Creative Invoice Template for Effortless and Professional Billing

Creating well-structured and visually appealing billing documents is essential for maintaining professionalism in any business. A well-crafted document not only reflects the quality of your services but also ensures clear communication with clients regarding payments. The right design can help you stand out while also providing all necessary details in a clear and organized manner.

By customizing your billing forms to suit your brand and business style, you can simplify the payment process and enhance client satisfaction. Whether you’re a freelancer, small business owner, or large enterprise, tailoring these documents allows you to create a seamless experience for both you and your customers. A unique and functional design can make your financial transactions more efficient and easily understood.

Optimizing your billing layout involves more than just adding a logo or color scheme. It requires an understanding of how the document will be used, the information it needs to convey, and the format that best suits your business needs. From choosing the right sections to ensuring easy readability, every element of your billing structure plays a crucial role in its effectiveness.

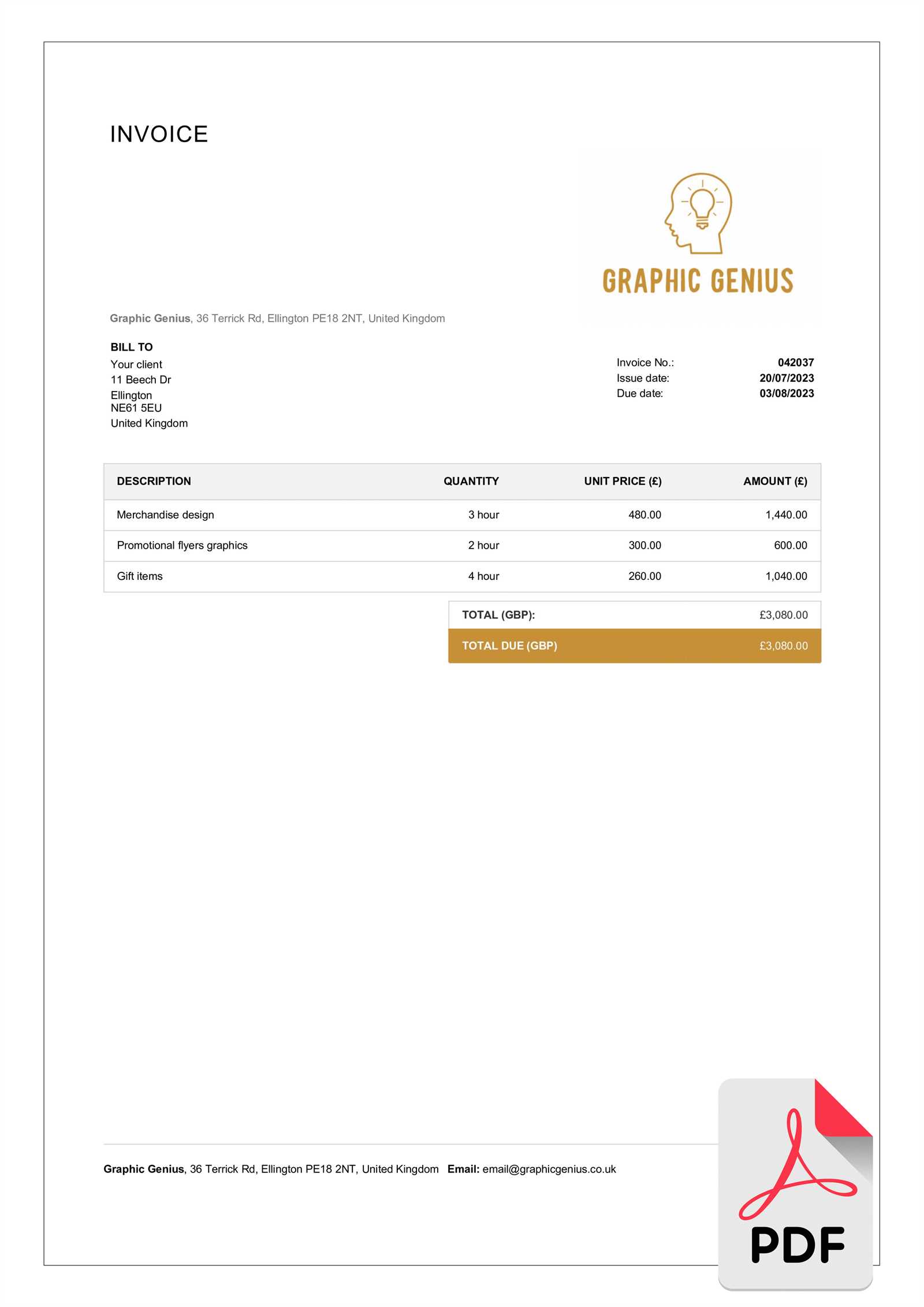

Creative Invoice Template Overview

When it comes to managing payments and client transactions, having a well-designed document is crucial. It serves not only as a professional tool but also as an essential point of communication between you and your clients. A thoughtfully crafted document can enhance your brand image and streamline financial operations, making it easier for both parties to understand terms, amounts, and deadlines.

These custom-built documents are flexible and can be adapted to any type of business. With the right layout, you can make your billing process more efficient and effective. Below are some key aspects to consider when exploring this type of document:

- Personalization: The ability to adjust the design to reflect your brand identity and meet your specific needs.

- Organization: Clear sections for all essential details, including amounts, services provided, and payment terms.

- Professional appearance: A clean, easy-to-read layout that communicates your professionalism and attention to detail.

- Efficiency: A format that simplifies the billing process, reducing the time spent on creating and sending out documents.

- Flexibility: The option to choose between digital or print formats depending on your client preferences.

Having a flexible, organized, and visually appealing billing document ensures that the transaction process runs smoothly and builds trust with clients. Whether you’re working on a one-time project or a long-term partnership, a polished layout can leave a lasting impression and foster positive business relationships.

Why Choose a Customizable Invoice

Having the ability to tailor your billing documents to suit the unique needs of your business offers numerous advantages. Customization allows you to create a solution that not only fits your company’s style but also ensures that all necessary details are presented clearly and professionally. By adapting the structure and appearance of these financial forms, you can make the process smoother for both you and your clients.

Enhanced Branding and Professionalism

One of the primary benefits of a customizable solution is the opportunity to align your financial documents with your brand identity. Including your company logo, color scheme, and consistent font choices can strengthen your business’s image and foster greater trust with your clients. A personalized layout communicates that you care about the details and that you are committed to professionalism in all aspects of your business.

Efficiency and Flexibility

Customizable documents allow you to add, remove, or rearrange sections to fit your specific business model. Whether you need to include extra terms, offer discounts, or itemize services in a particular way, customization ensures that all relevant information is presented exactly as you need it. This flexibility not only saves time but also reduces the chances of errors or misunderstandings that could arise from a one-size-fits-all format.

