Customs Invoice Template for UK Shipments

When shipping goods internationally, proper documentation is crucial to ensure smooth processing and compliance with regulations. Accurate records not only help avoid delays but also minimize the risk of additional charges or penalties. In the UK, having the right paperwork in place is essential for facilitating cross-border transactions, whether for business or personal purposes.

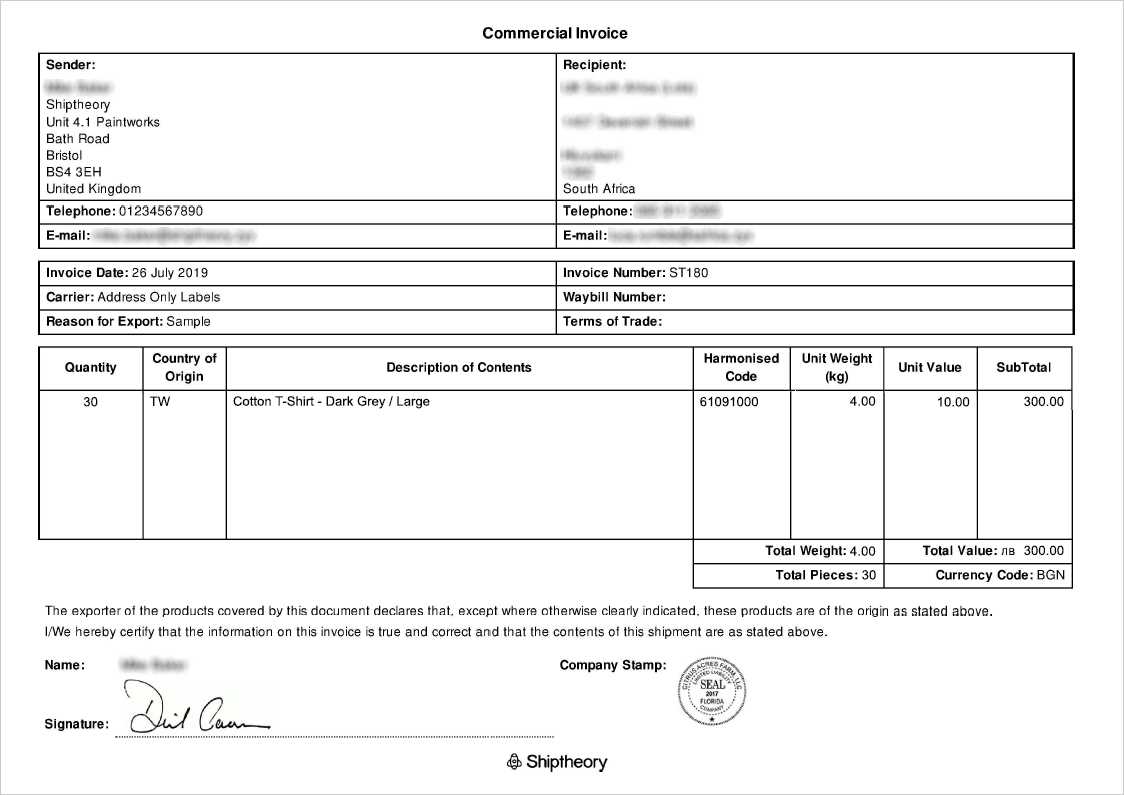

One of the key documents required for international shipping is a detailed list of items being sent, including their value, description, and origin. This helps authorities assess duties and taxes while ensuring that all goods are correctly classified and processed. A clear, organized document simplifies the shipment procedure, making it easier for both the sender and the receiver.

By using a well-structured form that adheres to UK regulations, businesses can improve their shipping efficiency and reduce the likelihood of disputes. Understanding how to properly fill out and submit this documentation can save time and prevent costly errors. In this guide, we will explore the essentials of creating a comprehensive shipping document for UK exports.

