How to Create a Credit Note to Cancel an Invoice with Template

In business transactions, there are times when a previously issued payment record needs to be amended or corrected. This could be due to a variety of reasons, such as overcharging, errors in calculations, or changes in the terms of a deal. Regardless of the cause, it’s essential to have a clear and formal process for making these adjustments, ensuring transparency and accuracy in financial dealings.

One of the most effective ways to handle this is by using a structured document designed to reflect such modifications. This document serves as an official record, providing both parties with a clear understanding of the updated figures. Whether you’re adjusting amounts due to returned goods, pricing discrepancies, or any other factor, creating a proper form for this process is crucial.

In this guide, we’ll explore how to craft a suitable document for revising past financial records. We’ll cover its key elements, offer tips on customization, and provide helpful insights on how this tool fits into your accounting system. By the end, you’ll have a reliable resource for handling payment discrepancies efficiently and professionally.

Understanding Credit Notes and Their Use

In business, there are situations where a transaction needs to be amended or reversed due to various reasons. This could happen when an error is made in the original documentation, or when a customer is dissatisfied with the product or service provided. To manage these scenarios, businesses often use specific forms designed to adjust previously issued financial records.

These documents serve as a formal way to reflect changes in the amounts owed or received, ensuring that both parties are on the same page regarding the revised terms. They are important tools for maintaining accurate financial statements and fostering transparent business practices.

When and Why They Are Used

Such forms are commonly used in cases where an adjustment is necessary, such as correcting pricing mistakes, accounting for returns, or addressing billing disputes. Without these forms, businesses might struggle to maintain clear records, which could lead to confusion, financial discrepancies, or even legal issues.

Benefits of Using These Forms

Using an official adjustment document helps prevent misunderstandings between buyers and sellers. It creates a clear trail of communication and ensures that both parties have a record of the changes made. In addition, these forms are essential for accounting purposes, as they help balance out any discrepancies that could affect financial reporting.

In summary, these forms provide a formal mechanism for correcting mistakes or making changes to previously issued documents, benefiting both businesses and customers by ensuring accuracy and clarity in financial dealings.

What is a Credit Note?

In financial transactions, there are occasions when a previously issued payment document requires adjustments due to errors, overcharges, or changes in the agreement between the buyer and seller. This type of document serves as an official record that reflects those changes, helping to update the original terms and amounts on both sides of the transaction.

Essentially, this document acts as a way to reduce the amount owed, either due to returned products, service issues, or pricing discrepancies. By issuing such a document, both parties ensure that the financial records remain accurate and that any necessary corrections are formally recognized.

Key Features of This Document

Although the specific name of the document may vary, it typically contains certain key pieces of information, including the reason for the adjustment, the date, and a reference to the original transaction. Below is a table that outlines the main features of such a form:

| Feature | Description |

|---|---|

| Reason for Adjustment | Indicates why the document is being issued, such as return of goods or billing error. |

| Original Transaction Reference | Links to the original document or transaction being modified. |

| Amount Adjusted | The amount that is being subtracted or modified from the original total. |

| New Balance | The updated amount that is now owed after the adjustment. |

Purpose and Use

This document helps ensure transparency and accuracy in the transaction process, providing both the buyer and seller with a formal acknowledgment of the adjustment. It also serves as a refere

Why Use a Credit Note for Invoices?

In business, adjustments to previous financial records are sometimes necessary due to various reasons such as pricing errors, product returns, or overpayments. These changes need to be formally documented to ensure that both the buyer and seller are in agreement about the revised terms. Using a structured document to reflect these modifications helps maintain clarity and accuracy in accounting records.

By issuing such a document, businesses can avoid confusion and keep all parties informed about the updated financial situation. It also allows for proper tracking of adjustments, ensuring that both sides are clear on the new amounts owed or refunded.

Reasons for Issuing an Adjustment Document

There are several situations in which this type of document is commonly used:

- Incorrect Billing: When there is a mistake in the amount originally charged.

- Returned Goods: When items are returned and the amount paid needs to be adjusted.