By choosing a customizable option, you gain control over both the aesthetics and functionality of your documents. Whether you are sending an estimate, a payment reminder, or a final bill, this level of personalization makes your workflow more efficient and tailored to your business’s specific needs.

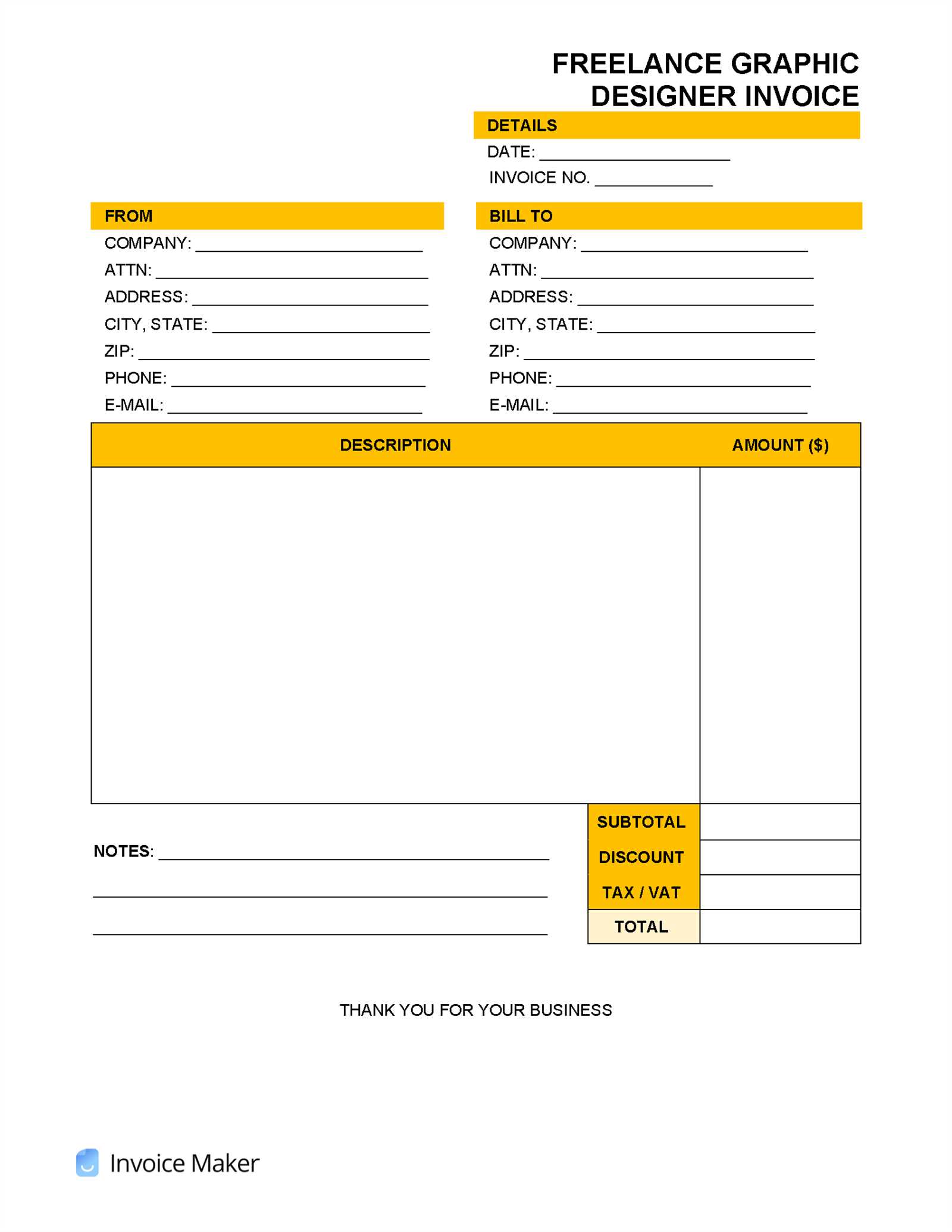

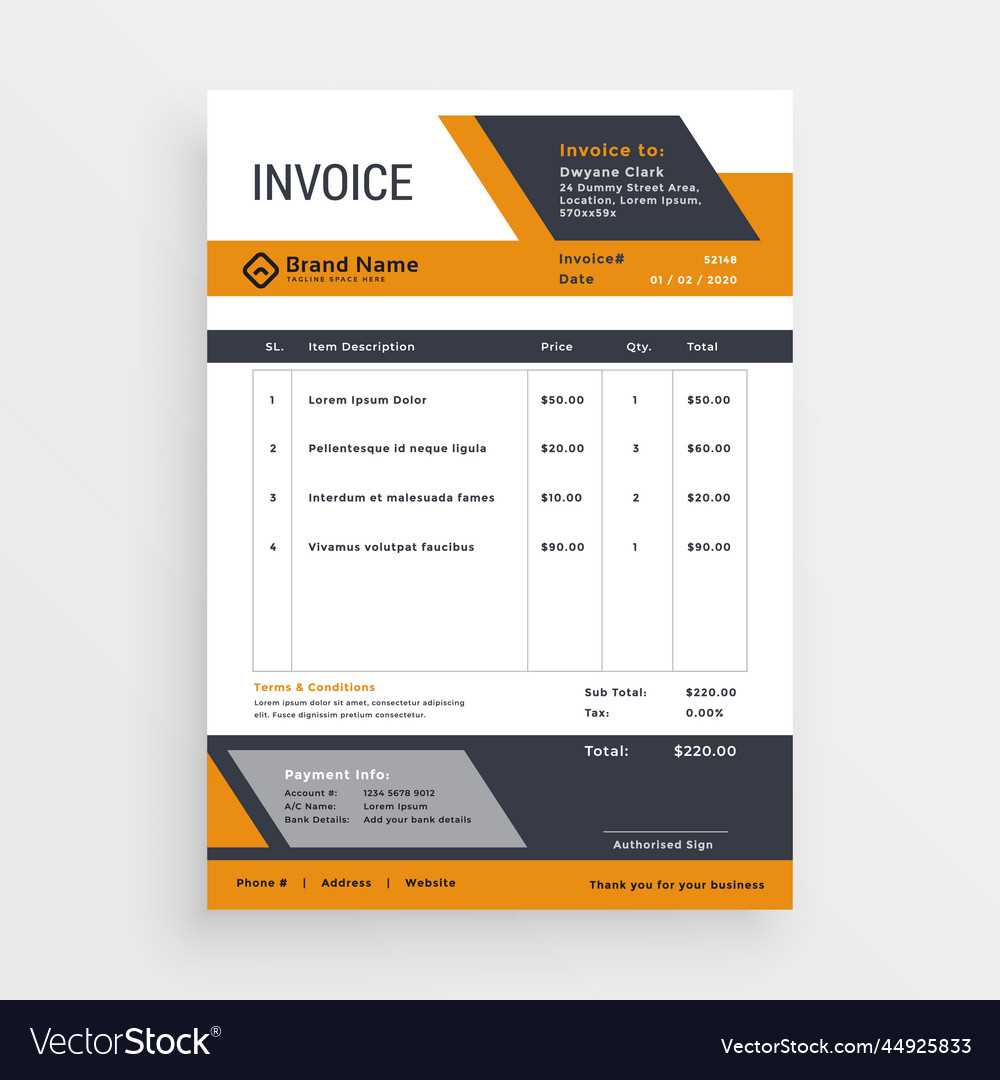

Top Features of a Creative Invoice

A well-designed billing document goes beyond just displaying payment information; it plays a key role in fostering clear communication between a business and its clients. The right structure, layout, and elements can ensure that the document is not only functional but also professional and easy to understand. Below are some essential features that can elevate any billing form and enhance the overall client experience.

- Clear Header with Branding: The header should include your company’s logo, name, and contact information, ensuring that the document is instantly recognizable and consistent with your brand’s identity.

- Itemized List of Services: Break down the products or services provided in a detailed, easy-to-read list. Each item should have its own description, quantity, and price to avoid confusion and ensure transparency.

- Payment Terms and Due Dates: Including clear payment terms, such as due dates, discounts for early payment, and penalties for late payment, helps set expectations and avoid misunderstandings.

- Unique Invoice Number: Every billing document should have a unique number for easy tracking and reference. This helps both you and your clients stay organized and ensures proper record-keeping.

- Client’s Information Section: Make sure to include the recipient’s full name, company name, and contact details, which helps in accurate communication and timely payments.

- Clean and Simple Layout: A well-organized layout with adequate white space makes it easier for clients to quickly scan and understand the details. Use clear headings and section dividers to separate different types of information.

- Personalized Notes or Messages: A short, friendly message or a thank-you note can add a personal touch and enhance customer relations. This can be an opportunity to express appreciation for continued business or offer future discounts.

These features combine to create a document that is not only practical but also adds a level of professionalism and personalization that helps build trust and strengthen business relationships.

How to Design Your Own Template

Designing a personalized billing document involves more than just filling in numbers and text. It’s about creating a clear and effective structure that communicates all necessary details while maintaining a professional appearance. By considering both functionality and aesthetics, you can design a document that suits your business needs and leaves a lasting impression on clients.

