How to Create Your Own Invoice Template

When managing any business, having a well-organized and professional document for billing is essential. It ensures clarity between you and your clients, helping streamline payment processes. A personalized approach to these documents not only enhances your brand image but also ensures accuracy and consistency in financial transactions.

Understanding the key components of such a document is crucial. By knowing what information needs to be included and how to structure it, you can craft a functional and appealing design tailored to your needs. Whether you’re using a simple text editor or a specialized online tool, it’s possible to adapt the structure to match your business requirements.

Customization plays a significant role in making this document uniquely suited to your brand. Incorporating your business’s logo, colors, and specific terms can make a noticeable difference. In the following sections, we’ll explore different ways to construct a practical and professional billing document suited to various types of businesses.

Designing a Custom Billing Document

Developing a well-structured document for financial transactions is key to ensuring smooth and professional dealings with clients. A well-organized structure that includes all necessary details not only improves clarity but also enhances the overall perception of your business. The design of such a document should be both functional and visually appealing, providing a clear representation of the goods or services rendered and the agreed-upon terms.

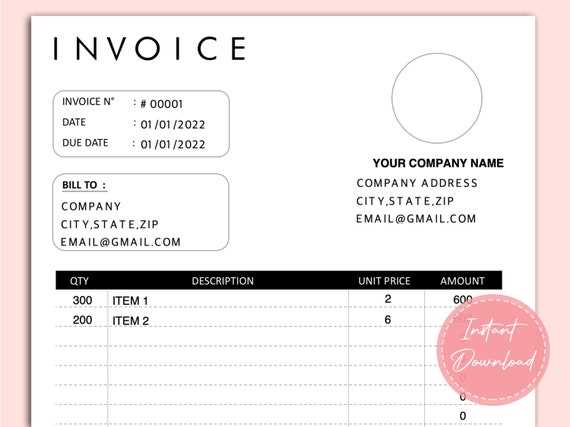

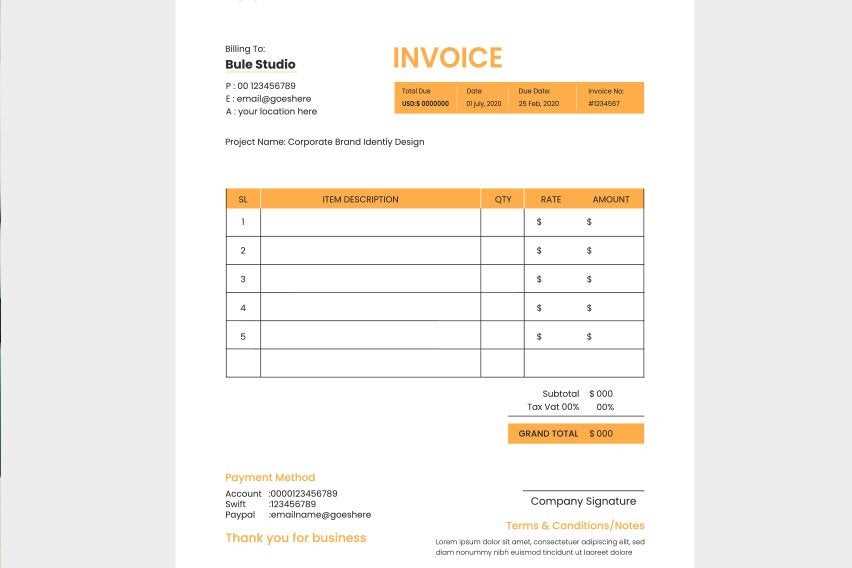

To begin, there are several essential components to consider when drafting this kind of document. These elements must be clearly presented to avoid any confusion during the payment process. Below is an example structure that covers the necessary sections for an effective billing document:

| Section | Description |

|---|---|

| Header | Include your company name, logo, and contact details for clear identification. |

| Client Information | Provide the client’s name, address, and contact information to specify the recipient. |

| Itemized List | List the products or services provided, along with descriptions and quantities. |

| Pricing Details | Clearly state the price for each item or service, including any applicable taxes or discounts. |

| Payment Terms | Indicate payment deadlines, methods, and any late fee policies. |

| Footer | Include additional notes, such as thank you messages or legal disclaimers. |

By following this simple structure, you can easily generate a document that is professional, consistent, and suited to your business’s unique needs. Once the content is ready, it can be formatted in various software tools, whether using a text editor, spreadsheet software, or specialized platforms designed for document creation.

