CSV Invoice Template for Easy and Efficient Invoicing

Managing financial transactions efficiently is essential for any business. The ability to quickly generate, track, and organize payment details can save time and reduce errors. With the right tools, billing can become a seamless part of your workflow, allowing you to focus on growing your business rather than administrative tasks.

One effective way to simplify this process is by using customizable document formats that are both easy to modify and universally compatible. These formats allow for quick adjustments, enabling businesses to meet their unique needs without the complexity of more advanced software solutions. By using a straightforward, data-driven approach, you can ensure accuracy and consistency across all records.

Whether you’re managing a small startup or overseeing a larger operation, adopting an organized system for creating and storing payment records can improve your overall efficiency. By utilizing an adaptable system, you can automate repetitive tasks, minimize mistakes, and keep your finances well organized for easy access and analysis at any time.

CSV Invoice Template Overview

Managing business transactions effectively requires a simple yet powerful way to document and organize payment details. Using a structured file format for generating these records allows businesses to keep everything in one place, making it easier to track financial activities, share with clients, and keep accurate logs for accounting purposes. This approach offers both flexibility and efficiency, streamlining your record-keeping process.

One of the key advantages of using this type of document format is its compatibility with various software tools. This makes it easier to integrate data with accounting systems, spreadsheets, or any other platforms you might use for financial management. The flexibility to adapt the structure to your specific needs ensures that the system works seamlessly within your existing workflow.

- Easy Customization: You can tailor the structure of your records to include relevant fields that match your business needs.

- Data Organization: A clear format helps in organizing transaction details, such as dates, amounts, and client information, for easy access and analysis.

- Time Efficiency: With a ready-made structure, you can quickly fill out and modify details, saving time on repetitive tasks.

- Compatibility: This file format works across multiple platforms, making it easy to share with clients, accountants, or other team members.

Overall, using a structured, customizable file format ensures that your financial records are both organized and accessible. It simplifies the invoicing process and helps maintain accuracy in documenting all business transactions.

Why Choose CSV for Invoicing

When it comes to managing financial records, choosing the right file format can greatly impact efficiency and accuracy. A widely used and flexible approach for generating transaction logs is the use of simple, structured data files. These formats offer businesses a straightforward way to organize and maintain payment records, while being compatible with many software systems.

There are several reasons why this format stands out as an excellent choice for documenting payments:

- Universal Compatibility: This file type can be opened and edited across various platforms, including spreadsheets, accounting software, and even basic text editors. This makes it easy to share data with clients, partners, or accounting teams.

- Simple Structure: The design of the file is basic yet powerful, focusing on raw data such as dates, amounts, and client details. This simplicity makes it easy to modify or expand the file as needed.

- Data Portability: You can easily import or export this data to and from other programs, making it simple to integrate into your broader financial workflow.

- Cost-Effective: Unlike specialized software solutions that often require expensive licenses, this format is free to use, reducing operational costs for small businesses and startups.

- Automation Potential: Many tools allow you to automate the generation and processing of these files, saving time and minimizing manual entry errors.

For small and large businesses alike, the ability to manage transactions using a simple, customizable file format helps reduce administrative overhead while keeping your records organized and easily accessible.

Benefits of Using a CSV Format

Choosing the right file format to manage business records can significantly improve efficiency and reduce errors. By using a straightforward, data-oriented approach, businesses can streamline their administrative processes while maintaining flexibility and accuracy in their financial documentation. The simplicity and adaptability of this format make it an excellent choice for managing essential transaction details.

Ease of Use

One of the main benefits of using this format is its user-friendliness. The structure is clean and easy to understand, which allows anyone with basic knowledge of spreadsheets or data entry tools to quickly generate and modify records. The format doesn’t require specialized training or software, making it accessible to businesses of all sizes.

Improved Data Management

This format enhances data organization, allowing businesses to store transaction details in a clear, logical structure. By separating key pieces of information into distinct columns, it becomes much easier to sort, filter, and analyze records. The format also simplifies the process of importing data into other software tools, enabling seamless integration with accounting platforms and financial systems.

Overall, using a data-centric approach provides numerous advantages, from simplifying the documentation process to improving the accuracy and accessibility of financial records.

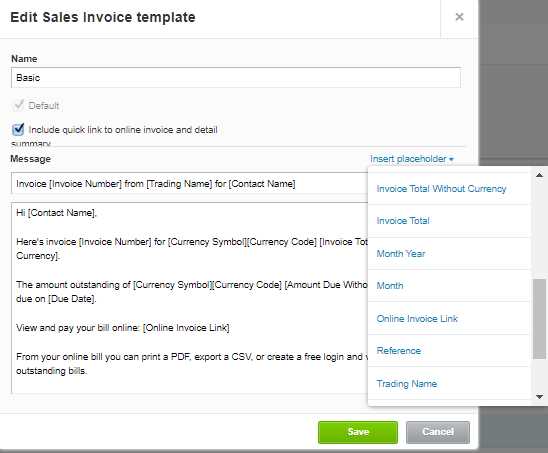

How to Customize Your CSV Invoice

Customizing your records to suit your business needs is crucial for ensuring that all essential information is captured correctly. By adjusting the structure of your data file, you can make it more relevant and user-friendly for your specific workflow. Customization not only enhances clarity but also ensures that the file aligns with your internal processes, from tracking transactions to preparing reports.

Adding Custom Fields

One of the first steps in personalizing your document is adding the fields that are most important to your business. For example, you can include columns for additional information such as payment terms, purchase order numbers, or specific tax codes. This flexibility allows you to track everything from product details to payment statuses, ensuring that all relevant data is at your fingertips.

Formatting for Clarity

Once you’ve added the necessary fields, it’s important to focus on the organization and layout of the document. Consider using bold headers for each category, and ensure that the columns are clearly labeled so that anyone reviewing the file can easily understand its contents. Adjusting column widths and text alignment can further improve readability and make it easier to analyze the data at a glance.

By tailoring the structure of your financial documents, you ensure that they meet your specific business needs, making them more efficient and effective for both day-to-day operations and long-term financial planning.

