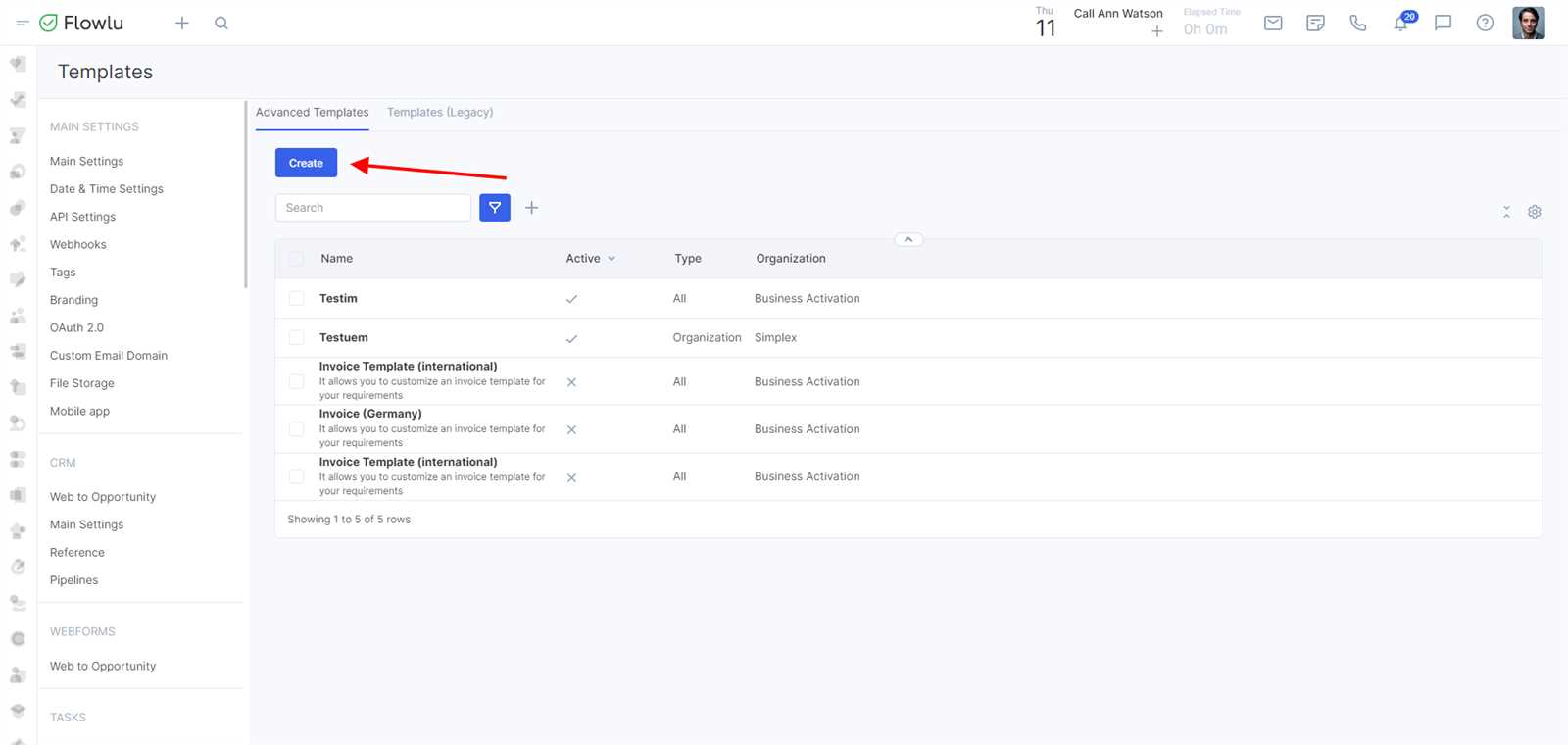

Create Your Own Custom Invoice Template

Efficient billing is essential for every business, whether you’re an independent freelancer or running a large organization. A well-designed document to request payments can help ensure smooth transactions and establish professionalism. By designing your own payment forms, you gain control over the information displayed and the overall look of your requests.

Tailoring these documents to reflect your brand and meet specific business needs can enhance communication with clients and improve payment processing. With the right layout, you can easily include relevant details, such as payment terms and due dates, making it easier for customers to understand and respond promptly.

Furthermore, a personalized document can help track payments and maintain accurate records, which is vital for accounting and financial management. In this guide, we’ll explore how to craft an effective billing document that fits your requirements while maintaining clarity and professionalism.

Custom Invoice Template Benefits

Designing a personalized billing document offers numerous advantages for businesses of all sizes. It allows companies to take control of their financial communication and ensure their requests align with their unique needs. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, having the ability to create a tailored request for payment helps streamline operations and maintain professionalism.

