Day Rate Invoice Template for Freelancers and Contractors

When working on a project-based basis, it’s crucial to have a clear and efficient system for tracking and requesting payments. A professional billing method ensures both parties are on the same page regarding compensation and expectations. With the right tools, you can simplify the process and focus more on your work while maintaining a smooth financial workflow.

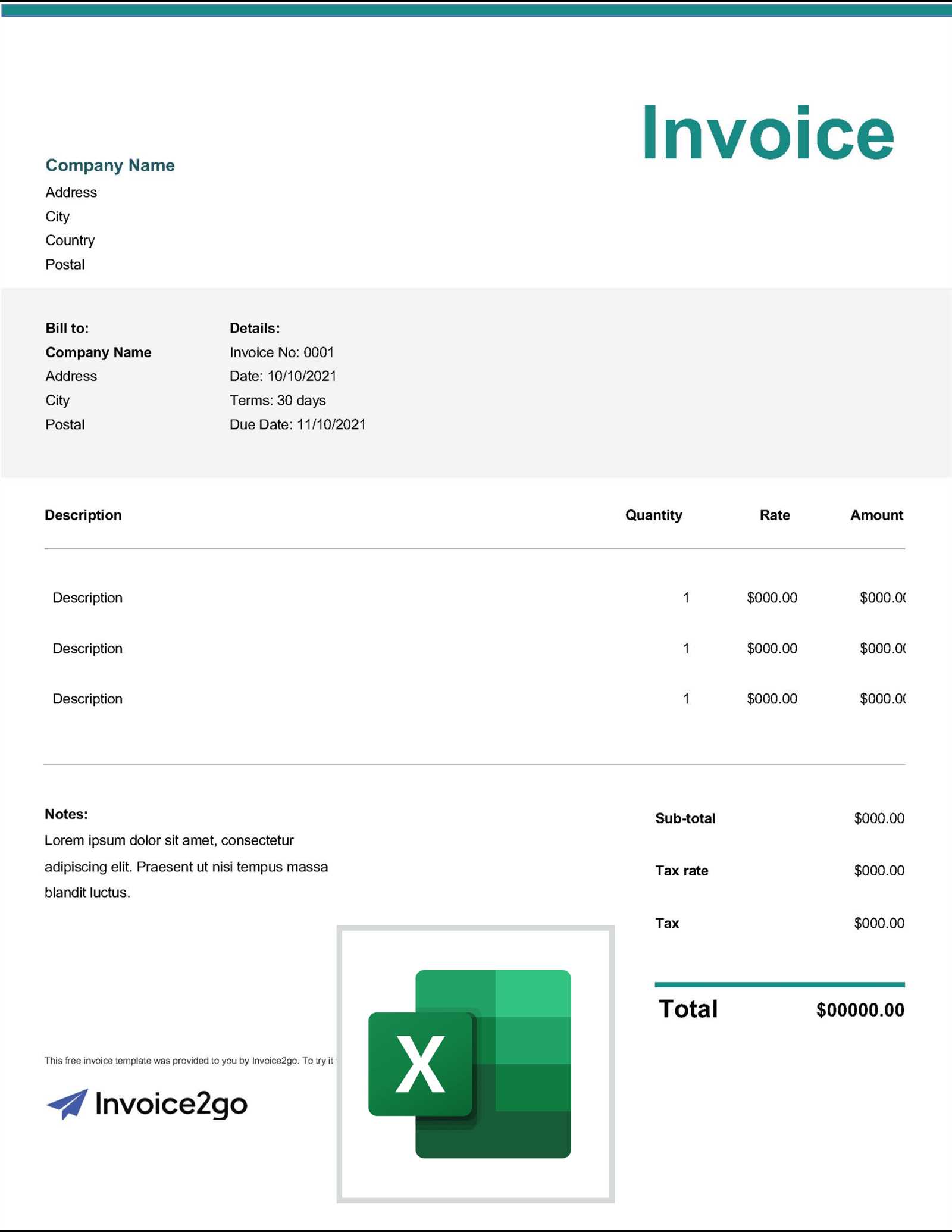

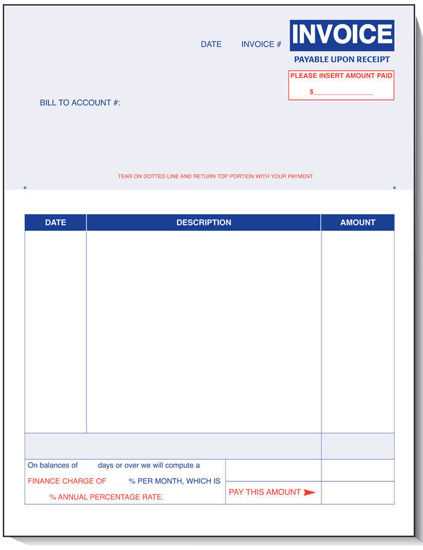

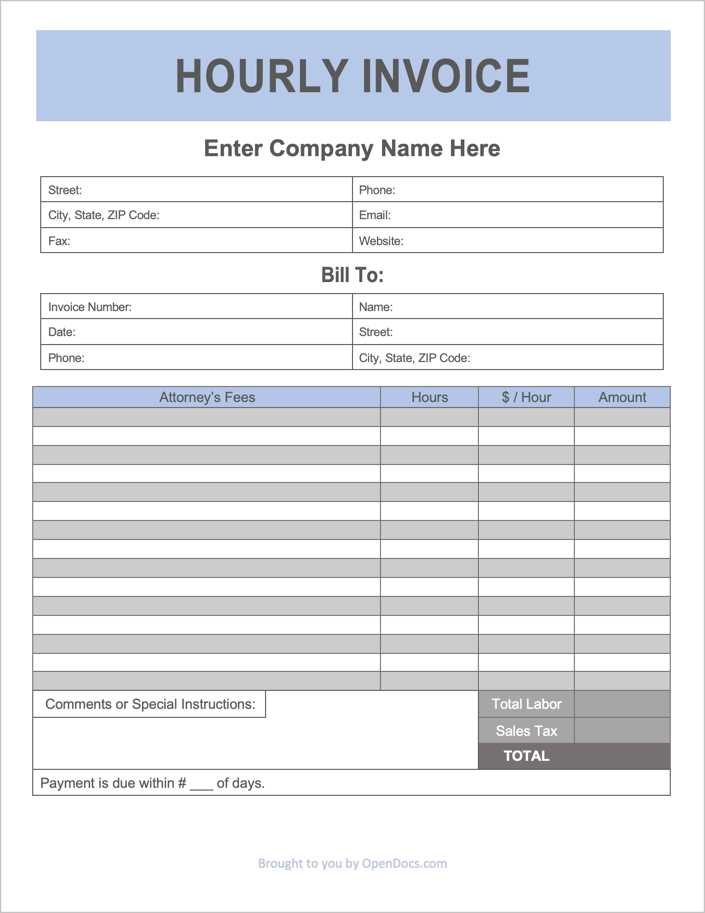

One of the most effective ways to handle payments is by using a structured document that outlines your daily fees, services provided, and payment terms. This document serves not only as a request for payment but also as a formal record of services rendered. By utilizing a customizable form, you can ensure consistency and professionalism every time you send out a request for compensation.

Understanding the components of such a document is essential to avoid confusion and ensure prompt payment. From correctly stating the hours worked to including your contact details, each element plays a role in ensuring clarity and minimizing delays. An efficient billing system will help you build trust with clients and streamline your financial processes.

Understanding Day Rate Invoices

In any project-based business relationship, it is essential to have a clear and efficient method for tracking and requesting payment for services rendered. This method allows professionals to establish transparent terms with clients and ensures fair compensation for their time and effort. A properly structured payment document offers both parties a clear understanding of the financial agreement and helps avoid potential disputes.

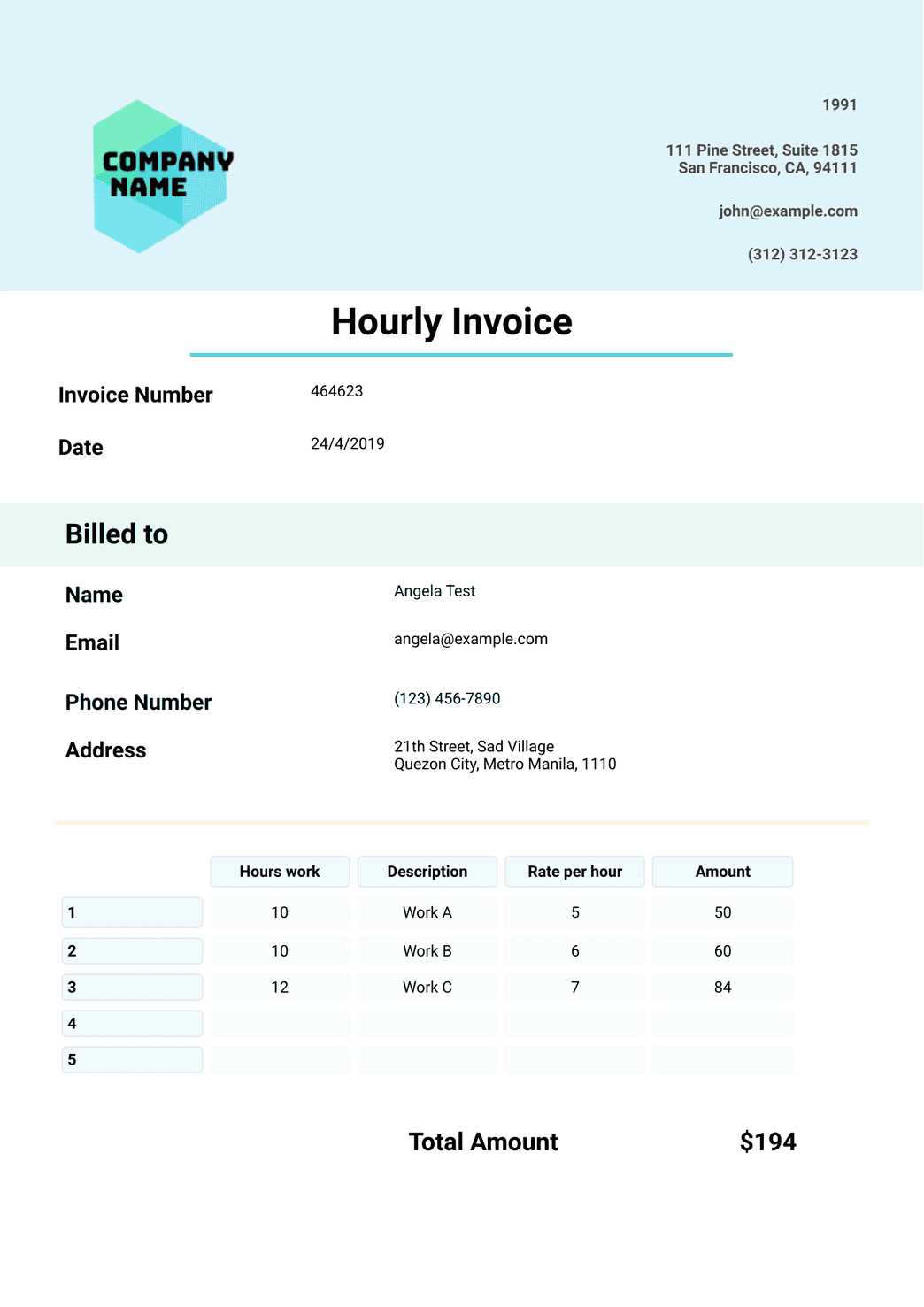

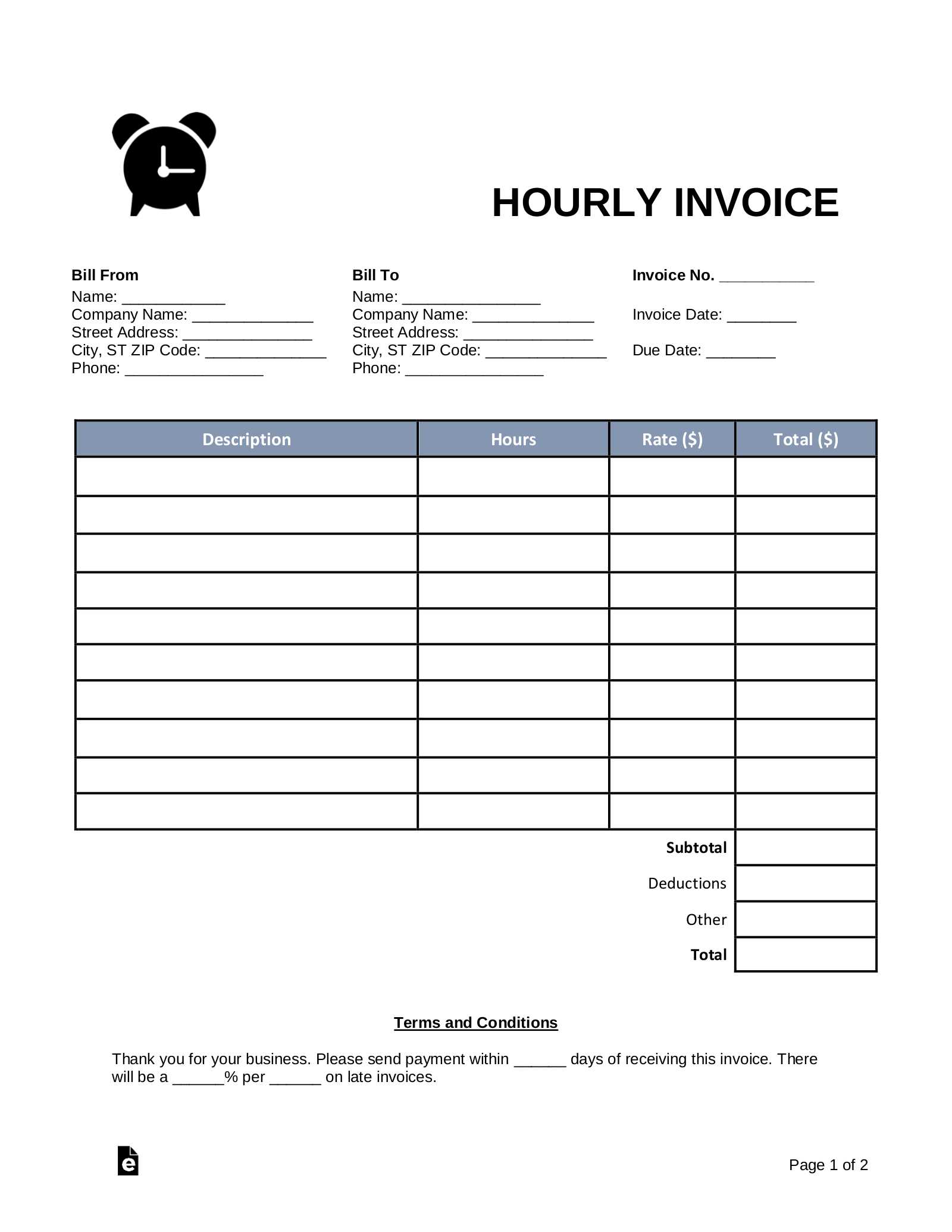

Such a document typically includes details about the time spent on the project, the services provided, and the agreed-upon fee for each unit of work. It acts as both a formal request for payment and a record of the completed work, making it easier to track progress and payments over time.

| Component | Description |

|---|---|

| Service Description | A brief outline of the work completed or services offered. |

| Work Duration | The amount of time spent working on the project, usually listed in hours or days. |

| Amount Due | The agreed payment for the time worked or services rendered, often calculated based on a set fee per unit. |

| Payment Terms | Conditions outlining when and how the payment should be made (e.g., net 30, upfront, etc.). |

By including these essential details, the document helps eliminate any confusion about the financial arrangements, leading to faster payments and a more professional relationship with clients. Understanding the components of a proper payment request is key to running a successful business and maintaining positive client interactions.

Why Use a Day Rate Invoice?

Opting for a structured approach to billing provides numerous advantages, especially for professionals working on a per-day basis. By outlining the work and associated costs clearly, it eliminates confusion and ensures both parties are aligned on financial expectations. This method benefits both the service provider and the client, streamlining the payment process and fostering trust.

Here are several reasons why this method is highly effective:

- Transparency: It provides a detailed breakdown of services provided and the time spent, making it easier for clients to understand the costs involved.

- Simplicity: Using a fixed amount for each workday simplifies the billing process, as there’s no need to calculate complex hourly rates or track multiple tasks.

- Consistency: With a set fee per day, clients know exactly what to expect, making budgeting easier for both parties.

- Professionalism: A well-organized payment document reflects a high level of professionalism, which can enhance your reputation and help build long-term client relationships.

- Efficiency: It speeds up the payment process, as both parties know the agreed amount upfront, reducing delays caused by disputes or misunderstandings.

In addition to these benefits, using this structured approach can help avoid common issues such as undercharging or overcomplicating payment requests. Clients will appreciate the clarity and straightforwardness, leading to faster payments and smoother transactions.

Benefits of Day Rate Billing

Charging a fixed fee for each day worked offers a range of advantages that simplify the payment process and provide stability for both professionals and clients. This approach removes the uncertainty of hourly billing and creates a more predictable structure for both parties, ensuring that expectations are clearly defined from the start.

One of the primary benefits is the ease of calculation. Instead of tracking hours worked and calculating complex totals, a set daily fee streamlines the entire process, making it quicker and more straightforward to request payment. This can lead to fewer billing errors and a faster turnaround on payments.

Consistency is another key advantage. Clients know exactly what they will pay for each day of work, regardless of fluctuations in the time spent or task complexity. This predictability makes budgeting easier for clients and allows service providers to plan their finances more effectively.

Additionally, this approach fosters transparency. Both parties are on the same page about the cost of services, reducing the risk of misunderstandings or disputes. It also provides professionals with a clear structure, making it easier to evaluate the profitability of their projects.

Lastly, offering a consistent daily fee can enhance your professional image. It communicates to clients that you have a well-organized billing system in place, which may increase trust and lead to longer-term relationships.

Essential Components of an Invoice

A well-organized billing document plays a critical role in ensuring clear communication between the service provider and the client. It outlines the details of the work completed and the corresponding costs, making it easier for both parties to track payments and maintain accurate records. Understanding the essential elements of this document helps eliminate confusion and ensures timely payment.

Here are the key components that should always be included:

| Component | Description | |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client Information | The full name, address, and contact details of the client you are billing. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Service Provider Details | Your name, business name (if applicable), address, and contact information. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Service Description | A clear outline of the work completed, including any relevant details or project milestones. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Amount Due | The total amount owed for the services rendered, calculated based on the agreed terms. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Terms | The specific conditions for payment, such as the due date or any late fees for delayed payments. | |||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Methods | Details on how the payment should be made (bank transfer, check, online payment, etc.). | |||||||||||||||||||||||||||||||||||||||||||||||||

| Invoice Number | A unique identifier for the document, which helps both you and the

How to Calculate Your Day RateDetermining the appropriate fee for your services requires careful consideration of several factors. This calculation ensures that your earnings reflect both the value you bring to clients and the time you invest in your work. In this section, we will explore the essential steps to arrive at a suitable price for your professional offerings, taking into account both fixed and variable elements of your business. Assess Your Annual Income GoalsStart by deciding how much you want to earn in a year. Consider your personal financial needs, business expenses, and the market rate for your skill set. This will give you a target amount that should cover your costs while ensuring profitability. Break down your desired yearly income into monthly and weekly targets to make the calculation more manageable. Account for Your Working HoursNext, estimate how many days or hours you plan to work annually. Be realistic about vacation time, sick leave, and any periods where you may not be available for paid projects. Subtract any non-billable time, such as administrative tasks or marketing efforts, to ensure you’re only calculating income based on actual client work. Factor in Overheads It’s essential to consider the additional costs of running your business. These may include software subscriptions, insurance, taxes, and office supplies. Divide your annual overheads by the total number of working days to ensure these expenses are accounted for in your final figure. Final Calculation Once you have your target annual income and working hours, you can easily divide the total desired earnings by the number of working days you plan to have. This will provide a solid foundation for your pricing structure, which can be adjusted depending on specific project complexities or client needs. Customizing Your Invoice TemplateAdapting the structure of your billing documents to match your brand and workflow can enhance professionalism and ensure clarity for your clients. A well-designed document not only helps convey the necessary details but also builds trust with those you work with. In this section, we will discuss how to personalize your billing document to meet your specific needs and preferences. Essential Elements to Include

Before diving into customization, ensure that your document contains the following key details:

Personalization OptionsOnce the basics are covered, you can begin to make the document more distinctive. Consider the following elements when customizing:

|