Understanding the Importance of Custom Invoices

Having a well-crafted billing document is a vital part of any business transaction. It serves not only as a record of the goods or services provided but also as a professional representation of your company. A document that is tailored to your specific needs ensures accuracy, minimizes confusion, and improves the client’s experience. It reflects the level of professionalism and attention to detail that clients expect from reliable businesses.

Personalization plays a crucial role in ensuring the document is aligned with your business’s identity. By including unique elements, such as a logo, company color scheme, and specific terms, you enhance the credibility and trustworthiness of the transaction. This can also be an opportunity to reinforce your brand and communicate your business’s values clearly.

Consistency is another key benefit. Using a personalized billing document for all transactions ensures uniformity in how financial interactions are presented. This consistency not only helps in keeping records organized but also makes it easier for clients to recognize and process their payments promptly. A custom approach can also help reduce mistakes and ensure all the necessary details are consistently included each time.

Essential Elements of a Billing Document

When preparing a professional document for financial transactions, certain key elements must be included to ensure clarity and accuracy. These essential components provide the necessary information for both parties to understand the terms of the agreement, the amounts due, and the specific services or goods exchanged. A well-structured document helps avoid confusion and fosters trust between businesses and their clients.

Here are the fundamental components that should be present in any well-designed billing document:

- Business Information: Include the company name, address, phone number, and email address for identification.

- Client Information: Clearly state the client’s name, billing address, and contact details to avoid any mix-up.

- Unique Document Number: Assign a reference number to each document for easy tracking and record-keeping.

- Itemized List: Provide a detailed description of the services or goods provided, along with their quantities and unit prices.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees or penalties if applicable.

- Taxes and Discounts: Clearly outline any applicable taxes or discounts and how they affect the total amount.

- Total Amount Due: Ensure the total due is clearly stated, including all taxes, fees, and discounts.

- Notes or Additional Information: Provide space for any terms, conditions, or special instructions that may be relevant to the client.

Including these core elements will help ensure that your document is both comprehensive and professional, meeting the needs of both the business and the client while promoting transparency in financial transactions.

Choosing the Right Invoice Format

Selecting the right format for a billing document is crucial for maintaining professionalism and clarity. The structure should be easy to navigate, ensuring that all the necessary details are easily understood by both parties involved. The choice of format depends on several factors, including the complexity of the transaction, the tools you are using, and your industry’s specific needs.

There are different formats available, each offering distinct advantages. Below is a comparison of some of the most commonly used formats:

| Format Type | Advantages |

|---|---|

| Basic Layout | Simple and easy to understand, suitable for small businesses or one-time transactions. |

| Itemized Layout | Perfect for detailed transactions, breaking down services or products, and including quantities and rates. |

| Multi-Page Format | Ideal for large businesses or more complex transactions that require multiple sections, such as detailed terms and conditions. |

| Customizable Digital Format | Allows for easy customization with company branding and quick modifications, useful for ongoing or recurring transactions. |

Choosing the right format largely depends on the nature of your business and the preferences of your clients. A simple, easy-to-read format works well for most small businesses, while a more comprehensive layout may be needed for larger enterprises or more detailed transactions. Ultimately, the goal is to ensure that the document is clear, professional, and serves its purpose effectively.

