Effective Customer Invoice Email Template for Clear Communication

Clear and professional communication is essential when managing financial transactions. Whether you’re dealing with a one-time sale or an ongoing partnership, conveying payment details accurately and politely plays a crucial role in maintaining positive relationships. A well-crafted message can help avoid confusion and delays, ensuring that both parties are aligned on terms and expectations.

In today’s fast-paced business world, the way you present billing information can influence how quickly payments are processed. A thoughtfully structured message not only provides essential details, but also reflects your professionalism and reliability. By following best practices for tone, content, and design, you can make this process smoother for both you and your clients.

Crafting the right message requires understanding your audience and delivering information in a straightforward yet courteous manner. It’s important to be clear about amounts, due dates, and payment methods, while also making sure the message remains friendly and approachable. Whether you’re sending a reminder or an initial request, getting the balance right is key to fostering trust and ensuring timely payments.

Understanding the Importance of Invoice Emails

Effective communication in financial transactions is a cornerstone of any successful business. When it comes to billing, ensuring that all relevant information reaches the right person in a clear and professional manner can make a significant difference in timely payments and overall client satisfaction. A well-structured message ensures that both parties are on the same page regarding amounts, deadlines, and payment methods.

These messages not only serve as reminders but also reinforce your credibility and professionalism. When properly crafted, they can help avoid misunderstandings and foster a positive relationship between you and your clients. The importance of this communication cannot be overstated, as it directly impacts cash flow and the overall efficiency of your business operations.

- Clarity and Precision: Clear communication about payment details helps clients understand exactly what is due and when, reducing confusion.

- Timeliness: Sending a prompt message ensures that the payment process begins on time, preventing unnecessary delays.

- Professionalism: A formal yet friendly tone conveys that you take your business seriously, enhancing your reputation.

- Record Keeping: These messages serve as written documentation of financial agreements and requests, which can be referenced later.

By giving attention to the content and structure of these communications, businesses can ensure smooth transactions and maintain strong, trust-based client relationships. They are not just about requesting funds but also about presenting your business in a responsible, organized, and efficient light.

Why a Professional Invoice Email Matters

In any business transaction, the way financial requests are communicated plays a significant role in shaping your professional image. A well-composed message that outlines payment expectations not only conveys essential details but also reinforces trust and reliability. A professional tone demonstrates that your business operates with transparency and efficiency, which can lead to smoother interactions and quicker payments.

When the financial aspect of a relationship is handled in a formal, yet approachable way, it shows respect for both parties involved. Clients are more likely to respond positively when they feel the communication is clear, polite, and precise. The ability to communicate these details professionally can make the difference between a prompt settlement and a delayed payment.

- Establishes Trust: A professional message demonstrates your commitment to clear communication and reliability, building confidence with your clients.

- Reduces Misunderstandings: By clearly outlining terms and expectations, you decrease the likelihood of confusion or disputes.

- Enhances Business Image: A well-crafted message reflects the quality of your business practices, showing that you value attention to detail.

- Encourages Timely Payments: Clients are more likely to settle bills promptly when they are presented with professional and organized financial requests.

- Prevents Delays: A professional approach can help avoid the common pitfalls of unclear or poorly structured communication, which often leads to payment delays.

In summary, treating financial communications with the same professionalism as any other aspect of your business can greatly influence your relationship with clients and the efficiency of your payment processes.

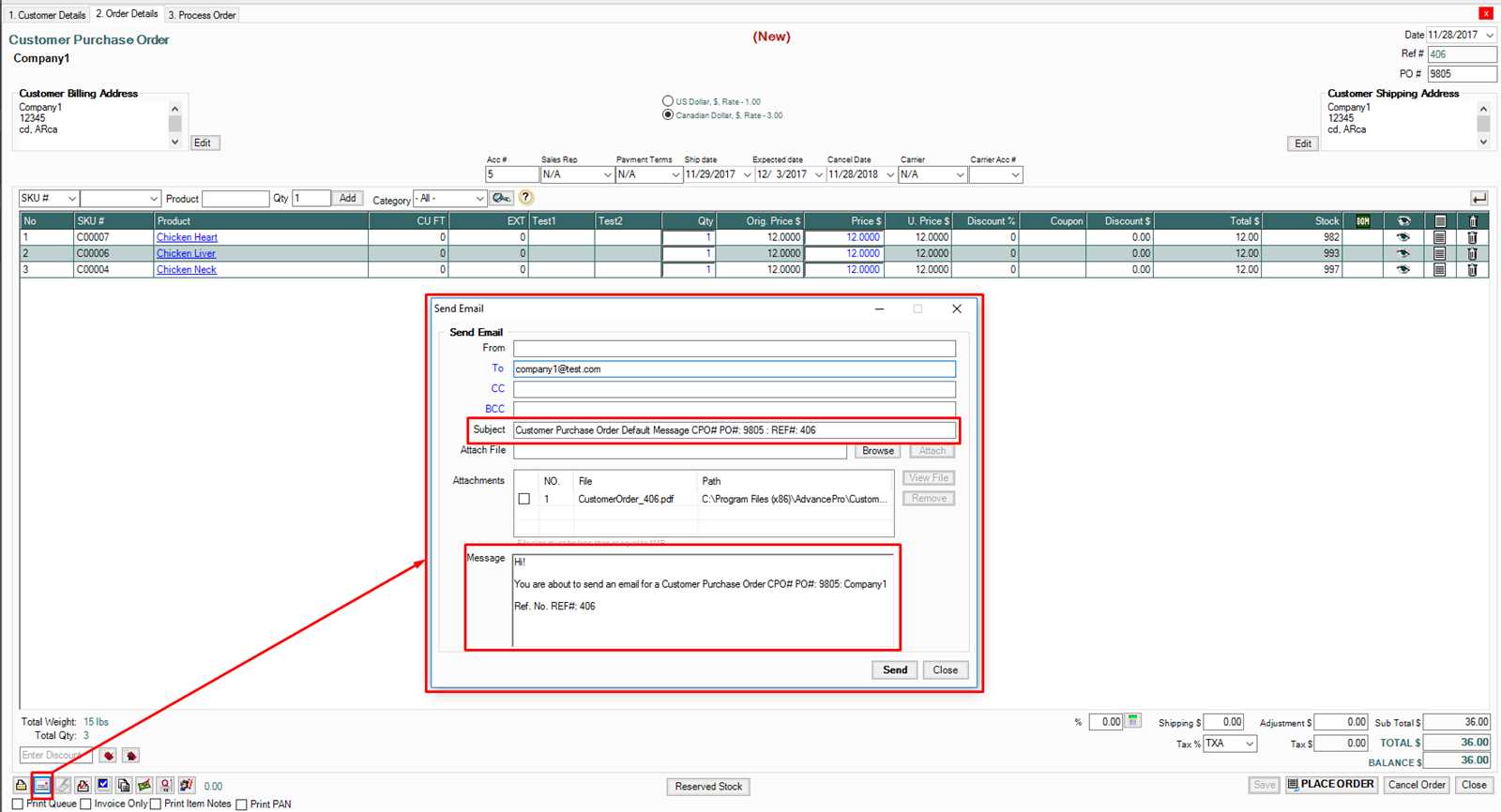

How to Write an Effective Invoice Email

Writing a clear and professional message for financial transactions is essential for maintaining smooth business operations. A well-crafted note that outlines payment details helps ensure both parties are on the same page and minimizes confusion. The goal is to communicate all necessary information in a concise, polite, and straightforward manner, encouraging timely action while also fostering trust and professionalism.

Key Elements of an Effective Payment Request

To write a message that gets results, it’s important to include the following elements:

