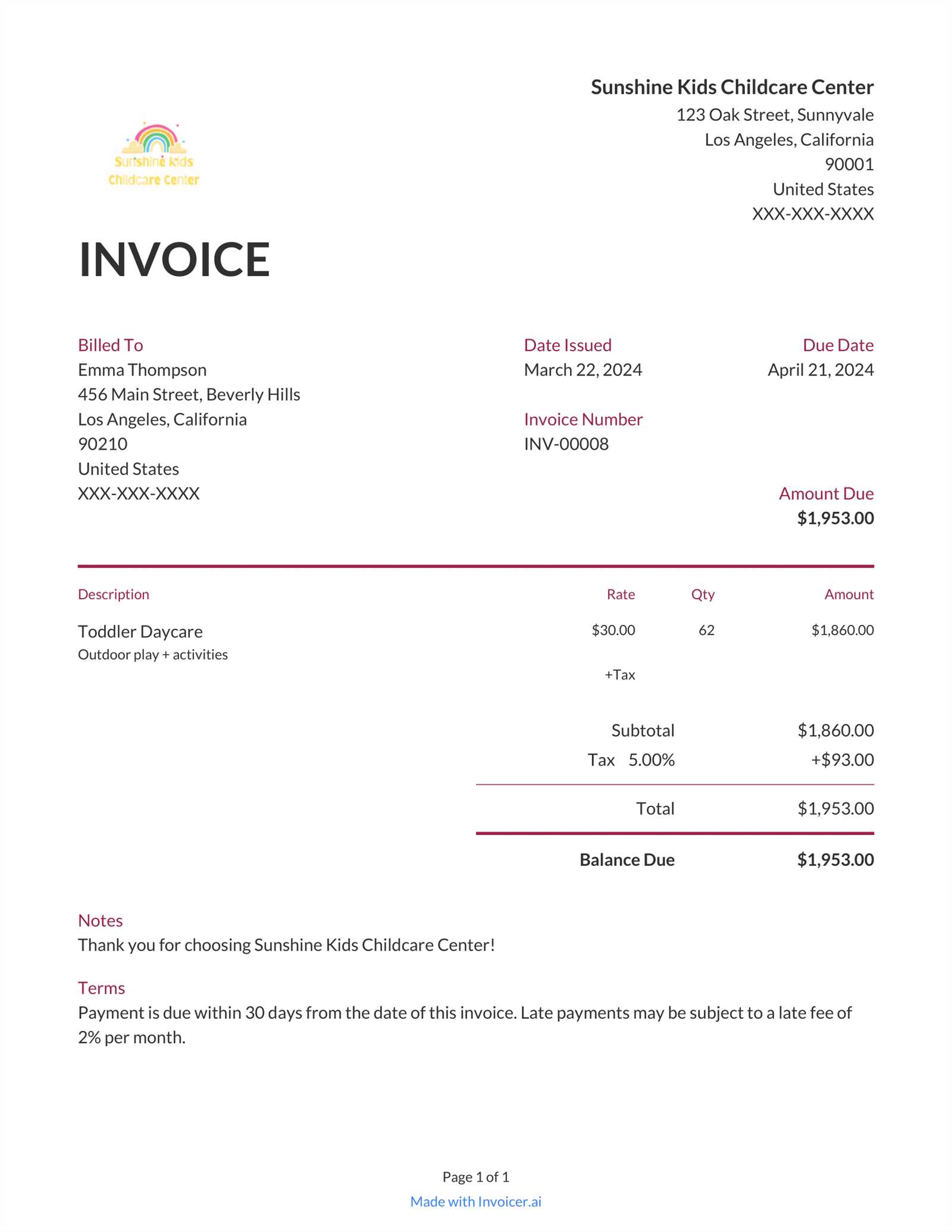

Creating accurate and professional financial statements is an essential part of managing any service-based business. When providing care for children, it is important to have a clear, organized document that outlines the services provided, payment amounts, and due dates. A structured approach to billing helps maintain transparency and ensures clients understand the charges and payment expectations.

