Custom T Shirt Invoice Template for Your Business

Effective billing is a crucial part of any business, ensuring clear communication between you and your customers. Having well-structured and professional billing documents not only promotes trust but also helps streamline financial transactions. A personalized approach to your billing can make your business stand out and present a polished, organized image.

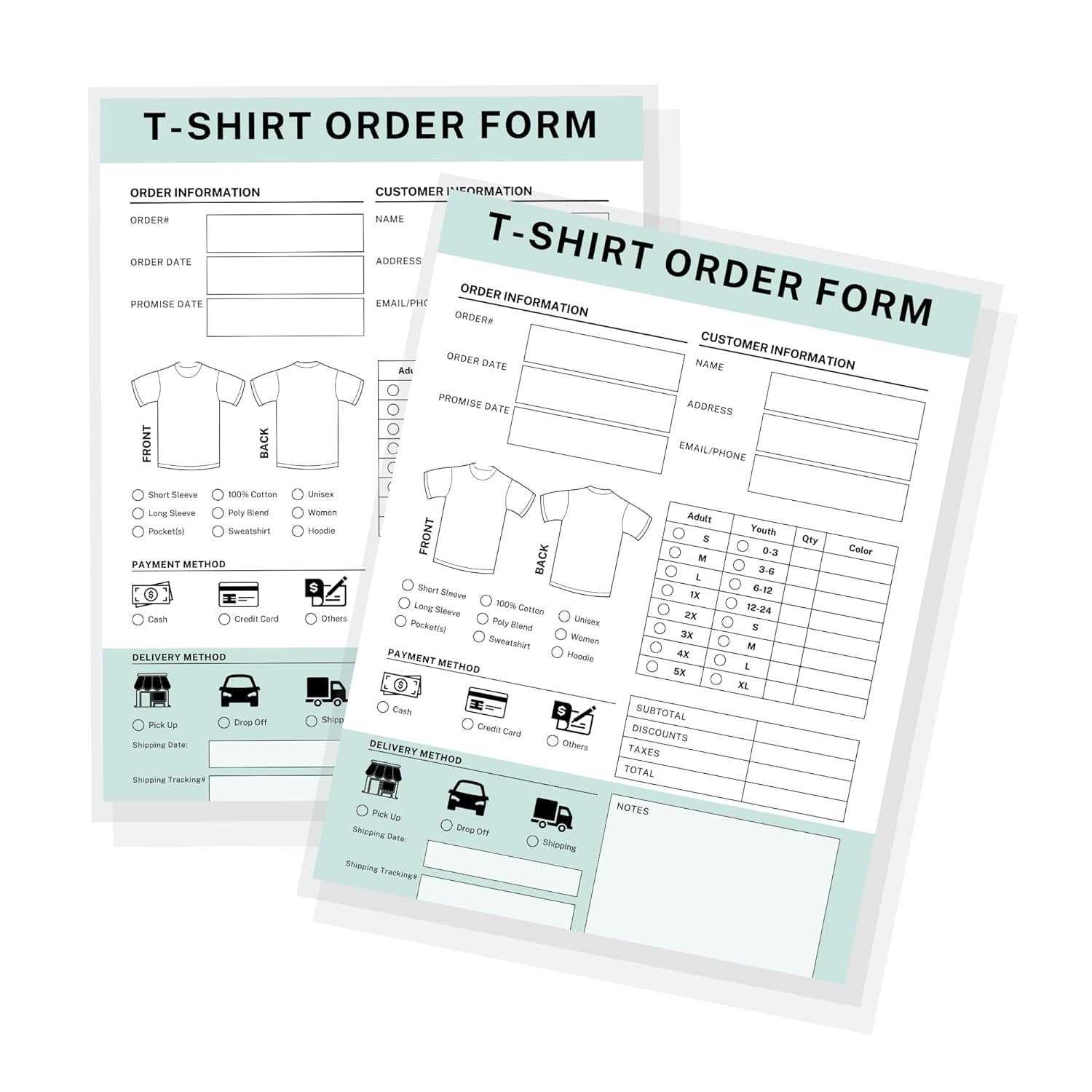

Whether you’re running a small creative studio or a large clothing brand, crafting personalized payment documents with the right elements can simplify the process of collecting payments. These documents should reflect your brand’s identity while also providing essential details such as payment terms, item descriptions, and pricing. A well-designed billing sheet can reduce confusion and improve customer satisfaction.

Personalizing your documents involves adding specific details like your logo, business name, and unique contact information. It’s important to ensure that the layout is clear, with a professional look that is easy for clients to understand. This guide will help you create the ideal document suited to your business needs, combining functionality and aesthetic appeal.

