Create Your Own Invoice Template for Free and Customize It Effortlessly

When managing a business or offering services, keeping track of payments and ensuring that each transaction is clearly documented is essential. Having a personalized billing sheet can streamline this process, making it more organized and professional. The good news is, crafting a unique and effective document doesn’t require advanced skills or expensive software.

With the right tools, it’s simple to design a document that suits specific needs, reflects the business brand, and includes all the necessary details for smooth transactions. By leveraging accessible resources, anyone can build a professional-looking bill that works for both small-scale operations and larger ventures.

In this guide, we will explore the steps involved in designing these important documents, offering tips on layout, content, and customization. Whether you’re an entrepreneur, freelancer, or small business owner, a well-structured billing sheet will help maintain clear communication with clients and ensure timely payments.

How to Create Free Invoice Templates

Designing a professional billing document can be both simple and cost-effective. With the right tools, anyone can generate a document that fits the needs of their business or services. The key is understanding the components that should be included and how to customize the layout for clarity and ease of use.

Choose the Right Platform

There are several online platforms and software options available that offer templates for generating bills without any cost. These platforms allow users to easily modify content and structure, ensuring that the document aligns with specific business requirements.

- Online generators: Websites like Invoice Generator or Canva allow quick customization with easy-to-use interfaces.

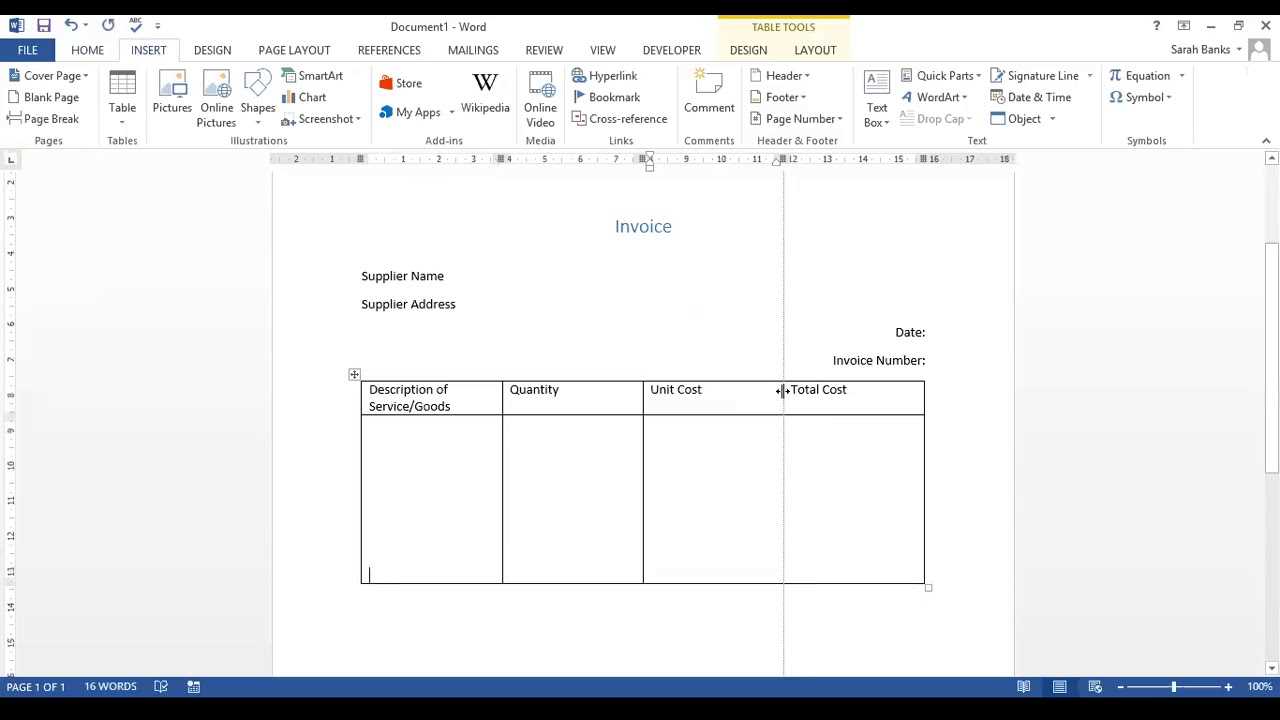

- Word processors: Tools like Google Docs or Microsoft Word offer built-in templates, which can be further personalized.

- Spreadsheets: Excel or Google Sheets are perfect for creating detailed and automated bills with built-in formulas.

Essential Components to Include

Regardless of the method or platform chosen, certain elements must be present in any billing document. These sections ensure that both the service provider and the client have all the necessary information for a smooth transaction.