Step 1: Choose the Layout and Structure

Before you start adding details, it’s important to determine the overall layout of your document. Consider what sections are essential for your business and how they should be arranged for maximum readability. A well-organized structure will help ensure that all necessary information is easy to find.

| Section | Description |

|---|---|

| Header | Include your company logo, contact information, and document title (e.g., “Payment Request”). |

| Client Information | List the client’s name, company, and contact details for clear communication. |

| Services Provided | Break down the items or services offered with a detailed description, quantity, and price. |

| Payment Terms | State the due date, accepted payment methods, and any late fees or discounts. |

| Footer | Include additional notes or messages, such as a thank-you note or instructions for making payment. |

Step 2: Add Personalization and Style

Once you’ve outlined the sections, the next step is to add visual elements that match your brand. Choose a color scheme, font styles, and any graphics that align with your business identity. However, make sure to keep it simple and professional–clarity should always be your priority.

By following these steps, you can create a functional and attractive document that not only meets your business’s needs but also enhances your company’s professionalism and reputation in the eyes of your clients.

Benefits of Using Digital Invoices

Adopting electronic documentation for transactions offers significant advantages over traditional paper-based methods. These benefits not only streamline processes but also contribute to a more efficient, eco-friendly, and cost-effective way of handling business communications. Below are some key reasons why making the switch to digital records can be a game-changer for businesses of all sizes.

Efficiency and Speed

One of the most immediate benefits of using digital documents is the speed at which transactions can be processed and delivered. With the ability to send and receive files instantly, businesses can avoid delays typically associated with printing, mailing, and waiting for physical documents to arrive. This accelerates the payment cycle and enhances cash flow.

- Immediate delivery and receipt of documents

- Faster approval processes

- Reduced human error in data entry

Cost-Effectiveness

By shifting to digital records, companies can drastically cut down on costs related to paper, ink, postage, and storage space. These savings can add up significantly over time, especially for businesses that regularly deal with large volumes of paperwork. Additionally, digital files take up no physical space, eliminating the need for filing cabinets and reducing administrative overhead.