Personalized Billing Document Guide

Creating an efficient and professional payment document is essential for any business. A well-designed billing sheet not only provides all necessary details but also enhances the overall customer experience. With the right elements in place, it’s easier to manage payments and ensure smooth transactions. This guide walks you through the process of designing an effective document tailored to your specific business needs.

Essential Components for Effective Billing

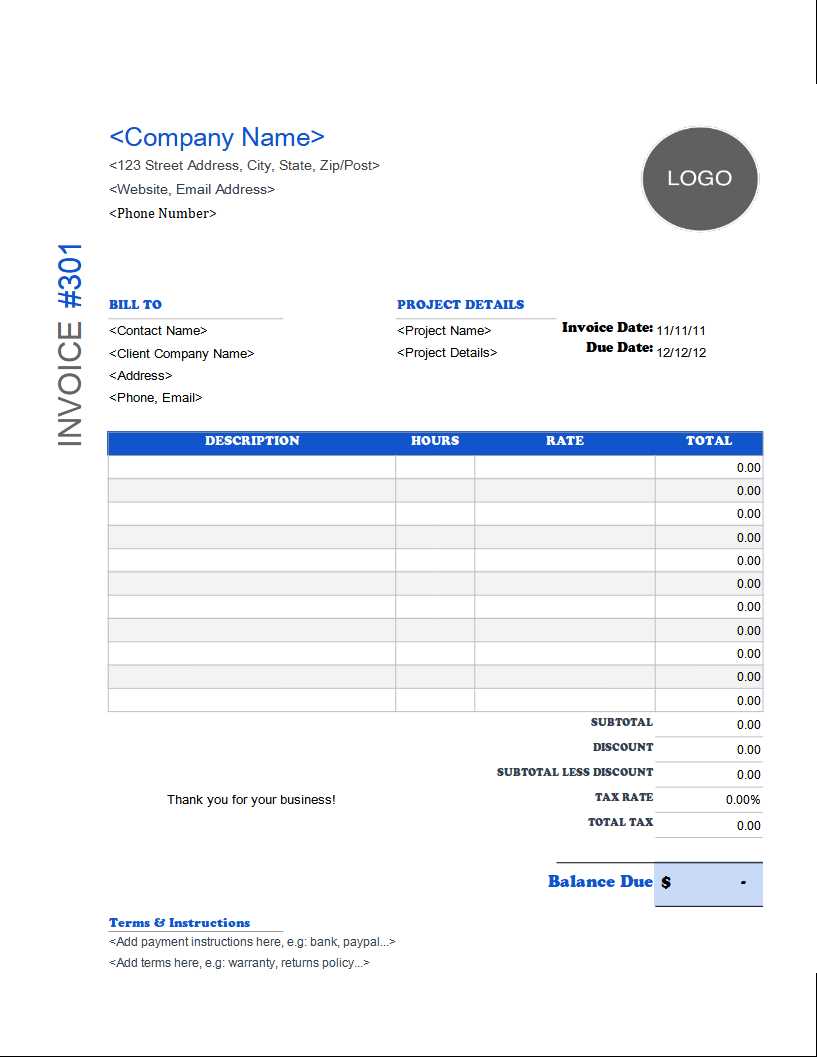

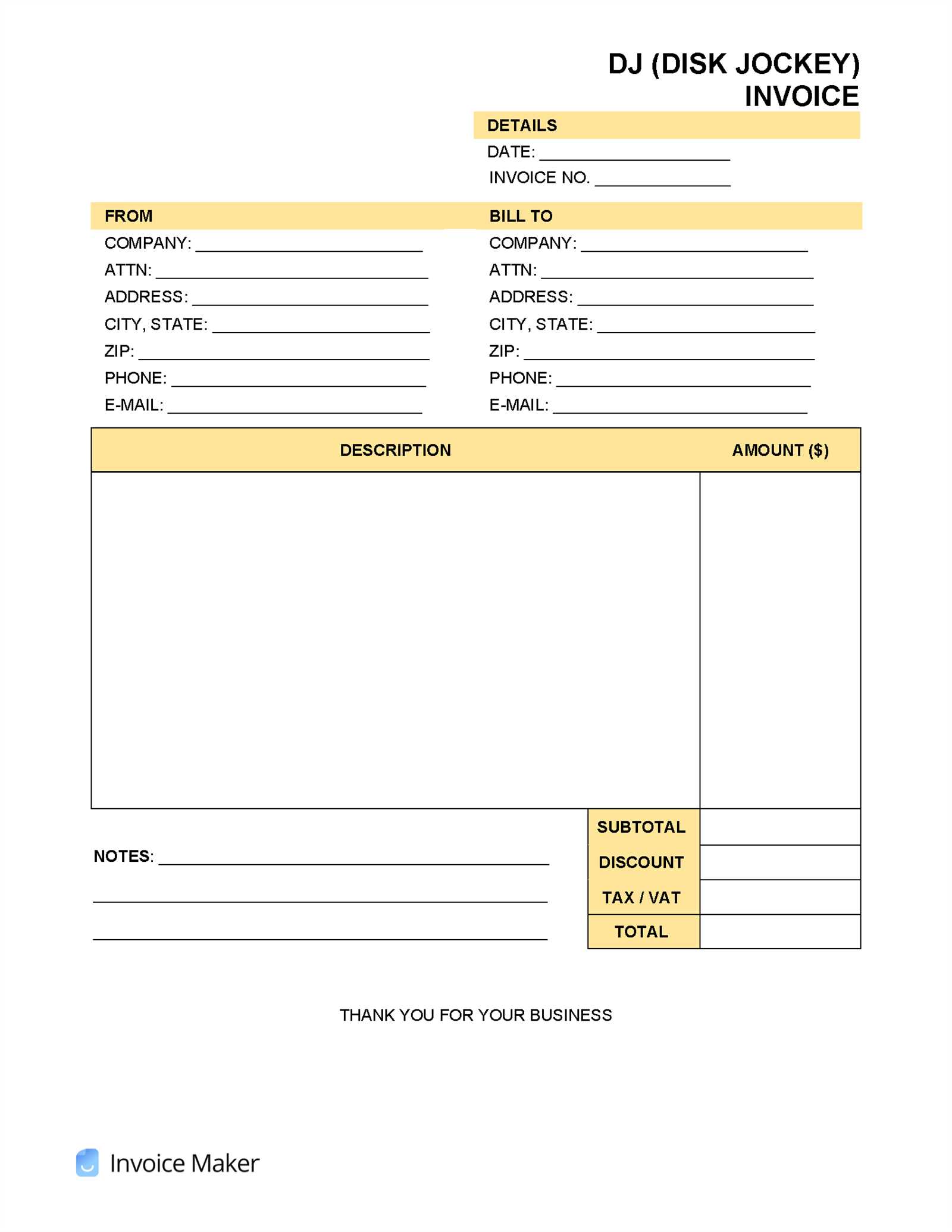

When crafting a billing document, it’s crucial to include certain key components that ensure clarity and professionalism. These include a clear breakdown of the products or services, pricing details, payment terms, and contact information. The layout should be clean and easy to read, with a structure that highlights the most important information first. Make sure to add your business logo and branding to give the document a personal touch and strengthen brand recognition.

Designing for Maximum Impact

Designing a billing document that aligns with your brand is important for maintaining a consistent professional image. You can choose to incorporate specific fonts, colors, and logos that reflect your business’s style. The document should be well-organized, making it easy for clients to identify what they are being charged for and when payment is due. This organization helps avoid misunderstandings and can lead to quicker payments.

Why Personalized Billing Documents Are Important

Personalized billing sheets play a crucial role in managing business finances and fostering professional relationships with customers. A tailored document not only ensures accurate payment processing but also creates a sense of professionalism and reliability. When designed thoughtfully, it can help reduce errors, speed up the payment process, and strengthen your brand identity.

Benefits of Personalized Billing

Customized documents allow you to control the information presented to your clients, ensuring that all necessary details are included and formatted clearly. This reduces confusion and provides a seamless experience for your customers. Below are some of the key benefits:

| Benefit | Description |

|---|---|