- Business details: Include the name, address, phone number, and email.

- Client information: Clearly list the recipient’s name and contact information.

- Service description: Include a breakdown of products or services provided, along with quantities and pricing.

- Payment terms: Specify the due date, accepted payment methods, and any late fees if applicable.

- Invoice number: Assign a unique number for tracking and record-keeping purposes.

By focusing on these essentials and utilizing user-friendly tools, generating a professional billing document becomes an easy and accessible task for anyone, regardless of their experience level.

Why You Should Use Custom Invoices

When managing business transactions, having a personalized document tailored to your needs is crucial. A unique and professional billing sheet not only helps maintain clarity but also strengthens the relationship between you and your clients. Customization ensures that all necessary details are included, making the payment process smooth and transparent.

Professionalism and Branding

A personalized billing document provides an opportunity to showcase your brand identity. By incorporating your business logo, colors, and design elements, you create a consistent and professional image that resonates with clients. This attention to detail can set you apart from competitors who may use generic or unprofessional formats.

- Logo: Displaying your company logo reinforces your brand identity.

- Custom design: Tailoring the layout can make the document more appealing and easier to read.

- Consistent experience: Clients will recognize your business through every interaction, from the website to the billing document.

Efficiency and Accuracy

Custom documents allow you to include only the information that is relevant to your business. This reduces the chances of errors and ensures you don’t miss important details. It also streamlines the entire process, making it faster to generate and send bills, saving valuable time.

- Simplified structure: A customized format can focus on the specific elements important to your business, such as service descriptions or payment terms.

- Fewer mistakes: You control the layout and content, reducing the risk of missing or incorrect information.

- Better tracking: Unique identifiers or custom numbering systems make it easier to organize and follow up on outstanding payments.

By using a custom document, you’re not only improving your own internal processes but also creating a more professional and memorable experience for your clients.

Steps to Design Your Own Invoices

Designing a billing document that fits your specific needs is a simple yet important process. With the right approach, you can build a clear and professional document that helps ensure smooth transactions and effective communication with clients. Following a structured process will allow you to create an efficient and customized solution that works best for your business.

Here are the key steps to follow when designing a customized billing sheet:

- Step 1: Choose a Platform – Select a tool or software that offers the flexibility to adjust layout and content. Options range from word processors to specialized online platforms, depending on your preferences.

- Step 2: Select the Layout – Decide on the structure that will best showcase your business details and payment information. Ensure that the layout is clean, professional, and easy to navigate.

- Step 3: Add Key Information – Include necessary details such as your business name, client contact information, service descriptions, amounts, payment terms, and invoice number.

- Step 4: Customize the Design – Personalize the document with elements that align with your brand, such as your logo, color scheme, and font style. A visually appealing design can make a lasting impression.

- Step 5: Review and Finalize – Double-check for any errors or missing information. Ensure that everything is accurate and that the document is ready to be sent to clients.

By following these steps, you can quickly develop a professional and functional document tailored to your business needs, improving the billing process and enhancing client interactions.