How to Personalize Your Billing Design

Customizing the layout of a financial document helps reflect your business’s identity and enhances its professional appearance. Personalization goes beyond just adding a logo; it includes adapting the overall design to fit the tone and style of your brand, creating a document that is both functional and visually appealing. The goal is to ensure that the design not only looks polished but also communicates the necessary details in a clear and organized manner.

To personalize the design effectively, consider the following elements:

- Branding Elements: Include your company logo, colors, and font choices to maintain brand consistency.

- Layout and Spacing: Ensure a clean layout with enough white space to make the document easy to read.

- Typography: Use clear, legible fonts and avoid overcomplicating with too many styles. Choose fonts that match the tone of your business.

- Client-Specific Details: If applicable, add personal touches like a thank-you note or a custom message that shows appreciation for the business relationship.

- Visual Hierarchy: Organize sections in a logical order with appropriate headings and subheadings to guide the reader’s eye.

By carefully selecting and incorporating these elements, you can produce a design that not only serves its functional purpose but also strengthens your brand image. Personalizing the layout is an opportunity to enhance the client’s experience while ensuring the document remains professional and effective.

Steps to Design a Billing Document in Word

Designing a professional billing document using word processing software is straightforward and offers flexibility for customization. By following a few simple steps, you can produce a document that is both functional and aligned with your business’s branding. Word processing tools allow for easy formatting, making it simple to create a document that looks polished and clear, while also providing all necessary details for transactions.

Follow these steps to design a well-structured financial document:

- Open a New Document: Start by opening a blank document in your word processor to begin designing from scratch.

- Add Company Information: At the top of the page, insert your business name, address, phone number, email, and any other relevant contact details.

- Insert Client Details: Below the company information, create a section for the client’s name, address, and contact information.

- Set up Table for Items: Insert a table to list products or services provided. Include columns for description, quantity, unit price, and total cost for each item.

- Include Payment Terms: Below the itemized list, provide a section for payment instructions, due date, and accepted payment methods.

- Calculate Total Amount: Add a row at the bottom of the table to calculate the total amount due, including any applicable taxes or discounts.

- Design Footer: Finish by including any additional information, such as thank you notes, legal disclaimers, or policies on late payments.

Once the structure is in place, you can adjust fonts, colors, and layout to match your business’s branding. Word processors also allow you to save the design for future use, making it easy to update and reuse for each new transaction.

Using Excel for Billing Document Design

Excel is an excellent tool for designing detailed financial documents due to its flexibility and powerful features. The spreadsheet format allows for easy calculations, organized data, and quick customization, making it an ideal choice for those looking to produce clear and professional records. With Excel, you can efficiently manage calculations such as totals, taxes, and discounts, while also ensuring the document’s layout is easy to read and visually appealing.

Steps to Design a Billing Document in Excel

Follow these steps to design an effective financial record using Excel:

- Set Up Headers: Create a header row to include key details such as company name, client name, and contact information.

- Insert a Table for Item Details: Set up a table with columns for description, quantity, unit price, and total cost. Excel’s grid layout makes this easy to structure.

- Use Formulas for Calculations: Utilize Excel’s built-in formulas to automatically calculate totals, taxes, and discounts. For example, use the SUM function to total the amounts.

- Apply Formatting: Adjust cell sizes, text alignment, and font styles to make the document clean and professional. Use bold for headers and currency formatting for amounts.

- Add Payment Terms: Include sections for payment due dates, terms, and accepted methods at the bottom of the document.

Advantages of Using Excel

Excel offers several benefits when designing a billing document:

- Automation: Automatic calculations reduce errors and save time on manual input.

- Customization: The spreadsheet format is highly customizable, allowing you to adjust the layout and design according to your needs.

- Data Management: Excel makes it easy to track and store financial data for future reference or reporting.

By using Excel, you can design an organized, functional, and efficient document that meets all your billing needs while providing professional results for clients.