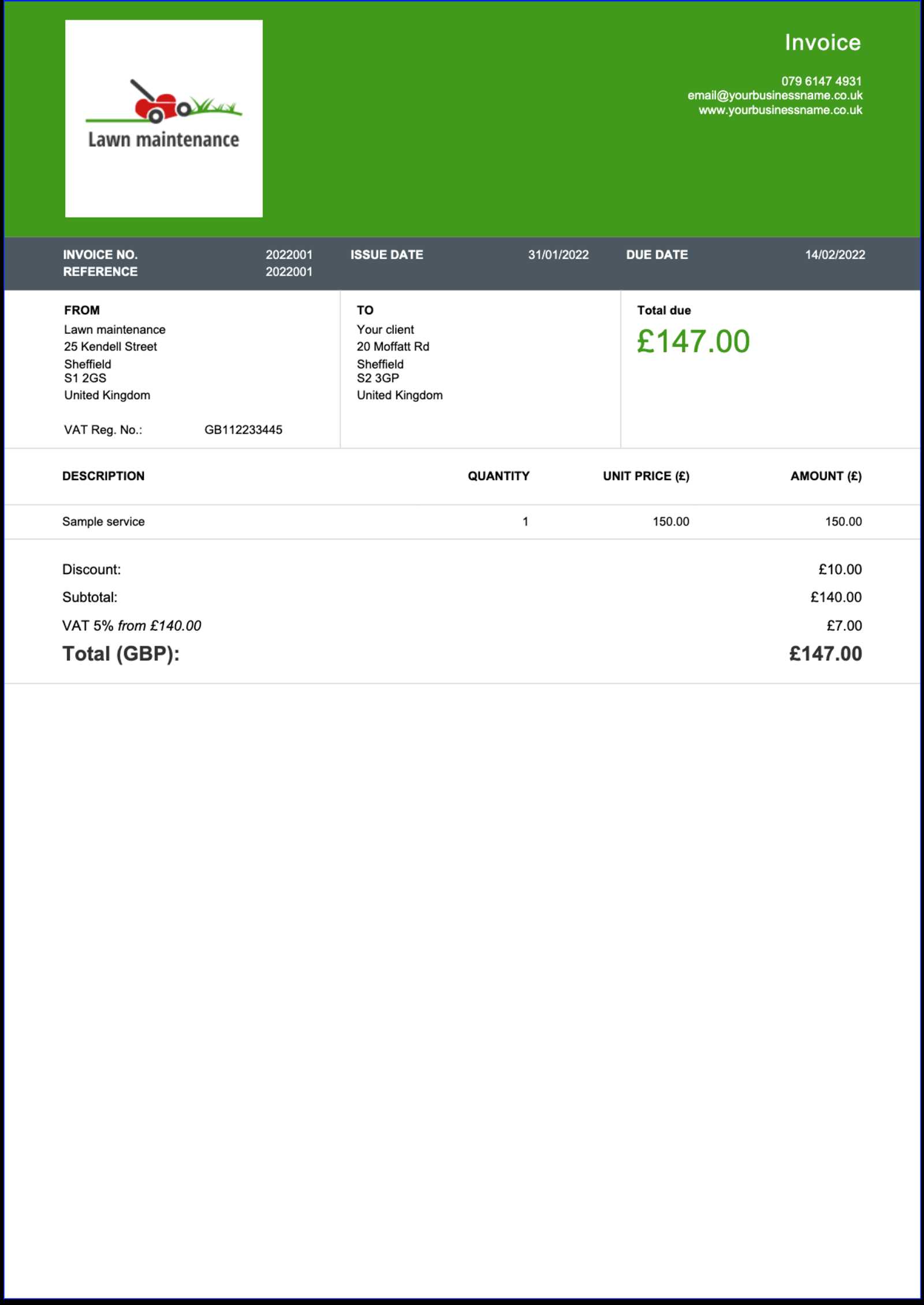

Customs Invoice Template UK

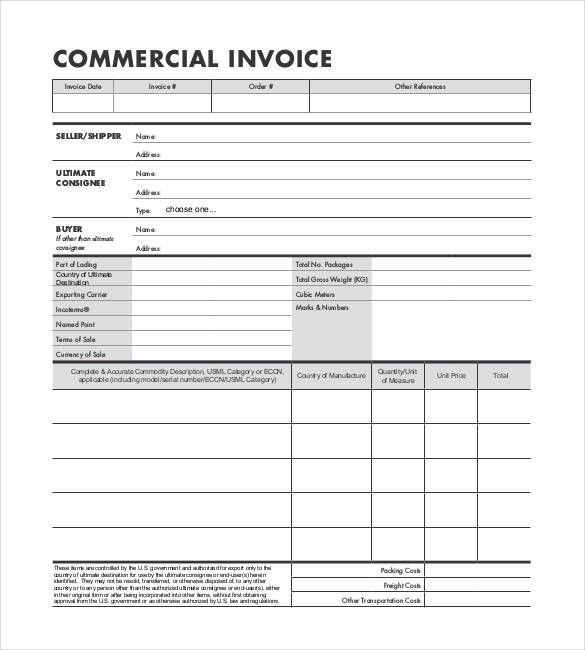

When shipping goods internationally, having a well-organized document that outlines the contents of the shipment is essential. This document should provide clear and concise information about the items being exported, including their value, description, and other relevant details. A properly structured form ensures smooth processing and compliance with regulations, preventing delays and additional costs. This section will guide you through the necessary components to include when preparing such a document for shipments from the UK.

Key Elements to Include

The document should cover all essential details to avoid confusion during the customs clearance process. Here are the key sections to consider:

| Section | Description |

|---|---|

| Sender Information | Details of the individual or company sending the goods, including address and contact details. |

| Recipient Information | Details of the individual or company receiving the goods, including address and contact details. |

| Item Description | A clear description of each item being sent, including its quantity, material, and purpose. |

| Value of Goods | The total value of the goods being sent, as well as the currency in which it is measured. |

| Country of Origin | The country where the goods were manufactured or produced. |

Formatting the Document

It is important to format the document in a professional manner, ensuring that all sections are clearly labeled and easy to read. A clean and organized layout will not only help in preventing errors but also demonstrate professionalism in your shipping practices. Ensure that the document includes all required details to avoid delays and facilitate the smooth transit of goods through customs procedures.

Importance of Accurate Shipping Documentation

Accurate documentation is crucial when sending goods across borders. A well-prepared record not only ensures that the shipment moves smoothly through all regulatory processes but also helps avoid delays, fines, or other complications. The details provided on these documents can affect the entire shipping experience, from clearance to delivery.

Having clear and precise information about the items being shipped allows authorities to correctly assess taxes, duties, and other regulatory requirements. Missing or incorrect details may lead to misunderstandings, causing the shipment to be held or even rejected. Furthermore, accurate records help both the sender and recipient track and manage the goods more efficiently.

In addition to facilitating timely delivery, proper documentation ensures that both parties remain in compliance with legal standards. It protects the interests of all involved by minimizing risks, especially when dealing with valuable or sensitive goods. Ensuring correctness in every aspect of the paperwork contributes to a smoother and more reliable international shipping process.

Key Elements of a Shipping Document

When preparing documentation for international shipments, certain key details must be included to ensure the goods are processed correctly. A well-structured record should provide a comprehensive overview of the shipment, including information about the sender, recipient, and the contents of the package. Having these elements clearly outlined reduces the chances of delays or errors during the shipping process.

Required Details to Include

Here are the essential sections that should be included in the document:

- Sender Information: Full details of the person or company sending the goods, including name, address, and contact information.

- Recipient Information: Complete details of the recipient, including their name, address, and contact number.

- Description of Goods: A detailed list of the items being shipped, including their type, quantity, and intended use.

- Value of Goods: The total value of the items in the shipment, which may be used for calculating taxes and duties.

- Country of Origin: The country where the goods were produced or manufactured.

Formatting for Clarity

To ensure accuracy and avoid confusion, it is important to format the document clearly. All sections should be organized in a logical order, with easy-to-read text and properly labeled categories. A clean layout helps to quickly verify that all necessary information is included, which speeds up processing and reduces the chances of delays.

How to Create a UK Shipping Document

Creating the correct documentation for shipments from the UK is an essential part of the shipping process. The goal is to provide accurate and detailed information about the goods being shipped, ensuring smooth passage through the necessary regulatory checks. This guide outlines the steps required to prepare a proper record for your international shipments.

First, begin by collecting all relevant information about the sender and recipient. This includes full names, addresses, and contact details. It’s essential to double-check that the recipient’s information is correct to avoid any delivery issues. Next, describe the items in the shipment with as much detail as possible, including quantity, material, and purpose of the goods.

After including the essential item details, the total value of the goods must be clearly stated. This is important for calculating applicable duties or taxes. Additionally, the country where the goods were manufactured or produced should be mentioned, as this is often needed for classification purposes during the customs process.

Finally, ensure that the document is formatted clearly and consistently. Use simple, readable fonts and make sure the sections are easy to navigate. This will make it easier for authorities to process the goods efficiently and prevent any misunderstandings that could lead to delays.

Legal Requirements for Shipping Documentation

When sending goods internationally, it is essential to meet legal requirements for proper documentation. These requirements ensure that shipments are processed according to the laws and regulations of the destination country. Failing to adhere to these legal obligations can result in delays, fines, or even the rejection of the shipment.

Mandatory Information

There are several key pieces of information that must be included in the documentation to comply with legal requirements. These typically include:

- Accurate item description: A clear and precise explanation of the goods being shipped, including quantity, weight, and intended use.

- Sender and recipient details: Full names, addresses, and contact information for both the sender and the recipient to ensure proper identification and delivery.

- Value of the goods: The total monetary value of the shipment, which may impact the calculation of duties or taxes.

- Country of origin: The country where the goods were produced or manufactured, which may influence the tariff classification of the items.