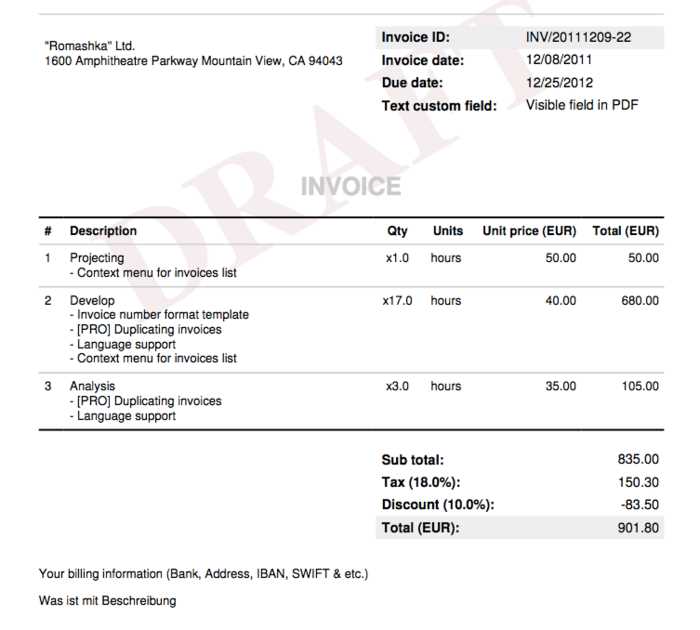

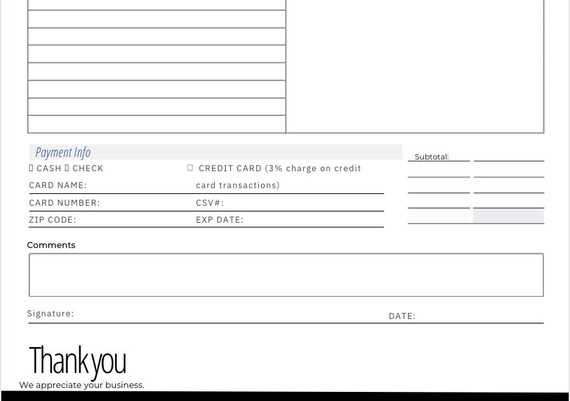

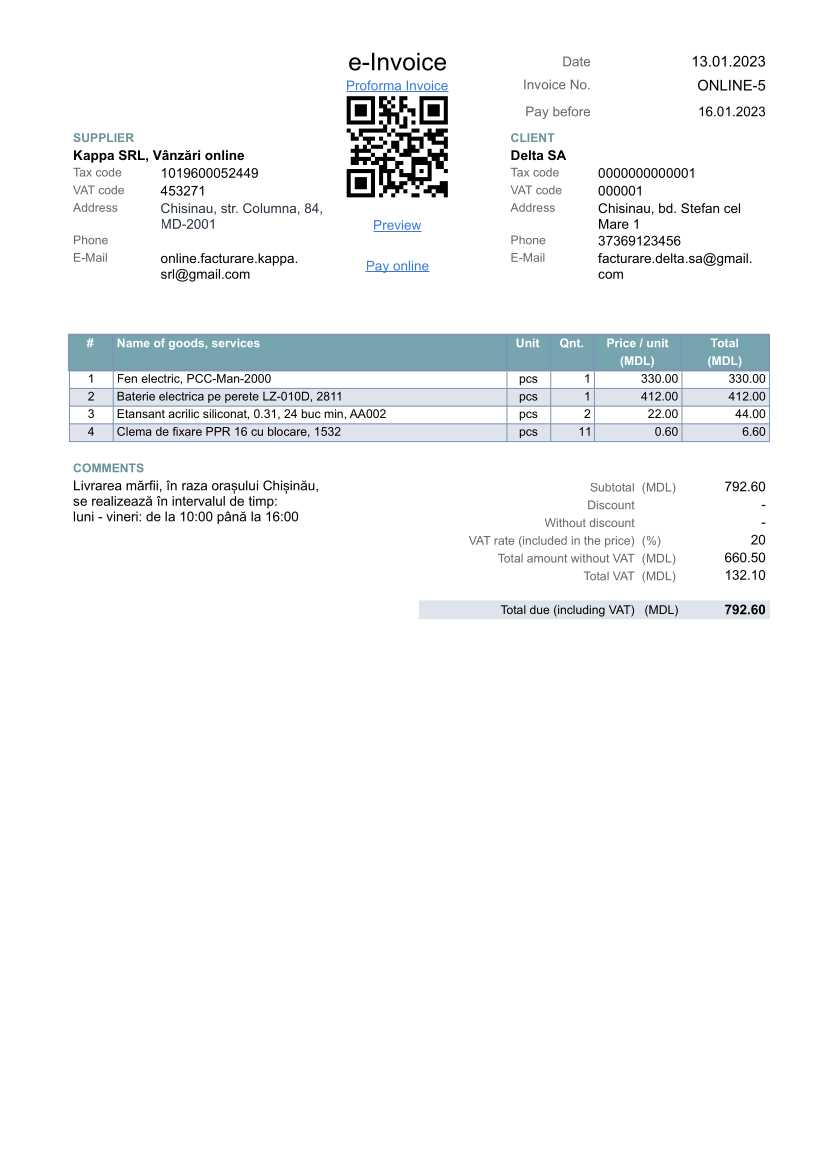

Essential Fields in a CSV Invoice

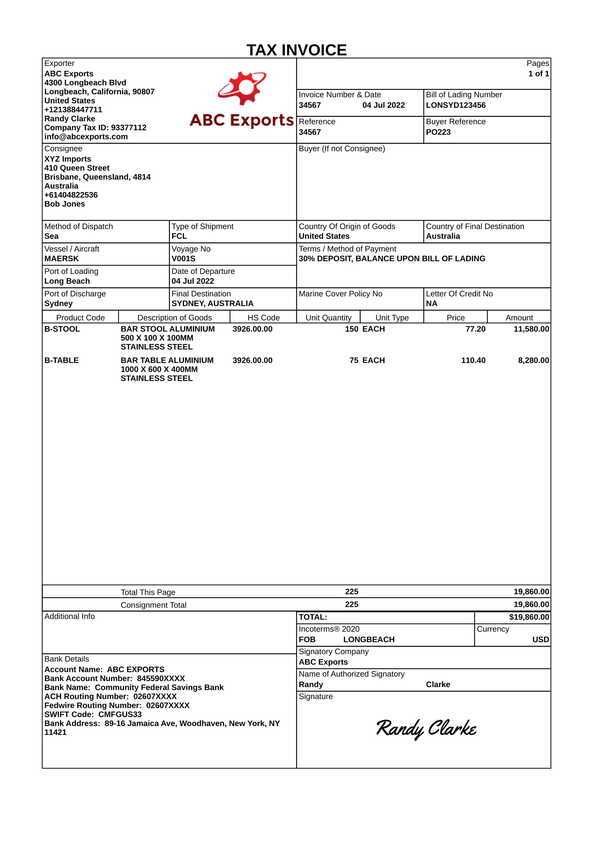

To ensure that all necessary details are properly documented, it is important to include key fields in your financial records. These fields help to capture relevant transaction information, making it easier to track payments, generate reports, and maintain accurate records. Customizing your file with the right data points not only streamlines the process but also ensures that all parties involved have clear and complete information.

Key Transaction Details

At the core of your document, you should include the following critical fields:

- Transaction Date: Capturing the date of the transaction helps to establish a clear timeline and is essential for both accounting and tax purposes.

- Client Information: Including the client’s name, address, and contact details ensures that the transaction is linked to the correct customer.

- Amount: Clearly stating the total amount due for the transaction helps to avoid misunderstandings and ensures transparency.

- Itemized List: If applicable, breaking down the products or services provided can offer clarity for both you and your clients, showing how the total was calculated.

Additional Fields for Clarity

Including the following optional fields can add even more structure and help improve the overall utility of your records:

- Payment Terms: Define when the payment is due (e.g., within 30 days) to ensure both parties are on the same page regarding deadlines.

- Tax Information: If applicable, including tax rates or exempt status helps ensure compliance with local regulations and provides an accurate breakdown of costs.

- Purchase Order Number: This is especially useful for businesses that work with recurring clients or have complex orders that require reference to previous agreements or contracts.

By ensuring these essential fields are included and clearly defined, you can create more organized, professional, and transparent records that serve both operational and financial purposes effectively.

Top Tools for Creating CSV Invoices

To effectively generate and manage payment records, businesses often rely on various tools that simplify the process of creating and organizing financial documents. These tools range from simple spreadsheet applications to specialized software designed to streamline the entire workflow. Choosing the right tool depends on the complexity of your needs, the size of your business, and your preferred level of automation.