Leveraging Online Tools for Billing Documents

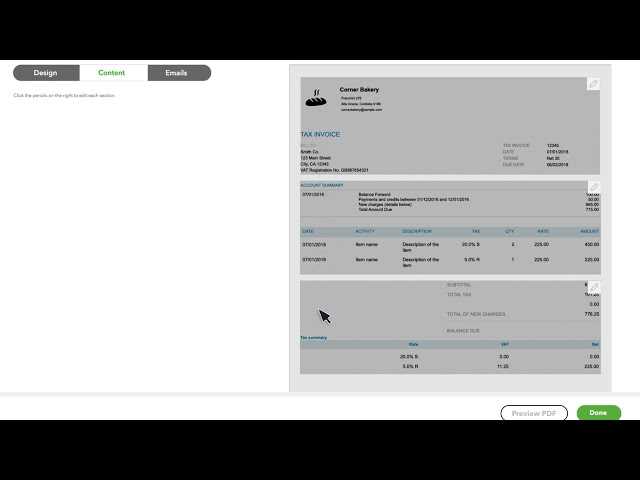

Online platforms designed for financial record management provide an easy and efficient way to generate professional documents. These tools typically come with pre-designed structures, making it quick to enter the necessary details and send records to clients. By utilizing web-based services, businesses can streamline the entire process, ensuring accuracy and saving time compared to traditional methods like manual entry or using software with complex features.

Benefits of Using Online Tools

Online tools offer a wide range of advantages, particularly for small businesses or those looking to simplify administrative tasks:

- Pre-built Designs: Many platforms provide ready-made layouts that can be customized with your details, ensuring a professional appearance without the need for advanced design skills.

- Ease of Use: These tools are typically user-friendly, allowing you to input information quickly and generate documents in minutes.

- Cloud Access: Since these tools are hosted online, you can access them from anywhere, ensuring flexibility for remote work or business operations on the go.

- Automatic Calculations: Most online platforms include automated functions for calculating totals, taxes, and other adjustments, reducing the risk of errors.

- Integration with Payment Systems: Many services allow for seamless integration with payment gateways, enabling you to collect payments directly through the document.

Popular Online Tools

There are several online services that can help you manage and generate billing documents effectively. Some of the popular options include:

- Invoicely: A cloud-based platform with a variety of templates and customizable options for businesses of all sizes.

- Wave: A free tool that allows small businesses to create, send, and track professional records with ease.

- Zoho Invoice: A comprehensive invoicing system that provides advanced features like time tracking, recurring billing, and multi-currency support.

- FreshBooks: An online accounting tool that helps with invoicing, expense tracking, and client management.

By leveraging these online tools, businesses can simplify the invoicing process while maintaining a high level of professionalism. These services make it easy to handle the complexities of financial documentation, allowing you to focus on what truly matters–growing your business.

Customizing Billing Document Layout for Clarity

Designing a financial document with clear organization enhances its readability and ensures that all necessary details are easily understood. A well-structured layout allows clients to quickly find important information such as amounts, payment terms, and services provided. By focusing on clarity, you can reduce confusion and provide a more professional experience for both parties.

To improve the layout and ensure your documents are as clear as possible, consider the following tips:

- Use Logical Sections: Divide the document into easily identifiable sections such as contact information, items or services, payment terms, and totals. This helps guide the reader’s eye through the document.

- Choose Readable Fonts: Select fonts that are easy to read, such as sans-serif styles, and avoid using too many different types. Consistency in font usage helps maintain a professional and clean appearance.

- Emphasize Key Information: Highlight or bold important details like the total amount due or payment deadline, ensuring they stand out for quick reference.

- Optimize White Space: Use appropriate spacing between sections and elements. White space prevents the document from feeling cluttered and makes it easier to read.

- Align Elements Properly: Ensure text and numbers are properly aligned. For example, right-align monetary values so they are easy to compare, and use consistent alignment for item descriptions and quantities.

By making these adjustments, you can significantly improve the legibility and effectiveness of the document. A clear, organized layout not only boosts professionalism but also fosters a positive client experience, making it easier for them to understand and process the document.