Compliance with National and International Laws

Each country has its own set of rules for handling international shipments, so it’s important to be aware of the specific regulations that apply to your destination. These regulations may include restrictions on certain types of goods or additional documentation requirements. Compliance ensures that the shipment is processed efficiently and reduces the risk of costly penalties.

Common Mistakes in Shipping Documentation

When preparing paperwork for international shipments, errors can lead to delays, fines, or even the rejection of the goods. Understanding common mistakes and how to avoid them is essential to ensure smooth processing and delivery. Below are some of the most frequent mistakes made when creating shipping records.

Missing or Inaccurate Information

One of the most common mistakes is failing to include necessary details or providing incorrect information. Here are some of the areas where errors can occur:

- Incorrect descriptions: Providing vague or inaccurate descriptions of the items can lead to confusion and delays. Always use clear and specific terms.

- Wrong recipient details: Errors in the recipient’s address, contact information, or name can result in failed deliveries or packages being sent back.

- Omitting the value of the goods: Failing to state the correct value can result in incorrect duty assessments or the refusal of the goods by authorities.

Failure to Meet Legal Standards

Another issue is not adhering to legal requirements, which vary depending on the country. Some common issues include:

- Lack of country of origin: Not stating the country where the goods were manufactured can cause problems with customs procedures.

- Incorrect tariff codes: Using the wrong codes for goods can result in misclassification, delays, or fines.

By carefully checking all the required details and ensuring they meet the legal requirements, you can avoid these mistakes and make the shipping process much smoother. Accurate paperwork is vital for a timely and efficient delivery experience.

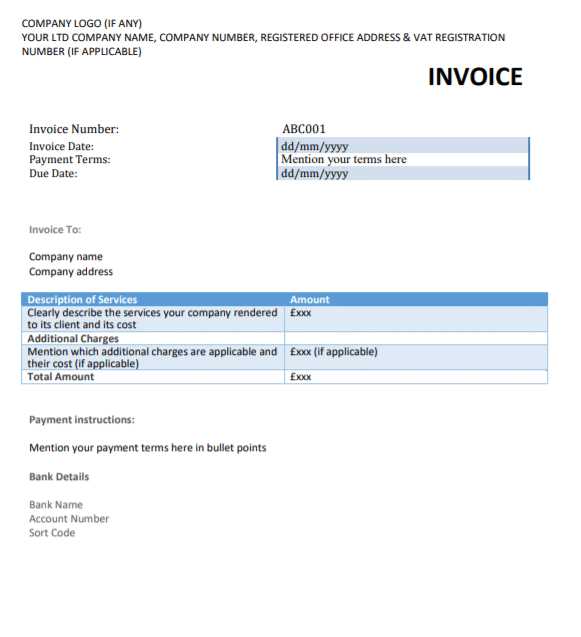

How to Format a Shipping Document

Proper formatting of shipping records is crucial for ensuring smooth processing and compliance with legal requirements. A well-structured document makes it easier for authorities to review the information, which can help avoid delays and errors. Here are the essential steps to format your shipping documentation correctly.

Essential Information to Include

Before focusing on the layout, it’s important to ensure that all necessary details are included. The following elements are essential for proper documentation:

- Sender and recipient details: Ensure that full names, addresses, and contact numbers are clearly listed at the top.

- Description of goods: Provide a detailed description of each item, including quantity, weight, and value.

- Country of origin: Indicate where the goods were manufactured or produced, as this is often required for classification purposes.

- Total value of the shipment: Include the monetary value of the goods to assist in calculating duties and taxes.

Structuring the Document

The layout of your document should be clear, easy to follow, and consistent throughout. Consider using the following structure:

- Header: Include basic information like the title of the document and the shipping details of the sender and recipient.

- Body: This section should contain the detailed descriptions of the goods, including quantity, value, and any relevant codes or classifications.

- Footer: A footer should include any additional notes or declarations, such as the total value and any tax details.

Formatting your document in a logical and organized manner helps ensure that all necessary information is easily accessible, which can prevent issues during the shipment process.

Understanding Duty and Tax Rates

When shipping goods internationally, understanding the different charges and taxes that may apply is crucial for both businesses and individuals. These costs are determined by various factors such as the nature of the goods, their value, and the country of import. Having a clear understanding of these rates ensures that shipments are processed smoothly and that all legal obligations are met.

Duty and tax rates are generally calculated based on the total value of the goods being shipped, including their cost, insurance, and freight (CIF). These rates can vary significantly depending on the type of product and its classification under international trade regulations. Below are some key points to consider when determining these rates:

- Product Classification: The classification of goods is essential for determining the appropriate rate. Different items may fall under different categories, each with its own rate.

- Value of Goods: Duties and taxes are often calculated as a percentage of the declared value of the goods, which must be accurately stated in the shipping records.

- Country-Specific Regulations: Each country may have its own duty rates and tax structures, which can vary for the same types of goods depending on the destination.

It’s important to research and ensure that the correct duties and taxes are calculated before shipment. Failing to do so can result in delays, unexpected fees, or even the rejection of goods at the destination. By understanding how these rates are applied, you can better manage the costs and avoid complications during international shipping.

Tips for International Shipping Documentation

Proper documentation is crucial when shipping goods internationally. Accurate and complete records can streamline the process, reduce the risk of delays, and help ensure compliance with all relevant laws. Below are key tips to help you prepare the necessary paperwork for a smooth shipping experience.

| Tip | Description |

|---|---|

| Double-check Details | Ensure that all information, including addresses, item descriptions, and values, is accurate and consistent across all documents. |

| Understand Requirements | Different countries have different regulations. Make sure you understand the documentation requirements of the destination country to avoid delays. |

| Use Clear Descriptions | Provide precise and detailed descriptions of the goods to prevent misunderstandings or misclassification that could affect duties and taxes. |