Spreadsheet Software

For most businesses, spreadsheet programs are the most accessible and commonly used tools for generating transaction logs. They offer a balance of simplicity and customization, allowing users to create structured records with ease.

- Microsoft Excel: One of the most popular tools, Excel allows users to design, edit, and store financial data in customizable sheets. Its powerful features, such as formulas, pivot tables, and data validation, make it ideal for managing more complex records.

- Google Sheets: A free, cloud-based alternative to Excel, Google Sheets offers real-time collaboration and easy sharing, making it an excellent option for teams that need to access and modify files remotely.

Dedicated Accounting Software

For businesses looking to automate the process and integrate with other financial systems, accounting software is an excellent choice. These tools often come with pre-built features specifically for generating structured records, handling payments, and generating reports.

- QuickBooks: This popular accounting software provides an intuitive interface for managing financial transactions, including generating structured payment records, sending invoices, and integrating with bank accounts.

- Xero: Another robust accounting tool, Xero offers cloud-based accounting and allows businesses to create financial records, track payments, and even automate repetitive tasks.

- FreshBooks: Designed specifically for small businesses, FreshBooks helps users create and manage professional-looking payment documents with ease. It also integrates with other business tools for seamless workflow management.

Each of these tools offers different strengths, so businesses should choose the one that best fits their size and operational needs, ensuring a streamlined and efficient process for handling financial records.

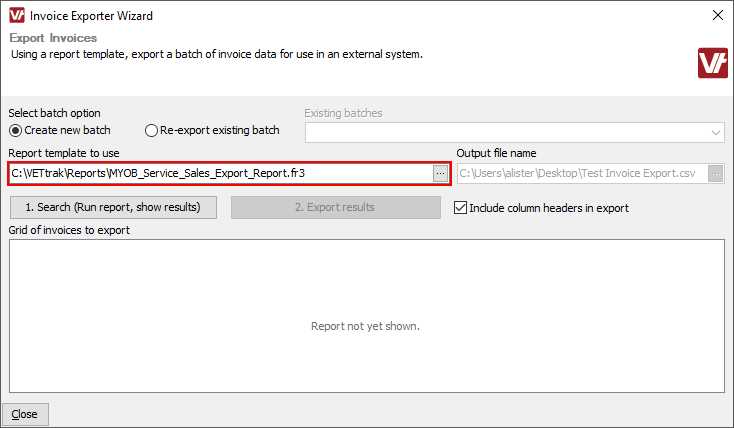

Automating Invoices with CSV Templates

Automating the process of generating financial documents can save businesses significant time and effort, especially for those handling large volumes of transactions. By utilizing data-driven structures, it’s possible to set up workflows that create, store, and even send these records automatically. Automation eliminates repetitive tasks, reduces human error, and ensures that records are always up to date.