- Lower overhead costs

- Reduced environmental impact

- No need for physical storage space

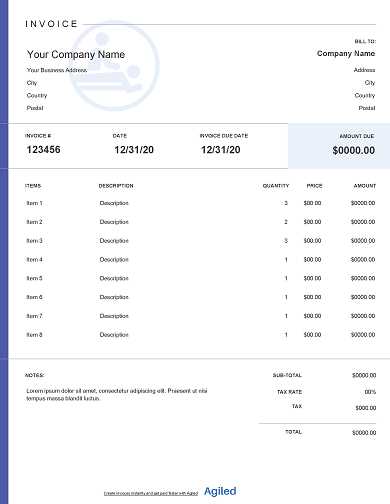

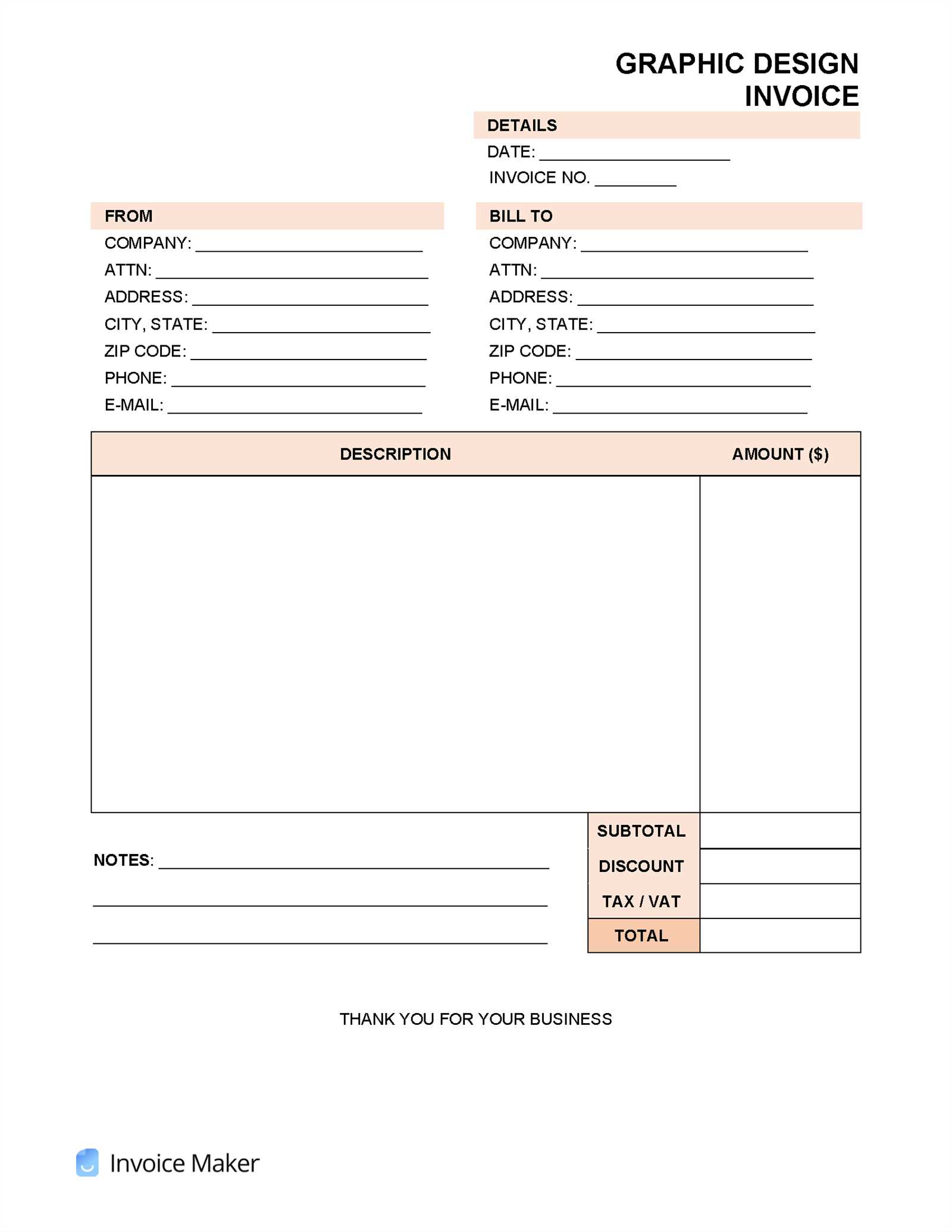

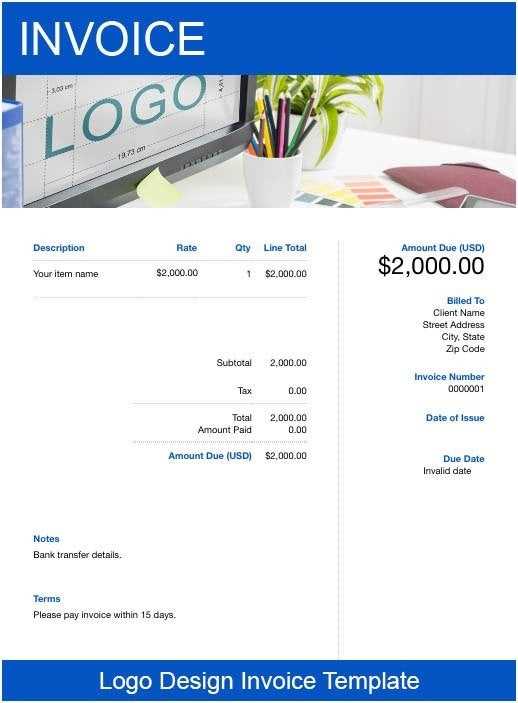

Free Invoice Templates for Small Businesses

Small enterprises often face budget constraints, making it essential to find solutions that are both effective and affordable. Access to pre-designed, no-cost documents can help entrepreneurs manage their financial records professionally without the need for costly software or design services. These resources allow businesses to present themselves in a polished manner, maintain accurate records, and streamline administrative tasks.

Benefits of Using Free Resources:

- Professional Appearance: Ready-made designs offer a clean, business-like presentation, ensuring credibility with clients.

- Time-Saving: With pre-structured forms, there’s no need to start from scratch, allowing business owners to focus on other priorities.

- Easy Customization: Many options are fully customizable to suit unique branding, making personalization simple.

These free tools enable small business owners to stay organized, improve cash flow, and maintain consistency without incurring additional costs.