| Professionalism | Tailored documents create a polished, businesslike appearance that reflects well on your company. |

| Brand Recognition | Incorporating your logo and brand colors reinforces your identity and increases customer loyalty. |

| Clarity | Clear organization and precise details reduce misunderstandings and promote timely payments. |

| Efficiency | Customized sheets streamline the billing process, making it easier for both you and your clients. |

Improved Customer Experience

When customers receive a well-organized and personalized document, it enhances their overall experience with your business. Clear and accurate billing not only promotes trust but also improves communication, ensuring that clients feel confident in their transactions. By personalizing your payment documents, you can build stronger, long-lasting relationships with your clients.

Key Features of a Billing Document

When designing a payment document for your business, it’s essential to include several key elements to ensure clarity and professionalism. These features provide both you and your customers with the necessary information to process transactions smoothly. A well-crafted document not only lists the items or services but also highlights payment terms, delivery details, and contact information.

| Feature | Description |

|---|---|

| Itemized List | A clear breakdown of the products or services provided, including quantity, description, and individual price. |

| Total Amount | The overall sum to be paid, which may include taxes, shipping, and any discounts applied. |

| Payment Terms | Details of the payment schedule, including due date, late fees, and accepted payment methods. |

| Business Information | Your company name, address, contact details, and any other relevant identifiers like tax ID numbers. |

| Client Information | Include the customer’s name, address, and contact information for reference and communication. |

| Invoice Number | A unique reference number to track and organize payments effectively. |

| Due Date | The date by which payment should be completed to avoid penalties. |

These essential features ensure that your payment documents are not only professional but also clear and straightforward for customers to understand. Including this information helps avoid confusion and establishes trust between your business and your clients.