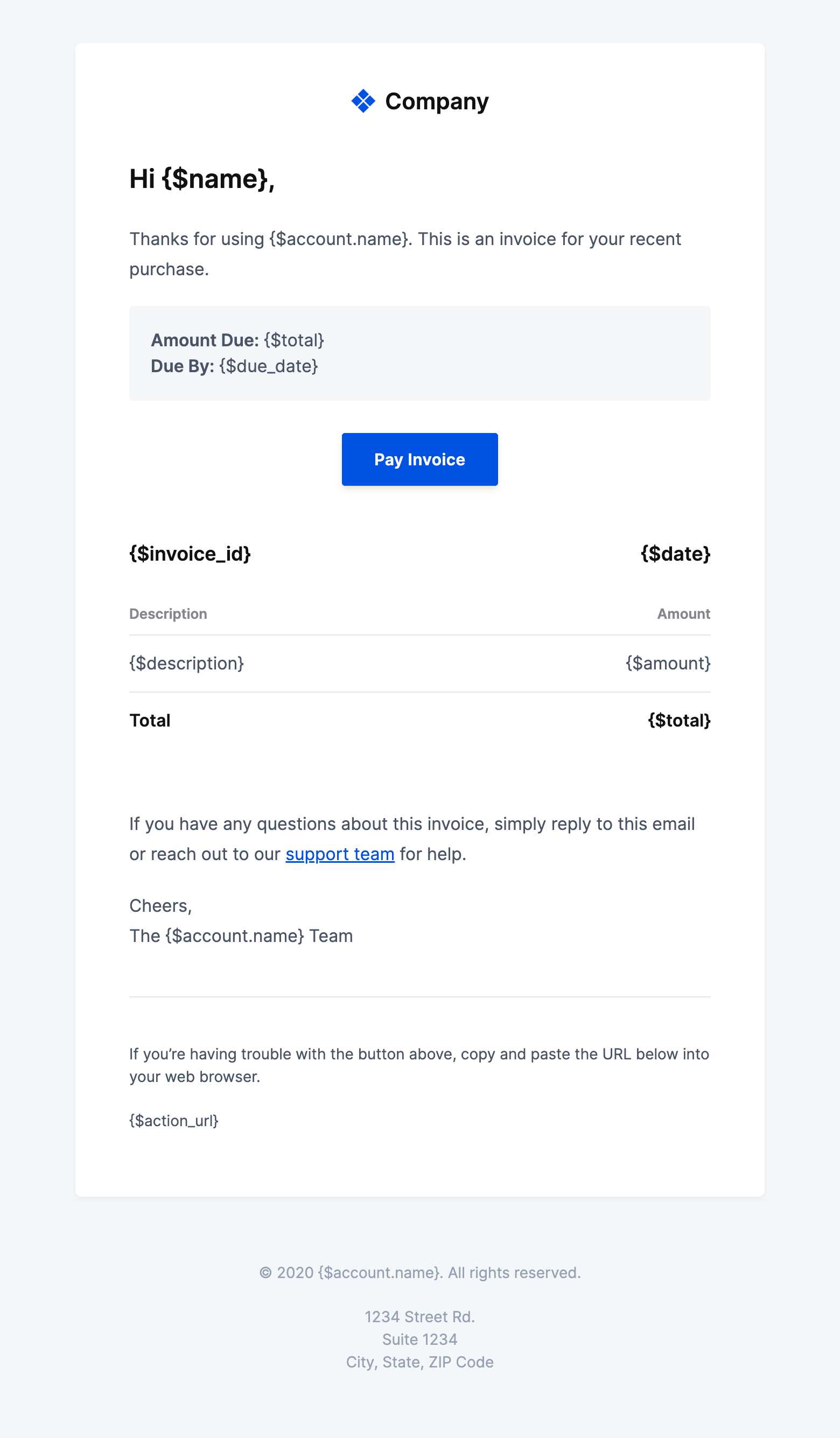

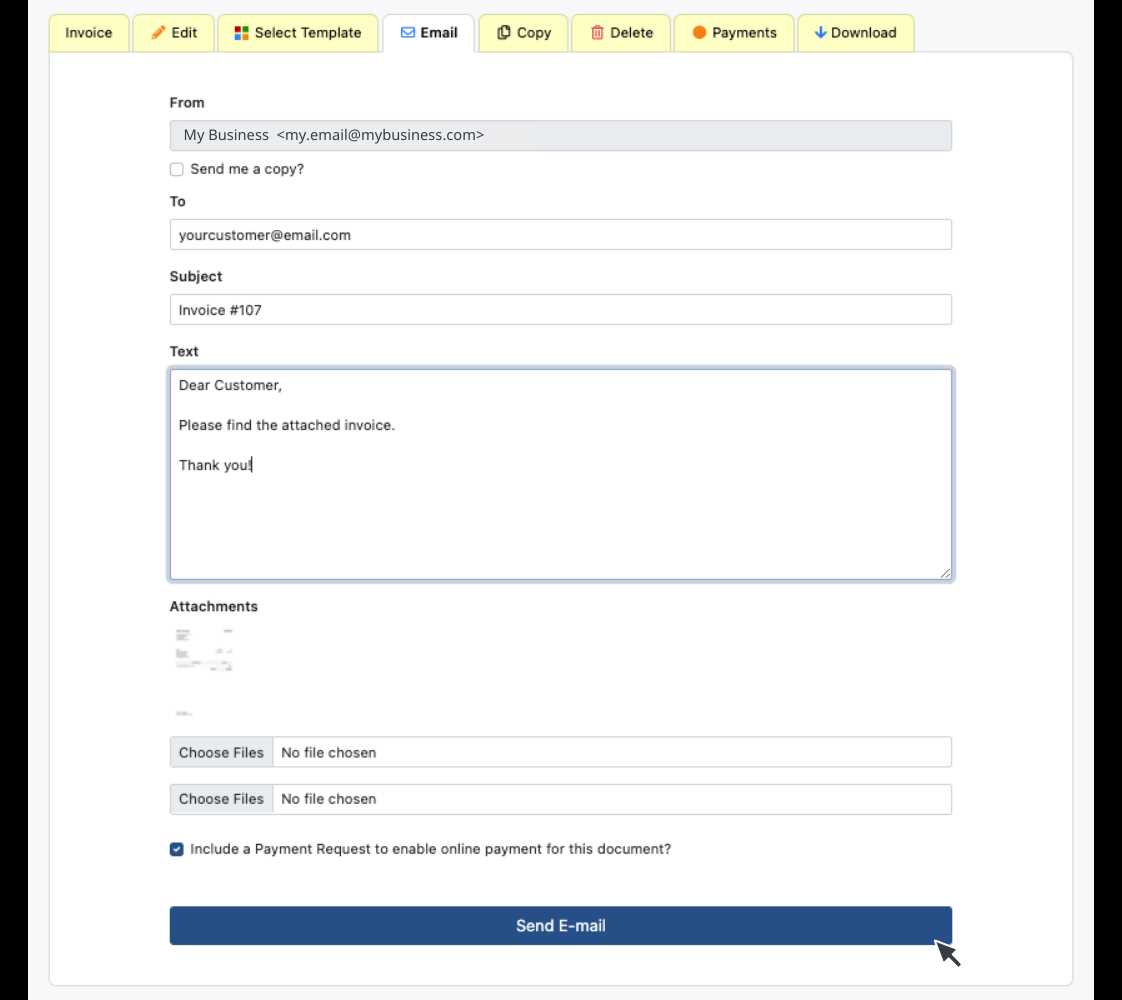

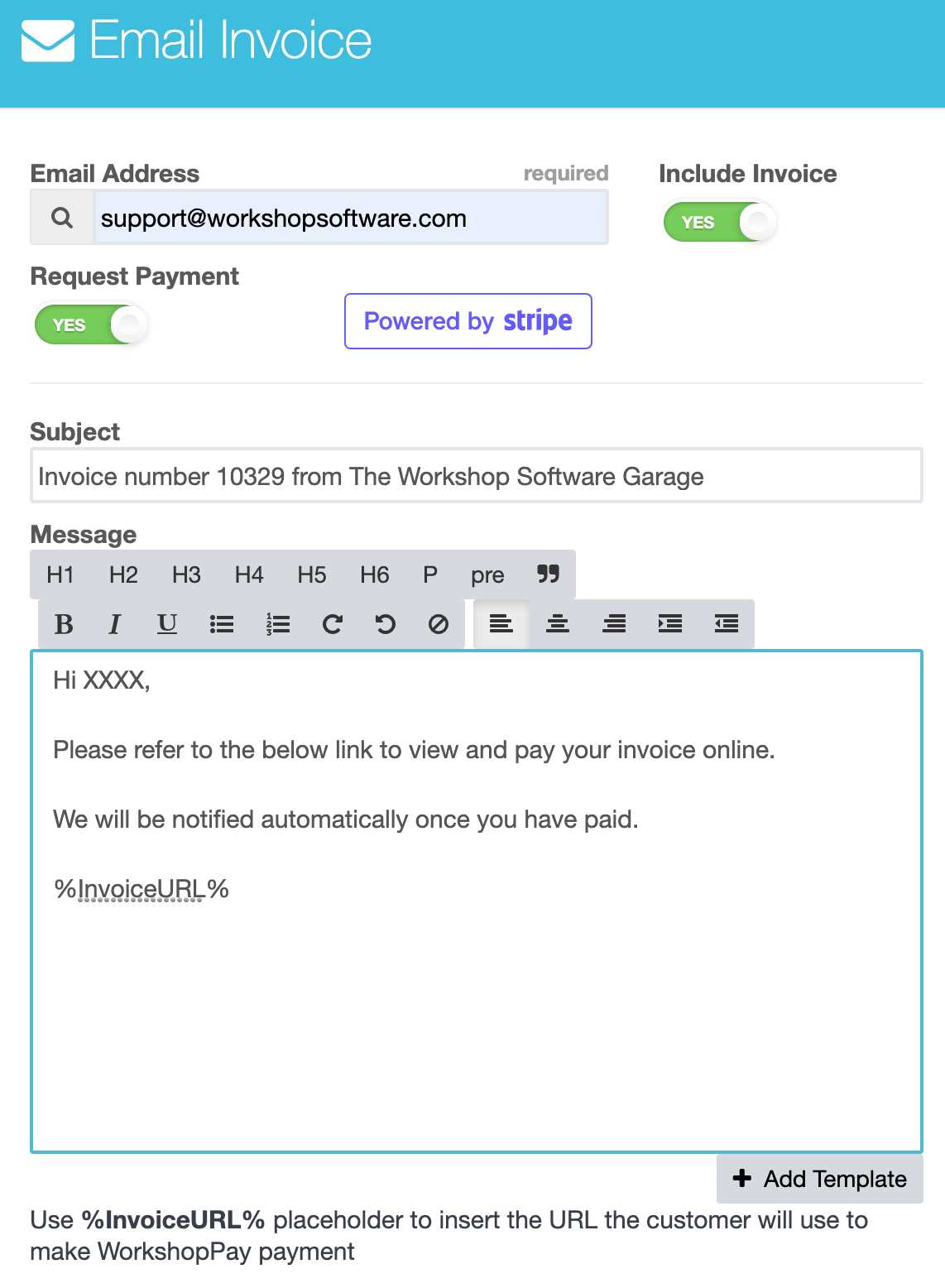

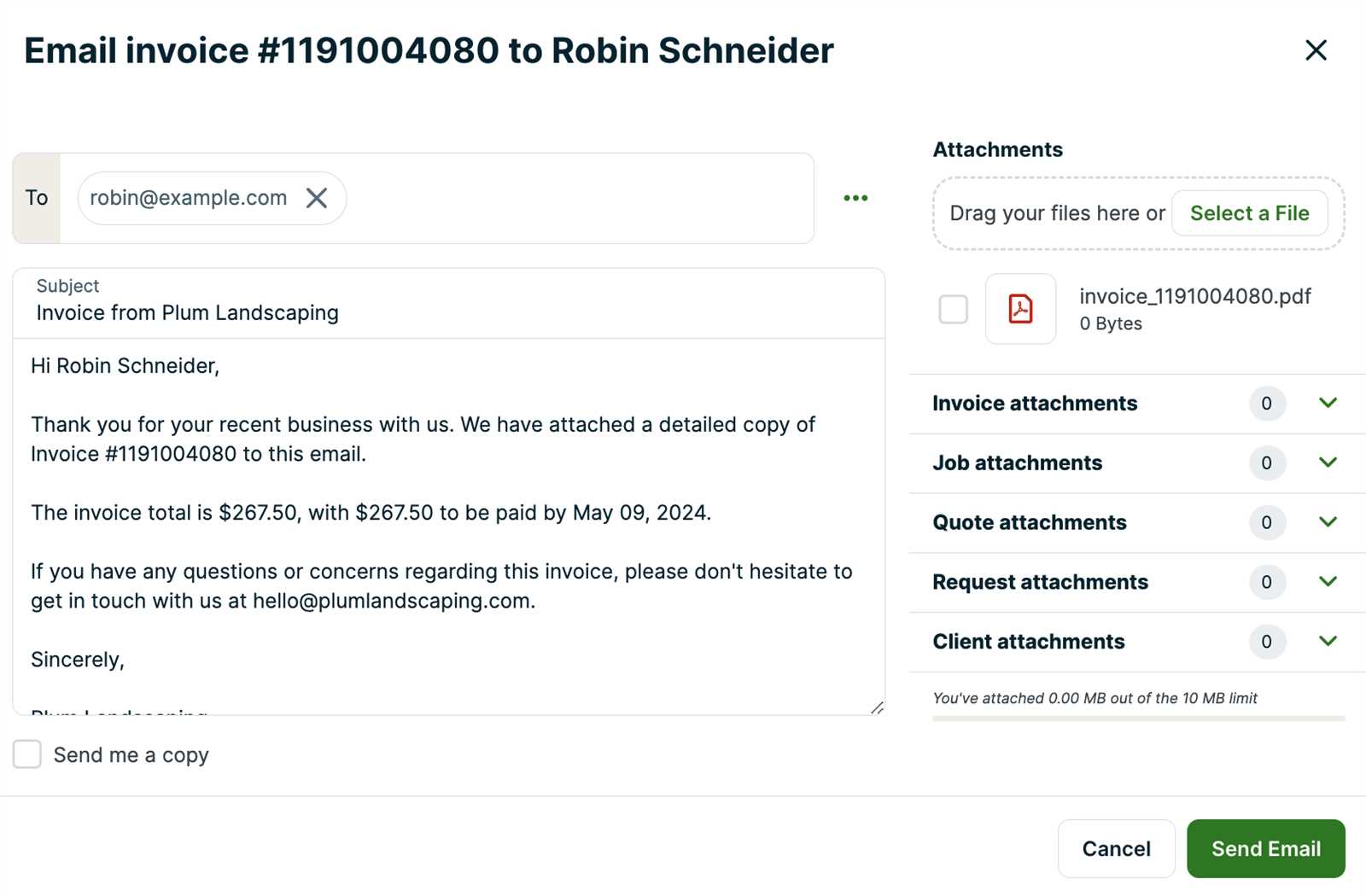

- Subject Line: Make the subject direct and informative, so the recipient understands the purpose of the message at a glance.

- Greeting: Always address the recipient politely, using their name if possible.

- Clear Payment Details: State the amount due, the payment deadline, and the accepted methods of payment clearly and prominently.

- Contact Information: Provide your contact details for any questions or concerns related to the payment.