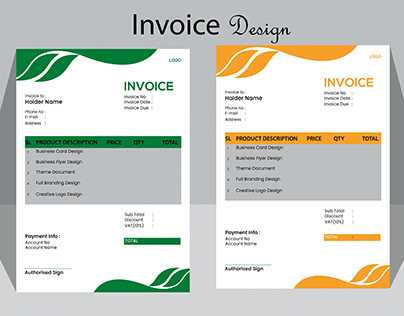

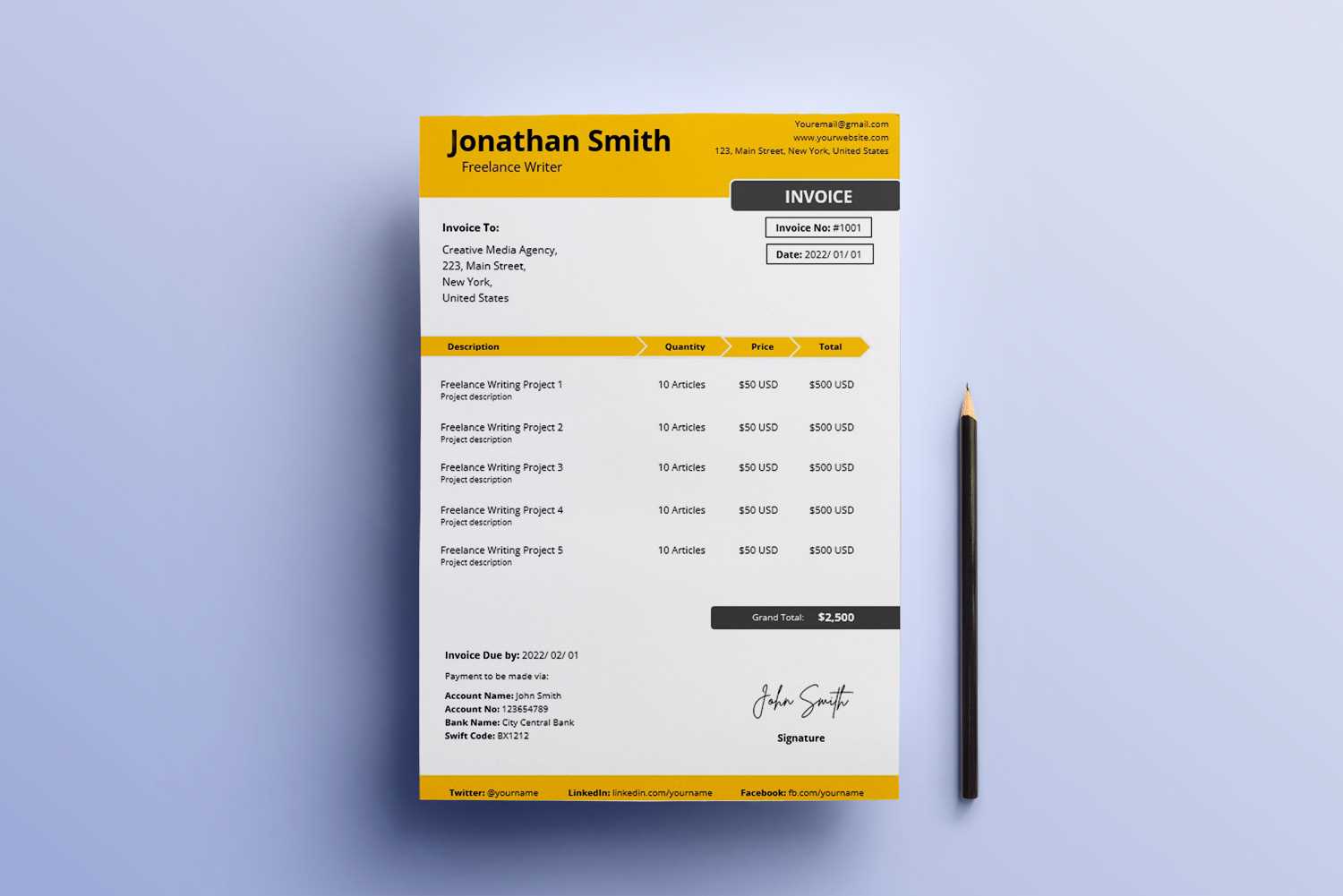

How to Personalize Your Invoices

Customizing financial documents to reflect your brand identity not only creates a professional image but also helps to establish trust with clients. Personalization can go beyond adding a logo or company details; it involves creating a distinctive design and style that aligns with your business’s personality. Below are several ways to make your documents unique and engaging.

1. Add Your Branding Elements

- Logo: Include your business logo at the top to immediately identify the document as yours.

- Business Colors: Use your brand’s color palette for headings, borders, and other elements to maintain consistency across all communications.

- Custom Fonts: Choose fonts that reflect your brand’s character, whether professional, modern, or casual.

2. Personalize the Message

- Thank You Note: Adding a simple thank you message can enhance customer relations and show appreciation.

- Payment Instructions: Clearly explain how to make a payment, including any relevant account details or online payment options.

- Custom Terms: If applicable, include personalized terms of payment or discounts for early settlement.

3. Create a Consistent Layout

- Simple and Clean: Ensure the design is easy to read, with clear sections for the services or products provided, totals, and contact information.

- Itemized Details: Break down the charges so clients can easily see what they are paying for.

- Professional Contact Information: Display your business address, phone number, and email, offering multiple ways for clients to reach you.

By making these adjustments, you can turn a basic document into a more personal and professional reflection of your brand, enhancing the overall client experience and helping your business stand out.

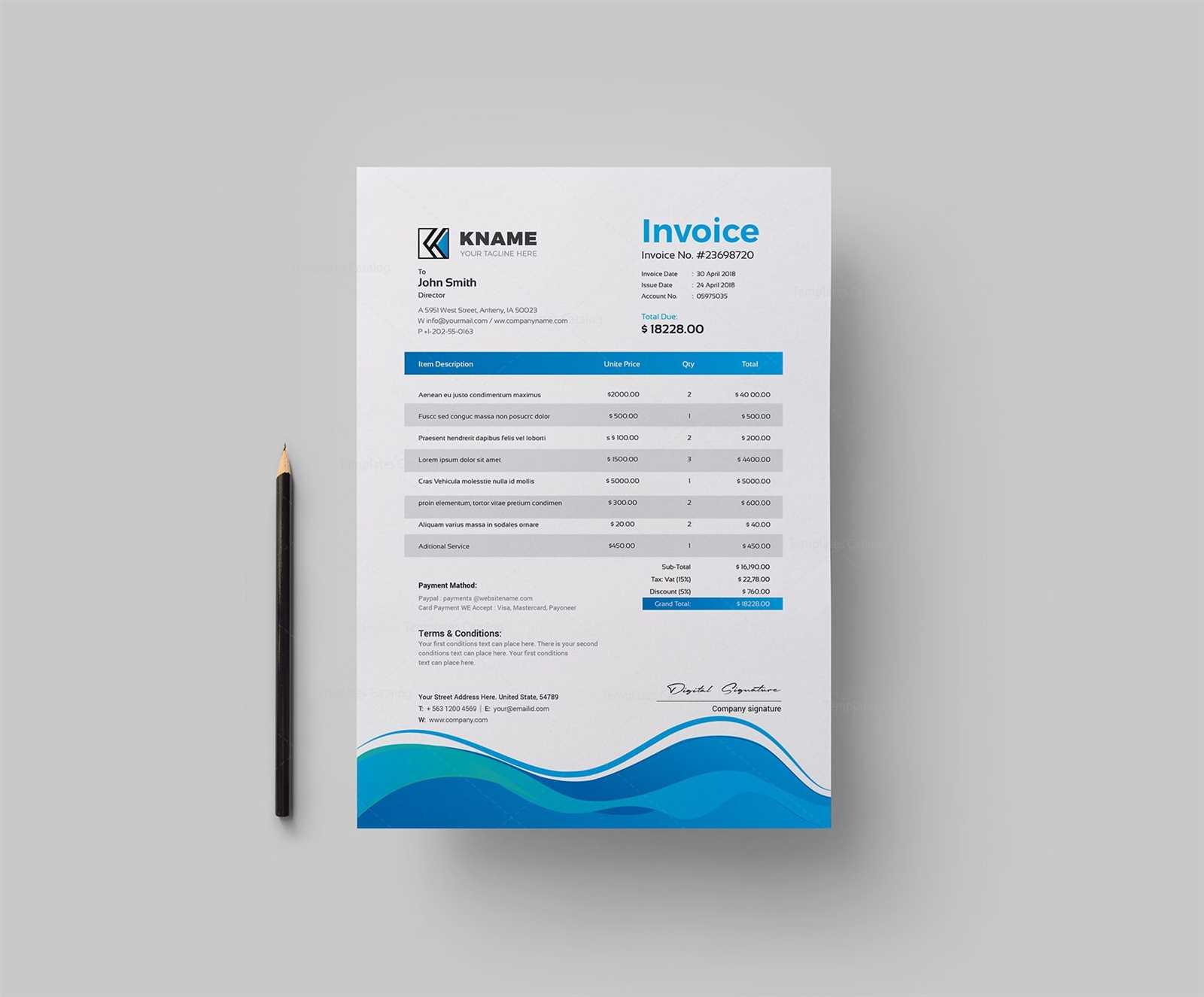

Choosing the Right Format for Invoices

Selecting the correct structure for your business documentation can make a significant difference in terms of ease of use, professionalism, and client satisfaction. Whether you are sending a digital or printed record, the format you choose should be both functional and aesthetically aligned with your brand. Here are some key considerations for choosing the right structure for your documents.