How to Design Your Billing Document

Designing an effective and professional payment document is essential to ensure a smooth transaction process. A well-structured document not only makes the payment process easier but also strengthens your brand’s identity. Here are key steps to consider when creating a document tailored to your business needs.

Step 1: Choose a Layout

The layout of your payment document should be clean and easy to read. Ensure that the important information stands out, such as the list of products or services, total amount, and payment details. You can choose from several layout options depending on your brand style, but make sure the design is consistent and organized.

- Use a simple grid layout with sections clearly defined for each piece of information.

- Ensure there is enough white space for clarity and visual appeal.

- Organize sections such as business details, client information, and product breakdown in separate areas.

Step 2: Include Necessary Information

Your billing document should include all essential details to avoid any confusion and ensure the transaction runs smoothly. Below are the key elements that should always be included:

- Business Information: Name, address, and contact details of your business.

- Client Information: Name, address, and contact details of the customer.

- Product/Service Breakdown: A detailed list of products or services provided, including quantities and prices.

- Total Amount: The overall cost including taxes, shipping, and any discounts or fees.

- Payment Terms: Payment due date, accepted methods of payment, and any applicable late fees.

Including these key elements ensures that the document is both comprehensive and professional, allowing your clients to quickly understand their charges and payment requirements.

Essential Information for Billing Documents

For a billing document to be effective, it must include several key details that ensure both the business and the customer are on the same page. These critical pieces of information help avoid misunderstandings and allow for smoother transactions. Below are the essential components that should always be included in any billing document.

Key Components to Include

- Business Details: Your company’s name, address, and contact information, ensuring clients can reach you easily for any questions or concerns.

- Customer Information: The client’s name, address, and contact details, which are crucial for delivering the correct product and tracking payments.

- Unique Reference Number: A distinct number for each transaction to ensure easy tracking and record-keeping.

- Breakdown of Products or Services: A detailed list of what was purchased or provided, including quantities, descriptions, and individual prices.

- Payment Terms: Specify when payment is due, acceptable methods of payment, and any penalties or late fees that may apply.

Additional Information to Consider

- Shipping and Handling: If applicable, provide details of any shipping costs or delivery charges, including tracking numbers and delivery dates.

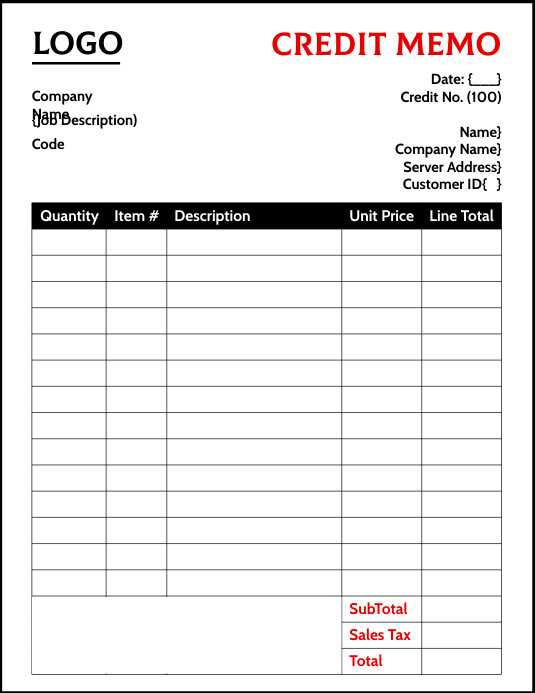

- Taxes: Ensure any relevant sales tax or VAT is clearly displayed to avoid confusion about the total amount due.

- Discounts or Promotions: If discounts or special offers are applied, include them and clearly indicate the adjusted total.

Including these elements in your billing document not only ensures accuracy but also fosters trust and professionalism with your clients. It helps them understand the charges, making it more likely that payments will be received promptly.

Choosing the Right Billing Document Format

Selecting the right format for your payment documents is essential to ensuring that they are both functional and professional. The format should suit your business’s needs while being easy for your clients to understand. Whether you opt for a simple text-based layout or a more graphic-rich design, the document should clearly communicate all the necessary information in a user-friendly manner.