A customizable document format provides the flexibility needed to tailor each statement according to the specific services rendered. By incorporating key details such as hourly rates, service dates, and payment terms, you can create a professional-looking bill that meets both your needs and those of your clients.

This tool allows you to easily generate and manage your financial records. With an intuitive format, you can quickly update pricing, include relevant information, and ensure consistency in your billing process. The ability to modify and personalize each statement saves time, reduces errors, and helps keep your business operations running smoothly.

Benefits of Using Word for Invoices

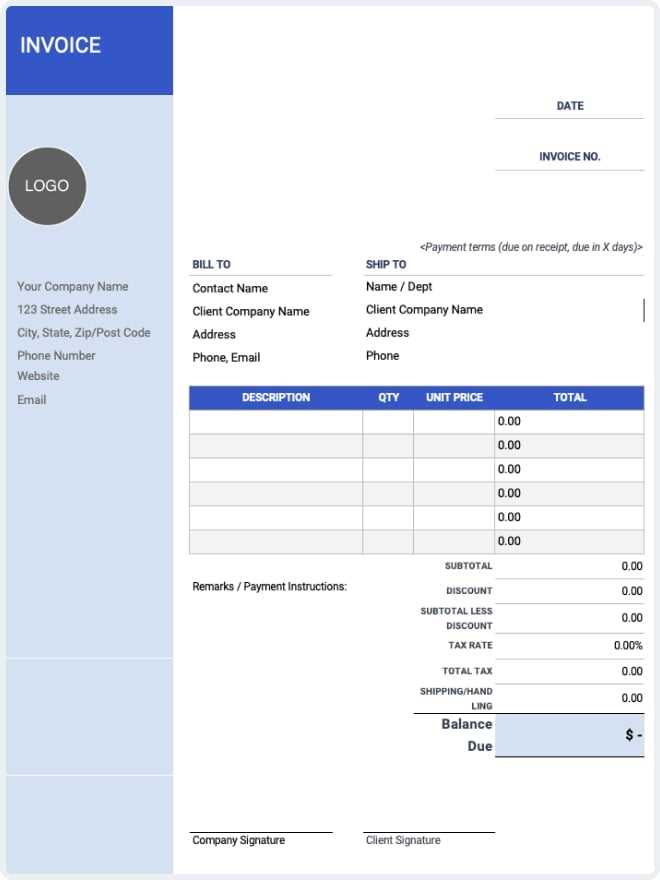

Choosing the right software to create financial statements is crucial for streamlining your billing process. The versatility and accessibility of certain text-processing programs make them a popular choice for professionals looking to generate clear, well-structured documents. These programs offer a range of features that allow users to customize layouts, include specific details, and ensure accuracy in every transaction.

Easy Customization and Editing

One of the key advantages of using a text-based program is the ability to easily modify and personalize each document. Whether you’re adjusting payment terms, adding new services, or updating client details, the flexibility of such software ensures that your financial records are always up-to-date. This customization can be done quickly without needing advanced technical skills.

Professional Appearance and Consistency

Another significant benefit is the ability to maintain a professional look for all your documents. With pre-designed layouts and the option to create your own, you can ensure that your records are clean, organized, and easy to understand. Consistency across all your financial statements not only boosts your credibility but also helps clients feel confident in your services.

Overall, using a text-editing program to manage your payment records provides an efficient and reliable way to keep track of transactions while presenting a polished and professional image to your clients.

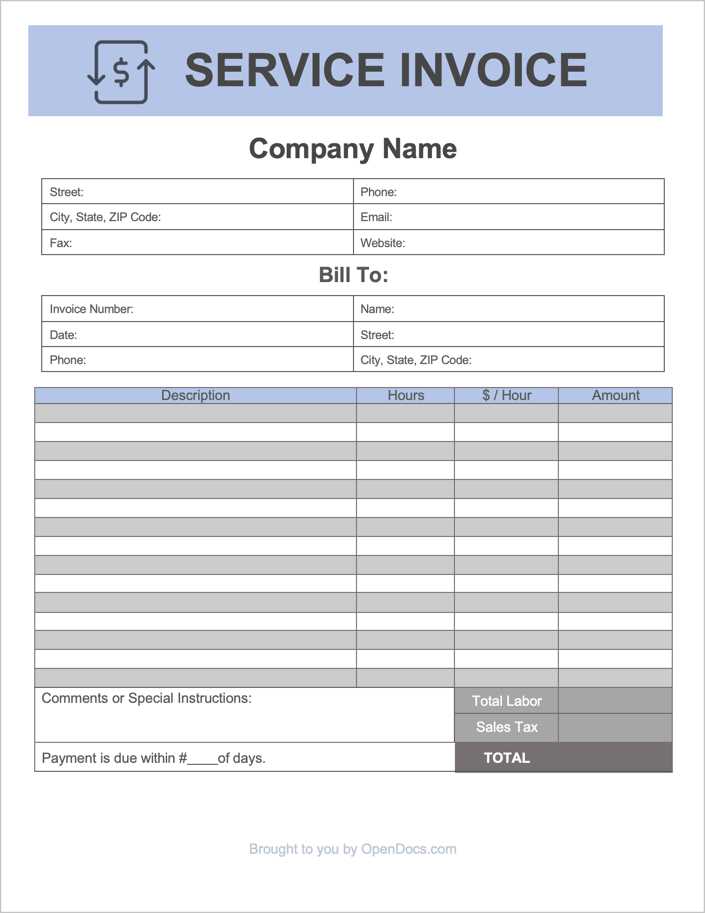

How to Customize Your Invoice Template

Personalizing your billing document is essential for ensuring that it reflects the unique aspects of your services. Customization allows you to add relevant information, adjust the layout, and include any specific details that cater to your business needs. By tailoring your financial statements, you can maintain a professional appearance while making the document more functional and aligned with your brand.

Start by adjusting the header section to include your business name, logo, and contact details. This not only reinforces your brand identity but also provides clients with clear information on how to reach you. Next, modify the sections related to the service details, such as dates, hourly rates, or package options, depending on what is applicable to your offerings.

It’s also important to set up fields for payment terms, due dates, and methods of payment. Including these details ensures clarity and helps avoid misunderstandings regarding the payment process. Don’t forget to review the overall layout for readability, ensuring that key information stands out and is easy to locate for your clients.

Customizing your billing document helps create a smooth transaction process while reflecting your professionalism and attention to detail. Whether you’re making small adjustments or completely redesigning the document, these changes contribute to a more efficient and personalized experience for both you and your clients.