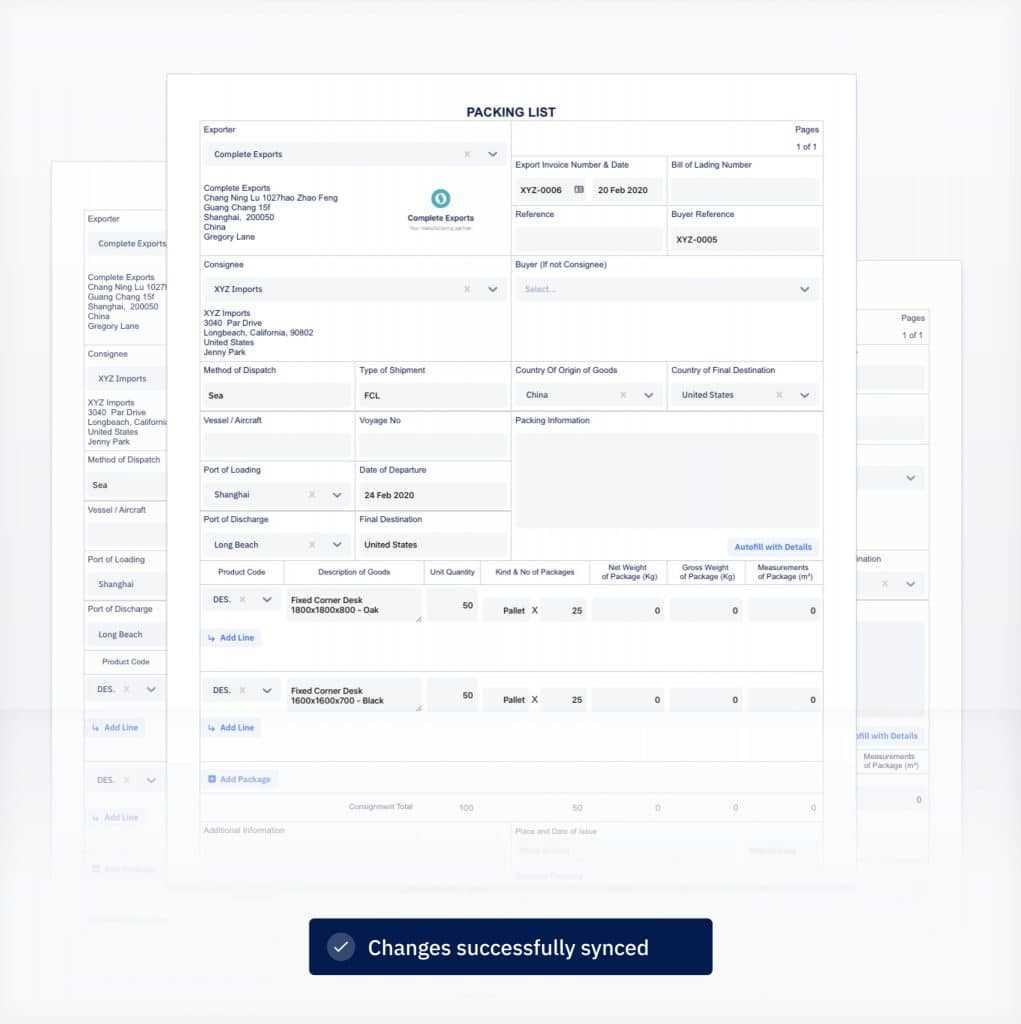

| Provide Supporting Documents | Ensure all required documents, such as invoices, packing lists, and certificates of origin, are included with the shipment. |

| Keep Copies | Maintain copies of all shipping documents for your records in case you need to refer to them later. |

By following these tips and preparing your paperwork carefully, you can reduce the likelihood of issues during international shipping, ensuring that your goods arrive on time and without complications.