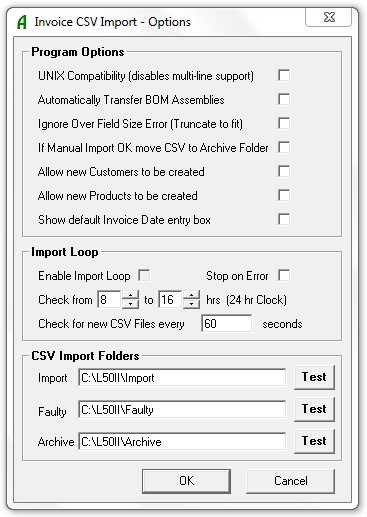

Setting Up Automated Workflows

Automating the creation of these records involves integrating your system with the right tools and data sources. Many software solutions allow you to pull data from accounting platforms or customer relationship management (CRM) systems to populate structured files automatically. This integration ensures accuracy and eliminates manual data entry, while also speeding up the process.

| Step | Action | Tools/Software |

|---|---|---|

| Step 1 | Integrate accounting software with CRM or database | QuickBooks, Xero, Salesforce |

| Step 2 | Set up automation rules for data entry | Zapier, Integromat |

| Step 3 | Customize document fields (e.g., client name, payment amount) | Google Sheets, Microsoft Excel |

| Step 4 | Schedule automatic creation and sending of records | Mailchimp, Zoho Mail |

Benefits of Automation

By automating the creation and management of these documents, businesses can save time, reduce errors, and ensure consistency in their financial operations. This automation also provides more control over deadlines, ensuring that records are created and sent out on time, every time.

How to Edit a CSV Invoice Easily

Modifying payment records or transaction documents doesn’t have to be a complicated process. With the right tools, making quick adjustments to your structured files can be done efficiently. Whether you need to correct an amount, add a new entry, or update client information, simple edits can be completed without much effort.

Using Spreadsheet Software

The easiest way to edit these records is by using popular spreadsheet programs such as Microsoft Excel or Google Sheets. These applications offer an intuitive interface that allows you to easily navigate through your data and make changes. You can:

- Edit individual cells: Click on the specific cell you want to modify and input the new information, such as an updated payment amount or a different service description.

- Insert or remove rows: To add or delete entries, simply right-click on a row and choose to insert or delete. This is useful when adding new transactions or removing outdated information.

- Use formulas: Spreadsheet programs allow you to use formulas to automatically calculate totals, taxes, and other values, reducing manual entry errors.

Editing in Text Editors

If you prefer working in a text editor, you can open your structured file in programs like Notepad or Sublime Text. While this requires a bit more attention to detail, it’s a quick way to make simple changes. Just locate the row or column you want to adjust, edit the data directly, and save the file in the correct format. Be careful with spacing and commas to ensure the integrity of the data remains intact.

In both methods, always double-check the edits to ensure everything is accurate before saving the changes, especially if the document is being used for further financial processing or reporting.

Common Mistakes to Avoid in CSV Invoices

When creating and managing financial records, small errors can quickly lead to confusion or even financial discrepancies. It’s crucial to pay attention to detail, ensuring that all data is entered correctly and consistently. While using a structured format can simplify the process, there are still common mistakes that businesses should avoid to ensure accuracy and professionalism in their documentation.

- Missing Required Information: Failing to include essential details such as payment dates, amounts, or client names can lead to confusion or disputes. Always double-check that all necessary fields are filled out correctly.

- Incorrect Formatting: One of the biggest issues when using structured data formats is improper alignment of columns or incorrect data types. Ensure that numbers, dates, and text are formatted consistently throughout the document.

- Inconsistent Tax Calculations: If your document includes tax calculations, ensure that the correct rates are applied consistently across all entries. Small errors in tax rates can result in significant discrepancies in totals.

- Not Saving in the Correct Format: Saving the file in an incorrect format or without proper extensions can cause compatibility issues. Always ensure that the file is saved in a widely accepted format that can be easily opened by other software tools.

- Overlooking Currency Symbols: If your records involve multiple currencies, make sure that the correct currency symbols are used in each relevant field. Mislabeling currencies can cause confusion and misinterpretation of amounts.

- Forgetting to Update Information: Always ensure that details like client addresses, contact info, and payment terms are up to date. Using outdated information can lead to errors in processing payments or sending documents to the wrong recipients.

- Not Double-Checking Totals:

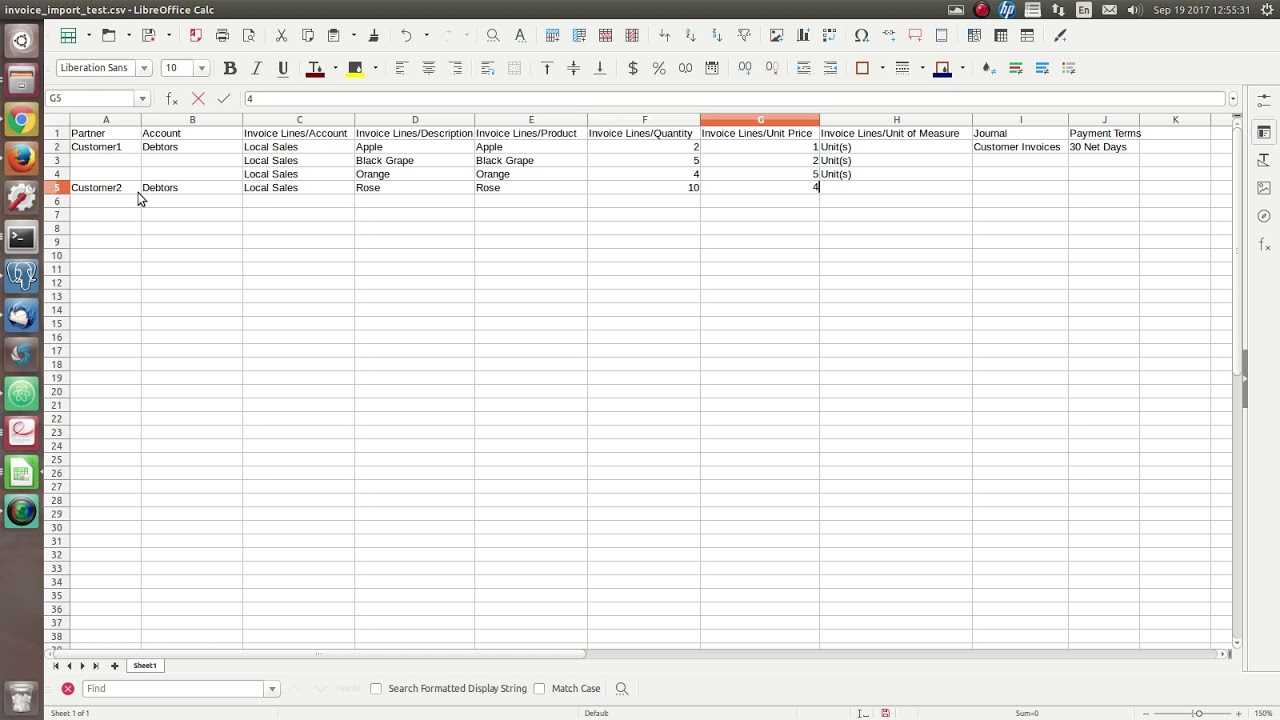

Understanding CSV File Structure

When working with data-driven records, it’s important to understand how the information is organized within the file. A structured data file typically follows a simple format, where each piece of information is separated by a delimiter, such as a comma or semicolon. Understanding this structure is crucial for both creating and editing your documents, as it ensures the data remains accessible and consistent across various platforms and tools.