Professionalism and Brand Consistency

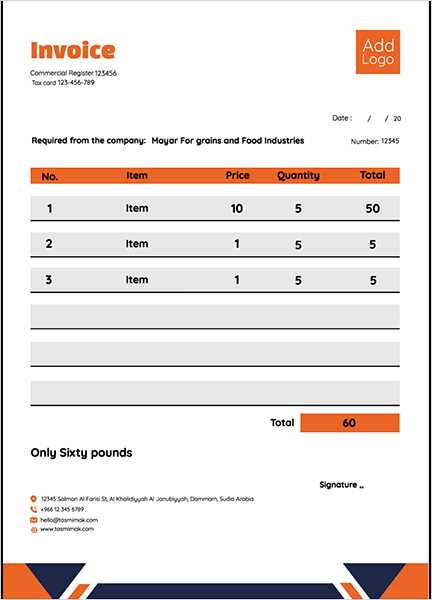

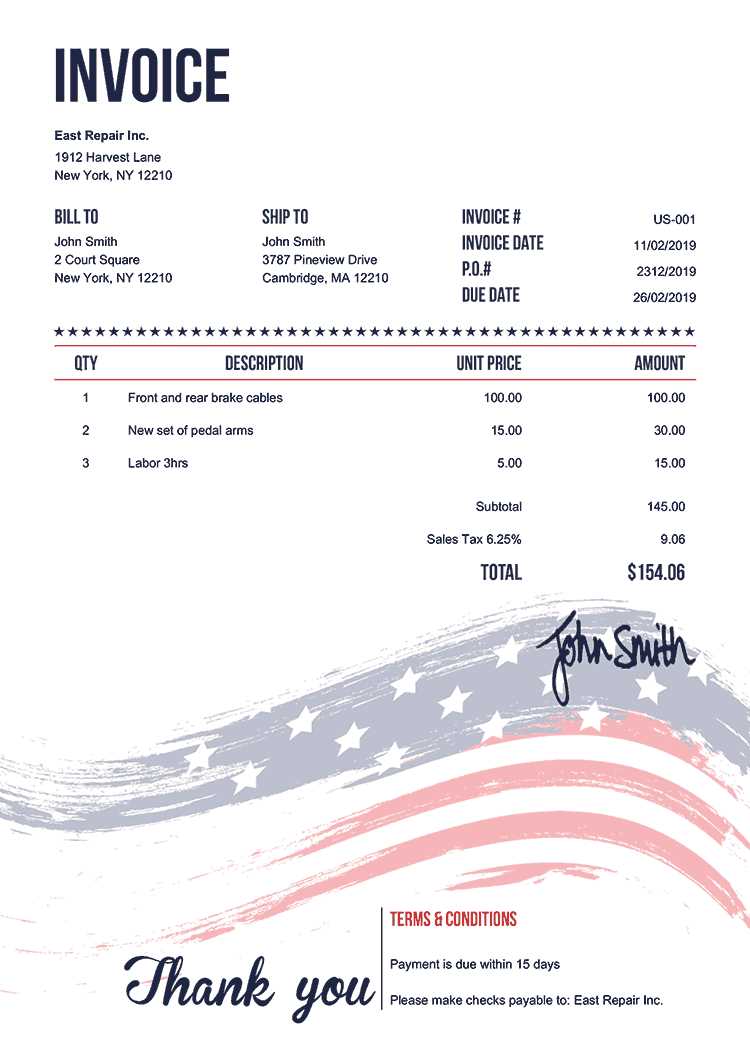

One of the primary benefits of a personalized billing form is the ability to enhance your business’s professional image. By incorporating your company logo, color scheme, and font style, you create a cohesive and recognizable look that reinforces your brand identity. Clients will appreciate receiving documents that reflect a polished, professional image, leading to stronger business relationships.

Improved Accuracy and Efficiency

Personalized billing forms allow you to include all the necessary details in a clear and organized manner. This reduces the chances of errors, such as missing information or incorrect amounts. Additionally, it makes the billing process quicker, as both you and your clients can easily reference the essential data, which improves overall efficiency.

| Benefit | Explanation |

|---|---|

| Brand Consistency | Reflects company identity with logos and design elements |

| Clear Communication | Ensures all relevant information is presented clearly |

| Time-Saving | Streamlines the payment request process for both parties |

| Increased Accuracy | Reduces errors by including pre-set data and fields |

How to Design an Invoice Template

Creating an effective billing form involves careful planning and a focus on clarity. The goal is to design a document that not only looks professional but also clearly communicates the necessary details of a transaction. By following a few key steps, you can craft a payment request that is easy to understand and visually appealing to your clients.