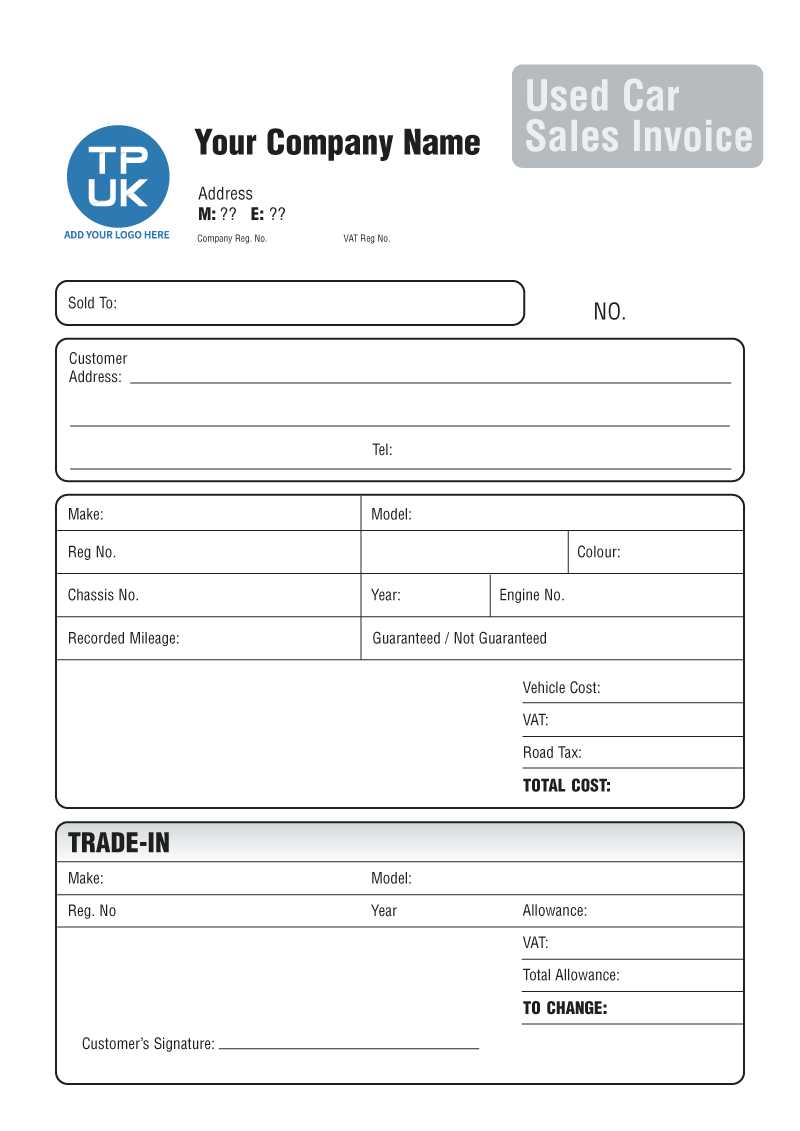

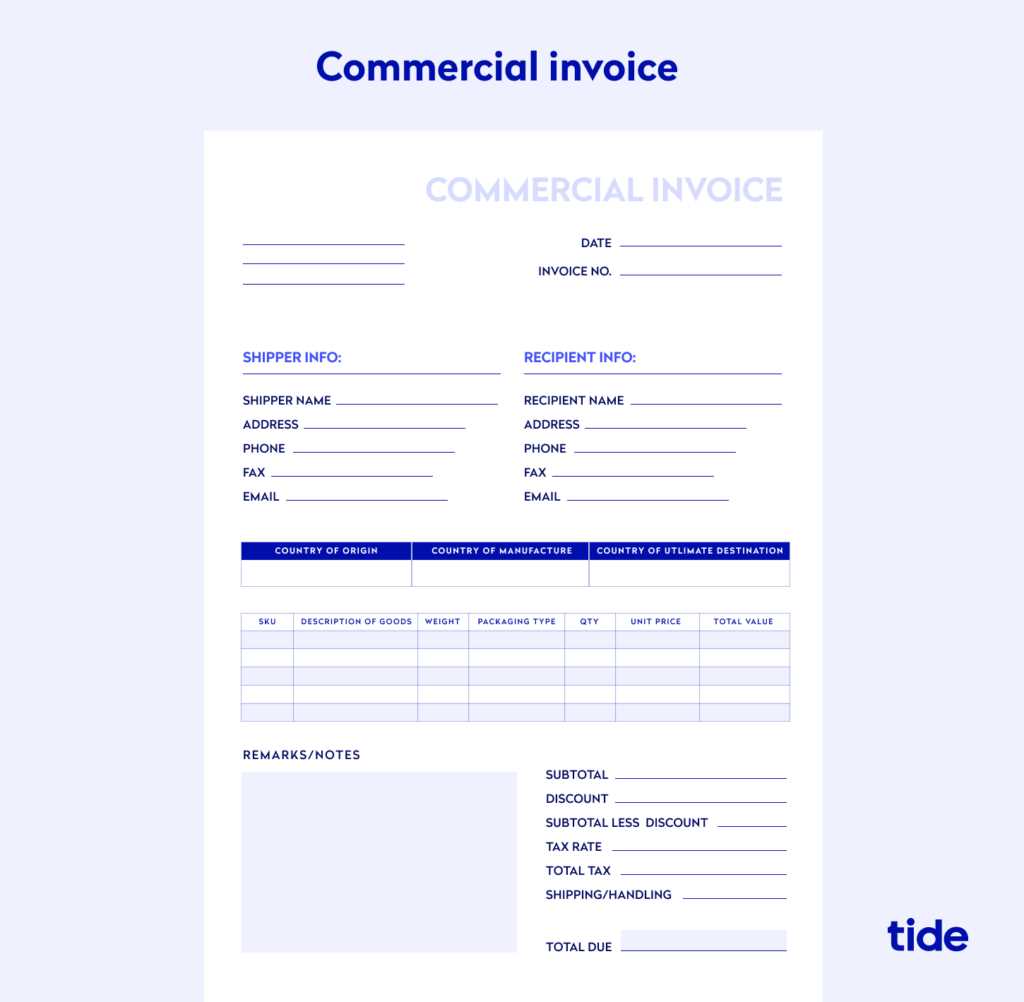

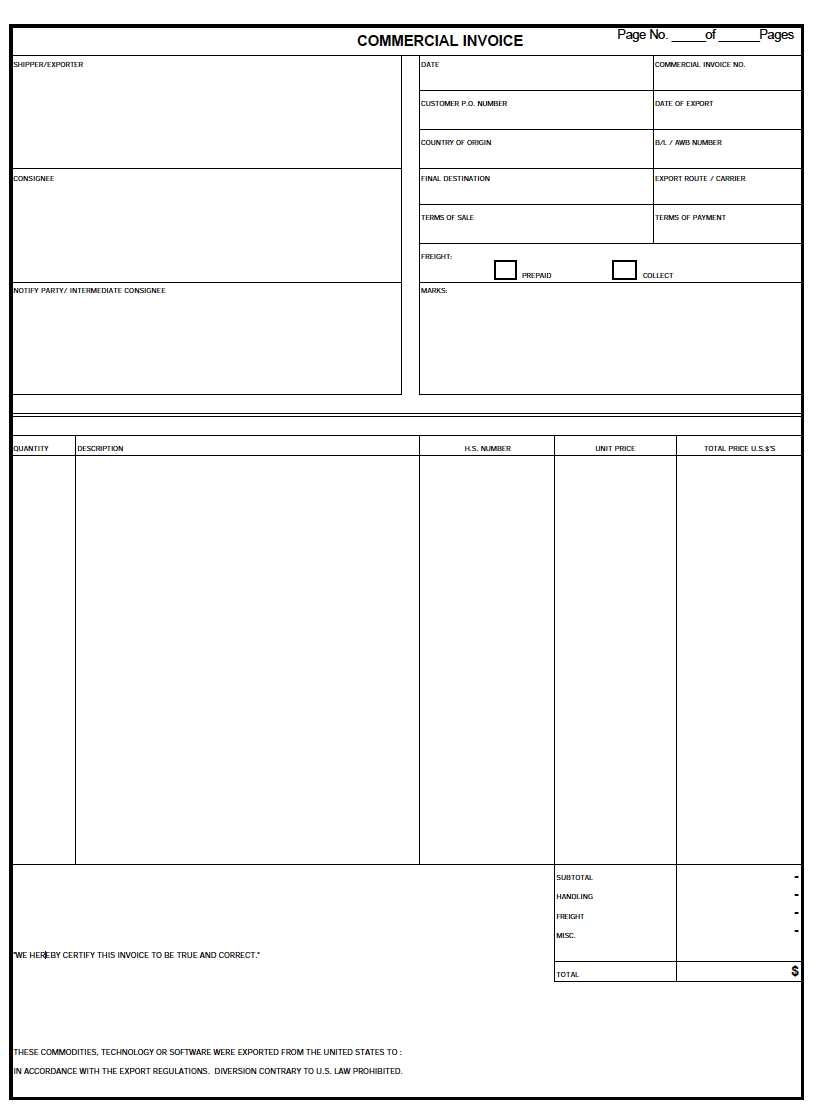

Customs Invoice vs Commercial Invoice

When shipping goods internationally, there are different types of documentation used to support the transaction. Two of the most commonly used documents are the customs declaration form and the commercial record of sale. These documents serve different purposes, and understanding their distinctions can help ensure compliance with international trade regulations.

- Customs Declaration Form: This document is typically required by the authorities in the importing country. It includes essential information such as the nature, value, and classification of the goods being shipped. It helps customs officers determine applicable duties and taxes, ensuring proper clearance of goods across borders.

- Commercial Record of Sale: A commercial record of sale is a more general document that details the transaction between the buyer and the seller. It includes information about the goods, the price, and the terms of the sale. This document is used for accounting, legal purposes, and internal records, and may not be directly involved in customs procedures.

While both documents contain similar information, the main difference lies in their purpose. The customs form is focused on facilitating the clearance of goods, while the commercial record is related to the sale itself. Both are essential for smooth international trade, but they play distinct roles in ensuring compliance and proper documentation during the shipping process.

When to Submit Your Customs Invoice

Submitting the correct paperwork at the right time is essential for ensuring smooth international shipments. This documentation should be submitted before the goods arrive at their destination, as it helps facilitate the clearance process and ensures that the goods are properly classified for tax and duty purposes. Timing is crucial, as late submission can lead to delays, fines, or even the seizure of goods.

Before Shipment: It is important to have all the necessary paperwork ready before you send the goods. This includes providing a full record of the sale, product descriptions, and accurate values. By submitting the required documentation ahead of time, you can avoid any customs issues upon arrival.

Upon Arrival: Depending on the country’s regulations, your documentation may also be submitted once the goods reach their destination. Customs authorities will review the paperwork and determine the applicable charges. It’s important to submit the documents in a timely manner to avoid delays in clearance.

Understanding the proper timing for submitting these essential documents can significantly reduce the risk of problems at the border and help ensure that shipments arrive on time and with all necessary charges accounted for. By preparing and submitting the correct paperwork when needed, you can ensure a smoother shipping experience and avoid unexpected costs.