- Friendly Tone: Even though the message is business-related, keep the tone warm and respectful to maintain a positive relationship.

Formatting and Design Tips

In addition to the content, the layout and presentation of the message can make a significant impact:

- Simple and Organized: Use bullet points or short paragraphs to break up the text, making it easier to read and understand.

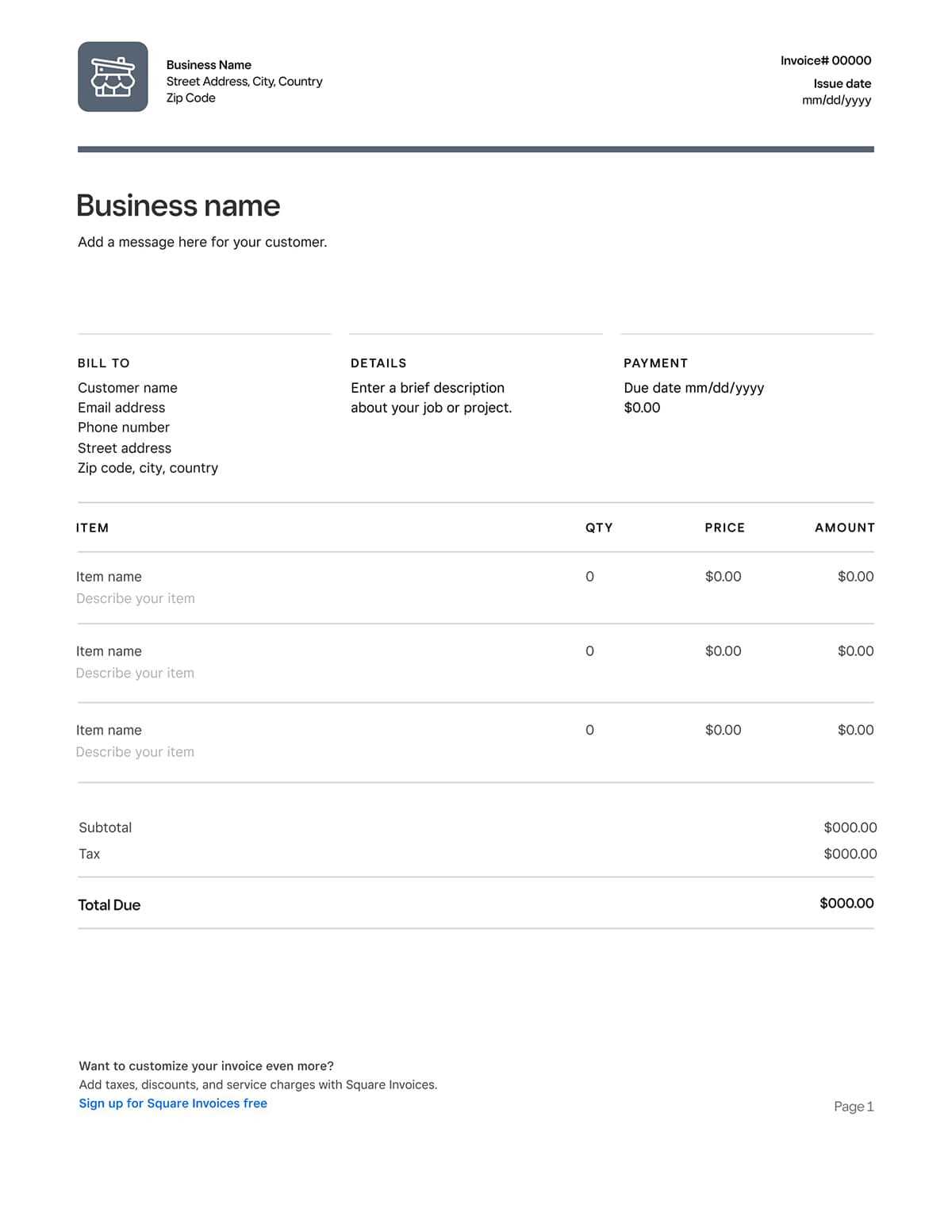

- Branding: If possible, incorporate your company’s logo or other visual elements to make the message look professional and align with your brand identity.