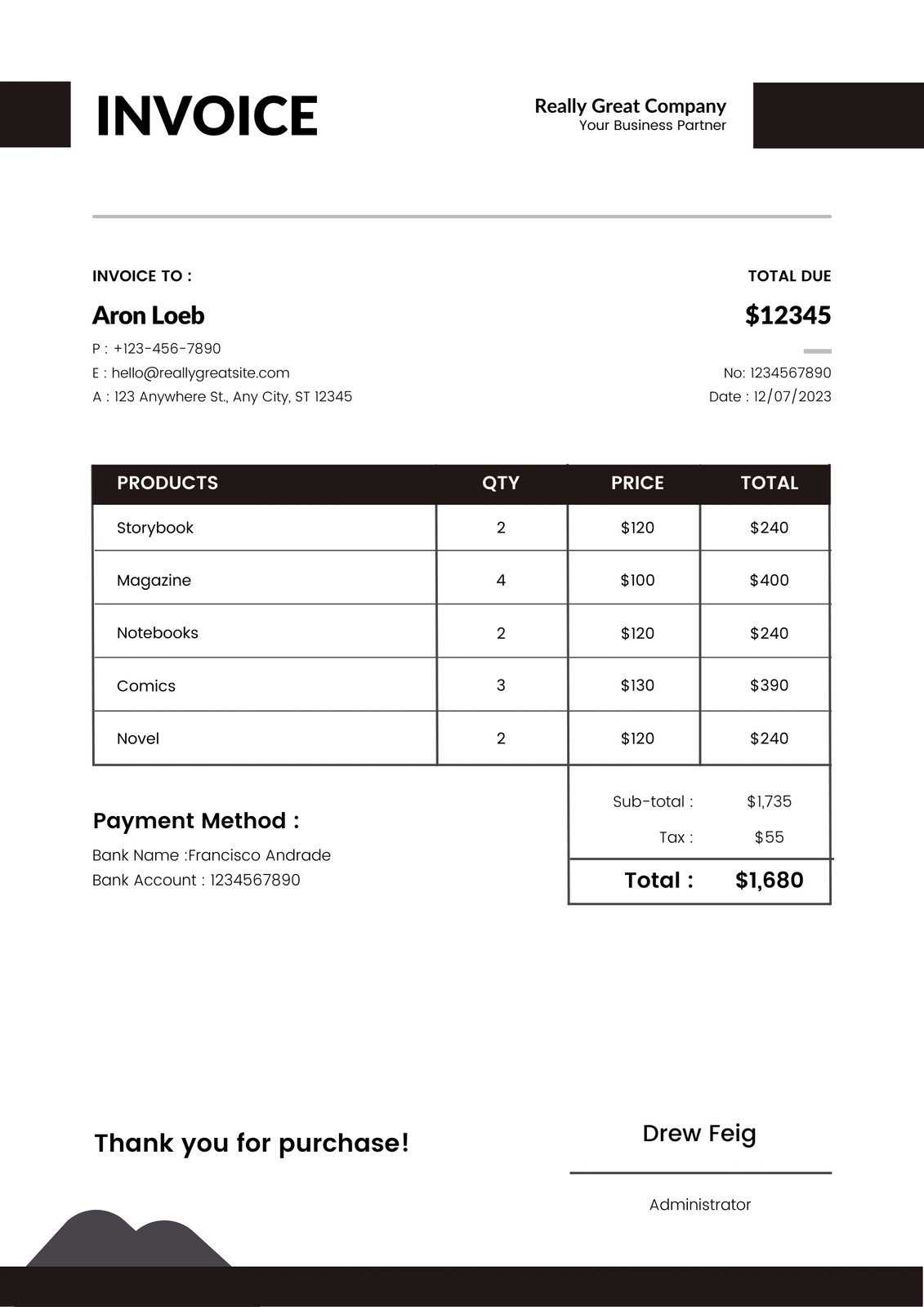

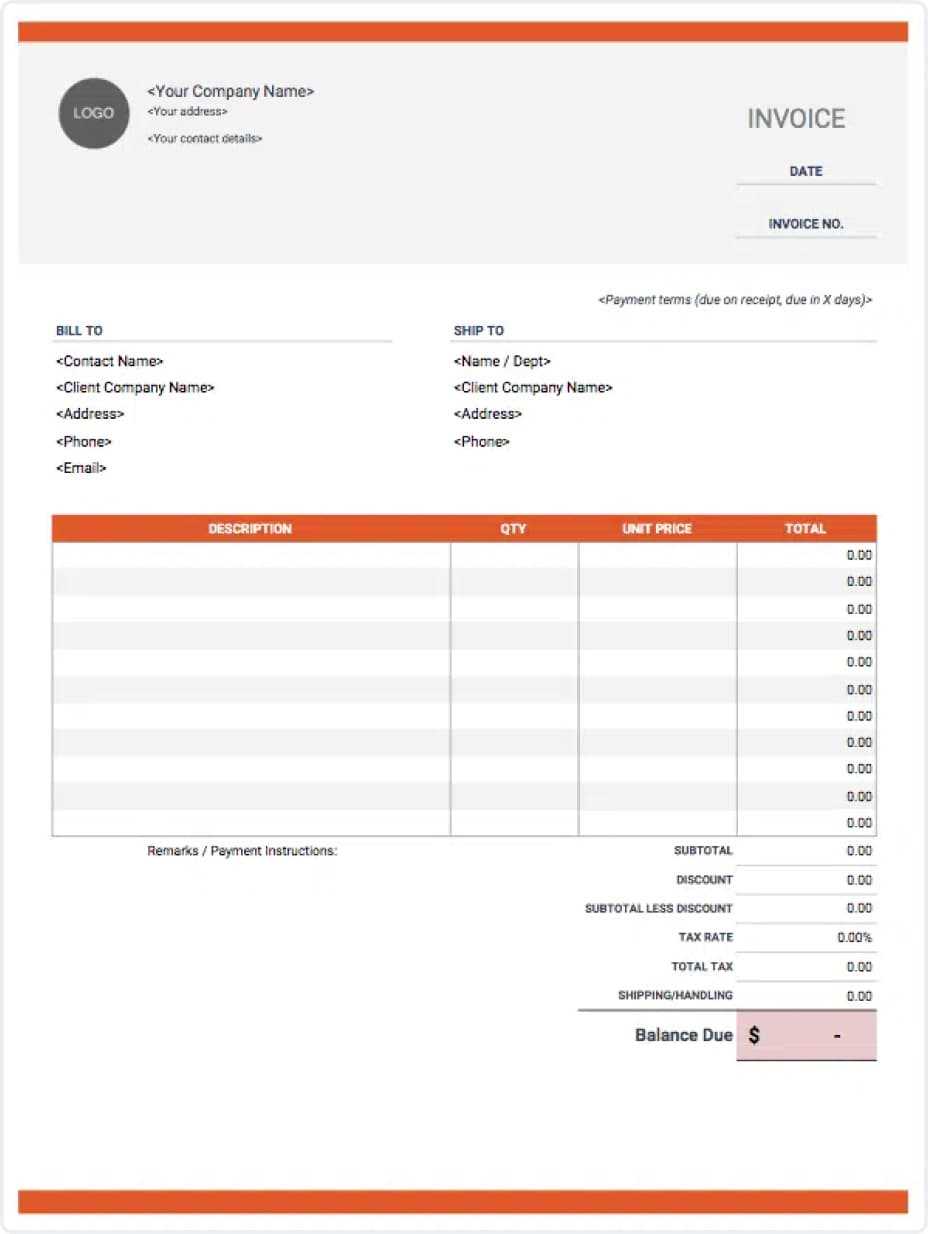

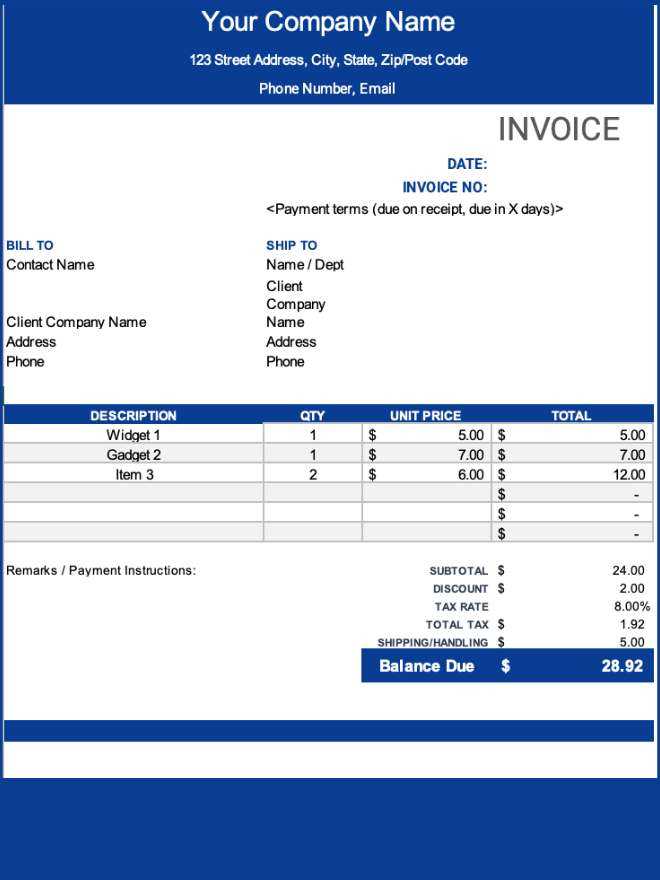

Start with the Essential Information

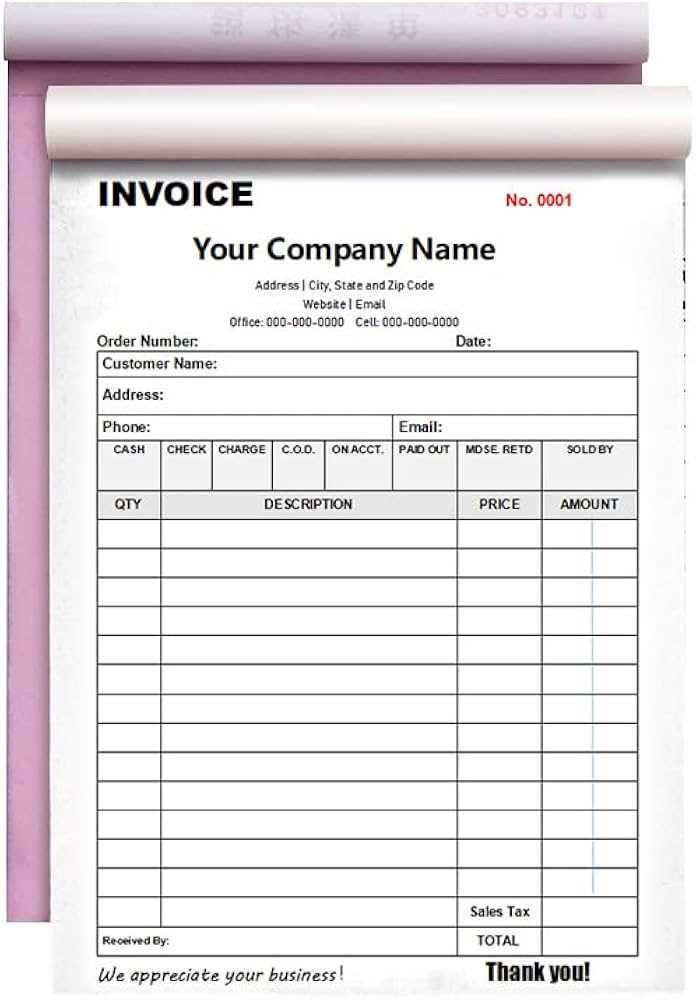

The first step in creating your billing form is ensuring all critical information is included. At a minimum, this should cover the following details: business name, contact information, payment terms, a list of products or services provided, the total amount due, and the payment due date. By including these elements, you ensure that your client has everything needed to process the payment smoothly.

Focus on Readability and Organization

Layout is a crucial element in the design process. Ensure that the form is structured in a way that allows the reader to easily locate the information they need. Use clear headings, a logical flow, and sufficient spacing between sections. Simple, uncluttered design will help the recipient focus on the key details and reduce confusion. Additionally, choose fonts that are easy to read, and maintain consistent text sizes for better organization.