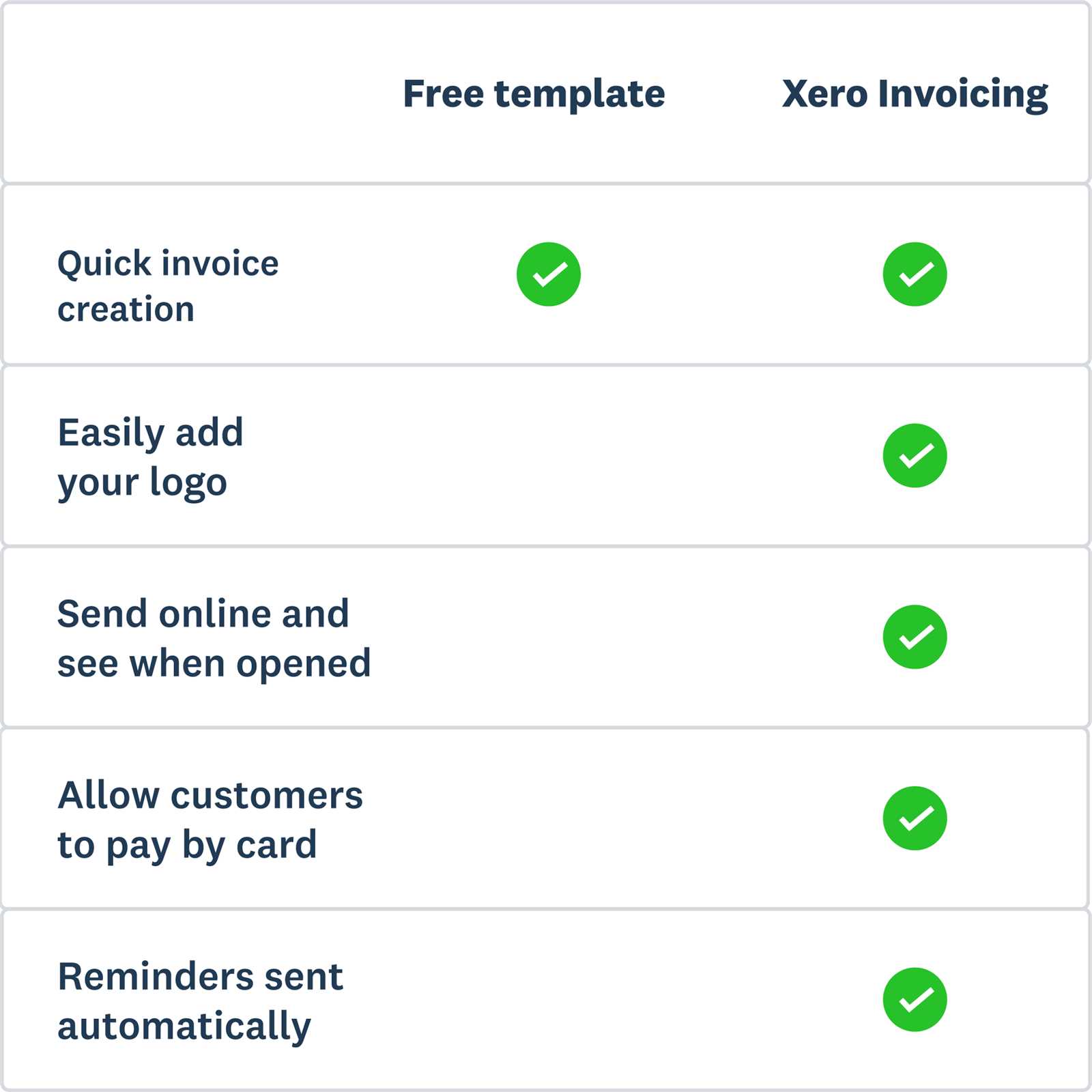

Top Free Invoice Template Tools

There are several online resources that allow you to design and generate professional billing documents without any cost. These tools provide templates and customization options, making it easy to adapt the layout to your business needs. Whether you’re a freelancer or a small business owner, these platforms offer intuitive features that simplify the process of creating detailed and visually appealing documents.

Here are some of the top platforms that provide excellent solutions for generating professional billing documents:

- Invoice Generator – A simple, no-frills tool that allows quick customization. Choose from various designs, enter your details, and generate a document ready for download or email.

- Canva – Known for its user-friendly interface, Canva offers a range of editable templates. You can easily personalize the layout with logos, colors, and other design elements to match your brand.

- Zoho Invoice – This online platform not only offers customizable billing sheets but also includes features for tracking payments, managing clients, and integrating with other business tools.

- Wave – A comprehensive tool that combines free invoice generation with accounting features. It offers easy-to-use templates and additional functionality like expense tracking and financial reporting.

- Google Docs – If you prefer working within a document editor, Google Docs offers free customizable formats that you can adjust according to your needs. It’s especially useful for those who need simple yet effective solutions.

These platforms provide accessible and practical tools that help you design high-quality billing documents in no time. Most offer essential features like text customization, automatic calculations, and file export options, making them a great choice for businesses of any size.

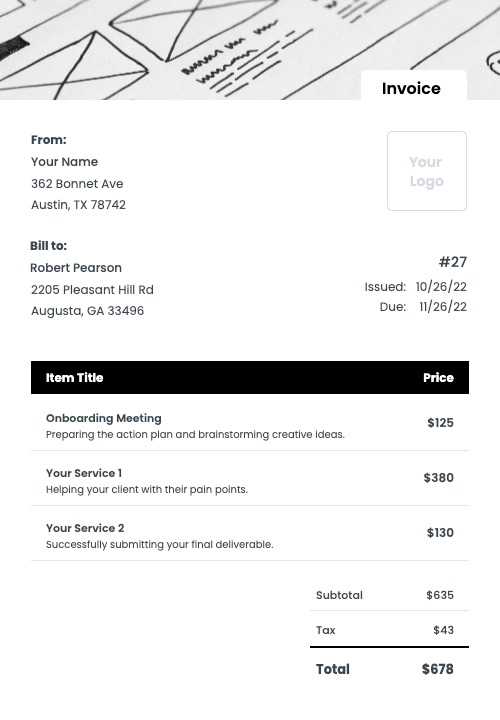

What to Include in Your Invoice

To ensure smooth transactions and clear communication with clients, it’s important to include all relevant details in your billing document. A well-structured record provides both parties with the necessary information to avoid confusion and ensure timely payments. Knowing what key elements to include will make your billing process more efficient and professional.