- Discounts or Price Changes: When agreed-upon discounts or price adjustments were not applied in the original transaction.

- Payment Disputes: When there is a disagreement over the amounts owed or paid.

Benefits of Using This Adjustment Document

There are several important benefits to using this document in your business transactions:

- Clear Communication: It helps prevent misunderstandings by clearly outlining the changes made to the original terms.

- Accurate Financial Records: It ensures that the financial records are updated and consistent with the current situation.

- Legal Protection: It can serve as proof of the transaction adjustment in case of future disputes or audits.

- Customer Satisfaction: It shows a commitment to resolving issues and can help maintain positive business relationships.

Ultimately, using a formal adjustment document ensures transparency and accuracy, helping businesses maintain reliable financial records and avoid potential conflicts.

Key Components of a Credit Note

When creating a document to amend a previous transaction, it’s essential to include all necessary information to ensure the change is clear and legally recognized. The form must contain several key elements that provide both parties with a transparent understanding of the adjustment. These components not only help clarify the revised terms but also make it easier to track and verify the changes in accounting records.

Each section of the document serves a specific purpose, from identifying the reason for the adjustment to detailing the updated amounts. Below are the main elements that should be included:

- Reference to Original Transaction: This links the amendment to the original transaction, ensuring both parties know exactly which document or payment record is being modified.

- Reason for Adjustment: A brief explanation of why the document is being issued–whether it’s due to a return, pricing error, or any other reason.

- Adjustment Amount: The amount that is being modified, reduced, or refunded, which helps in clearly outlining the financial change.

- New Balance: The final amount owed after the adjustment is made. This shows the updated figure the customer is expected to pay or the refund amount to be issued.

- Dates: The date when the adjustment was issued and the date of the original transaction, helping to place both in the correct timeline.

- Seller and Buyer Information: Basic details about the buyer and seller, such as names, addresses, and contact information, ensuring that both parties are easily identifiable.

- Document Number: A unique identifier for the document to help track and reference it in the future.

Including these key elements ensures that the form is not only legally valid but also practical for record-keeping and financial transparency. Properly detailing the changes can help avoid misunderstandings and provide a reliable audit trail for both businesses and customers.

Difference Between Credit Note and Debit Note

In business transactions, two types of documents are commonly used to adjust or correct previous payment records: one is issued when the amount owed needs to be reduced, and the other when the amount owed needs to be increased. While both serve the purpose of amending a financial record, they function in opposite ways, and it’s important to understand the distinction between them for accurate accounting and clear communication between parties.

The key difference lies in the direction of the adjustment. One document is used when a refund, reduction, or correction is required, while the other is used when an additional charge or adjustment is necessary. Understanding when to use each form helps ensure that business transactions are properly documented and balanced.

- Purpose: The first type is used to decrease the amount due, often due to product returns or overcharging. The second type, however, is used when the seller needs to request additional payment from the buyer, such as in cases of missed charges or additional services.

- Effect on the Account: The first document reflects a negative adjustment, reducing the total outstanding amount. The second document reflects a positive adjustment, increasing the amount owed.

- Typical Scenarios: The first type is typically used when a refund is issued or when a billing error results in an overpayment. The second type is issued when the initial amount was too low or when the buyer receives additional goods or services not accounted for initially.

Both documents are essential tools for keeping business records accurate and ensuring proper financial reconciliation. However, understanding when and how to use each one ensures that the correct adjustments are made, minimizing confusion and improving overall transaction clarity.

When to Issue a Credit Note

There are specific situations in business where a previously issued financial record needs to be amended or adjusted. This could happen for a variety of reasons, ranging from errors in the original transaction to changes in the terms of a sale. Knowing when to issue such a document is crucial for maintaining accurate accounting and transparent communication between parties.

Issuing this document is necessary when a reduction in the total amount owed is required. This typically occurs when a customer returns goods, a billing error is discovered, or the terms of a deal are revised after the initial agreement. It serves as a formal acknowledgment of the change and ensures that both parties have a clear and updated record.