Choosing the Right Template for Your Business

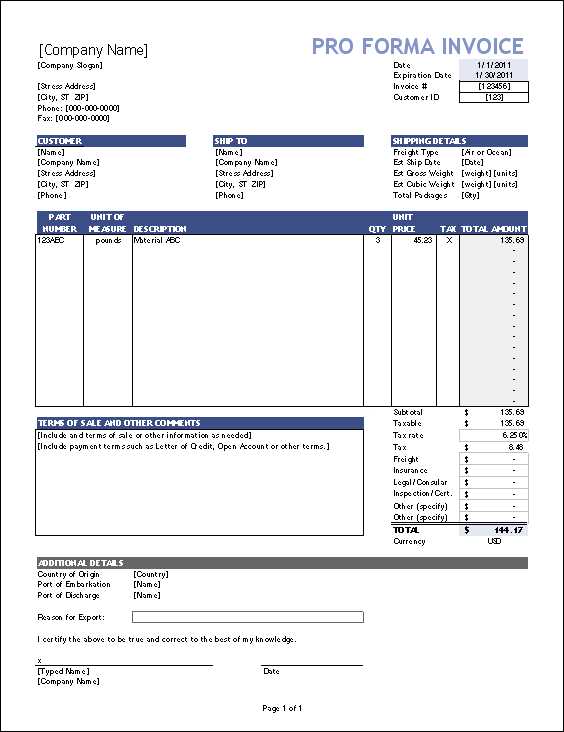

Selecting the right payment request format is crucial for ensuring smooth transactions and clear communication with clients. The chosen design should reflect your business’s style and meet practical needs, allowing for efficient processing while maintaining professionalism. Understanding your unique business requirements will guide you in choosing the most suitable option for your operations.

Consider Your Industry and Branding

Each business operates in a unique environment, which should be reflected in the design of your payment request. A creative agency might prefer a modern, visually striking layout, while a legal firm may opt for a more formal and straightforward approach. Think about the tone you wish to convey and select a design that complements your brand’s identity. Incorporating your logo, color scheme, and fonts can help maintain consistency across all client-facing materials.

Assess Functional Needs

Beyond aesthetics, functionality is key in choosing the right format. Think about the information you need to include, such as itemized lists of services, taxes, or discounts. Ensure the design you select allows for easy modification of these fields. Additionally, if your business handles recurring transactions or multiple payment methods, select a format that accommodates these needs efficiently.

Essential Elements of an Invoice

A well-structured billing document should clearly present all necessary details to ensure smooth payment processing. Including key elements not only adds to the professionalism of the document but also ensures that clients have all the information required to complete their transactions without delay. Below is a list of core components that make up an effective payment request form.

- Business Information: Start with the details of your company, including the business name, address, phone number, and email. This makes it easy for the recipient to identify the source and contact you if needed.

- Client Details: Include the recipient’s name or business name, contact information, and address. This personalizes the document and ensures it reaches the correct party.