At its core, the structure consists of rows and columns. Each row represents a single entry or record, while each column corresponds to a specific type of information. For example, one column might hold the client’s name, while another contains the payment amount or transaction date. The data within each row is separated by a delimiter, making it easy to extract, manipulate, or transfer the information between software systems.

- Rows: Each row in the file represents a separate record, containing all relevant information for a specific transaction or entry.

- Columns: Columns define the categories or attributes of the data. Common columns in business records may include customer names, product descriptions, prices, and payment statuses.

- Delimiters: A delimiter, often a comma or semicolon, separates the values in each column. This is what makes it possible for software to correctly interpret the data structure and display it in a readable form.

By understanding this basic structure, you can better manage your records, customize your files, and ensure that the data is compatible with the tools you are using for accounting, reporting, or communication.

CSV Invoice vs Excel Format

When managing financial records, the choice of file format can significantly impact workflow efficiency and compatibility with various systems. Two of the most commonly used formats for storing and sharing structured data are simple text-based files and spreadsheet formats. While both are useful, they each have distinct advantages and limitations, depending on the business needs and technical requirements.

CSV Format

The main strength of this file type is its simplicity and universal compatibility. As a plain text file, it stores data in rows and columns separated by commas (or other delimiters), which makes it easy to export, import, and process in many systems and software applications. Its lightweight nature allows it to be opened and edited using basic text editors, and it is commonly used for transferring large datasets across different platforms.

- Advantages: Fast to load, easy to share, minimal file size, compatible with a wide range of software tools.

- Limitations: Lacks advanced features like formulas, formatting, and graphs. The user interface is less intuitive for non-technical users.

Excel Format

Excel is a more robust solution, offering powerful data manipulation tools, such as formulas, charts, and pivot tables. It is well-suited for those who need to perform calculations, create complex reports, or visualize data in a more user-friendly format. Excel files are commonly used in accounting and financial analysis because of their ability to handle larger volumes of data and advanced functions.

- Advantages: Rich functionality, including calculation tools, cell formatting, and data visualization options.

- Limitations: Larger file size, compatibility issues across different versions of Excel, and the need for specific software to open and edit the file.

In summary, while both formats serve the purpose of storing and sharing structured data, the choice between the two largely depends on the level of complexity required for your documents. If you need a simple, universally compatible file for basic record-keeping, a plain text file may be sufficient. However, if you need advanced features and a more user-friendly interface for financial analysis, a spreadsheet format like Excel may be the better option.

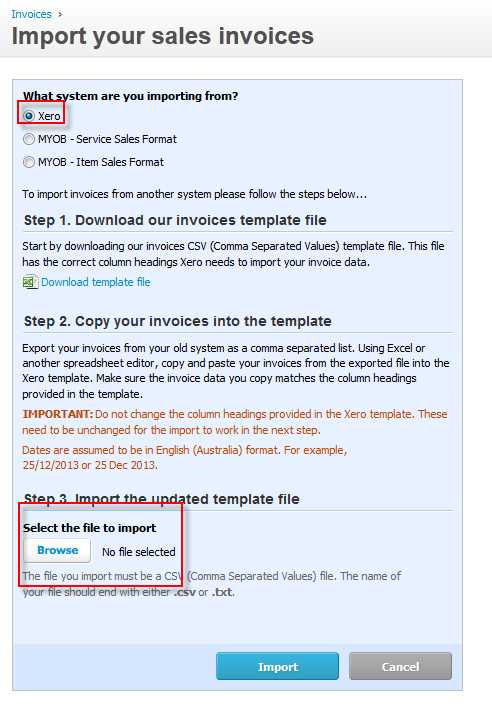

Integrating CSV Invoices with Accounting Software

Integrating structured data files with accounting software can greatly enhance efficiency and reduce the risk of errors. By automatically importing transaction records from your data files into accounting systems, you can streamline bookkeeping, improve reporting accuracy, and save time on manual entry. This process not only helps ensure that financial data is consistently up to date but also provides greater insight into your business’s financial health.

Accounting software tools typically support data imports from standard file formats, allowing you to seamlessly upload records and automatically populate your accounts, ledgers, or payment tracking systems. Whether you are using software like QuickBooks, Xero, or FreshBooks, setting up an integration with your structured data files can significantly improve your financial management process.

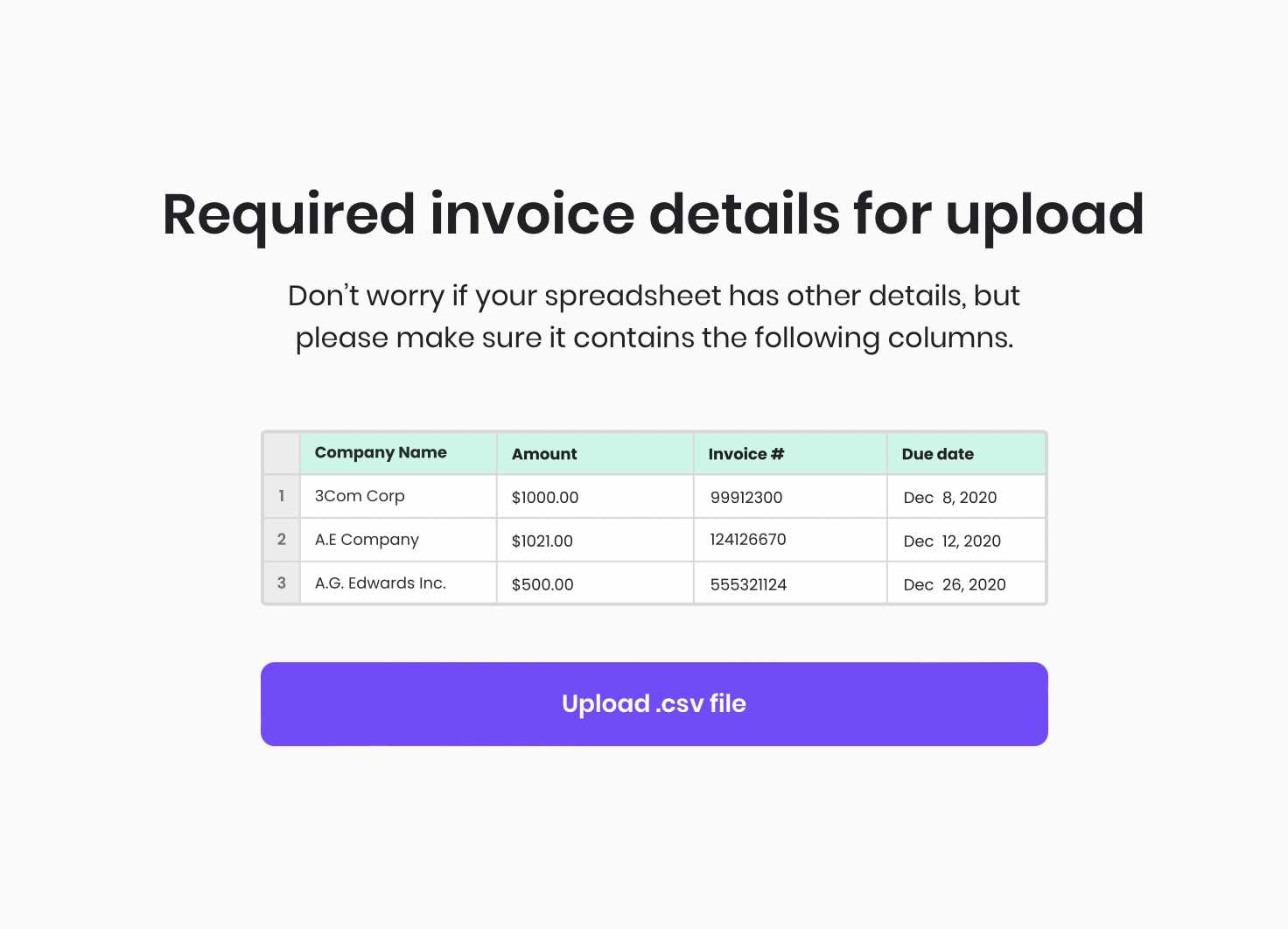

Steps to Integrate Data Files with Accounting Tools

- Choose the Right Software: Ensure your accounting software supports importing data from files, such as CSV or tab-delimited text formats. Most modern accounting platforms offer this feature.

- Prepare Your Data: Before uploading, make sure your file is well-organized with the correct structure. Double-check that each column is accurately labeled and formatted to match the fields in your accounting software.

- Upload the File: Use the software’s import tool to upload the prepared file. Many accounting systems will allow you to map your data columns to the appropriate fields within the system (e.g., payment date, customer name, amount due).

- Review and Reconcile: After importing, review the data in your accounting software to ensure everything is correct. Make any necessary adjustments before finalizing the process.

Benefits of Integration

Integrating structured financial records with accounting software offers several advantages:

- Reduced Manual Work: Automating data transfers saves time on manual entry and minimizes the risk of errors.

- Faster Financial Reporting: With real-time updates, your accounting software will always reflect the latest transaction data, helping you generate reports quickly.

- Improved Accuracy: Automated integrations reduce the chances of human error, leading to more accurate financial records and fewer discrepancies.

By streamlining the process of transferring data between your records and accounting software, you c

Best Practices for Organizing CSV Data

Properly organizing structured data files is essential for efficient data management, ease of analysis, and accuracy in reporting. When dealing with transaction records or business-related information, ensuring that the data is well-structured from the start will save time and effort in the long run. By following best practices, you can avoid confusion, prevent errors, and make it easier to share and process the data across different systems.

1. Use Clear and Consistent Column Headers

Column headers should be descriptive and consistent throughout your file. This helps anyone viewing or processing the data to easily understand what each column represents. For example, use headers like “Customer Name,” “Product Description,” or “Amount Due,” rather than ambiguous terms. Additionally, ensure that the headers are uniform in spelling, formatting, and capitalization to maintain consistency.

- Be specific: Avoid using vague column names like “Data” or “Info.” Use precise terms like “Payment Date” or “Total Amount.”

- Standardize formatting: Ensure headers are capitalized consistently, using either all uppercase or proper case for clarity.

2. Maintain Data Consistency

Consistency is key when it comes to data. Ensure that the data entered into each column follows the same format throughout the file. This means using consistent date formats, currency symbols, or numeric representations. For instance, if you’re using “MM/DD/YYYY” for dates, avoid mixing it with “DD/MM/YYYY” in different rows.

- Dates: Stick to one date format throughout the file, such as “MM/DD/YYYY” or “YYYY-MM-DD.”

- Currency: Use the same currency symbol and decimal places across all financial columns (e.g., “$1,000.00” or “€1.000,00”).