- Product Returns: If a customer returns an item or cancels a service, this document helps reflect the revised amount owed.

- Overcharging or Billing Errors: When an error is discovered in the original calculation, such as charging more than the agreed price.

- Discounts or Price Adjustments: When discounts or price changes are not applied correctly during the original transaction.

- Failed Deliveries or Damaged Goods: If the buyer receives incomplete or damaged goods, the amount may need to be adjusted accordingly.

- Contract Amendments: When the terms of the agreement between buyer and seller change after the initial sale.

Issuing this formal document in these situations ensures that the financial records are accurate, minimizes confusion, and provides a clear trail of changes for future reference. It also serves to protect both parties legally, as it acts as an official acknowledgment of the transaction modification.

Common Reasons for Cancelling an Invoice

There are various scenarios in business transactions where a previously issued payment record needs to be amended or nullified. These situations can arise due to errors in pricing, incorrect items listed, or even issues with the delivery of goods or services. Understanding the most common reasons for making such adjustments is key for businesses to maintain accurate financial records and clear communication with customers.

When discrepancies occur between the original amount billed and what is actually due, businesses often issue a formal document to reflect the necessary changes. Below are some of the most frequent reasons that might lead to such adjustments:

Reasons for Modifications

| Reason | Description |

|---|---|

| Overcharging | When a customer is charged more than the agreed price, either due to an error or incorrect rate applied. |

| Incorrect Items or Services | If items or services listed on the payment record do not match what was actually provided or purchased. |

| Product Returns | If a customer returns goods, the amount originally charged may need to be adjusted accordingly. |

| Shipping Errors | If the wrong products are shipped or if there are issues with the delivery that require adjustments to the total cost. |

| Discounts Not Applied | If an agreed-upon discount or promotional offer was not included in the original record. |

Addressing Discrepancies

These types of adjustments are essential for ensuring that both parties have a correct understanding of the financial details. By addressing discrepancies promptly, businesses can maintain a positive relationship with customers, avoid confusion, and ensure their financial records remain accurate.

Steps to Create a Credit Note

When adjusting a previously issued financial record, it’s important to follow a clear and systematic process to ensure all necessary information is included. This formal document serves to correct any discrepancies in the original transaction, whether due to errors in pricing, product returns, or other reasons. By following a structured process, you can ensure that the adjustment is accurate, legally valid, and easy to understand for both parties involved.

The steps for creating this document involve gathering the required details, properly formatting the information, and ensuring all necessary sections are included to reflect the changes accurately. Below are the main steps to follow when preparing this formal record:

Step 1: Gather Required Information

The first step is to collect all the details related to the original transaction. This includes the reference number, the date, the customer’s information, and the reason for the adjustment. Additionally, make sure you have the original transaction amount and any relevant supporting documentation (e.g., receipts, order forms, emails). This will help ensure that the new document is linked to the correct financial record and is accurate in all aspects.

Step 2: Include Relevant Details in the Document

Next, you’ll need to create a new record that clearly outlines the changes being made. The document should include the following key elements:

- Reference to the Original Transaction: Clearly state the original transaction that is being amended.

- Adjustment Reason: Explain why the adjustment is necessary (e.g., overcharging, returned products, etc.).

- Amount Adjusted: Specify the amount being refunded, reduced, or changed.

- New Total Amount: Show the updated amount the customer now owes or the refund they will receive.

- Document Number: Assign a unique number for easy future reference and tracking.

Essential Information in a Credit Note When creating a document to modify a previous transaction, it’s important to include certain key details that ensure the change is clearly understood and properly recorded. This document serves as an official record of the adjustments made, and having the right information is crucial for both the buyer and the seller. The details included in this document help maintain accurate financial records, facilitate communication, and avoid misunderstandings.

Each adjustment form should contain specific elements to ensure it is legally valid and easy to follow. These essential components help outline the nature of the adjustment, provide context for both parties, and enable easy reference in future transactions or audits. Below are the key pieces of information that must be included:

- Original Transaction Reference: A clear link to the original record being amended. This helps both parties easily identify the source of the change.