Here are the essential elements that should be part of any professional billing document:

- Business Information: Include the name, address, contact number, and email address of your company or yourself. This helps clients easily reach out with any questions or concerns.

- Client Information: List the full name or company name of the recipient, along with their contact details. This helps ensure the document is properly attributed and that there are no misunderstandings.

- Invoice Number: Assign a unique identifier for each transaction. This is crucial for tracking payments and managing records.

- Issue Date: Clearly state the date the bill was issued. This provides a reference for payment terms and due dates.

- Payment Due Date: Indicate when the payment should be made, ensuring both parties are clear on the deadline.

- Description of Goods or Services: Detail the items or services provided, including quantities, unit prices, and a brief description for clarity.

- Total Amount Due: Clearly state the total amount due, breaking down costs as needed (e.g., taxes, shipping). This allows clients to see how the total is calculated.

- Payment Terms: Specify the accepted payment methods (e.g., bank transfer, credit card) and any late fees or penalties for overdue payments.

- Additional Notes: Include any relevant terms or conditions, such as refund policies or special instructions for payment. This helps manage expectations.

Including these critical details ensures that both you and your clients are on the same page. A clear and thorough billing document helps avoid delays an

Choosing the Right Invoice Layout

Selecting an appropriate structure for your billing document is crucial for clarity and professionalism. A well-organized layout ensures that all necessary information is easy to find, helping clients process the details quickly. The right arrangement can also reinforce your brand’s identity while making the document visually appealing and simple to understand.

Here are some important considerations when choosing the ideal layout:

- Clarity and Simplicity: Keep the design clean and straightforward. Avoid unnecessary elements or complex graphics that could distract from important details like payment terms or amounts due.

- Prioritize Key Information: Position the most important details, such as contact information and amounts due, at the top or in easily accessible sections. This helps clients quickly identify critical information.

- Consistency with Branding: Ensure that the layout reflects your brand’s colors, fonts, and overall style. Consistency between all business documents builds a cohesive, professional image.

- Readability: Choose fonts that are easy to read, and make sure there’s enough white space between sections to avoid a cluttered appearance. This will help prevent errors or misunderstandings.

- Flexibility: The layout should be adaptable to various situations. Whether you’re billing for a single service or multiple products, the structure should allow easy modification without compromising on clarity.

By keeping these factors in mind, you can design a billing document that is not only functional but also professionally presented, which can enhance your relationship with clients and improve overall payment processing.

How to Save Your Template for Future Use

Once you’ve designed a professional billing document that suits your needs, it’s essential to save it in a way that makes it easy to access and reuse. A well-organized system allows you to streamline your billing process, saving time and effort with every transaction. There are various methods to store and manage your files, depending on the tools you used to design them and your personal preferences.

Options for Saving and Storing Files

Here are some of the most common ways to store your completed billing documents for future use:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Cloud Storage (Google Drive, Dropbox) | Store files online for easy access from any device. | Accessible anywhere, automatic backups. | Requires internet connection, storage limits. |

| Desktop Folders | Save documents on your computer’s hard drive. | Quick access, no internet required. | Risk of data loss if not backed up. |

| Invoice Management Software | Use dedicated software to store and manage billing files. | Centralized storage, organized by client or project. | May require subscription, some tools have learning curves. |

| Email Drafts | Email the document to yourself and save it in your inbox. | Simple, quick access from email inbox. | Can become cluttered, difficult to organize over time. |

Tips for Easy Access and Organization

To ensure you can quickly retrieve your documents when needed, consider naming files with clear, consistent naming conventions. Use terms like client name, date, or project number to make searching easier. Additionally, categorize your files into folders or use tags if your software or storage platform supports it. These small steps

Customizing Your Template for Different Clients

Every client has unique needs, and tailoring the details of each billing document ensures clarity and professionalism in every transaction. Customization allows you to provide personalized service, maintain better relationships, and improve communication. Adjusting the layout, information, and terms based on the specific client or project can help ensure the document reflects the individual nature of the service provided.

Here are some key ways to customize your document for different clients:

- Client-Specific Details: Always include accurate client information, such as their company name, address, and contact details. For large projects, you may also include a client reference number or specific project title.