- Call to Action: Be sure to include a clear request for action, such as “Please make payment by [due date]” or “Let us know if you have any questions.”

By following these guidelines, you can ensure that your payment requests are both effective and professional, helping you maintain strong client relationships and prompt payments.

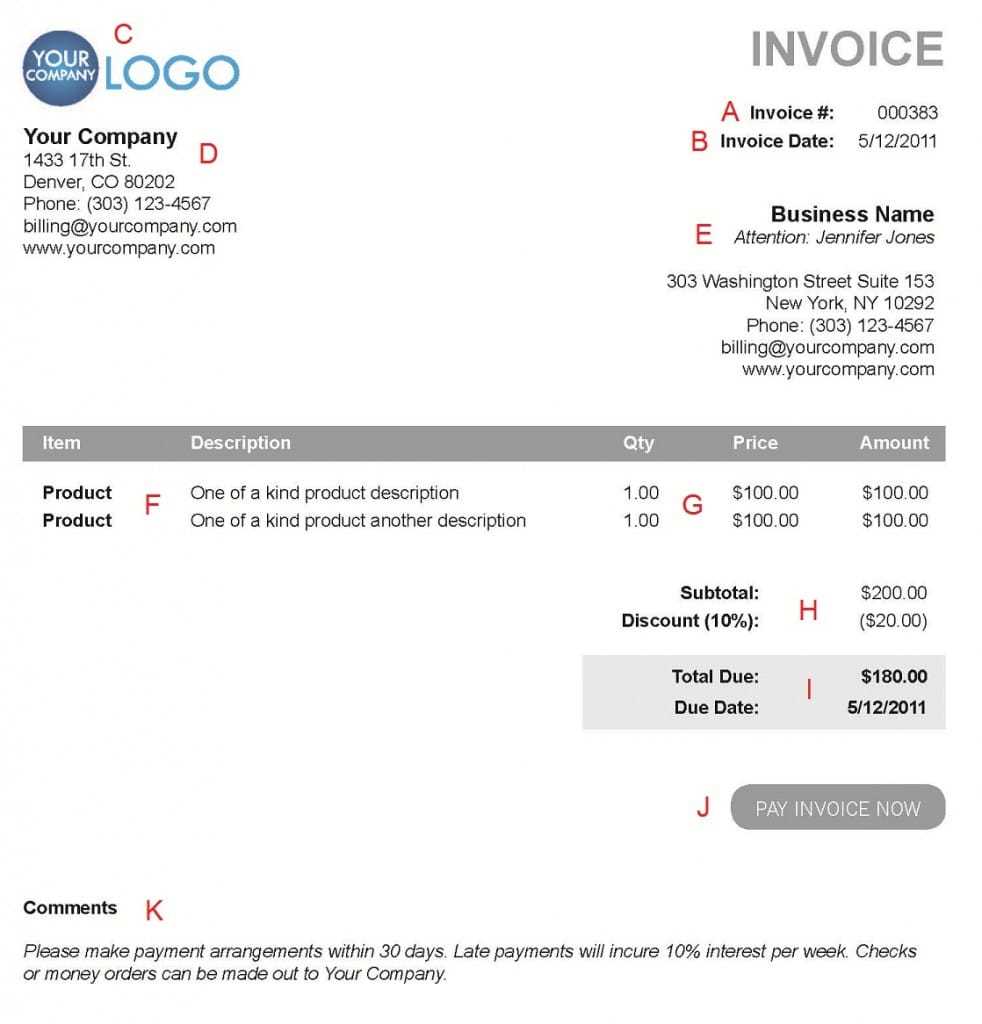

Key Components of a Payment Request Message

For a payment request to be clear and effective, it must contain several critical elements that provide all the necessary details without overwhelming the recipient. The message should be structured in a way that makes it easy for the recipient to understand the amount due, the payment deadline, and how to proceed. Ensuring that these components are included will help maintain professionalism and reduce the chances of delays or misunderstandings.

Essential Details to Include:

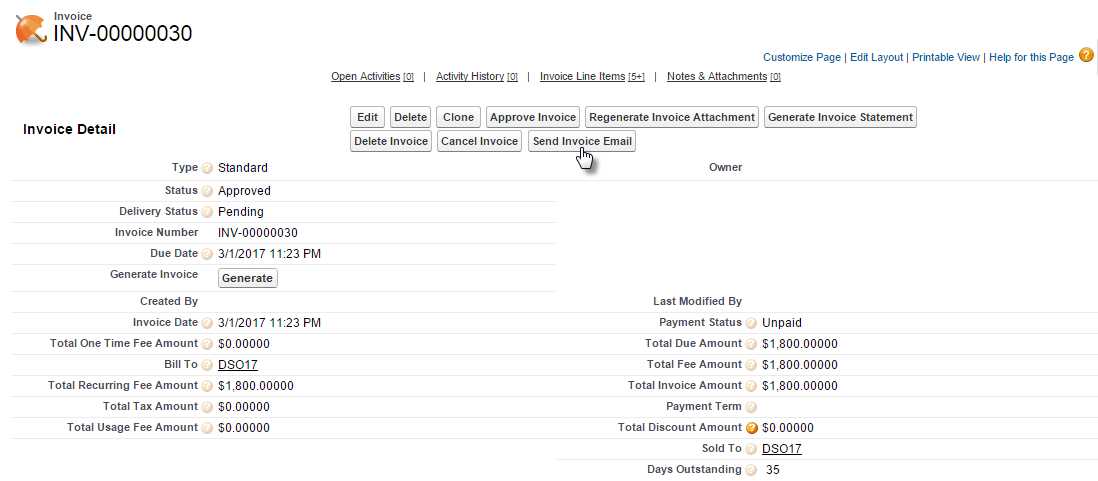

- Subject Line: A concise subject line that clearly indicates the purpose of the message, such as “Payment Due for [Service/Product Name].” This ensures the recipient knows exactly what to expect when opening the message.

- Salutation: Start with a polite greeting that addresses the recipient personally. This helps set a positive tone from the outset.

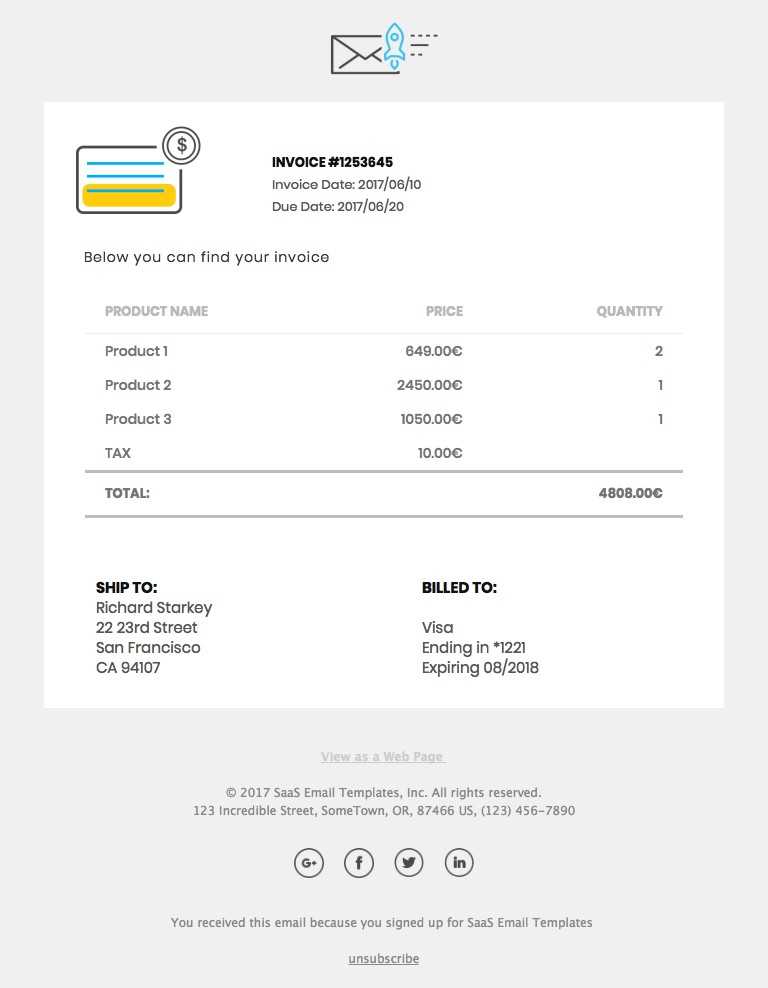

- Invoice Reference or Number: Always include a unique reference or number to help the recipient identify the payment request quickly, especially if they need to refer to it later.