- Reason for the Adjustment: A brief explanation outlining why the change is being made (e.g., incorrect pricing, product returns, service issues).

- Adjusted Amount: The specific amount being reduced, refunded, or modified. This should be clearly stated to avoid any confusion about the financial impact.

- Updated Balance: The new total amount owed or refunded after the adjustment has been made.

- Document Identification Number: A unique number that identifies the adjustment record. This helps track and reference the document in the future.

- Dates: Include both the date of the original transaction and the date the adjustment is issued. This provides context for the timing of the changes.

- Buyer and Seller Information: Names, contact details, and addresses of both parties involved. This ensures that the document is properly attributed to the correct entities.

By ensuring that all of these essential details are included, businesses can maintain clear and accurate records, avoid disputes, and ensure that all adjustments are formally recognized. This clarity is vital for smooth financial operations and maintaining good customer relationships.

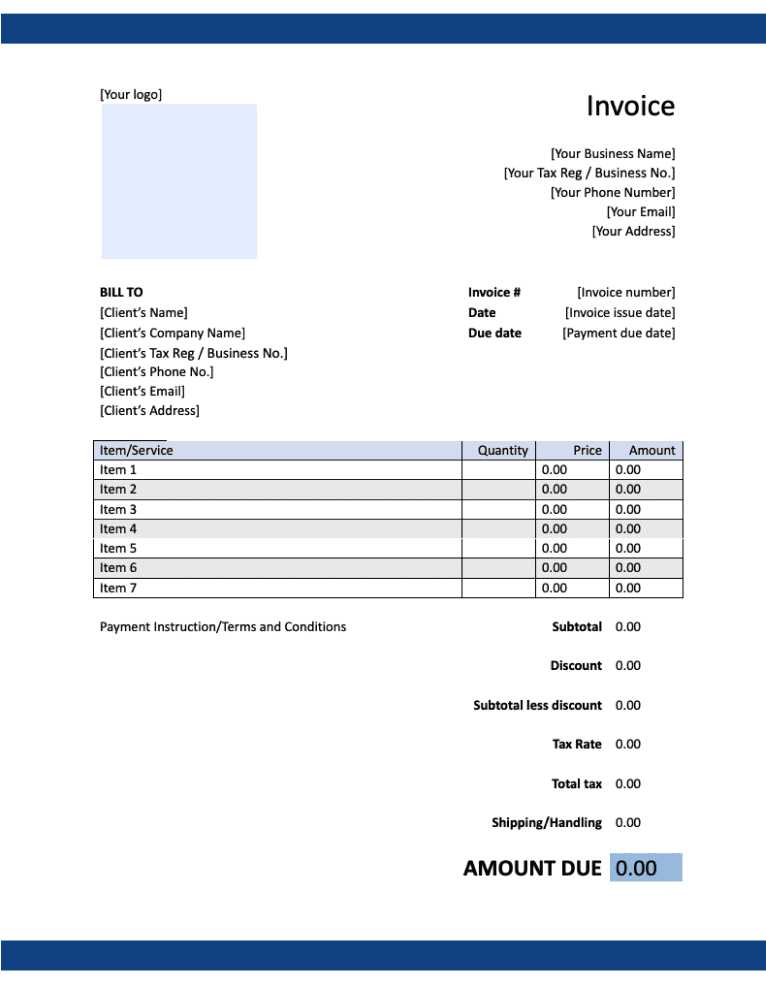

How to Format a Credit Note Template

Creating a structured and well-organized document to amend a previously issued payment record is essential for clarity and accuracy. The format of this document should be straightforward, professional, and easy to understand for both the buyer and the seller. By following a logical structure, businesses can ensure that all relevant information is included and presented in a way that avoids confusion.

The format should prioritize clarity and completeness while maintaining a professional appearance. The key elements should be arranged in a logical order, with headings and sections that are easy to navigate. Below are the general guidelines to follow when formatting such a document:

- Header Section: At the top of the document, include the title of the document (e.g., “Adjustment Record”) and ensure that both the buyer’s and seller’s contact details are clearly stated. This section should also feature a unique document reference number and the date of issuance.

- Reference to Original Transaction: Immediately below the header, provide a reference to the original transaction that is being amended. This helps establish the connection between the adjustment and the initial payment record.

- Reason for the Change: Clearly state the reason for the modification (e.g., billing error, returned goods, or incorrect pricing). This section should be concise but informative, providing enough context to understand the change.

- Details of the Adjustment: Include a breakdown of the changes being made, such as the amount being reduced or refunded. This section should be clearly labeled and itemized if necessary, with a clear explanation of how the final adjusted amount was calculated.

- Updated Total: After detailing the adjustments, clearly state the new balance that is owed or refunded. This should be prominently displayed and easy to locate within the document.

- Footer Section: At the bottom of the document, include additional information such as payment instructions, terms and conditions (if applicable), and space for both parties to sign or acknowledge the adjustment.

By follow

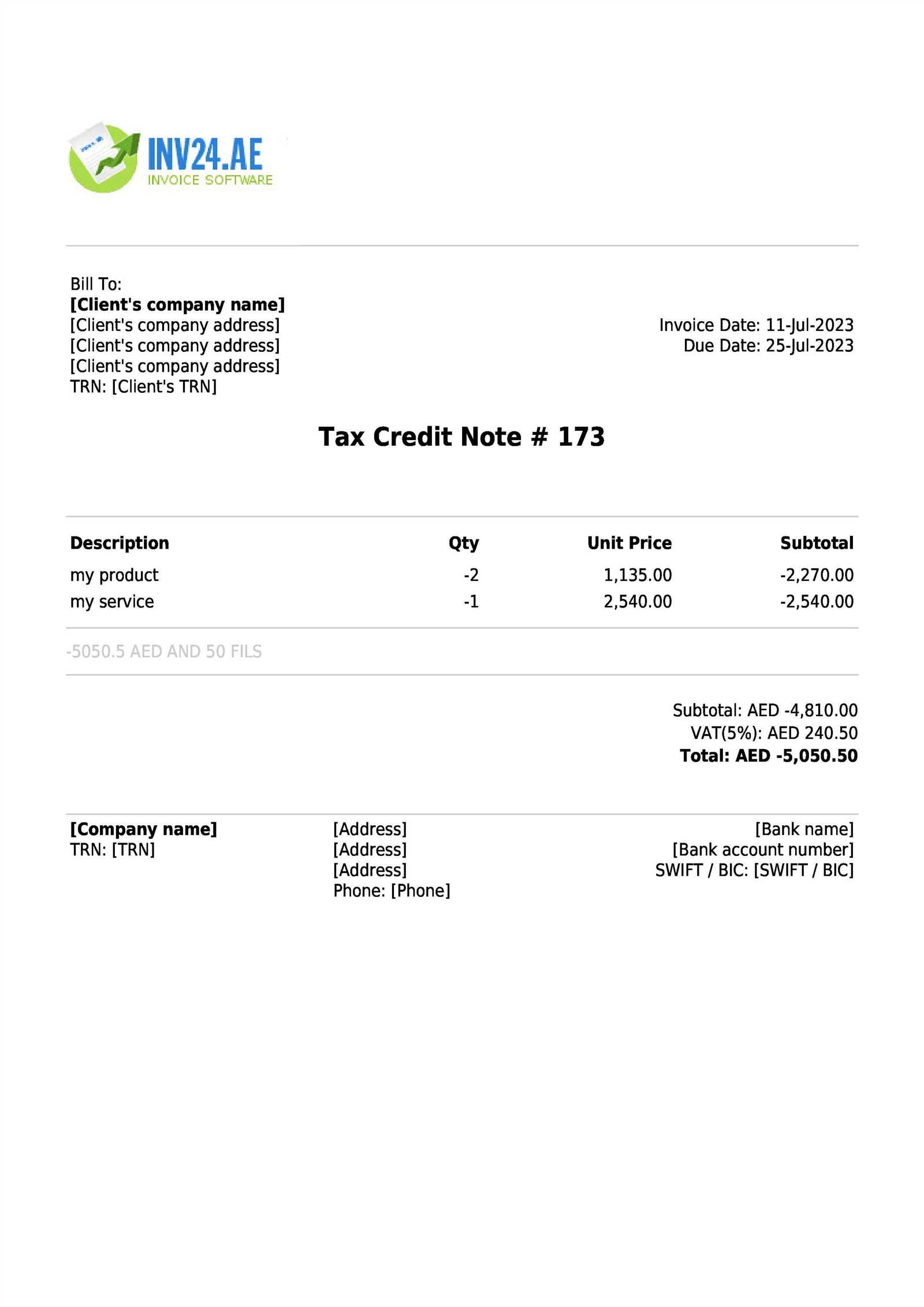

Examples of Credit Note Templates

When it comes to adjusting a financial record, having a well-organized document template can streamline the process and ensure all relevant details are clearly presented. Below are examples of how such a document can be formatted to communicate necessary changes to the original transaction. These examples can serve as a guideline for creating your own customized form to reflect adjustments effectively.

Example 1: Simple Adjustment Document

This basic format is used for straightforward adjustments, such as correcting an overcharge or refunding an amount for returned goods. It includes all the essential information in a simple, easy-to-read structure.

Field Example Document Number 12345 Date of Issue April 15, 2024 Original Transaction Reference #98765 Reason for Adjustment Returned Items – Defective Amount Adjusted $150.00 Updated Total Amount $200.00 Example 2: Detailed Adjustment Document

This more comprehensive example provides a breakdown of each adjustment, including specific items or services involved. It is particularly useful for situations where multiple corrections are necessary, such as partial returns or recalculations based on discounts or pricing changes.

Field Example Customizing Your Credit Note Template

When creating a document to amend a prior transaction, it’s important to tailor it to your specific business needs and branding. Customizing your form ensures that it not only includes the required information but also reflects your company’s identity and maintains consistency across all business communications. A personalized document helps create a professional appearance and fosters trust with clients.

Customizing such a form involves adjusting the layout, adding company logos, selecting the most relevant information to display, and ensuring that it aligns with your business processes. Below are some key areas where customization can make your document more effective and professional:

Personalizing the Layout and Design

The design and layout of your document should reflect your company’s branding. Including your logo, business name, contact details, and any other brand-specific elements makes the document look official and polished. You can also adjust the font, colors, and structure of the form to align with your corporate style.

Including Relevant Business Information

Every business has unique requirements when it comes to documentation. Customize your form to include specific fields that are relevant to your business operations, such as internal reference numbers, payment terms, or tax information. Below is an example of how the structure might look:

Field Example Document Title Transaction Adjustment Record Company Logo Placed in the header Company Information Company Name, Address, Phone Number, Email Payment Terms Net 30 Days Reason for Adjustment Overpayment, Product Return, Incorrect Charge Orig Legal Requirements for Credit Notes

When adjusting a financial record, it’s essential to ensure that the document meets all legal and regulatory requirements. This helps prevent disputes, ensures compliance with tax laws, and protects both the business and its customers. Various regions may have specific rules governing such documents, and businesses must adhere to them when issuing an adjustment.

Legal requirements can vary by jurisdiction, but they generally include specific information that must be included on the document. These details ensure that the transaction remains transparent and verifiable. Below are the most common legal elements required when creating a document to amend a transaction:

Key Information for Legal Compliance

To ensure the document complies with legal standards, businesses must include certain key elements. These elements help maintain clear records for auditing purposes and guarantee that any amendments are traceable and properly documented. Below is an example of what should be included:

Field Example Document Title Transaction Adjustment Record Unique Document Number TXN-4567 Date of Issue July 15, 2024 Original Transaction Reference #12345 Reason for Amendment Overcharge for Products Adjusted Amount $250.00 Tax Information VAT Included – 15% Party Details Buyer Name, Address, and Contact Info Region-Specific Legal Considerations

Different regions have specific regulations for financial documentation. For example, in some countries, the amended document must be marked as “reversed” or “adjusted” to indicate its purpose clearly. Additionally, cer

How Credit Notes Impact Accounting Records

When adjustments are made to previous financial transactions, it’s important to understand how these changes affect a business’s accounting records. Any modification to a sale or payment needs to be reflected in the books to ensure accurate financial reporting. These changes can have a significant impact on revenue, tax liabilities, and overall financial health.