1. Digital vs. Printed

- Digital Format: Sending files via email or online platforms allows for faster delivery, reduces costs, and provides the convenience of electronic record-keeping.

- Printed Format: While less common in today’s digital world, some clients may prefer paper records. Ensure the format is easy to print, clear, and well-organized.

2. File Types to Consider

- PDF: The most widely used format for documents, ensuring your layout stays consistent across all devices and platforms. It’s easy to share and secure with password protection.

- Word Documents: Offers flexibility if you need to make edits, but might not maintain its structure perfectly when opened on different devices.

- Excel/Spreadsheet: Ideal for itemized lists or when complex calculations are involved, but may not offer the most professional appearance for some businesses.

3. Simplicity vs. Detail

- Simple Layout: A clean and basic design works best for straightforward transactions or smaller businesses that don’t need detailed breakdowns.

- Detailed Layout: If you are providing multiple services or items, a detailed layout will help clients understand the charges and maintain transparency.

Choosing the right format depends on your business needs, your clients’ preferences, and the complexity of your transactions. By selecting a suitable format, you can ensure clear communication and a professional appearance.

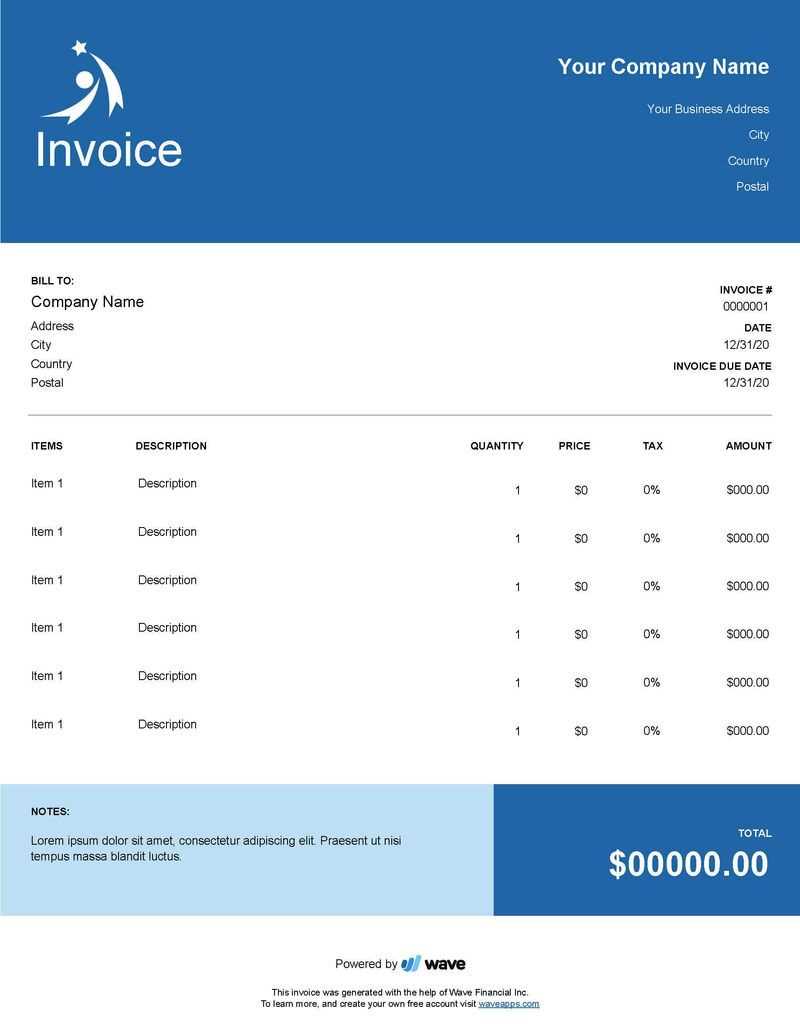

Essential Elements for a Professional Invoice

A well-structured business document is crucial for maintaining professionalism and clarity in financial transactions. To ensure your records are clear, accurate, and legally sound, there are several key components that should be included. These elements not only help to communicate the necessary details but also contribute to the overall credibility of your business.

- Header with Business Information: Always include your business name, address, contact details, and logo. This makes the document easily identifiable and adds a professional touch.

- Unique Identification Number: Assigning a unique reference number to each document helps with tracking and organization, and it is also useful for accounting purposes.

- Date and Payment Due Date: Clearly state the date the document was issued and the deadline for payment. This helps avoid confusion and ensures both parties are on the same page regarding payment terms.

- Client Information: Include the client’s name, company (if applicable), address, and contact details. This ensures that the right person receives the correct information and facilitates communication if needed.

- Itemized List of Services or Goods: Provide a detailed description of the products or services provided, including quantities, unit prices, and total amounts. This breakdown ensures transparency and helps clients understand what they are paying for.

- Subtotal, Taxes, and Total Amount: Clearly state the subtotal, any applicable taxes, and the final total. This ensures there are no hidden fees or surprises, fostering trust between you and the client.

- Payment Instructions: Specify how and where payments can be made. This could include bank account details, online payment links, or any other relevant information.

- Terms and Conditions: Including payment terms, such as late fees or early payment discounts, helps set clear expectations and prevents potential disputes.

By incorporating these essential elements, you ensure that your business documents are not only clear and professional but also legally compliant and easy to process for your clients.

How to Save Time with Invoice Templates

Using pre-designed formats for billing and financial documents can significantly reduce the time spent on administrative tasks. By having a consistent structure in place, business owners can quickly generate professional records without having to start from scratch each time. Below are several ways these resources can save time and increase efficiency in day-to-day operations.

1. Streamlining Data Entry

One of the main advantages of using pre-designed documents is that they eliminate the need for repetitive data entry. By filling out essential details like client information, services rendered, and payment terms only once, you can easily reuse the format for multiple transactions.

| Field | Details |

|---|---|

| Client Name | Pre-filled or easily added |

| Payment Terms | Saved for future use |

| Service Descriptions | Reusable with minor edits |

2. Avoiding Design Work

With a structured format already in place, there’s no need to spend time designing each document. Templates provide a ready-made layout, so you can focus on adding the specific details, reducing the time spent on formatting or creating custom designs.