- Payment Amount: Clearly state the total amount due. Make sure to break it down if there are multiple items or charges involved, so the recipient knows exactly what they are paying for.

- Payment Due Date: Specify the exact date by which the payment should be made. If you are sending a reminder, be sure to mention the original due date to encourage prompt action.

- Accepted Payment Methods: List the available payment options (e.g., bank transfer, credit card, online payment portal) to provide the recipient with choices that are convenient for them.

- Contact Information: Offer a way for the recipient to reach out in case of questions or issues. This could include a phone number or email address for customer support or billing inquiries.

- Polite Closing: End with a courteous closing, expressing appreciation for the recipient’s attention to the matter. This leaves a positive impression and maintains good relations.

Including these key elements in your payment request message will ensure clarity and professionalism, fostering better communication and encouraging timely payments.

Best Practices for Sending Invoice Emails

To ensure that financial communications are efficient and lead to timely payments, it’s important to follow a set of best practices when sending out payment requests. Clear, professional, and well-timed messages can help streamline the process, reduce errors, and maintain good relationships with clients. These practices focus on structure, timing, and clarity, making it easier for the recipient to respond promptly.

- Send Promptly: Always send your payment requests as soon as possible after the service is rendered or the product is delivered. Sending it early gives the recipient enough time to review and process the payment.

- Use a Clear and Direct Subject Line: The subject line should instantly convey the purpose of the message. For example, “Payment Due for [Service/Product Name] – Due Date [MM/DD/YYYY].” This helps recipients prioritize and address the matter quickly.

- Personalize the Message: Address the recipient by name and include specific details about the transaction. Personalized communication builds rapport and makes the request feel more direct and important.

- Maintain a Professional Tone: Even though the message is about payment, keep the tone friendly but formal. Avoid using overly casual language or demands, as this can come across as unprofessional.

- Include All Relevant Details: Ensure that all necessary information is clearly laid out, such as payment amount, due date, and available payment methods. Avoid the use of jargon or overly complicated language that may confuse the recipient.

- Follow Up If Necessary: If payment has not been made by the due date, send a gentle reminder. Make sure your follow-up message maintains a polite tone and provides any additional information the recipient may need to complete the payment.

- Double-Check for Accuracy: Before sending the message, carefully review all information for accuracy, including payment amounts, dates, and contact details. Errors in these areas can lead to confusion and delays in payment.

- Provide Easy Payme

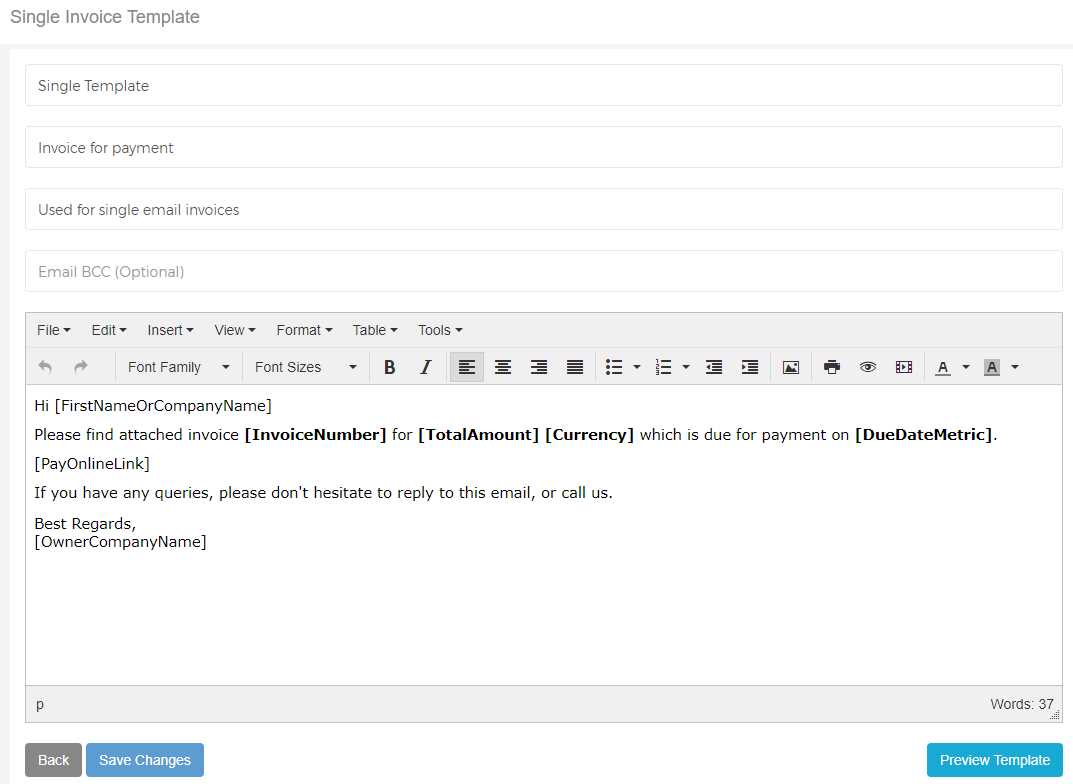

Customizing Your Payment Request Message

Personalizing your financial communication is a key step in building stronger relationships with clients and ensuring that payment requests are well-received. Tailoring your messages allows you to align with your brand’s voice, address clients specifically, and provide relevant details that will make the process clearer and smoother for both parties. Customization adds a personal touch, which can encourage quicker responses and create a more positive impression.

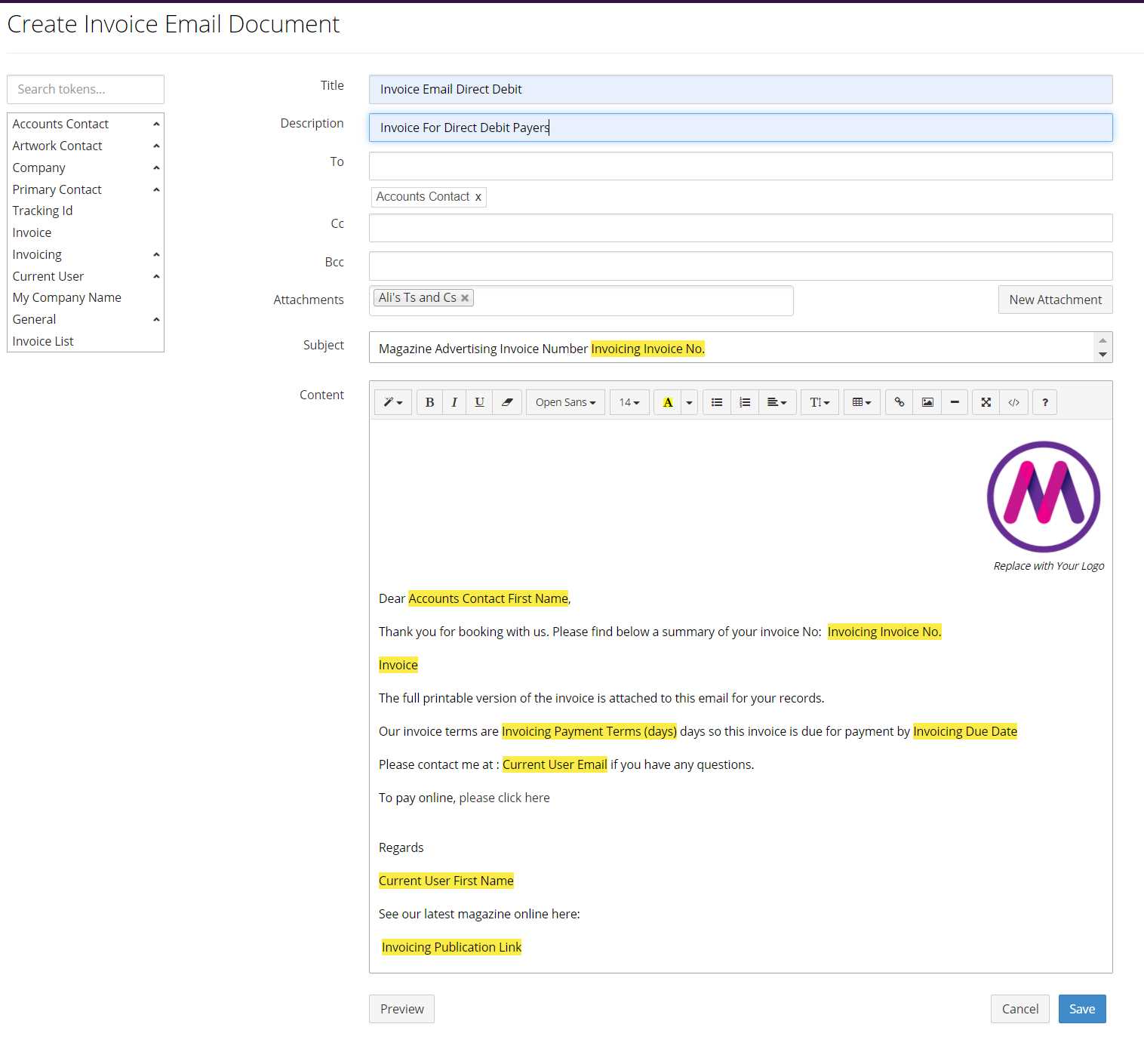

There are several elements you can adjust to make your payment request message more effective and aligned with your business’s style and the recipient’s needs:

- Branding and Design: Incorporate your company’s logo, colors, and fonts to make the message instantly recognizable and consistent with your other communications. This adds a level of professionalism and reinforces your brand identity.