Adding Company Branding to Billing Documents

Incorporating brand elements into financial documents can significantly enhance your company’s image and foster recognition. By embedding your logo, color scheme, and font style into these records, you present a cohesive and professional look that reinforces your identity. Customizing these details allows clients to immediately recognize your business, even in the context of routine administrative tasks like payments.

Benefits of Branding in Financial Documents

Incorporating brand elements into financial documents is more than just a design choice. It offers several strategic advantages:

- Consistency: Consistent branding across all materials, including billing documents, strengthens your company’s identity and makes it easier for clients to connect with your business.

- Professionalism: A branded document conveys professionalism and attention to detail, building trust with clients.

- Recognition: Clients will immediately recognize your company’s documents, making them more likely to engage with your content and services.

How to Add Branding Elements

Integrating branding into your financial records is straightforward. Here are some key elements to include:

- Logo: Place your logo prominently at the top of the document. This helps with immediate recognition and sets the tone for the entire document.

- Color Scheme: Use your brand’s color palette to highlight headings, borders, and key information. Be mindful of readability, and avoid overloading the document with too many colors.

- Fonts: Stick to your brand’s font style, ensuring consistency with other materials. Avoid using too many different fonts, as this can detract from the document’s clarity.

- Tagline or Slogan: Including a short brand message or tagline in a subtle location can further reinforce your company’s message without overwhelming the document.

By adding these branding elements, you ensure that every interaction with your financial documents reflects your business’s identity. This not only builds a strong, professional image but also creates a more memorable experience for your clients.

Setting Up Payment Terms on Billing Documents

Defining clear and precise payment terms in financial documents ensures both parties are aligned on expectations and deadlines. By specifying the conditions under which payment is due, businesses can avoid misunderstandings and delays. Including this information in a well-organized manner helps maintain transparency and trust in the transaction process.

Here are some common payment terms and guidelines to include in your documents:

| Payment Term | Description |

|---|---|

| Due on Receipt | Payment is expected immediately upon receipt of the document. |

| Net 30 | Payment is due within 30 days of the issue date. |

| Net 60 | Payment is due within 60 days of the issue date. |

| Due on the 15th | Payment is due on the 15th of the following month. |

| COD (Cash on Delivery) | Payment must be made upon delivery of goods or services. |

Clearly outlining these terms not only helps clients understand their obligations but also provides a point of reference in case any disputes arise. By defining deadlines and payment methods, businesses can ensure smooth transactions and maintain a professional relationship with their clients.

Including Tax Information in Billing Documents

Accurate tax details are essential in any financial document to ensure compliance and clarity for both parties involved. Including tax information helps prevent confusion regarding the total amount due and guarantees that the correct rates are applied. By providing this information, businesses also make it easier for clients to process their payments and maintain proper records for accounting purposes.

To ensure that tax information is properly displayed, include the following elements in the document:

| Tax Type | Rate | Amount |

|---|---|---|

| Sales Tax | 8% | $16.00 |

| VAT | 20% | $40.00 |

| Service Tax | 5% | $10.00 |

When including taxes, it’s important to be specific about the type of tax applied, such as sales tax, VAT, or service charges, and clearly state the rate and the calculated amount. Additionally, make sure to specify whether tax is included in the total price or listed separately to avoid confusion. This transparency helps ensure the document is accurate and reduces potential issues during payment processing or audits.