- Unique Document Number

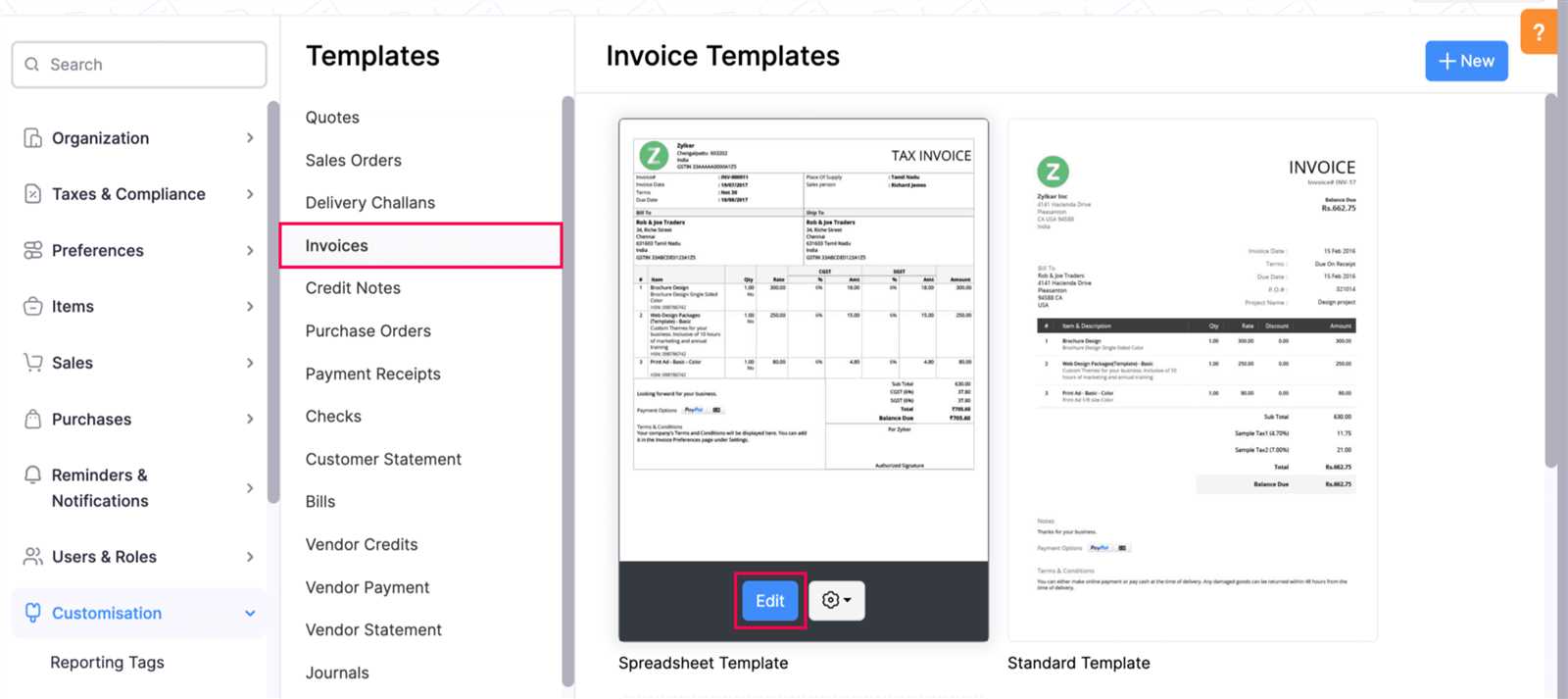

Top Software for Custom Invoices

Creating professional and branded payment documents is easier with the right software. Many digital tools are available to help businesses streamline the process of crafting these documents, offering customizable features that cater to specific needs. The following platforms provide flexibility, ease of use, and various functionalities to meet the demands of modern businesses.

Popular Platforms for Small Businesses

- FreshBooks: Known for its user-friendly interface, this platform allows businesses to create branded documents quickly. FreshBooks also integrates with various payment gateways and offers tracking features for efficient payment management.

- QuickBooks: A powerful tool for small to medium-sized businesses, QuickBooks offers a range of design options for financial documents and provides additional accounting featu

Top Software for Custom Invoices

Creating professional and branded payment documents is easier with the right software. Many digital tools are available to help businesses streamline the process of crafting these documents, offering customizable features that cater to specific needs. The following platforms provide flexibility, ease of use, and various functionalities to meet the demands of modern businesses.

Popular Platforms for Small Businesses

- FreshBooks: Known for its user-friendly interface, this platform allows businesses to create branded documents quickly. FreshBooks also integrates with various payment gateways and offers tracking features for efficient payment management.

- QuickBooks: A powerful tool for small to medium-sized businesses, QuickBooks offers a range of design options for financial documents and provides additional accounting features. Users can manage records and expenses in one place, simplifying financial workflows.

- Wave: This free option is ideal for freelancers or small businesses with basic needs. Wave includes a variety of templates, payment processing, and tracking, making it a valuable tool for those on a budget.

Advanced Options for Larger Enterprises

- Zoho Books: Designed for growing businesses, Zoho Books provides advanced customization and a wide range of integrations with other business tools. It includes robust reporting and tracking features, along with templates tailored for scalability.

- Xero: Xero is popular for its intuitive design and comprehensive set of accounting tools. It offers detailed customization, allowing businesses to reflect their brand identity in every document while maintaining organized financial records.

- Sage 50cloud: For larger enterprises, Sage 50cloud delivers powerful features that combine desktop and cloud capabilities. The platform allows for advanced modifications, multi-user collaboration, and detailed financial tracking.

These software options support businesses in efficiently managing their financial documentation while offering customizable designs to meet specific branding needs. Choosing the right tool depends on the size and nature of your business, as well as the features that best support your workflow.

Free vs Paid Invoice Templates

When choosing the best design for billing documents, businesses often face the decision between no-cost and premium options. Both types offer distinct advantages, depending on the needs and scale of the organization. Understanding the key differences between free and paid options can help in selecting the best fit for your business.

Advantages of Free Options

- Cost-Effective: Free designs are ideal for startups or freelancers with limited budgets. They provide essential formatting without the need for upfront investment.

- Basic Functionality: Many free designs include fundamental components needed for billing, such as itemized lists and space for basic company details, making them suitable for simple business needs.

- Easy to Access: Free formats are widely available and can of

Free vs Paid Invoice Templates

When choosing the best design for billing documents, businesses often face the decision between no-cost and premium options. Both types offer distinct advantages, depending on the needs and scale of the organization. Understanding the key differences between free and paid options can help in selecting the best fit for your business.

Advantages of Free Options

- Cost-Effective: Free designs are ideal for startups or freelancers with limited budgets. They provide essential formatting without the need for upfront investment.

- Basic Functionality: Many free designs include fundamental components needed for billing, such as itemized lists and space for basic company details, making them suitable for simple business needs.

- Easy to Access: Free formats are widely available and can often be customized with minimal software requirements, making them accessible for anyone looking for a quick solution.