- Numbers: Ensure all numbers are formatted similarly, e.g., use commas for thousands and periods f

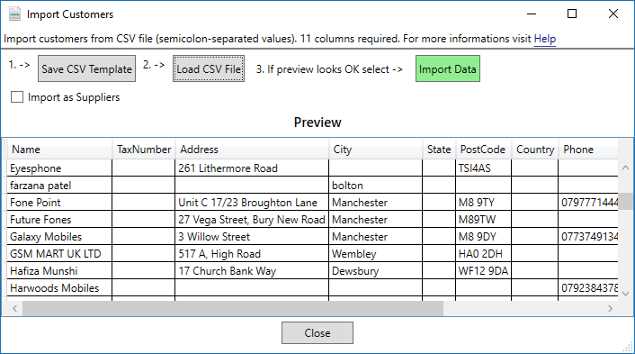

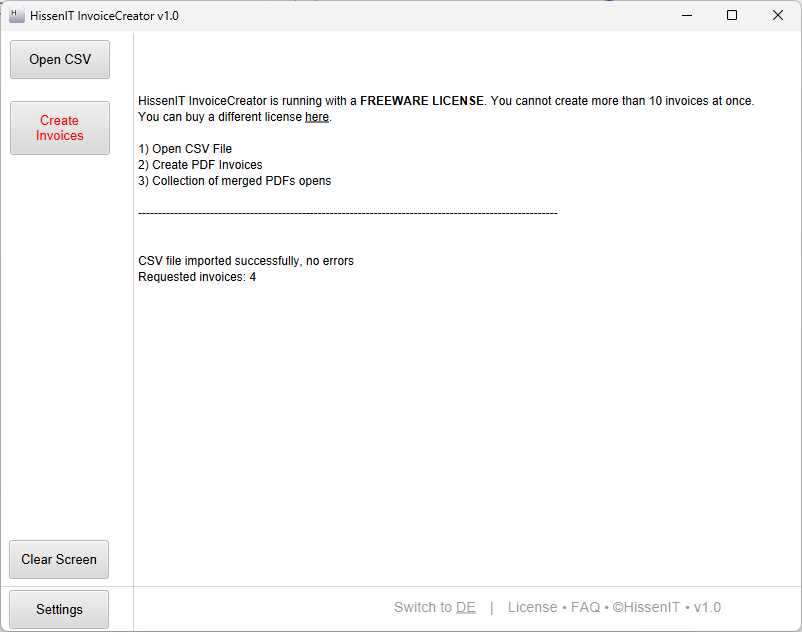

How to Import CSV Invoices to Other Programs

Importing structured data into different software programs can save time and improve accuracy in your workflow. Whether you’re transferring transaction records into accounting software, a customer relationship management system, or a data analysis tool, understanding how to properly import files can ensure smooth integration. By following the correct steps, you can easily move your data between systems while maintaining its integrity and ensuring no data is lost in the process.

Steps to Import Data into Popular Software

Most modern software programs support importing structured data, and the process is typically straightforward. Here’s how you can import your records into various tools:

- Step 1: Prepare Your File: Before importing, ensure that your structured data is well-organized with clear headers and consistent formatting. Verify that all necessary information is present and free of errors.

- Step 2: Choose Import Option: Open your software program and locate the option to import or upload data. This may be labeled as “Import Data,” “Upload,” or “Import File” in the software’s interface.

- Step 3: Select the Correct File Format: Ensure you are selecting the appropriate file type for import. Most programs accept common formats such as .csv or .txt, but it’s important to choose the right one to avoid issues with data recognition.

- Step 4: Map the Data Fields: Some programs will ask you to map the columns from your file to the appropriate fields in the software (e.g., mapping “Customer Name” to the “Client Name” field). Double-check that all columns are correctly matched.

- Step 5: Finalize the Import: After mapping the fields, proceed with the import. Review the data for accuracy once it’s in the program and correct any discrepancies before saving or finalizing the process.

Tips for Ensuring a Smooth Import

- Check for Errors: Before importing, carefully review your file to ensure there are no empty rows, missing columns, or incorrect data formats. This helps avoid issues during the import process.

- Use Software Guides: Refer to the help documentation of the software you’re using for specific instructions on importing data. Each tool might have slig

Maintaining Data Accuracy in CSV Files

Ensuring the accuracy of data within structured files is essential for reliable decision-making, financial tracking, and reporting. Even small errors in a dataset can lead to significant mistakes when the information is used in other applications or software. To maintain high-quality records, it’s crucial to implement practices that prevent inaccuracies, facilitate proper data entry, and ensure consistency throughout the entire file.

Best Practices for Ensuring Data Accuracy

Here are some strategies to help you maintain data accuracy when working with structured files:

- Standardize Data Entry: Use consistent formats for all fields. For example, ensure that dates follow the same format across the entire file (e.g., “MM/DD/YYYY” or “YYYY-MM-DD”) and that numbers are displayed with a consistent decimal structure.

- Use Validation Rules: Many software tools allow you to set up validation rules to ensure that the data entered is within acceptable parameters. For instance, you can restrict entries to certain formats, such as ensuring that a phone number contains only numbers or that the payment amount is always positive.

- Double-Check Entries: Always verify the data before saving or sharing the file. Review the information for typographical errors, missing data, or inconsistent formats. This is particularly important when dealing with financial or transaction data.

- Automate Data Importing: To minimize human error, automate the process of importing data whenever possible. This reduces the chances of manually entering incorrect information and speeds up the overall workflow.

Tools to Help Maintain Data Accuracy

Several tools and methods can be used to help you maintain accuracy when managing structured data:

- Data Validation Tools: Many spreadsheet programs and data management tools offer built-in features for validating data as it is entered. These tools help identify incorrect entries in real-time.

- Automated Data Importers: Use automated data importers that handle large datasets without human intervention. This minimizes the potential for errors when transferring data between systems.

- Data Cleaning Software: For larger datasets, specialized software can be used to clean and standardize data, ensuring uniformity and preventing mistakes.

By following these practices and leveraging the right tools, you can significantly improve the accuracy of your structured files. Maintaining clean, accurate data will not only enhance your workflow but wil

Ensuring Security of Your CSV Invoices

When working with sensitive business data, protecting your records from unauthorized access, loss, or tampering is crucial. Structured data files, which often contain financial details, customer information, and transaction histories, require careful security measures to prevent breaches. Safeguarding this information not only helps maintain privacy but also ensures compliance with legal and industry standards for data protection.

Best Practices for Data Security

To ensure the security of your files, it’s essential to implement a combination of technical safeguards and operational procedures:

- Encryption: Always encrypt sensitive files before storing or sharing them. Encryption turns your data into a secure format that is unreadable without the correct decryption key, adding an extra layer of protection in case of unauthorized access.

- Access Control: Limit access to your files to only authorized personnel. Ensure that password protection is used for systems storing sensitive data and consider role-based access controls to restrict certain users from viewing or editing specific information.