- Personalized Service Descriptions: Tailor the descriptions of the products or services provided, ensuring that the client can easily understand the work done and the value delivered.

- Payment Terms and Conditions: Some clients may have different payment preferences or terms. Adjust deadlines, payment methods, and discounts based on what was agreed upon with each client.

- Discounts and Offers: If applicable, make sure to apply any special offers, discounts, or payment plans that were negotiated specifically for the client or project.

- Branding Adjustments: If the client has specific branding guidelines, consider adjusting colors, fonts, or logos to align with their preferences. A personalized document enhances their experience and demonstrates attention to detail.

By tailoring your document to fit the specifics of each client, you not only ensure accuracy but also build stronger relationships and enhance your professional image.

Adding Branding to Your Invoice Template

Incorporating brand elements into your billing documents is an effective way to reinforce your business identity and create a consistent experience for clients. A well-branded document not only looks professional but also helps distinguish your business from others, leaving a lasting impression. Customizing the design to reflect your brand’s visual style enhances both the credibility and the appeal of your documents.

Key Branding Elements to Include

Here are some of the most important brand elements you can integrate into your billing document:

- Logo: Your logo should be prominently displayed at the top of the page, preferably in the header. It’s a simple way to associate the document with your business.

- Color Scheme: Use your brand’s colors to create a visually cohesive document. This can include background colors, font colors, or borders that align with your business’s established palette.

- Typography: Consistent font styles help reinforce your brand’s personality. Choose a font that is both legible and matches your company’s image, whether formal, modern, or creative.

- Brand Message or Tagline: Including a brief tagline or business statement can remind clients of your value proposition, making your document more memorable.

- Custom Footer: Add a footer that includes links to your website or social media accounts, further promoting your brand and providing easy access to additional information.

Why Branding Matters

Branding is more than just aesthetics–it’s about building trust and reinforcing your business’s values with each interaction. A branded document communicates that you take your business seriously and helps clients recognize you as a professional entity. It also contributes to brand recognition and can make your services stand out in a competitive market.

By integrating these branding elements into your billing document, you not only enhance the overall look but also provide a consistent, professional experience that strengthens your business’s reputation.

Benefits of Using Digital Invoices

In the modern business landscape, digital billing has become an essential tool for streamlining operations, saving time, and improving accuracy. Digital documents not only provide convenience but also enhance the overall client experience. They allow businesses to quickly send, track, and store payment records while offering a range of additional advantages over traditional paper-based methods.

Advantages of Switching to Digital Billing

Here are some of the key benefits of using digital documents for your transactions:

| Benefit | Description | Impact on Business |

|---|---|---|

| Time-Saving | Digital files can be generated, sent, and received almost instantly, significantly reducing the time needed for processing. | Faster payments and quicker processing of transactions. |

| Cost-Effective | By eliminating paper, postage, and manual processing, digital billing cuts operational costs. | Lower overhead costs and more efficient use of resources. |

| Environmentally Friendly | Digital billing reduces paper usage, helping businesses minimize their environmental footprint. | Supports sustainability efforts and eco-conscious branding. |

| Accuracy | Automated calculations and easy-to-check formats reduce human error in documents. | Fewer mistakes and clearer, more precise records. |

| Easy Tracking | Digital documents can be easily stored, organized, and accessed, making tracking payments more efficient. | Improved financial management and easier audits. |

| Security | With encryption and password protection, digital files are safer from loss or theft compared to paper records. | Reduced risk of fraud and enhanced data security. |

| Management Practice | Description | Benefits |

|---|---|---|

| Organize by Client | Keep detailed records of each client’s billing history, including all pending and completed payments. This helps ensure you never miss a payment. | Improved tracking and personalized service. |

| Use Software Tools | Leverage invoicing software to automate the creation, sending, and tracking of documents. Many platforms also offer reporting and analytics features. | Saves time, reduces errors, and provides insights into business performance. |

| Set Up Reminders | Automate payment reminders for clients who have outstanding balances. Set reminders for due dates, overdue payments, and upcoming billing cycles. | Minimizes late payments and ensures timely follow-ups. |

| Maintain Backup Records | Always keep a backup copy of all payment documents, either digitally or in print. Use cloud storage or secure servers to prevent loss of important data. | Safeguards important financial records and ensures you have access when needed. |

| Track Payment Status | Use a tracking system to monitor the status of each payment request. Mark documents as paid, pending, or overdue to maintain a clear overview. | Provides a clear and organized financial picture, making it easier to follow up with clients. |

By implementing these management strategies, you can keep your financial records organized, reduce the risk of mistakes, and ensure smoother cash flow. Streamlined processes lead to more efficient business operations and improved relationships with clients.