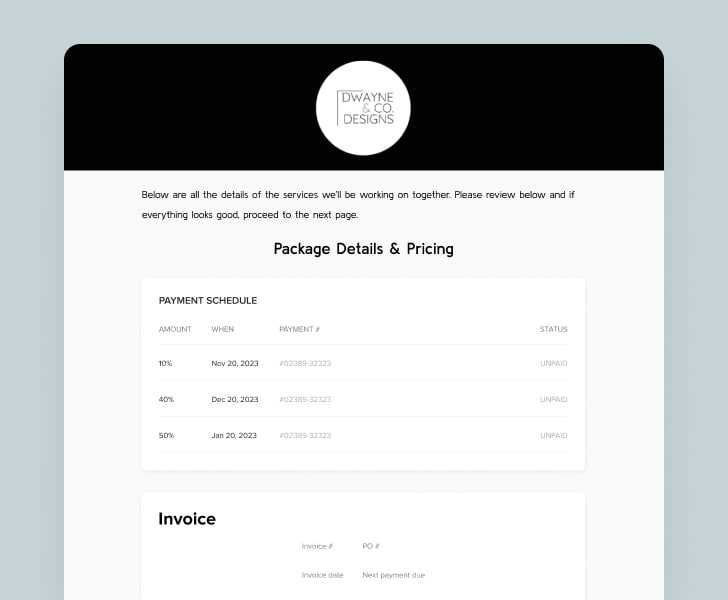

Creating Recurring Billing Documents

Setting up billing documents for regular transactions can save time and ensure consistency for both the business and the client. These documents are particularly useful for services or products that are provided on a subscription basis or require periodic payments. By automating the process, businesses can ensure that payments are received on time without having to manually generate new records each period.

When designing these documents, it’s important to include the following key elements:

- Frequency: Clearly state the billing cycle, such as monthly, quarterly, or annually, to avoid confusion about payment intervals.

- Start and End Dates: Indicate the period the charge covers, including both the start and end dates of the service or product delivery.

- Payment Methods: Specify accepted payment methods to ensure that the client knows how to make the payment.

- Renewal Terms: Include information about automatic renewal, if applicable, and any cancellation policies.

By setting up recurring documents with clear, concise details, businesses can ensure that they are paid promptly and reduce administrative overhead. This streamlined approach benefits both parties by providing transparency and minimizing the need for frequent updates or adjustments.

Invoice Formats for Various Industries

Different sectors require specific details to be included in their billing documents. Each industry has unique requirements for presenting charges, terms, and services rendered. Understanding the variations between sectors ensures that businesses can produce clear, effective documents that meet both legal and client expectations.

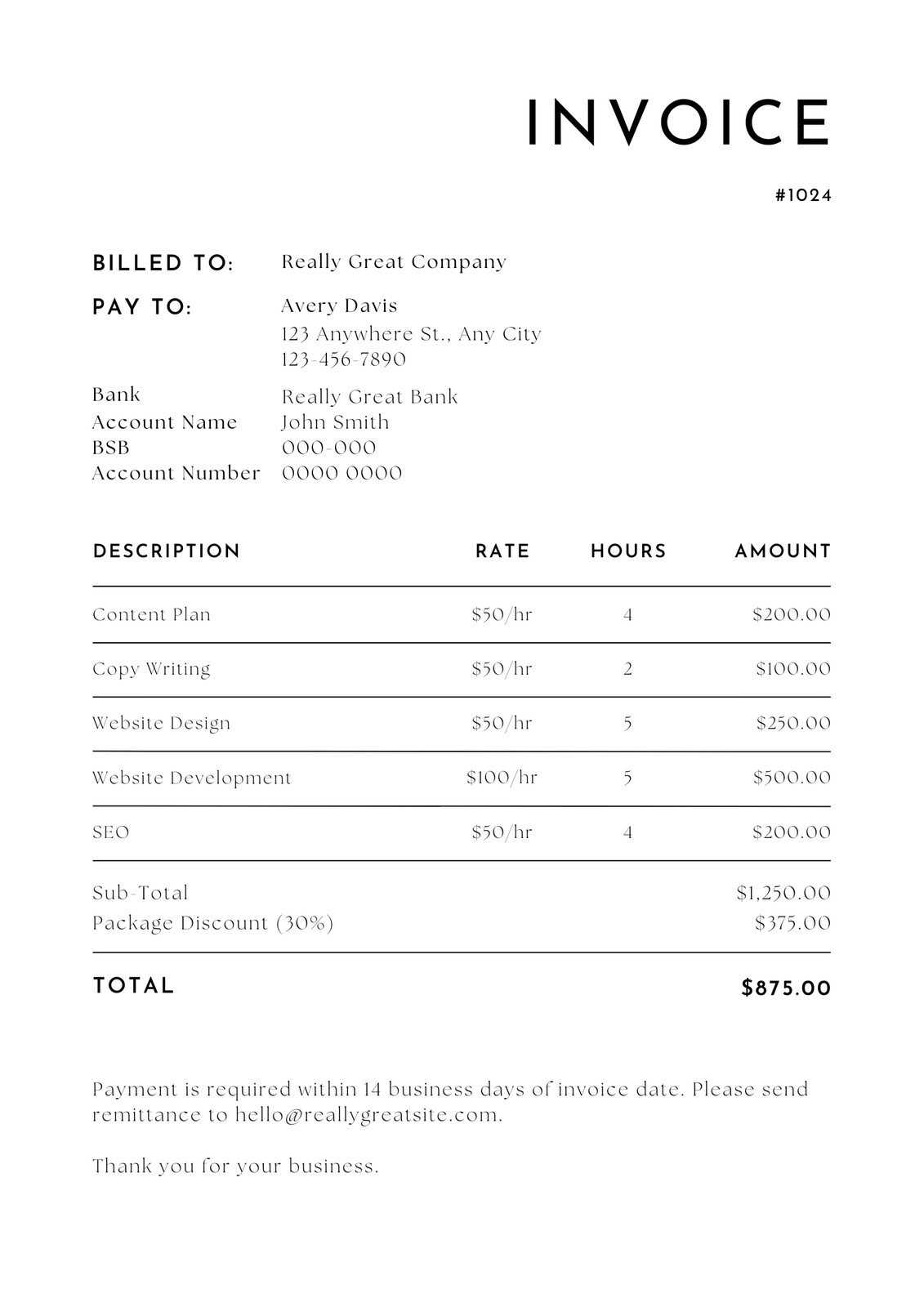

Creative and Design Services

For those in the creative industry, such as graphic designers or photographers, it is essential to clearly list the services provided, the project scope, and any milestone-based payments. It’s also common to include the number of revisions allowed and additional fees for overtime work.

Consulting and Professional Services

Consultants often need to outline the specific hours worked, the rates charged, and any other service-related expenses. It’s important to clearly state the nature of the consulting services, whether it’s hourly, project-based, or retainer-based. Including terms of payment and any cancellation fees ensures clarity for both parties.

Understanding the unique needs of each industry helps to tailor these documents in a way that best serves both the service provider and the client. By making these adjustments, businesses can ensure that they meet the expectations of their industry while maintaining a professional appearance in every transaction.

How to Save and Share Your Billing Document

Once a billing document is finalized, it’s crucial to save it in a secure and accessible format for future reference. Additionally, sharing this document with clients or partners efficiently ensures timely payment and reduces the chances of miscommunication. Understanding the best practices for saving and sharing these files can streamline the administrative process and enhance professionalism.

Saving Your Document

When saving the final version, choose a format that preserves its structure and content, such as PDF. This format is universally accessible and prevents any accidental editing. Make sure to name the file clearly with details like the client’s name, date, and service provided to easily locate it later.

Sharing the Document

There are various methods to share a finalized billing document, depending on the client’s preferences and communication channels. Common methods include email, cloud storage services, or through specialized invoicing platforms. It’s important to use a secure method, ensuring the confidentiality of the transaction details.

By following these steps, businesses can ensure that billing documents are properly saved, easily retrievable, and securely shared, making the process efficient and transparent for both parties.

Common Mistakes to Avoid in Billing Documents

Even though creating billing documents may seem straightforward, it’s easy to overlook essential details that can lead to confusion or delayed payments. Certain mistakes can compromise the clarity of the document, which may cause misunderstandings with clients or delay the payment process. Recognizing and avoiding these errors is crucial to maintaining professionalism and smooth business operations.

Errors to Watch Out For

- Missing or Incorrect Contact Information: Always double-check that both the service provider’s and the client’s contact details are accurate. Any mistakes here can delay communication and payments.

- Unclear Payment Terms: Ensure that payment deadlines, methods, and late fee policies are explicitly stated to avoid misunderstandings.

- Omitting Detailed Descriptions: Vague descriptions of services or products can lead to confusion. It’s essential to list all items or services provided with clear, concise explanations.

- Incorrect Calculations: Double-check all amounts, including taxes and discounts. Simple arithmetic errors can cause trust issues with clients.

- Not Including Tax Information: If applicable, ensure all tax rates and amounts are included to avoid legal complications and ensure compliance with regulations.

By avoiding these common mistakes, businesses can improve their invoicing process, reduce disputes, and ensure timely payments from clients. A well-organized billing document fosters better client relationships and enhances credibility.

Tips for Organizing Your Billing Files

Properly managing billing documents is essential for maintaining efficient business operations. Organizing these records not only makes it easier to find specific documents when needed but also helps with tracking payments, managing taxes, and preparing for audits. With the right approach, you can streamline your workflow and ensure all important files are accessible and well-structured.

Effective Organizational Strategies

- Use a Clear Naming System: Develop a consistent naming convention for each document. Include key information like the client’s name, date, and invoice number to make searching easier.

- Organize by Date or Client: Categorize documents either by the date of issuance or by client name. This allows you to quickly locate past transactions and track payment schedules.

- Leverage Cloud Storage: Use cloud-based platforms to store your documents. These services offer secure backup and the ability to access your files from anywhere.

- Set Up Folders and Subfolders: Create specific folders for each client or project, with subfolders for different years or months. This adds another layer of organization and ensures easy navigation.

- Track Payment Status: Include payment status (paid, pending, overdue) in your file names or within a tracking sheet. This will help you keep track of outstanding balances and remind clients when necessary.

Tools to Assist in Organization

- Spreadsheet Software: Tools like Excel or Google Sheets can be used to maintain a centralized record of all transactions, including payment status, dates, and amounts.

- Document Management Software: Consider using specialized software that helps automate the storage, organization, and retrieval of billing documents. These tools often integrate with accounting systems and can simplify the entire process.

By implementing these strategies, you’ll be able to maintain an organized and efficient system that will save time and reduce the risk of errors in your financial records.

Updating Your Billing Document Format Regularly

Maintaining an up-to-date format for all financial documents is crucial for ensuring accuracy and compliance with changing regulations. As businesses grow and evolve, so do their needs, which means that periodically reviewing and adjusting the structure of these documents helps maintain clarity and professionalism. Regular updates also ensure that important legal or financial changes are reflected in the document layout, enhancing both efficiency and customer satisfaction.

Reasons for Updating Regularly

- Compliance with New Regulations: Tax laws, business regulations, and other industry standards can change over time. It’s important to update documents to comply with these new rules and avoid penalties.

- Reflecting Business Changes: As your business expands, you may add new services or change pricing structures. Keeping your documents updated helps ensure that all relevant details are accurately represented.

- Improving User Experience: Periodic updates allow you to simplify and enhance the user experience. Whether it’s for internal use or your clients, ensuring clarity and ease of use can lead to better communication and fewer mistakes.

Key Areas to Review

- Contact Information: Ensure that all contact details, such as phone numbers, addresses, and email addresses, are current.

- Tax Rates: Verify that applicable tax rates are correct and reflect the latest legal requirements.

- Design and Layout: Make periodic adjustments to the design to keep it professional and aligned with your brand. This could involve changes in font, color scheme, or the overall structure of the document.

- Payment Terms: Review the payment terms regularly to ensure that they align with industry practices or your business policies.

Regularly reviewing and updating the format of your financial documents ensures that your business stays organized, professional, and legally compliant while making a positive impression on your clients.