- Regular Backups: Implement regular backups of your structured files. This ensures that, in case of accidental loss or damage, you can recover the data without significant disruption to your operations.

- Secure File Sharing: When sharing files electronically, use secure channels like encrypted email, secure file transfer protocols (SFTP), or cloud storage with robust security features, such as two-factor authentication (2FA).

- Audit Trails: Maintain an audit trail to track who accessed, modified, or shared the data. This helps identify potential security breaches and enhances accountability for handling sensitive information.

Using Software with Built-in Security Features

Many modern software tools provide built-in security features that can help protect your structured files. These tools offer the following advantages:

- Automatic Encryption: Some programs offer automatic encryption for files upon saving or sharing, ensuring that sensitive data is always protected.

- Access Management: Tools often include role-based access settings that allow you to specify who can view, edit, or share specific records, helping enforce the principle of least privilege.

- Cloud-Based Security: Cloud storage solutions with strong security protocols, such as end-to-end encryption, ensure that your files are stored safely and can only be accessed by authorized users.

By following these practices and utilizing secure software options, you can ensure the integrity and confidentiality of your structured data, reducing the risk of data breaches and maintaining the trust of your c

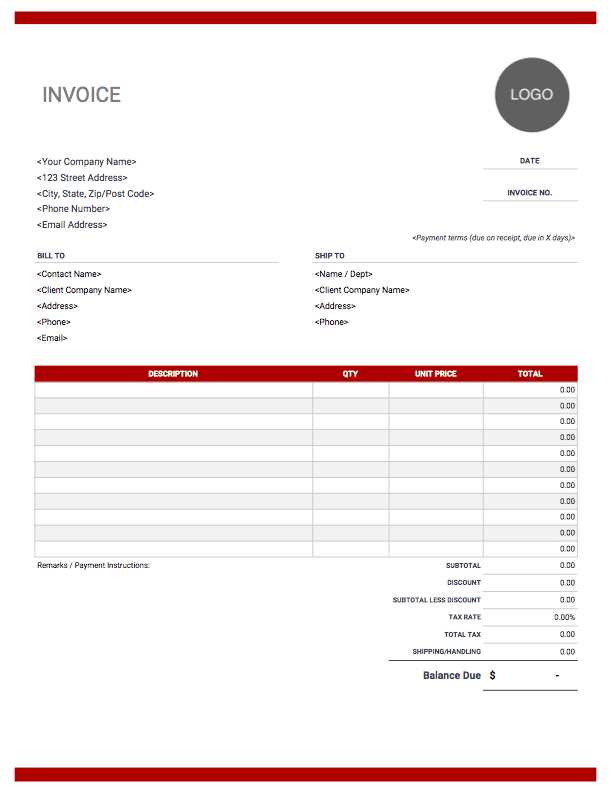

Free and Paid CSV Invoice Templates

When it comes to managing business transactions, having a well-organized data file can streamline your processes significantly. Whether you’re sending billing statements or managing records, choosing the right structured data format is crucial. There are a variety of options available–both free and paid–that offer pre-made formats for handling business records efficiently. Depending on your specific needs, you may choose a free option for simplicity or a paid solution for additional features and customizations.

Free Options for Structured Data Files

Free solutions are an excellent starting point for small businesses or individuals looking to save costs while maintaining organization. These options typically offer basic functionality and can be easily modified to suit your needs:

- Basic Layouts: Free formats usually provide simple, clean structures with essential fields like customer name, date, and total amount, allowing you to quickly record transactions.

- Customizable Fields: While basic, many free formats allow some degree of customization, letting you add or remove fields according to your requirements.

- Widely Accessible: Free options can be used with popular spreadsheet tools like Excel or Google Sheets, ensuring easy access and compatibility.

- Limitations: Free options may come with fewer advanced features such as automated calculations, reporting, or integration with other software systems.

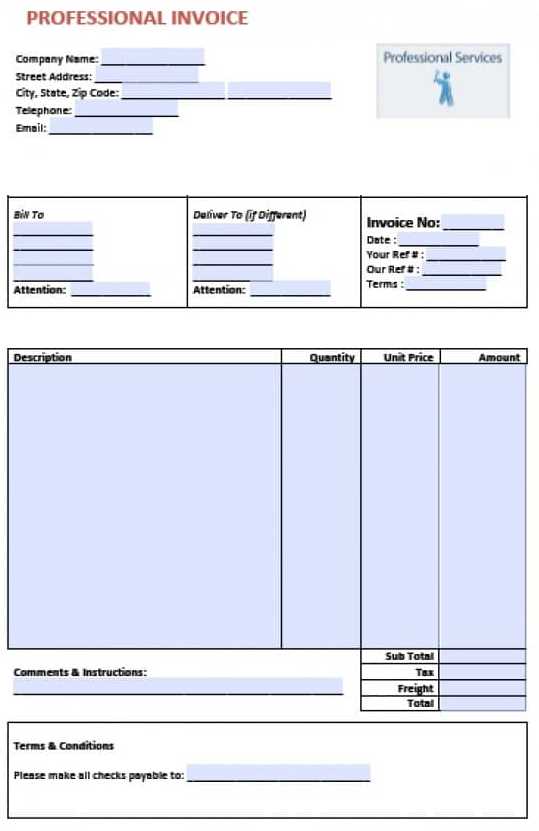

Paid Options for Enhanced Features

If your business requires more advanced functionality, paid solutions offer additional features that can greatly enhance your workflow. These often come with robust tools designed for efficiency and customization:

- Advanced Customization: Paid solutions often allow you to create highly customized layouts, including unique fields and formulas for automatic calculations.

- Integration Capabilities: Many premium options integrate with accounting software or other business systems, enabling seamless data transfer between platforms.

- Professional Design: Paid formats often come with polished, professional designs that are ready to use and can make a positive impression on clients.

- Support and Updates: Paid templates typically offer customer support, as well as regular updates to ensure compatibility with the latest tools and technologies.

Choosing between free and paid solutions depends on your specific needs and budget. Free formats are ideal for those just starting out or with basic requirements, while paid options provide more flexibility, professional designs, and integration features for larger or more complex operations.