By implementing these systems, you can streamline your financial processes, minimize human error, and free up valuable time to focus on other areas of your business.

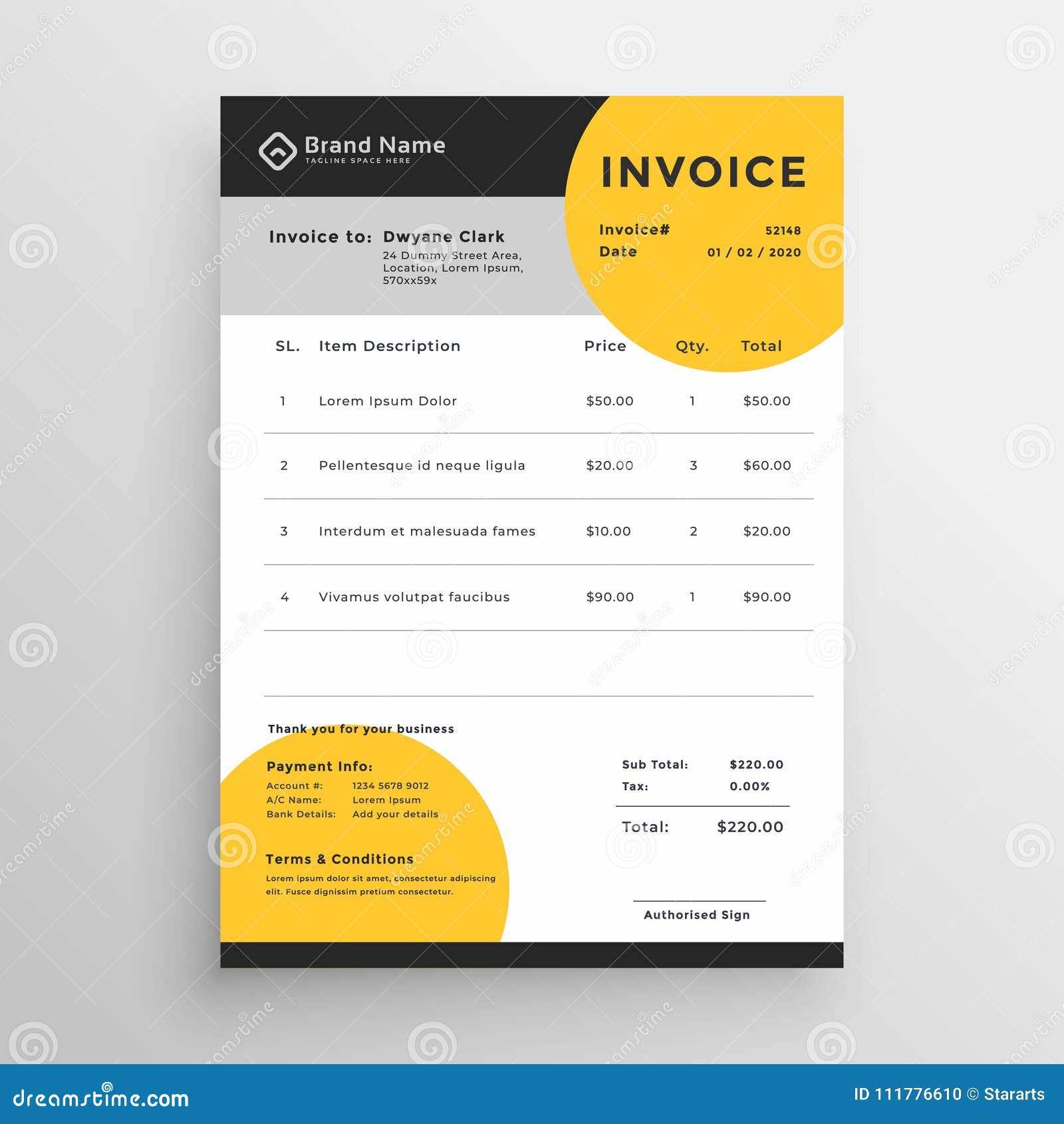

Creative Design Tips for Invoices

Design plays a crucial role in ensuring that your financial documents are not only functional but also visually appealing and professional. By focusing on aesthetic elements, you can make your records stand out, leaving a positive impression on your clients. Below are some tips to enhance the design of your business documents while maintaining clarity and simplicity.

- Use Your Brand Colors: Incorporating your business’s color scheme can create a sense of consistency and professionalism. Choose two or three complementary colors to use for headings, borders, and highlights without overwhelming the design.

- Choose a Clear Font: Opt for fonts that are easy to read and professional. Sans-serif fonts like Arial or Helvetica work well for digital documents, while serif fonts such as Times New Roman can add a more traditional touch for printed materials. Avoid using too many different fonts in one document.

- Add Visual Hierarchy: Create a sense of order by varying font sizes and weights. Use larger, bold text for section headings and totals, while keeping body text smaller and simple. This makes the document easier to scan and understand quickly.

- Incorporate a Logo: Including your company logo at the top of the document reinforces your brand identity. Make sure it’s clear and high-quality, positioned in a way that doesn’t clutter the page.

- Leave White Space: Avoid overcrowding the page. Ample white space helps to reduce visual clutter and makes the document more readable. Ensure that there is enough padding around text and numbers to keep the layout clean.

By following these design tips, you can make your business documents more visually appealing and easier for your clients to navigate. A well-designed document not only looks professional but also enhances the overall client experience, helping to establish trust and clarity in your transactions.

Understanding Invoice Layouts and Structure

The way you organize and structure your business documents is critical for ensuring clarity, efficiency, and professionalism. A well-organized document provides clear information to your clients, making it easier for them to review the charges and process payments. Whether it’s for a small service or a large transaction, having a consistent layout is essential to maintaining good business practices.

Key Components of an Effective Layout

- Header Section: This should include your business name, logo, and contact details. It immediately informs the recipient who the document is from.

- Unique Identifier: A reference number or code helps to track the document and distinguishes it from others in your records.

- Client Information: Include the recipient’s name, company (if applicable), and contact information. This helps ensure the document reaches the right person and can be used for future correspondence.

- Detailed List of Services or Products: Clearly break down each item or service provided, along with quantities, unit prices, and totals. This ensures transparency and helps avoid misunderstandings.

Organizing the Total Amount

- Subtotal: This is the sum of all individual items or services before any additional charges or discounts.

- Taxes: Include any applicable taxes, specifying the rate and total tax amount.

- Discounts or Adjustments: If applicable, subtract any discounts or adjustments before calculating the final total.

- Final Total: The final amount due, including taxes and discounts. This should be clearly highlighted to avoid confusion.