- Personalized Greetings: Address the recipient by name and refer to any specific transactions or services. A personalized greeting makes the message feel more direct and less like a generic reminder.

- Clear and Relevant Details: Ensure the message includes only the most relevant information for that particular recipient. For example, highlight specific products, services, or charges that apply to them, rather than using generic terms that may not be as relevant.

- Adjusting the Tone: Depending on your relationship with the recipient, you may choose to modify the tone. For example, a more casual and friendly tone may be appropriate for long-term clients, while a more formal approach might be needed for first-time transactions.

- Payment Instructions and Links: Make the payment process as easy as possible by including direct links to payment portals or clear instructions on how to proceed. You can even add multiple options if your business accepts different forms of payment.

- Adding Reminders and Follow-Ups: Customize the message to include payment reminders based on the due date. For clients who need more time, offer a follow-up message that is polite and professional, reiterating important information like payment options and deadlines.

- Incorporate Additional Information: If necessary, add attachments or links to relevant documents, such as receipts, contracts, or service agreements, so that the recipient can reference them easily.

By customizing your payment request messages, you not only streamline the process but also improve the likelihood of timely payments and foster stronger, more personal connections with your clients.

How to Avoid Common Invoice Email Mistakes

When sending financial requests, even small errors can lead to confusion, delays, or strained relationships with clients. It’s crucial to ensure that your communication is clear, professional, and accurate. By being mindful of common mistakes and taking steps to avoid them, you can improve the efficiency of your billing process and maintain positive interactions with your clients.

Common Errors to Watch Out For

Here are some of the most frequent mistakes when sending payment requests, along with tips for avoiding them:

- Missing or Incorrect Details: Failing to include the correct payment amount, due date, or service details can create confusion and delays. Always double-check your figures and ensure that the message contains all the necessary information.

- Unclear Payment Instructions: If payment instructions are vague or difficult to follow, clients may delay their payment or make mistakes. Be specific about how and where the payment should be made, and provide links to payment portals if possible.

- Too Casual or Too Formal Tone: The tone of your communication should reflect your business relationship. A message that’s too casual may seem unprofessional, while one that’s overly formal may feel cold and distant. Striking the right balance is key to maintaining a positive interaction.

- Sending Without Proofreading: Spelling mistakes or grammatical errors can detract from the professionalism of your message and cause confusion. Always proofread your request before sending it to ensure everything is clear and correct.

- Failure to Personalize: Using generic language or a template without customization can make the recipient feel like just another name on a list. Personalizing the message with the recipient’s name, transaction details, and specific payment information makes the communication feel more relevant and valued.

Tips for Clear and Professional Communication

To avoid these common pitfalls, follow these best practices:

- Review All Details: Before sending, double-check the payment amount, due date, and any attached documents to ensure everything is accurate and up-to-date.

- Use Clear and Simple Language: Avoid jargon or overly complicated terms. Keep your instructions easy to follow and direct.

- Proofread Your Message: Check for typos, incorrect punctuation, or any unclear wording that might lead to misunderstandings.

- Follow Up Politely: If you haven’t received payment by the due d

Choosing the Right Tone for Payment Request Messages

The tone you use in your financial communication plays a crucial role in shaping how the recipient perceives the message and your business. Striking the right balance between professionalism and approachability can encourage a timely response while maintaining a positive relationship. Whether you’re sending a first request or a follow-up, the tone sets the stage for how the recipient engages with the payment process.

Choosing an appropriate tone depends on factors such as your relationship with the recipient, the context of the transaction, and your company’s brand identity. A tone that is too harsh or demanding may lead to a negative response, while one that is too casual could undermine the seriousness of the request.

- Formal and Polite: If you’re dealing with a new client or a formal business relationship, it’s important to maintain a professional tone. Keep the language respectful, and avoid using overly casual expressions or slang.

- Friendly but Professional: For long-term clients or those you have an established rapport with, a friendly, yet respectful tone is appropriate. This approach encourages a positive response while still conveying the importance of timely payment.

- Neutral and Direct: When the payment is overdue, a neutral and direct tone is often the most effective. Avoid being overly harsh or aggressive, but make it clear that the payment is due and needs to be addressed.

- Empathetic: In situations where there may have been an issue with payment or the client is facing financial difficulties, a more understanding tone is key. Acknowledge any potential issues and offer assistance, showing that you’re willing to work with the client.

Finding the right tone is not just about choosing words–it’s about communicating respect and clarity while encouraging action. Adjust your tone based on the recipient and situation, and always aim for a tone that reflects your business’s professionalism and commitment to positive, long-term relationships.

How to Handle Late Payments in Payment Request Messages

Late payments can be a common challenge in business, but addressing them effectively through clear, polite communication can help maintain good relationships while ensuring that your business gets paid. How you approach the situation in your financial messages can influence whether the payment is received promptly or if further delays occur. It’s important to strike a balance between being firm about the payment while still maintaining professionalism and respect for the recipient.

When addressing overdue payments, it’s essential to remain courteous but assertive. The tone should encourage swift action without sounding aggressive, and it should offer a solution or assistance if needed. Here are some strategies for handling late payments effectively:

- Send a Gentle Reminder: After the payment due date has passed, send a polite follow-up message. Acknowledge that the client may have simply overlooked the due date and provide clear details about the outstanding amount and deadline.

- Be Clear About the Consequences: If the payment continues to be delayed, let the recipient know that there will be consequences, such as late fees or the suspension of services. Be firm, but still polite and professional in your tone.

- Offer Payment Options: Sometimes, clients miss payments due to financial difficulties. In these cases, consider offering alternative payment methods or extending the payment deadline. This can foster goodwill and demonstrate flexibility.

- Set a New Deadline: When sending reminders, always specify a new deadline for payment. This reinforces urgency and gives the recipient a clear timeframe for resolving the matter.

- Maintain a Professional Tone: While it may be frustrating to deal with late payments, it’s important to keep your communication courteous and professional. Avoid using language that might come off as accusatory or confrontational.

By handling overdue payments with professionalism and tact, you ensure that your business remains respectful and reliable while still protecting its interests. Clear, respectful communication is key to maintaining strong relationships with clients, even in challenging situations.

Adding Payment Instructions to Payment Request Messages

Clear and straightforward payment instructions are crucial for ensuring that recipients can easily process payments without confusion. By including simple and concise guidelines, you make it easier for clients to understand how to fulfill their financial obligations, which can lead to faster and more accurate payments. Providing clear instructions can also help minimize errors and reduce the need for follow-up messages.

Key Elements of Payment Instructions

When adding payment instructions to your message, ensure that the information is easy to follow and covers all necessary details. Here are the essential components to include:

- Accepted Payment Methods: Specify which payment methods are available (e.g., credit card, bank transfer, PayPal, check). This allows the recipient to choose the most convenient option for them.

- Payment Portal Links: If you’re using an online payment portal, include a direct link to make the payment process as simple as possible. This minimizes the chance of delays due to navigational difficulties.

- Banking Details: If payments need to be made via bank transfer, provide clear banking details, including account number, routing number, and any other relevant information. Make sure these details are accurate and easy to read.

- Instructions for Payment Confirmation: Let the recipient know if there is any additional step to confirm payment, such as sending a payment receipt or reference number once the payment has been made.

- Currency and Amount: Clearly specify the amount due and the currency in which the payment should be made, especially for international transactions. This avoids confusion over exchange rates or incorrect amounts.

Formatting Tips for Clarity

To ensure the instructions are easily understood, follow these formatting tips:

- Bullet Points: Break down complex payment instructions into bullet points for quick readability. This makes it easier for the recipient to follow each step.

- Highlight Important Details: Use bold or italics to emphasize crucial information, such as the payment deadline, the total amount due, or the payment method.

- Concise Language: Avoid jargon and keep the language simple. Use clear, direct sentences that make it easy for anyone to understand how to complete the payment.

By adding clear and comprehensive payment instructions, you create a smoother, more efficient process for your clients, reducing the chance of errors or delays and encouraging faster payments.

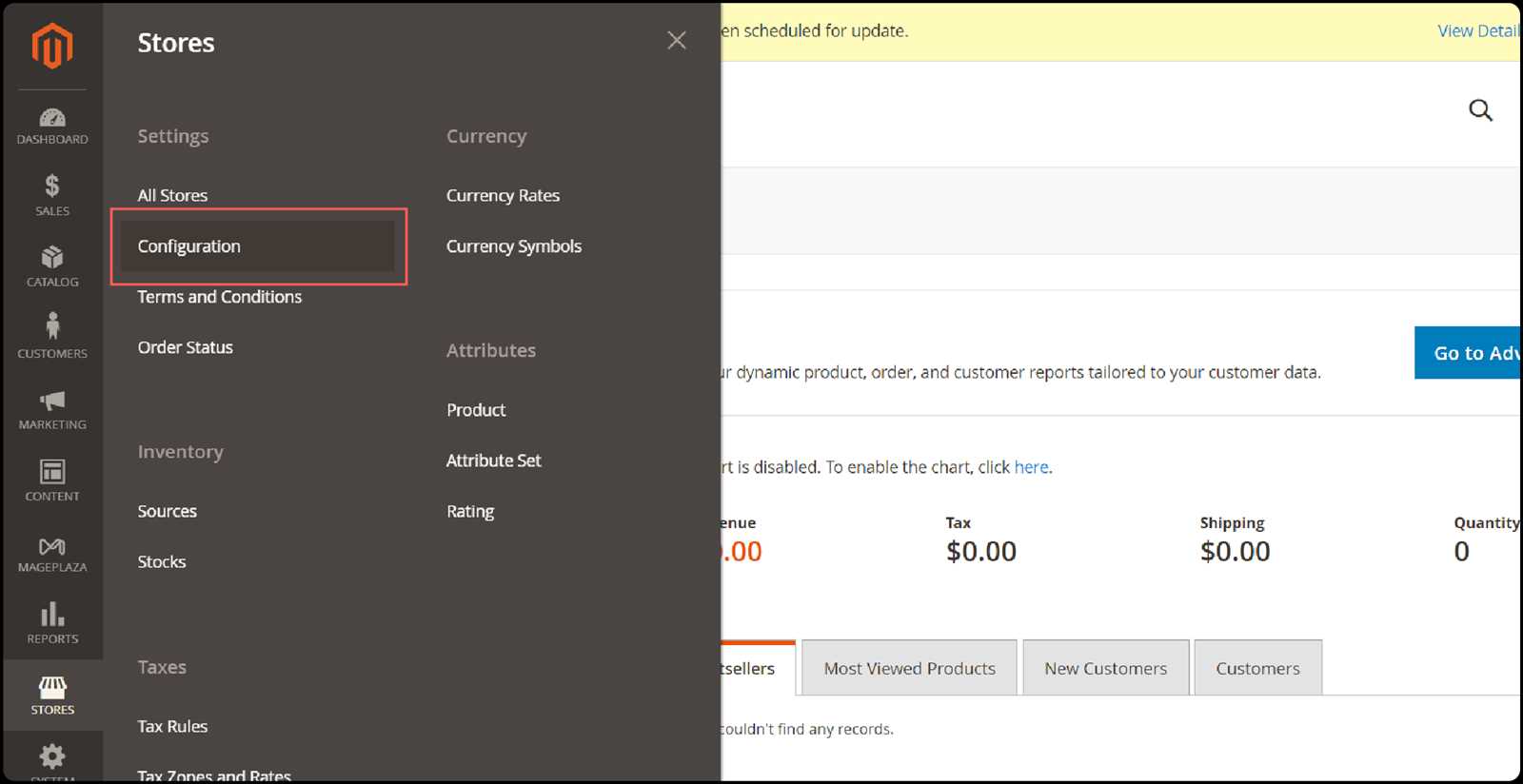

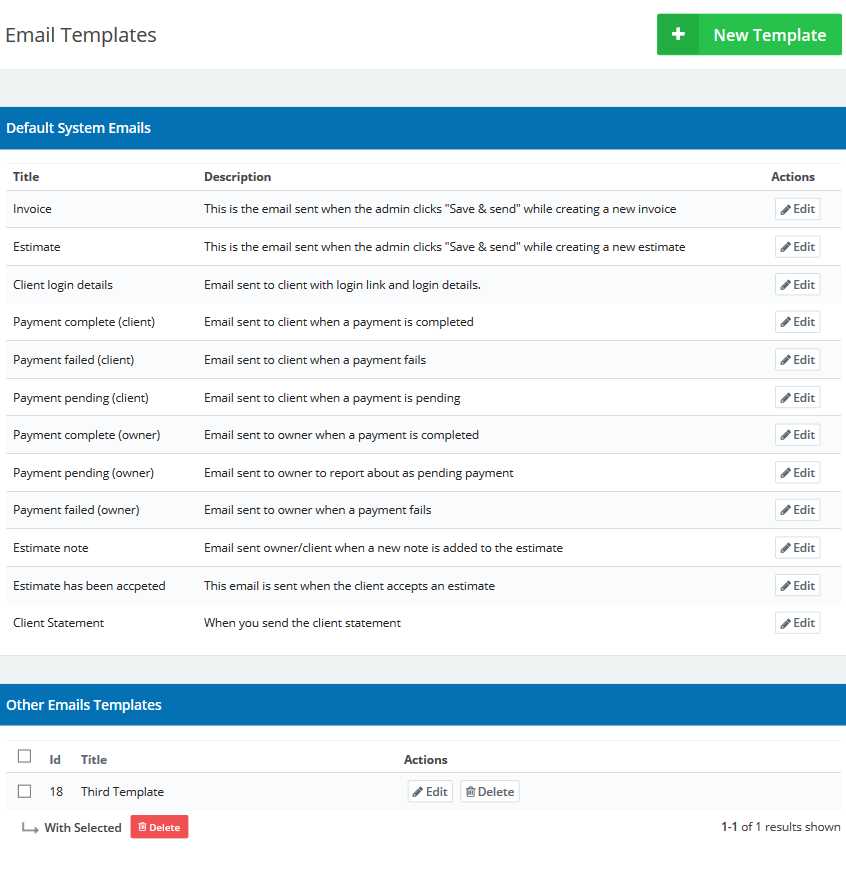

How to Automate Payment Request Messages for Efficiency

Automating the process of sending payment reminders and requests can significantly streamline your workflow, save time, and reduce the chances of human error. By setting up automated systems, you can ensure that clients receive timely, accurate notifications about payments without needing to send them manually each time. This approach not only improves efficiency but also creates a more professional and consistent experience for your clients.

Steps to Automate Payment Request Messages

To automate the process effectively, follow these key steps:

- Choose an Automation Tool: Select a software or platform that integrates with your existing invoicing or accounting system. Many platforms, such as QuickBooks, FreshBooks, and Xero, offer built-in automation features for generating and sending payment reminders.

- Set Up Payment Reminders: Create automated reminders that are sent at specific intervals, such as a few days before the payment is due, on the due date, and after the due date if payment has not been received. These reminders can be customized based on your preferred schedule.

- Personalize Messages: Although the process is automated, ensure that each message feels personalized. Many tools allow you to insert the recipient’s name, invoice details, and payment information automatically into the message, making it feel less generic.

- Define Trigger Points: Set up trigger points that automatically send messages when certain conditions are met, such as when a payment is due or when the payment deadline has passed. This ensures timely and relevant communication with minimal manual intervention.

Benefits of Automating Payment Requests

Automating your payment request process offers several advantages:

- Time-Saving: Automation eliminates the need for manual follow-ups, freeing up your time for other important tasks.

- Consistency: Automated messages ensure that payment requests are sent consistently, reducing the risk of overlooking deadlines or forgetting to follow up on late payments.

- Improved Cash Flow: By ensuring timely reminders, automation can help accelerate payments, leading to improved cash flow and financial stability for your business.

- Reduced Errors: Automated systems can minimize the chances of sending incorrect or incomplete payment details, reducing the need for clarification or corrections.

By leveraging automation for your payment requests, you create a more efficient process that benefits both your business and your clients, ultimately

Design Tips for Your Payment Request Message

The design of your financial communication plays a key role in how recipients perceive the message and, ultimately, in how quickly they act on it. A well-designed payment request can make the process smoother for both parties, improving readability and clarity while also reflecting your brand’s professionalism. Simple, organized, and visually appealing messages will enhance the likelihood that the recipient will engage with the content promptly.

Key Design Considerations

Here are some essential design tips to help make your payment request message stand out while ensuring it remains clear and effective:

- Keep It Clean and Simple: Avoid clutter and distractions. Use ample white space to break up sections and make it easier for the recipient to focus on key details. A minimalist approach is often the most effective.

- Brand Consistency: Your payment request should align with your brand’s visual identity. Use your company’s logo, colors, and fonts to create a cohesive look across all communication channels. This adds credibility and makes the message instantly recognizable.

- Readable Fonts: Choose easy-to-read fonts and sizes. Stick to standard fonts like Arial, Helvetica, or Times New Roman for clarity, and avoid overly decorative or difficult-to-read styles.

- Clear Section Headings: Use bold headings or sections to break the message into digestible parts. This helps the recipient quickly find important information, such as the payment amount, due date, and payment methods.

- Highlight Important Information: Use bold text or color to emphasize critical details, such as the total amount due, the due date, and payment instructions. However, avoid overusing these techniques, as too much emphasis can become distracting.

Additional Design Tips for Success

- Mobile-Friendly Layout: Ensure that your message is easily readable on mobile devices. Many clients will access the request via their phones, so use a responsive design that adjusts properly to different screen sizes.

- Use Simple Tables: If you need to present detailed information, such as breakdowns of charges, consider using simple tables. Tables are effective for organizing data in an easy-to-read format that allows the recipient to quickly review the payment details.

- Include Call-to-Action Buttons: If applicable, include clear call-to-action buttons for easy access to payment portals or instructions. A button with text like “Pay Now” or “Complete Payment” makes the next step obvious and accessible.

By incorporating these design principles int

Legal Considerations for Payment Request Messages

When sending financial communications, it’s crucial to be aware of the legal obligations and regulations that may apply to your messages. Whether you’re dealing with overdue payments or confirming new transactions, your communication must meet certain legal requirements to protect your business and avoid any potential disputes. Understanding these legal considerations ensures that you are compliant with industry regulations and helps you maintain a trustworthy relationship with clients.

Key Legal Aspects to Consider

Here are some important legal factors to keep in mind when drafting and sending financial messages:

- Accurate and Transparent Information: It is essential to provide correct and clear information regarding payment terms, amounts due, and any penalties for late payments. Misleading or incorrect details could lead to legal disputes or claims of fraud.

- Data Protection and Privacy: Be mindful of data protection laws, such as GDPR or CCPA, when handling personal and financial information. Only include necessary details and ensure that sensitive data is handled securely and in compliance with privacy regulations.

- Clear Payment Terms: Specify payment due dates, methods of payment, and any associated fees or penalties for late payments. These terms should be agreed upon in advance and communicated clearly to avoid any misunderstandings.

- Documentation of Agreements: Keep records of all communications, including payment requests, confirmations, and agreements. This documentation may be necessary in case of disputes or legal actions to demonstrate compliance with contractual obligations.

- Right to Charge Late Fees: If you plan to charge late fees or interest for overdue payments, make sure that these charges are stated in your agreement with the client. Be transparent about how these fees are calculated and when they will be applied.

- Proper Language and Tone: Avoid using threatening or overly aggressive language in your payment requests. Always ensure that your communication is professional, polite, and non-confrontational. Harassment or coercive language could lead to legal consequences under consumer protection laws.

Best Practices for Legal Compliance

To ensure that your financial communications are legally sound, follow these best practices:

- Review Legal Requirements: Familiarize yourself with the specific legal requirements relevant to your location and industry. Different jurisdictions may have different regulations regarding payment terms, collection practices, and consumer rights.

- Include Payment Details in Contracts: Ensure that all terms regarding payments are clearly outlined in your agreements or contracts with clients. This reduces the likelihood of confusion or disputes later on.

- Clarity and Transparency: Ensure that all details about payment terms, amounts, and deadlines are clear and easy to understand. By providing transparent information, you eliminate confusion and demonstrate honesty in your financial dealings.

- Professional Tone: Maintaining a respectful and professional tone in every message is crucial. Even when reminding clients about overdue payments, a polite and composed approach reassures them that you value their business.

- Timeliness: Sending payment notifications promptly shows that you are organized and responsible. A timely reminder not only helps clients manage their own finances but also reflects positively on your ability to handle business operations efficiently.

- Personalization: When appropriate, personalize your messages to make them feel less transactional. Addressing clients by name and referencing specific details of the agreement can foster a stronger connection and make the communication feel more genuine.

- Increased Client Loyalty: When clients trust you, they are more likely to return for future business and recommend your services to others.

- Fewer Disputes: Clear and respectful communication minimizes misunderstandings and potential conflicts, leading to smoother business transactions.

- Improved Payment Timeliness: Clients who trust you are more likely to adhere to payment terms, ensuring a steadier cash flow for your business.

- Review the Payment Terms: Before reaching out, ensure that the payment terms were clear and agreed upon. Double-check the due date and confirm that the payment has indeed passed the agreed-upon timeline.

- Send a Friendly Reminder: If the payment has only recently become overdue, start with a polite reminder. Often, clients may have simply forgotten about the payment or are dealing with internal delays. A gentle nudge can encourage prompt action.

- Be Professional and Courteous: Keep your tone respectful, regardless of the situation. Avoid sounding confrontational or accusatory. The goal is to resolve the issue without damaging the client relationship.

- Provide Clear Payment Instructions: Make it easy for the client to make the payment by including clear, detailed instructions on how to do so. This reduces any confusion and increases the chances of prompt settlement.

- Send a Second Follow-Up: If the payment is still not received after the first reminder, send a second, firmer follow-up. This should still be polite but should emphasize the importance of settling the bill promptly to avoid further action.

- Set a Deadline for Payment: In your follow-up communication, establish a specific deadline for payment. Let the client know that after this date, you may need to escalate the matter.

- Offer Payment Plans: If the client is experiencing financial difficulties, offering a payment plan can be a win-win situation. It shows empathy and helps secure at least partial payment.

- Send a Formal Notice: If all attempts at resolution fail, send a formal notice indicating that the outstanding balance must be settled by a certain date or legal action may be taken.

- Maintain Records: Keep a detailed record of all communications related to the payment follow-up. This documentation can be useful if you need to escalate the matter further.

How to Track Payment Request Message Deliverability

Ensuring that your payment notifications reach their intended recipients is critical for timely payments and efficient communication. If a payment request does not reach the client, it can lead to delayed payments, confusion, and unnecessary follow-ups. Tracking the deliverability of these messages helps you identify potential issues early and take corrective actions, ensuring that your financial communications are effective and reliable.

Methods for Tracking Deliverability

There are several ways to track the deliverability of your payment requests, ranging from basic checks to more advanced email tracking tools. Below are some common methods:

Method Description Pros Cons Use Email Tracking Tools Most email platforms offer tracking tools that let you know whether the message has been opened or clicked. These tools often provide detailed reports on delivery status, open rates, and bounce rates. Detailed insights, real-time tracking, and reporting. Helpful for understanding client engagement. Some advanced features may require a subscription or a higher-tier plan. Monitor Bounce Rates Emails that “bounce” indicate deliverability issues. Monitoring bounce rates can help identify whether the message was rejected by the recipient’s email server. Simple method to check if emails are reaching recipients. Doesn’t provide data on whether the email was opened or acted upon. Check Spam Folder Deliverability Periodically check whether your payment requests are being marked as spam. Some email systems have a “spam” folder where messages are filtered. Helps identify deliverability problems caused by spam filters. Doesn’t give comprehensive insights into overall message performance. Set Up Read Receipts A read receipt allows you to see when the recipient has opened your payment request message, indicating that it has been delivered successfully. Provides confirmation of whether the recipient has opened the message. Not always reliable, as recip Using Payment Request Messages to Build Client Trust

How you communicate regarding financial matters can significantly impact your relationships with clients. By sending well-crafted, clear, and professional payment requests, you show that your business is organized, reliable, and transparent. This not only facilitates timely payments but also builds long-term trust, as clients will feel more confident in your services and value your professionalism. The tone, accuracy, and consistency of your messages can set the stage for positive client interactions moving forward.

Key Elements to Establish Trust

Here are several important elements to consider when using payment request messages to cultivate trust with clients:

Benefits of Building Trust Through Payment Requests

By focusing on these elements, you can leverage payment communications as an opportunity to build stronger relationships with clients. Some benefits of establishing trust through your financial messages include:

Using payment requests as an opportunity to reinforce trust will not only help you maintain strong client relationships but also establish your business as a reliable, professional, and transparent entity. By ensuring that each message is clear, professional, and considerate, you set the foundation for long-term, successful partnerships.

How to Follow Up on Unpaid Bills

When payments are overdue, it’s essential to follow up promptly and professionally. An effective follow-up process helps maintain cash flow while preserving good relationships with clients. The way you approach an unpaid balance can influence whether the client responds positively or negatively. A well-structured follow-up can demonstrate professionalism, courtesy, and respect for both the client and your business.

Steps to Effectively Follow Up on Unpaid Bills

Here are the key steps to ensure a smooth and effective follow-up process:

Advanced Tips for Managing Unpaid Balances

If the payment continues to be delayed, consider these additional steps:

By following these steps and maintaining professionalism throughout th