There are several formats to consider, depending on your business style and the preferences of your customers. Some prefer a straightforward, no-frills design, while others might look for a more visually engaging layout that reflects the company’s branding. Regardless of the approach, clarity and ease of use should always be top priorities.

Factors to Consider

- Simplicity: A clean and straightforward format ensures that all essential details are easily accessible without distractions.

- Branding: Including your logo, business colors, and other brand elements helps create a consistent, professional appearance.

- Customization: A flexible layout allows you to add or remove sections as needed based on the specific needs of each transaction.

- Compatibility: Ensure the format you choose is compatible with various devices and software, allowing for easy viewing and printing by both you and your clients.

Popular Formats

- Digital Format: A PDF document is widely used for its universal accessibility and professional presentation. It’s easy to send via email and ensures formatting remains intact.

- Spreadsheet Format: Some businesses prefer to use spreadsheet software like Excel for its flexibility and the ability to automatically calculate totals, taxes, and discounts.

- Online Billing Platforms: For businesses that need to send documents regularly, online tools or software may provide pre-designed formats that streamline the process and offer additional features, such as automatic reminders for overdue payments.

Choosing the right format will ultimately depend on the size and style of your business. It’s important to evaluate the needs of both your company and your clients to ensure smooth, hassle-free transactions.

How to Add Personalization to Billing Documents

Personalizing your payment documents can enhance the client experience by making your business appear more approachable and professional. A personalized document doesn’t just list the transaction details; it reflects your brand identity and establishes a stronger connection with your customers. By adding small touches, you can create a document that feels tailored to each client while maintaining consistency in your business’s operations.

Key Personalization Elements

There are several ways you can personalize your payment documents to make them stand out. Consider adding the following elements:

- Client’s Name: Addressing the client by name at the top of the document can make it feel more personal and focused.

- Business Branding: Incorporating your company’s logo, colors, and fonts helps reinforce your brand identity and ensures the document looks professional.

- Personalized Message: Including a thank-you note or special message on the document can help build customer loyalty and encourage repeat business.

- Custom Payment Terms: Offering personalized payment terms or discounts based on the client’s history can add a thoughtful touch.

Benefits of Personalization

Adding personal elements to your documents can benefit your business in multiple ways. Not only does it create a more positive experience for your clients, but it can also help foster long-term relationships. Personalized payment documents can help your business stand out in a competitive market, leading to increased client satisfaction and improved retention.

Using Software to Create Billing Documents

Creating professional and accurate payment documents can be time-consuming, especially when done manually. Using specialized software can streamline the process, saving you time while ensuring consistency and accuracy in each transaction. Software tools offer various features, including customizable designs, automatic calculations, and easy record-keeping, making them an ideal solution for businesses of all sizes.

Advantages of Using Software

There are several benefits to utilizing software for creating payment documents. Below are some of the key advantages:

- Efficiency: Software can automate many aspects of document creation, from generating totals and taxes to sending out the final document.

- Customization: Most software tools allow you to tailor the design of your documents to match your business brand, while also providing flexibility for different types of transactions.

- Error Reduction: With built-in formulas and automated calculations, software reduces the chances of errors in totals or tax rates, ensuring more accurate billing.

- Time-Saving: Pre-made templates and automation features allow you to create documents in a fraction of the time it would take manually.

Popular Software Tools

There are many software solutions available that cater to different business needs. Some of the most popular include:

- QuickBooks: A well-known accounting tool that offers easy-to-use billing document features, including templates, automatic calculations, and integration with other financial tools.

- FreshBooks: A cloud-based solution with customizable templates and invoicing options designed specifically for small businesses and freelancers.

- Zoho Invoice: An online tool that allows businesses to create and send payment documents, track expenses, and manage client information all in one place.

Using software to create billing documents not only improves the efficiency of your business operations but also enhances professionalism, ensuring your documents are consistently well-organized and accurately reflect your business’s image.

How to Include Tax and Shipping Details

When creating billing documents, it’s crucial to clearly outline any applicable taxes and shipping charges. These elements are often a significant part of the total amount due, and both you and your client should be aware of them to avoid confusion or disputes. Properly listing tax rates, shipping costs, and their breakdowns ensures transparency and accuracy in your billing process.

Including these details effectively requires precision, especially if your business operates in regions with varying tax rates or multiple shipping options. By clearly distinguishing between the product price, tax, and shipping charges, you provide your client with a full understanding of their total cost.

How to Present Tax and Shipping Information

The best way to include tax and shipping information is in separate, clearly labeled sections within the document. This allows your client to quickly identify each charge and verify the amounts.

| Description | Amount |

|---|---|

| Product Price | $50.00 |

| Tax (5%) | $2.50 |

| Shipping Fee | $5.00 |

| Total Amount Due | $57.50 |

Additional Tips

- Tax Rate: Clearly state the tax rate applied, especially if it varies based on location or product type.