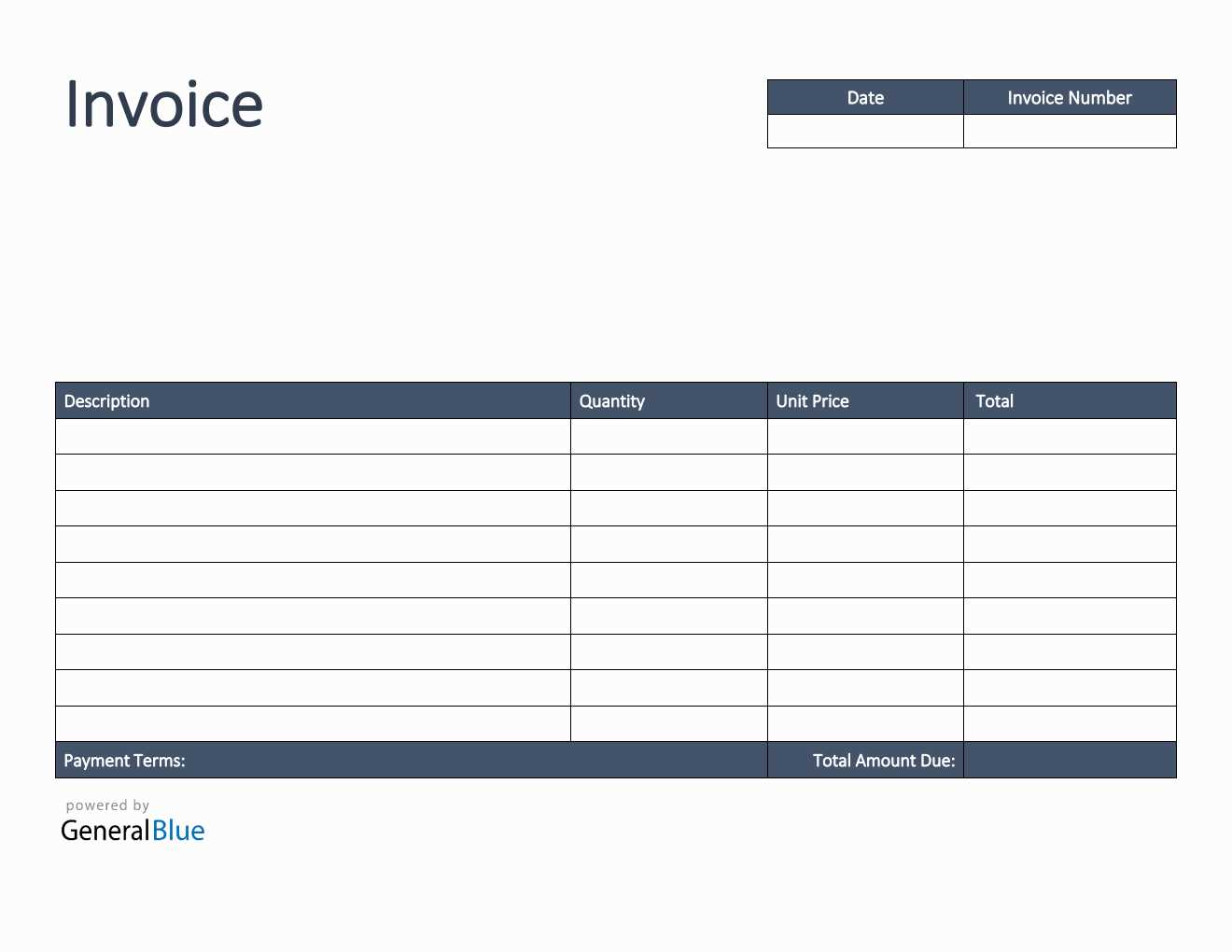

Online Tools for Invoice Creation

Creating accurate and professional documentation for international shipments has never been easier thanks to a variety of online platforms. These tools streamline the process of generating all necessary paperwork, ensuring that details are correctly filled in and compliant with regulations. With the convenience of cloud-based services, businesses can quickly generate forms, saving both time and effort.

Here are some of the key advantages of using online tools for creating shipping and commercial documents:

- Easy to Use: Most platforms are user-friendly, requiring little to no technical knowledge to navigate.

- Customizable Fields: You can modify fields to match specific requirements for each shipment or destination.

- Compliance Features: Many tools are built to ensure that the generated documents comply with international shipping regulations.

- Real-Time Updates: Online platforms often allow for immediate updates to the forms based on any regulatory changes.

- Cloud Storage: Generated documents can be stored online, ensuring easy access from any location.

Some popular online tools for generating professional shipping documents include:

- Invoice Generator: A simple tool that allows you to create professional forms quickly with customizable options.

- Zoho Invoice: A comprehensive tool offering robust features like automated calculations and multi-currency support.

- QuickBooks: Known for its accounting features, QuickBooks also provides tools for creating and managing commercial documents.

- FreshBooks: A cloud-based platform designed to help businesses create and send billing documents with ease.

By leveraging online tools, businesses can simplify the process of creating essential documents, ensuring accuracy and compliance without the need for extensive manual work.

How to Handle Invoice Discrepancies

Discrepancies in documentation can cause delays and potential legal issues during international shipments. It is essential to address any mismatches between the information provided and the details required by authorities swiftly and accurately. Recognizing and correcting errors promptly helps ensure smooth processing and avoids penalties or delays.

Common discrepancies might include incorrect item descriptions, mismatched values, or missing details. These errors can arise due to simple human mistakes or misunderstanding of the specific regulations. Regardless of the cause, it is important to take the necessary steps to resolve the issue quickly to avoid complications.

Here are the steps to take when handling discrepancies in your shipping forms:

- Review the Details: Double-check the information on the form to ensure the discrepancies are clearly identified. Compare it with the original transaction records.

- Contact the Relevant Authorities: If an error is noticed, promptly contact the relevant authorities or service providers to inform them of the issue.

- Provide Supporting Documents: If necessary, submit supporting documents such as purchase orders, receipts, or contracts that validate the correct details of the shipment.

- Correct the Information: Make the necessary adjustments to the documentation to reflect the accurate data.

- Resubmit the Updated Forms: Once the corrections are made, resubmit the updated forms for processing.

Sometimes discrepancies can arise from issues outside of your control, such as system errors or misunderstandings with shipping partners. Below is a table of potential causes for discrepancies and their corresponding solutions:

| Issue | Solution |

|---|---|

| Incorrect value declared | Provide updated invoices or receipts to show the correct value of goods. |

| Missing product descriptions | Ensure all product descriptions are clearly stated and align with official classifications. |

| Wrong tariff code used | Consult the correct tariff guide and submit updated documentation with the correct code. |

| Missing signatures or dates | Review the document and ensure all required signatures and dates are included. |

By carefully reviewing the documents and taking prompt action to address any discrepancies, you can ensure that the shipment process remains as efficient and compliant as possible.