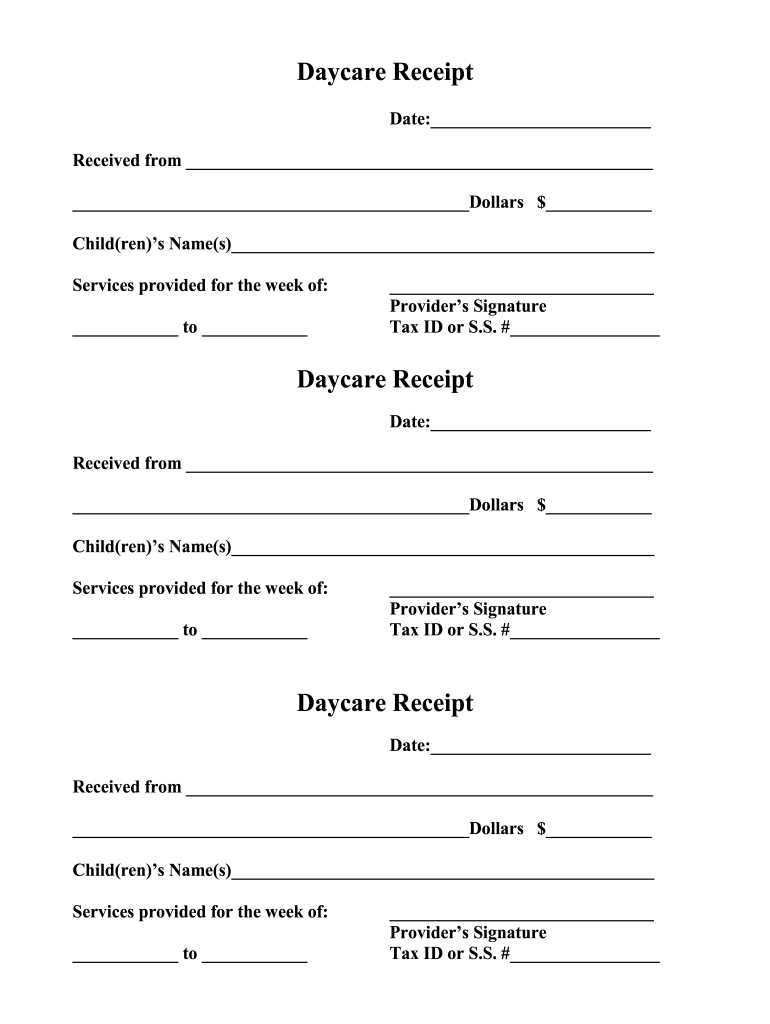

Essential Elements in Daycare Invoices

When creating a billing document for services rendered, it’s important to include certain key components that ensure clarity and accuracy. A well-structured record not only helps prevent confusion but also establishes trust with clients. To create an effective statement, you need to provide all relevant information in a format that is easy to understand.

First and foremost, you should include your business name, address, and contact information. This helps clients easily identify who the document is from and how to reach you if needed. Alongside this, the client’s details, such as name and address, should also be included for reference and proper record-keeping.

Service description is another critical element. Clearly outline the care services provided, including dates, hours worked, and specific charges for each service. This level of detail not only clarifies what is being billed but also prevents any potential disputes about services rendered.

Another essential aspect is the payment terms. Specify the amount due, the due date, and any late fees if applicable. Including this information ensures that clients understand their financial obligations and can help expedite the payment process. Additionally, providing clear instructions on accepted payment methods makes it easier for clients to settle their bills promptly.

Finally, a unique invoice number is important for tracking and organizing your records. This helps both you and your clients keep a clear history of transactions, especially when referencing previous payments or resolving any issues in the future.

Steps to Create a Daycare Invoice

Creating a clear and accurate billing document is crucial for maintaining professionalism and ensuring prompt payment. By following a few simple steps, you can generate a document that clearly outlines the services provided, payment terms, and client details. This guide will walk you through the process of creating an effective financial statement that meets both your needs and those of your clients.

Step 1: Gather Client and Service Information

Start by collecting all the necessary details about your client and the services you provided. This includes the client’s name, address, and contact information, as well as the dates of care and the specific services rendered. Having all this information ready will help you create a comprehensive and accurate document.

Step 2: Set Up Your Document Layout

Next, choose a clean layout that includes space for all necessary fields. If you’re creating your document manually, make sure to leave room for the following sections: your business information, client details, a description of services, and payment terms. An organized structure will help make the document easy to read and understand.

| Service Description | Hours/Quantity | Rate | Total |

|---|---|---|---|

| Child care for 3 hours | 3 | $15/hour | $45 |

| Pickup and drop-off service | 2 | $10/hour | $20 |

Ensure you include a breakdown of services with clear descriptions, quantities, and costs. This transparency helps clients easily understand what they are being charged for, reducing the risk of misunderstandings.

Step 3: Add Payment Terms and Instructions

Specify the total amount due and the payment due date. Be sure to include any applicable late fees or discounts if relevant. Also, provide clear instructions on how payments should be made, whether through cash, credit card, or other methods. Including these details will help avoid delays and confusion when the time comes for your clients to settle their bills.

By following these steps, you can create a professional and effective billing statement that ensures accurate payment records and builds a positive relationship with your clients.

Why Choose Word for Invoicing

When it comes to creating billing documents, flexibility and ease of use are key factors to consider. Choosing the right software can simplify the process and help ensure that your records are professional, consistent, and easy to manage. A widely used text-processing program offers several benefits that make it an ideal choice for many businesses, particularly those that need customizable, professional-looking documents.