- Shipping Breakdown: If multiple shipping options are available, list each option along with its corresponding cost to allow the client to choose.

- International Charges: For international shipments, include any customs duties or import taxes that may apply, ensuring the client is fully aware of additional costs.

By including tax and shipping details in a straightforward and transparent manner, you maintain professionalism while ensuring that your client understands every aspect of their total cost.

Best Practices for Professional Billing Documents

Creating a well-structured and professional billing document is essential for maintaining a strong relationship with clients and ensuring smooth transactions. A well-designed document not only reflects the professionalism of your business but also reduces the risk of errors and misunderstandings. By following a set of best practices, you can ensure that your documents are clear, accurate, and easy to process.

Key Elements to Include

To create a professional document, ensure that the following key elements are always included:

- Clear Header: Include your business name, contact information, and logo at the top of the document. This reinforces your brand identity and makes it easy for clients to reach you if needed.

- Unique Identification Number: Assign a unique number to each document for easy tracking and reference.

- Detailed Breakdown: Clearly list each item or service provided, along with corresponding prices and quantities.

- Payment Terms: Include your payment terms and deadlines, such as due dates, late fees, and accepted payment methods.

- Total Amount: Ensure the final amount due is prominently displayed and includes a breakdown of all charges, including taxes and fees.

Formatting Tips for Clarity

Proper formatting plays a significant role in making your document easy to read and professional. Here are some formatting tips:

- Use Consistent Fonts: Stick to one or two simple, professional fonts to keep the document clean and readable.

- Organize Information: Group related items together and use headings to separate different sections of the document.

- Keep It Simple: Avoid clutter. A simple and well-organized layout ensures that clients can easily find the information they need.

- Double-Check for Accuracy: Ensure that all details, such as prices, dates, and contact information, are accurate to avoid confusion or disputes.

By following these best practices, you ensure that your billing documents are not only professional in appearance but also efficient and easy to understand. This can contribute to smoother transactions and stronger client relationships.

How to Calculate Pricing for Apparel

Accurately calculating the cost of your products is essential for maintaining a profitable business. Pricing decisions must factor in various costs, from production and materials to labor and overhead. By understanding how to properly calculate pricing, you can ensure that your products are competitively priced while still generating the profit you need.

Key Factors to Consider

When determining the price of an item, consider the following components:

- Material Costs: The cost of raw materials used to create the product, such as fabric, ink, and other components. Ensure that all materials are accounted for, including any specialty items.

- Labor Costs: Include the time and wages required to create the item. If you outsource production or hire contractors, make sure to include those expenses in the calculation.

- Overhead Costs: This includes operational expenses such as utilities, rent, and equipment maintenance. These costs should be allocated to each product produced.

- Packaging and Shipping: Don’t forget to factor in the cost of packaging materials and the cost of shipping items to customers. These can vary depending on the size and destination of each order.

Pricing Calculation Formula

Once you have all your costs, you can calculate the price using the following formula:

- Determine the total cost: Add up all material, labor, and overhead costs.

- Set your desired profit margin: Decide on the percentage of profit you want to make from each product. A typical range for a healthy profit margin in retail is 20-50%.

- Calculate the price: Multiply the total cost by the profit margin and add it to the total cost to arrive at your selling price. For example, if the total cost is $10 and your desired profit margin is 40%, your price would be $14.

Example Pricing Breakdown

- Material Cost: $5.00

- Labor Cost: $3.00

- Overhead Cost: $2.00

- Shipping & Packaging: $1.00

- Total Cost: $11.00

- Desired Profit Margin: 40%

- Final Price: $15.40

Setting Up Payment Terms on Billing Documents

Establishing clear and concise payment terms is crucial for maintaining smooth financial transactions with clients. Properly set payment conditions ensure that both parties are aware of when payments are due, and what the expectations are for late or partial payments. Having this information clearly outlined helps avoid confusion and fosters positive relationships with customers.

Key Payment Terms to Include

To create effective payment terms, consider including the following elements:

- Due Date: Clearly specify the exact date by which the payment should be made. This can be a specific calendar date or a set number of days from the transaction date (e.g., 30 days from the date of issue).

- Accepted Payment Methods: List the types of payments you accept, such as credit cards, bank transfers, checks, or online payment systems. This helps clients understand their options for submitting payment.

- Late Payment Penalties: If applicable, define the penalties for late payments, such as a fixed fee or interest charged for overdue accounts. This encourages timely payments and discourages delays.

- Discounts for Early Payment: Some businesses offer discounts for customers who pay early. Clearly state the percentage or fixed amount that can be discounted if the payment is received before the due date.