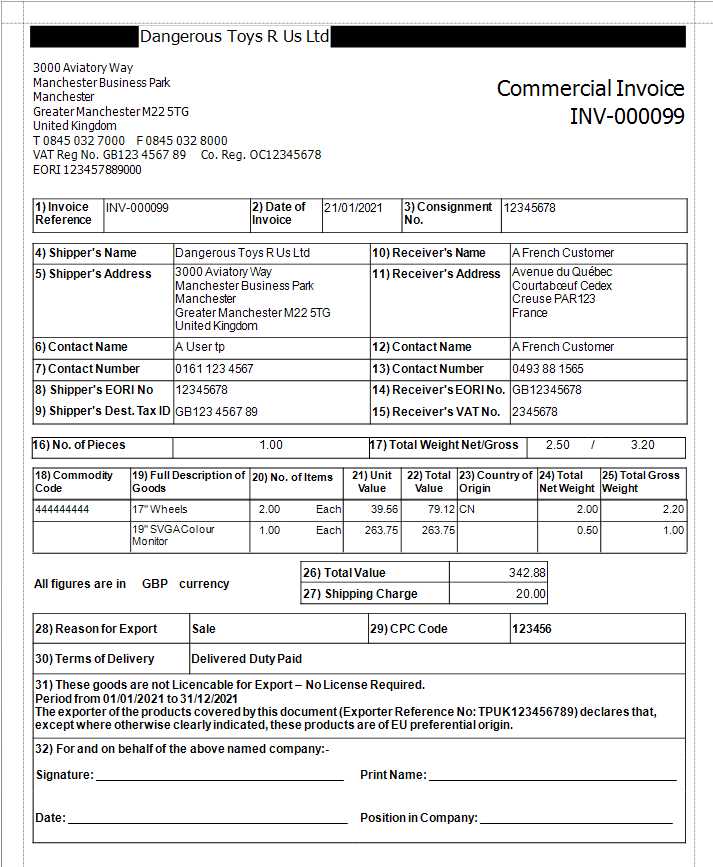

Documentation Requirements for Exports

When sending goods overseas, it is crucial to provide the correct documentation to ensure smooth customs processing. The proper paperwork helps authorities verify the details of the shipment, such as the value, quantity, and type of products being exported. Accurate documentation can prevent delays, fines, and even the rejection of shipments. In this section, we will cover the key requirements and information needed for export documentation.

Essential Elements for Export Documentation

There are several critical components that need to be included in export paperwork. These elements not only ensure compliance but also provide clarity to customs officials about the contents of the shipment.

- Exporter Details: Include the name, address, and contact information of the exporting company or individual.

- Receiver Information: Provide the name and contact details of the recipient or consignee, along with their address and tax identification number if required.

- Description of Goods: A detailed description of the products being shipped, including their quantity, value, and country of origin.

- HS Code: The Harmonized System (HS) code for each product, which classifies goods for international trade.

- Declaration of Value: The correct value of the shipment, including the total value of goods and any applicable shipping costs.

- Payment Terms: Indicate the payment method and terms, such as prepaid or collect, if applicable.

Common Additional Information

Some shipments may require additional documentation based on the product type or destination country. The following may be necessary for certain exports:

- Export License: If the products fall under controlled categories, such as military or high-tech items, an export license may be required.

- Certificates of Origin: A certificate that confirms the country where the goods were manufactured.

- Insurance Details: If the shipment is insured, include the insurance policy number and coverage details.

- Customs Declarations: Some countries require additional declarations or forms to accompany shipments, such as proof of payment for tariffs or taxes.

Ensuring that all required information is included and accurate can help prevent any issues during the export process. By following the proper documentation guidelines, exporters can facilitate faster processing and reduce the risk of costly delays or fines.

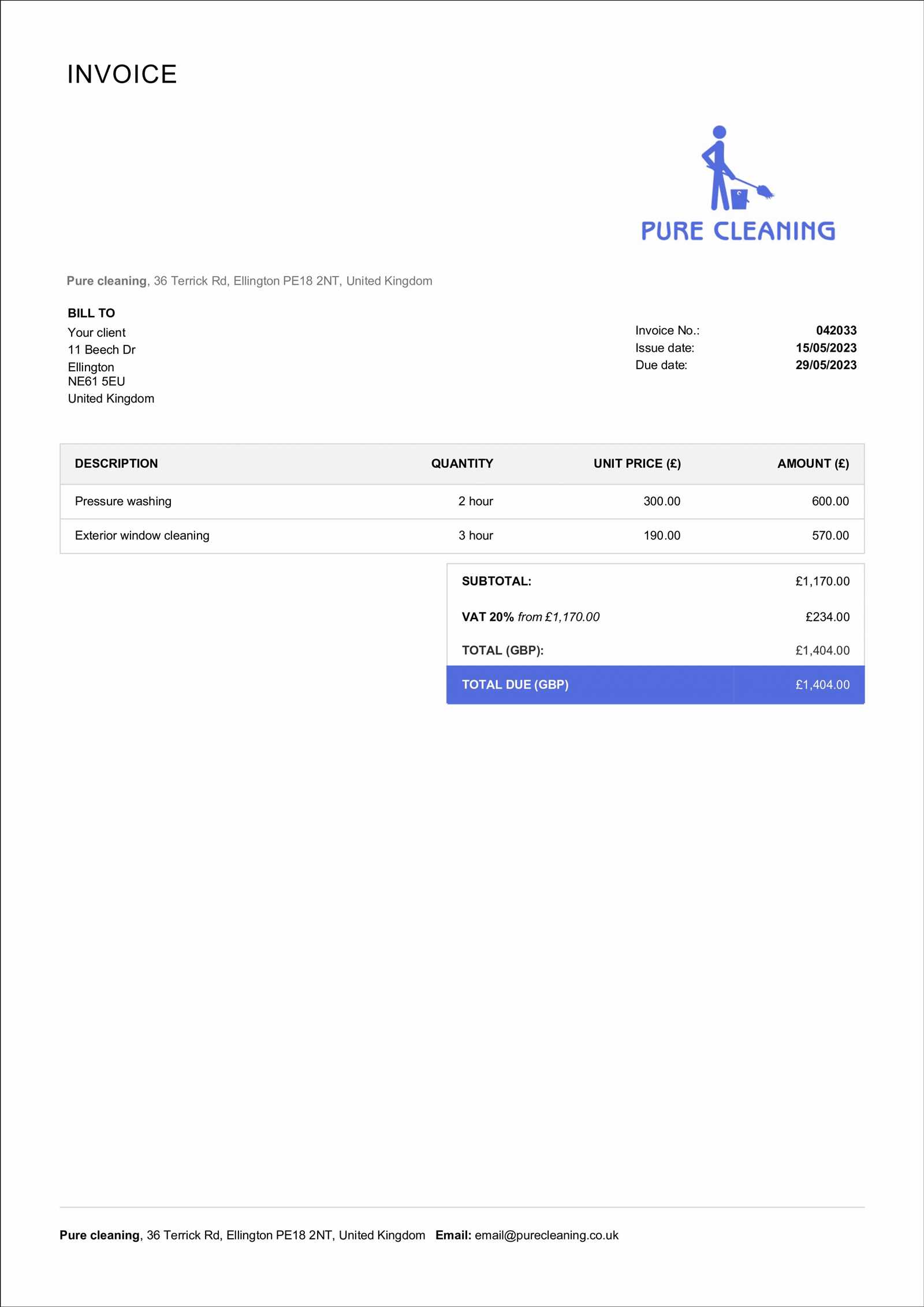

VAT on Goods and Services in the UK

The taxation system in the UK includes a value-added tax (VAT) that applies to most goods and services sold within the country. This tax is added at various stages of production and distribution, with businesses typically passing the cost onto consumers. Understanding the VAT rates, exemptions, and the responsibility for collecting and remitting VAT is essential for businesses operating in the UK. This section outlines the key points about VAT on goods and services in the UK, helping both businesses and individuals navigate the process.

VAT Rates in the UK

The UK applies different VAT rates depending on the type of goods or services being supplied. The standard rate applies to most items, while some goods and services are subject to reduced rates or are completely exempt from VAT. Below are the main VAT rates in the UK:

- Standard Rate: The most common VAT rate of 20%, which applies to most goods and services.

- Reduced Rate: A lower VAT rate of 5%, applied to specific goods and services, such as energy-saving products and children’s car seats.

- Zero Rate: A VAT rate of 0%, applied to goods like food, books, and public transport.

- Exempt: Some goods and services are exempt from VAT altogether, such as financial services and education.

VAT Registration and Compliance

Businesses with taxable turnover above a certain threshold are required to register for VAT. Once registered, they must charge VAT on their sales and can reclaim VAT on their business-related purchases. It’s essential for businesses to keep accurate records and file VAT returns periodically to ensure compliance with the law. Small businesses below the VAT registration threshold may choose to register voluntarily.

Failure to comply with VAT regulations can result in penalties and fines, so understanding the requirements and maintaining proper documentation is crucial for businesses in the UK.

Template Customization for Specific Needs

Adapting documents for specific purposes and requirements is an essential practice in international trade and business transactions. Customizing these documents ensures they accurately represent the information needed for each unique situation, whether for different products, services, or shipping methods. Tailoring a document for particular needs can improve clarity, streamline processes, and help meet legal and regulatory requirements in various regions.

Adjusting for Industry-Specific Requirements

Different industries may require additional information or specific formats to meet regulatory standards or internal needs. For instance, a business in the technology sector may need to include serial numbers or product specifications in a particular layout, while a manufacturer may require detailed descriptions of parts or materials. To ensure compliance and efficient processing, consider incorporating the following:

- Product Descriptions: Clearly list product details such as serial numbers, weight, and model numbers.

- HS Codes: Add harmonized system codes for easy identification of goods for customs clearance.

- Certification Numbers: Include necessary certificates, such as safety or quality control approvals.

Customizing for Different Destinations

When shipping goods internationally, the documentation might need to vary depending on the destination country’s regulations. Tailoring documents based on the destination ensures smoother processing and adherence to local laws. Consider the following when customizing documents for different regions:

- Legal Requirements: Some countries have specific legal requirements for trade documentation, such as additional certifications or specific language needs.

- Tax and Duty Rates: Different countries may have different tax rates or duties, so it’s important to ensure the document reflects these accordingly.

By customizing documents for these needs, businesses can ensure smooth transactions, prevent delays, and enhance communication with customs and other authorities involved in the shipping process.

Storing and Organizing Documents for International Trade

Proper management and organization of trade-related paperwork are crucial for efficient business operations and compliance with regulations. Storing these documents in an orderly manner not only helps businesses stay organized but also ensures they can be easily retrieved when needed, especially during audits or for customs processing. Whether kept digitally or physically, following a structured approach can save time and prevent potential errors.

Digital Storage Solutions

In today’s digital age, many businesses opt for electronic storage due to its accessibility, security, and ease of retrieval. Implementing a digital filing system helps streamline the process of organizing documents, making it easier to maintain and access records. Consider these best practices for digital storage:

- Cloud Storage: Use cloud-based systems to securely store documents online, providing easy access from anywhere.

- Organized Folders: Create a clear folder structure, categorizing documents by year, type of transaction, or destination.

- Backup Systems: Regularly back up files to prevent loss of data due to system failures or technical issues.

Physical Document Organization

For businesses that still rely on physical records, it is important to maintain a tidy and secure filing system. Proper organization of hard copies ensures that documents can be easily located when required. Here are some tips for physical document storage:

- File Cabinets: Use labeled file cabinets with separate sections for each category, such as invoices, receipts, and contracts.

- Filing by Date: Sort documents chronologically to make tracking and retrieval easier.

- Secure Storage: Store sensitive documents in a secure location, ensuring they are protected from unauthorized access or damage.

Whether opting for digital or physical storage, keeping documents well-organized is essential for businesses involved in international trade. A well-structured system minimizes the risk of misplacing important paperwork and ensures compliance with legal and financial requirements.

How Shipping Documentation Impacts Delivery Speed

Shipping paperwork plays a crucial role in ensuring the smooth and timely movement of goods across borders. Accurate and complete documentation can either accelerate the shipping process or cause unnecessary delays. Proper preparation of these documents ensures that shipments comply with regulations and pass through necessary checks without complications, ultimately influencing how quickly goods reach their destination.

Key Factors That Affect Shipping Speed

Several elements related to shipping documentation can either facilitate or hinder the transit of goods. Here’s how they impact delivery times:

- Accuracy of Information: If the details provided on the shipping documents are incorrect or incomplete, shipments can be delayed due to the need for corrections or further verification.

- Completeness of Required Documentation: Missing documents or failure to include all necessary details can result in shipments being held for inspection or returned for clarification, which adds to the overall shipping time.

- Clearance Procedures: Properly prepared documents enable quicker processing during customs checks, reducing the time a shipment spends waiting for approval and inspection.

Best Practices for Speeding Up the Process

To avoid delays and ensure a fast shipping experience, it’s important to follow these best practices for preparing shipping paperwork:

- Double-Check Details: Verify that all the required information, such as the description of goods, values, and shipping terms, is accurate and complete.

- Use Digital Filing Systems: Digital records allow for quick access to documents and enable faster submissions, reducing the time spent on paperwork processing.

- Familiarize with Regulations: Understand the specific documentation requirements for your destination country to avoid missing key information that could slow down the process.

Properly managing shipping documents can make a significant difference in delivery timelines. Ensuring the accuracy, completeness, and timely submission of required paperwork helps prevent delays and accelerates the customs clearance process, leading to faster shipping overall.