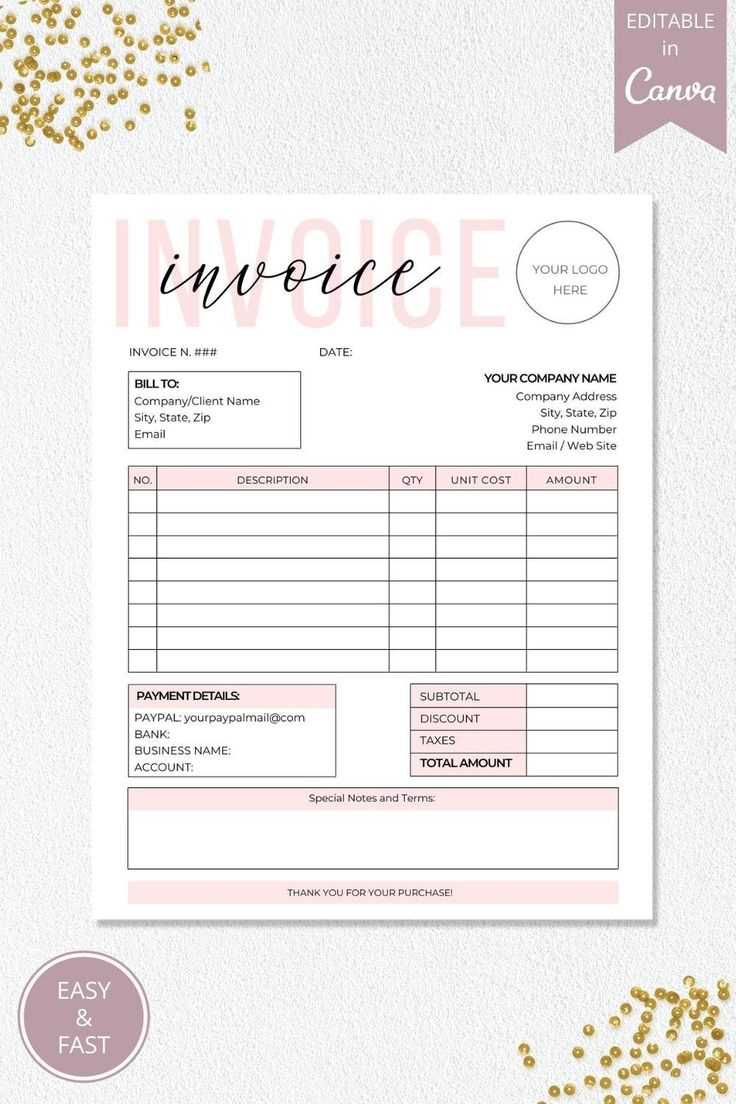

Benefits of Paid Options

- Advanced Customization: Paid designs typically offer a higher degree of personalization, allowing businesses to incorporate unique branding elements such as logos, colors, and specific layouts.

- Additional Features: Premium options often include advanced functionalities, such as integrated payment links, automated tracking, and compatibility with various accounting software, which can streamline the billing process.

- Professional Appearance: Paid options are often crafted with enhanced designs, providing a polished look that reflects professionalism and can help build trust with clients.

Ultimately, the choice between free and paid formats depends on the specific requirements of your business and your budget. For those just starting, free options provide a practical solution, while businesses looking to elevate their client interactions may find value in the added features of premium designs.

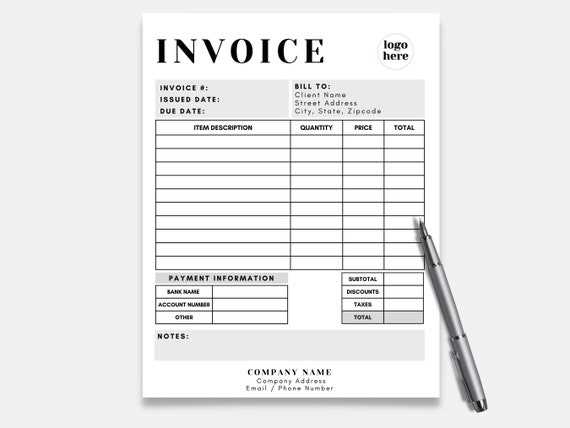

Tips for Professional Invoice Design

Creating a clear and polished billing document can significantly improve the impression your business leaves on clients. A well-structured format that includes essential details not only enhances readability but also fosters trust and ensures faster payment processing. Here are some key tips to achieve a professional look in your billing documents.

Emphasize Branding and Clarity

- Use Your Logo: Including your business logo helps reinforce your brand identity, making your documents instantly recognizable and giving them a polished, professional touch.

- Choose a Clean Layout: A simple, well-organized structure is essential. Keep sections clear with adequate spacing and distinct headings, helping clients quickly find relevant details.

- Select Consistent Fonts and Colors: Choosing a professional font and a color scheme that aligns with your brand creates a cohesive appearance. Avoid excessive styles that could detract from readability.

- Due Date: State the exact date by which the payment is expected. This can help avoid delays and keeps both parties aligned on expectations.

- Accepted Payment Methods: Listing available payment options, such as bank transfers, credit cards, or online platforms, gives clients flexibility while setting clear boundaries.

- Late Payment Policies: Specify any fees or interest charges for overdue payments. Mentioning these terms upfront acts as a reminder and encourages prompt payments.

- Early Payment Discounts: If you offer incentives for early payments, clearly state the discount percentage and the deadline to qualify, encouraging clients to pay ahead of time.

- Bank Transfers: A popular choice, especially for large sums, as it provides a secure way to transfer funds directly from a client’s bank account.

- Credit and Debit Cards: Widely accepted and familiar to most clients, cards are convenient and enable instant processing.

Automating Invoicing with Custom Templates

Streamlining the billing process through automation can save significant time and reduce errors, providing a more efficient workflow for businesses. By setting up reusable formats, companies can handle billing operations with greater speed and accuracy, ultimately improving cash flow and reducing the workload on staff.

Benefits of Automation

Time Savings: Automated systems eliminate the need to create documents from scratch each time a transaction is processed. This approach allows teams to focus on other essential tasks, as repetitive data entry is minimized.

Reduced Errors: Manual billing often leads to mistakes due to human error. By implementing automated systems, businesses can decrease errors in calculations, client information, and other key details, ensuring accuracy and professionalism.

Features to Look For in an Automation Tool

When selecting a system to automate your billing, certain features are essential for effective management:

- Integration Capabilities: Tools that can sync with accounting

Ensuring Legal Compliance in Invoices

When creating billing documents, it is crucial to adhere to the legal requirements set by local and international laws. Compliance ensures that your business operations remain transparent, lawful, and free from potential disputes or fines. Properly structured billing statements not only protect your business but also foster trust with your clients.