By paying attention to the structure and layout of your business documents, you can enhance professionalism, reduce errors, and make the payment process smoother for your clients. Clear sections and organized information build trust and ensure both parties are on the same page.

Integrating Your Template with Accounting Software

Connecting your business documents to accounting software can drastically simplify your financial management. By automating the process of entering data into your accounting system, you save time, reduce human error, and ensure accuracy in your financial records. The integration process allows for seamless data transfer between your billing documents and your accounting platform, making it easier to track income, expenses, and payments.

1. Simplifying Data Entry

Once your document layout is connected to accounting software, key details such as client information, amounts, and payment terms can be automatically transferred. This eliminates the need for manual data entry, reducing the risk of mistakes and saving valuable time.

- Automatic Population: Client names, product or service descriptions, and prices can be pre-filled into your accounting system from the document.

- Real-Time Syncing: When a document is generated, it automatically updates your accounting records, providing an accurate and up-to-date view of your finances.

2. Streamlining Financial Reporting

Integration makes it easy to generate financial reports, track cash flow, and analyze revenue trends. With data flowing directly into your accounting system, you can generate summaries, profit and loss statements, and tax reports with just a few clicks.

- Effortless Reconciliation: Payments can be matched with generated documents automatically, streamlining the reconciliation process.

- Accurate Tax Reporting: Integrated software helps you calculate and track taxes automatically, ensuring compliance and reducing errors during tax season.

By linking your documents with accounting software, you create a more efficient and reliable system for managing your finances. This integration allows you to focus more on growing your business while automating repetitive tasks and reducing the risk of mistakes.

Best Practices for Invoice Formatting

When designing billing documents, clarity and professionalism are paramount. A well-organized structure not only ensures smooth transactions but also reflects positively on your business. Whether you are crafting a financial statement for a client or managing internal records, following specific formatting guidelines helps convey important details effectively and prevents confusion.

Here are some essential practices to follow when structuring your documents:

- Keep it simple and clean: Use a layout that is easy to read and visually appealing. Avoid clutter by organizing information into clear sections, such as contact details, itemized services, and totals.

- Ensure proper alignment: Align key elements, such as dates, amounts, and descriptions, in a way that allows for quick scanning. This reduces errors and improves readability.

- Include all necessary details: Always provide accurate information such as the recipient’s name, your business contact details, a unique reference number, and payment instructions.

Consider using a structured approach with clearly defined categories and consistent styling. This will make it easier for both parties to verify the information and prevent misunderstandings.

- Break down charges: Use a table or list format to present each item, its description, rate, and total cost. This breakdown is crucial for transparency.

- Highlight important dates: Ensure the date of issue, due date, and payment terms are clearly visible, preferably in bold or at the top of the page.

- Choose legible fonts: Use simple, professional fonts like Arial or Helvetica. Stick to a size that’s easy to read without strain.

By following these fundamental guidelines, you can enhance the professionalism of your billing documents and ensure that they serve their purpose effectively.

Common Mistakes to Avoid in Invoices

Even minor errors in billing documents can lead to confusion, delayed payments, and frustration for both parties. It’s crucial to pay attention to the details and ensure accuracy at every stage of creating your financial records. Small mistakes can tarnish your professionalism and create unnecessary complications in the payment process.

Here are some common pitfalls to watch out for:

- Incorrect or missing contact information: Failing to include accurate contact details, such as your business name, address, phone number, and email, can create difficulties in communication and delays in payment.

- Vague or unclear descriptions: Always provide a clear, specific description of the goods or services provided. Ambiguity can lead to misunderstandings and disputes over charges.

- Calculation errors: Double-check all amounts, tax rates, and totals. A simple math error can damage trust and cause unnecessary back-and-forth.

Don’t overlook the details. Small mistakes, like missing dates or wrong amounts, can give the impression of carelessness, so it’s vital to review your document thoroughly before sending it out.

- Failure to specify payment terms: Always make it clear when the payment is due, what methods are acceptable, and any late fees that may apply. Lack of clarity can lead to late payments or confusion about how to settle the bill.

- Unprofessional formatting: A cluttered, disorganized layout can make it difficult to understand the key details of the statement. Stick to a clean, structured format that’s easy to read.

- Not numbering your documents: Every document should have a unique reference number. Without one, tracking and managing multiple statements becomes challenging, especially for accounting purposes.

By avoiding these common mistakes, you’ll maintain a smooth workflow, ensure faster payments, and present a more professional image to your clients and partners.

How to Update Your Invoice Template

Keeping your billing documents up to date is essential for ensuring that they remain professional, clear, and aligned with any changes in your business or industry standards. Updating your format helps you incorporate new details, maintain consistency, and adapt to evolving legal or financial requirements.

Review Key Information

The first step in updating your billing format is to check if any key information needs to be changed or added. Over time, certain details like your business address, tax rates, or payment terms may change. Ensure these are reflected correctly in the new version.

| Section | What to Update |

|---|---|

| Business Information | Check for any address, phone, or email updates. |

| Tax Information | Ensure the correct tax rate is applied, especially if your location or the applicable laws have changed. |

| Payment Terms | Review the payment schedule and methods to ensure they reflect your current practices. |

Design and Layout Enhancements

In addition to updating content, it’s important to assess the layout and design of your document. A simple redesign can make the statement more readable and visually appealing. Consider using a more modern font, adjusting the alignment, or adding branding elements such as your logo or color scheme.

Regularly revisiting and revising your billing records ensures that they not only remain accurate but also keep up with the best practices in financial documentation, making the process smoother for both you and your clients.

Legal Considerations for Invoice Design

When designing billing documents, it’s crucial to consider the legal implications to ensure compliance with local, regional, and international regulations. Failing to include the correct information or follow required formats can lead to legal disputes or financial penalties. Understanding these key elements helps protect both your business and your clients.

Essential Legal Information

Every billing document must include specific details to meet legal requirements. These typically include:

- Business Identification: Your company’s full legal name, business registration number, and contact details should be clearly visible.

- Tax Identification Number: Depending on the jurisdiction, it’s often necessary to include your VAT or sales tax number, especially if your business is tax-registered.

- Itemized Breakdown: You must clearly list each product or service provided, including the quantity, description, unit price, and total amount, to ensure transparency.

- Payment Terms: Legal payment terms should be specified, such as due dates, late fees, and accepted payment methods. This ensures both parties are aware of their responsibilities.

Compliance with Local Regulations

Legal requirements vary by country and even by region. Some areas have specific rules about how financial documents should be formatted, what details need to be included, and how tax rates should be applied. Always research the applicable laws in your area or consult a legal professional to ensure that your billing documents align with local regulations.

Failure to comply with these legal standards could result in fines or delays in payment processing. By staying informed about the legal requirements in your jurisdiction, you can avoid costly mistakes and maintain a trustworthy relationship with your clients.