Best Practices for Clear Payment Terms

To ensure that your payment terms are understood and followed, here are some best practices:

- Keep Terms Simple: Avoid overly complex language. Make the terms clear and easy to understand so that clients know exactly when and how to pay.

- Highlight Key Dates: Make sure the payment due date and any early payment discounts or penalties are clearly visible on the document.

- Consistent Enforcement: Ensure that payment terms are consistently applied to all clients. This establishes fairness and reduces potential disputes.

- Use Professional Language: Maintain a professional tone throughout your documents, which helps build trust and reflects your business’s reliability.

By including well-defined payment terms, you create a professional and transparent payment process, minimizing confusion and protecting your business from late or missed payments.

Customizing Layout for Branding

The design and structure of your billing documents play a significant role in reinforcing your brand identity. By tailoring the layout, colors, fonts, and logos, you can create a consistent and professional image that resonates with your customers. This not only enhances your brand recognition but also adds a sense of reliability and professionalism to your business interactions.

Key Elements to Personalize

There are several design elements to consider when adjusting your layout for branding purposes:

- Logo Placement: Positioning your logo prominently at the top of the document helps clients immediately recognize your brand. This can be paired with your company name and slogan to further enhance visibility.

- Color Scheme: Consistently using your brand’s color palette throughout the layout helps create a cohesive visual identity. Choose colors that align with your brand’s values and overall aesthetic.

- Typography: Use fonts that match your brand’s tone, whether it’s formal, modern, or playful. Ensure that the fonts are legible and suitable for professional documents, while still reflecting your brand personality.

- Branding Tagline or Message: Including a brief slogan or tagline can reinforce your company’s message and remind clients of what your business stands for.

Design Consistency Across Documents

Consistency is key when branding any business document. The same design elements that appear in your invoices should also be present in other materials like receipts, quotes, or promotional flyers. This helps clients associate your documents with your brand, improving overall recognition and trust.

- Header and Footer: Include a consistent header and footer with your logo and contact details to maintain a unified look across all communications.

- Visual Balance: Ensure that the design is visually balanced and doesn’t appear overcrowded. White space can help separate important information and create a cleaner, more professional appearance.

By customizing the layout of your billing documents to align with your brand, you create a more professional and memorable experience for your clients, strengthening your company’s image and increasing brand loyalty.

How to Automate Billing Document Generation

Automating the creation of billing documents can streamline your business operations and save valuable time. By setting up automated processes, you can eliminate manual entry, reduce errors, and ensure timely delivery of documents to your clients. There are various tools and strategies available to help you achieve this goal with ease and efficiency.

Steps to Set Up Automation

To get started with automation, follow these steps to set up your system:

- Choose the Right Software: Select an automation tool or software that suits your business needs. Popular tools often integrate with your accounting system and allow you to create, store, and send documents automatically.

- Integrate with Your Database: Link your automation tool with your customer database or order management system. This ensures that the correct details, such as client names, addresses, and product/service information, are pulled automatically for each document.

- Create a Document Structure: Define the layout and fields that should appear in each document. This includes setting up placeholders for items such as company details, customer information, and pricing.

- Set Up Trigger Events: Configure triggers that automatically generate and send documents when specific actions occur, such as after a sale, a completed order, or payment confirmation.

- Test and Review: Before fully implementing the system, test it with a few dummy transactions to ensure that everything works as expected. Double-check for accuracy and that all data is correctly populated.

Benefits of Automated Document Generation

Automating document generation offers several advantages for businesses:

- Time Efficiency: Save time by eliminating the need for manual document creation. This allows your team to focus on more strategic tasks.

- Accuracy: Reduce the risk of errors caused by manual data entry. Automated systems pull data directly from your database, ensuring consistency and accuracy.

- Consistency: Maintain a consistent look and feel for all of your billing documents. Automation ensures that every document adheres to your branding and formatting standards.

- Improved Customer Experience: With timely and accurate documents, your clients will have a smoother experience with your business, leading to greater trust and satisfaction.

By automating your billin

Sending Billing Documents to Customers Efficiently

Efficiently sending billing documents is crucial to maintaining a smooth transaction process and ensuring timely payments. By leveraging the right methods and tools, you can simplify the distribution process, reduce delays, and improve communication with your clients. Here are the key strategies for effectively delivering billing statements to customers.

Methods for Sending Documents

There are several ways to send documents, and choosing the right one depends on your business model and customer preferences. Consider these options:

- Email: Sending documents via email is one of the most common and fastest methods. You can either attach the document directly or use a secure link for customers to download it.

- Online Portals: For businesses with recurring transactions, setting up a customer portal where clients can log in to view, download, and pay their documents can enhance convenience and streamline operations.

- Postal Mail: Though less common, sending hard copies by mail may be necessary for certain clients or industries that require physical documentation. Always ensure proper tracking to avoid lost items.

Best Practices for Efficiency

To optimize the sending process, follow these best practices:

- Automated Sending: Use automation tools to send documents as soon as they are generated, reducing manual effort and ensuring no delays in delivery.

- Clear Instructions: Provide customers with clear payment instructions within the document, including payment options, deadlines, and any additional information to avoid confusion.

- Batch Sending: For businesses with high volumes of transactions, batch sending allows you to deliver multiple documents at once, reducing time spent on individual correspondence.

- Tracking and Reminders: Implement a system for tracking sent documents and set up automated reminders for customers who have not completed payments within the specified time frame.

By adopting these methods and practices, you can ensure that your billing documents are sent effi

Tracking Payments and Outstanding Billing Statements

Effectively monitoring payments and identifying any overdue amounts is essential for maintaining healthy cash flow in your business. Keeping track of payments ensures that you stay on top of your financials and can address any outstanding balances promptly. This section will explore the best practices for monitoring payments and managing overdue accounts.

How to Monitor Payments

To ensure you are aware of incoming payments and can manage them properly, implement a system for tracking transactions. Here are some methods for keeping your records organized:

- Automated Payment Systems: Utilize payment platforms that automatically update the status of payments. These systems can notify you when a payment is received and even mark transactions as complete in your records.

- Manual Tracking: For smaller operations, manually tracking payments in spreadsheets or accounting software can be effective. Regularly update records with dates of payments and outstanding balances.

- Online Payment Dashboards: Many payment processors offer dashboards that provide a real-time overview of payments received, pending amounts, and overdue balances. Use these tools for quick, easy access to payment statuses.

Handling Outstanding Balances

Outstanding balances can cause cash flow issues, so it’s important to act quickly when you notice an overdue account. Consider these strategies for managing overdue payments:

- Automated Reminders: Set up automated email reminders or notifications for clients with overdue payments. Ensure the reminders are polite but firm, and clearly state the due amount and payment terms.

- Grace Periods: Offering a brief grace period can provide customers with extra time to make payments while avoiding immediate penalties. However, be sure to communicate this clearly and follow up as necessary.

- Payment Plans: For larger outstanding balances, consider offering installment plans. This helps customers manage their payments and ensures that you receive partial payments while waiting for the full amount.

- Collection Services: If a payment becomes significantly overdue, you may need to resort to third-party collection agencies. This should be a last resort after attempting all other methods of resolution.

Tracking payments and following up on overdue accounts efficiently is key to sustaining your business operations. With a clear system i

How to Handle Billing Disputes

Disputes regarding payments are an inevitable part of doing business. Whether it’s due to a misunderstanding, an error in charges, or dissatisfaction with the product or service provided, addressing these disagreements promptly and professionally is crucial for maintaining positive relationships with customers. This section will outline steps to take when dealing with disputes and how to resolve them efficiently.

Identify the Source of the Dispute

The first step in handling any dispute is to carefully assess the situation and determine the root cause. This can involve reviewing the payment details, contract terms, and communications between both parties. Consider the following:

- Check for Errors: Ensure that the charges are accurate and match the agreed-upon terms. Sometimes, discrepancies arise due to simple clerical mistakes or miscommunication.

- Clarify Terms: Review the original agreement or contract to ensure that both you and the customer have a mutual understanding of what was agreed upon.

- Understand the Customer’s Concerns: Listen to your customer’s perspective. Their complaint might be rooted in a misunderstanding, or they may have valid concerns that need to be addressed.

Communicate Clearly and Professionally

Effective communication is key when resolving billing disputes. Approach the situation with professionalism and empathy. Here are some tips:

- Respond Promptly: Don’t let the dispute drag on. Address the customer’s concerns as soon as possible to avoid frustration on both sides.

- Be Transparent: Provide all necessary documentation that supports your charges, such as contracts, quotes, or previous communications.

- Offer Solutions: Once the issue is identified, propose a reasonable solution. Whether it’s a discount, partial refund, or another form of resolution, work with the customer to find a fair outcome.

- Remain Professional: Even if the dispute becomes contentious, always maintain a calm and respectful tone. A professional approach can help de-escalate the situation.

Document the Resolution

After resolving the dispute, it’s important to document the outcome for both your records and the customer’s. This ensures that there are no future misunderstandings. Make sure to:

- Update Your Records: Note the resolution in your payment or accounting system to reflect any changes made to the original terms.

- Provide Confirmation: Send the customer a written confirmation of the resolution, outlining the agreed-upon terms and actions taken. This can prevent future confusion or disputes.

Han