Accounting records must accurately reflect any amendments to a transaction. For example, when an adjustment document is issued, it typically results in a reduction in revenue or accounts receivable, and this needs to be properly recorded. Below are the key ways in which such adjustments affect accounting entries:

- Impact on Revenue: The reduction in revenue due to an amended transaction must be recorded. This ensures that the business’s financial statements reflect only the actual income received, not the initial overstatement.

- Adjustments to Accounts Receivable: If a payment adjustment is issued, the business needs to update its accounts receivable to reflect the reduced amount owed by the customer. This helps ensure that outstanding balances are accurate.

- Tax Implications: Adjustments may affect the tax calculation. For instance, if sales tax was included in the original amount, the adjusted document will need to account for this change, and tax records must be updated accordingly.

- Corrections to Cost of Goods Sold (COGS): In some cases, adjustments may also impact the cost of goods sold. If the adjustment relates to returned products, businesses will need to adjust their inventory and COGS figures.

- Financial Reporting: Properly recorded adjustments ensure that financial reports, such as profit and loss statements, accurately reflect the business’s true financial position. Failure to properly record such changes can lead to incorrect financial reporting.

Maintaining accurate accounting records when amendments are made is crucial for ensuring compliance with financial regulations and presenting a true picture of the company’s performance. Businesses should be diligent in

Best Practices for Using Credit Notes

Effectively managing transaction adjustments is essential for businesses to maintain accuracy and transparency in their financial dealings. When amending a previous transaction, it’s important to follow a set of best practices to ensure that the process is efficient, clear, and compliant with legal requirements. Proper handling of such documents not only avoids errors but also builds trust with clients and ensures smooth operations.

Key Best Practices to Follow

Below are some important practices that can help businesses streamline their processes when issuing adjustments for previous transactions:

Best Practice Description Document All Details Clearly Ensure that all relevant information is included, such as the reason for the adjustment, the original transaction reference, and any financial changes. This helps maintain clarity and transparency. Use Unique Reference Numbers Assign a unique reference number to each adjustment document. This will help track changes and provide a clear audit trail for future reference. Maintain Consistent Formatting Keep the document’s format consistent with your company’s other business forms. This ensures that it looks professional and is easy to understand for both clients and internal staff. Issue Adjustments Promptly Whenever a change ne Sending and Managing Credit Notes

Effectively managing and sending documents to amend prior transactions is crucial for maintaining accurate financial records and fostering trust with customers. Timely and professional handling of such documents helps prevent confusion and ensures smooth business operations. The process involves clear communication, appropriate documentation, and proper tracking to ensure that both the business and the client are on the same page.

When issuing an adjustment document, it’s important to follow a structured process to ensure that it reaches the right recipient, is properly recorded, and complies with business and legal requirements. Below are key practices to follow for efficiently sending and managing these important documents:

Best Practices for Sending Adjustments

To avoid delays and errors, businesses should follow a few essential steps when sending adjustment documents:

- Timely Delivery: Ensure that the document is sent as soon as the issue is identified. Delays in sending adjustments may lead to confusion or disputes with clients, especially if they have already made payments based on the original transaction.

- Clear Communication: When sending an adjustment document, always include a clear explanation of why the change was necessary. This helps maintain transparency and ensures that the client understands the reason for the update.

- Choose the Right Method: Depending on your relationship with the client and their preferences, send the document via email, postal service, or another suitable platform. Electronic delivery is faster and can include digital signatures, but ensure that the method is secure and traceable.

- Confirm Receipt: Always confirm that the client has received and reviewed the adjustment document. This can be done through an acknowledgment receipt, email confirmation, or a phone call to ensure the document has been reviewed and accepted.

Managing Adjustments Efficiently

Managing adjustments within your business’s system is just as important as sending them. Proper tracking and record-keeping help avoid errors and simplify the reconciliation process at the end of each financial period.

- Organize Documentation: Maintain a well-organized filing system for all adjust

Automating Credit Note Generation

In today’s fast-paced business environment, automating the process of generating documents to adjust previous transactions can significantly improve efficiency and reduce the risk of human error. By utilizing automation, businesses can streamline the creation, issuance, and tracking of these documents, saving time and resources while ensuring accuracy and compliance with financial standards.

Automating the creation of adjustment documents not only accelerates the process but also allows for greater consistency in format, content, and delivery. With the right tools, businesses can quickly generate these records based on pre-defined criteria, such as order details, customer information, or transaction discrepancies, ensuring that all necessary data is captured and no essential information is omitted.

Benefits of Automation

There are several advantages to automating the generation of adjustment documents:

- Increased Efficiency: Automation reduces the manual effort involved in creating these documents, saving time and enabling employees to focus on other critical tasks.

- Consistency and Accuracy: Automated systems can standardize the content and format of adjustment documents, ensuring that all required fields are correctly filled out and reducing the risk of errors.

- Improved Compliance: Automated systems can be programmed to comply with legal and regulatory requirements, ensuring that all necessary information is included in the documents and reducing the risk of non-compliance.

- Faster Processing: By automatically generating documents, businesses can expedite the adjustment process, improving cash flow management and reducing delays in customer service.

- Better Record Keeping: Automated systems can store documents digitally and maintain a clear, organized record of all adjustments, which can be easily retrieved for audits, disputes, or future reference.

Key Features of an Automated System

To fully benefit from automation, businesses should look for key features in their system that help streamline the process of generating and managing adjustment documents:

- Pre-Configured Templates: Use customizable templates that can automatically populate fields with relevant transaction details, such as the original transaction reference, amount, and reason for

Tips for Avoiding Invoice Disputes with Credit Notes

Managing adjustments to previous transactions effectively is essential for preventing misunderstandings and disputes between businesses and their clients. When discrepancies arise, having a clear and professional process for handling these issues can go a long way in avoiding conflicts and maintaining strong business relationships. By following a few strategic practices, businesses can ensure that any necessary amendments to financial records are clear, transparent, and less likely to lead to disagreements.

Proper communication, accurate documentation, and a well-organized workflow are key to reducing the potential for disputes. Below are some practical tips to help businesses minimize issues related to adjustments and keep their financial processes smooth and efficient.

Clear Communication with Clients

One of the most common causes of disputes is a lack of clear communication. Being upfront and transparent with clients about why an adjustment is necessary can prevent confusion and dissatisfaction. Here are some essential communication practices:

- Inform Clients Early: As soon as an issue is identified, notify the client promptly and explain the reason for the adjustment. Early communication can help manage expectations and prevent any surprises.

- Provide Clear Explanations: Ensure that the reasons for adjustments are communicated clearly and are easy for the client to understand. Providing context, such as billing errors or product returns, helps clients feel more comfortable with the changes.

- Offer Support: If clients have questions or concerns about the adjustment, be ready to offer assistance. This can help resolve issues before they escalate into disputes.

Accurate Documentation and Record-Keeping

Having well-documented records is crucial when managing transaction amendments. Accurate records not only protect the business but also help in resolving disputes more efficiently. Here are a few practices to follow:

- Use Consistent Formats: Always maintain a consistent format for your records. This ensures that all necessary information is included and makes it easier to retrieve past adjustments when needed.

- Include Detailed Information: Clearly outline the transaction details in the document, including the reason for the change, the original transaction amount, and any other relevant details. This transparency reduces the chance of misunderstand