Key Advantages of Using Text-Editing Software

This software provides numerous features that streamline the billing process:

- Customization: You can easily adjust layouts, fonts, colors, and content to reflect your brand and business needs.

- Accessibility: Most users are familiar with this type of program, making it accessible to a wide range of professionals without the need for specialized training.

- Cost-effective: The software is often available for a low cost or even for free, reducing the financial burden on small businesses or independent service providers.

- Easy Editing: You can quickly make changes to existing documents, whether adjusting payment terms or correcting minor errors, without starting from scratch.

Efficient Document Management

Using a text-editing program also helps with organizing and storing your financial records. You can easily save and retrieve documents, share them via email, or print them as needed. The ability to store documents in multiple formats (such as PDF) ensures that you can send them in a format that is universally accessible to clients and stakeholders.

Overall, choosing a text-processing program for creating your financial records offers an efficient, flexible, and user-friendly way to manage billing tasks, giving you more time to focus on providing quality services to your clients.

Free Billing Templates for Word

For service providers, having access to free, ready-to-use billing documents can save time and ensure that all financial transactions are properly recorded. With the right format, you can quickly create professional-looking statements, streamline your administrative tasks, and focus more on providing your services. Luckily, there are a variety of free customizable options available that allow you to generate invoices easily, without the need for complex software or design skills.

Free billing templates come in different styles and formats, allowing you to choose one that suits your business needs. Whether you need a simple document or a more detailed one, these templates provide an easy starting point for your invoicing process. Below are some key features of these templates:

- Simple Setup: Templates are pre-designed and easy to customize, allowing you to input your business information, services provided, and payment details without hassle.

- Time-Saving: Templates eliminate the need to design a document from scratch, making it faster to generate bills for clients.

- Professional Appearance: Pre-designed layouts give your billing documents a polished, consistent, and professional look every time.

- Customization Options: Many templates offer flexibility in adjusting fields such as pricing, service descriptions, and payment terms to suit your specific requirements.

- Free of Charge: Numerous online sources offer these templates at no cost, making them an ideal solution for small businesses or freelancers looking to manage their finances effectively without additional expense.

Using these free templates ensures that your financial records are organized, accurate, and reflect the professionalism of your services. Whether you’re new to billing or just looking for a more efficient way to manage payments, these tools can help streamline your operations and improve client satisfaction.

How to Track Payments with Invoices

Keeping track of payments is essential for maintaining healthy cash flow and avoiding any misunderstandings with clients. By using a clear and organized billing system, you can easily monitor outstanding balances, track paid amounts, and identify any overdue payments. Below are some methods to effectively manage and track payments using your financial documents.

Steps to Track Payments

Here are a few key steps to help you stay on top of payments:

- Include Payment Due Dates: Always specify a clear due date on each document to set expectations for when the payment should be made.

- Assign a Unique Reference Number: Assign a unique number to each document. This helps both you and the client easily reference specific transactions, especially in case of future questions or issues.

- Record Partial Payments: If a client makes a partial payment, update the document to reflect the amount paid and the remaining balance. This ensures clarity on how much is still owed.

- Track Payment Status: Mark each document with a “paid” or “unpaid” status to keep track of which payments are complete and which are pending.

- Set Up Payment Reminders: For unpaid or overdue balances, set up reminders or follow-ups. Automated reminders can help ensure clients don’t forget about their payment obligations.

Using Payment Records for Future Reference

By keeping organized records of all transactions, you create a reliable history of payments. This is helpful for both business accounting and for resolving any potential disputes in the future. You can also use these records to analyze your revenue patterns and make informed decisions about your pricing and payment policies.

Ultimately, tracking payments accurately with well-documented statements ensures that your financial processes run smoothly, reducing the risk of errors and delays in receiving payments.

Adding Payment Terms to Your Template

Clearly defined payment terms are crucial for setting expectations with your clients and ensuring that payments are made on time. Including specific details about payment deadlines, accepted methods, and late fees can help reduce misunderstandings and improve cash flow. When creating your billing document, it is important to include these terms in a clear and concise manner so both you and your clients are on the same page.

Here are a few key elements to consider when adding payment terms to your document:

- Due Date: Specify the exact date by which the payment should be made. This helps establish clear deadlines and prevents delays in receiving funds.

- Accepted Payment Methods: Clearly list the payment methods you accept, such as credit cards, bank transfers, checks, or online payment platforms. This ensures your clients know their options for making payments.

- Late Fees: If applicable, include information about any late fees or penalties for overdue payments. For example, you could specify a percentage fee for each day or week the payment is delayed.

- Discounts for Early Payment: You may choose to offer a discount for early payments. Be sure to outline the conditions under which a discount applies, such as a specific number of days before the due date.

- Payment Installments: If you allow clients to pay in installments, be sure to specify the installment amounts, due dates, and any interest or fees related to payment plans.

By including these details in your billing document, you provide your clients with a clear understanding of how and when they should pay, helping to avoid confusion and ensuring that payments are received promptly. Well-structured payment terms can also improve your business’s financial stability and create more professional interactions with clients.

Organizing Your Billing Records Effectively

Keeping your financial records organized is essential for managing your cash flow, meeting tax requirements, and maintaining a professional image. Whether you’re a small business owner or a freelancer, having a clear system for tracking payments, outstanding balances, and past transactions can save time and reduce the risk of errors. An efficient record-keeping system allows you to quickly access past records, resolve payment issues, and improve your overall financial management.

To organize your billing documents effectively, consider the following tips:

- Use a Consistent Naming System: Develop a simple and consistent naming convention for your financial documents. For example, you can use the client’s name and the date of the transaction to easily identify files (e.g., “JohnDoe_Sept2024”).

- Create Folders by Date or Client: Organize your records into folders by month, quarter, or client. This makes it easier to track payments over time and locate specific documents when needed.

- Track Payment Status: Implement a system to mark documents as “paid” or “unpaid.” This can help you quickly see which accounts need attention and prevent overdue payments from slipping through the cracks.

- Store Digital Copies: Keep digital copies of all financial records, such as PDFs or scanned images. This provides an easy way to back up your files and reduces the clutter of paper records.

- Regularly Update Your Records: Make it a habit to update your billing documents regularly. Enter payments as they are received and review outstanding balances periodically to ensure that no payments are missed.

By maintaining well-organized billing records, you can streamline your financial management, reduce the risk of errors, and ensure that all transactions are accurately tracked. This not only saves time but also helps you stay on top of your finances, making it easier to focus on growing your business.

Top Features of a Good Invoice Template

A well-designed billing document serves as a key tool in maintaining clear financial records and ensuring timely payments. The right structure can enhance communication with clients and provide all necessary details in an easy-to-read format. When selecting or designing a billing document, it’s important to prioritize clarity, functionality, and professionalism. Below are some key features to look for in an effective financial statement layout.

| Feature | Description |

|---|---|

| Clear Branding | Include your business name, logo, and contact details at the top to ensure your document looks professional and helps clients identify who the statement is from. |

| Detailed Service Breakdown | Provide a clear description of services rendered, along with dates, hours, and individual charges. This ensures transparency and reduces potential disputes. |

| Unique Identification Number | A unique reference number for each statement helps you track documents and organize your financial records more efficiently. |

| Payment Terms and Due Date | Clearly state the due date for payment, along with any penalties for late payments or discounts for early settlement. |

| Payment Methods | List the available payment methods (credit card, bank transfer, etc.) so clients know how they can settle their balance. |

| Totals and Tax Breakdown | Include a summary of the total charges, taxes, and any additional fees, giving clients a clear overview of what they owe. |

These key features help create an organized, professional, and transparent financial record that clients can easily understand. A well-structured document also facilitates smoother transactions, making it easier for both businesses and clients to manage payments efficiently.

How to Avoid Common Billing Mistakes

Accurate and timely billing is essential for maintaining a healthy cash flow and strong client relationships. However, mistakes in financial records are common, and they can lead to confusion, delayed payments, and even disputes. By understanding and avoiding common errors, you can ensure that your transactions run smoothly and professionally. Below are some tips to help you avoid these common billing pitfalls.

Double-Check Details

One of the most frequent mistakes is missing or incorrect information. Always double-check that client details, service descriptions, and pricing are correct before finalizing a document. Small errors can lead to confusion or delayed payments, and they can create an impression of unprofessionalism.

- Ensure the client’s name, address, and contact information are accurate.

- Verify the dates and hours worked or services provided.

- Confirm the pricing, including taxes or additional fees.

Clearly State Payment Terms

Another common mistake is vague or unclear payment terms. If the payment deadlines, methods, and penalties for late fees are not clearly outlined, it can lead to misunderstandings with clients. Be sure to specify the due date, accepted payment methods, and any late charges to set clear expectations.

- Include a specific due date for payment.

- List all accepted payment options (e.g., credit card, bank transfer, check).

- Clarify any additional fees, such as late payment penalties or discounts for early settlement.

By being thorough and clear with your billing documents, you can avoid these mistakes and ensure smoother transactions. A well-organized and professional approach to billing not only helps improve cash flow but also strengthens your relationship with clients.

Adjusting Your Invoice for Different Services

When providing multiple types of services, it’s important to tailor your billing documents accordingly to reflect the unique requirements and pricing structures for each one. Different services may have varying rates, durations, and conditions, and your financial records should clearly reflect these distinctions. By adjusting your billing format to suit the specific nature of each service, you ensure that both you and your clients have a clear understanding of the charges and expectations.

Service-Specific Details

Each service you offer may require a different level of detail on the billing statement. Here are some adjustments you can make depending on the type of service rendered:

- Hourly vs. Fixed Rates: For services charged by the hour, make sure to list the total hours worked and the hourly rate. For fixed-price services, clearly state the agreed-upon amount and any conditions attached.

- Recurring Services: If the service is ongoing, such as a subscription or a regular maintenance check, include the billing cycle (e.g., weekly, monthly) and mention any applicable discounts for long-term commitments.

- Additional Costs: Some services might incur additional charges, such as travel fees, material costs, or overtime. Ensure these extra costs are clearly listed as separate line items so the client can see the breakdown of the total amount due.

Providing Service Descriptions

Including a brief description of each service provided helps clients understand exactly what they are paying for. This is particularly important for services that may vary in scope or complexity. Providing detailed descriptions also ensures transparency, making it easier for clients to see the value they’re receiving and helping avoid disputes over unclear charges.

- Describe any special projects or one-time services with specifics about what was delivered.

- List any optional add-ons or upgrades that may affect the overall cost of the service.

By adjusting your financial records to reflect the specifics of each service, you make the billing process more transparent, accurate, and professional. This not only helps ensure timely payments but also strengthens your reputation for clarity and organization.

Printing and Sending Your Billing Document

Once your financial document is complete and ready for submission, it’s important to ensure it is delivered in the most professional and efficient manner. Whether you choose to print a physical copy or send it digitally, the process of sending your billing statement plays a key role in ensuring timely payment and maintaining clear communication with your clients. Below are steps to follow when preparing and sending your financial document.

Printing Your Billing Statement

If you prefer to send a hard copy, printing your document should be done in a way that ensures it appears professional and easy to read. Here are some key tips for printing:

- Use High-Quality Paper: Opt for clean, high-quality paper to print your billing document. This enhances its professionalism and makes a better impression on your clients.

- Check Layout and Alignment: Before printing, double-check that the document’s layout is properly aligned, and that all information is visible and legible. Avoid cluttered formatting that could confuse your client.

- Consider a Personalized Letterhead: Printing your document on branded paper with your company logo and contact details reinforces your business identity and makes the document more formal.

Sending Your Billing Document

Once printed, you can choose to send the document via traditional mail or electronically. The method you choose should depend on the client’s preferences and your business practices.

- Postal Mail: If sending a hard copy, make sure to use a reliable postal service. You may also want to send the document with tracking to ensure it reaches the client securely.

- Email: Sending the document digitally is quicker and more cost-effective. Save the document as a PDF and attach it to an email. In the email, be sure to include a brief message explaining the charges and any payment instructions.

- Online Payment Systems: If you use an online payment platform, you can directly upload and send the document through the platform, which may also allow clients to make payments immediately upon receiving the statement.

Whichever method you choose, always ensure the document is sent promptly after services are completed to avoid any delays in payment. A timely, well-presented billing statement not only reflects professionalism but also increases the likelihood of prompt payment from your clients.

Integrating Billing with Accounting Software

Integrating your billing process with accounting software can greatly streamline your financial management. By automating the transfer of billing data into your accounting system, you can reduce the likelihood of errors, save time, and ensure that your records are always up to date. This integration not only improves efficiency but also enhances your ability to track cash flow, generate financial reports, and stay on top of outstanding payments.

Benefits of Integration

Linking your billing process directly to accounting software offers several key advantages:

- Time Savings: Automation eliminates the need for manual data entry, allowing you to focus on other aspects of your business.

- Accuracy: By syncing your billing details with your accounting system, you reduce the risk of human error and ensure that all figures are consistent across your records.

- Real-Time Updates: Integration ensures that your financial records are always up to date. As soon as a payment is received or a billing document is created, the information is automatically reflected in your accounting system.

- Improved Reporting: With integrated systems, generating financial reports such as profit and loss statements, tax summaries, and accounts receivable reports becomes much easier and faster.

How to Integrate Billing with Accounting Software

Integrating your billing process with accounting software is often a simple process, depending on the software you use. Many accounting platforms offer built-in tools or third-party integrations that allow for seamless syncing. Here’s how to get started:

- Choose Compatible Software: Ensure that your accounting software supports integration with your billing platform. Popular accounting tools like QuickBooks, Xero, or FreshBooks often provide built-in integrations with various billing systems.

- Set Up Integration: Follow the integration setup instructions provided by your accounting software or billing platform. This may involve linking your accounts and syncing data fields such as client names, service descriptions, and payment amounts.

- Test the Connection: Once integration is set up, test the connection by creating a sample billing document and checking if the information flows into the accounting system correctly.

- Maintain Regular Syncing: Make sure that the data syncs automatically at regular intervals or after each transaction to keep your records accurate and up to date.

By integrating your billing system with accounting software, you can automate many aspects of financial tracking, ensure greater accuracy, and improve your overall workflow. This integration allows you to focus more on growing your business while maintaining control over your financial health.

Improving Cash Flow with Accurate Billing Statements

Maintaining a healthy cash flow is crucial for any business, and one of the most effective ways to improve it is by ensuring that your financial documents are accurate and clear. Timely and correct billing not only ensures that clients understand what they owe but also helps you get paid promptly. When your billing system is organized and transparent, you reduce the risk of delays and disputes, ultimately supporting your business’s financial stability.

Accurate financial statements allow you to track payments more easily, identify any outstanding balances, and avoid costly errors that can slow down payment collection. They also create a professional image for your business, which can build trust and encourage timely payments from clients. Below are some key strategies to improve cash flow through effective billing.

- Provide Clear and Detailed Statements: Ensure that your billing documents contain all necessary information, such as services provided, dates, payment terms, and total amounts due. Clear statements help clients process payments faster and reduce the chances of misunderstandings.

- Set Payment Deadlines: Always specify a clear due date for payments. If possible, offer early payment discounts to incentivize quicker payments or set up penalties for late payments to encourage timely settlement.

- Automate Billing Reminders: Implement automated reminders for clients who have outstanding balances. Friendly reminders can help prompt clients to pay without requiring manual follow-up.

- Accept Multiple Payment Methods: Make it easier for clients to pay by offering multiple payment options, such as credit cards, bank transfers, or online payment platforms. The more convenient the payment process, the more likely clients are to pay on time.

By focusing on the accuracy and efficiency of your financial documents, you can ensure that payments are received faster, reducing the risk of cash flow issues and enabling your business to run more smoothly.