Each jurisdiction may have specific rules regarding the information that must be included, such as tax rates, business registration numbers, and other mandatory details. Understanding and incorporating these requirements is essential to avoid non-compliance and legal complications. Additionally, it is important to keep up to date with any changes in tax regulations or accounting practices that may affect your billing processes.

Key elements that may require attention for compliance include accurate tax calculations, clear payment terms, and proper documentation of services or goods provided. By ensuring all the necessary information is correctly included, businesses can prevent issues with audits or disputes.

How to Save and Store Your Templates

Organizing and securely storing your billing documents is essential for efficient business management. Whether you are working with digital files or printed formats, having a reliable system ensures that you can easily access and manage your records. Proper storage also helps in maintaining a consistent workflow and protects important data from loss or damage.

When saving your documents digitally, it’s important to choose a format that preserves the integrity of your layout and data. Common options include PDF, Word, or Excel files. Cloud storage solutions provide the added benefit of easy access from any device, along with backup features that safeguard against data loss. For local storage, ensure you have a clear folder structure and naming conventions to make retrieval simple.

For businesses that need to store large volumes of records, consider using a document management system. These systems allow for categorization, tagging, and easy searching of files, making it easier to find specific documents when needed. Regular backups and ensuring proper security measures are in place will further protect your important files.

- Integration Capabilities: Tools that can sync with accounting

Adding Branding to Your Invoice

Incorporating elements of your brand into billing documents helps reinforce your business identity, making each interaction memorable and professional. By aligning these documents with your visual style, you create a consistent and recognizable experience for your clients, strengthening their trust and confidence in your services.

Key Elements for Brand Integration

Brand Element Description Logo Placement Position your logo prominently at the top, establishing immediate recognition. This creates a professional impression and helps reinforce your identity. Color Scheme Use colors associated with your brand in headings, borders, or section backgrounds. Consistent colors make the documen Common Mistakes in Invoice Creation

Crafting a clear and effective billing document requires careful attention to detail, as small oversights can lead to misunderstandings or delays in payment. Avoiding common pitfalls ensures that your records are accurate, easy to understand, and professional, ultimately supporting smooth financial transactions with your clients.

Omitting Important Details

One frequent mistake is leaving out key information, such as payment terms, due dates, or detailed descriptions of provided services. Each document should include specific line items, amounts, and dates to prevent confusion. Providing clear terms and conditions upfront helps avoid follow-up questions or disputes, making the transaction more efficient for both parties.

Using Inconsistent Formatting

Another common error is inconsistent formatting, which can make your documents appear unprofessional. Issues such as irregular font sizes, mismatched colors, or unaligned text may distract from the content and reduce readability. Maintaining uniformity in layout and design improves clarity and ensures that essential details are easy to locate,

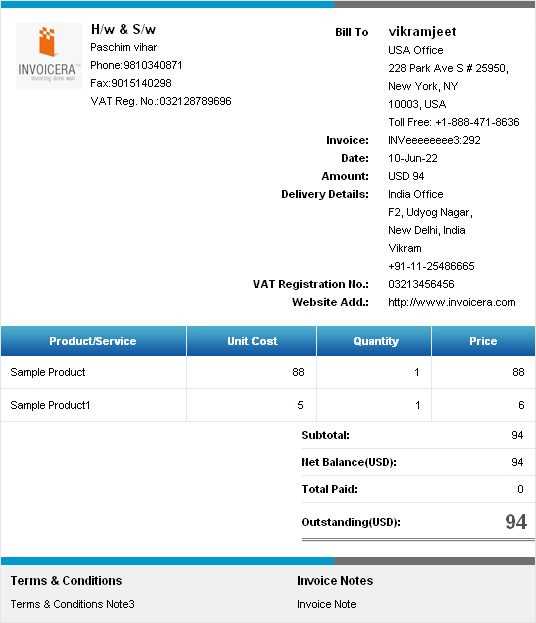

How to Include Tax Information

Properly adding tax details is essential for transparency and regulatory compliance, ensuring clients are fully informed about their total charges. Clear, accurate tax breakdowns help avoid misunderstandings and streamline financial record-keeping for both you and your clients.

To start, clearly specify the type and rate of tax applied to each item. Common taxes include sales tax, value-added tax (VAT), and goods and services tax (GST), depending on your region. Each tax should be shown as a separate line item, typically below the subtotal, with the rate or percentage visibly displayed. This structure clarifies exactly how much tax is added and avoids confusion over final costs.

Additionally, include any relevant tax identification numbers as required by local laws. In many regions, displaying a tax ID provides legitimacy and ensures compliance, especially for clients needing do

Making Payment Terms Clear

Clarity in payment terms is crucial for ensuring smooth transactions and preventing misunderstandings. By providing specific details about payment expectations, both parties can have a transparent understanding of timelines and conditions, fostering trust and promoting timely payments.

Key Elements to Include

St

Incorporating Multiple Payment Methods

Offering a variety of payment options can make it easier for clients to complete transactions swiftly and with minimal hassle. By accommodating different preferences, businesses can enhance client satisfaction and reduce payment delays, making the process more convenient for both parties.

Why Multiple Options Matter

Clients often have their preferred ways of settling payments, whether through bank transfers, credit cards, or digital wallets. By including several methods, you can streamline transactions and avoid potential barriers. This approach shows flexibility, catering to a wider range of needs and ensuring that clients aren’t limited by a single payment method.

Key Payment Options to Consider: